Attached files

| file | filename |

|---|---|

| EX-23.3 - EX-23.3 - PAR PHARMACEUTICAL HOLDINGS, INC. | d880840dex233.htm |

| EX-23.2 - EX-23.2 - PAR PHARMACEUTICAL HOLDINGS, INC. | d880840dex232.htm |

| EX-23.4 - EX-23.4 - PAR PHARMACEUTICAL HOLDINGS, INC. | d880840dex234.htm |

Table of Contents

As filed with the Securities and Exchange Commission on May 11, 2015

Registration No. 333-202710

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Par Pharmaceutical Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 2834 | 46-0634834 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

One Ram Ridge Road

Chestnut Ridge, New York 10977

(845) 573-5500

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Paul V. Campanelli

Chief Executive Officer

Par Pharmaceutical Holdings, Inc.

One Ram Ridge Road

Chestnut Ridge, New York 10977

(845) 573-5500

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Patrick O’Brien, Esq. Ropes & Gray LLP Prudential Tower 800 Boylston Street Boston, MA 02199 (617) 951-7000 |

Barry J. Gilman, Esq. Par Pharmaceutical Holdings, Inc. One Ram Ridge Road Chestnut Ridge, New York 10977 (845) 573-5500 |

William V. Fogg, Esq. Cravath, Swaine & Moore LLP Worldwide Plaza 825 Eighth Avenue New York, New York 10019 (212) 474-1000 |

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨ |

Accelerated filer ¨ | Non-accelerated filer x | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion

Preliminary prospectus dated May 11, 2015

Prospectus

shares

Par Pharmaceutical Holdings, Inc.

Common stock

This is the initial public offering of common stock of Par Pharmaceutical Holdings, Inc. We are selling shares of our common stock and the selling stockholders identified in this prospectus are selling shares of our common stock. We will not receive any proceeds from the sale of shares being sold by the selling stockholders.

Prior to the offering, there has been no public market for our common stock. We expect the public offering price to be between $ and $ per share. We intend to apply to have our common stock listed on the New York Stock Exchange under the symbol “PRX.”

We and the selling stockholders have granted the underwriters an option to purchase up to an additional shares of our common stock at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus.

After the completion of this offering, investment funds affiliated with TPG Global, LLC will continue to own a majority of the voting power of our outstanding shares of common stock. As a result, we expect to be a “controlled company” within the meaning of the corporate governance standards of the New York Stock Exchange. See “Principal and selling stockholders.”

Investing in the common stock involves risks. See ‘‘Risk factors’’ beginning on page 19 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful and complete. Any representation to the contrary is a criminal offense.

| Per share | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount |

$ | $ | ||||||

| Proceeds to us, before expenses(1) |

$ | $ | ||||||

| Proceeds to selling stockholders, before expenses |

$ | $ | ||||||

| (1) | We have agreed to reimburse the underwriters for certain expenses in connection with this offering. See “Underwriting (conflicts of interest).” |

The underwriters expect to deliver the shares of common stock to investors on or about , 2015.

| J.P. Morgan | Goldman, Sachs & Co. | |||||

| Citigroup | Morgan Stanley | |||||

| BofA Merrill Lynch | Deutsche Bank Securities | Evercore ISI | ||

| RBC Capital Markets | TPG Capital BD, LLC | BMO Capital Markets | Mizuho | |||

Prospectus dated , 2015.

Table of Contents

| 1 | ||||

| 19 | ||||

| 52 | ||||

| 54 | ||||

| 55 | ||||

| 56 | ||||

| 57 | ||||

| 59 | ||||

| Management’s discussion and analysis of financial condition and results of operations |

65 | |||

| 115 | ||||

| 147 | ||||

| 155 | ||||

| 180 | ||||

| 182 | ||||

| 184 | ||||

| 189 | ||||

| 193 | ||||

| Material United States federal income tax considerations for non-U.S. holders |

195 | |||

| 200 | ||||

| 212 | ||||

| 212 | ||||

| 212 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus or in any free writing prospectus that we authorize to be distributed to you. Neither we nor the underwriters have authorized anyone to provide you with different information, and neither we nor the underwriters take responsibility for any other information others may give you. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover, regardless of time of delivery of this prospectus or of any sale of our common stock. Our business, prospects, financial condition and results of operations may have changed since that date.

i

Table of Contents

Industry and market data

This prospectus includes market share, ranking, industry data and forecasts that we obtained from industry publications and surveys, including from IMS Health Incorporated (“IMS Health”) and EvaluatePharma, a service of Evaluate Ltd., public filings and internal company sources. Industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. Statements as to our market position and ranking are based on market data currently available to us, management’s estimates, and assumptions we have made regarding the size of our markets within our industry.

Trademarks and service marks

We own or have rights to trademarks, service marks or trade names that we use in connection with the operation of our business. For example, our names and logos are protected. Some of the trademarks we own or have the right to use include “Par,” “Par Pharmaceutical,” “Par Pharmaceutical Companies, Inc.,” “Par Formulations,” “Nascobal,” “Megace,” “Vasostrict,” “Adrenalin” and “Aplisol.” We have applied for trademarks of “Par Specialty Pharmaceuticals” and “Par Sterile Products.” All other trademarks or service marks appearing in this prospectus that are not identified as marks owned by us are the property of their respective owners.

Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may be listed without the ®, SM and TM symbols, but we will assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks and trade names.

ii

Table of Contents

This summary highlights information contained in other parts of this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in shares of our common stock and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. You should read the entire prospectus carefully, especially “Risk factors” and our financial statements and the related notes, before deciding to buy shares of our common stock. This summary contains forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from the results discussed in the forward-looking statements as a result of certain factors, including those set forth in “Risk factors” and “Cautionary note regarding forward-looking statements.”

In this prospectus, the terms “we,” “us,” “our,” “Company,” “Issuer” and other similar terms refer to Par Pharmaceutical Holdings, Inc. and its subsidiaries, including Par Pharmaceutical Companies, Inc. (“Par Pharmaceutical Companies”), unless expressly stated otherwise or the context otherwise requires. References in this prospectus to fiscal years are to our fiscal years, which end on December 31.

On September 28, 2012, pursuant to an Agreement and Plan of Merger, we were acquired by investment funds affiliated with TPG Global, LLC (together with its affiliates, “TPG” or the “Sponsor”) and certain co-investors (the “Merger”). Please note that our discussion of certain financial information for the year ended December 31, 2012 includes data from the “Predecessor” period, which covers the period preceding the Merger (January 1, 2012 to September 28, 2012) and data from the “Successor” period, which covers the period following the inception of the Company (July 12, 2012 (date of “inception”) to December 31, 2012), on a combined basis. Although this presentation of financial information on a combined basis does not comply with U.S. generally accepted accounting principles (“GAAP”), we believe it provides a reasonable method of comparison to the other periods presented in this prospectus. The data is being presented for analytical purposes only. Combined operating results (i) have not been prepared on a pro forma basis as if the Merger occurred on the first day of the period, (ii) may not reflect the actual results we would have achieved absent the Merger and (iii) may not be predictive of future results of operations.

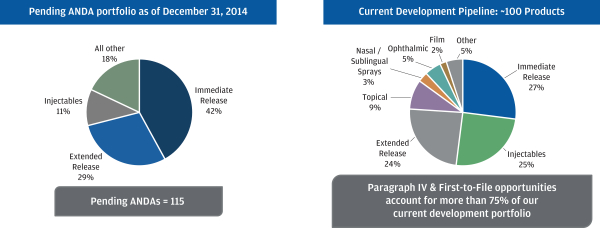

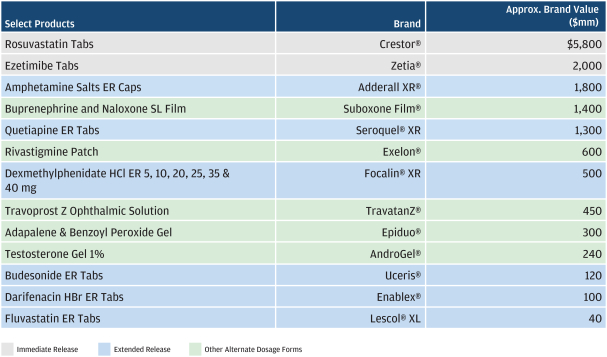

Our company

We are a leading U.S. pharmaceutical company specializing in developing, licensing, manufacturing, marketing and distributing generic drugs. We have a generics portfolio of approximately 95 products across an extensive range of dosage forms and delivery systems, including immediate and extended release oral solids (tablets, orally disintegrating tablets, capsules and powders), injectables, nasal sprays, ophthalmics (which are sterile pharmaceutical preparations administered for ocular conditions) and transdermal patches (which are medicated adhesive patches designed to deliver the drug through the skin). Our focus is on high-barrier-to-entry products that are difficult to formulate, difficult to manufacture or face complex legal and regulatory challenges. These products often see limited competition, tend to be more profitable than commoditized generic drugs and often have longer life cycles. We have an integrated team-based approach to product development that combines our formulation, regulatory, legal, manufacturing and commercial capabilities. As of December 31, 2014, we had over 200 products in our pipeline, which included 115 Abbreviated New Drug Applications (“ANDA”) pending with the U.S. Food and Drug Administration (the “FDA”) representing $36.7 billion of combined annual sales for the corresponding branded products (“branded product sales”) in 2014, including 32 potential first-to-file and six potential first-to-market opportunities.

Our company operates in two business segments, Par Pharmaceutical, which includes generic products marketed under Par Pharmaceutical and sterile products marketed under Par Sterile Products, LLC (“Par

1

Table of Contents

Sterile,” formerly known as JHP Pharmaceuticals, LLC), and Par Specialty Pharmaceuticals (“Par Specialty,” formerly known as Strativa Pharmaceuticals), which markets two branded products. For the year ended December 31, 2014, we had revenue of $1,308.6 million and adjusted EBITDA of $433.8 million. Our product development strategy and ability to execute strategic transactions has resulted in a compound annual revenue growth rate of 12.2% and an adjusted EBITDA compound annual growth rate of 20.4% over the last three years. Our goal is to strengthen our position as a leading pharmaceutical company by developing and commercializing generic drugs with limited competition, significant barriers to entry and longer life cycles.

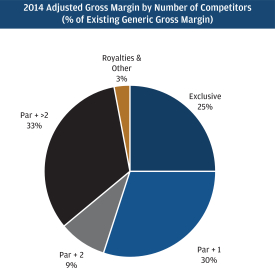

Our approach to product development is to target high-barrier-to-entry generic products, including first-to-file or first-to-market opportunities. A “first-to-file” product refers to an ANDA that is the first ANDA filed containing a Paragraph IV patent challenge to the corresponding branded product, which offers the opportunity for 180 days of generic marketing exclusivity if approved by the FDA and if we are successful in litigating the patent challenge. A “first-to-market” product refers to a product that is the first marketed generic equivalent of a branded product for reasons apart from statutory marketing exclusivity, such as the generic equivalent of a branded product that is difficult to formulate or manufacture. Our potential first-to-file and first-to-market opportunities account for 33% of our pipeline of 115 ANDAs, which we believe is one of the highest in the industry and demonstrates our differentiated development capabilities. As a result, more than half of our generic adjusted gross margin in 2014 was earned from products that are either exclusive or have two or fewer competitors, which we believe leads to more sustainable market share and profitability for our product portfolio.

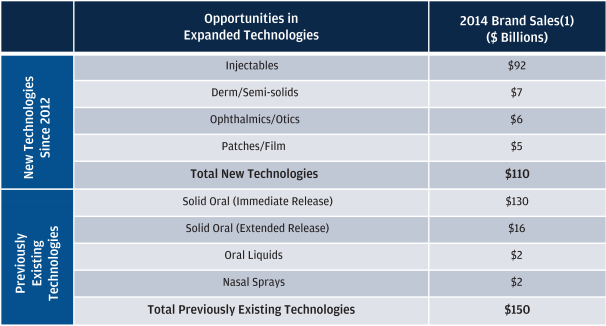

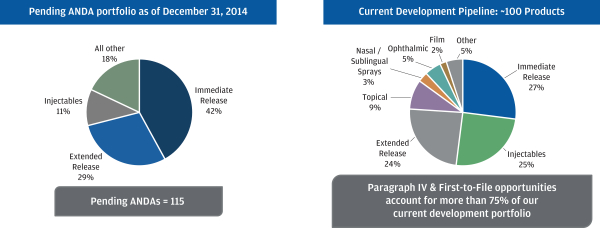

We have invested significant resources and focus to expand our technology capabilities to develop a range of products in-house, including immediate release oral solids and alternate dosage forms such as extended-release oral solids, injectables, topicals, nasal sprays, ophthalmics, films and transdermal patches. Our development pipeline reflects these efforts. As of December 31, 2014, our pipeline included over 200 products, 115 of which are pending at the FDA and approximately 100 of which are in development. In addition to development capabilities, we have acquired bioequivalence and clinical end point study capabilities. We also entered into an agreement to acquire a dedicated, lower-cost active pharmaceutical ingredient (“API”) development and manufacturing facility in India, which we plan to operate upon the closing of the acquisition. As a result of these investments, we have the flexibility to more fully control the management and development of key products from formulation stage to commercialization. The following charts demonstrate our pipeline of new product opportunities and our portfolio of alternate dosage products:

We are committed to high product quality standards and allocate significant resources and focus to quality assurance, quality control and manufacturing excellence. We operate five FDA approved manufacturing

2

Table of Contents

facilities, four of which are located in the United States and one in India, with ample capacity and room for expansion. In addition, our facilities have passed all recent FDA inspections. As a result of our operational excellence and high quality and compliance standards, we have not received any warning letters from the FDA with respect to manufacturing plants we have operated since before 2000, which we believe differentiates us from other generic manufacturers. Our track record in high-quality manufacturing and supply reliability is most recently demonstrated by the 2014 CVS Health Supplier Partner Award based on providing innovative product offerings, commitment to customer service and consistency of supply.

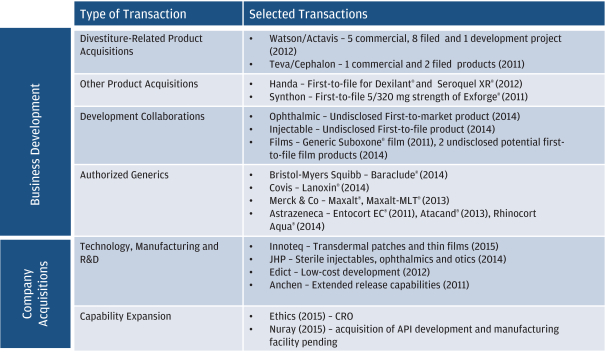

Our senior management team has a strong track record and established history of executing and integrating business development opportunities and strategic acquisitions. Since 2011, we have completed and integrated over 20 business development transactions and six company acquisitions. These transactions have enhanced and deepened our presence in the industry by expanding our portfolio of products in development and manufacturing capabilities. We believe we are a partner of choice to brand companies seeking an authorized generics partner. Authorized generics are generic versions of branded drugs licensed to generic drug companies by brand drug companies that may be sold during (and after) the statutory exclusivity period granted to the first-to-file generic equivalent to the branded product. We also believe we are a partner of choice to large generic companies for product divestitures that arise as a result of industry consolidation, and for smaller development organizations looking for a partner that has deep experience with product development, patent litigation strategy and a strong market presence.

Recent performance

Paul Campanelli was appointed as our Chief Executive Officer in September 2012 following the Merger. Prior to the Merger, Mr. Campanelli served as Par’s Chief Operating Officer, having held positions of increasing responsibility since joining the Company in 2001. Over the past two years, under Mr. Campanelli’s leadership, we have made significant investments in expanding our research, development and manufacturing capabilities. These investments have resulted in:

| • | submitting 61 ANDAs since the Merger, resulting in a total of 115 ANDAs pending at the FDA as of December 31, 2014, compared to 89 ANDAs pending as of December 31, 2012; |

| • | diversifying our development portfolio from 83 development projects with 60 alternate dosage forms (including extended release solid oral dose) at December 31, 2012 to approximately 100 products in development with 70 alternate dosage forms (including extended release solid oral dose) at December 31, 2014; |

| • | diversifying our manufacturing capabilities from largely solid oral dose capabilities in 2012 to capabilities covering almost all generic presentations, such as gels, nasal sprays, ophthalmics, films, transdermal patches and injectable products; |

| • | expanding our core competencies to provide us the flexibility to more fully control key product development by acquiring Par Biosciences Private Limited (“Par Biosciences” formerly known as Ethics Bio Lab Private Limited), a Chennai, India-based clinical research organization (“CRO”) that conducts bioequivalence and clinical end point studies, and by lowering development and manufacturing costs for a portion of our product portfolio through the utilization of Par Formulations Private Limited (formerly known as Edict Pharmaceuticals Private Limited), a Chennai, India-based developer and manufacturer of generic pharmaceuticals; |

| • | enhancing our portfolio through business development and product acquisitions, including our November 2012 acquisition of a mix of marketed products, ANDAs awaiting FDA approval and one late-stage development product in connection with Watson Pharmaceuticals, Inc.’s (“Watson”) acquisition of Actavis Group; |

3

Table of Contents

| • | diversifying our revenue base such that over half of our total adjusted gross margin is derived from products that are either exclusive or have two or fewer competitors for the year ended December 31, 2014; and |

| • | establishing Par Laboratories Europe, Ltd. in 2015, a U.K.-based business office which will serve as an entry point into the European generics market. |

In addition, the following financial metrics highlight improvements since the fiscal year ended December 31, 2011:

| • | total revenue increased from $926.1 million for the year ended December 31, 2011 to $1,308.6 million for the year ended December 31, 2014, representing a compounded annual growth rate (“CAGR”) of 12.2%; |

| • | adjusted gross margin increased from $406.0 million for the year ended December 31, 2011 to $674.7 million for the year ended December 31, 2014, representing a CAGR of 18.5%; |

| • | adjusted gross margin as a percentage of revenue increased from 43.8% for the year ended December 31, 2011 to 51.2% for the year ended December 31, 2014; |

| • | adjusted EBITDA increased from $248.5 million for the year ended December 31, 2011 to $433.8 million for the year ended December 31, 2014, representing a CAGR of 20.4%; and |

| • | adjusted EBITDA as a percentage of revenue increased from 26.8% for the year ended December 31, 2011 to 33.1% for the year ended December 31, 2014. |

Adjusted gross margin and adjusted EBITDA are non-GAAP financial measures and should not be considered substitutes for and are not comparable with net income or net operating income as determined in accordance with GAAP. We recorded a net loss of $105.5 million for the year ended December 31, 2014, a net loss of $105.9 million for the year ended December 31, 2013 and a net loss of $33.5 million for the combined 2012 year-end period. For additional information regarding these financial measures, including an explanation and reconciliation of our non-GAAP measures to the most directly comparable measure presented in accordance with GAAP, see “Summary historical and pro forma condensed consolidated financial data” included elsewhere in this prospectus. The Merger was accounted for as a business combination and therefore resulted in a new accounting basis. Our results of operations for the year ended 2012 presented elsewhere in this prospectus are presented for the predecessor and successor periods, which relate to the periods preceding the Merger (January 1, 2012 through September 28, 2012) and succeeding (July 12, 2012 (inception) through December 31, 2012) the inception date, respectively. The successor period reflects the new accounting basis established for us as of the inception date. In the discussion above, we present our net loss for the combined 2012 full year period for comparative purposes, using the mathematical sum of the net loss reported for the successor and predecessor periods. In addition, throughout the document we present certain other 2012 measures on a combined basis. Such information represents non-GAAP measures because Successor is on a new basis of accounting. These measures should not be considered substitutes for and are not compatible with GAAP measures. The information is presented in this manner as we believe it enables a reasonable comparison. This financial information may not reflect the actual financial results we would have achieved absent the Merger and may not be predictive of future financial results. For a presentation of our results of operations for the year ended 2012 on a GAAP basis, showing the separate predecessor and successor periods, see “Selected historical consolidated financial data.”

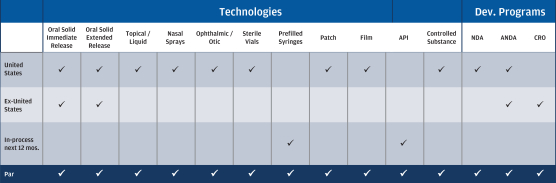

Our capabilities

Since 2011, we have strategically expanded our technology, manufacturing, handling and development capabilities, shifting from primarily solid oral immediate and extended release products to a diversified array of dosage forms. These expanded technologies represent a sizeable market opportunity, with 2014 branded

4

Table of Contents

product sales utilizing these technologies of approximately $110 billion, according to IMS Health . As of December 31, 2014, our development product portfolio included 26 immediate-release oral solids, 24 injectables, 23 extended-release oral solids, eight topicals, five ophthalmics, three nasal sprays and two films. As of December 31, 2014, approximately 70% of our development portfolio targets alternate dosage forms such as extended-release oral solids, injectables, topicals, nasal sprays, ophthalmics, films and transdermal patches.

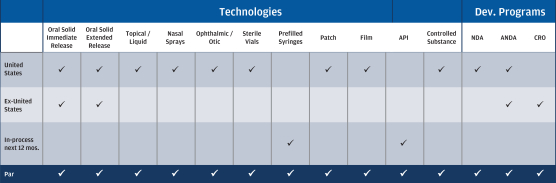

The following graphic shows Par Pharmaceutical’s current capabilities and new in-process opportunities:

Our comprehensive suite of technology, manufacturing and development capabilities increases the likelihood of success in commercializing high-barrier-to-entry products and obtaining first-to-file and first-to-market status on our products, yielding more sustainable market share and profitability.

Our strengths

Our senior executive team has a strong track record of product selection and development, and has launched 47 new products since 2011, eight of which have been first-to-file and one of which has been first-to-market. We have an integrated team-based approach to product development that combines our formulation, regulatory, legal, manufacturing and commercial capabilities. We believe that the strengths of Par are as follows:

Focused approach to product selection targeting high-barrier-to-entry products with long-term value. We specialize in high-barrier-to-entry products that are difficult to formulate, difficult to manufacture or face complex legal and regulatory challenges. These products often see limited competition and tend to be more profitable than commoditized generic drugs. A large portion of our generics gross margin comes from products where we are either the exclusive generic or have two or fewer competitors. As of December 31, 2014, among our top ten generic drugs by revenue, more than half maintain market shares in excess of 50%.

Full suite of technology capabilities. We have a full suite of dosage forms, including immediate release oral solids and alternate dosage forms such as extended release oral solids, injectables, topicals, nasal sprays, ophthalmics, films and transdermal patches. Our acquisition of Par Biosciences provides us with bioequivalence study capabilities, which allows us to control the speed, cost and execution of development. In addition, we are in the process of acquiring an API development and manufacturing facility. These expanded capabilities provide the flexibility to more fully control the management and development of key products from formulation stage to commercialization.

Diverse portfolio of products. We have a generics portfolio of approximately 95 products across an extensive range of dosage forms and delivery systems. In addition to our current products, our pipeline consists of new products that will further expand and diversify our portfolio. We believe our broad suite of products has allowed us to increase our market presence and develop long term relationships with customers.

5

Table of Contents

Deep, targeted pipeline with high visibility into future launches. We have a large number of products pending regulatory approval and a robust pipeline of products in development. As of December 31, 2014, we had 115 ANDAs pending with the FDA representing $36.7 billion of combined branded product sales in 2014, including 32 potential first-to-file and six potential first-to-market opportunities representing $14.8 billion of combined branded product sales in 2014. Our potential first-to-file and first-to-market opportunities account for 33% of our pending ANDA pipeline, which we believe is one of the highest in the industry and differentiates our development capabilities. As of December 31, 2014, our Paragraph IV opportunities accounted for approximately 55% of our current development portfolio, and 70% of the development portfolio targets alternate dosage forms.

Commitment to manufacturing excellence with a culture of quality and compliance. We have invested significant resources and focus on quality assurance, quality control and manufacturing excellence. As of December 31, 2014, we operated five FDA approved manufacturing facilities, four of which are located in the United States and one in India, with ample capacity and room for expansion. As a result of our commitment to operational excellence and high quality and compliance standards, we have not received any warning letters from the FDA with respect to manufacturing plants we have operated since before 2000, which we believe differentiates us from other generic manufacturers.

Proven success in identifying and executing on business development and strategic acquisitions. We have successfully completed and integrated over 20 business development transactions and six company acquisitions since 2011, which has expanded our product portfolio, development capabilities and manufacturing platforms. Our experience and extensive network of relationships in the industry allows us to identify a significant number of opportunities and execute on them quickly and efficiently. Given our strong track record of success in executing similar transactions in the past in an effective and efficient manner, we believe that we are well positioned to compete for these potential opportunities.

Track record of strong top-line revenue growth and significant cash flow generation. We submitted 11, 21, 21 and 30 new ANDA filings during 2011, 2012, 2013 and 2014, respectively, and introduced 38 new generic products during that period. Driven by our diversification into alternate dosage forms and targeted product selection, our net product revenue has grown from $887.5 million in 2011 to $1,278.1 million in 2014, which represents a CAGR of 12.9% over that period, and our adjusted EBITDA has grown from $248.5 million in 2011 to $433.8 million in 2014, which represents a CAGR of 20.4% over that period. Our adjusted gross margin as a percentage of revenue has expanded from 43.8% in 2011 to 51.2% in 2014.

Experienced management team with a strong track record of operational execution. We have a highly experienced leadership team that is committed to developing, manufacturing, marketing and distributing safe, innovative and quality pharmaceuticals. The four members of our executive management team average approximately 25 years of experience in the pharmaceutical industry, and each has been with us for at least nine years, with the exception of Terrance Coughlin, our Chief Operating Officer, who joined us in April 2014. Our leadership team has a proven track record of high quality manufacturing and supply reliability. This leadership team has enabled us to successfully execute on our business strategy, growing revenue and enhancing profitability.

6

Table of Contents

Our strategy

Our goal is to strengthen our position as a leading pharmaceutical company by developing and commercializing generic drugs with limited competition, high barriers to entry and longer life cycles. In implementing our strategy, we are focused on the following:

Grow our core business in attractive high-value segments. Our strategy focuses on high-value generic products, including first-to-file and first-to-market opportunities. By specializing in high-barrier-to-entry products that are either difficult to manufacture and/or present complex legal and regulatory challenges, we are able to market products that are more profitable and longer-lived relative to our competitors. As a result, over half of our generic adjusted gross margin as of December 31, 2014 was earned from products that are either exclusive or have two or fewer competitors.

Advance our pipeline to continue building our portfolio. We have expanded our development portfolio from approximately 60 products in development at December 31, 2011 to 100 as of December 31, 2014. We have also further diversified our product pipeline from approximately 30 to 70 products in alternate dosage forms as of the same periods. We have grown our ANDAs pending with the FDA from 57 products at December 31, 2011 to 115 products at December 31, 2014, including 32 potential first-to-file and six potential first-to-market opportunities. We expect to continue our research and development efforts to strengthen and grow our portfolio and we expect to submit approximately 20 to 25 new ANDA filings during each of 2015, 2016 and 2017.

Strategically expand our technology capabilities across development and manufacturing. We have made significant investments to enhance our technology platforms and have expanded our capabilities to manufacture products in alternate dosage forms. We believe this will become an increasingly strategic asset over time. We will continue to invest in expanding our technology capabilities across development and manufacturing to develop high-barrier-to-entry products.

Build upon our success in strategic acquisitions and business development. We have an established history of successfully executing and integrating strategic acquisitions that have enhanced and deepened our presence in our industry. Through these acquisitions, we have expanded our portfolio of products, pipeline, manufacturing and technological capabilities. We expect business development to remain a priority for us as we continue to identify and execute on transactions that fit our strategy and focus on high-barrier-to-entry products.

Leverage existing platform to drive operational efficiency. As a well-established industry player, we have built broad infrastructure in areas of technology, manufacturing, development, sales and distribution. This enables us to go from product selection to commercialization in an efficient manner, driving sales growth and enhancing profitability. As our portfolio expands, we can leverage these existing capabilities to accelerate bottom-line growth and margin expansion.

Risk factors

An investment in our common stock involves a high degree of risk. Any of the factors set forth under “Risk factors” may limit our ability to successfully execute our business strategy. You should carefully consider all of the information set forth in this prospectus and, in particular, should evaluate the specific factors set forth under “Risk factors” in deciding whether to invest in our common stock. Among these important risks are the following:

| • | If we are unable to successfully develop or commercialize new products, our operating results will suffer. |

| • | If we fail to obtain exclusive marketing rights for our generic products or fail to introduce these generic products on a timely basis, our revenues, gross margin and operating results may decline significantly. |

7

Table of Contents

| • | We face intense competition in the pharmaceutical industry from both brand and generic companies, which could significantly limit our growth and materially adversely affect our financial results. |

| • | Due to our dependence on a limited number of products, our business could be materially adversely affected if our key products do not perform as well as expected. |

| • | Our profitability depends on our major customers. If these relationships do not continue as expected, our business, condition (financial and otherwise), prospects and results of operations could materially suffer. |

| • | Our competitors, including brand pharmaceutical companies, or other third parties may allege that we are infringing their intellectual property, forcing us to expend substantial resources in resulting litigation, the outcome of which is uncertain. Any unfavorable outcome of such litigation, including losses related to “at-risk” product launches, could have a material adverse effect on our business, financial position and results of operations. |

| • | We are, and will continue to be in the future, a party to legal proceedings that could result in unexpected adverse outcomes. |

| • | Due to extensive regulation and enforcement in the pharmaceutical industry, we face significant uncertainties and potentially significant costs associated with our efforts to comply with applicable regulations. Failure to comply could result in material adverse effects to our business, financial position and results of operations. |

| • | The substantial indebtedness of our indirect subsidiary, Par Pharmaceutical Companies, could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or our industry and prevent us from meeting obligations on our indebtedness. |

For additional information about the risks we face, please see the section of this prospectus captioned “Risk factors” beginning on page 18 of this prospectus.

Our sponsor

TPG is a leading global private investment firm founded in 1992 with over $67 billion of assets under management as of December 31, 2014, and offices in San Francisco, Fort Worth, Austin, Beijing, Dallas, Hong Kong, Houston, London, Luxembourg, Melbourne, Moscow, Mumbai, New York, São Paulo, Shanghai, Singapore, Tokyo and Toronto. TPG has extensive experience with global public and private investments executed through leveraged buyouts, recapitalizations, spinouts, growth investments, joint ventures and restructurings. The firm’s investments span a variety of industries, including healthcare, financial services, travel and entertainment, technology, energy, industrials, retail, consumer, real estate and media and communications.

Following the completion of this offering, TPG will own approximately % of our common stock, or % if the underwriters’ option to purchase additional shares of our common stock is fully exercised. As a result, we expect to be a “controlled company” within the meaning of the corporate governance standards of the New York Stock Exchange (the “NYSE”). As a result, we will qualify for, and continue to rely on, exemptions from certain corporate governance requirements and you will not have the same protections afforded to stockholders of companies that are subject to such requirements. Additionally, TPG will continue to have significant influence over us and decisions made by stockholders and may have interests that differ from yours. See “Risk factors—Risks related to our common stock and this offering—TPG will continue to have significant influence over us after this offering, including control over decisions that require the approval of stockholders, which could limit your ability to influence the outcome of matters submitted to stockholders for a vote.”

8

Table of Contents

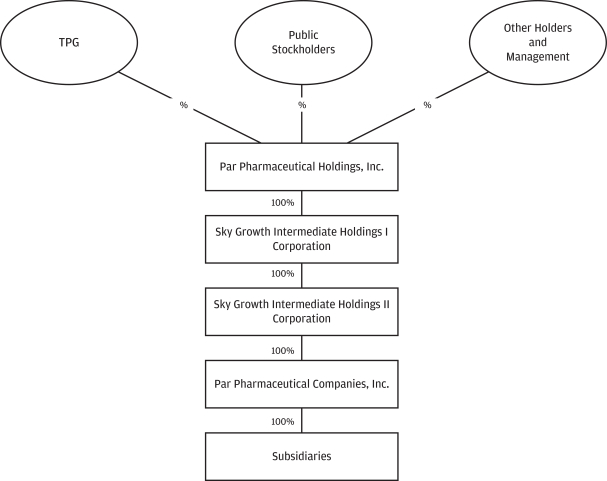

Corporate information and structure

Par Pharmaceutical Holdings, Inc. is a Delaware corporation that was formed on July 12, 2012 in connection with the Merger under the name Sky Growth Holdings Corporation. On March 4, 2015, Sky Growth Holdings Corporation changed its name to Par Pharmaceutical Holdings, Inc. The only material asset of Par Pharmaceutical Holdings, Inc. is the equity interest of Sky Growth Intermediate Holdings I Corporation, which is the holder of 100% of the equity interest of Sky Growth Intermediate Holdings II Corporation, which is the holder of 100% of the equity of Par Pharmaceutical Companies, Inc. and was the holding company prior to the Merger. Prior to the Merger, we conducted our operations through the subsidiaries of Par Pharmaceutical Companies, Inc. and we continue to do so subsequent to the Merger. Our principal executive offices are located at One Ram Ridge Road, Chestnut Ridge, New York 10977, and our telephone number at that address is (845) 573-5500. Our website is located at http://www.parpharm.com. Our website and the information contained on our website do not constitute part of this prospectus.

The following chart shows our simplified organization structure immediately following the consummation of this offering assuming no exercise of the underwriters’ option to purchase additional shares.

9

Table of Contents

The offering

| Common stock offered by us |

shares |

| Common stock offered by the selling stockholders |

shares |

| Common stock to be outstanding after this offering |

shares (or shares if the underwriters exercise their option to purchase additional shares in full) |

| Option to purchase additional shares |

The underwriters have an option for a period of 30 days to purchase up to additional shares of our common stock from us and additional shares of our common stock from the selling stockholders. |

| Use of proceeds |

We estimate that the net proceeds to us from this offering will be approximately $ million, or approximately $ million if the underwriters exercise their option to purchase additional shares in full, at an assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover of this prospectus, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds of this offering to repay indebtedness. We intend to use the remainder of the net proceeds, if any, for working capital and other general corporate purposes, including supporting our strategic growth opportunities in the future. We will not receive any of the proceeds from the sale of our common stock by the selling stockholders named in this prospectus. See “Use of proceeds.” |

| Dividend policy |

Our board of directors does not currently intend to pay dividends on our common stock. However, we expect to reevaluate our dividend policy on a regular basis following the offering and may, subject to compliance with the covenants contained in the agreements governing our indebtedness and other considerations, determine to pay dividends in the future. The declaration, amount and payment of any future dividends on shares of our common stock will be at the sole discretion of our board of directors, which may take into account general and economic conditions, our financial condition and results of operations, our available cash and current and anticipated cash needs, capital requirements, contractual, legal, tax and regulatory restrictions, the implications of the payment of dividends by us to our stockholders or by our subsidiaries to us, and any other factors that our board of directors may deem relevant. See “Dividend policy” and “Description of indebtedness.” |

| Principal stockholders |

Upon completion of this offering, TPG will continue to beneficially own a controlling interest in us. As a result, we intend to avail ourselves of the controlled company exemption under the rules of the NYSE. See “Risk factors” and “Management.” |

10

Table of Contents

| Risk factors |

You should read the “Risk factors” section of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. |

| Proposed NYSE ticker symbol |

“PRX” |

| Conflicts of Interest |

Affiliates of TPG Capital BD, LLC, an underwriter of this offering, own in excess of 10% of our issued and outstanding common stock. Therefore, a “conflict of interest” is deemed to exist under Rule 5121(f)(5)(B) of the Financial Industry Regulatory Authority (“FINRA”). In addition, because the TPG Funds (as defined under “Principal and selling stockholder”) are affiliates of TPG Capital BD, LLC and, as selling stockholders, will receive more than 5% of the net proceeds of this offering, a “conflict of interest” is also deemed to exist under FINRA Rule 5121(f)(5)(C)(ii). Accordingly, this offering will be made in compliance with the applicable provisions of FINRA Rule 5121. In accordance with FINRA Rule 5121(c), no sales of the shares will be made to any discretionary account over which TPG Capital BD, LLC exercises discretion without the prior specific written approval of the account holder. However, no “qualified independent underwriter” is required because the underwriters primarily responsible for managing this offering are free of any “conflict of interest,” as that term is defined in the rule. See “Use of proceeds” and “Underwriting (conflicts of interest).” |

The number of shares of common stock to be outstanding after this offering is based on 784,251,980 shares of common stock outstanding as of March 31, 2015 and excludes the following:

| • | 74,370,679 shares reserved for future issuance in connection with the exercise of outstanding stock options at a weighted-average exercise price of $0.82 per share; |

| • | 344,531 shares reserved for issuance upon vesting of restricted stock units; |

| • | 184,060 shares of common stock reserved for future issuance under our 2012 Equity Incentive Plan (the “2012 EIP”); and |

| • | shares of common stock reserved for future issuance under the 2015 Equity Incentive Plan (the “2015 EIP”), which shall take effect prior to the consummation of this offering. |

Unless otherwise indicated, this prospectus reflects and assumes the following:

| • | a -for- stock split on our common stock effected on , 2015; |

| • | the adoption of our amended and restated certificate of incorporation and our amended and restated bylaws, to be effective upon the closing of this offering; |

| • | no exercise by the underwriters of their option to purchase up to additional shares of our common stock in this offering; and |

| • | an initial public offering price of $ per share, the midpoint of the price range set forth on the cover of this prospectus. |

11

Table of Contents

Summary historical and pro forma condensed consolidated financial data

The following table sets forth summary historical consolidated financial data for the periods ended and at the dates indicated below. Our summary historical consolidated financial data as of December 31, 2013 (Successor) and December 31, 2014 (Successor) and for the years ended December 31, 2013 (Successor) and December 31, 2014 (Successor) and for the period from January 1, 2012 to September 28, 2012 (Predecessor) and from July 12, 2012 (inception) to December 31, 2012 (Successor) presented in this table has been derived from our historical audited consolidated financial statements included elsewhere in this prospectus. We derived the summary historical consolidated balance sheet data presented below as of December 31, 2012 (Successor) from our unaudited consolidated financial statements that are not included in this prospectus. Our summary historical condensed consolidated financial data for the periods as of and for the three months ended March 31, 2015 (Successor) and March 31, 2014 (Successor) presented in this table has been derived from our historical unaudited condensed consolidated financial statements included elsewhere in this prospectus. Our historical operating results are not necessarily indicative of future operating results.

On September 28, 2012, Sky Growth Acquisition Corporation, our wholly owned subsidiary, merged with and into Par Pharmaceutical Companies, which resulted in a change in basis of our assets and liabilities. Periods following our inception are referred to as the “Successor” periods. As a result of the Merger and the resulting change in basis of our assets and liabilities, the Predecessor and Successor period financial data is not comparable. Refer to “—Recent performance” for more information.

The summary historical and unaudited pro forma combined financial data set forth below is not necessarily indicative of the results of future operations and should be read in conjunction with “Selected historical consolidated financial data,” “Capitalization,” “Management’s discussion and analysis of financial condition and results of operations” and the financial statements and related notes included elsewhere in this prospectus.

12

Table of Contents

| Three months ended March 31, |

Fiscal year ended December 31, |

Period from July 12 to December 31, |

Period from January 1 to September 28, |

|||||||||||||||||||||||

| 2015 | 2014 | 2014 | 2013 | 2012 | 2012 | |||||||||||||||||||||

| (Successor) | (Successor) | (Successor) | (Successor) | (Successor) | (Predecessor) | |||||||||||||||||||||

| ($ in thousands, except per share amounts) | ||||||||||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||||||||

| Net product sales |

$ | 353,119 | $ | 282,833 | $ | 1,278,106 | $ | 1,062,453 | $ | 237,338 | $ | 780,797 | ||||||||||||||

| Other product related revenues |

6,125 | 6,251 | 30,515 | 35,014 | 8,801 | 23,071 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total revenues |

359,244 | 289,084 | 1,308,621 | 1,097,467 | 246,139 | 803,868 | ||||||||||||||||||||

| Cost of goods sold, excluding amortization expense |

165,379 | 150,668 | 643,851 | 595,166 | 157,893 | 431,174 | ||||||||||||||||||||

| Amortization expense |

48,792 | 44,102 | 185,655 | 184,258 | 42,801 | 30,344 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total cost of goods sold |

214,171 | 194,770 | 829,506 | 779,424 | 200,694 | 461,518 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Gross margin |

145,073 | 94,314 | 479,115 | 318,043 | 45,445 | 342,350 | ||||||||||||||||||||

| Research and development |

26,850 | 34,624 | 119,095 | 100,763 | 19,383 | 66,606 | ||||||||||||||||||||

| Selling, general and administrative |

56,386 | 50,941 | 181,136 | 155,164 | 73,760 | 165,604 | ||||||||||||||||||||

| Intangible asset impairment |

— | 41,758 | 146,934 | 100,093 | — | 5,700 | ||||||||||||||||||||

| Settlements and loss contingencies, net |

(25 | ) | — | 90,107 | 25,650 | 10,059 | 45,000 | |||||||||||||||||||

| Restructuring costs |

363 | 1,146 | 5,413 | 1,816 | 241 | — | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total operating expenses |

83,574 | 128,469 | 542,685 | 383,486 | 103,443 | 282,910 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Loss on sale of product rights |

— | — | (3,042 | ) | — | — | — | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Operating income (loss) |

61,499 | (34,155 | ) | (66,612 | ) | (65,443 | ) | (57,998 | ) | 59,440 | ||||||||||||||||

| Other (expense) income, net |

— | — | (3,489 | ) | (6,213 | ) | 5,500 | — | ||||||||||||||||||

| Interest income |

17 | 14 | 18 | 87 | 50 | 424 | ||||||||||||||||||||

| Interest expense |

(29,511 | ) | (25,467 | ) | (108,427 | ) | (95,484 | ) | (25,985 | ) | (9,159 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Income (loss) before (benefit) provision for income tax |

32,005 | (63,597 | ) | (178,510 | ) | (167,053 | ) | (78,433 | ) | 50,705 | ||||||||||||||||

| Provision (benefit) for income taxes |

11,720 | (24,232 | ) | (72,993 | ) | (61,182 | ) | (23,727 | ) | 29,530 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income (loss) |

$ | 20,285 | $ | (39,365 | ) | $ | (105,517 | ) | $ | (105,871 | ) | $ | (54,706 | ) | $ | 21,175 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Basic income (loss) per common share |

$ | 0.03 | $ | (0.05 | ) | $ | (0.14 | ) | $ | (0.15 | ) | $ | (0.08 | ) | $ | 0.58 | ||||||||||

| Diluted income (loss) per common share |

$ | 0.02 | $ | (0.05 | ) | $ | (0.14 | ) | $ | (0.15 | ) | $ | (0.08 | ) | $ | 0.57 | ||||||||||

| Weighted average common share outstanding: |

||||||||||||||||||||||||||

| Basic |

784,048 | 737,839 | 772,728 | 704,009 | 698,047 | 36,449 | ||||||||||||||||||||

| Diluted |

814,578 | 737,839 | 772,728 | 704,009 | 698,047 | 37,231 | ||||||||||||||||||||

| Other Financial Data: |

||||||||||||||||||||||||||

| Cash provided by (used in) |

||||||||||||||||||||||||||

| Operating activities |

$ | 100,207 | $ | 89,139 | $ | 145,245 | $ | 113,045 | $ | (54,745 | ) | $ | 153,760 | |||||||||||||

| Investing activities |

(51,285 | ) | (490,859 | ) | (519,575 | ) | (12,198 | ) | (2,026,531 | ) | (46,602 | ) | ||||||||||||||

| Financing activities |

(107,482 | ) | 492,200 | 488,690 | (9,631 | ) | 1,841,261 | 9,205 | ||||||||||||||||||

| Capital expenditures |

(8,492 | ) | (13,212 | ) | (45,460 | ) | (17,465 | ) | (10,306 | ) | (11,454 | ) | ||||||||||||||

| Adjusted EBITDA(1) |

131,523 | 77,182 | 433,804 | 306,872 | 63,519 | 239,853 | ||||||||||||||||||||

| Adjusted gross margin(2) |

194,595 | 141,506 | 674,729 | 510,117 | 110,013 | 387,788 | ||||||||||||||||||||

| Unaudited Pro Forma Data(3): |

||||||||||||||||||||||||||

| Basic loss per common share |

$ | $ | ||||||||||||||||||||||||

| Diluted loss per common share |

$ | $ | ||||||||||||||||||||||||

| Weighted average common shares outstanding: |

||||||||||||||||||||||||||

| Basic |

||||||||||||||||||||||||||

| Diluted |

||||||||||||||||||||||||||

| Balance Sheet Data (at period end): |

||||||||||||||||||||||||||

| Cash and cash equivalents |

$ | 185,880 | $ | 220,560 | $ | 244,440 | $ | 130,080 | $ | 38,864 | ||||||||||||||||

| Total assets |

2,875,935 | 3,174,813 | 3,007,134 | 2,637,569 | 2,846,687 | |||||||||||||||||||||

| Total long-term debt, including current maturities (gross) |

2,346,148 | 1,931,678 | 1,925,837 | 1,545,340 | 1,542,363 | |||||||||||||||||||||

| Stockholders’ equity |

71,462 | 623,032 | 566,080 | 553,436 | 651,169 | |||||||||||||||||||||

|

|

|

|

||||||||||||||||||||||||

13

Table of Contents

| (1) | “Adjusted EBITDA” is a financial measure that is not defined under GAAP. We present adjusted EBITDA because we consider it an important supplemental measure of our performance and our ability to service our indebtedness and we believe that it provides greater transparency into our results of operations and is frequently used by investors in the evaluation of companies in the industry. In addition, our management believes that adjusted EBITDA is a useful financial metric to assess our operating performance from period to period by excluding certain material unusual items and certain other adjustments we believe are not reflective of our ongoing operations and our performance. Adjusted EBITDA represents net (loss) income before interest expense, net, provision (benefit) for income taxes, depreciation and amortization, intangible asset impairment, restructuring costs, settlements and loss contingencies, net transaction related costs including severance, upfront and development milestones, stock-based compensation expense and certain other non-recurring, non-cash and other cash expenses. Adjusted EBITDA does not represent and should not be considered as an alternative to net income or cash flow from operations, as determined by GAAP, and our calculations thereof may not be comparable to that reported by other companies. Adjusted EBITDA has limitations as an analytical tool and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. For example, adjusted EBITDA: |

| • | does not reflect our capital expenditures or future requirements for capital expenditures or contractual commitments; |

| • | does not reflect expenditures related to current business development and product acquisition activities, including payments due under existing agreements related to products in various stages of development or contingent payments tied to the achievement of sales milestones; |

| • | does not reflect changes in, or cash requirements for, our working capital needs; |

| • | does not reflect significant interest expense or the cash requirements necessary to service interest or principal payments on our debt; |

| • | excludes income tax payments that represent a reduction in cash available to us; |

| • | does not reflect any cash requirements for assets being depreciated and amortized that may have to be replaced in the future; |

| • | does not reflect the impact of earnings or charges resulting from matters we consider not be indicative of our ongoing operations; and |

| • | may be calculated differently by other companies in our industry, thereby limiting the usefulness as a comparative measure. |

Because of these limitations, adjusted EBITDA should not be considered as a measure of discretionary cash available to us to invest in the growth of our business or as measures of cash that will be available to us to meet our obligations. We compensate for these limitations by using adjusted EBITDA along with other comparative tools, together with GAAP measurements, to assist in the evaluation of operating performance. These GAAP measurements include net (loss) income, cash flow from operating activities and other cash flow data. We have significant uses of cash flow from operating activities, including capital expenditures, interest payments, debt principal repayments, transaction related costs including severance, upfront and development milestones, taxes and other non-recurring charges, which are not reflected in adjusted EBITDA. Adjusted EBITDA should not be considered in isolation or as an alternative to net (loss) income, cash flow generated by operating, investing, or financing activities or other financial statement data presented in the consolidated financial statements as an indicator of financial performance or liquidity. You should therefore not place undue reliance on adjusted EBITDA or ratios calculated using this measure. Our GAAP-based measures can be found in our consolidated financial statements and related notes included elsewhere in this prospectus.

14

Table of Contents

The table below reconciles net income (loss) to adjusted EBITDA for the periods presented. Adjusted EBITDA excludes the impact of discontinued operations for all periods.

| Three months ended March 31, |

Fiscal year ended December 31, |

Period from July 12 to December 31, |

Period from January 1 to September 28, |

|||||||||||||||||||||||

| 2015 | 2014 | 2014 | 2013 | 2012 | 2012 | |||||||||||||||||||||

| (Successor) | (Successor) | (Successor) | (Successor) | (Successor) | (Predecessor) | |||||||||||||||||||||

| (unaudited) | (unaudited) | (unaudited) | (unaudited) | (unaudited) | (unaudited) | |||||||||||||||||||||

| ($ in thousands) | ||||||||||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||||||||

| Net income (loss) |

$ | 20,285 | $ | (39,365 | ) | $ | (105,517 | ) | $ | (105,871 | ) | $ | (54,706 | ) | $ | 21,175 | ||||||||||

| Interest expense, net |

29,494 | 25,453 | 108,409 | 95,397 | 25,935 | 8,735 | ||||||||||||||||||||

| Provision (benefit) for income taxes |

11,720 | (24,232 | ) | (72,993 | ) | (61,182 | ) | (23,727 | ) | 29,530 | ||||||||||||||||

| Depreciation and amortization |

57,083 | 50,663 | 213,564 | 207,646 | 50,348 | 44,426 | ||||||||||||||||||||

| Cost of goods on acquired inventory step-up(a) |

— | 2,986 | 9,031 | 6,557 | 21,543 | 4,048 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| EBITDA |

118,582 | 15,505 | 152,494 | 142,547 | 19,393 | 107,914 | ||||||||||||||||||||

| Litigation and loss contingencies, net(b) |

— | — | 90,107 | 25,650 | 10,059 | 45,000 | ||||||||||||||||||||

| AWP and DOJ litigation costs(c) |

901 | 1,676 | 4,269 | 9,131 | 3,110 | 7,757 | ||||||||||||||||||||

| Restructuring costs(d) |

363 | 1,146 | 5,413 | 1,816 | 241 | — | ||||||||||||||||||||

| Transaction related costs including severance(e) |

1,365 | 3,786 | 7,461 | 5,447 | 32,951 | 45,882 | ||||||||||||||||||||

| Upfront and development milestones(f) |

— | — | — | — | 350 | 10,000 | ||||||||||||||||||||

| Inventory write-downs related to patent litigation(g) |

— | — | — | — | — | 10,318 | ||||||||||||||||||||

| Intangible asset impairment(h) |

— | 41,758 | 146,934 | 100,093 | — | 5,700 | ||||||||||||||||||||

| Loss on sale of product rights(i) |

— | — | 3,042 | — | — | — | ||||||||||||||||||||

| Gain on sale of securities and other investments(j) |

— | — | — | (1,122 | ) | — | — | |||||||||||||||||||

| Cost associated with refinancing of senior term loan |

— | 7,136 | 7,136 | 1,411 | — | — | ||||||||||||||||||||

| Loss on debt extinguishment(k) |

— | 3,989 | 3,989 | 7,335 | — | — | ||||||||||||||||||||

| Gain on bargain purchase(l) |

— | — | — | — | (5,500 | ) | — | |||||||||||||||||||

| Stock based compensation expense(m) |

5,213 | 942 | 8,678 | 9,154 | 2,240 | 7,282 | ||||||||||||||||||||

| Management fee(n) |

1,000 | 935 | 4,000 | 3,611 | 675 | — | ||||||||||||||||||||

| Special discretionary dividend equivalent bonus |

4,185 | — | — | — | — | — | ||||||||||||||||||||

| Other(o) |

(86 | ) | 309 | 281 | 1,799 | — | — | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Adjusted EBITDA |

$ | 131,523 | $ | 77,182 | $ | 433,804 | $ | 306,872 | $ | 63,519 | $ | 239,853 | ||||||||||||||

|

|

|

|

||||||||||||||||||||||||

| (a) | Represents the charge associated with acquisitions for acquired inventory which was increased to its estimated selling price, less the cost of disposal and a reasonable profit allowance for the selling effort (the “inventory step-up”), as required under GAAP. The inventory step-up was recognized into earnings based on normal inventory turns and resulted in costs above standard post-acquisition costs. |

| (b) | During the period from January 1, 2012 to September 28, 2012 (Predecessor), we recorded an accrual of $45.0 million as management’s best estimate of a potential loss related to a potential global settlement with respect to an inquiry by the U.S. Department of Justice (the “DOJ”) into Par Specialty’s promotional practices in the sales and marketing of Megace® ES. In the period from July 12, 2012 (inception) to December 31, 2012 (Successor), we recorded additional estimated amounts for accrued interest and legal expenses that we are liable for paying in the final settlement. We also accrued for a contingent liability of $9.0 million related to omeprazole/sodium bicarbonate patent litigation during this period. In 2013, we recorded an incremental provision of $25.7 million related to the settlement of average wholesale price (“AWP”) litigation claims (Illinois $19.8 million, Louisiana $3.3 million, Utah $1.7 million and Kansas $0.9 million). In 2014, we recorded an incremental provision of $91.0 million related to the settlement of omeprazole/sodium bicarbonate patent litigation for $100.0 million. During 2014, we also received an arbitration award of approximately $0.9 million from a former partner related to a discontinued project. |

| (c) | Consists of external legal costs incurred in conjunction with our defense of the actions brought by various states and the DOJ as it relates to the AWP litigation and the promotional practices of Par Specialty’s marketing of Megace® ES. |

| (d) | In January 2013, we initiated a restructuring of Par Specialty, in anticipation of entering into a settlement agreement and corporate integrity agreement (“CIA”) that terminated the DOJ ongoing investigation of Par Specialty’s marketing of Megace® ES. We reduced our Par Specialty workforce by approximately 70 people, with the majority of the reductions in the sales force. The remaining Par Specialty sales force has been reorganized into a single sales team of approximately 60 professionals that focus their marketing efforts principally on Nascobal® Nasal Spray. In connection with these actions, we incurred expenses for severance and other employee-related costs as well as the termination of certain contracts. In 2014, subsequent to the Par Sterile acquisition, we eliminated 25 redundant positions within Par |

15

Table of Contents

| Pharmaceutical and accrued severance and other employee-related costs for those employees affected by the workforce reduction. Additionally, due to a change in our product development strategy, we eliminated 36 redundant positions within our Irvine location and accrued severance and other employee-related costs for these employees affected by the workforce reduction. |

| (e) | Consists of transaction-related expenses incurred in connection with the acquisition of Anchen Incorporated and its subsidiary Anchen Pharmaceuticals, Inc. (collectively, “Anchen”), Par Formulations and Par Sterile as well as transaction-related expenses incurred in connection with the Merger and related transactions. |

| (f) | Represents the initial payments made to acquire generic ANDAs and/or distribution rights from various other pharmaceutical manufacturers prior to the product achieving legal and/or regulatory approval. |

| (g) | Represents the write down of certain pre-launch and commercial inventory resulting from the loss of patent litigation including omeprazole/sodium bicarbonate and omega-3 acid ethyl esters oral capsules. |

| (h) | During the period from January 1, 2012 to September 28, 2012 (Predecessor), we abandoned an in-process research and development project and exited the market of a commercial product both of which were acquired in the Anchen acquisition and recorded a total corresponding intangible asset impairment of $5.7 million. During the year ended December 31, 2013, we recorded intangible asset impairments totaling approximately $100.1 million for in-process research and development (“IPR&D”) relating to classes of products and projects that were evaluated as part of the annual evaluation of indefinite lived intangible assets, as well as five products not expected to achieve their originally forecasted operating results, and we ceased selling a product that had been acquired with the divested products from the merger of Watson and Actavis Group. During the year ended December 31, 2014 we recorded intangible asset impairments totaling approximately $146.9 million related to an adjustment to the forecasted operating results for two IPR&D intangible asset groups and eight Par Pharmaceutical segment products compared to their originally forecasted operating results at date of acquisition, inclusive of one discontinued product, one partially impaired product primarily due to the contract ending with the partner and a partially impaired IPR&D project from the Par Sterile acquisition due to an adverse court ruling pertaining to related patent litigation. The estimated fair values of the assets were determined by completing updated discounted cash flow models. |

| (i) | We recognized a loss on the sale of product rights of $3.0 million during the fiscal year ended December 31, 2014, related to the sale of multiple ANDAs. |

| (j) | During the year ended December 31, 2013, we recorded a gain on sale of stock of a public pharmaceutical company of $1.1 million. |

| (k) | In February 2013, we refinanced our term loan facility. In accordance with the applicable accounting guidance for debt modifications and extinguishments, approximately $5.9 million of the existing unamortized deferred financing costs and $1.4 million of the related $10.5 million soft call premium were written off in connection with this refinancing. In February 2014, in conjunction with our acquisition of Par Sterile, we amended certain senior facilities. In accordance with the applicable accounting guidance for debt modifications and extinguishments, approximately $4.0 million of the existing unamortized deferred financing costs were written off in connection with this repricing. |

| (l) | During the period from July 12, 2012 (inception) to December 31, 2012 (Successor), we acquired U.S. marketing rights to five generic products that were marketed by Watson or Actavis Group, as well as eight ANDAs awaiting regulatory approval at that time and a generic product in late-stage development, in connection with the merger of Watson and Actavis Group. The acquisition resulted in a bargain purchase under FASB ASC 805, Business Combinations. The purchase price of the acquisition was allocated to the assets acquired, with the excess of the fair value of assets acquired over the purchase price recorded as a gain. The gain was mainly attributed to the FTC mandated divestiture of products by Watson and Actavis Group in conjunction with the approval of the Watson and Actavis Group merger. |

| (m) | Represents the non-cash expense associated with stock-based compensation awards issued to various executive and non-executive employees. |

| (n) | In connection with the Merger and related transactions, we entered into a management services agreement with an affiliate of TPG (the “Manager”) pursuant to such agreement, and in exchange for on-going consulting and management advisory services, the Manager receives an annual monitoring fee paid quarterly equal to 1% of EBITDA as defined under the credit agreement for the Senior Credit Facilities. There is an annual cap of $4.0 million for this fee. The Manager also receives reimbursement for out-of-pocket expenses incurred in connection with services provided pursuant to the agreement. We recorded an expense of $4.0 million and $3.6 million for consulting and management advisory service fees and out-of-pocket expenses in the years ended December 31, 2014 and December 31, 2013, respectively, and $0.7 million in the period from July 12, 2012 (inception) to December 31, 2012 (Successor). |

| (o) | Other includes costs associated with our CIA (2013 and 2014) and additional pharmaceutical manufacturer’s fee charges recorded under PPACA due to final IRS regulations issued in 2014. |

16

Table of Contents

| (2) | We present adjusted gross margin because we believe it is a useful indicator of our operating performance and facilitates a meaningful comparison to our peers. In particular, we believe that adjusted gross margin is a useful indicator of our operating performance because adjusted gross margin measures our operating performance without regard to acquisition transaction-related amortization expenses. In addition, our management uses adjusted gross margin for planning purposes, including the preparation of our annual operating budget and assessment of performance. The table below reconciles gross margin to adjusted gross margin for the periods presented. “Adjusted gross margin” is a financial measure that is not defined under GAAP. Adjusted gross margin represents gross margin plus amortization expense, stock based compensation expense related to cost of goods, inventory write-downs related to patent litigation and cost of goods acquired on inventory step up. Adjusted gross margin does not represent and should not be considered as an alternative to gross margin, as determined by GAAP, and our calculations thereof may not be comparable to that reported by other companies. |

| Three months ended March 31, |

Fiscal year ended December 31, |

Period from July 12 to December 31, |

Period from January 1 to September 28, |

|||||||||||||||||||||||

| 2015 | 2014 | 2014 | 2013 | 2012 | 2012 | |||||||||||||||||||||

| (Successor) (unaudited) |

(Successor) (unaudited) |

(Successor) (unaudited) |

(Successor) (unaudited) |

(Successor) (unaudited) |

(Predecessor) (unaudited) |

|||||||||||||||||||||

| ($ in thousands) | ||||||||||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||||||||

| Gross margin |

$ | 145,073 | $ | 94,315 | $ | 479,115 | $ | 318,043 | $ | 45,445 | $ | 342,350 | ||||||||||||||

| Amortization expense |

48,792 | 44,102 | 185,655 | 184,258 | 42,801 | 30,344 | ||||||||||||||||||||

| Stock based compensation expense related to cost of goods |

253 | 89 | 858 | 902 | 224 | 728 | ||||||||||||||||||||

| Inventory write-downs related to patent litigation(a) |

— | — | — | — | — | 10,318 | ||||||||||||||||||||

| Cost of goods acquired on inventory step up(b) |

— | 2,986 | 9,031 | 6,557 | 21,543 | 4,048 | ||||||||||||||||||||

| Special discretionary dividend equivalent bonus |

460 | — | ||||||||||||||||||||||||

| Other |

17 | 14 | 70 | 357 | — | — | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Adjusted gross margin |

$ | 194,595 | $ | 141,506 | $ | 674,729 | $ | 510,117 | $ | 110,013 | $ | 387,788 | ||||||||||||||

|

|

|

|

||||||||||||||||||||||||

| (a) | Represents the write down of certain pre-launch and commercial inventory resulting from the loss of patent litigation including omeprazole/sodium bicarbonate and omega-3 acid ethyl esters oral capsules. |

| (b) | Represents the charge associated with acquisitions for acquired inventory which was increased to its estimated selling price, less the cost of disposal and a reasonable profit allowance for the selling effort (the “inventory step-up”), as required under GAAP. The inventory step-up was recognized into earnings based on normal inventory turns and resulted in costs above standard post-acquisition costs. |

| (3) | Pro Forma Earnings Per Share: |

In February 2015, we amended our credit agreement governing the Senior Credit Facilities, which included new borrowings in an aggregate principal amount of $425.0 million that were used to pay a cash dividend to our stockholders of $494.3 million and, pursuant to the terms of the Sky Growth Holdings Corporation 2012 Equity Incentive Plan, dividend-equivalent payments to certain employees of $36.5 million and a special discretionary dividend-equivalent bonus totaling $4.2 million to certain employees (the “Dividend Recapitalization”). For the purposes of the pro forma earnings per share of common stock calculations, we have assumed that the Dividend Recapitalization had occurred as of January 1, 2014. The basic and diluted pro forma per share of common stock calculations presented below give effect to the Dividend Recapitalization and the number of shares whose proceeds would be necessary to fund the Dividend Recapitalization in addition to historical EPS. The basic pro forma earnings per share of common stock is computed by dividing net loss available to common shareholders by the pro forma weighted average number of shares of common stock outstanding during the period. The diluted pro forma earnings per share of common stock calculation also assumes the conversion, exercise or issuance of all potential shares of common stock, unless the effect of inclusion would be anti-dilutive.

17

Table of Contents

The following presents the computation of pro forma basic and diluted earnings per share:

| (In thousands, except per share data) | March 31, 2015 |

December 31, 2014 |

||||||

| Numerator: |

||||||||

| Net income/(loss) as reported |

$ | $ | ||||||

| Net income/(loss) pro forma adjustments: |

||||||||

| Interest expense, net of tax |

||||||||

| Amortization of debt issuance costs and discount, net of tax |

||||||||

|

|

|

|

|

|||||

| Pro forma net income/(loss) |

$ | $ | ||||||

|

|

|

|

|

|||||

| Denominator: |

||||||||

| Weighted average common shares used in computing basic and diluted loss per common share outstanding |

||||||||

| Adjustment for common stock issued whose proceeds will be used to fund the Dividend Recapitalization |

||||||||

| Pro forma weighted average common shares used in computing basic income per common share outstanding |

||||||||

|

|

|

|

|