Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Po Yuen Cultural Holdings (Hong Kong) Co., Ltd. | Financial_Report.xls |

| EX-31 - EXHIBIT 31 - Po Yuen Cultural Holdings (Hong Kong) Co., Ltd. | exhibit31.htm |

| EX-32 - EXHIBIT 33 - Po Yuen Cultural Holdings (Hong Kong) Co., Ltd. | exhibit32.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| (Mark One) | |

| [ X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the year ended March 31, 2015 | |

| OR | |

| [ ] | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

WEWEARABLES, INC.

(Exact name of registrant as specified in its charter)

Commission file number: 333-198615

| Nevada | 47-1100063 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 7 Whitford, Irvine, CA | 92602 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code:

(714) 791-1305

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| None | None |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes [ ] No [x]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [x] No [ ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [x] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [x]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer [ ] | Accelerated filer [ ] | ||

| Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [x] |

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Act). Yes [x] No []

As of September 30, 2014 (last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of the voting common stock held by non-affiliates of the Registrant (without admitting that any person whose shares are not included in such calculation is an affiliate) was approximately $0.

As of May 11, 2015, there were 20,412,000 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

| Table of Contents | ||

| Part I | Page | |

| Item 1 | Business | 4 |

| Item 1A | Risk Factors | 12 |

| Item 1B | Unresolved Staff Comments | 21 |

| Item 2 | Properties | 21 |

| Item 3 | Legal Proceedings | 21 |

| Item 4 | Mine Safety Disclosures | 21 |

| Part II | ||

| Item 5 | Market for Registrant’s Common Equity and Related Stockholder Matters | 22 |

| Item 6 | Selected Financial Data | 25 |

| Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 25 |

| Item 7A | Quantitative and Qualitative Disclosure about Market Risk | 29 |

| Item 8 | Financial Statements and Supplementary Data | 30 |

| Item 9 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosures | 40 |

| Item 9A | Controls and Procedures | 41 |

| Item 9B | Other Information | |

| Part III | ||

| Item 10 | Directors, Executive Officers of the Registrant | 42 |

| Item 11 | Executive Compensation | 43 |

| Item 12 | Security Ownership of Certain Beneficial Holders and Management | 45 |

| Item 13 | Certain Relationships and Related Transactions | 46 |

| Item 14 | Principal Accountant Fees and Services | 46 |

| Part IV | ||

| Item 15 | Exhibits, Financial Statement Schedules | 48 |

| Signatures | 49 |

| -3- |

FORWARD LOOKING STATEMENTS

There are statements in this Annual Report that are not historical facts. These “forward-looking statements” can be identified by use of terminology such as “believe,” “hope,” “may,” “anticipate,” “should,” “intend,” “plan,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy” and similar expressions. You should be aware that these forward-looking statements are subject to risks and uncertainties that are beyond our control. For a discussion of these risks, you should read this entire Annual Report carefully, especially the risks discussed under “Risk Factors.” Although management believes that the assumptions underlying the forward looking statements included in this Annual Report are reasonable, they do not guarantee our future performance, and actual results could differ from those contemplated by these forward looking statements. The assumptions used for purposes of the forward-looking statements specified in the following information represent estimates of future events and are subject to uncertainty as to possible changes in economic, legislative, industry, and other circumstances. As a result, the identification and interpretation of data and other information and their use in developing and selecting assumptions from and among reasonable alternatives require the exercise of judgment. To the extent that the assumed events do not occur, the outcome may vary substantially from anticipated or projected results, and, accordingly, no opinion is expressed on the achievability of those forward-looking statements. In the light of these risks and uncertainties, there can be no assurance that the results and events contemplated by the forward-looking statements contained in this Annual Report will in fact transpire. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. We do not undertake any obligation to update or revise any forward-looking statements.

PART I

ITEM 1 BUSINESS

Overview

WeWearables, Inc., a Nevada corporation, (“WeWearables” “Company” “we,” “us,” or “our”) was incorporated on May 14, 2014. Most of the activity through March 31, 2015 involved incorporation efforts, development of our internet portal and mobile applications.

We are a development stage company and have limited financial resources. We have not established a source of equity or debt financing. Our financial statements include a note emphasizing the uncertainty of our ability to remain as a going concern.

Company Overview

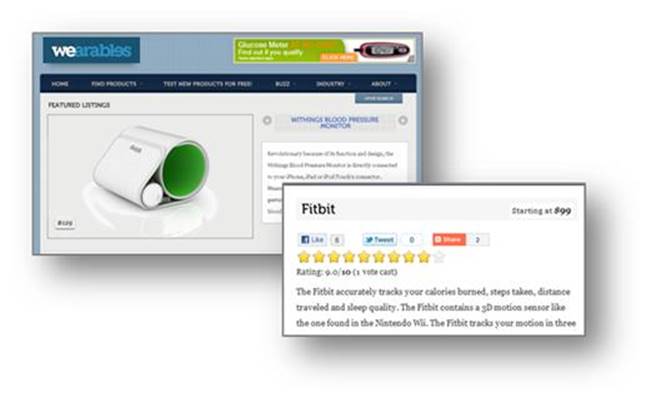

WeWearables plans to market and distribute the next generation of wearable health and wellness devices. The “wearables” mainly consists of tracking devices that are worn on your wrist, waist, ankle or shoe that tie to your smart phone to track and report on your fitness and activity levels. WeWearables is targeting the next generation of devices that focus on smart, wearable products to help with specific diseases or solve direct healthcare issues. The human body is an untapped information source and consumers are looking for better ways to track and manage their health or improve their fitness or wellness. WeWearables is focused on the distribution of wearable products that target this industry.

Product Overview

WeWearables is focused on the following three business models:

WeWearables.com eCommerce Market place – an online marketplace to shop, compare, review, rate and purchase the latest wearable technology. The marketplace will be modeled after zappos.com or casa.com, similar to how other e-commerce websites focus on specific products and target markets. Amazon currently owns and/or operates over 20+ specialty e-commerce websites such as Diapers.com (for kids), Fabric.com (for sewing), Wag.com (for pets) and many others.

| -4- |

WeWearables Vending Machines – Vending machines can be placed in fitness centers, medical groups, doctors’ offices and other locations where people with specific diseases or chronic conditions are visiting. The vending machines will be stocked with devices specific to the market they are placed in. For example, a cardiology practice would have a vending machine with a wearable blood pressure cuff and heart monitoring equipment and fitness tracker (pedometer). An OB/GYN practice would have a vending machine with fitness, weight loss, baby monitors and other related wearable devices. A custom designed vending machine will be created with a large flat screen monitor to display ads and promote wearables products at each vending machine location. The WeWearables Marketplace software will allow wearable vendors to place their products at these vending locations and to run advertising on the vending machine.

WeWearables Retail Kiosks – Small retail kiosks inside malls will help promote the brand and online marketplace and also have direct retail sales. Kiosks will be designed to have interactive equipment that connects with people’s mobile phones and tablet devices. Kiosks can be owned directly by us or franchised by territory.

| -5- |

All three business models will be supported by advertising revenue. Wearables technology requires user education before the consumer can purchase the device. There are large advertising budgets around wearable technology from companies such as Nike, Adidas, Fitbit, Withings, and many others.

Our Plan

Our plan to continue as a going concern is to reach the point where we begin generating sufficient revenues from our product(s) or services to meet our obligations on a timely basis. We may not be able to finish the development of any products in the future because of a lack of available funds or financing to do so. In the early stages of our operations, we will continue to keep costs to a minimum. The cost to develop our business plan as currently outlined below may be in excess of $100,000. To the extent the development is more costly and our current funds to undertake the business plan are insufficient, we will need to obtain additional funding. If we are unable to obtain adequate funding or financing, the Company faces the ultimate likelihood of business failure. There are no assurances that we will be able to raise any funds or establish any financing program for the Company’s growth.

The following outlines the steps or stages that we expect to encounter and the necessary funding needed for each stage. Within each stage we have outlined the metrics or performance that we must accomplish as we move forward with our business plan. This should enable the Company to continue as a going concern as long as we are able to seek additional financing on acceptable terms.

Stage One (Months 1 – 3) ($25,000 est. costs)

WeWearables will be an e-commerce platform and advertising system that powers the website, vending machines and retail kiosks. This will allow us to sell products in multiple locations and and/or advertise products in these locations.

| - | outline the scope of work and framework to initiate the development of our mobile application which will allow you to purchase items from your phone. The same software application framework will be used to power the website, vending machines and retail kiosks. This will allow WeWearables to manage orders, sales, inventory and advertising in multiple locations |

| -6- |

| - | setup development and production servers and define database architecture and APIs |

| - | setup coding platform and coding of our software based upon the initial scope of work and development framework |

| - | finish building our Company web site to provide our identity and service offering |

Stage Two (Months 3 – 5) ($20,000 est. costs)

| - | begin e-commerce website and mobile app development based on scope of work and framework defined in stage one |

| - | initiate testing of our e-commerce and mobile software application to improve and refine components of our system to uphold quality and application usability |

| - | analyze and test software for integration capabilities with other 3rd party software applications |

| - | Partner with third party vending machine providers |

| - | Contract kiosk supplier to build prototype kiosks |

Stage Three (Months 6 – 8) ($30,000 est. costs)

| - | initiate a multi-faceted marketing campaign to attract new customers |

| - | work with wearables vendors on registering products on the WeWearables platform and advertising rates |

| - | research and refine our target market of potential customers by using geographic, demographic, and business needs analysis of specific industries |

| - | finalize application development and software integration components of our software and commence alpha testing with select target customers and partners |

| - | refine and improve the software based on simple feedback, bugs, fixes, and needs of our alpha testing group |

Install pilot vending machines

| - | Install pilot kiosks in medical offices and key retail locations |

Stage Four (Month 9 - 12) ($40,000 est. costs)

| - | release software to the marketplace in a controlled marketing campaign to specific target market as a beta release |

| - | refine and release new versions of software based upon feedback and bug fixes, as well as meet the needs of specific industry sectors |

| -7- |

Rollout vending machines in Southern California market

| - | Rollout kiosks in Southern California market |

As mentioned above the time-line estimate(s) (stages) are predicated upon the Company obtaining the necessary financing either through equity or debt financing. If we are not able to obtain the necessary levels of financing as determined by the above stages, we will not be able to meet or achieve any of the time-line objectives. In that case the Company will be forced to proceed on a piecemeal basis using primarily the services of our president and chief executive officer and limited use of outside contractors when and if limited funds are obtained. Our president and chief executive officer devotes in excess of twenty (20) hours a week to our continued business efforts. There is no realistic way to predict the timing or completion in that scenario.

Our business plan requires further completion of these tasks which will require the hiring of employees and/or outside contractors. With the level of sophistication and expertise of our president and chief executive officer, as well as other various industry professionals that he knows, the Company should make further progress in its development of the intended products and services for its planned divisions, but currently no specific timeframe can be provided. Most if not all of these actions will be predicated on the Company obtaining the necessary financing to accomplish these steps. If financing is not available on terms reasonable to the Company and its shareholders, then the progression steps of this business plan will not occur as planned and may never occur.

We currently have no additional sources of financing and no commitments for financing. There are no assurances that we will obtain sufficient financing or the necessary resources to enter into contractual agreements with outside developers or sales/marketing firms. If we do not receive any funding or financing, our business is likely to be maintained with limited operations for at least the next 12 months because our president and chief executive officer, will continue providing his professional services without current compensation. We do not currently have a formal agreement in place with our president and chief executive officer covering this period; however, our president and chief executive officer’s current plan is to do substantially all administrative and planning work as well as basic programming and marketing work on his own without cash compensation while he seeks other sources of funding for the Company.

Market Overview

The term ‘Wearables” refers to any device or product which can be worn by a person to integrate computing in his daily activity. Wearable technology mainly consist of electronic devices including wristwear, armwear, headgear, belts, apparel/textiles, glasses, legwear, footwear, skin patches and more. Currently, the most popular wearable products are activity trackers wore on the belt or wrist, smart watches, smart clothing including shirts, headbands, hats, shoes and leggings, patches on your arm or back and implants in your ear or stomach.

Wearables are used to track movement, heart rate, sleep, temperature, respiration, skin conductance (bio feedback), brain activity, hydration, posture, glucose levels, oxygen levels and more. Most wearables require a smart phone to smart watch to collect and store the data and an app (mobile app) to view the results of the data. Stored data can be used to track trends and changes, providing valuable insight to wearable users.

| -8- |

The growth of the wearables market is being driven by many market conditions, including the development and adoption of new smart phone technology. Newer smart phone technology includes low energy Bluetooth radios (BLE) first introduced with the iPhone 4s, wireless charging coils introduced in 2013 by several smart phone manufacturers, low cost MEMS accelerometer, improve wireless and data connectivity and the ability for smart phones and wearable devices to offload signal processing from sensors and leveraging cloud computing technology to store data.

Combined, these market factors make it cheaper and easier for consumers to purchase and use wearable technology and to provide an easy way to track, store and manage data that is collected by their wearable devices.

Consumers are not the only ones utilizing Wearable technology. Hospitals, corporations, biotech industry, pharmaceutical industry, insurance providers and many others utilize wearable technology to help control costs, improve patient outcomes or support clinical studies.

Market Opportunity

Millions in advertising have been spent by companies such as Nike, Adidas, Qualcomm, Fitbit, WiThings, Jawbone and others to educate the market about wearable technology. Almost of these devices only provide general trending and tracking of your fitness or activity levels.

Many people enjoy using these devices, but at some point users get a really good idea of how many steps or how much activity they’ve had on a day without even using the device. Customers are now looking for smart devices that better help them track and manage their specific needs or healthcare conditions such as COPD, sleep, obesity, diabetes, etc.

The wearable technology is possible now because so many people own a smartphone or a tablet. This provides the computing power, Internet or Bluetooth connectivity and apps to view your results. For wearable companies, this makes it feasible to have a lower cost product or sensor technology without having to build in all the connectivity, computing power and software.

Competition

The wearables market faces significant competition. The notable large competitors are online resellers such as Amazon and brick and mortar stores such as BestBuy, Walmart and sporting goods stores. Additionally, we face competition from direct sales by the device makers Apple, Google, Samsung, Sony, Epson, LG, Intel, Nike, Adidas, Qualcomm, Fitbit, WiThings, and Jawbone. Currently, there is no dominant industry leader. We plan to provide specialized best in market products through our distribution channels. The Company expects to face further competition from new market entrants and possible alliances among competitors in the future as the convergence of information processing and telecommunications continues. Many of the Company's current and potential competitors have significantly greater financial, technical, marketing and other resources than the Company. As a result, they may be better able to respond or adapt to new or emerging technologies and changes in client requirements or to devote greater resources to the development, marketing and sales of their services than the Company. There can be no assurance that the Company will be able to compete successfully. In addition, the Company will be faced with numerous competitors, both strategic and financial, in attempting to obtain competitive products. Many actual and potential competitors we believe are part of much larger companies with substantially greater financial, marketing and other resources than the Company, and there can be no assurance that the Company will be able to compete effectively against any of its future competitors.

Intellectual Property

We have no patents or trademarks.

| -9- |

Government Regulation and Industry Standards

The US Food and Drug Administration has proposed to largely deregulate a sizable list of Class II and Class I medical devices and no longer require their makers to go through the 510(k) process. The agency made clear the deregulatory move would not necessarily exempt the device makers from other steps like appropriately registering and labeling their wares as medical devices or quality systems requirements.

Among the product codes the FDA listed, a handful are ones that digital health device clearances have used in recent years — or even recent months. That means fast followers could be in a position to launch sooner with less regulatory constraints, and incumbents may be able to iterate their already-cleared products more quickly.

Thermometers. The FDA has removed 510(k) requirements for clinical digital thermometers, which include smartphone-enabled, peel-and-stick temperature-sensing patches.

Smart Body Scales. Many of the wireless-enabled weight scales in the market today have 510(k) clearance from the FDA because they offer body fat analysis via impedance, which sends a low-level, electrical zap through the body.

Ophthalmic cameras. Smartphone peripherals that turn the device into ophthalmic cameras no longer need to seek 510(k) clearance under FDA’s draft guidance document.

Additional products The FDA’s full list also includes a number of hearing aid devices and supporting software, which might mean some hearing aid management apps no longer need to go through 510(k). The document could affect the regulatory status of many other digital health devices.

See http://www.fda.gov/downloads/MedicalDevices/DeviceRegulationandGuidance/GuidanceDocuments/UCM407292.pdf

Employees

As of May 11, 2015, we had one employee which serves as our president, and chief executive officer, Mr. Chen. During fiscal year ending March 31, 2015 (dependent on financing and available working capital), Mr. Chen will devote at least twenty (20) hours a week to us and may increase the number of hours as necessary. Mr. Chen is allowed to devote this time to our Company as he is not limited or restricted from being involved with us by his current employer. Mr. Chen is under no contractual agreement with the Company. However, our president, and chief executive officer’s current plan is to provide all administrative and planning work as well as perform the basic coding for software and initial marketing efforts on his own without any cash compensation while he seeks other sources of funding for the Company and its business plan.

Mr. Chen has been initially compensated through the form of common stock or equity in the Company, and will continue to forego cash payments for his services until the Company is profitable. Beyond Mr. Chen’s services, we have currently been working with an independent software development firm, which has been utilized on an “as needed” basis, and we may in the future use other independent contractors and consultants to assist in many aspects of our business on an “as needed” or per project basis pending adequate financial resources being available or their ability to defer payment for their services.

There is no written employment contract or agreement in place with our president and chief executive officer.

Property

Our office and mailing address is 7 Whitford, Irvine, CA 92602. The space is provided to us by Mr. Chen. Mr. Chen incurs no incremental costs as a result of our using the space. Therefore, he does not charge us for its use. There is no written lease agreement.

| -10- |

Litigation

We are not party to any pending, or to our knowledge, threatened litigation of any type.

Reports to security holders.

(1) To the extent required by federal and state law, the Company will deliver an annual report to security holders.

(2) The Company will file reports with the SEC. The Company will be a reporting company and will comply with the requirements of the Exchange Act.

(3) The public may read and copy any materials the Company files with the SEC at the SEC's Public Reference Room at 100 F. Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Additionally, the SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, which can be found at http://www.sec.gov.

| -11- |

| ITEM 1.A | RISK FACTORS |

An investment in the Company is highly speculative in nature and involves an extremely high degree of risk. If any of the following risk were to occur, then our business, financial condition, results of operations and/or prospects could be materially adversely affected. If that happens, the market price of our common stock, if any, could decline, and investors may lose all or part of their investment.

Risks Related to the Business

| 1. | WeWearables has virtually no financial resources. Our independent registered auditors’ report includes an explanatory paragraph stating that there is substantial doubt about our ability to continue as a going concern. |

WeWearables is an early stage company and has virtually no financial resources. We had a cash balance of $131,448 as of March 31, 2015. We have working capital deficit of $87,584 and a stockholders’ deficit of $87,584 at March 31, 2015. Our independent registered auditors included an explanatory paragraph in their opinion on our financial statements as of and for the period ended March 31, 2015 that states that Company losses from operations raise substantial doubt about its ability to continue as a going concern. We may seek additional financing. The financing sought may be in the form of equity or debt financing from various sources as yet unidentified. No assurances can be given that we will generate sufficient revenue or obtain the necessary financing to continue as a going concern.

Our current resources and source of funds, which primarily consist of officer debt are sufficient to keep our business operations functioning for the next three months. We do not have a formal agreement with our president and chief executive officer to fund the Company’s working capital needs; however our president and chief executive officer’s current plan is to do the majority of the work on his own without cash compensation while he seeks other sources of funding. The Company has started the development of an initial design and framework of its proposed portal platform, as well as through the efforts of a software development firm which the Company has been working with on an as “needed basis.” We currently spend between $2,500 and $10,000 per month in operational expenses. We have not generated any revenues from our business, and our expenses will be accrued and deferred until sufficient financing is obtained or our president and chief executive officer or others who know our president and chief executive officer loans the necessary funds to pay for these expenses. No assurances can be given that we will be able to receive funds from our president and chief executive officer or others to continue our operations beyond a month-to-month basis.

2. WeWearables is and will continue to be completely dependent on the services of our president and chief executive officer, Thomas Chen, the loss of whose services may cause our business operations to cease, and we will need to engage and retain qualified employees and consultants to further implement our strategy.

WeWearables’s operations and business strategy are completely dependent upon the knowledge and business connections of Mr. Chen our president and chief executive officer. He is under no contractual obligation to remain employed by us. If he should choose to leave us for any reason or becomes ill and is unable to work for an extended period of time before we have hired additional personnel, our operations will likely fail. Even if we are able to find additional personnel, it is uncertain whether we could find someone who could develop our business along the lines described in this filing. We will likely fail without the services of Mr. Chen or an appropriate replacement(s).

We intend to acquire key-man life insurance on the life of Mr. Chen naming us as the beneficiary when and if we obtain the resources to do so and if he is insurable. We have not yet procured such insurance, and there is no guarantee that we will be able to obtain such insurance in the future. Accordingly, it is important that we are able to attract, motivate and retain highly qualified and talented personnel and independent contractors.

| -12- |

Mr. Chen’s current employment does not limit or restrict him from being involved with our Company, and his employment allows him the flexibility to provide at least 20 hours per week to our Company.

3. Because we have only recently commenced business operations, we face a high risk of business failure.

The Company was formed in May 2014. All of our efforts to date have related to developing our business plan and beginning business activities. Through March 31, 2015, we had no operating revenues. We face a high risk of business failure. The likelihood of the success of the Company must be considered in light of the expenses, complications and delays frequently encountered in connection with the establishment and expansion of new businesses and the competitive environment in which the Company will operate. There can be no assurance that future revenues will occur or be significant enough or that we will be able to sell its products and services at a profit, if at all. Future revenues and/or profits, if any, will depend on many various factors, including, but not limited to both initial and continued market acceptance of the Company’s website and the successful implementation of its planned growth strategy.

The Company has commenced internally developing our website. In the early stages of our operations, we will continue to keep costs to a minimum. The cost to develop our business plan as currently outlined may be in excess of $250,000. We will need additional funds to market our website. If we are unable to obtain adequate funding or financing, the Company faces the ultimate likelihood of business failure. There are no assurances that we will be able to raise any funds or establish any financing program for the Company’s growth.

4. We may not have or ever have the resources or ability to implement and manage growth strategy.

Although the Company expects to experience growth based on being able to implement its business plan, actual operations may never occur because the business plan may never be implemented because of lack of funds to do so. If the Company’s business plan and growth strategy are implemented, of which no assurances can be given, a significant strain on the Company’s management, operating systems and/or financial resources will be imposed. Failure by the Company’s management to manage this growth, if it occurs, or unexpected difficulties encountered during growth, could have a material adverse impact on the Company’s results of operations or financial condition.

The Company’s ability to operate profitably will depend upon a number of factors, including (i) identifying distribution channels, (ii) generating sufficient funds from our then existing operations or obtaining third-party financing or additional capital, (iii) the Company’s management team and its financial and accounting controls and (iv) staffing, training and retaining of skilled personnel, if any at all. Certain of these factors will be beyond the Company’s control and may be adversely affected by the economy or actions taken by competing companies. There can be no assurance that the Company will be able to execute and manage a growth strategy effectively or at all.

5. We may not be successful in hiring technical personnel because of the competitive market for qualified technical people.

The Company's future success depends largely on its ability to attract, hire, train and retain highly qualified technical personnel to provide the Company's services. Competition for such personnel is intense. There can be no assurance that the Company will be successful in attracting and retaining the technical personnel it requires to conduct and expand its operations successfully and to differentiate itself from its competition. The Company's results of operations and growth prospects could be materially adversely affected if the Company were unable to attract, hire, train and retain such qualified technical personnel.

6. Our reliance on referrals from outside contacts to develop business may not be effective.

The Company initially will rely on our president and chief executive officer, Mr. Chen, for a majority of its leads and believes that independent outside sales reps will also be an important source of sales referrals in the foreseeable future. However, as is typical within the industry, there are no contractual requirements that an outside sales person use or recommend the Company. We currently have no contracts or agreements in place with any outside sales professional. No assurances can be given that using independent outside sales reps will result in any meaningful numbers of sales leads or referrals.

| -13- |

7. We will face competition from companies with significantly greater resources and name recognition.

The markets in which the Company will operate are characterized by intense competition from several types of solution and technical service providers. The Company expects to face further competition from new market entrants and possible alliances among competitors in the future as the convergence of information processing and telecommunications continues. Many of the Company's current and potential competitors have significantly greater financial, technical, marketing and other resources than the Company. As a result, they may be better able to respond or adapt to new or emerging technologies and changes in client requirements or to devote greater resources to the development, marketing and sales of their services than the Company. There can be no assurance that the Company will be able to compete successfully. In addition, the Company will be faced with numerous competitors, both strategic and financial, in attempting to obtain competitive products. Many actual and potential competitors we believe are part of much larger companies with substantially greater financial, marketing and other resources than the Company, and there can be no assurance that the Company will be able to compete effectively against any of its future competitors.

8. There are significant potential conflicts of interest.

Our personnel will be required to commit substantial time to our affairs and, accordingly, these individual(s) (particularly our president and chief executive officer) may have conflicts of interest in allocating management time among various business activities. In the course of other business activities, certain key personnel (particularly our president and chief executive officer) may become aware of business opportunities which may be appropriate for presentation to us, as well as other entities with which they are affiliated. As such, there may be conflicts of interest in determining to which entity a particular business opportunity should be presented.

We cannot provide assurances that our efforts to eliminate the potential impact of conflicts of interest will be effective.

9. We are subject to the periodic reporting requirements of Section 15(d) of the Exchange Act that will require us to incur audit fees and legal fees in connection with the preparation of such reports. These additional costs could reduce or eliminate our ability to earn a profit.

We are required to file periodic reports with the SEC pursuant to the Exchange Act and the rules and regulations promulgated thereunder. In order to comply with these requirements, our independent registered public accounting firm will have to review our financial statements on a quarterly basis and audit our financial statements on an annual basis. Moreover, our legal counsel will have to review and assist in the preparation of such reports. The costs charged by these professionals for such services cannot be accurately predicted at this time because factors such as the number and type of transactions that we engage in and the complexity of our reports cannot be determined at this time and will have a major effect on the amount of time to be spent by our auditors and attorneys. However, the incurrence of such costs will obviously be an expense to our operations and thus have a negative effect on our ability to meet our overhead requirements and earn a profit. We may be exposed to potential risks resulting from any new requirements under Section 404 of the Sarbanes-Oxley Act of 2002. If we cannot provide reliable financial reports or prevent fraud, our business and operating results could be harmed, investors could lose confidence in our reported financial information, and the trading price of our common stock, if a market ever develops, could drop significantly.

10. Our internal controls may be inadequate, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public.

Our management is responsible for establishing and maintaining adequate internal control over our financial reporting. As defined in Exchange Act Rule 13a-15(f), internal control over financial reporting is a process designed by, or under the supervision of, the principal executive and principal financial officer and effected by the board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that:

| -14- |

| - | pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the Company; |

| - | provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and/or directors of the Company; and |

| - | provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company's assets that could have a material effect on the financial statements. |

Our internal controls may be inadequate or ineffective, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public. Investors relying upon this misinformation may make an uninformed investment decision.

11. The costs of being a public company could result in us being unable to continue as a going concern.

As a public company, we will have to comply with numerous financial reporting and legal requirements, including those pertaining to audits, quarterly reporting and internal controls. The costs of this compliance could be significant. If our revenues are insufficient, and/or we cannot satisfy many of these costs through the issuance of our shares, we may be unable to satisfy these costs through the normal course of business which would result in our being unable to continue as a going concern.

12. Having only one director limits our ability to establish effective independent corporate governance procedures and increases the control of our president and chief executive officer.

We have only one director who also serves as our president and chief executive officer. Accordingly, we cannot establish board committees comprised of independent members to oversee functions like compensation or audit issues. In addition, currently a vote of board members is decided in favor of the chairman (who is our president, and chief executive officer), which gives him complete control over all corporate issues.

Until we have a larger board of directors that would include some independent members, if ever, there will be limited oversight of our president and chief executive officer’s decisions and activities and little ability for minority shareholders to challenge or reverse those activities and decisions, even if they are not in the best interests of minority shareholders.

13. Resources may limit the Company’s ability to get access to products and/or manufacturers of key products.

WeWearables will have limited access to products for sale on the e-Commerce, vending machine and retail locations. Until we build relationships or have access to vendors and vendor terms, it will be difficult to purchase and resale wearable technologies.

Larger retailers may also have exclusive relationships with wearables products that WeWearables will not have access to, limiting WeWearables catalogs and products.

14. Product liability

Although WeWearables will be a reseller of wearable technology, we may be subject to product liability claims if people or properties are harmed by the products we sell. This liability may be mitigated by manufacturer. A significant product liability judgment or a widespread product recall may negatively impact on sales and profitability of the affected brand or all brands for a period of time depending on product availability, competitive reaction and consumer attitudes.

| -15- |

Risks Related to Our Common Stock

15. Because we have nominal assets and no revenue, we are considered a "shell company" and will be subject to more stringent reporting requirements.

The Securities and Exchange Commission ("SEC") adopted Rule 405 of the Securities Act and Exchange Act Rule 12b-2 which defines a shell company as a registrant that has no or nominal operations, and either (a) no or nominal assets; (b) assets consisting solely of cash and cash equivalents; or (c) assets consisting of any amount of cash and cash equivalents and nominal other assets. Our balance sheet reflects that we have no cash or any other tangible asset and, therefore, we are defined as a shell company. The new rules prohibit shell companies from using a Form S-8 to register securities pursuant to employee compensation plans. However, the new rules do not prevent us from registering securities pursuant to S-1 registration statements. Additionally, the new rule regarding Form 8-K requires shell companies to provide more detailed disclosure upon completion of a transaction that causes it to cease being a shell company. If an acquisition is undertaken (of which we have no current intention of doing), we must file a current report on Form 8-K containing the information required pursuant to Regulation S-K within four business days following completion of the transaction together with financial information of the acquired entity. In order to assist the SEC in the identification of shell companies, we are also required to check a box on Form 10-Q and Form 10-K indicating that we are a shell company. To the extent that we are required to comply with additional disclosure because we are a shell company, we may be delayed in executing any mergers or acquiring other assets that would cause us to cease being a shell company. The SEC adopted a new Rule 144 effective February 15, 2008, which makes resales of restricted securities by shareholders of a shell company more difficult.

16. Shareholders may be diluted significantly through our efforts to obtain financing and satisfy obligations through issuance of additional shares of our common stock.

We have no committed source of financing. Wherever possible, our board of directors will attempt to use non-cash consideration to satisfy obligations. In many instances, we believe that the non-cash consideration will consist of restricted shares of our common stock. Our board of directors has authority, without action or vote of the shareholders, to issue all or part of the authorized (150,000,000) shares but unissued (129,578,000) shares. In addition, if a trading market develops for our common stock, we may attempt to raise capital by selling shares of our common stock, possibly at a discount to market. These actions will result in dilution of the ownership interests of existing shareholders, further dilute common stock book value, and that dilution may be material.

17. The interests of shareholders may be hurt because we can issue shares of our common stock to individuals or entities that support existing management with such issuances serving to enhance existing management’s ability to maintain control of our company.

Our board of directors has authority, without action or vote of the shareholders, to issue all or part of the authorized but unissued common shares. Such issuances may be issued to parties or entities committed to supporting existing management and the interests of existing management which may not be the same as the interests of other shareholders. Our ability to issue shares without shareholder approval serves to enhance existing management’s ability to maintain control of our company.

18. Our articles of incorporation provide for indemnification of officers and directors at our expense and limit their liability that may result in a major cost to us and hurt the interests of our shareholders because corporate resources may be expended for the benefit of officers and/or directors.

Our Articles of Incorporation at Article X provide for indemnification as follows: "No director or officer of the Corporation shall be personally liable to the Corporation or any of its stockholders for damages for breach of fiduciary duty as a director or officer; provided, however, that the foregoing provision shall not eliminate or limit the liability of a director or officer: (i) for acts or omissions which involve intentional misconduct, fraud or knowing violation of law; or (ii) the payment of dividends in violation of Section 78.300 of the Nevada Revised Statutes. Any repeal or modification of an Article by the stockholders of the Corporation shall be prospective only, and shall not adversely affect any limitation of the personal liability of a director or officer of the Corporation for acts or omissions prior to such repeal or modification."

| -16- |

We have been advised that, in the opinion of the SEC, indemnification for liabilities arising under federal securities laws is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification for liabilities arising under federal securities laws, other than the payment by us of expenses incurred or paid by a director, officer or controlling person in the successful defense of any action, suit or proceeding, is asserted by a director, officer or controlling person in connection with our activities, we will (unless in the opinion of our counsel, the matter has been settled by controlling precedent) submit to a court of appropriate jurisdiction, the question whether indemnification by us is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue. The legal process relating to this matter if it were to occur is likely to be very costly and may result in us receiving negative publicity, either of which factors is likely to materially reduce the market and price for our shares, if such a market ever develops.

19. Currently, there can be no assurances that any established public market will ever develop or that our common stock will be quoted for trading and, even if quoted, it is likely to be subject to significant price fluctuations.

There can be no assurances as to whether

| (i) | any market for our shares will develop; |

| (ii) | the prices at which our common stock will trade; or |

| (iii) | the extent to which investor interest in us will lead to the development of an active, liquid trading market. Active trading markets generally result in lower price volatility and more efficient execution of buy and sell orders for investors. |

Our common stock is unlikely to be followed by any market analysts, and there may be few institutions acting as market makers for our common stock. Either of these factors could adversely affect the liquidity and trading price of our common stock. Until our common stock is fully distributed and an orderly market develops in our common stock, if ever, the price at which it trades is likely to fluctuate significantly. Prices for our common stock will be determined in the marketplace and may be influenced by many factors, including the depth and liquidity of the market for shares of our common stock, developments affecting our business, including the impact of the factors referred to elsewhere in these Risk Factors, investor perception of the Company and general economic and market conditions. No assurances can be given that an orderly or liquid market will ever develop for the shares of our common stock.

Because of the anticipated low price of the securities being registered, many brokerage firms may not be willing to effect transactions in these securities.

20. Any market that develops in shares of our common stock will be subject to the penny stock regulations and restrictions pertaining to low priced stocks that will create a lack of liquidity and make trading difficult or impossible.

The trading of our securities, if any, will be in the over-the-counter market which is commonly referred to as the OTCBB as maintained by FINRA. As a result, an investor may find it difficult to dispose of, or to obtain accurate quotations as to the price of our securities.

Rule 3a51-1 of the Exchange Act establishes the definition of a "penny stock," for purposes relevant to us, as any equity security that has a minimum bid price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to a limited number of exceptions which are not available to us. It is likely that our shares will be considered to be penny stocks for the immediately foreseeable future. This classification severely and adversely affects any market liquidity for our common stock.

| -17- |

For any transaction involving a penny stock, unless exempt, the penny stock rules require that a broker or dealer approve a person's account for transactions in penny stocks and the broker or dealer receive from the investor a written agreement to the transaction setting forth the identity and quantity of the penny stock to be purchased. In order to approve a person's account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience and objectives of the person and make a reasonable determination that the transactions in penny stocks are suitable for that person and that that person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the SEC relating to the penny stock market, which, in highlight form, sets forth:

| - | the basis on which the broker or dealer made the suitability determination, and |

| - | that the broker or dealer received a signed, written agreement from the investor prior to the transaction. |

Disclosure also has to be made about the risks of investing in penny stock in both public offerings and in secondary trading and commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Additionally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

Because of these regulations, broker-dealers may not wish to engage in the above-referenced necessary paperwork and disclosures and/or may encounter difficulties in their attempt to sell shares of our common stock, which may affect the ability of selling shareholders or other holders to sell their shares in any secondary market and have the effect of reducing the level of trading activity in any secondary market. These additional sales practice and disclosure requirements could impede the sale of our securities, if and when our securities become publicly traded. In addition, the liquidity for our securities may decrease, with a corresponding decrease in the price of our securities. Our shares, in all probability, will be subject to such penny stock rules for the foreseeable future and our shareholders will, in all likelihood, find it difficult to sell their securities.

21. The market for penny stocks has experienced numerous frauds and abuses that could adversely impact investors in our stock.

Company management believes that the market for penny stocks has suffered from patterns of fraud and abuse. Such patterns include:

| - | Control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; |

| - | Manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; |

| - | "Boiler room" practices involving high pressure sales tactics and unrealistic price projections by sales persons; |

| - | Excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and |

| - | Wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the inevitable collapse of those prices with consequent investor losses. |

| -18- |

22. Any trading market that may develop may be restricted by virtue of state securities “Blue Sky” laws that prohibit trading absent compliance with individual state laws. These restrictions may make it difficult or impossible to sell shares in those states.

There is currently no established public market for our common stock, and there can be no assurance that any established public market will develop in the foreseeable future. Transfer of our common stock may also be restricted under the securities or securities regulations laws promulgated by various states and foreign jurisdictions, commonly referred to as “Blue Sky” laws. Absent compliance with such individual state laws, our common stock may not be traded in such jurisdictions. Because the securities registered hereunder have not been registered for resale under the blue sky laws of any state, the holders of such shares and persons who desire to purchase them in any trading market that might develop in the future, should be aware that there may be significant state blue sky law restrictions upon the ability of investors to sell the securities and of purchasers to purchase the securities. These restrictions prohibit the secondary trading of our common stock. We currently do not intend to and may not be able to qualify securities for resale in at least 17 states which do not offer manual exemptions (or may offer manual exemptions but may not to offer one to us if we are considered to be a shell company at the time of application) and require shares to be qualified before they can be resold by our shareholders. Accordingly, investors should consider the secondary market for our securities to be a limited one. See also “Plan of Distribution-State Securities-Blue Sky Laws.”

23. Our board of directors (consisting of one person, our president and chief executive officer) has the authority, without stockholder approval, to issue preferred stock with terms that may not be beneficial to common stockholders and with the ability to affect adversely stockholder voting power and perpetuate their control over us.

Our articles of incorporation allow us to issue shares of preferred stock without any vote or further action by our stockholders. Our board of directors has the authority to fix and determine the relative rights and preferences of preferred stock. Our board of directors also has the authority to issue preferred stock without further stockholder approval, including large blocks of preferred stock. As a result, our board of directors could authorize the issuance of a series of preferred stock that would grant to holders the preferred right to our assets upon liquidation, the right to receive dividend payments before dividends are distributed to the holders of common stock and the right to the redemption of the shares, together with a premium, prior to the redemption of our common stock.

24. The ability of our president, and chief executive officer to control our business may limit or eliminate minority shareholders’ ability to influence corporate affairs.

Our president, and chief executive officer, Mr. Chen beneficially owns an aggregate of 83.28% of our outstanding common stock assuming the sale of all shares being registered. Because of their beneficial stock ownership, our president, and chief executive officer will be in a position to continue to elect our board of directors, decide all matters requiring stockholder approval and determine our policies. The interests of our president, and chief executive officer may differ from the interests of other shareholders with respect to the issuance of shares, business transactions with or sales to other companies, selection of officers and directors and other business decisions. The minority shareholders would have no way of overriding decisions made by our president and chief executive officer. This level of control may also have an adverse impact on the market value of our shares because our president and chief executive officer may institute or undertake transactions, policies or programs that may result in losses, may not take any steps to increase our visibility in the financial community and/or may sell sufficient numbers of shares to significantly decrease our price per share.

| -19- |

25. All of our presently issued and outstanding common shares are restricted under Rule 144 of the Securities Act, as amended. When the restriction on any or all of these shares is lifted, and the shares are sold in the open market, the price of our common stock could be adversely affected.

Of the presently outstanding shares of common stock, 20,050,000 shares are "restricted securities" as defined under Rule 144 promulgated under the Securities Act and may only be sold pursuant to an effective registration statement or an exemption from registration, if available. Rule 144 provides in essence that a person who is not an affiliate and has held restricted securities for a prescribed period of at least six (6) months if purchased from a reporting issuer or twelve (12) months (as is the case herein) if purchased from a non-reporting Company, may, under certain conditions, sell all or any of his shares without volume limitation, in brokerage transactions. Affiliates, however, may not sell shares in excess of 1% of the Company’s outstanding common stock every three months. As a result of revisions to Rule 144 which became effective on August 15, 2008, there is no limit on the amount of restricted securities that may be sold by a non-affiliate (i.e., a stockholder who has not been an officer, director or control person for at least 90 consecutive days) after the restricted securities have been held by the owner for the aforementioned prescribed period of time. A sale under Rule 144 or under any other exemption from the Act, if available, or pursuant to registration of shares of common stock of present stockholders, may have a depressive effect upon the price of the common stock in any market that may develop.

26. We do not expect to pay cash dividends in the foreseeable future.

We have never paid cash dividends on our common stock. We do not expect to pay cash dividends on our common stock at any time in the foreseeable future. The future payment of dividends directly depends upon our future earnings, capital requirements, financial requirements and other factors that our board of directors will consider. Since we do not anticipate paying cash dividends on our common stock, return on your investment, if any, will depend solely on an increase, if any, in the market value of our common stock.

27. Because we are not subject to compliance with rules requiring the adoption of certain corporate governance measures, our stockholders have limited protection against interested director transactions, conflicts of interest and similar matters.

The Sarbanes-Oxley Act of 2002, as well as rule changes proposed and enacted by the SEC, the New York and American Stock Exchanges and the Nasdaq Stock Market, as a result of Sarbanes-Oxley, require the implementation of various measures relating to corporate governance. These measures are designed to enhance the integrity of corporate management and the securities markets and apply to securities that are listed on those exchanges or the Nasdaq Stock Market. Because we are not presently required to comply with many of the corporate governance provisions and because we chose to avoid incurring the substantial additional costs associated with such compliance any sooner than legally required, we have not yet adopted these measures.

Because none of our directors (currently one person) are independent directors, we do not currently have independent audit or compensation committees. As a result, these directors have the ability, among other things, to determine their own level of compensation. Until we comply with such corporate governance measures, regardless of whether such compliance is required, the absence of such standards of corporate governance may leave our stockholders without protections against interested director transactions, conflicts of interest, if any, and similar matters and investors may be reluctant to provide us with funds necessary to expand our operations.

We intend to comply with all corporate governance measures relating to director independence as and when required. However, we may find it very difficult or be unable to attract and retain qualified officers, directors and members of board committees required to provide for our effective management as a result of Sarbanes-Oxley Act of 2002. The enactment of the Sarbanes-Oxley Act of 2002 has resulted in a series of rules and regulations by the SEC that increase responsibilities and liabilities of directors and executive officers. The perceived increased personal risk associated with these recent changes may make it more costly or deter qualified individuals from accepting these roles.

| -20- |

28. You may have limited access to information regarding our business because our obligations to file periodic reports with the SEC could be automatically suspended under certain circumstances.

We are subject to certain informational requirements of the Exchange Act, as amended and we will be required to file periodic reports (i.e., annual, quarterly and material events) with the SEC which will be immediately available to the public for inspection and copying. In the event during the year that our registration statement becomes effective, these reporting obligations may be automatically suspended under Section 15(d) of the Exchange Act if we have less than 300 shareholders and do not file a registration statement on Form 8-A (of which we have no current plans to file). If this occurs after the year in which our registration statement becomes effective, we will no longer be obligated to file such periodic reports with the SEC and access to our business information would then be even more restricted. After this registration statement on Form S-1 becomes effective, we may be required to deliver periodic reports to security holders as proscribed by the Exchange Act, as amended. However, we will not be required to furnish proxy statements to security holders and our directors, officers and principal beneficial owners will not be required to report their beneficial ownership of securities to the SEC pursuant to Section 16 of the Exchange Act until we have both 500 or more security holders and greater than $10 million in assets. This means that access to information regarding our business and operations will be limited. However, we plan to voluntarily continue reporting in the absence of an SEC reporting obligation.

29. We are an emerging growth company within the meaning of the Securities Act, and as a consequence of taking advantage of certain exemptions from reporting requirements that are available to emerging growth companies, our financial statements may not be comparable to companies that comply with public company effective dates.

We are an emerging growth company as defined in Section 2(a)(19) of the Securities Act of 1933, as amended (the “Securities Act”). Pursuant to Section 107 of the Jumpstart Our Business Startups Act, we may take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards, meaning that we can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have chosen to take advantage of the extended transition period for complying with new or revised accounting standards applicable to public companies to delay adoption of such standards until such standards are made applicable to private companies. Accordingly, our financial statements may not be comparable to the financial statements of public companies that comply with such new or revised accounting standards.

For all of the foregoing reasons and others set forth herein, an investment in our securities in any market that may develop in the future involves a high degree of risk.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

The Company utilizes rented offices at 7 Whitford, Irvine, CA 92602. The space is provided to us by Mr. Chen. Mr. Chen incurs no incremental costs as a result of our using the space. Therefore, he does not charge us for its use. There is no written lease agreement

ITEM 3. LEGAL PROCEEDINGS

We have no outstanding, material legal proceedings.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

| -21- |

PART II

| ITEM 5 | MARKET FOR REGISTRANTS COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCAHSES OF EQUITY SECURITIES |

(a) Market Information.

The Company’s common stock is currently quoted on the OTC Markets and OTC Bulletin Board under the symbol “WWRB”. The following table sets forth the high and low per share sales prices for our common stock for each of the quarters as reported by the OTC Markets.

| Quarter Ended | High | Low | ||||||||

| June 30, 2014 | $ | N/A | $ | N/A | ||||||

| September 30, 2014 | N/A | N/A | ||||||||

| December 31, 2014 | N/A | N/A | ||||||||

| March 31, 2015 | $ | N/A | $ | N/A | ||||||

There was no closing price of our common stock as reported on the OTC Markets on May 11, 2015.

|

Description of Securities |

The Company is authorized by its Certificate of Incorporation to issue an aggregate of 175,000,000 shares of capital stock, of which 150,000,000 are shares of common stock, par value $0.001 per share (the "Common Stock") and 25,000,000 are shares of preferred stock, par value $0.001 per share (the “Preferred Stock”). As of May 11, 2015, 20,412,000 shares of Common Stock were issued and outstanding.

Preferred Stock

Our certificate of incorporation authorizes the issuance of 25,000,000 shares of preferred stock with designations, rights and preferences determined from time to time by our board of directors. No shares of preferred stock have been designated, issued or were outstanding as of May 11, 2015. Accordingly, our board of directors is empowered, without stockholder approval, to issue up to 25,000,000 shares of preferred stock with voting, liquidation, conversion, or other rights that could adversely affect the rights of the holders of the common stock. Although we have no present intention to issue any shares of preferred stock, there can be no assurance that we will not do so in the future.

Among other rights, our board of directors may determine, without further vote or action by our stockholders:

| - | the number of shares and the designation of the series; |

| - | whether to pay dividends on the series and, if so, the dividend rate, whether dividends will be cumulative and, if so, from which date or dates, and the relative rights of priority of payment of dividends on shares of the series; |

| - | whether the series will have voting rights in addition to the voting rights provided by law and, if so, the terms of the voting rights; |

| - | whether the series will be convertible into or exchangeable for shares of any other class or series of stock and, if so, the terms and conditions of conversion or exchange; |

| -22- |

| - | whether or not the shares of the series will be redeemable and, if so, the dates, terms and conditions of redemption and whether there will be a sinking fund for the redemption of that series and, if so, the terms and amount of the sinking fund; and |

| - | the rights of the shares of the series in the event of our voluntary or involuntary liquidation, dissolution or winding up and the relative rights or priority, if any, of payment of shares of the series. |

We presently do not have plans to issue any shares of preferred stock. However, preferred stock could be used to dilute a potential hostile acquirer. Accordingly, any future issuance of preferred stock or any rights to purchase preferred shares may have the effect of making it more difficult for a third party to acquire control of us. This may delay, defer or prevent a change of control in our Company or an unsolicited acquisition proposal. The issuance of preferred stock also could decrease the amount of earnings attributable to, and assets available for distribution to, the holders of our common stock and could adversely affect the rights and powers, including voting rights, of the holders of our common stock.

Common Stock

Our certificate of incorporation authorizes the issuance of 150,000,000 shares of common stock. There are 20,412,000 shares of our common stock issued and outstanding at May 11, 2015. The holders of our common stock:

| - | have equal ratable rights to dividends from funds legally available for payment of dividends when, as and if declared by the board of directors; |

| - | are entitled to share ratably in all of the assets available for distribution to holders of common stock upon liquidation, dissolution or winding up of our affairs; |

| - | do not have preemptive, subscription or conversion rights, or redemption or access to any sinking fund; and |

| - | are entitled to one non-cumulative vote per share on all matters submitted to stockholders for a vote at any meeting of stockholders |

See also Plan of Distribution regarding negative implications of being classified as a “Penny Stock.”

Authorized but Unissued Capital Stock

Nevada law does not require stockholder approval for any issuance of authorized shares. These additional shares may be used for a variety of corporate purposes, including future public offerings to raise additional capital or to facilitate corporate acquisitions.

One of the effects of the existence of un-issued and unreserved common stock (and/or preferred stock) may be to enable our board of directors to issue shares to persons friendly to current management, which issuance could render more difficult or discourage an attempt to obtain control of our board by means of a merger, tender offer, proxy contest or otherwise, and thereby protect the continuity of our management and possibly deprive the stockholders of opportunities to sell their shares of our common stock at prices higher than prevailing market prices.

The description of certain matters relating to the securities of the Company is a summary and is qualified in its entirety by the provisions of the Company's Certificate of Incorporation and By-Laws.

| -23- |

In order to qualify for listing on the Nasdaq SmallCap Market, a company must have at least (i) net tangible assets of $4,000,000 or market capitalization of $50,000,000 or net income for two of the last three years of $750,000; (ii) public float of 1,000,000 shares with a market value of $5,000,000; (iii) a bid price of $4.00; (iv) three market makers; (v) 300 shareholders and (vi) an operating history of one year or, if less than one year, $50,000,000 in market capitalization. For continued listing on the Nasdaq SmallCap Market, a company must have at least (i) net tangible assets of $2,000,000 or market capitalization of $35,000,000 or net income for two of the last three years of $500,000; (ii) a public float of 500,000 shares with a market value of $1,000,000; (iii) a bid price of $1.00; (iv) two market makers; and (v) 300 shareholders.

If, after a business combination, we do not meet the qualifications for listing on the Nasdaq SmallCap Market. On April 7, 2000, the Securities and Exchange Commission issued a clarification with regard to the reporting status under the Securities Exchange Act of 1934 of a non-reporting company after it acquired a reporting “blank check” company. This letter clarified the Commission’s position that such Company would not be a successor issuer to the reporting obligation of the “blank check” company by virtue of Exchange Act Rule 12g-3(a).

We intend that any merger we undertake would not be deemed a “back door” registration since we would remain the reporting company and the Company that we merge with would not become a successor issuer to our reporting obligations by virtue of Commission Rule 12g-3(a).

(b) Holders

As of May 11, 2015, there were approximately 42 holders of record of our common stock.

(c) Dividends.

The Registrant has not paid any cash dividends to date and does not anticipate or contemplate paying dividends in the foreseeable future. It is the present intention of management to utilize all available funds for the development of the Registrant's business.

(d) Securities Authorized for Issuance under Equity Compensation Plans .

None.

| (e) Recent Sale of Unregistered Securities |

In May 2014, the Company issued 17,000,000 shares of our common stock to Thomas Chen, our president,as founder shares.

In May 2014, the Company issued 3,000,000 shares of our common stock for services.

In September 2014, the Company issued 50,000 shares of our common stock for services.

In January 2015, we completed a public offering whereby we sold 362,000 shares of our common stock at $0.10 per share for total gross proceeds of $36,200.

We relied upon Section 4(2) of the Securities Act of 1933, as amended for the above issuances. We believed that Section 4(2) was available because:

| • | None of these issuances involved underwriters, underwriting discounts or commissions; | |

| • | We placed restrictive legends on all certificates issued; | |

| • | No sales were made by general solicitation or advertising; | |

| • | Sales were made only to accredited investors |

| -24- |

In connection with the above transactions, we provided the following to all investors:

| • | Access to all our books and records. | |

| • | Access to all material contracts and documents relating to our operations. | |

| • | The opportunity to obtain any additional information, to the extent we possessed such information, necessary to verify the accuracy of the information to which the investors were given access. |

The Company’s Board of Directors has the power to issue any or all of the authorized but unissued Common Stock without stockholder approval. The Company currently has no commitments to issue any shares of common stock.

ITEM 6. SELECTED FINANCIAL DATA

We are a smaller reporting company as defined by Rule

12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

| ITEM 7 | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |