Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DANAHER CORP /DE/ | d927995d8k.htm |

Exhibit 99.1

PALL: WELCOME TO DANAHER

May 15, 2015 |

Forward Looking Statements

Statements in this presentation that are not strictly historical, including statements regarding the

proposed acquisition of Pentagon, the expected timetable for completing the acquisition, future

financial and operating results, benefits and synergies of the acquisition, future opportunities for the

combined businesses, the anticipated separation of the Company into two independent companies, the

expected timetable for completing the separation, future financial and operating performance of

each company, benefits and synergies of the separation, strategic and competitive advantages of

each company, the leadership of each company, future opportunities for each company and any other statements regarding events or

developments that we believe or anticipate will or may occur in the future are

"forward-looking" statements within the meaning of the federal securities laws. There

are a number of important factors that could cause actual results, developments and business decisions to differ materially from those

suggested or indicated by such forward-looking statements and you should not place undue reliance on

any such forward-looking statements. These factors include, among other things: economic

conditions affecting the industries in which Danaher’s businesses and Pentagon operate, the

uncertainty of regulatory approvals, Danaher’s and Pentagon’s ability to satisfy the merger

agreement conditions and consummate the transaction on a timely basis or at all, Danaher's

ability to successfully integrate Pentagon’s operations and employees with Danaher's existing business, the ability to

realize anticipated growth, synergies and cost savings from the acquisition, Pentagon’s performance

and maintenance of important business relationships, Danaher’s ability to satisfy the

necessary conditions to consummate the separation on a timely basis or at all, Danaher's ability to

successfully separate the two companies and realize the anticipated benefits from the separation, the

maintenance of important business relationships, deterioration of or instability in the economy,

the markets we serve and the financial markets, the impact of our restructuring activities on our ability to

grow, contractions or growth rates and cyclicality of markets we serve, competition, our ability to

develop and successfully market new products and technologies and expand into new markets, the

potential for improper conduct by our employees, agents or business partners, our ability to

successfully identify, consummate and integrate appropriate acquisitions and successfully complete

divestitures and other dispositions, contingent liabilities relating to acquisitions and

divestures, our ability to close the anticipated merger of our Communications business with NetScout, Inc. and

achieve the desired benefits of that transaction, our compliance with applicable laws and regulations

(including regulations relating to medical devices and the healthcare industry) and changes in

applicable laws and regulations, our ability to effectively address cost reductions and other changes in the

healthcare industry, risks relating to potential impairment of goodwill and other intangible assets,

currency exchange rates, tax audits and changes in our tax rate and income tax liabilities,

litigation and other contingent liabilities including intellectual property and environmental, health and safety

matters, risks relating to product, service or software defects, product liability and recalls, risks

relating to product manufacturing, the impact of our debt obligations on our operations and

liquidity, our relationships with and the performance of our channel partners, commodity costs and surcharges,

our ability to adjust purchases and manufacturing capacity to reflect market conditions, reliance on

sole sources of supply, labor matters, international economic, political, legal, compliance and

business factors, disruptions relating to man-made and natural disasters, security breaches or other

disruptions of our information technology systems and pension plan costs. Additional information

regarding the factors that may cause actual results to differ materially from these

forward-looking statements is available in our SEC filings, including our 2014 Annual Report on Form 10-K and Quarterly

Report on Form 10-Q for the first quarter of 2015. These forward-looking statements speak only

as of the date of this release and the Company does not assume any obligation to update or revise

any forward-looking statement, whether as a result of new information, future events and developments or

otherwise. |

Welcome to Danaher!

We value your past efforts, the company you’ve built and the

customer relationships you’ve developed.

We’re excited to have you on our team.

We look forward to working and growing with you! |

Overview

About Danaher

Our Portfolio with Pall

Our Values

Danaher Business System (DBS)

Success stories –

acquisitions and innovation

The weeks ahead

What you can expect from Danaher |

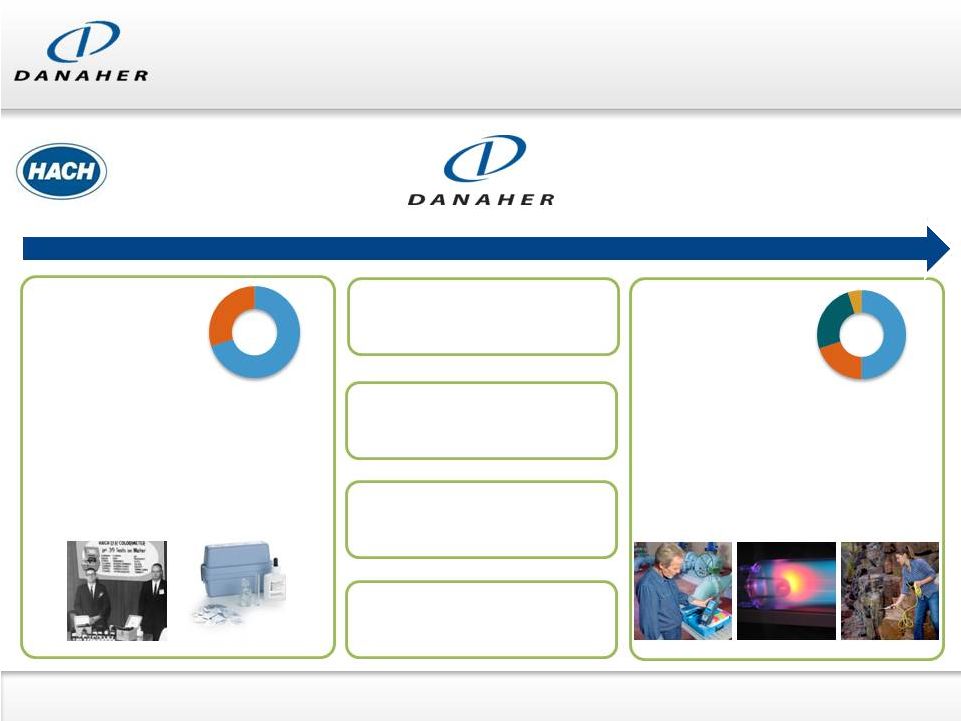

Danaher with Pall

You are joining other fantastic companies

Danaher

2014 Revenue: $16.5B*

Life Sciences

$2.5B

Water Quality

$2.0B

Pall

$2.8B

Product ID

$1.6B

Diagnostics

$4.8B

Dental

$2.9B

Founded in 1984

Headquartered in

Washington, DC

New York Stock Exchange

Ticker: DHR

Global team of ~52,000

associates (including Pall)

* Reflects aggregate revenues from constituent businesses (including with respect to “Future

Danaher,” Pall) for the respective, most recently completed fiscal year. Pall revenues are

based on 2014 FYE ended July 31, 2014. Includes $0.7B of annual revenues for Nobel Biocare and $0.2B of annual revenues

for Devicor, each of which was acquired in December 2014. |

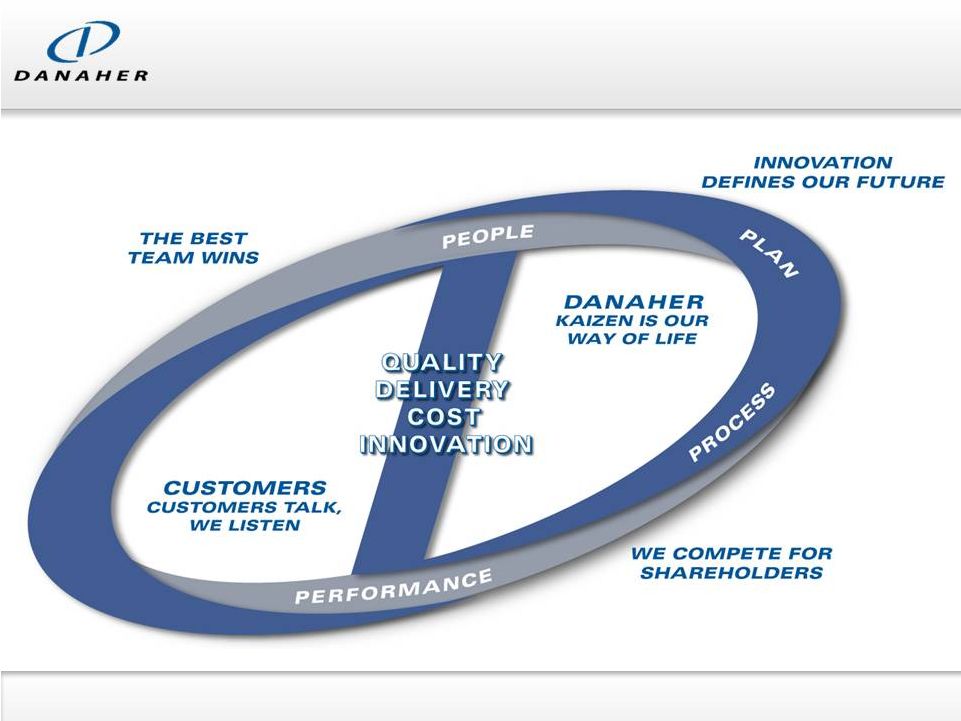

Our

Core Values The Best Team Wins

Customers Talk, We Listen

Kaizen is Our Way of Life

Innovation Defines our Future

We Compete for Shareholders |

Danaher Business System |

Associate

development

GROWTH

LEAN

LEADERSHIP

Leadership

development

Business process

Develop

Deliver

Dream

Reliability

Operations

•

What’s unique about DBS tools?

Transactional

Crucial

conversations

Financial

acumen

Recruiting and

selection

Introduction to DBS

Training and

facilitation

DBS leader

boot camp

DBS leader

continuing

education

Development for

growth

DBS tool

certification (MBB)

Change management

Accelerated

product

development

Breakthrough

ideation

/ open innovation

Customer

segmentation

Demand

generation

Toll Gate #2 kaizen

Lean software design

Project management

Product life cycle

management

Intellectual

property process

Positioning and

Messaging Kaizen

Inside sales

Value selling

Sales force initiative

Product life cycle

management

Search engine

optimization

Pay per click kaizen

On-Line

nurturing kaizen

Strategic

negotiations

Reliability PD

boot Camp

Customer defect

tracking and

resolution

Supplier quality

management

Design for reliability

Failure mode

effects analysis

Customer service

and support

Personal review

and team inspection

User experience

design

Quality system basics

Value analysis/

value engineering

Just in time

accounting

Sourcing workshop

and supply base

management

Commodity

management

Supply chain and

logistics

best practices

Accounts receivable

best practices

DBS compliance

for medical device

manufacturing

Production sales

inventory

Lean supply chain

(Strategic supplier

productivity)

Lean conversion

Total productive

manufacturing

Danaher materials

process

(Includes kanban)

Heijunka

Set-up reduction

Production

preparation process

Energy conservation

kaizen

Variation reduction

kaizen

Measurement

system analysis

GM

Policy Deployment *

Acquisition

Integration

Strategic Planning

Leadership and

organization

communications*

Developing

growth leaders *

Risk assessment *

Leveraging

your impact *

Executive champion

orientation

Advanced talent

assessment *

Adjusting your

leadership style *

Accounts payable

best practices

Transactional

lean conversion and

Daily Mgmt.

Product planning

group

Price leakage kaizen

Pricing margin

management

ID, developing and

communications*

Situational

leadership

Driving the

Danaher culture

Leading

multiple P&Ls

Leadership

essentials

DBS FUNDAMENTALS

Voice of

the customer

Value stream

mapping

Standard work

Transactional process

improvement

Kaizen basics

5S

Problem

solving process

Visual and daily

management

Speedy

Design Review (SDR)

DBS Toolkit Today

-Integrated and improved over time

-Smart usage

pick for highest impact

-Velocity of implementation

-Commitment to use

everybody’s job

-

Shared across Danaher companies

-* = Class in DHR Leadership Program |

Core Value Drivers

Quality

On-Time Delivery

Customer

Associate

Shareholder

Internal Fill Rate

Turnover

Core Growth

OMX

Cash Flow / Working Capital Turnover

Return on Invested Capital

How we measure our success |

Why is Danaher an exciting opportunity?

Markets:

Leading positions and outstanding global brands well positioned

within markets with strong growth vectors

IP / Technology:

Highly technical, rich IP environment provides opportunity

for continued innovation leadership

People:

DBS culture provides framework for continuous learning and

professional development. Committed associates with great depth

of

insight into customers, markets and products

Growth opportunities:

Well capitalized company provides organic and

inorganic investment opportunities and resultant growth for both

associates

and customers |

1999

TODAY

Water Quality Acquisition Success

Revenue:

~$125M

Operating

Margin:

High

teens

Associates

~550

Products

+

=

WATER QUALITY PLATFORM

Technology to test, analyze and

treat ultra-pure, waste, ground,

ocean and drinking water

Water testing equipment

for municipal and

industrial customers

Acquisitions

Research &

Development

Sales & Marketing

Geographic

Footprint

Revenue:

~$2.0B

Operating

Margin:

~25%

Associates

~6,800

Products

50%

North

America

20%

Europe

25%

HGMs

5%

Other

70%

North

America

30%

Other

Growth investments made a good company even better…

still improving! |

Focus in the Coming Weeks

Stay focused on serving customers well

Leverage the acquisition as an opportunity for growth

Be open to new ideas

Get to know Danaher and our formula for success |

What You Can Expect from Danaher –

In the Coming Months

Ongoing interaction, communication and engagement from

Danaher and Pall leaders

Until close:

Danaher and Pall will continue to operate separately

Danaher will not be involved in Pall’s day-to-day business

activities Start planning transition activities

Upon close:

From a publicly traded company to a wholly-owned subsidiary

Will run as a stand-alone operating company within Danaher, retaining

the Pall brand

Changes in financial reporting |

What You Can Expect from Danaher –

After Close

First 100 days

Pall leadership immersed in DBS

Pall leadership will work with Danaher to update your Strategic Plan

3 to 5 year planning horizon

Focused on growing the business, defining opportunities around costs

and investments

Change is led by the Pall leadership team |

Communication Lines are Open

It’s normal to feel apprehension, uncertainty and mistrust

Danaher has done this before, but each situation is unique

We don’t have it all figured out yet

For now, there are more questions than answers, but we will keep

lines of communication open

Communication is a two-way street and we welcome your questions and

feedback |

|

ADDITIONAL INFORMATION ABOUT THE MERGER

A meeting of the shareholders of Pall will be announced to obtain shareholder

approval of the proposed transaction.

Pall

intends

to

file

with

the

SEC

a

proxy

statement

and

other

relevant

documents

in

connection

with the proposed transaction. The definitive proxy statement will be sent or given

to the shareholders of Pall

and

will

contain

important

information

about

the

proposed

transaction

and

related

matters.

PALL'S

SHAREHOLDERS

ARE

URGED

TO

READ

THE

DEFINITIVE

PROXY

STATEMENT

AND

OTHER

RELEVANT

MATERIALS

WHEN

THEY

BECOME

AVAILABLE

BECAUSE

THEY

WILL

CONTAIN

IMPORTANT

INFORMATION

ABOUT

PALL,

DANAHER

AND

THE

PROPOSED

TRANSACTION.

Investors

may

obtain

a

free

copy

of

these

materials

(when

they

are

available)

and

other

documents

filed

by

Pall

with

the

SEC

at

the

SEC’s

website

at

www.sec.gov, at

Pall's

website

at

www.pall.com

or

by

sending

a

written

request

to

pall,

Attn:

Investor

Relations, 25 Harbor Park Drive, Port Washington, NY, 11050.

PARTICIPANTS IN THE SOLICITATION

Pall, Danaher and their respective directors and executive officers and other persons

may be deemed to be participants

in

the

solicitation

of

proxies

from

the

shareholders

of

Pall

in

favor

of

the

proposed

merger.

Information

regarding

the

persons

who

may,

under

the

rules

of

the

SEC,

be

considered

to

be

participants in the solicitation of Pall's shareholders in connection with the

proposed transaction, and any interest they have in the proposed transaction,

will be set forth in the definitive proxy statement when it is filed with the

SEC. Additional information regarding Danaher's directors and executive officers is included in

Danaher's Annual Report on Form 10-K for the year ended December 31, 2014, filed

with the SEC on February 25, 2015 and the proxy statement for Danaher's 2015

Annual Meeting of Shareholders, filed with the

SEC

on

March

27,

2015.

Additional

information

regarding

Pall's

directors

and

executive

officers

is

included in Pall's Annual Report on Form 10-K for the fiscal year ended July 31,

2014, filed with the SEC on September

8,

2014

and

the

proxy

statement

for

Pall's

2014

Annual

Meeting

of

Shareholders,

filed

with

the

SEC on October 31, 2014. |