Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST INTERSTATE BANCSYSTEM INC | d924091d8k.htm |

Page 1

presenting at the

DA Davidson

17

th

Annual

Financial Services Conference

Denver, Colorado

May 12-13, 2015

Exhibit 99.1 |

First Interstate

BancSystem Safe Harbor

This

presentation

contains

“forward-looking

statements”

within

the

meaning

of

Section

27A

of

the

Securities

Act

of

1933,

as

amended,

and

Rule

175

promulgated

thereunder,

and

Section

21E

of

the

Securities

Exchange

Act

of

1934,

as

amended,

and

Rule

3b-6

promulgated

thereunder,

that

involve

inherent

risks

and

uncertainties.

Any

statements

about

our

plans,

objectives,

expectations,

strategies,

beliefs,

or

future

performance

or

events

constitute

forward-looking

statements.

Forward-looking

statements

involve

known

and

unknown

risks,

uncertainties,

assumptions,

estimates

and

other

important

factors

that

could

cause

actual

results

to

differ

materially

from

any

results,

performance

or

events

expressed

or

implied

by

such

forward-looking

statements.

Such

forward-looking

statements

include

but

are

not

limited

to

statements

about

revenues,

income

from

the

origination

and

sale

of

loans,

net

interest

margin,

quarterly

provisions

for

loan

losses,

non-interest

expense,

loan

growth,

non-performing

assets

and

net

charge-off

of

loans

and

other

statements

that

are

not

historical

facts.

These

forward-looking

statements

are

subject

to

risks

and

uncertainties

that

may

cause

actual

results

to

differ

materially

from

those

projected,

including

but

not

limited

to

the

following:

the

factors

described

in

our

Form

10-K

and

subsequent

filings

with

the

Securities

and

Exchange

Commission

(“SEC”),

including

under

the

sections

entitled

“Risk

Factors”.

The

risk

factors

described

in

Forms

10-K

are

not

necessarily

all

of

the

important

factors

that

could

cause

our

actual

results,

performance

or

achievements

to

differ

materially

from

those

expressed

in

or

implied

by

any

of

the

forward-looking

statement

contained

in

this

presentation.

Other

unknown

or

unpredictable

factors

also

could

affect

our

results.

All

forward-looking

statements

attributable

to

us

or

persons

acting

on

our

behalf

are

expressly

qualified

in

their

entirety

by

the

cautionary

statements

set

forth

above.

Forward-looking

statements

speak

only

as

of

the

date

they

are

made

and

we

do

not

undertake

or

assume

any

obligation

to

update

publicly

any

of

these

statements

to

reflect

actual

results,

new

information

or

future

events,

changes

in

assumptions

or

changes

in

other

factors

affecting

forward-looking

statements,

except

to

the

extent

required

by

applicable

laws.

If

we

update

one

or

more

forward-looking

statements,

no

inference

should

be

drawn

that

we

will

make

additional

updates

with

respect

to

those

or

other

forward-looking

statements.

Page 2 |

Why invest in

First Interstate BancSystem? Committed to increasing Shareholder Value

Long Track Record of Profitability

Low-Cost Core Deposit Funding

Conservative Credit Strategy which Limits Exposure to

Large Losses

Diversified Customer Base tempers Economic Volatility

Significant Market Share provides Leverage in Pricing

Growth Opportunities

First Interstate

BancSystem Page 3

|

First Interstate

BancSystem Total Return to

Shareholders Page 4

Since the IPO in March 2010 over 100% increase in shareholder value

|

First Interstate

BancSystem Maximizing

Shareholder Value Page 5

Management’s priority is to achieve growth through: |

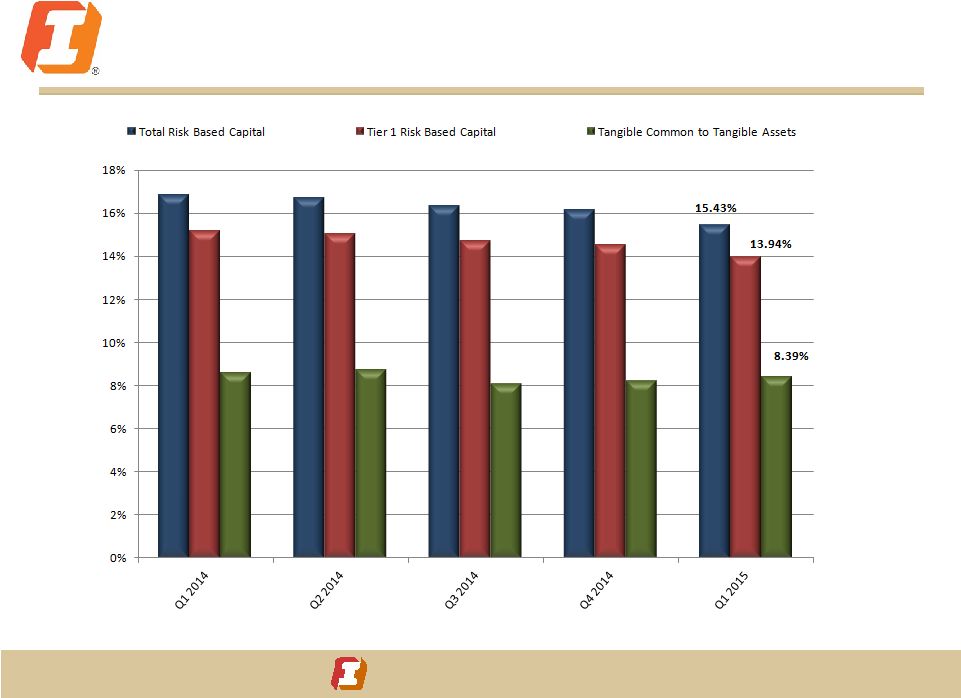

First Interstate

BancSystem Strong Capital allows

Growth Page 6 |

First Interstate

BancSystem Page 7

Our History:

Strong Earnings

Performance

and

Stable Balance Sheet

First Interstate

BancSystem |

First Interstate

BancSystem Core Pre-tax

Pre-Provision Income exclusive of acquisition and litigation costs

Page 8

(in thousands) |

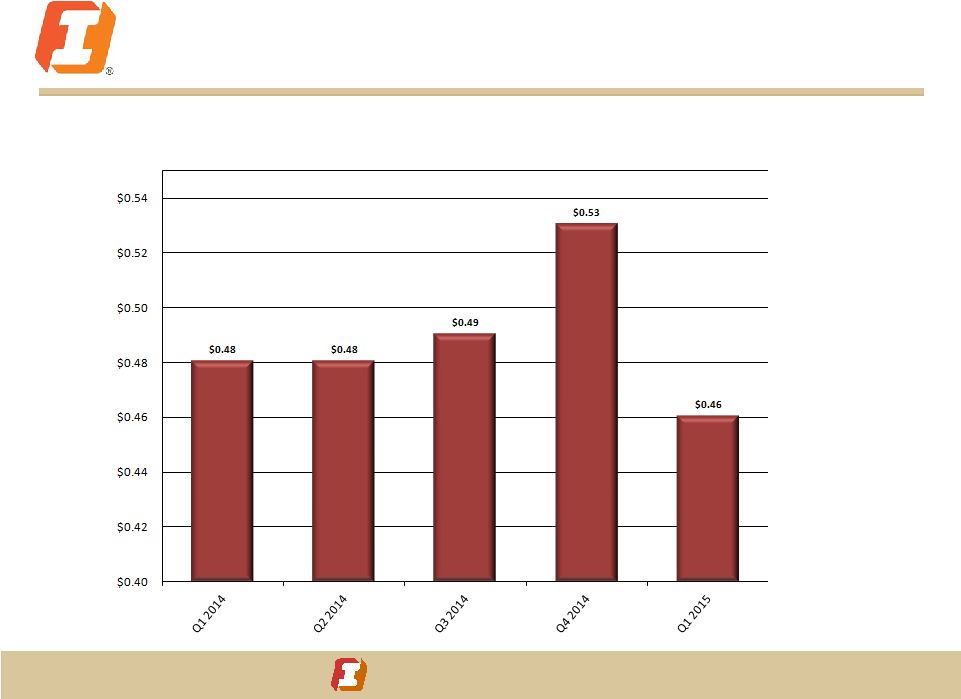

First Interstate

BancSystem Core Earnings Per

Share exclusive of acquisition and litigation costs

Page 9 |

First Interstate

BancSystem Stable Earnings

Ratios Page 10

Annualized Return on Avg. Common Equity

Annualized Return on Avg. Assets |

First Interstate

BancSystem Low-risk

Investment Portfolio Effective Duration of

the portfolio is 2.61

years

Average yield of the

portfolio is 1.70%

Strategy: Maintain

short duration with

minimal credit risk

and an emphasis on

stable cash flows

and extension risk

mitigation.

Page 11

$2.3 Billion

(as of 3/30/15) |

First Interstate

BancSystem Page 12

Diversified Loan Portfolio

$4.9 Billion in Loans

$4.9 Billion in Loans

Loan growth

12.9% year over year, including the

acquisition of Mountain West Bank

4.6% year over year organic growth

Positive economic indicators

Low unemployment

Increasing demand

Strong indirect lending network

Conservative credit practices

In-house limit of $15 Million versus

legal lending limit over $90 Million |

Returning to

a Normalized Credit Environment (In thousands)

1.11% of Total Assets

First Interstate

BancSystem Page 13

|

First Interstate

BancSystem Strong Core Deposit

Base First Interstate

BancSystem Page 14

(as of 3/31/2015)

Low Cost of Funds

24 basis points |

First Interstate

BancSystem Page 15

Growth Strategy

First Interstate

BancSystem |

Page

16 A Unique Footprint |

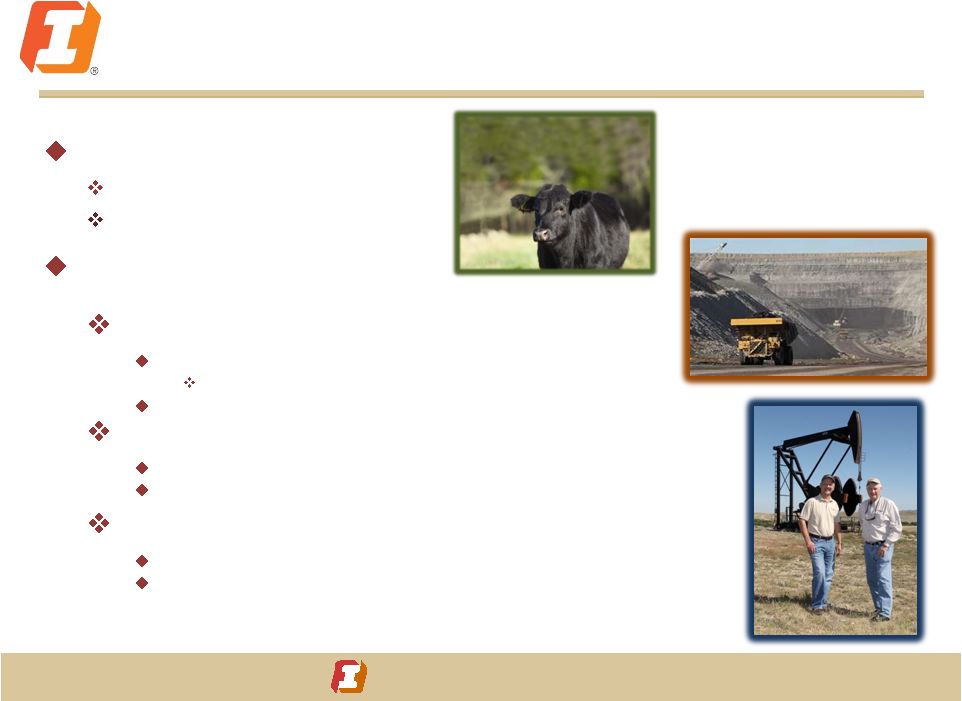

First Interstate

BancSystem Diversified

Industries soften impact of Economic Volatility Agriculture

Cattle

Crops

Page 17

Energy

Oil and Natural Gas

Greater Williston Basin Area

Bakken formation

Powder River Basin

Coal

MT Ranked #1 and WY ranked #3 in demonstrated Coal Reserves

WY Ranked #1 in Production

Wind

MT, WY and SD in the top 10 for potential wind energy development

MT has the fastest national growth rate for wind energy |

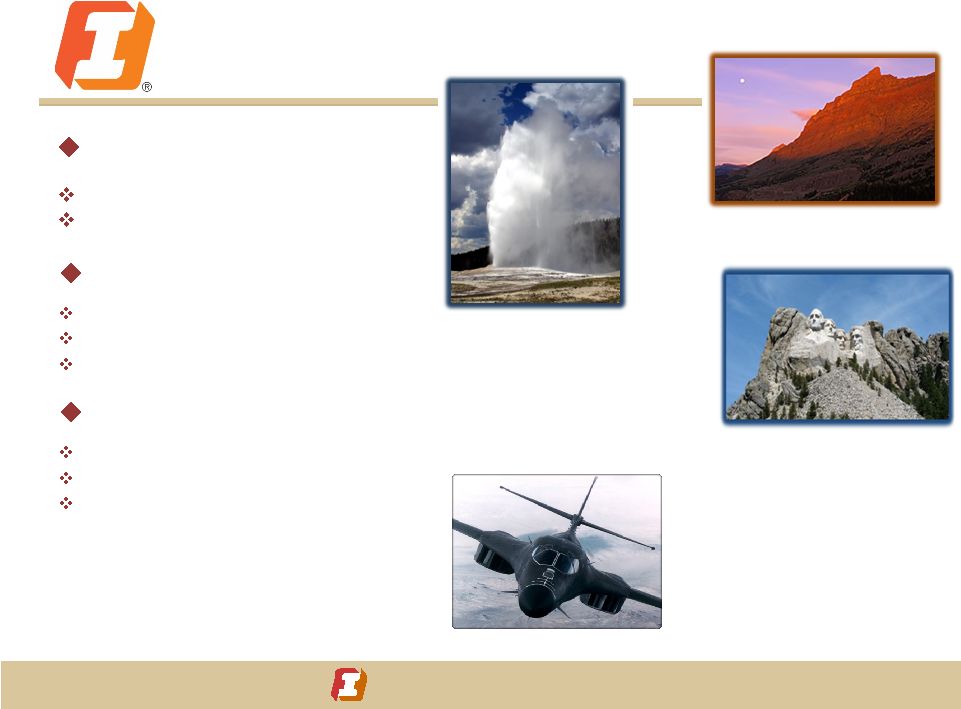

First Interstate

BancSystem Tourism

Glacier National Park, MT

Yellowstone National Park, WY

Major National Parks

Summer/Winter Opportunities

Mount Rushmore, SD

Page 18

Healthcare

Aging population base

Regional healthcare centers

Veterans Administration healthcare

Military /Government

Ellsworth Air Force Base, SD

Malmstrom Air Force Base, MT

F.E. Warren Air Force Base, WY

B1B Lancer,

Ellsworth Air Force Base |

First Interstate

BancSystem Low Unemployment

allows room for expansion Page 19 |

First Interstate

BancSystem Market Share

– a “sweet spot”

First Interstate

BancSystem (June 30,

2014) Locations

Market Share*

Riverton, WY

44%

Sheridan, WY

40%

Laramie, WY

33%

Missoula, MT

31%

Gillette, WY

30%

Casper, WY

27%

Billings, MT

23%

Great Falls, MT

23%

Helena, MT

23%

Spearfish, SD

21%

Jackson, WY-ID

17%

Bozeman, MT

16%

Kalispell, MT

13%

Cheyenne, WY

8%

Rapid City, SD

7%

Page 20

* The market share percentages are per the FDIC, adjusted for credit union deposits within

each community, including deposits attributable to the Mountain West Bank acquisition.

Market share allows us to influence cost of funds and still leaves room for growth:

|

First Interstate

BancSystem Page 21

Delivering what the Customer Needs:

Wealth Management

AUM -

$4.6 Billion and growing

Bakken influence creating wealth

Wealth advisors positioned across our

footprint

Mortgage Lending

Strong purchase activity within our

markets

Ability to expand our market share

Recently opened a mortgage office in

Sioux Falls, SD

Payment Services

Focused strategy to increase business

card usage

Local reward program attracts personal

card usage

Non-Interest Income Strategy for Growth |

First Interstate

BancSystem Moving forward

Page 22

Customer

Centric

Technology

Expectations

Reduce Bricks

and Mortar

Becoming flexible and responsive to the changing environment |

Why invest in

First Interstate BancSystem? Because we’re: Committed to increasing

Shareholder Value Have a Long Track Record of Profitability

Provide Low-Cost Core Deposit Funding

Our Conservative Credit Strategy Limits Exposure to

Large Losses

We have a Diversified Customer Base that tempers

Economic Volatility

Our Significant Market Share provides Leverage

There are Great Growth Opportunities

First Interstate

BancSystem Page 23

|

First Interstate

BancSystem Page 24

Appendix

First Interstate

BancSystem |

First Interstate

BancSystem Long Term History

with Solid Performance Company Snap Shot

Headquartered in Billings, MT with 80 banking offices across

Montana, Wyoming and South Dakota.

Total Assets of $8.5 Billion; Total Loans of $4.9 Billion.

Regional bank offering retail and commercial banking, along

with wealth management, cash management, credit card

and mortgage services.

NASDAQ:

FIBK Market Cap: $1.3B

Company

Performance

Q1 2015 net income to common shareholders of $21.0

million, or $0.46 per share;

Pre-tax, Pre-Provision net income of $32.5 million, a 16.5%

increase from Q1 2014.

Recently announced 25% increase in dividend to $.20 per

share.

Continued improvement in credit quality trends

Page 25 |

First Interstate

BancSystem Balance Sheet

Page 26

2015

2014

2014

2014

2014

BALANCE SHEET SUMMARIES

31-Mar

31-Dec

30-Sep

30-Jun

31-Mar

Assets:

Cash and cash equivalents

$

637,803

$

798,670

$

819,963

$

503,648

$

610,531

Investment securities

2,340,904

2,287,110

2,169,774

2,093,985

2,095,088

Total loans

4,927,306

4,897,443

4,854,382

4,506,362

4,364,838

Less allowance for loan losses

75,336

74,200

74,231

78,266

81,371

Net loans

4,851,970

4,823,243

4,780,151

4,428,096

4,283,467

Premises and equipment, net

192,748

195,212

207,181

180,341

179,942

Goodwill and intangible assets (excluding mortgage servicing

rights)

216,815

218,870

218,799

187,502

187,858

Company owned life insurance

154,741

153,821

152,761

138,899

138,027

Other real estate owned, net

15,134

13,554

18,496

16,425

16,594

Mortgage servicing rights, net

14,093

14,038

13,894

13,443

13,474

Other assets

104,334

105,418

100,333

89,040

92,844

Total assets

$

8,528,542

$

8,609,936

$

8,481,352

$

7,651,379

$

7,617,825

Liabilities and stockholders' equity:

Deposits:

Non-interest bearing

$

1,757,664

$

1,791,364

$

1,637,151

$

1,533,484

$

1,458,460

Interest bearing

5,210,495

5,214,848

5,322,348

4,645,558

4,676,677

Total deposits

6,968,159

7,006,212

6,959,499

6,179,042

6,135,137

Securities sold under repurchase agreements

462,073

502,250

432,478

462,985

488,898

Accounts payable, accrued expenses and other liabilities

58,335

72,006

63,713

51,456

48,770

Long-term debt

43,048

38,067

36,882

36,893

36,905

Subordinated debentures held by subsidiary trusts

82,477

82,477

102,916

82,477

82,477

Total liabilities

7,614,092

7,701,012

7,595,488

6,812,853

6,792,187

Stockholders' equity:

Common stock

310,544

323,596

321,132

283,697

286,553

Retained earnings

599,727

587,862

572,362

560,469

546,444

Accumulated other comprehensive income (loss)

4,179

(2534)

(7630)

(5640)

(7359)

Total stockholders' equity

914,450

908,924

885,864

838,526

825,638

Total liabilities and stockholders' equity

$

8,528,542

$

8,609,936

$

8,481,352

$

7,651,379

$

7,617,825 |

First Interstate

BancSystem Income

Statement Page 27

2015

2014

INCOME

STATEMENT

SUMMARIES

1st Qtr

4th Qtr

3rd Qtr

2nd Qtr

1st Qtr

Net interest income

$

64,325

$

65,516

$

65,082

$

59,727

$

58,136

Net interest income on a fully-taxable equivalent ("FTE")

basis

65,381

66,585

66,129

60,806

59,243

Provision for loan losses

1,095

118

261

(2,001)

(5,000)

Non-interest income:

Other service charges, commissions and fees

9,867

11,429

10,458

9,699

9,156

Income from the origination and sale of loans

5,906

5,554

7,346

6,380

4,660

Wealth management revenues

4,937

4,775

5,157

4,609

4,455

Service charges on deposit accounts

3,944

4,432

4,331

3,929

3,875

Investment securities gains (losses), net

6

(19)

(8)

17

71

Other income

3,122

5,190

2,079

1,937

1,889

Total non-interest income

27,782

31,361

29,363

26,571

24,106

Non-interest expense:

Salaries and wages

25,349

23,717

25,914

24,440

22,442

Employee benefits

7,780

6,812

7,841

7,164

8,313

Occupancy, net

4,492

4,770

4,534

4,253

4,239

Furniture and equipment

3,793

4,120

3,338

3,157

3,201

Outsourced technology services

2,463

2,468

2,346

2,309

2,300

Other real estate owned income, net

(61)

(61)

(58)

(134)

(19)

Core deposit intangible amortization

854

855

688

354

354

Non-core expenses

70

2,368

5,052

597

—

Other expenses

14,852

16,604

15,303

13,780

13,508

Total non-interest expense

59,592

61,653

64,958

55,920

54,338

Income before taxes

31,420

35,106

29,226

32,379

32,904

Income taxes

10,440

12,330

10,071

11,302

11,511

Net income

$

20,980

$

22,776

$

19,155

$

21,077

$

21,393

Core net income**

$

21,020

$

24,260

$

22,302

$

21,438

$

21,349 |

First Interstate

BancSystem Performance

Metrics Page 28

PER

COMMON

SHARE

DATA

Net income -

basic

$

0.46

$

0.50

$

0.43

$

0.48

$

0.49

Net income -

diluted

0.46

0.49

0.42

0.47

0.48

Core net income -

diluted

0.46

0.53

0.49

0.48

0.48

Cash dividend paid

0.20

0.16

0.16

0.16

0.16

Book value at period end

20.13

19.85

19.40

18.95

18.60

Tangible book value at period end**

15.36

15.07

14.61

14.71

14.37

OUTSTANDING

COMMON

SHARES

At period-end

45,429,468

45,788,415

45,672,922

44,255,012

44,390,095

Weighted-average

shares

-

basic

45,378,230

45,485,548

44,911,858

44,044,260

43,997,815

Weighted-average

shares

-

diluted

45,840,191

46,037,344

45,460,288

44,575,963

44,620,776

SELECTED

ANNUALIZED

RATIOS

Return on average assets

1.00

%

1.05

%

0.93

%

1.12

%

1.16

%

Core return on average assets**

1.00

1.12

1.09

1.14

1.16

Return on average common equity

9.38

10.09

8.55

10.18

10.74

Core return on average common equity**

9.40

10.75

9.96

10.36

10.72

Return on average tangible common equity**

12.35

13.34

11.17

13.16

14.00

Net FTE interest income to average earning assets

3.43

3.38

3.55

3.54

3.52 |

First Interstate

BancSystem Asset Quality

Page 29

2015

2014

ASSET QUALITY

Mar 31

Dec 31

Sep 30

Jun 30

Mar 31

Allowance for loan losses

$

75,336

$

74,200

$

74,231

$

78,266

$

81,371

As a percentage of period-end loans

1.53

%

1.52

%

1.53

%

1.74

%

1.86

%

Net charge-offs (recoveries) during quarter

$

(41)

$

149

$

4,296

$

1,104

$

(1,032)

Annualized as a percentage of average loans

0.00

%

0.01

%

0.36

%

0.10

%

(0.10

)%

Non-performing assets:

Non-accrual loans

$

73,941

$

62,182

$

71,915

$

79,166

$

88,114

Accruing loans past due 90 days or more

5,175

2,576

1,348

1,494

1,664

Total non-performing loans

79,116

64,758

73,263

80,660

89,778

Other real estate owned

15,134

13,554

18,496

16,425

16,594

Total non-performing assets

94,250

78,312

91,759

97,085

106,372

As a percentage of:

Total loans and OREO

1.91

%

1.59

%

1.88

%

2.15

%

2.43

%

Total assets

1.11

%

0.91

%

1.08

%

1.27

%

1.40

% |