Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Samson Resources Corp | d926482d8k.htm |

1

st

Quarter 2015 Conference Call

May 20, 2015

Supplemental Materials

Exhibit 99.1 |

2

Cautionary Statement Regarding Forward-Looking Statements

Forward-Looking & Other Cautionary Statements

The information in this presentation by Samson Resources Corporation (the “Company,”

“we” or “our”) includes “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. All statements included in this

presentation, other than statements of historical fact, may constitute forward-looking statements, including, but not limited

to, statements or information regarding our future growth, results of operations, operational

and financial performance, business prospects and opportunities and future events.

Words such as, but not limited to, “anticipate,” “continue,” “estimate,” “expect,” “may,” “might,” “will,” “project,”

“should,” “believe,” “intend,” “continue,”

“could,” “plan,” “predict,” “potential,” “goal,” “foresee” and negatives of these words and similar expressions

are intended to identify forward-looking statements. In particular, statements about our

expectations, beliefs, plans, objectives, assumptions or future events or performance

contained in this presentation are forward-looking statements.

All forward-looking statements involve risks and uncertainties. The occurrence of the

events described and the achievement of the expected results depend on many events and

assumptions, some or all of which are not predictable or within our control. Factors that may cause actual results to differ

from expected results include, but are not limited to: (i) our substantial indebtedness; (ii)

our ability to refinance, restructure or amend our indebtedness or otherwise improve

our capital structure and liquidity; (iii) fluctuations in oil and natural gas prices; (iv) the uncertainty inherent in

estimating our reserves, future net revenues and PV-10; (v) the timing and amount of

future production of oil and natural gas; (vi) cash flow and changes in the

availability and cost of capital; (vii) environmental, drilling and other operating risks, including liability claims as a result of our oil and

natural gas operations; (viii) proved and unproved drilling locations and future drilling

plans; (ix) the effects of existing and future laws and governmental regulations,

including environmental, hydraulic fracturing and climate change regulation; (x) restrictions contained in our debt

agreements; (xi) our ability to generate sufficient cash to service our indebtedness; (xii)

our ability to make acquisitions and divestitures on favorable terms or at all; and

(xiii) any of the risk factors and other cautionary statements, including under the heading “Risk Factors,” described in the Company’s

Annual Report on form 10-K for the year ended December 31, 2014, and in the other

documents and reports we file from time to time with the Securities and Exchange

Commission.

Readers are cautioned not to place undue reliance on forward-looking statements. Should

one or more of the risks or uncertainties referenced above occur, or should underlying

assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-

looking statements. Further, new factors that could cause actual results to differ materially

from those described in forward-looking statements emerge from time to time, and it

is not possible to predict all such factors, or the extent to which any such factor or combination of factors may cause actual

results to differ from those contained in any forward-looking statement.

Each forward-looking statement speaks only as of the date of this presentation, and,

except as otherwise required by applicable law, we disclaim any duty to update any

forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances

after the date of this presentation.

Non-GAAP Disclosures

This presentation refers to certain non-GAAP financial measures. Definitions of these

measures and reconciliation between U.S. GAAP and non-GAAP financial measures are

included at the end of this presentation. |

3

Q1’15 Financial & Operating Metrics

(1)

Including realized derivatives.

(2)

Income Statement G&A excluding stock-based G&A compensation expenses of $0.29 and

$0.21 per Mcfe for quarter ended March 31, 2015 and March 31, 2014, respectively. Note: Q1’15 Cash G&A

(3)

Cash operating margin is a non-GAAP financial measure. A description of cash

operating margin is included at the end of this presentation and the calculation of the measure is provided above.

(4)

Adjusted EBITDA is a non-GAAP financial measure. A reconciliation to its nearest

GAAP financial measure is included at the end of this presentation. (2)

(3)

(4)

(1)

Q1'15

Q1'14

Difference

Production (MMcfe/d)

518

529

(11)

Realized Price ($/Mcfe)

$3.93

$5.67

($1.74)

Operating Expenses ($/Mcfe)

LOE

$1.16

$0.95

$0.21

Production Tax

$0.26

$0.43

($0.17)

Cash G&A

$0.71

$0.65

$0.06

Total

$2.13

$2.03

$0.10

Cash Operating Margin ($/Mcfe)

$1.80

$3.64

($1.84)

Adjusted EBITDA ($MM)

$92

$179

($87)

excludes approximately $0.16 per Mcfe related to officer retention awards and also excludes

approximately $0.10 per Mcfe related to professional fees associated with debt restructuring. |

4

Q1’15 Free Cash Flow & Net Debt

($MM)

(1)

Q1’15 inclusive of Arkoma divestiture proceeds of $48 million.

(2)

(3)

Long-term debt (including debt classified as current) of approximately $4.2 billion less

cash and cash equivalents of approximately $194 million. Note: Totals may not sum

due to independent rounding. (2)

(3)

(1)

Q1'15

Q1'14

Difference

Cash Flow From Operations

$20

$103

($83)

Divestiture Proceeds

$61

$6

$55

Total

$81

$109

($28)

Cash Capital Expenditures:

Drilling and Completion

$106

$131

($25)

LGG, Facility & Other

$11

$7

$4

Capitalized Cash Interest & Internal Costs

$86

$131

($45)

Total

$203

$269

($66)

Free Cash Flow Before Financing Activities

($122)

($160)

$38

Net Debt

$4,003

Reflects net cash provided by operating activities plus net cash used in investing

activities. |

Current Hedge

Position Year

Bbls/d

(1)

Swap Price

2015

3,500

$90.91

Year

Bbls/d

(1)

Swap Price

2015

750

$37.07

Year

MMBtu/d

(1)

Wtd Avg

Floor

2015

(2)

186,000

$4.04

2016

(3)

161,000

$4.04

2017

40,000

$3.92

NGL Swaps

Oil Swaps

Natural Gas Swaps & Collars

(1)

Volumes are rounded.

(2)

2015 includes 20,000 MMBtu/d of CY 2015 collars.

(3)

2016 includes 30,000 MMBtu/d of natural gas collars to the extent our counterparty elects to

exercise their collar options. Note: 2015 includes balance of the year only.

As of April 30, 2015

Mark to Market Value of Approximately $125 MM (~$75 MM associated with 2015)

5 |

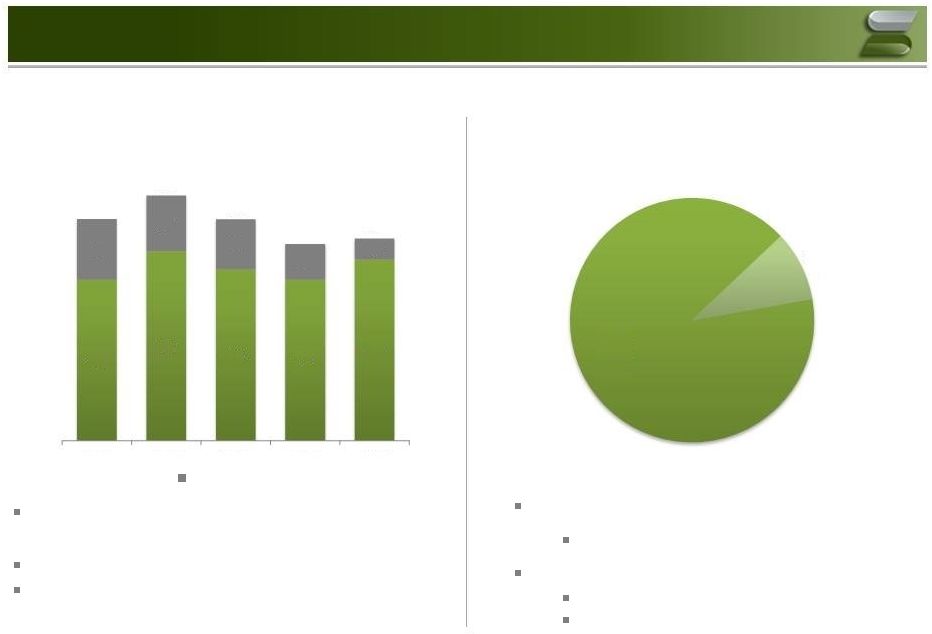

Q1’15

Production and Capital Summary Q1’15

Oil

and

Gas

Capital

by

Type

(2)

($MM)

6

Q1’15

Pro

Forma

Production

(1)

up

12

MMcfe/d

sequentially from Q4’14

27 wells turned to sales in Q1’15

Maintaining CY 2015 Guidance of 435 to 460

MMcfe/d

Total Oil and Gas Capital Spend of $116 MM

91% D&C

Non-D&C Oil and Gas Capital of $11 MM

$8 MM Facilities / Other

$3 MM LG&G

Production By Quarter

(MMcfe/d)

(1)

Q1’15 Pro Forma production of 506 MMcfe/d includes 11 MMcfe/d associated with the GDP

acquisition which closed December 22, 2014. (2)

Cash capital expenditures.

Note: Totals may not sum due to independent rounding.

Divested Production

494

511

500

494

506

35

33

29

21

12

529

543

530

515

518

Q1'14

Q2'14

Q3'14

Q4'14

Q1'15

D&C

$106

Non-D&C

$11 |

7

Non-GAAP Disclosures

Cash operating margin, EBITDA, Adjusted EBITDA and Covenant Adjusted EBITDA are non-GAAP

financial measures. We believe that the presentation of these non-GAAP

financial measures will provide useful information to investors in assessing our financial condition and results of operations.

Cash operating margin represents our average realized sales price per Mcfe, including the

effect of realized derivatives, less (i) lease operating expenses per Mcfe,

(ii) production and ad valorem taxes per Mcfe and (iii) general and administrative expenses

per Mcfe, excluding stock based compensation expenses. The per unit components of

cash operating margin are determined by dividing the applicable component by our total production on a natural gas equivalent basis. We believe that

cash operating margin is an important measure that can facilitate comparisons of our

performance between periods and to the performance of our peer companies.

EBITDA is defined as net income (loss) before interest expense, income tax expense (benefit),

depreciation and amortization. Adjusted EBITDA represents EBITDA adjusted as applicable

in the relevant period for select items specified in the credit agreement governing our revolving credit facility, including unrealized hedging

losses (gains), non-cash stock compensation expenses, management and similar fees paid to

our sponsors, costs associated with the preparation and implementation of certain

public company compliance obligations, losses (gains) on non-ordinary course asset dispositions, ceiling test charges and certain unusual and non-recurring

charges. We define Covenant Adjusted EBITDA as total Adjusted EBITDA less the Adjusted EBITDA

attributable to any assets or businesses disposed of during the relevant period. We

believe that the presentation of EBITDA, Adjusted EBITDA and Covenant Adjusted EBITDA is important to provide management and investors with

(i) additional information to evaluate our ability to service and comply with our debt

obligations, adjusting for certain items required or permitted in calculating covenant

compliance under the credit agreement governing our revolving credit facility, (ii) a supplemental indicator of the operational performance and value of our

business, (iii) an additional criterion for evaluating our performance relative to peer

companies and (iv) supplemental information about certain material non-cash and

other items that may not continue at the same level in the future.

We refer to PV-10 as the present value of estimated future net cash flows of estimated

proved reserves as calculated in the respective reserve report using a discount rate of

10%. This amount includes projected revenues, estimated production costs and estimated future development costs and excludes the estimated cash flows

related to future asset retirement obligations (“ARO”) and future income taxes. We

have also included PV-10 after ARO below. PV-10 after ARO includes the present

value of ARO related to proved reserves using a 10% discount rate and no inflation of current

costs. We believe that the non-GAAP financial measures of PV-10 and

PV-10 after ARO are relevant and useful for evaluating the relative monetary significance

of our proved oil and natural gas reserves. We believe the use of pre-tax measures

is valuable because there are many unique factors that can impact an individual company when estimating the amount of future income taxes to be paid.

Management believes that the presentation of these measures provides useful information to

investors because they are widely used by investors in evaluating oil and natural gas

companies. Net income (loss) is the GAAP financial measure most directly comparable to each of EBITDA,

Adjusted EBITDA and Covenant Adjusted EBITDA. Our non-GAAP financial measures

should not be considered as alternatives to the most directly comparable GAAP financial measures. Each of these non-GAAP financial measures has

important limitations as an analytical tool because it excludes some, but not all, items that

affect the most directly comparable GAAP financial measure. You should not consider

these non-GAAP financial measures in isolation or as a substitute for analysis of our results as reported under GAAP. Because cash operating margin, EBITDA,

Adjusted EBITDA and Covenant Adjusted EBITDA may be defined differently by other companies in

our industry, our definitions of these non-GAAP financial measures may not be

comparable to similarly titled measures of other companies, thereby diminishing their utility.

Management compensates for the limitations of these non-GAAP financial measures as an

analytical tool by reviewing the comparable GAAP financial measures, understanding the

difference between the non-GAAP financial measures, on the one hand, and each of their respective most directly comparable GAAP financial

measures, on the other hand, and incorporating this knowledge into its decision-making

processes. We believe that investors benefit from having access to the same financial

measures that our management uses in evaluating our financial condition and results of operations.

The following table presents reconciliations of EBITDA, Adjusted EBITDA and Covenant Adjusted

EBITDA to net income (loss) for each of the periods indicated. |

8

Q1’15 Adjusted EBITDA Reconciliation

(1)

(2)

Stock compensation expense recognized in earnings, net of capitalization.

(3)

Quarterly management fee.

(4)

Incorporates net adjustment of approximately ($16) MM to account for acquired and divested

EBITDA, as per the credit agreement governing our revolving credit facility. Covenant Adjusted EBITDA

measured on a rolling four-quarters basis is used to determine our compliance with the

financial performance covenant in the credit agreement governing our revolving credit facility.

Three Months

Twelve Months

Ended

Ended

March 31, 2015

March 31, 2015

Net income (loss)

(490,331)

$

(1,909,890)

$

Interest expense, net

64,127

135,559

Provision (benefit) for income taxes

(271,559)

(1,060,629)

Depreciation, depletion and amortization

(1)

105,372

469,520

EBITDA

(592,391)

$

(2,365,440)

$

Adjustment for unrealized hedging losses (gains)

(22,956)

(170,631)

Adjustment for non-cash stock compensation expense

(2)

14,601

52,882

Adjustment for fees paid to co-investors

(3)

5,788

22,326

Adjustment for fees paid for public company compliance

277

3,150

(Gain) loss on sale of other property and equipment

3,784

4,833

Provision to reduce carrying value of oil and gas properties

629,517

2,954,863

Unusual or non-recurring charges described in credit agreement

53,376

74,336

Adjusted EBITDA

91,996

$

576,319

$

Covenant Adjusted EBITDA

(4)

560,274

$

Includes depreciation, depletion and amortization of oil and

gas properties and depreciation and amortization of other property and equipment and accretion of ARO.

Note: Calculated as of 3/31/15 with respect to Samson Resources Corporation and its

consolidated subsidiaries by reference to the applicable terms of the credit agreement governing our revolving

credit facility. |