Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Imprivata Inc | Financial_Report.xls |

| 10-Q - FORM 10-Q - Imprivata Inc | d899224d10q.htm |

| EX-31.2 - EX-31.2 - Imprivata Inc | d899224dex312.htm |

| EX-32.1 - EX-32.1 - Imprivata Inc | d899224dex321.htm |

| EX-10.8 - EX-10.8 - Imprivata Inc | d899224dex108.htm |

| EX-31.1 - EX-31.1 - Imprivata Inc | d899224dex311.htm |

| EX-10.9 - EX-10.9 - Imprivata Inc | d899224dex109.htm |

Exhibit 10.7

EIGHTH AMENDMENT

THIS EIGHTH AMENDMENT(the “Eighth Amendment”) is made and entered into as of the 16th day of January 2015 (the “Execution Date”), by and between NORMANDY LEXINGTON ACQUISITION, LLC, a Delaware limited liability company (“Landlord”), and IMPRIVATA, INC., a Delaware corporation (“Tenant”).

RECITALS

A. Landlord and Tenant are parties to that certain office lease agreement dated April 24, 2007, which lease has been previously amended by a First Amendment dated as of January 14, 2009, a Second Amendment to Lease dated as of April 16, 2010 (“Second Amendment”), a Third Amendment to Lease dated as of March 2, 2012, a related Right of First Offer Letter dated October 29, 2012 (“Right of First Offer Letter”), a Fourth Amendment dated as of December 28, 2012 (“Fourth Amendment”), a Fifth Amendment dated August 12, 2013 (“Fifth Amendment”), a Sixth Amendment to Lease dated as of January 14, 2014 (“Sixth Amendment”) and a Seventh Amendment dated April 19, 2014 (collectively, the “Lease”). Pursuant to the Lease, Landlord has leased to Tenant space currently containing approximately: (i) 29,887 rentable square feet located on the third (3rd) floor, (ii) 19,863 rentable square feet located on the second (2nd) floor, and (iii) 22,268 rentable square feet on the first (1st) floor of the Building 1 portion of the building (collectively, the “Original Premises”) located at 10 Maguire Road, Lexington, Massachusetts (the “Building”). The Original Premises contain, in the aggregate, 72,018 rentable square feet.

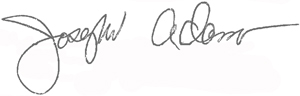

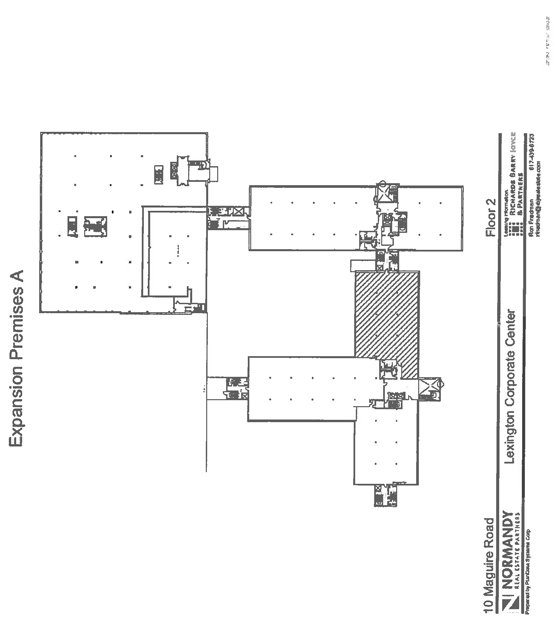

B. Tenant has requested that additional premises containing approximately 20,999 rentable square feet of space, comprising: (i) 8,872 rentable square feet on the second (2nd) floor of the Building, as shown on Exhibit A, Eighth Amendment – Sheet 1 attached hereto (“Expansion Premises A”), and (ii) 12,127 rentable square feet on the second (2nd) floor of the Building as shown on Exhibit A, Eighth Amendment – Sheet 2, attached hereto (“Expansion Premises B”), (hereinafter sometimes collectively referred to as the “8th Amendment Expansion Premises”) be added to the Original Premises, and that the Lease be appropriately amended. Landlord is willing to do the same on the following terms and conditions.

C. The Lease by its terms shall expire on September 30, 2019 (“Prior Termination Date”), and the parties desire to extend the Term of the Lease, all on the following terms and conditions.

NOW, THEREFORE, in consideration of the mutual covenants and agreements herein contained and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Landlord and Tenant agree as follows:

| I. | Expansion and Commencement Date. |

Effective as of the Expansion Premises A Commencement Date (defined below), the Original Premises shall be increased from 72,018 rentable square feet on the first (1st), second (2nd) and third (3rd) floors of the Building to 80,890 rentable square feet on the first (1st), second (2nd) and third (3rd) floors of the Building by the addition of Expansion Premises A, and effective as of the Expansion Premises B Commencement Date (defined below), the Original Premises, as previously increased by the addition thereto of Expansion Premises A, shall be further increased from 80,890 rentable square feet on the first (1st), second (2nd) and third (3rd) floors of the Building to 93,017 rentable square

feet on the first (1st), second (2nd) and third (3rd) floors of the Building by the addition of Expansion Premises B. From and after the Expansion Premises A Commencement Date, references in the Lease to the Premises shall be deemed to refer to the Original Premises and Expansion Premises A, collectively, and from and after the Expansion Premises B Commencement Date, references in the Lease to the Premises shall be deemed to refer to the Original Premises, Expansion Premises A, and Expansion Premises B, collectively. The 8th Amendment Expansion Premises are subject to all the terms and conditions of the Lease except as expressly modified herein, except that Tenant shall not be entitled to receive any allowances, abatements, or other financial concessions granted with respect to the Original Premises unless such concessions are expressly provided for herein with respect to the 8th Amendment Expansion Premises.

| A. | The “Expansion Premises A Commencement Date” shall be the date that Landlord delivers Expansion Premises A to Tenant in accordance with the terms of this Eighth Amendment, which is scheduled for October 1, 2015. The Expansion Premises A Commencement Date shall be delayed to the extent that Landlord fails to deliver possession of Expansion Premises A for any reason, including but not limited to, holding over by the current occupant thereof. Any such delay in the Expansion Premises A Commencement Date shall not subject Landlord to any liability for any loss or damage resulting therefrom; provided, however, that Landlord shall diligently use commercially reasonable efforts to deliver possession of Expansion Premises A to Tenant as soon thereafter as possible. Notwithstanding the foregoing, in the event that Landlord does not deliver the Expansion Premises A to Tenant by December 1, 2015 (the “Target Expansion Premises A Delivery Date”), then Tenant shall be entitled to an abatement of Base Rent with respect to Expansion Premises A in an amount equal to the product of (i) $607.67 multiplied by (ii) the number of days that elapse after December 1, 2015, until the date on which the Expansion Premises A has been delivered to Sublessee in the condition required by this Eighth Amendment. If the Expansion Premises A Commencement Date is delayed, the Extended Termination Date (as hereinafter defined) shall not be similarly extended. |

| B. | The “Expansion Premises B Commencement Date” shall be September 1, 2016. |

| C. | The “Expansion Premises A Rent Commencement Date” shall be three (3) months after the Expansion Premises A Commencement Date. |

| D. | The “Expansion Premises B Rent Commencement Date” shall be January 1, 2017. |

| II. | Base Rent. |

| A. | Original Premises Through Prior Termination Date. The Base Rent, Additional Rent and all other charges under the Lease with respect to the Original Premises shall be payable as provided therein through and including the Prior Termination Date. |

2

| B. | Original Premises From and After Extension Date. As of the Extension Date (as defined hereafter), the schedule of Base Rent payable with respect to the Original Premises (72,018 square feet) during the Extended Term (as defined hereafter) is the following: |

| Time Period |

Annual Rate Per Rentable Square Foot |

Annual Base Rent |

Monthly Base Rent | |||||||||

| 10/1/19-12/31/19: |

$ | 28.00 | $ | 2,016,504.00 | * | $ | 168,042.00 | |||||

| 1/1/20-12/31/20: |

$ | 29.00 | $ | 2,088,522.00 | $ | 174,043.50 | ||||||

| 1/1/21-12/31/21: |

$ | 30.00 | $ | 2,160,540.00 | $ | 180,045.00 | ||||||

| * | annualized |

All such Base Rent shall be payable by Tenant in accordance with the terms of the Lease.

| C. | 8th Amendment Expansion Premises From 8th Amendment Expansion Premises Commencement Date Through Extended Termination Date. In addition to Tenant’s obligation to pay Base Rent for the Original Premises, Tenant shall pay Base Rent for the 8th Amendment Expansion Premises as follows: |

| I. | Expansion Premises A (8,872 square feet): |

| Time Period |

Annual Rate Per Rentable Square Foot |

Annual Base Rent |

Monthly Base Rent | |||||||||

| Expansion Premises A Commencement Date – Expansion Premises A Rent Commencement Date: |

$ | -0- | $ | -0- | $ | -0- | ||||||

| Expansion Premises A Rent Commencement Date-12/31/16: |

$ | 25.00 | $ | 221,800.00 | $ | 18,483.33 | ||||||

| 1/1/17-12/31/17: |

$ | 26.00 | $ | 230,672.00 | $ | 19,222.67 | ||||||

| 1/1/18-12/31/18: |

$ | 27.00 | $ | 239,544.00 | $ | 19,962.00 | ||||||

| 1/1/19-12/31/19: |

$ | 28.00 | $ | 248,416.00 | $ | 20,701.33 | ||||||

| 1/1/20-12/31/20: |

$ | 29.00 | $ | 257,288.00 | $ | 21,440.67 | ||||||

| 1/1/21-12/31/21: |

$ | 30.00 | $ | 266,160.00 | $ | 22,180.00 | ||||||

| II. | Expansion Premises B (12,127 square feet): |

| Time Period |

Annual Rate Per Rentable Square Foot |

Annual Base Rent |

Monthly Base Rent | |||||||||

| 9/1/16-12/31/16: |

$ | -0- | $ | -0- | $ | -0- | ||||||

| 1/1/17-12/31/17: |

$ | 26.00 | $ | 315,302.00 | $ | 26,275.17 | ||||||

| 1/1/18-12/31/18: |

$ | 27.00 | $ | 327,429.00 | $ | 27,285.75 | ||||||

| 1/1/19-12/31/19: |

$ | 28.00 | $ | 339,556.00 | $ | 28,296.33 | ||||||

| 1/1/20-12/31/20: |

$ | 29.00 | $ | 351,683.00 | $ | 29,306.92 | ||||||

| 1/1/21-12/31/21: |

$ | 30.00 | $ | 363,810.00 | $ | 30,317.50 | ||||||

3

| III. | Tenant’s Pro Rata Share With Respect to 8th Amendment Expansion Premises. |

| A. | For the period commencing with the Expansion Premises A Commencement Date, and ending on the Extended Termination Date, Tenant’s Pro Rata Share for Expansion Premises A shall be 3.11% (i.e., 8,872 rentable square feet of Expansion Premises A divided by 285,133 rentable square feet of the Building). |

| B. | For the period commencing with the Expansion Premises B Commencement Date, and ending on the Extended Termination Date, Tenant’s Pro Rata Share for Expansion Premises B shall be 4.25% (i.e., 12,127 rentable square feet of Expansion Premises B divided by 285,133 rentable square feet of the Building). |

| IV. | Expenses and Taxes. |

| A. | Original Premises during the Extended Term. For the period commencing with the Extension Date, and ending on the Extended Termination Date, Tenant shall pay for Tenant’s Pro Rata Share of Expenses and Taxes applicable to the Original Premises in accordance with the terms of the Lease. |

| B. | Expansion Premises A Commencement Date Through Extended Termination Date. For the period commencing with the Expansion Premises A Commencement Date, and ending on the Extended Termination Date, Tenant shall pay for Tenant’s Pro Rata Share of Expenses and Taxes applicable to Expansion Premises A in accordance with the terms of the Lease, provided, however, during such period: |

| (i) | the Base Year for the computation of Tenant’s Pro Rata Share of Expenses applicable to Expansion Premises A shall be calendar year 2015; and |

| (ii) | the Base Year for the computation of Tenant’s Pro Rata Share of Taxes applicable to Expansion Premises A shall be fiscal year 2016 (i.e., July 1, 2015, through June 30, 2016). |

| C. | Expansion Premises B Commencement Date Through Extended Termination Date. For the period commencing with the Expansion Premises B Commencement Date, and ending on the Extended Termination Date, Tenant shall pay for Tenant’s Pro Rata Share of Expenses and Taxes applicable to Expansion Premises B in accordance with the terms of the Lease, provided, however, during such period: |

| (i) | the Base Year for the computation of Tenant’s Pro Rata Share of Expenses applicable to Expansion Premises B shall be calendar year 2015; and |

| (ii) | the Base Year for the computation of Tenant’s Pro Rata Share of Taxes applicable to Expansion Premises B shall be fiscal year 2016 (i.e., July 1, 2015, through June 30, 2016). |

4

| V. | Condition of 8th Amendment Expansion Premises. Landlord shall deliver the 8th Amendment Expansion Premises to Tenant on the Expansion Premises A Commencement Date, and the Expansion Premises B Commencement Date, respectively, in broom-clean condition, free of all personal property, debris and free of any occupants, but otherwise in its “as is” condition as of each such date, subject, however, to the following provisions of this Section V. Tenant agrees to accept the 8th Amendment Expansion Premises “as is” without any agreements, representations, understandings or obligations on the part of Landlord to perform any alterations, repairs or improvements, except as may be expressly provided otherwise in this Eighth Amendment. Notwithstanding the foregoing, Landlord agrees that the Building systems serving the 8th Amendment Expansion Premises will be in good working order at the time Landlord delivers each of Expansion Premises A and Expansion Premises B to Tenant hereunder. Landlord further agrees that Expansion Premises B shall be separately demised at Landlord’s sole cost and expense prior to the Expansion B Commencement Date. In addition, if the electricity serving the 8th Amendment Expansion Premises is not separately metered or submetered, Landlord shall, it its sole cost and expense, prior to the Expansion B Commencement Date, cause the electric service to the 8th Amendment Expansion Premises either (i) to be separately metered or submetered or (ii) to be connected to the meter or submeter servicing the Original Premises. |

| VI. | Electricity with Respect to 8th Amendment Expansion Premises. Tenant shall pay, as Additional Rent, for all electricity consumed in the 8th Amendment Expansion Premises in accordance with the terms and conditions set forth in Section 7 of the Lease. |

| VII. | Responsibility for Improvements to Additional Expansion Premises. Tenant may perform improvements to the 8th Amendment Expansion Premises in accordance with the Work Letter attached hereto as Exhibit B, Eighth Amendment, and Tenant shall be entitled to the 8th Amendment Expansion Allowance (as defined in Exhibit B, Eighth Amendment) in connection with work in the 8th Amendment Expansion Premises only, as more fully described in Exhibit B, Eighth Amendment. |

| VIII. | Extension. |

The Term of the Lease is hereby extended for a period commencing on October 1, 2019, and terminating on December 31, 2021 (“Extended Termination Date”), unless sooner terminated in accordance with the terms of the Lease. That portion of the Term commencing the day immediately following the Prior Termination Date (“Extension Date”) and ending on the Extended Termination Date shall be referred to herein as the “Extended Term”.

5

| IX. | Extension Options. The Extension Option set forth in Section V of the Third Amendment, as amended by Section IX of the Fourth Amendment and Section VIII of the Fifth Amendment, shall apply to both the Original Premises and the 8th Amendment Expansion Premises (and may be exercised only with respect to the entirety of both such spaces); provided, however, that Section IX of the Fourth Amendment shall be modified as follows: |

| i) | “Section V.A. is deleted and the following is substituted in its place: |

“Grant of Option: Conditions. Tenant shall have the right to extend the Term (the “Extension Option”) for one (1) additional period of five (5) years, commencing on January 1, 2022, and ending on December 31, 2026 (the “Fifth Extended Term”), if:”

| ii) | Section V.A.(i) is deleted and the following is substituted in its place: |

“(i) Landlord received notice of exercise (“Initial Extension Notice”) not later than January 1, 2021, and not earlier than October 1, 2020.”

| iii) | The first (1st) sentence of Section V.B.(i) is deleted and the following is substituted in its place: |

“(i) The initial Base Rent rate per rentable square foot during the Fifth Extended Term shall equal the Prevailing Market rate (hereinafter defined) per rentable square foot for the Premises.”

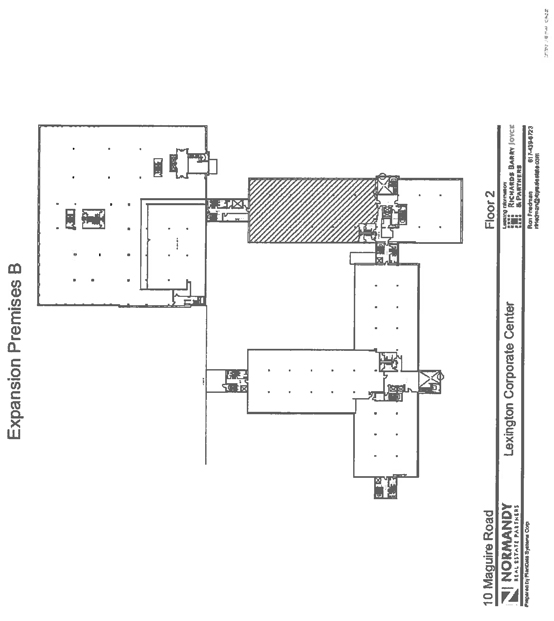

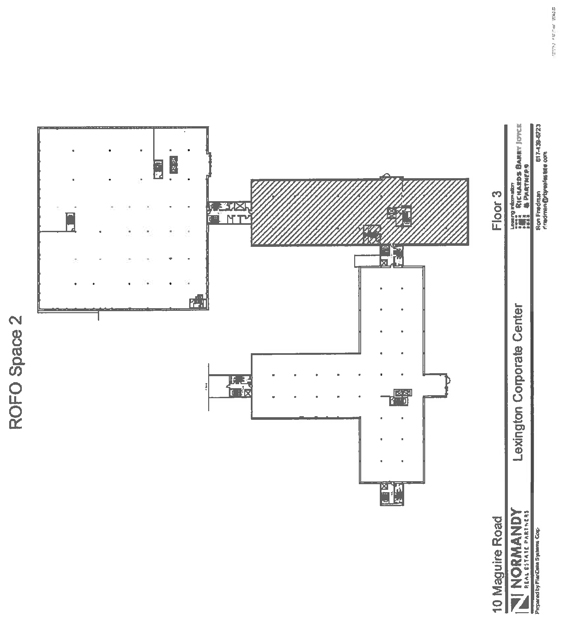

| X. | Right of First Offer. Tenant shall continue to have the Right of First Offer set forth in Section VII of the Third Amendment, except that Section VII of the Third Amendment shall be modified as follows: |

| i) | The first (1st) sentence of Section VII.A. of the Third Amendment is deleted and the following is substituted in its place: |

“Tenant shall have the following ongoing right of first offer (the “Right of First Offer”) with respect to: (i) 11,385 square feet on the first (1st) floor of Building 2, as shown on Exhibit C, Eighth Amendment – Sheet 1, attached hereto, and (ii) 19,725 square feet on the third (3rd) floor of Building 2, as shown on Exhibit C, Eighth Amendment – Sheet 2, attached hereto (the “Offering Space”).

| XI. | Letter of Credit |

The parties hereby acknowledge that Landlord is currently holding a Security Deposit in the form of a Letter of Credit in the amount of One Hundred Twenty Thousand Four Hundred Seventeen and 27/100 Dollars ($120,417.27) pursuant to Section 6 of the Lease, as modified by Section 2.01 of the First Amendment, Section VI of the Second Amendment, Section VIII of the Third Amendment, Section III of the Fourth Amendment, and Section X of the Fifth Amendment. No additional Security Deposit shall be required with respect to the 8th Amendment Expansion Premises, and Landlord shall continue to hold the current Security Deposit/Letter of Credit in accordance with the terms of the Lease.

| XII. | Inapplicable and Deleted Lease Provisions. |

| A. | Exhibit C to the Lease and Schedule I to Exhibit C to the Lease (Work Letter); Section IV of the Second Amendment (Abatement of Rent); Exhibit B of the Fourth Amendment (Work Letter); Exhibit B of the Fifth Amendment (Work Letter), and Exhibit B to the Sixth Amendment shall have no applicability with respect to this Eighth Amendment. |

| B. | Section IX of the Sixth Amendment (Termination Option) is hereby deleted and is of no further force or effect. |

6

| XIII. | Miscellaneous. |

| A. | This Eighth Amendment and the Lease set forth the entire agreement between the parties with respect to the matters set forth herein. There have been no additional oral or written representations or agreements. Under no circumstances shall Tenant be entitled to any Rent abatement, improvement allowance, leasehold improvements, or other work to the Premises, or any similar economic incentives that may have been provided Tenant in connection with entering into the Lease, unless specifically set forth in this Eighth Amendment. |

| B. | Except as herein modified or amended, the provisions, conditions and terms of the Lease shall remain unchanged and in full force and effect. |

| C. | In the case of any inconsistency between the provisions of the Lease and this Eighth Amendment, the provisions of this Eighth Amendment shall govern and control. |

| D. | Submission of this Eighth Amendment by Landlord is not an offer to enter into this Eighth Amendment but rather is a solicitation for such an offer by Tenant. Landlord shall not be bound by this Eighth Amendment until Landlord has executed and delivered the same to Tenant. |

| E. | The capitalized terms used in this Eighth Amendment shall have the same definitions as set forth in the Lease to the extent that such capitalized terms are defined therein and not redefined in this Eighth Amendment. |

| F. | Tenant hereby represents to Landlord that Tenant has dealt with no broker in connection with this Eighth Amendment, other than T3 Realty Advisors (“Tenant’s Broker”) and TW/Richards Barry Joyce & Partners, LLC (“Landlord’s Broker”) (collectively, the “Brokers”). Tenant agrees to indemnify and hold Landlord, its trustees, members, principals, beneficiaries, partners, officers, directors, employees, mortgagee(s) and agents, and the respective principals and members of any such agents harmless from all claims of any brokers, other than the Brokers, claiming to have represented Tenant in connection with this Eighth Amendment. Landlord hereby represents to Tenant that Landlord has dealt with no broker, other than the Brokers, in connection with this Eighth Amendment. Landlord agrees to indemnify and hold Tenant, its trustees, members, principals, beneficiaries, partners, officers, directors, employees, and agents, and the respective principals and members of any such agents harmless from all claims of any brokers claiming to have represented Landlord in connection with this Eighth Amendment. Landlord shall be responsible for any commission payable to the Brokers by reason of this Eighth Amendment. |

| G. | Each signatory of this Eighth Amendment represents hereby that he or she has the authority to execute and deliver the same on behalf of the party hereto for which such signatory is acting. |

7

IN WITNESS WHEREOF, Landlord and Tenant have duly executed this Sixth Amendment as of the day and year first above written.

| LANDLORD: | ||||

| NORMANDY LEXINGTON ACQUISITION, LLC, a Delaware limited liability company | ||||

| By: |

| |||

|

| ||||

| Name: | Joseph Adamo | |||

| Title: | Vice President | |||

| TENANT: | ||||

| IMPRIVATA, INC., a Delaware corporation | ||||

| By: |

| |||

|

| ||||

| Name: | Jeff Kalowski | |||

| Title: | CFO | |||

8

EXHIBIT A, EIGHTH AMENDMENT – SHEET 1

EXPANSION PREMISES A

Exhibit A-1, Eighth Amendment

EXHIBIT A, EIGHTH AMENDMENT – SHEET 2

EXPANSION PREMISES B

Exhibit A-2, Eighth Amendment

EXHIBIT B, EIGHTH AMENDMENT

WORK LETTER

This Exhibit is attached to and made a part of the Eighth Amendment by and between NORMANDY LEXINGTON ACQUISITION, LLC, a Delaware limited liability company (“Landlord”), and IMPRIVATA, INC., a Delaware corporation (“Tenant”), for space in the Building located at 10 Maguire Road, Lexington, Massachusetts.

As used in this Workletter, the “Premises” shall be deemed to mean the 8th Amendment Expansion Premises, as defined in the attached Eighth Amendment.

8th Amendment Expansion Premises Alterations and 8th Amendment Expansion Premises Allowance:

| A. | From and after the Expansion Premises A Commencement Date, Tenant shall have the right to perform alterations and improvements in Expansion Premises A and from and after the Expansion Premises B Commencement Date, Tenant shall have the right to perform alterations and improvements in Expansion Premises B. All such alterations and improvements are referred to herein as the “8th Amendment Expansion Premises Alterations”. Notwithstanding the foregoing, Tenant and its contractors shall not have the right to perform 8th Amendment Expansion Premises in the 8th Amendment Expansion Premises unless and until Tenant has complied with all of the terms and conditions of Section 9 of the Lease, including, without limitation, approval by Landlord of the final plans for the 8th Amendment Expansion Premises Alterations and the contractors to be retained by Tenant to perform such 8th Amendment Expansion Premises Alterations. Landlord’s consent is solely for the benefit of Landlord, and neither Tenant nor any third party shall have the right to rely on Landlord’s consent, or its approval of Tenant’s plans, for any purpose whatsoever. Landlord shall execute any documents reasonably required to obtain such permits or governmental approvals, and shall otherwise reasonably cooperate with Tenant’s efforts to obtain the same at no out of pocket expense to Landlord. Tenant shall be responsible for all elements of the design of Tenant’s plans (including, without limitation, compliance with law, functionality of design, the structural integrity of the design, the configuration of the 8th Amendment Expansion Premises and the placement of Tenant’s furniture, appliances and equipment), and Landlord’s approval of Tenant’s plans shall in no event relieve Tenant of the responsibility for such design. Landlord’s approval of the contractors to perform the 8th Amendment Expansion Premises Alterations shall not be unreasonably withheld, delayed or conditioned. The parties agree that Landlord’s approval of the general contractor to perform the 8th Amendment Expansion Premises Alterations shall not be considered to be unreasonably withheld if any such general contractor (i) does not have trade references reasonably acceptable to Landlord, (ii) does not maintain insurance as required pursuant to the terms of this Lease, (iii) does not have the ability to be bonded for the work in an amount of no less than 150% of the total estimated cost of the 8th Amendment Expansion Premises Alterations, (iv) does not provide current financial statements reasonably acceptable to Landlord, or (v) is not licensed as a contractor in the Commonwealth of Massachusetts. Tenant acknowledges the foregoing is not intended to be an exclusive list of the reasons why Landlord may reasonably withhold its consent to a general contractor. Landlord hereby approves Avison Young (“AY”) as Tenant’s general contractor. |

Exhibit B-1, Eighth Amendment

| B. | Provided Tenant is not in default (after the expiration of any applicable grace or cure period), Landlord agrees to contribute Seven Hundred Thirty-Four Thousand Nine Hundred Sixty-Five and 00/100 Dollars ($734,965.00) (i.e., $35.00 per square foot of the 8th Amendment Expansion Premises) (the “8th Amendment Expansion Premises Allowance”) toward the cost of performing the 8th Amendment Expansion Premises Alterations in preparation of Tenant’s occupancy of the 8th Amendment Expansion Premises. The 8th Amendment Expansion Premises Allowance may only be used for the cost of preparing design and construction documents and mechanical and electrical plans and hard costs in connection with the 8th Amendment Expansion Premises Alterations. The 8th Amendment Expansion Premises Allowance, less a 10% (or 5%, if such percentage is the retainage amount required in Tenant’s construction contracts) retainage (which retainage shall be payable as part of the final draw), shall be paid to Tenant or, at Landlord’s option, to the order of the general contractor that performs the 8th Amendment Expansion Premises Alterations, in periodic disbursements within thirty (30) days after receipt of the following documentation: (i) an application for payment and sworn statement of contractor substantially in the form of AIA Document G-702 covering all work for which disbursement is to be made to a date specified therein; (ii) a certification from an AIA architect substantially in the form of the Architect’s Certificate for Payment which is located on AIA Document G702, Application and Certificate of Payment; (iii) Contractor’s, subcontractor’s and material supplier’s waivers of liens which shall cover all 8th Amendment Expansion Premises Alterations for which disbursement is being requested and all other statements and forms required for compliance with the mechanics’ lien laws of the Commonwealth of Massachusetts, together with all such invoices, contracts, or other supporting data as Landlord or Landlord’s Mortgagee may reasonably require; (iv) a cost breakdown for each trade or subcontractor performing the 8th Amendment Expansion Premises Alterations; (v) plans and specifications for the 8th Amendment Expansion Premises Alterations, together with a certificate from an AIA architect that such plans and specifications comply in all material respects with all laws affecting the Building, Property and 8th Amendment Expansion Premises; (vi) copies of all construction contracts for the 8th Amendment Expansion Premises Alterations, together with copies of all change orders, if any; and (vii) a request to disburse from Tenant containing an approval by Tenant of the work done and a good faith estimate of the cost to complete the 8th Amendment Expansion Premises Alterations. Upon completion of the 8th Amendment Expansion Premises Alterations, and prior to final disbursement of the 8th Amendment Expansion Premises Allowance, Tenant shall furnish Landlord with: (1) general contractor and architect’s completion affidavits, (2) full and final waivers of lien, (3) receipted bills covering all labor and materials expended and used, (4) as-built plans of the 8th Amendment Expansion Premises Alterations, and (5) the certification of Tenant and its architect that the 8th Amendment Expansion Premises Alterations have been installed in a good and workmanlike manner in accordance with the approved plans, and in accordance with applicable laws, codes and ordinances. In no event shall Landlord be required to disburse the 8th Amendment Expansion Premises Allowance more than one time per month. If the 8th Amendment Expansion Premises Alterations |

Exhibit B-2, Eighth Amendment

| exceed the 8th Amendment Expansion Premises Allowance, Tenant shall be entitled to the 8th Amendment Expansion Premises Allowance in accordance with the terms hereof, but each individual disbursement of the 8th Amendment Expansion Premises Allowance shall be disbursed in the proportion that the 8th Amendment Expansion Premises Allowance bears to the total cost for the 8th Amendment Expansion Premises Alterations, less the 10% (or lesser amount, as set forth above) retainage referenced above. Notwithstanding anything herein to the contrary, Landlord shall not be obligated to disburse any portion of the 8th Amendment Expansion Premises Alterations during the continuance of an uncured default under the Lease, and Landlord’s obligation to disburse shall only resume when and if such default is cured. |

| C. | In no event shall the 8th Amendment Expansion Premises Allowance be used for the purchase of equipment, furniture or other items of personal property of Tenant. If Tenant does not submit a request for payment of the entire 8th Amendment Expansion Premises Allowance to Landlord in accordance with the provisions contained in this Exhibit B, Eighth Amendment, by the date that is eighteen (18) months after the Expansion Premises B Commencement Date, any unused amount shall accrue to the sole benefit of Landlord, it being understood that Tenant shall not be entitled to any credit, abatement or other concession in connection therewith. Notwithstanding the foregoing, provided that Tenant has commenced construction of the 8th Amendment Expansion Premises Alterations before March 1, 2018, and is diligently pursuing the completion thereof, Tenant may elect to extend the foregoing deadline until September 1, 2018, by giving Landlord notice of such election before March 1, 2018. Tenant shall be responsible for all applicable state sales or use taxes, if any, payable in connection with the 8th Amendment Expansion Premises Alterations and/or 8th Amendment Expansion Premises Allowance. Landlord shall be entitled to deduct from the 8th Amendment Expansion Premises Allowance a construction management fee for Landlord’s oversight of the 8th Amendment Expansion Premises Alterations in an amount equal to 5% of the total cost of the 8th Amendment Expansion Premises Alterations; provided however that such fee shall be waived if Tenant employs AY, or any successor general contractor used by Landlord, as its general contractor. |

| D. | Except as otherwise set forth in this Eighth Amendment, Tenant agrees to accept the 8th Amendment Expansion Premises in their “as-is” condition and configuration, it being agreed that Landlord shall not be required to perform any work or, except as provided above with respect to the 8th Amendment Expansion Premises Allowance, incur any costs in connection with the construction or demolition of any improvements in the 8th Amendment Expansion Premises. |

| E. | This Exhibit B, Eighth Amendment shall not be deemed applicable to any additional space added to the Premises at any time or from time to time, whether by any options under the Lease or otherwise, or to any portion of the original Premises or any additions to the Premises in the event of a renewal or extension of the original Term of the Lease, whether by any options under the Lease or otherwise, unless expressly so provided in the Lease or any amendment or supplement to the Lease. |

Exhibit B-3, Eighth Amendment

EXHIBIT C, EIGHTH AMENDMENT – SHEET 1

OFFERING SPACE

Exhibit C-1, Eighth Amendment

EXHIBIT C, EIGHTH AMENDMENT – SHEET 2

OFFERING SPACE

Exhibit C-2, Eighth Amendment