Attached files

| file | filename |

|---|---|

| 8-K - SUN TRUST INVESTOR PRESENTATION - INDEPENDENT BANK CORP | a8-ksuntrustinvestorpresen.htm |

SunTrust Financial Services Conference May 19, 2015 Robert Cozzone – Chief Financial Officer and Treasurer Exhibit 99.1

(2) Who We Are • Main Sub: Rockland Trust • Market: Eastern Massachusetts • Loans: $5.4 B • Deposits: $5.7 B • $AUA: $2.5 B • Market Cap: $1.1 B • NASDAQ: INDB

(3) Key Messages • Track record of consistent, solid performance • Robust core deposit and deal flow activity • Well-positioned for rising rate environment • Growing fee revenue sources • Tangible book value steadily rising • Disciplined risk management culture

(4) Company Footprint Rank 2014 1 25.2% 41% Rank 2014 5 5.0% 19% Rank 2013 3 10.4% 12% Rank 2014 6 7.8% 12% Rank 2014 19 1.2% 10% Rank 2014 15 0.3% 5% Rank 2014 32 0.3% 1% Bristol County Worcester County Suffolk County Middlesex County Norfolk County % of INDB Dep.Share Barnstable County (Cape Cod) Market Plymouth County

(5) Recent Accomplishments • Record operating EPS performance in 2014 • Acquired Peoples Federal Bancshares – first retail presence in Boston • Capitalizing on expansion moves in Greater Boston • Strong household growth rate • Keeping pace with digital trend, esp. mobile banking • Greater operating efficiency

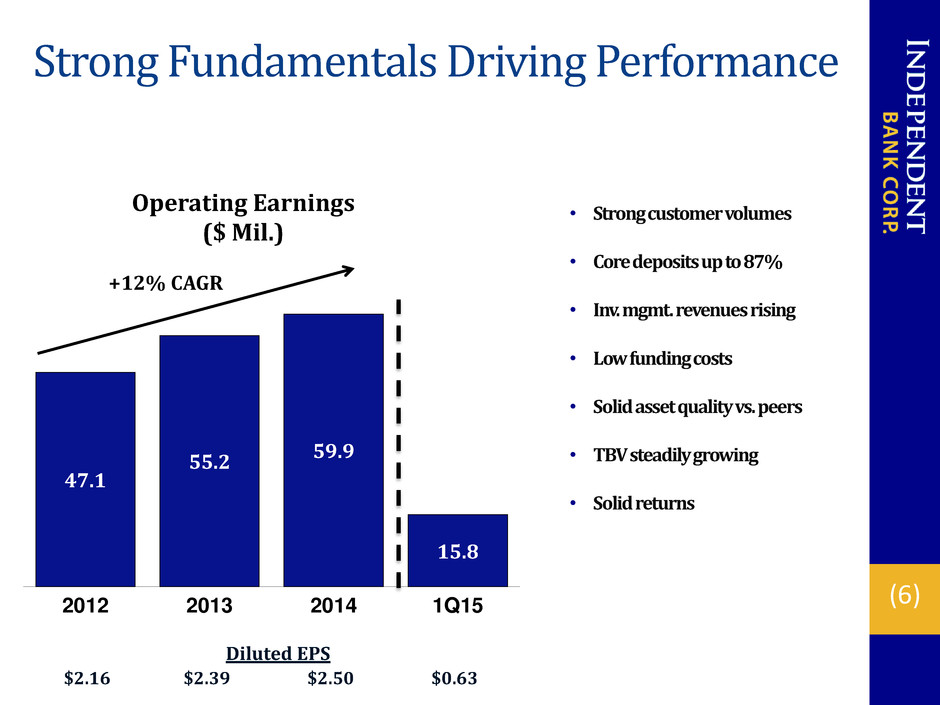

(6) Strong Fundamentals Driving Performance 47.1 55.2 59.9 15.8 2012 2013 2014 1Q15 Operating Earnings ($ Mil.) +12% CAGR Diluted EPS $2.16 $2.39 $2.50 $0.63 • Strong customer volumes • Core deposits up to 87% • Inv. mgmt. revenues rising • Low funding costs • Solid asset quality vs. peers • TBV steadily growing • Solid returns

(7) Robust Commercial Lending Franchise TOTAL LOANS $5.4 B AVG. YIELD: 4.08% Comm'l 71% Resi Mtg 13% Home Eq 16% • Long-term CRE/ C&I lender • Strong name recognition in local markets • Growing in sophistication and capacity • Expanded market presence • Disciplined underwriting

(8) Low Cost Deposit Base Demand Deposits 28% Money Market 19% Savings/Now 40% CDs 13% TOTAL DEPOSITS $5.7 B AVG. COST: 0.21% 1Q 2015 • Valuable source of liquidity • Sizable demand deposit component • Relationship-based approach • Excellent household growth • Growing commercial base CORE DEPOSITS: 87%

(9) 816 2,546 2006 1Q15 AUAs ($ Mil.) 6.1 19.6 5.1 2006 2014 1Q15 Revenues ($ Mil.) Investment Management : Transformed Into High Growth Business • Successful business model • Growing source of fee revenues • Strong feeder business from Bank • Expanding investment center locations • Cross-sell opportunity in acquired bank markets +212% +221%

(10) Well-Positioned for Rising Rates: Prudent Balance Sheet Management -5% 0% 5% 10% 15% 20% Year 0 Year 1 Year 2 % In cr e ase o n N e t In te re st In co m e Interest Rate Sensitivity Down 100 Up 200 Up 400 Flat Up 200

(11) Asset Quality: Well Managed 28.8 34.7 27.5 30.3 2012 2013 2014 1Q15 NPLs ($ Mil.) 9.7 8.8 8.5 .09 4.8 2012 2013 2014 1Q15 Net Chargeoffs ($ Mil.) customer fraud 14.5 customer fraud NPL/Loan % 0.64% 0.73% 0.55% 0.56% Peers 1.14%* Loss Rate 26bp 36bp 19bp 1bp Peers 15bp* * Source: FFIEC Peer Group 2; $3-10 Billion in Assets, December 31, 2014 Incl. 90 days + overdue

(12) Strong Capital Position (period end) 8.7% 8.6% 8.8% 9.5% 2012 2013 2014 1Q15 6.6% 6.9% 7.4% 7.7% 2012 2013 2014 1Q15 Tier 1 Leverage % Tangible Common % $16.12 $17.18 $19.18 $19.82 2012 2013 2014 1Q15 Tangible Book Value +23% • Strong internal capital generation • No storehousing of excess capital • No external equity raising • No dividend cuts

(13) 2015 Outlook: Key Expectations Loans Low end + 4-6% organic Led by commercial segment Deposits + 3-4% organic Emphasis on core deposits Net Int. Mar. % Low 3.40s% Continued pressure on loan yields Non Int. Inc. + 3-4% organic Ongoing core customer growth Non Int. Exp. + 3-4% organic Selective franchise investments with further improvement in operating efficiency Net Chgoffs $ 5-8 MM Continued strong asset quality Provision $ 7-10 MM Tax Rate ~29% vs. 28.5% in '14 Operating EPS Tang. Common % $ 7.75-8% Continuing to build $ 2.63-2.73 Record EPS performance expected

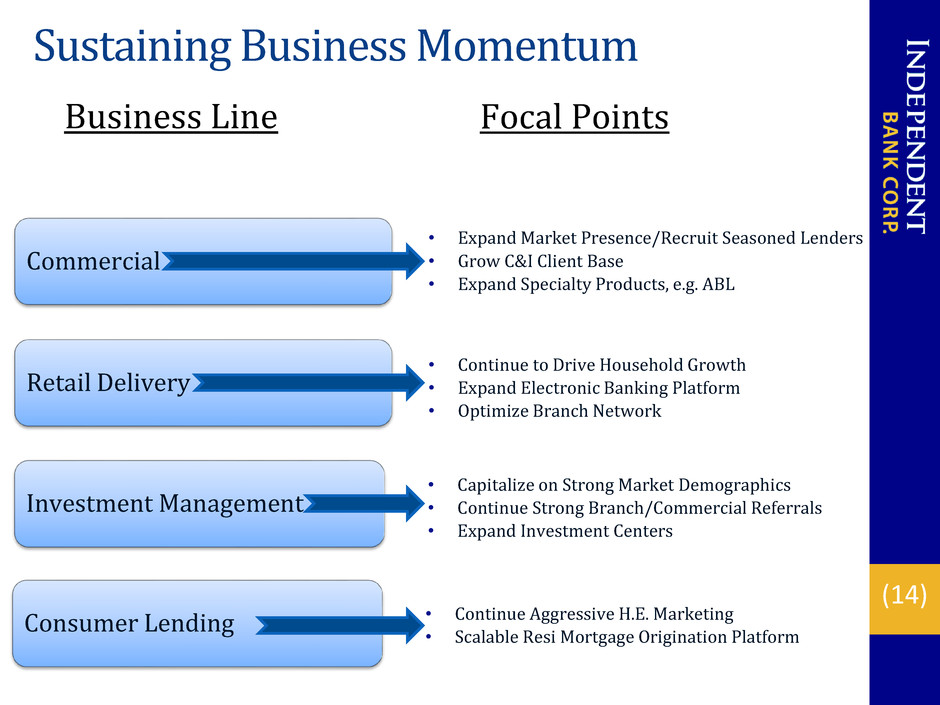

(14) Sustaining Business Momentum Business Line • Expand Market Presence/Recruit Seasoned Lenders • Grow C&I Client Base • Expand Specialty Products, e.g. ABL Commercial • Continue to Drive Household Growth • Expand Electronic Banking Platform • Optimize Branch Network Retail Delivery • Capitalize on Strong Market Demographics • Continue Strong Branch/Commercial Referrals • Expand Investment Centers Investment Management • Continue Aggressive H.E. Marketing • Scalable Resi Mortgage Origination Platform Consumer Lending Focal Points

(15) Expanded Presence in Vibrant Greater Boston Long-Term Commercial Lender in Greater Boston Central Bancorp $357MM Deposits 10 Branches – Nov. 2012 Investment Management and Commercial Lending Center October 2013 Peoples Federal Bancshares $432MM Deposits 8 Branches – Feb. 2015

(16) Building Franchise Value Disciplined Acquisitions Deal Value: $16.9MM 11% Core Dep. Premium* Falmouth Bancorp Jul ‘04 $140mm Assets $137mm Deposits 4 Branches Deal Value: $102.2 MM 17% Core Dep. Premium* Slade’s Ferry Bancorp Mar ‘08 $630mm Assets $411mm Deposits 9 Branches Deal Value: $84.5MM 2% Core Dep. Premium* Benjamin Franklin Bancorp Apr ‘09 $994mm Assets $701mm Deposits 11 Branches Deal Value: $52.0MM 8% Core Dep. Premium* Central Bancorp Nov ‘12 $537mm Assets $357mm Deposits 10 Branches Deal Value: $40.3MM 8% Core Dep. Premium* Mayflower Bancorp Nov’13 $243mm Assets $219mm Deposits 8 Branches $464mm Assets $432mm Deposits 8 Branches Deal Value: $141.8MM 10% Core Dep. Premium** All Acquisitions Immediately Accretive *Incl. CDs <$100k Deal metrics based on closing price and actual acquired assets Peoples Federal Bancshares Feb ‘15

(17) Major Opportunities in Acquired Bank Markets: Capitalizing on Rockland Trust Brand Investment Management Commercial Banking Retail/ Consumer • $2.5 billion AUA • Wealth/Institutional • Strong referral network • Sophisticated products • Expanded presence • In depth market knowledge • Award winning customer service • Electronic/mobile banking • Competitive home equity products Acquired Bank Customer Bases

(18) Augmenting Organic Growth • Expanding asset-based lending capability • Streamlining of mobile banking app • Launching of a new and improved RocklandTrust.com website • Grand re-opening of modern branch in Somerville • Tax credit community lending programs • Attracting senior talent from within the region Low-Risk Growth Opportunities

(19) Raising the Bar on Operational Excellence Business Intelligence/Knowledge Management • Further leverage analytics to drive business results • Grow and deepen quality customer relationships • Better align sales, marketing, and relationship management Process Improvement • Focused on cost and quality of delivery • Elevate the customer experience • Embed culture of continuous improvement

(20) Attentive to Shareholder Returns $0.84 $0.88 $0.96 $0.26 2012 2013 2014 1Q15 Cash Dividends Declared Per Share

(21) INDB Investment Merits • High quality franchise in attractive markets • Strong organic business volumes • Operating platform that can be leveraged further • Capitalizing on in-market consolidation opportunities • Diligent stewards of shareholder capital • Grounded management team • Positioned to grow, build, and acquire to drive long-term value creation

(22) NASDAQ Ticker: INDB www.rocklandtrust.com Robert Cozzone – CFO & Treasurer Shareholder Relations: (781) 878-6100 Statements contained in this presentation that are not historical facts are “forward-looking statements” that are subject to risks and uncertainties which could cause actual results to differ materially from those currently anticipated due to a number of factors, which include, but are not limited to, factors discussed in documents filed by the Company with the Securities and Exchange Commission from time to time.