Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - LAKE AREA CORN PROCESSORS LLC | Financial_Report.xls |

| EX-31.1 - CERTIFICATION - LAKE AREA CORN PROCESSORS LLC | exhibit311-certification33.htm |

| EX-32.1 - CERTIFICATION - LAKE AREA CORN PROCESSORS LLC | exhibit321-certification33.htm |

| EX-32.2 - CERTIFICATION - LAKE AREA CORN PROCESSORS LLC | exhibit322-certification33.htm |

| EX-31.2 - CERTIFICATION - LAKE AREA CORN PROCESSORS LLC | exhibit312-certification33.htm |

| 10-Q - 10-Q LACP FQE 3.31.15 - LAKE AREA CORN PROCESSORS LLC | a10-qfqe33115.htm |

Form 6342 (4-2013)

Farm Credit Services of America

THIRD AMENDMENT TO CREDIT AGREEMENT

This Third Amendment to Credit Agreement (“Amendment”) is made and entered into effective the 4th day of May, 2015, by and between Farm Credit Services of America, PCA and Farm Credit Services of America, FLCA (collectively “Lender”) and Dakota Ethanol, L.L.C., a South Dakota limited liability company (“Borrower”) to amend and modify the Credit Agreement dated May 15, 2013, as amended (hereinafter referred to as the “Credit Agreement”). The Credit Agreement and underlying Loan Documents are modified only to the extent necessary to give effect to the terms of this Amendment, and the remaining terms of said Loan Documents, not otherwise inconsistent herewith, are ratified by the parties. Capitalized terms used but not otherwise defined herein have the respective meanings given to them in the Credit Agreement.

In consideration of the mutual agreements, provisions and covenants herein contained, and furthermore to induce Lender to consider financial accommodations for the Borrower under the terms and provisions of the Credit Agreement, the parties hereby agree as follows:

1. The following sections are hereby revised and amended, to read:

Section 6.10.1 Working Capital. Borrower agrees to maintain minimum Working Capital of not less than $6,000,000.00 measured monthly. “Working Capital” shall mean Current Assets minus Current Liabilities. In the event that Loan Facility D is not fully advanced, the un-advanced long term portion of this commitment will be included in the calculation of Working Capital. Additionally, current liabilities will include any outstanding balance on Loan Facility A.

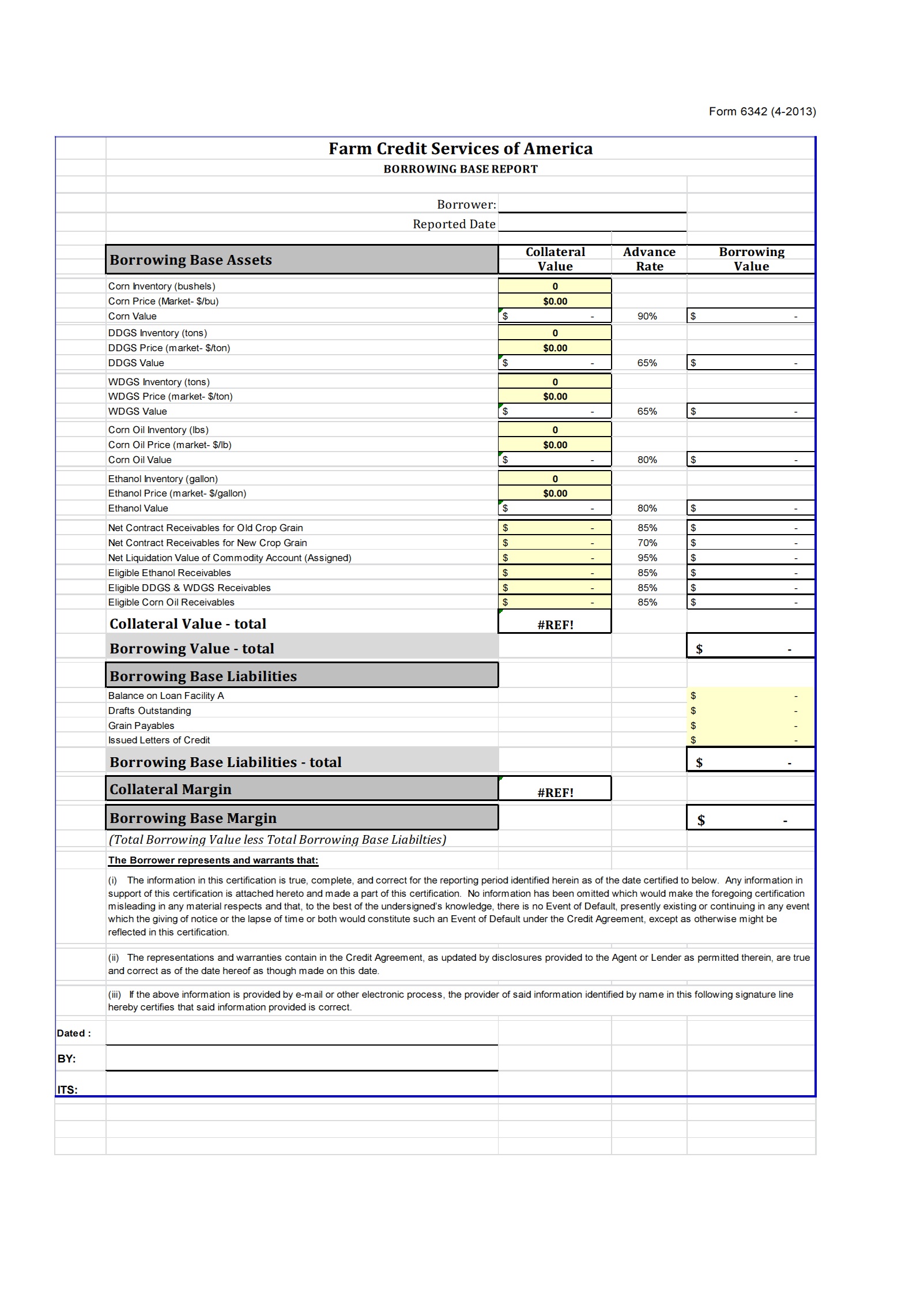

Section 6.12 Borrowing Base. Borrower agrees to maintain a minimum margin between the value and advance rate of certain secured assets identified as Borrowing Base Assets and the amount of certain liabilities identified as Borrowing Base Liabilities (Borrowing Base) included in and computed according to a Borrowing Base Report acceptable to Lender, an example of which is attached hereto as Exhibit ‘C’. Lender shall have the right, in its sole discretion, to adjust any values set forth in the Borrowing Base Report and such adjusted values will be the values for the determination of the Borrowing Base Margin. No item shall be included in the Borrowing Base Report if such item is subject to any Lien, claim or security interest (other than that granted to Lender.)

Borrower agrees to provide Lender with such Borrowing Base Report monthly (Reporting Period), or more often at the discretion of Lender, during the term of the Loan(s) commencing on May 31, 2015. Nothwithstanding the foregoing, Borrower will not be required to provide Lender a Borrowing Base Report for any December Reporting Period if there is no outstanding balance on Loan Facility A on the Report Date of that December Reporting Period. Said Borrowing Base Report shall be dated the last day of the Reporting Period (Report Date) and reflect true and accurate inventory of Borrowing Base Assets and Borrowing Base Liabilities current through the end of the Reporting Period. Said Borrowing Base Report shall be completed by Borrower and provided to Lender no later than the 30th day following the Report Date, by ordinary mail or electronic transmission.

Borrowing Base Assets shall mean the total of those assets listed as Borrowing Base Assets in the Borrowing Base Report.

Borrowing Base Liabilities shall mean the total of those liabilities listed as Borrowing Base Liabilities in the Borrowing Base Report.

Borrower agrees to maintain a minimum Borrowing Base margin calculated by deducting the Borrowing Base Liabilities from the Borrowing Base Assets in an amount equal to or greater than $0 (Minimum Borrowing Base Margin).

Upon receipt of the Borrowing Base Report, Lender will determine Borrower's credit availability based on the value of the inventory and assets owned by Borrower on each Report Date and whether Borrower is in compliance with their Borrowing Base. Should the total Borrowing Base Liabilities exceed the Borrowing value of total Borrowing Base Assets, Borrower agrees to restore compliance with the Borrowing Base margin within 30 days from the Report Date and that during said restoration period Lender may advance credit to Borrower as Lender may deem reasonable to protect its collateral. It is agreed that if Borrower cannot, or will not, reduce the total Borrowing Base Liabilities to an amount equal to or less than the borrowing value of the total Borrowing Base Assets within said restoration period, Lender may deem said failure to be a material breach of this Agreement and an Event of Default.

Section 7.8 Indebtedness. Borrower will not create, incur, assume, guaranty, permit or suffer to exist any Indebtedness or otherwise become liable with respect to the obligations or liabilities of any person or entity, except (i) Permitted Indebtedness, as listed on Schedule 7.8; (ii) Indebtedness of Borrower arising under this Agreement; (iii) Indebtedness existing prior to the date of this Agreement that has been disclosed in writing to Lender; (iv) Subordinated Debt, as herein defined; (v) trade payables of Borrower incurred in the ordinary course of business; (vi) term indebtedness to other creditors not to exceed $1,000,000.00 in the aggregate, that is either secured by a lien subordinated to Lender or a lien position acceptable to Lender; and (vii) operating and capital leases with annual payments not exceeding $500,000.00 in the aggregate, with additional allowance for any rail car lease commitments.

2. | Exhibit ‘C’ (Borrowing Base Report) is hereby replaced by the new Exhibit ‘C’ hereto attached. |

Borrower hereby represents and warrants to the Lender that, after giving effect to this Amendment, (i) no Default or Event of Default exists under the Credit Agreement or any of the other Loan Documents and (ii) the representations and warranties set forth in the Credit Agreement are true and correct in all material respects as of the date hereof (except for those which expressly relate to an earlier date).

Borrower hereby ratifies the Credit Agreement as amended and acknowledges and reaffirms (i) that it is bound by all terms of the Credit Agreement applicable to it and (ii) that it is responsible for the observance and full performance of its respective obligations.

Borrower hereby certifies that the person(s) executing this Amendment on behalf of Borrower is/are duly authorized to execute such document on behalf of Borrower and that there have been no changes in the name, ownership, control, organizational documents, or legal status of the Borrower since the last application, loan, or loan servicing action; that all resolutions, powers and authorities remain in full force and effect, and that the information provided by Borrower is and remains true and correct.

This Amendment may be executed by the parties hereto in several counterparts, each of which shall be deemed to be an original and all of which shall constitute one and the same agreement. Delivery of executed counterparts of this Amendment by telecopy shall be effective as an original and shall constitute a representation that an original shall be delivered.

THIS AMENDMENT SHALL BE DEEMED TO BE A CONTRACT MADE UNDER AND GOVERNED BY THE INTERNAL LAWS OF THE STATE OF NEBRASKA. A CREDIT AGREEMENT MUST BE IN WRITING TO BE ENFORCEABLE UNDER NEBRASKA LAW. TO PROTECT YOU AND US FROM ANY MISUNDERSTANDINGS OR DISAPPOINTMENTS, ANY CONTRACT, PROMISE, UNDERTAKING OR OFFER TO FOREBEAR REPAYMENT OF MONEY OR TO MAKE ANY OTHER FINANCIAL ACCOMMODATION IN CONNECTION WITH THIS AMENDMENT MUST BE IN WRITING TO BE EFFECTIVE.

This Amendment shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns.

[Signature page and Exhibit follow]

IN WITNESS WHEREOF, the parties hereto have set their hand effective the day and year first above written.

BORROWER:

Dakota Ethanol, L.L.C.,

a South Dakota limited liability company

By: /s/ Scott Mundt

Scott Mundt, Chief Executive Officer

Address for Notice: P.O. Box 100, Wentworth, South Dakota 57075

LENDER:

Farm Credit Services of America, PCA

Farm Credit Services of America, FLCA

By: /s/ Kathryn J. Jrahm

Kathryn J. Frahm, Vice President

Address for Notice: P.O. Box 2409, Omaha, Nebraska 68103-9935