Attached files

| file | filename |

|---|---|

| 8-K - MAXIMUS, INC. 8-K - MAXIMUS, INC. | a51101007.htm |

| EX-99.1 - EXHIBIT 99.1 - MAXIMUS, INC. | a51101007ex99_1.htm |

Exhibit 99.2

Operator: Greetings, and welcome to the MAXIMUS Fiscal 2015 Second Quarter Conference Call. At this time, all participants are in a listen-only mode. A brief question-and-answer session will follow the formal presentation. [Operator Instructions] As a reminder, this conference is being recorded.

It is now my pleasure to introduce your host Lisa Miles, Senior Vice President of Investor Relations for MAXIMUS. Thank you. Ms. Miles. You may now begin.

Lisa Miles

SVP-Investor Relations & Corporate Communications

Good morning. Thank you for joining us on today's conference call. I would like to point out that we've posted a presentation on our website under the Investor Relations page to assist you in following along with today's call.

With me today is Chief Executive Officer, Rich Montoni; President, Bruce Caswell; and Chief Financial Officer, Rick Nadeau.

Before we begin, I'd like to remind everyone that a number of statements being made today will be forward looking in nature. Please remember that such statements are only predictions, and actual events and results may differ materially as a result of risks we face, including those discussed in Exhibit 99.1 of our SEC filings.

We encourage you to review the summary of these risks in our most recent 10-K filed with the SEC. The company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances.

Today's presentation may contain non-GAAP financial information. Management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of our financial performance, identifying trends in our results and providing meaningful period-to-period comparisons. For a reconciliation of non-GAAP measures presented in this document, please see the company's most recent quarterly earnings press release.

And with that, I'll turn the call over to Rick.

Richard J. Nadeau

Chief Financial Officer & Treasurer

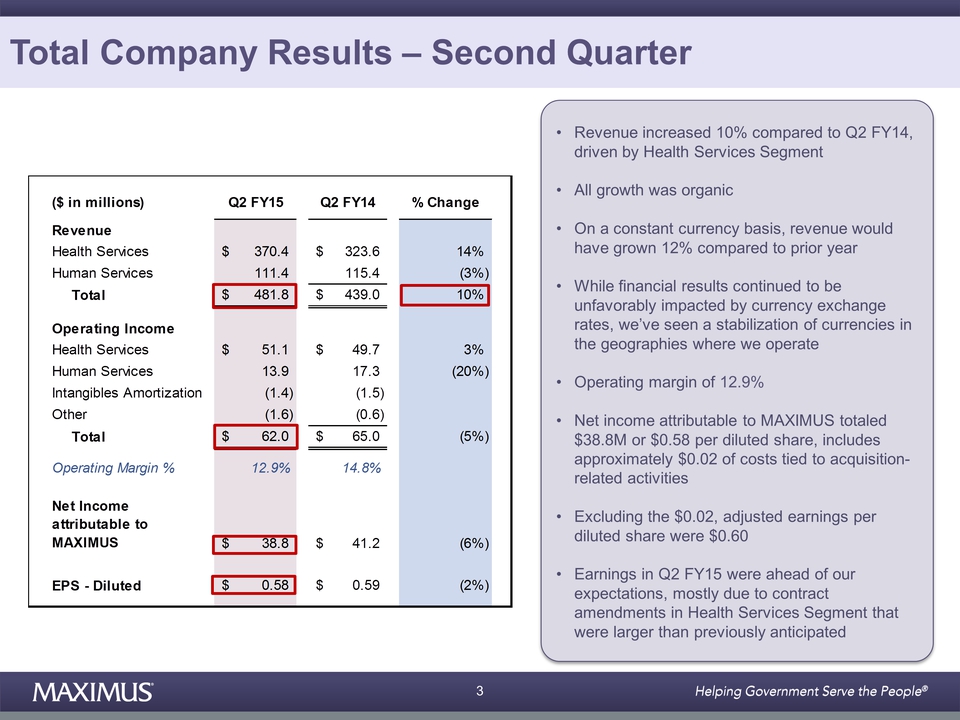

Thanks, Lisa. This morning MAXIMUS reported second quarter revenue of $482 million, a 10% increase compared to the same period last year, driven by the Health Services segment. Our growth in the quarter was organic, and on a constant currency basis revenue would have grown 12% compared to the prior-year.

Meanwhile, financial results continue to be unfavorably impacted by currency exchange rates in the second quarter, we've seen a stabilization of currencies in the geographies where we operate since our last call.

For the second quarter of fiscal 2015, operating income totaled $62.0 million, and the company delivered an operating margin of 12.9%. For the second quarter, net income attributable to MAXIMUS totaled $48.8 million or $0.58 per diluted share, which includes approximately $0.02 of cost tied to acquisition-related activities. Excluding this, adjusted earnings per diluted share was $0.60.

Earnings in the quarter were ahead of our expectations, mostly due to a couple of contract amendments in the Health Segment that were larger than previously anticipated.

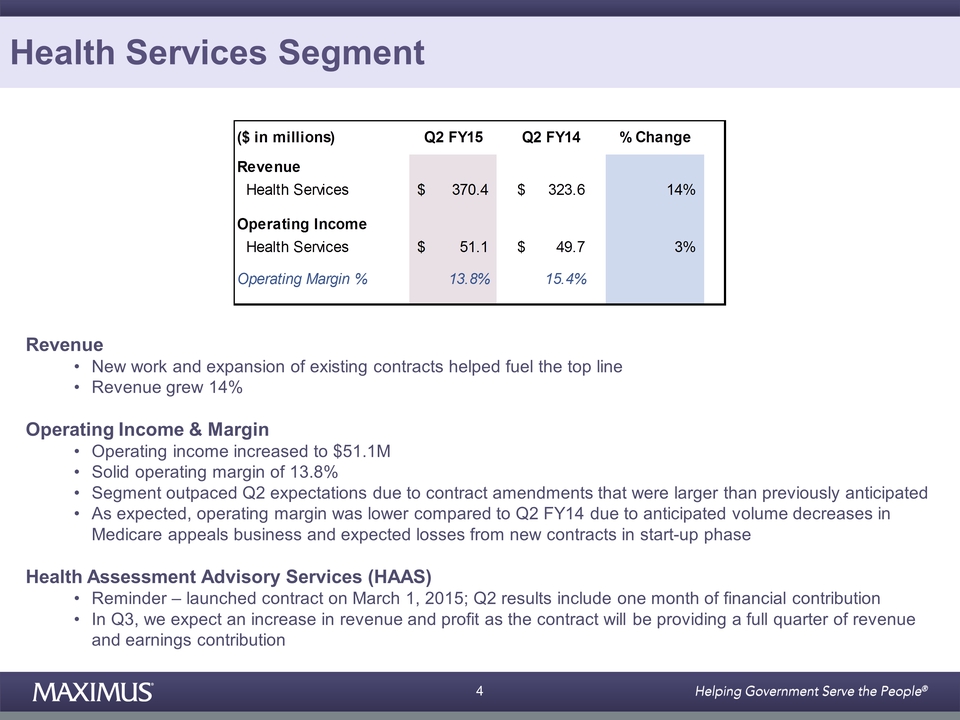

Let me speak to our results by segment. Starting with Health Services. The Health Services segment experienced another solid quarter of financial results. New work in the expansion of existing contracts helped fuel the top line. As a result, revenue in the second quarter grew 14% to $370 million compared to the same period last year.

Health Services segment operating income in the second quarter of fiscal 2015 increased to $51.1 million compared to the same period last year. For the second quarter, the Heath segment delivered solid operating margins of 13.8%. This segment outpaced our expectations for the quarter due to contract amendments that were larger than previously anticipated.

As expected, operating margin was lower than the same period last year, due to the anticipated volume decreases in our Medicare appeals business, and the expected losses from new contracts in startup phase. As a reminder, we launched the UK's Health Assessment Advisory Service contract on March 1, and second quarter results included one month of financial contribution.

So looking now to Q3, we expect an increase in revenue and profit as the contract will be providing a full quarter of revenue and earnings contribution. All-in-all, another solid quarter from Health Services segment.

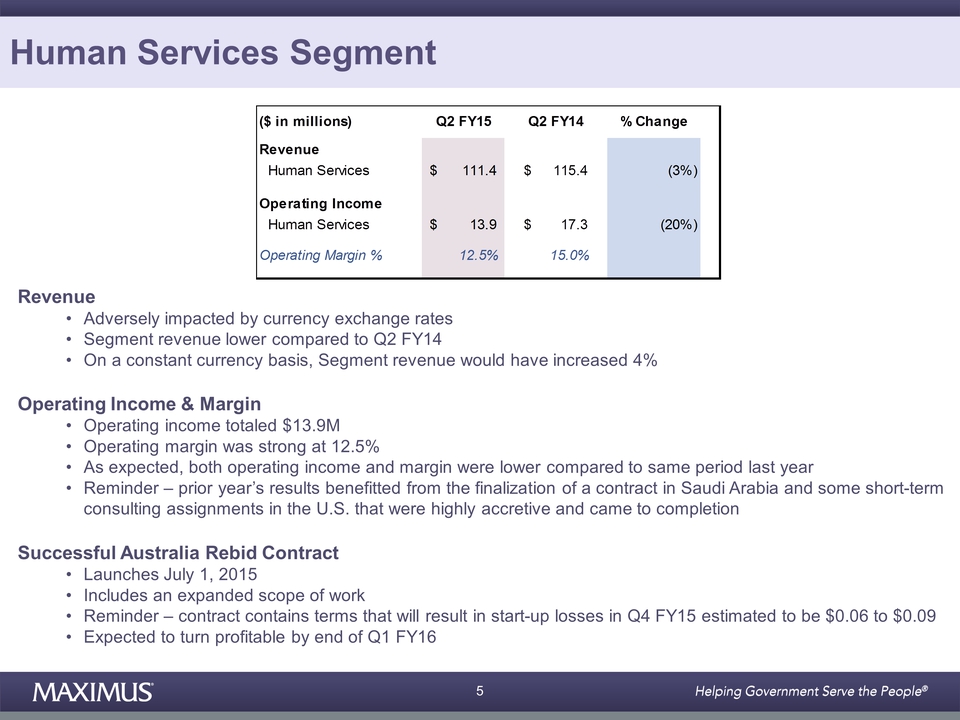

Now, let's turn our attention to financial results for Human Services. Once again the Human Services segment felt the greatest impact for adverse currency exchange rates. For the second quarter of fiscal 2015, revenue for this Human Services segment totaled $111 million and was lower compared to the same period last year. But on a constant currency basis, this segment's revenue would have increased 4%.

Second quarter operating income from Human Services segment totaled $13.9 million, and operating margin was strong at 12.5%. As expected, both operating income and margin were lower compared to last year. And as a reminder, the prior year's results benefited from the finalization of a contract in Saudi Arabia, and some short- term consulting assignments in the U.S. that were highly accretive and came to completion.

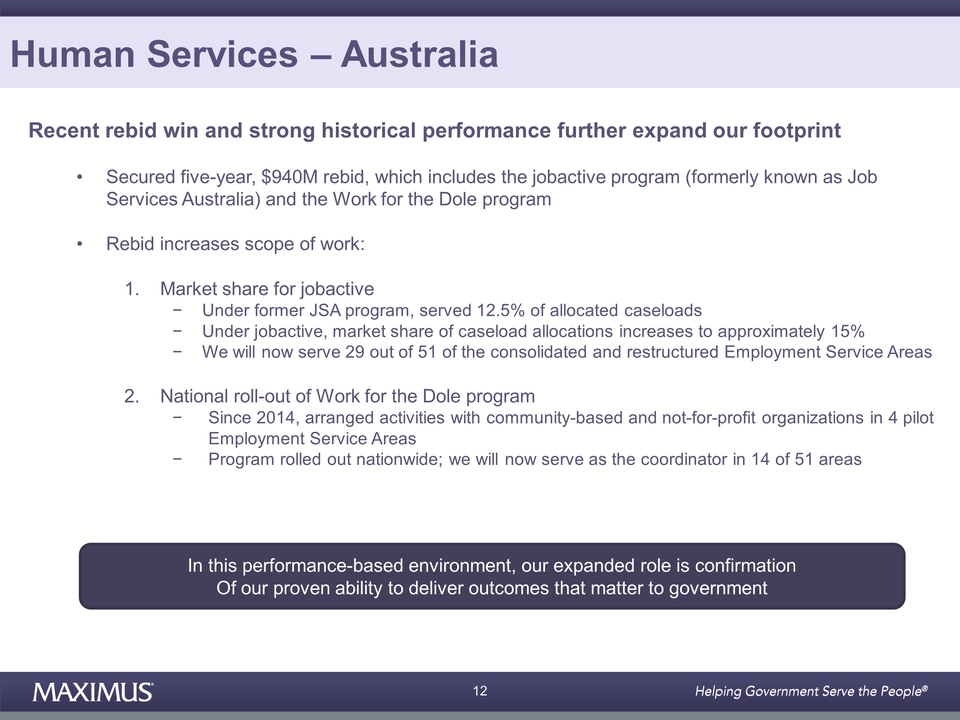

As previously announced, we were successful in our rebid in Australia, and the new contract launches on July 1. We noted in this morning's press release that the new contract includes an expanded scope of work. As a reminder, the contract contains terms that will results in start-up losses in our fourth quarter of fiscal 2015, which we estimate to be $0.06 to $0.09 per diluted share. The contract is expected to turn profitable by the end of the first quarter of fiscal 2016.

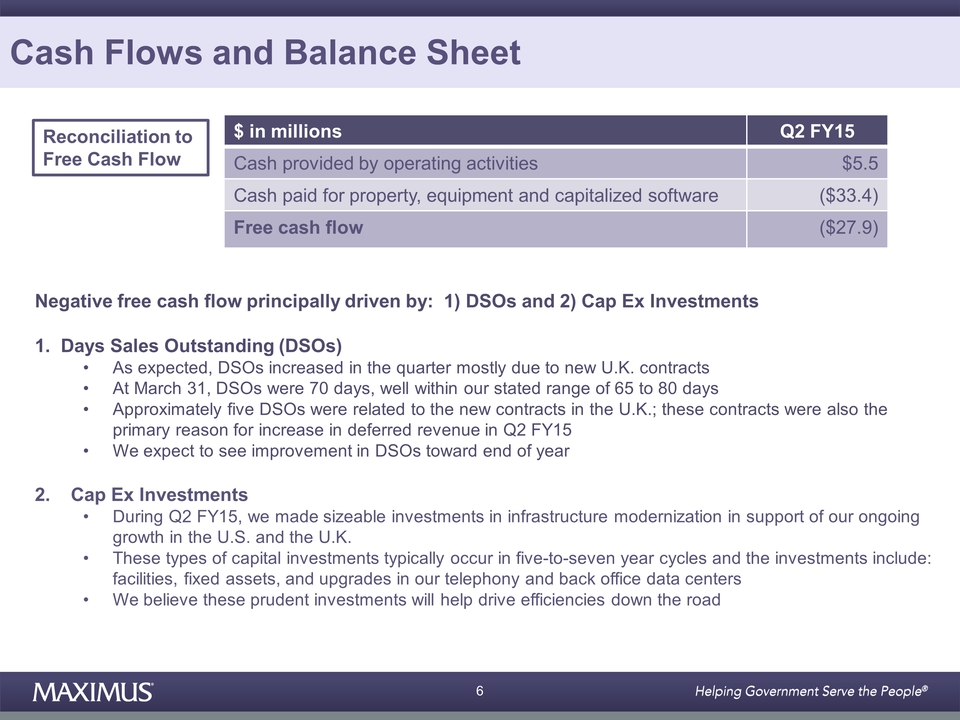

Moving on to cash flows and balance sheet items. For the second quarter of fiscal 2015, cash provided from operating activities totaled $5.5 million. And we have negative free cash flow of $27.9 million. The negative free cash flow was principally driven by two items. One, the increase in DSOs; and two, CapEx investments. As expected, DSOs increased in the quarter mostly due to the new contracts in United Kingdom, the Health Assessment Advisory Service and Fit for Work contracts.

At March 31, DSOs were 70 days, which is well within our stated range of 65 days to 80 days. Approximately five of these DSOs were related to the new contracts in the UK. These contracts in the UK were also the primary reason for the increase in deferred revenue in the second quarter. We should expect to see improvement in DSOs towards the end of the year.

Also, during the second quarter, we made some sizeable investments in infrastructure modernization in support of our ongoing growth in United States and United Kingdom. These types of capital investments typically occur in five-year to seven-year cycles. The investments include facilities, fixed assets, and upgrades in our telephony and back-office data centers. We believe these good investments will help drive efficiencies down the road.

During the second quarter, we also amended our credit facility agreement. The expanded credit facility, [ph] leaves us a (08:56) revolving line of credit up to $400 million and an uncommitted increase option up to an additional $200 million. The facility is available for general corporate purposes including working capital, CapEx and selective acquisitions.

Subsequent to quarter close, we tapped into the new credit line to complete the acquisition of Acentia in April. As a reminder, this was an all-cash transaction with a total purchase price of approximately $300 million. We funded acquisition and related costs with domestic cash on hand and approximately $225 million borrowed under the amended credit facility. Acentia is expected to contribute approximately $110 million in revenue for second half of fiscal 2015.

Also, after quarter closed, we completed the Remploy transaction. We recommend that investors view this largely as an acquisition of a single contract, and the incumbent workforce of approximately 850 experienced personnel. Remploy will contribute approximately $30 million to $35 million in revenue for remainder of our fiscal 2015, and the vast majority relates to Work Choice contract.

MAXIMUS has a 70% ownership and Remploy employees have a collective 30% stake in the business. Remploy has a long history of supporting people with complex barriers into employment. And this will help MAXIMUS better support thousands more disabled people into work in the years to come. Rich will talk about this in more detail later on.

From a capital allocation perspective, we will continue to focus on practical usage of cash to grow the business both organically and through acquisition. In addition to supporting the longer-term growth objective of MAXIMUS, other priority uses of cash include our quarterly cash dividends and our opportunistic share repurchase program.

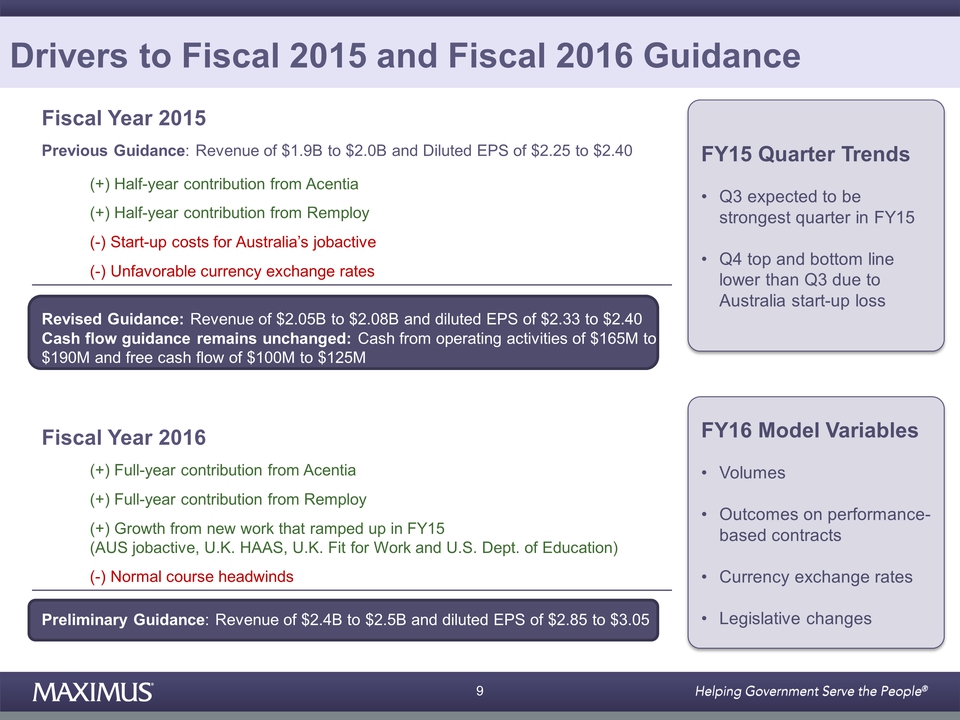

And lastly, as noted in this morning's press release, we are increasing our fiscal 2015 revenue guidance due to the expected revenue contributions from Acentia and Remploy. We now expect fiscal 2015 revenue to range between $2.05 billion and $2.08 billion.

In addition, we are bringing up the bottom end of our GAAP earnings range. We now expect fiscal 2015 earnings in the range of $2.33 to $2.40 per diluted share with bias towards the upper end of the range. This range considers the expected contributions from Acentia and Remploy, which we are forecasting to range between $0.07 and $0.09 of earnings per diluted share for the second half of fiscal 2015.

As expected, the accretion from these acquisitions will be offset by the start-up losses of the new jobactive program in Australia of approximately $0.06 to $0.09 per diluted share. As a reminder, we increased our market share through this successful rebid. As a result, the anticipated startup loss is higher and we forecast it in our initial guidance at the beginning of the year.

The other consideration for fiscal 2015 guidance is currency impacts. As we discussed last quarter, we have been negatively impacted by currency exchange rates relative to when we issued guidance in November. Since our last call in February, the currencies have stabilized. So the degradation has abated, and there is no material change to the information provided on our last call.

We still estimate on a favorable currency impact to total company revenue of approximately $45 million and operating income of approximately $4.5 million or $0.05 per diluted share. This compared to the exchange rates that were assumed when we completed our forecast in late October.

We also wanted to provide some quarterly flavor for the rest of fiscal 2015. First, as previously disclosed, Q3 is still expected to be stronger than our Q2, primarily due to a full quarter's contribution from the new Health Assessment Advisory Service contract that began contributing revenue and profit in March.

Right now, Q3 is shaping up to be the strongest quarter for fiscal 2015. And our fiscal fourth quarter will be lower on the top line and bottom line principally due to the start-up headwind on the new contract in Australia.

We are also maintaining our cash flow guidance for fiscal 2015. We still expect cash provided from operating activities to be in the range of $165 million to $190 million. And we expect free cash flow to be in the range of $100 million to $125 million, but towards the lower-end of the range due to the capital investments we are making.

And lastly, while we think it's too early to provide formal guidance for fiscal 2016, we thought it would be helpful to provide some direction for next fiscal year. As you know, we've had a number of developments in fiscal 2015 that will have a positively impact to fiscal 2016, including full year contributions from Acentia and Remploy acquisitions, and the ongoing growth for new work that was presently ramping up in fiscal 2015, this includes the rebid win in Australia that also brings along increased market share.

While these are all affirmative tailwinds, we do manage an entire portfolio of contracts, and in any given year, we naturally expect to experience some headwinds. [ph] And this outlook (16:01) does contemplate some of those puts and takes in the overall model. When we add this all up, we think fiscal 2016 is shaping up to be another strong growth year.

Our estimates are predicated on what we know today, and they assume no other dramatic headwinds [ph] of the event (16:23) normal course fluctuations that we see, year-in and year-out. As a result, our preliminary estimated revenue for fiscal 2016 is in the range of $2.4 billion to $2.5 billion. We preliminarily expect earnings per diluted share to range between $2.85 and $3.05.

We're obviously in a number of variables that can affect our financial results. This will include changes in volumes, outcomes on performance-based contracts, fluctuations in currency and legislative changes.

But overall, we remain on track for solid results in fiscal 2015, and more importantly the foundation set to deliver another strong year of growth in fiscal 2016. Thanks for joining us this morning. And now, I'll turn the call over to Rich.

Richard A. Montoni

Chief Executive Officer & Director

Thank you, Rick, and good morning. With another quarter of solid operational and financial results under our belt, we remain on the growth path we've set for the remainder of the fiscal year and beyond.

Since our last call, we've had several positive developments in both segments that bring meaningful contributions to the achievement of our long-term growth strategy. This includes the Acentia and Remploy acquisitions as well as the expanded scope of work in Australia. These developments coupled with the organic growth from new and existing programs represent the basis for our continued growth into the next year, that being fiscal 2016.

We not only provide preliminary guidance this early, it's useful to offer more insight to the investment community on how we are thinking about next year as investors consider these multiple developments. So let's start with the Human Services segment where our recently bid win in our strong historical performance helped us further expand our footprint in Australia.

We are pleased to secure the five-year $940 million rebid for the new jobactive program; it will start on July 1. As we mentioned in our recent press release, jobactive is the new name for Job Services Australia or JSA program. We've been increasing our scope of work in two different ways. The first is our market share. Under JSA, we serve 12.5% of allocated caseloads. Under the new jobactive contract, we gain a net pick-up in expected volumes, which increases our market share of caseload allocations to approximately 15%. The Australian government also consolidated and restructured the number of Employment Service Areas for jobactive. There are now 51 areas, and MAXIMUS will support jobseekers in 29 of them.

The second increase in scope is related to the national roll-out of the Work for the Dole program. Since 2014 MAXIMUS provided services in four of the pilot employment service areas, where we arrange activities with community-based and not-for-profit organizations. The Australian government has now taken the program nationwide and MAXIMUS will serve as the coordinator for 14 areas of the 51 areas.

In this performance-based environment, our expanded role is confirmation of our proven ability to deliver the outcomes that matter to our government clients. In this case, successfully helping jobseekers obtain sustainable employment. It's certainly an important component of our longer-term growth strategy, and I congratulate our Australian team on a job well done.

Now turning to our UK operations, where we completed the acquisition of Remploy in April. We are very excited to welcome this highly regarded organization to MAXIMUS through a 70%, 30% partnership. Remploy is well- known for successfully assisting people with complex barriers into employment and complements our existing portfolio. They're one of the primary providers for Work Choice, which is the government's employment program for people with disabilities and health conditions.

Remploy has a 70-year history of delivering disability employment services throughout the United Kingdom. Following the Second World War, the government established Remploy to provide training and employment for injured and disabled ex-military and miners. Since then Remploy has evolved into an organization that has dedicated to supporting people with disabilities and health condition into mainstream employment; and MAXIMUS is firmly committed to continuing this mission.

Remploy increases our global presence as a world-leading provider of disability employment services. This will enhance our business development efforts for emerging opportunities. Our experience running similar services in other geographies, most notably Australia complements Remploy's expertise in United Kingdom. MAXIMUS and Remploy share similar cultures and values and our integration efforts are going well. We're excited to grow together and transform the lives of even more people through sustainable long-term employment.

Let's move on to Health Services segment. Here we introduced a new growth platform for our U.S. federal services business with the acquisition of Acentia. Most notably, the acquisition provides us with additional contract vehicles and access to federal government agencies that are core to the MAXIMUS business model. In federal contracting market, government agencies typically seek support from vendors through three different channels, contract vehicles, full and open procurements, and set-asides for entities like small businesses.

Contract vehicles allow agencies to prequalify a selected set of vendors to support their needs. Only these pre- vetted companies have the exclusive opportunity to bid on contracts and task orders. The civilian services space is the sweet spot for MAXIMUS, majority of support work is issued through contract vehicles. Acentia brings numerous contract vehicles; which now allow MAXIMUS to bid as a prime contractor for both IT support and business process management opportunities. In the past, we could only access these bids by relying on teaming arrangements; now we believe the acquisition opens up an entirely new set of opportunities for us.

Acentia also allows MAXIMUS to be at full-service provider to the federal government and our integrated business development team is already hard at work on opportunities. As a provider of technology and management solutions, Acentia has cultivated positive relationships with a number of federal health and civilian agencies. These include the Internal Revenue Service, the U.S. Defense Health Agency and the U.S. Department of Labor.

We plan to build upon the success, and overtime introduce additional core services to this new set of agencies. It's important to remember that, federal business development efforts often have a long runway due to the federal procurement process. We are optimistic that the acquisition will serve as an important step in our long-term strategy to continue to grow our U.S. federal book of business and drive shareholder value.

During the second quarter, the Health Services segment also wrapped up activities for the Affordable Care Act's second open enrollment period or OE3. As we mentioned in last quarter, we continue to provide value to our clients as they address additional ACA requirements such as new tax forms and Special Enrollment Period. Overall, it was another successful open enrollment period, and we believe that we are getting closer to a steady state as we look ahead to OE3.

We are pleased that ACA revenue has come on stronger than our initial expectations at the beginning of the year; this is due in part to better-than-expected repeat work as well as providing states with additional support services tied to meeting requirements under the act. It's important to remember that we operate a portfolio of ACA-related work that goes beyond call center operations. This broader scope includes; the training and certification of community assisters and brokers, premium and cost-sharing collections, eligibility appeals in some states, and social media management.

We presently expect that ACA-related revenue for the full year of fiscal 2015 will be up about 10% compared to last year. At this point, we think the annual revenues from ACA have largely stabilized into more of a steady state, but it's also important to put it in perspective. We estimate that ACA-related revenue will be about 15% of consolidated revenue for fiscal 2015.

Let me now move on to our International Health Operations, where MAXIMUS successfully launched the Health Assessment Advisory Service in the UK on March 1. This is the contract where MAXIMUS is conducting assessment for individuals seeking certain disability benefits according to the rules set down by the United Kingdom parliament. Our start-up of operations are progressing well. We're working hard to achieve the program's goals related to improved service to UK citizens, including increasing the overall number of healthcare professionals who support the program.

This allows us to meet our assessment volume requirement and lower the backlog so people can be assessed in a timely manner. Nearly all of the employees transferred over from the previous provider, and early indications are that we are meeting our recruitment targets for healthcare professionals.

This is key in helping us bring about positive change, and although it's early days, we're also on track to meet our requirements for assessment volumes. As a remainder, our longer-term goals for the program include reducing the long lead times, improving the quality of the assessment and making the assessment process less intimidating.

We remain actively engaged with different stakeholder groups in the United Kingdom as a top priority for this highly visible program. As part of our stakeholder outreach, we've established a Customer Representative Group that covers more than 20 national disability organizations. Together, we're identifying areas where we can make meaningful improvements such as; clinical training, the assessment interview, accessibility of sites and customer communications. In fact, we've already received positive feedback from some of the member organizations of our efforts to improve the accessibility of the clinical sites.

All-in-all, it was a great quarter for both segments, we are executing on the work recently won, securing our base book of business with key rebid wins and launching new opportunities for future growth.

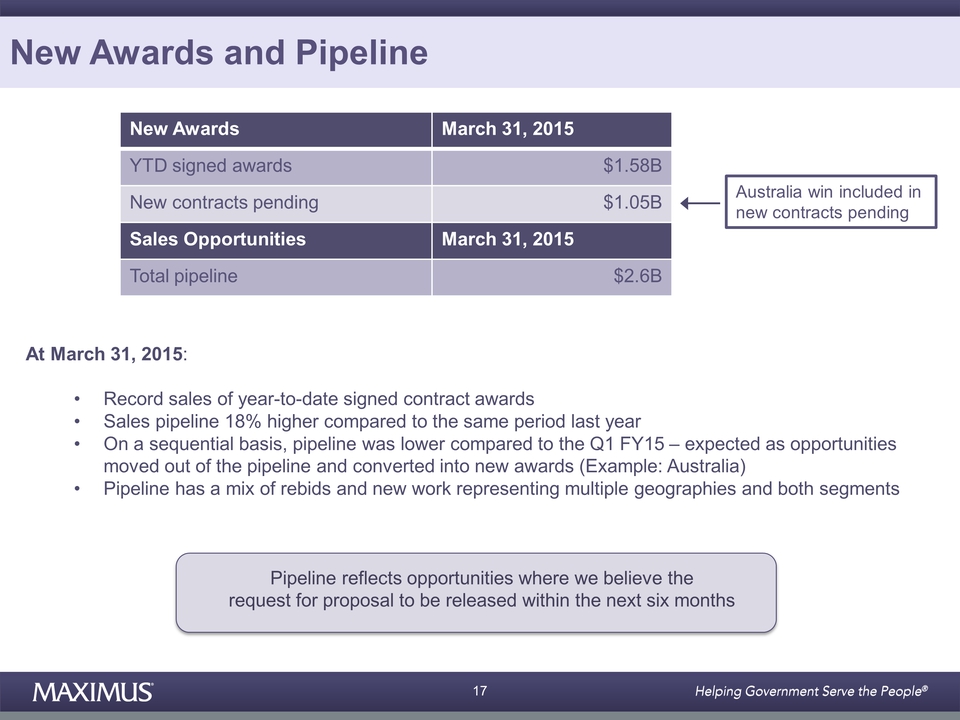

Moving on to new awards and pipeline. MAXIMUS posted sales at March 31, year-to-date signed contract awards of $1.58 billion. At March 31, we also had an additional $1.05 billion in new awarded unsigned contracts, including the jobactive rebid contract in Australia.

With these two large wins now signed, we are at a record level of annual signed contract [ph] announced (28:13). Our sales pipeline was strong at $2.6 billion at March 31. This is an 18% increase over our pipeline for the same- period of last year.

On a sequential basis, the pipeline was lower compared to the first quarter of fiscal 2015; this is very much expected as we've had larger opportunities such as the Australian rebid move out of the pipeline and convert into new rewards. As a remainder, our reported pipeline only reflects opportunities, where we believe the RFP is expected to be released within the next six months.

Overall, our pipelines holds a broad mix of rebids and new work representing multiple geographies and both segments. In conclusion, we are pleased to have introduced several new initiatives that bolster our existing platforms for long-term growth. We are equally excited about our preliminary guidance for fiscal 2016, which represents another year of expected solid revenue and earnings growth, much of which is organic.

But it's important to recognize [ph] as our people, are at the (29:22) heart of our ability to continue to deliver on our commitments to our clients; they are what drives our success on a daily basis. So let me take a moment to welcome to our new colleagues from Acentia and Remploy. On behalf of the management team, I thank our operations team and healthcare professionals in the United Kingdom who did a tremendous job as they successfully launched the new Health Assessment Advisory Service.

And finally, I reiterate our appreciation for our Australian team whose consistently higher performance played the key role in the latest rebid reward.

With that, let's open it up for questions. Operator?

Operator: Thank you. [Operator Instructions] Our first question comes from the line of Charlie Strauzer with CJS Securities. Please go ahead with your question.

Charles Strauzer

CJS Securities, Inc.

Hi, good morning. Two questions for you, the first one is, I saw that the ACA revenue was up year-over-year with kind of unexpected, and just wondering what your thoughts were going to fiscal 2016. And then also two; if you could [indiscernible] (31:07) I'd be done with that, sorry.

Richard A. Montoni

Chief Executive Officer & Director

Okay, Charlie. Good morning, this is Rich. Thanks for the question. You are asking what we're expecting for ACA revenue in 2016, and I'm actually going to ask Rick Nadeau to fill that question.

Richard J. Nadeau

Chief Financial Officer & Treasurer

Yeah, as Rich mentioned the ACA revenue is expected to be approximately 10% higher in this fiscal 2015. We think that the revenues from ACA have largely stabilized, and are more at a steady state run rate at this particular point. Although, it's certainly, based on what we know today, our preliminary guidance assumes that the revenue from the ACA-related work will be relatively stable, and at similar levels as compared to FY 2015, I mean, there will be some puts and takes within the portfolio, but we're projecting stable.

Charles Strauzer

CJS Securities, Inc.

Great. And then just, my second is just any update on the Texas rebid?

Richard A. Montoni

Chief Executive Officer & Director

On the Texas rebid, Charlie, the bids have been submitted, and as you know, we think past performances, and everyone drive around any rebid type situation, and we're really proud of the job that the team has done historically. So we think we're well-positioned.

However, it is a competitive environment, and we're anxious to hear. I think it's going to be probably a late summer type announcement. And as you know this, the current contract runs through December 31, 2015.

Lisa Miles

SVP-Investor Relations & Corporate Communications

Next question please?

Operator: Our next question comes from the line if Richard Close with Avondale Partners. Please go ahead with your question.

Richard Collamer Close

Avondale Partners LLC

Yes. Thanks, Lisa for putting a good presentation together for us. I'm curious with respect to Acentia, that transaction, can you talk a little bit more about the opportunities that you guys see ahead of – for that, and how big of an impact has been on the pipeline so far?

Richard A. Montoni

Chief Executive Officer & Director

Good question, Richard. I'll talk about opportunities. I think the opportunities with Acentia, and we touched upon this in the call. I really do think they're long-term in nature. And I think that because, two reasons, one, I think the nature of the business with government inherently takes – has a long sales cycle, one year to two years for these larger jobs to germinate in and ultimately be awarded, and that's true with the U.S. Federal Government.

And two; I believe there's long-term opportunities as governments look to providers who can provide a more holistic solutions. We are seeing a bit of a consolidation in the industry globally as governments are stretched to deal with many, many, many vendor. In some programs there has been hundreds of vendors.

There tends to be a trend here to consolidate vendors, meaning the awards would be larger per vendor and I also think the nature of the scope would be increased, not just traditional labor-based BPO, but with technology playing a larger role in those solutions.

So I think, Acentia combining with MAXIMUS puts us in a position, where not only do we have that historic BPO capability, but more [ph] IPO (34:25) capability, which will further enhance our holistic offering in those agencies, which by the way are key along the – with the vehicles that we get with the Acentia combination. And there was a second part to your question; I think you were asking what's the impact on the pipeline?

Richard Collamer Close

Avondale Partners LLC

Yeah.

Richard A. Montoni

Chief Executive Officer & Director

And the answer is, the information we just shared with you about pipeline at March 31 excludes Acentia. So as you would expect, when we pull together, that data for June 30, will add the Acentia information on top of it.

Richard Collamer Close

Avondale Partners LLC

I had a follow-up on the ACA revenue, if you could, how did you guys actually accomplish this in fiscal 2015 considering, you thought there was going to be a $50 million to $100 million headwind?

Richard A. Montoni

Chief Executive Officer & Director

I'm going to ask Bruce Caswell who's here with us today to answer that. And then I may provide some info as well. Go ahead, Bruce.

Bruce L. Caswell

President

Sure. And Richard, the reality is, of course, we operate more than just customer call centers related specifically to ACA-related calls. So we have a fairly diverse portfolio of services that we provide our clients. It's not uncommon in some of our contracts to provide additional functions, that can see increases in volumes over time.

We do things like training and certification of community assisters and brokers, we handle premium and cost sharing collections for some of our clients, we handle in fact eligibility appeals as to do that at the federal level, but we also do it in some of our state contracts.

Also this year was a bit different than last year. You may recall, we had for the first time, people coming back and reenrolling and renewing. And just prior to the open enrollment period opening, there was a concerted effort to encourage individuals to come back to the exchanges and see how the premiums in the exchanges may have changed, and not just auto reenroll.

And then as we reached the end of the open enrollment period, we had transactions related to these 1095-A forms, the tax forms that the IRS is putting up for the first time. And always, you'll see some special enrollment period activities as the open enrollment period closes. And then the last component I would add is that, in many of our health insurance exchange contracts, we do work related to supporting the Medicaid requirements under the Affordable Care Act for those populations.

And many of these households have complex family situation, where certain individuals might qualify for Medicaid and others for exchange policies. So we support our clients doing things by eligibility applications screening and eligibility support services related to that. So it's really just a collection of those additional, call it non-traditional call center activities that comprise the growth there.

Lisa Miles

SVP-Investor Relations & Corporate Communications

Thanks, Richard. Next question, please?

Operator: Our next question comes from the line of Dave Styblo with Jefferies. Please go ahead with your question.

David A. Styblo

Jefferies LLC

Hi, good morning. Thanks for the questions. I did want to stay on Acentia for another minute here. And Rich, I was just hoping you would give us perhaps some more color about sort of the – the short-term goal that you'll be able to take now with this deal. Because – it essentially, it sounds like – the nugget here is, you get a feet up a table, where you didn't previously have a seat for some of these RFPs that were out there.

So if that's the case, I'm understanding it right, then. What do those contracts will looks like, are they much larger, similar size, sort of ones that you're going after, given that you're – you're now having access to a variety of different departments. And then also, what would the expected margin profile be on those types of future wins?

Richard A. Montoni

Chief Executive Officer & Director

Okay, good. Good series of questions, David. In terms of the short-term goal, and I guess it's very appropriate today. I think it's very meaningful increase on our opportunities.

As many folks know, dealing with the U.S. Federal Government, the majority of the work in our belief is awarded through these contract vehicles. So if you are not one of the limited companies initially awarded a seat on that vehicle, you are not able bid.

And we've not had these vehicles in our portfolio up through this acquisition of Acentia. The acquisition of Acentia add some very meaningful vehicles and good customer relationships with the exact agencies that are of interest to MAXIMUS. So that would be civilian and health agencies.

So I think the short-term goal, I can't quantify, and I can't give you a preliminary indication of how much it's going to add to our pipeline this year and next year. I think it is quite meaningful. That was really one of the principle drivers behind – the strategic drivers behind the combination.

In terms of margin, as we know, U.S. federal government work is oftentimes cost-plus, a good portion of the work for Acentia is cost-plus, so it operates in a lower margin environment; put it in a category. We expect the portfolio to perform in the 10% to 15% range. I expect that the contracts we pick-up from Acentia will be at the lower end of that range. Rick?

Richard J. Nadeau

Chief Financial Officer & Treasurer

Yeah. And also you'll have to remember that, when you do an acquisition, you had intangible assets that are recorded as part of the purchase accounting. So you will see amortization of intangibles on a going-forward basis that will tend to reduce the – will reduce the operating income.

As you see, we book that out on the face of the income statement this time, and we plan to continue to do that for you. So if you want to do an [ph] EBITDA (40:08) type of calculation, you can see it readily off the face of the income statement.

David A. Styblo

Jefferies LLC

Okay. That's helpful. And my follow-up is, is on Australia. So can you maybe walk us through a little bit more about why, why the start-up losses for the expansion, is it – your debt, you're gaining, you have to put up new facilities, expanding into new territories, is that part of the reason?

And then more importantly, my understanding, it's sort of – the contract is that, it's going to be a little bit more performance base, and so that would suggest to me that perhaps the margins would be at least the same, if not higher than what you were earning before, am I taking it out that correctly?

And then if I could kind of tag-on, as we think about an earnings slingshot from 2016, I know you don't go to 2017, too much. But I suspect that contracts would have a higher earnings than [ph] $0.16 of losses (40:57); part of losses in fiscal 2016.

Richard A. Montoni

Chief Executive Officer & Director

Let me take the margin expectation, given the fact that there is more than a performance-based element to it. And then I'm going to hand-off the first part of your question to Rick Nadeau, because it is principally accounting, or it's our kind of principle that is, just the first part of your question, in terms of why we have this start-up loss.

You are right there is one key aspect of new contract over the old contract that makes it more performance-based in particular is significant [indiscernible] (41:29) is when we not only find somebody a job, but they've been in that job for – under the old contract 13 weeks. The government under the new contract extended that to 26 weeks, so that is more [ph] paid for support performance (41:40).

And yes, you're right. As a result, we do think that our margin should be improved, vis-à-vis the old contract or at a minimum maintain, and that's our expectation as we move forward. And you're also right that we don't want to get into fiscal 2017 speculation at this point David. So with that back to Rick Nadeau as it relates to why we have these start-up losses.

Richard J. Nadeau

Chief Financial Officer & Treasurer

In both the Job Services contract, the current contract and jobactive contract, the new contract there are service fee revenues. In the old contract, Job Services contract, those are earned over a three-month period. With the new contract, the government push that back, and you now earn those service fees over a six-month period.

So actually, our deferred revenue if you will, will grow as a result of that. So we're still getting service revenues, we just earned them over a longer period of time, we'll ultimately get the whole amount, but we'll have to record the revenue on them slower than we have in the past, and thus, that gives us that $0.07 to $0.09 hold that we talked about in that fourth quarter.

Lisa Miles

SVP-Investor Relations & Corporate Communications

Thanks, David. Next question, please?

Operator: Our next question comes from the line of Stephen Lynch with Wells Fargo. Please go ahead with your question.

Stephen B. Lynch

Wells Fargo Securities LLC

Hey, guys, thanks for taking my questions. I wanted to see if I could get some more clarity around which contract amendments drove the upside in Health Services in the quarter? Was that principally related to ACA work coming in higher than expected?

Richard A. Montoni

Chief Executive Officer & Director

That was a variety of – or a couple of different contract amendments. And I want to just address that – that [ph] reason (43:16) that's an accounting thing as much as – as well as the negotiation item, we can't record revenue on change orders until they're actually signed.

And so you can't wind up with the situation where you have the cost in one period, and the revenue in another. And so that's really that, plus the fact that as time progresses, you learn more about the amendments, and you actually have some negotiation around them and you learn more about them. So that's really the – what happened there.

Stephen B. Lynch

Wells Fargo Securities LLC

Okay. And then, if I could get any thoughts you have on the future of the Medicare RAC program? Maybe your expectations for when the program could get going again, and then when it does, how you expect to get deals processed or evolved given the efforts to increase clarity to providers with the Two Midnight rule and rules like that?

Richard A. Montoni

Chief Executive Officer & Director

Let's ask Bruce Caswell to share a few thoughts in that regard.

Bruce L. Caswell

President

Sure. I guess, I would say that, I feel like, we've seen a bit of the new normal as it relates to the RAC program. And so while they're still working through the contract awards under the new program, and I guess there's some consolidation occurring within the industry.

We wouldn't expect to see volumes return to the level that we saw obviously in 2013 when things really peaked. And in fact there's been lot of discussion about that recently, because that's now led to a fairly significant backlog above our level, at the administrative law judge level.

So I would say, we'll continue to watch the space. We also noted that, we had lost two small contracts related to Medicare appeals, so we operate in a slightly smaller domain presently. And I'm thinking that, as the rule around Two Midnight Stay and so forth becomes more final; and these new contracts are awarded. Again we'll probably see appeals volumes; we're presently seeing them without substantial new growth.

Richard A. Montoni

Chief Executive Officer & Director

Yeah. I would add to that, I agree with Bruce as it relates to – I think from the RAC program per say, which is just one program in the whole universe of appeals that we may be at a new normal. I'd also add to it that we have experienced and believe we'll continue to experience an increase in the demand for appeals outside of that RAC program.

So it just seems to me inherent and running a tighter ship with these programs as governments move forward, and this is not just in the U.S., but we're seeing increased demand for quality independent appeals, which firms like MAXIMUS offer. So we're excited about the appeals space. And I'm pleased to say that we're more in portfolio situation with the appeals and years back, we're kind of standalone with just the – in the Medicare appeals.

Lisa Miles

SVP-Investor Relations & Corporate Communications

Thanks, Stephen. Next question, please?

Operator: Our next question comes from the line of Allen Klee with Sidoti & Company. Please go ahead with your question.

Allen Klee

Sidoti & Co. LLC

Yes. Hi. Within Australia, the – how do you think about the incremental revenue associated with the – what you mentioned, the national roll-out of the Work for the Dole program?

Richard A. Montoni

Chief Executive Officer & Director

I think about – when I think about the Australia new award, my key thoughts are one, that this is another casing point where performance is most important, where governments, large governments are building partnership with key suppliers. I talked earlier about the trend towards consolidating suppliers, that's certainly the case in Australia. And in this case, and MAXIMUS has worked really hard, our teams work really hard to achieve that performance and the confidence of this client.

I think it's also very rewarding that they've chosen to roll into the scope of the old JSA program, and now the jobactive program, this additional Work for the Dole feature. It's almost like two contracts being awarded in one.

And again, I think it's an affirmation of the government's confidence, emphasis on performance by larger vendors, and in particular MAXIMUS, I think picked up more than its fair share as it relates to Work for the Dole. It may be a small piece, but we think it's a very, very strategic.

Many governments who have welfare programs are very much focused on younger folks looking for ways to get them employed and Work for the Dole as a feature that is being rolled out large scale nationally in Australia, but other countries are also talking about similar features in their welfare program.

Thank you. Is that helpful, Stephen – excuse me, Allen?

Allen Klee

Sidoti & Co. LLC

Thank you. Thank you.

Richard A. Montoni

Chief Executive Officer & Director

Next question, please.

Operator: [Operator Instructions] Our next question comes from the line of Frank Sparacino with First Analysis. Please go ahead with your question.

Frank Sparacino

First Analysis Securities Corp.

Hi, guys. Rich, I was hoping to go back Remploy, if you play a bit of unusual transaction for you guys, and just wanted to understand sort of the attraction there, what the business looks like from a profitability standpoint as you all have synergies, you probably have the work that you guys are doing in the UK right now?

Richard A. Montoni

Chief Executive Officer & Director

Great question, Frank. And we are very excited about the Remploy combination, and it does have some unusual features, and I actually think it's the unusual features that may it a really good fit for MAXIMUS and for Remploy.

As I talked about on the call notes, this is a function that [ph] Here 24/7 (49:09) has been owned by the UK government. It was formed after World War II to focus delivering work opportunities to disabled veterans returning from war, and then they expanded the scope to include miners. And originally they actually had factories that had been opened to employ these individuals and produce goods that were then re-sold.

They closed the factories some time ago. But Remploy has continued to be very dedicated, and it has elevated itself to be highly regarded as very, very good at helping disabled individuals. Find good productive work. And we think that's a capability that is just core of what we do, and we like to get better at it. Remploy offer some model features that we'd like to learn from and extend not only in the UK but in other countries as well.

We also think it's advantageous from the government's perspective and from our Remploy's perspective, as it means, by way the government can effectively spin-off or mutualize a function that's important, but not inherently governmental, which is a trend in the UK. But to do so in a responsible fashion, by combining it with a firm like MAXIMUS, and we committed to not only – to continue the dedicated mission, the focused mission of Remploy, but to enhance it.

So I think, [ph] closure (50:40) I'd say it, it represents a great opportunity to the roughly 850 employees of Remploy, whom I believe are very excited about this combination. So, all-in-all I think it's a very unique one, but a very exciting one. So I'd say, stay tuned as we move forward with the Remploy combination. Next question please?

Operator: Our next question comes from the line of Brian Kinstlinger with the Maxim Group. Please go ahead with your question.

Brian David Kinstlinger

Maxim Group LLC

Great. Thanks. Good morning.

Richard A. Montoni

Chief Executive Officer & Director

Good morning, Brian.

Brian David Kinstlinger

Maxim Group LLC

How are you?

Richard A. Montoni

Chief Executive Officer & Director

Excellent. Thank you.

Brian David Kinstlinger

Maxim Group LLC

Can you give us some quantitative details on a pipeline, such as how much represents new business versus re- competes, obviously we have Texas. And then, what does the geographic rating look like?

Richard A. Montoni

Chief Executive Officer & Director

Well, we typically stick to the quantification that we've shared with you, but I will add to it. And I'd say, from a geographic perspective, I'm pleased, it really is spread across all of our existing markets. So I don't see any particular concentration. And our teams have been working really hard to focus on growing all aspects of the business.

So demand is pretty much universal. As it relates to new business versus rebid business, again while we don't quantify that, we continue to be in a position where the majority, in order of 50% of that sales pipeline is new work.

Brian David Kinstlinger

Maxim Group LLC

Okay. And maybe just tell me – may be you can tell us, specifically how, besides the [indiscernible] (52:19) as you've done some large deals in the past. But in addition, on Acentia, they do a lot of IT services, which isn't your primary focus.

So I'm curious as you use those [ph] U.S. (52:29) for the Federal Government, is the plan to use those to cross sell BPO services and use them or the focus is also, be a little bit more on IT services in your business?

Richard A. Montoni

Chief Executive Officer & Director

Well, I think we would encourage Acentia to continue to move forward with its existing line of business and retain its work and grow its work. But a key element of the strategic combination of the two programs is to cross-fertilize these capabilities and where there are opportunities to sell BPO into those agencies. Rest assured, the team is very much focused on identifying those opportunities and moving forward and rolling out with that – with those margin orders as we speak.

Lisa Miles

SVP-Investor Relations & Corporate Communications

Thanks, Brian. Next question, please?

Operator: [Operator Instructions] Our next question comes from the line, a follow-up from Frank Sparacino with First Analysis. Please go ahead with your follow-up.

Frank Sparacino

First Analysis Securities Corp.

Hi, again. Just real quick, in our mission looking at 2016, [indiscernible] (53:38), so it looks like on organic basis, we're looking for roughly kind of [ph] 10%, 13% growth in fiscal 2016. Is that right Rich?

Richard A. Montoni

Chief Executive Officer & Director

Rick Nadeau, does that feel about right?

Richard J. Nadeau

Chief Financial Officer & Treasurer

Yeah, that feels about right. I mean, we go through and we look at it, obviously we you a range, so you are within the right striking distance when you think about adding Acentia and Remploy, which is not organic, and then adding in our – in an organic piece. That's a hard way – that's hard thing to say – [ph] when it comes organic (54:12).

Richard A. Montoni

Chief Executive Officer & Director

Roughly, and I think we're in the vicinity of top line total fiscal 2016 over 2015 of, say 20%; of that approximately 12% is organic.

Frank Sparacino

First Analysis Securities Corp.

Perfect. Thank you, guys.

Richard A. Montoni

Chief Executive Officer & Director

Next question please?

Operator: Thank you. Ladies and gentlemen, this does conclude our teleconference for today. You may now disconnect your lines at this time. Thank you for your participation and have a wonderful day.

Fiscal 2015 Second Quarter Earnings Richard J. Nadeau Chief Financial Officer May 7, 2015

Forward-looking Statements & Non-GAAP Information These slides should be read in conjunction with the Company’s most recent quarterly earnings press release, along with listening to or reading a transcript of the comments of Company management from the Company’s most recent quarterly earnings conference call. This document may contain non-GAAP financial information. Management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of our financial performance, identifying trends in our results, and providing meaningful period-to-period comparisons. These measures should be used in conjunction with, rather than instead of, their comparable GAAP measures. For a reconciliation of non-GAAP measures to the comparable GAAP measures presented in this document, see the Company’s most recent quarterly earnings press release. Throughout this presentation, numbers may not add due to rounding. A number of statements being made today will be forward-looking in nature. Such statements are only predictions and actual events or results may differ materially as a result of risks we face, including those discussed in our SEC filings. We encourage you to review the summary of these risks in Exhibit 99.1 to our most recent Form 10-K filed with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances.

Revenue Health Services $ 370.4 $ 323.6 14% Human Services 111.4 115.4 (3%) Total $ 481.8 $ 439.0 10% Operating Income Health Services $ 51.1 $ 49.7 3% Human Services 13.9 17.3 (20%) Intangibles Amortization (1.4) (1.5) Other (1.6) (0.6) Total $ 62.0 $ 65.0 (5%) Operating Margin % 12.9% 14.8%Net Income attributable to MAXIMUS $ 38.8 $ 41.2 (6%) EPS - Diluted $ 0.58 $ 0.59 (2%) ($ in millions) Q2 FY15 Q2 FY14 % Change Total Company Results – Second Quarter Revenue increased 10% compared to Q2 FY14, driven by Health Services Segment All growth was organic On a constant currency basis, revenue would have grown 12% compared to prior year While financial results continued to be unfavorably impacted by currency exchange rates, we’ve seen a stabilization of currencies in the geographies where we operate Operating margin of 12.9% Net income attributable to MAXIMUS totaled $38.8M or $0.58 per diluted share, includes approximately $0.02 of costs tied to acquisition related activities Excluding the $0.02, adjusted earnings per diluted share were $0.60 Earnings in Q2 FY15 were ahead of our expectations, mostly due to contract amendments in Health Services Segment that were larger than previously anticipated

Health Services Segment Revenue New work and expansion of existing contracts helped fuel the top line Revenue grew 14% Operating Income & Margin Operating income increased to $51.1M Solid operating margin of 13.8% Segment outpaced Q2 expectations due to contract amendments that were larger than previously anticipated As expected, operating margin was lower compared to Q2 FY14 due to anticipated volume decreases in Medicare appeals business and expected losses from new contracts in start-up phase Health Assessment Advisory Services (HAAS) Reminder – launched contract on March 1, 2015; Q2 results include one month of financial contribution In Q3, we expect an increase in revenue and profit as the contract will be providing a full quarter of revenue and earnings contribution Revenue Health Services370.4$ 323.6$ 14%Operating Income Health Services51.1$ 49.7$ 3%Operating Margin %13.8%15.4%% Change($ in millions)Q2 FY15Q2 FY14

Human Services Segment Revenue Adversely impacted by currency exchange rates Segment revenue lower compared to Q2 FY14 On a constant currency basis, Segment revenue would have increased 4% Operating Income & Margin Operating income totaled $13.9M Operating margin was strong at 12.5% As expected, both operating income and margin were lower compared to same period last year Reminder – prior year’s results benefitted from the finalization of a contract in Saudi Arabia and some short-term consulting assignments in the U.S. that were highly accretive and came to completion Successful Australia Rebid Contract Launches July 1, 2015 Includes an expanded scope of work Reminder – contract contains terms that will result in start-up losses in Q4 FY15 estimated to be $0.06 to $0.09 Expected to turn profitable by end of Q1 FY16 Revenue Human Services111.4$ 115.4$ (3%)Operating Income Human Services13.9$ 17.3$ (20%)Operating Margin %12.5%15.0%% Change($ in millions)Q2 FY15Q2 FY14

Cash Flows and Balance Sheet Reconciliation to Free Cash Flow Negative free cash flow principally driven by: 1) DSOs and 2) Cap Ex Investments 1. Days Sales Outstanding (DSOs) As expected, DSOs increased in the quarter mostly due to new U.K. contracts At March 31, DSOs were 70 days, well within our stated range of 65 to 80 days Approximately five DSOs were related to the new contracts in the U.K.; these contracts were also the primary reason for increase in deferred revenue in Q2 FY15 We expect to see improvement in DSOs toward end of year 2.Cap Ex Investments During Q2 FY15, we made sizeable investments in infrastructure modernization in support of our ongoing growth in the U.S. and the U.K. These types of capital investments typically occur in five-to-seven year cycles and the investments include: facilities, fixed assets, and upgrades in our telephony and back office data centers We believe these prudent investments will help drive efficiencies down the road $ in millions Q2 FY15 Cash provided by operating activities $5.5 Cash paid for property, equipment and capitalized software ($33.4) Free cash flow ($27.9)

Credit Facility Agreement & Acentia Acquisition Amended Credit Facility Agreement Expanded facility for revolving line of credit up to $400M and uncommitted increase option up to additional $200M Facility is available for general corporate purposes, including working capital, cap ex and selected acquisitions Acentia Acquisition Subsequent to quarter close, we tapped into the new credit line to complete Acentia acquisition in April Reminder – this was an all-cash transaction with a total purchase price of approximately $300M Funded acquisition and related costs with domestic cash on hand and approximately $225M borrowed under the amended credit facility Acentia is expected to contribute approximately $110M in revenue for second half of FY15

Remploy Transaction We recommend that investors view this largely as an acquisition of a single contract and the incumbent workforce of approximately 850 experienced personnel Remploy will contribute approximately $30M to $35M (USD) in revenue for remainder of our FY15 and the vast majority relates to Work Choice contract MAXIMUS has a 70% ownership and Remploy employees have a collective 30% stake in the business Remploy has a long history of supporting people with complex barriers into employment This will help MAXIMUS better support thousands more disabled people into work in the years to come

Drivers to Fiscal 2015 and Fiscal 2016 Guidance FY16 Model Variables Volumes Outcomes on performance-based contracts Currency exchange rates Legislative changes FY15 Quarter Trends Q3 expected to be strongest quarter in FY15 Q4 top and bottom line lower than Q3 due to Australia start-up loss Fiscal Year 2015 Previous Guidance: Revenue of $1.9B to $2.0B and Diluted EPS of $2.25 to $2.40 (+) Half-year contribution from Acentia (+) Half-year contribution from Remploy (-) Start-up costs for Australia’s jobactive (-) Unfavorable currency exchange rates Revised Guidance: Revenue of $2.05B to $2.08B and diluted EPS of $2.33 to $2.40 Cash flow guidance remains unchanged: Cash from operating activities of $165M to $190M and free cash flow of $100M to $125M Fiscal Year 2016 (+) Full-year contribution from Acentia (+) Full-year contribution from Remploy (+) Growth from new work that ramped up in FY15 (AUS jobactive, U.K. HAAS, U.K. Fit for Work and U.S. Dept. of Education) (-) Normal course headwinds Preliminary Guidance: Revenue of $2.4B to $2.5B and diluted EPS of $2.85 to $3.05

Fiscal 2015 Second Quarter Earnings Richard Montoni Chief Executive Officer May 7, 2015

Contributions for Long-Term Growth Several positive developments in both segments that bring meaningful contributions to our long-term growth strategy: Acentia acquisition Remploy joint venture Expanded scope of work in Australia These developments and organic growth from new and existing programs represent the basis for continued growth into next year We remain on the growth path we set for the remainder of the fiscal year and beyond

Human Services Australia Recent rebid win and strong historical performance further expand our footprint Secured five-year, $940M rebid, which includes the jobactive program (formerly known as Job Services Australia) and the Work for the Dole program Rebid increases scope of work: 1.Market share for jobactive Under former JSA program, served 12.5% of allocated caseloads Under jobactive, market share of caseload allocations increases to approximately 15% We will now serve 29 out of 51 of the consolidated and restructured Employment Service Areas 2.National roll-out of Work for the Dole program Since 2014, arranged activities with community-based and not-for-profit organizations in 4 pilot Employment Service Areas Program rolled out nationwide; we will now serve as the coordinator in 14 of 51 areas In this performance-based environment, our expanded role is confirmation Of our proven ability to deliver outcomes that matter to government

Human Services – United Kingdom Completed Remploy acquisition in April 70% partnership with highly regarded organization (employees maintain 30%) Renowned for assisting people with complex barriers into employment; complements our existing portfolio Primary provider for Work Choice, a government employment program for people with disabilities and health conditions About Remploy Seventy-year history of delivering disability employment services throughout the U.K. Following WWII, the U.K. Government established Remploy to provide training and employment for injured and disabled ex-military and miners Remploy now dedicated to supporting people with disabilities and health conditions into mainstream employment; MAXIMUS is firmly committed to continuing this mission Global Presence Increases our global presence as a world-leading provider of disability employment services Enhances our business development efforts for emerging opportunities MAXIMUS and Remploy share similar cultures and values; integration efforts are going well

Health Services – Acentia Acquisition A new growth platform for our U.S. federal services business Provides us with additional contract vehicles and access to federal government agencies Federal government agencies seek support from vendors through three different channels: 1) Contract vehicles 2) Full and open procurements 3) Set-asides for entities like small businesses The importance of contract vehicles Allow agencies to prequalify a selected set of vendors Only pre-vetted companies can bid on contracts and task orders Majority of support work in the civilian space is issued through contract vehicles Acentia brings numerous contract vehicles; allows us to bid as a prime contractor for IT support and business process management opportunities In the past, we could only access these bids by relying on teaming arrangements; acquisition opens up an entirely new set of opportunities for us A full-service provider to the federal government Acentia has cultivated positive relationships with a number of federal agencies (Internal Revenue Service, the U.S. Defense Health Agency and the U.S. Department of Labor) Plan to build upon this success and introduce additional core services to new agencies over time An important step in our long-term strategy to continue to grow our U.S. federal book of business and drive shareholder value

Affordable Care Act – Second Open Enrollment The Affordable Care Act’s second open enrollment period was very successful; getting closer to steady state as we look ahead to OE3 Total ACA revenue was stronger than initial expectations due to better-than-expected repeat work and additional support services Our portfolio of ACA work goes beyond call centers and includes: the training & certification of assisters and brokers, premium & cost-sharing collections, eligibility appeals in some states, and social media management Presently expect ACA-related revenue for the full FY 15 will be up about 10% compared to last year; think annual ACA revenues have largely stabilized Estimate that ACA related revenue will be about 15% of consolidated revenue for FY 15

Health Services – United Kingdom Successfully launched the Health Assessment Advisory Service (HAAS) on March 1 Conduct assessments for individuals seeking certain disability benefits Start-up going well and working to achieve program goals for improved service Increasing the number of healthcare professionals to help meet volume requirements and lower backlog so people can be assessed in a more timely manner Meeting recruitment targets and are also on track to meet our requirements for assessment volumes Longer-term goals for the program include: Reducing long wait times Improving quality of the assessment Making assessment process less intimidating Remain actively engaged with different stakeholder groups Top priority for this highly visible program Established a Customer Representative Group that covers more than 20 national disability organizations Identifying areas for meaningful improvements: clinical training, the assessment interview, accessibility of sites and customer communications

New Awards and Pipeline At March 31, 2015: Record sales of year-to-date signed contract awards Sales pipeline 18% higher compared to the same period last year On a sequential basis, pipeline was lower compared to the Q1 FY15 – expected as opportunities moved out of the pipeline and converted into new awards (Example: Australia) Pipeline has a mix of rebids and new work representing multiple geographies and both segments New Awards March 31, 2015 YTD signed awards $1.58B New contracts pending $1.05B Sales Opportunities March 31, 2015 Total pipeline $2.6B Pipeline reflects opportunities where we believe the request for proposal to be released within the next six months Australia win included in new contracts pending

Conclusion and Appreciation Pleased to have introduced several new initiatives that bolster our existing platforms for long-term growth Equally excited with preliminary guidance for fiscal 2016, which represents another year of solid growth (much of which is organic) Our people are at the heart of our ability to continue to deliver on our commitments to our clients; they are what drives our success on a daily basis Welcome to our new colleagues from Acentia and Remploy; thank you to our U.K. team for the successful Health Assessment Advisory Service launch; reiterate our appreciation for our Australian team whose consistently high performance played a key role in the jobactive rebid award