Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Southcross Energy Partners, L.P. | a8-k2015naptpinvestorprese.htm |

May 2015 – NAPTP MLP Conference Presentation April 30, 2014 May 2015 National Association of Publicly Traded Partnerships 2015 MLP Investor Conference

May 2015 – NAPTP MLP Conference Presentation This presentation contains forward-looking statements and information. Forward-looking statements include, without limitation, any statement that may project, indicate or imply future results, events, performance or achievements, and may contain the words “expect,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “will be,” “will continue,” “will likely result” and similar expressions, or future conditional verbs such as “may,” “will,” “should,” “would” and “could.” In addition, any statement concerning future financial performance (including future revenues, earnings or growth rates), ongoing business strategies or prospects, and possible actions taken by us, our subsidiaries or our affiliates, are also forward-looking statements. These forward-looking statements involve external risks and uncertainties, including, but not limited to, those described under the section entitled “Risk Factors” included in our 2014 Annual Report on Form 10-K (as updated by our Quarterly Reports on Form 10- Q). Forward-looking statements are based on current expectations and projections about future events and are inherently subject to a variety of risks and uncertainties, many of which are beyond the control of our management team. All forward-looking statements in this presentation and in any other written or oral forward-looking statements attributable to us, or to persons acting on our behalf, are expressly qualified in their entirety by these risks and uncertainties. These risks and uncertainties include, among others: • the volatility of natural gas, crude oil and NGL prices and the price and demand of products derived from these commodities, particularly in the depressed energy price environment that began in the second half of 2014, which has the potential for further deterioration and may result in a material reduction in exploration, development and production; • competitive conditions in our industry and the extent and success of producers increasing production or replacing declining production and our success in obtaining new sources of supply; • industry conditions and supply of pipelines, processing and fractionation capacity relative to available natural gas from producers; • our dependence upon a relatively limited number of customers for a significant portion of our revenues; • actions taken or inactions or non-performance by third parties, including suppliers, contractors, operators, processors, transporters and customers; • our ability to effectively recover NGLs at a rate equal to or greater than our contracted rates with customers; • our ability to produce and market NGLs at the anticipated differential to NGL index pricing; • our access to markets enabling us to match pricing indices for purchases and sales of natural gas and NGLs; • our ability to complete projects within budget and on schedule, including but not limited to, timely receipt of necessary government approvals and permits, our ability to control the costs of construction and other factors that may impact projects; • our ability to consummate acquisitions, successfully integrate the acquired businesses and realize anticipated cost savings and other synergies from any acquisitions, including with respect to our acquisition of certain gathering and processing assets from TexStar Midstream Services, LP in August 2014; • our ability to manage over time changing exposure to commodity price risk; • the effectiveness of our hedging activities or our decisions not to undertake hedging activities; • our access to financing and ability to remain in compliance with our financing covenants, and the potential for lack of access to debt capital markets if the depressed energy price environment that began in the second half of 2014 continues; • our ability to generate sufficient operating cash flow to fund our quarterly distributions; • changes in general economic conditions; • the effects of downtime associated with our assets or the assets of third parties interconnected with our systems; • operating hazards, fires, natural disasters, weather-related delays, casualty losses and other matters beyond our control; • the failure of our processing and fractionation plants to perform as expected, including outages for unscheduled maintenance or repair; • the effects of laws and governmental regulations and policies; • the effects of existing and future litigation; and • other financial, operational and legal risks and uncertainties detailed from time to time in our filings with the U.S. Securities and Exchange Commission. Developments in any of these areas could cause actual results to differ materially from those anticipated or projected, affect our ability to maintain distribution levels and/or access necessary financial markets or cause a significant reduction in the market price of our common units. The foregoing list of risks and uncertainties may not contain all of the risks and uncertainties that could affect us. In addition, in light of these risks and uncertainties, the matters referred to in the forward-looking statements contained in this presentation may not, in fact, occur. Accordingly, undue reliance should not be placed on these statements. We undertake no obligation to publicly update or revise any forward-looking statements as a result of new information, future events or otherwise, except as otherwise required by law. Cautionary Statements 1

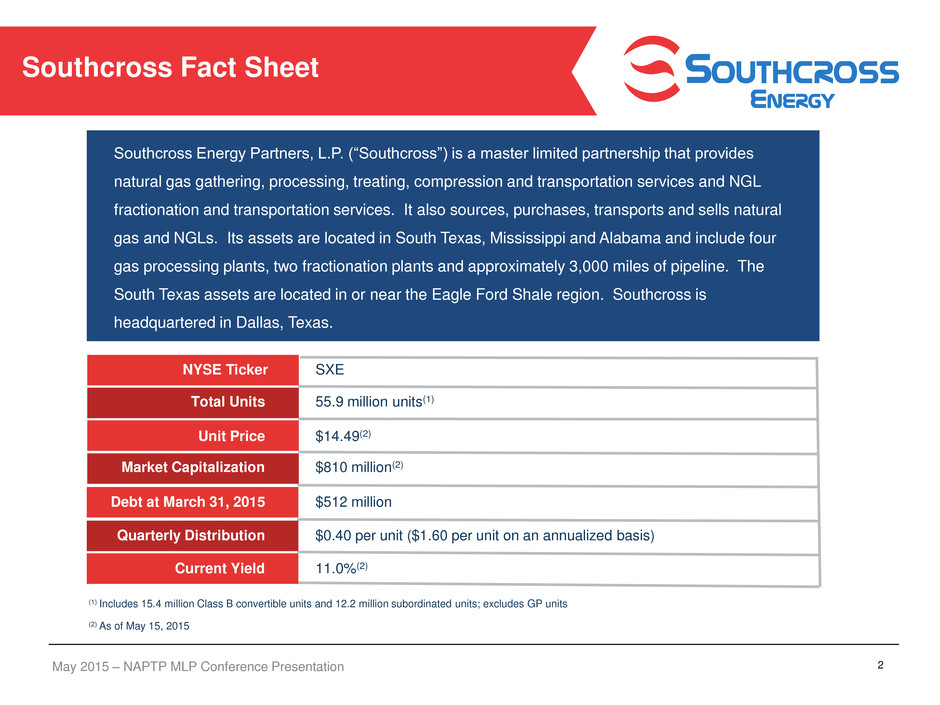

May 2015 – NAPTP MLP Conference Presentation 2 NYSE Ticker Total Units Unit Price Market Capitalization SXE 55.9 million units(1) $14.49(2) $810 million(2) $512 million Debt at March 31, 2015 Quarterly Distribution $0.40 per unit ($1.60 per unit on an annualized basis) Current Yield 11.0%(2) (1) Includes 15.4 million Class B convertible units and 12.2 million subordinated units; excludes GP units (2) As of May 15, 2015 Southcross Fact Sheet Southcross Energy Partners, L.P. (“Southcross”) is a master limited partnership that provides natural gas gathering, processing, treating, compression and transportation services and NGL fractionation and transportation services. It also sources, purchases, transports and sells natural gas and NGLs. Its assets are located in South Texas, Mississippi and Alabama and include four gas processing plants, two fractionation plants and approximately 3,000 miles of pipeline. The South Texas assets are located in or near the Eagle Ford Shale region. Southcross is headquartered in Dallas, Texas.

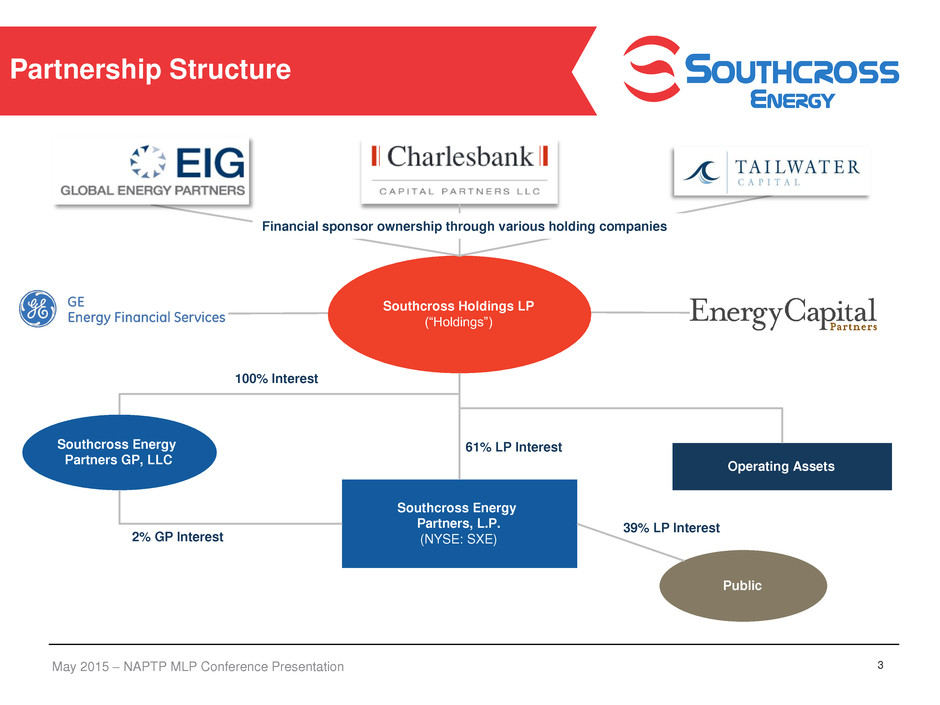

May 2015 – NAPTP MLP Conference Presentation Partnership Structure Southcross Holdings LP (“Holdings”) Southcross Energy Partners, L.P. (NYSE: SXE) Operating Assets Public 39% LP Interest 2% GP Interest 61% LP Interest Southcross Energy Partners GP, LLC Financial sponsor ownership through various holding companies 3 100% Interest

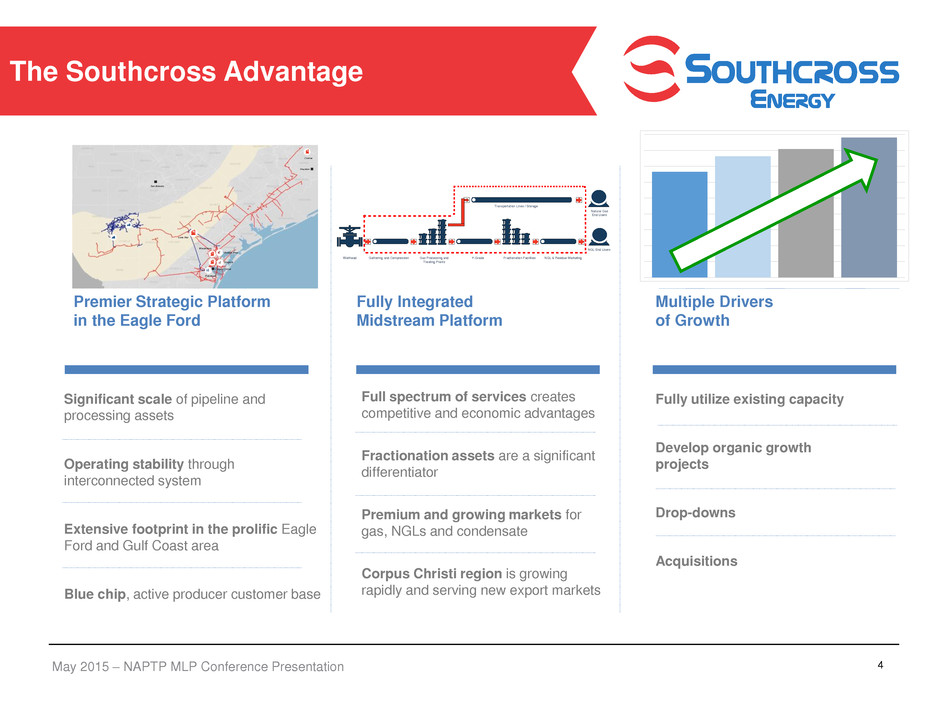

May 2015 – NAPTP MLP Conference Presentation The Southcross Advantage 4 Significant scale of pipeline and processing assets Operating stability through interconnected system Extensive footprint in the prolific Eagle Ford and Gulf Coast area Blue chip, active producer customer base Full spectrum of services creates competitive and economic advantages Fractionation assets are a significant differentiator Premium and growing markets for gas, NGLs and condensate Corpus Christi region is growing rapidly and serving new export markets Fully utilize existing capacity Develop organic growth projects Drop-downs Acquisitions Premier Strategic Platform in the Eagle Ford Fully Integrated Midstream Platform Multiple Drivers of Growth Corpus Christi San Antonio Houston Conroe Lone Star Woodsboro Bonnie View Gregory Robstown Wellhead Gathering and Compression Gas Processing and Treating Plants Y-Grade Fractionation Facilities Natural Gas End Users Transportation Lines / Storage NGL End Users NGL & Residue Marketing

May 2015 – NAPTP MLP Conference Presentation 5 Southcross Focus Outstanding Operational Performance Aggressively Growing Our Business Growth in Distributions Deliver on Our Core Values Execute on Our Strategy

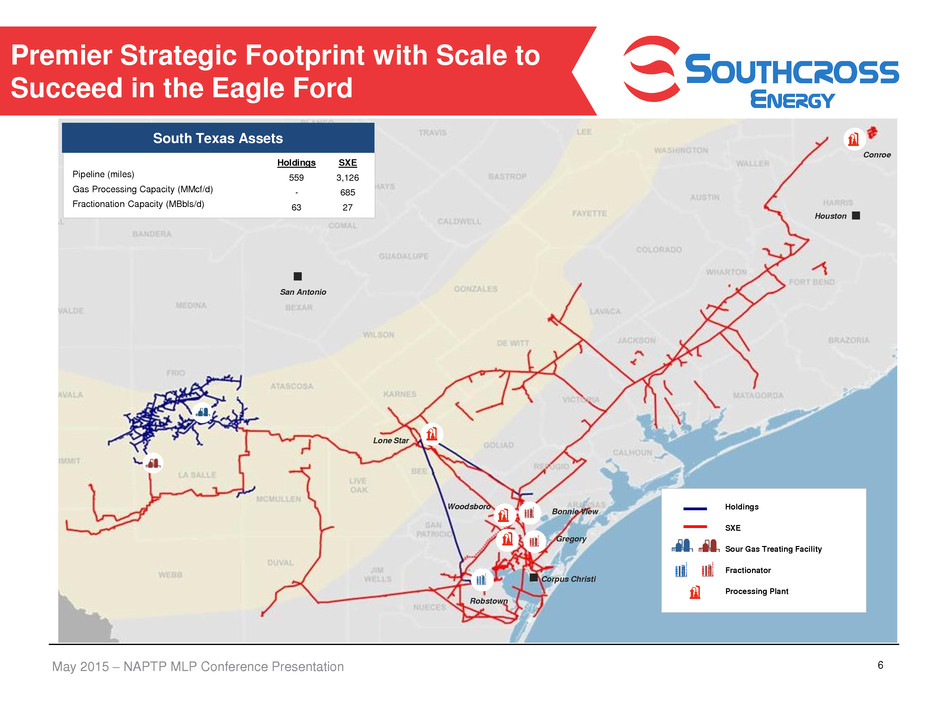

May 2015 – NAPTP MLP Conference Presentation Pipeline (miles) Gas Processing Capacity (MMcf/d) Fractionation Capacity (MBbls/d) Holdings 559 - 63 SXE 3,126 685 27 South Texas Assets Premier Strategic Footprint with Scale to Succeed in the Eagle Ford Holdings SXE Sour Gas Treating Facility Fractionator Processing Plant 6 Corpus Christi San Antonio Houston Conroe Lone Star Woodsboro Bonnie View Gregory Robstown

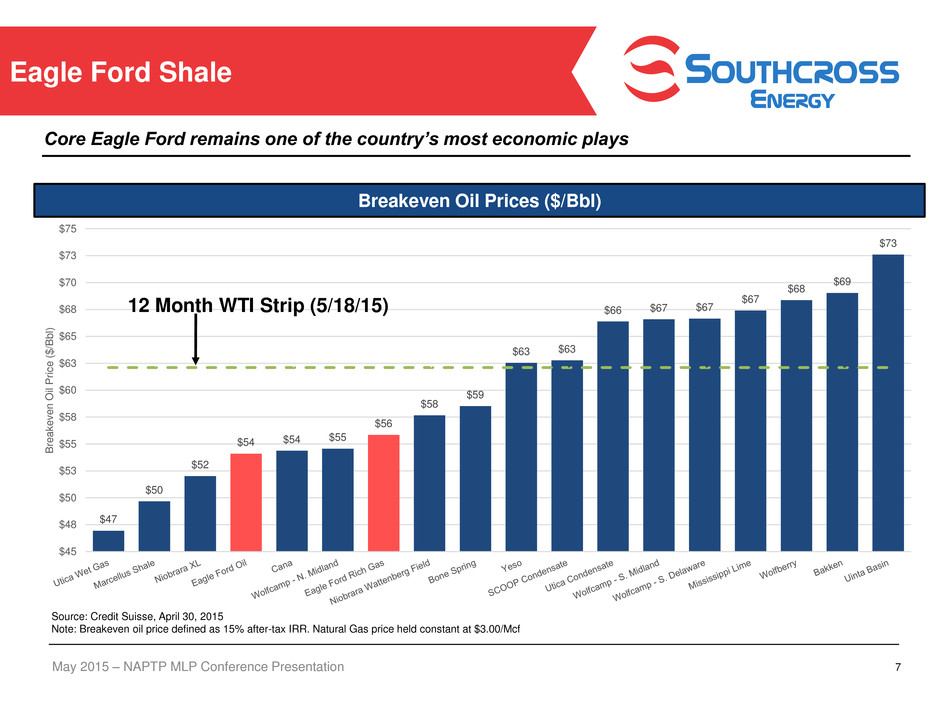

May 2015 – NAPTP MLP Conference Presentation Eagle Ford Shale 7 Core Eagle Ford remains one of the country’s most economic plays Source: Credit Suisse, April 30, 2015 Note: Breakeven oil price defined as 15% after-tax IRR. Natural Gas price held constant at $3.00/Mcf Breakeven Oil Prices ($/Bbl) $47 $50 $52 $54 $54 $55 $56 $58 $59 $63 $63 $66 $67 $67 $67 $68 $69 $73 $45 $48 $50 $53 $55 $58 $60 $63 $65 $68 $70 $73 $75 B re a k e v e n Oil P ri c e ( $ /B b l) 12 Month WTI Strip (5/18/15)

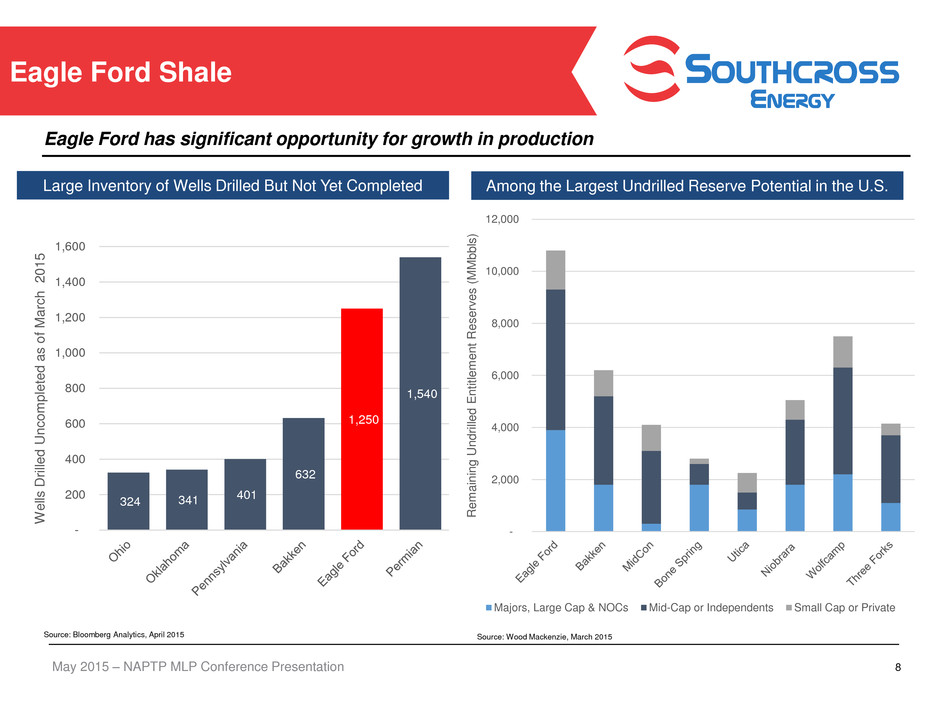

May 2015 – NAPTP MLP Conference Presentation Eagle Ford Shale 8 Eagle Ford has significant opportunity for growth in production Source: Wood Mackenzie, March 2015 324 341 401 632 1,250 1,540 - 200 400 600 800 1,000 1,200 1,400 1,600 W el ls D ril le d Un co m pl et ed a s o f M ar ch 2 01 5 Source: Bloomberg Analytics, April 2015 Large Inventory of Wells Drilled But Not Yet Completed Among the Largest Undrilled Reserve Potential in the U.S. - 2,000 4,000 6,000 8,000 10,000 12,000 Re m ai ni ng Undr ill ed E nt itl em en t Re ser ve s (M M bb ls ) Majors, Large Cap & NOCs Mid-Cap or Independents Small Cap or Private

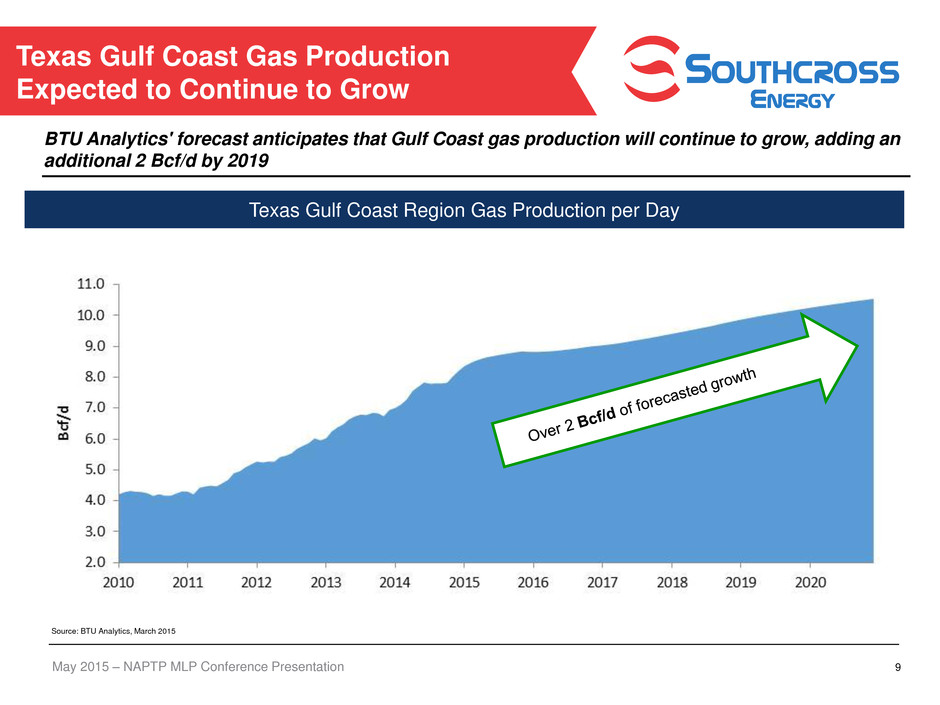

May 2015 – NAPTP MLP Conference Presentation Texas Gulf Coast Gas Production Expected to Continue to Grow 9 BTU Analytics' forecast anticipates that Gulf Coast gas production will continue to grow, adding an additional 2 Bcf/d by 2019 Texas Gulf Coast Region Gas Production per Day Source: BTU Analytics, March 2015

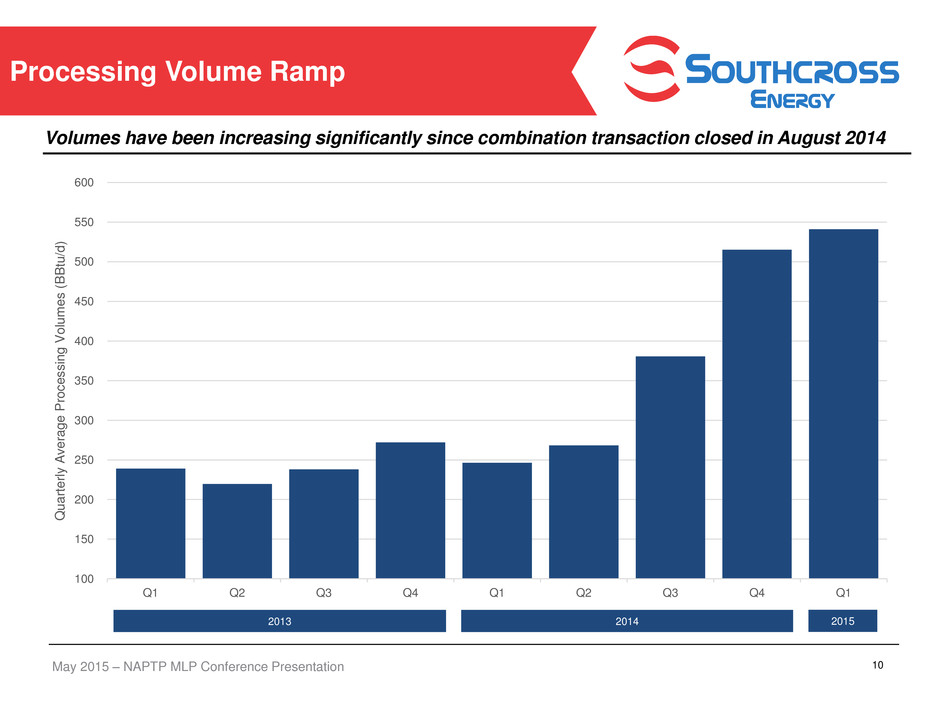

May 2015 – NAPTP MLP Conference Presentation Processing Volume Ramp 10 Volumes have been increasing significantly since combination transaction closed in August 2014 100 150 200 250 300 350 400 450 500 550 600 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q u a rter ly A v erage P ro c e s s in g V o lu m e s ( B B tu /d ) 2013 2014 2015

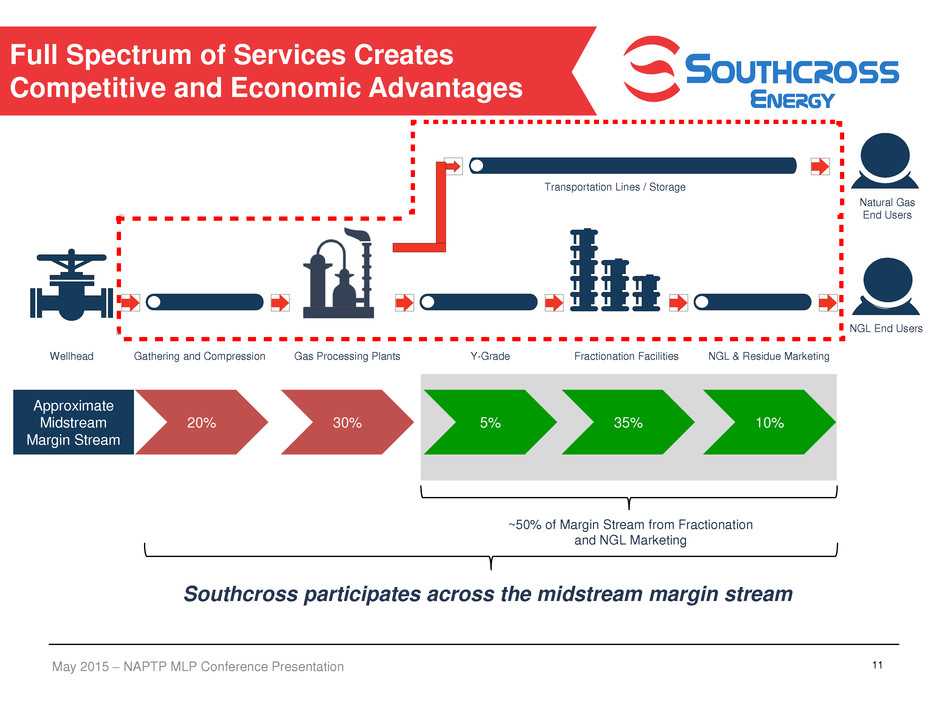

May 2015 – NAPTP MLP Conference Presentation Full Spectrum of Services Creates Competitive and Economic Advantages 11 Wellhead Gathering and Compression Gas Processing Plants Y-Grade Fractionation Facilities Natural Gas End Users Transportation Lines / Storage NGL End Users NGL & Residue Marketing 20% 30% 5% 35% 10% Approximate Midstream Margin Stream Southcross participates across the midstream margin stream ~50% of Margin Stream from Fractionation and NGL Marketing

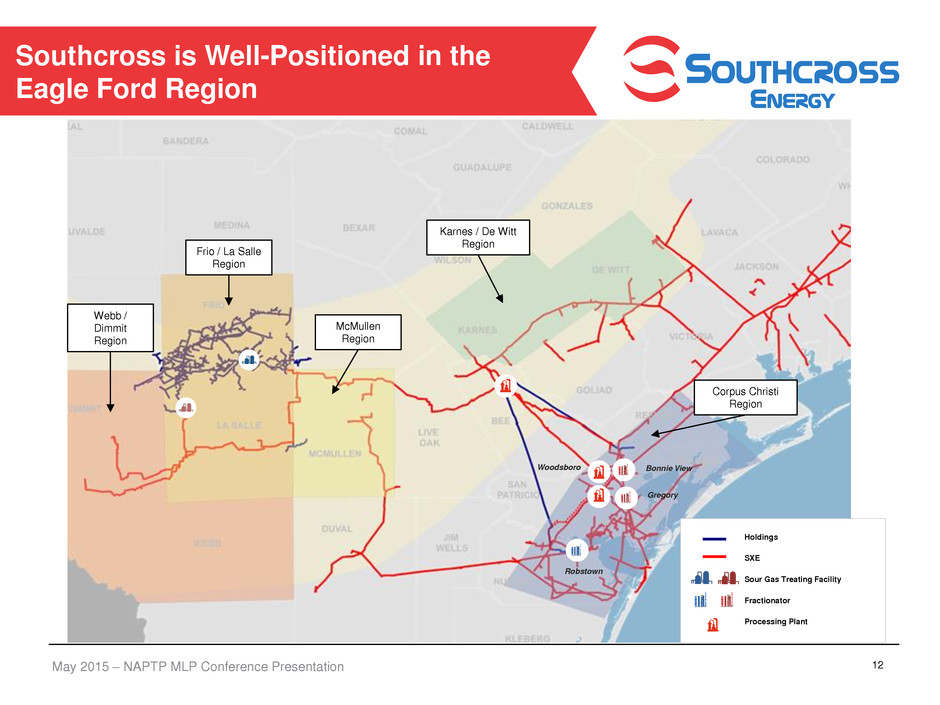

May 2015 – NAPTP MLP Conference Presentation Southcross is Well-Positioned in the Eagle Ford Region 12 Karnes / De Witt Region Frio / La Salle Region Webb / Dimmit Region McMullen Region Corpus Christi Region Woodsboro Bonnie View Gregory Robstown Holdings SXE Sour Gas Treating Facility Fractionator Processing Plant

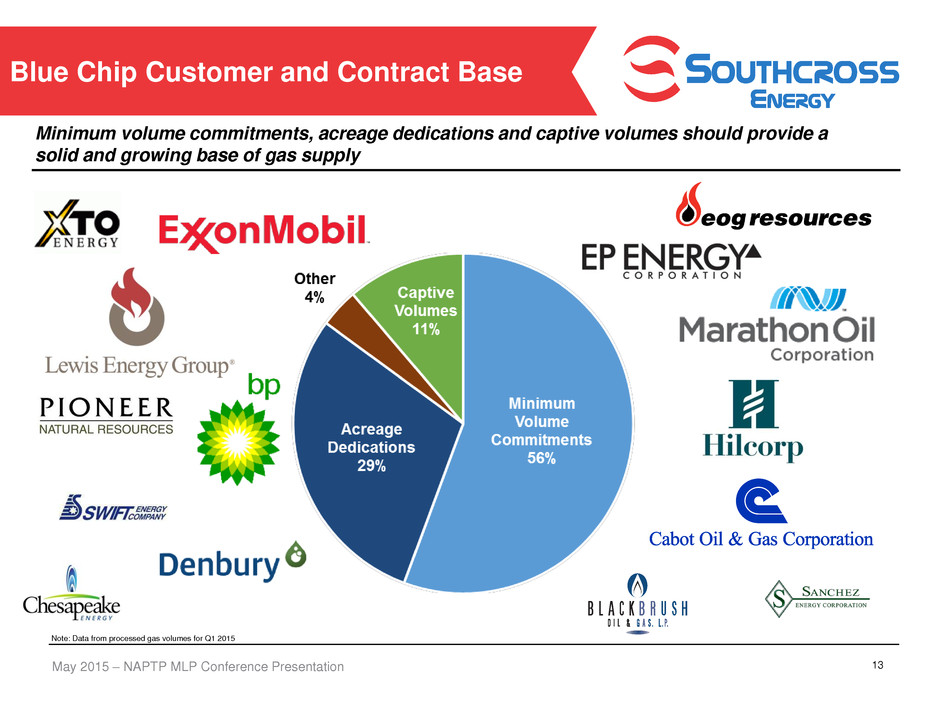

May 2015 – NAPTP MLP Conference Presentation 13 Blue Chip Customer and Contract Base Minimum volume commitments, acreage dedications and captive volumes should provide a solid and growing base of gas supply October November 2015E Southcross Processing Capacity Commodity Exposure 23% Note: Data from processed gas volumes for Q1 2015

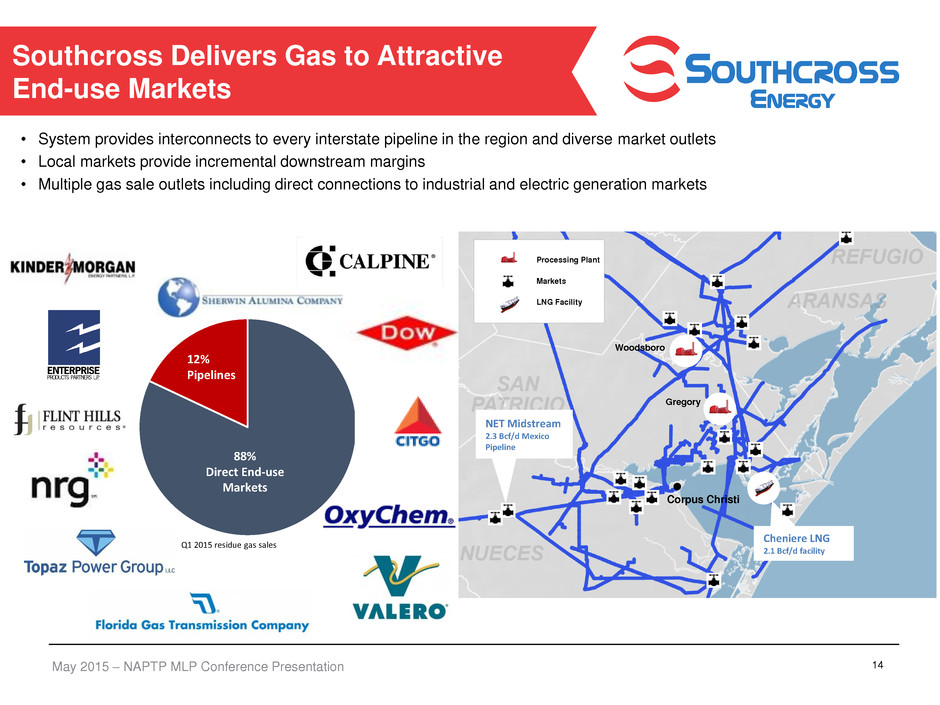

May 2015 – NAPTP MLP Conference Presentation • System provides interconnects to every interstate pipeline in the region and diverse market outlets • Local markets provide incremental downstream margins • Multiple gas sale outlets including direct connections to industrial and electric generation markets Southcross Delivers Gas to Attractive End-use Markets 14 Q1 2015 residue gas sales 88% Direct End-use Markets 12% Pipelines Corpus Christi Woodsboro Gregory NET Midstream 2.3 Bcf/d Mexico Pipeline Cheniere LNG 2.1 Bcf/d facility Processing Plant Markets LNG Facility

May 2015 – NAPTP MLP Conference Presentation 15 Lower Gulf Coast Projects Fuel Growth Refining Projects • Valero upgrading 325kb/d Corpus Christi refinery • Flint Hills is currently reconfiguring its 230kb/d Corpus Christi West Refinery • Martin Midstream, Magellan Midstream and Trafigura constructing condensate splitters at facilities in Corpus Christi Lyondell / Equistar Ethylene Capacity Expansion • Lyondell to add 800 million lbs/year of ethylene capacity at Corpus Christi plant by 2016 • 20,000 Bbl/d of estimated increase in ethane demand by 2016 Cheniere • Signed agreement to supply EDF with 380,000 tons / year of LNG from Train 3 as early as 2019 • FERC approved project on December 31, 2014, and the Port of Corpus Christi approved on March 17, 2015 • FERC approved a natural gas export license for the facility up to 2.1 Bcf/d on May 12, 2015 and Cheniere’s Board subsequently approved the start of construction Trafigura / Buckeye Texas Hub • Buckeye Partners LP completed the $860 million acquisition of 80% of Corpus Christi midstream business from Trafigura including the Corpus deep-water marine terminal and rail facility • New 50,000 bbl/d condensate splitter and 2.7 MMBbls/d of additional LPG storage capacity expected to be in service by mid-2015 NET Midstream Pipeline to Mexico • 120-mile, 42” and 48” natural gas pipeline with 2.3 Bcf/d of initial capacity (expandable to 3.0 Bcf/d) is now operational • Long-term firm gas transportation agreement with MexGas Supply Ltd., a subsidiary of Pemex OxyChem Corpus Christi Development Projects • OxyChem 110,000 Bbl/d propane export facility at Ingleside expected to begin operations in 2015 • OxyChem and MexiChem are currently constructing a 1.2 billion lbs/year ethylene cracker expected to go into service during 2017 (34,000 Bbl/d ethane demand)

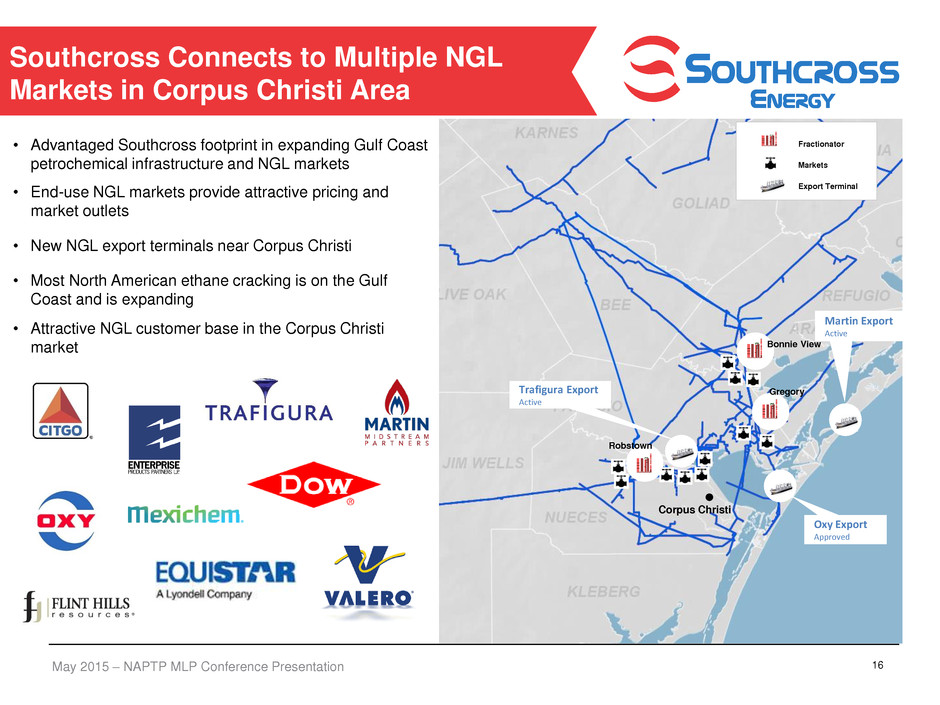

May 2015 – NAPTP MLP Conference Presentation Southcross Connects to Multiple NGL Markets in Corpus Christi Area 16 Corpus Christi Fractionator Markets Export Terminal Bonnie View Gregory Trafigura Export Active Oxy Export Approved Martin Export Active Robstown • Advantaged Southcross footprint in expanding Gulf Coast petrochemical infrastructure and NGL markets • End-use NGL markets provide attractive pricing and market outlets • New NGL export terminals near Corpus Christi • Most North American ethane cracking is on the Gulf Coast and is expanding • Attractive NGL customer base in the Corpus Christi market

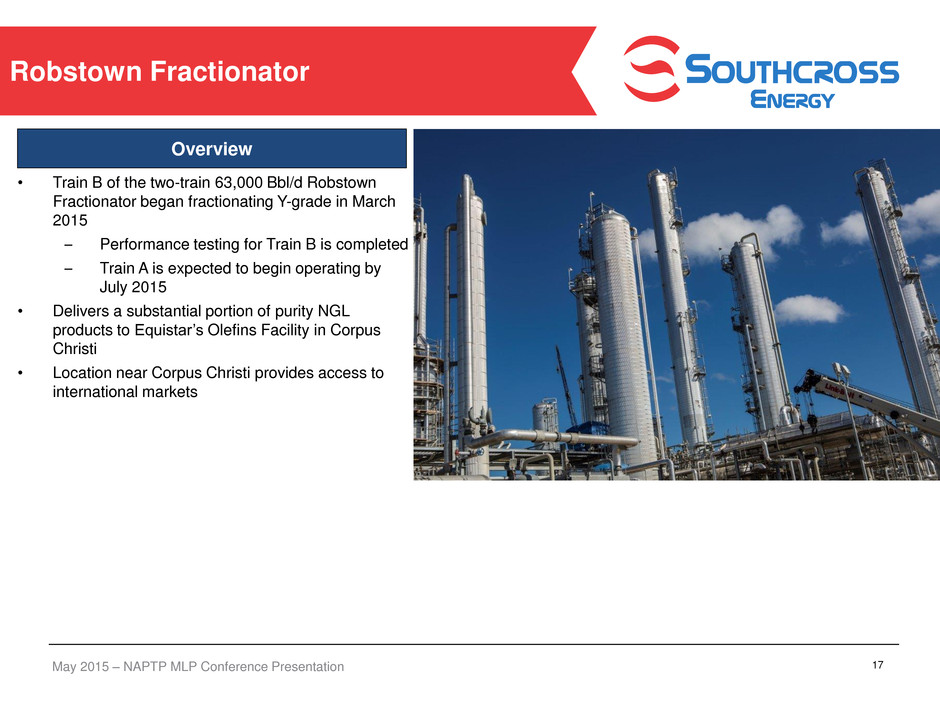

May 2015 – NAPTP MLP Conference Presentation Overview Robstown Fractionator 17 • Train B of the two-train 63,000 Bbl/d Robstown Fractionator began fractionating Y-grade in March 2015 – Performance testing for Train B is completed – Train A is expected to begin operating by July 2015 • Delivers a substantial portion of purity NGL products to Equistar’s Olefins Facility in Corpus Christi • Location near Corpus Christi provides access to international markets

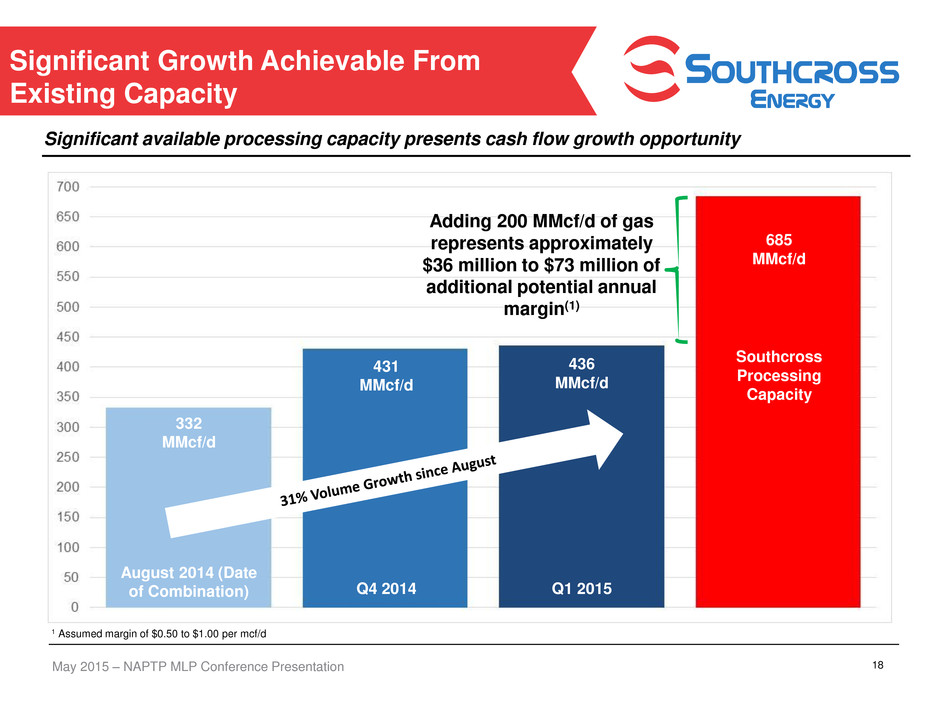

May 2015 – NAPTP MLP Conference Presentation Significant Growth Achievable From Existing Capacity 18 1 Assumed margin of $0.50 to $1.00 per mcf/d Significant available processing capacity presents cash flow growth opportunity 332 MMcf/d 431 MMcf/d 436 MMcf/d August 2014 (Date of Combination) Southcross Processing Capacity 685 MMcf/d Adding 200 MMcf/d of gas represents approximately $36 million to $73 million of additional potential annual margin(1) Q1 2015 Q4 2014

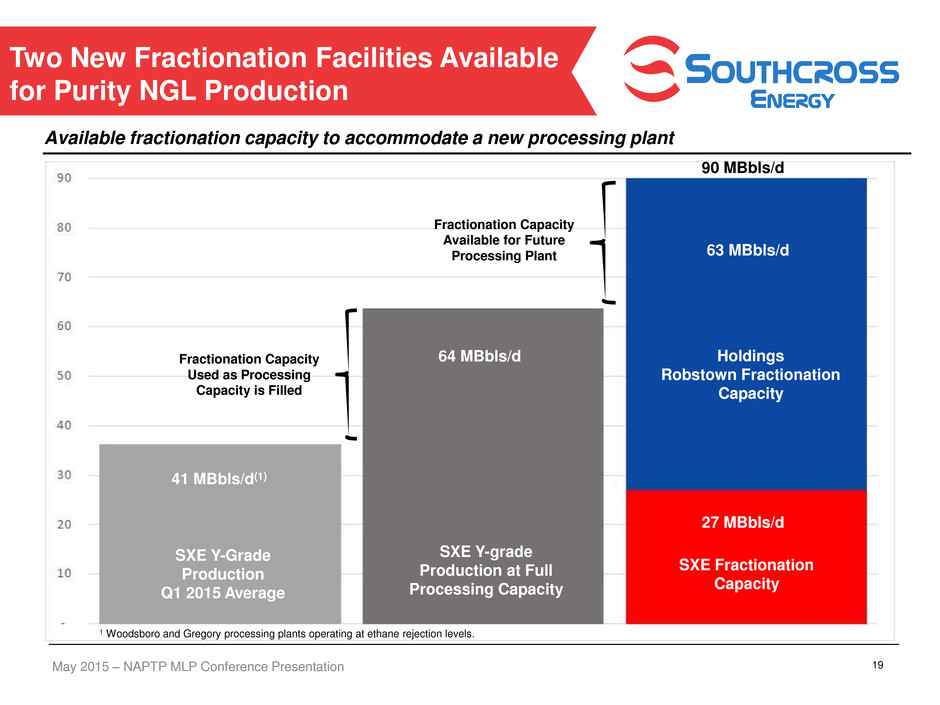

May 2015 – NAPTP MLP Conference Presentation Two New Fractionation Facilities Available for Purity NGL Production 19 SXE Y-Grade Production Q1 2015 Average 41 MBbls/d(1) SXE Y-grade Production at Full Processing Capacity 64 MBbls/d SXE Fractionation Capacity 27 MBbls/d 63 MBbls/d Holdings Robstown Fractionation Capacity 90 MBbls/d Available fractionation capacity to accommodate a new processing plant Fractionation Capacity Used as Processing Capacity is Filled Fractionation Capacity Available for Future Processing Plant 1 Woodsboro and Gregory processing plants operating at ethane rejection levels.

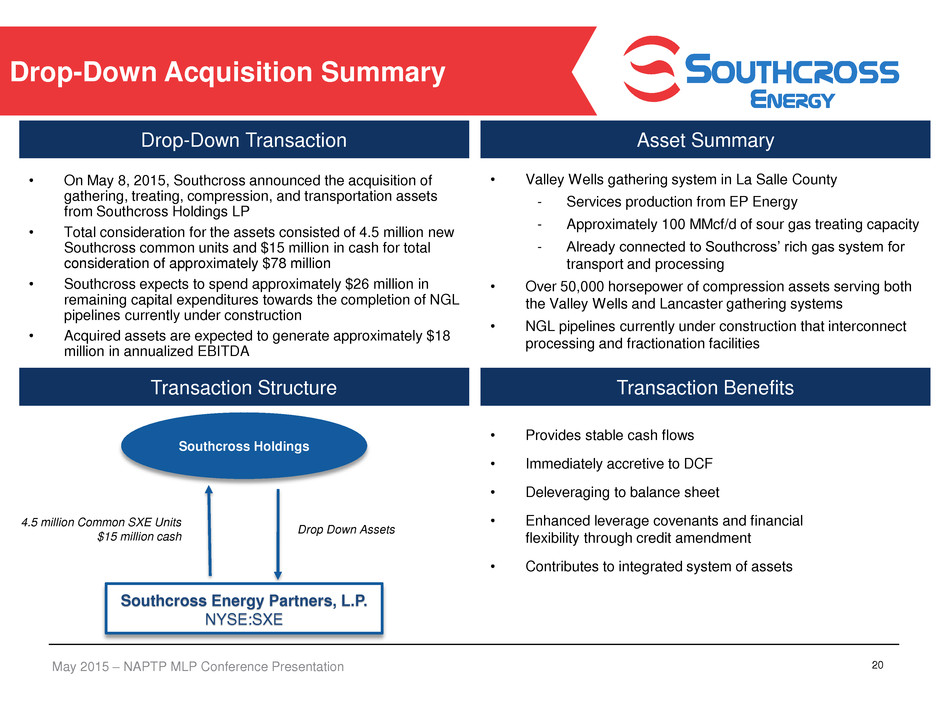

May 2015 – NAPTP MLP Conference Presentation Drop-Down Acquisition Summary 20 Transaction Benefits • Provides stable cash flows • Immediately accretive to DCF • Deleveraging to balance sheet • Enhanced leverage covenants and financial flexibility through credit amendment • Contributes to integrated system of assets Asset Summary Transaction Structure • Valley Wells gathering system in La Salle County - Services production from EP Energy - Approximately 100 MMcf/d of sour gas treating capacity - Already connected to Southcross’ rich gas system for transport and processing • Over 50,000 horsepower of compression assets serving both the Valley Wells and Lancaster gathering systems • NGL pipelines currently under construction that interconnect processing and fractionation facilities Southcross Holdings Southcross Energy Partners, L.P. NYSE:SXE 4.5 million Common SXE Units $15 million cash Drop Down Assets Drop-Down Transaction • On May 8, 2015, Southcross announced the acquisition of gathering, treating, compression, and transportation assets from Southcross Holdings LP • Total consideration for the assets consisted of 4.5 million new Southcross common units and $15 million in cash for total consideration of approximately $78 million • Southcross expects to spend approximately $26 million in remaining capital expenditures towards the completion of NGL pipelines currently under construction • Acquired assets are expected to generate approximately $18 million in annualized EBITDA

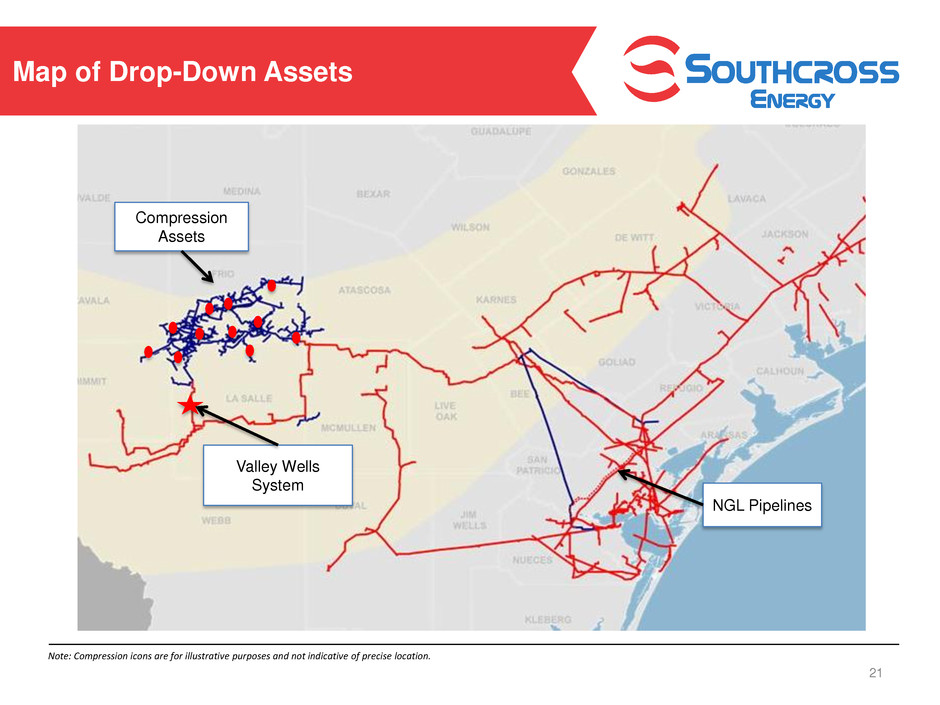

21 Map of Drop Down Assets Note: Compression icons are for illustrative purposes and not indicative of precise location. Compression Assets Valley Wells System NGL Pipelines Map of Drop-Down Assets

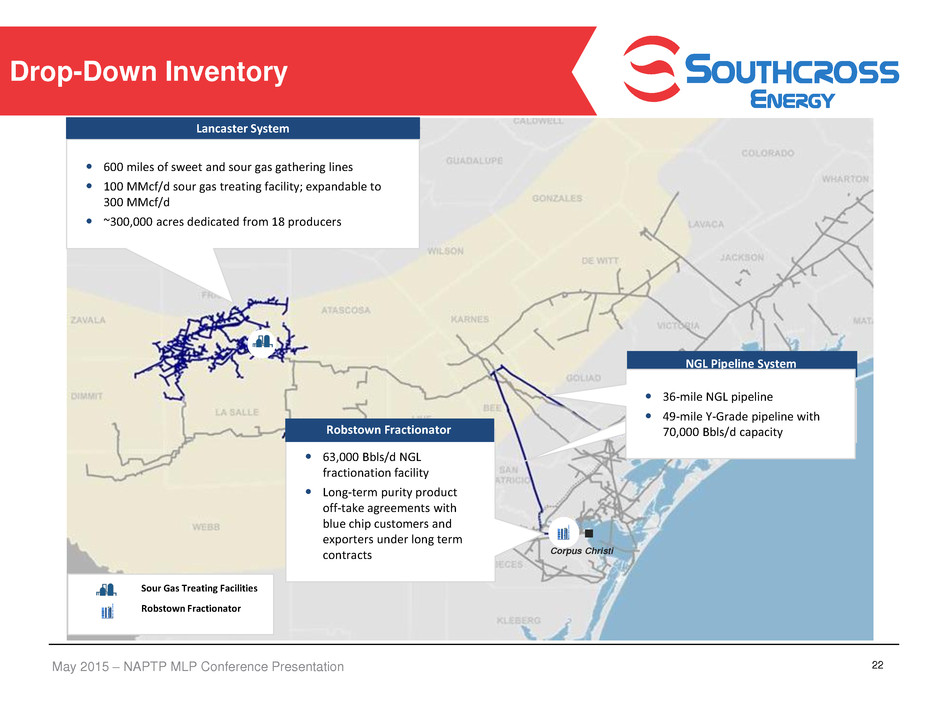

May 2015 – NAPTP MLP Conference Presentation 600 miles of sweet and sour gas gathering lines 100 MMcf/d sour gas treating facility; expandable to 300 MMcf/d ~300,000 acres dedicated from 18 producers Lancaster System NGL Pipeline System Drop-Down Inventory 22 Sour Gas Treating Facilities Robstown Fractionator 63,000 Bbls/d NGL fractionation facility Long-term purity product off-take agreements with blue chip customers and exporters under long term contracts Robstown Fractionator Corpus Christi 70,000 Bbls/d Y‐grade pipeline 36-mile NGL pipeline 49-mile Y‐Grade pipeline with 70,000 Bbls/d capacity

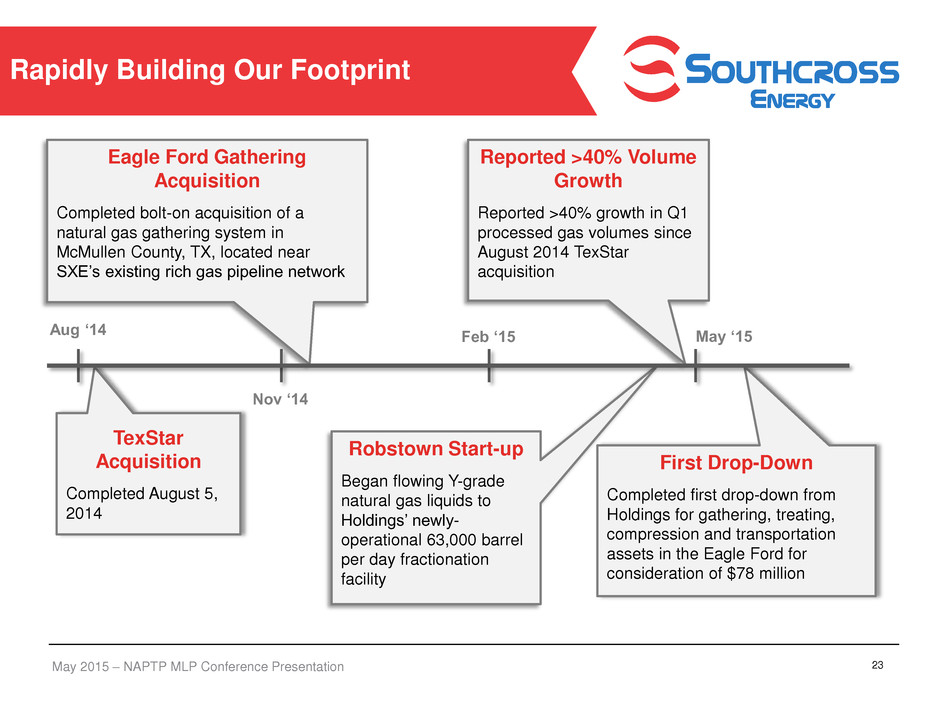

May 2015 – NAPTP MLP Conference Presentation 23 Rapidly Building Our Footprint Aug ‘14 May ‘15 Feb ‘15 Nov ‘14 Eagle Ford Gathering Acquisition Completed bolt-on acquisition of a natural gas gathering system in McMullen County, TX, located near SXE’s existing rich gas pipeline network First Drop-Down Completed first drop-down from Holdings for gathering, treating, compression and transportation assets in the Eagle Ford for consideration of $78 million Robstown Start-up Began flowing Y-grade natural gas liquids to Holdings’ newly- operational 63,000 barrel per day fractionation facility Reported >40% Volume Growth Reported >40% growth in Q1 processed gas volumes since August 2014 TexStar acquisition TexStar Acquisition Completed August 5, 2014

May 2015 – NAPTP MLP Conference Presentation 24 Investment Merits Investment Merits • High quality assets – Premier midstream platform in the prolific Eagle Ford and South Texas area – Fully integrated midstream platform with connectivity to quality end-use markets – Well-positioned for growth of Corpus Christi petrochemical and export markets • Attractive and identifiable growth opportunities – Filling available processing and fractionation capacity – Organic growth projects and expansion – Attractive assets at Holdings for future potential drop-downs • Experienced management team • Solid private equity sponsor support • Attractive yield versus gathering and processing peers

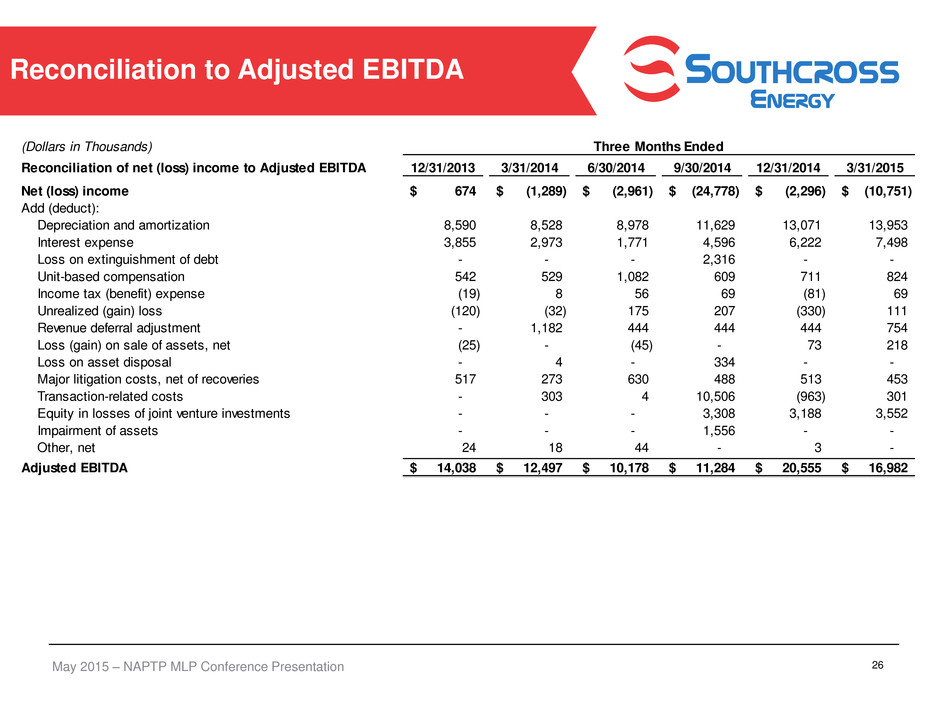

May 2015 – NAPTP MLP Conference Presentation We report our financial results in accordance with accounting principles generally accepted in the United States, or GAAP. We also present the non-GAAP financial measures of Adjusted EBITDA, gross operating margin and distributable cash flow. We define Adjusted EBITDA as net income/loss, plus interest expense, income tax expense, depreciation and amortization expense, equity in losses of joint venture investments, certain non-cash charges (such as non-cash unit-based compensation, impairments, loss on extinguishment of debt and unrealized losses on derivative contracts), major litigation costs net of recoveries, transaction-related costs, revenue deferral adjustment, loss on sale of assets and selected charges that are unusual or non-recurring; less interest income, income tax benefit, unrealized gains on derivative contracts, equity in earnings of joint venture investments and selected gains that are unusual or non-recurring. Adjusted EBITDA should not be considered an alternative to net income, operating cash flow or any other measure of financial performance presented in accordance with GAAP. Adjusted EBITDA is used as a supplemental measure by our management and by external users of our financial statements such as investors, commercial banks, research analysts and others, to assess the financial performance of our assets without regard to financing methods, capital structure or historical cost basis; the ability of our assets to generate cash sufficient to support our indebtedness and make future cash distributions; operating performance and return on capital as compared to those of other companies in the midstream energy sector, without regard to financing or capital structure; and the attractiveness of capital projects and acquisitions and the overall rates of return on investment opportunities. We define gross operating margin as the sum of revenues less the cost of natural gas and NGLs sold. For our fixed-fee contracts, we record the fee as revenue and there is no offsetting cost of natural gas and NGLs sold. For our fixed-spread and commodity-sensitive arrangements, we record as revenue all of our proceeds from the sale of the natural gas and NGLs and record as an expense the associated cost of natural gas and NGLs sold. We define distributable cash flow as Adjusted EBITDA, plus interest income and income tax benefit, less cash paid for interest (net of capitalized costs), income tax expense and maintenance capital expenditures. We use distributable cash flow to analyze our performance and liquidity. Distributable cash flow does not reflect changes in working capital balances. Distributable cash flow is used to assess the ability of our assets to generate cash sufficient to support our indebtedness and make future cash distributions to our unit holders; and the attractiveness of capital projects and acquisitions and the overall rates of return on alternative investment opportunities. We believe that the presentation of these non-GAAP financial measures provides useful information to investors in assessing our financial condition, results of operations and cash flows from operations. Reconciliations of Adjusted EBITDA, gross operating margin and distributable cash flow to their most directly comparable GAAP measure are included in this press release. Our non-GAAP financial measures should not be considered as alternatives to the most directly comparable GAAP financial measure. Each of these non-GAAP financial measures has important limitations as an analytical tool because each excludes some but not all items that affect the most directly comparable GAAP financial measure. You should not consider any of Adjusted EBITDA, gross operating margin or distributable cash flow in isolation or as a substitute for analysis of our results as reported under GAAP. Because Adjusted EBITDA, gross operating margin and distributable cash flow may be defined differently by other companies in our industry, our definitions of these non-GAAP financial measures may not be comparable to similarly titled measures of other companies, thereby diminishing their utility. Non-GAAP Financial Measures 25

May 2015 – NAPTP MLP Conference Presentation 26 Reconciliation to Adjusted EBITDA (Dollars in Thousands) Reconciliation of net (loss) income to Adjusted EBITDA 12/31/2013 3/31/2014 6/30/2014 9/30/2014 12/31/2014 3/31/2015 Net (loss) income 674$ (1,289)$ (2,961)$ (24,778)$ (2,296)$ (10,751)$ Add (deduct): Depreciation and amortization 8,590 8,528 8,978 11,629 13,071 13,953 Interest expense 3,855 2,973 1,771 4,596 6,222 7,498 Loss on extinguishment of debt - - - 2,316 - - Unit-based compensation 542 529 1,082 609 711 824 Income tax (benefit) expense (19) 8 56 69 (81) 69 Unrealized (gain) loss (120) (32) 175 207 (330) 111 Revenue deferral adjustment - 1,182 444 444 444 754 Loss (gain) on sale of assets, net (25) - (45) - 73 218 Loss on asset disposal - 4 - 334 - - Major litigation costs, net of recoveries 517 273 630 488 513 453 Transaction-related costs - 303 4 10,506 (963) 301 Equity in losses of joint venture investments - - - 3,308 3,188 3,552 Impairment of assets - - - 1,556 - - Other, net 24 18 44 - 3 - Adjusted EBITDA 14,038$ 12,497$ 10,178$ 11,284$ 20,555$ 16,982$ Three Months Ended