Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Gogo Inc. | d923325d8k.htm |

May

11, 2015 Investor

Presentation

Exhibit 99.1 |

©2015 Gogo Inc. and Affiliates. Proprietary & Confidential.

2

SAFE HARBOR STATEMENT

2

This presentation contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act

of 1934 that are based on management’s beliefs and assumptions and on information

currently available to management. Most forward-looking statements contain words

that identify them as forward-looking, such as “anticipates,”

“believes,” “continues,” “could,” “seeks,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,”

“projects,” “should,” “will,” “would” or

similar expressions and the negatives of those terms that relate to future events. Forward-looking statements involve known and

unknown risks, uncertainties and other factors that may cause Gogo’s actual

results, performance or achievements to be materially different from any projected results,

performance or achievements expressed or implied by the forward-looking statements.

Forward-looking statements represent the beliefs and assumptions of Gogo only

as of the date of this presentation and Gogo undertakes no obligation to update or

revise publicly any such forward-looking statements, whether as a result of new

information, future events or otherwise. As such, Gogo’s future results may vary

from any expectations or goals expressed in, or implied by, the forward-looking

statements included in this presentation, possibly to a material degree.

Gogo cannot assure you that the assumptions made in preparing any of the

forward-looking statements will prove accurate or that any long-term financial or operational

goals and targets will be realized. In particular, the availability and performance of

certain technology solutions yet to be implemented by the Company set forth in this

presentation represent aspirational long-term goals based on current expectations.

For a discussion of some of the important factors that could cause Gogo’s results to

differ materially from those expressed in, or implied by, the forward-looking

statements included in this presentation, investors should refer to the disclosure contained

under the headings “Risk Factors” and “Cautionary Note Regarding

Forward-Looking Statements” in the Company’s Annual Report on Form 10-K filed with the SEC on

February 27, 2015.

Note to Certain Operating and Financial Data

In addition to disclosing financial results that are determined in accordance with U.S.

generally accepted accounting principles (“GAAP”), Gogo also discloses in this

presentation certain non-GAAP financial information, including Adjusted EBITDA and

Cash CapEx. These financial measures are not recognized measures under GAAP, and

when analyzing our performance or liquidity, as applicable, investors should (i) use Adjusted EBITDA in addition to, and not as an alternative to, net loss attributable

to common stock as a measure of operating results, and (ii) use Cash CAPEX in addition

to, and not as an alternative to, consolidated capital expenditures when

evaluating our liquidity.

In addition, this presentation contains various customer metrics and operating data,

including numbers of aircraft or units online, that are based on internal company data,

as well as information relating to the commercial and business aviation market, and our

position within those markets. While management believes such information and

data are reliable, they have not been verified by an independent source and there are

inherent challenges and limitations involved in compiling data across various

geographies and from various

sources. |

WHY

INVEST IN GOGO LARGE GROWTH OPPORTUNITY

HIGH BARRIERS TO ENTRY

EXPERIENCE & SCALE

LEADING POSITION

ATTRACTIVE ECONOMICS

©2015 Gogo Inc. and Affiliates. Proprietary & Confidential.

3 |

MARKET & COMPANY

OVERVIEW |

©2015 Gogo Inc. and Affiliates. Proprietary & Confidential.

AVIATION INTERNET TRENDS

5

1

2

3

4

5

Connected

aircraft

transform

global

aviation

–

the

last

frontier

of

internet

connectivity

Cost, coverage, capacity and reliability are just now reaching critical

inflection points

Next gen technologies expected to increase speeds from 10 to 100Mbps

within 5 years with a comparable reduction in costs

More bandwidth drives demand from business traveler connectivity

today

to

every

person

and

most

‘things’

on

aircraft

in

10

years

Airlines will demand ‘Always Available Everywhere for Every Plane’

|

CA

- North America

(“CA-NA”)

CA -

Rest of World

(“CA-ROW”)

(1) Source:

Boeing

Current

Market

Outlook

2014

–

2033,

excludes:

cargo

aircraft.

(2) Source: JetNet iQ Report Q4 2014; General Aviation Manufacturers Association

2014 Statistical Databook, excludes Rest of World turbo props. ©2015 Gogo

Inc. and Affiliates. Proprietary & Confidential. ADDRESSABLE CONNECTED

AIRCRAFT Commercial Aviation (“CA”)

Business Aviation (“BA”)

2.6x size

of CA-NA

A LARGE AND GROWING GLOBAL

CONNECTED AVIATION MARKET

The connected aircraft industry is worth up to $30 billion

6

5,300

7,300

2013

2033F

13,900

32,000

2013

2033F

30,300

37,800

2014

2024F

(1)

(2)

1.4x

2.3x

1.2x |

©2015 Gogo Inc. and Affiliates. Proprietary & Confidential.

Largest Market Share in CA-NA

GOGO’S IMPRESSIVE SCALE AND REACH

Largest Market Share in BA

68% of connected aircraft

Note:

Data

based

on

management

estimates,

trade

publications

and

other

public

sources

as

of

3/31/2015

(1) Gogo satellite business aircraft includes 5,402 aircraft online comprised of

5,353 Iridium equipped aircraft and 49 SwiftBroadband equipped aircraft as of 3/31/15

(2) Based on management estimates as of 3/31/2015

(3) Includes Gogo awarded aircraft as of 5/7/2015

Broadband

Narrowband

#1 Global in-flight connectivity provider

Leader in North America and expanding internationally

7

Untapped CA-ROW market

88% of broadband aircraft

63% of Iridium satellite aircraft

1

(2)

(2)

(2)

2Ku –

Leading global satellite technology

–

300+ aircraft to be installed w/ 2Ku

2,200

524

349

154

2,983

400

318

10,700

5,353

3,144 |

©2015 Gogo Inc. and Affiliates. Proprietary & Confidential.

LONG-TERM PARTNERSHIPS WITH OUR MAJOR

AVIATION PARTNERS

8

North America

Original Equipment Manufacturers

Fractional Jet Operators

Commercial Aviation

Business Aviation

International |

©2015 Gogo Inc. and Affiliates. Proprietary & Confidential.

9

WHY WE WIN

Specialize in aviation and telecom

Excellent reliability

Superior technology & economics

End-to-end service provider

1

2

3

4 |

©2015 Gogo Inc. and Affiliates. Proprietary & Confidential.

10

WE SPECIALIZE IN AIRCRAFT AND HAVE

A TRACK RECORD OF INNOVATION

1

2

3

4

EXPERTISE IN INTERNET, AVIATION AND TELECOM

ATG / ATG-4

1

st

generation

of

technology

North America coverage

2Ku

2

nd

generation

of

technology

Global coverage

Intellectual

Property

100+ patents globally

Other Aviation

Innovations

Leader in wireless in-flight entertainment: 1,800+ aircraft

installed

Other industry leading IFC & IFE product innovations: Crew

Connect, Text & Talk, Universal Cabin System, and others

|

©2015 Gogo Inc. and Affiliates. Proprietary & Confidential.

GOGO’S TECHNOLOGY AGAIN

DISRUPTS THE

GLOBAL AVIATION INDUSTRY

ATG-4: North America coverage

2Ku: Global coverage

11

ATG-4 Antenna

2Ku Antenna

70 Mbps at launch, 100 Mbps when spot beam Ku-band

satellites are launched

Low

cost

producer

–

estimated

half

the

bandwidth

cost

compared to other satellite solutions

Most complete global coverage

Half

the

height

of

traditional

antenna

–

lower

drag,

fuel

savings

Leverages Gogo’s existing Ku-band network and future high

throughput Ku satellites

10 Mbps regional solution, North

America coverage

Proprietary solution enabling overnight

installs

Years of experience delivering

broadband service

Gogo is the only ATG solution

provider: network, equipment, service |

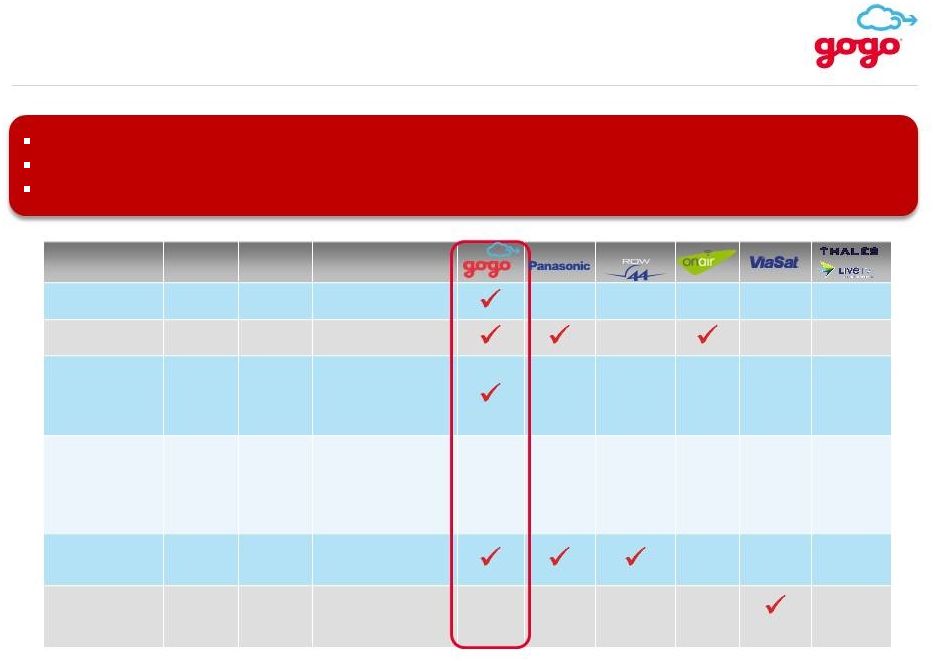

©2015 Gogo Inc. and Affiliates. Proprietary & Confidential.

Technology

Region

Peak

Speed

Key Attributes

Iridium

Global

2.4 Kbps

-

Low data speeds

Swift Broadband

Global

432 Kbps

-

Low data speeds

ATG / ATG-4

Regional

3.1 / 9.8

Mbps

-

Overnight install

-

Suits all aircraft types

-

Lower latency vs.

satellite

2Ku

Global

70-100

Mbps

-

2x spectrally efficient

vs. Ku / Ka band

-

Lower profile radome

-

More robust and

reliable

Expected

2015

Launch

Ku Band

Global

50 Mbps

-

Global coverage

-

Multiple suppliers

Ka Band

Global

50 Mbps

-

Spot beam

technology

-

Next Generation

Expected

2015

Launch

Expected

2015

Launch

(Regional)

Expected

2015

Launch

Broadest suite of technologies and full fleet connectivity solutions

Proprietary 2Ku technology: higher peak speed (70-100 Mbps) than competitors at half

the bandwidth cost ATG / ATG-4: fastest deployment time (overnight) and

lightest equipment LARGEST TECHNOLOGY PORTFOLIO

12 |

©2015 Gogo Inc. and Affiliates. Proprietary & Confidential.

13

EXCELLENT RELIABILITY

75+ million

sessions

7,800+ flights

per day

98% +

ATG End-to-End

System Availability

Source: Company information |

©2015 Gogo Inc. and Affiliates. Proprietary & Confidential.

14

THE MOST COMPLETE END-TO-END

AVIATION SERVICE PROVIDER

Operations-focused connectivity

services for airlines and crew

Dedicated customer support services

Network monitoring and bandwidth

management

Airborne equipment for ATG and

satellite

Certification, installation,

maintenance, etc.

Connectivity and wireless

entertainment services across a

range of passenger devices

ATG / ATG-4 for North America

2Ku / Ku / Ka for global satellite service

Passenger Services

Equipment and Equipment

Related Services

Airline / Owner / Operator

Services

Operations-Oriented

Communications Services

Global Network Solutions |

FINANCIALS |

©2015 Gogo Inc. and Affiliates. Proprietary & Confidential.

16

GROWING REVENUE DRIVES PROFITABILITY

Note: Minor differences exist due to rounding

(1) Please see reconciliation of Adjusted EBITDA in appendix

Adjusted EBITDA

(1)

($MM)

$49

CA-ROW

Segment Loss

Revenue

($MM)

$89

Adjusted EBITDA

$93

$37

$160

$328

$408

$428

2009

2011

2013

2014

Q1 2015

LTM

($89)

($1)

$8

$11

$14

$41

$78

$80

2009

2011

2013

2014

Q1 2015

LTM

62%

CAGR |

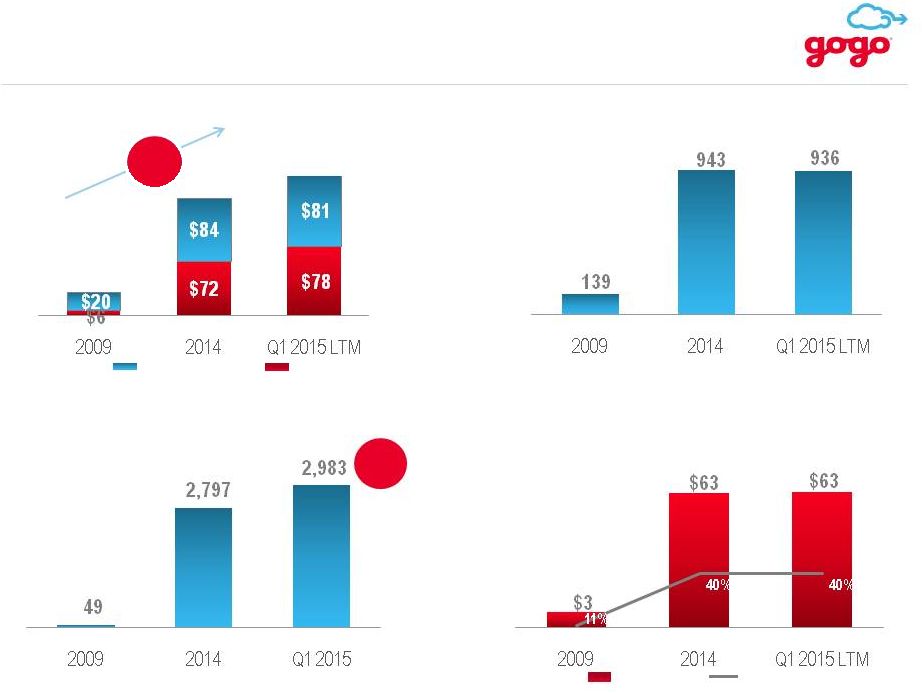

©2015 Gogo Inc. and Affiliates. Proprietary & Confidential.

17

CA -

NA: REVENUE AND SEGMENT PROFIT GROWTH

Note: Minor differences exist due to rounding

(1) We define ARPA as the aggregate service revenue for the annual period divided by

the number of aircraft online during that period Revenue

($MM) Annualized ARPA

(1)

($000s)

Segment Profit

($MM)

11%

Margin

Aircraft Online

(End of Period)

102 Q/Q

Increase

$11

$251

$266

$24

$121

$127

2009

2014

Q1 2015 LTM

2009

2014

Q1 2015 LTM

692

2,098

2,200

2009

2014

Q1 2015

$(91)

$26

$30

2009

2014

Q1 2015 LTM |

©2015 Gogo Inc. and Affiliates. Proprietary & Confidential.

BA: HIGH-MARGIN SERVICE REVENUE DRIVES

PROFITABILITY AND CASH FLOW

$26

$156

$159

Equipment Revenue

Service Revenue

Revenue ($MM)

Segment Profit

($MM)

Segment Profit Margin

Segment Profit

ATG Aircraft Online

(End of Period)

186 Q/Q

Increase

ATG Units Shipped

Note: Minor differences exist due to rounding.

43%

CAGR

©2015 Gogo Inc. and Affiliates. Proprietary & Confidential.

18 |

©2015 Gogo Inc. and Affiliates. Proprietary & Confidential.

116 aircraft online as of 3/31/2015

Near global Ku-band satellite network

2Ku technology selected by 6 airlines

for trial or adoption

(1) Figures reflect aircraft under non-binding agreements

(2) Includes Gogo awarded aircraft as of 5/7/2015

International Aircraft Wins

(cumulative)

Executing Our International Expansion

CA-ROW Segment Loss ($MM)

International Partners

CA -

ROW: FOCUS ON INTERNATIONAL EXPANSION

(1)

(2)

1

85

116

180

257

293

318

2012

2013

2014

Q1 2015

Aircraft Online (end of period)

Cumulative Aircraft Awards

$14

$41

$78

$80

2012

2013

2014

Q1 2015 LTM

19 |

©2015 Gogo Inc. and Affiliates. Proprietary & Confidential.

20

NORMALIZED CAPEX MODEL

(1) Please see reconciliation of Cash CapEx in the Appendix

Gross CapEx

Capitalized

software

Airborne

equipment

Network

equipment

Over the past two

years, Gogo’s Cash

CapEx has been

stable at ~$100

million

Equipment proceeds received from airlines

and landlord incentives

Cash CapEx

(1) |

©2015 Gogo Inc. and Affiliates. Proprietary & Confidential.

Why Does Gogo Win?

Specialize in aviation and telecom

End-to-end service provider

Superior technology and cost

Deliver excellent reliability

Focused Strategy

Gain global share

Grow ARPA

Increase bandwidth to aircraft

Deliver consistent execution

GOGO -

A COMPELLING INVESTMENT OPPORTUNITY

Gogo is a leading aero communications service provider

for the global aviation

industry 21 |

Q&A |

APPENDIX |

©2015 Gogo Inc. and Affiliates. Proprietary & Confidential.

24

ADJUSTED EBITDA RECONCILIATION ($MM)

2009

2010

2011

2012

2013

2014

Q1

2014

Q2

2014

Q3

2014

Q4

2015

Q1

Net Income

(142)

(140)

(18)

(96)

(146)

(17)

(19)

(25)

(24)

(20)

Interest Income

(0)

(0)

(0)

(0)

(0)

(0)

(0)

(0)

(0)

(0)

Interest Expense

30

–

1

9

29

7

7

9

9

10

Income Tax Provision

–

3

1

1

1

–

–

–

–

–

Depreciation & Amortization

22

31

33

37

56

16

15

17

17

19

EBITDA

(91)

(106)

16

(49)

(60)

6

4

2

2

9

Fair Value Derivative

Adjustments

–

33

(59)

(10)

36

–

–

–

–

–

Class

A and Class B Senior

Convertible Preferred Stock

Return

–

18

31

52

29

–

–

–

–

–

Accretion of Preferred Stock

–

9

10

10

5

–

–

–

–

–

Stock-based Compensation

Expense

1

2

2

4

6

2

2

3

3

3

Loss on Extinguishment of

Debt

2

–

–

–

–

–

–

–

–

–

Write Off of Deferred Equity

Financing Costs

–

–

–

5

–

–

–

–

–

–

Amortization of Deferred

Airborne Lease Incentives

–

(1)

(1)

(4)

(8)

(3)

(3)

(4)

(4)

(4)

Adjusted EBITDA

(89)

(45)

(1)

9

8

5

3

1

1

8

Note: Minor differences exist due to rounding |

©2015 Gogo Inc. and Affiliates. Proprietary & Confidential.

25

CASH CAPEX RECONCILIATION ($MM)

2009

2010

2011

2012

2013

2014

Q1

2014

Q2

2014

Q3

2014

Q4

2015

Q1

Purchases of

Property and

Equipment

(69)

(33)

(33)

(67)

(105)

(32)

(28)

(35)

(37)

(53)

Acquisition of

Intangible Assets

(Capitalized

Software)

(8)

(7)

(10)

(12)

(16)

(4)

(5)

(5)

(3)

(4)

Consolidated Capital

Expenditures

(77)

(40)

(43)

(79)

(121)

(36)

(33)

(41)

(40)

(57)

Change in Deferred

Airborne Lease

Incentives

–

9

11

18

9

5

3

5

17

9

Amortization of

Deferred Airborne

Lease Incentives

–

1

1

4

8

3

3

3

4

4

Landlord Incentives

–

–

–

–

–

–

–

2

7

12

Cash CapEx

(77)

(30)

(31)

(58)

(104)

(29)

(27)

(30)

(12)

(32)

Note: Minor differences exist due to rounding |