Attached files

| file | filename |

|---|---|

| EX-1.1 - EX-1.1 - Intersect ENT, Inc. | d924484dex11.htm |

| EX-23.1 - EX-23.1 - Intersect ENT, Inc. | d924484dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on May 20, 2015

Registration No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Intersect ENT, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 3841 | 20-0280837 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

1555 Adams Drive

Menlo Park, California 94025

(650) 641-2100

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Lisa D. Earnhardt

President and Chief Executive Officer

Intersect ENT, Inc.

1555 Adams Drive

Menlo Park, California 94025

(650) 641-2100

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Matthew B. Hemington Brett D. White Seth J. Gottlieb Cooley LLP 3175 Hanover Street Palo Alto, California 94304 Telephone: (650) 843-5000 Facsimile: (650) 849-7400 |

B. Shayne Kennedy Thomas E. Mitchell Latham & Watkins LLP 650 Town Center Drive, 20th Floor Costa Mesa, California 92626 Telephone: (714) 540-1235 Facsimile: (714) 755-8290 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) |

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Securities to be Registered |

Amount to be Registered (1) |

Proposed Maximum Offering Price per |

Proposed Maximum Aggregate Offering |

Amount of Registration Fee | ||||

| Common Stock, par value $0.001 per share |

3,450,000 | $24.25 | $83,662,500 | $9,722 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes additional shares that the underwriters have the option to purchase. |

| (2) | Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended, based on the average of the high and low trading prices for the common stock as reported by the NASDAQ Global Market on May 19, 2015. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated May 20, 2015

Preliminary Prospectus

3,000,000 Shares

Common Stock

We are offering shares of our common stock. Our common stock is listed on The NASDAQ Global Market under the symbol “XENT.” On May 19, 2015, the last reported sale price of our common stock on The NASDAQ Global Market was $24.02.

We are an “emerging growth company” as that term is defined under the federal securities laws of the United States and, as such, may elect to comply with certain reduced public company reporting requirements for this and future filings.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 13 of this prospectus.

| Per Share | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| (1) | See “Underwriting” for additional disclosure regarding the compensation payable to the underwriters. |

We have granted to the underwriters an option to purchase up to 450,000 additional shares of common stock at the public offering price, less the underwriting discounts and commissions, for 30 days after the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to investors on or about , 2015.

| J.P. Morgan | BofA Merrill Lynch |

| Leerink Partners | Canaccord Genuity | William Blair | ||

The date of this prospectus is , 2015.

Table of Contents

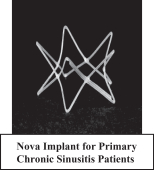

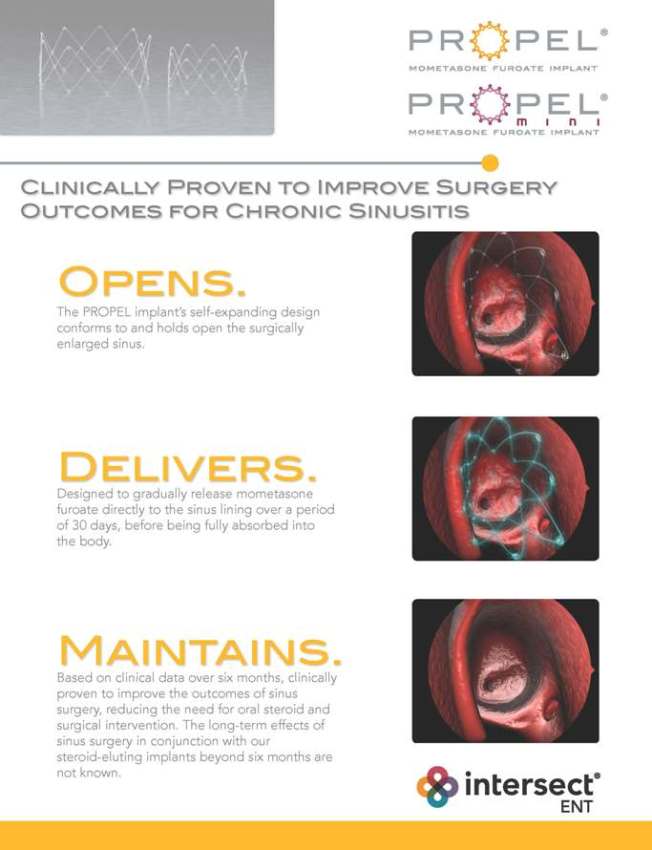

CLINICALLY PROVEN TO IMPROVE SURGERY OUTCOMES FOR CHRONIC SINUSITIS OPENS. The PROPEL implant’s self-expanding design conforms to and holds open the surgically enlarged sinus. DELIVERS. Designed to gradually release mometasone furoate directly to the sinus lining over a period of 30 days, before being fully absorbed into the body. MAINTAINS. Based on clinical data over six months, clinically proven to improve the outcomes of sinus surgery, reducing the need for oral steroid and surgical intervention. The long-term effects of sinus surgery in conjunction with our steroid-eluting implants beyond six months are not known.

Table of Contents

Neither we nor the underwriters have authorized anyone to provide you with information that is different from that contained in or incorporated by reference in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the underwriters are offering to sell shares of common stock and are seeking offers to buy shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in or incorporated by reference in this prospectus is accurate only as of the date on the front of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

To the extent there is a conflict between the information contained in this prospectus, on the one hand, and the information contained in any document incorporated by reference filed with the Securities and Exchange Commission (“SEC”) before the date of this prospectus, on the other hand, you should rely on the information in this prospectus. If any statement in a document incorporated by reference is inconsistent with a statement in another document incorporated by reference having a later date, the statement in the document having the later date modifies or supersedes the earlier statement.

TRADEMARKS

Intersect ENT, Inc. and our logo are our trademarks and are used in this prospectus and in the documents incorporated by reference in this prospectus. This prospectus and the documents incorporated by reference in this prospectus also include trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, our trademarks and tradenames referred to in this prospectus and in the documents incorporated by reference in this prospectus appear without the ™ symbol, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or the right of the applicable licensor to these trademarks and tradenames.

INVESTORS OUTSIDE THE UNITED STATES

Neither we nor any of the underwriters have taken any action that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons who have come into possession of this prospectus in a jurisdiction outside the United States are required to inform themselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

i

Table of Contents

This summary highlights information contained elsewhere in this prospectus and in the documents incorporated by reference. This summary is not complete and may not contain all the information you should consider before investing in our common stock. You should read this entire prospectus and the documents incorporated by reference in this prospectus carefully, especially the risks of investing in our common stock discussed under the heading “Risk Factors,” and our financial statements and related notes incorporated by reference in this prospectus before making an investment decision. Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus and the documents incorporated by reference in this prospectus to “Intersect ENT,” “the company,” “we,” “us” and “our” refer to Intersect ENT, Inc.

Overview

We are a commercial stage drug-device company committed to improving the quality of life for patients with ear, nose and throat conditions. We have developed a drug releasing bioabsorbable implant technology that enables targeted and sustained release of therapeutic agents. This targeted drug delivery technology is designed to allow ear, nose and throat, or ENT, physicians to improve patient care. Our approved and in-development products are designed to treat the spectrum of needs among the estimated 3.5 million U.S. patients who are managed by ENT physicians for chronic sinusitis, one of the most prevalent chronic diseases in the United States and one of the most costly conditions for U.S. employers. Chronic sinusitis patients range from those needing and electing surgery, those not having had sinus surgery and those that have had one or more surgeries but continue to suffer symptoms. To address these patient groups, we are:

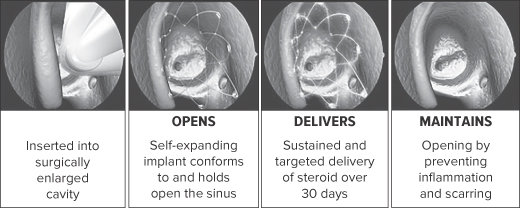

| • | Marketing PROPEL® and PROPEL mini, the first and only steroid releasing implants approved by the U.S. Food and Drug Administration, or FDA, for use in patients undergoing surgery for chronic sinusitis. As of March 31, 2015, we estimate that physicians have treated over 60,000 patients with PROPEL and PROPEL mini. PROPEL and PROPEL mini have been proven clinically in a meta-analysis of prospective, multicenter, randomized, controlled, double-blind clinical studies to improve surgical outcomes, including a 35% reduction in the need for postoperative oral steroid and surgical intervention. Inserted by a physician into the ethmoid sinuses following sinus surgery, the self-expanding implants are designed to conform to and hold open the surgically enlarged sinus, while gradually releasing an anti-inflammatory steroid over a period of 30 days, before being fully absorbed into the body. |

| • | Conducting a clinical trial designed to evaluate the benefit of PROPEL mini when placed in the frontal sinuses following sinus surgery and to support an expanded indication for this approved product. |

| • | Conducting clinical trials of RESOLVE, a steroid releasing implant designed to provide a cost-effective, less invasive solution for patients that have had ethmoid sinus surgery yet suffer from recurrent sinus obstruction due to polyps. The RESOLVE implant is designed to be placed in the ethmoid sinus in a procedure conducted in the physician’s office as an alternative to revision surgery. We have completed three studies of RESOLVE in a total of 117 patients and are currently conducting the RESOLVE II trial, a phase III blinded evaluation enrolling 300 patients to assess the safety and efficacy of the product. |

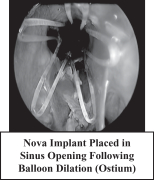

| • | Conducting clinical trials of NOVA, a steroid releasing implant designed to fit the ostia, or openings, of the dependent sinuses following enlargement of the sinuses. While such sinus enlargement is performed on both revision and primary patients, NOVA has potential to expand the treatable patient population by providing a cost-effective, less invasive solution for patients with primary chronic sinusitis, specifically those that have not had sinus surgery, who may benefit from a less invasive procedure performed in the physician’s office. We recently completed a 15 patient study to assess the feasibility of implant placement and outcomes measured through three months, and we expect to engage in additional clinical studies to further assess the safety and efficacy of NOVA. |

According to the Centers for Disease Control and Prevention, or CDC, approximately 12% of the U.S. adult population, or 29 million people, are affected by chronic sinusitis, making it more prevalent than heart disease

1

Table of Contents

and asthma. Chronic sinusitis is an inflammatory condition in which the sinus lining becomes swollen and inflamed, leading to significant patient morbidity. Chronic sinusitis significantly impacts the quality of life of patients, including difficulty breathing, chronic headaches, recurrent infections, bodily pain and loss of sense of smell and taste. These persistent symptoms can severely impact a patient’s day-to-day well-being, resulting in frequent doctor visits and lost work productivity and can lead to chronic fatigue and depression. Chronic sinusitis is managed by a combination of medical management and surgical intervention. The first line of therapy is medical management involving antibiotics, anti-inflammatory steroids and decongestants. Sinusitis is the most common reason for adult outpatient antibiotic use in the United States, comprising 11% of all antibiotic prescriptions. Patients whose symptoms persist despite medical management are recommended to undergo functional endoscopic sinus surgery, or FESS. FESS is performed in the operating room to open the blocked sinus pathways by removing inflamed tissue and bone using surgical tools. Although sinus surgery can be effective, a majority of patients experience recurrent symptoms which commonly necessitate additional treatment with medications and surgery.

Our target market in the United States consists of more than 3.5 million people with chronic sinusitis who are managed by ENT physicians and who we believe could benefit from products that incorporate our drug releasing bioabsorbable implant technology. This target market includes approximately 540,000 patients who undergo FESS for chronic sinusitis each year in the United States, approximately 770,000 patients who have previously undergone FESS but continue to suffer symptoms of chronic sinusitis, and 2.3 million patients who have chronic sinusitis but have not had FESS. This surgery incidence includes patients who are under the age of 18 and surgeries on the frontal sinuses, both of which represent potential expanded future indications for PROPEL and PROPEL mini and would require FDA approval.

While our current commercial focus is the U.S. market, PROPEL and PROPEL mini do have authorization to affix the CE Mark. We plan to initiate efforts that will allow for future expansion into international geographies. Approximately 450,000 and 250,000 FESS procedures are performed annually in the Asia Pacific and European regions, respectively. We intend to target four to six large markets in these regions. Our commercialization strategy will consider several factors including regulatory requirements, reimbursement coverage for our products, and key opinion leader support. We estimate the annual total addressable international market for PROPEL and PROPEL mini to be over $1.0 billion in our target international markets, and that this market would increase significantly with the addition of our in development RESOLVE and NOVA products.

In the first half of 2013, we began scaling our U.S. direct commercial presence. As of March 31, 2015, we estimate that over 1,500 accounts are stocking PROPEL for use by the ENT surgeon with an average selling price, or ASP, of approximately $728 per unit. Based on the number of units shipped as of March 31, 2015, we estimate that physicians have treated over 60,000 patients with our PROPEL implants. For the years ended December 31, 2014, 2013 and 2012, we generated revenue of $38.6 million, $17.9 million and $5.9 million, respectively, and had a net loss of $18.4 million, $18.4 million and $16.4 million, for each respective year. For the three months ended March 31, 2015, we generated revenue of $13.4 million, and had a net loss of $5.3 million. As of March 31, 2015, we had an accumulated deficit of $102.0 million.

We have expanded our sales organization to include 66 territory managers as of March 31, 2015, an expansion of 27% from our 52 territory managers as of December 31, 2014. We intend to continue to grow our sales force in order to expand our communication of the benefits of our steroid releasing implants to our physician customers. We have developed a base of recurring revenue that we expect will support future revenue growth, and in addition, we intend to seek to add new physician users and to expand the frequency of use among current physician users.

Current Treatments for Chronic Sinusitis and Their Limitations

The treatment of chronic sinusitis often entails a combination of medical management and surgical intervention to treat the underlying inflammation of the sinus lining, while addressing the secondary symptoms caused by obstruction of the natural drainage pathways.

2

Table of Contents

Medical Management

The first line of therapy for chronic sinusitis is medical management, which typically includes prescribed antibiotics, anti-inflammatory steroids and decongestants. Despite limited efficacy of use of antibiotics in this patient population and the consequence of increasing bacterial resistance, we believe there is pervasive overuse of these drugs, which could lead to patient resistance and has resulted in sinusitis being identified as a major target in national efforts to reduce unnecessary medical intervention. Sinusitis is the most common reason for adult outpatient antibiotic use in the United States, comprising 11% of all antibiotic prescriptions. In addition, physicians often prescribe decongestants and other drugs to target mucus accumulation.

Steroids are prescribed in two forms, oral steroid pills and nasal steroid sprays, both of which have serious limitations. Oral steroid therapy is effective at reaching the sinus lining, but it does so by means of systemic exposure and therefore carries the risk of serious side effects, including glaucoma, bone loss, weight gain, psychosis and difficulty in controlling blood glucose levels in patients with diabetes. Nasal steroid sprays, commonly indicated for rhinitis, or inflammation of the nasal passage, are routinely prescribed for chronic sinusitis patients. While nasal steroid sprays avoid systemic exposure and thus lack such serious side effects, an estimated 70% of the drug is swallowed and the remainder is directed to the nasal passages, instead of the sinuses, which limits efficacy. In a published study, the fraction of drug deposited in the sinuses from a nasal steroid spray was measured to be less than 2%. Poor patient compliance further limits the effectiveness of nasal steroid sprays. Although medical management can reduce symptoms, an estimated 20% or more of chronic sinusitis patients who receive medical therapy are unresponsive.

Of note, medical management is not only used as a first line of therapy for patients afflicted with primary chronic sinusitis, situations in which patients have not had sinus surgery, but also for patients who have recurrent symptoms despite having sinus surgery. Patients in both stages of the condition are managed medically and hence are subject to the limitations described above.

Sinus Surgery

In cases where patients are symptomatic despite medical management, a physician may recommend FESS. In the FESS procedure, the physician enlarges the inflamed and obstructed sinus pathways by removing inflamed tissue and bone in order to facilitate normal sinus drainage and aeration. First introduced in the United States in the 1980s, FESS is considered the standard of care for surgical intervention to treat chronic sinusitis. During the procedure, the honeycomb-like cells of the ethmoid sinuses are removed, resulting in one large open cavity. Given their essential role in sinus function, the ethmoid sinuses are opened in over 85% of FESS procedures. The dependent sinuses each drain into the ethmoid sinuses through ostia, which may be enlarged by either surgically removing tissue or via balloon dilation.

FESS is typically performed under general anesthesia in an operating room. During the procedure, a physician inserts an endoscope into the nasal cavity to provide visualization of the patient’s anatomy. Surgical instruments, powered cutting tools and balloon dilation devices are used to remove or dilate obstructive tissue and bone. Following the surgical intervention, physicians often pack the newly opened ethmoid sinuses with gauze or other obstructive sinus packing materials to hold the sinus cavities open. A follow-up office visit is required several days after the procedure to remove the sinus packing materials and an additional one to two follow-up visits typically occur over the first four to six weeks following surgery to monitor for and treat complications. A typical FESS procedure is paid at a Medicare rate of approximately $10,000. Private insurer payment rates average 139% of Medicare rates nationally.

Since the introduction of FESS, several new technologies, such as image-guided surgical navigation systems, powered surgical instruments and balloon sinus dilation devices have expanded the addressable patient population who can benefit from FESS. For instance, balloon sinus dilation devices were developed to be used in combination with traditional surgical instruments during FESS to treat the dependent sinuses and have now allowed for treatment of some patients in the physician office setting.

3

Table of Contents

While FESS is the standard of care for treating chronic sinusitis, it has several limitations:

| • | Limited effectiveness. Inflammation and scarring in the postoperative period are common and can compromise the surgical result by negatively impacting the ability of the sinuses to heal. This increases the need for continued medical management and additional surgical procedures. Within the first year after surgery, approximately 64% of patients experience recurrent symptoms. |

| • | Limited ability to address postoperative inflammation. While oral steroids prescribed postoperatively can be effective at addressing inflammation and scarring, the required doses are significant and can result in serious systemic side effects, including glaucoma, bone loss, weight gain, and psychosis. Further, they have restricted use in diabetic individuals, patients with glaucoma and certain psychological disorders. We believe, as a result, only 20% of physicians prescribe them routinely after surgery. The absence of anti-inflammatory steroid therapy leaves the surgical wound susceptible to postoperative complications. |

| • | Pain and discomfort during postoperative period. During surgery, an ENT physician typically places sinus packing materials into the ethmoid sinuses to physically separate tissues in an attempt to prevent scarring and adhesions. Following surgery, physicians see patients two to three times in order to monitor for and, if necessary, to treat complications as well as remove these sinus packing materials. The sinus packing materials are removed by pulling or suctioning them from the newly opened cavity, a painful and time-consuming process, often necessitating pain medication. Moreover, the use of sinus packing materials obstructs the newly opened sinuses, leading to patient symptoms of congestion and discomfort. Despite the use of packing materials, scarring and adhesions are common, necessitating painful removal of additional tissue during postoperative treatments. |

| • | Potential for revision surgery. Within the first year after FESS, approximately 10% of patients will return to the operating room to undergo a revision procedure, while additional patients will return for a revision procedure after one year. We believe the risk of potential revision surgery is a significant deterrent to some patients that would otherwise undergo FESS for chronic sinusitis. |

Our Solution

We are building a portfolio of products based on our drug releasing bioabsorbable implant technology that are designed to provide localized drug delivery to treat patients across the continuum of care in chronic sinusitis. In addition to the approved commercial uses of PROPEL and PROPEL mini in the ethmoid sinuses, we are conducting trials to expand the use of PROPEL mini in the frontal sinus and to evaluate two new products, NOVA, a product that has the potential to treat primary patients who have never received sinus surgery, and RESOLVE, designed to treat patients with recurrent sinusitis who might otherwise be candidates for an additional FESS procedure.

4

Table of Contents

Our Clinical Stage Products

Our two commercial products, PROPEL and PROPEL mini are indicated for use following ethmoid sinus surgery. We are conducting the PROGRESS clinical trial to evaluate the safety and effectiveness of PROPEL mini for use following frontal sinus surgery in order to expand its indication. In addition, we are conducting clinical trials to evaluate two new products, RESOLVE and NOVA, for treatment of patients across the continuum of care in chronic sinusitis.

| NOVA

|

PROPEL

|

RESOLVE

| ||

|

|

|

| ||

| Office Treatment for Primary CS Patients |

Treatment to Improve Surgical Outcomes |

Office Treatment for Recurrent CS Patients |

PROPEL

Our PROPEL implants are designed to improve the outcomes of sinus surgery by holding open the sinus passageways, reducing postoperative inflammation and scarring. These implants are inserted by a physician under endoscopic visualization following sinus surgery in the ethmoids. Once inserted, the self-expanding implants conform to and hold open the surgically enlarged sinus, while gradually releasing an anti-inflammatory steroid, mometasone furoate, directly to the sinus lining over a period of 30 days. Mometasone furoate, which is available generically, is the active ingredient in NASONEX, a nasal spray used to treat allergic rhinitis and other indications. The implants fully absorb into the body over a period of four to six weeks or are removed at the discretion of a physician during a routine office visit. Once absorbed or removed, the implant no longer provides structural support. The graphic below illustrates the operation of PROPEL and PROPEL mini in the sinuses:

We believe the principal benefits of our PROPEL steroid releasing implants are:

| • | Improved surgical outcomes. Our PROPEL implants have been clinically proven to improve FESS results by reducing postoperative inflammation and scarring. In a meta-analysis of prospective, multicenter, randomized, controlled, double-blind clinical studies, our PROPEL implants provided a 46% relative reduction in inflammation and a 70% relative reduction in scarring compared to the control implant. The control implant was identical to the PROPEL implant in composition, size, structure and |

5

Table of Contents

| mode of insertion but lacked the mometasone furoate coating. Postoperative complications, such as inflammation and polyps as well as scarring or adhesions, are common reasons for FESS failure. |

| • | Targeted steroid therapy to address postoperative inflammation. Our PROPEL implants are the first and only FDA approved drug releasing bioabsorbable sinus implants. They deliver an anti-inflammatory steroid postoperatively directly to the sinus lining in a controlled fashion over a period of 30 days, which helps in the wound healing process. In a meta-analysis of prospective, multicenter, randomized, controlled, double-blind clinical studies, our PROPEL implants reduced the need for oral steroids by 40% compared to the control implant. |

| • | Reduced pain and discomfort during postoperative period. Our PROPEL implants improve postoperative care. Once inserted, the self-expanding implants are designed to conform to and hold open the surgically enlarged ethmoid sinuses until fully absorbed into the body, which improves wound healing without obstructing the sinuses and causing congestion. Our steroid releasing implants are designed to obviate the need for sinus packing materials, which can be a significant source of postoperative pain and discomfort. Our PROPEL implants significantly reduce scarring and adhesions, which reduces the potential for pain in postoperative treatments. |

| • | Reduced surgical revisions. In clinical studies, our PROPEL implants demonstrated a significant reduction in the need for postoperative surgical intervention. In a meta-analysis of prospective, multicenter, randomized, controlled, double-blind clinical studies, our PROPEL implants provided a 35% relative reduction in the need for postoperative oral steroids and surgical intervention compared to the control implant. We believe that patients who have been deterred by the high revision rates associated with FESS may now consider surgical intervention to treat their chronic sinusitis condition. |

We believe these benefits will help expand the size of the FESS market as referring physicians increase their prescription of surgical intervention for chronic sinusitis and more patients elect to undergo sinus surgery to treat their condition.

RESOLVE

Our PROPEL steroid releasing implants are clinically proven to improve surgical results for patients undergoing FESS, reducing the need for postoperative surgical and steroid intervention. However, given the underlying chronic inflammation associated with this condition, recurrent obstruction of the sinus cavity can occur over time following sinus surgery, especially in patients afflicted with polyps, a sign of severe inflammation. Improving care of such chronic patients holds meaningful opportunity to significantly reduce healthcare costs by preventing revision surgery. We are developing the RESOLVE steroid releasing implant that can be placed in the physician office setting during a routine visit as an alternative treatment option for patients who are candidates for revision surgery. The implant is based on the same drug releasing bioabsorbable implant technology as PROPEL, but is designed to have greater radial strength in order to dilate an obstructed, polyp-filled sinus cavity, and deliver drug for an extended period of time. RESOLVE is subject to regulation as a drug product and will require the submission to the FDA of a New Drug Application, or NDA, and approval of the NDA before we can make RESOLVE commercially available in the U.S. We intend to pursue the NDA for this implant under Section 505(b)(2) of the FDCA. Section 505(b)(2) would enable us to rely, in part, on the FDA’s findings of safety and efficacy for an existing product, or published literature, in support of our NDA.

|

|

|

6

Table of Contents

NOVA

We are also developing NOVA, a steroid releasing implant designed to fit the ostia, or openings, of the dependent sinuses following sinus enlargement in the operating room or in the office. NOVA has the potential to provide a cost-effective, less invasive solution for these patients. It is designed to facilitate delivery and placement in patients who have primary disease in the office setting and hence has a smaller size and lower profile than PROPEL mini. Therefore, we believe this product will further expand the addressable patient population to those that are either indicated for sinus surgery and choose not to proceed or those with less severe disease that would otherwise be treated with medical management. A 15 patient multi-center, non-randomized clinical study to assess the feasibility of this implant was recently completed. Our next steps are to commence clinical studies of NOVA in both the frontal and maxillary sinuses.

|

|

|

Our family of drug releasing implants consists of bioabsorbable polymers that control local drug release and provide structural support to adjacent tissues during the healing process, while the implant is gradually and fully absorbed into the body. We believe the development, manufacturing, and regulatory approval for products incorporating this technology requires capabilities in polymer science, drug delivery, analytical testing and combination products. These competencies allow our technical team to tailor drug formulation, polymer design, drug release duration, implant radial strength and degradation period to meet different clinical needs. This expertise has been utilized in the development of PROPEL and PROPEL mini and is currently being leveraged in the development of our pipeline products. Any new products we develop, or changes that we make in the therapeutic agent used in PROPEL or PROPEL mini, will require FDA approval prior to commercialization in the United States.

Our Strategy

Our goal is to be a leading drug-device company committed to advancing clinically proven therapeutic solutions that improve the quality of life for patients with ENT conditions. The key elements of our strategy include:

| • | Expand our sales organization to support growth. In the territories in which we focus, our sales team has been able to achieve meaningful adoption and utilization since our first product launch in September 2011. We have expanded our sales organization to include 66 territory managers as of March 31, 2015, an expansion of 27% from our 52 territory managers as of December 31, 2014. We plan to continue to expand our sales force to provide ENT physicians in the United States with access to our steroid releasing implants. We believe that investment will continue to drive both adoption and expanded usage of our products to establish our steroid releasing implants as the standard of care. |

| • | Promote awareness among ENT physicians, referring physicians and patients. We believe that many patients with chronic sinusitis are currently undertreated, and we intend to educate ENT physicians, allergists, primary care physicians or other referring medical professionals and patients to raise awareness of the disease and available treatment alternatives, including the advantages of using our steroid releasing implants. We intend to continue promoting this awareness through conducting advertising campaigns, training and educating physicians, publishing additional clinical data demonstrating the benefits of our devices and exhibiting at tradeshows. |

7

Table of Contents

| • | Advance our platform of innovative products for additional chronic sinusitis patients. We believe improving treatment options for chronic sinusitis patients across the continuum of care holds tremendous market opportunity, and has significant potential to reduce healthcare costs. We are developing additional products, RESOLVE and NOVA, using our drug releasing bioabsorbable implant technology that are designed to treat and manage patients with chronic sinusitis across the continuum of care from primary patients who have not undergone sinus surgery procedures to revision patients who would otherwise be candidates for repeat FESS procedures. These products are currently under clinical evaluation in the United States. We are also working to expand indications for our PROPEL implants to allow for the treatment of the dependent sinuses. |

| • | Facilitate access to our products via third-party reimbursement. Our currently approved products are commonly treated as general supplies utilized in sinus surgery and, if covered by third-party payors, are paid for as part of the FESS procedure. In addition, we are working to ensure patients and physicians have access to our technologies across the continuum of care from the operating room to the office setting. This means pursuing coding in all settings as well as working with payors to establish medical policies supporting the clinical and economic value of these products, in order to facilitate access to our drug releasing implants as we expand our commercialization efforts in the United States. |

| • | Introduce our steroid releasing implants in markets outside the United States. While our current commercial focus is the U.S. market, we plan to initiate efforts that will allow for future expansion into international geographies. To that end, in July 2014, we received authorization to affix the CE mark for PROPEL and PROPEL mini which enables market access in Europe. Based on the number of sinus surgeries in Europe and the Asia-Pacific region, we estimate the annual total addressable market for PROPEL and PROPEL mini in these regions to be greater than $1.0 billion. We plan to leverage our FDA-approved products and clinical data to access these markets, starting first with the development of clinical, regulatory and reimbursement strategies for countries in Europe and the Asia-Pacific region. |

Risks Related to Our Business

Our ability to successfully operate our business is subject to numerous risks, including those that are generally associated with operating in the medical device industry. Any of the factors set forth under the heading “Risk Factors” may limit our ability to successfully execute our business strategy. You should carefully consider all of the information set forth or incorporated by reference in this prospectus and, in particular, you should evaluate the specific factors set forth under the heading “Risk Factors” in deciding whether to invest in our common stock. Some of the principal risks relating to our business and our ability to execute our business strategy include:

| • | We have incurred significant operating losses since inception and may not be able to achieve profitability. |

| • | All of our revenue is generated from a limited number of products and we are completely dependent on the success of our PROPEL and PROPEL mini steroid releasing implants, which have a limited commercial history. If these products fail to gain widespread market acceptance, our business will suffer. |

| • | The establishment of adequate coverage and reimbursement is important for sales of our products. Coverage and reimbursement policies for procedures using our steroid releasing implants could affect the adoption of our products, particularly our product candidates for the physician office setting as well as our efforts to commercialize our products in markets outside the United States. |

| • | Pricing pressure from our hospital and ambulatory surgery center customers due to limited coverage and reimbursement for our products may impact our ability to sell our products at prices necessary to support our current business strategies. |

| • | We may never obtain regulatory approval for future products or products outside the United States. |

| • | If we are unable to protect our intellectual property, or operate our business without infringing on the intellectual property rights of third parties, our business will be negatively affected. |

8

Table of Contents

Corporate Information

We were incorporated in Delaware in October 2003 as Sinexus, Inc. We changed our name to Intersect ENT, Inc. in November 2009. Our offices are located at 1555 Adams Drive, Menlo Park, California 94025. Our telephone number is (650) 641-2100. Our corporate website is at www.intersectent.com. The information contained on or that can be accessed through our website is not incorporated by reference into this prospectus, and you should not consider information on our website to be part of this prospectus or in deciding to purchase our common stock.

Implications of Being an Emerging Growth Company

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies. These include, but are not limited to, (1) reduced obligations with respect to the disclosure of selected financial data in registration statements filed with the Securities and Exchange Commission, or the SEC, including the registration statement on Form S-1 of which this prospectus is a part, (2) reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, (3) an exception from compliance with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, and (4) exemptions from the requirements of holding a non-binding advisory vote on executive compensation and the requirement to obtain stockholder approval of any golden parachute payments not previously approved.

We may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1.0 billion in annual revenue, we have more than $700 million in market value of our stock held by non-affiliates or we issue more than $1.0 billion of non-convertible debt over a three-year period. We may choose to take advantage of some, but not all, of the available exemptions. We have taken advantage of certain reduced reporting burdens in this prospectus and in the documents incorporated by reference in this prospectus. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

In addition, Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, or Securities Act, for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have taken advantage of such extended transition period, and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for private companies. Section 107 of the JOBS Act provides that we can elect to opt out of the extended transition period at any time, which election is irrevocable.

9

Table of Contents

The Offering

| Issuer |

Intersect ENT, Inc. |

| Common stock offered by us |

3,000,000 shares |

| Common stock outstanding immediately after this offering |

26,632,973 shares (or 27,082,973 shares if the underwriters exercise in full their option to purchase additional shares) |

| Underwriters’ option to purchase additional shares |

450,000 shares |

| Use of proceeds |

We intend to use the net proceeds from this offering for general corporate purposes. See “Use of Proceeds” on page 19 for a more complete description of the intended use of proceeds from this offering. |

| Risk factors |

See “Risk Factors” beginning on page 13 and other information included in or incorporated by reference in this prospectus for a discussion of factors that you should consider carefully before deciding to invest in our common stock. |

| NASDAQ Global Market Symbol |

“XENT” |

The number of shares of common stock to be outstanding after this offering is based on 23,632,973 shares of common stock outstanding as of March 31, 2015, and excludes the following:

| • | 3,126,286 shares of common stock issuable upon the exercise of outstanding options as of March 31, 2015, having a weighted average exercise price of $10.00 per share; |

| • | 4,238,849 shares of common stock reserved for future issuance under our 2014 Equity Incentive Plan, as well as any automatic increases in the number of shares of common stock reserved for future issuance under this plan; and |

| • | 496,092 shares of common stock reserved for future issuance under our 2014 Employee Stock Purchase Plan. |

Unless otherwise indicated, all information in this prospectus assumes:

| • | no exercise of options outstanding as of March 31, 2015; and |

| • | no exercise of the underwriters’ option to purchase additional shares from us. |

10

Table of Contents

Summary Financial Data

The following tables summarize our financial data and should be read together with the section in our Annual Report on Form 10-K for the year ended December 31, 2014, or Annual Report, and Quarterly Report on Form 10-Q for the three months ended March 31, 2015, or Quarterly Report, titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes, all of which are incorporated by reference in this prospectus.

The statements of operations data for the years ended December 31, 2014 and 2013 are derived from our audited financial statements included in our Annual Report. The statements of operations data for the three months ended March 31, 2015 and 2014, and the balance sheet data as of March 31, 2015, are derived from our unaudited interim financial statements included in our Quarterly Report. We have prepared the unaudited interim financial statements on the same basis as the audited financial statements and have included, in our opinion, all adjustments, consisting only of normal recurring adjustments that we consider necessary for a fair presentation of the financial information set forth in those statements. Our historical results are not necessarily indicative of our future results and are not necessarily indicative of results to be expected for the full year ending December 31, 2015, or any other period.

| Fiscal Years Ended December 31, |

Three Months Ended March 31, |

|||||||||||||||

| 2014 | 2013 | 2015 | 2014 | |||||||||||||

| (in thousands, except per share data) |

(unaudited) | |||||||||||||||

| Statements of operations data: |

||||||||||||||||

| Revenue |

$ | 38,587 | $ | 17,931 | $ | 13,372 | $ | 7,497 | ||||||||

| Cost of sales |

10,223 | 8,150 | 2,792 | 2,360 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

28,364 | 9,781 | 10,580 | 5,137 | ||||||||||||

| Gross margin |

74 | % | 55 | % | 79 | % | 69 | % | ||||||||

| Operating expenses: |

||||||||||||||||

| Selling, general and administrative |

36,111 | 18,229 | 12,620 | 6,658 | ||||||||||||

| Research and development |

10,331 | 9,518 | 3,326 | 2,577 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

46,442 | 27,747 | 15,946 | 9,235 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(18,078 | ) | (17,966 | ) | (5,366 | ) | (4,098 | ) | ||||||||

| Interest and other income (expense), net |

(284 | ) | (403 | ) | 28 | (311 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

$ | (18,362 | ) | $ | (18,369 | ) | $ | (5,338 | ) | $ | (4,409 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss per share, basic and diluted(1) |

$ | (1.61 | ) | $ | (12.57 | ) | $ | (0.23 | ) | $ | (2.49 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average common shares used to compute net loss per share, basic and diluted(1) |

11,384 | 1,461 | 23,488 | 1,773 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | Reflects the conversion of all outstanding shares of convertible preferred stock into common stock, on a one-for-one basis, immediately prior to the closing of our initial public offering in July 2014. |

11

Table of Contents

| December 31, 2014 |

March 31, 2015 | |||||||||

| (in thousands) |

(actual) | (as adjusted)(1)(2) | ||||||||

| (unaudited) | ||||||||||

| Balance sheet data: |

||||||||||

| Cash, cash equivalents and short-term investments |

$ | 48,443 | $ | 42,906 | ||||||

| Working capital |

52,167 | 47,852 | ||||||||

| Total assets |

62,953 | 57,926 | ||||||||

| Total liabilities |

9,141 | 8,244 | ||||||||

| Accumulated deficit |

(96,621 | ) | (101,959 | ) | ||||||

| Total stockholders’ equity |

53,812 | 49,682 | ||||||||

| (1) | Reflects the sale by us of 3,000,000 shares of common stock in this offering, at the assumed public offering price of $ per share, the last reported sale price of our common stock on The NASDAQ Global Market on , 2015, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. |

| (2) | A $1.00 increase (decrease) in the assumed public offering price of $ per share, the last reported sale price of our common stock on The NASDAQ Global Market on , 2015, would increase (decrease) each of as adjusted cash and cash equivalents, working capital, total assets and total stockholders’ equity by $ million, assuming the number of shares we are offering, as set forth on the cover page of this prospectus, remains the same, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We may also increase or decrease the number of shares we are offering. An increase (decrease) of 500,000 in the number of shares we are offering would increase (decrease) each of as adjusted cash and cash equivalents, working capital, total assets and total stockholders’ equity by approximately $ million, assuming the assumed public offering price per share remains the same. The as adjusted information is illustrative only, and we will adjust this information based on the actual public offering price, number of shares offered and other terms of this offering determined at pricing. |

12

Table of Contents

Investing in our common stock involves a high degree of risk. Before deciding whether to invest in shares of our common stock, you should carefully consider the risks described in the section entitled “Risk Factors” included in our Quarterly Report on Form 10-Q for the three months ended March 31, 2015, filed with the Securities and Exchange Commission, or SEC, on May 11, 2015, which is incorporated by reference in its entirety, as well as any amendment or update thereto reflected in our subsequent filings with the SEC. You should consider carefully the risk factors discussed therein and below, and all other information contained in or incorporated by reference in this report before making an investment decision. If any of the risks discussed in this report actually occur, they may materially harm our business, financial condition, operating results, cash flows or growth prospects. As a result, the market price of our common stock could decline, and you could lose all or part of your investment. Additional risks and uncertainties that are not yet identified or that we think are immaterial may also materially harm our business, financial condition, operating results, cash flows or growth prospects and could result in a complete loss of your investment. You should also carefully consider the following risk factors related to this offering:

We expect that the price of our common stock will fluctuate substantially and you may not be able to sell the shares you purchase in this offering at or above the offering price.

The offering price for the shares of our common stock sold in this offering will be determined by negotiation between the representatives of the underwriters and us. This price may not reflect the market price of our common stock following this offering. In addition, the market price of our common stock has been, and is likely to continue to be, highly volatile. From our IPO in July 2014 through May 19, 2015, the price of our common stock has fluctuated from a low of $12.02 to a high of $28.80. The price of our common stock may continue to fluctuate substantially due to many factors, including:

| • | volume and timing of sales of our steroid releasing implants; |

| • | the introduction of new products or product enhancements by us or others in our industry; |

| • | disputes or other developments with respect to our or others’ intellectual property rights; |

| • | our ability to develop, obtain regulatory clearance or approval for, and market new and enhanced products on a timely basis; |

| • | product liability claims or other litigation; |

| • | quarterly variations in our results of operations or those of others in our industry; |

| • | sales of large blocks of our common stock, including sales by our executive officers and directors; |

| • | media exposure of our steroid releasing implants or products of others in our industry; |

| • | changes in governmental regulations or in the status of our regulatory approvals or applications; |

| • | changes in earnings estimates or recommendations by securities analysts; and |

| • | general market conditions and other factors, including factors unrelated to our operating performance or the operating performance of our competitors. |

In recent years, the stock markets generally have experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of those companies. Broad market and industry factors may significantly affect the market price of our common stock, regardless of our actual operating performance. These fluctuations may be even more pronounced in the trading market for our common stock shortly following this offering. If the market price of shares of our common stock after this offering does not ever exceed the offering price, you may not realize any return on your investment in us and may lose some or all of your investment.

In addition, in the past, class action litigation has often been instituted against companies whose securities have experienced periods of volatility in market price. Securities litigation brought against us following volatility in our stock price, regardless of the merit or ultimate results of such litigation, could result in substantial costs, which would hurt our financial condition and operating results and divert management’s attention and resources from our business.

13

Table of Contents

These and other factors may make the price of our stock volatile and subject to unexpected fluctuation.

If you purchase our common stock in this offering, you will incur immediate and substantial dilution in the book value of your shares.

Investors purchasing common stock in this offering will pay a price per share that substantially exceeds our as adjusted net tangible book value per share. As a result, investors purchasing common stock in this offering will incur immediate dilution of $ per share, representing the difference between the assumed public offering price of $ per share, the last reported price of our common stock on The NASDAQ Global Market on , 2015, and our as adjusted net tangible book value per share as of March 31, 2015. Furthermore, if outstanding options are exercised, you could experience additional dilution. For more information on the dilution you may suffer as a result of investing in this offering, see the section entitled “Dilution.”

If we sell shares of our common stock in future financings, stockholders may experience immediate dilution and, as a result, our stock price may decline.

We may from time to time issue additional shares of common stock at a discount from the current trading price of our common stock. As a result, our stockholders would experience immediate dilution upon the sale of any shares of our common stock at such discount. In addition, as opportunities present themselves, we may enter into financing or similar arrangements in the future, including the issuance of debt securities, preferred stock or common stock. If we issue common stock or securities convertible into common stock, our common stockholders would experience additional dilution and, as a result, our stock price may decline.

A significant portion of our total outstanding shares are restricted from immediate resale but may be sold into the market in the near future. This could cause the market price of our common stock to drop significantly, even if our business is doing well.

Sales of a substantial number of shares of our common stock in the public market could occur at any time. These sales, or the perception in the market that the holders of a large number of shares intend to sell their shares, could result in a decrease in the market price of our common stock. Immediately after this offering, we will have 26,632,973 shares of common stock outstanding based on the shares outstanding as of March 31, 2015. This includes the shares that we are selling in this offering, which may be resold in the public market immediately without restriction, unless purchased by our affiliates. Of the remaining shares, shares are restricted as a result of lock-up agreements but will be able to be sold 60 days after this offering. Moreover, holders of a significant number of shares of our common stock have rights, subject to some conditions, to require us to file registration statements covering their shares or to include their shares in registration statements that we may file for ourselves or other stockholders as described in the section of this prospectus entitled “Description of Capital Stock—Registration Rights.” We have also registered all shares of common stock that we may issue under our equity compensation plans. These shares can be freely sold in the public market upon issuance, subject to volume limitations applicable to affiliates and the lock-up agreements described in the “Underwriting” section of this prospectus.

Our directors, officers and principal stockholders have significant voting power and may take actions that may not be in the best interests of our other stockholders.

After this offering and based on shares outstanding as of March 31, 2015, our officers, directors and principal stockholders each holding more than 5% of our common stock, collectively, will control approximately 39.0% of our outstanding common stock. As a result, these stockholders, if they act together, will be able to significantly influence the management and affairs of our company and most matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions. This concentration of ownership may have the effect of delaying or preventing a change of control and might adversely affect the market price of our common stock. This concentration of ownership may not be in the best interests of our other stockholders.

14

Table of Contents

We have broad discretion in the use of proceeds of this offering for working capital and general corporate purposes.

The net proceeds of this offering may be used for general corporate purposes, which may include clinical trial and research and development expenditures, working capital, international expansion and other commercial expenditures, acquisition of new technologies or businesses and investments. Within those categories, we have not determined the specific allocation of the net proceeds of this offering. Our management will have broad discretion over the use and investment of the net proceeds of this offering within those categories. Accordingly, investors in this offering have only limited information concerning management’s specific intentions and will need to rely upon the judgment of our management with respect to the use of proceeds.

We are an “emerging growth company” and we cannot be certain if the reduced disclosure requirements applicable to “emerging growth companies” will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and we may take advantage of certain exemptions and relief from various reporting requirements that are applicable to other public companies that are not “emerging growth companies.” In particular, while we are an “emerging growth company” (1) we will not be required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act, (2) we will be exempt from any rules that may be adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotations or a supplement to the auditor’s report on financial statements, (3) we will be subject to reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and (4) we will not be required to hold nonbinding advisory votes on executive compensation or stockholder approval of any golden parachute payments not previously approved. Investors may find our common stock less attractive if we rely on the exemptions and relief granted by the JOBS Act. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may decline or become more volatile.

Provisions in our corporate charter documents and under Delaware law could make an acquisition of us more difficult and may prevent attempts by our stockholders to replace or remove our current management.

Provisions in our amended and restated certificate of incorporation and our amended and restated bylaws may discourage, delay or prevent a merger, acquisition or other change in control of us that stockholders may consider favorable, including transactions in which stockholders might otherwise receive a premium for their shares. These provisions could also limit the price that investors might be willing to pay in the future for shares of our common stock, thereby depressing the market price of our common stock. In addition, these provisions may frustrate or prevent any attempts by our stockholders to replace or remove our current management by making it more difficult for stockholders to replace members of our board of directors. Because our board of directors is responsible for appointing the members of our management team, these provisions could in turn affect any attempt by our stockholders to replace current members of our management team. Among others, these provisions include that:

| • | our board of directors has the right to expand the size of our board of directors and to elect directors to fill a vacancy created by the expansion of the board of directors or the resignation, death or removal of a director, which prevents stockholders from being able to fill vacancies on our board of directors; |

| • | our stockholders may not act by written consent or call special stockholders’ meetings; as a result, a holder, or holders, controlling a majority of our capital stock would not be able to take certain actions other than at annual stockholders’ meetings or special stockholders’ meetings called by the board of directors, the chairman of the board, the chief executive officer or the president; |

| • | our certificate of incorporation prohibits cumulative voting in the election of directors, which limits the ability of minority stockholders to elect director candidates; |

| • | the affirmative vote of holders of at least 66-2/3% of the voting power of all of the then outstanding shares of voting stock, voting as a single class, will be required (a) to amend certain provisions of our certificate of incorporation, including provisions relating to the size of the board, removal of directors, |

15

Table of Contents

| special meetings, actions by written consent and cumulative voting and (b) to amend or repeal our bylaws, although our bylaws may be amended by a simple majority vote of our board of directors; |

| • | stockholders must provide advance notice and additional disclosures in order to nominate individuals for election to the board of directors or to propose matters that can be acted upon at a stockholders’ meeting, which may discourage or deter a potential acquiror from conducting a solicitation of proxies to elect the acquiror’s own slate of directors or otherwise attempting to obtain control of our company; and |

| • | our board of directors may issue, without stockholder approval, shares of undesignated preferred stock; the ability to issue undesignated preferred stock makes it possible for our board of directors to issue preferred stock with voting or other rights or preferences that could impede the success of any attempt to acquire us. |

Moreover, because we are incorporated in Delaware, we are governed by the provisions of Section 203 of the Delaware General Corporation Law, which prohibits a person who owns in excess of 15% of our outstanding voting stock from merging or combining with us for a period of three years after the date of the transaction in which the person acquired in excess of 15% of our outstanding voting stock, unless the merger or combination is approved in a prescribed manner.

16

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference in this prospectus contain forward-looking statements concerning our business, operations and financial performance and condition, as well as our plans, objectives and expectations for our business operations and financial performance and condition. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “predict,” “potential,” “positioned,” “seek,” “should,” “target,” “will,” “would,” and other similar expressions that are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. These forward-looking statements include, but are not limited to, statements about:

| • | estimates of our future revenue, expenses, capital requirements and our needs for additional financing; |

| • | our ability to obtain additional financing in this or future offerings; |

| • | the implementation of our business model and strategic plans for our products, technologies and businesses; |

| • | our future clinical results; |

| • | competitive companies and technologies and our industry; |

| • | our ability to manage and grow our business by expanding our sales to existing customers or introducing our products to new customers; |

| • | our ability to establish and maintain intellectual property protection for our products or avoid claims of infringement; |

| • | extensive government regulation; |

| • | the timing or likelihood of regulatory filings and approvals; |

| • | our ability to hire and retain key personnel; |

| • | our financial performance; |

| • | the volatility of our share price; and |

| • | our expectations regarding use of proceeds from this offering. |

Forward-looking statements are based on management’s current expectations, estimates, forecasts, and projections about our business and the industry in which we operate, and management’s beliefs and assumptions and are not guarantees of future performance or development and involve known and unknown risks, uncertainties, and other factors that are in some cases beyond our control. As a result, any or all of our forward-looking statements in this prospectus or incorporated by reference in this prospectus may turn out to be inaccurate. Furthermore, if the forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under “Risk Factors” and elsewhere in or incorporated by reference in this prospectus. Potential investors are urged to consider these factors carefully in evaluating the forward-looking statements. These forward-looking statements speak only as of the date of this prospectus. Except as required by law, we assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future. You should, however, review the factors and risks we describe in the reports we will file from time to time with the SEC after the date of this prospectus.

17

Table of Contents

MARKET, INDUSTRY AND OTHER DATA

This prospectus and the documents incorporated by reference in this prospectus contain estimates, projections and other information concerning our industry, our business, and the markets for our products and product candidates, including data regarding the estimated size of those markets, their projected growth rates, the perceptions and preferences of patients and physicians regarding certain therapies and other prescription, prescriber and patient data, as well as data regarding market research, estimates and forecasts prepared by our management. We obtained the industry, market and other data throughout this prospectus and the documents incorporated by reference in this prospectus from our own internal estimates and research, as well as from industry publications and research, surveys and studies conducted by third parties.

Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. In some cases, we do not expressly refer to the sources from which this data is derived.

18

Table of Contents

We estimate that the net proceeds from this offering of 3,000,000 shares of common stock will be approximately $ million, or $ million if the underwriters exercise their option to purchase additional shares in full, assuming a public offering price of $ per share, the last reported sale price of our common stock on The NASDAQ Global Market on , 2015, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us.

A $1.00 increase (decrease) in the assumed public offering price of $ per share would increase (decrease) the net proceeds from this offering by approximately $ million, assuming that the number of shares we are offering, as set forth on the cover page of this prospectus, remains the same, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We may also increase or decrease the number of shares we are offering. Each increase (decrease) of 500,000 shares in the number of shares we are offering would increase (decrease) the net proceeds to us from this offering by approximately $ million, assuming that the assumed public offering price remains the same, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

We intend to use the net proceeds from this offering for general corporate purposes, which may include clinical trial and research and development expenditures, working capital, international expansion and other commercial expenditures, acquisition of new technologies or businesses and investments. The amount and timing of our actual expenditures will depend upon numerous factors, including the results of our research and development efforts, the timing and success of our ongoing clinical studies or clinical studies we may commence in the future and the timing of regulatory submissions. As a result, our management will have broad discretion over the use of the net proceeds to us from this offering.

Pending the use of the proceeds to us from this offering, we intend to invest these proceeds in interest-bearing, investment-grade securities, certificates of deposit, or government securities.

19

Table of Contents

PRICE RANGE OF OUR COMMON STOCK

Shares of our common stock have been traded on The NASDAQ Global Market, or NASDAQ, under the symbol “XENT” since our IPO on July 24, 2014. The following table sets forth, for the periods indicated, the high and low intraday prices per share of our common stock as reported by NASDAQ.

| High | Low | |||||||

| Fiscal Year Ending December 31, 2015 |

||||||||

| First quarter |

$ | 28.80 | $ | 18.10 | ||||

| Second quarter (through May 19, 2015) |

$ | 27.20 | $ | 22.88 | ||||

| Fiscal Year Ended December 31, 2014 |

||||||||

| Third quarter (beginning July 24, 2014) |

$ | 18.30 | $ | 12.02 | ||||

| Fourth quarter |

21.39 | 15.05 | ||||||

On May , 2015, the last sale price of our common stock as reported on NASDAQ was $ per share. As of May , 2015, there were approximately holders of record of our common stock. Because many of our shares are held by brokers and other institutions on behalf of stockholders, we are unable to estimate the total number of stockholders represented by these recordholders.

20

Table of Contents

We have never declared or paid any cash dividends on our capital stock, and we do not currently intend to pay any cash dividends on our capital stock in the foreseeable future. We currently intend to retain all available funds and any future earnings to support operations and to finance the growth and development of our business. Any future determination to pay dividends will be made at the discretion of our board of directors subject to applicable laws, and will depend upon, among other factors, our results of operations, financial condition, contractual restrictions and capital requirements. Our future ability to pay cash dividends on our capital stock may also be limited by the terms of any future debt or preferred securities or future credit facility.

21

Table of Contents

The following table sets forth our cash, cash equivalents and short-term investments and our capitalization as of March 31, 2015:

| • | on an actual basis; |

| • | on an as adjusted basis to give effect to the issuance and sale of 3,000,000 shares of common stock in this offering at an assumed public offering price of $ per share, the last reported sale price of our common stock on The NASDAQ Global Market on , 2015, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. |

You should read this information together with our financial statements and related notes incorporated by reference in this prospectus and the information set forth under the headings and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report and our Quarterly Report incorporated by reference in this prospectus.

| March 31, 2015 | ||||||||

| Actual | As Adjusted(1) | |||||||

| (in thousands, except share and per share data) |

(unaudited) | |||||||

| Cash, cash equivalents and short-term investments |

$ | 42,906 | ||||||

| Stockholders’ equity: |

||||||||

| Preferred stock, $0.001 par value, |

||||||||

| Authorized shares: 10,000,000 actual and as adjusted |

||||||||

| Issued and outstanding shares: none actual and as adjusted |

— | — | ||||||

| Common stock, $0.001 par value; |

||||||||

| Authorized shares: 150,000,000 actual and as adjusted |

||||||||

| Issued and outstanding shares: 23,632,973 actual and 26,632,973 as adjusted |

24 | |||||||

| Additional paid-in capital |

151,617 | |||||||

| Accumulated deficit |

(101,959 | ) | (101,959 | ) | ||||

|

|

|

|

|

|||||

| Total stockholders’ equity |

49,682 | |||||||

|

|

|

|

|

|||||

| Total capitalization |