Attached files

| file | filename |

|---|---|

| EX-5.1 - LEGAL OPINION LETTER - TOA Optical Tech, Inc. | legalopinion.htm |

| EX-23.2 - CONSENT - MESSINEO & CO. - TOA Optical Tech, Inc. | consent_messineo.htm |

| EX-23.1 - CONSENT - MALONEBAILEY - TOA Optical Tech, Inc. | consent_mb.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

AMENDMENT NO. 4

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 CURRENT REPORT

TOA OPTICAL TECH, INC.

(Exact name of registrant as specified in its charter)

Date: May 15, 2015

| Delaware | 5065 | 42-1778734 |

(State or Other Jurisdiction of Incorporation) |

(Primary Standard Classification Code) | (IRS Employer Identification No.) |

1-1-36, Nishiawaji,

Higashiyodogawa-ku Osaka 533-0031, Japan

info@toa-group.asia

Telephone: +81-6-6325-5035

(Address,

including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Please send copies of all correspondence to:

ETN SERVICES, LLC

780 Reservoir Avenue, #123

Cranston, RI 02910

TELEPHONE: (401) 440-9533

FAX: (401) 633-7300

Email: teakwood5@cox.net

(Name, address, including zip code, and

telephone number,

including area code, of agent for service)

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. |X|

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration Statement number of the earlier effective registration statement for the same offering. |_|

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.|_|

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.|_|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer |_| | Accelerated filer |_| |

| Non-accelerated filer |_| (Do not check if a smaller reporting company) | Smaller reporting company |X| |

- 1 -

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Offering Price Per Share (1) |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee (2) |

Common Stock, $0.0001 par value |

68,000,000 | $0.25 | $17,000,000 | $2,189.60 |

| (1) | The offering price has been arbitrarily determined by the Company and bears no relationship to assets, earnings, or any other valuation criteria. No assurance can be given that the shares offered hereby will have a market value or that they may be sold at this, or at any price. |

| (2) | Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(o) of the Securities Act of 1933. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY OUR EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED. THERE IS NO MINIMUM PURCHASE REQUIREMENT FOR THE OFFERING TO PROCEED.

- 2 -

PRELIMINARY PROSPECTUS

TOA OPTICAL TECH, INC.

68,000,000 SHARES OF COMMON STOCK

$0.0001 PAR VALUE PER SHARE

Prior to this Offering, no public market has existed for the common stock of TOA OPTICAL TECH, INC. Upon completion of this Offering, we will attempt to have the shares quoted on the OTCBB “Over the Counter Bulletin Board” and or OTCQB tier of the Over the Counter Marketplace “OTC”. There is no assurance that the Shares will ever be quoted on the OTCBB and or OTCQB . To be quoted on the OTCBB and or OTCQB , a market maker must apply to make a market in our common stock. As of the date of this Prospectus, we have not made any arrangement with any market makers to quote our shares.

In this public offering we, “Toa Optical Tech, Inc.” are offering 8,000,000 shares of our common stock and our selling shareholders are offering 60,000,000 shares of our common stock. We will not receive any of the proceeds from the sale of shares by the selling shareholders. Shareholders may also sell their shares at market prices or in privately negotiated transactions if at such time are shares are quoted on the OTCBB and or OTCQB tier of the OTC marketplace. The offering is being made on a self-underwritten, “best efforts” basis. There is no minimum number of shares required to be purchased by each investor. The shares offered by the Company will be sold on our behalf by our President and CEO Tatsumi Shioya. Mr. Shioya is deemed to be an underwriter of this offering. He will not receive any commissions or proceeds for selling the shares on our behalf. All of the shares being registered for sale by the Company will be sold at a fixed price of $0.25 per share for the duration of the Offering. If at any times our shares are quoted on the OTCBB shareholders may sell their own shares at prevailing market prices or at privately negotiated prices. Assuming all of the 8,000,000 shares being offered by the Company are sold, the Company will receive $2,000,000 in net proceeds. Assuming 6,000,000 shares (75%) being offered by the Company are sold, the Company will receive $1,500,000 in net proceeds. Assuming 4,000,000 shares (50%) being offered by the Company are sold, the Company will receive $1,000,000 in net proceeds. Assuming 2,000,000 shares (25%) being offered by the Company are sold, the Company will receive $500,000 in net proceeds. There is no minimum amount we are required to raise from the shares being offered by the Company and any funds received will be immediately available to us. There is no guarantee that we will sell any of the securities being offered in this offering. Additionally, there is no guarantee that this Offering will successfully raise enough funds to institute our company’s business plan. Additionally, there is no guarantee that a public market will ever develop and you may be unable to sell your shares.

*Mr. Abe, our controlling shareholder is also deemed to be an underwriter in this offering and will resell his shares at a fixed price for the duration of the offering.

This primary offering will automatically terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) 365 days from the effective date of this Prospectus, unless extended by our directors for an additional 90 days. We may however, at our discretion terminate the offering at any time.

In their audit report dated September 19, 2014, our auditors have expressed substantial doubt as to our ability to continue as a going concern.

| SHARES OFFERED | PRICE TO | SELLING AGENT | PROCEEDS TO | ||||||

| BY COMPANY | PUBLIC | COMMISSIONS | THE COMPANY | ||||||

| Per Share | $ | 0.25 | Not applicable | $ | 0.25 | ||||

| Minimum Purchase | None | Not applicable | Not applicable | ||||||

| Total (8,000,000 shares) | $ | 8,000,000.00 | Not applicable | $ | 2,000,000.00 | ||||

| SHARES OFFERED | PRICE TO | SELLING AGENT | PROCEEDS TO THE SELLING | ||||||

| BY SELLING SHAREHOLDERS | PUBLIC | COMMISSIONS | SHAREHOLDERS | ||||||

| Per Share | $ | 0.25 | Not applicable | $ | 0.25 | ||||

| Minimum Purchase | None | Not applicable | Not applicable | ||||||

| Total (60,000,000 shares) | $ | 60,000,000.00 | Not applicable | $ | 15,000,000.00 | ||||

*Tatsumi Shioya owns 0% of the voting power of our outstanding capital stock.

*At this time our Director and Secretary, Hajime Abe owns approximately 71.1% of the voting power of our outstanding capital stock. After the offering, assuming all of his personal shares and those shares being offered on behalf of the company are sold, Mr. Abe will hold or have the ability to control approximately 59.5% of the voting power of our outstanding capital stock.

If at such time our shares are quoted on the OTCBB and or OTCQB the selling stockholders may sell their shares at prevailing market prices or at privately negotiated prices.

Prior to such time that shares of the shareholders mentioned herein are quoted on the OTCQB of the OTC Marketplace and or OTCBB, selling shareholders will sell their shares at a fixed price of $0.25 a share.

*Mr. Shioya does not intend to solicit any potential purchasers through oral solicitation and his participation in the offering will be limited to the activities set forth in Rule 3a4-1(a)(4)(iii) under the Exchange Act. Mr. Shioya plans to take a passive approach in the offering, only directly soliciting potential investors that are family, friends, and business acquaintances all of which will be done without oral solicitation, and only through the mailing of letters notifying such individuals of the Company’s offering. Should they then choose to invest Mr. Shioya will perform ministerial and clerical work involved in effecting any such transaction. Mr. Shioya will also perform the same ministerial and clerical work should other individuals come forth that would like to invest who discovered the offering through other means such as the internet, word of mouth, or other indirect means. It should be noted that Mr. Shioya will only be able to utilize written communication should he have written approval of another officer of the Company. In this case he will need to acquire the permission of the Company’s only other Officer, Secretary, Treasurer, CFO, and Director.

If all the shares are not sold in the company’s offering, there is the possibility that the amount raised may be minimal and might not even cover the costs of the offering, which the Company estimates at $30,000. The proceeds from the sale of the securities will be placed directly into the Company’s account; any investor who purchases shares will have no assurance that any monies, beside their own, will be subscribed to the prospectus. All proceeds from the sale of the securities are non-refundable, except as may be required by applicable laws. All expenses incurred in this offering are being paid for by Hajime Abe, our Secretary, Treasurer, CFO and Director. There has been no public trading market for the common stock of Toa Optical Tech, Inc.

The Company qualifies as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, which became law in April 2012 and will be subject to reduced public company reporting requirements.

THESE SECURITIES ARE SPECULATIVE AND INVOLVE A HIGH DEGREE OF RISK. YOU SHOULD PURCHASE SHARES ONLY IF YOU CAN AFFORD THE COMPLETE LOSS OF YOUR INVESTMENT. PLEASE REFER TO ‘RISK FACTORS’ BEGINNING ON PAGE 8.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

You should rely only on the information contained in this Prospectus and the information we have referred you to. We have not authorized any person to provide you with any information about this Offering, the Company, or the shares of our Common Stock offered hereby that is different from the information included in this Prospectus. If anyone provides you with different information, you should not rely on it.

The date of this prospectus is May 15, 2015

- 3 -

The following table of contents has been designed to help you find important information contained in this prospectus. We encourage you to read the entire prospectus.

You should rely only on the information contained in this prospectus or contained in any free writing prospectus filed with the Securities and Exchange Commission. We have not authorized anyone to provide you with additional information or information different from that contained in this prospectus filed with the Securities and Exchange Commission. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States.

In this Prospectus, ‘‘TOA Optical,’’ “TOA Optical Tech, ”the “Company,’’ ‘‘we,’’ ‘‘us,’’ and ‘‘our,’’ refer to TOA Optical Tech, Inc., unless the context otherwise requires. Unless otherwise indicated, the term ‘‘fiscal year’’ refers to our fiscal year ending July 31. Unless otherwise indicated, the term ‘‘common stock’’ refers to shares of the Company’s common stock.

This Prospectus, and any supplement to this Prospectus include “forward-looking statements”. To the extent that the information presented in this Prospectus discusses financial projections, information or expectations about our business plans, results of operations, products or markets, or otherwise makes statements about future events, such statements are forward-looking. Such forward-looking statements can be identified by the use of words such as “intends”, “anticipates”, “believes”, “estimates”, “projects”, “forecasts”, “expects”, “plans” and “proposes”. Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These include, among others, the cautionary statements in the “Risk Factors” section and the “Management’s Discussion and Analysis of Financial Position and Results of Operations” section in this Prospectus.

This summary only highlights selected information contained in greater detail elsewhere in this Prospectus. This summary may not contain all of the information that you should consider before investing in our common stock. You should carefully read the entire Prospectus, including “Risk Factors” beginning on Page 8, and the condensed financial statements, before making an investment decision.

All dollar amounts refer to US dollars unless otherwise indicated.

The Company

TOA Optical Tech, Inc., a Delaware corporation (“the Company”) was incorporated under the laws of the State of Delaware on July 22, 2013.

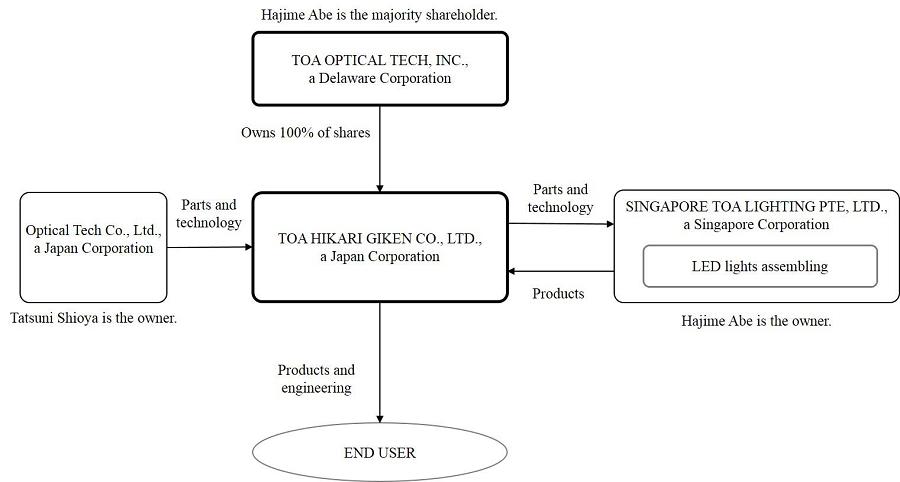

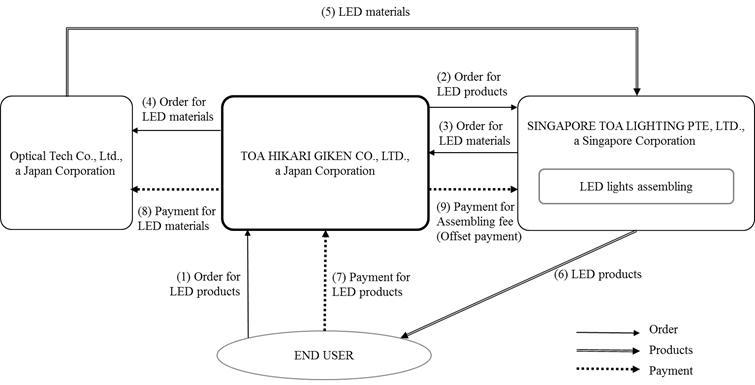

The Company is a start-up company and conducts a trading business through TOA HIKARI GIKEN CO., LTD., a Japan Corporation (“TOA Hikari”), which is our wholly owned subsidiary. Our business is engaged in a range of global business activities including the worldwide trade, distribution and sale of LED products.

TOA Hikari concentrates on the trade, distribution, and sale of LED lights to customers throughout Asia.

Our principal executive offices are located at 1-1-36, Nishiawaji, Higashiyodogawa-ku Osaka 533-0031, Japan. Our phone number is +81-6-6325-5035.

Our activities have been limited to developing our business and financial plans. We will not have the necessary capital to develop or execute our business plan until we are able to secure financing. There can be no assurance that such financing will be available on suitable terms. Even if we raise 100% of the offering, we may not have sufficient capital to begin generating further revenues from operations.

We believe we need to raise $1,000,000 to execute our business plan over the next 12 months. The funds raised in this offering, even assuming we sell all the shares being offered, may be insufficient to commercialize our intended service offering or develop our business strategy.

We will receive proceeds from the sale of 8,000,000 shares of our common stock and intend to use the proceeds from this offering to begin implementing the business plan of our company. The expenses of this offering, including the preparation of this prospectus and the filing of this registration statement, estimated at $30,000.00, are being paid for by Hajime Abe, our Secretary, Treasurer, CFO and Director. The maximum proceeds to us from this offering ($2,000,000) will satisfy our basic subsistence level, cash requirements for up to 24 months including legal and accounting costs associated with this offering, the costs associated with our continuous disclosure obligations, incidental expenses, and the cost of implementing the investigative aspects of our business plan, including identifying and securing additional sources of financing, consultants, operating equipment, marketing and facility. 75% of the possible proceeds from the offering by the company ($1,500,000) will satisfy our basic, subsistence level cash requirements for up to 18 months, while 50% of the proceeds ($1,000,0000) will sustain us for up to 12 months, and 25% of the proceeds ($500,000) will sustain us for up to six months. Our budgetary allocations may vary, however, depending upon the percentage of proceeds that we obtain from the offering. For example, we may determine that is it more beneficial to allocate funds toward securing potential financing and business opportunities in the short terms rather than to conserve funds to satisfy continuous disclosure requirements for a longer period. We do not have adequate funds to satisfy our working capital requirements for the next twelve months unless we can raise the $1,000,000. During the 12 months following the completion of this offering, we intend to implement our business and marketing plan.

- 4 -

In their audit report dated September 19, 2014, our auditors have expressed an opinion that substantial doubt exists as to whether we can continue as an ongoing business. Because our Director, Secretary, Treasurer, and CFO Hajime Abe, may be unwilling or unable to loan or advance any additional capital to us, we believe that if we do not raise additional capital within 12 months of the effective date of this registration statement, we may be required to suspend or cease the implementation of our business plan.

If we raise $1,000,000 it would still be insufficient to commercialize our business or develop our business strategy for any period more than 12 months. Consequently, we may need to raise more money to implement our business plan over the next 12 months.

Our Offering

We have authorized capital stock consisting of 500,000,000 shares of common stock, $0.0001 par value per share (“Common Stock”) and 20,000,000 shares of preferred stock, $0.0001 par value per share (“Preferred Stock”). We have 60,000,000 shares of Common Stock and 1,000,000 of Preferred Stock issued and outstanding. Through this offering we will register a total of 68,000,000 shares. These shares represent 8,000,000 additional shares of common stock to be issued by us and 60,000,000 shares of common stock by our selling stockholders. We may endeavor to sell all 8,000,000 shares of common stock after this registration becomes effective. Upon effectiveness of this Registration Statement, the selling stockholders may also sell their own shares. The price at which we, the company, offer these shares is at a fixed price of $0.25 per share for the duration of the offering. The selling stockholders will also sell shares at a fixed price of $0.25 for the duration of the offering however, if at such time our shares are quoted on the OTCQB of the Over The Counter Marketplace “OTC” and or OTCBB the selling stockholders may sell their shares at prevailing market prices or at privately negotiated prices. There is no arrangement to address the possible effect of the offering on the price of the stock. We will receive all proceeds from the sale of our common stock but we will not receive any proceeds from the selling stockholders.

*The primary offering on behalf of the company is separate from the secondary offering of the selling stockholders in that the proceeds from the shares of stock sold by the selling stockholder’s will go directly to them, not the company. The same idea applies if the company approaches or is approached by investors who then subsequently decide to invest with the company. Those proceeds would then go to the company. Whomever the investors decide to purchase the shares from will be the beneficiary of the proceeds. None of the proceeds from the selling stockholder’s will be utilized or given to the company.

*Mr. Abe, our controlling shareholder is also deemed to be an underwriter in this offering and will resell his shares at a fixed price for the duration of the offering.

*We will notify investors by filing an information statement that will be available for public viewing on the SEC Edgar Database of any such extension of the offering.

| Securities being offered by the Company | 8,000,000 shares of common stock, at a fixed price of $0.25 offered by us in a direct offering. Our offering will automatically terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) 365 days from the effective date of this prospectus unless extended by our Board of Directors for an additional 90 days. We may however, at our discretion terminate the offering at any time.

|

| Securities being offered by the Selling Stockholders | 60,000,000 shares of common stock, at a fixed price of $0.25 offered by selling stockholders in a resale offering. As previously mentioned this fixed price applies at all times unless at any time our shares are quoted on the OTCQB tier of the Over The Counter Marketplace “OTC” and or OTCBB “Over the Counter Bulletin Board” which at such time shares may be sold at prevailing market prices or at which at such time thereafter they may sell any quantity of their shares during any period of time if seen fit. This offering will automatically terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) 365 days from the effective date of this prospectus unless extended by our Board of Directors for an additional 90 days. We may however, at our discretion terminate the offering at any time. |

| Offering price per share | We and the selling shareholders will sell the shares at a fixed price per share of $0.25 for the duration of this Offering. The selling shareholders however, if at such time it occurs that our shares are quoted on the OTCQB of the OTC Marketplace and or the OTCBB “Over the Counter Bulletin Board” , may sell their shares at prevailing market prices or in privately negotiated transactions. |

| Number of shares outstanding before the offering of common stock | 60,000,000 common shares are currently issued and outstanding. |

| Number of shares outstanding after the offering of common shares | 68,000,000 common shares will be issued and outstanding if we sell all of the shares we are offering. |

| The minimum number of shares to be sold in this offering |

None. |

| Market for the common shares | There is no public market for the common shares. The price per share is $0.25 |

| We may not be able to meet the requirement for a public listing or quotation of our common stock. Furthermore, even if our common stock is quoted or granted listing, a market for the common shares may not develop. | |

| The offering price for the shares will remain at $0.25 per share for the duration of the offering. If at such time it occurs that our shares are quoted on the OTC Marketplace, the selling stockholders may sell their shares at prevailing market prices or in privately negotiated transactions. |

- 5 -

| Use of Proceeds | We intend to use the net proceeds to us for working capital, specifically, purchasing of products, marketing, developing new LED product lines, developing a customer base, recruiting, training and establishing of additional corporate sales agents and performance of financial strategies. |

| Termination of the Offering | This offering will automatically terminate upon the earlier to occur of (i) 365 days after this registration statement becomes effective with the Securities and Exchange Commission, or (ii) the date on which all 68,000,000 shares registered hereunder have been sold. We may, at our discretion, extend the offering for an additional 90 days or terminate the offering at any time. |

| Terms of the Offering | Our CEO, Tatsumi Shioya, will sell the 8,000,000 shares of common stock on behalf of the company, upon effectiveness of this registration statement, on a BEST EFFORTS basis. |

| Subscriptions: | All subscriptions once accepted by us are irrevocable.

|

| Registration Costs | We estimate our total offering registration costs to be approximately $30,000.

|

| Risk Factors: | See “Risk Factors” and the other information in this prospectus for a discussion of the factors you should consider before deciding to invest in shares of our common stock. |

Our officers & director, control persons and/or affiliates do not intend to purchase any Shares in this Offering.

Currently, our CEO owns 0% of the outstanding shares of common stock and preferred stock in the Company.

If all the Shares in this Offering are sold, Hajime Abe, our Secretary, Treasurer, CFO and Director will own approximately 59.5% of the voting power of our outstanding capital stock. However, if only 75% of his shares, 50% of his shares or 25% of his Shares in this Offering are sold, our Secretary, Treasurer, CFO, and Director will own 60.2%, 61.0% or 61.7%, respectively.

*The “After Offering” percentages in the table below assumes Mr. Abe sells all of his personal shares of common stock but retains all of his shares of preferred stock. The voting power below takes into consideration his preferred shares of stock. Each one share of preferred stock has voting rights equivalent to 100 shares of common stock.

| Before | After offering | |||||

| offering | 100% | 75% | 50% | 25% | ||

| Common stock | ||||||

| Number of shares outstanding | 60,000,000 | 68,000,000 | 66,000,000 | 64,000,000 | 62,000,000 | |

| Director and Officer ownership | 13,690,000 | 0 | 0 | 0 | 0 | |

| Percentage | 22.8% | 0.0% | 0.0% | 0.0% | 0.0% | |

| Series A Preferred stock (100 votes) | ||||||

| Number of shares outstanding | 1,000,000 | 1,000,000 | 1,000,000 | 1,000,000 | 1,000,000 | |

| Director and Officer ownership | 1,000,000 | 1,000,000 | 1,000,000 | 1,000,000 | 1,000,000 | |

| Percentage | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | |

| Voting powers | ||||||

| Number of voting powers | 160,000,000 | 168,000,000 | 166,000,000 | 164,000,000 | 162,000,000 | |

| Director and Officer voting powers | 113,690,000 | 100,000,000 | 100,000,000 | 100,000,000 | 100,000,000 | |

| Percentage | 71.1% | 59.5% | 60.2% | 61.0% | 61.7% | |

You should rely only upon the information contained in this prospectus. We have not authorized anyone to provide you with information different from that which is contained in this prospectus. We are offering to sell common stock and seeking offers to common stock only in jurisdictions where offers and sales are permitted.

- 6 -

SUMMARY OF OUR FINANCIAL INFORMATION

The following table sets forth selected financial information, which should be read in conjunction with the information set forth in the “Management’s Discussion and Analysis of Financial Position and Results of Operations” section and the accompanying financial statements and related notes included elsewhere in this Prospectus.

The tables and information below are derived from our financial statements for the period from July 22, 2013 (Inception) to July 31, 2014 and for the period from August 1, 2014 to January 31, 2015.

| As of | As of | As of | ||||

| January 31, 2015 | July 31, 2014 | July 31, 2013 | ||||

| (unaudited) | (audited) | (audited) | ||||

| Cash and Deposits | $ | 1 | $ | - | $ | - |

| Inventories | $ | 17,030 | $ | 19,457 | $ | - |

| Prepaid expenses | $ | - | $ | - | $ | 2,000 |

| TOTAL ASSETS | $ | 17,031 | $ | 19,457 | $ | 2,000 |

| Account payables-Related Party | $ | 17,030 | $ | 19,457 | $ | - |

| Loan from director | $ | 35,956 | $ | 11,273 | $ | 2,244 |

| Other account payables | $ | 7,350 | $ | 8,605 | $ | - |

| TOTAL LIABILITIES | $ | 60,336 | $ | 39,335 | $ | 2,244 |

| Common stock | $ | 6,000 | $ | 6,000 | $ | 2,000 |

| Preferred Stock | $ | 100 | $ | 100 | $ | - |

| Additional paid-in capital | $ | 4,494 | $ | 4,494 | $ | - |

| Deficit accumulated during the development stage | $ | (52,642) | $ | (30,591) | $ | (4,244) |

| Foreign currency translation adjustment | $ | (1,257) | $ | 119 | $ | - |

| TOTAL SHAREHOLDERS’ EQUITY | $ | (43,306) | $ | (19,878) | $ | (2,244) |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 17,031 | $ | 19,457 | $ | - |

Statement of operations – Consolidated base

| Six months | Year | Year | ||||

| Ended | Ended | Ended | ||||

| January 31, 2015 | July 31, 2014 | July 31, 2013 | ||||

| (unaudited) | (audited) | (audited) | ||||

| Revenues | $ | - | $ | - | $ | - |

| Cost of revenues | $ | - | $ | - | $ | - |

| Gross profit | $ | - | $ | - | $ | - |

| Expenses | $ | 22,051 | $ | 26,347 | $ | 4,244 |

| NET INCOME (LOSS) | $ | (22,051) | $ | (26,347) | $ | (4,244) |

| NET INCOME(LOSS) PER SHARE | $ | (0.00) | $ | (0.00) | $ | (0.00) |

The Company is electing to not opt out of JOBS Act extended accounting transition period. This may make its financial statements more difficult to compare to other companies.

Pursuant to the JOBS Act of 2012, as an emerging growth company the Company can elect to opt out of the extended transition period for any new or revised accounting standards that may be issued by the PCAOB or the SEC. The Company has elected not to opt out of such extended transition period, which means that when a standard is issued or revised and it has different application dates for public or private companies, the Company, as an emerging growth company, can adopt the standard for the private company. This may make comparison of the Company’s financial statements with any other public company which is not either an emerging growth company nor an emerging growth company which has opted out of using the extended transition period difficult or impossible as possible different or revised standards may be used.

Emerging Growth Company

The recently enacted JOBS Act is intended to reduce the regulatory burden on emerging growth companies. The Company meets the definition of an emerging growth company and so long as it qualifies as an “emerging growth company,” it will, among other things:

| · | be temporarily exempted from the internal control audit requirements Section 404(b) of the Sarbanes-Oxley Act; |

| · | be temporarily exempted from various existing and forthcoming executive compensation-related disclosures, for example: “say-on-pay”, “pay-for-performance”, and “CEO pay ratio”; |

| · | be temporarily exempted from any rules that might be adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or supplemental auditor discussion and analysis reporting; |

| · | be temporarily exempted from having to solicit advisory say-on-pay, say-on-frequency and say-on-golden-parachute shareholder votes on executive compensation under Section 14A of the Securities Exchange Act of 1934, as amended; |

| · | be permitted to comply with the SEC’s detailed executive compensation disclosure requirements on the same basis as a smaller reporting company; and, |

| · | be permitted to adopt any new or revised accounting standards using the same timeframe as private companies (if the standard applies to private companies). |

Our company will continue to be an emerging growth company until the earliest of:

| · | the last day of the fiscal year during which we have annual total gross revenues of $1 billion or more; |

| · | the last day of the fiscal year following the fifth anniversary of the first sale of our common equity securities in an offering registered under the Securities Act; |

| · | the date on which we issue more than $1 billion in non-convertible debt securities during a previous three-year period; or |

| · | the date on which we become a large accelerated filer, which generally is a company with a public float of at least $700 million (Exchange Act Rule 12b-2). |

MANAGEMENT’S DISCUSSION AND ANALYSIS

Our Company operates through its wholly owned subsidiary, TOA Hikari Giken Co., Ltd., also referenced in this registration statement as “TOA Hikari”, which was initially formed as an Osaka, Japan Corporation on June 2, 2014.

TOA Hikari conducts a trade business that concentrates on the distribution, and sale of LED lighting units to customers throughout Asia.

Currently our primary focus is on our product referred to as the “Special Surface LED Illuminator.”

This LED illuminator and module can be used for an array of purposes in which specialized lighting might be required. This unit can also solve several issues that have been previously pervasive amongst competitor lighting components such as lack of transparency, lack of lighting tones, limited color spectrum, limited tints, and poor illumination.

For the twelve months ended July 31, 2014, the Company had revenues of $0, cost of revenues of $0, expenses of $26,347 and net loss of $26,347 as compared to revenues of $0, cost of revenues of $0, expenses of $4,244 and net loss of $4,244 for the twelve months ended July 31, 2013. As of July 31, 2014, the Company has total assets of $19,457 and shareholders’ deficit of $19,878 as compared to total assets of $2,000 and shareholders’ deficit of $2,244 as of July 31, 2013.

The previous change in expenses, and net loss is attributed to the fact that the Company is now carrying out operations in purchasing and attempting to resell its LED products. Attributed to this are increased expenses that did not exist previously when the Company was not carrying out any specific business operations. For the period ending July 31, 2014, the Company purchased sample LED products for sales activities in the amount of $19,457 (2,000,000 JPY) from Optical Tech Co., Ltd.

As of July 31, 2014, the Company had no off-balance sheet arrangements.

For the six months ended January 31, 2015, the Company had revenues of $0, cost of revenues of $0, expenses of $22,051 and net loss of $22,051 as compared to revenues of $0, cost of revenues of $0, expenses of $1,098 and net loss of $1,098 for the six months ended January 31, 2014. As of January 31, 2015, the Company has total assets of $17,031 and shareholders’ deficit of $43,306 as compared to total assets of $0 and shareholders’ deficit of $847 as of January 31, 2014. The previous change in expenses, and net loss is attributed to the fact that the Company is now carrying out operations in purchasing and attempting to resell its LED products.

Our cash balance is $1 as of January 31, 2015. Our cash balance is not sufficient to fund our limited levels of operations for any period of time. We have been utilizing and may utilize funds from Hajime Abe, our sole director, who has informally agreed to advance funds to allow us to pay for offering costs, filing fees, and professional fees. Hajime Abe, however, has no formal commitment, arrangement or legal obligation to advance or loan funds to the company. In order to implement our plan of operations for the next twelve-month period, we require a minimum of $1,000,000 of funding. Being a start-up company, we have very limited operating history. After a twelve-month period we may need additional financing but currently do not have any arrangements for such financing.

We are a start-up company and have generated no revenue to date. Long term financing beyond the maximum aggregate amount of this offering will be required to fully implement our business plan. The exact amount of funding will depend on funding required for full implementation of our business plan. Our expansion may include expanding our office facilities, hiring sales personnel and expanding our product line. We do not currently have plans for our expansion, and have not yet decided on the scale of our expansion if we decided to do so and on the exact amount of funding needed for our long term financing.

If we do not receive any proceeds from the offering or the minimum amount of $1,000,000 that we require to operate for the next 12 months Hajime Abe, has informally agreed to advance us funds, however, he has no formal commitment, arrangement or legal obligation to advance or loan funds to the company.

To meet our need for cash we are attempting to raise money from this offering. We believe that we will be able to raise enough money through this offering to start our proposed operations but we cannot guarantee that once we start operations we will stay in business after doing so. If we are unable to successfully find customers we may quickly use up the proceeds from this offering and will need to find alternative sources of funding. At the present time, we have not made any arrangements to raise additional cash, other than through this offering.

If we need additional cash and cannot raise it, we will either have to suspend operations until we do raise the cash we need, or cease operations entirely. Even if we raise $1,000,000 from this offering, it will most likely only last one year. We may need more funds for business operations in the next year, and we will have to revert to obtaining additional money.

- 7 -

Please consider the following risk factors and other information in this prospectus relating to our business before deciding to invest in our common stock.

This offering and any investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and all of the information contained in this prospectus before deciding whether to purchase our common stock. If any of the following risks actually occur, our business, financial condition and results of operations could be harmed. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

We consider the following to be the material risks for an investor regarding this offering. Our company should be viewed as a high-risk investment and speculative in nature. An investment in our common stock may result in a complete loss of the invested amount.

An investment in our common stock is highly speculative, and should only be made by persons who can afford to lose their entire investment in us. You should carefully consider the following risk factors and other information in this report before deciding to become a holder of our common stock. If any of the following risks actually occur, our business and financial results could be negatively affected to a significant extent.

Risks Relating to Our Company and Our Industry

We will require additional funds in the future to achieve our current business strategy and our inability to obtain funding will cause our business to fail.

We will need to raise additional funds through public or private debt or equity sales in order to fund our future operations and fulfill contractual obligations in the future. These financings may not be available when needed. Even if these financings are available, it may be on terms that we deem unacceptable or are materially adverse to your interests with respect to dilution of book value, dividend preferences, liquidation preferences, or other terms. Our inability to obtain financing would have an adverse effect on our ability to implement our current business plan and develop our products, and as a result, could require us to diminish or suspend our operations and possibly cease our existence.

Even if we are successful in raising capital in the future, we will likely need to raise additional capital to continue and/or expand our operations. If we do not raise the additional capital, the value of any investment in our Company may become worthless. In the event we do not raise additional capital from conventional sources, it is likely that we may need to scale back or curtail implementing our business plan.

The Company, being a start-up Company has not generated any revenues since our inception in July 2013.

We are a start-up company. Our ability to continue as a going concern is dependent upon our ability to commence a commercially viable operation and to achieve profitability. Since our inception in July 2013, we have not generated any revenue, and currently have only limited operations. These factors raise substantial doubt about our ability to continue as a going concern. We may not be able to generate revenues in the future and as a result the value of our common stock may become worthless. There are no assurances that we will be successful in raising additional capital or successfully developing and commercializing our products and become profitable.

We have a limited operating history that you can use to evaluate us, and the likelihood of our success must be considered in light of the problems, expenses, difficulties, complications and delays that we may encounter because we are a small developing company. As a result, we may not be profitable and we may not be able to generate sufficient revenue to develop as we have planned.

We were incorporated in Delaware in July of 2013. We have no significant assets or financial resources. The likelihood of our success must be considered in light of the expenses and difficulties in development of worldwide clients, customers, recruiting and keeping clients and/ or customers and obtaining financing to meet the needs of our plan of operations. Since we have a limited operating history we may not be profitable and we may not be able to generate sufficient revenues to meet our expenses and support our anticipated activities.

- 8 -

Because we will obtain products from a company other than our own, a disruption in the delivery of LED products or materials may have a greater effect on us than on our competitors.

We have and will continue to purchase our LED products and materials from OPTICAL TECH. Deliveries of our products or materials that we use in further development (that we first purchase from them) may be disrupted through products shortages.

If our competitors are able to deliver products when we cannot, our reputation may be damaged and we may lose customers to our competitors.

Currently, we rely heavily on the existence of OPTICAL TECH., as they are our exclusive supplier of LED products and materials for such components. Any financial or legal issues faced by OPTICAL TECH may greatly impact our business and cause a loss or complete loss in your investment.

Because all of our products, materials, and components come directly from OPTICAL TECH, if they face financial troubles such as bankruptcy, or legal disputes they may not be able to continue their normal course of business, leaving us with little or no LED products to deliver to our customers. If in the event that OPTICAL TECH was forced to cease operations due to bankruptcy or any other reason, we would be left without a supplier of LED products and or materials making it difficult if not impossible to continue operations. This would be extremely detrimental to us as we would be left with no product to sell to customers worldwide. This could cause a loss or complete loss in your investment if this were to occur.

Conflicts of interest may arise with respect to determining the terms and conditions of the transactions between TOA Hikari, Optical Tech and Singapore TOA Lighting.

At this time we do not have any agreements with or between TOA Hikari, Optical Tech or Singapore TOA Lighting. Tatsumi Shioya who is our President and CEO is also the owner of Optical Tech and Hajime Abe who is our Director is also the owner of Singapore TOA Lighting. Currently, we have no agreements concerning the terms and conditions for future transactions between any of the above mentioned entities. As a result, conflicts of interest may arise with respect to determining the terms and conditions for future sale of products and operations.

We operate in a highly competitive environment, and if we are unable to compete with our competitors, our business, financial condition, results of operations, cash flows and prospects could be materially adversely affected.

We operate in a highly competitive environment. Our competition includes small, medium, and large scale manufacturers of lighting products, all of which may distribute similar LED units and at competitive prices. A highly competitive environment could materially adversely affect our business, financial condition, results of operations, cash flows and prospects.

Because we are small and do not have much capital, our marketing campaign may not be enough to attract sufficient clients to operate profitably. If we do not make a profit, we will suspend or cease operations.

Due to the fact we are small and do not have much capital, we must limit our marketing activities and may not be able to make our product known to potential customers. Because we will be limiting our marketing activities, we may not be able to attract enough customers to operate profitably. If we cannot operate profitably, we may have to suspend or cease operations.

Because the Company’s headquarters and assets are located outside the United States in Japan, investors may experience difficulties in attempting to effect service of process and to enforce judgments based upon US Federal Securities Laws against the Company and its non-US resident officers and directors.

While we are organized under the laws of State of Delaware, our officers and Directors are non-US residents and our headquarters and assets are located outside the United States in Japan. Consequently, it may be difficult for investors to affect service of process on them in the United States and to enforce in the United States judgments obtained in United States courts against them based on the civil liability provisions of the United States securities laws. Since all our assets will be located outside U.S. it may be difficult or impossible for U.S. investors to collect a judgment against us.

- 9 -

We expect our quarterly financial results to fluctuate.

We expect our net sales and operating results to vary significantly from quarter to quarter due to a number of factors, including changes in:

• Demand for our products;

• Our ability to retain existing customers or encourage repeat purchases;

• Our ability to manage our product inventory;

• General economic conditions;

• Advertising and other marketing costs;

• Costs of expanding to other LED products.

As a result of the variability of these and other factors, our operating results in future quarters may be below the expectations of public market analysts and investors.

Our future success is dependent, in part, on the performance and continued service of Tatsumi Shioya, our President and CEO. Without his continued service, we may be forced to interrupt or eventually cease our operations.

We are presently dependent to a great extent upon the experience, abilities and continued services of Tatsumi Shioya, our President and CEO. We currently do not have an employment agreement with Mr. Shioya. The loss of his services would delay our business operations substantially.

Our future success is dependent, in part, on the performance and continued service of Hajime Abe, our Secretary, Treasurer, CFO and Director. Without his continued service, we may be forced to interrupt or eventually cease our operations.

We are presently dependent to a great extent upon the experience, abilities and continued services of Hajime Abe, our Secretary, Treasurer, CFO and Director. We currently do not have an employment agreement with Mr. Abe. The loss of his services would delay our business operations substantially.

Because our current Secretary, Treasurer, CFO and Director has other business interests, he may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail.

Hajime Abe, our Secretary, Treasurer, CFO and Director, currently devotes approximately twenty hours per week providing management services to us. While he presently possesses adequate time to attend to our interest, it is possible that the demands on him from other obligations could increase, with the result that he would no longer be able to devote sufficient time to the management of our business. The loss of Hajime Abe to our company could negatively impact the development and implementation of our business. The other businesses which Hajime Abe conducts and operates are not in the LED distribution industry. Unless the other business interests, of which Mr. Hajime Abe is associated, expanded their businesses to include LED lighting distribution, they will not be or become a competitor to the Company. As it stands today these other businesses do not compete with the Company regarding distribution of LED lighting units.

Because our current President has other business interests, he may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail.

Tatsumi Shioya, our President and CEO, currently devotes approximately twenty hours per week providing management services to us. While he presently possesses adequate time to attend to our interest, it is possible that the demands on him from other obligations could increase, with the result that he would no longer be able to devote sufficient time to the management of our business. The loss of Tatsumi Shioya to our company could negatively impact the development and implementation of our business. The other businesses which Tatsumi Shioya conducts and operates are not in the LED lights distribution industry. Unless the other business interests of which Mr. Tatsumi Shioya is associated with expanded their businesses to include LED lights distribution, they could then become a competitor to the Company. As it stands today however, these other businesses do not compete with the Company regarding LED lighting distribution or have any intentions of doing so. Other business interests however, of Optical Tech Co., Ltd, a Japan Corporation may in fact affect our own business’s operating results. Currently, Optical Tech Co., Ltd. is our principal technology provider. If they ceased to serve as our provider of such LED technologies, it could negatively affect our business.

If Hajime Abe, or Tatsumi Shioya should resign or die, we will not have a Director, CEO or President, which could result in our operations suspending. If that should occur, you could lose your investment.

We are extremely dependent on the services of Tatsumi Shioya, our President and CEO, as well as Hajime Abe, our Secretary, Treasurer, CFO and Director for the future success of our business. The loss of the services of Tatsumi Shioya or Hajime Abe could have an adverse effect on our business, financial condition and results of operations. If either party should resign or die we will not have a chief executive officer, president, and or director depending on the situation. If that should occur, until we find another person to act as our chief executive officer, president, or director our operations could be suspended. In that event it is possible you could lose most if not all of your entire investment.

- 10 -

Our future success is dependent on our implementation of our business plan. We have many significant steps still to take.

Our success will depend in large part in our success in achieving several important steps in the implementation of our business plan, including the following: acquiring business information, development of clients, development of more suppliers of products, implementing order processing and customer service capabilities, and management of business process. If we are not successful, we will not be able to fully implement or expand our business plan.

Our success depends upon our ability to attract and hire key personnel. Since many of our personnel will be required to be bilingual, or to have other special skills, the pool of potential employees may be small and in high demand by our competitors. Our inability to hire qualified individuals will negatively affect our business, and we will not be able to implement or expand our business plan.

Our business is greatly dependent on our ability to attract key personnel. We will need to attract, develop, motivate and retain highly skilled technical employees. Competition for qualified personnel is intense and we may not be able to hire or retain qualified personnel. Our management has limited experience in recruiting key personnel which may hurt our ability to recruit qualified individuals. If we are unable to retain such employees, we will not be able to implement or expand our business plan.

If we cannot effectively increase and enhance our sales and marketing capabilities, we may not be able to increase our revenues.

We need to further develop our sales and marketing capabilities to support our commercialization efforts. If we fail to increase and enhance our marketing and sales force, we may not be able to enter new or existing markets. Failure to recruit, train and retain new sales personnel, or the inability of our new sales personnel to effectively market and sell our products, could impair our ability to gain market acceptance of our products.

Our sole Director, Hajime Abe, beneficially owns approximately or has the right to vote on 71.1% of our outstanding common stock and preferred stock in total. As a result, he will have the ability to control substantially all matters submitted to our stockholders for approval including:

• Election of our board of directors;

• Removal of any of our directors;

• Amendment of our Certificate of Incorporation or bylaws;

• Adoption of measures that could delay or prevent a change in control or impede a merger, takeover or other business combination involving us.

As a result of his ownership and position, he is able to influence all matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions. In addition, the future prospect of sales of significant amounts of shares held by him could affect the market price of our common stock if the marketplace does not orderly adjust to the increase in shares in the market and the value of your investment in our company may decrease. Mr. Abe's stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over our stock price.

Because our current business partners are established by related parties, we have potential risks due to potential conflicts of interest.

Tatsumi Shioya who is President and CEO of the Company is also the owner, President and Director of Optical Tech Co., Ltd. and Hajime Abe who is Director and beneficial owner of the Company is also owner, President and Director of Singapore TOA Lighting PTE, Ltd. Each company is a vital partner to our Company and directly influences our operations. If a conflict of interest arises between any of the aforementioned Companies and our own Company due to the fact that related parties own the above entities, certain business decisions may negatively impact our own sales, operations, results, and other relevant matters leading to a decrease in the value of our overall stock and Company. This may negatively impact any investment made in our Company.

- 11 -

Our growth will place significant strains on our resources.

The Company is currently in the exploration stage, with only limited operations, and has generated no revenue since inception in July 2013. The Company's growth, if any, is expected to place a significant strain on the Company's managerial, operational and financial resources. Moving forward, the Company's systems, procedures or controls may not be adequate to support the Company's operations and/or the Company may be unable to achieve the rapid execution necessary to successfully implement its business plan. The Company's future operating results, if any, will also depend on its ability to add additional personnel commensurate with the growth of its operations, if any. If the Company is unable to manage growth effectively, the Company's business, results of operations and financial condition will be adversely affected.

The recently enacted JOBS Act will allow the Company to postpone the date by which it must comply with certain laws and regulations intended to protect investors and to reduce the amount of information provided in reports filed with the SEC.

The recently enacted JOBS Act is intended to reduce the regulatory burden on “emerging growth companies”. The Company meets the definition of an “emerging growth company” and so long as it qualifies as an “emerging growth company,” it will, among other things:

-be exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that its independent registered public accounting firm provide an attestation report on the effectiveness of its internal control over financial reporting;

-be exempt from the "say on pay” provisions (requiring a non-binding shareholder vote to approve compensation of certain executive officers) and the "say on golden parachute” provisions (requiring a non-binding shareholder vote to approve golden parachute arrangements for certain executive officers in connection with mergers and certain other business combinations) of The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and certain disclosure requirements of the Dodd-Frank Act relating to compensation of Chief Executive Officers;

-be permitted to omit the detailed compensation discussion and analysis from proxy statements and reports filed under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and instead provide a reduced level of disclosure concerning executive compensation; and

-be exempt from any rules that may be adopted by the Public Company Accounting Oversight Board (the “PCAOB”) requiring mandatory audit firm rotation or a supplement to the auditor’s report on the financial statements.

Although the Company is still evaluating the JOBS Act, it currently intends to take advantage of all of the reduced regulatory and reporting requirements that will be available to it so long as it qualifies as an “emerging growth company”. The Company has elected not to opt out of the extension of time to comply with new or revised financial accounting standards available under Section 102(b)(1) of the JOBS Act. Among other things, this means that the Company's independent registered public accounting firm will not be required to provide an attestation report on the effectiveness of the Company's internal control over financial reporting so long as it qualifies as an “emerging growth company”, which may increase the risk that weaknesses or deficiencies in the internal control over financial reporting go undetected. Likewise, so long as it qualifies as an “emerging growth company”, the Company may elect not to provide certain information, including certain financial information and certain information regarding compensation of executive officers, which would otherwise have been required to provide in filings with the SEC, which may make it more difficult for investors and securities analysts to evaluate the Company. As a result, investor confidence in the Company and the market price of its common stock may be adversely affected.

Notwithstanding the above, we are also currently a “smaller reporting company”, meaning that we are not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent company that is not a smaller reporting company and have a public float of less than $75 million and annual revenues of less than $50 million during the most recently completed fiscal year. In the event that we are still considered a “smaller reporting company”, at such time are we cease being an “emerging growth company”, the disclosure we will be required to provide in our SEC filings will increase, but will still be less than it would be if we were not considered either an “emerging growth company” or a “smaller reporting company”. Specifically, similar to “emerging growth companies”, “smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; and have certain other decreased disclosure obligations in their SEC filings, including, among other things, being required to provide only two years of audited financial statements in annual reports. Decreased disclosures in our SEC filings due to our status as an “emerging growth company” or “smaller reporting company” may make it harder for investors to analyze the Company’s results of operations and financial prospects.

We are an “emerging growth company” under the JOBS Act of 2012, and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We are choosing to take advantage of the extended transition period for complying with new or revised accounting standards. As a result, our financial statements may not be comparable to those of companies that comply with public company effective dates.

We will remain an “emerging growth company” for up to five years, although we will lose that status sooner if our revenues exceed $1 billion, if we issue more than $1 billion in non-convertible debt in a three year period, or if the market value of our common stock that is held by non-affiliates exceeds $700 million.

As we are a publicly reporting company, we will continue to incur significant costs in staying current with reporting requirements. Our management will be required to devote substantial time to compliance initiatives. Additionally, the lack of an internal audit group may result in material misstatements to our financial statements and ability to provide accurate financial information to our shareholders.

Our management and other personnel will need to devote a substantial amount of time to compliance initiatives to maintain reporting status. Moreover, these rules and regulations, that are necessary to remain as an SEC reporting Company, will be costly as an external third party consultant(s), attorney, or firm, may have to assist in some regard to following the applicable rules and regulations for each filing on behalf of the company.

We currently do not have an internal audit group, and we will eventually need to hire additional accounting and financial staff with appropriate public company experience and technical accounting knowledge to have effective internal controls for financial reporting.

Moreover, if we are not able to comply with the requirements or regulations as an SEC reporting company, in any regard, we could be subject to sanctions or investigations by the SEC or other regulatory authorities, which would require additional financial and management resources.

- 12 -

Risks Relating to the Company’s Securities

We may never have a public market for our common stock or may never trade on a recognized exchange. Therefore, you may be unable to liquidate your investment in our stock.

There is no established public trading market for our securities. Our shares are not and have not been listed or quoted on any exchange or quotation system.

In order for our shares to be quoted, a market maker must agree to file the necessary documents with the National Association of Securities Dealers, which operates the OTCQB and OTCBB . In addition, it is possible that such application for quotation may not be approved and even if approved it is possible that a regular trading market will not develop or that if it did develop, will be sustained. In the absence of a trading market, an investor may be unable to liquidate their investment.

We may in the future issue additional shares of our common stock, which may have a dilutive effect on our stockholders.

Our Certificate of Incorporation authorizes the issuance of 500,000,000 shares of common stock, of which 60,000,000 shares are issued and outstanding as of May 15, 2015. The future issuance of our common shares may result in substantial dilution in the percentage of our common shares held by our then existing stockholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

We may issue shares of preferred stock in the future that may adversely impact your rights as holders of our common stock.

Our Certificate of Incorporation authorizes us to issue up to 20,000,000 shares of preferred stock. Accordingly, our board of directors will have the authority to fix and determine the relative rights and preferences of preferred shares, as well as the authority to issue such shares, without further stockholder approval. Currently, our series A preferred stock entitles the holder thereof to 100 votes on all matters upon which the holders of the common stock of the Company are entitled to vote. Series A Preferred Stock does not have any dividend, conversion, liquidation, or other rights or preferences, including redemption or sinking fund provisions. However, our board of directors could authorize the issuance of a series of preferred stock that would grant to holders preferred rights to our assets upon liquidation, the right to receive dividends before dividends are declared to holders of our common stock, and the right to the redemption of such preferred shares, together with a premium, prior to the redemption of the common stock. To the extent that we do issue such additional shares of preferred stock, your rights as holders of common stock could be impaired thereby, including, without limitation, dilution of your ownership interests in us. In addition, shares of preferred stock could be issued with terms calculated to delay or prevent a change in control or make removal of management more difficult, which may not be in your interest as holders of common stock.

We do not currently intend to pay dividends on our common stock and consequently, your ability to achieve a return on your investment will depend on appreciation in the price of our common stock.

We have never declared or paid any cash dividends on our common stock and do not currently intend to do so for the foreseeable future. We currently intend to invest our future earnings, if any, to fund our growth. Therefore, you are not likely to receive any dividends on your common stock for the foreseeable future and the success of an investment in shares of our common stock will depend upon any future appreciation in its value. There is no guarantee that shares of our common stock will appreciate in value or even maintain the price at which our stockholders have purchased their shares.

- 13 -

We may be exposed to potential risks resulting from requirements under Section 404 of the Sarbanes-Oxley Act of 2002.

As a reporting company we are required, pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, to include in our annual report our assessment of the effectiveness of our internal control over financial reporting. We do not have a sufficient number of employees to segregate responsibilities and may be unable to afford increasing our staff or engaging outside consultants or professionals to overcome our lack of employees.

We do not currently have independent audit or compensation committees. As a result, our directors have the ability, among other things, to determine their own level of compensation. Until we comply with such corporate governance measures, regardless of whether such compliance is required, the absence of such standards of corporate governance may leave our stockholders without protections against interested director transactions, conflicts of interest and similar matters and investors may be reluctant to provide us with funds necessary to expand our operations.

The costs to meet our reporting and other requirements as a public company subject to the Exchange Act of 1934 is and will be substantial and may result in us having insufficient funds to expand our business or even to meet routine business obligations.

As a public entity, subject to the reporting requirements of the Exchange Act of 1934, we will continue to incur ongoing expenses associated with professional fees for accounting, legal and a host of other expenses for annual reports and proxy statements. We estimate that these costs will range up to $35,000 per year for the next few years and will be higher if our business volume and activity increases. As a result, we may not have sufficient funds to grow our operations.

State Securities Laws may limit secondary trading, which may restrict the states in which and conditions under which you can sell Shares.

Secondary trading in our common stock may not be possible in any state until the common stock is qualified for sale under the applicable securities laws of the state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in the state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, the common stock in any particular state, the common stock cannot be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse to permit secondary trading in our common stock, the liquidity for the common stock could be significantly impacted.

- 14 -

Risks Relating to this Offering

Investors cannot withdraw funds once invested and will not receive a refund.

Investors do not have the right to withdraw invested funds. Subscription payments will be paid to Toa Optical Tech, Inc. and held in our corporate bank account if the Subscription Agreements are in good order and the Company accepts the investor’s investment. Therefore, once an investment is made, investors will not have the use or right to return of such funds.

Mr. Shioya does not intend to solicit any potential purchasers through oral solicitation and his participation in the offering will be limited to the activities set forth in Rule 3a4-1(a)(4)(iii) under the Exchange Act.

Mr. Shioya does not intend to solicit any potential purchasers through oral solicitation and his participation in the offering will be limited to the activities set forth in Rule 3a4-1(a)(4)(iii) under the Exchange Act. Mr. Shioya plans to take a passive approach in the offering, only directly soliciting potential investors that are family, friends, and business acquaintances all of which will be done without oral solicitation, and only through the mailing of letters notifying such individuals of the Company’s offering. Should they then choose to invest Mr. Shioya will perform ministerial and clerical work involved in effecting any such transaction. Mr. Shioya will also perform the same ministerial and clerical work should other individuals come forth that would like to invest who discovered the offering through other means such as the internet, word of mouth, or other indirect means. It should be noted that Mr. Shioya will only be able to utilize written communication should he have written approval of another officer of the Company. In this case he will need to acquire the permission of the Company’s only other Officer, Secretary, Treasurer and Chief Financial Officer Hajime Abe. Such limitations on Mr. Abe’s participation may severely limit the ability of investors to sell shares as part of the direct offering.

The trading in our shares will be regulated by the Securities and Exchange Commission Rule 15G-9 which established the definition of a “Penny Stock.”

The shares being offered are defined as a penny stock under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), and rules of the Commission. The Exchange Act and such penny stock rules generally impose additional sales practice and disclosure requirements on broker-dealers who sell our securities to persons other than certain accredited investors who are, generally, institutions with assets in excess of $4,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 ($300,000 jointly with spouse), or in transactions not recommended by the broker-dealer. For transactions covered by the penny stock rules, a broker dealer must make certain mandated disclosures in penny stock transactions, including the actual sale or purchase price and actual bid and offer quotations, the compensation to be received by the broker-dealer and certain associated persons, and must deliver certain disclosures required by the Commission. Consequently, the penny stock rules may make it difficult for you to resell any shares you may purchase.

We are selling the shares of this offering without an underwriter and may be unable to sell any shares.

This offering is self-underwritten, that is, we are not going to engage the services of an underwriter to sell the shares; we intend to sell our shares through our President, who will receive no commissions. There is no guarantee that he will be able to sell any of the shares. Unless he is successful in selling all of the shares of our Company’s offering, we may have to seek alternative financing to implement our business plan.

We may face difficulties and challenges as a result of the selling shareholders offering concurrently with our own offering of shares for sale. This may result in less proceeds to the Company.

The selling shareholders will be offering shares for sale at the same time as the Company. This may result in competition in selling shares and also a loss of potential investors whose proceeds as a result of purchasing shares, would have gone to the Company. This may have a negative effect on future business operations and performance of the Company.

Due to the lack of a trading market for our securities, you may have difficulty selling any shares you purchase in this offering.