Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Premier, Inc. | d923923d8k.htm |

| EX-99.1 - EX-99.1 - Premier, Inc. | d923923dex991.htm |

| EX-99.2 - EX-99.2 - Premier, Inc. | d923923dex992.htm |

Third Quarter Fiscal 2015

Financial Results and Update

May 11, 2015

Exhibit 99.3 |

2

©

2015 PREMIER, INC.

Forward-looking statements and Non-GAAP financial

measures |

Susan DeVore, President & CEO

Overview and Business Update |

4

©

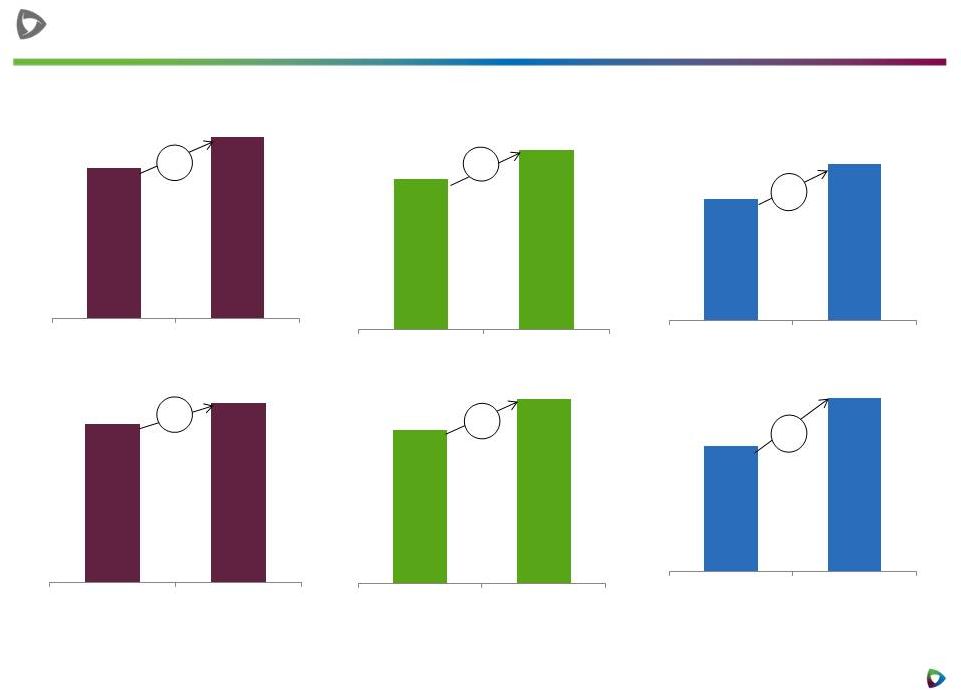

2015 PREMIER, INC.

Third-quarter highlights

*

*See non-GAAP Adjusted EBITDA, Segment Adjusted EBITDA, and Adjusted Fully

Distributed Earnings Per Share reconciliations to GAAP equivalents in Appendix.

Strong overall financial performance

Total net revenue up 16% YoY, driven by double-digit

growth in both business segments

Adjusted EBITDA up 14% YoY

Adjusted fully distributed earnings per share of

$0.38 up 13% YoY

On track to achieve 99% GPO retention rate and 94%

SaaS institutional renewal rate for FY2015

Raising full-year guidance |

5

©

2015 PREMIER, INC.

Third-quarter revenue growth drivers

Supply Chain Services revenue up 15%

»

Net administrative fees revenue up 9.1%

»

Products revenue up 25%

Performance Services revenue up 19%

»

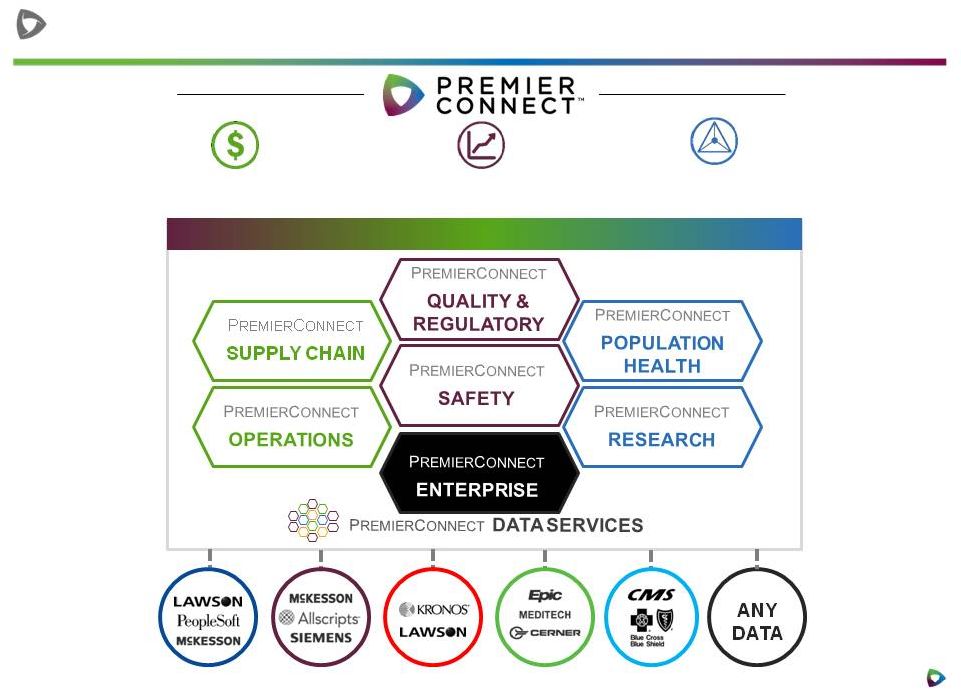

Continued growth of PremierConnect

Saas-based subscriptions and renewals,

and growth in Advisory Services

»

Finished quarter with solid bookings &

strong sales pipeline |

6

©

2015 PREMIER, INC.

Addressing member needs for continuous improvement

Manage

Populations

Improve

Quality and Safety

Reduce

Costs

BILLING

PURCHASING

CLAIMS

CLINICAL

FINANCIAL

Combines People, Process, and Technology |

7

©

2015 PREMIER, INC.

Medicare payment reform –

a watershed event

Payment reform rewarding value, promoting

population health and discouraging fee-for-service

»

»

Bill permanently reforms the Medicare physician

payment system (Sustainable Growth Rate formula)

»

Alters the economic incentives in market, pushing

providers to embrace population health and risk-based

contracts for cost and quality outcomes

We believe Premier is well positioned to lead health

systems through this transformation

Congress passes Medicare Access and

CHIP

Reauthorization Act of 2015 (MACRA) |

8

©

2015 PREMIER, INC.

Recognized leader in population health management

Premier Population Health Management Advisory

Services ranked #1 by KLAS

The PACT Population Health Collaborative

is the model for integrated care delivery,

bringing together approx. 400 hospitals in

30 states

The Bundled Payment Collaborative works

to reduce the cost of an episode of care,

improve patient outcomes and redesign

care delivery with approximately 120

hospitals in 27 states

Pioneered data-driven performance improvement

collaboratives and technologies focused on

accountable care organizations and alternate

payment models |

Michael Alkire, Chief Operating Officer

Operations Update |

10

©

2015 PREMIER, INC.

A platform for continuous performance improvement

Manage

Populations

Improve

Quality and Safety

Reduce

Costs

BILLING

PURCHASING

CLAIMS

CLINICAL

FINANCIAL

Combines People, Process, and Technology |

11

©

2015 PREMIER, INC.

Third-quarter Supply Chain Services revenue

Supply Chain Services revenue

increased 15%

»

»

Expanding contract penetration in

both acute and alternate site

»

Continuing impact of the

recruitment and conversion of new

members

»

Improved utilization trends

»

Timing of cash receipts

»

»

Ongoing member support for direct

sourcing and specialty pharmacy

businesses

$108.1

$118.0

$58.7

$73.4

3Q'14

3Q'15

Net Admin Fees

Products

Other Services and Support

15%

$167.0

$192.1

Supply Chain Services

Net revenue

(millions)

GPO net admin fees revenue

increased 9.1%

Products revenue increased 25% |

12

©

2015 PREMIER, INC.

High-growth Supply Chain Products businesses

Direct sourcing

»

Helping our members

achieve significant savings

on basic commodity products

Specialty pharmacy

»

Helping our members

manage chronic, high-cost

patients in a population

health environment

$ 58.7

$ 73.4

3Q'14

3Q'15

Supply Chain Products

Net revenue

(millions)

25% |

13

©

2015 PREMIER, INC.

A platform for continuous performance improvement

Manage

Populations

Improve

Quality and Safety

Reduce

Costs

BILLING

PURCHASING

CLAIMS

CLINICAL

FINANCIAL

Combines People, Process, and Technology |

14

©

2015 PREMIER, INC.

Supply

Analytics

Sourcing &

Contract

Management

Catalog

Management

ERP / Materials

Management

PREMIERCONNECT

SUPPLY CHAIN

PremierConnect

®

Supply Chain

Supply Chain Workflow

Plan

Source

Contract

Buy

Receive

Pay

Manage |

15

©

2015 PREMIER, INC.

Supply

Analytics

Complete Visibility

Categorize ALL

transactions

Contract Optimization

Identify trends and

variation

Actionable Information

Understand Why spend

is changing

Sourcing &

Contract

Management

Optimize & Manage

GPO, regional and local

contracts

Source of Truth

Right product, right time,

best price

Data Integration

Insights across all

your facilities

Catalog

Management

Drive Standardization

Cleanse, standardize &

control item master

Customized Catalog

Supports your

standards across acute

& non-acute

Price Accuracy

Maintains pricing

across multiple ERPs

ERP / Materials

Management

Manage Process

Supply chain &

operations

End to End

Procurement

Financial, Fixed Assets &

Purchasing

Flexible & Scalable

Cloud

based

–

connect

your growing facilities

Technology enabled supply chain |

16

©

2015 PREMIER, INC.

Expanding Population Health Advisory Services relationships

Innovate

Health

Alliance

–

Albany

NY

North

Shore-LIJ

Health

System

–

New

York

LifeBridge

Health

–

Baltimore |

17

©

2015 PREMIER, INC.

SYMMEDRx providing solutions for physician preference

Physician

preference contract

management and

data services

Partnership with large academic member

health system delivers savings of ~24% on

medical devices related to just one disease

state

Three-year agreement with Greater New York

Hospital Association to provide comprehensive

data analysis and consultative support to drive

savings across all disease states |

Craig McKasson, Chief Financial Officer

Financial Review |

19

©

2015 PREMIER, INC.

the

Third-quarter consolidated and segment highlights

*

Consolidated

Net revenue (millions)

Supply Chain Services

Net revenue (millions)

Performance Services

Net revenue (millions)

Adjusted

EBITDA

(millions)

Adjusted EBITDA (millions)

Adjusted EBITDA (millions)

*See

non-GAAP

Adjusted

EBITDA

and

non-GAAP

Segment

Adjusted

EBITDA

reconciliations

to

GAAP

equivalents

in

Appendix.

16%

15%

19%

14%

11%

29%

$20.3

$26.2

3Q'14

3Q'15

$91.3

$103.7

3Q'14

3Q'15

$58.6

$69.6

3Q'14

3Q'15

$91.5

$101.6

3Q'14

3Q'15

$167.0

$192.1

3Q'14

3Q'15

$225.6

$261.7

3Q'14

3Q'15 |

20

©

2015 PREMIER, INC.

Third-quarter Supply Chain Services revenue

Supply Chain Services revenue

increased 15%

»

GPO net admin fees revenue

increased 9.1%

»

Expanding contract penetration in

both acute and alternate site

»

Continuing impact of the

recruitment and conversion of new

members

»

Improved utilization trends

»

Timing of cash receipts

»

Products revenue increased 25%

»

Ongoing member support for direct

sourcing and specialty pharmacy

businesses

$58.7

$73.4

3Q'14

3Q'15

Net Admin Fees

Products

Other Services and Support

15%

$167.0

$192.1

Supply Chain Services

Net

revenue

(millions)

$108.1

$118.0 |

21

©

2015 PREMIER, INC.

Third-quarter Performance Services revenue

»

Performance Services revenue

increased 19%

»

Continued growth of PremierConnect

SaaS-based subscriptions and

renewals

»

Continued growth of Advisory

Services led by engagements tied to:

»

Cost management

»

Population health

»

Physician preference

»

Capital equipment planning

$58.6

$69.6

3Q'14

3Q'15

19%

Performance Services

Net

revenue

(millions) |

22

©

2015 PREMIER, INC.

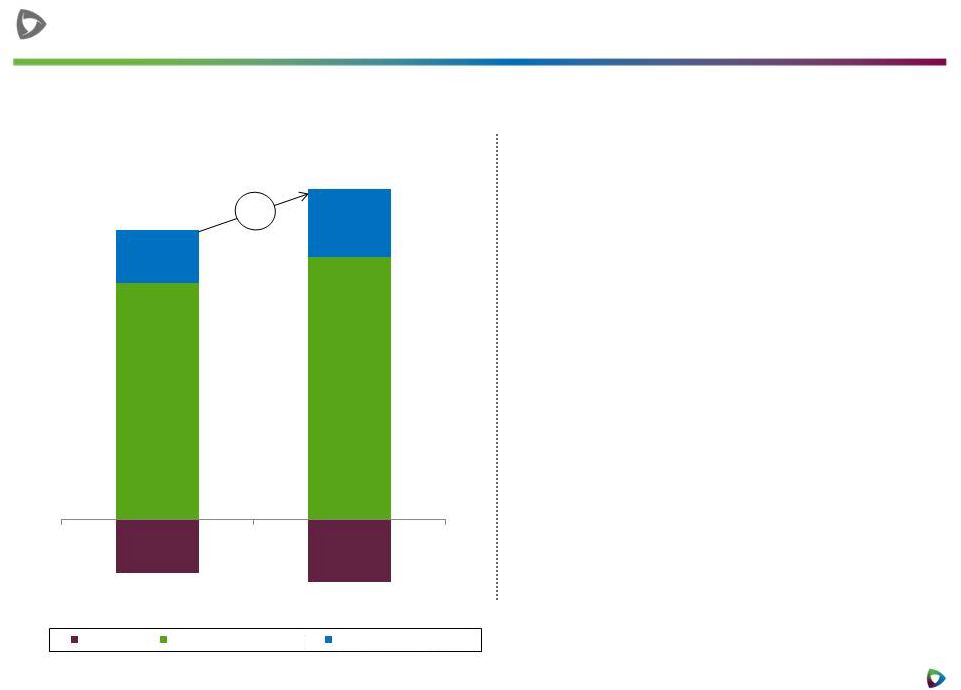

Third-quarter adjusted EBITDA*

Consolidated adjusted EBITDA

increased 14%

»

»

Strong net admin fee revenue

growth

»

Expanding direct sourcing

activities

»

»

New PremierConnect SaaS-based

subscription sales

»

Contribution from Aperek and

Theradoc acquisitions

»

Effective management of operating

expenses

Supply Chain Services adjusted

EBITDA increased 11%

Performance Services adjusted

EBITDA increased 29%

($20.5)

($24.0)

$91.5

$101.6

$20.3

$26.2

3Q'14

3Q'15

Corporate

Supply Chain Services

Performance Services

14%

Adjusted EBITDA

(millions)

$91.3

$103.7

* See non-GAAP adjusted fully distributed net income and non-GAAP earnings per share on

fully distributed net income reconciliations to GAAP equivalents in Appendix |

23

©

2015 PREMIER, INC.

Third-quarter non-GAAP adjusted fully distributed net

income*

$0.34

$0.38

Non-GAAP earnings per share on adjusted fully

distributed net income –

diluted

»

Calculates income taxes at

40% on pre-tax income,

assuming taxable C corporate

structure

»

Calculates adjusted fully

distributed earnings per

share, assuming total Class A

and B common shares held

by public

$49.1

$55.3

3Q'14

3Q'15

(in millions, except per share data)

13%

* See non-GAAP adjusted fully distributed net income and non-GAAP earnings per share on

fully distributed net income reconciliations to GAAP equivalents in Appendix |

24

©

2015 PREMIER, INC.

Cash flow and capital flexibility at March 31, 2015

CONSIDERABLE CASH AND

DEBT CAPACITY

AVAILABLE

AMPLE CAPITAL

FLEXIBILITY FOR FUTURE

ACQUISITIONS AND

BUSINESS GROWTH

*Three

months

ended

March

31,

2015.

Company

defines

free

cash

flow

as

cash

provided

by

operating

activities

less

distributions

to

limited

partners

and

purchases of property and equipment. See non-GAAP free cash flow

reconciliation to GAAP equivalent in Appendix. Year-to-date cash flow

from operations of $255.6 million

Third-quarter free cash flow of $59.5 million

*

Cash, cash equivalents & marketable securities

of $503.3 million

No outstanding borrowings on $750 million five-

year unsecured revolving credit facility |

25

©

2015 PREMIER, INC.

Fiscal 2015 annual guidance*

*

Guidance is based on comparisons with prior-year non-GAAP pro forma

results, which have been adjusted to reflect the impact of the company’s reorganization and IPO. The

Company does not reconcile guidance for adjusted EBITDA and non-GAAP adjusted

fully distributed net income per-share to net income (loss) or GAAP earnings per share

because the Company does not provide guidance for reconciling items between net

income (loss) and adjusted EBITDA and non-GAAP adjusted fully distributed earnings per

share. The Company is unable to provide guidance for these reconciling items since

certain items that impact net income (loss) are outside of the Company’s control and cannot be

reasonably predicted. Accordingly, a reconciliation to net income (loss) or GAAP

earnings per share is not available without unreasonable effort. Financial

guidance for year ending June 30, 2015: »

6%-7% net administrative fee revenue growth

»

27%-32% product revenue growth

»

Continued high GPO retention rates

Guidance Assumptions:

»

Continued demand for integrated offerings of SaaS-based

subscription and licensed products, advisory services and

collaboratives

»

Continuation of high SaaS institutional renewal rates

Updated

Pro Forma

Previous

(in millions, except per share data)

FY 2015

% YoY Change

FY 2015

Net Revenue:

Supply Chain Services segment

$720.0 -

$733.0

13% -

15%

$706.0 -

$725.0

Performance Services segment

$268.0 -

$275.0

15% -

18%

$268.0 -

$275.0

Total Net Revenue

$988.0 -

$1008.0

14% -

16%

$974.0 -

$1000.0

Non-GAAP adjusted EBITDA

$384.0 -

$392.0

9% -

12%

$382.0 -

$390.0

Non-GAAP adjusted fully distributed EPS

$1.40 -

$1.44

8% -

11%

$1.40 -

$1.44

Premier, Inc. updates full-year fiscal 2015 financial guidance, as

follows: Fiscal 2015 Financial Guidance

Supply Chain Services growth driven by:

Performance Services growth driven by: |

26

©

2015 PREMIER, INC.

Exchange update

On April 30, 2015, approximately 276,000

Class B units were exchanged for Class A

common shares on 1-for-1 basis; equal

number of Class B common shares retired

Next exchange on July 31, 2015 |

27

©

2015 PREMIER, INC.

Targeted and disciplined acquisition strategy

We expect acquisitions to play major role in

providing solutions for member health systems

to thrive in the healthcare environment of

tomorrow

»

Evaluating multiple opportunities

»

Seeking innovative and unique solutions

»

Employing well-defined, diligent process

»

Continue to evaluate all types of acquisitions,

from strategic tuck-ins to transformational |

Questions |

Appendix |

30

©

2015 PREMIER, INC.

Year-to-date nine-month financial highlights

*

Consolidated

Supply Chain Services

Net revenue (millions)

Performance Services

Net revenue (millions)

Adjusted

EBITDA

(millions)

Adjusted EBITDA (millions)

Adjusted EBITDA (millions)

*Comparisons are with year-ago non-GAAP pro forma information that reflects

the impact of the company’s reorganization and initial public offering.

See Adjusted EBITDA, Segment Adjusted EBITDA and Adjusted Fully Distributed Net

Income reconciliations to GAAP equivalents in Appendix. $633.8

$740.5

$464.1

$542.0

$169.8

$198.4

$257.8

$293.1

3Q'14

3Q'15

$260.8

$290.2

3Q'14

3Q'15

$54.4

$67.7

3Q'14

3Q'15

3Q'14

3Q'15

3Q'14

3Q'15

3Q'14

3Q'15

17%

17%

14%

17%

11%

25%

Consolidated

Net revenue (millions) |

31

©

2015 PREMIER, INC.

Fiscal 2015 and fiscal 2014 non-GAAP reconciliations

2015*

2014*

2015*

2014

Reconciliation of Pro Forma Net Revenue to Net Revenue:

Pro Forma Net Revenue

261,723

$

225,598

$

740,476

$

633,820

$

Pro forma adjustment for revenue share post-IPO

—

—

—

41,263

Net Revenue

261,723

$

225,598

$

740,476

$

675,083

$

Net income

72,029

$

101,980

$

202,724

$

265,985

$

Pro forma adjustment for revenue share post-IPO

—

—

—

(41,263)

Interest and investment income, net

(204)

(400)

(517)

(641)

Income tax expense

2,026

9,413

12,107

24,461

Depreciation and amortization

11,538

9,396

33,107

26,952

Amortization of purchased intangible assets

2,554

802

6,598

2,158

EBITDA

87,943

121,191

254,019

277,652

Stock-based compensation

7,285

6,299

21,129

13,118

Acquisition related expenses

2,863

984

6,408

1,303

Strategic and financial restructuring expenses

2

733

1,281

3,614

Loss (gain) on investment

1,000

(37,850)

1,000

(37,850)

Adjustment to tax receivable agreement liability

1,073

—

—

—

Acquisition related adjustment -

deferred revenue

3,563

—

9,224

—

Other expense (income), net

16

(52)

10

(56)

Adjusted EBITDA

103,745

$

91,305

$

293,071

$

257,781

$

Segment Adjusted EBITDA:

Supply Chain Services

101,600

$

91,477

$

290,210

$

302,076

$

Pro forma adjustment for revenue share post-IPO

—

—

—

(41,263)

Supply Chain Services

(including pro forma adjustment)

101,600

$

91,477

$

290,210

$

260,813

$

Performance Services

26,166

20,307

67,717

54,367

Corporate

(24,021)

(20,479)

(64,856)

(57,399)

Adjusted EBITDA

103,745

$

91,305

$

293,071

$

257,781

$

Depreciation and amortization

(11,538)

(9,396)

(33,107)

(26,952)

Amortization of purchased intangible assets

(2,554)

(802)

(6,598)

(2,158)

Stock-based compensation

(7,285)

(6,299)

(21,129)

(13,118)

Acquisition related expenses

(2,863)

(984)

(6,408)

(1,303)

Strategic and financial restructuring expenses

(2)

(733)

(1,281)

(3,614)

Adjustment to tax receivable agreement liability

(1,073)

—

—

—

Acquisition related adjustment -

deferred revenue

(3,563)

—

(9,224)

—

Equity in net income of unconsolidated affiliates

(5,197)

(3,566)

(14,812)

(12,171)

Deferred compensation plan (income) expense

(759)

—

209

—

68,911

69,525

200,721

198,465

Pro forma adjustment for revenue share post-IPO

—

—

—

41,263

Operating income

68,911

$

69,525

$

200,721

$

239,728

$

Equity in net income of unconsolidated affiliates

5,197

3,566

14,812

12,171

Interest and investment income, net

204

400

517

641

(Loss) gain on investment

(1,000)

37,850

(1,000)

37,850

Other income (expense), net

743

52

(219)

56

Income before income taxes

74,055

$

111,393

$

214,831

$

290,446

$

Three Months Ended

March 31,

Nine Months Ended

March 31,

Supplemental Financial Information -

Reporting of Pro Forma Adjusted EBITDA

(Unaudited)

(In thousands)

Reconciliation of Selected Non-GAAP Measures to GAAP Measures

and Non-GAAP Adjusted Fully Distributed Net Income

Reconciliation of Net Income to Adjusted EBITDA and Reconciliation of

Segment Adjusted EBITDA to Income Before Income Taxes: * Note

that no pro forma adjustments were made for the three and nine months ended March 31, 2015 and the three months

ended March 31, 2014; as such, actual results are presented for each of

these periods. |

32

©

2015 PREMIER, INC.

Fiscal 2015 and fiscal 2014 non-GAAP reconciliations

2015*

2014*

2015*

2014

Reconciliation of Non-GAAP Pro Forma Adjusted Fully Distributed Net

Income: Net income attributable to shareholders

12,209

$

13,525

$

30,753

$

19,453

$

Pro forma adjustment for revenue share post-IPO

—

—

—

(41,263)

Income tax expense

2,026

9,413

12,107

24,461

Stock-based compensation

7,285

6,299

21,129

13,118

Acquisition related expenses

2,863

984

6,408

1,303

Strategic and financial restructuring expenses

2

733

1,281

3,614

Loss (gain) on investment

1,000

(37,850)

1,000

(37,850)

Adjustment to tax receivable agreement liability

1,073

—

—

—

Acquisition related adjustment -

deferred revenue

3,563

—

9,224

—

Amortization of purchased intangible assets

2,554

802

6,598

2,158

Net income attributable to noncontrolling interest in Premier LP

59,568

87,925

170,135

246,055

Non-GAAP pro forma adjusted fully distributed income before income

taxes 92,143

81,831

258,635

231,049

Income tax expense on fully distributed income before income

taxes 36,857

32,732

103,454

92,420

Non-GAAP Pro Forma Adjusted Fully Distributed Net Income

55,286

$

49,099

$

155,181

$

138,629

$

*

Note

that

no

pro

forma

adjustments

were

made

for

the

three

and

nine

months

ended

March

31,

2015

and

the

three

months

ended

March

31,

2014; as such, actual results are presented for each of these

periods. Three Months Ended

March 31,

Nine Months Ended

March 31,

(Unaudited)

(In thousands)

Reconciliation of Selected Non-GAAP Measures to GAAP Measures

and Non-GAAP Adjusted Fully Distributed Net Income

Supplemental Financial Information - Reporting of Pro Forma Adjusted

EBITDA |

33

©

2015 PREMIER, INC.

Fiscal 2015 and fiscal 2014 non-GAAP reconciliations

2015

2014

Reconciliation of Non-GAAP Free Cash Flow to Net Cash Provided by

Operating Activities: Net cash provided by operating

activities 101,860

$

90,173

$

Purchases of property and equipment

(18,653)

(13,823)

Distributions to limited partners

(23,701)

(17,419)

Non-GAAP free cash flow

59,506

$

58,931

$

Non-GAAP Adjusted EBITDA

103,745

$

91,305

$

Supplemental Financial Information -

Reporting of Non-GAAP Free Cash Flow

Reconciliation of Selected Non-GAAP Measures to GAAP Measures

(Unaudited)

(In thousands)

Three Months Ended

March 31, |

34

©

2015 PREMIER, INC.

Fiscal 2015 and fiscal 2014 non-GAAP reconciliations

2015*

2014*

2015*

2014

Reconciliation of numerator for GAAP EPS to Non-GAAP EPS on Adjusted

Fully Distributed Net Income Net income (loss) attributable to

shareholders after adjustment of redeemable limited partners'

capital to redemption amount (374,853)

$

509,239

$

(781,216)

$

(3,204,645)

$

Adjustment of redeemable limited partners' capital to redemption

amount

387,062

(495,714)

811,969

3,224,098

Net income attributable to shareholders

12,209

13,525

30,753

19,453

Pro forma adjustment for revenue share post-IPO

—

—

—

(41,263)

Income tax expense

2,026

9,413

12,107

24,461

Stock-based compensation

7,285

6,299

21,129

13,118

Acquisition related expenses

2,863

984

6,408

1,303

Strategic and financial restructuring expenses

2

733

1,281

3,614

Loss (gain) on investment

1,000

(37,850)

1,000

(37,850)

Adjustment to tax receivable agreement liability

1,073

—

—

—

Acquisition related adjustment -

deferred revenue

3,563

—

9,224

—

Amortization of purchased intangible assets

2,554

802

6,598

2,158

Net income attributable to noncontrolling interest in Premier LP

59,568

87,925

170,135

246,055

Non-GAAP pro forma adjusted fully distributed income before income

taxes 92,143

81,831

258,635

231,049

Income tax expense on fully distributed income before income

taxes 36,857

32,732

103,454

92,420

Non-GAAP pro forma adjusted fully distributed net income

55,286

$

49,099

$

155,181

$

138,629

$

Reconciliation of denominator for GAAP EPS to Non-GAAP Adjusted Fully

Distributed Net Income Weighted Average:

Common shares used for basic and diluted earnings per share

37,316

32,375

35,066

23,394

Potentially dilutive shares

1,148

181

845

100

Class A common shares outstanding

-

-

-

8,981

Conversion of Class B common units

106,706

112,608

109,184

112,608

Weighted average fully distributed shares outstanding -

diluted

145,170

145,164

145,095

145,083

Reconciliation of GAAP EPS to Adjusted Fully Distributed EPS

GAAP earnings (loss) per share

$

(10.05) $

15.73 $

(22.28) $

(136.99) Impact of adjustment of redeemable limited partners'

capital to redemption amount

$

10.37 $

(15.31)

$ 23.16

$ 137.82

Impact of additions:

Pro forma adjustment for revenue share post-IPO

$

-

$

-

$

-

$

(1.76) Income tax expense

$

0.05

$

0.29

$

0.35

$

1.05 Stock-based compensation

$

0.20

$

0.19

$

0.60

$

0.56 Acquisition related expenses

$

0.08

$

0.03

$

0.18

$

0.06 Strategic and financial restructuring expenses

$

0.00

$

0.02

$

0.04

$

0.15 Loss (gain) on investment

$

0.03

$

(1.17)

$

0.03

$

(1.62) Adjustment to tax receivable agreement liability

$

0.03

$

-

$

-

$

- Acquisition related

adjustment - deferred revenue

$

0.10

$

-

$

0.26

$

- Amortization of purchased

intangible assets

$

0.07

$

0.02

$

0.19

$

0.09 Net income attributable to noncontrolling interest in

Premier LP

$

1.60

$

2.72

$

4.85

$ 10.52

Impact of corporation taxes

$

(0.99)

$

(1.01)

$

(2.95)

$

(3.95) Impact of increased share count

$

(1.11)

$

(1.17)

$

(3.36)

$

(4.97) Non-GAAP earnings per share on adjusted fully

distributed net income -

diluted

$

0.38

$ 0.34

$

1.07

$

0.96

Three Months Ended

March 31,

Nine Months Ended

March 31,

(Unaudited)

(In thousands, except per share data)

Reconciliation of Selected Non-GAAP Measures to GAAP Measures

* Note that no pro forma adjustments were made for the three and nine

months ended March 31, 2015 and the three months ended March 31,

2014; as such, actual results are presented for each of these periods.

Supplemental Financial Information - Reporting of Net Income and

Earnings Per Share |