Attached files

| file | filename |

|---|---|

| EX-3.1 - EX-3.1 - Green Plains Partners LP | d858339dex31.htm |

| EX-23.1 - EX-23.1 - Green Plains Partners LP | d858339dex231.htm |

| EX-23.2 - EX-23.2 - Green Plains Partners LP | d858339dex232.htm |

Table of Contents

As filed with the Securities and Exchange Commission on May 18, 2015

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Green Plains Partners LP

(Exact name of Registrant as Specified in its Charter)

| Delaware | 4610 | 47-3822258 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

450 Regency Parkway, Suite 400

Omaha, Nebraska 68114

(402) 884-8700

(Address, including Zip Code, and Telephone Number, including Area Code, of Registrant’s Principal Executive Offices)

Todd A. Becker

President and Chief Executive Officer

Green Plains Holdings LLC

450 Regency Parkway, Suite 400

Omaha, Nebraska 68114

(402) 884-8700

(Name, Address, including Zip Code, and Telephone Number, including Area Code, of Agent for Service)

Copies to:

| G. Michael O’Leary Stephanie Beauvais Andrews Kurth LLP 600 Travis St., Suite 4200 Houston, Texas 77002 (713) 220-4200 |

Ryan J. Maierson Thomas G. Brandt Latham & Watkins LLP 811 Main Street, Suite 3700 Houston, Texas 77002 (713) 546-5400 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) | ||||||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum |

Amount of Registration Fee | ||

| Common units representing limited partner interests |

$200,000,000 | $23,240 | ||

|

| ||||

|

| ||||

| (1) | Includes common units issuable upon exercise of the underwriters’ option to purchase additional common units. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o). |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated May 18, 2015

PROSPECTUS

Common Units

Representing Limited Partner Interests

This is an initial public offering of common units representing limited partner interests of Green Plains Partners LP. We are offering common units in this offering. We expect that the initial public offering price will be between $ and $ per common unit. We were recently formed by Green Plains Inc., or our parent, and no public market currently exists for our common units. We have applied to list our common units on the NASDAQ Global Market under the symbol “GPP.” We are an “emerging growth company” as that term is defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act.

Investing in our common units involves a high degree of risk. Before buying any common units, you should carefully read the discussion of risks of investing in our common units in “Risk Factors” beginning on page 23.

These risks include the following:

| • | We may not have sufficient cash from operations following the establishment of cash reserves and payment of fees and expenses, including cost reimbursements to our general partner and its affiliates, to enable us to pay the minimum quarterly distribution to our unitholders. |

| • | Our pro forma financial data are not necessarily representative of the results of what we would have achieved and may not be a reliable indicator of our future results. |

| • | The assumptions underlying the forecast of distributable cash flow that we include in “Our Cash Distribution Policy and Restrictions on Distributions” are inherently uncertain and are subject to significant business, economic, financial, regulatory and competitive risks and uncertainties that could cause actual results to differ materially from those forecasted. |

| • | Green Plains Trade Group LLC, or Green Plains Trade, a subsidiary of our parent, will initially account for a substantial portion of our revenues. Therefore, we will be subject to the business risks of Green Plains Trade and, as a result of its direct ownership by our parent, to the business risks of our parent. If Green Plains Trade is unable to satisfy its obligations under the commercial agreements with us for any reason, our revenues would decline and our financial condition, results of operations, cash flows and ability to make distributions to our unitholders would be adversely affected. |

| • | Green Plains Trade may suspend, reduce or terminate its obligations under the commercial agreements with us in certain circumstances, which could have a material adverse effect on our financial condition, results of operations, cash flows and ability to make distributions to our unitholders. |

| • | Our parent will own and control our general partner, which has sole responsibility for conducting our business and managing our operations. Our general partner and its affiliates, including our parent and Green Plains Trade, have conflicts of interest with us and limited duties to us and our unitholders, and they may favor their own interests to our detriment and that of our unitholders. |

| • | Our partnership agreement restricts the remedies available to holders of our common units and our subordinated units for actions taken by our general partner that might otherwise constitute breaches of fiduciary duty. |

| • | Our unitholders have limited voting rights and are not entitled to elect our general partner or the board of directors of our general partner, which could reduce the price at which our common units will trade. |

| • | Immediately effective upon the closing of this offering, unitholders will experience substantial dilution of $ in tangible net book value per common unit. |

| • | Our tax treatment depends on our status as a partnership for U.S. federal income tax purposes. If the Internal Revenue Service were to treat us as a corporation for U.S. federal income tax purposes, which would subject us to entity-level taxation, or if we were otherwise subjected to a material amount of additional entity-level taxation, then our distributable cash flow to our unitholders would be substantially reduced. |

| • | Even if our unitholders do not receive any cash distributions from us, our unitholders will be required to pay taxes on their share of our taxable income. |

| Per Common Unit | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds to Green Plains Partners LP, before expenses |

$ | $ | ||||||

| (1) | Excludes an aggregate structuring fee equal to % of the gross proceeds of this offering payable to Barclays Capital Inc. Please read “Underwriting.” |

The underwriters may also purchase up to an additional common units from us at the initial public offering price, less the underwriting discounts and commissions and a structuring fee payable by us, within 30 days from the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the common units on or about , 2015.

| Barclays | BofA Merrill Lynch | |

Prospectus dated , 2015

Table of Contents

i

Table of Contents

| Page | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

93 | |||

| 93 | ||||

| 93 | ||||

| 95 | ||||

| Factors Affecting the Comparability of Our Financial Results |

97 | |||

| 98 | ||||

| 101 | ||||

| 102 | ||||

| 105 | ||||

| 105 | ||||

| 107 | ||||

| 107 | ||||

| 108 | ||||

| 108 | ||||

| 111 | ||||

| 114 | ||||

| 116 | ||||

| 116 | ||||

| 120 | ||||

| 121 | ||||

| 123 | ||||

| 125 | ||||

| 127 | ||||

| 130 | ||||

| 131 | ||||

| 131 | ||||

| 131 | ||||

| 132 | ||||

| 132 | ||||

| 134 | ||||

| 135 | ||||

| 135 | ||||

| 135 | ||||

| 135 | ||||

| 136 | ||||

| 136 | ||||

| Directors and Executive Officers of Green Plains Holdings LLC |

137 | |||

| 139 | ||||

| 139 | ||||

| 140 | ||||

| SECURITY OWNERSHIP AND CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

141 | |||

| 142 | ||||

| Distributions and Payments to Our General Partner and Its Affiliates |

142 | |||

| Agreements with Affiliates in Connection with the Transactions |

144 | |||

| 148 | ||||

| 148 | ||||

| 154 | ||||

ii

Table of Contents

| Page | ||||

| 158 | ||||

| 158 | ||||

| 158 | ||||

| 158 | ||||

| 159 | ||||

| 160 | ||||

| 160 | ||||

| 160 | ||||

| 160 | ||||

| 160 | ||||

| 161 | ||||

| 162 | ||||

| 163 | ||||

| 163 | ||||

| 166 | ||||

| 167 | ||||

| 167 | ||||

| 168 | ||||

| 168 | ||||

| 168 | ||||

| 168 | ||||

| 169 | ||||

| 169 | ||||

| 169 | ||||

| 170 | ||||

| 170 | ||||

| 171 | ||||

| 171 | ||||

| 171 | ||||

| 172 | ||||

| 172 | ||||

| 172 | ||||

| 173 | ||||

| 175 | ||||

| 175 | ||||

| 175 | ||||

| 176 | ||||

| 177 | ||||

| 178 | ||||

| 179 | ||||

| 179 | ||||

| 185 | ||||

| 186 | ||||

| 188 | ||||

| 189 | ||||

| 190 | ||||

| 192 | ||||

| 192 | ||||

| INVESTMENT IN GREEN PLAINS PARTNERS LP BY EMPLOYEE BENEFIT PLANS |

194 | |||

iii

Table of Contents

| Page | ||||

| 196 | ||||

| 196 | ||||

| 196 | ||||

| 197 | ||||

| 197 | ||||

| 198 | ||||

| 198 | ||||

| 198 | ||||

| 199 | ||||

| 199 | ||||

| 199 | ||||

| 199 | ||||

| 200 | ||||

| 200 | ||||

| 201 | ||||

| 201 | ||||

| 201 | ||||

| 202 | ||||

| F-1 | ||||

| APPENDIX A—AMENDED AND RESTATED AGREEMENT OF LIMITED PARTNERSHIP OF GREEN PLAINS PARTNERS LP |

A-1 | |||

| B-1 | ||||

You should rely only on the information contained in this prospectus or in any free writing prospectus we may authorize to be delivered to you. We have not, and the underwriters have not, authorized any other person to provide you with information different from that contained in this prospectus and any free writing prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the common units. Our business, financial condition, results of operations and prospects may have changed since that date. We will update this prospectus as required by federal securities laws.

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. Please read “Risk Factors” and “Cautionary Note Concerning Forward-Looking Statements.”

iv

Table of Contents

Industry and Market Data

The market data and certain other statistical information used throughout this prospectus are derived from a variety of sources, including independent industry publications, government publications or other published independent sources, which we did not participate in preparing, as well as our good faith estimates, which have been derived from management’s knowledge and experience in the areas in which our business operates. Although we have not independently verified the accuracy or completeness of the third-party information included in this prospectus, based on management’s knowledge and experience, we believe that the third-party sources are reliable and that the third-party information included in this prospectus or in our estimates is accurate and complete. Estimates of market size and relative positions in a market are difficult to develop and are inherently uncertain and subject to change based on various factors, including those discussed under the section entitled “Risk Factors.” Accordingly, investors should not place undue weight on the industry and market share data presented in this prospectus.

v

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus. It does not contain all of the information that you should consider before purchasing our common units. You should carefully read the entire prospectus, including “Risk Factors” and the historical and unaudited pro forma financial statements and related notes included elsewhere in this prospectus before making an investment decision. Unless otherwise indicated, the information in this prospectus assumes (1) an initial public offering price of $ per common unit (the midpoint of the price range set forth on the cover page of this prospectus) and (2) that the underwriters do not exercise their option to purchase additional common units. You should read “Risk Factors” beginning on page 23 for more information about important factors that you should consider before purchasing our common units.

Unless the context otherwise requires, references in this prospectus to “our partnership,” “we,” “our,” “us” or like terms, when used in a historical context, refer to BlendStar LLC and its subsidiaries, our predecessor for accounting purposes, also referred to as “our Predecessor,” and when used in the present tense or prospectively, refer to Green Plains Partners LP and its subsidiaries. References to (i) “our general partner” and “Green Plains Holdings” refer to Green Plains Holdings LLC; (ii) “our parent” and “Green Plains” refer to Green Plains Inc. or, as the context may require, Green Plains Inc. and its subsidiaries, other than us, our subsidiaries and our general partner; and (iii) “Green Plains Trade” refers to Green Plains Trade Group LLC, a wholly-owned subsidiary of our parent.

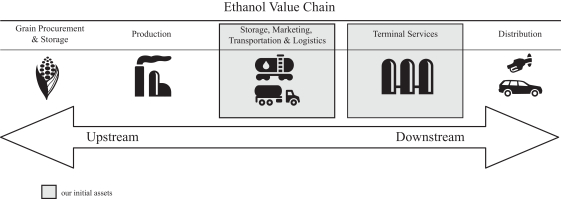

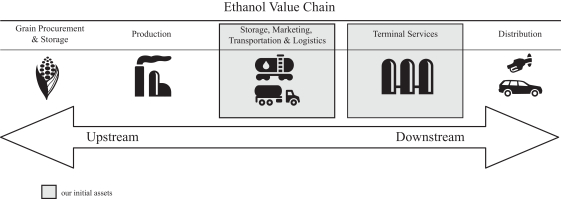

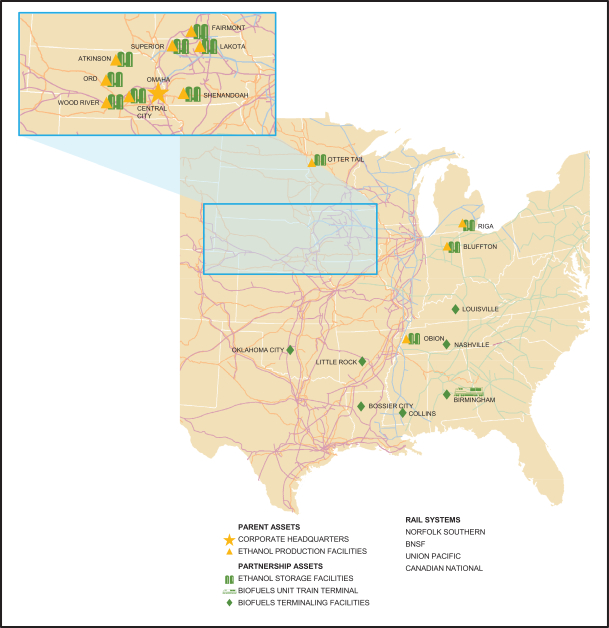

Green Plains Partners LP

We are a fee-based Delaware limited partnership recently formed by our parent, Green Plains Inc., to own, operate, develop and acquire ethanol and fuel storage tanks, terminals, transportation assets and other related assets and businesses. We expect to be our parent’s primary vehicle to own, operate and expand the downstream logistics assets required to support its approximately 1.2 billion gallons per year, or bgy, ethanol marketing and distribution business because our assets are the principal method of storing and delivering the ethanol our parent produces for its customers. Our parent believes that this vertical integration will enable it to further expand its downstream logistics activities and better capture the economic value of these operations within the ethanol value chain. The ethanol that our parent produces is fuel grade, principally from the starch extracted from corn, and is primarily used in the blending of gasoline. Ethanol currently comprises approximately 10% of the U.S. gasoline market and is an economical source of octane and oxygenate for blending into the fuel supply. We generate a substantial portion of our revenues by charging fixed fees to Green Plains Trade for receiving, storing, transferring and transporting ethanol and other fuels. We do not take ownership of, or receive any payments based on the value of, the ethanol or fuel we handle; as a result, we will not have any direct exposure to fluctuations in commodity prices.

Our initial assets include:

| • | Ethanol Storage Facilities. We own 27 ethanol storage facilities located at or near our parent’s twelve ethanol production plants located in Indiana, Iowa, Michigan, Minnesota, Nebraska and Tennessee and which have a current combined ethanol production capacity of approximately 1.0 bgy. Our ethanol storage assets currently have a combined storage capacity of approximately 26.6 million gallons, or mmg, and have the ability to efficiently and effectively store and load railcars and tanker trucks with all of the ethanol produced at our parent’s ethanol production plants. For the years ended December 31, 2014 and 2013, our ethanol storage assets had annual throughput of approximately 966.2 million gallons per year, or mmgy, and 729.2 mmgy, respectively, which represents 95.6% and 94.0%, respectively, of the combined daily average production capacity of our parent’s ethanol production plants. For the three months ended March 31, 2015, our ethanol storage assets had aggregate throughput of approximately 232.5 mmg, which represents 92.4% of the combined daily average production capacity of our parent’s ethanol production plants. |

1

Table of Contents

| • | Fuel Terminal Facilities. We provide terminal services and logistics solutions through our fuel terminal facilities that we own and operate through our wholly-owned subsidiary, BlendStar LLC. These fuel terminal facilities, at eight locations in seven south-central U.S. states, have fuel holding tanks and access to major rail lines for transporting ethanol or other fuels. Additionally, our Birmingham, Alabama-Unit Train Terminal, or our Birmingham facility, is one of 20 facilities in the United States capable of efficiently receiving and offloading ethanol and other fuels from unit trains. Our fuel terminal facilities have a current combined total storage capacity of approximately 7.4 mmg and, for the year ended December 31, 2014 and the three months ended March 31, 2015, had an aggregate throughput of approximately 324.8 mmgy and 80.4 mmg, respectively. |

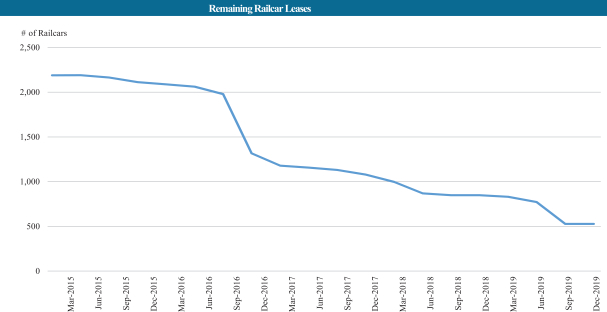

| • | Transportation Assets. Our transportation assets include a leased railcar fleet of approximately 2,200 railcars that are exclusively dedicated to transporting product for our parent, including its ethanol and other fuels, from our fuel terminal facilities or third-party production facilities to refineries throughout the United States and international export terminals. |

We intend to seek opportunities to grow our business by pursuing organic projects and acquisitions of complementary assets from third parties in cooperation with our parent and on our own. For example, our parent has announced that it is expanding production at its ethanol production plants by approximately 100 mmgy and will explore certain other expansion projects at its ethanol production plants in the future. These expansion projects, when implemented, will enable us to utilize the strategic location and capacity of our assets and will increase annual throughput at our ethanol storage facilities with minimal capital.

A substantial portion of our revenues and cash flows will initially be derived from commercial agreements with Green Plains Trade. At the closing of this offering, we will (1) enter into (i) a ten-year fee-based storage and throughput agreement, (ii) a six-year fee-based rail transportation services agreement, and (iii) a one-year fee-based trucking transportation services agreement and (2) assume (i) an approximately 2.5-year fee-based terminaling agreement for our Birmingham facility, which we refer to as our Birmingham terminaling agreement, and (ii) various other terminaling agreements for our other fuel terminal facilities, each with Green Plains Trade. Our storage and throughput agreement and certain of our terminaling agreements, including the Birmingham terminaling agreement, will be supported by minimum volume commitments, and our rail transportation services agreement will be supported by minimum railcar take-or-pay usage commitments. We believe that the nature of these agreements will provide stable and predictable cash flows over time. The following table sets forth additional information regarding our storage and throughput agreement, our Birmingham terminaling agreement and our rail transportation services agreement with Green Plains Trade at the closing of this offering:

| Agreement |

Remaining Primary Term (years) |

Annualized Minimum Commitment(1) |

Actual Year Ended December 31, 2014 Volumes |

Rate | ||||||||||||

| Storage and Throughput |

10(2) | 850.0 mmgy | 966.2 mmgy | $0.05 per gallon(3) | ||||||||||||

| Birmingham Terminaling(4) |

2.5(5) | 33.2 mmgy(5) | 40.6 mmgy(5) | $0.0355 per gallon | ||||||||||||

| Rail Transportation Services |

6(6) | 2,210 railcars(7) | 2,186 railcars(7) | $1,053 per railcar(8) | ||||||||||||

| (1) | Represents the minimum volume commitments under our storage and throughput agreement and our Birmingham terminaling agreement, and the minimum railcar take-or-pay usage commitment under our rail transportation services agreement. |

| (2) | After the end of the remaining primary term, our storage and throughput agreement will automatically renew for successive one-year terms unless either party provides notice of termination one year prior to the end of the applicable term. |

| (3) | The rate of $0.05 per gallon is effective through the last day of the fifth year of the primary term of the storage and throughout agreement. As of the first day of the sixth year of the primary term of the storage |

2

Table of Contents

| and throughout agreement, the rate will be increased by an amount equal to the percentage change, if any, in the Producer Price Index, or PPI, since the closing of this offering, and such increased rate will be in effect for the remainder of the primary term. |

| (4) | In addition to our Birmingham terminaling agreement, at the closing of this offering, we will assume all of our Predecessor’s other terminaling agreements with Green Plains Trade for our other fuel terminal facilities. These agreements have terms ranging from month-to-month up to six months. |

| (5) | Our Birmingham terminaling agreement was amended on February 27, 2015 to, among other things, increase the minimum monthly charge to $98,150, which represents $0.0355 per gallon on Green Plains Trade’s minimum throughput of approximately 2.8 mmg at our Birmingham facility. Upon the expiration of the remaining primary term, our Birmingham terminaling agreement will automatically renew for successive one-year terms unless either party provides notice of termination 90 days prior to the end of the applicable term. |

| (6) | At the closing of this offering, the remaining primary term of our rail transportation services agreement will last for six years. Our leased railcars are subject to lease agreements with various terms. Upon the expiration of the term of any individual railcar lease agreement, the leased railcars under that agreement will no longer be subject to the rail transportation services agreement. The weighted average term of the railcar lease agreements as of December 31, 2014 was 3.5 years. Please read “Business—Our Assets and Operations—Transportation Assets” for further discussion of the railcar lease agreements. |

| (7) | Represents the weighted average number of railcars leased by us subject to our rail transportation services agreement for the twelve months ending December 31, 2014. As of March 31, 2015, we had a total of 2,210 railcars leased. Green Plains Trade will be obligated to pay the monthly railcar fee regardless of usage. The minimum railcar commitment and the rate charged per railcar depend on the terms of our existing railcar lease agreements. Please read “Business—Commercial Agreements with Our Parent’s Affiliate” for additional information. |

| (8) | Represents the current average monthly fee payable to us by Green Plains Trade under our rail transportation services agreement for each railcar leased by us as of March 31, 2015, which includes approximately $220 per month in excess of our costs to lease each railcar. Excludes railcars leased by Green Plains Trade from a third party but for which we receive a management fee of $40 per month per railcar under our transportation agreement. |

For more information related to our commercial agreements with Green Plains Trade, as well as the revenue we expect to receive in connection with these agreements for the twelve months ending June 30, 2016, please read “Our Cash Distribution Policy and Restrictions on Distributions—Significant Forecast Assumptions” and “Business—Commercial Agreements with Our Parent’s Affiliate.”

For the year ended December 31, 2014 and the three months ended March 31, 2015, we had pro forma revenues of approximately $86.2 million and $22.0 million, respectively, pro forma net income of approximately $53.0 million and $13.2 million, respectively, and pro forma Adjusted EBITDA of approximately $59.4 million and $14.7 million, respectively. Our parent and its subsidiaries accounted for approximately 90.2% and 90.5% of our pro forma revenues for such periods, respectively. For the year ended December 31, 2014 and the three months ended March 31, 2015, our Predecessor had revenues of approximately $12.8 million and $3.4 million, respectively, and net income of approximately $2.3 million and $0.8 million, respectively. We use Adjusted EBITDA to measure our financial performance and to internally manage our business; however, Adjusted EBITDA calculations may vary from company to company. Please read “Selected Historical and Pro Forma Condensed Consolidated Financial and Operating Data—Non-GAAP Financial Measure” for a definition of Adjusted EBITDA and a reconciliation of pro forma net income as determined in accordance with U.S. generally accepted accounting principles, or GAAP, to Adjusted EBITDA.

Our parent is a Fortune 1000, vertically-integrated producer, marketer and distributor of ethanol and is the fourth largest ethanol producer in North America. Our parent’s operations extend throughout the ethanol value chain, beginning upstream with grain handling and storage operations, continuing through its ethanol, distillers

3

Table of Contents

grains and corn oil production operations, and ending downstream with its marketing, terminal and distribution services. Please read “Industry Overview” for a more-detailed discussion of the ethanol industry.

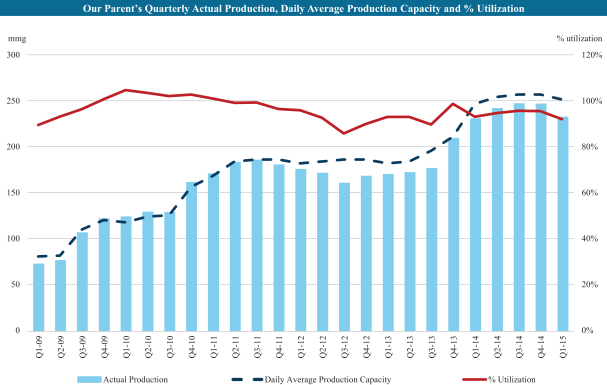

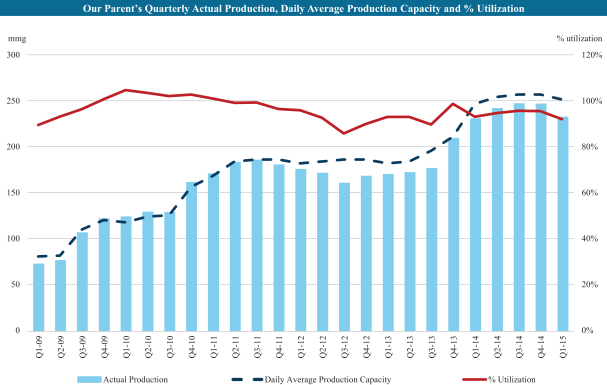

We benefit significantly from our relationship with our parent. We were formed by our parent to be its primary vehicle to expand the downstream logistics activities required to support its ethanol marketing and distribution business. Our parent operated at approximately 95.6% and 92.4% of its daily average production capacity for the year ended December 31, 2014 and the three months ended March 31, 2015, respectively. We plan to capitalize on our parent’s production capability because our assets are the principal method of storing and delivering the ethanol our parent produces to its customers. Our commercial agreements with Green Plains Trade will account for a substantial portion of our revenues and Green Plains Trade will be our primary customer. From January 1, 2009 to March 31, 2015, our parent’s quarterly ethanol production increased 217.6%, from 73.2 mmg to 232.5 mmg, primarily from third-party acquisitions. Over the same time period, our parent’s ethanol production averaged 96.3%, and never fell below 86.2%, of its daily average production capacity. Our parent’s quarterly actual production, daily average production capacity and utilization are highlighted by the chart below:

Following the completion of this offering, our parent will retain a majority ownership interest in us through its sole ownership of our general partner, a % limited partner interest in us and all of our incentive distribution rights. In addition, we will enter into an omnibus agreement at the closing of this offering under which we will be granted a right of first offer, for a period of five years, on any (1) ethanol storage or terminal assets that our parent may acquire or construct in the future, (2) fuel storage and terminal facilities that our parent may acquire or construct in the future, and (3) ethanol and fuel transportation assets that our parent currently owns or may acquire in the future, if our parent decides to sell any such assets. The consummation and timing of any acquisition of assets owned by our parent will depend upon, among other things, (1) our parent’s willingness to offer such asset for sale and its ability to obtain any necessary consents, (2) our determination that such asset is suitable for our business at that particular time, and (3) our ability to agree on a mutually acceptable price,

4

Table of Contents

negotiate definitive transaction documents and obtain financing. While our parent is not obligated to sell us any assets or promote and support the successful execution of our growth plan and strategy, we believe that our parent will be incentivized to serve as a critical source of our growth and will provide us with various growth opportunities in the future.

We believe that the following competitive strengths position us to successfully execute our business strategies:

| • | Long-Term Fee-Based Contracts with Minimum Volume or Usage Commitments. A substantial portion of our revenues and cash flows will initially be derived from our commercial agreements with Green Plains Trade, including our (1) ten-year fee-based storage and throughput agreement, (2) six-year fee-based rail transportation services agreement, (3) Birmingham terminaling agreement and (4) various other terminaling and transportation agreements. Our storage and throughput agreement and certain of our terminaling agreements, including the Birmingham terminaling agreement, will be supported by minimum volume commitments, and our rail transportation services agreement will be supported by minimum railcar take-or-pay usage commitments. |

| • | Advantageous Relationship with Our Parent. We expect to be our parent’s primary vehicle to own, operate and expand the downstream logistics assets required to support our parent’s approximately 1.2 bgy ethanol marketing and distribution business. Our parent has stated that it intends to expand its existing ethanol production plants, continue to pursue potential accretive acquisitions of additional ethanol production plants and further develop its downstream ethanol distribution services. We believe that our parent, as owner of a % limited partner interest in us, all of our incentive distribution rights and our general partner, is motivated to promote and support the successful execution of our principal business objectives and to pursue projects that directly or indirectly enhance the value of our assets. We expect this may be accomplished through the following means: |

| • | Organic Growth. Certain expansion projects that may be implemented by our parent at its ethanol production plants would enable us to utilize the strategic location and capacity of our assets and would increase annual throughput at our facilities. For example, our parent has announced that it is expanding production at its ethanol production plants by approximately 100 mmgy and will explore certain other expansion projects at its ethanol production plants in the future. We expect that our capital expenditures associated with such potential expansion projects will be minimal since our ethanol storage facilities have available capacity to accommodate growth in our parent’s throughput. |

| • | Accretive Acquisitions. We believe the U.S. ethanol production industry is poised for further consolidation and that our parent has the proven ability to identify, acquire and integrate accretive production assets. We intend to pursue strategic acquisitions independently and jointly with our parent to complement and grow our business. In addition, under our omnibus agreement, we will be granted a five-year right of first offer on any (1) ethanol storage or terminal assets that our parent may acquire or construct in the future, (2) fuel storage or terminal facilities that our parent may acquire or construct in the future, and (3) ethanol and fuel transportation assets that our parent currently owns or may acquire in the future, if our parent decides to sell any such assets. |

| • | Development of Downstream Distribution Services. We believe our parent will continue to use its logistical capabilities and expertise to develop its downstream ethanol distribution services. For example, we believe our parent will explore opportunities with third-party ethanol producers that would develop additional opportunities for downstream ethanol distribution services. We believe we will benefit from our parent’s marketing and distribution strategy due to the strategic location of our ethanol storage facilities and our fuel terminal facilities. |

5

Table of Contents

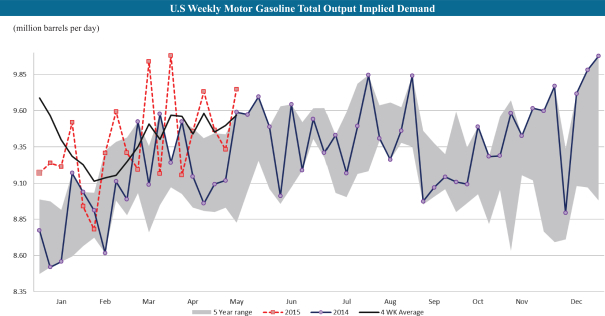

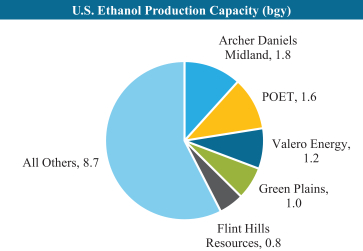

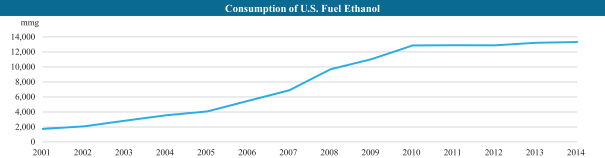

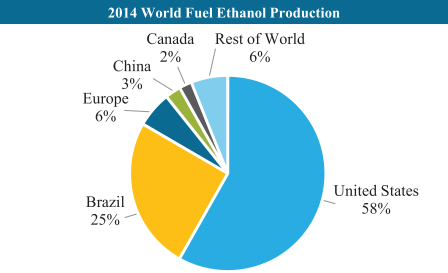

| • | Favorable Industry Fundamentals and Growing Demand for Ethanol. Led by the United States, global ethanol production has grown significantly over recent years, as approximately 30 countries either mandate or incentivize ethanol and bio-diesel blending for motor fuels. Annual reported global production has increased from approximately 5.0 billion gallons in 2001 to approximately 24.6 billion gallons in 2014, according to the U.S. Energy Information Administration, or EIA, and the Renewable Fuels Association, or RFA. From 2001 to 2014, U.S. ethanol industry production grew from 1.8 billion gallons to 14.3 billion gallons, and today ethanol comprises approximately 10% of the U.S. gasoline market, according to the EIA. Furthermore, according to the EIA and RFA, the United States and Brazil are the two largest producers and exporters of ethanol in the world, with the United States accounting for approximately 58% of global production as of December 31, 2014. According to the RFA, as of January 2015, there were 213 ethanol plants in the United States, capable of producing an aggregate of 15.9 bgy of ethanol. We believe global demand for ethanol, as a proportion of total transportation fuels demand, will continue to increase due to a continuing focus on reducing reliance on petroleum-based transportation fuels. |

| • | Strategically-Located, Long-Lived Assets with Geographic Diversity and Low Operating and Capital Requirements. We benefit from a portfolio of relatively new storage and logistics assets that have expected remaining weighted-average useful lives of over 20 years and are strategically located near major rail lines in seven U.S. states, enabling us to reach a broad and diverse geographic area. Additionally, the geographic diversity of our assets minimizes our exposure to weather-related downtime and transportation congestion. Given the nature of our asset portfolio, we expect to incur only modest maintenance-related capital expenditures in the near future. |

| • | Proven Management Team. Our senior management team averages approximately 25 years of industry experience. We have specific expertise across all aspects of the ethanol supply, production and distribution chain—from agribusiness, to plant operations and management, to commodity markets, to ethanol marketing and distribution. We believe the level of operational and financial expertise of our management team will allow us to successfully execute our business strategies. Each member of our senior management team will be an employee of our parent and will devote the portion of such member’s time to our business and affairs that is required to manage and conduct our operations. |

| • | Financial Flexibility. At the closing of this offering, we expect to enter into a -year $ million revolving credit facility, which will remain undrawn at closing. We believe we will have the financial flexibility to execute our growth strategy through the available borrowing capacity under our new revolving credit facility and our ability to access the debt and equity capital markets. |

Our primary business objectives are to maintain stable and predictable cash flows and to increase our quarterly cash distribution per unit over time. We intend to accomplish these objectives by executing the following business strategies:

| • | Generate Stable, Fee-Based Cash Flows. We intend to generate stable and predictable cash flows over time by providing fee-based logistics services. A substantial portion of our revenues and cash flows will initially be derived from our commercial agreements with Green Plains Trade, including our (1) ten-year fee-based storage and throughput agreement, (2) six-year fee-based rail transportation services agreement, (3) Birmingham terminaling agreement, and (4) various other transportation and terminaling agreements. Our storage and throughput agreement and certain of our terminaling agreements, including the Birmingham terminaling agreement, will be supported by minimum volume commitments, and our rail transportation services agreement will be supported by minimum railcar take-or-pay usage commitments. Under these agreements, we will not have direct exposure to fluctuations in commodity prices. As we grow our business beyond our current assets and operations, we will seek to enter into similar fee-based contracts with our parent and third parties that generate stable and predictable cash flows. |

6

Table of Contents

| • | Pursue Attractive Organic Growth Opportunities. We intend to enhance the profitability of our initial assets by pursuing, individually or with our parent, organic growth projects. For example, we believe certain expansion projects that may be implemented by our parent at its ethanol production plants would enable us to utilize the strategic location and capacity of our assets and would increase annual throughput at our facilities. We believe our capital expenditures associated with such potential expansion projects would be minimal since our ethanol storage facilities have available capacity to accommodate growth in our parent’s throughput. In addition, we expect to collaborate with our parent and other potential third-party customers to identify other growth opportunities to construct assets and build businesses that will enable them to pursue their business strategies while providing us with stable cash flows through fee-based service agreements. |

| • | Pursue Accretive Acquisitions. We intend to pursue strategic, accretive acquisitions of complementary assets from our parent and third parties. Under our omnibus agreement, we will be granted a five-year right of first offer on any (1) ethanol storage or terminal assets that our parent may acquire or construct in the future, (2) fuel storage or terminal facilities that our parent may acquire or construct in the future, and (3) ethanol and fuel transportation assets that our parent currently owns or may acquire in the future, if our parent decides to sell any such assets. In addition, we intend to continually monitor the marketplace, individually and in conjunction with our parent, to identify and pursue asset acquisitions from third parties that complement or diversify our existing operations. We expect to pursue both ethanol and other fuel storage and terminal assets, initially focusing on assets in close geographic proximity to our existing asset base. |

| • | Conduct Safe, Reliable and Efficient Operations. We are committed to maintaining the safety, reliability, environmental compliance and efficiency of our operations. All of our assets are staffed by experienced industry personnel. We, along with our parent, will also continue to focus on incremental operational improvements to enhance overall production results. We will seek to improve our operating performance through commitment to our preventive maintenance program along with employee training, safety and development programs. We believe these objectives are integral to maintaining stable cash flows and critical to the success of our business. |

| • | Maintain Financial Strength and Flexibility. We intend to maintain financial strength and flexibility, which should enable us to pursue acquisitions and new growth opportunities as they arise. We expect to have $ million of liquidity in the form of $ million of cash on hand and $ million of undrawn borrowing capacity under our new revolving credit facility at the closing of this offering. We believe that our borrowing capacity and ability to access debt and equity capital markets after this offering will provide us with the financial flexibility necessary to achieve our organic and accretive acquisition growth strategies. |

Our parent is a Fortune 1000, vertically-integrated producer, marketer and distributor of ethanol focused on generating stable operating margins through its diversified business segments and its risk management strategy and is the fourth largest ethanol producer in North America. Our parent believes that owning and operating strategically-located assets throughout the ethanol value chain enables it to mitigate changes in commodity prices and differentiates it from companies focused only on ethanol production. Our parent has operations throughout the ethanol value chain, beginning upstream with its grain handling and storage operations, continuing through its ethanol, distillers grains and corn oil production operations, and ending downstream with its marketing, terminal and distribution services.

Our parent reviews its operations within four separate operating segments: (1) production of ethanol and distillers grains, collectively referred to as ethanol production, (2) corn oil production, (3) grain handling and storage and cattle feedlot operations, collectively referred to as agribusiness, and (4) marketing, merchant trading and logistics services for self-produced and third-party ethanol, distillers grains, corn oil and other commodities,

7

Table of Contents

collectively referred to as marketing and distribution. Our parent also is a partner in a joint venture to commercialize advanced photo-bioreactor technologies for growing and harvesting algal biomass.

Our parent has announced that it is expanding production at its ethanol production plants by approximately 100 mmgy and will explore certain other expansion projects at its ethanol production plants in the future. These expansion projects, when implemented, will enable us to utilize the strategic location and capacity of our assets and will increase annual throughput at our facilities. We expect that our capital expenditures associated with such potential expansion projects will be minimal since our ethanol storage facilities have available capacity to accommodate growth in our parent’s throughput. For more information related to our parent, please read “Business—Our Parent.”

While our relationship with Green Plains and its affiliates is a significant strength, it is also a source of potential risks and conflicts. Please read “Risk Factors—Risks Related to an Investment in Us” and “Conflicts of Interest and Duties.”

Our initial assets consist of the following:

Ethanol Storage Facilities. We own and operate 27 ethanol storage tanks, located at or near our parent’s twelve ethanol production plants, with a combined on-site ethanol storage capacity of approximately 26.6 mmg and aggregate throughput capacity of approximately 1,330 mmgy. For the year ended December 31, 2014 and the three months ended March 31, 2015, our ethanol storage assets had throughput of approximately 966.2 mmg and 232.5 mmg, respectively, which represents 95.6% and 92.4%, respectively, of our parent’s combined daily average production capacity. Our parent’s ethanol production plants are located in Indiana, Iowa, Michigan, Minnesota, Nebraska and Tennessee and have a combined ethanol production capacity of approximately 1.0 bgy. Each of our parent’s ethanol production plants are located adjacent to and have access to major rail lines. Our ethanol storage assets are the principal method of storing and loading the ethanol that our parent produces at its ethanol production plants for delivery to its customers. The chart below summarizes our parent’s ethanol production plant locations, along with our on-site ethanol storage capacity as of March 31, 2015, throughput for the year ended December 31, 2014 and the three months ended March 31, 2015, major rail line access and initial operation or acquisition date for each location:

| Ethanol Production Plant |

On-Site Ethanol Storage Capacity (thousands of gallons) |

Throughput Year Ended December 31, 2014 (mmg)(1) |

Throughput Three Months Ended March 31, 2015 (mmg)(1) |

Major Rail Line Access |

Initial Operation or Acquisition Date(2) | |||||||||||

| Atkinson, Nebraska |

2,074 | 47 | 11 | BNSF | Jun. 2013 | |||||||||||

| Bluffton, Indiana |

3,000 | 113 | 28 | Norfolk Southern | Sep. 2008 | |||||||||||

| Central City, Nebraska |

2,250 | 106 | 26 | Union Pacific | Jul. 2009 | |||||||||||

| Fairmont, Minnesota |

3,124 | 101 | 23 | Union Pacific | Nov. 2013 | |||||||||||

| Lakota, Iowa |

2,500 | 106 | 26 | Union Pacific | Oct. 2010 | |||||||||||

| Obion, Tennessee |

3,000 | 116 | 27 | Canadian National | Nov. 2008 | |||||||||||

| Ord, Nebraska |

1,550 | 59 | 14 | Union Pacific | Jul. 2009 | |||||||||||

| Otter Tail, Minnesota |

2,000 | 44 | 12 | BNSF | Mar. 2011 | |||||||||||

| Riga, Michigan |

1,239 | 54 | 13 | Norfolk Southern | Oct. 2010 | |||||||||||

| Shenandoah, Iowa |

1,524 | 69 | 16 | BNSF | Aug. 2007 | |||||||||||

| Superior, Iowa |

1,238 | 54 | 12 | Union Pacific | Jul. 2008 | |||||||||||

| Wood River, Nebraska |

3,124 | 98 | 24 | Union Pacific | Nov. 2013 | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total (subject to rounding) |

26,623 | 966 |

|

232 |

|

|||||||||||

|

|

|

|

|

|

|

|||||||||||

| (1) | Throughput for our storage facilities is equal to plant production at our parent’s ethanol production plants. |

| (2) | The Bluffton, Obion, Shenandoah and Superior ethanol production plants were constructed by our parent. All other ethanol production plants were acquired by our parent. |

8

Table of Contents

Fuel Terminal Facilities. We provide terminal services and logistics solutions through our fuel terminal facilities that we own and operate. These fuel terminal facilities, at eight locations in seven south-central U.S. states, have fuel holding tanks and access to major rail lines for transporting ethanol or other fuels. Additionally, the Birmingham facility is one of 20 facilities in the United States capable of efficiently receiving and offloading ethanol and other fuels from unit trains. Our fuel terminal facilities have a combined total storage capacity of approximately 7.4 mmg and, for the year ended December 31, 2014 and the three months ended March 31, 2015, had an aggregate throughput of approximately 324.8 mmg and 80.4, respectively. The chart below summarizes our fuel terminal facilities, along with our on-site storage capacity as of March 31, 2015, throughput for the year ended December 31, 2014 and the three months ended March 31,2015, and major rail line access for each location:

| Fuel Terminal Facility Location |

On-Site Storage Capacity (thousands of gallons) |

Throughput Year Ended December 31, 2014 (mmg) |

Throughput Three Months Ended March 31, 2015 (mmg) |

Major Rail Line Access |

||||||||||||

| Birmingham, Alabama—Unit Train Terminal |

6,542 | 215 | 51 | BNSF | ||||||||||||

| Other Fuel Terminal Facilities |

880 | 110 | 30 | (1 | ) | |||||||||||

| (1) | Major rail line access to our seven other fuel terminal facilities is available from BNSF, KCS, Canadian National, Union Pacific, Norfolk Southern and CSX. |

Transportation Assets. Our transportation assets include a leased railcar fleet of approximately 2,200 railcars that are exclusively dedicated to transporting product for our parent, including its ethanol and other fuels, to refineries throughout the United States and international export terminals from our fuel terminal facilities or third-party production facilities. The remaining lease contract terms for our railcars range from less than one year to approximately six years, with a weighted average remaining term of 3.5 years as of December 31, 2014. We also operate three trucks dedicated to transporting ethanol and other fuels from receipt points identified by Green Plains Trade to nominated delivery points.

Our Emerging Growth Company Status

With less than $1.0 billion in revenue during our most recent fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we may, for up to five years, take advantage of specified exemptions from reporting and other regulatory requirements that are otherwise applicable generally to public companies. These exemptions include:

| • | presentation of only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations in the registration statement of which this prospectus is a part; |

| • | exemption from the auditor attestation requirement on the effectiveness of our system of internal control over financial reporting; |

| • | exemption from the adoption of new or revised financial accounting standards until they would apply to private companies; |

| • | exemption from compliance with any new requirements adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer; and |

| • | reduced disclosure about executive compensation arrangements. |

9

Table of Contents

We may take advantage of these provisions until we are no longer an emerging growth company, which will occur on the earliest of (i) the last day of the fiscal year following the fifth anniversary of this offering, (ii) the last day of the fiscal year in which we have more than $1 billion in annual revenue, (iii) the date on which we have more than $700 million in market value of our common units held by non-affiliates or (iv) the date on which we have issued more than $1 billion of non-convertible debt over a three-year period.

We have elected to take advantage of all of the applicable JOBS Act provisions, except that we will elect to opt out of the exemption that allows emerging growth companies to extend the transition period for complying with new or revised financial accounting standards. This election is irrevocable.

Accordingly, the information that we provide you may be different than what you may receive from other public companies in which you hold equity interests.

An investment in our common units involves risks associated with our business, our partnership structure and the tax characteristics of our common units. You should carefully consider the following risk factors, the risks described in “Risk Factors” and the other information in this prospectus before investing in our common units. Please also read “Cautionary Note Concerning Forward-Looking Statements.”

| • | We may not have sufficient cash from operations following the establishment of cash reserves and payment of fees and expenses, including cost reimbursements to our general partner and its affiliates, to enable us to pay the minimum quarterly distribution to our unitholders. |

| • | Our pro forma financial data are not necessarily representative of the results of what we would have achieved and may not be a reliable indicator of our future results. |

| • | The assumptions underlying the forecast of distributable cash flow that we include in “Our Cash Distribution Policy and Restrictions on Distributions” are inherently uncertain and are subject to significant business, economic, financial, regulatory and competitive risks and uncertainties that could cause actual results to differ materially from those forecasted. |

| • | Green Plains Trade will initially account for a substantial portion of our revenues. Therefore, we will be subject to the business risks of Green Plains Trade and, as a result of its direct ownership by our parent, to the business risks of our parent. If Green Plains Trade is unable to satisfy its obligations under the commercial agreements with us for any reason, our revenues would decline and our financial condition, results of operations, cash flows and ability to make distributions to our unitholders would be adversely affected. |

| • | Green Plains Trade may suspend, reduce or terminate its obligations under the commercial agreements with us in certain circumstances, which could have a material adverse effect on our financial condition, results of operations, cash flows and ability to make distributions to our unitholders. |

| • | Our parent will own and control our general partner, which has sole responsibility for conducting our business and managing our operations. Our general partner and its affiliates, including our parent and Green Plains Trade, have conflicts of interest with us and limited duties to us and our unitholders, and they may favor their own interests to our detriment and that of our unitholders. |

| • | Our partnership agreement restricts the remedies available to holders of our common units and our subordinated units for actions taken by our general partner that might otherwise constitute breaches of fiduciary duty. |

| • | Our unitholders have limited voting rights and are not entitled to elect our general partner or the board of directors of our general partner, which could reduce the price at which our common units will trade. |

| • | Immediately effective upon the closing of this offering, unitholders will experience substantial dilution of $ in tangible net book value per common unit. |

10

Table of Contents

| • | Our tax treatment depends on our status as a partnership for U.S. federal income tax purposes. If the Internal Revenue Service were to treat us as a corporation for U.S. federal income tax purposes, which would subject us to entity-level taxation, or if we were otherwise subjected to a material amount of additional entity-level taxation, then our distributable cash flow to our unitholders would be substantially reduced. |

| • | Even if our unitholders do not receive any cash distributions from us, our unitholders will be required to pay taxes on their share of our taxable income. |

We were formed in March 2015 by our parent to own, operate, develop and acquire ethanol and fuel storage tanks, terminals, transportation assets and other related assets and businesses. In connection with this offering, our parent will contribute our Predecessor and our other initial assets and operations to us.

Additionally, each of the following transactions have occurred or will occur in connection with this offering:

| • | we will issue common units and subordinated units to our parent, representing an aggregate % limited partner interest in us, and general partner units, representing a 2% general partner interest in us, and all of our incentive distribution rights to our general partner; |

| • | we will issue common units to the public in this offering, representing a % limited partner interest in us, and will apply the net proceeds as described in “Use of Proceeds”; |

| • | we will enter into a new $ million revolving credit facility; |

| • | we will enter into a storage and throughput agreement and transportation agreements with Green Plains Trade and assume terminaling agreements and leases for our railcars; and |

| • | we will enter into an omnibus agreement and an operational services and secondment agreement with our parent. |

We have granted the underwriters a 30-day option to purchase up to an aggregate of additional common units. The net proceeds from any exercise by the underwriters of their option to purchase additional common units from us will be used to redeem, from our parent, a number of common units equal to the number of common units issued upon exercise of the option at a price per common unit equal to the net proceeds per common unit in this offering before expenses but after deducting underwriting discounts and structuring fees. Accordingly, any exercise of the underwriters’ option will not affect the total number of units outstanding or the amount of cash needed to pay the minimum quarterly distribution on all units.

Organizational Structure After the Transactions

After giving effect to the transactions described above under “—The Transactions,” assuming the underwriters’ option to purchase additional common units from us is not exercised, our ownership will be held as follows:

| Public common units |

% | |||

| Parent common units |

% | |||

| Parent subordinated units |

% | |||

| General partner interest |

2 | % | ||

|

|

|

| ||

| Total |

100 | % | ||

|

|

|

|

11

Table of Contents

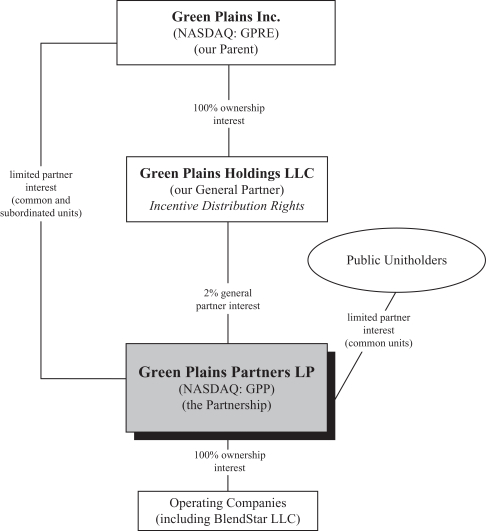

The following diagram depicts our simplified organizational structure after giving effect to the transactions described above under “—The Transactions,” assuming the underwriters’ option to purchase additional common units from us is not exercised.

Management of Green Plains Partners LP

We are managed and operated by the board of directors and executive officers of Green Plains Holdings LLC, our general partner. Green Plains is the sole owner of our general partner and has the right to appoint the entire board of directors of our general partner, including the independent directors appointed in accordance with the listing standards of The NASDAQ Stock Market LLC, or NASDAQ. Unlike shareholders in a publicly-traded corporation, our unitholders will not be entitled to elect our general partner or the board of directors of our general partner. Many of the executive officers and directors of our general partner also currently serve as executive officers of Green Plains. For more information about the directors and executive officers of our general partner, please read “Management—Directors and Executive Officers of Green Plains Holdings LLC.”

12

Table of Contents

In order to maintain operational flexibility, our operations will be conducted through, and our operating assets will be owned by, various operating subsidiaries. We may, in certain circumstances, contract with third parties to provide personnel in support of our operations. However, neither we nor our subsidiaries will have any employees. Our general partner is responsible for providing the personnel necessary to conduct our operations, whether through directly hiring employees or by obtaining the services of personnel employed by Green Plains, its affiliates or third parties. In addition, pursuant to the operational services and secondment agreement that will be entered into at the closing of this offering, certain of Green Plains’ employees (including our Chief Executive Officer) will be seconded to our general partner to provide management, maintenance and operational services with respect to our business. Substantially all of the personnel that will conduct our business immediately following the closing of this offering will be employed or contracted by our general partner, but we sometimes refer to these individuals in this prospectus as our employees because they provide services directly to us. Please read “Management.”

Principal Executive Offices and Internet Address

Our principal executive offices are located at 450 Regency Parkway, Suite 400, Omaha, Nebraska 68114, and our telephone number is (402) 884-8700. Following the completion of this offering, our website will be located at www.greenplainspartners.com. We expect to make our periodic reports and other information filed with or furnished to the Securities and Exchange Commission, or SEC, available, free of charge, through our website, as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. Information on our website or any other website is not incorporated by reference into this prospectus and does not constitute a part of this prospectus.

Summary of Conflicts of Interest and Duties

Under our partnership agreement, our general partner has a duty to manage us in a manner it believes is in the best interests of our partnership. However, because our general partner is a wholly-owned subsidiary of Green Plains, the officers and directors of our general partner also have a duty to manage the business of our general partner in a manner that they believe is in the best interests of Green Plains. As a result of this relationship, conflicts of interest may arise in the future between us and our unitholders, on the one hand, and our general partner and its affiliates, including Green Plains, on the other hand. For example, our general partner will be entitled to make determinations that affect the amount of cash distributions we make to the holders of common units, which in turn has an effect on whether our general partner receives incentive distributions. In addition, our general partner may determine to manage our business in a way that directly benefits Green Plains’ businesses, rather than indirectly benefitting Green Plains solely through its ownership interests in us. All of these actions are permitted under our partnership agreement and will not be a breach of any duty (fiduciary or otherwise) of our general partner.

Delaware law provides that Delaware limited partnerships may, in their partnership agreements, expand, restrict or eliminate the fiduciary duties otherwise owed by the general partner to limited partners and the partnership, provided that partnership agreements may not eliminate the implied contractual covenant of good faith and fair dealing. Our partnership agreement contains various provisions replacing the fiduciary duties that would otherwise be owed by our general partner with contractual standards governing the duties of the general partner and contractual methods of resolving conflicts of interest. The effect of these provisions is to restrict the remedies available to our unitholders for actions that might otherwise constitute breaches of our general partner’s fiduciary duties. Our partnership agreement also provides that affiliates of our general partner, including Green Plains, are not restricted from competing with us, and neither our general partner nor its affiliates have any obligation to present business opportunities to us. By purchasing a common unit, the purchaser agrees to be bound by the terms of our partnership agreement and consents to various actions and potential conflicts of interest contemplated in our partnership agreement that might otherwise be considered a breach of fiduciary or

13

Table of Contents

other duties under Delaware law. Please read “Conflicts of Interest and Duties—Duties of the General Partner” for a description of the fiduciary duties imposed on our general partner by Delaware law, the replacement of those duties with contractual standards under our partnership agreement and certain legal rights and remedies available to holders of our common units and subordinated units. For a description of our other relationships with our affiliates, please read “Certain Relationships and Related Party Transactions.”

14

Table of Contents

| Common units offered to the public |

common units. |

| common units if the underwriters exercise in full their option to purchase additional common units from us. |

| Units outstanding after this offering |

common units and subordinated units, representing an aggregate % limited partner interest in us. The general partner will own a 2% general partner interest in us. |

| Use of proceeds |

We expect to receive net proceeds of approximately $ million from the sale of common units offered by this prospectus, based on an assumed initial public offering price of $ per common unit (the midpoint of the price range set forth on the cover page of this prospectus), after deducting underwriting discounts, structuring fees and estimated offering expenses. We intend to use the net proceeds from this offering as follows: |

| • | $ million will be distributed to our parent; |

| • | $ million will be used to pay origination fees under our new revolving credit facility; and |

| • | $ million will be retained by us for general partnership purposes. |

| The net proceeds from any exercise by the underwriters of their option to purchase additional common units from us will be used to redeem from our parent a number of common units equal to the number of common units issued upon exercise of the option at a price per common unit equal to the net proceeds per common unit in this offering before expenses but after deducting underwriting discounts and structuring fees. Accordingly, any exercise of the underwriters’ option will not affect the total number of units outstanding or the amount of cash needed to pay the minimum quarterly distribution on all units. |

| Cash distributions |

We intend to make a minimum quarterly distribution of $ per unit for each whole quarter, or $ per unit on an annualized basis, to the extent we have sufficient cash at the end of each quarter after establishment of cash reserves and payment of fees and expenses, including payments to our general partner. We refer to the amount of such cash as “available cash.” Our ability to pay the minimum quarterly distribution is subject to various restrictions and other factors described in more detail under the caption “Our Cash Distribution Policy and Restrictions on Distributions.” |

| For the quarter in which this offering closes, we will pay a prorated distribution on our units covering the period from the completion of this offering through , 2015, based on the actual number of days in that period. |

15

Table of Contents

| In general, we will pay any cash distributions we make each quarter in the following manner: |

| • | first, 98% to the holders of common units and 2% to our general partner, until each common unit has received a minimum quarterly distribution of $ plus any arrearages from prior quarters; |

| • | second, 98% to the holders of subordinated units, and 2% to our general partner until each subordinated unit has received a minimum quarterly distribution of $ ; and |

| • | third, 98% to all unitholders, pro rata, and 2% to our general partner until each unit has received a distribution of $ . |

| If cash distributions to our unitholders exceed per unit in any quarter, our general partner will receive, in addition to its 2% general partner interest, increasing percentages, up to 48%, of the cash we distribute in excess of that amount. We refer to these distributions as “incentive distributions.” In certain circumstances, our general partner, as the initial holder of our incentive distribution rights, has the right to reset the target distribution levels described above to higher levels based on our cash distributions at the time of the exercise of this reset election. Please read “Provisions of Our Partnership Agreement Relating to Cash Distributions.” |

| If we do not have sufficient available cash at the end of each quarter, we may, but are under no obligation to, borrow funds to pay the minimum quarterly distribution to our unitholders. |

| We believe, based on our financial forecast and related assumptions included in “Our Cash Distribution Policy and Restrictions on Distributions—Estimated Distributable Cash Flow for the Twelve Months Ending June 30, 2016,” that we will generate sufficient distributable cash flow for the twelve months ending June 30, 2016 to support the payment of the minimum quarterly distribution of $ per unit on all of our common units and subordinated units and the corresponding distributions on our general partner’s 2% general partner interest. However, we do not have a legal obligation to pay distributions at our minimum quarterly distribution rate or at any other rate, subject to the requirement in our partnership agreement to distribute all of our available cash, and there is no guarantee that we will make quarterly cash distributions to our unitholders. Please read “Our Cash Distribution Policy and Restrictions on Distributions.” |

| Subordinated units |

Our parent will initially own all of our subordinated units. The principal difference between our common units and subordinated units is that for any quarter during the subordination period, the subordinated units will not be entitled to receive any distribution until the common units have received the minimum quarterly distribution for such quarter plus any arrearages in the payment of the minimum |

16

Table of Contents

| quarterly distribution from prior quarters during the subordination period. Subordinated units will not accrue arrearages. |

| Conversion of subordinated units |

The subordination period will end on the first business day after the date that we have earned and paid distributions of at least (1) $ (the annualized minimum quarterly distribution) on each of the outstanding common units and subordinated units and the corresponding distribution on our general partner’s 2% general partner interest for each of three consecutive, non-overlapping four quarter periods ending on or after , 2018, or (2) $ (150% of the annualized minimum quarterly distribution) on each of the outstanding common units and subordinated units and the corresponding distribution on our general partner’s 2% general partner interest and the related distributions on the incentive distribution rights for any four-quarter period ending on or after , 2016, in each case provided there are no arrearages in payment of the minimum quarterly distributions on our common units at that time. |

| The subordination period also will end upon the removal of our general partner other than for cause if no subordinated units or common units held by the holders of subordinated units or their affiliates are voted in favor of that removal. |

| When the subordination period ends, each outstanding subordinated unit will convert into one common unit, and common units will no longer be entitled to arrearages. Please read “Provisions of Our Partnership Agreement Relating to Cash Distributions—Subordinated Units and Subordination Period.” |

| Issuance of additional partnership interests |

Our partnership agreement authorizes us to issue an unlimited number of additional partnership interests and the options, rights, warrants and appreciation rights relating to partnership interests on such terms and conditions as our general partner shall determine, in its sole distribution, without the approval of our unitholders. Our unitholders will not have preemptive or participation rights to purchase their pro rata share of any additional partnership interests issued. Please read “Units Eligible for Future Sale” and “Our Partnership Agreement—Issuance of Additional Securities.” |

| Limited voting rights |

Our general partner will manage and operate us. Unlike the holders of common stock in a corporation, our unitholders will have only limited voting rights on matters affecting our business. Our unitholders will have no right to elect our general partner or its directors on an annual or other continuing basis. Our general partner may not be removed except by a vote of the holders of at least 66 2/3% of the outstanding units, including any units owned by our general partner and its affiliates, voting together as a single class. Upon consummation of this offering, our parent will own % of our total outstanding |

17

Table of Contents

| common units and subordinated units on an aggregate basis (or % of our total outstanding common units and subordinated units on an aggregate basis, if the underwriters exercise in full their option to purchase additional common units). This will give our parent the ability to prevent the removal of our general partner. Please read “Our Partnership Agreement—Voting Rights.” |

| Limited call right |

If at any time our general partner and its affiliates own more than 80% of the outstanding common units, our general partner has the right, but not the obligation, to purchase all of the remaining common units at a price equal to the greater of (1) the average of the daily closing price of our common units over the 20 trading days preceding the date that is three business days before notice of exercise of the call right is first mailed and (2) the highest per-unit price paid by our general partner or any of its affiliates for common units during the 90-day period preceding the date such notice is first mailed. At the completion of this offering and assuming the underwriters’ option to purchase additional common units from us is not exercised, our general partner and its affiliates will own approximately % of our common units. At the end of the subordination period (which could occur as early as within the quarter ending , 2016), assuming no additional issuances of common units by us (other than upon the conversion of the subordinated units) and the underwriters’ option to purchase additional common units from us is not exercised, our general partner and its affiliates will own % of our outstanding common units and therefore would not be able to exercise the call right at that time. Please read “Our Partnership Agreement—Limited Call Right.” |

| Estimated ratio of taxable income to distributions |

We estimate that if our unitholders own their common units purchased in this offering through the record date for distributions for the period ending December 31, 2017, our unitholders will be allocated, on a cumulative basis, an amount of federal taxable income for that period that will be % or less of the cash distributed to our unitholders with respect to that period. For example, if our unitholders receive an annual distribution of $ per unit, we estimate that the average allocable federal taxable income per year will be no more than approximately $ per unit. Thereafter, the ratio of allocable taxable income to cash distributions to our unitholders could substantially increase. Please read “Material U.S. Federal Income Tax Consequences—Tax Consequences of Unit Ownership—Ratio of Taxable Income to Distributions” for the basis of this estimate. |

18

Table of Contents

| Material U.S. federal income tax consequences |

Subject to the discussion under “Material U.S. Federal Income Tax Consequences—Partnership Status” and the limitations set forth therein, it is the opinion of Andrews Kurth LLP that we will be classified as a partnership for federal income tax purposes. As a result, we generally will incur no federal income tax liability. Instead, each of our unitholders will be required to take into account his share of items of our income, gain, loss and deduction in computing his federal income tax liability, regardless of whether cash distributions are made to him by us. Consequently, a unitholder may be liable for federal income taxes as a result of ownership of our units even if he has not received a cash distribution from us. Cash distributions by us to a unitholder generally will not give rise to income or gain. |