Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AMERIANA BANCORP | d925826d8k.htm |

1

AMERIANA BANCORP

ANNUAL MEETING

THURSDAY, MAY 14,

|

CEO PRESENTATION

: ASBI

Exhibit 99.1

2015 |

2

FORWARD-LOOKING STATEMENT

This presentation contains forward-looking statements, which

include statements about Ameriana’s future financial performance,

business plans and strategies. They often include words like

“believe,”

“expect,”

“anticipate,”

“estimate,”

and “intend”

or future or

conditional verbs such as “will,”

“would,”

“should,”

“could”

or “may.”

Forward-looking statements involve future risks and uncertainties

because of factors that could cause actual results to differ

materially from those expressed or implied. Specific risk factors

and other uncertainties that could affect the accuracy of forward-

looking statements are included in Ameriana’s Form 10-K for the

year ended December 31, 2014. Ameriana does not undertake any

obligation to update forward-looking statements made in this

document. |

3

AMERIANA BANCORP

ANNUAL FINANCIAL PERFORMANCE

(IN THOUSANDS)

Year Ended

December 31,

Interest Income

Interest Expense

Net Interest Income

Provision for Loan Losses

Non-Interest Income

Non-Interest Expense

Income before Income Taxes

Income Tax Expense

Net Income

2014

2013

$18,146

$ 16,980

2,997

3,003

15,149

13,977

322

5,617

17,211

3,233

867

755

5,801

16,095

2,928

741

$ 2,187

$ 2,366 |

4

AMERIANA BANCORP

QUARTERLY FINANCIAL PERFORMANCE

(IN THOUSANDS)

Three Months

Ended March 31,

2015

2014

$ 4,169

$ 4,474

646

758

3,523

3,716

105

150

1,559

1,364

4,318

3,917

659

1,013

157

284

$ 502

$ 729

Interest Income

Interest Expense

Net Interest Income

Provision for Loan Losses

Non-Interest Income

Non-Interest Expense

Income before Income Taxes

Income Tax Expense

Net Income |

5

AMERIANA BANK CAPITAL

(AS OF 3/31/15)

Bank

Peer*

Tier 1 Leverage Capital

9.40%

10.18%

Common Equity Tier 1 Capital

13.67

14.47

Tier 1 RBC/Risk Wtd. Assets

13.67

14.54

Total RBC/Risk Wtd. Assets

14.90

15.66

Source: FDIC UBPR 3/31/2015

*Peer group defined by FDIC for Ameriana is “Peer Group 3”

–

insured

commercial banks having assets between $300 million and $1 billion

|

6

AMERIANA BANK

KEY METRICS

(AS OF 3/31/15)

Bank

Peer*

Non-accrual Loans/Total Loans

1.41%

0.94%

NCL+ OREO/Lns. + OREO

3.37

1.64

Net Loss/Avg. Loans (1

st

Qtr Annualized)

0.03

0.07

ALLL/Total Loans

1.23

1.44

Current Rest. Loans/Total Loans

1.85

0.55

Source: FDIC UBPR 3/31/2015

*Peer

group

defined

by

FDIC

for

Ameriana

is

“Peer

Group

3”

–

insured

commercial

banks having assets between $300 million and $1 billion |

7

AMERIANA BANCORP

FINANCIAL PERFORMANCE

(FIRST QUARTER 2015)

Positive Factors:

•

•

•

Net income of $502,000, or $0.17 per diluted share for the

first quarter of 2015

Declared a quarterly dividend of $0.04 per share, which

represented a $0.02 per share increase

Continued growth in tangible book value per share to $13.35

|

8

AMERIANA BANK

FINANCIAL PERFORMANCE

(FIRST QUARTER 2015)

Positive Factors:

•

•

•

o

•

Source: FDIC UBPR 3/31/2015

Total loans increased $3.7 million and strong pipeline at the end

of the first quarter

Total

deposits

increased

$11.6

million

–

growing

momentum

in

new Indianapolis metropolitan market banking centers

Assets per employee is improving ($ per million)

$3.34 compared to $3.33 in the same quarter in 2014,

($3.28 at 12/31/2014 and $3.23 at 12/31/2013)

Non-Interest income as a percent of Average Assets was higher

than

peer

at

1.31%

compared

to

peer

at

0.74%

for

1

st

Qtr.

2015.

*Peer

group

defined

by

FDIC

for

Ameriana

is

“Peer

Group

3”

–

insured

commercial

banks

having

assets

between

$300

million and $1 billion |

9

AMERIANA BANK

FINANCIAL PERFORMANCE

(FIRST QUARTER 2015)

Negative Factors:

•

•

•

•

•

Source: FDIC UBPR 3/31/2015

*Peer

group

defined

by

FDIC

for

Ameriana

is

“Peer

Group

3”

–

insured

commercial

banks

having

assets between $300 million and $1 billion

Funding costs are somewhat higher than peer

Assets per employee remains lower than peer (i.e. excess

capacity)

DDAs, although increasing, remain below high-performing peer

banks

Other non-personnel expenses are higher than peer

Personnel and occupancy expense, due to number of new

offices, is higher than peer |

10

AMERIANA BANK

FINANCIAL PERFORMANCE

(FIRST QUARTER 2015)

Profitability: (% of Avg. Assets)

Bank

Peer*

Interest Expense

Other Operating Expense

Occupancy Expense

Personnel Expense

Total Overhead Expense

Efficiency Ratio

Assets Per Employee ($ in millions)

Average Personnel Expense

Source: FDIC UBPR 3/31/2015

*Peer

group

defined

by

FDIC

for

Ameriana

is

“Peer

Group

3”

–

insured

commercial

banks

having

assets

between

$300 million and $1 billion

0.51%

0.40%

1.02

0.87

0.56

0.35

1.88

1.60

3.46

2.83

79.76

66.70

$3.34

$4.92

61.94

74.75

Per Employee

($ in thousands) |

11

AMERIANA BANK

FINANCIAL PERFORMANCE

(FIRST QUARTER 2015)

Profitability: (%)

Bank

Peer

Avg. Earning Assets/Avg. Assets

87.98%

93.93%

Avg. Int. Bearing Fds/Avg. Assets

82.57

75.59

Int. Income/Avg. Earning Assets

4.01

4.13

NII/Average Earning Assets

3.44

3.70

Net Loans/Avg. Assets

66.76

65.07

Source: FDIC UBPR 3/31/2015

*Peer

group

defined

by

FDIC

for

Ameriana

is

“Peer

Group

3”

–

insured

commercial

banks

having assets between $300 million and $1 billion |

12

AMERIANA BANK

FINANCIAL PERFORMANCE

(FIRST QUARTER 2015)

Profitability: (%)

Bank

Peer

AFS Securities/Avg. Assets

10.18%

18.79%

DDA/Avg. Assets

6.62

12.05

Core Deposits/Avg. Assets

79.92

77.08

FHLB/Avg. Assets

5.58

2.60

Source: FDIC UBPR 3/31/2015

*Peer

group

defined

by

FDIC

for

Ameriana

is

“Peer

Group

3”

–

insured

commercial

banks

having

assets

between $300 million and $1 billion |

13

TOTAL LOANS

(DOLLARS IN THOUSANDS)

$326,573

$317,595

$317,087

$318,287

$316,960

$321,025

$324,723

12/31/2009

12/31/2010

12/31/2011

12/31/2012

12/31/2013

12/31/2014

3/31/2015 |

14

TOTAL DEPOSITS

(DOLLARS IN THOUSANDS)

$338,381

$337,978

$337,250

$356,703

$362,701

$378,947

$390,577

12/31/2009

12/31/2010

12/31/2011

12/31/2012

12/31/2013

12/31/2014

3/31/2015 |

15

NET INTEREST INCOME

(DOLLARS IN THOUSANDS)

$12,689

$13,411

$13,924

$14,187

$13,977

$15,149

$3,523

2009

2010

2011

2012

2013

2014

1Q2015 |

16

NET INTEREST MARGIN

(ON A FULLY TAX-EQUIVALENT BASIS)

3.08%

3.63%

3.73%

3.71%

3.63%

3.68%

3.45%

2009

2010

2011

2012

2013

2014

1Q2015 |

17

NON-PERFORMING LOANS

(DOLLARS IN THOUSANDS)

$9,053

$11,247

$8,828

$7,604

$5,067

$4,391

$4,571

12/31/2009

12/31/2010

12/31/2011

12/31/2012

12/31/2013

12/31/2014

3/31/2015 |

18

NON-ACCRUAL LOANS

(AS OF 3/31/2015)

($ in thousands)

Single-family residences –

Countrywide

originations (8 loans)

$ 1,762

Land for commercial development

836

Commercial real estate

812

Commercial

495

3,905

Single-family residences (13 loans)

607

HELOCs (6

loans)

58

$ 4,570

Sub-total

Total |

19

NON-PERFORMING LOANS/TOTAL LOANS

2.78%

3.54%

2.79%

2.39%

1.60%

1.37%

1.41%

12/31/2009

12/31/2010

12/30/2011

12/31/2012

12/31/2013

12/31/2014

3/31/2015 |

20

OREO

(DOLLARS IN THOUSANDS)

$3,881

$9,067

$9,067

$6,326

$5,172

$6,639

$6,606

12/31/2009

12/31/2010

12/31/2011

12/31/2012

12/31/2013

12/31/2014

3/31/2015 |

OTHER REAL ESTATE OWNED

(AS OF 3/31/2015)

($ in thousands)

Retail strip center (partially occupied) and one outlot

$

1,985

Residential condominium development

1,536

Single

family

residence

–

rented

781

Developed commercial land

820

Undeveloped land and developed residential building lots

721

Commercial real estate

251

Undeveloped land

214

Developed commercial lot

113

Sub-total

6,421

Three single-family residences (unrelated)

185

Total

21

$ 6,606 |

22

OREO/TOTAL LOANS

1.19%

2.85%

2.38%

1.99%

1.63%

2.07%

2.03%

12/31/2009

12/31/2010

12/31/2011

12/31/2012

12/31/2013

12/31/2014

3/31/2015 |

23

NET CHARGE-OFFS

(DOLLARS IN THOUSANDS)

$1,166

$1,726

$1,465

$1,038

$1,001

$412

$24

2009

2010

2011

2012

2013

2014

1Q2015 |

24

NET CHARGE-OFFS/AVG. LOANS

0.35%

0.54%

0.47%

0.33%

0.31%

0.13%

0.01%

2009

2010

2011

2012

2013

2014

1Q2015 |

ALLOWANCE FOR LOAN LOSSES

(DOLLARS IN THOUSANDS)

$4,005

$4,212

$4,212

$4,239

$3,993

$3,903

$3,984

12/31/2009

12/31/2010

12/31/2011

12/31/2012

12/31/2013

12/31/2014

3/31/2015

25 |

ALLOWANCE FOR LOAN LOSSES/TOTAL LOANS

1.23%

1.33%

1.30%

1.30%

1.26%

1.22%

1.23%

12/31/2009

12/31/2010

12/31/2011

12/31/2012

12/31/2013

12/31/2014

3/31/2015

26 |

TROUBLED DEBT RESTRUCTURINGS (TDRS)

(DOLLARS IN THOUSANDS)

$268

$8,393

$9,016

$12,171

$11,558

$7,455

$7,395

12/31/2009

12/31/2010

12/31/2011

12/31/2012

12/31/2013

12/31/2014

3/31/2015

27 |

28

TROUBLED DEBT RESTRUCTURINGS

(TDRS -

AS OF 3/31/2015)

($ in thousands)

Hotel

loan

$

3,676 Substandard

Developed commercial

land

915

Pass

Commercial (3

loans)

186

Non-accrual

Subtotal

4,777

Single-family residence –

Countrywide

origination 240

Pass

Single-family residence –

Countrywide

origination 206

Substandard

Single-family residence –

Countrywide origination (4 loans) 986

Non-accrual

Single-family

residence

967

Pass

Single-family

residence

219

Substandard

$7,395

Total |

29

•

To be a relevant and robust

alternative to “banking as

usual”

in central Indiana

•

To grow into new markets by

doing what it takes to

become a fully established,

leading citizen and business

advocate in each

neighborhood we serve

•

To uphold and act on the

core values of a true

community bank

OUR VISION |

30

To engage every

customer in a meaningful

dialogue regarding their

financial needs and

provide advice and

financial solutions that

assist them in achieving

their goals

OUR MISSION |

31 |

32 |

33 |

AMERIANA BUSINESS STRATEGY

•

Customer needs client strategy focused on building

long-term relationships

•

Disciplined, relationship-building culture along all

business units

•

Business units

o

Commercial

o

Consumer

o

Mortgage

o

Insurance

o

Financial Management

•

Primary focus is value creation through growth in

Indianapolis and legacy markets

34 |

AMERIANA COMMERCIAL STRATEGY

•

C&I / Owner-Occupied CRE / Investment Real Estate

•

Focused on small business and middle market clients

•

Target

loan

size

is

$25,000

-

$5

million

•

Working capital lines, equipment financing, letters of credit, term

real estate and interest rate risk tools available

•

SBA Lending expertise

•

Experienced lending team, primarily focused on Indianapolis

market

•

Full suite of depository products, mobile and online money

management tools, merchant processing, insurance and 401(k)

plan expertise

35 |

AMERIANA CONSUMER LENDING STRATEGY

•

Consumer lending focused on residential mortgage,

home equity, auto and other closed-end loans

•

Mortgage originators located in key markets within

our footprint

•

Fully-automated Loan Origination System in

compliance with all current regulations

•

Online consumer application system

36 |

AMERIANA RETAIL STRATEGY

•

Develop relationships focused on meeting financial

lifecycle needs and building products per household

•

On-The-Go Checking is key acquisition product

•

Focused on omni channel customer experience to

provide seamless integration between branch and

electronic delivery channels.

o

ATM access

o

Telephone Banking

o

Call Center

o

Online Banking

o

Mobile

Banking

–

check

deposit,

bill

pay,

alerts,

etc.

o

e-Account Opening

37 |

REGULATORY AND ENTERPRISE

RISK MANAGEMENT

•

Experienced ERM Team

o

Janelle

Gamble,

SVP

–

Chief

Risk

Officer

+

Compliance

and

CRA Officer

Gloria Corbin, BSA

Stephanie Cunningham, Compliance

Ron Holloway, Loan Review

Joan Kerulis and Debra Hay, Audit

38 |

CUSTOMER GROWTH TREND

Total

Customers

–

Business

&

Personal

16334

16942

17136

17788

18267

18558

19262

14500

15000

15500

16000

16500

17000

17500

18000

18500

19000

19500

2008 -

2014

39 |

5

YEAR GROWTH IN CHECKING ACCOUNTS 40

12,389

13,266

14,610

15,592

16,465

10000

11000

12000

13000

14000

15000

16000

17000

2010

2011

2012

2013

2014 |

SHIFT IN DEPOSIT MIX

Non-Maturity

Deposits

39%

41

12/31/08

CDs

61%

12/31/14

CDs

36%

Deposits

64%

Non-Maturity |

5

YEAR GROWTH IN DEBIT CARD INTERCHANGE

$568,609.01

$687,884.99

$737,072.89

$843,756.85

$960,203.49

$400,000.00

$500,000.00

$600,000.00

$700,000.00

$800,000.00

$900,000.00

$1,000,000.00

2010

2011

2012

2013

2014

42 |

5

YEAR GROWTH IN NSF/FOREIGN ATM $400,000.00

$500,000.00

$600,000.00

$700,000.00

$800,000.00

$900,000.00

$1,000,000.00

$1,100,000.00

$1,200,000.00

2010

2011

2012

2013

2014

43

$827,900.73

$827,897.54

$914,066.58

$960,912.88

$1,068,849.82 |

INCREASE IN MOBILE BANKING USAGE

25% Increase in Mobile Banking Users

44 |

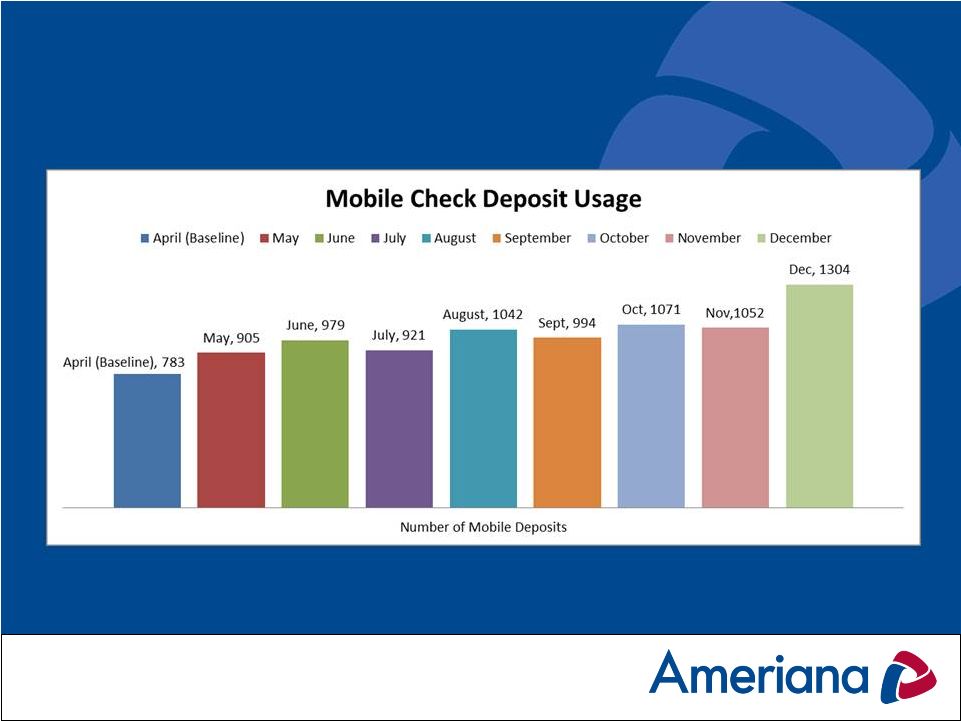

INCREASE IN MOBILE CHECK DEPOSIT

67% Increase in Mobile Deposits

45 |

INCREASE IN MOBILE PICTURE PAY

156% Increase in Picture Pay usage

46 |

Rating of Account Opening Experience

100% of those surveyed rated Ameriana at “Good”

or “Excellent”

CUSTOMER SURVEY RESULTS

47

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Poor

Fair

Good

Excellent

2008

2009

2010

2011

2013

2014 |

Likelihood of Using Additional

Ameriana Products and Services

In 2014, 92% said they would use additional services, compared to 84%

in 2013, 93% in 2011, 99% in 2010, 79% in 2009 and 74% in 2008.

CUSTOMER SURVEY RESULTS

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

Very Unlikely

Unlikely

Likely

Very Likely

Not Sure

2008

2009

2010

2011

2013

2014

48 |

Likelihood of Recommending Ameriana

In 2014, 96% said they would use additional services, compared to

95% in 2013, 98% in 2011, 95% in 2010, 95% in 2009 and 98% in 2008.

CUSTOMER SURVEY RESULTS

49

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Very Unlikely

Unlikely

Likely

Very Likely

Not Sure

2008

2009

2010

2011

2013

2014 |

Name recognition and awareness built with

Ameriana name campaign.

AMERIANA’S TV SPOT

50 |

REDESIGNED WEBSITE

51 |

52 |

53 |

54 |

55 |

COMMUNITY SERVICE &

OUTREACH

56 |

New

Castle Optimist of the Year Cathy Crabtree

Ameriana Insurance Agency

57 |

Henry County United Fund’s

Spirit of Caring Business of the Year Award

COMMUNITY OUTREACH

58 |

Paul

W. Prior Scholarship Winner Ashley Criswell (Diana

Criswell’s daughter, New Castle Main)

COMMUNITY OUTREACH

59 |

•

Knightstown recognized as a Small Business Saturday Champion

•

Donated a total of $38,625 to 49 different area non-profit

organizations via

Checking It Forward

®

•

Sponsored Geist Half for 5

th

Year

which

raises

funds

to

fight

childhood

obesity

•

Westfield Banking Center held its 6th Annual Fall Festival to support the

Westfield Youth Assistance Program

60

Community

for the 3

rd

year in a row |

Fishers Crossing

11991 FISHERS CROSSING

OPENED 2 BANKING CENTERS

Noblesville

107 W. LOGAN STREET

61 |

BROAD RIPPLE BANKING CENTER

59

TH

& COLLEGE AVENUE

Opening Fall 2015

62 |

2015

EARNINGS TARGETS BANK

BANCORP

$3,208,000

$2,497,000

CHALLENGES FOR 2015

•

•

•

•

63

Fragile, slow moving economic recovery

Extremely competitive commercial loan market

Net interest margin compression resulting from ongoing low

interest rate environment

Initial costs associated with retail expansion strategy

|

STOCK PERFORMANCE

(July 2012 –

Present)

Source: SNL Financial 5/11/2015

64 |

STOCK PERFORMANCE

Change %

As of 5/11/2015

YTD

1 Year

3 Years

ASBI

(9.73)

19.29

212.15

SNL Bank & Thrift

0.82

13.13

62.81

SNL Bank < $500mm

6.31

10.14

58.03

KBW Bank

1.12

10.36

58.95

NASDAQ Bank

1.00

9.59

49.69

SNL Micro Cap

2.22

10.41

52.34

Source: SNL Financial

65 |

AMERIANA FRANCHISE HIGHLIGHTS

•

Focused on improving shareholder value

•

Increased dividend

•

Growth strategies focused on building relationships, growing

deposits and fee revenue

•

Investments in Indianapolis area are producing results

•

Well-capitalized with ability to support further organic growth

•

Able to effectively manage to increased regulatory requirements

66 |

DONALD C. “DANNY”

DANIELSON

1919-2015

•

Director of Ameriana Bank

since 1971

•

Director of Ameriana

Bancorp since 1990

67 |

QUESTIONS?

68 |