Attached files

| file | filename |

|---|---|

| 8-K - 8-K - REMY INTERNATIONAL, INC. | a8-k2015investorpresentati.htm |

Investor Presentation May 2015

FORWARD-LOOKING STATEMENT This presentation may contain forecasts, projections, expectations, or opportunities regarding Remy that are "forward-looking statements" as defined in the Private Securities Litigation Act of 1995. Such forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from anticipated results, including, but not limited to, future financial results and liquidity, development of new products and services, the effect of competitive products or pricing, the effect of commodity and raw material prices, the impact of supply chain cost management initiatives, restructuring risks, customs duty claims, litigation uncertainties and warranty claims, conditions in the automotive industry, foreign currency fluctuations, costs related to re-sourcing and outsourcing products, the effect of economic conditions, in addition to other factors CONFIDENTIAL - COPYRIGHT ©2015 REMY INTERNATIONAL identified in Remy International statements. The Company undertakes no obligation to update this information or to publicly update any forward-looking statements.

■ Leading supplier for OE and aftermarket applications ■ Emerging leader in manufacturing hybrid electric motors ■ Innovative and technology-driven product offerings supported by strong patent portfolio Global market leader in the manufacturing and remanufacturing of rotating electrical components for commercial and passenger vehicles Remy International Building on our Powerful Heritage ■ Formed in 1896 as Remy Electric Company with the development of the Remy Magneto ■ In 1918, Delco Remy began operating as a division of General Motors ■ Became independent entity in 1994 after more than 75 years with GM ■ Commenced NASDAQ trading in Dec 2012 ■ Completed Fidelity share distribution Dec 2014 ■ Acquired USA Industries (2014) and Maval Manufacturing (2015) ■ Strong Cash Flow & Balance Sheet – Conservative Leverage ■ Positioned for strong global growth 3 Great Company – 119 Year History – Exciting Future

What makes Remy different? square4 Strong Brands – Delco Remy®, Remy® & Wicked Bilt® square4 Leading-Edge Technology – High efficiency alternators, Start-stop motors & high power density electric motors square4 Manufacturing Experience – More starter motors installed than all domestic competitors combined 4 square4 Minimal Capital Requirement – Only 2.5% of sales spent on capex square4 Aftermarket presence – Stable and reliable earnings stream square4 Focus on Controllable items – Safety, Quality, Cost, Working Capital and Cash flow Recognized as industry leader

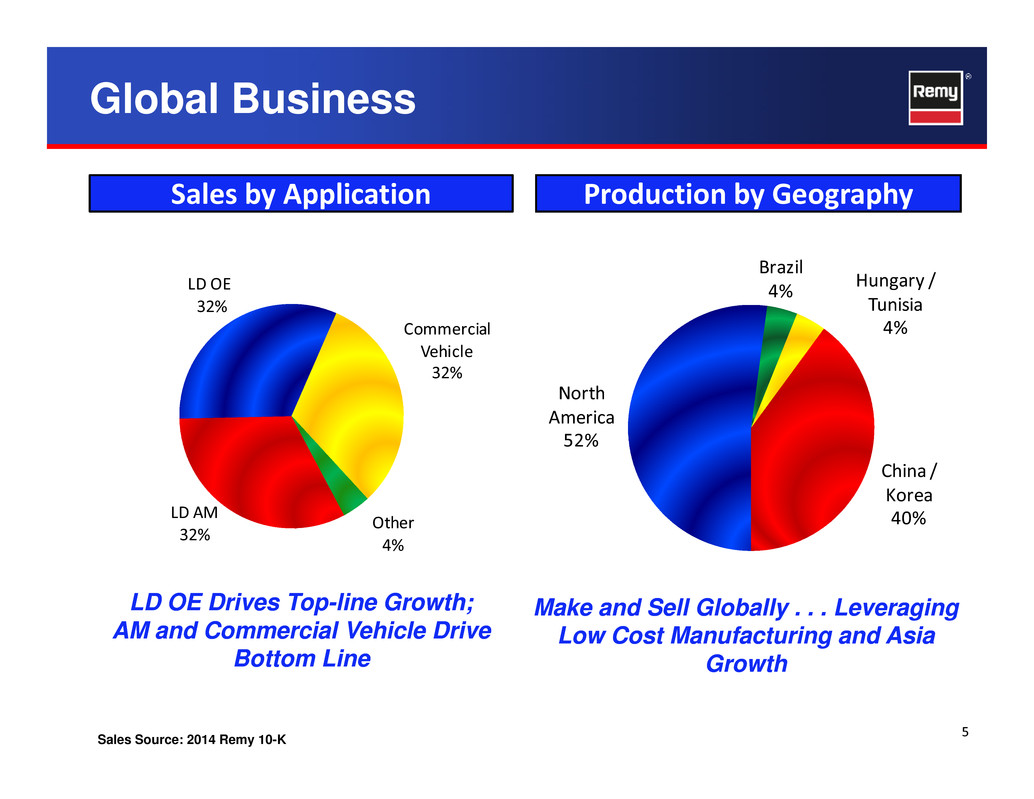

North Hungary / Tunisia 4% Brazil 4% Production by Geography Global Business Sales by Application LD OE 32% Commercial Vehicle 32% America 52% China / Korea 40% 5 Make and Sell Globally . . . Leveraging Low Cost Manufacturing and Asia Growth Sales Source: 2014 Remy 10-K LD OE Drives Top-line Growth; AM and Commercial Vehicle Drive Bottom Line LD AM 32% Other 4%

Aftermarket CustomersOE Customers “Marquee” Customer Base 6 Selling to Market Leaders in All Regions Under Our Globally Recognized Brands

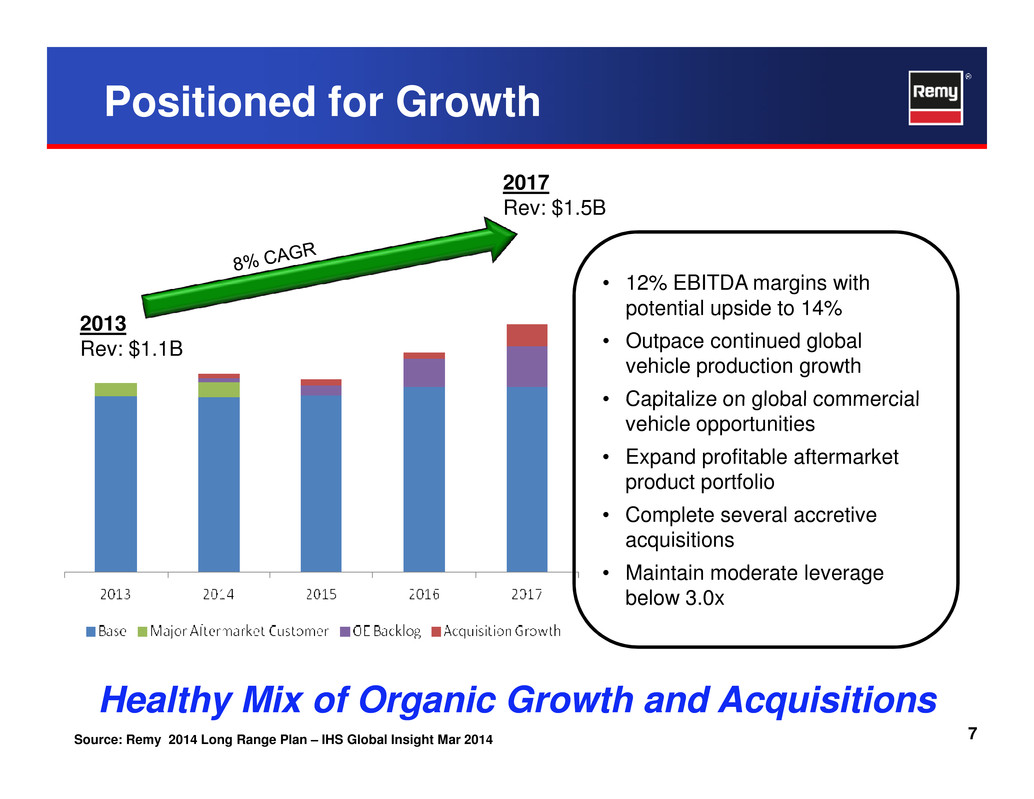

Positioned for Growth 2013 Rev: $1.1B • 12% EBITDA margins with potential upside to 14% • Outpace continued global vehicle production growth • Capitalize on global commercial 2017 Rev: $1.5B 7 Healthy Mix of Organic Growth and Acquisitions vehicle opportunities • Expand profitable aftermarket product portfolio • Complete several accretive acquisitions • Maintain moderate leverage below 3.0x Source: Remy 2014 Long Range Plan – IHS Global Insight Mar 2014

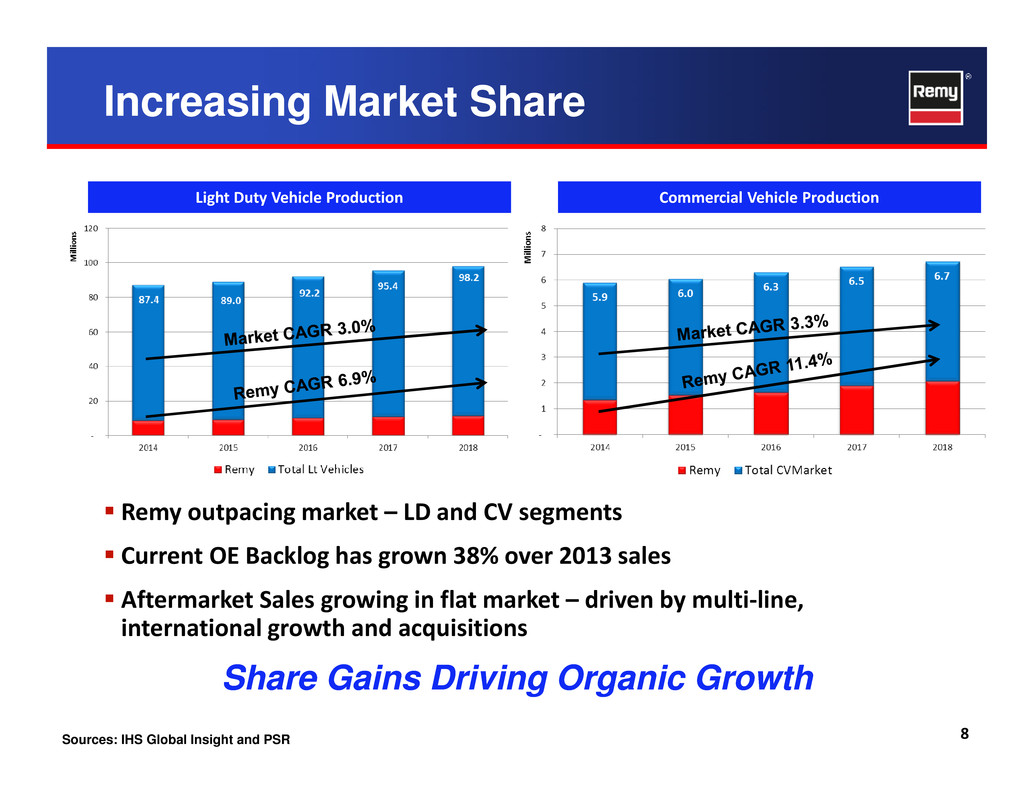

Increasing Market Share Light Duty Vehicle Production Commercial Vehicle Production 8 square4 Remy outpacing market – LD and CV segments square4 Current OE Backlog has grown 38% over 2013 sales square4 Aftermarket Sales growing in flat market – driven by multi-line, international growth and acquisitions Sources: IHS Global Insight and PSR Share Gains Driving Organic Growth

China Growth Opportunity China Light Duty Vehicle Production China Medium & Heavy Duty Production 9 square4 World’s largest automotive market square4 1/3 of Global Commercial Vehicle Market square4 50% of Global Light Duty growth from 2014 – 2018 will come from China square4 Remy China OE sales only 49% of Remy North America sales - Room to grow square4 New Wuhan plant doubles China production capacity to 5 million units Source: IHS Global Insight: Q1 2015 data for LD/HD respectively Leverage China Market for Growth

Automotive & 12V & 48V iBAS e-Turbocharger SR & IPM ISG HVH250 & 410 A N D F U E L C O N S U M P T I O N MARKET OPPORTUNITIES FOR INCREASED ELECTRIFICATION MGI & TFPM Market Drivers for Increased Vehicle Electrification: (1) Comply with Global Regulations at Minimum Cost (2) Reduce Cost of Vehicle Ownership Growth Opportunities Through Remy Technology 10 ▐Starter-based Start / Stop 2005 ▐Full Hybrid Systems 1997 Heavy Duty Long Life Starters R E D U C E D C O 2 A N D F U E L C O N S U M P T I O N Market is evaluating multiple approaches to improve CO2 and fuel economy INCREASING ELECTRIFICATION & COST ▐Integrated Starter- Generator (ISG) 2003 ▐Electric Air Boosting for Downsized Engines 2016 ▐ Belt Alternator- Starter w/ Integrated Electronics 2014 ▐High Power Density Generators 2017+ Remy is well-positioned to provide motoring and generating power solutions, in starting, charging, traction, and engine accessories

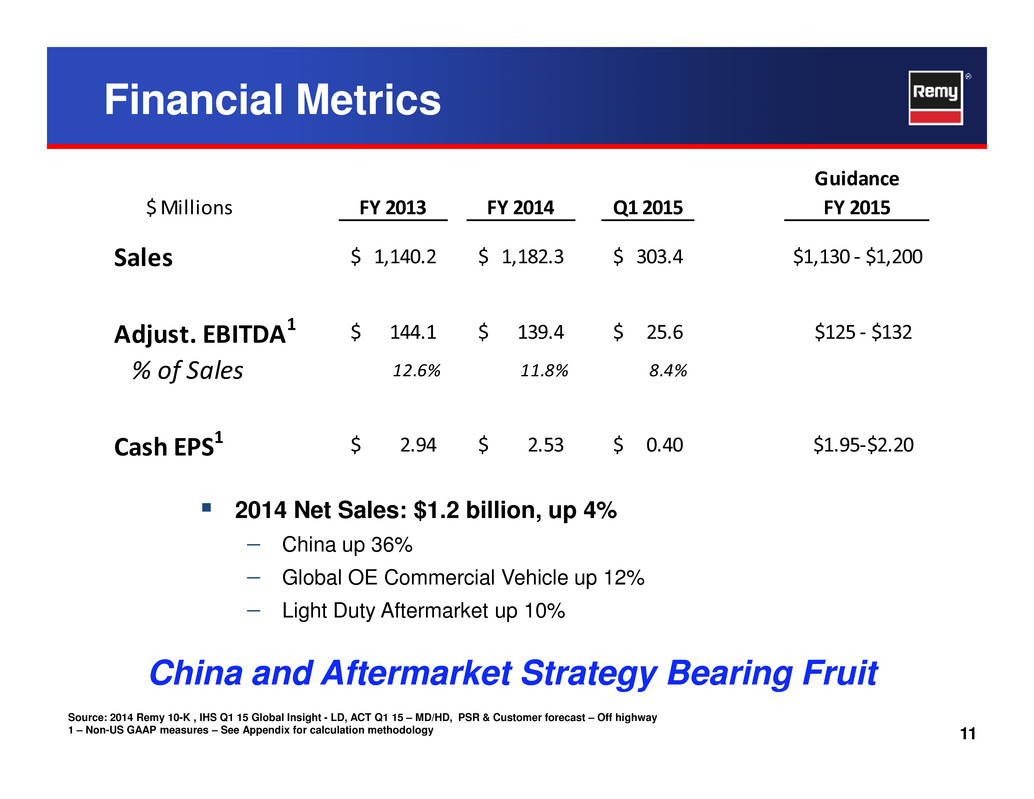

Financial Metrics Guidance $ Millions FY 2013 FY 2014 Q1 2015 FY 2015 Sales 1,140.2$ 1,182.3$ 303.4$ $1,130 - $1,200 Adjust. EBITDA1 144.1$ 139.4$ 25.6$ $125 - $132 % of Sales 12.6% 11.8% 8.4% square4 2014 Net Sales: $1.2 billion, up 4% − China up 36% − Global OE Commercial Vehicle up 12% − Light Duty Aftermarket up 10% 11 China and Aftermarket Strategy Bearing Fruit Cash EPS1 2.94$ 2.53$ 0.40$ $1.95-$2.20 Source: 2014 Remy 10-K , IHS Q1 15 Global Insight - LD, ACT Q1 15 – MD/HD, PSR & Customer forecast – Off highway 1 – Non-US GAAP measures – See Appendix for calculation methodology

Performance Evolution 2007 2014 2017 Yesterday Today Tomorrow Revenue $1.1 billion $1.2 billion $1.5 billion EBITDA % 5% 11.8% 12 - 14% Business Mix Original Equipment 52% 48% 50% 12 Poised for Top and Bottom Line Organic Growth Aftermarket 48% 52% 50% Regional Mix Americas 81% 69% 60% Europe 11% 7% 10% Asia 8% 24% 30% Net Debt / Adjusted EBITDA 6.8x 1.6x below 2.0x Cash EPS $2.53 ~$3.24

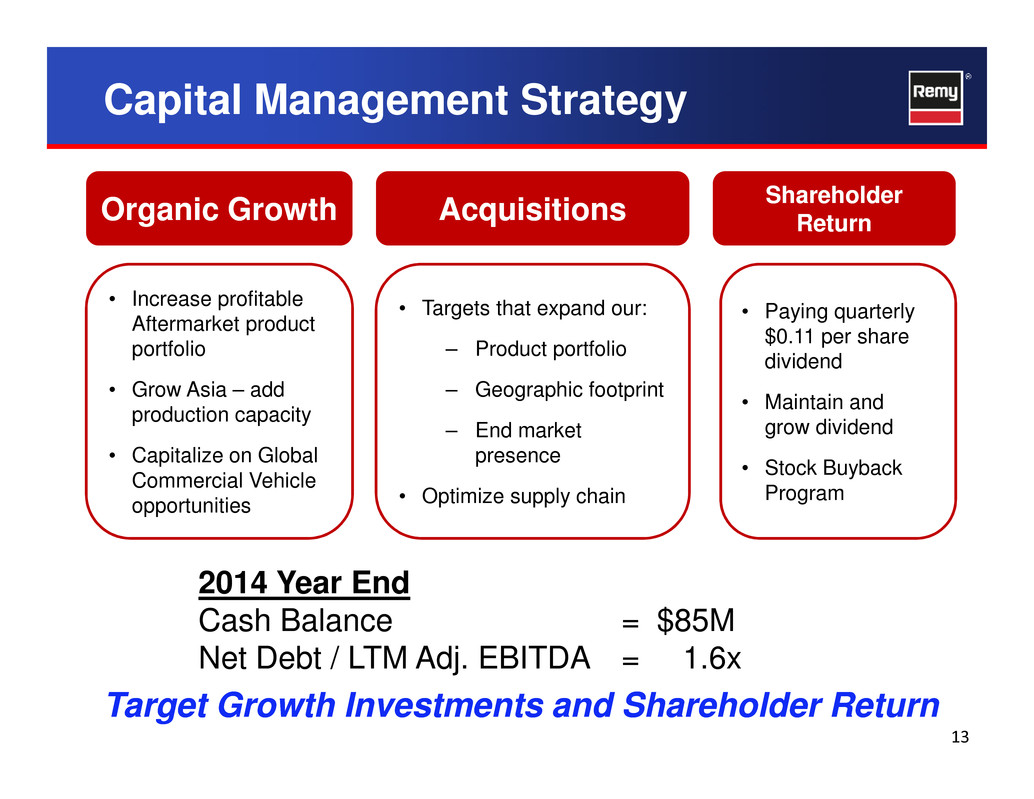

Capital Management Strategy Organic Growth Acquisitions ShareholderReturn • Increase profitable Aftermarket product portfolio • Grow Asia – add • Targets that expand our: – Product portfolio – Geographic footprint • Paying quarterly $0.11 per share dividend • Maintain and 13 production capacity • Capitalize on Global Commercial Vehicle opportunities – End market presence • Optimize supply chain grow dividend • Stock Buyback Program 2014 Year End Cash Balance = $85M Net Debt / LTM Adj. EBITDA = 1.6x Target Growth Investments and Shareholder Return

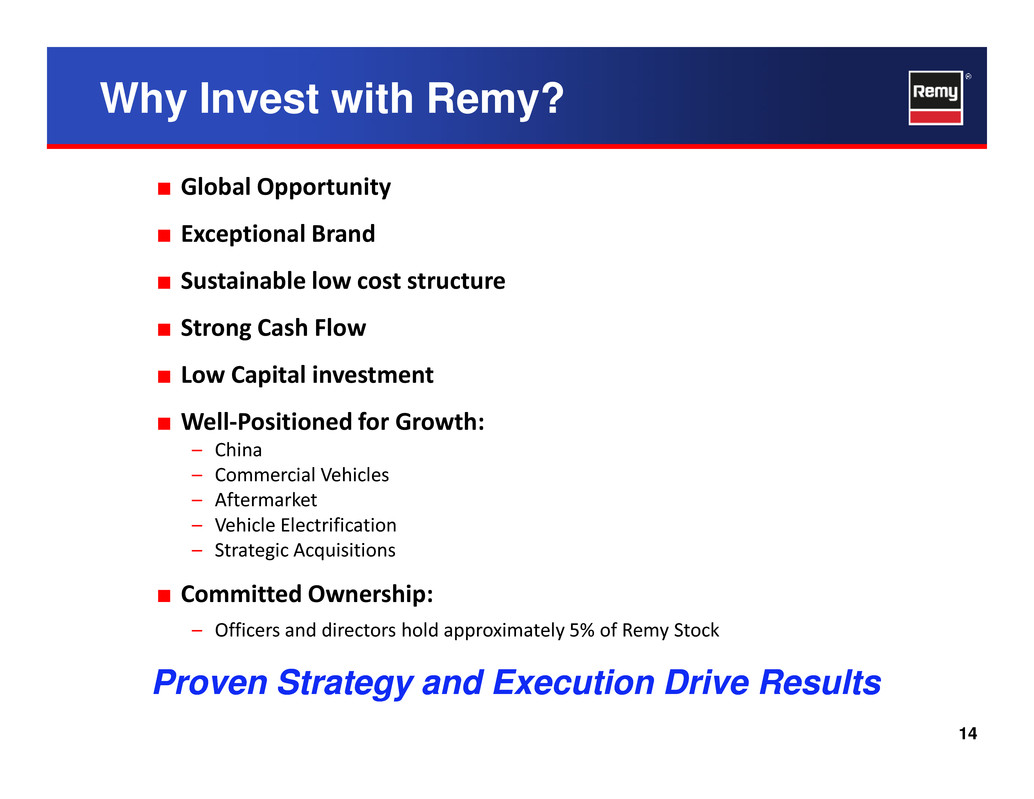

Why Invest with Remy? ■ Global Opportunity ■ Exceptional Brand ■ Sustainable low cost structure ■ Strong Cash Flow ■ Low Capital investment 14 Proven Strategy and Execution Drive Results ■ Well-Positioned for Growth: – China – Commercial Vehicles – Aftermarket – Vehicle Electrification – Strategic Acquisitions ■ Committed Ownership: – Officers and directors hold approximately 5% of Remy Stock

Appendix 15

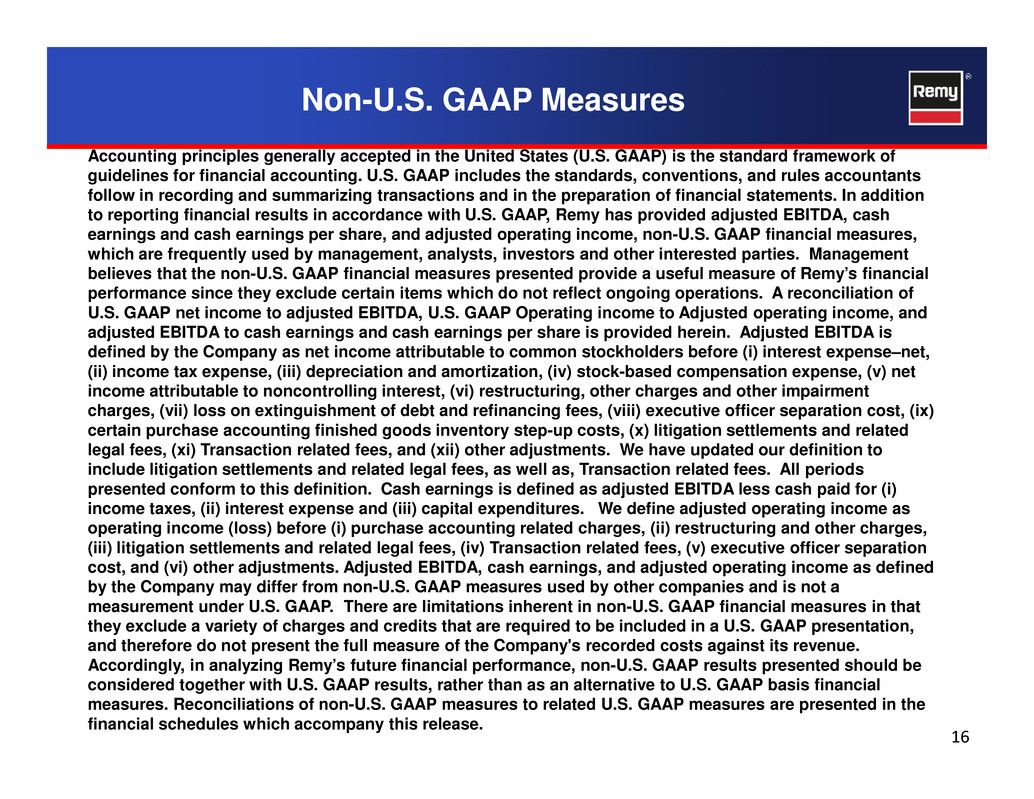

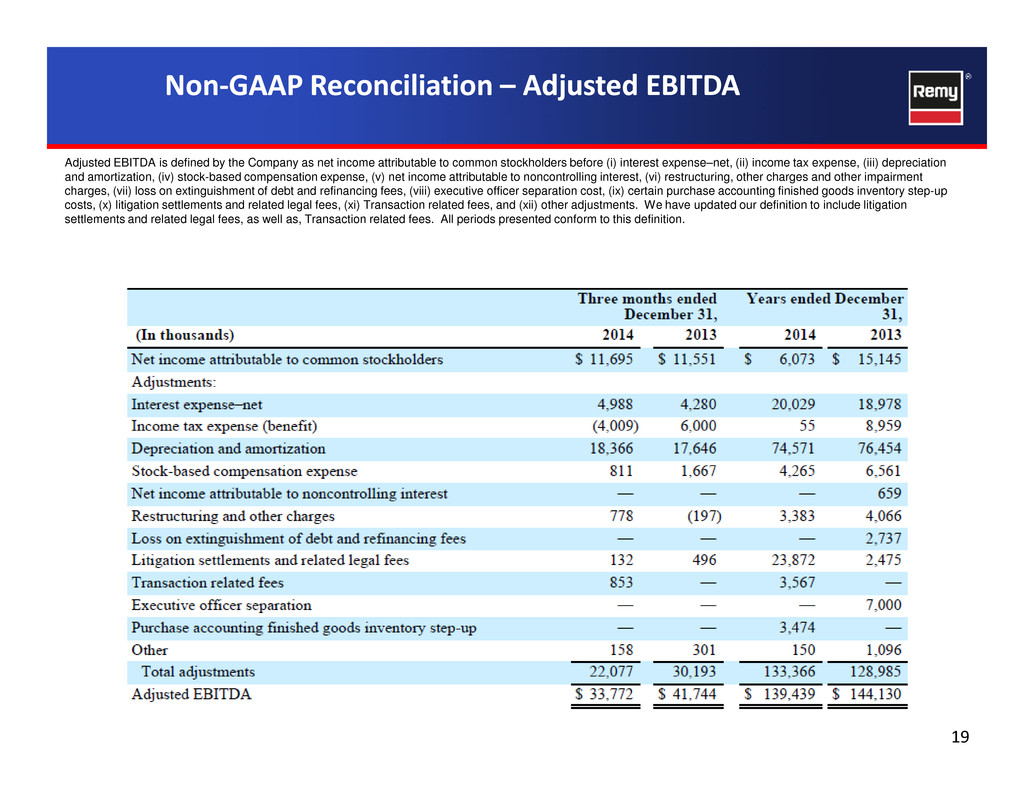

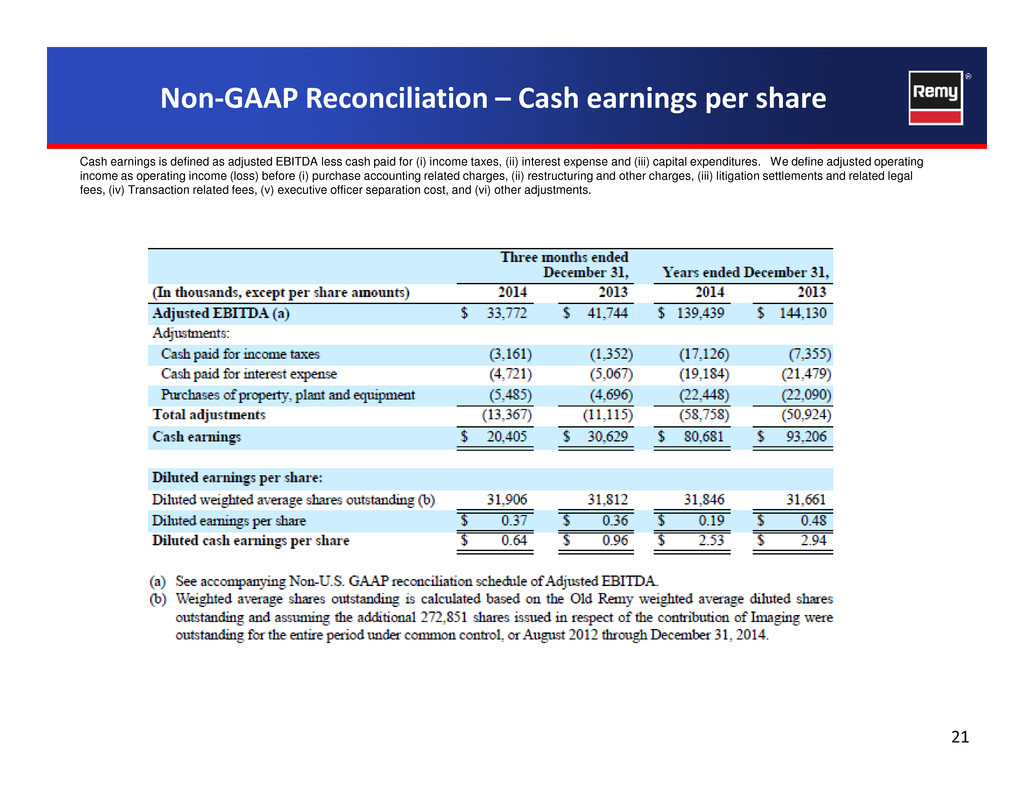

Non-U.S. GAAP Measures Accounting principles generally accepted in the United States (U.S. GAAP) is the standard framework of guidelines for financial accounting. U.S. GAAP includes the standards, conventions, and rules accountants follow in recording and summarizing transactions and in the preparation of financial statements. In addition to reporting financial results in accordance with U.S. GAAP, Remy has provided adjusted EBITDA, cash earnings and cash earnings per share, and adjusted operating income, non-U.S. GAAP financial measures, which are frequently used by management, analysts, investors and other interested parties. Management believes that the non-U.S. GAAP financial measures presented provide a useful measure of Remy’s financial performance since they exclude certain items which do not reflect ongoing operations. A reconciliation of U.S. GAAP net income to adjusted EBITDA, U.S. GAAP Operating income to Adjusted operating income, and adjusted EBITDA to cash earnings and cash earnings per share is provided herein. Adjusted EBITDA is defined by the Company as net income attributable to common stockholders before (i) interest expense–net, (ii) income tax expense, (iii) depreciation and amortization, (iv) stock-based compensation expense, (v) net income attributable to noncontrolling interest, (vi) restructuring, other charges and other impairment 16 charges, (vii) loss on extinguishment of debt and refinancing fees, (viii) executive officer separation cost, (ix) certain purchase accounting finished goods inventory step-up costs, (x) litigation settlements and related legal fees, (xi) Transaction related fees, and (xii) other adjustments. We have updated our definition to include litigation settlements and related legal fees, as well as, Transaction related fees. All periods presented conform to this definition. Cash earnings is defined as adjusted EBITDA less cash paid for (i) income taxes, (ii) interest expense and (iii) capital expenditures. We define adjusted operating income as operating income (loss) before (i) purchase accounting related charges, (ii) restructuring and other charges, (iii) litigation settlements and related legal fees, (iv) Transaction related fees, (v) executive officer separation cost, and (vi) other adjustments. Adjusted EBITDA, cash earnings, and adjusted operating income as defined by the Company may differ from non-U.S. GAAP measures used by other companies and is not a measurement under U.S. GAAP. There are limitations inherent in non-U.S. GAAP financial measures in that they exclude a variety of charges and credits that are required to be included in a U.S. GAAP presentation, and therefore do not present the full measure of the Company's recorded costs against its revenue. Accordingly, in analyzing Remy’s future financial performance, non-U.S. GAAP results presented should be considered together with U.S. GAAP results, rather than as an alternative to U.S. GAAP basis financial measures. Reconciliations of non-U.S. GAAP measures to related U.S. GAAP measures are presented in the financial schedules which accompany this release.

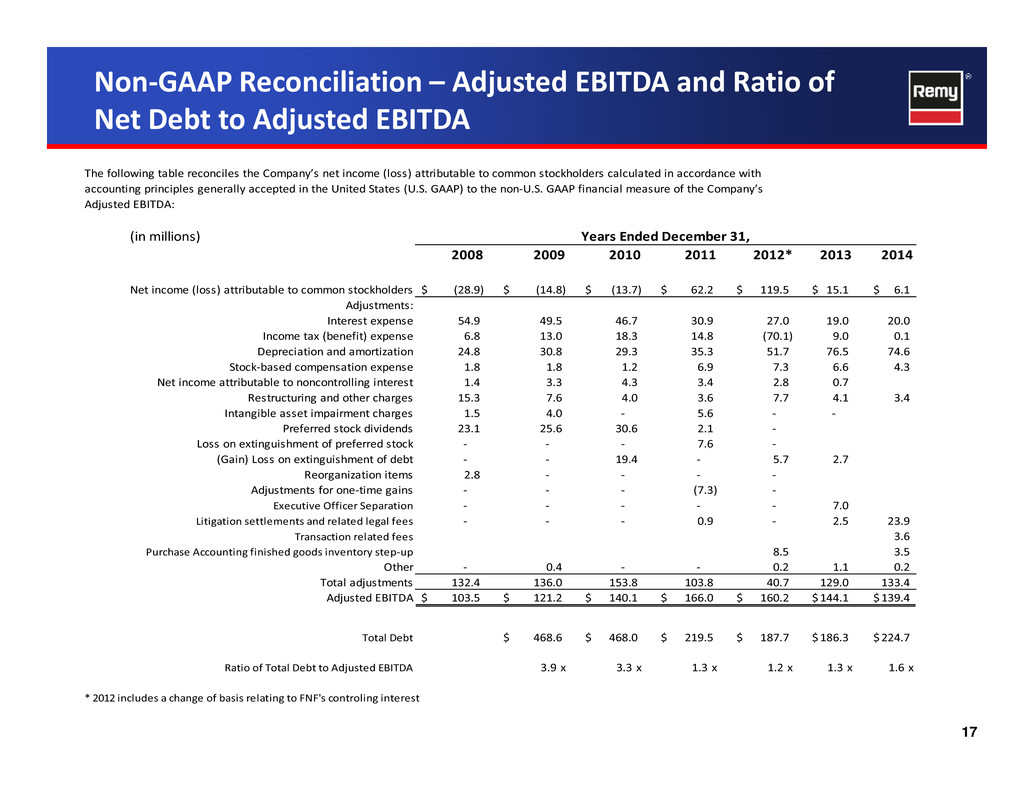

Non-GAAP Reconciliation – Adjusted EBITDA and Ratio of Net Debt to Adjusted EBITDA (in millions) Years Ended December 31, 2008 2009 2010 2011 2012* 2013 2014 Net income (loss) attributable to common stockholders (28.9)$ (14.8)$ (13.7)$ 62.2$ 119.5$ 15.1$ 6.1$ Adjustments: Interest expense 54.9 49.5 46.7 30.9 27.0 19.0 20.0 Income tax (benefit) expense 6.8 13.0 18.3 14.8 (70.1) 9.0 0.1 Depreciation and amortization 24.8 30.8 29.3 35.3 51.7 76.5 74.6 Stock-based compensation expense 1.8 1.8 1.2 6.9 7.3 6.6 4.3 Net income attributable to noncontrolling interest 1.4 3.3 4.3 3.4 2.8 0.7 Restructuring and other charges 15.3 7.6 4.0 3.6 7.7 4.1 3.4 The following table reconciles the Company’s net income (loss) attributable to common stockholders calculated in accordance with accounting principles generally accepted in the United States (U.S. GAAP) to the non-U.S. GAAP financial measure of the Company’s Adjusted EBITDA: 17 Intangible asset impairment charges 1.5 4.0 - 5.6 - - Preferred stock dividends 23.1 25.6 30.6 2.1 - Loss on extinguishment of preferred stock - - - 7.6 - (Gain) Loss on extinguishment of debt - - 19.4 - 5.7 2.7 Reorganization items 2.8 - - - - Adjustments for one-time gains - - - (7.3) - Executive Officer Separation - - - - - 7.0 Litigation settlements and related legal fees - - - 0.9 - 2.5 23.9 Transaction related fees 3.6 Purchase Accounting finished goods inventory step-up 8.5 3.5 Other - 0.4 - - 0.2 1.1 0.2 Total adjustments 132.4 136.0 153.8 103.8 40.7 129.0 133.4 Adjusted EBITDA 103.5$ 121.2$ 140.1$ 166.0$ 160.2$ 144.1$ 139.4$ Total Debt 468.6$ 468.0$ 219.5$ 187.7$ 186.3$ 224.7$ Ratio of Total Debt to Adjusted EBITDA 3.9 x 3.3 x 1.3 x 1.2 x 1.3 x 1.6 x * 2012 includes a change of basis relating to FNF's controling interest

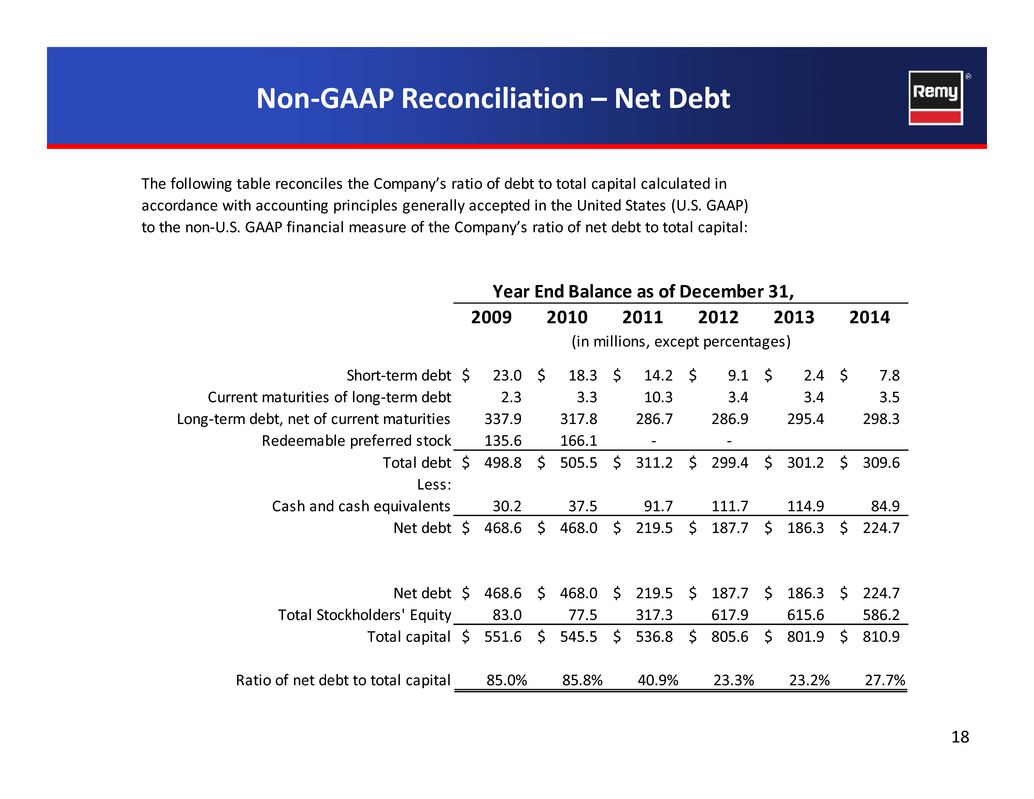

Non-GAAP Reconciliation – Net Debt 2009 2010 2011 2012 2013 2014 (in millions, except percentages) Short-term debt 23.0$ 18.3$ 14.2$ 9.1$ 2.4$ 7.8$ Current maturities of long-term debt 2.3 3.3 10.3 3.4 3.4 3.5 The following table reconciles the Company’s ratio of debt to total capital calculated in accordance with accounting principles generally accepted in the United States (U.S. GAAP) to the non-U.S. GAAP financial measure of the Company’s ratio of net debt to total capital: Year End Balance as of December 31, 18 18 Long-term debt, net of current maturities 337.9 317.8 286.7 286.9 295.4 298.3 Redeemable preferred stock 135.6 166.1 - - Total debt 498.8$ 505.5$ 311.2$ 299.4$ 301.2$ 309.6$ Less: Cash and cash equivalents 30.2 37.5 91.7 111.7 114.9 84.9 Net debt 468.6$ 468.0$ 219.5$ 187.7$ 186.3$ 224.7$ Net debt 468.6$ 468.0$ 219.5$ 187.7$ 186.3$ 224.7$ Total Stockholders' Equity 83.0 77.5 317.3 617.9 615.6 586.2 Total capital 551.6$ 545.5$ 536.8$ 805.6$ 801.9$ 810.9$ Ratio of net debt to total capital 85.0% 85.8% 40.9% 23.3% 23.2% 27.7%

Non-GAAP Reconciliation – Adjusted EBITDA Adjusted EBITDA is defined by the Company as net income attributable to common stockholders before (i) interest expense–net, (ii) income tax expense, (iii) depreciation and amortization, (iv) stock-based compensation expense, (v) net income attributable to noncontrolling interest, (vi) restructuring, other charges and other impairment charges, (vii) loss on extinguishment of debt and refinancing fees, (viii) executive officer separation cost, (ix) certain purchase accounting finished goods inventory step-up costs, (x) litigation settlements and related legal fees, (xi) Transaction related fees, and (xii) other adjustments. We have updated our definition to include litigation settlements and related legal fees, as well as, Transaction related fees. All periods presented conform to this definition. 19 19

square4 Production Rates: – Global LD Production up 1.8% – North America MD/HD Production up 9.2% – Off highway production down 9.3% Guidance Assumptions 20 square4 Currency & Commodities: – Euro @ 1.12 – Korean Won @ 1099.2 – Brazil Real @ 2.80 – Copper @ $2.88 per pound

Non-GAAP Reconciliation – Cash earnings per share Cash earnings is defined as adjusted EBITDA less cash paid for (i) income taxes, (ii) interest expense and (iii) capital expenditures. We define adjusted operating income as operating income (loss) before (i) purchase accounting related charges, (ii) restructuring and other charges, (iii) litigation settlements and related legal fees, (iv) Transaction related fees, (v) executive officer separation cost, and (vi) other adjustments. 21 21