Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - ETF Managers Group Commodity Trust I | Financial_Report.xls |

| EX-31.1 - EXHIBIT 31.1 - ETF Managers Group Commodity Trust I | v408833_ex31-1.htm |

| EX-32.2 - EXHIBIT 32.2 - ETF Managers Group Commodity Trust I | v408833_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - ETF Managers Group Commodity Trust I | v408833_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - ETF Managers Group Commodity Trust I | v408833_ex31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x | Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the quarterly period ended March 31, 2015. |

OR

| ¨ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from to . |

Commission File Number:

001-36851

ETF Managers Group Commodity Trust I

(Exact name of registrant as specified in its charter)

| Delaware | 36-4793446 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

35 Beechwood Road

Suite 2B

Summit, NJ 07901

(Address of principal executive offices) (Zip code)

(908) 897-0518

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ | Smaller reporting company x |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

¨Yes x No

Indicate the number of Shares outstanding, as of May 1, 2015: 250,040

ETF MANAGERS GROUP COMMODITY TRUST I

Table of Contents

| - 2 - |

ETF MANAGERS GROUP COMMODITY TRUST I

Condensed Statements of Financial Condition

March 31, 2015 (Unaudited)

| ETF Managers | |||||||

| Sit Rising | Group Commodity |

||||||

| Rate ETF | Trust I | ||||||

| Assets | |||||||

| Investment in short-term securities, at fair value (cost $5,708,925 and $5,708,925, respectively) | $ | 5,688,644 | $ | 5,688,644 | |||

| Cash | 1,000 | 1,000 | |||||

| Segregated cash held by broker | 549,697 | 549,697 | |||||

| Total assets | $ | 6,239,341 | $ | 6,239,341 | |||

| Liabilities and shareholders' capital | |||||||

| Options written, at fair value (premiums received $27,540 and $27,540, respectively) | 60,586 | 60,586 | |||||

| Payable on open futures contracts | 102,703 | 102,703 | |||||

| Due to related party | 7,654 | 7,654 | |||||

| Total liabilities | 170,943 | 170,943 | |||||

| Shareholders' capital | |||||||

| Paid in capital | 6,246,665 | 6,246,665 | |||||

| Accumulated earnings (deficit) | (178,267 | ) | (178,267 | ) | |||

| Total shareholders' capital | 6,068,398 | 6,068,398 | |||||

| Total liabilities and shareholders' capital | $ | 6,239,341 | $ | 6,239,341 | |||

| Shares outstanding (unlimited authorized) | 250,040 | ||||||

| Net asset value per share | $ | 24.27 | |||||

| Market value per share | $ | 24.32 | |||||

See accompanying notes to unaudited financial statements.

| - 3 - |

ETF MANAGERS GROUP COMMODITY TRUST I

Condensed Schedule of Investments

March 31, 2015 (Unaudited)

SIT RISING RATE ETF

| DESCRIPTION | Contracts | Fair Value | ||||||

| Purchased Options - 0.1% | ||||||||

| CBT U.S. Treasury 10 Year Note, Strike Price $127.50 Expiring 4/24/2015 | 22 | $ | 4,813 | |||||

| TOTAL PURCHASED OPTIONS (cost $25,094) | 4,813 | |||||||

| Short-Term Investments - 93.6% | Shares | |||||||

| First American US Treasury Money Market Fund, 0.00%* | 5,683,831 | 5,683,831 | ||||||

| TOTAL SHORT-TERM INVESTMENTS | 5,683,831 | |||||||

| Total Investments (cost $5,708,925) - 93.7% | 5,688,644 | |||||||

| Assets in Excess of Other Liabilities – 6.3% (a) | 379,754 | |||||||

| TOTAL NET ASSETS – 100.0% | $ | 6,068,398 | ||||||

| * Annualized seven-day yield as of March 31, 2015 | ||||||||

| (a) $460,994 of cash is pledged as collateral for futures contracts and written options | ||||||||

| Written Options Contracts | Contracts | |||||||

| CBT U.S. 5 year Note, Strike Price $119.00 Expiring 4/24/2015 | 47 | $ | (60,586 | ) | ||||

| (Premiums received $27,539) | $ | (60,586 | ) | |||||

| Unrealized | ||||||||

| Gain/ | ||||||||

| Short Futures Contracts | Contracts | (Loss) | ||||||

| CBT U.S. Treasury 5 Year Note, Expiring June 2015 (Underlying Face Amount at Market Value ($3,084,998) | 26 | $ | (40,412 | ) | ||||

| CBT U.S. Treasury 2 Year Note, Expiring June 2015 (Underlying Face Amount at Market Value ($13,525,166) | 62 | (62,291 | ) | |||||

| $ | (102,703 | ) | ||||||

See accompanying notes to unaudited financial statements.

| - 4 - |

ETF MANAGERS GROUP COMMODITY TRUST I

Condensed Statements of Operations for the Period from February 19, 2015* to March 31, 2015

(Unaudited)

| Investment Income | SIT RISING RATE ETF | ETF MANAGERS GROUP COMMODITY TRUST I | ||||||

| Investment Income | ||||||||

| Interest | $ | - | $ | - | ||||

| Expenses | ||||||||

| Commodity Pool Operator management fees | $ | 6,318 | $ | 6,318 | ||||

| Commodity Trading Advisor fees | 2,214 | 2,214 | ||||||

| Audit fees | 22,424 | 22,424 | ||||||

| Tax preparation fees | 9,731 | 9,731 | ||||||

| Admin/accounting/custodian/transfer agent fees | 5,594 | 5,594 | ||||||

| Legal fees | 3,370 | 3,370 | ||||||

| Printing and postage expenses | 2,528 | 2,528 | ||||||

| Chief Compliance Officer fees | 2,106 | 2,106 | ||||||

| Principal Financial Officer fees | 2,106 | 2,106 | ||||||

| Regulatory reporting fees | 2,106 | 2,106 | ||||||

| Brokerage commissions | 1,352 | 1,352 | ||||||

| Distribution fees | 1,685 | 1,685 | ||||||

| Insurance expense | 1,685 | 1,685 | ||||||

| Listing & calculation agent fees | 1,505 | 1,505 | ||||||

| Other expenses | 1,451 | 1,451 | ||||||

| Wholesale support fees | 632 | 632 | ||||||

| Total Expenses | 66,807 | 66,807 | ||||||

| Less: Waiver of Commodity Trading Advisor fees | (2,214 | ) | (2,214 | ) | ||||

| Less: Expenses absorbed by Sponsor | (53,753 | ) | (53,753 | ) | ||||

| Net Expenses | 10,840 | 10,840 | ||||||

| Net Investment Income (Loss) | $ | (10,840 | ) | $ | (10,840 | ) | ||

| Net Realized and Unrealized Gain (Loss) on Investment Activity | ||||||||

| Net Realized Gain (Loss) | ||||||||

| Futures and options contracts | $ | (11,396 | ) | $ | (11,396 | ) | ||

| Change in Unrealized Gain (Loss) | ||||||||

| Futures contracts and options | (156,031 | ) | (156,031 | ) | ||||

| Net realized and unrealized gain (loss) | (167,427 | ) | (167,427 | ) | ||||

| Net income (loss) | $ | (178,267 | ) | $ | (178,267 | ) | ||

* Commencement of investment operations.

See accompanying notes to unaudited financial statements.

| - 5 - |

ETF MANAGERS GROUP COMMODITY TRUST I

Condensed Statements of Changes in Shareholders' Capital for the Period from February 19, 2015* to March 31, 2015

(Unaudited)

| SIT RISING RATE ETF | ETF MANAGERS GROUP COMMODITY TRUST I | |||||||

| Shareholders' Capital at February 19, 2015 | $ | 5,001,000 | $ | 5,001,000 | ||||

| Increase (decrease) in Shareholders' Capital from share transactions | ||||||||

| Addition of 50,000 and 50,000 shares, respectively | 1,245,665 | 1,245,665 | ||||||

| Net increase (decrease) in Shareholders' Capital from share transactions | 1,245,665 | 1,245,665 | ||||||

| Increase (decrease) in Shareholders' Capital from operations | ||||||||

| Net investment income (loss) | (10,840 | ) | (10,840 | ) | ||||

| Net realized gain (loss) | (11,396 | ) | (11,396 | ) | ||||

| Change in net unrealized gain (loss) | (156,031 | ) | (156,031 | ) | ||||

| Net increase (decrease) in Shareholders' Capital from operations | (178,267 | ) | (178,267 | ) | ||||

| Shareholders' Capital at March 31, 2015 | $ | 6,068,398 | $ | 6,068,398 | ||||

* Commencement of investment operations.

See accompanying notes to unaudited financial statements.

| - 6 - |

ETF MANAGERS GROUP COMMODITY TRUST I

Condensed Statements of Cash Flows for the Period from February 19, 2015* to March 31, 2015

(Unaudited)

| SIT RISING RATE ETF | ETF MANAGERS GROUP COMMODITY TRUST I | |||||||

| Cash flows provided (used in) by operating activities | ||||||||

| Net income (loss) | $ | (178,267 | ) | $ | (178,267 | ) | ||

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | ||||||||

| Purchase of investments | (5,688,644 | ) | (5,688,644 | ) | ||||

| Increase in cash held by broker | (549,697 | ) | (549,697 | ) | ||||

| Increase in options written, at fair value | 60,586 | 60,586 | ||||||

| Increase in payable on open futures contracts | 102.703 | 102,703 | ||||||

| Increase in due to related party | 7,654 | 7,654 | ||||||

| Net cash provided by (used in) operating activities | (6,245,665 | ) | (6,245,665 | ) | ||||

| Cash flows from financing activities | ||||||||

| Proceeds from sale of shares | 1,245,665 | 1,245,665 | ||||||

| Net cash provided by financing activities | 1,245,665 | 1,245,665 | ||||||

| Net increase (decrease) in cash | (5,000,000 | ) | (5,000,000 | ) | ||||

| Cash, beginning of period | 5,001,000 | 5,001,000 | ||||||

| Cash, end of period | $ | 1,000 | $ | 1,000 | ||||

* Commencement of investment operations.

See accompanying notes to unaudited financial statements.

| - 7 - |

ETF MANAGERS GROUP COMMODITY TRUST I

Notes to Financial Statements

March 31, 2015 (unaudited) (continued)

(1) Organization

SIT RISING RATE ETF (the “Fund”), a series of the ETF Managers Group Commodity Trust I (a Delaware statutory trust formed on July 23, 2014), commenced investment operations on February 19, 2015. The Fund offers common units of beneficial interest (the “Shares”) only to certain eligible financial institutions (the “Authorized Participants”) in one or more blocks of 50,000 Shares (a “Creation Basket”). ETF Managers Capital LLC (the “Sponsor”), a Delaware limited liability company and a wholly owned subsidiary of Exchange Traded Managers Group LLC, serves as the managing owner and commodity pool operator of the Fund. The Sponsor seeded the Fund with a capital contribution of $1,000 in exchange for 40 Shares (Founders Shares) at the initial issuance price of $25.00 per share on September 26, 2014. Sit Fixed Income Advisors II, LLC (“Sit”) is registered as a “commodity trading advisor” and acts as such for the Fund. On January 8, 2015, Sit increased the seeding of the Fund with a capital contribution of $5,000,000 at the initial issuance price of $25.00 per share. From September 26, 2014 through February 18, 2015 the Fund had no operating activities and as a result the financial statement disclosures related to the prior period have been omitted.

The Fund commenced investment operations on February 19, 2015. The Fund commenced trading on the NYSE Arca, Inc. (the “NYSE Arca”) on February 19, 2015 and trades under the symbol “RISE”.

Sit is paid a fee equal to 0.35% per annum for its services as the commodity trading advisor to the Fund, payable by the Fund. Sit is a subsidiary of Sit Investment Associates, Inc.

The Fund’s investment objective is to profit from rising interest rates by tracking the performance of a portfolio (the “Benchmark Portfolio”) consisting of exchange traded futures contracts and options on futures on 2, 5 and 10 year U.S. Treasury securities (“Treasury Instruments”) weighted to achieve a targeted negative 10 year average effective portfolio duration (the “Benchmark Component Instruments”). The Fund seeks to achieve its investment objective by investing in the Benchmark Component Instruments currently constituting the Benchmark Portfolio. The Benchmark Portfolio is maintained by Sit and will be rebalanced, reconstituted, or both, monthly (typically on the 15th of each month and on the next business day if the 15th is a holiday, weekend, or other day on which the national exchanges are closed) to maintain a negative 10 year average effective duration. The Benchmark Portfolio and the Fund will each maintain a short position in Treasury Instruments. The Fund does not use futures contracts or options to obtain leveraged investment results. The Fund will not invest in swaps or other over the counter derivative instruments.

The weighting of the Treasury Instruments constituting the Benchmark Component Instruments will be based on each maturity’s duration contribution. The expected range for the duration weighted percentage of the 2 year and 5 year maturity Treasury Instruments will be from 30% to 70%. The expected range for the duration weighted percentage of the 10 year maturity Treasury Instruments will be from 5% to 25%. The relative weightings of the Benchmark Component Instruments will be shifted between maturities when there are material changes in the shape of the yield curve, for example, if the Federal Reserve began raising short term interest rates more than long term interest rates. In such an instance, Sit, which maintains the Benchmark Portfolio, will elect to increase the weightings of the 2 year and reduce the weighting in the 10 year maturity. Conversely, Sit will do the opposite if the Federal Reserve began raising long term interest rates more than short term interest rates. Reconstitution and rebalancing each will occur monthly, on the 15th, except for as noted above or if there are radical changes in the yield curve such that effective duration is outside of a range from negative nine to negative 11-year average effective duration, in which case Sit will adjust the maturities of the Treasury Instruments before the next expected monthly reconstitution.

| - 8 - |

ETF MANAGERS GROUP COMMODITY TRUST I

Notes to Financial Statements

March 31, 2015 (unaudited) (continued)

The Sponsor anticipates that approximately 5% to 15% of the Fund’s assets will be used as payment for or collateral for Treasury Instruments. In order to collateralize its Treasury Instrument positions the Fund will hold such assets, from which it will post margin to its futures commission merchant (“FCM”), SG Americas Securities, LLC., in an amount equal to the margin required by the relevant exchange, and transfer to its FCM any additional amounts that may be separately required by the FCM. When establishing positions in Treasury Instruments, the Fund will be required to deposit initial margin with a value of approximately 3% to 10% of the value of each Treasury Instrument position at the time it is established. These margin requirements are subject to change from time to time by the exchange or the FCM. On a daily basis, the Fund will be obligated to pay, or entitled to receive, variation margin in an amount equal to the change in the daily settlement level of its Treasury Instruments positions. Any assets not required to be posted as margin with the FCM will be held at the Fund’s administrator in cash or cash equivalents as discussed below.

The Benchmark Portfolio will be invested in Benchmark Component Instruments and rebalanced, as noted above to maintain a negative average effective portfolio duration of approximately 10 years. Duration is a measure of estimated price sensitivity relative to changes in interest rates. Portfolios with longer durations are typically more sensitive to changes in interest rates. For example, if interest rates rise by 1%, the market value of a security with an effective duration of 5 years would decrease by 5%, with all other factors being constant, and likewise the market value of a security with an effective duration of negative 5 years would increase by 5%, with all other factors being constant. The correlation between duration and price sensitivity is greater for securities rated investment-grade than it is for securities rated below investment-grade.

Duration estimates are based on assumptions by Sit and are subject to a number of limitations. Effective duration is calculated based on historical price changes of U.S. Treasuries and Treasury Instruments held by the Benchmark Portfolio, and therefore is a more accurate estimate of price sensitivity provided interest rates remain within their historical range. Investments in debt securities typically decrease in value when interest rates rise. The risk is usually greater for longer-term debt securities.

The Fund will incur certain expenses in connection with its operations. The Fund will hold cash or cash equivalents such as U.S. Treasuries or other high credit quality, short-term fixed-income or similar securities for direct investment or as collateral for the Treasury Instruments and for other liquidity purposes and to meet redemptions that may be necessary on an ongoing basis. These expenses and income from the cash and cash equivalent holdings may cause imperfect correlation between changes in the Fund’s net asset value (“NAV”) and changes in the Benchmark Portfolio, because the Benchmark Portfolio does not reflect expenses or income.

The Fund seeks to trade its positions prior to maturity; accordingly, natural market forces may cost the Fund while rebalancing. Each time the Fund seeks to reconstitute its positions, barring movement in the underlying securities, the futures and option prices may be higher or lower. Such differences in price, barring a movement in the price of the underlying security, will constitute “roll yield” and may inhibit the Fund’s ability to achieve its investment objective.

Several factors determine the total return from investing in a futures contract position. One factor that impacts the total return that will result from investing in near month futures contracts and “rolling” those contracts forward each month is the price relationship between the current near month contract and the next month contract.

When the Sponsor purchases an option that expires “out of the money,” the Fund will realize a loss. The Sponsor may not be able to invest the Fund’s assets in futures and options contracts having an aggregate notional amount exactly equal to that which is required to achieve a negative 10 year average effective duration. For example, as standardized contracts, U.S. Treasury futures contracts are denominated in specific dollar amounts, and the Fund’s NAV and the proceeds from the sale of a Creation Basket are unlikely to be an exact multiple of the amounts of those contracts. As a result, in such circumstances, the Fund may be better able to achieve the exact amount of exposure desired through the use of other investments.

The Sponsor will close existing positions when it determines it would be appropriate to do so and reinvest the proceeds in other positions. Positions may also be closed out to meet orders for Redemption Baskets.

| - 9 - |

ETF MANAGERS GROUP COMMODITY TRUST I

Notes to Financial Statements

March 31, 2015 (unaudited) (continued)

(2) Summary of Significant Accounting Policies

(a) Basis of Accounting

The accompanying financial statements of the Fund have been prepared in conformity with U.S. generally accepted accounting principles.

The accompanying financial statements are unaudited, but in the opinion of management, all adjustments (which include normal recurring adjustments) considered necessary to present fairly the financial statements have been made. The Fund’s Prospectus dated February 11, 2015 should be read in conjunction with these interim financial statements. Interim period results are not necessarily indicative of results for a full-year period.

(b) Use of Estimates

The preparation of the financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and accompanying notes. Actual results could differ from those estimates. There were no significant estimates used in the preparation of the financial statements.

(c) Cash

The cash amount shown in the Statement of Financial Condition dated March 31, 2015 represents non-segregated cash with the custodian.

(d) Cash Held by Broker

Sit is registered as a “commodity trading advisor” and acts as such for the Fund. Sit is a subsidiary of Sit Investment Associates, Inc. The Fund’s arrangement with SG Americas Securities, LLC, the Fund’s FCM, requires the Fund to meet its variation margin requirement related to the price movements, both positive and negative, on futures contracts held by the Fund by keeping cash on deposit with the Commodity Broker. These amounts are shown as Segregated cash held by broker in the Statement of Financial Condition. The Fund deposits cash and United States Treasury Obligations with the FCM subject to Commodity Futures Trading Commission (the “CFTC”) regulations and various exchange and broker requirements. The combination of the Fund’s deposits with its FCM of cash and United States Treasury Obligations and the unrealized gain or loss on open futures contracts (variation margin) represents the Fund’s overall equity in its brokerage trading account. The Fund uses its cash held by the FCM to satisfy variation margin requirements. The Fund earns interest on its cash deposited with the FCM and is recorded on the accrual basis.

(e) Final Net Asset Value for Fiscal Period

The calculation time of the Fund’s final net asset value for creation and redemption of Fund shares for the period ended March 31, 2015 was at 4:00 p.m. Eastern Time.

Although the Fund’s shares may continue to trade on secondary markets subsequent to the calculation of the final NAV, the 4:00 p.m. Eastern Time represented the final opportunity to transact in creation or redemption baskets for the period from February 19, 2015 to March 31, 2015.

| - 10 - |

ETF MANAGERS GROUP COMMODITY TRUST I

Notes to Financial Statements

March 31, 2015 (unaudited) (continued)

Fair value per share is determined at the close of the NYSE Arca.

For financial reporting purposes, the Fund values its investments positions based upon the final closing price in their primary markets. Accordingly, the investment valuations in these financial statements differ from those used in the calculation of the Fund’s final creation/redemption NAV at March 31, 2015.

(f) Investment Valuation

Short-term investments, excluding U.S. Treasury Bills, are carried at amortized cost, which approximates fair value. U.S. Treasury Bills are valued as determined by an independent pricing service based on methods which include consideration of: yields or prices of securities of comparable quality, coupon, maturity and type; indications as to values from dealers; and general market conditions.

Futures contracts are valued at the last settled price on the applicable exchange on which that futures contract trades.

(g) Financial Instruments and Fair Value

The Fund discloses the fair value of its investments in accordance with the Financial Accounting Standards Board (FASB) fair value measurement and disclosure guidance which requires a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The disclosure requirements establish a fair value hierarchy that distinguishes between: (1) market participant assumptions developed based on market data obtained from sources independent to the Fund (observable inputs); and (2) the Fund’s own assumptions about market participant assumptions developed based on the best information available under the circumstances (unobservable inputs). The three levels defined by the disclosure requirements hierarchy are as follows:

Level I: Quoted prices (unadjusted) in active markets for identical assets and liabilities that the reporting entity has the ability to access at the measurement date.

Level II: Inputs other than quoted prices included within Level I that are observable for the asset or liability, either directly or indirectly. Level II inputs include the following: quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the asset or liability, and inputs that are derived principally from or corroborated by observable market data by correlation or other means (market-corroborated inputs).

Level III: Unobservable pricing input at the measurement date for the asset or liability. Unobservable inputs shall be used to measure fair value to the extent that observable inputs are not available.

| - 11 - |

ETF MANAGERS GROUP COMMODITY TRUST I

Notes to Financial Statements

March 31, 2015 (unaudited) (continued)

In some instances, the inputs used to measure fair value might fall in different levels of the fair value hierarchy. The level in the fair value hierarchy within which the fair value measurement in its entirety falls shall be determined based on the lowest input level that is significant to the fair value measurement in its entirety.

Fair value measurements also require additional disclosure when the volume and level of activity for the asset or liability have significantly decreased, as well as when circumstances indicate that a transaction is not orderly.

The following table summarizes the valuation of investments at March 31, 2015 using the fair value hierarchy:

| Short-Term Investments | Written Options Contracts | Future Contracts | Total | |||||||||||||

| Level I – Quoted Prices | $ | 5,688,644 | a | $ | (60,586 | )b | $ | (102,703 | )c | $ | 5,525,355 | |||||

a – Included in Investments in short-term investments in the Statement of Financial Condition.

b – Included in Options Written, at fair value in the Statement of Financial Condition.

c – Included in Payable on open futures contracts in the Statement of Financial Condition.

There were no Level II or Level III type holdings at March 31, 2015 and during the period from February 19, 2015 to March 31, 2015.

The inputs or methodology used for valuing investments are not necessarily an indication of the risk associated with investing in those securities.

(h) Investment Transactions and Related Income

Investment transactions are recorded on the trade date. All such transactions are recorded on the identified cost basis, and marked to market daily. Unrealized gain/loss on open futures contracts is reflected in Receivable/Payable on open futures contracts in the Statement of Financial Condition and the change in the unrealized gain/loss between periods is reflected in the Statement of Operations. Discounts on short-term securities purchased are accreted daily and reflected as Interest Income in the Statement of Operations.

(i) Federal Income Taxes

The Fund is registered as a Delaware statutory trust and is treated as a partnership for U.S. federal income tax purposes. Accordingly, the Fund does not expect to incur U.S. federal income tax liability; rather, each beneficial owner is required to take into account their allocable share of the Fund’s income, gain, loss, deductions and other items for the Fund’s taxable year ending with or within the beneficial owner’s taxable year.

Management of the Fund has reviewed the open tax year and major jurisdictions and concluded that there is no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken in future tax returns. The Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. On an ongoing basis, management will monitor its tax positions taken to determine if adjustments to its conclusions are necessary based on factors including, but not limited to, further implementation of guidance expected from the Financial Accounting Standards Board and on-going analysis of tax law, regulation, and interpretations thereof.

| - 12 - |

ETF MANAGERS GROUP COMMODITY TRUST I

Notes to Financial Statements

March 31, 2015 (unaudited) (continued)

(3) Investments

(a) Short-Term Investments

The Fund may purchase U.S. Treasury Bills, agency securities, and other high-credit quality short-term fixed income or similar securities with original maturities of one year or less. A portion of these investments may be used as margin for the Fund’s trading in futures contracts.

(b) Accounting for Derivative Instruments

In seeking to achieve the Fund’s investment objective, the Sponsor uses a mathematical approach to investing. Using this approach, the Sponsor determines the type, quantity and mix of investment positions that the Sponsor believes in combination should produce returns consistent with the Fund’s objective.

All open derivative positions at March 31, 2015 for the Fund are disclosed in the Schedule of Investments and the notional value of these open positions relative to the shareholders’ capital of the Fund is generally representative of the notional value of open positions to shareholder’s capital throughout the reporting period for the Fund. The volume associated with derivative positions varies on a daily basis as the Fund transacts in derivative contracts in order to achieve the appropriate exposure, as expressed in notional value, in comparison to shareholders’ capital consistent with the Fund’s investment objective.

Following is a description of the derivative instruments used by the Fund during the reporting period, including the primary underlying risk exposures.

(c) Futures Contracts

The Fund enters into futures contracts to gain exposure to changes in the value of the Benchmark Portfolio. A futures contract obligates the seller to deliver (and the purchaser to accept) the future cash settlement of a specified quantity and type of a treasury futures contract at a specified time and place. The contractual obligations of a buyer or seller of a treasury futures contract may generally be satisfied by making an offsetting sale or purchase of an identical futures contract on the same or linked exchange before the designated date of delivery.

Upon entering into a futures contract, the Fund is required to deposit and maintain as collateral at least such initial margin as required by the exchange on which the transaction is affected. The initial margin is segregated as Cash held by broker, as disclosed in the Statement of Financial Condition, and is restricted as to its use. Pursuant to the futures contract, the Fund agrees to receive from or pay to the broker an amount of cash equal to the daily fluctuation in value of the futures contract. Such receipts or payments are known as variation margin and are recorded by the Fund as unrealized gains or losses. The Fund will realize a gain or loss upon closing a futures transaction.

Futures contracts involve, to varying degrees, elements of market risk (specifically treasury price risk) and exposure to loss in excess of the amount of variation margin. The face or contract amounts reflect the extent of the total exposure the Fund has in the particular classes of instruments. Additional risks associated with the use of futures contracts include imperfect correlation between movements in the price of the futures contracts and the market value of the underlying securities and the possibility of an illiquid market for a futures contract. With futures contracts, there is minimal counterparty risk to the Fund since futures contracts are exchange-traded and the exchange’s clearinghouse, as counterparty to all exchange-traded futures contracts, guarantees the futures contracts against default.

| - 13 - |

ETF MANAGERS GROUP COMMODITY TRUST I

Notes to Financial Statements

March 31, 2015 (unaudited) (continued)

Fair Value of Derivative Instruments, As of March 31, 2015

| Asset Derivatives | Liability Derivatives | |||||||||||

| Derivatives | Statement of Financial Condition |

Unrealized Gain |

Statement of Financial Condition |

Unrealized Loss |

||||||||

| Interest Rate Risk | Payable on open futures contracts | $ | (102,703 | )* | ||||||||

| Interest Rate Risk | Written options, at fair value | $ | (53,328 | )** | ||||||||

| * | Represents cumulative depreciation of futures contracts as reported in the Statement of Financial Condition. |

| ** | Represents cumulative depreciation of options contracts as reported in the Statement of Financial Condition. |

The Effect of Derivative Instruments on the Statement of Operations

For the Period February 19, 2015 to March 31, 2015

| Derivatives | Location of Gain(Loss) on Derivatives | Realized Gain (Loss) on Derivatives Recognized in Income |

Change in Unrealized gain (loss) on Derivatives Recognized in Income |

|||||||

| Interest Rate Risk | Net realized gain (loss) on futures and options contracts and/or Change in unrealized gain (loss) on futures and options contracts |

$ | (11,396 | ) | $ | (156,031 | ) | |||

The futures and options contracts open at March 31, 2015 are indicative of the activity for the period from February 19, 2015 to March 31, 2015.

(4) Agreements

(a) Management Fee

The Fund pays the Sponsor an annual management fee, monthly in arrears, in an amount calculated as the greater of 0.15% of its average daily net assets, or $56,250 (the “Management Fee”). The Management Fee is paid in consideration of the Sponsor’s advisory services to the Fund. Additionally, Sit receives an annual fee, monthly in arrears, for its services equal to 0.35% of the Fund’s average daily net assets. As of February 19, 2015, Sit has agreed to waive its license and services fee and the Sponsor has voluntarily agreed to correspondingly assume the remaining expenses of the Fund so that Fund expenses do not exceed an annual rate of 1.50%, excluding brokerage commissions, of the value of the Fund’s average daily net assets (the “Expense Cap”). The assumption of expenses and waiver of the license and services fee are contractual on the part of the Sponsor and Sit, respectively, through February 1, 2016.

The waiver of the license and services fee, pursuant to the undertaking, amounted to $2,214 for the period from February 19, 2015 to March 31, 2015. The Fund currently accrues its daily expenses up to the Expense Cap. At the end of each month, the accrued amount is remitted to the Sponsor as the Sponsor has assumed, and is responsible for the payment of, the routine operational, administrative and other ordinary expenses of the Fund which aggregated $53,753 for the period from February 19, 2015 to March 31, 2015.

| - 14 - |

ETF MANAGERS GROUP COMMODITY TRUST I

Notes to Financial Statements

March 31, 2015 (unaudited) (continued)

(b) The Administrator, Custodian, Fund Accountant and Transfer Agent

The Fund has appointed U.S. Bank, a national banking association, with its principal office in Milwaukee, Wisconsin, as the custodian (the “Custodian”). Its affiliate, U.S. Bancorp Fund Services, is the Fund accountant (“the Fund accountant”) of the Fund transfer agent (the “Transfer Agent”) for Fund shares and administrator for the Fund (the “Administrator”). It performs certain administrative and accounting services for the Fund and prepares certain SEC, NFA and CFTC reports on behalf of the Fund. (U.S. Bank and U.S. Bancorp Fund Services are referred to collectively hereinafter as “U.S. Bank”).

For the first year of services, the Fund has agreed to pay U.S. Bank 0.05% of assets under management (“AUM”), with a $45,000 minimum annual fee payable for its administrative, accounting and transfer agent services and 0.01% of AUM, with an annual minimum of $4,800 for custody services.

(c) The Distributor

Esposito Securities LLC (the “Distributor”) provides statutory and wholesaling distribution services to the Fund. The Fund pays the Distributor an annual fee for such distribution services, which for the first year will equal 0.02% of AUM, with a minimum of $15,000 payable annually. Pursuant to the Distribution Services Agreement between the Sponsor, the Fund and the Distributor, the Distributor assists the Sponsor and the Fund with certain functions and duties relating to distribution and marketing services to the Fund, including reviewing and approving marketing materials and certain regulatory compliance matters. The Distributor also assists with the processing of creation and redemption orders.

The Distributor is paid a minimum annual fee of $15,000 by the Fund of the Fund’s average daily net asset value. For the period from February 19, 2015 to March 31, 2015 the Fund incurred $1,685 in distribution fees which is included in the Statement of Operations.

(d) The Commodity Broker

SG Americas Securities, LLC (the “Commodity Broker”), a Delaware limited liability company, serves as the Fund’s clearing broker. In its capacity as clearing broker, the Commodity Broker executes and clears the Fund’s futures transactions and performs certain administrative services for the Fund.

The Fund pays respective brokerage commissions, including applicable exchange fees, National Futures Association (“NFA”) fees, give–up fees, pit brokerage fees and other transaction related fees and expenses charged in connection with trading activities in CFTC regulated investments. Brokerage commissions on futures contracts are recognized on a half-turn basis.

The Sponsor does not expect brokerage commissions and fees to exceed 0.118% of the net asset value of the Fund during the first year of its operations for execution and clearing services on behalf of the Fund, although the actual amount of brokerage commissions and fees in any year or any part of any year may be greater. The effects of trading spreads, financing costs associated with financial instruments, and costs relating to the purchase of U.S. Treasury Securities or similar high credit quality short-term fixed-income or similar securities are not included in the forgoing analysis. For the period from February 19, 2015 to March 31, 2015, the Fund incurred $1,352 in Brokerage Commissions and fees as disclosed in the Statement of Operations.

| - 15 - |

ETF MANAGERS GROUP COMMODITY TRUST I

Notes to Financial Statements

March 31, 2015 (unaudited) (continued)

(e) The Trustee

Under the Amended and Restated Declaration of Trust and Trust Agreement (the “Trust Agreement”), Wilmington Trust Company, the Trustee of the Fund (the “Trustee”) serves as the sole trustee of the Fund in the State of Delaware. The Trustee will accept service of legal process on the Fund in the State of Delaware and will make certain filings under the Delaware Statutory Trust Act. Under the Trust Agreement, the Sponsor has the exclusive management and control of all aspects of the business of the Fund. The Trustee does not owe any other duties to the Fund, the Sponsor or the Shareholders of the Fund. The Trustee has no duty or liability to supervise or monitor the performance of the Sponsor, nor does the Trustee have any liability for the acts or omissions of the Sponsor. For the period from February 19, 2015 to March 31, 2015, the Fund incurred $324 in trustee fees which is included in Other expenses in the Statement of Operations.

(f) Routine Offering, Operational, Administrative and Other Ordinary Expenses

The Sponsor, in accordance with the Fund’s Expense Cap limitation pays all of the routine offering, operational, administrative and other ordinary expenses of the Fund in excess of 1.50% (excluding brokerage commissions) of the Fund’s average daily net assets, including, but not limited to, accounting and computer services, the fees and expenses of the Trustee, Administrator, Custodian, Transfer Agent and Distributor, legal and accounting fees and expenses, tax return preparation expenses, filing fees, and printing, mailing and duplication costs. For the period from February 19, 2015 to March 31, 2015, the Fund incurred $66,807 routine offering, operational, administrative or other ordinary expenses.

The license and services fee waiver by Sit and the assumption of Fund expenses above the Expense Cap by the Sponsor, pursuant to the undertaking (as discussed in Note 4a), amounted to $2,214 and $53,753, respectively, for the period from February 19, 2015 to March 31, 2015.

(g) Organizational and Offering Costs

Expenses incurred in connection with organizing the Fund and up to the offering of its Shares upon commencement of its investment operations on February 19, 2015, were paid by the Sponsor and Sit without reimbursement. Accordingly, all such expenses are not reflected in the Statement of Operations. The Fund will bear the costs of its continuous offering of Shares and ongoing offering expenses. Such ongoing offering costs will be included as a portion of the Routine Offering, Operational, Administrative and Other Ordinary Expenses. These costs will include registration fees for regulatory agencies and all legal, accounting, printing and other expenses associated therewith. These costs will be accounted for as a deferred charge and thereafter amortized to expense over twelve months on a straight-line basis or a shorter period if warranted.

For the period from February 19, 2015 to March 31, 2015, the Fund did not incur such expenses.

(h) Extraordinary Fees and Expenses

The Fund will pay all extraordinary fees and expenses, if any. Extraordinary fees and expenses are fees and expenses which are nonrecurring and unusual in nature, such as legal claims and liabilities, litigation costs or indemnification or other unanticipated expenses. Such extraordinary fees and expenses, by their nature, are unpredictable in terms of timing and amount. For the period from February 19, 2015 to March 31, 2015, the Fund did not incur such expenses.

| - 16 - |

ETF MANAGERS GROUP COMMODITY TRUST I

Notes to Financial Statements

March 31, 2015 (unaudited) (continued)

(5) Creations and Redemptions

The Fund issues and redeems Shares from time to time, but only in one or more Creation Baskets. A Creation Basket is a block of 50,000 Shares of the Fund. Baskets may be created or redeemed only by Authorized Participants.

Except when aggregated in Creation Baskets, the Shares are not redeemable securities. Retail investors, therefore, generally will not be able to purchase or redeem Shares directly from or with the Fund. Rather, most retail investors will purchase or sell Shares in the secondary market with the assistance of a broker. Thus, some of the information contained in these Notes to Financial Statements – such as references to the Transaction Fee imposed on creations and redemptions – is not relevant to retail investors.

(a) Transaction Fees on Creation and Redemption Transactions

In connection with orders to create and redeem one or more Creation Baskets, an Authorized Participant is required to pay a transaction fee, or AP Transaction Fee, of $500 per order, which goes directly to the Custodian. The AP Transaction Fees are paid by the Authorized Participants and not by the Fund.

(b) Share Transactions

| Summary of Share Transactions for the Period from February 19, 2015 to March 31, 2015 | ||||||||

| Shares | Paid in Capital | |||||||

| Shares Sold | 50,000 | $ | 1,245,665 | |||||

| Shares Redeemed | - | - | ||||||

| Net Increase (Decrease) | 50,000 | $ | 1,245,665 | |||||

(6) Risk

(a) Investment Related Risk

The NAV of the Fund’s shares relates directly to the value of the U.S. treasuries, cash and cash equivalents held by the Fund and the portfolio’s negative effective duration established and maintained through the Fund’s investment in Treasury Instruments. Fluctuations in the prices of these assets could materially adversely affect the value and performance of an investment in the Fund’s shares. Past performance is not necessarily indicative of future results; all or substantially all of an investment in the Fund could be lost.

Investments in debt securities typically decrease in value when interest rates rise, however, the Fund attempts to maintain a portfolio with a negative effective duration and therefore anticipates that an increase in interest rates may increase the Fund’s value, and a decrease in rates may lower the Fund’s value. The NAV of the Fund’s shares relates directly to the value of U.S. Treasuries and Treasury Instruments held by the Fund which are materially impacted by interest rate movements. The magnitude of the impact on value from a change in interest rates is often greater for longer-term fixed income than shorter-term securities. Interest rates have been near historic lows since the market events of 2008 and may remain low.

Interest rate movements are heavily influenced by the action of the Board of Governors of the Federal Reserve System and other central banks. Their actions are based on judgments and policies which involve numerous political and economic factors which are unpredictable. Recent interest rate and monetary policies have been unprecedented and may continue to be so.

| - 17 - |

ETF MANAGERS GROUP COMMODITY TRUST I

Notes to Financial Statements

March 31, 2015 (unaudited) (continued)

The Fund attempts to track a portfolio benchmark. The performance of the Fund may not closely track the performance of the benchmark portfolio for a variety of reasons. For example, the Fund incurs operating expenses and portfolio transaction costs not incurred by the benchmark. The Fund is also required to manage cash flows and may experience operational inefficiencies the benchmark does not. In addition, the Fund may not be fully invested in the contents of its benchmark at all times or may hold securities not included in its benchmark.

The Fund invests in Treasury Instruments and U.S. treasuries with exposure to different maturity dates. Generally, the Fund’s exposure to securities with maturities of 2 and 5 years will be greater than its exposure to securities with maturities of 10 years. Interest rates do not change uniformly for U.S. Treasuries of different maturities and therefore if interest rates rise, the investment performance of the Fund will be impacted by the Fund’s current maturity exposure which may be different from the expectations of the Sponsor and investors in the Fund. At any time, the Fund’s maturity exposure may not be optimal with respect to a movement in interest rates which would negatively impact performance.

(b) Liquidity Risk

In certain circumstances, such as the disruption of the orderly markets for the futures contracts or Financial Instruments in which the Fund invests, the Fund might not be able to dispose of certain holdings quickly or at prices that represent what the market value may have been in an orderly market. Futures and option positions cannot always be liquidated at the desired price. It is difficult to execute a trade at a specific price when there is a relatively small volume of buy and sell orders in a market. A market disruption can also make it difficult to liquidate a position. The large size of the positions that the Fund may acquire increases the risk of illiquidity both by making its positions more difficult to liquidate and by potentially increasing losses while trying to do so. Such a situation may prevent the Fund from limiting losses, realizing gains or achieving a high correlation with the Benchmark Portfolio.

(7) Profit and Loss Allocations and Distributions

Pursuant to the Trust Agreement, income and expenses are allocated pro rata among the Shareholders monthly based on their respective percentage interests as of the close of the last trading day of the preceding month. Any losses allocated to the Sponsor which are in excess of the Sponsor’s capital balance are allocated to the Shareholders in accordance with their respective interest in the Fund as a percentage of total Shareholders’ capital. Distributions (other than redemption of units) may be made at the sole discretion of the Sponsor on a pro rata basis in accordance with the respective interests of the Shareholders.

(8) Indemnifications

The Sponsor, either in its own capacity or in its capacity as the Sponsor and on behalf of the Fund, has entered into various service agreements that contain a variety of representations, or provide indemnification provisions related to certain risks service providers undertake in performing services which are in the best interests of the Fund. As of March 31, 2015, the Fund had not received any claims or incurred any losses pursuant to these agreements and expects the risk of such losses to be remote.

(9) Termination

The term of the Fund is perpetual unless terminated earlier in certain circumstances as described in the Prospectus.

| - 18 - |

ETF MANAGERS GROUP COMMODITY TRUST I

Notes to Financial Statements

March 31, 2015 (unaudited) (continued)

(10) Net Asset Value and Financial Highlights

The Fund is presenting the following net asset value and financial highlights related to investment performance for a Share outstanding throughout the period from February 19, 2015 to March 31, 2015. The net investment income and total expense ratios are calculated using average net assets. The net asset value presentation is calculated by dividing the Fund’s net assets by the average daily number of Shares outstanding. The net investment income (loss) and expense ratios have been annualized. The total return is based on the change in net asset value and market value of the Shares during the period. An individual investor’s return and ratios may vary based on the timing of their transactions in Fund Shares.

For the Period from February

19, 2015 March 31, 2015 | ||||

| Net Asset Value | ||||

| Net asset value per Share, beginning of period | $ | 25.00 | ||

| Net investment income (loss) | (0.05 | ) | ||

| Net realized and unrealized gain (loss) | (0.68 | ) | ||

| Net Income (Loss) | (0.73 | ) | ||

| Net Asset Value per Share, end of period | $ | 24.27 | ||

| Market Value per Share, end of period | $ | 24.32 | (a) | |

| Ratios to Average Net Assets* | ||||

| Expense Ratio*** | 1.71 | % | ||

| Expense Ratio before Waiver / Assumption | 10.56 | % | ||

| Net Investment Income (Loss) | (1.71 | )% | ||

| Total Return, at Net Asset Value** | (2.92 | )% | ||

| Total Return, at Market Value** | (2.72 | )% | ||

| * | Percentages are annualized. |

** Percentages are not annualized. Net Asset Value (NAV) and Market Value returns are calculated from when the Fund began operations and Shares were initially listed and publicly available (February 19, 2015).

*** As of February 19, 2015 Fund expenses have been capped at 1.50% of average daily net assets, plus brokerage commissions, as disclosed in Note 4(a).

(a) Represents the closing bid/ask mean as of March 31, 2015.

(11) New Accounting Pronouncements

In June 2014, the Financial Accounting Standards Board issued ASU No. 2014-11 “Repurchase to Maturity Transactions, Repurchase Financings, and Disclosures.” ASU No. 2014-11 makes limited changes to the accounting for repurchase agreements, clarifies when repurchase agreements and securities lending transactions should be accounted for as secured borrowings, and requires additional disclosures regarding these types of transactions. The guidance is effective for fiscal years beginning on or after December 15, 2014, and for interim periods within those fiscal years. Management is currently evaluating the impact these changes may have on the Fund’s financial statement disclosures.

(12) Subsequent Events

The Fund evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date the financial statements were issued. This evaluation did not result in any subsequent events that necessitated disclosures and/or adjustments.

| - 19 - |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

This information should be read in conjunction with the financial statements and notes included in Item 1 of Part I of this Quarterly Report (the “Report”). The discussion and analysis which follows may contain trend analysis and other forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934 which reflect our current views with respect to future events and financial results. Words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “seek,” “outlook” and “estimate,” as well as similar words and phrases, signify forward-looking statements. ETF Managers Group Commodity Trust I’s forward-looking statements are not guarantees of future results and conditions, and important factors, risks and uncertainties may cause our actual results to differ materially from those expressed in our forward-looking statements.

You should not place undue reliance on any forward-looking statements. Except as expressly required by the Federal securities laws, ETF Managers Capital, LLC undertakes no obligation to publicly update or revise any forward-looking statements or the risks, uncertainties or other factors described in this Report, as a result of new information, future events or changed circumstances or for any other reason after the date of this Report.

Overview

ETF Managers Group Commodity Trust I (the “Trust”) is a Delaware statutory trust formed on July 23, 2014, and it is a series trust consisting of one series: Sit Rising Rate ETF (the “Fund” and any future series will be a “Fund”). The Fund issues common units, called the “Shares,” representing fractional undivided beneficial interests in the Fund. The Trust and the Fund operate pursuant to the Trust’s Amended and Restated Declaration of Trust and Trust Agreement (the “Trust Agreement”).

ETF Managers Capital, LLC (the “Sponsor”) shall have the power and authority to establish and designate one or more series (“Funds”) and to issue shares thereof, from time to time as it deems necessary or desirable. The Sponsor shall have exclusive power to fix and determine the relative rights and preferences as between the shares of any series as to the right of redemption, special and relative rights as to dividends and other distributions and on liquidation, conversion rights, and conditions under which the series shall have separate voting rights or no voting rights. The term for which the Trust is to exist commenced on the date of the filing of the Certificate of Trust, and the Trust and any Fund shall exist in perpetuity, unless earlier terminated in accordance with the provisions of the Trust Agreement. Separate and distinct records shall be maintained for each Fund and the assets associated with a Fund shall be held in such separate and distinct records (directly or indirectly, including a nominee or otherwise) and accounted for in such separate and distinct records separately from the assets of any other Fund. Each Fund shall be separate from all other Funds created as series of the Trust in respect of the assets and liabilities allocated to that Fund and shall represent a separate investment portfolio of the Trust.

The sole Trustee of the Trust is Wilmington Trust, N.A. (the “Trustee”), and the Trustee serves as the Trust’s corporate trustee as required under the Delaware Statutory Trust Act (“DSTA”). The Trustee’s principal offices are located at 1100 North Market Street, Wilmington, Delaware 19890. The Trustee is unaffiliated with the Sponsor. The rights and duties of the Trustee and the Sponsor with respect to the offering of the Shares and Fund management and the shareholders are governed by the provisions of the DSTA and by the Trust Agreement.

On January 29, 2015, the initial Form S-1 for the Fund was declared effective by the U.S. Securities and Exchange Commission (“SEC”). On January 8, 2015, 4 Creation Baskets for the Fund were issued representing 200,000 shares and $5,000,000. The Fund began trading on the New York Stock Exchange (“NYSE”) Arca on February 19, 2015.

The Fund is designed and managed to track the performance of a portfolio (the “Benchmark Portfolio”) consisting of exchange traded futures contracts and options on futures on 2, 5 and 10-year U.S. Treasury securities (“Treasury Instruments”) weighted to achieve a targeted negative 10 year average effective portfolio duration (the “Benchmark Component Instruments”).

| - 20 - |

The Investment Objective of the Fund

The Fund’s investment objective is to profit from rising interest rates by tracking the performance of the Benchmark Portfolio consisting of exchange traded futures contracts and options on futures on 2, 5 and 10-year U.S. Treasury securities weighted to achieve a targeted negative 10 year average effective portfolio duration. The Fund seeks to achieve its investment objective by investing in the Benchmark Component Instruments currently constituting the Benchmark Portfolio.

The Benchmark Portfolio is maintained by Sit Fixed Income Advisors II, LLC (“Sit”) and will be rebalanced, reconstituted, or both, monthly (typically on the 15th of each month and on the next business day if the 15th is a holiday, weekend, or other day on which the national exchanges are closed) to maintain a negative 10 year average effective duration. The Benchmark Portfolio and the Fund will each maintain a short position in Treasury Instruments. The Fund does not use futures contracts or options to obtain leveraged investment results. The Benchmark Component Instruments currently constituting the Benchmark Portfolio as of March 31, 2015 include:

Name | Ticker | Market Value USD | ||||

| US 5YR FUTR OPTN MAY15C | FVK5C1190 | (60,586) | ||||

| US 5YR NOTE (CBT) JUN15 | FVM5 | (3,125,484 | ) | |||

| US 2 YR NOTE (CBT) JUN15 | TUM5 | (13,587,688 | ) | |||

| US 10YR FUT OPTN MAY15P | TYK5P1275 | 4,813 | ||||

The Benchmark Component Instruments currently constituting the Benchmark Portfolio and anticipated rebalancing dates, as well as the daily holdings of the Fund, are available on the Fund’s website at www.risingrateetf.com.

The weighting of the Treasury Instruments constituting the Benchmark Component Instruments will be based on each maturity’s duration contribution. The expected range for the duration weighted percentage of the 2 year and 5 year maturity Treasury Instruments will be from 30% to 70%. The expected range for the duration weighted percentage of the 10 year maturity Treasury Instruments will be from 5% to 25%. The relative weightings of the Benchmark Component Instruments will be shifted between maturities when there are material changes in the shape of the yield curve, for example, if the Federal Reserve began raising short term interest rates more than long term interest rates. In such an instance, Sit, which maintains the Benchmark Portfolio, will increase the weightings of the 2 year and reduce the weighting in the 10 year maturity Treasury Instruments. Conversely, Sit will do the opposite if the Federal Reserve began raising long term interest rates more than short term interest rates. Reconstitution and rebalancing each will occur monthly, on the 15th, except for as noted above or if there are radical changes in the yield curve such that effective duration is outside of a range from negative nine to negative 11-year average effective duration, in which case Sit will adjust the maturities of the Treasury Instruments before the next expected monthly reconstitution.

The Sponsor anticipates that approximately 5% to 15% of the Fund’s assets will be used as payment for or collateral for Treasury Instruments. In order to collateralize its Treasury Instrument positions the Fund will hold such assets, from which it will post margin to its FCM, in an amount equal to the margin required by the relevant exchange, and transfer to its FCM any additional amounts that may be separately required by the FCM. When establishing positions in Treasury Instruments, the Fund will be required to deposit initial margin with a value of approximately 3% to 10% of the value of each Treasury Instrument position at the time it is established. These margin requirements are subject to change from time to time by the exchange or the FCM. On a daily basis, the Fund will be obligated to pay, or entitled to receive, variation margin in an amount equal to the change in the daily settlement level of its Treasury Instruments positions. Any assets not required to be posted as margin with the FCM will be held at the Fund’s administrator in cash or cash equivalents as discussed below.

| - 21 - |

The Benchmark Portfolio will be invested in Benchmark Component Instruments and rebalanced, as noted above, to maintain a negative average effective portfolio duration of approximately 10 years. Duration is a measure of estimated price sensitivity relative to changes in interest rates. Portfolios with longer durations are typically more sensitive to changes in interest rates. For example, if interest rates rise by 1%, the market value of a security with an effective duration of 5 years would decrease by 5%, with all other factors being constant, and likewise the market value of a security with an effective duration of negative 5 years would increase by 5%, with all other factors being constant. Duration estimates are based on assumptions by Sit and are subject to a number of limitations. Duration is a more accurate estimate of price sensitivity provided interest rate changes are small and occur equally in short-term and long-term securities. Investments in debt securities typically decrease in value when interest rates rise. The risk is usually greater for longer-term debt securities.

The Fund will incur certain expenses in connection with its operations. The Fund will hold cash or cash equivalents such as U.S. Treasuries or other high credit quality, short-term fixed-income or similar securities for direct investment or as collateral for the Treasury Instruments and for other liquidity purposes and to meet redemptions that may be necessary on an ongoing basis. These expenses and income from the cash and cash equivalent holdings may cause imperfect correlation between changes in the Fund’s NAV and changes in the Benchmark Portfolio, because the Benchmark Portfolio does not reflect expenses or income.

The Sponsor

ETF Managers Capital, LLC is the sponsor of the Trust and the Fund. The Sponsor is a Delaware limited liability company, formed on June 12, 2014. The principal office is located at 35 Beechwood Road, Suite 2B, Summit, NJ 07901. The Sponsor is registered as a commodity pool operator (“CPO”) with the Commodity Futures Trading Commission (“CFTC”) and became a member of the National Futures Association (“NFA”) on September 23, 2014. The Trust and the Fund operates pursuant to the Trust Agreement.

The Sponsor is a wholly-owned subsidiary of Exchange Traded Managers Group LLC (“ETFMG”), a limited liability company domiciled and headquartered in New Jersey. The Sponsor maintains its main business office at 35 Beechwood Road, Suite 2B, Summit, NJ 07901.

Under the Trust Agreement, the Sponsor has exclusive management and control of all aspects of the Trust’s business. The Trustee has no duty or liability to supervise the performance of the Sponsor, nor will the Trustee have any liability for the acts or omissions of the Sponsor. The shareholders have no voice in the day to day management of the business and operations of the Fund and the Trust, other than certain limited voting rights as set forth in the Trust Agreement. In the course of its management of the business and affairs of the Fund and the Trust, the Sponsor may, in its sole and absolute discretion, appoint an affiliate or affiliates of the Sponsor as additional sponsors and retain such persons, including affiliates of the Sponsor, as it deems necessary to effectuate and carry out the purposes, business and objectives of the Trust.

Results of Operations

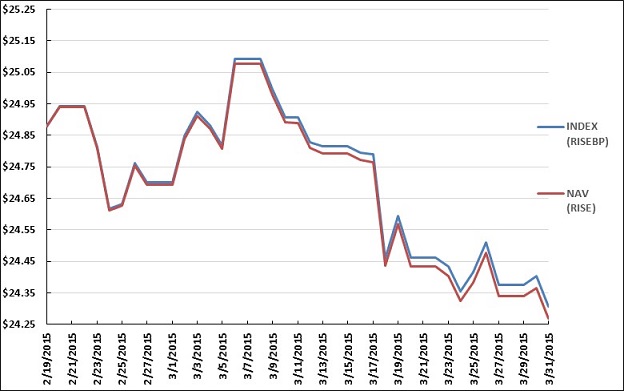

COMPARISON OF PER SHARE RISE NAV TO RISE MARKET VALUE

FOR THE PERIOD FROM FEBRUARY 19, 2015 TO MARCH 31, 2015

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE OR NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

The per Share market value of RISE and its NAV tracked closely for the period from February 19, 2015 to March 31, 2015.

| -22- |

COMPARISON OF PER SHARE RISE NAV TO BENCHMARK PORTFOLIO

FOR THE PERIOD FROM FEBRUARY 19, 2015 TO MARCH 31, 2015

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR BENCHMARK PORTFOLIO LEVELS AND CHANGES, POSITIVE OR NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

The graph above compares the return of RISE with the benchmark portfolio returns for the period from February 19, 2015 to March 31, 2015. The difference in the NAV price and the benchmark value often results in the appearance of a NAV discount to the benchmark. The difference is related to the cumulative impact on NAV of the Fund’s expenses.

FOR THE PERIOD FROM FEBRUARY 19, 2015 TO MARCH 31, 2015

Fund Share Price Performance

During the period from February 19, 2015 (commencement of Shares trading on the NYSE Arca) to March 31, 2015, the NYSE Arca market value of each Share decreased (-2.56%) from $24.96 per Share, representing the initial trade on February 20, 2015, to $24.32 per Share, representing the closing price on March 31, 2015. The Share price high and low for the period from February 20, 2015 to March 31, 2015 and related change from the initial Share price on February 20, 2015 was as follows: Shares traded from a high of $25.17 per Share (+0.84%) on March 6, 2015 to a low of $24.50 per Share (-1.84%) on March 20, 2015.

Fund Share Net Asset Performance

For the period from February 19, 2015 (commencement of investment operations) to March 31, 2015, the net asset value of each Share decreased (-2.92%) from $25.00 per Share to $24.27 per Share. For the period from February 19, 2015 to March 31, 2015 losses in the futures and options contracts and fund expenses resulted in the overall decrease in the NAV per Share during the period from February 19, 2015 to March 31, 2015.

Net loss for the period from February 19, 2015 to March 31, 2015, was $178,267, resulting from net realized losses on futures and options contracts of $11,396, net unrealized losses on futures and options contracts of $156,031, and the net operating loss of $10,840.

Calculating NAV

The Fund’s NAV is calculated by:

| · | Taking the current market value of its total assets; | |

| · | Subtracting any liabilities; and | |

| · | Dividing that total by the total number of outstanding shares. |

| - 23 - |

The Administrator calculates the NAV of the Fund once each NYSE Arca trading day. The NAV for a particular trading day is released after 4:00 p.m. New York time. Trading during the core trading session on the NYSE Arca typically closes at 4:00 p.m. New York time. The Administrator uses the CME closing price (determined at the earlier of the close of the CME) for the contracts traded on the CME, but calculates or determines the value of all other Fund investments using market quotations, if available, or other information customarily used to determine the fair value of such investments as of the earlier of the close of the NYSE Arca or 4:00 p.m. New York time, in accordance with the current Administrative Agency Agreement among U.S. Bancorp Fund Services, the Fund and the Sponsor. “Other information” customarily used in determining fair value includes information consisting of market data in the relevant market supplied by one or more third parties including, without limitation, relevant rates, prices, yields, yield curves, volatilities, spreads, correlations or other market data in the relevant market; or information of the types described above from internal sources if that information is of the same type used by the Fund in the regular course of its business for the valuation of similar transactions. The information may include costs of funding, to the extent costs of funding are not and would not be a component of the other information being utilized. Third parties supplying quotations or market data may include, without limitation, dealers in the relevant markets, end-users of the relevant product, information vendors, brokers and other sources of market information.

In addition, in order to provide updated information relating to the Fund for use by investors and market professionals, the NYSE Arca calculates and disseminates throughout the core trading session on each trading day an updated indicative fund value. The indicative fund value is calculated by using the prior day’s closing NAV per share of the Fund as a base and updating that value throughout the trading day to reflect changes in the most recently reported trade price for the futures and options held by the Fund traded on the CME. The indicative fund value share basis disseminated during NYSE Arca core trading session hours should not be viewed as an actual real time update of the NAV, because the NAV is calculated only once at the end of each trading day based upon the relevant end of day values of the Fund’s investments.

The indicative fund value is disseminated on a per share basis every 15 seconds during regular NYSE Arca core trading session hours of 9:30 a.m. New York time to 4:00 p.m. New York time. The normal trading hours of the CME are 10:00 a.m. New York time to 2:30 p.m. New York time. This means that there is a gap in time at the beginning and the end of each day during which the Fund’s shares are traded on the NYSE Arca, but real-time CME trading prices for contracts traded on the CME are not available. During such gaps in time the indicative fund value will be calculated based on the end of day price of such contracts from the CME’s immediately preceding trading session. In addition, other investments and U.S. Treasuries held by the Fund will be valued by the Administrator, using rates and points received from client-approved third party vendors (such as Reuters and WM Company) and advisor quotes. These investments will not be included in the indicative fund value.

The NYSE Arca disseminates the indicative fund value through the facilities of CTA/CQ High Speed Lines. In addition, the indicative fund value is published on the NYSE Arca’s website and is available through on-line information services such as Bloomberg and Reuters.

Dissemination of the indicative fund value provides additional information that is not otherwise available to the public and is useful to investors and market professionals in connection with the trading of the Fund shares on the NYSE Arca. Investors and market professionals are able throughout the trading day to compare the market price of the Fund and the indicative fund value. If the market price of the Fund shares diverges significantly from the indicative fund value, market professionals will have an incentive to execute arbitrage trades. For example, if the Fund appears to be trading at a discount compared to the indicative fund value, a market professional could buy the Fund shares on the NYSE Arca and take the opposite position in Treasury Instruments. Such arbitrage trades can tighten the tracking between the market price of the Fund and the indicative fund value and thus can be beneficial to all market participants.

Critical Accounting Policies

The Fund’s critical accounting policies are as follows:

Preparation of the financial statements and related disclosures in accordance with U.S. generally accepted accounting principles requires the application of appropriate accounting rules and guidance, as well as the use of estimates. The Fund’s application of these policies involves judgments and the use of estimates. Actual results may differ from the estimates used and such differences could be material. The Fund holds a significant portion of its assets in futures contracts and a money market fund, which are held at fair value.

The Fund calculates its net asset value as of the NAV Calculation Time as described above.

| - 24 - |

The values which are used by the Fund for its Treasury Instruments are provided by its commodity broker who uses market prices when available. In addition, the Fund estimates interest income on a daily basis using prevailing rates earned on its cash and cash equivalents. These estimates are adjusted to the actual amount received on a monthly basis and the difference, if any, is not considered material.

Credit Risk

When the Fund enters into Benchmark Component Instruments, it will be exposed to the credit risk that the counterparty will not be able to meet its obligations. For purposes of credit risk, the counterparty for the Benchmark Component Instruments traded on the CME and other futures exchanges is the clearinghouse associated with those exchanges. In general, clearinghouses are backed by their members who may be required to share in the financial burden resulting from the nonperformance of one of their members, which should significantly reduce credit risk. There can be no assurance that any counterparty, clearinghouse, or their financial backers will satisfy their obligations to the Fund.

The Sponsor will attempt to minimize certain of these market and credit risks by normally:

| · | executing and clearing trades with creditworthy counterparties, as determined by the Sponsor; |

| · | limiting the outstanding amounts due from counterparties of the Fund; |

| · | not posting margin directly with a counterparty; |

| · | limiting the amount of margin or premium posted at the FCM; and |

| · | ensuring that deliverable contracts are not held to such a date when delivery of an underlying asset could be called for. |

The Commodity Exchange Act (“CEA”) requires all FCMs, such as the Fund’s clearing broker, to meet and maintain specified fitness and financial requirements, to segregate customer funds from proprietary funds and account separately for all customers’ funds and positions, and to maintain specified books and records open to inspection by the staff of the CFTC. The CFTC has similar authority over introducing brokers, or persons who solicit or accept orders for commodity interest trades but who do not accept margin deposits for the execution of trades. The CEA authorizes the CFTC to regulate trading by FCMs and by their officers and directors, permits the CFTC to require action by exchanges in the event of market emergencies, and establishes an administrative procedure under which customers may institute complaints for damages arising from alleged violations of the CEA. The CEA also gives the states powers to enforce its provisions and the regulations of the CFTC.

On November 14, 2013, the CFTC published final regulations that require enhanced customer protections, risk management programs, internal monitoring and controls, capital and liquidity standards, customer disclosures and auditing and examination programs for FCMs. The rules are intended to afford greater assurances to market participants that customer segregated funds and secured amounts are protected, customers are provided with appropriate notice of the risks of futures trading and of the FCMs with which they may choose to do business, FCMs are monitoring and managing risks in a robust manner, the capital and liquidity of FCMs are strengthened to safeguard the continued operations and the auditing and examination programs of the CFTC and the self-regulatory organizations are monitoring the activities of FCMs in a thorough manner.

Liquidity and Capital Resources

The Fund does not anticipate making use of borrowings or other lines of credit to meet its obligations. The Fund meets its liquidity needs in the normal course of business from the proceeds of the sale of its investments or from the cash, cash equivalents and/or the collateralizing Treasury Securities that it holds. The Fund’s liquidity needs include: redeeming its shares, providing margin deposits for existing Benchmark Component Instruments, the purchase of additional Benchmark Component Instruments, and paying expenses.