Attached files

| file | filename |

|---|---|

| EX-99 - EXHIBIT 99 - FEDERAL AGRICULTURAL MORTGAGE CORP | a2015q1pressrelease.htm |

| 8-K - 8-K - FEDERAL AGRICULTURAL MORTGAGE CORP | a2015q1earningsrelease8-k.htm |

2015 EQUITY INVESTOR PRESENTATION FIRST QUARTER

FARMER MAC Forward-Looking Statements In addition to historical information, this presentation includes forward- looking statements that reflect management’s current expectations for Farmer Mac’s future financial results, business prospects, and business developments. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance, or achievements. Management’s expectations for Farmer Mac’s future necessarily involve a number of assumptions and estimates and the evaluation of risks and uncertainties. Various factors or events could cause Farmer Mac’s actual results to differ materially from the expectations as expressed or implied by the forward-looking statements. Some of these factors are identified and discussed in Farmer Mac’s Annual Report on Form 10-K for the year ended December 31, 2014, filed with the U.S. Securities and Exchange Commission (“SEC”) on March 16, 2015, and Quarterly Report on Form 10-Q filed with the SEC on May 11, 2015, each of which are also available on Farmer Mac’s website (www.farmermac.com). In light of these potential risks and uncertainties, no undue reliance should be placed on any forward-looking statements expressed in this presentation. Any forward-looking statements made in this presentation are current only as of March 31, 2015. Farmer Mac undertakes no obligation to release publicly the results of revisions to any such forward-looking statements to reflect any future events or circumstances, except as otherwise mandated by the SEC. NO OFFER OR SOLICITATION OF SECURITIES This presentation does not constitute an offer to sell or a solicitation of an offer to buy any Farmer Mac security. Farmer Mac securities are offered only in jurisdictions where permissible by offering documents available through qualified securities dealers. Any investor who is considering purchasing a Farmer Mac security should consult the applicable offering documents for the security and their own financial and legal advisors for information about and analysis of the security, the risks associated with the security, and the suitability of the investment for the investor’s particular circumstances. Copyright © 2015 by Farmer Mac. No part of this document may be duplicated, reproduced, distributed, or displayed in public in any manner or by any means without the written permission of Farmer Mac. EQUITY INVESTOR PRESENTATION 2015 02

FARMER MAC Non-GAAP Financial Measures This presentation is for general informational purposes only, is current only as of March 31, 2015, and should be read in conjunction with Farmer Mac’s Quarterly Report on Form 10-Q filed with the SEC on May 11, 2015. Farmer Mac uses core earnings, a non-GAAP financial measure, to measure corporate economic performance and develop financial plans because, in management's view, core earnings is a useful alternative measure in understanding Farmer Mac's economic performance, transaction economics, and business trends. Core earnings principally differs from net income attributable to common stockholders by excluding the effects of fair value fluctuations, which are not expected to have a cumulative net impact on financial condition or results of operations reported in accordance with GAAP if the related financial instruments are held to maturity, as is generally expected. Core earnings also differs from net income attributable to common stockholders by excluding specified infrequent or unusual transactions that Farmer Mac believes are not indicative of future operating results and that may not reflect the trends and economic financial performance of Farmer Mac's core business. Accordingly, the loss from retirement of the Farmer Mac II LLC Preferred Stock in first quarter 2015 has been excluded from core earnings because it is not a frequently occurring transaction and not indicative of future operating results. This is also consistent with Farmer Mac’s previous treatment of these types of origination costs associated with securities underwriting that are capitalized and deferred during the life of the security. This non-GAAP financial measure may not be comparable to similarly labeled non-GAAP financial measures disclosed by other companies. Farmer Mac's disclosure of this non-GAAP measure is intended to be supplemental in nature, and is not meant to be considered in isolation from, as a substitute for, or as more important than, the related financial information prepared in accordance with GAAP. EQUITY INVESTOR PRESENTATION 2015 03

FARMER MAC Table of Contents 05 OVERVIEW AND HIGHLIGHTS 12 PORTFOLIO AND LINES OF BUSINESS 16 FINANCIAL PERFORMANCE 20 FUNDING AND RISK MANAGEMENT 24 APPENDIX EQUITY INVESTOR PRESENTATION 2015 04

Overview and Highlights

FARMER MAC Farmer Mac Overview CREATED IN THE 1980S TO HELP PREVENT FUTURE AGRICULTURAL CREDIT CRISES • Provides a secondary market for agricultural and rural utilities loans • Broadens access and drives more efficient loan pricing • Reduces agricultural credit market volatility LINES OF BUSINESS • Farm & Ranch • USDA Guarantees • Rural Utilities • Institutional Credit DIVERSE PRODUCT SUITE PROVIDED TO LENDERS • Loan Purchases • Wholesale Funding • Credit Protection OVERVIEW AND HIGHLIGHTS 06 1987 1996 1998 1999 2008 FARMER MAC INITIALLY CHARTERED BY CONGRESS AS AN INSTRUMENTALITY OF THE UNITED STATES FIRST MAJOR CHARTER REVISION AND EXPANSION OF AUTHORITY (E.G., DIRECT LOAN PURCHASES) OUTSTANDING BUSINESS VOLUME REACHES $1 BILLION FIRST LISTED ON NYSE (AGM & AGM.A) SECOND MAJOR CHARTER REVISION AND EXPANSION OF AUTHORITY (RURAL UTILITIES) OUTSTANDING BUSINESS VOLUME REACHES $10 BILLION

FARMER MAC Farmer Mac Investment Highlights •Rigorous underwriting standards •Low delinquencies •Low cumulative historical credit losses Quality Assets •Business directly financed through issuance of low-cost debt to capital markets • Issue debt at narrow, GSE spreads to U.S. Treasuries Funding Advantage •Robust worldwide demand for agricultural products •Increase market share through significant business development efforts •Increasing financial investment in agriculture leads to new wholesale financing opportunities Growth Prospects •Overhead / outstanding business volume ~ 25 bps •Outstanding business volume / total employees ~$200 million per employee Operational Efficiency •Steady core earnings growth •Annual core earnings return on equity ~ 15% to 25% •Steady growth in common dividends Consistent Returns OVERVIEW AND HIGHLIGHTS 7

FARMER MAC $9.1 $11.7 $11.3 $11.0 $9.1 $10.0 $12.9 $16.5 $23.2 $11.2 $13.4 $11.8 $9.3 $12.6 $11.6 $15.3 $9.5 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 2011 2012 2013 2014 2015 $ I N M IL L IO N S 1Q 2Q 3Q 4Q $42.9 $49.6 $54.9 $53.0 $9.1 Core Earnings OVERVIEW AND HIGHLIGHTS 8 Core earnings for 2014 include the effects of the cash management and liquidity initiative implemented in the second quarter 2014, and the capital structure initiative under which Farmer Mac issued $150 million of preferred stock in advance of the planned March 30, 2015 redemption of all outstanding Farmer Mac II Preferred Stock and related FALConS. (1) (1)

FARMER MAC Business Volume OVERVIEW AND HIGHLIGHTS 9 $4.8 $5.2 $5.4 $5.3 $5.4 $5.6 $6.0 $6.4 $6.1 $6.5 $1.6 $1.7 $1.8 $1.7 $1.8 $1.0 $1.1 $1.0 $1.0 $1.0 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 2012 2013 2014 1Q14 1Q15 $ I N B IL L IO N S Farm & Ranch Institutional Credit USDA Guarantees Rural Utilities $14.6 AS OF YEAR-END AS OF QUARTER-END (1) Includes on- and off-balance sheet outstanding business volume $13.0 $14.0 $14.1 $14.7 (1)

FARMER MAC Credit Quality OVERVIEW AND HIGHLIGHTS 10 $53.1 $39.7 $29.4 $32.1 1.21% 0.83% 0.56% 0.60% 0.44% 0.30% 0.21% 0.22% 0.00% 0.50% 1.00% 1.50% $0.0 $20.0 $40.0 $60.0 $80.0 1Q12 1Q13 1Q14 1Q15 $ I N M IL L IO N S 90-Day Delinquencies 90-Day Delinquencies % of Farm & Ranch Portfolio Only % of Total Portfolio

FARMER MAC $519 $591 $766 $664 $531 $145 $192 $345 $261 $97 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $0 $200 $400 $600 $800 2012 2013 2014 1Q14 1Q15 E X C E S S S T A T U TO R Y C A P IT A L $ IN M IL L IO N S C O R E C A P IT A L $ I N M IL L IO N S Core Capital Excess Statutory Capital AS OF YEAR-END AS OF QUARTER-END Capital OVERVIEW AND HIGHLIGHTS 11 (1) Core capital defined as total equity less accumulated other comprehensive income (2) Excess statutory capital defined as core capital less statutory minimum capital (1) (2)

Portfolio and Lines of Business

FARMER MAC Lines of Business and Products Product Type Potential Customers Lines of Business $ IN BILLIONS AND PERCENTAGE OF TOTAL LOAN PURCHASES • Ag Banks • Insurance Companies • Rural Utilities Cooperatives F & R USDA RU IC Total $2.6 17% $1.8 12% $1.0 7% -- $5.4 36% WHOLESALE FUNDING • AgVantage • Farm Equity AgVantage • Ag Banks • Insurance Companies • Ag Investment Funds • Rural Utilities Cooperatives -- -- -- $6.5 45% $6.5 45% CREDIT PROTECTION • Purchase Commitments/ AMBS Guarantees • FCS Institutions • Ag Banks • Insurance Companies • Rural Utility Cooperatives $2.8 19% -- -- -- $2.8 19% Total $5.4 $1.8 $1.0 $6.5 $14.7 = Allowances and provisions recorded on these assets PORTFOLIO AND LINES OF BUSINESS 13 AS OF MARCH 31, 2015

FARMER MAC Portfolio Summary Farm & Ranch 36% USDA 12% Rural Utilitie s 7% Institut ional Credit 45% Outstanding Business Volume by Line of Business AgVan tage 45% On- Balanc e Sheet Loans 24% Stand bys 15% AMBS 4% USDA Guaran tees 12% Outstanding Business Volume by Product Type Crops 55% Perma nent Plantin gs 17% Livest ock 23% Part- time Farm 3% Ag. Storag e and Proces sing 2% Farm & Ranch Loans by Commodity Type AS OF MARCH 31, 2015 PORTFOLIO AND LINES OF BUSINESS 14 (1) Farm & Ranch Loans include on-Balance Sheet loans and standby purchase commitments (1)

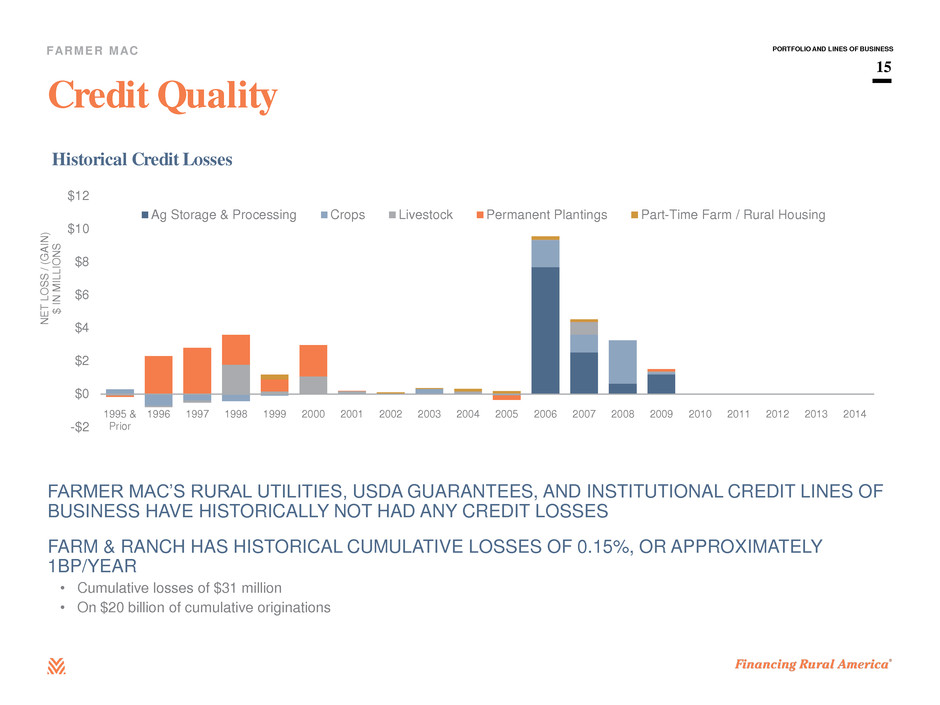

FARMER MAC Credit Quality FARMER MAC’S RURAL UTILITIES, USDA GUARANTEES, AND INSTITUTIONAL CREDIT LINES OF BUSINESS HAVE HISTORICALLY NOT HAD ANY CREDIT LOSSES FARM & RANCH HAS HISTORICAL CUMULATIVE LOSSES OF 0.15%, OR APPROXIMATELY 1BP/YEAR • Cumulative losses of $31 million • On $20 billion of cumulative originations PORTFOLIO AND LINES OF BUSINESS 15 -$2 $0 $2 $4 $6 $8 $10 $12 1995 & Prior 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 N E T L OS S / ( GA IN ) $ I N M IL L IO N S Historical Credit Losses Ag Storage & Processing Crops Livestock Permanent Plantings Part-Time Farm / Rural Housing

Financial Performance

FARMER MAC First Quarter 2015 Performance NET EFFECTIVE SPREAD OF 86 BPS, COMPARED TO 84 BPS LAST YEAR • Increase mostly attributable to lower funding costs (improved spreads on refinanced assets) and higher nonaccrual income in first quarter 2015 compared to first quarter 2014 CORE EARNINGS OF $9.1 MILLION ($0.80 PER DILUTED COMMON SHARE), COMPARED TO $11.0 MILLION ($0.97 PER DILUTED COMMON SHARE) IN FIRST QUARTER 2014 • Decline primarily due to the loss of $2.1 million dividend income/tax benefits on the CoBank preferred stock; and • $2.3 million in additional dividends paid on the Farmer Mac preferred stock issued in the first half of 2014 TOTAL BUSINESS VOLUME OF $14.7 BILLION • Purchased $215 million of AgVantage securities • Purchased $130 million of Farm & Ranch loans • Purchased $89 million of USDA securities • Total business volume growth of $63 million after repayments CREDIT QUALITY REFLECTS THE STRENGTH OF THE AGRICULTURAL AND RURAL UTILITIES SECTORS • 90-day delinquencies of $32 million (0.60% of Farm & Ranch loans), up from $19 million (0.35% of Farm & Ranch loans) in 2014 – Increase in 90-day delinquencies during first quarter 2015 was primarily driven by one borrower in the Northwest geographic region, to which Farmer Mac had exposure of $9.8 million as of March 31 2015, whose delinquency was not related to industry conditions or the profitability of the borrower’s operation • Average 90-day delinquency rate for the Farm & Ranch line of business over the last fifteen years is approximately 1% REGULATORY CAPITAL LEVEL EXCEEDS STATUTORY MINIMUM CAPITAL LEVELS BY $97 MILLION, OR 22% • Redeemed all $250 million of the outstanding Farmer Mac II Preferred Stock on March 30, 2015, which triggered the redemption of all outstanding related Farm Asset Linked Capital Securities (“FALConS”) on the same date FINANCIAL PERFORMANCE 17

FARMER MAC ($ in thousands) Mar-15 Dec-14 Sep-14 Jun-14 Mar-14 Dec-13 Sep-13 Jun-13 Mar-13 Revenues: Net effective spread 29,257$ 28,443$ 29,765$ 29,049$ 26,436$ 30,022$ 28,693$ 28,891$ 28,976$ Guarantee and commitment fees 4,012 4,096 4,153 4,216 4,315 4,252 4,134 4,126 4,079 Other (405) (1,285) (2,001) (520) (410) 427 (466) 3,274 187 Total revenues 32,864 31,254 31,917 32,745 30,341 34,701 32,361 36,291 33,241 Credit related (income)/expense: (Release of)/provisions for losses (696) (479) (804) (2,557) 674 12 (36) (704) 1,176 REO operating expenses (1) 48 1 59 2 3 35 259 126 Losses/(gains) on sale of REO 1 28 - (168) 3 (26) (39) (1,124) (47) Total credit related (income)/expense (696) (403) (803) (2,666) 679 (11) (40) (1,569) 1,255 Operating expenses: Compensation and employee benefits 5,693 4,971 4,693 4,889 4,456 4,025 4,523 4,571 4,698 General and administrative 2,823 2,992 3,123 3,288 2,794 3,104 2,827 2,715 2,917 Regulatory fees 600 600 593 594 594 594 593 594 594 Total operating expenses 9,116 8,563 8,409 8,771 7,844 7,723 7,943 7,880 8,209 Net earnings 24,444 23,094 24,311 26,640 21,818 26,989 24,458 29,980 23,777 Income tax expense/(benefit) 6,692 4,858 6,327 (4,734) 4,334 5,279 6,263 7,007 6,081 Non-controlling interest 5,354 5,414 5,412 5,819 5,547 5,546 5,547 5,547 5,547 Preferred stock dividends 3,295 3,296 3,283 2,308 952 882 881 881 851 Core earnings 9,103$ 9,526$ 9,289$ 23,247$ 10,985$ 15,282$ 11,767$ 16,545$ 11,298$ Core Earnings by Quarter Ended Farmer Mac’s Core Earnings History FINANCIAL PERFORMANCE 18 (1) See page 28 of Appendix for reconciliation of GAAP net income attributable to common stockholders to core earnings (1)

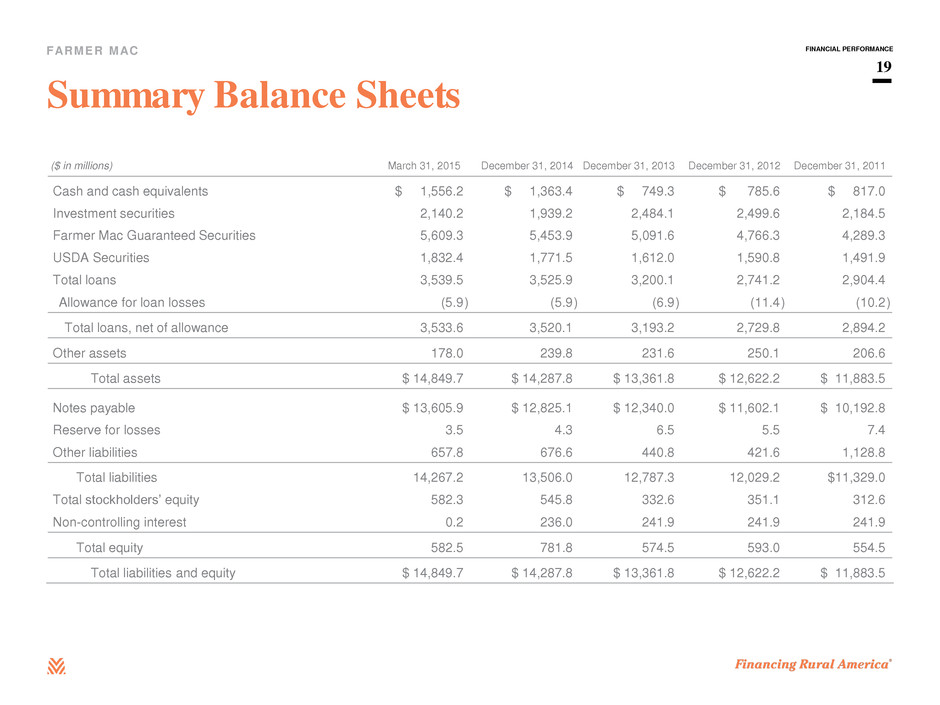

FARMER MAC Summary Balance Sheets FINANCIAL PERFORMANCE 19 ($ in millions) March 31, 2015 December 31, 2014 December 31, 2013 December 31, 2012 December 31, 2011 Cash and cash equivalents $ 1,556.2 $ 1,363.4 $ 749.3 $ 785.6 $ 817.0 Investment securities 2,140.2 1,939.2 2,484.1 2,499.6 2,184.5 Farmer Mac Guaranteed Securities 5,609.3 5,453.9 5,091.6 4,766.3 4,289.3 USDA Securities 1,832.4 1,771.5 1,612.0 1,590.8 1,491.9 Total loans 3,539.5 3,525.9 3,200.1 2,741.2 2,904.4 Allowance for loan losses (5.9 ) (5.9 ) (6.9 ) (11.4 ) (10.2 ) Total loans, net of allowance 3,533.6 3,520.1 3,193.2 2,729.8 2,894.2 Other assets 178.0 239.8 231.6 250.1 206.6 Total assets $ 14,849.7 $ 14,287.8 $ 13,361.8 $ 12,622.2 $ 11,883.5 Notes payable $ 13,605.9 $ 12,825.1 $ 12,340.0 $ 11,602.1 $ 10,192.8 Reserve for losses 3.5 4.3 6.5 5.5 7.4 Other liabilities 657.8 676.6 440.8 421.6 1,128.8 Total liabilities 14,267.2 13,506.0 12,787.3 12,029.2 $11,329.0 Total stockholders’ equity 582.3 545.8 332.6 351.1 312.6 Non-controlling interest 0.2 236.0 241.9 241.9 241.9 Total equity 582.5 781.8 574.5 593.0 554.5 Total liabilities and equity $ 14,849.7 $ 14,287.8 $ 13,361.8 $ 12,622.2 $ 11,883.5

Funding and Risk Management

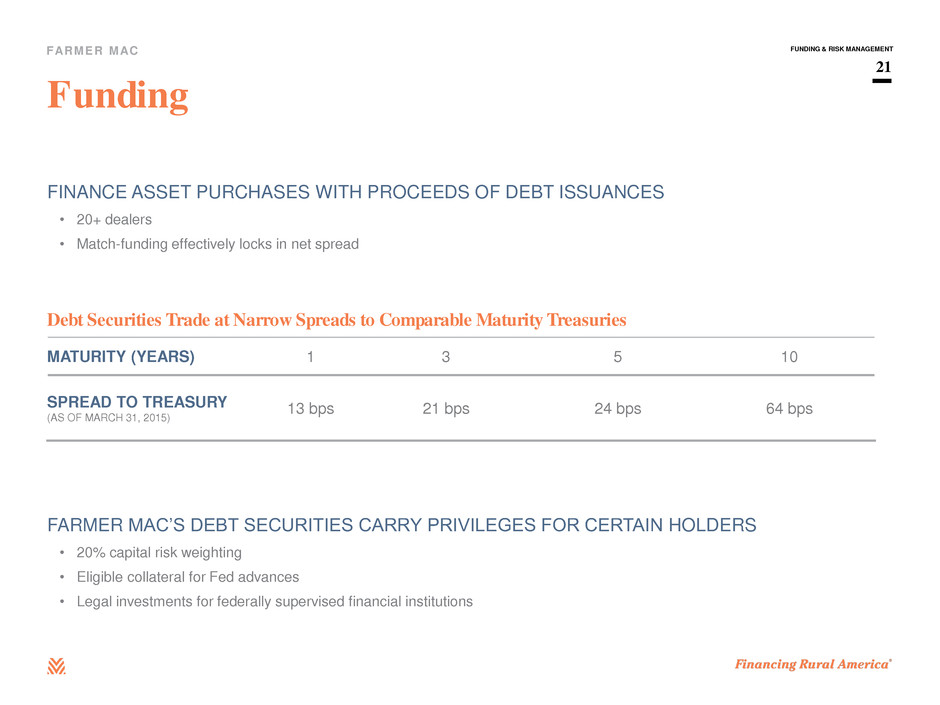

FARMER MAC Funding FINANCE ASSET PURCHASES WITH PROCEEDS OF DEBT ISSUANCES • 20+ dealers • Match-funding effectively locks in net spread FARMER MAC’S DEBT SECURITIES CARRY PRIVILEGES FOR CERTAIN HOLDERS • 20% capital risk weighting • Eligible collateral for Fed advances • Legal investments for federally supervised financial institutions FUNDING & RISK MANAGEMENT 21 Debt Securities Trade at Narrow Spreads to Comparable Maturity Treasuries MATURITY (YEARS) 1 3 5 10 SPREAD TO TREASURY (AS OF MARCH 31, 2015) 13 bps 21 bps 24 bps 64 bps

FARMER MAC Interest Rate Risk MATCH FUND ASSET PURCHASES WITH LIABILITIES THAT HAVE SIMILAR INTEREST RATE CHARACTERISTICS • Duration and convexity matching • Coupon type • Reset frequency MANAGE PRE-PAYMENT RISK ON MORTGAGES • Callable debt and bullet issuances across spectrum of maturities • Can adjust effective asset and debt coupon and duration characteristics through the use of interest rate swaps PERFORM REGULAR STRESS TESTING AND DISCLOSE A VARIETY OF SENSITIVITY MEASURES • Duration Gap • Market Value of Equity (MVE) Sensitivity • Net Interest Income (NII) Sensitivity FUNDING & RISK MANAGEMENT 22

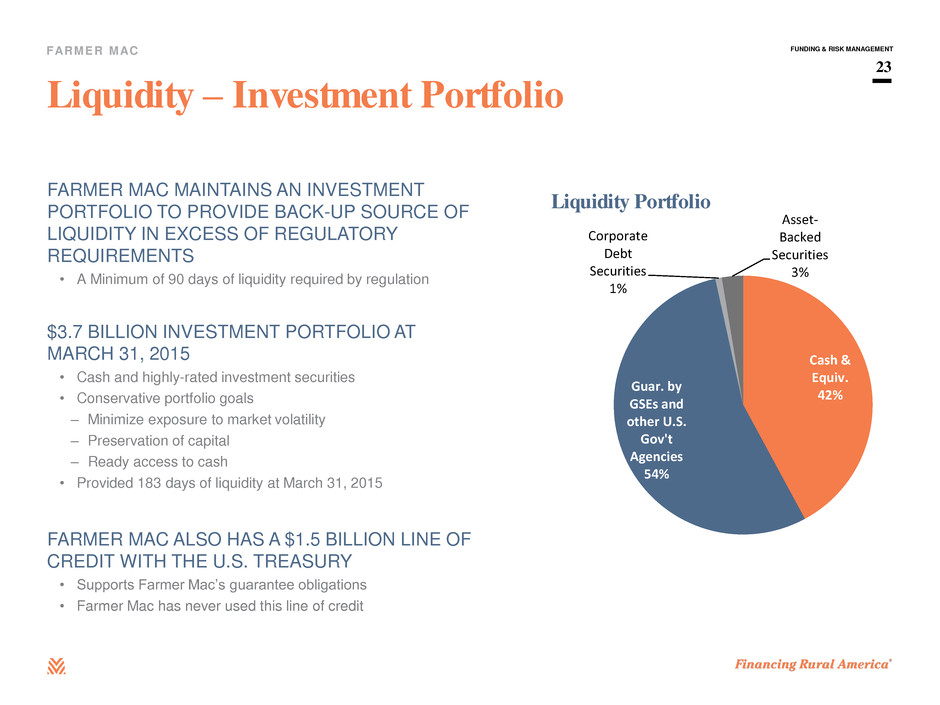

FARMER MAC Liquidity – Investment Portfolio FARMER MAC MAINTAINS AN INVESTMENT PORTFOLIO TO PROVIDE BACK-UP SOURCE OF LIQUIDITY IN EXCESS OF REGULATORY REQUIREMENTS • A Minimum of 90 days of liquidity required by regulation $3.7 BILLION INVESTMENT PORTFOLIO AT MARCH 31, 2015 • Cash and highly-rated investment securities • Conservative portfolio goals – Minimize exposure to market volatility – Preservation of capital – Ready access to cash • Provided 183 days of liquidity at March 31, 2015 FARMER MAC ALSO HAS A $1.5 BILLION LINE OF CREDIT WITH THE U.S. TREASURY • Supports Farmer Mac’s guarantee obligations • Farmer Mac has never used this line of credit FUNDING & RISK MANAGEMENT 23 Cash & Equiv. 42% Guar. by GSEs and other U.S. Gov't Agencies 54% Corporate Debt Securities 1% Asset- Backed Securities 3% Liquidity Portfolio

Appendix

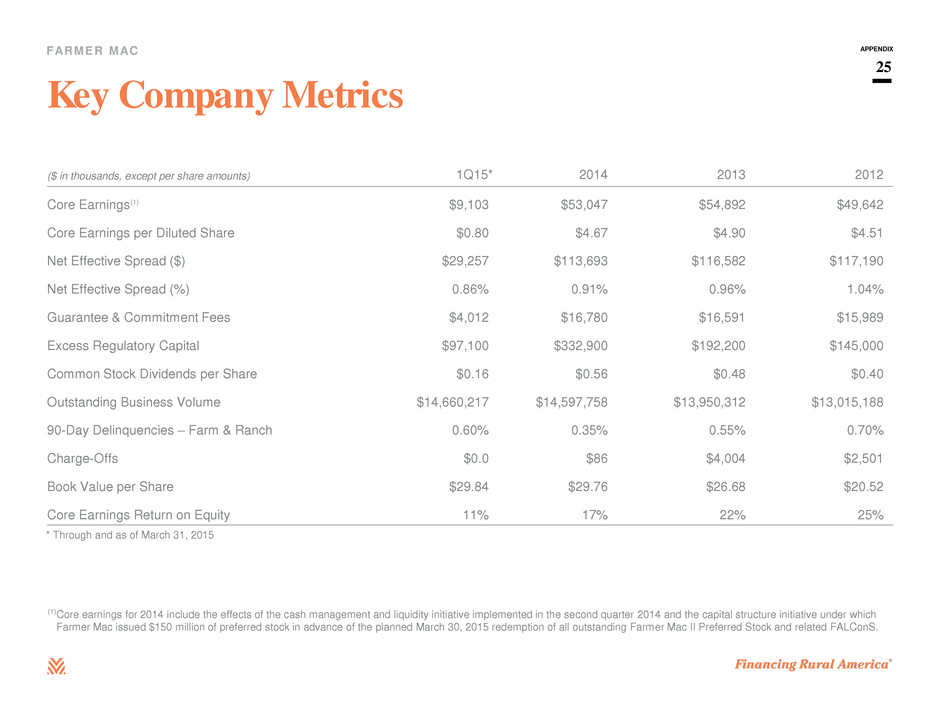

FARMER MAC Key Company Metrics APPENDIX 25 ($ in thousands, except per share amounts) 1Q15* 2014 2013 2012 Core Earnings $9,103 $53,047 $54,892 $49,642 Core Earnings per Diluted Share $0.80 $4.67 $4.90 $4.51 Net Effective Spread ($) $29,257 $113,693 $116,582 $117,190 Net Effective Spread (%) 0.86% 0.91% 0.96% 1.04% Guarantee & Commitment Fees $4,012 $16,780 $16,591 $15,989 Excess Regulatory Capital $97,100 $332,900 $192,200 $145,000 Common Stock Dividends per Share $0.16 $0.56 $0.48 $0.40 Outstanding Business Volume $14,660,217 $14,597,758 $13,950,312 $13,015,188 90-Day Delinquencies – Farm & Ranch 0.60% 0.35% 0.55% 0.70% Charge-Offs $0.0 $86 $4,004 $2,501 Book Value per Share $29.84 $29.76 $26.68 $20.52 Core Earnings Return on Equity 11% 17% 22% 25% Core earnings for 2014 include the effects of the cash management and liquidity initiative implemented in the second quarter 2014 and the capital structure initiative under which Farmer Mac issued $150 million of preferred stock in advance of the planned March 30, 2015 redemption of all outstanding Farmer Mac II Preferred Stock and related FALConS. (1) (1) * Through and as of March 31, 2015

FARMER MAC Core Earnings (Non-GAAP Measure) APPENDIX 26 ($ in millions) 1Q15* 2014 2013 2012 Net effective spread: Interest income $65.1 $ 256.9 $ 267.1 $ 285.5 Interest expense 35.8 143.2 150.5 168.3 Net effective spread 29.3 113.7 116.6 117.2 Non-interest income: Guarantee and commitment fees 4.0 16.8 16.6 16.0 Other (expense)/income (0.4 ) (4.2 ) 3.4 1.4 Non-interest income 32.9 12.6 20.0 17.4 Non-interest expenses: (Release of)/provision for losses (0.7 ) (3.2 ) (0.4 ) 1.9 Compensation and employee benefits 5.7 19.0 17.8 19.2 General and administrative 2.9 12.2 11.6 11.1 Other non-interest expenses 0.6 2.4 2.4 2.4 Non-interest expense 8.5 30.4 31.4 34.6 Core earnings before income taxes 24.4 95.9 105.2 100.0 Income tax expense 6.6 10.8 24.6 25.3 Core earnings before preferred stock dividends 17.8 85.1 80.6 74.7 Preferred stock dividends (8.7 ) (32.0 ) (25.7 ) (25.1 ) Core earnings $ 9.1 $ 53.0 $ 54.9 $ 49.6 * Through and as of March 31, 2015

FARMER MAC ($ in thousands) 1Q15* 2014 2013 2012 Net income attributable to common stockholders 1,818$ 38,251$ 71,833$ 43,894$ Less the after-tax effects of: Unrealized (losses)/gains on financial derivatives and hedging activities (582) (6,480) 29,368 4,325 Unrealized gains/(losses) on trading assets 236 1,038 (533) 200 Amortization of premiums/discounts and deferred gains on assets consolidated at fair value (529) (9,457) (12,467) (7,266) Net effects of settlements on agency forwards (164) 103 573 856 Lower of cost or fair value adjustments on loans held for sale - - - (3,863) Loss on retirement of Farmer Mac II LLC Preferred Stock (6,246) - - - Core earnings 9,103$ 53,047$ 54,892$ 49,642$ Core Earnings by Period Ended Reconciliation of Net Income to Core Earnings APPENDIX 27 Relates to the write-off of deferred issuance costs as a result of the retirement of Farmer Mac II LLC Preferred Stock (1) (1) * Through and as of March 31, 2015

FARMER MAC Reconciliation of Net Income to Core Earnings APPENDIX 28 ($ in thousands) Mar-15 Dec-14 Sep-14 Jun-14 Mar-14 Dec-13 Sep-13 Jun-13 Mar-13 Net income attributable to common stockholders 1,818$ 5,647$ 11,586$ 20,205$ 813$ 12,485$ 15,413$ 27,745$ 16,190$ Reconciling items (after-tax effects): Unrealized (losses)/gains on f inancial derivatives and hedging activities (582) (3,717) 2,685 (3,053) (2,395) 8,003 4,632 11,021 5,712 Unrealized gains/(losses) on trading assets 236 679 (21) (46) 426 (50) (407) (212) 136 Amortization of premiums/discounts and deferred gains on assets consolidated at fair value (529) (811) (440) (179) (8,027) (10,864) (421) (564) (618) Net effects of settlements on agency forw ards (164) 30 73 236 (176) 114 (158) 955 (338) Loss on retirement of Farmer Mac II LLC Preferred Stock (6,246) - - - - - - - - Core earnings 9,103$ 9,526$ 9,289$ 23,247$ 10,985$ 15,282$ 11,767$ 16,545$ 11,298$ Core Earnings by Quarter Ended

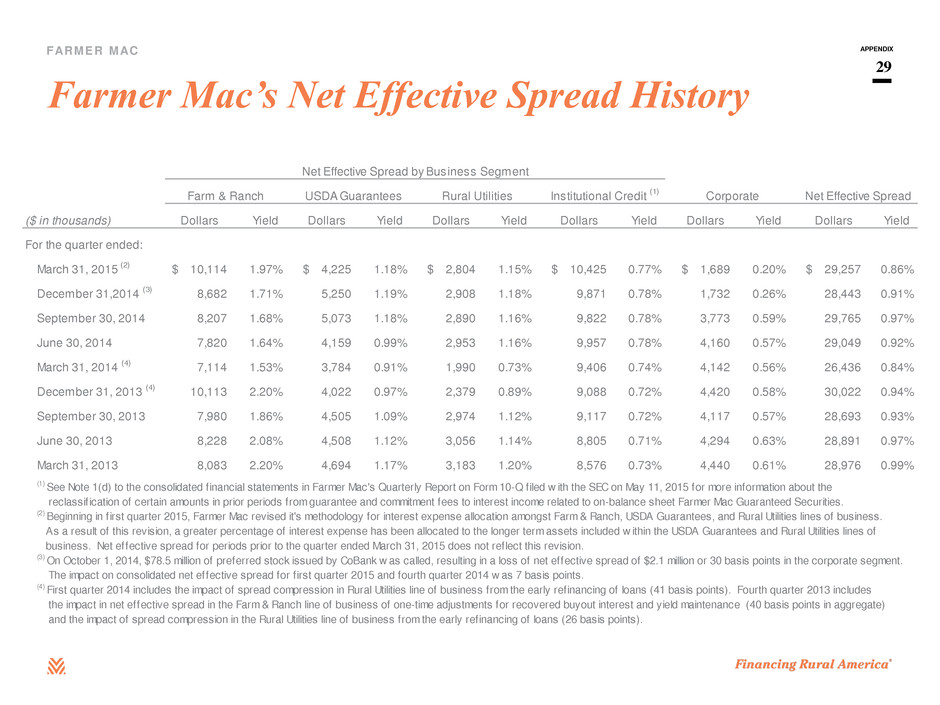

FARMER MAC Farmer Mac’s Net Effective Spread History APPENDIX 29 ($ in thousands) Dollars Yield Dollars Yield Dollars Yield Dollars Yield Dollars Yield Dollars Yield For the quarter ended: March 31, 2015 (2) 10,114$ 1.97% 4,225$ 1.18% 2,804$ 1.15% 10,425$ 0.77% 1,689$ 0.20% 29,257$ 0.86% December 31,2014 (3) 8,682 1.71% 5,250 1.19% 2,908 1.18% 9,871 0.78% 1,732 0.26% 28,443 0.91% September 30, 2014 8,207 1.68% 5,073 1.18% 2,890 1.16% 9,822 0.78% 3,773 0.59% 29,765 0.97% June 30, 2014 7,820 1.64% 4,159 0.99% 2,953 1.16% 9,957 0.78% 4,160 0.57% 29,049 0.92% March 31, 2014 (4) 7,114 1.53% 3,784 0.91% 1,990 0.73% 9,406 0.74% 4,142 0.56% 26,436 0.84% December 31, 2013 (4) 10,113 2.20% 4,022 0.97% 2,379 0.89% 9,088 0.72% 4,420 0.58% 30,022 0.94% September 30, 2013 7,980 1.86% 4,505 1.09% 2,974 1.12% 9,117 0.72% 4,117 0.57% 28,693 0.93% June 30, 2013 8,228 2.08% 4,508 1.12% 3,056 1.14% 8,805 0.71% 4,294 0.63% 28,891 0.97% March 31, 2013 8,083 2.20% 4,694 1.17% 3,183 1.20% 8,576 0.73% 4,440 0.61% 28,976 0.99% (1) See Note 1(d) to the consolidated f inancial statements in Farmer Mac's Quarterly Report on Form 10-Q filed w ith the SEC on May 11, 2015 for more information about the reclassif ication of certain amounts in prior periods from guarantee and commitment fees to interest income related to on-balance sheet Farmer Mac Guaranteed Securities. (2) Beginning in f irst quarter 2015, Farmer Mac revised it's methodology for interest expense allocation amongst Farm & Ranch, USDA Guarantees, and Rural Utilities lines of business. As a result of this revision, a greater percentage of interest expense has been allocated to the longer term assets included w ithin the USDA Guarantees and Rural Utilities lines of business. Net effective spread for periods prior to the quarter ended March 31, 2015 does not reflect this revision. (3) On October 1, 2014, $78.5 million of preferred stock issued by CoBank w as called, resulting in a loss of net effective spread of $2.1 million or 30 basis points in the corporate segment. The impact on consolidated net effective spread for f irst quarter 2015 and fourth quarter 2014 w as 7 basis points. (4) First quarter 2014 includes the impact of spread compression in Rural Utilities line of business from the early refinancing of loans (41 basis points). Fourth quarter 2013 includes the impact in net effective spread in the Farm & Ranch line of business of one-time adjustments for recovered buyout interest and yield maintenance (40 basis points in aggregate) and the impact of spread compression in the Rural Utilities line of business from the early refinancing of loans (26 basis points). Net Effective SpreadInstitutional Credit (1) Net Effective Spread by Business Segment Farm & Ranch USDA Guarantees Rural Utilities Corporate

FARMER MAC Regulatory/Congressional Oversight SEC REGULATION UNDER FEDERAL SECURITIES LAWS SUBJECT TO NYSE RULES AND REGULATIONS SINCE 1999 REGULATED BY THE FARM CREDIT ADMINISTRATION (FCA) THROUGH ITS OFFICE OF SECONDARY MARKET OVERSIGHT CONGRESSIONAL OVERSIGHT THROUGH SENATE AND HOUSE AG COMMITTEES APPENDIX 30

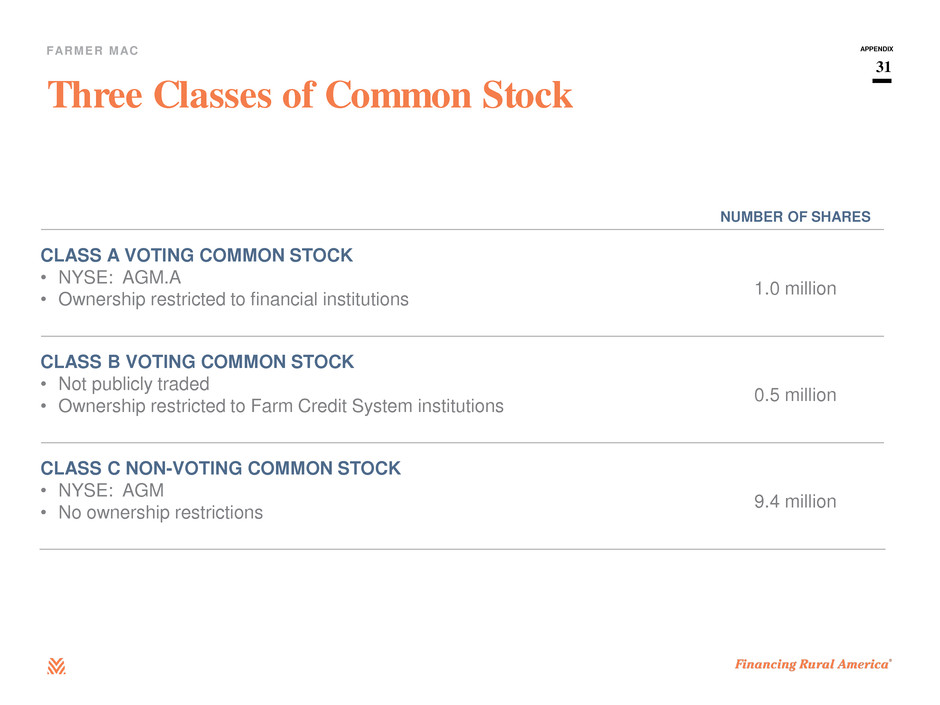

FARMER MAC Three Classes of Common Stock NUMBER OF SHARES CLASS A VOTING COMMON STOCK • NYSE: AGM.A • Ownership restricted to financial institutions 1.0 million CLASS B VOTING COMMON STOCK • Not publicly traded • Ownership restricted to Farm Credit System institutions 0.5 million CLASS C NON-VOTING COMMON STOCK • NYSE: AGM • No ownership restrictions 9.4 million APPENDIX 31

FARMER MAC Three Classes of Preferred Stock NUMBER OF SHARES SERIES A NON-CUMULATIVE PREFERRED STOCK • NYSE: AGM.PR.A • Dividend Yield: 5.875%** • Option to redeem at any time on or after January 17, 2018 • Redemption Value: $25 per share 2.4 million SERIES B NON-CUMULATIVE PREFERRED STOCK • NYSE: AGM.PR.B • Dividend Yield: 6.875%** • Option to redeem at any time on or after April 17, 2019 • Redemption Value: $25 per share 3.0 million SERIES C FIXED-TO-FLOATING NON-CUMULATIVE PREFERRED STOCK • NYSE: AGM.PR.C • Dividend Yield: 6.000%** • Option to redeem at any time on or after July 18, 2024 • Redemption Value: $25 per share 3.0 million APPENDIX 32 **Par value annual dividend yield