Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MERCER INTERNATIONAL INC. | d923638d8k.htm |

Exhibit 99.1

MERCER

INTERNATIONAL

GROUP

Investor Discussion Materials

May 2015

Forward Looking Statements

The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking statements. Certain information included in this

presentation contains statements that are forward-looking, such as statements relating to results of operations and financial conditions and business development activities, as well as capital spending and financing sources. Such forward-looking

information involves important risks and uncertainties that could significantly affect anticipated results in the future and, accordingly, such results may differ materially from those expressed in any forward-looking statements made by or on behalf

of Mercer. For more information regarding these risks and uncertainties, review Mercer’s filings with the United States Securities and Exchange Commission, including the risks disclosed under “Risk Factors” in our annual reports on

Form 10-K and our quarterly reports on Form 10-Q. Unless required by law, we do not assume any obligation to update forward-looking statements based on unanticipated events or changed expectations.

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com MERCER 2

Mercer International Inc.

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

MERCER 3

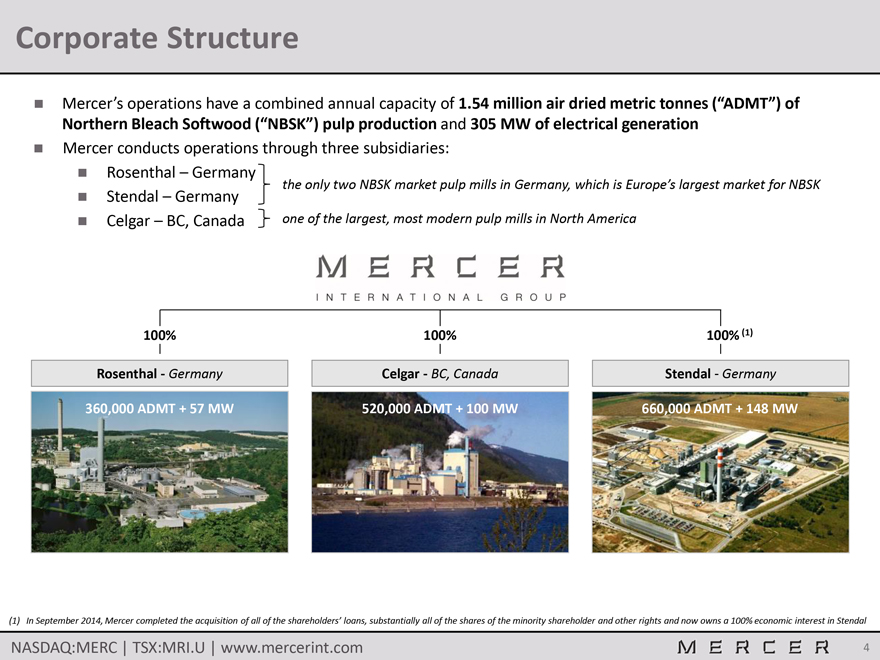

Corporate Structure

Mercer’s operations have a combined annual capacity of 1.54 million air dried metric tonnes (“ADMT”) of Northern Bleach Softwood (“NBSK”)

pulp production and 305 MW of electrical generation

Mercer conducts operations through three subsidiaries:

Rosenthal – Germany the only two NBSK market pulp mills in Germany, which is Europe’s largest market for NBSK

Stendal – Germany

Celgar – BC, Canada one of the largest, most modern pulp mills in

North America

MERCER

INTERNATIONAL GROUP

100%

Rosenthal - Germany

360,000 ADMT + 57 MW

100%

Celgar - BC, Canada

520,000 ADMT + 100 MW

100% (1)

Stendal - Germany

660,000 ADMT + 148 MW

(1) In September 2014, Mercer completed the acquisition of all of the

shareholders’ loans, substantially all of the shares of the minority shareholder and other rights and now owns a 100% economic interest in Stendal

NASDAQ:MERC

| TSX:MRI.U | www.mercerint.com

MERCER 4

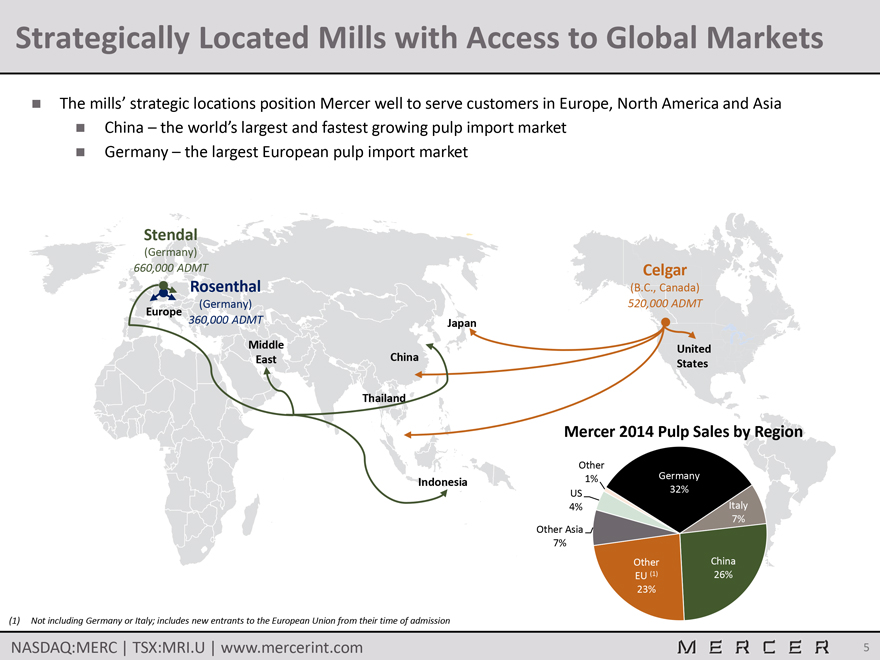

Strategically Located Mills with Access to Global Markets

The mills’ strategic locations position Mercer well to serve customers in Europe, North America and Asia

China – the world’s largest and fastest growing pulp import market

Germany –

the largest European pulp import market

Stendal

(Germany)

660,000 ADMT

Rosenthal

(Germany)

Europe 360,000 ADMT

Middle

East

Japan

China

Thailand

Indonesia

Celgar

(B.C., Canada)

520,000 ADMT

United

States

Mercer 2014 Pulp Sales by Region

Other

1%

US

4%

Other Asia

7%

Germany

32%

Italy

7%

Other

EU (1)

23%

China

26%

(1) Not including Germany or Italy; includes new entrants to the European

Union from their time of admission

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

MERCER 5

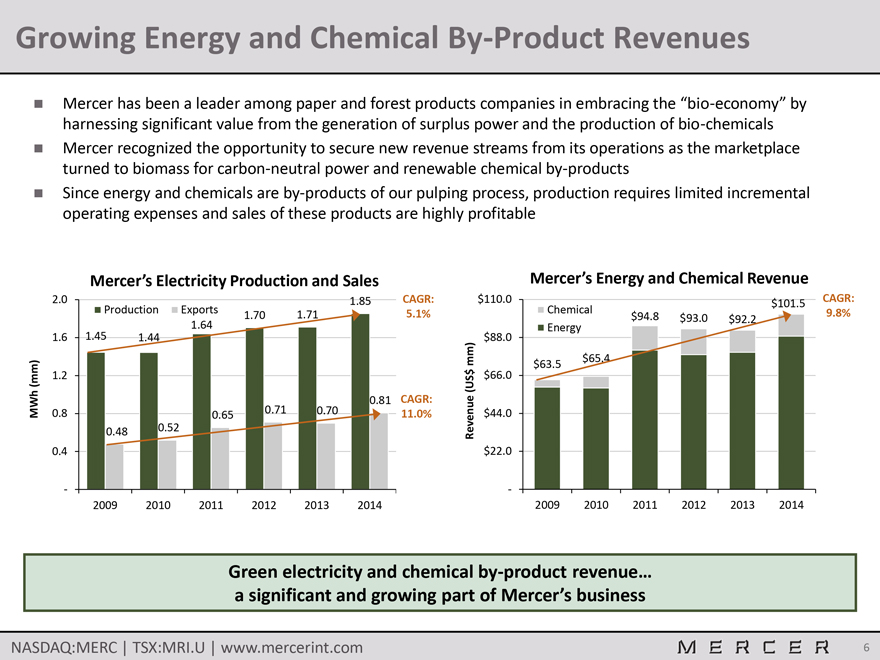

Growing Energy and Chemical By-Product Revenues

Mercer has been a leader among paper and forest products companies in embracing the “bio-economy” by harnessing significant value from the generation of surplus power and

the production of bio-chemicals

Mercer recognized the opportunity to secure new revenue streams from its operations as the marketplace turned to biomass for

carbon-neutral power and renewable chemical by-products

Since energy and chemicals are by-products of our pulping process, production requires limited incremental

operating expenses and sales of these products are highly profitable

Mercer’s Electricity Production and Sales

MWh (mm)

2.0

1.6

1.2

0.8

0.4

-

Production 1.45 Exports 1.44 1.64 1.70 1.71 1.85 CAGR: 5.1%

0.48 0.52 0.65 0.71 0.70 0.81 CAGR: 11.0%

2009 2010 2011 2012 2013 2014

Mercer’s Energy and Chemical Revenue

Revenue (US$ mm)

$110.0

$88.0

$66.0

$44.0

$22.0

-

Chemical Energy $63.5 $65.4 $94.8 $93.0 $92.2 $101.5 CAGR: 9.8%

2009 2010

2011 2012 2013 2014

Green electricity and chemical by-product revenue…

a

significant and growing part of Mercer’s business

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

MERCER 6

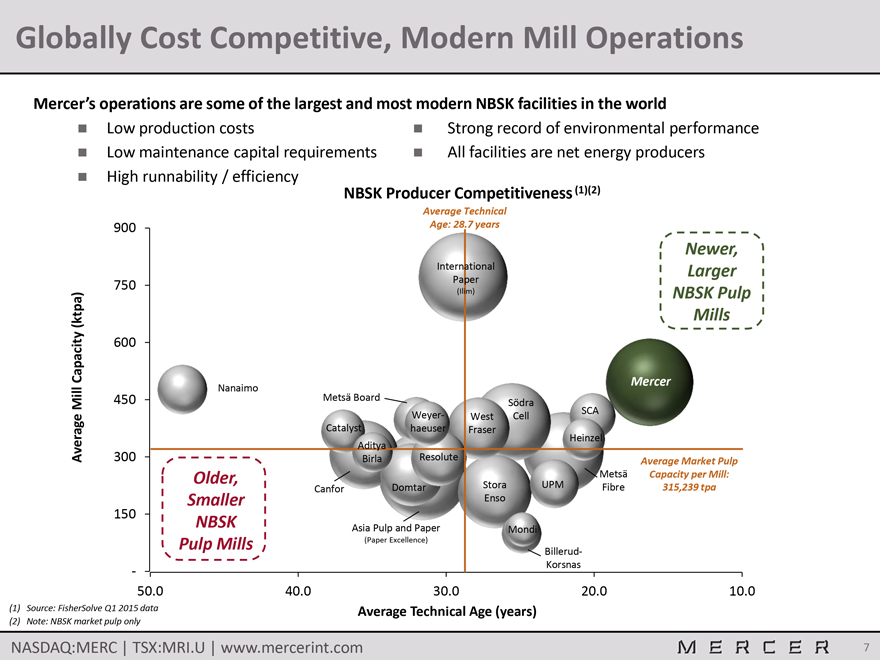

Globally Cost Competitive, Modern Mill Operations

Mercer’s operations are some of the largest and most modern NBSK facilities in the world

Low production costs

Low maintenance capital requirements

High runnability / efficiency

Strong record of environmental performance

All facilities are net energy producers

NBSK Producer Competitiveness (1)(2)

Average Technical

Age: 28.7 years

International

Paper

(Ilim)

Average Mill Capacity (ktpa)

900 750 600 450 300 150 -

50.0 40.0 30.0 20.0 10.0

Older, Smaller NBSK Pulp Mills

Nanaimo

Metsä Board

Catalyst

Aditya Birla

Canfor

Asia Pulp and Paper

(Paper Excellence)

Weyer-haeuser

Resolute

Domtar

West Fraser

Stora Enso

Södra Cell

UPM

Mondi

SCA

Heinzel

Metsä Fibre

Billerud-Korsnas

Mercer

Average Market Pulp

Capacity per Mill:

315,239 tpa

Newer,

Larger

NBSK Pulp

Mills

Average Technical Age (years)

(1) Source: FisherSolve Q1 2015 data

(2) Note: NBSK market pulp only

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

MERCER 7

Mercer Investment Thesis

The NBSK market has transitioned over time to balanced

Permanent closure of

high cost mills

Continued growth from emerging markets

Demand for NBSK from

high value paper producers continues to grow

End uses such as tissues, towels and other speciality products

Growth in high value products has outpaced printing & writing paper declines

Mercer’s mills are modern and cost competitive

Low capital requirements

Achieving high runnability

Mercer’s green energy and bio-chemicals

businesses continue to add value

Significant and stable income streams

Revenue was ~$101 million in fiscal year 2014

Recent refinancing /

acquisition activities have Mercer well positioned

Acquired minority interest in the Stendal mill

Simplified structure / recapitalized balance sheet (new long term senior notes)

Reduced long

term debt through more efficient use of cash

Added more flexibility to the operations

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

MERCER 8

The NBSK Market

| NASDAQ:MERC | TSX:MRI.U | www.mercerint.com | MERCER 9 |

Introduction to the Major Themes in NBSK

Current themes surrounding the NBSK market include:

The impact of digital media on paper

demand and end uses

The effect of China and other emerging economies’ continuing growth

The net supply impact of mill closures, facility conversions, restarts and new mill announcements

The potential supply impact of integrated players selling their pulp on the market

The impact

of additional hardwood capacity coming online

| NASDAQ:MERC | TSX:MRI.U | www.mercerint.com | MERCER 10 |

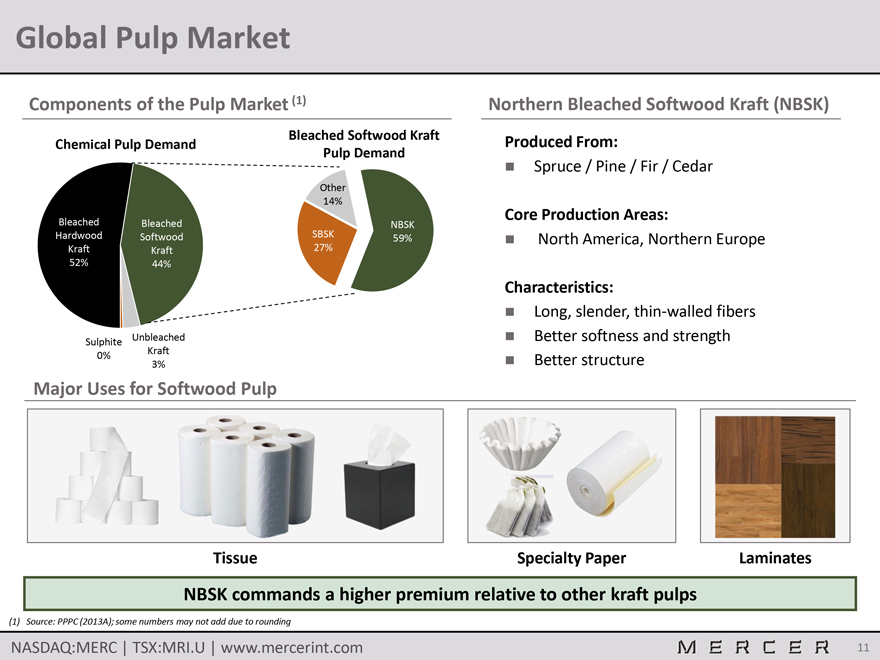

Global Pulp Market Components of the Pulp Market (1)

Bleached Softwood Kraft Chemical Pulp Demand Pulp Demand Other 14% Bleached Bleached NBSK Hardwood Softwood SBSK 59% Kraft Kraft 27% 52% 44% Sulphite Unbleached 0% Kraft 3%

Northern Bleached Softwood Kraft (NBSK) Produced From: Spruce / Pine / Fir / Cedar Core Production Areas: North America, Northern Europe Characteristics: Long,

slender, thin-walled fibers Better softness and strength Better structure Major Uses for Softwood Pulp Tissue Specialty Paper Laminates

NBSK commands a higher

premium relative to other kraft pulps (1) Source: PPPC (2013A); some numbers may not add due to rounding NASDAQ:MERC | TSX:MRI.U | www.mercerint.com MERCER 11

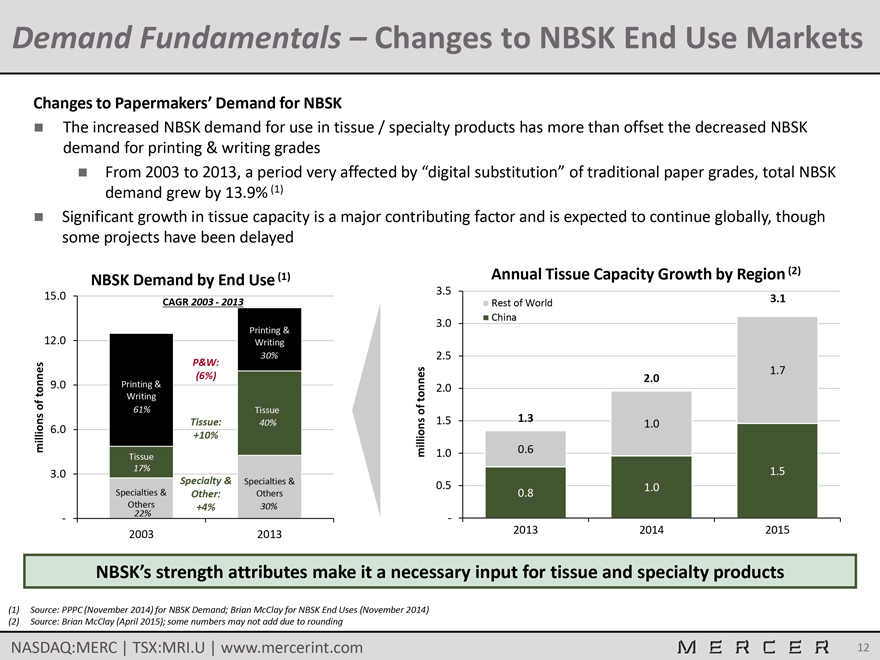

Demand Fundamentals – Changes to NBSK End Use Markets

Changes to Papermakers’ Demand for NBSK

The increased NBSK demand for use in tissue /

specialty products has more than offset the decreased NBSK demand for printing & writing grades

From 2003 to 2013, a period very affected by “digital

substitution” of traditional paper grades, total NBSK demand grew by 13.9% (1)

Significant growth in tissue capacity is a major contributing factor and is

expected to continue globally, though some projects have been delayed

| NBSK Demand by End Use (1) 15.0 CAGR 2003 - 2013 Printing & 12.0 Writing 30% P&W: (6%) tonnes 9.0 Printing & Writing of 61% Tissue Tissue: 40% millions 6.0 +10% Tissue 3.0 17% Specialty & Specialties & Specialties & Other: Others Others +4% 30% — 22% 2003 2013 |

| Annual Tissue Capacity Growth by Region (2) 3.5 Rest of World 3.1 3.0 China 2.5 1.7 2.0 tonnes 2.0 of 1.5 1.3 1.0 millions 1.0 0.6 1.5 0.5 1.0 0.8 — 2013 2014 2015 |

NBSK’s strength attributes make it a necessary input for tissue and specialty products

(1) Source: PPPC (November 2014) for NBSK Demand; Brian McClay for NBSK End Uses (November 2014)

(2) Source: Brian McClay (April 2015); some numbers may not add due to rounding

| NASDAQ:MERC | TSX:MRI.U | www.mercerint.com | MERCER 12 |

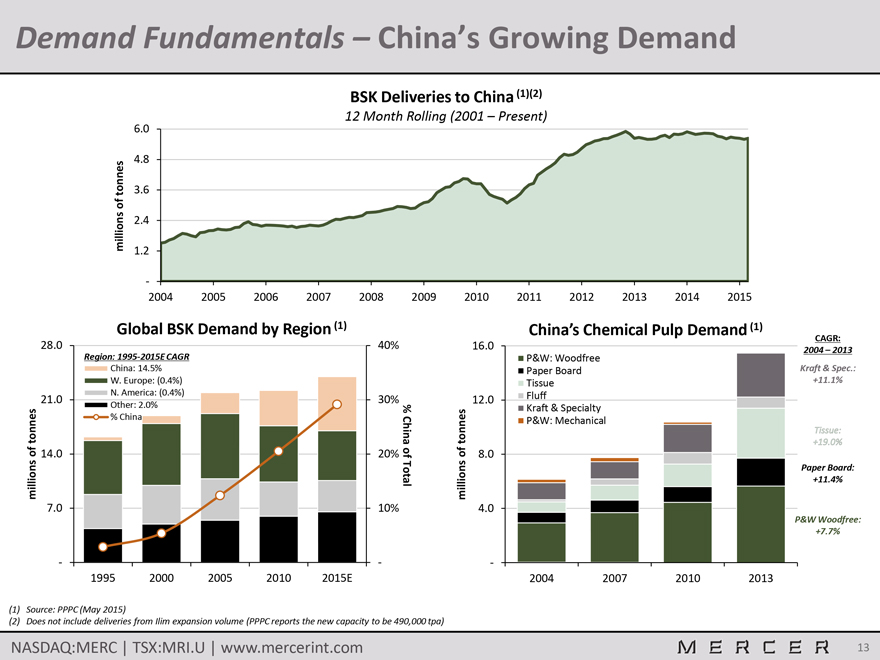

Demand Fundamentals – China’s Growing Demand

BSK Deliveries to China (1)(2)

12 Month Rolling (2001 – Present)

| 6.0 4.8 tonnes 3.6 of millions 2.4 1.2 — |

| 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 |

| Global BSK Demand by Region (1) 28.0 40% Region: 1995-2015E CAGR China: 14.5% W. Europe: (0.4%) N. America: (0.4%) 21.0 30% Other: 2.0% % tonnes % China China of 14.0 of 20% millions Total 7.0 10% — — 1995 2000 2005 2010 2015E |

| China’s Chemical Pulp Demand (1) CAGR: 16.0 2004 – 2013 P&W: Woodfree Paper Board Kraft & Spec.: Tissue +11.1% 12.0 Fluff Kraft & Specialty Tissue: tonnes P&W: Mechanical +19.0% of 8.0 Paper Board: millions +11.4% 4.0 P&W Woodfree: +7.7% — 2004 2007 2010 2013 |

(1) Source: PPPC (May 2015)

(2) Does not include

deliveries from Ilim expansion volume (PPPC reports the new capacity to be 490,000 tpa)

| NASDAQ:MERC | TSX:MRI.U | www.mercerint.com | MERCER 13 |

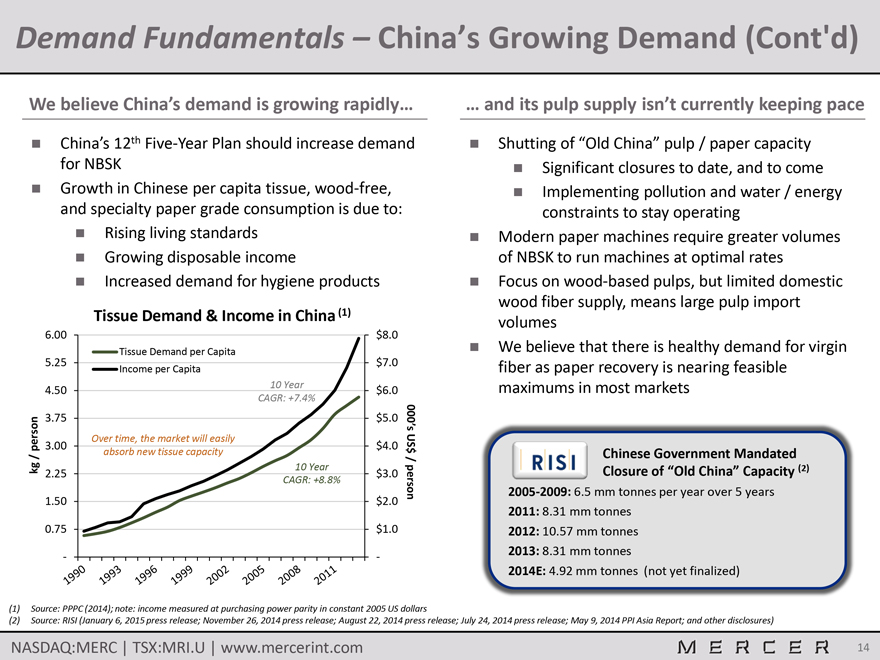

Demand Fundamentals – China’s Growing Demand (Cont’d) We believe China’s demand is growing rapidly… China’s 12th Five-Year Plan should increase demand for NBSK Growth in Chinese per capita tissue, wood-free, and specialty paper grade consumption is due to: Rising living standards Growing disposable income Increased demand for hygiene products

| Tissue Demand & Income in China (1) 6.00 $8.0 Tissue Demand per Capita 5.25 $7.0 Income per Capita 4.50 10 Year $6.0 CAGR: +7.4% 3.75 $5.0 000’s person 3.00 Over time, the market will easily $4.0 US absorb new tissue capacity $ / / kg 2.25 10 Year $3.0 CAGR: +8.8% person 1.50 $2.0 0.75 $1.0 — — 1990 1993 1996 1999 2002 2005 2008 2011 |

… and its pulp supply isn’t currently keeping pace Shutting of “Old China” pulp / paper capacity Significant closures

to date, and to come Implementing pollution and water / energy constraints to stay operating Modern paper machines require greater volumes of NBSK to run machines at optimal rates Focus on wood-based pulps, but limited domestic wood fiber supply,

means large pulp import volumes We believe that there is healthy demand for virgin fiber as paper recovery is nearing feasible maximums in most markets

RISI

Chinese Government Mandated Closure of “Old China” Capacity (2) 2005-2009: 6.5 mm tonnes per year over 5 years

2011: 8.31 mm tonnes 2012: 10.57 mm

tonnes 2013: 8.31 mm tonnes 2014E: 4.92 mm tonnes (not yet finalized)

(1) Source: PPPC (2014); note: income measured at purchasing power parity in constant 2005 US

dollars

(2) Source: RISI (January 6, 2015 press release; November 26, 2014 press release; August 22, 2014 press release; July 24, 2014 press release; May 9, 2014

PPI Asia Report; and other disclosures)

| NASDAQ:MERC | TSX:MRI.U | www.mercerint.com | MERCER 14 |

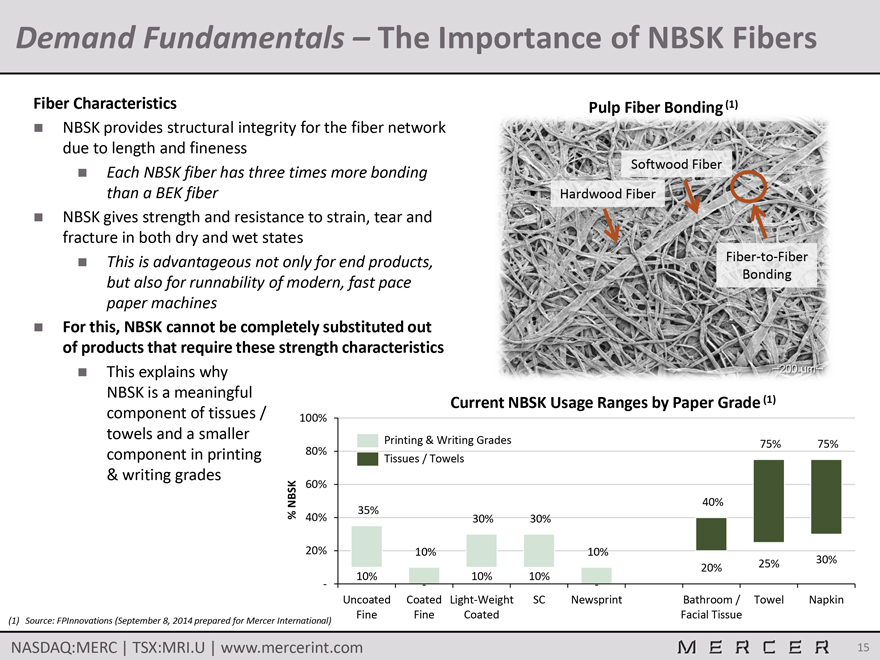

Demand Fundamentals – The Importance of NBSK Fibers

Fiber Characteristics

NBSK provides structural integrity for the fiber network due to length

and fineness

Each NBSK fiber has three times more bonding than a BEK fiber

NBSK gives strength and resistance to strain, tear and fracture in both dry and wet states

This is advantageous not only for end products, but also for runnability of modern, fast pace paper machines

For this, NBSK cannot be completely substituted out of products that require these strength characteristics

This explains why NBSK is a meaningful component of tissues / towels and a smaller component in printing & writing grades

Pulp Fiber Bonding (1)

Softwood Fiber

Hardwood Fiber

Fiber-to-Fiber Bonding

| Current NBSK Usage Ranges by Paper Grade (1) 100% % NBSK Printing & Writing Grades 75% 75% 80% Tissues / Towels 60% 40% 35% 40% 30% 30% 20% 10% 10% 30% 20% 25% 10% 10% 10% — — — Uncoated Coated Light-Weight SC Newsprint Bathroom / Towel Napkin Fine Fine Coated Facial Tissue |

(1) Source: FPInnovations (September 8, 2014 prepared for Mercer International)

| NASDAQ:MERC | TSX:MRI.U | www.mercerint.com | MERCER 15 |

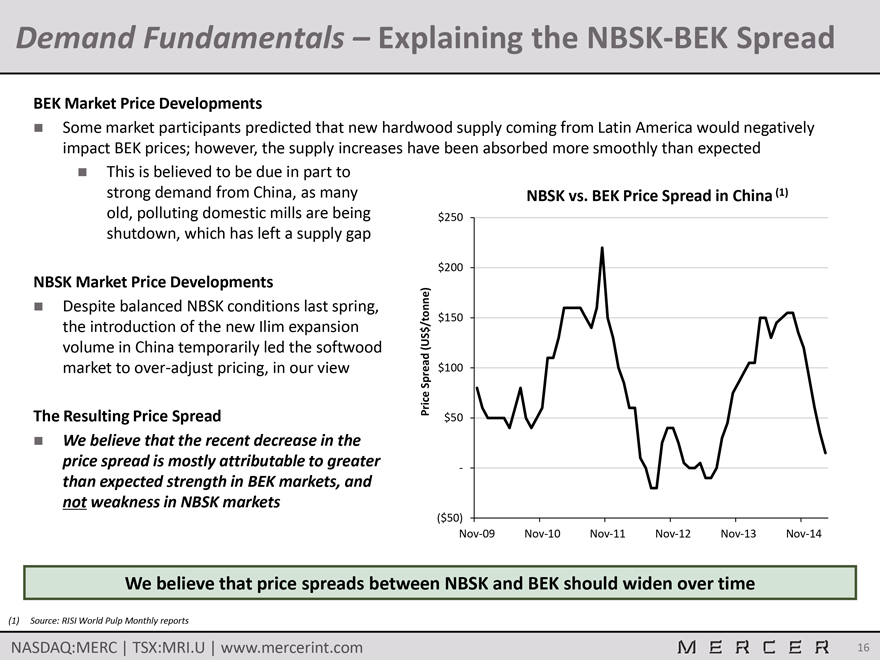

Demand Fundamentals – Explaining the NBSK-BEK Spread BEK Market Price Developments Some market

participants predicted that new hardwood supply coming from Latin America would negatively impact BEK prices; however, the supply increases have been absorbed more smoothly than expected

This is believed to be due in part to strong demand from China, as many old, polluting domestic mills are being shutdown, which has left a supply gap

NBSK Market Price Developments Despite balanced NBSK conditions last spring, the introduction of the new Ilim expansion volume in China temporarily led the softwood market to

over-adjust pricing, in our view The Resulting Price Spread We believe that the recent decrease in the price spread is mostly attributable to greater than expected strength in BEK markets, and not weakness in NBSK markets

| NBSK vs. BEK Price Spread in China (1) Price $250 Spread $200 (US $/tonne) $150 $100 $50 — ($50) Nov-09 Nov-10 Nov-11 Nov-12 Nov-13 Nov-14 |

We believe that price spreads between NBSK and BEK should widen over time

| (1) Source: RISI World Pulp Monthly reports | ||||

| NASDAQ:MERC | TSX:MRI.U | www.mercerint.com | MERCER | 16 | ||

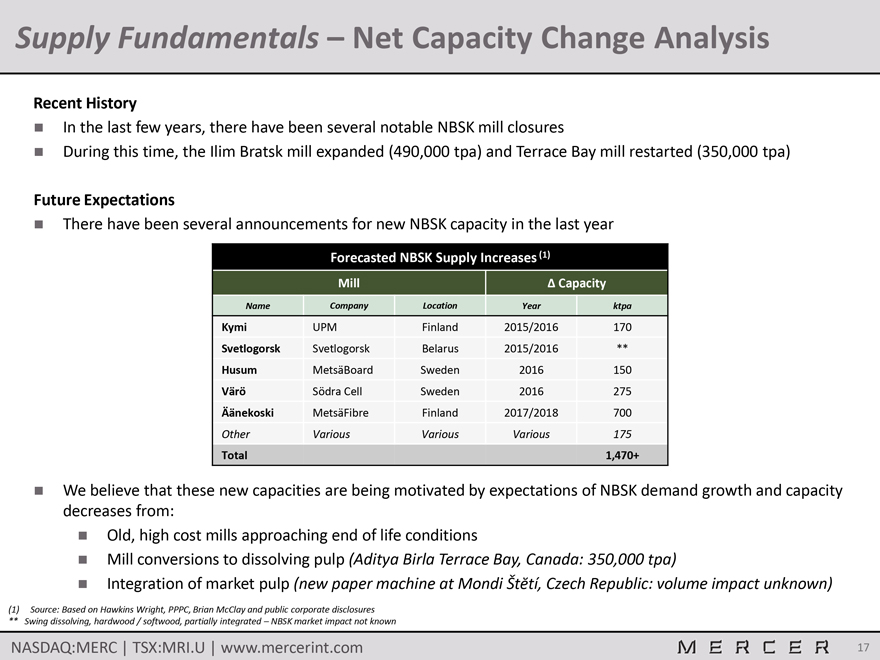

Supply Fundamentals – Net Capacity Change Analysis Recent History In the last few years, there have been

several notable NBSK mill closures

During this time, the Ilim Bratsk mill expanded (490,000 tpa) and Terrace Bay mill restarted (350,000 tpa) Future Expectations

There have been several announcements for new NBSK capacity in the last year

| Forecasted NBSK Supply Increases (1) Mill Capacity Name Company Location Year ktpa Kymi UPM Finland 2015/2016 170 Svetlogorsk Svetlogorsk Belarus 2015/2016 ** Husum MetsäBoard Sweden 2016 150 Värö Södra Cell Sweden 2016 275 Äänekoski MetsäFibre Finland 2017/2018 700 Other Various Various Various 175 Total 1,470+ |

We believe that these new capacities are being motivated by expectations of NBSK demand growth and capacity decreases from:

Old, high cost mills approaching end of life conditions Mill conversions to dissolving pulp (Aditya Birla Terrace Bay, Canada: 350,000 tpa) Integration of market pulp (new paper

machine at Mondi Štĕtí, Czech Republic: volume impact unknown) (1) Source: Based on Hawkins Wright, PPPC, Brian McClay and public corporate disclosures ** Swing dissolving, hardwood / softwood, partially integrated – NBSK

market impact not known NASDAQ:MERC | TSX:MRI.U | www.mercerint.com MERCER 17

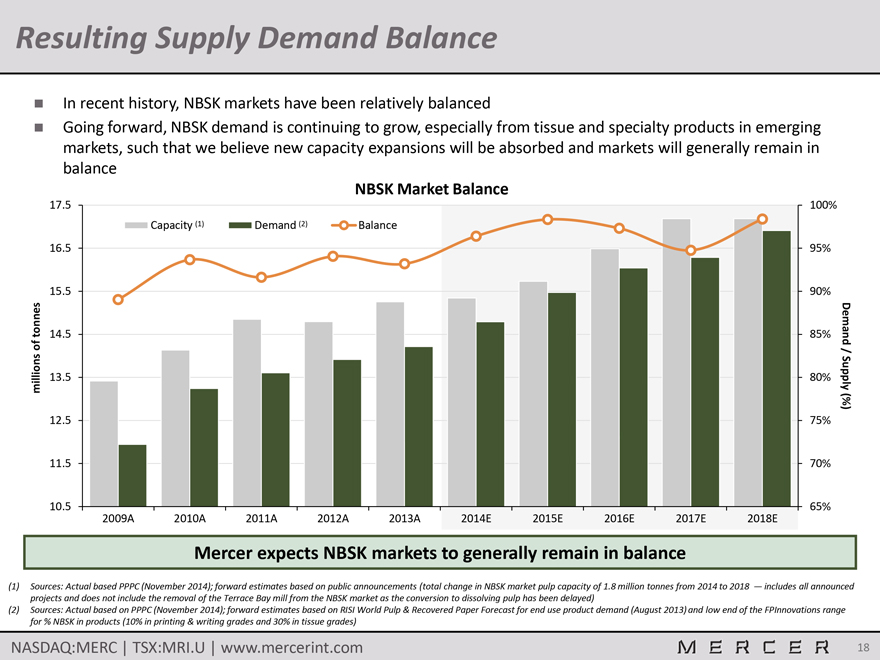

Resulting Supply Demand Balance

In recent history, NBSK markets have been relatively balanced

Going forward, NBSK demand is

continuing to grow, especially from tissue and specialty products in emerging markets, such that we believe new capacity expansions will be absorbed and markets will generally remain in balance

| NBSK Market Balance 17.5 100% Capacity (1) Demand (2) Balance millions 16.5 95% of 15.5 90% tonnes 14.5 85% Demand / 13.5 80% Supply (%) 12.5 75% 11.5 70% 10.5 65% 2009A 2010A 2011A 2012A 2013A 2014E 2015E 2016E 2017E 2018E |

Mercer expects NBSK markets to generally remain in balance

(1) Sources: Actual based PPPC (November 2014); forward estimates based on public announcements (total change in NBSK market pulp capacity of 1.8 million tonnes from 2014 to 2018

— includes all announced

projects and does not include the removal of the Terrace Bay mill from the NBSK market as the conversion to dissolving pulp has been

delayed)

(2) Sources: Actual based on PPPC (November 2014); forward estimates based on RISI World Pulp & Recovered Paper Forecast for end use product demand

(August 2013) and low end of the FPInnovations range

for % NBSK in products (10% in printing & writing grades and 30% in tissue grades)

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com MERCER 18

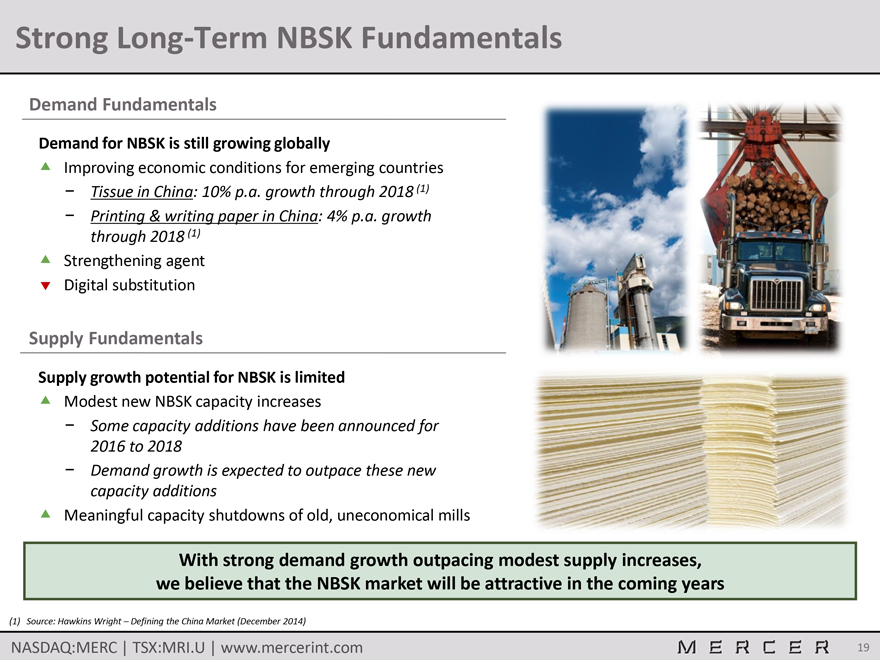

Strong Long-Term NBSK Fundamentals

Demand Fundamentals

Demand for NBSK is still growing globally

Improving economic conditions for emerging countries

Tissue in China: 10% p.a. growth through

2018 (1)

Printing & writing paper in China: 4% p.a. growth through 2018

(1)

Strengthening agent Digital substitution

Supply Fundamentals

Supply growth potential for NBSK is limited

Modest new NBSK capacity increases

Some capacity additions have been announced for 2016 to 2018

Demand growth is expected to

outpace these new capacity additions

Meaningful capacity shutdowns of old, uneconomical mills

With strong demand growth outpacing modest supply increases,

we believe that the NBSK market

will be attractive in the coming years

(1) Source: Hawkins Wright – Defining the China Market (December 2014)

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com MERCER 19

Financial Performance and Recent Developments

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com MERCER 20

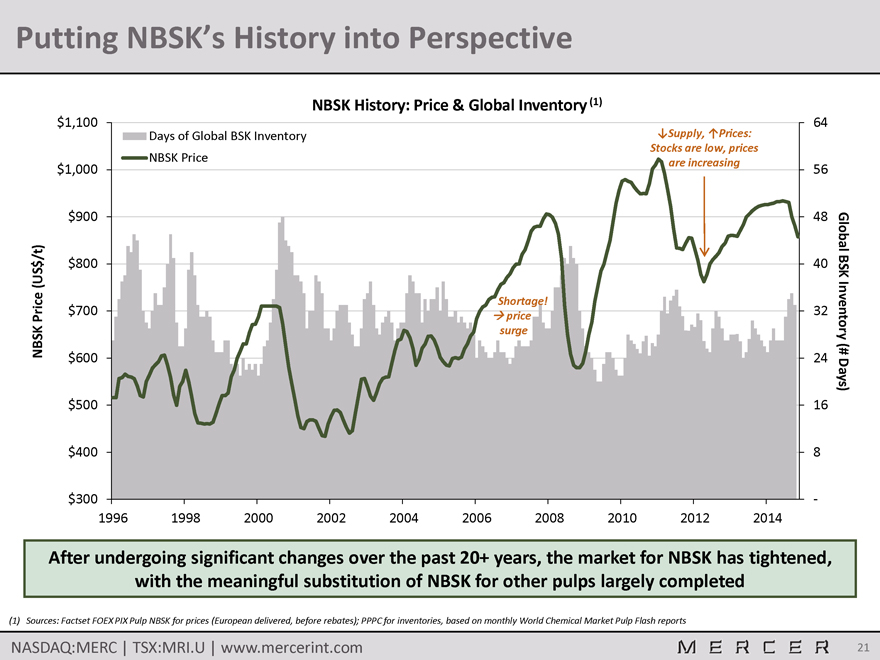

Putting NBSK’s History into Perspective

| NBSK History: Price & Global Inventory (1) $1,100 64 Days of Global BSK Inventory Supply, Prices: Stocks are low, prices NBSK Price are increasing NBSK $1,000 56 Price $900 48 (US$/t) Global $800 40 BSK Shortage! $700 price 32 surge Inventory (# $600 24 Days) $500 16 $400 8 $300 — 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 |

After undergoing significant changes over the past 20+ years, the market for NBSK has tightened,

with the meaningful substitution of NBSK for other pulps largely completed

(1) Sources:

Factset FOEX PIX Pulp NBSK for prices (European delivered, before rebates); PPPC for inventories, based on monthly World Chemical Market Pulp Flash reports

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com MERCER 21

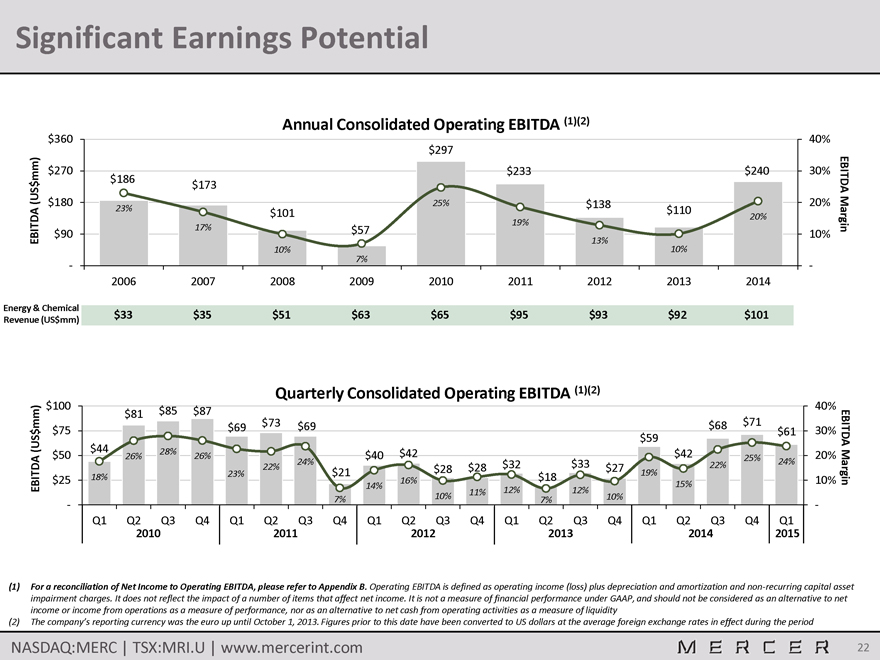

Significant Earnings Potential

Annual Consolidated Operating EBITDA (1)(2)

EBITDA (US$mm)

$360

$180

$270

$90

-

Energy & Chemical

Revenue (US$mm)

$186

23%

2006

$33

$173

17%

2007

$35

$101

10%

2008

$51

$57

7%

2009

$63

$297

25%

2010

$65

$233

19%

2011

$95

$138

13%

2012

$93

$110

10%

2013

$92

$240

20%

2014

$101

40%

30%

20%

10%

-

EBITDA Margin

Quarterly Consolidated Operating EBITDA (1)(2)

EBITDA (US$mm)

$100

$75

$50

$25

-

$44

18%

Q1

$81

26%

Q2

$85

28%

Q3

$87

26%

Q4

2010

$69

23%

Q1

$73

22%

Q2

$69

24%

Q3

$21

7%

Q4

2011

$40

14%

Q1

$42

16%

Q2

$28

10%

Q3

$28

11%

Q4

2012

$32

12%

Q1

$18

7%

Q2

$33

12%

Q3

$27

10%

Q4

2013

$59

19%

Q1

$42

15%

Q2

$68

22%

Q3

$71

25%

Q4

2014

$61

24%

Q1

2015

40%

30%

20%

10%

-

EBITDA Margin

(1) For a reconciliation of Net Income to Operating EBITDA,

please refer to Appendix B. Operating EBITDA is defined as operating income (loss) plus depreciation and amortization and non-recurring capital asset impairment charges. It does not reflect the impact of a number of items that affect net income. It

is not a measure of financial performance under GAAP, and should not be considered as an alternative to net income or income from operations as a measure of performance, nor as an alternative to net cash from operating activities as a measure of

liquidity

(2) The company’s reporting currency was the euro up until October 1, 2013. Figures prior to this date have been converted to US dollars at the

average foreign exchange rates in effect during the period

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com MERCER 22

Mercer’s Recent Developments

Corporate Refinancing

On November 26, 2014, Mercer completed a new senior notes debt offering

$250 million in 7.00% senior notes due in 2019

$400 million in 7.75% senior

notes due in 2022

The proceeds were used to refinance / repay current debt facilities, including:

Two loan facilities related to the Stendal mill (totalling $499 million at September 30, 2014)

9.50% Senior Notes due in 2017 (totalling $334 million in principal at September 30, 2014)

Also, certain mill level working capital facilities were created / extended; current facilities now in place include:

Stendal: €75 million maturing in October 2019

Rosenthal: €25 million maturing in

October 2016 and €5 million maturing in December 2015

Celgar: C$40 million maturing in May 2019

An estimated $168 million of cash was used from the balance to permanently delever long term debt

As at March 31, 2015, Mercer’s debt outstanding to LTM EBITDA was 2.9x

Stendal

Acquisition

In September 2014, Mercer acquired all of the shareholders’ loans, substantially all of the shares of the minority shareholder and other rights in

the Stendal mill to obtain a 100% economic interest

Around the same time, Mercer also made a capital investment of $20 million in the mill

Mercer’s corporate structure has been simplified through recent debt refinancing and acquisition activities

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com MERCER 23

Mercer’s Recent Developments (Cont’d)

Capital Projects

Rosenthal’s new 6,000 tonne per year tall oil plant became fully

operational in Q4 2014, on schedule and on budget

Completed Stendal’s Project Blue Mill on schedule and on budget

Enhanced pulp production capacity (30,000 ADMT per year) and added new electrical generating capacity (46 MW)

Celgar Workforce Reduction

Expected annual cost savings of $8 to $10 million

80% realized in 2014

Performance BioFilaments

In June 2014, Mercer and Resolute Forest Products launched a new 50/50 joint venture company called Performance BioFilaments

The joint venture is set to commercialize novel product applications for cellulose filaments, an innovative biomaterial derived from wood fiber

PERFORMANCE BioFilaments

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com MERCER 24

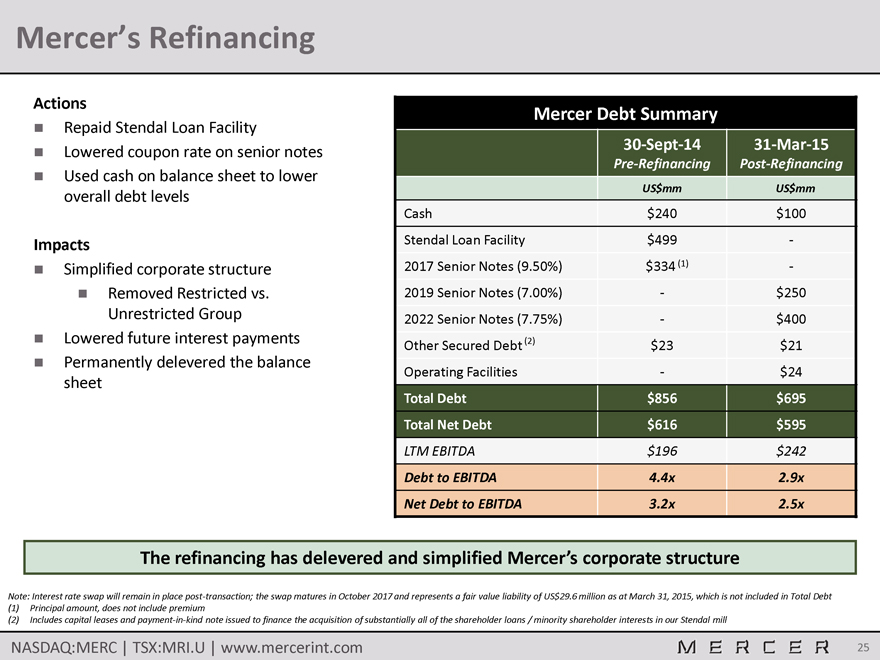

Mercer’s Refinancing

Actions

Repaid Stendal Loan Facility

Lowered coupon rate on senior notes

Used cash on balance sheet to lower overall debt levels

Impacts

Simplified corporate structure

Removed Restricted vs. Unrestricted Group

Lowered future interest payments

Permanently delevered the balance sheet

Mercer Debt Summary

Cash

Stendal Loan Facility

2017 Senior Notes (9.50%)

2019 Senior Notes (7.00%)

2022 Senior Notes (7.75%)

Other Secured Debt (2)

Operating Facilities

Total Debt

Total Net Debt

LTM EBITDA

Debt to EBITDA

Net Debt to EBITDA

30-Sept-14

Pre-Refinancing

US$mm

$240

$499

$334(1)

-

-

$23

-

$856

$616

$196

4.4x

3.2x

31-Mar-15

Post-Refinancing

US$mm

$100

-

-

$250

$400

$21

$24

$695

$595

$242

2.9x

2.5x

The refinancing has delevered and simplified Mercer’s corporate structure

Note: Interest rate swap will remain in place post-transaction; the swap matures in October 2017 and represents a fair value liability of US$29.6 million as at

March 31, 2015, which is not included in Total Debt

(1) Principal amount, does not include premium

(2) Includes capital leases and payment-in-kind note issued to finance the acquisition of substantially all of the shareholder loans / minority shareholder interests in our Stendal

mill

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com MERCER 25

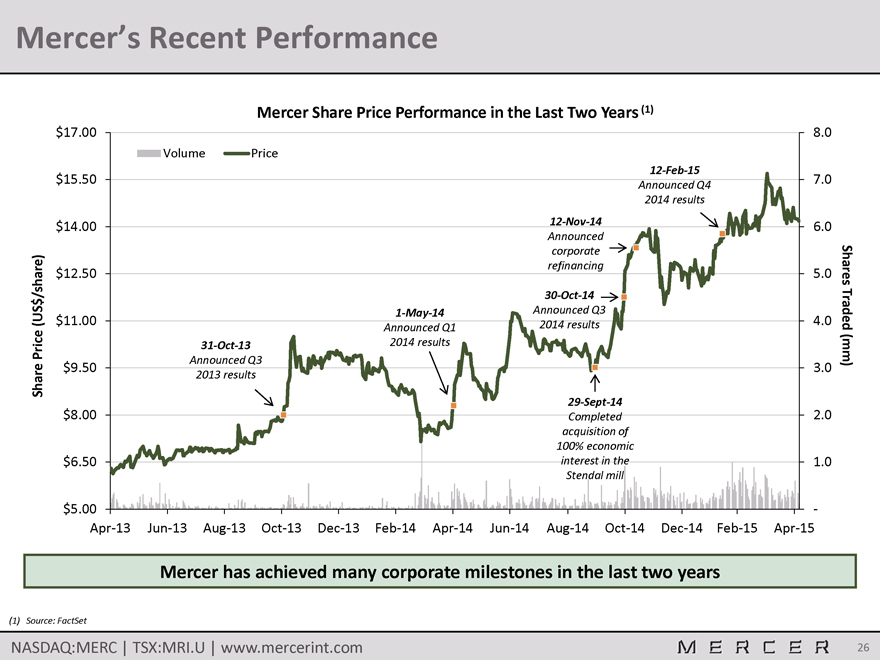

Mercer’s Recent Performance

Mercer Share Price Performance in the Last Two Years (1)

Share Price (US$/share)

$17.00

$15.50

$14.00

$12.50

$11.00

$9.50

$8.00

$6.50

$5.00

Volume

31-Oct-13

Announced Q3

2013 results

Price

1-May-14

Announced Q1

2014 results

12-Feb-15

Announced Q4

2014 results

12-Nov-14

Announced

corporate

refinancing

30-Oct-14

Announced Q3

2014 results

29-Sept-14

Completed

acquisition of

100% economic

interest in the

Stendal mill

8.0

7.0

6.0

5.0

4.0

3.0

2.0

1.0

-

Shares Traded (mm)

Apr-13 Jun-13 Aug-13 Oct-13 Dec-13 Feb-14 Apr-14 Jun-14 Aug-14 Oct-14

Dec-14 Feb-15 Apr-15

Mercer has achieved many corporate milestones in the last two years

(1) Source: FactSet

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com MERCER 26

Mercer - Summary

The

largest “pure-play” NBSK market pulp producer

Globally cost competitive, modern mill operations

Strategically located mills with excellent access to key markets

Stable and growing revenue

from high-margin energy & bio-chemical by-product sales

Strong long-term NBSK fundamentals

Significant leverage to the NBSK pulp cycle

Recently recapitalized and delevered the balance

sheet

Experienced management team

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

MERCER 27

Appendix A

Detailed

Overview of Operations

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com MERCER 28

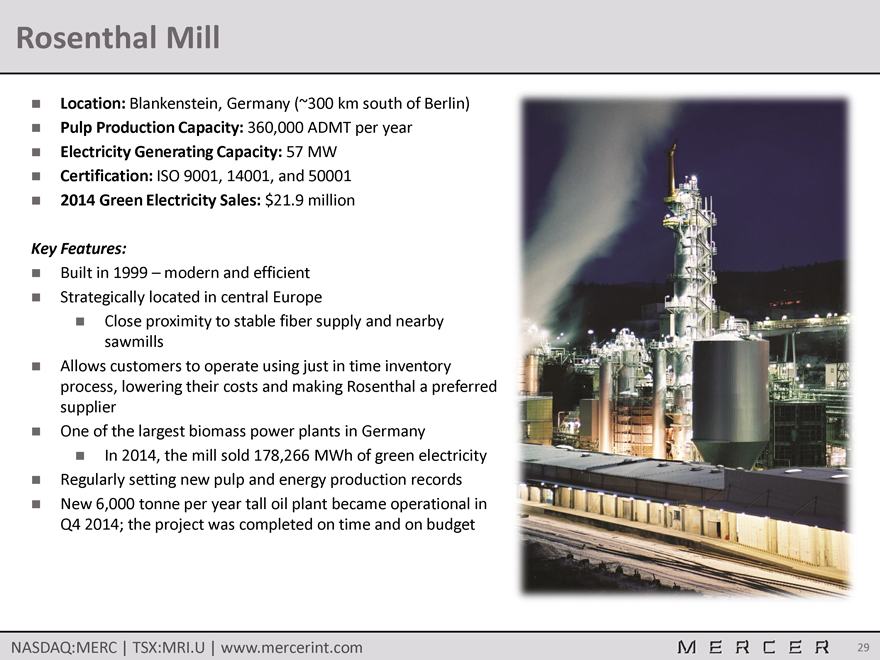

Rosenthal Mill

Location:

Blankenstein, Germany (~300 km south of Berlin)

Pulp Production Capacity: 360,000 ADMT per year

Electricity Generating Capacity: 57 MW

Certification: ISO 9001, 14001, and 50001

2014 Green Electricity Sales: $21.9 million

Key Features:

Built in 1999 - modern and efficient

Strategically located in central Europe

Close proximity to stable fiber supply and nearby sawmills

Allows customers to operate using

just in time inventory process, lowering their costs and making Rosenthal a preferred supplier

One of the largest biomass power plants in Germany

In 2014, the mill sold 178,266 MWh of green electricity

Regularly setting new pulp and energy

production records

New 6,000 tonne per year tall oil plant became operational in Q4 2014; the project was completed on time and on budget

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com MERCER 29

Celgar Mill

Location:

Castlegar, BC, Canada (~600 km east of Vancouver)

Pulp Production Capacity: 520,000 ADMT per year

Electricity Generating Capacity: 100 MW

Certification: ISO 9001 and 14001

2014 Green Electricity Sales: $10.1 million

Key Features:

Modern and efficient

Abundant and low cost fiber, by global standards

Green Energy Project was completed in September 2010

In 2014, the mill sold 119,719 MWh of

green electricity

Secured C$57.7 million in non-repayable capital funding from government of Canada for green capital investments

Majority used to fund Green Energy Project

Continues to demonstrate significant upside

potential

Regularly setting production records and increasing the amount of bio-energy generated

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com MERCER 30

Stendal Mill

Location:

Stendal, Germany (~130 km west of Berlin)

Pulp Production Capacity: 660,000 ADMT per year

Electricity Generating Capacity: 148 MW

Certification: ISO 9001 and 14001

2014 Green Electricity Sales: $56.8 million

2014 Chemical Sales: $12.5 million

Key Features:

Completed in 2004, it’s one of the newest and largest pulp mills in the

world

In September 2014, Mercer completed the acquisition of all of the shareholders’ loans, substantially all of the shares of the minority shareholder and

other rights in the Stendal mill

One of the largest biomass power plants in Germany

In 2014, exported 509,773 MWh

Project Blue Mill was completed in Q4 2013 (on time and on

budget) and increased the mill’s annual pulp production capacity by 30,000 ADMT and electricity generation by 109,000 MWh

Regularly setting new performance

records

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com MERCER 31

Appendix B

Reconciliation

of Net Income to Operating EBITDA

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com MERCER 32

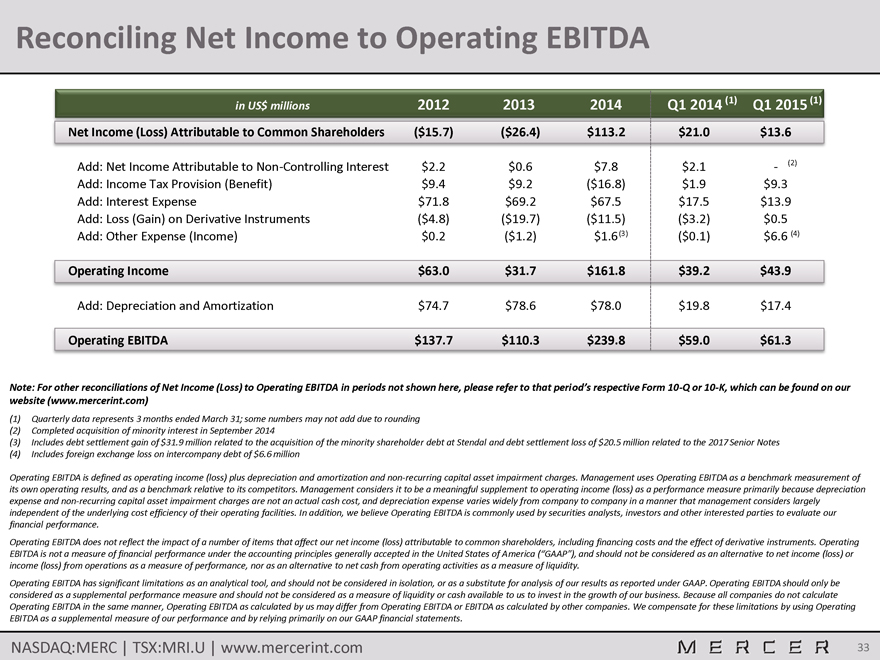

Reconciling Net Income to Operating EBITDA

in US$ millions

Net Income (Loss) Attributable to Common Shareholders

Add: Net Income Attributable to Non-Controlling Interest

Add: Income Tax Provision (Benefit)

Add: Interest Expense

Add: Loss (Gain) on Derivative Instruments

Add: Other Expense (Income)

Operating Income

Add: Depreciation and Amortization

Operating EBITDA

2012

($15.7)

$2.2

$9.4

$71.8

($4.8)

$0.2

$63.0

$74.7

$137.7

2013

($26.4)

$0.6

$9.2

$69.2

($19.7)

($1.2)

$31.7

$78.6

$110.3

2014

$113.2

$7.8

($16.8)

$67.5

($11.5)

$1.6(3)

$161.8

$78.0

$239.8

Q1 2014 (1)

$21.0

$2.1

$1.9

$17.5

($3.2)

($0.1)

$39.2

$19.8

$59.0

Q1 2015 (1)

$13.6

- (2)

$9.3

$13.9

$0.5

$6.6 (4)

$43.9

$17.4

$61.3

Note: For other reconciliations of Net Income (Loss) to Operating EBITDA in periods not shown here, please refer to that period’s respective Form 10-Q or 10-K, which can be

found on our website (www.mercerint.com)

(1) Quarterly data represents 3 months ended March 31; some numbers may not add due to rounding (2) Completed

acquisition of minority interest in September 2014

(3) Includes debt settlement gain of $31.9 million related to the acquisition of the minority shareholder debt

at Stendal and debt settlement loss of $20.5 million related to the 2017 Senior Notes (4) Includes foreign exchange loss on intercompany debt of $6.6 million

Operating EBITDA is defined as operating income (loss) plus depreciation and amortization and non-recurring capital asset impairment charges. Management uses

Operating EBITDA as a benchmark measurement of its own operating results, and as a benchmark relative to its competitors. Management considers it to be a meaningful supplement to operating income (loss) as a performance measure primarily because

depreciation expense and non-recurring capital asset impairment charges are not an actual cash cost, and depreciation expense varies widely from company to company in a manner that management considers largely independent of the underlying cost

efficiency of their operating facilities. In addition, we believe Operating EBITDA is commonly used by securities analysts, investors and other interested parties to evaluate our financial performance.

Operating EBITDA does not reflect the impact of a number of items that affect our net income (loss) attributable to common shareholders, including financing costs and the effect of

derivative instruments. Operating EBITDA is not a measure of financial performance under the accounting principles generally accepted in the United States of America (“GAAP”), and should not be considered as an alternative to net income

(loss) or income (loss) from operations as a measure of performance, nor as an alternative to net cash from operating activities as a measure of liquidity.

Operating EBITDA has significant limitations as an analytical tool, and should not be considered in isolation, or as a substitute for analysis of our results as

reported under GAAP. Operating EBITDA should only be considered as a supplemental performance measure and should not be considered as a measure of liquidity or cash available to us to invest in the growth of our business. Because all companies do

not calculate Operating EBITDA in the same manner, Operating EBITDA as calculated by us may differ from Operating EBITDA or EBITDA as calculated by other companies. We compensate for these limitations by using Operating EBITDA as a supplemental

measure of our performance and by relying primarily on our GAAP financial statements.

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com MERCER 33