Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT - Yulong Eco-Materials Ltd | fs12015a6ex23i_yulongeco.htm |

As filed with the U.S. Securities and Exchange Commission on May 11, 2015

Registration No. 333-201170

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 6 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

YULONG ECO-MATERIALS LIMITED

(Exact name of Registrant as specified in its charter)

| Cayman Islands | 3270 | Not Applicable | ||

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer | ||

| incorporation or organization) | Classification Code Number) | Identification Number) |

Eastern End of Xiwuzhuang Village

Jiaodian Town, Xinhua Area

Pingdingshan, Henan Province

People’s Republic of China

Phone: +86-375-8888988

(Address, including zip code, and telephone number including area code, of registrant’s principal executive office)

LKP Global Law, LLP

1901 Avenue of the Stars, Suite 480

Los Angeles, California 90067

424-239-1890

(Name, address, including zip code, and telephone number including area code, of agent for service)

Copies to:

Kevin K. Leung, Esq. LKP Global Law, LLP 1901 Avenue of the Stars, Suite 480 Los Angeles, California 90067 Tel: 424-239-1890 Fax: 424-869-6692 |

William

N. Haddad, Esq. Reed Smith LLP 599 Lexington Avenue New York, New York 10022 Tel: (212) 521-5400 Fax: (212) 521-5450 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☐ | Smaller reporting company ☒ |

| (Do not check if a smaller reporting company) | |||

CALCULATION OF REGISTRATION FEE

| Title of Class of Securities to be Registered | Amount to be Registered | Proposed

Maximum Aggregate Price Per Share | Proposed

Maximum Aggregate Offering Price (1) | Amount of Registration Fee | ||||||||||||

| Ordinary shares, $0.001 par value per share | 2,587,500 | (2) | $ | 7.25 | $ | 18,759,375 | $ | 2,179.84 | ||||||||

| Warrants to purchase ordinary shares | - | - | - | - | (3) | |||||||||||

| Ordinary shares underlying warrants(4)(5) | 112,500 | (6) | 7.25 | 815,625 | 94.78 | |||||||||||

| Total | 2,700,000 | $ | 7.25 | $ | 19,575,000 | $ | 2,274.62 | (7) | ||||||||

| (1) | Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes 337,500 ordinary shares, which the underwriters have the option to purchase to cover over-allotments, if any. |

| (3) | No registration fee pursuant to Rule 457(g) under the Securities Act. |

| (4) | The warrants are exercisable at a per share exercise price equal to 100% of the public offering price. As estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act, based on an estimated proposed maximum aggregate offering price of $815,625, or 5% of $16,312,500. |

| (5) | The ordinary shares underlying the warrants are being registered solely in connection with the Securities and Exchange Commission’s Compliance and Disclosure Interpretations for Securities Act Sections, Question 139.05. |

| (6) | Includes shares equal to 2.875% of the ordinary shares being offered in this offering (excluding over-allotment), underlying the warrants being granted to the underwriters, and shares equal to 2.125% of the ordinary shares being offered in this offering (excluding over-allotment), underlying the warrants granted to Cuttone & Co, Inc., who is acting as our independent financial adviser. |

| (7) | Previously paid. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to the said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION DATED , 2015 |

2,250,000 Ordinary Shares

YULONG ECO-MATERIALS LIMITED

This is the initial public offering of ordinary shares of Yulong Eco-Materials Limited. We are offering 2,250,000 ordinary shares to be sold in the offering. On March 3, 2015, we effectuated a reverse stock split on a 4-for-5 basis. We anticipate that the initial public offering price will be between $6.25 and $7.25 per share.

No public market currently exists for our ordinary shares. We have applied to list our ordinary shares on the NASDAQ Capital Market under the symbol “YECO,” which listing we expect to occur immediately prior to the date of this prospectus. No assurance can be given that our application will be approved. If the application is not approved, we will not complete this offering.

We are an “emerging growth company” as defined under applicable Federal securities laws and may elect to comply with reduced public company reporting requirements.

Investing in our ordinary shares involves risks. See “Risk Factors” beginning on page 6 of this prospectus for a discussion of information that should be considered in connection with an investment in our ordinary shares.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price | $ | $ | ||||||

| Underwriting discounts and commissions (1) | $ | $ | ||||||

| Proceeds, before expenses, to Yulong Eco-Materials Limited | $ | $ |

| (1) | The underwriters will receive compensation in addition to the underwriting discount. See “Underwriting” beginning on page 81 of this prospectus for a description of such compensation. |

We have granted the underwriters a 45-day option to purchase up to 337,500 additional ordinary shares solely to cover over-allotments, if any.

The underwriters expect to deliver the shares against payment therefor on or about , 2015.

| Axiom

Capital Management, Inc. |

Northland Capital Markets |

ViewTrade Securities, Inc. |

, 2015

You should rely only on the information contained in this prospectus or any free writing prospectus prepared by or on behalf of us or to which we have referred you. Neither we nor the underwriters have authorized anyone to provide you with additional or different information. We take no responsibility for, and can provide no assurance as to the reliability of any other information that others may give you. Neither this prospectus nor any free writing prospectus is an offer to sell anywhere or to anyone where or to whom we are not permitted to offer or to sell securities under applicable law. The information in this prospectus or any free writing prospectus is accurate only as of the date of this prospectus or such free writing prospectus, as applicable. Our business, financial condition, results of operations and prospects may have changed since such date.

For investors outside the United States: Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus outside of the United States.

| i |

MARKET, INDUSTRY AND OTHER DATA

This prospectus includes market and industry data and forecasts that we have developed from independent research firms, publicly available information, various industry publications, other published industry sources or our internal data and estimates. Independent research reports, industry publications and other published industry sources generally indicate that the information contained therein was obtained from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information. Although we believe that the publications and reports are reliable, neither we nor the underwriters have independently verified the data. Our internal data, estimates and forecasts are based on information obtained from our investors, trade and business organizations and other contacts in the markets in which we operate and our management’s understanding of industry conditions. Although we believe that such information is reliable, we have not had such information verified by any independent sources.

CONVENTIONS THAT APPLY TO THIS PROSPECTUS

Unless we indicate otherwise or the context requires, all information in this prospectus does not reflect the exercise by the underwriters of their over-allotment option to purchase up to 337,500 additional ordinary shares.

Except where the context otherwise requires and for purposes of this prospectus only:

| “ordinary shares” or “shares” refers to Yulong’s ordinary shares, par value $0.001 per share; |

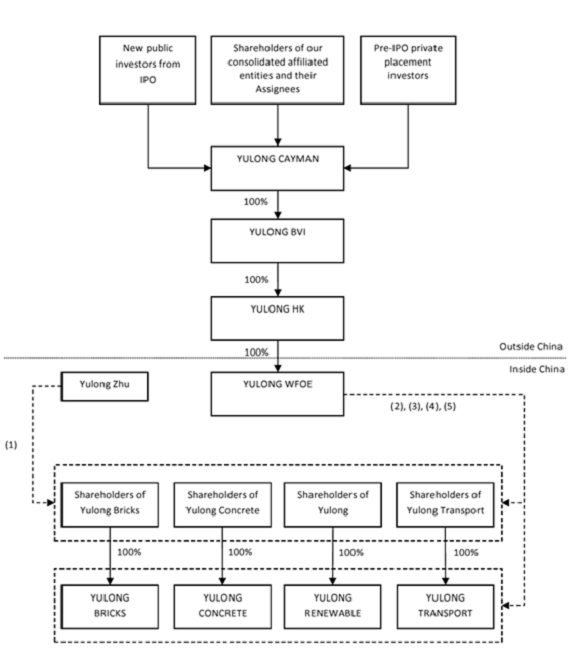

| “we,” “us,” “our company,” or “Company” refers to Yulong and its subsidiaries and consolidated entities; |

| “Yulong” refers to Yulong Eco-Materials Limited, a Cayman Islands exempted company; |

| “Yulong BVI” refers to China Xing De (BVI) Limited, a British Virgin Islands company which is wholly-owned by Yulong; |

| “Yulong HK” refers to China Xing De (Hong Kong) Limited, a Hong Kong company which is wholly-owned by Yulong BVI; |

| “Yulong WFOE” refers to Zhengzhou Xing De Enterprise Management & Consulting Co., Ltd., a PRC company which is wholly-owned by Yulong HK; |

| “Yulong Bricks” refers to Henan Jianyida Industrial Co., Ltd., a PRC company which is contractually controlled by Yulong WFOE; |

| “Yulong Concrete” refers to Pingdingshan Hengji Concrete Co., Ltd., a PRC company which is contractually controlled by Yulong WFOE; |

| “Yulong Transport” refers to Pingdingshan Hengji Industrial Co., Ltd., a PRC company which is contractually controlled by Yulong WFOE; |

| “Yulong Renewable” refers to Pingdingshan Xulong Renewable Resource Co., Ltd., a PRC company which is contractually controlled by Yulong WFOE; |

| “Yulong Group” and “our consolidated affiliated entities” refer to Yulong Bricks, Yulong Concrete, Yulong Transport and Yulong Renewable, collectively; |

| “PRC” or “China” or “Chinese” refers to the People’s Republic of China, and, for the purposes of this prospectus, excludes Hong Kong, Macau and Taiwan; |

| ii |

| “RMB” refers to the legal currency of the PRC; |

| “$” refers to the legal currency of the United States; |

| “mt” refers to metric ton or metric tons; |

| “kg” refers to kilogram or kilograms; |

| “m3” refers to cubic meter or cubic meters; |

| “Securities Act” refers to the Securities Act of 1933, as amended; and |

| “Exchange Act” refers to the Securities Exchange Act of 1934, as amended. |

Our financial statements are expressed in $, which is our reporting currency. The functional currency of Yulong is $ and the functional currency of our consolidated affiliated entities is RMB. This prospectus contains amounts denominated in, and contains translations of certain RMB amounts into $ at specified rates. With respect to amounts not recorded in our reporting currency, or $, amounts of our assets and liabilities were translated from each subsidiary’s functional currency at the exchange rates as of the relevant balance sheet date; equity amounts were translated at historical exchange rates; and amounts of revenues, expenses, gains and losses were translated using the average rates for the relevant period. We make no representation that any currency amounts could have been, or could be, converted into any other currency at any particular rate, or at all.

| iii |

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. You should read the entire prospectus carefully, including our financial statements and related notes included in this prospectus and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” before making an investment decision.

Where indicated, information regarding share amounts and share prices have been presented on a pro forma basis to reflect the 4-for-5 reverse stock split that we effected on March 3, 2015.

Our Company

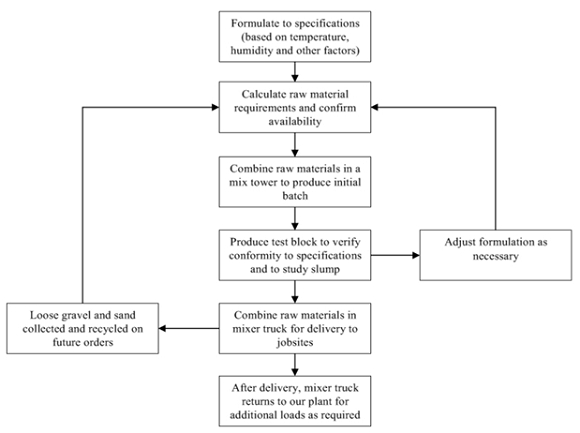

We are a vertically integrated manufacturer of eco-friendly building products located in the city of Pingdingshan in Henan Province, China. Our primary operating entities, Yulong Concrete and Yulong Brick, began operations in 2004 and 2006, respectively, and since that time have become Pingdingshan’s leading producers of fly-ash bricks and concrete. For our fiscal year ended June 30, 2014, our consolidated revenue from continuing operations was $44.5 million, of which we derived approximately 33.6% from bricks and 66.4% from concrete, while our income from operations was $15.2 million. Our consolidated revenue from continuing operations for the nine months ended March 31, 2015 was $33.6 million, of which we derived approximately 35.0% from bricks and 65.0% from concrete. For more information on our consolidated revenue and results of operations for the years ended June 30, 2014 and 2013, and the nine months ended March 31, 2015 and 2014, please see our consolidated financial statements included elsewhere in this prospectus.

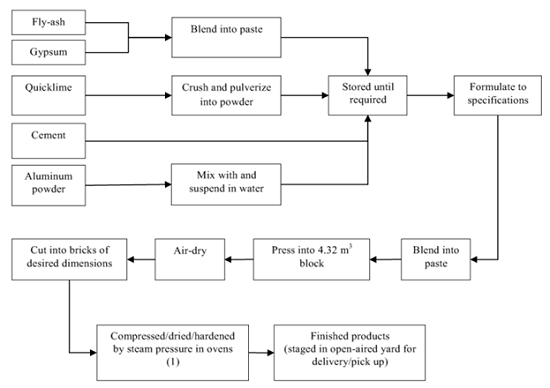

Based on internal research of published government data and our customers’ purchases (including the bricks and concrete produced for us by third-party manufacturers), we commanded approximately 51% of the brick market and 30% of the concrete market in Pingdingshan in both fiscal 2014 and fiscal 2013. Because of the nature of our products, new customers come to us either because of our reputation or by referral from our existing customers, and our selling efforts emphasize personal relationships over product marketing. Further, we believe that our fly-ash bricks are eco-friendly as they contain at least 30% of reclaimed fly-ash in place of traditional cement, thereby reducing raw material consumption. Our fly-ash bricks also consume less energy during manufacturing than their traditional counterparts, thereby producing less greenhouse gas emissions.

In connection with our plans to establish waste hauling operations and to produce bricks from construction waste, we have: (i) been granted exclusive right by the Pingdingshan municipal government to transport and process construction waste in the built-up area of Pingdingshan consisting of the four districts (Shilong, Weidong, Xinhua and Zhanhe) and two special districts (Gaoxing and Xincheng) under the administration of the municipal government (subject to exclusions imposed by special municipal regulations), which exclusive right has commenced concurrently with the formal operations of our waste recycling plant; (ii) contracted to acquire an additional 70 haul trucks to augment our current fleet of 50 trucks for a total of 120 haul trucks to transport the waste; and (iii) built a state-of-the-art recycling plant to process the waste, and a brick plant to utilize the processed waste. We commenced our hauling operations in late April 2015, in conjunction with formal operations at the recycling plant and one production line of our new brick plant.

Our Competitive Strengths

We believe the following strengths differentiate us from our competitors and are key drivers of our success:

| ● | Environmentally friendly products In addition to our fly-ash bricks which are each comprised of at least 30% in reclaimed fly-ash, we have begun to produce bricks from construction waste consisting of discarded bricks and concrete that we have the exclusive right to collect in the built-up area of Pingdingshan (subject to exclusions imposed by special municipal regulations). We have also built a research and development facility that will focus on renewable construction materials. Given China’s growing public awareness of pollution and resource conservation, we believe such efforts will be crucial for us to remain the market leader in Pingdingshan. |

| ● | Effective operational management. The effective management of all aspects of our operations allows us to achieve consistent quality in our products, thereby putting us at the top of the industry. |

| ● | Maintenance of relationships. Our reputation and track record have allowed us to not only successfully built relationships with the top real estate and construction companies operating in and around Pingdingshan, but will help us gain new business from existing as well as new customers. |

Our Business Strategy

We believe we can continue to grow our revenue by executing on the following strategies:

| ● | We can advance our market position, which we estimate to be approximately 51% of the brick market and 30% of the concrete market in Pingdingshan in fiscal 2014 (including bricks and concrete produced for us by third-party manufacturers) based on internal studies of published government data and our customers’ purchases, by investing in our existing operations. We want to invest in personnel training and equipment and production upgrades necessary to maintain the consistent quality of our products, on which our reputation and our sale efforts rely upon. We also seek to expand our sales team which can improve our ability to gather and process market and customer data, and tailor customer service. We believe that we can largely fund these efforts organically through our operations. As necessary, we may also seek financing from banks or our founder. |

| 1 |

| ● | By expanding from our current production capability, we can better position ourselves to capitalize on market demands that we project. Based on internal studies of published government data and customer information, we estimate that Pingdingshan currently requires approximately 0.9 million m3 of bricks and 2.4 million m3 of concrete annually. In addition to our four brick production lines each capable of producing 100,000 m3 annually, and two concrete mixing towers each capable of producing 200,000 m3 annually, we added a new brick production line in late April 2015. With this new line, which has annual capacity of 75,000 m3, we can begin to offer additional products that can appeal to the growing public concerns over environmental pollution and resource conservation. We have funded construction of our new brick plant housing the new line and new construction waste recycling plant (as well as our research and development center) thus far with cash flow from operations and loans from some of the shareholders of our consolidated affiliated entities. We intend to use the net proceeds from this offering to add another production line for the brick plant, and acquire 70 additional hauling trucks to support the recycling plant. If we are unable to complete this offering, however, we will use our future working capital, and look to banks and, if necessary, our founder, for financing. |

Recent Developments

On February 27, 2015, five shareholders of Yulong Group, namely Ms. Yingtao Miao, Mr. Guangjiang Zhu, Mr. Hu Zhu, Mr. Lei Zhu and our founder Mr. Yulong Zhu, agreed to convert the RMB equivalent of $9,892,692 in the aggregate due to them from Yulong Group into our ordinary shares at the initial public offering price per share, effective upon consummation of our initial public offering. For additional information regarding such related party indebtedness, please see “Related Party Transactions–Other Related Transactions.” At an initial offering price of $6.75 per share, which is the midpoint of the range set forth on the cover page of this prospectus, this would result in the issuance by us of 1,465,584 ordinary shares in the aggregate to these five shareholders.

Summary Risk Factors

We are subject to a number of risks, including risks that may prevent us from achieving our business objectives or may adversely affect our business, financial condition, results of operations, cash flows and prospects. You should carefully consider these risks, including all of the risks discussed in the section entitled “Risk Factors” beginning on page 6 of this prospectus, before investing in our ordinary shares. Risks relating to our business relate to, among other things:

| ● | the geographical limit of our current operations to the city of Pingdingshan; |

| ● | our ability to maintain our market position; and |

| ● | our ability to raise sufficient capital to carry out our growth strategy. |

Corporate Information

Corporate History

Yulong was incorporated as an exempted company with limited liability under the laws of Cayman Islands on March 10, 2011.

We conduct all of our operations through Yulong Group in China. Yulong WFOE, our wholly owned PRC subsidiary, has entered into a series of contractual arrangements with each of the four Yulong Group companies, as well as their shareholders, which enable us to:

| ● | exercise effective control over Yulong Group; |

| ● | receive substantially all of the economic benefits of Yulong Group in the form of service fees in consideration for the consulting services provided by Yulong WFOE; and |

| ● | have an exclusive option to purchase all of the equity interests in Yulong Group when and to the extent permitted under PRC laws. |

We do not have any equity interest in any of our consolidated affiliated entities, all of which is beneficially owned and controlled by our founder Mr. Yulong Zhu. However, as a result of these contractual arrangements, we are considered the primary beneficiary of each of the four Yulong Group companies and we treat them as our consolidated affiliated entities under generally accepted accounting principles in the United States, or U.S. GAAP. We have consolidated the financial results of these companies in our consolidated financial statements in accordance with U.S. GAAP. For a description of these contractual arrangements, see “Our Corporate History and Structure—Contractual Arrangements.” For a detailed description of the risks associated with our corporate structure and the contractual arrangements that support our corporate structure, see “Risk Factors—Risks Related to Our Corporate Structure.”

Corporate Information

Our principal executive offices are located at the Eastern End of Xiwuzhuang Village, Jiaodian Town, Xinhua District, Pingdingshan, Henan Province, China. Our telephone number is (86-375) 8888588.

| 2 |

Implications of Being an Emerging Growth Company

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act, or the JOBS Act, and we are eligible to take advantage of certain exemptions from various reporting and financial disclosure requirements that are applicable to other public companies, that are not emerging growth companies, including, but not limited to, (1) presenting only two years of audited financial statements and only two years of related management’s discussion and analysis of financial condition and results of operations in this prospectus; (2) not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, (3) reduced disclosure obligations regarding executive compensation in our periodic reports, and (4) exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. We intend to take advantage of these exemptions. As a result, investors may find investing in our ordinary shares less attractive as a result.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act, for complying with new or revised accounting standards. As a result, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to opt out of such extended transition period and acknowledge such election is irrevocable pursuant to Section 107 of the JOBS Act.

We could remain an emerging growth company for up to five years, or until the earliest of (1) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (2) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter and we have been publicly reporting for at least 12 months, or (3) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period. Even if we no longer qualify for the exemptions for an emerging growth company, we may still be, in certain circumstances, subject to scaled disclosure requirements as a smaller reporting company. For example, smaller reporting companies, like emerging growth companies, are not required to provide a compensation discussion and analysis under Item 402(b) of Regulation S-K or auditor attestation of internal controls over financial reporting.

| 3 |

The Offering

| Ordinary shares offered by us | 2,250,000 shares | |

| Over-allotment option | The underwriters have a 45-day option to purchase up to an additional 337,500 ordinary shares to cover over-allotments, if any. | |

| Ordinary shares to be outstanding after this offering | 11,715,584 shares (or 12,052,084 shares if the underwriters exercise in full their option to purchase additional ordinary shares). | |

| Use of Proceeds | We intend to use the net proceeds from this offering as follows:

● approximately $12.9 million in connection with Yulong Renewable’s operations, to add another production line for the new brick plant, and acquire 70 additional hauling trucks to support the new recycling plant; and

● the balance for general corporate purposes.

See “Use of Proceeds.”

| |

| Risk Factors | See “Risk Factors” for a discussion of factors you should carefully consider before deciding whether to invest in our ordinary shares. | |

| Dividend Policy | We do not currently expect to pay dividends on our ordinary shares for the foreseeable future. | |

| Proposed trading symbol | We have applied to list our ordinary shares on the NASDAQ Capital Market under the symbol “YECO.” |

Unless we indicate otherwise, the information in this prospectus:

| ● | is based on 8,000,000 shares of ordinary shares outstanding as of March 2, 2015; | |

| ● | gives effect to the 4-for-5 reverse stock split effected on March 3, 2015; |

| ● | gives effect to the issuance of 2,250,000 ordinary shares in this offering; |

| ● | assumes no exercise by the underwriters of their over-allotment option; |

| ● | assumes that the initial public offering price of our ordinary shares will be $6.75 per share, which is the midpoint of the price range set forth on the cover page of this prospectus; and |

|||

| ● | assumes the conversion of $9,892,692 in certain related party indebtedness at a conversion price of $6.75, which is the midpoint of the range set forth on the cover page of this prospectus, into 1,465,584 ordinary shares upon the closing of this offering. |

| 4 |

SUMMARY CONSOLIDATED FINANCIAL AND OTHER DATA

The following summary condensed financial data for the fiscal years ended June 30, 2014 and 2013, respectively, and for the nine months ended March 31, 2015 and 2014, respectively, are derived from our consolidated financial statements included elsewhere in this prospectus. The historical results presented below are not necessarily indicative of financial results to be achieved in future periods.

Prospective investors should read these summary condensed financial data together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the related notes included elsewhere in this prospectus.

| As

of June 30, | As

of March 31 | |||||||||||

| 2014 | 2013 | 2015 | ||||||||||

| (Unaudited) | ||||||||||||

| Summary Consolidated Balance Sheet Data: | ||||||||||||

| Cash | $ | 19,732,770 | $ | 5,792,625 | $ | 15,987,305 | ||||||

| Accounts receivable, net | $ | 5,181,394 | $ | 3,962,884 | $ | 7,719,405 | ||||||

| Total current assets | $ | 26,752,661 | $ | 14,261,287 | $ | 24,626,537 | ||||||

| Total assets | $ | 69,555,330 | $ | 57,079,453 | $ | 71,740,967 | ||||||

| Total current liabilities | $ | 13,616,232 | $ | 13,381,677 | $ | 18,731,963 | ||||||

| Total liabilities | $ | 31,908,728 | $ | 30,219,134 | $ | 27,649,880 | ||||||

| Total shareholder's equity | $ | 37,646,602 | $ | 26,860,319 | $ | 44,091,087 | ||||||

| For

the Years Ended June 30, | For

the Nine Months Ended March 31, | |||||||||||||||

| 2014 | 2013 | 2015 | 2014 | |||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||

| Summary Consolidated Statements of Comprehensive Income Data: | ||||||||||||||||

| Revenues | ||||||||||||||||

| Bricks | $ | 14,956,906 | $ | 13,955,354 | $ | 11,760,921 | $ | 10,628,650 | ||||||||

| Concrete | 29,499,530 | 28,525,265 | 21,888,479 | 21,675,987 | ||||||||||||

| Total revenues | 44,456,436 | 42,480,619 | 33,649,400 | 32,304,637 | ||||||||||||

| Cost of revenues | ||||||||||||||||

| Bricks | 5,773,533 | 5,997,073 | 4,654,917 | 4,126,267 | ||||||||||||

| Concrete | 21,729,928 | 20,786,582 | 16,753,593 | 15,802,220 | ||||||||||||

| Total cost of revenues | 27,503,461 | 26,783,655 | 21,408,510 | 19,928,487 | ||||||||||||

| Gross profit | 16,952,975 | 15,696,964 | 12,240,890 | 12,376,150 | ||||||||||||

| Operating expenses: | ||||||||||||||||

| Selling | 930,470 | 869,295 | 509,789 | 652,226 | ||||||||||||

| General and administrative | 806,037 | 711,954 | 2,379,241 | 928,206 | ||||||||||||

| Total operating expenses | 1,736,507 | 1,581,249 | 2,889,030 | 1,580,432 | ||||||||||||

| Income from operations | 15,216,468 | 14,115,715 | 9,351,860 | 10,795,718 | ||||||||||||

| Other expenses | (1,265,147 | ) | (1,159,478 | ) | (1,047,912 | ) | (936,062 | ) | ||||||||

| Income before income tax | 13,951,321 | 12,956,237 | 8,303,948 | 9,859,656 | ||||||||||||

| Provision for income tax | 3,259,147 | 2,906,742 | 2,097,387 | 2,325,686 | ||||||||||||

| Net income | 10,692,174 | 10,049,495 | 6,206,561 | 7,533,970 | ||||||||||||

| Other comprehensive income | ||||||||||||||||

| Foreign currency translation adjustment | 94,109 | 661,344 | 237,924 | 49,230 | ||||||||||||

| Comprehensive income | $ | 10,786,283 | $ | 10,710,839 | $ | 6,444,485 | $ | 7,583,200 | ||||||||

| Earnings per share | ||||||||||||||||

| Basic and diluted (giving effect to the 4-for-5 reverse stock split effected on March 3, 2015) | $ | 1.34 | $ | 1.26 | $ | 0.78 | $ | 0.94 | ||||||||

| 5 |

Investing in our ordinary shares involves a high degree of risk. You should consider and read carefully all of the risks and uncertainties described below, as well as other information included in this prospectus, including our consolidated financial statements and related notes appearing at the end of this prospectus, before making an investment decision. Any of the following risks could have a material and adverse effect on our business, financial condition and results of operations. In any such case, the market price of our ordinary shares could decline, and you may lose all or part of your investment. This prospectus also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks we face as described below and elsewhere in this prospectus.

Risks Related to Our Business and Our Industry

Our current operations are geographically limited to the city of Pingdingshan.

Because we operate and sell all of our products in and around Pingdingshan, our future growth opportunities depend on the growth and stability of the economy in the city. A downturn in the local economy or the implementation of local policies unfavorable to real estate development may cause a decrease in the demand for our bricks and concrete, which could have a negative impact on our profitability and business.

Our income will decrease if the construction and building material industries in Pingdingshan experience a downturn, or if such industries do not realize an increase in demand at the pace we expect.

Our fly-ash brick and concrete products serve as key components in construction and building projects for a wide range of industries and private and public sector projects in Pingdingshan. Therefore, we are subject to the general changes in economic conditions affecting many segments of the local as well as the overall Chinese economy. Demands for bricks and concrete are typically affected by a number of factors, including, but not limited to:

| ● | the level of residential and commercial construction in and around Pingdingshan, including reductions in the demand for new residential housing construction below current or historical levels; |

| ● | the availability of state funds for public or infrastructure construction; |

| ● | the changes in mix of our customers and business, which result in periodic variations in the margins of jobs performed during any particular quarter; and |

| ● | the budgetary spending patterns of customers. |

Many of these factors are beyond our control. If there is a decline in construction activity in Pingdingshan or a rise in the costs of doing business in China, demand for our products may decline which in turn could have material adverse effects on our business, financial condition, results of operations and cash flows. Moreover, our operating results in any particular quarter may not be indicative of the results that you can expect for any other quarter or for the entire year.

Our operating results may vary significantly from one reporting period to another and may be adversely affected by the seasonal and cyclical nature of the markets we serve.

The construction materials business is seasonal. In particular, our first quarter sales and results of operations are usually lower than other quarters due to the general slowdown in business activities in China during the Chinese New Year period. In addition, demand for our products during the winter months is typically lower than in other months because of inclement winter weather. Sustained periods of inclement weather or permitting delays could postpone or delay projects, and consequently, could adversely affect our business, financial condition, results of operations and cash flows. The relative demand for our products is a function of the highly cyclical construction industry. As a result, our revenues may be adversely affected by declines in the construction industry generally and in Pingdingshan.

| 6 |

Competition in Pingdingshan’s building and construction materials industry could adversely affect our results of operations.

We are the market leader in Pingdingshan’s building and construction materials industry with respect to bricks and concrete, and we believe there are currently only two brick manufacturers and two concrete manufacturers that have the capabilities to effectively compete against us. If any one of them can operate at lower costs than us, or can access financial resources to be able to accept lower margins than us, then it will have a competitive advantage over us. Although we believe our products are superior to those from the four companies that we deem competitors as well as any other bricks and concrete producers in Pingdingshan, there is no assurance that existing or new competitors may not overtake our current market position by reason of events and factors beyond our control.

Our growth strategy is capital intensive; without additional capital on favorable terms we may not accomplish our strategic plan.

Our growth strategy is premised upon investing and upgrading our existing operations as well constructing new plants to increase capacity and product offerings, all of which will require significant amount of capital. Although we have met our capital needs historically through our operations, bank loans and loans from some of the shareholders of our consolidated affiliated entities, there can be no assurance that we will be able to do so in the future, despite our current level of revenue and net income, and our track record of performance. Our inability to raise sufficient capital or inability to raise capital on acceptable terms to fund our strategy would negatively impact our projected revenues and our projected growth.

Our overall profitability is sensitive to price changes of our raw materials.

Our products are price-sensitive to raw material costs, which, for example, account for approximately 78% of our production cost for bricks, and approximately 95% for concrete, in fiscal 2014. Raw material prices are subject to changes in response to relatively minor fluctuations in supply and demand (such as the shortage brought on the national energy conservation policy at the beginning of 2013), general economic conditions and market conditions, all of which are beyond our control. While we were able to pass along increased raw material costs to our brick customers in fiscal 2013 and 2014, we were unable to do so entirely to our concrete customers, and there is no assurance that we can continue to do so in the future. If we are unable to pass along any increase in raw material costs to our customers, our profitability could be materially and adversely affected.

We depend on third parties for supplies essential to operate our business.

We rely on third parties to provide us with supplies, including cement and other raw materials, necessary for our operations. We cannot assure you that our favorable working relationships with our current suppliers will continue in the future. Because many of them are the largest suppliers in Pingdingshan, we may have difficulty replacing any of them with another local supplier that can match their quantity and quality of raw materials or their pricing. Additionally, there have historically been periods of supply shortages in the construction industry, particularly in a strong economy. The adoption of new government policies such as the national energy conservation policy at the beginning of 2013 has also led to both supply shortage and price increase for some raw materials such as quicklime and cement, which we believe will continue while the policy is in effect. One of our suppliers has requested that we use a third-party manufacturer that is affiliated with the supplier to make our bricks, which we have agreed to in order to ensure that we can access sufficient raw materials in light of the likelihood of ongoing shortage.

If any of our suppliers stop doing business with us for any reason such that we are unable to source sufficient raw materials for our needs, or if our suppliers experience disruptions to their business, such as labor disputes, supply shortages or distribution problems, our business, financial condition, results of operations and cash flows could be materially and adversely affected.

| 7 |

We depend on third parties to produce some of our products.

We use third-party manufacturers generally when orders exceed our production capacities. Such was the case for concrete in fiscal 2014 and 2013, and for the nine months ended March 31, 2015. Such third-party manufacturers produce bricks and concrete with their employees and equipment using our pre-formulated raw material blends and under our supervision, and allow us to stage the finished products (in the case of bricks) onsite until our customers take delivery. In return, we pay them a fee for every cubic meter of finished product.

We currently have one manufacturer for bricks and one for concrete, and believe that our relationships with them are good. In addition, we believe that we currently have more bargaining power over them in that the brick manufacturer lacks a sales department to develop business in the local market, while we are one of the concrete manufacturer’s principal customers. As such, their fees have not materially affected our cost of revenue and resulting gross profit. There can be no assurance, however, that we will be able to maintain our arrangements with these manufacturers indefinitely. While there are other local manufacturers, we may need to expend considerable time to determine if a replacement candidate can produce at the capacity and quality to suit our purpose. Our inability to timely replace a manufacturer could materially disrupt our operations. Furthermore, there is no assurance that a replacement manufacturer will accept fee comparable to what we are currently paying. Higher fee will increase our cost of revenue and negatively impact our gross profit.

Our operations are subject to various hazards that may cause personal injury or property damage and increase our operating costs, and which may exceed the coverage of our insurance.

There are inherent risks to our operations. For example, operating mixer trucks, particularly when loaded, exposes our drivers and others to traffic hazards. Our drivers are subject to the usual hazards associated with providing services on construction sites, while our plant personnel are subject to the hazards associated with moving and storing large quantities of heavy raw materials and finished products. Operating hazards can cause personal injury and loss of life, damage to or destruction of property, plant and equipment and environmental damage. Although we conduct training programs designed to reduce these risks, we cannot eliminate these risks. We maintain vehicle and commercial insurance to cover property damages and personal injuries resulting from traffic accidents, and rely on state mandated social insurance for work-related injuries of our employees. However, any claim that exceeds the scope of our insurance coverage, if successful and of sufficient magnitude, could result in the incurrence of substantial costs and the diversion of resources, which could have a material adverse effect on us. In addition, we do not have any business liability, disruption, litigation or property insurance coverage for our operations. Any uninsured occurrence of loss or damage to property, or litigation or business disruption may also materially and adversely affect our ability to operate.

We may incur material costs and losses as a result of claims our products do not meet regulatory requirements or contractual specifications.

Our operations involve providing products that must meet building code or other regulatory requirements and contractual specifications for durability, stress-level capacity, weight-bearing capacity and other characteristics. If we fail or are unable to provide products meeting these requirements and specifications, we may face economic penalties, including price adjustments, rejection of deliveries and/or termination of contracts, and our reputation could be damaged. In the past, we have not had any claims of this kind asserted against us, although no assurance can be given that no such claim will be made in the future. If a significant product-related claim or claims are made and resolved against us in the future, such resolution may have a material adverse effect on our business, financial condition, results of operations and cash flows.

Our operations may incur substantial liabilities to comply with environmental laws and regulations.

Our concrete and fly-ash brick manufacturing operations are subject to laws and regulations relating to the release or disposal of materials into the environment or otherwise relating to environmental protection. Our failure to have complied with the applicable laws may result in the assessment of administrative, civil and criminal penalties, the incurrence of investigatory or remedial obligations and the imposition of injunctive relief. Resolution of these matters may require considerable management time and expense. In addition, changes in environmental laws and regulations occur frequently and any changes that result in more stringent or costly manufacturing, storage, transport, disposal or cleanup requirements could require us to make significant expenditures to reach and maintain compliance and may otherwise have a material adverse effect on our industry in general and on our own results of operations, competitive position or financial condition.

The loss of services of the senior management and key personnel of our consolidated affiliated entities could severely disrupt our business and growth or if such persons compete against us.

Our future success is significantly dependent upon the continued service of the senior management and key technical personnel of our consolidated affiliated entities. In particular, we rely heavily on our founder, Yulong Zhu, to continue to manage our business, operations and sales and marketing activities as well as to maintain personal and direct relationships with many of our major customers. While the departure of Mr. Zhu is unlikely while he remains the beneficial owner of 100% of the equity interests of our consolidated affiliated entities, he may choose to reduce his level of involvement, or not to take part at all, especially if a conflict of interest or other disagreement arises between him and us. See “—Risks Related to Our Corporate Structure—The shareholders of our consolidated affiliated entities may have potential conflicts of interest with us, which may materially and adversely affect our business.” In addition, Mr. Zhu may act, or cause our consolidated affiliated entities and/or their shareholders to act, detrimentally against, our interests. See “—Risks Related to Our Corporate Structure—Shareholders of our consolidated affiliated entities may breach, or cause our consolidated affiliated entities to breach, or refuse to renew, the existing contractual arrangements we have with them and our consolidated affiliated entities. Any failure by our consolidated affiliated entities or their shareholders to perform their obligations under our contractual arrangements with them would have a material adverse effect on our business and financial condition.”

The loss of Mr. Zhu’s services or those of any other members of the senior management or key personnel of our consolidated affiliated entities may materially and adversely affect our business and operations. For instance, it could jeopardize our relationships with customers and result in the loss of customer engagements. If we lose the service of any such senior management member or key personnel, we may not be able to locate and obtain the service of qualified replacements, and may incur additional expenses to recruit and train new personnel, which could severely disrupt our business and growth. In addition, if any of such senior management or key technical personnel joins a competitor or forms a competing company, we may lose customers, know-how, key professionals and employees.

| 8 |

If we are not able to complete our acquisition of the land use rights underlying our facilities, we may have to incur substantial costs in order to enforce our rights or lose access to the land and thus our facilities.

While we have paid in full to the relevant villagers committees for the land use rights to the lands underlying the facilities of Yulong Bricks and Yulong Concrete pursuant to written agreements such committees, the transfer registration for such rights has not been completed as of the date of this prospectus. In addition, we have made only partial payment for the land use right to the land underlying the facilities of Yulong Renewable, pursuant to a written agreement with the holder of such right. If we cannot, for any reason, complete the transfer registration for the land used by Yulong Bricks or Yulong Concrete, or cannot complete our purchase of the land used by Yulong Renewable, we would need to rely on our written agreements with the holders of the underlying land use rights to exercise our rights. If any such holder decides to breach its agreement with us, we may have to pay additional money to such holder to ensure continuing access to our facilities and avoid any disruption to operations, which would in turn increase our production costs and thereby reduce our profitability. There can be no assurance, however, that such breach can be resolved on terms acceptable to us. Any efforts to enforce our rights in a court in China can be protracted and involve substantial costs, and there can be no assurance that the outcome would be favorable to us. See “–Risks Related to Doing Business in China–Uncertainties with respect to the PRC legal system could adversely affect us.”

If, as a result of any of the foregoing, we can no longer access our facilities, all or substantially all of our investments in them could be lost, and we would not be able to continue operations.

Severe weather can reduce construction activity and lead to a decrease in demand for our products.

Our operations and the demand for our products are affected by weather conditions in Pingdingshan. Sustained adverse weather conditions such as rain, extreme cold or snow could disrupt or curtail outdoor construction activity which in turn could reduce demand and the quality of our products and have a material adverse effect on our operations, financial performance or prospects.

The ongoing and projected slowdown in our collection of accounts receivable may materially and negatively impact our future operating cash flow and revenue.

Since the quarter ended September 30, 2014, our collection of accounts receivable has slowed, and we believe that this may continue for the next two to three fiscal quarters until bank lending to small- and medium-size enterprises ease and/or other lending options become more readily available to our customers. As a result, the slowdown may negatively impact our future operating cash flow. In addition to monitoring our accounts receivable collection process very closely, we are also requiring many of our customers to pay off their balances before making additional sales to them. Doing so, however, may force some of these customers to buy from our competitors and to stop doing business with us in the future. Should a sufficient number of our customers stop doing business with us and to the extent we are unable to attract new business to replace any such lost customers, our future revenue would be materially and negatively impacted.

Our operations may be adversely affected if the funding sources on which we are relying to support our operations for the next 12 months do not materialize.

As of March 31, 2015, we had cash and cash equivalent approximately $16.0 million, but will require approximately $15.4 million within the next 12 months. As a result, we believe that our current working capital is sufficient to support routine operations for the next 12 months. We also believe that our working capital should further improve now that Yulong Renewable has commenced formal. In addition, our founder has agreed to fund us on an as needed basis to meet our obligations, as he has done in the past, although there is no assurance that he will have the ability to do so if and when our need arises. If, however, Yulong Renewable does not perform as expected, or our founder is unable to fund us as needed, despite his commitment to do so, we can seek new, or refinance existing, bank financing. The availability of such financing on terms acceptable to us, however, is also uncertain. As such, if we are unable to obtain funds as needed and/or our working capital does not improve as anticipated, we may be forced to curtail operations from current levels or shut down operations in their entirety.

| 10 |

If our exclusive right to collect and process construction waste is terminated or expires, we may have difficulty sourcing the discarded bricks and concrete in quantities that we may need for our new facilities or on terms acceptable to us.

Through Yulong Renewable, we process construction waste consisting of discarded bricks and concrete at our new recycling plant. We then transform them into various types of recycled bricks at our new brick plant, which currently has one production line. We have a 20-year exclusive right to collect and process construction waste in the built-up area of Pingdingshan consisting of the four districts and two special districts under the administration of the municipal government (subject to exclusions imposed by special municipal regulations) pursuant to our agreement with the Pingdingshan Housing and Urban-Rural Development Bureau and licenses issued by the Pingdingshan Construction Wastes Management Office, which exclusive right has commenced concurrently with the formal operations of our recycling plant in late April 2015. Such right, however, may be terminated if, for example, we were to breach our obligations and fail to correct such breach within a specified time period, or if we were to fail to expand our operations as needed to meet the city’s requirements. Should our right terminate, or expire without being renewed, we may not be able to source discarded bricks and concrete in quantities that we may require for Yulong Renewable’s current and future operations and/or on terms that are acceptable to us. Should that happen, we would be unable to carry out our business plans, which in turn would have a material negative impact our projected revenues and growth.

Risks Related to Our Corporate Structure

If the Chinese government determines that the contractual arrangements through which we control our consolidated affiliated entities do not comply with applicable regulations, our business could be adversely affected.

There are uncertainties regarding the interpretation and application of PRC laws, rules and regulations, including but not limited to the laws, rules and regulations governing the validity and enforcement of the contractual arrangements with the Yulong Group companies and their shareholders. Although we have been advised by our PRC counsel that based on their understanding of the current PRC laws, rules and regulations, the contractual arrangements, as well our ability to enforce our rights thereunder, comply with all applicable PRC laws, rules and regulations, and do not violate, breach, contravene or otherwise conflict with any applicable PRC laws, rules or regulations, we cannot assure you that the PRC regulatory authorities will not determine that our corporate structure and contractual arrangements violate PRC laws, rules or regulations. If the PRC regulatory authorities determine that our contractual arrangements are in violation of applicable PRC laws, rules or regulations, they will become invalid or unenforceable. In addition, new PRC laws, rules and regulations may be introduced from time to time to impose additional requirements that may be applicable to our contractual arrangements.

The Chinese government has broad discretion in dealing with violations of laws and regulations, including levying fines, revoking business and other licenses and requiring actions necessary for compliance. In particular, licenses and permits issued or granted to us by relevant governmental bodies may be revoked at a later time by higher regulatory bodies. We cannot predict the effect of the interpretation of existing or new Chinese laws or regulations on our businesses. We cannot assure you that our current ownership and operating structure would not be found in violation of any current or future Chinese laws or regulations. As a result, we may be subject to sanctions, including fines, and could be required to restructure our operations or cease to provide certain services. Any of these or similar actions could significantly disrupt our business operations or restrict us from conducting a substantial portion of our business operations, which could materially and adversely affect our business, financial condition and results of operations.

| 11 |

If we or Yulong Group are determined to be in violation of any existing or future PRC laws, rules or regulations or fail to obtain or maintain any of the required governmental permits or approvals, the relevant PRC regulatory authorities would have broad discretion in dealing with such violations, including:

| ● | revoking the business and operating licenses of Yulong Group and/or voiding the contractual arrangements; |

| ● | discontinuing or restricting the operations of Yulong Group; |

| ● | imposing conditions or requirements with which we or Yulong Group may not be able to comply; |

| ● | requiring us to restructure the relevant ownership structure or operations; |

| ● | restricting or prohibiting our use of the proceeds from our initial public offering to finance our business and operations in China; or |

| ● | imposing fines or other forms of economic penalties. |

As we do not have direct ownership of Yulong Group, the imposition of any of these penalties may have a material adverse effect on our financial condition, results of operations and prospects.

Our contractual arrangements with our consolidated affiliated entities may not be as effective in providing operational control as direct ownership.

We have relied and expect to continue to rely on contractual arrangements with Yulong Group companies and their shareholders to operate our business. For a description of these contractual arrangements, see “Our Corporate History and Structure—Contractual Arrangements.” These contractual arrangements may not be as effective in providing us with control over these affiliated entities as direct ownership. If we had direct ownership of these entities, we would be able to exercise our rights as a shareholder to effect changes in the board of directors, which in turn could effect changes, subject to any applicable fiduciary obligations, at the management level. However, under the current contractual arrangements, we rely on the performance by these entities and their shareholders of their contractual obligations to exercise control over our consolidated affiliated entities. Therefore, our contractual arrangements with our consolidated affiliated entities may not be as effective in ensuring our control over our China operations as direct ownership would be.

Shareholders of our consolidated affiliated entities may breach, or cause our consolidated affiliated entities to breach, or refuse to renew, the existing contractual arrangements we have with them and our consolidated affiliated entities. Any failure by our consolidated affiliated entities or their shareholders to perform their obligations under our contractual arrangements with them would have a material adverse effect on our business and financial condition.

Our founder Yulong Zhu beneficially owns 100% of the equity interests in each of our consolidated affiliated entities, including through the Silent Shareholders Investment Agreement with their other shareholders. Under such agreement, these other shareholders disclaim all of the rights and obligations associated with their equity interests, which rights and obligations are borne solely by Mr. Zhu. As such, Mr. Zhu may breach, or cause our consolidated affiliated entities and/or the other shareholders to breach, or refuse to renew, the existing contractual arrangements we have with them and our consolidated affiliated entities. If our consolidated affiliated entities or their shareholders fail to perform their obligations under the contractual arrangements, we may have to incur substantial costs and expend resources to enforce our rights under the contracts. We may have to rely on legal remedies under PRC law, including seeking specific performance or injunctive relief and claiming damages, which may not be effective. For example, if Mr. Zhu or the other shareholders of a Yulong Group company (at Mr. Zhu’s direction) were to refuse to transfer their equity interests in in such company to us or our designee when we exercise the call option pursuant to these contractual arrangements, if they transfer the equity interests to other persons against our interests, or if they were otherwise to act in bad faith toward us, then we may have to take legal actions to compel them to perform their contractual obligations. Immediately after this offering, Mr. Zhu will own approximately 41.03% of our issued and outstanding ordinary shares (assuming that the RMB equivalent of $9,892,692 in certain related party indebtedness are converted into 1,465,584 ordinary shares at a conversion price of $6.75, which is the midpoint of the range set forth on the cover page of this prospectus). There can be no assurance, however, that such holding will effectively deter Mr. Zhu from causing a breach of the contractual arrangements.

All of these contractual arrangements are governed by PRC law and provide for the resolution of disputes through arbitration in the PRC. Accordingly, these contracts would be interpreted in accordance with PRC law and any disputes would be resolved in accordance with PRC legal procedures. The legal system in the PRC is not as developed as in other jurisdictions, such as the United States. As a result, uncertainties in the PRC legal system could limit our ability to enforce these contractual arrangements. Under PRC law, rulings by arbitrators are final, parties cannot appeal the arbitration results in courts, and the prevailing parties may only enforce the arbitration awards in PRC courts through arbitration award recognition proceedings, which would incur additional expenses and delay. In the event we are unable to enforce these contractual arrangements, we may not be able to exert effective control over our consolidated affiliated entities, and our ability to conduct our business may be negatively affected.

Contractual arrangements our Chinese subsidiary has entered into with our consolidated affiliated entities may be subject to scrutiny by the PRC tax authorities and a finding that we or our consolidated affiliated entities owe additional taxes could substantially reduce our consolidated net income and the value of your investment.

Under PRC laws and regulations, arrangements and transactions among related parties may be subject to audit or challenge by the PRC tax authorities within ten years after the taxable year when the transactions are conducted. We could face material and adverse tax consequences if the PRC tax authorities determine that the contractual arrangements among Yulong WFOE, our consolidated affiliated entities and the shareholders of our consolidated affiliated entities do not represent arm’s-length prices and consequently adjust Yulong WFOE’s or our consolidated affiliated entities’ income in the form of a transfer pricing adjustment. A transfer pricing adjustment could, among other things, result in a reduction, for PRC tax purposes, of expense deductions recorded by our consolidated affiliated entities, which could in turn increase their tax liabilities. In addition, the PRC tax authorities may impose late payment fees and other penalties on Yulong WFOE or our consolidated affiliated entities for any unpaid taxes. Our consolidated net income may be materially and adversely affected if Yulong WFOE or our consolidated affiliated entities’ tax liabilities increase or if they are subject to late payment fees or other penalties.

| 12 |

The shareholders of our consolidated affiliated entities may have potential conflicts of interest with us, which may materially and adversely affect our business.

The shareholders of our consolidated affiliated entities include Yulong Zhu, our director and chief executive officer. Mr. Zhu is also a beneficial owner of our company and a PRC citizen. He directly holds 54% of the equity interests in Yulong Bricks, and 68% in Yulong Renewable, but through the Silent Shareholders Investment Agreement, he controls 100% of the equity interests in each of our consolidated affiliated entities. See “Business—Our Corporate History and Structure—Contractual Arrangements.” Conflicts of interest may arise between his roles as director, officer and/or beneficial owner of our holding company and as a shareholder of our consolidated affiliated entities. We cannot assure you that when conflicts of interest arise, any or all of these equity holders will act in the best interests of our company or such conflicts will be resolved in our favor. Currently, we do not have any arrangements to address potential conflicts of interest between such equity holder and our company. We rely on Mr. Zhu to comply with the laws of China, which protect contracts, provide that directors and executive officers owe a duty of loyalty and a duty of diligence to our company and require them to avoid conflicts of interest and not to take advantage of their positions for personal gains. We also rely on the laws of Cayman Islands, which provide that directors owe a duty of care and a duty of loyalty to our company. If we cannot resolve any conflict of interest or dispute between us and the shareholders of our consolidated affiliated entities, we would have to rely on legal proceedings, which could result in disruption of our business and subject us to substantial uncertainty as to the outcome of any such legal proceedings.

We may rely on dividends and other distributions on equity paid by our PRC subsidiary to fund any cash and financing requirements we may have. Any limitation on the ability of our PRC subsidiary to pay dividends to us could have a material adverse effect on our ability to conduct our business.

We are a holding company, and we may rely on dividends and other distributions on equity to be paid by our wholly-owned PRC subsidiary, Yulong WFOE, for our cash and financing requirements, including the funds necessary to pay dividends and other cash distributions to our shareholders and service any debt we may incur. If Yulong WFOE incurs debt on its own behalf in the future, the instruments governing the debt may restrict its ability to pay dividends or make other distributions to us. We may also sell our ordinary shares, as this offering, or request our founder Yulong Zhu to advance funds on our behalf to meet our cash and financial requirements, although there can be no assurance that we will be able to do so.

Under PRC laws and regulations, each of Yulong WFOE and our consolidated affiliated entities is required to set aside at least 10% of its after-tax profits each year, if any, to fund certain statutory reserve funds until such reserve funds reach 50% of its registered capital. In addition, Yulong WFOE may allocate a portion of its after-tax profits based on PRC accounting standards to enterprise expansion fund and staff bonus and welfare fund at its discretion. Each of our consolidated affiliated entities may allocate a portion of its after-tax profits based on PRC accounting standards to a discretionary surplus fund at its discretion. The statutory reserve funds and the discretionary funds are not distributable as cash dividends. Remittance of dividends by a wholly foreign-owned company out of China is subject to examination by the banks designated by SAFE. As of June 30, 2014 and 2013, and as of March 31, 2015, Yulong WFOE and our consolidated affiliated entities had collectively appropriated $3,771,665, $3,073,651 and $3,921,951 of retained earnings for their statutory reserves, respectively.

Any limitation on the ability of our consolidated affiliated entities to make payments to Yulong WFOE under the contractual arrangements, or the ability of Yulong WFOE to pay dividends or make other distributions to us, could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends, or otherwise fund and conduct our business.

PRC regulation of loans to, and direct investment in, PRC entities by offshore holding companies and governmental control of currency conversion may restrict or prevent us from using the proceeds of this offering to make loans to our PRC subsidiary and consolidated affiliated entities or to make additional capital contributions to our PRC subsidiary, which may materially and adversely affect our liquidity and our ability to fund and expand our business.

We are an offshore holding company conducting our operations in China through our PRC subsidiary and consolidated affiliated entities. We may make loans to our PRC subsidiary and consolidated affiliated entities, or we may make additional capital contributions to our PRC subsidiary.

Any loans by us to our PRC subsidiary, which is treated as a foreign-invested enterprise under PRC law, are subject to PRC regulations and foreign exchange loan registrations. For example, loans by us to Yulong WFOE to finance its activities cannot exceed statutory limits and must be registered with the local counterpart of the State Administration of Foreign Exchange, or SAFE. The current amounts of approved total investment and registered capital of Yulong WFOE are approximately $140,000 and $100,000, respectively, which means Yulong WFOE cannot currently obtain loans in excess of $40,000 from our entities outside of China. We may also decide to finance Yulong WFOE by means of capital contributions. These capital contributions must be approved by the PRC Ministry of Commerce or its local counterpart. With respect to the proceeds we expect to receive from this offering, we intend to them as capital contribution to Yulong WFOE after consulting with our PRC counsel. Thus, Yulong WFOE would, immediately after the completion of this offering, apply with the PRC Ministry of Commerce or its local counterpart to raise its registered capital and total investment amounts by at least the net amount of the proceeds. Once approved, we would be able to remit the proceeds as capital contribution to Yulong WFOE and deposit them directly into its foreign currency account. In addition, we will most likely finance the activities of our consolidated affiliated entities with the proceeds from this offering in RMB from Yulong WFOE to our consolidated affiliated entities.

On August 29, 2008, SAFE promulgated the Circular on the Relevant Operating Issues Concerning the Improvement of the Administration of the Payment and Settlement of Foreign Currency Capital of Foreign-Invested Enterprises, or SAFE Circular 142, regulating the conversion by a foreign-invested enterprise of foreign currency registered capital into RMB by restricting how the converted RMB may be used. SAFE Circular 142 provides that the RMB capital converted from foreign currency registered capital of a foreign-invested enterprise may only be used for purposes within the business scope approved by the applicable governmental authority and may not be used for equity investments within the PRC. In addition, SAFE strengthened its oversight of the flow and use of the RMB capital converted from foreign currency registered capital of a foreign-invested company. The use of such RMB capital may not be altered without SAFE approval, and such RMB capital may not in any case be used to repay RMB loans if the proceeds of such loans have not been used. Such requirements are also known as the “payment-based foreign currency settlement system” established under the SAFE Circular 142. Violations of SAFE Circular 142 could result in severe monetary or other penalties. Furthermore, SAFE promulgated a circular on November 19, 2010, or Circular No. 59 and another supplemental circular on July 18, 2011, known as Circular No. 88, which tightens the examination on the authenticity of settlement of net proceeds from an offering and requires that the settlement of net proceeds shall be in accordance with the description in its prospectus.

On March 30, 2015, SAFE issued the Circular on the Reform of the Administration of the Payment and Settlement of Foreign Currency Capital of Foreign-Invested Enterprises (“SAFE Circular 19”), which will be effective on June 1, 2015, and which will abolish the application of SAFE Circular 142 and Circular No. 88 when it becomes effective. Pursuant to SAFE Circular 19, foreign-invested enterprises may either continue to follow the payment-based foreign currency settlement system or elect to follow the “conversion-at-will” of foreign currency settlement system. Where a foreign-invested enterprise follows the conversion-at-will of foreign currency settlement system, it may convert any or 100% amount of the foreign currency in its capital account into RMB at any time. The converted RMB will be kept in a designated account known as “Settled but Pending Payment Account,” and if the foreign-invested enterprise needs to make further payment from such designated account, it still needs to provide supporting documents and go through the review process with its bank. In addition, foreign-invested enterprises shall not use its capital and RMB obtained from foreign exchange settlement for purposes within the following negative list: (a) directly or indirectly for expenditures outside of its business scope or expenditures prohibited by national laws and regulations; (b) directly or indirectly for investment in securities, except as otherwise prescribed by applicable laws and regulations; (c) directly or indirectly for the disbursing RMB entrusted loans (other than as permitted in its business scope); (d) for repayment of inter-corporate borrowings (including money advanced by third parties) and the repayment of certain RMB bank loans that have been sub-lent to third parties; and (e) for the expenditures related to the purchase of real estate which is not for self-use, unless it is a foreign-invested real estate enterprise.

| 13 |

In light of the various requirements imposed by PRC regulations on loans to and direct investment in PRC entities by offshore holding companies, including SAFE Circular 142 or SAFE Circular 19, we cannot assure you that we will be able to complete the necessary government registrations or obtain the necessary government approvals on a timely basis, if at all, with respect to future loans by us to our PRC subsidiary or with respect to future capital contributions by us to our PRC subsidiary. If we fail to complete such registrations or obtain such approvals, our ability to use the proceeds we expect to receive from this offering and to capitalize or otherwise fund our PRC operations may be negatively affected, which could materially and adversely affect our ability to timely complete the recycling plant and brick plant for Yulong Renewable, and to expand our business.

If our PRC subsidiary or consolidated affiliated entities become the subject of a bankruptcy or liquidation proceeding, we may lose the ability to use and enjoy all of their assets, which could reduce the size of our operations and materially and adversely affect our business, ability to generate revenues and the market price of our ordinary shares.