Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended March 31, 2015

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period From ____to _____

Commission File Number: 000-22373

CHINA FRUITS CORP.

(Exact name of small business issuer as specified in its charter)

| Nevada | 90-0315096 |

| (State or other jurisdiction of | (IRS Employer Identification No.) |

| incorporation or organization) |

Bldg. 3 Sec. 7, 188 Nan Si Huan Xi Rd.

Fengtai Dist. Beijing, P. R. China

(Address of principal executive offices)

+86 (10) 6792-8610

(Issuer's telephone number)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [x]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act

Yes [ ] No [x]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [x] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files).

Yes [x] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 if Regulation S-K (229.405 of this Chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy of information statements incorporated by reference in Part III of this Form 10-Q or any amendments to this Form 10-Q.

Yes [ ] No [x]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ |

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) |

| Accelerated filer | ☐ |

| Smaller reporting company | ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in rule 12b-2 of the exchange act).

Yes [ ] No [x]

Number of shares of common stock, par value $.001, outstanding as of May 18, 2015: 2,140,702

Number of shares of preferred stock outstanding as of May 18, 2015:

Series A, par value $.001 - 13,150

Series B, par value $.001 - 12,100,000

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING INFORMATION

The discussion contained in this 10-Q under the Securities Exchange Act of 1934, as amended, contains forward-looking statements that involve risks and uncertainties. The issuer's actual results could differ significantly from those discussed herein. These include statements about our expectations, beliefs, intentions or strategies for the future, which we indicate by words or phrases such as "anticipate," "expect," "intend," "plan," "will," "we believe," "the Company believes," "management believes" and similar language, including those set forth in the discussions under "Notes to Consolidated Financial Statements" and "Management's Discussion and Analysis or Plan of Operation" as well as those discussed elsewhere in this Form 10-Q. We base our forward-looking statements on information currently available to us, and we assume no obligation to update them. Statements contained in this Form 10-Q that are not historical facts are forward-looking statements that are subject to the "safe harbor" created by the Private Securities Litigation Reform Act of 1995.

| (1) |

| (2) |

China Fruits Corp.

Consolidated Financial Statements

March 31, 2015 and December 31, 2014

(Stated in US Dollars)

| (3) |

China Fruits Corp.

| Content | Page |

| Report of Independent Registered Public Accounting Firm | 5 |

| Consolidated Balance Sheets | 6 |

| Consolidated Statements of Income | 7 |

| Consolidated Statements of Stockholders’ Equity | 8 |

| Consolidated Statements of Cash Flows | 9 |

| Notes to Consolidated Financial Statements | 10 - 19 |

| (4) |

To: The Board of Directors and Stockholders of

China Fruits Corp.

Report of Independent Registered Public Accounting Firm

We have reviewed the accompanying consolidated balance sheets of China Fruits Corporation as of March 31, 2015 and December 31, 2014, and the related consolidated statements of income, stockholders' equity, and cash flows for the three months periods ended March 31, 2015 and 2014. These financial statements are the responsibility of the Company's management.

We conducted our review in accordance with the standards of the Public Company Accounting Oversight Board (United States). A review of interim financial statements consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with the standards of the Public Company Accounting Oversight Board, the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, we do not express such an opinion.

Based on our review, we are not aware of any material modifications that should be made to the accompanying consolidated interim financial statements for them to be in conformity with U.S. generally accepted accounting principles.

We have previously audited, in accordance with auditing standards of the Public Company Accounting Oversight Board (United States), the balance sheets of China Fruits Corporation as of December 31, 2014, and the related statements of income, comprehensive income, retained earnings, and cash flows for the year then ended and in our report dated May 20, 2015, expressed an unqualified opinion on those financial statements. In our opinion, the information set forth in the accompanying condensed balance sheet as of December 31, 2014, is fairly stated, in all material respects, in relation to the balance sheet from which it has been derived.

| San Mateo, California | WWC, P.C. |

| May 20, 2015 | Certified Public Accountants |

|

| (5) |

China Fruits Corporation

Consolidated Balance Sheets

As of March 31, 2015 and December 31, 2014

Unaudited

(Stated in US Dollars)

| 3/31/2015 | Audited 12/31/2014 | |||||||||||

| ASSETS | ||||||||||||

| Current Assets | Notes | |||||||||||

| Cash & Cash Equivalents | $ | 37,080 | $ | 801,356 | ||||||||

| Accounts Receivable, Net | 3 | 34,757,522 | 41,433,191 | |||||||||

| Other Receivable, Net | 4 | 757,612 | 585,520 | |||||||||

| Advance to Supplies | 5 | 4,112,748 | 5,857,017 | |||||||||

| Inventories | 6 | 3,134,891 | 1,859,173 | |||||||||

| Prepaid Expense | 7 | 142,739 | 89,558 | |||||||||

| Refundable Tax | 2,347,120 | 1,779,485 | ||||||||||

| Due From The Related Party | 8 | — | 1,114,279 | |||||||||

| TOTAL CURRENT ASSETS | 45,289,712 | 53,519,579 | ||||||||||

| Noncurrent Assets | ||||||||||||

| Investment | 9 | 163,690 | 162,906 | |||||||||

| Property, Plant & Equipment, Net | 10 | 3,668,320 | 3,366,085 | |||||||||

| Construction in Progress | 3,044 | 356,793 | ||||||||||

| Intangible Assets, Net | 11 | 301,063 | 307,614 | |||||||||

| Other Long-term Asset Deposit | 55,592 | 55,326 | ||||||||||

| Long-term amortization | 280 | 1,115 | ||||||||||

| TOTAL NON-CURRENT ASSETS | 4,191,989 | 4,249,839 | ||||||||||

| TOTAL ASSETS | $ | 49,481,701 | $ | 57,769,418 | ||||||||

| LIABILITIES & STOCKHOLDERS' EQUITY | ||||||||||||

| CURRENT LIABILITIES | ||||||||||||

| Accounts payable and accrued expenses | $ | 33,854,910 | $ | 40,583,792 | ||||||||

| Short-term loans | 12 | 2,807,287 | 4,936,059 | |||||||||

| Customer deposit | 13 | 757,457 | 767,396 | |||||||||

| Taxes payable | 1,783,383 | 1,360,123 | ||||||||||

| Other payables | 1,647,621 | 841,156 | ||||||||||

| Due to related parties | 14 | 2,178,390 | 1,941,527 | |||||||||

| Accrued liabilities and payroll tax liabilities | 362,837 | 1,262,399 | ||||||||||

| Long-term bank loan, current portion | 15 | 379,761 | 377,942 | |||||||||

| TOTAL CURRENT LIABILITIES | 43,771,646 | 52,070,394 | ||||||||||

| LONG-TERM LIABILITIES | ||||||||||||

| Long term bank loan | 15 | 756,249 | 342,103 | |||||||||

| TOTAL LONG TERM LIABILITIES | 756,249 | 342,103 | ||||||||||

| TOTAL LIABILITIES | $ | 44,527,895 | $ | 52,412,497 |

| 3/31/2015 | Audited

12/31/2014 | ||||||

| STOCKHOLDERS' EQUITY | |||||||

| Common stock, par value

$.001, 100,000,000 shares authorized, 2,089,016 and 1,998,049 shares issued

and outstanding as of March 31, 2015 and December 31, 2014, respectively |

$ | 2,089 | $ | 1,998 | |||

| Preferred

stock, 200,000,000 shares authorized, designated as Series A and Series B. Series A: par value $.001; 2,000,000 shares authorized, 13,150 shares issued and outstanding as of March 31, 2015 and December 31, 2014, respectively |

13 | 13 | |||||

| Series B; par value $0.001,

voting; 50,000,000 shares authorized, 12,100,000 shares issued and outstanding as of March 31, 2015 and December 31, 2014,

respectively |

12,100 | 12,100 | |||||

| Additional paid in capital | 4,208,272 | 3,837,817 | |||||

| Statutory reserve | 170,950 | 170,950 | |||||

| Retained earnings | 71,078 | 873,924 | |||||

| Accumulated other comprehensive income | 489,304 | 460,119 | |||||

| TOTAL STOCKHOLDERS’ EQUITY | 4,953,806 | 5,356,921 | |||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 49,481,701 | $ | 57,769,418 | |||

| (6) |

China Fruits Corporation

Consolidated Statements of Income

For the three months ended March 31, 2015 and 2014

Unaudited

(Stated in US Dollars)

| Three Months Ended | ||||||||||||||||||||||

| REVENUES: | Note | 3/31/2015 | 3/31/2014 | |||||||||||||||||||

| Sales | 2 | (d) | $ | 5,850,335 | $ | 8,015,860 | ||||||||||||||||

| Cost of goods sold | 2 | (e) | (5,293,100 | ) | (7,098,744) | |||||||||||||||||

| GROSS PROFIT | 557,235 | 917,116 | ||||||||||||||||||||

| OPERATING EXPENSES: | ||||||||||||||||||||||

| Selling expenses | 642,945 | 596,470 | ||||||||||||||||||||

| General and administrative expenses | 742,910 | 327,710 | ||||||||||||||||||||

| TOTAL OPERATING EXPENSES | 1,385,855 | 924,180 | ||||||||||||||||||||

| INCOME (LOSS) FROM CONTINUING OPERATIONS | (828,620 | ) | (7,064) | |||||||||||||||||||

| OTHER INCOME (EXPENSE): | ||||||||||||||||||||||

| Other income | — | 14,308 | ||||||||||||||||||||

| Other expense | (1,710 | ) | — | |||||||||||||||||||

| Interest income | 62 | 60 | ||||||||||||||||||||

| Interest expense | (85,239) | (51,109) | ||||||||||||||||||||

| Government grants | 155,988 | 239,132 | ||||||||||||||||||||

| TOTAL OTHER INCOME (LOSS) & EXPENSE | 69,101 | 202,391 | ||||||||||||||||||||

| INCOME (LOSS) FROM CONTINUING OPERATIONS BEFORE INCOME TAXES | (759,519) | 195,327 | ||||||||||||||||||||

| Income tax expense | 2 | (k) | 43,327 | 80,615 | ||||||||||||||||||

| NET INCOME (LOSS) | (802,846) | $ | 114,712 | |||||||||||||||||||

| Other compressive income | ||||||||||||||||||||||

| -Foreign currency translation gain (Loss) | 2 | (m) | 29,185 | (31,194) | ||||||||||||||||||

| COMPREHENSIVE INCOME / (LOSS) | (773,661) | 83,518 | ||||||||||||||||||||

| Income/(Loss) per common share: | ||||||||||||||||||||||

| -Basic | (0.39) | 0.06 | ||||||||||||||||||||

| -Fully diluted | (0.15) | 0.06 | ||||||||||||||||||||

| Weighted average number of common shares outstanding: | ||||||||||||||||||||||

| -Basic | 2,065,564 | 1,998,049 | ||||||||||||||||||||

| -Fully diluted | 5,439,447 | 1,998,049 | ||||||||||||||||||||

| (7) |

China Fruits Corporation

Consolidated Statements of Stockholders’ Equity

As of March 31, 2015 and December 31, 2014

Unaudited

(Stated in US Dollars)

| Common Stock (Shares) | Series "A" Preferred (Shares) | Series "B" Preferred (Shares) | Common Stock (Amount) | Series "A" Preferred (Amount) | Series "B" Preferred (Amount) | Additional Paid in Capital | Statutory Reserve | Accumulated Other Comprehensive Income (Loss) | Accumulated Deficit | Total | ||||||||||||||||||||||||||||||||||

| Balance at January 1, 2014 | 1,998,049 | 13,150 | 12,100,000 | $ | 1,998 | $ | 13 | $ | 12,100 | $ | 3,837,817 | $ | 170,950 | $ | 474,419 | $ | (2,003,096 | ) | $ | 2,494,201 | ||||||||||||||||||||||||

| Net income | 2,877,020 | 2,877,020 | ||||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustment | (14,300 | ) | (14,300 | ) | ||||||||||||||||||||||||||||||||||||||||

| Balance at December 31, 2014 | 1,998,049 | 13,150 | 12,100,000 | $ | 1,998 | $ | 13 | $ | 12,100 | $ | 3,837,817 | $ | 170,950 | $ | 460,119 | $ | 873,924 | $ | 5,356,921 | |||||||||||||||||||||||||

| Balance at January 1, 2015 | 1,998,049 | 13,150 | 12,100,000 | $ | 1,998 | $ | 13 | $ | 12,100 | $ | 3,837,817 | $ | 170,950 | $ | 460,119 | $ | 873,924 | $ | 5,356,921 | |||||||||||||||||||||||||

| Net loss | (802,846 | ) | (802,846 | ) | ||||||||||||||||||||||||||||||||||||||||

| Issuance of common shares | 90,967 | 91 | 91 | |||||||||||||||||||||||||||||||||||||||||

| Increased in additional paid in capital | 370,455 | 370,455 | ||||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustment | 29,185 | 29,185 | ||||||||||||||||||||||||||||||||||||||||||

| Balance at March 31, 2015 | 2,089,016 | 13,150 | 12,100,000 | $ | 2,0898 | $ | 13 | $ | 12,100 | $ | 4,208,272 | $ | 170,950 | $ | 489,304 | $ | 71,078 | $ | 4,953,806 | |||||||||||||||||||||||||

(1) Common Stock and Additional Paid-In Capital at January 1, 2014, December 31, 2014, January 1, 2015

and March 31, 2015 have been adjusted retroactively to reflect a 1-for-25 reverse stock split effected April 30, 2015.

| (8) |

China Fruits Corporation

Consolidated Statements of Cash Flows

For the three months ended March 31, 2015 and 2014

Unaudited

(Stated in US Dollars)

| For the three months ended | ||||||||

| 3/31/2015 | 3/31/2014 | |||||||

| Net Income/(loss) | $ | (802,846 | ) | $ | 114,711 | |||

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | ||||||||

| Depreciation and amortization | 87,925 | 59,425 | ||||||

| Bad debt expense | 395,005 | |||||||

| (Increase)/decrease in operating assets: | ||||||||

| Accounts receivable | 6,283,260 | (884,262 | ) | |||||

| Inventories | (1,275,717 | ) | 1,035,267 | |||||

| Other receivable | (172,092 | ) | — | |||||

| Prepaid expenses and other current assets | 1,123,187 | 326,376 | ||||||

| Related party receivable | 1,114,279 | — | ||||||

| Increase/(decrease) in operating activities: | ||||||||

| Accounts payable | (6,728,883 | ) | (2,689,030 | ) | ||||

| Other payables and accrued liabilities | (81,527 | ) | (509,719 | ) | ||||

| Tax payable | 423,259 | 164,677 | ||||||

| Customer deposit | (9,939 | ) | — | |||||

| Net cash (used in) provided by operating activities | $ | 355,911 | $ | (2,382,555 | ) | |||

| Cash Flows from Investing Activities | ||||||||

| (Increase)/decrease in Construction in Progress | $ | 355,466 | $ | — | ||||

| Purchase of property and equipment | (358,977 | ) | (10,225 | ) | ||||

| Net cash provided (used in) by investing activities | $ | (3,511 | ) | $ | (10,225 | ) | ||

| Cash Flows from Financing Activities | ||||||||

| Repayments of short-term loans | $ | (2,152,527 | ) | |||||

| Advanced from related party | 572,916 | 3,699,006 | ||||||

| Repayments of advanced from related party | ||||||||

| Proceeds from notes payable – related party | — | 251,546 | ||||||

| Due to stockholders | 19,420 | — | ||||||

| Proceeds from long-term loan | 412,499 | — | ||||||

| Net cash provided by (used in) Financing Activities | $ | (1,147,692 | ) | $ | 3,950,552 | |||

| Foreign currency translation adjustment | 31,016 | (11,736 | ) | |||||

| Net increase/(decrease) in cash & cash equivalents for the periods | (764,276 | ) | 1,546,036 | |||||

| Cash & cash equivalents: | ||||||||

| Beginning of period | $ | 801,356 | $ | 40,217 | ||||

| End of period | $ | 37,080 | $ | 1,586,253 | ||||

| Supplementary disclosures of cash flows information: | ||||||||

| Interest received | $ | 149 | $ | — | ||||

| Interest paid | $ | 71,147 | $ | 41,091 | ||||

| Income taxes paid | $ | 259,829 | $ | 164 | ||||

| Supplementary disclosure of non-cash financing activity: | ||||||||

| Conversion of debt and accrued interests to equity | $ | 358,978 | $ | — | ||||

| (9) |

| 1. | ORGANIZATION AND PRINCIPAL ACTIVITIES |

China Fruits Corporation (the “Company” or “CHFR”) was incorporated in the State of Delaware on January 6, 1993 as Vaxcel, Inc. On December 19, 2000, CHFR changed its name to eLocity Networks Corporation. On August 6, 2002, CHFR further changed its name to Diversified Financial Resources Corporation. The principal activities of CHFR at that time was seeking and consummating a merger or acquisition opportunity with a business entity. On May 12, 2006, CHFR was re-domiciled to the State of Nevada.

On May 31, 2006, CHFR completed a stock exchange transaction with Jiangxi Taina Guo Ye Yon Xian Gong Si (“Tai Na”). Tai Na was incorporated as a limited liability company in the People’s Republic of China (“PRC”) on October 28, 2005 with its principal place of business in Nanfeng Town, Jiangxi Province, the PRC. Tai Na is principally engaged in manufacturing, trading, and distributing of Nanfeng tangerine, and operating franchise retail stores for fresh fruits through its wholly-owned subsidiary, Tai Na International Fruits (Beijing) Co. Ltd. (“Tai Na Beijing”)

The stock exchange transaction involved two simultaneous transactions:

The majority shareholder of CHFR delivered the 13,150 convertible Series A preferred shares and 12,100,000 non-convertible Series B preferred shares of CHFR to Tai Na’s owners in exchange for total payments of $500,000 in cash and;

CHFR issued to Tai Na’s owners an amount equal to 30,000,000 new investment shares of common stock of CHFR pursuant to Regulation S under the Securities Act of 1933, as amended, in exchange for all of the registered capital of Tai Na.

Upon completion of the exchange, Tai Na and its wholly-owned subsidiary, Tai Na Beijing, became wholly-owned subsidiaries of CHFR and the former owners of Tai Na then owned 99% of the issued and outstanding shares of the Company.

On August 18, 2006, CHFR changed its name to its current name “China Fruits Corporation”.

The stock exchange transaction has been accounted for as a reverse acquisition and recapitalization of the CHFR whereby Tai Na is deemed to be the accounting acquirer (legal acquiree) and CHFR to be the accounting acquiree (legal acquirer). The accompanying consolidated financial statements are in substance those of Tai Na and Tai Na Beijing, with the assets and liabilities, and revenues and expenses, of CHFR being included effective from the date of stock exchange transaction. CHFR is deemed to be a continuation of the business of Tai Na. Accordingly, the accompanying consolidated financial statements include the following:

(1) The balance sheet consists of the net assets of the accounting acquirer at historical cost and the net assets of the accounting acquiree at historical cost;

(2) The financial position, results of operations, and cash flows of the accounting acquirer for all periods presented as if the recapitalization had occurred at the beginning of the earliest period presented and the operations of the accounting acquiree from the date of stock exchange transaction.

On June 16, 2014, CHFR incorporated a subsidiary entity, US-China Fruits Company Limited, in the British Virgin Island.

CHFR, Tai Na, Tai Na Beijing, and US-China Fruits Company Limited are hereinafter referred to as (the “Company”).

| (10) |

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

| (a) | Basis of presentation |

These accompanying consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America.

| (b) | Use of estimates |

In preparing these consolidated financial statements, management makes estimates and assumptions that affect the reported amounts of assets and liabilities in the balance sheets and revenues and expenses during the year reported. Actual results may differ from these estimates.

| (c) | Basis of consolidation |

The consolidated financial statements include the financial statements of the Company and its subsidiaries.

All significant inter-company balances and transactions within the Company and subsidiary have been eliminated upon consolidation.

| (d) | Revenue recognition |

The Company derives revenues from the resale of tangerine and other fresh fruits purchased from third parties, net of value added taxes (“VAT”). The Company is subject to VAT which is levied on the majority of the products of the Company at the rate of 17% on the invoiced value of sales. Output VAT is borne by customers in addition to the invoiced value of sales and input VAT is borne by the Company in addition to the invoiced value of purchases to the extent not refunded for export sales.

In accordance with guidance issued by the FASB, the Company recognizes revenue when persuasive evidence of an arrangement exists, transfer of title has occurred or services have been rendered, the selling price is fixed or determinable and collectability is reasonably assured. The Company’s sales arrangements are not subject to warranty.

The Company recognizes revenue from the sale of products upon delivery to the customers and the transfer of title and risk of loss. The Company did not record any product returns for the quarter ended March 31, 2015.

| (e) | Cost of revenue |

Cost of revenues consists primarily of material costs, direct labor, depreciation, and overheads, which are directly attributable to the manufacture of products and the provision of services.

| (f) | Accounts receivable |

Accounts receivable are recorded at the invoiced amount and do not bear interest. The Company extends unsecured credit to its customers in the ordinary course of business but mitigates the associated risks by performing credit checks and actively pursuing past due accounts. An allowance for doubtful accounts is established and determined based on managements’ assessment of known requirements, aging of receivables, payment history, the customer’s current credit worthiness, and the economic environment.

| (g) | Inventories |

Inventories consist of finished goods and are valued at lower of cost or market value, cost being determined on the first-in, first-out method. The Company periodically reviews historical sales activity to determine excess, slow moving items and potentially obsolete items and also evaluates the impact of any anticipated changes in future demand. The spoilage will be written-off directly to the profit and loss when it occurs.

| (h) | Plant and equipment, net |

Plant and equipment are stated at cost less accumulated depreciation and accumulated impairment losses, if any. Depreciation is calculated on the straight-line basis over the following expected useful lives from the date on which they become fully operational and after taking into account their estimated residual values:

| Depreciable life | Residual value | ||

| Plant and machinery | 10-12 years | 5% | |

| Furniture, fixture and equipment | 5-6 years | 5% |

Expenditure for maintenance and repairs is expensed as incurred.

| (i) | Impairment of long lived assets |

The Company evaluated the recoverability of its property, plant, equipment, and other long-lived assets in accordance with FASB ASC 360, “Property, Plant and Equipment”, which requires recognition of impairment of long-lived assets in the event the net book value of such assets exceed the estimated future undiscounted cash flows attributable to such assets or the business to which such intangible assets relate. No impairments of these types of assets were recognized for the period ended March 31, 2015 and December 31, 2014.

| (11) |

| (j) | Comprehensive income (loss) |

FASB ASC 220, “Reporting Comprehensive Income”, establishes standards for reporting and display of comprehensive income, its components and accumulated balances. Comprehensive income as defined includes all changes in equity during the year from non-owner sources. Accumulated comprehensive income, as presented in the accompanying consolidated statement of stockholders’ equity consists of changes in unrealized gains and losses on foreign currency translation. This comprehensive income is not included in the computation of income tax expense or benefit.

| (k) | Income taxes |

The Company accounts for income tax using FASB ASC 740 “Accounting for Income Taxes”, which requires the asset and liability approach for financial accounting and reporting for income taxes. Under this approach, deferred income taxes are provided for the estimated future tax effects attributable to temporary differences between financial statement carrying amounts of assets and liabilities and their respective tax bases, and for the expected future tax benefits from loss carry-forwards and provisions, if any. Deferred tax assets and liabilities are measured using the enacted tax rates expected in the years of recovery or reversal and the effect from a change in tax rates is recognized in the consolidated statement of operations and comprehensive income in the period of enactment. A valuation allowance is provided to reduce the amount of deferred tax assets if it is considered more likely than not that some portion of, or all of the deferred tax assets will not be realized.

| (l) | Net earnings (loss) per share |

The Company reports earnings (loss) per share in accordance with FASB Accounting Standards Codification 260 “Earnings per Share” (“ASC 260”). This statement requires dual presentation of basic and diluted earnings (loss) with a reconciliation of the numerator and denominator of the earnings (loss) per share computations. Basic earnings per share amounts are based on the weighted average shares of common outstanding. If applicable, diluted earnings per share assume the conversion, exercise or issuance of all common stock instruments such as options, warrants and convertible securities, unless the effect is to reduce a loss or increase earnings per share. Accordingly, this presentation has been adopted for the periods presented. There were no adjustments required to net income for the periods presented in the computation of diluted earnings per share.

| (m) | Foreign currencies translation |

The reporting currency of the Company is the United States dollar (“U.S. dollars”). Transactions denominated in currencies other than U.S. dollar are calculated at the average rate for the period. Monetary assets and liabilities denominated in currencies other than U.S. dollar are translated into U.S. dollar at the rates of exchange ruling at the balance sheet date. The resulting exchange differences are recorded in the other comprehensive income/expenses in the consolidated statement of operations and comprehensive income.

The Company’s subsidiaries maintain their books and records in local currency, the Renminbi Yuan (“RMB”), which is functional currency as being the primary currency of the economic environment in which their operations are conducted. In general, for consolidation purposes, the Company translates the subsidiaries’ assets and liabilities into U.S. dollars using the applicable exchange rates prevailing at the balance sheet date, and the statement of operations is translated at average exchange rates during the reporting period. Adjustments resulting from the translation of the subsidiary’s financial statements are recorded as accumulated other comprehensive income/expenses.

| (n) | Retirement plan costs |

Contributions to retirement schemes (which are defined contribution plans) are charged to general and administrative expenses in the consolidated statements of income and comprehensive income as and when the related employee service is provided.

| (o) | Related parties |

Parties, which can be a corporation or individual, are considered to be related if the Company has the ability, directly or indirectly, to control the other party or exercise significant influence over the other party in making financial and operating decisions. Companies are also considered to be related if they are subject to common control or common significant influence. Material related party transactions have been identified in Note 8 and 14 in the financial statements.

| (p) | Fair value of financial instruments |

The Company follows paragraph 825-10-50-10 of the FASB Accounting Standards Codification (“ASC”) for disclosures about fair value of its financial instruments and paragraph 820-10-35-37 of the FASB ASC (“Paragraph 820-10-35-37”) to measure the fair value of its financial instruments. Paragraph 820-10-35-37 establishes a framework for measuring fair value in U.S. GAAP, and expands disclosures about fair value measurements. To increase consistency and comparability in fair value measurements and related disclosures, Paragraph 820-10-35-37 establishes a fair value hierarchy which prioritizes the inputs to valuation techniques used to measure fair value into three broad levels. The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. The three levels of fair value hierarchy defined by Paragraph 820-10-35-37 are described below:

| Level 1 | Quoted market prices available in active markets for identical assets or liabilities as of the reporting date. |

| Level 2 | Pricing inputs other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable as of the reporting date. |

| Level 3 | Pricing inputs that are generally observable inputs and not corroborated by market data. |

The carrying amounts of the Company’s financial assets and liabilities, such as cash and accounts payable approximate their fair values because of the short maturity of these instruments.

The Company does not have any assets or liabilities measured at fair value on a recurring or a non-recurring basis. Consequently, the Company has neither fair value adjustments for assets and liabilities measured at fair value at March 31, 2015 and December 31, 2014 nor gains or losses are reported in the statement of operations that are attributable to the change in unrealized gains or losses relating to those assets and liabilities still held at the reporting date for the for the period ended March 31, 2015 and December 31, 2014, respectively.

| (q) | Subsequent Events |

The Company evaluated for subsequent events through the issuance date of the Company’s financial statements.

| (r) | Recent Accounting Pronouncements |

In January 2015, The FASB issued ASU No. 2015-01, “Income Statement—Extraordinary and Unusual Items (Subtopic 225-20)”.This Update eliminates from GAAP the concept of extraordinary items. Subtopic 225-20, Income Statement—Extraordinary and Unusual Items, required that an entity separately classify, present, and disclose extraordinary events and transactions. Presently, an event or transaction is presumed to be an ordinary and usual activity of the reporting entity unless evidence clearly supports its classification as an extraordinary item. Paragraph 225-20-45-2 contains the following criteria that must both be met for extraordinary classification:

Unusual nature. The underlying event or transaction should possess a high degree of abnormality and be of a type clearly unrelated to, or only incidentally related to, the ordinary and typical activities of the entity, taking into account the environment in which the entity operates.

Infrequency of occurrence. The underlying event or transaction should be of a type that would not reasonably be expected to recur in the foreseeable future, taking into account the environment in which the entity operates.

If an event or transaction meets the criteria for extraordinary classification, an entity is required to segregate the extraordinary item from the results of ordinary operations and show the item separately in the income statement, net of tax,after income from continuing operations. The entity also is required to disclose applicable income taxes and either present or disclose earnings-per-share data applicable to the extraordinary item.

The amendments in this Update are effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2015. A reporting entity may apply the amendments prospectively. A reporting entity also may apply the amendments retrospectively to all prior periods presented in the financial statements. Early adoption is permitted provided that the guidance is applied from the beginning of the fiscal year of adoption. The effective date is the same for both public business entities and all other entities.

The Company adopted ASU No. 2015-01 prospectively and has applied it to the presentation of the financial statements.

As of March 31, 2015, there are no other recently issued accounting standards not yet adopted that would or could have a material effect on the Company’s consolidated financial statements.

| (12) |

| 3. | ACCOUNTS RECEIVABLE, NET |

The Company evaluates the need of an allowance for doubtful accounts based on specifically identified amounts that management believes to be uncollectible. If actual collections experience changes, revisions to the allowance may be required. The Company did not experience significant losses from uncollectible accounts in the past; accordingly, the management decided to accrue one percent of the accounts receivable outstanding within one year and a hundred percent of the accounts receivable outstanding for longer than one year as bad debt allowance as of March 31, 2015 and December 31, 2014, respectively.

| 3/31/2015 | 12/31/2014 | ||||

| Accounts receivable | $ | 35,689,367 | $ | 41,972,638 | |

| Less: Allowance for bad debt | (931,847) | (539,437) | |||

| Accounts receivable, net | $ | 34,757,522 | $ | 41,433,191 | |

The bad debt expenses for the period ended March 31, 2015 and for the year ended December 31, 2014 are 392,410 and 498,267, respectively.

| 4. | OTHER RECEIVABLES |

The Company advances money to several third parties during business operation. These receivables bear no interest and are due on demand except otherwise noted. As of March 31, 2015 and December 31, 2014, the Company had other receivables of $757,612 and $585,520, respectively.

| 5. | ADVANCE TO SUPPLIERS |

As of March 31, 2015 and December 31, 2014, the Company had made advance to suppliers of $4,112,748 and $5,857,017, respectively, for the purchases of inventories.

| 3/31/2015 | 12/31/2014 | ||||

| Deposit for purchases of tangerines | $ | 2,057,400 | $ | 4,232,289 | |

| Deposit for purchases of other fruits | 727,107 | 1,496,924 | |||

| Others | 1,328,241 | 127,804 | |||

| $ | 4,112,748 | $ | 5,857,017 | ||

| 6. | INVENTORIES |

Inventories as of March 31, 2015 and December 31, 2014 consisted of the following:

| 3/31/2015 | 12/31/2014 | |||

| Purchases | $ | 55,702 | $ | 996,125 |

| Raw materials | 2,657,592 | 589,642 | ||

| Packing materials | 421,597 | 273,406 | ||

| $ | 3,134,891 | $ | 1,859,173 |

The Company performs physical inventory count on a regular basis and instead of recording an allowance for spoilage, the spoilage will be written-off directly to the income statement when it occurs. The spoilage rate is approximately 2% of average inventory.

| (13) |

| 7. | PREPAID EXPENSES |

As of March 31, 2015 and December 31, 2014, the Company had prepayments of $89,558 and $89,558, respectively, which consisted of the following:

| 3/31/2015 | 12/31/2014 | |||

| Prepaid Rent | $ | 140,438 | $ | 85,192 |

| Other | 2,301 | 4,366 | ||

| $ | 142,739 | $ | 89,558 |

| 8. | DUE FROM RELATED PARTY |

As of March 31, 2015 and December 31, 2014, the Company had related party receivables of $0 and $1,114,279, respectively.

| 3/31/2015 | 12/31/2014 | ||

| Chen, Quanlong | $ - | $ 1,114,279 |

Cash advances was provided to the Mr. Chen, Quanlong for procurement of inventory, which is a normal business activity. The receivable amount was settled when inventory is received.

| 9. | INVESTMENT COMMITMENT |

On February 28, 2014, China Fruits Corp, through its wholly owned subsidiary, Taina International Fruits (Beijing) Co., Ltd, entered into an acquisition agreement with Baojia Guoye Co. Ltd. for the acquisition of three retail stores in Hangzhou, Zhejiang Province, China. The total consideration of the transaction amounted to $163,690 (RMB 1,000,000). The Company has already fully paid Baojia Guoye Co. Ltd as of March 31, 2015.

As of the date of the report, the transaction is still not yet completed because the transfer of business registrations and related licenses has not been completed. Thus, the accounts for these three retail stores are not consolidated.

| 10. | PLANT AND EQUIPMENT, NET |

Plant and equipment, net as of March 31, 2015 and December 31, 2014 consisted of the following:

| 3/31/2015 | At Cost | Accumulated Depreciation | Net | |||

| Buildings | $ | 3,998,557 | $ | (794,800) | $ | 3,203,757 |

| Leasehold Improvement | 95,877 | (19,974) | 75,903 | |||

| Machinery & equipment | 246,398 | (69,891) | 176,507 | |||

| Motor vehicles | 146,595 | (97,115) | 49,480 | |||

| Office equipment | 313,746 | (173,820) | 139,926 | |||

| Others | 38,453 | (15,706) | 22,747 | |||

| $ | 4,839,626 | $ | (1,171,306) | $ | 3,668,320 |

| 12/31/2014 | At Cost | Accumulated Depreciation | Net | |||

| Buildings | $ | 3,625,642 | $ | (748,967) | $ | 2,876,675 |

| Leasehold Improvement | 95,418 | (11,927) | 83,491 | |||

| Machinery & equipment | 245,217 | (64,256) | 180,961 | |||

| Motor vehicles | 145,893 | (90,274) | 55,619 | |||

| Office equipment | 308,750 | (163,481) | 145,269 | |||

| Others | 38,269 | (14,199) | 24,070 | |||

| $ | 4,459,189 | $ | (1,093,104) | $ | 3,366,085 |

The depreciation expense for the years ended March 31, 2015 and December 31, 2014 are 78,202 and 170,169, respectively.

| (14) |

| 11. | INTANGIBLE ASSETS, NET |

Intangible assets, net as of March 31, 2015 and December 31, 2014 consisted of the following:

| 3/31/2015 | 12/31/2014 | |||

| Land use right | $ | 480,831 | $ | 478,528 |

| Computer Software | 6,973 | 6,940 | ||

| Less: accumulated amortization | (186,741) | (177,854) | ||

| $ | 301,063 | $ | 307,614 |

| 12. | SHORT TERM LOANS |

As of March 31, 2015 and December 31, 2014, the Company had short-term loan of $2,807,287 and $4,936,059, respectively, from various local banks and local government. The detailed terms were set forth as follows:

| Remark | 3/31/2015 | 12/31/2014 | |||

| Local Government, zero interest, due on no later than November 30, 2013 (Applying for waiver) | 515,624 | 513,155 | |||

| Bank of China, 7.2% annual interest, due on March 18, 2015 | - | 187,342 | |||

| Jiangxi Nanfeng Rural Cooperative Bank, 8.0% annual interest, due on January 4, 2015 | - | 1,954,875 | |||

| Industrial and Commercial Bank of China, 7.28% annual interest, due on December 10, 2015 | B | 1,964,283 | 1,954,875 | ||

| China Merchant Bank, 12.0% annual interest, due on April 15, 2015 | 327,380 | 325,812 | |||

| $ | 2,807,287 | $ | 4,936,059 |

Remark:

A: Secured by collaterals of land and real estates located in Nanfeng, Jiangxi Provicne, China.

B: Secured by personal gurantees of company’s management

| Jiangxi Taina Nanfeng Orange Co., Ltd. has also borrowed loans from local government with the following provisions: |

| 3/31/2015 | 12/31/2014 | |||||||

| Local Government, zero interest, due on no later than November 30, 2012 | $ | 73,661 | $ | 73,307 | ||||

| Local Government, zero interest, due on no later than November 30, 2013 | 73,661 | 73,308 | ||||||

| Local Government, zero interest, due on no later than November 30, 2012 | 184,151 | 183,270 | ||||||

| Local Government, zero interest, due on no later than November 30, 2013 | 184,151 | 183,270 | ||||||

| $ | 515,624 | $ | 513,155 |

All balances were due on or before November 30, 2013. The Company has applied for a waiver from the local government and the application is still in process. Accordingly, no repayment has been made as of March 31, 2015 since the government did not demand repayment of such loans.

| 13. | CUSTOMER DEPOSIT |

As of March 31, 2015 and December 31, 2014, the Company had customer deposits of $757,457 and $767,396, respectively, representing payments received for orders not yet shipped or payments from customers for prepaid membership cards.

| (15) |

| 14. | DUE TO RELATED PARTIES |

As of March 31, 2015 and December 31, 2014, the Company had loan payable to related party of $2,178,389 and $1,941,527, respectively. These loans are due within one year.

| 3/31/2015 | 12/31/2014 | ||

| Due to shareholders | $ 235,521 | $ 575,079 | |

| Due to Related parties: | 1,942,869 | 1,366,448 | |

| Total | $ 2,178,390 | $ 1,941,527 |

The shareholders paid all necessary overseas consulting and advising fees, lawyer fees, and accounting fees from period to period out of their own personal bank accounts in the United States due to the strict laws and regulations imposed by the Chinese government on out-going foreign currency wire transfers. The amount outstanding as of March 31, 2015 and December 31, 2014 was $235,521 and $575,079, respectively.

On March 31, 2014, the Company entered into convertible promissory notes with four shareholders (the holders) with the maximum accumulated principal of USD 600,000, in accordance with the terms of the convertible promissory notes with the interest at 6% per annum without collateral.

On November 13, 2014, the Company entered into an additional convertible promissory note with one of the four shareholders with the maximum accumulated principal of USD 100,000, in accordance with the terms of the convertible promissory notes with the interest at 6% per annum without collateral.

The breakdown of the four convertible promissory notes as of March 31, 2015 were set forth as follows:

| Outstanding balance as of 3/31/2015 | Maximum accumulated principal set forth in convertible promissory note | |||

| Shareholder A | $ | 71,700 | $ | 150,000 |

| Shareholder B | - | 250,000 | ||

| Shareholder C | 46,166 | 100,000 | ||

| Shareholder D | 117,655 | 200,000 | ||

| $ | 235,521 | $ | 700,000 |

Holders may demand repayment of all amounts loaned to the Company though the date of its repayment request upon thirty (30) days written notice to the Company after five (5) years from effective date.

The Company may, at its option, at any time and from time to time, prepay all or any part of the principal balance of the notes, without penalty or premium, provided that concurrently with each such prepayment the Company shall pay accrued interest on the principal, if any, so prepaid to the date of such prepayment.

Upon not less than five (5) days advance written notice of one party hereto to the other (“Conversion note”), at any time or from time to time, the holders or the Company, at each’s sole option, may convert the outstanding principal amount of the Notes, or any portion of the principal amount hereof, and any accrued interest, in whole or in part, into shares of the common stock of the Company. Any amount so converted will be converted into common stock at a conversion price which is equivalent to the previous day’s closing bid price of the day immediately prior to delivery of the Conversion Note (the “Conversion Price”).

In the event the Company should at any time after the date hereof do either of the following: i) fix a record date for the effectuation of a split or subdivision of the outstanding common stock of the Company, or ii) grant the holders of the Company common stock a dividend or other distribution payable in additional shares of common stock without the payment of any consideration by such holder for the additional shares of common stock (“Stock Adjustment”), then, as of the record date (or the date of suck Stock Adjustment if no record date is fixed), the conversion price of the notes shall be appropriately adjusted so that the number of shares of common stock issuable upon conversion of the notes shall be adjusted in proportion to such changein the number of outstanding shares in order to insure such Stock Adjustment does not decrease the conversion value of the notes.

Governing law of the notes shall be the laws of State of Nevada.

On January 7, 2015, the Company (“Maker”) entered into a debt purchase agreement with certain holders of the convertible promissory notes (“Assignors”). In executing the agreement, the assignors sold 50% of the rights of the convertible promissory notes in the amount of $250,000, or $125,000, to two assignees (hereinafter referred as “assignee A” and “assignee B”) for a cash consideration of $75,000. Both assignees converted the notes into common stocks and the transactions are summarized in the following table:

| Assignee A: | ||||

| Date of conversion | Principal of note converted | Interest expenses of note converted | Conversion price | Common stock issued |

| 1/27/2015 | $31,250 | - | $0.146 | 8,562 |

| 2/27/2015 | $31,250 | $222 | $0.1299 | 9,691 |

| Assignee B: | ||||

| Date of conversion | Principal of note converted | Interest expenses of note converted | Conversion price | Common stock issued |

| 1/12/2015 | $31,250 | - | $0.146 | 8,562 |

| 2/27/2015 | $31,250 | $154 | $0.1299 | 9,691 |

On January 12, 2015, one of the holders of the convertible promissory note converted the notes into common stock and the transaction is summarized in the following table:

| Shareholder B: | ||||

| Date of conversion | Principal of note converted | Interest expenses of note converted | Conversion price | Common stock issued |

| 1/12/2015 | $233,978 | $11,192 | $0.18 | 54,482 |

On March 16, 2015, the Company (“Maker”) entered into a debt purchase agreement with certain holders of the convertible promissory notes (“Assignors”). In executing the agreement, the assignors sold the rest of the 50% of the rights of the convertible promissory notes in the amount of $250,000, or $125,000, to two assignees (hereinafter referred as “assignee A” and “assignee B”) for a cash consideration of $75,000.

| (16) |

| 15. | LONG TERM DEBT |

Current portions of long-term debt consisted of the following as of March 31, 2015 and December 31, 2014:

| 3/31/2015 | 12/31/2014 | |||

| China Merchant Bank, 7.38% annual interest, due on 3/2/2015 | $ | - | $ | 94,485 |

| China Merchant Bank, 7.38% annual interest, due on 6/2/2015 | 94,940 | 94,485 | ||

| China Merchant Bank, 7.38% annual interest, due on 9/2/2015 | 94,940 | 94,486 | ||

| China Merchant Bank, 7.38% annual interest, due on 12/2/2015 | 94,940 | 94,486 | ||

| China Merchant Bank, 7.38% annual interest, due on 3/2/2016 | 94,941 | - | ||

| $ | 379,761 | $ | 377,942 |

Non-current portions of long-term debt consisted of the following as of March 31, 2015 and December 31, 2014:

| 3/31/2015 | 12/31/2014 | |||

| China Merchant Bank, 7.38% annual interest, due on 3/2/2016 | $ | - | $ | 94,486 |

| China Merchant Bank, 7.38% annual interest, due on 6/2/2016 | 94,940 | 94,486 | ||

| China Merchant Bank, 7.38% annual interest, due on 9/2/2016 | 153,869 | 153,131 | ||

| China Merchant Bank, 7.28% annual interest, due on 12/10/2017 | 327,380 | - | ||

| China Merchant Bank, 7.28% annual interest, due on 12/1/2017 | 180,060 | - | ||

| $ | 756,249 | $ | 342,103 |

On September 3, 2014, Taina International Fruits (Beijing) Co., Ltd entered into a loan agreement with CITIC Trust Limited in the amount of $814,531 (RMB 5,000,000) with a 7.38% annual interest rate and due date on September 2, 2016. The principal is to be repaid on a quarterly basis. The quarterly repayment is set at $94,486 (RMB 580,000), and any remaining balance will be paid off at its due date on 9/2/2016. On September 4, 2014, CITIC Trust Limited transferred its interest in the ownership of the loan to China Merchant Bank. Any repayment made to the loan will subsequently be paid to China Merchant Bank directly. This loan is secured by Beijing Agricultral Financing Gurantee Co. Limited. In connection with this gurantee, the Company used its land and real estates located in Nanfeng, Jiangxi Province, China as collaterials.

On January 8, 2015, Jiangxi Taina Guo Ye Yon Xian Gong Si entered into a loan agreement with ICBC Industrial and Commercial Bank of China nanfeng branch in the amount of 327,280 (RMB2,000,000) with 7.28% annual interest rate and due date on December 10, 2017. This loan is secured by a shareholder of the company. In connection with this gurantee, the Company used its land and real estates located in Nanfeng, Jiangxi Province, China as collaterials.

On February 12, 2015, Jiangxi Taina Guo Ye Yon Xian Gong Si entered into a loan agreement with ICBC Industrial and Commercial Bank of China Nanfeng branch in the amount of 180,060 (RMB1,100,000) with 7.28% annual interest rate and due date on December 1, 2017. This loan is secured by a shareholder of the company. In connection with this gurantee, the Company used its land and real estates located in Nanfeng, Jiangxi Province, China as collaterials.

| (17) |

| 16. | GOVERNMENT GRANTS |

For the period ended March 31, 2015 and 2014, the Company received grants and rewards from local government in amount of $155,988 and $239,132, respectively. The governmental grants were to encourage the Company’s efforts on modern agricultural development. These grants were interest-free and bear no repayment requirements.

| 17. | NET INCOME/(LOSS) PER SHARE |

Basic net income/(loss) per share is computed using the weighted average number of the ordinary shares outstanding during the periods.

The following table sets forth the computation of basic net income/(loss) per share for the period ended March 31, 2015 and 2014, respectively:

| For the period ended | ||||||||

| 3/31/2015 | 3/31/2014 | |||||||

| Net Income/(Loss) | $ | (802,846 | ) | 114,711 | ||||

| Net Income/(Loss) Per Share – Basic | (0.39 | ) | 0.06 | |||||

| Net Income/(Loss) Per Share – Fully diluted | (0.15 | ) | 0.06 | |||||

| Weighted Average Number of Shares Outstanding – Basic | 2,065,564 | 1,998,049 | ||||||

| Weighted Average Number of Shares Outstanding – Fully Diluted | 5,439,447 | 1,998,049 | ||||||

** Less than $0.01

| 18. | CONCENTRATION AND RISKS |

(a) For the period ended March 31, 2015 and March 31, 2014, 100% of the Company’s assets were located in the PRC. Approximately 80% of the Company’s revenues were derived from customers located in the PRC for the period ended March 31, 2015 and approximately 42% of the Company’s revenues were derived from customers located in the PRC for the year ended March 31, 2014.

For the three months March 31, 2015, major customers with their revenues are presented as follows:

| Customers | Revenue | % | Accounts Receivable | |||

| Customer A | $ | 1,300,722 | 24% | $ | - | |

| Customer B | $ | 1,084,252 | 20% | $ | 1,084,252 | |

| Revenue as of March 31, 2015 | $ | 5,850,335 |

For the three months March 31, 2014, major customers with their revenues are presented as follows:

| Customers | Revenue | % | Accounts Receivable | |||

| Customer A | $ | 4,432,166 | 55% | $ | 3,105,042 | |

| Customer B | $ | 195,212 | 2% | $ | ||

| Customer C | $ | 127,302 | 2% | $ | ||

| Revenue as of March 31, 2014 | $ | 8,015,860 |

(b) Credit risk

Financial instruments that potentially subject the Company to significant concentrations of credit risk consist principally of cash and trade accounts receivable. The Company performs ongoing credit evaluations of its customers' financial condition, but does not require collateral to support such receivables.

| (18) |

| 19. | COMMITMENT AND CONTINGENCIES |

The Company rented plant, office, and retailing spaces under a non-cancelable operating lease agreement. On March 3, 2012, the Company entered into a five-year lease agreement for an additional warehouse and logistic space to store, pack and deliver fresh fruits. The lease term is from March 10, 2012 through March 9, 2017, and the total rental payment is approximately $733,078. Accordingly, the remaining two years minimum rental payments for that warehouse required as of March 31, 2015 are as follows:

| Period ended March 31 | Lease payment | |

| 2015 | $ | 126,321 |

| 2016 | 179,276 | |

| $ | 305,597 |

On July 25, 2014, the Company entered into a three-year lease agreement for an additional office space. The lease term is from August 18, 2014 through August 17, 2017, and the total rental payment is approximately $2,385,552. Accordingly, the remaining three years minimum rental payments for this office required as of March 31, 2015 are as follows:

| Year ended December 31 | Lease payment | |

| 2015 | $ | 287,019 |

| 2016 | 406,603 | |

| 2017 | 282,925 | |

| $ | 976,548 |

For the periods ended March 31, 2015 and year ended December 31, 2014, total rental expense for China Fruits Corporation was $129,367 and $389,692, respectively.

| 20. | REVERSE STOCK SPLIT |

On March 27, 2015, the majority of the holders of outstanding shares of the Company consented to the following action:

A combination of the shares of common stock of the Company, or reverse stock split, such that each twenty-five (25) shares of common stock into one (1) share of common stock. The action was approved by the Board of Directors on the same day.

The action has been filed with the SEC and is disclosed in the Schedule 14C Information Statement on April 7, 2015.

| 21. | SUBSEQUENT EVENT |

In accordance with ASC Topic 855-10, the Company has analyzed its operations subsequent to March 31, 2015 to the date these financial statements were issued and the Company has identified the following material subsequent event to disclose in these financial statements:

On March 16, 2015, the Company (“Maker”) entered into a debt purchase agreement with certain holders of the convertible promissory notes (“Assignors”). In executing the agreement, the assignors sold 50% of the rights of the convertible promissory notes in the amount of $250,000, or $125,000, to two assignees (hereinafter referred as “assignee A” and “assignee B”) for a cash consideration of $75,000. Both assignees converted the notes into common stocks after the balance sheet date and the transactions are summarized in the following table:

| Assignee A: | ||||

| Date of conversion | Principal of note converted | Interest expenses of note converted | Conversion price | Common stock issued |

| 4/16/2015 | $62,500 | $130 | $0.0987 | 25,382 |

| Assignee B: | ||||

| Date of conversion | Principal of note converted | Interest expenses of note converted | Conversion price | Common stock issued |

| 4/16/2015 | $62,500 | - | $0.0987 | 25,329 |

*

On April 30, 2015, the 1-25 reverse stock split took effect and, as a result, the number of issued and outstanding shares of the Company's Common Stock is reduced from 53,493,175 shares to approximately 2,139,727 shares. The accompanying financial statements have been retroactively adjusted to reflect the effects of the reverse stock split that occurred after the date of the most recent financial statements.

| (19) |

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

Forward Looking Statements

Certain statements in this report, including statements of our expectations, intentions, plans and beliefs, including those contained in or implied by "Management's Discussion and Analysis" and the Notes to Consolidated Financial Statements, are "forward-looking statements", within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), that are subject to certain events, risks and uncertainties that may be outside our control. The words “believe”, “expect”, “anticipate”, “optimistic”, “intend”, “will”, and similar expressions identify forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. We undertake no obligation to update or revise any forward-looking statements. These forward-looking statements include statements of management's plans and objectives for our future operations and statements of future economic performance, information regarding our expansion and possible results from expansion, our expected growth, our capital budget and future capital requirements, the availability of funds and our ability to meet future capital needs, the realization of our deferred tax assets, and the assumptions described in this report underlying such forward-looking statements. Actual results and developments could differ materially from those expressed in or implied by such statements due to a number of factors, including, without limitation, those described in the context of such forward-looking statements, our expansion strategy, our ability to achieve operating efficiencies, our dependence on distributors, capacity, suppliers, industry pricing and industry trends, evolving industry standards, domestic and international regulatory matters, general economic and business conditions, the strength and financial resources of our competitors, our ability to find and retain skilled personnel, the political and economic climate in which we conduct operations and the risk factors described from time to time in our other documents and reports filed with the Securities and Exchange Commission (the "Commission"). Additional factors that could cause actual results to differ materially from the forward-looking statements include, but are not limited to: 1) our ability to successfully develop and deliver our products on a timely basis and in the prescribed condition; 2) our ability to compete effectively with other companies in the same industry; 3) our ability to raise sufficient capital in order to effectuate our business plan; and 4) our ability to retain our key executives.

History

As used herein the terms "We", the "Company", "CHFR", the "Registrant," or the "Issuer" refers to China Fruits Corporation, its subsidiary and predecessors, unless indicated otherwise. We were incorporated in the State of Delaware on January 6, 1993, as Vaxcel, Inc. On December 19, 2000, we changed our name to eLocity Networks Corporation. On August 6, 2002, we changed our name to Diversified Financial Resources Corporation. In May 2006, our board decided to redomicile from the State of Delaware to the State of Nevada. Their decision was approved by the holders of a majority of the voting power of the Company.. On August 18, 2006, we changed our name to China Fruits Corporation.

As of April 1, 2006, we entered into a Plan of Exchange (the “Agreement”), between and among us, Jiang Xi Tai Na Guo Ye You Xian Gong Si, a corporation organized and existing under the laws of the Peoples’ Republic of China (“PRC”), which changed its corporate name to Jiangxi TainaNanfeng Orange Co., Ltd. in February of 2007 (collectively referred to herein as “Tai Na”), the shareholders of Tai Na (the “Tai Na Shareholders”) and our Majority Shareholder.

Pursuant to the terms of the Agreement, two simultaneous transactions were consummated at closing, as follows: (i) our Majority Shareholder delivered 13,150 of our convertible Series A preferred shares and 12,100,000 non-convertible Series B preferred shares to the Tai Na Shareholders in exchange for total payments of $500,000 in cash and (ii) we issued to the Tai Na Shareholders an amount equal to 30,000,000 new investment shares of our common stock pursuant to Regulation S under the Securities Act of 1933, as amended, in exchange for all of their shares of registered capital of Tai Na. Upon completion of the exchange, Tai Na became our wholly-owned subsidiary. All of these conditions to closing have been met, and we, Tai Na, the Tai Na Shareholders and our Majority Shareholders declared the exchange transaction consummated on May 31, 2006. The transaction was treated for accounting purposes as a capital transaction and recapitalization by the accounting acquirer and as a re-organization by the accounting acquiree.

| (20) |

Business Description of the Issuer

Since the reverse merger was consummated, we have continued operations of Tai Na, a company located in Nan Feng County, Jiang Xi Province, a well-known agricultural area for tangerines plantation in China, which is primarily engaged in manufacturing, trading and distributing fresh tangerines and other fresh fruits in China and oversea markets. In 2008, we incorporated a wholly-owned subsidiary, Tai Na International Fruits (Beijing) Co. Ltd. (“Tai Na Beijing”) in Beijing, China and relocated the corporate headquarters to Beijing. The headquarters office currently consists of approximately 17,700 square feet for daily operations, which are adequate not only for our current operations, but also for our growth in the near future. We believe that having headquarters in Beijing has a positive effect on our corporate image and the implementation of our marketing strategies.

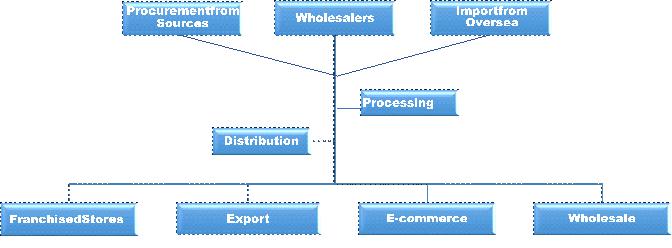

We have been focused on the industry related to fresh fruits business since 2005 and devoted to operating franchise retail stores since 2007. After almost a decade of experience in manufacturing, trading and distributing fresh fruits in the domestic and oversea markets, we are building up a sophisticated business model integrating farmers, plantation alliances, wholesalers, franchised stores, export channels and e-commerce, which effectively shortens fresh fruits distribution process from the plantation to consumers due to the following:

Business Model of China Fruits Corp.

Stable supplies

Our signature tangerines are from Nan Feng County, China, an agricultural county in China famous for high-quality tangerines for centuries attributable to particular natural resources at that area. Nanfeng tangerines were selected solely for Chinese royals in the past and became very popular in the market during recent decades. Since our wholly-owned subsidiary, Jiangxi TainaNanfeng Orange Co., Ltd. is considered as one of biggest enterprises in Nan Feng County, we have a strong long-term relationship with the local government anda high reputation amongst local farmers. Therefore, approximately 30% of Nan Feng County tangerines have been processed in our manufacturing facility and distributed through our sales network.

In addition to Nanfeng tangerines, our products sold in the franchised stores include other popular fresh fruits, such as grapes, pears, kiwi, and so on. In order to ensure the stability of supplies for these fruits, we establish alliances with different fruit plantations, each of which are closely monitored by our own staff. Periodic checks are carried out on the plantations directly by us. Therefore, we are able to obtain instant information about our supplies sources, including growing environment, fruits quality and output. Our onsite staff also assist in facilitating the shipping process during the seasons. We believe it is cost efficient for us to make alliances with different fruit plantations and will seek for alliance opportunities with more fruit plantations in 2015.

Efficient process

Our manufacture facility in Nan Feng County includes a set of temperature and humidity auto-control equipment with capacity of 1,500 tons to effectively maintain the quality of our tangerines. We also have two automatic product lines for fruit selection, the hourly process capacity of which is 10 ton/hour and 15 ton/hour, respectively. During the year of 2014, our total production was 17,000 tons. We expect the production capacity will reach 34,000 tons in 2015 due to the improvement of production efficiency.

Since 2012, we have established a systematic logistics center to support the expanding retail network.We believe a sound warehouse and logistics center will help us to improve efficiency and reduce operating expenses. Especially for fresh fruits, the prompt handling and delivery is significant to reduce loss from spoilage. Our warehouse and logistic space is located in Beijing with approximately 26,700 square feet to store, select, pack and deliver fresh fruits. After the full operation of the logistics center, we believe both operating expenses and cost of goods sold will be reduced due to large-scale purchases and delivery.

In addition, with the support from the local government in Nan Feng County, we utilized an area of 98,505 square feet to establish an Express Export Zone (“EEZ”) to speed up the process of exporting fresh tangerines and other fresh fruits. The government departments including Customs, Inspections and Clearing have setup a satellite office onsite to facilitate the process. We believe the setup of this EEZ is good for us to improve our operating efficiencies and also serves as a bridge connecting local enterprises to the world and benefits our local economy. EEZ also provides us with a platform and opportunity to develop our logistics business for international trading. Therefore, we invested approximately $325,024 (RMB 2,000,000) in August 2014 to setup a new subsidiary called NanfengTaina Logistic Co. Ltd. (“Taina Logistic”), which is wholly-owned by Jiangxi TainaNanfeng Orange Co., Ltd. and is engaged in shipping, warehousing, assorting agriculture products and packing. We believe the business in Taina Logistic will provide a revenue stream for Jiangxi TainaNanfeng Orange Co., Ltd. during the slow seasons, which normally are the second and third quarter of each year.

| (21) |

Expanding Sales Network

The last and important section of our business model is our sales network, which determines the ratio of our inventory turnover and the efficiency of our working capital. We have been devoted to establish a systematic and efficient sales network for years. In 2015, our sales network covered franchised retail stores, export, e-commerce and wholesale.

| · | Increasing Franchised Retail Stores |

The franchised retail stores build up the direct channel between the end users and us, which facilitates the process from our manufacture plants to the markets, benefits us in adjusting our business strategies when market changes. We provide the stores with our standard management systems, supplies, as well as renovation to unify store display, color and signage pursuant to the franchise requirements. The fresh fruits sold in the stores include our own products as well as the products from our alliance plantations. By the end of the first quarter of 2015, the number of our franchised retail stores reached by 61, increasing by approximately 369% compared to 13 stores during the same period in 2014. Such expansion was accomplished via acquisitions, franchise sales or direct setups. There are 43 stores within Beijing area, of which 2 stores are wholly owned by us under direct management, and 41 stores are managed by franchisees. The remaining 18 stores are located in different provinces including Hebei, Jiangxi, Yunnan and Zhejiang, all of which are managed by franchisees. Our franchise system is a cost-effective means of acquiring distribution for our fruit products.

In addition, we entered into an acquisition agreement on February 28, 2014 with BaojiaGuoye Co. Ltd. (“Baojia”), a corporation existing and organized under the laws of China, pursuant to which we paid cash of $162,512 (RMB 1,000,000) to acquire Baojia’s three retail stores in Hangzhou, Zhejiang Province, China. As of the date of this report, the acquisition transaction has not closed since the transfer of business registrations and related licenses has not been completed. Thus, the accounts for these three retail stores were not included in the consolidated financial statements as of March 31, 2015.

In order to efficiently and systematically manage our franchised retail stores throughout China, we plan to incorporate regional franchise management companies, all of which will be wholly-owned and managed directly by Tai Na Beijing. The regional franchise management companies serve as a hub to cover all stores within the region, which significantly reduce the spoilage rate due to long distance transportation and improve logistic efficiency. The first two regional franchise management companies are located in Nanchang and Hangzhou. Both cities have leading positions amongst Tier II cities in China with great potential to have growth in their local economies. They will be our next target markets to expand our franchised retail stores after the Beijing area. As of March 31, 2015, there are 7 stores in Hangzhou area and 4 stores in Nanchang area. We estimate that the number of retail stores in 2015 will reach 20 and 10 in Hangzhou and Nanchang, respectively. The total number of retailed stores throughout China is expected to be 135 in 2015.

We will periodically evaluate the operations in the existing stores and replace those in poor performance with new stores. We believe we are able to expand our market shares through an effective and efficient franchise retail network. We expect to gain greater market shares via brand recognition in the near future.

| · | Forming New BVI Subsidiary for export |

Our revenue from fresh fruits export was a key component of our revenues, which was approximately $1 million, or 18% of total revenues in first quarter of 2015. In order to simplify the procedures of import and export, our Board of Directors authorized and approved to setup a new subsidiary called US-China Fruits Company Limited (“US-China Fruits”) under the laws of British Virgin Islands in June of 2014, of which we have 99.99% ownership. The articles of incorporation of US-China Fruits were filed on June 16, 2014. The switch from current exporting system to new system involving US-China Fruits was not completed; thus, there were no activities in US-China Fruits as of March 31, 2015. We believe the new subsidiary will facilitate the export process and increase the efficiency when we develop oversea markets.

| · | Developing E-commerce Market |

E-commerce overcomes the geographic barrier and provides us with a powerful access to the non-China markets. Currently all of our e-commerce business is conducted by a related party, and we are the exclusive supplier for all the fruits sold online. We plan to integrate this section into our corporate structure in 2015. According to our strategic plans, we will develop our online fruit stores on the popular e-commerce platforms associated with Alibaba, and further expand our fruit e-commerce business to the leading business-to-consumer platforms like Taobao.com, Tmall.com, JD.com, and Yhd.com, and other major group-buying websites. Working with these well-developed e-commerce platforms, we expect to establish our competitive niche with respect to high quality, wide range of variety and efficient delivery.

Eventually, we will develop an “Online Distribution and Franchise” system in order to build a comprehensive vertical fruit e-commerce platform with major fruit participants, operators and industry bodies. We believe e-commerce market will share the same significance as traditional markets in the near future. Our goal is to combine e-commerce with our growing retail stores network to introduce an “online to offline” business model for our clients. Such integration will increase our brand recognition and market shares in fruit e-commerce business.

When our business model is running efficiently, we believe all components within our model will be benefited and profitable, and, as a result, our business will experience a significant growth rate in 2015.

| (22) |

RESULTS OF OPERATIONS FOR THE THREE MONTHS ENDED MARCH 31, 2015 AND 2014

Revenues

Gross revenues were $5,850,335 for the three months ended March 31, 2015, compared to gross revenues of $8,015,860 for the same period ended March 31, 2014. The decrease in revenues during the first quarter of 2015 was due primarily to the decrease in revenues from oversea markets. After the expansion in network of franchised retail stores, the Company switched its focus from oversea markets to the domestic market. During the first quarter of 2015, the revenues from franchised stores were approximately $4.0 million, an increase of 78% compared to the same period in 2014. The Company also had revenues from e-commerce in amount of approximately $1.0 million, which were zero during the same period in 2014. However, the revenues increased in domestic market and e-commerce failed to completely offset the revenues decreased in oversea markets, resulting in the decrease by approximately 27% in total.

We generate our revenues from sales of fresh fruits and related products, including our signature tangerine. The revenues are recognized when persuasive evidence of a sale exists, transfer of title has occurred, the selling price is fixed or determinable and collectability is reasonably assured. Our sales arrangements are not subject to a warranty. We did not record any product returns during three months ended March 31, 2015.

We expect our sales to increase during in 2015 as our moves toward implementing our business plan, including the increase in franchise retail stores, the increase in marketing budgets. In 2015, we will pick Nanchang and Hangzhou as our next target markets to expand our franchised retail stores after Beijing area. Both cities have leading positions amongst Tier II cities in China with great potential to have a boom in local economy. As of March 31, 2015, there are 7 stores in Hangzhou area and 4 stores in Nanchang area. We estimate that the number of retail stores in 2015 will reach 20 and 10 in Hangzhou and Nanchang, respectively. The total number of retailed stores throughout China is expected to be 135 in 2015.

We will periodically evaluate the operations in the existing stores and replace those in poor performance with new stores. We believe we are able to expand our market shares through an effective and efficient franchise retail network. We expect more market shares via brand recognition in the near future.

Net Income / (Loss)

We had net loss of $802,846 for the three months ended March 31, 2015, compared to net income of $114,711 for the three months ended March 31, 2014.The net loss during the first quarter of 2015 was due to insufficient gross profit to cover increasing operating expenses. Due to the decrease in revenues from oversea markets, the revenues in the first quarter of 2015 dropped approximately 27% compared to the same period in 2014. On the other hand, the operating expenses increased by approximately 50% compared to the same period in 2014 due to the sales networks expansion. Comparatively, the net income during the first quarter of 2014 was due primarily to the decrease in operating loss resulting from the increase in gross profit. In addition, we received the grants from government in amount $239,132, which was to encourage our contribution in modern agriculture. We had loss from operation without the government grant.

There can be no assurance that we will achieve or maintain profitability, or that any revenue growth will take place in the future.

Expenses

Operating expenses for the three months ended March 31, 2015 were $1,385,855, increased by $461,675, or 50%, compared to $924,180 for the same period ended March 31, 2014. The increase in operating expenses during the first quarter of 2015 was due primarily to the increase in general and administrative expenses, which were $742,910 in the first quarter of 2015, compared to $327,710 in the same period ended March 31, 2014.

Cost of Goods Sold