Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NOBLE ENERGY INC | d924252d8k.htm |

| EX-99.1 - EX-99.1 - NOBLE ENERGY INC | d924252dex991.htm |

| EX-2.1 - EX-2.1 - NOBLE ENERGY INC | d924252dex21.htm |

| EX-99.4 - EX-99.4 - NOBLE ENERGY INC | d924252dex994.htm |

| EX-99.3 - EX-99.3 - NOBLE ENERGY INC | d924252dex993.htm |

Exhibit 99.2

NBL noble energy Energizing the World, Bettering People’s Lives® NOBLE ENERGY ENTERS EAGLE FORD AND PERMIAN

Criteria For Capturing A New U.S. Onshore Play Potential Liquids-Rich Core Area Substantial Running Room for Growth Strong Returns that Compete within the Portfolio Attractive on Valuation Metrics Adds Balance and Diversity Leverages U.S. Onshore Expertise Rosetta Resources is a Strategic, Accretive Acquisition 2 NBL

Transaction Details All-Stock Transaction for 0.542 Shares of NBL Implied value of $26.62 per ROSE share, a 28% premium to the avg. price over last 30 trading days ROSE shareholders will own 9.6% of NBL Attractive Valuation Metrics Enterprise Value / 1Q 2015 Production—~$58,500 per Boe/d Enterprise Value / Proved Reserves—~$13.65 per Boe Two New Core Areas: Eagle Ford Shale and Permian Basin 1Q 2015 production of 66 MBoe/d (62% liquids) Year end 2014 proved reserves of 282 MMBoe Immediately Accretive to Earnings and Cash Flow per Share Expect to Close in 3Q 2015 3 NBL

Strategic Rationale Material U.S. Onshore • Establishes footprint in Eagle Ford and Permian, complementing the DJ Basin and Marcellus Position • Premier U.S. resource plays with attractive economics Significant Benefit to • Transaction immediately accretive to per share production, reserves, earnings and cash flow Shareholders • All-stock transaction allows all shareholders to participate in substantial upside • Substantial production growth within cash flow Positioned for Growth • Potential to expand Eagle Ford and Permian through bolt-on opportunities Greater Portfolio • Material positions with running room; enhances regional and commodity diversity Balance • Strengthens global portfolio with the addition of over 1,800 gross liquids-rich locations • Integration approach maintains momentum in the Eagle Ford and Permian Synergies • Leverages technical expertise across four U.S. areas • Remain committed to investment grade rating Strong Balance Sheet • Strong financial position and robust liquidity 4 NBL

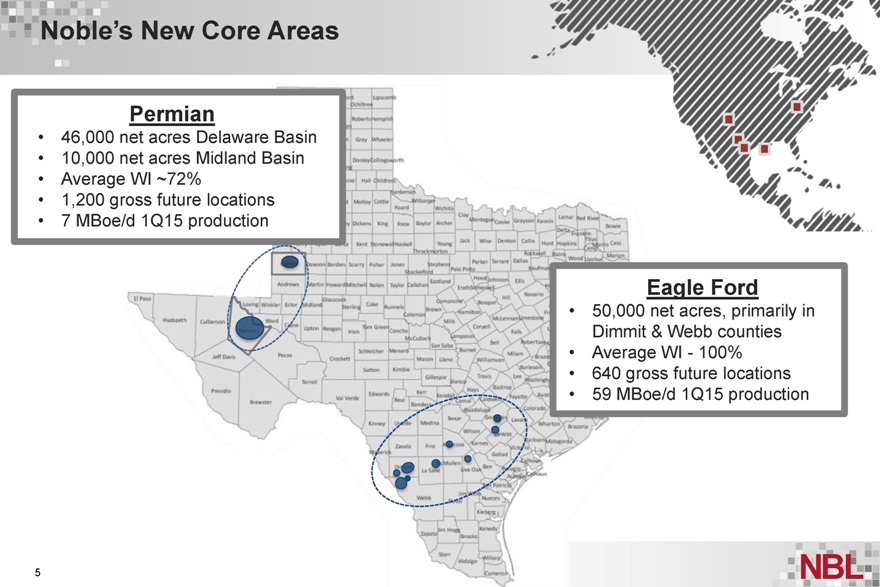

Noble’s New Core Areas Permian • 46,000 net acres Delaware Basin • 10,000 net acres Midland Basin • Average WI ~72% • 1,200 gross future locations • 7 MBoe/d 1Q15 production Eagle Ford • 50,000 net acres, primarily in Dimmit & Webb counties • Average WI—100% • 640 gross future locations • 59 MBoe/d 1Q15 production 5 NBL

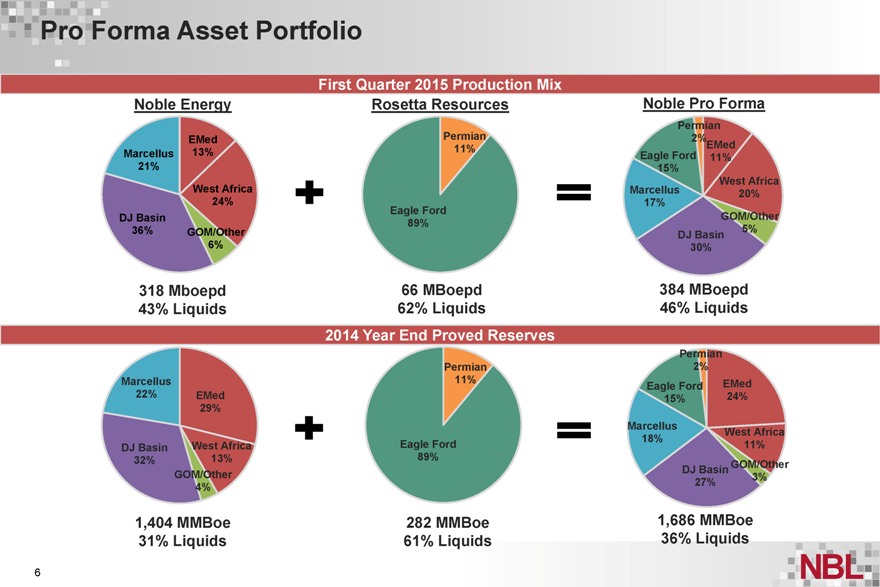

Pro Forma Asset Portfolio First Quarter 2015 Production Mix Noble Energy Rosetta Resources Noble Pro Forma Permian EMed Permian 2% 11% EMed Marcellus 13% Eagle Ford 11% 21% 15% West Africa West Africa Marcellus 20% 24% Eagle Ford 17% DJ Basin GOM/Other 89% 36% GOM/Other 5% DJ Basin 6% 30% 318 Mboepd 66 MBoepd 384 MBoepd 43% Liquids 62% Liquids 46% Liquids 2014 Year End Proved Reserves Permian Permian 2% Marcellus 11% EMed Eagle Ford 22% EMed 15% 24% 29% Marcellus West Africa 18% DJ Basin West Africa Eagle Ford 11% 32% 13% 89% GOM/Other DJ Basin GOM/Other 3% 27% 4% 1,404 MMBoe 282 MMBoe 1,686 MMBoe 31% Liquids 61% Liquids 36% Liquids 6 NBL

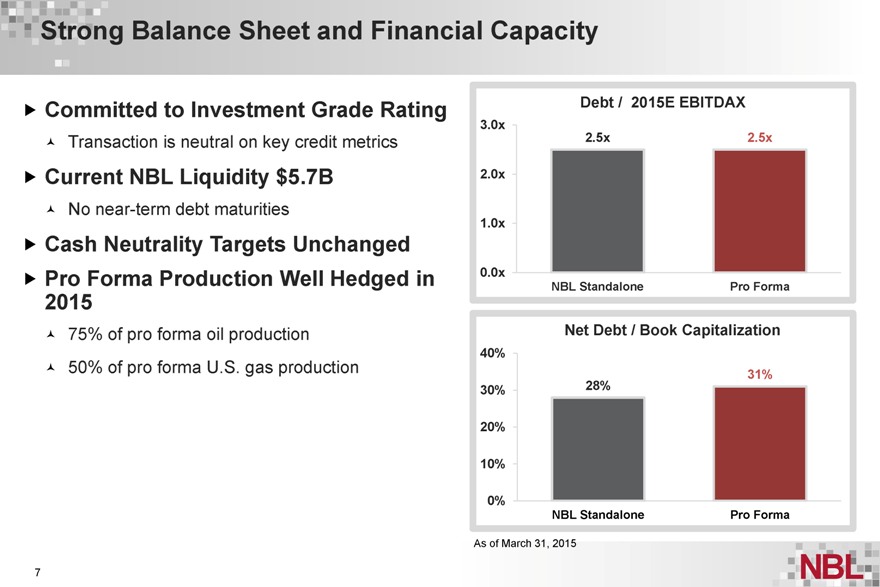

Strong Balance Sheet and Financial Capacity Committed to Investment Grade Rating Debt / 2015E EBITDAX 3.0x Transaction is neutral on key credit metrics 2.5x 2.5x Current NBL Liquidity $5.7B 2.0x No near-term debt maturities 1.0x Cash Neutrality Targets Unchanged Pro Forma Production Well Hedged in 0.0x 2015 NBL Standalone Pro Forma 75% of pro forma oil production Net Debt / Book Capitalization 50% of pro forma U.S. gas production 40% 28% 31% 30% 20% 10% 0% NBL Standalone Pro Forma As of March 31, 2015 7 NBL

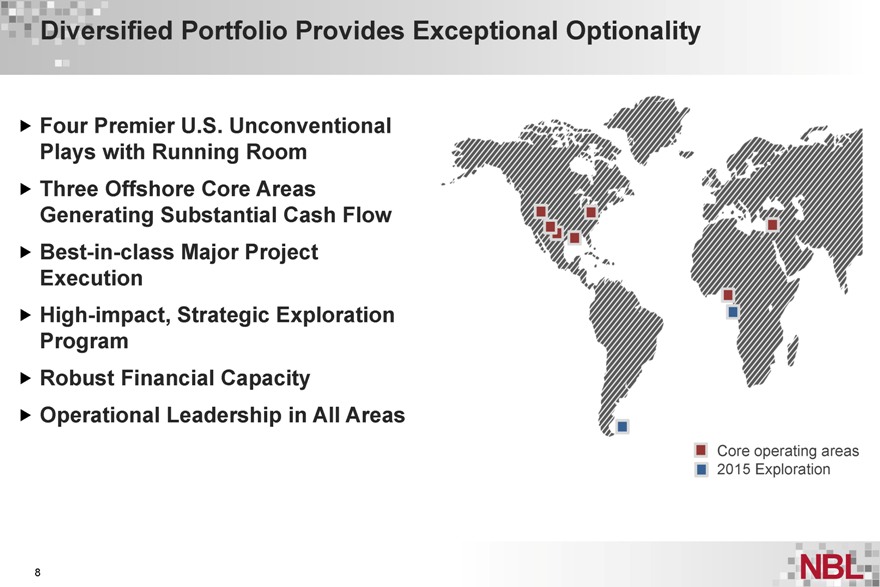

Diversified Portfolio Provides Exceptional Optionality Four Premier U.S. Unconventional Plays with Running Room Three Offshore Core Areas Generating Substantial Cash Flow Best-in-class Major Project Execution High-impact, Strategic Exploration Program Robust Financial Capacity Operational Leadership in All Areas Core operating areas 2015 Exploration NBL 8

Forward-looking Statements and Other Matters This presentation contains certain “forward-looking statements” within the meaning of federal securities laws. Words such as “anticipates”, “believes,” “expects”, “intends”, “will”, “should”, “may”, and similar expressions may be used to identify forward-looking statements. Forward-looking statements are not statements of historical fact and reflect Noble Energy’s current views about future events. Such forward-looking statements include, but are not limited to, statements about the benefits of the proposed merger involving Noble Energy and Rosetta, including future financial and operating results, Noble Energy’s plans, objectives, expectations and intentions, the expected timing of completion of the transaction, and other statements that are not historical facts, including estimates of oil and natural gas reserves and resources, estimates of future production, assumptions regarding future oil and natural gas pricing, planned drilling activity, future results of operations, projected cash flow and liquidity, business strategy and other plans and objectives for future operations. No assurances can be given that the forward-looking statements contained in this presentation will occur as projected and actual results may differ materially from those projected. Forward-looking statements are based on current expectations, estimates and assumptions that involve a number of risks and uncertainties that could cause actual results to differ materially from those projected. These risks and uncertainties include, without limitation, the ability to obtain the requisite Rosetta shareholder approval; the risk that Rosetta or Noble Energy may be unable to obtain governmental and regulatory approvals required for the merger, or required governmental and regulatory approvals may delay the merger or result in the imposition of conditions that could cause the parties to abandon the merger, the risk that a condition to closing of the merger may not be satisfied, the timing to consummate the proposed merger, the risk that the businesses will not be integrated successfully, the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than expected, disruption from the transaction making it more difficult to maintain relationships with customers, employees or suppliers, the diversion of management time on merger-related issues, the volatility in commodity prices for crude oil and natural gas, the presence or recoverability of estimated reserves, the ability to replace reserves, environmental risks, drilling and operating risks, exploration and development risks, competition, government regulation or other actions, the ability of management to execute its plans to meet its goals and other risks inherent in Noble Energy’s and Rosetta’s businesses that are discussed in Noble Energy’s and Rosetta’s most recent annual reports on Form 10-K, respectively, and in other Noble Energy and Rosetta reports on file with the Securities and Exchange Commission (the “SEC”). These reports are also available from the sources described above. Forward-looking statements are based on the estimates and opinions of management at the time the statements are made. Noble Energy undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise. This presentation also contains certain historical and forward-looking non-GAAP measures of financial performance that management believes are good tools for internal use and the investment community in evaluating Noble Energy’s overall financial performance. These non-GAAP measures are broadly used to value and compare companies in the crude oil and natural gas industry. Please also see Noble Energy’s website at http://www.nobleenergyinc.com under “Investors” for reconciliations of the differences between any historical non-GAAP measures used in this presentation and the most directly comparable GAAP financial measures. The GAAP measures most comparable to the forward-looking non-GAAP financial measures are not accessible on a forward-looking basis and reconciling information is not available without unreasonable effort. NBL

Forward-looking Statements and Other Matters The Securities and Exchange Commission requires oil and gas companies, in their filings with the SEC, to disclose proved reserves that a company has demonstrated by actual production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions. The SEC permits the optional disclosure of probable and possible reserves, however, we have not disclosed our probable and possible reserves in our filings with the SEC. We use certain terms in this presentation, such as “discovered unbooked resources”, “resources”, “risked resources”, “recoverable resources”, “unrisked resources”, “unrisked exploration prospectivity” and “estimated ultimate recovery” (EUR). These estimates are by their nature more speculative than estimates of proved, probable and possible reserves and accordingly are subject to substantially greater risk of being actually realized. The SEC guidelines strictly prohibit us from including these estimates in filings with the SEC. Investors are urged to consider closely the disclosures and risk factors in our most recent Form 10-K and in other reports on file with the SEC, available from Noble Energy’s offices or website, http://www.nobleenergyinc.com. Additional Information And Where To Find It: This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed merger between Noble Energy and Rosetta, Noble Energy will file with the SEC a Registration Statement on Form S-4 that will include a proxy statement of Rosetta that also constitutes a prospectus of Noble Energy. Rosetta will mail the proxy statement/prospectus to its shareholders. This document is not a substitute for any prospectus, proxy statement or any other document which Noble Energy or Rosetta may file with the SEC in connection with the proposed transaction. Noble Energy and Rosetta urge Rosetta investors and shareholders to read the proxy statement/prospectus regarding the proposed merger when it becomes available, as well as other documents filed with the SEC, because they will contain important information. You may obtain copies of all documents filed with the SEC regarding this transaction, free of charge, at the SEC’s website (www.sec.gov). You may also obtain these documents, free of charge, from Noble Energy’s website (www.nobleenergyinc.com) under the tab “Investors” and then under the heading “SEC Filings.” You may also obtain these documents, free of charge, from Rosetta’s website (www.rosettaresources.com) under the tab “Investors” and then under the heading “SEC Filings.” Participants In The Merger Solicitation: Noble Energy, Rosetta, and their respective directors, executive officers and certain other members of management and employees may be soliciting proxies from Rosetta shareholders in favor of the merger and related matters. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of Rosetta shareholders in connection with the proposed merger will be set forth in the proxy statement/prospectus when it is filed with the SEC. You can find information about Noble Energy’s executive officers and directors in its definitive proxy statement filed with the SEC on March 27, 2015. You can find information about Rosetta’s executive officers and directors in its definitive proxy statement filed with the SEC on March 26, 2015. Additional information about Noble Energy’s executive officers and directors and Rosetta’s executive officers and directors can be found in the above-referenced Registration Statement on Form S-4 when it becomes available. You can obtain free copies of these documents from Noble Energy and Rosetta using the contact information above. NBL

NBL noble energy Energizing the World, Bettering People’s Lives®