Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|

x |

Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period ended March 31, 2015.

OR

|

o |

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to .

Commission file number: 001-33459

Genesis Healthcare, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

20-3934755 |

|

(State or other jurisdiction of |

|

(IRS Employer |

|

|

|

|

|

101 East State Street |

|

|

|

Kennett Square, Pennsylvania |

|

19348 |

|

(Address of principal executive offices) |

|

(Zip Code) |

(610) 444-6350

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o |

|

Accelerated filer x |

|

|

|

|

|

Non-accelerated filer o |

|

Smaller reporting company o |

|

(do not check if smaller reporting company) |

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The number of shares outstanding of each of the issuer’s classes of common stock, as of the close of business on May 7, 2015, was:

Class A common stock, $0.001 par value — 73,591,665 shares

Class B common stock, $0.001 par value — 15,511,603 shares

Class C common stock, $0.001 par value — 64,449,380 shares

Genesis Healthcare, Inc.

Form 10-Q

PART I — FINANCIAL INFORMATION

GENESIS HEALTHCARE, INC. AND SUBSIDIARIES

(IN THOUSANDS, EXCEPT SHARE AND PER SHARE DATA)

(UNAUDITED)

|

|

|

March 31, 2015 |

|

December 31, 2014 |

| ||

|

|

|

|

|

|

| ||

|

Assets: |

|

|

|

|

| ||

|

Current assets: |

|

|

|

|

| ||

|

Cash and equivalents |

|

$ |

95,708 |

|

$ |

87,548 |

|

|

Restricted cash and investments in marketable securities |

|

52,234 |

|

38,211 |

| ||

|

Accounts receivable, net of allowances for doubtful accounts of $139,389 at March 31, 2015 and $133,529 at December 31, 2014 |

|

763,006 |

|

605,830 |

| ||

|

Prepaid expenses |

|

49,112 |

|

72,873 |

| ||

|

Other current assets |

|

38,453 |

|

33,511 |

| ||

|

Deferred income taxes |

|

2,443 |

|

58,213 |

| ||

|

|

|

|

|

|

| ||

|

Total current assets |

|

1,000,956 |

|

896,186 |

| ||

|

Property and equipment, net of accumulated depreciation of $555,828 at March 31, 2015 and $502,176 at December 31, 2014 |

|

3,947,941 |

|

3,493,250 |

| ||

|

Restricted cash and investments in marketable securities |

|

120,547 |

|

108,529 |

| ||

|

Other long-term assets |

|

163,326 |

|

140,119 |

| ||

|

Deferred income taxes |

|

142,018 |

|

160,531 |

| ||

|

Identifiable intangible assets, net of accumulated amortization of $48,507 at March 31, 2015 and $42,661 at December 31, 2014 |

|

233,181 |

|

173,112 |

| ||

|

Goodwill |

|

423,387 |

|

169,681 |

| ||

|

|

|

|

|

|

| ||

|

Total assets |

|

$ |

6,031,356 |

|

$ |

5,141,408 |

|

|

|

|

|

|

|

| ||

|

Liabilities and Stockholders’ Deficit: |

|

|

|

|

| ||

|

Current liabilities: |

|

|

|

|

| ||

|

Current installments of long-term debt |

|

$ |

12,746 |

|

$ |

12,518 |

|

|

Capital lease obligations |

|

3,004 |

|

2,875 |

| ||

|

Financing obligations |

|

1,098 |

|

1,138 |

| ||

|

Accounts payable |

|

218,565 |

|

194,508 |

| ||

|

Accrued expenses |

|

155,484 |

|

125,831 |

| ||

|

Accrued compensation |

|

255,881 |

|

192,838 |

| ||

|

Self-insurance reserves |

|

144,897 |

|

130,874 |

| ||

|

|

|

|

|

|

| ||

|

Total current liabilities |

|

791,675 |

|

660,582 |

| ||

|

|

|

|

|

|

| ||

|

Long-term debt |

|

980,911 |

|

525,728 |

| ||

|

Capital lease obligations |

|

1,005,555 |

|

1,002,762 |

| ||

|

Financing obligations |

|

2,928,998 |

|

2,911,200 |

| ||

|

Deferred income taxes |

|

— |

|

19,215 |

| ||

|

Self-insurance reserves |

|

400,309 |

|

355,344 |

| ||

|

Other long-term liabilities |

|

129,428 |

|

124,067 |

| ||

|

Commitments and contingencies |

|

|

|

|

| ||

|

Stockholders’ deficit: |

|

|

|

|

| ||

|

Class A common stock (par $0.001, 175,000,000 shares authorized, issued and outstanding 73,587,665 and 49,864,878 at March 31, 2015 and December 31, 2014, respectively) |

|

74 |

|

50 |

| ||

|

Class B common stock (par $0.001, 30,000,000 shares authorized, issued and outstanding 15,511,603 and 0 at March 31, 2015 and December 31, 2014, respectively) |

|

16 |

|

— |

| ||

|

Class C common stock (par $0.001, 150,000,000 shares authorized, issued and outstanding 64,449,380 and 0 at March 31, 2015 and December 31, 2014, respectively) |

|

64 |

|

— |

| ||

|

Additional paid-in capital |

|

298,369 |

|

143,492 |

| ||

|

Accumulated deficit |

|

(417,974 |

) |

(603,254 |

) | ||

|

Accumulated other comprehensive income |

|

631 |

|

515 |

| ||

|

Total stockholders’ deficit before noncontrolling interests |

|

(118,820 |

) |

(459,197 |

) | ||

|

Noncontrolling interests |

|

(86,700 |

) |

1,707 |

| ||

|

|

|

|

|

|

| ||

|

Total stockholders’ deficit |

|

(205,520 |

) |

(457,490 |

) | ||

|

|

|

|

|

|

| ||

|

Total liabilities and stockholders’ deficit |

|

$ |

6,031,356 |

|

$ |

5,141,408 |

|

See accompanying notes to the unaudited consolidated financial statements.

GENESIS HEALTHCARE, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(IN THOUSANDS, EXCEPT PER SHARE DATA)

(UNAUDITED)

|

|

|

Three months ended March 31, |

| ||||

|

|

|

2015 |

|

2014 |

| ||

|

|

|

|

|

|

| ||

|

Net revenues |

|

$ |

1,343,001 |

|

$ |

1,186,544 |

|

|

|

|

|

|

|

| ||

|

Salaries, wages and benefits |

|

819,938 |

|

746,490 |

| ||

|

Other operating expenses |

|

348,285 |

|

292,698 |

| ||

|

Lease expense |

|

36,419 |

|

32,799 |

| ||

|

Depreciation and amortization expense |

|

59,933 |

|

47,500 |

| ||

|

Interest expense |

|

121,313 |

|

108,750 |

| ||

|

Loss on early extinguishment of debt |

|

3,234 |

|

499 |

| ||

|

Investment income |

|

(416 |

) |

(943 |

) | ||

|

Other income |

|

(7,611 |

) |

— |

| ||

|

Transaction costs |

|

86,069 |

|

2,249 |

| ||

|

Equity in net (income) loss of unconsolidated affiliates |

|

(153 |

) |

44 |

| ||

|

|

|

|

|

|

| ||

|

Loss before income tax benefit |

|

(124,010 |

) |

(43,542 |

) | ||

|

Income tax benefit |

|

(5,648 |

) |

(2,754 |

) | ||

|

|

|

|

|

|

| ||

|

Loss from continuing operations |

|

(118,362 |

) |

(40,788 |

) | ||

|

Income (loss) from discontinued operations, net of taxes |

|

112 |

|

(3,194 |

) | ||

|

|

|

|

|

|

| ||

|

Net loss |

|

(118,250 |

) |

(43,982 |

) | ||

|

Less net loss (income) attributable to noncontrolling interests |

|

5,684 |

|

(185 |

) | ||

|

Net loss attributable to Genesis Healthcare, Inc. |

|

$ |

(112,566 |

) |

$ |

(44,167 |

) |

|

|

|

|

|

|

| ||

|

Loss per common share: |

|

|

|

|

| ||

|

Basic and diluted: |

|

|

|

|

| ||

|

Weighted average shares outstanding for basic and diluted (loss) income from continuing operations per share |

|

75,234 |

|

49,865 |

| ||

|

|

|

|

|

|

| ||

|

Basic and diluted net (loss) income per common share: |

|

|

|

|

| ||

|

Loss from continuing operations attributable to Genesis Healthcare, Inc. |

|

$ |

(1.50 |

) |

$ |

(0.82 |

) |

|

Income (loss) from discontinued operations |

|

0.00 |

|

(0.06 |

) | ||

|

Net loss attributable to Genesis Healthcare, Inc. |

|

$ |

(1.50 |

) |

$ |

(0.88 |

) |

See accompanying notes to the unaudited consolidated financial statements.

GENESIS HEALTHCARE, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(IN THOUSANDS)

(UNAUDITED)

|

|

|

Three months ended March 31, |

| ||||

|

|

|

2015 |

|

2014 |

| ||

|

Net loss attributable to Genesis Healthcare, Inc. |

|

$ |

(112,566 |

) |

$ |

(44,167 |

) |

|

Net unrealized gain on marketable securities, net of tax |

|

270 |

|

132 |

| ||

|

Comprehensive loss |

|

(112,296 |

) |

(44,035 |

) | ||

|

Comprehensive (loss) income attributable to noncontrolling interests |

|

(5,382 |

) |

185 |

| ||

|

Comprehensive loss attributable to Genesis Healthcare, Inc. |

|

$ |

(117,678 |

) |

$ |

(43,850 |

) |

See accompanying notes to the unaudited consolidated financial statements.

GENESIS HEALTHCARE, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ DEFICIT

(IN THOUSANDS)

(UNAUDITED)

|

|

|

Class A Common Stock |

|

Class B Common Stock |

|

Class C Common Stock |

|

Additional |

|

Accumulated |

|

Accumulated |

|

Stockholders’ |

|

Noncontrolling |

|

Total |

| |||||||||||||||

|

|

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

paid-in capital |

|

deficit |

|

income (loss) |

|

deficit |

|

interests |

|

deficit |

| |||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

|

Balance at December 31, 2013 |

|

49,865 |

|

$ |

50 |

|

— |

|

$ |

— |

|

— |

|

$ |

— |

|

$ |

161,452 |

|

$ |

(349,269 |

) |

$ |

1,068 |

|

$ |

(186,699 |

) |

$ |

2,818 |

|

$ |

(183,881 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

|

Comprehensive (loss) income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

|

Net loss |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(253,985 |

) |

— |

|

|

|

|

|

|

| |||||||||

|

Net unrealized loss on marketable securities, net of tax |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(553 |

) |

|

|

|

|

|

| |||||||||

|

Total comprehensive (loss) income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(254,538 |

) |

2,456 |

|

(252,082 |

) | |||||||||

|

Distributions to stockholders |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(17,960 |

) |

— |

|

— |

|

(17,960 |

) |

— |

|

(17,960 |

) | |||||||||

|

Distributions to noncontrolling interests |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(3,567 |

) |

(3,567 |

) | |||||||||

|

Balance at December 31, 2014 |

|

49,865 |

|

$ |

50 |

|

— |

|

$ |

— |

|

— |

|

$ |

— |

|

$ |

143,492 |

|

$ |

(603,254 |

) |

$ |

515 |

|

$ |

(459,197 |

) |

$ |

1,707 |

|

$ |

(457,490 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

|

Combination share conversion |

|

23,723 |

|

24 |

|

15,512 |

|

16 |

|

64,449 |

|

64 |

|

130,530 |

|

297,846 |

|

(154 |

) |

428,326 |

|

(80,186 |

) |

348,140 |

| |||||||||

|

Comprehensive loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

|

Net loss |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(112,566 |

) |

— |

|

|

|

|

|

|

| |||||||||

|

Net unrealized gain on marketable securities, net of tax |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

270 |

|

|

|

|

|

|

| |||||||||

|

Total comprehensive loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(112,296 |

) |

(5,382 |

) |

(117,678 |

) | |||||||||

|

Share based compensation |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

24,347 |

|

— |

|

— |

|

24,347 |

|

— |

|

24,347 |

| |||||||||

|

Distributions to noncontrolling interests |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(2,839 |

) |

(2,839 |

) | |||||||||

|

Balance at March 31, 2015 |

|

73,588 |

|

$ |

74 |

|

15,512 |

|

$ |

16 |

|

64,449 |

|

$ |

64 |

|

$ |

298,369 |

|

$ |

(417,974 |

) |

$ |

631 |

|

$ |

(118,820 |

) |

$ |

(86,700 |

) |

$ |

(205,520 |

) |

See accompanying notes to the unaudited consolidated financial statements.

GENESIS HEALTHCARE, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(IN THOUSANDS)

(UNAUDITED)

|

|

|

Three months ended March 31, |

| ||||

|

|

|

2015 |

|

2014 |

| ||

|

|

|

|

|

|

| ||

|

Cash flows from operating activities: |

|

|

|

|

| ||

|

Net loss |

|

$ |

(118,250 |

) |

$ |

(43,982 |

) |

|

Adjustments to reconcile net loss to net cash (used in) provided by operating activities: |

|

|

|

|

| ||

|

Non-cash interest and leasing arrangements, net |

|

23,413 |

|

22,456 |

| ||

|

Other non-cash charges and gains, net |

|

(7,587 |

) |

3,178 |

| ||

|

Share based compensation |

|

25,373 |

|

— |

| ||

|

Depreciation and amortization |

|

60,077 |

|

49,151 |

| ||

|

Provision for losses on accounts receivable |

|

23,392 |

|

18,870 |

| ||

|

Equity in net (income) loss of unconsolidated affiliates |

|

(153 |

) |

44 |

| ||

|

Provision for deferred taxes |

|

(9,493 |

) |

(8,733 |

) | ||

|

Changes in assets and liabilities: |

|

|

|

|

| ||

|

Accounts receivable |

|

(43,860 |

) |

(17,559 |

) | ||

|

Accounts payable and other accrued expenses and other |

|

44,606 |

|

(10,607 |

) | ||

|

|

|

|

|

|

| ||

|

Total adjustments |

|

115,768 |

|

56,800 |

| ||

|

|

|

|

|

|

| ||

|

Net cash (used in) provided by operating activities |

|

(2,482 |

) |

12,818 |

| ||

|

|

|

|

|

|

| ||

|

Cash flows from investing activities: |

|

|

|

|

| ||

|

Capital expenditures |

|

(16,721 |

) |

(23,573 |

) | ||

|

Purchase of marketable securities |

|

(15,319 |

) |

(7,728 |

) | ||

|

Proceeds on maturity or sale of marketable securities |

|

10,158 |

|

9,718 |

| ||

|

Net change in restricted cash and equivalents |

|

(361 |

) |

(7,034 |

) | ||

|

Sale of investment in joint venture |

|

26,358 |

|

— |

| ||

|

Sales of assets |

|

1,263 |

|

— |

| ||

|

Other, net |

|

912 |

|

12 |

| ||

|

|

|

|

|

|

| ||

|

Net cash provided by (used in) investing activities |

|

6,290 |

|

(28,605 |

) | ||

|

|

|

|

|

|

| ||

|

Cash flows from financing activities: |

|

|

|

|

| ||

|

Borrowings under revolving credit facility |

|

146,500 |

|

139,000 |

| ||

|

Repayments under revolving credit facility |

|

(151,000 |

) |

(112,000 |

) | ||

|

Proceeds from issuance of long-term debt |

|

360,000 |

|

— |

| ||

|

Proceeds from tenant improvement draws under lease arrangements |

|

95 |

|

1,290 |

| ||

|

Repayment of long-term debt |

|

(330,627 |

) |

(3,255 |

) | ||

|

Debt issuance costs |

|

(17,777 |

) |

(3,853 |

) | ||

|

Distributions to noncontrolling interests |

|

(2,839 |

) |

(7,572 |

) | ||

|

|

|

|

|

|

| ||

|

Net cash provided by financing activities |

|

4,352 |

|

13,610 |

| ||

|

|

|

|

|

|

| ||

|

Net increase (decrease) in cash and equivalents |

|

8,160 |

|

(2,177 |

) | ||

|

Cash and equivalents: |

|

|

|

|

| ||

|

Beginning of period |

|

87,548 |

|

61,413 |

| ||

|

|

|

|

|

|

| ||

|

End of period |

|

$ |

95,708 |

|

$ |

59,236 |

|

|

|

|

|

|

|

| ||

|

Supplemental disclosure of cash flow information: |

|

|

|

|

| ||

|

Interest paid |

|

$ |

94,948 |

|

$ |

92,915 |

|

|

Taxes paid |

|

5,917 |

|

2,695 |

| ||

|

|

|

|

|

|

| ||

|

Non-cash financing activities: |

|

|

|

|

| ||

|

Capital leases |

|

$ |

— |

|

$ |

13,096 |

|

|

Financing obligations |

|

3,682 |

|

38,865 |

| ||

|

Assumption of long-term debt |

|

326,610 |

|

— |

| ||

See accompanying notes to the unaudited consolidated financial statements.

GENESIS HEALTHCARE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(1) General Information

Description of Business

Genesis Healthcare, Inc. is a healthcare services company that through its subsidiaries (collectively, the Company) owns and operates skilled nursing facilities, assisted living facilities, hospices, home health providers and a rehabilitation therapy business. The Company has an administrative service company that provides a full complement of administrative and consultative services that allows our affiliated operators and third-party operators with whom the Company contracts to better focus on delivery of healthcare services. The Company provides inpatient services through 511 skilled nursing, assisted living and behavioral health centers located in 34 states. Revenues of the Company’s owned, leased and otherwise consolidated centers constitute approximately 85% of its revenues.

The Company provides a range of rehabilitation therapy services, including speech pathology, physical therapy, occupational therapy and respiratory therapy. These services are provided by rehabilitation therapists and assistants employed or contracted at substantially all of the centers operated by the Company, as well as by contract to healthcare facilities operated by others. After the elimination of intercompany revenues, the rehabilitation therapy services business constitutes approximately 12% of the Company’s revenues.

The Company provides an array of other specialty medical services, including management services, physician services, staffing services, hospice and home health services, and other healthcare related services, which comprise the balance of the Company’s revenues.

Basis of Presentation

The accompanying consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles. In the opinion of management, the consolidated financial statements include all necessary adjustments for a fair presentation of the financial position and results of operations for the periods presented.

The accompanying unaudited consolidated financial statements have been prepared in accordance with the instructions for Form 10-Q of Regulation S-X and do not include all of the disclosures normally required by generally accepted accounting principles or those normally required in annual reports on Form 10-K. Accordingly, these financial statements should be read in conjunction with the audited consolidated financial statements of the Company for the year ended December 31, 2014 filed with the Securities and Exchange Commission on Form 8-K/A on February 26, 2015. The accompanying consolidated balance sheet at December 31, 2014 was derived from audited consolidated financial statements, but does not include all disclosures required by generally accepted accounting principles.

Certain prior year amounts have been reclassified to conform to current period presentation, the effect of which was not material. The Company’s membership interest at December 31, 2014 has been recast as common stock and additional paid-in capital.

The Company’s financial position at March 31, 2015 includes the impact of the Combination (as defined in Note 3 — “Significant Transactions and Events — The Combination with Skilled”), which has been accounted for as a reverse acquisition using the acquisition method effective February 2, 2015.

Recent Accounting Pronouncements

In May 2014, the Financial Accounting Standards Board (the FASB) issued ASU No. 2014-09, Revenue from Contracts with Customers, (ASU 2014-09) which changes the requirements for recognizing revenue when entities enter into contracts with customers. Under ASU 2014-09, an entity will recognize revenue when it transfers promised goods or services to customers in an amount that reflects what it expects in exchange for the goods or services. It also requires more detailed disclosures to enable users of financial statements to understand the nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers. The adoption of ASU 2014-09 is effective for annual and interim periods beginning after December 15, 2017 and early adoption is not permitted. The Company is still evaluating the effect, if any, ASU 2014-09 will have on the Company’s consolidated financial condition and results of operations.

GENESIS HEALTHCARE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

In April 2015, the FASB issued ASU No. 2015-03, Simplifying the Presentation of Debt Issuance Costs, (ASU 2015-03). This ASU requires an entity to present debt issuance costs as a direct deduction from the carrying amount of the related debt liability, consistent with debt discounts. The costs will continue to be amortized to interest expense using the effective interest method. The adoption of ASU 2015-03 is effective for fiscal years beginning after December 15, 2015, and interim periods within those fiscal years, with early adoption permitted. This ASU requires retrospective application to all prior periods presented in the financial statements. The adoption of ASU No. 2015-03 is not expected to have a material impact on the Company’s consolidated financial condition and results of operations.

(2) Certain Significant Risks and Uncertainties

Revenue Sources

The Company receives revenues from Medicare, Medicaid, private insurance, self-pay residents, other third-party payors and long-term care facilities that utilize its rehabilitation therapy and other services. The Company’s inpatient services segment derives approximately 79% of its revenue from Medicare and various state Medicaid programs.

The sources and amounts of the Company’s revenues are determined by a number of factors, including licensed bed capacity and occupancy rates of its inpatient facilities, the mix of patients and the rates of reimbursement among payors. Likewise, payment for ancillary medical services, including services provided by the Company’s rehabilitation therapy services business, varies based upon the type of payor and payment methodologies. Changes in the case mix of the patients as well as payor mix among Medicare, Medicaid and private pay can significantly affect the Company’s profitability.

It is not possible to quantify fully the effect of legislative changes, the interpretation or administration of such legislation or other governmental initiatives on the Company’s business and the business of the customers served by the Company’s rehabilitation therapy business. The potential impact of reforms to the United States healthcare system, including potential material changes to the delivery of healthcare services and the reimbursement paid for such services by the government or other third party payors, is uncertain at this time. Accordingly, there can be no assurance that the impact of any future healthcare legislation or regulation will not adversely affect the Company’s business. There can be no assurance that payments under governmental and private third-party payor programs will be timely, will remain at levels similar to present levels or will, in the future, be sufficient to cover the costs allocable to patients eligible for reimbursement pursuant to such programs. The Company’s financial condition and results of operations are and will continue to be affected by the reimbursement process, which in the healthcare industry is complex and can involve lengthy delays between the time that revenue is recognized and the time that reimbursement amounts are settled.

Laws and regulations governing the Medicare and Medicaid programs, and our business generally, are complex and are often subject to a number of ambiguities in their application and interpretation. The Company believes that it is in substantial compliance with all applicable laws and regulations. However, from time to time the Company and its affiliates are subject to pending or threatened lawsuits and investigations involving allegations of potential wrongdoing, some of which may be material or involve significant costs to resolve and/or defend against, or may lead to other adverse effects on the Company and its affiliates including, but not limited to, fines, penalties and exclusion from participation in the Medicare and/or Medicaid programs. Our business is subject to a number of other known and unknown risks and uncertainties, which are discussed in Item 1A (Risk Factors) of our Annual Report on Form 10-K for the fiscal year ended December 31, 2014, which was filed with the Securities and Exchange Commission on February 20, 2015.

GENESIS HEALTHCARE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(3) Significant Transactions and Events

The Combination with Skilled

On August 18, 2014, Skilled Healthcare Group, Inc., a Delaware corporation (Skilled) entered into a Purchase and Contribution Agreement with FC-GEN Operations Investment, LLC (FC-GEN) pursuant to which the businesses and operations of FC-GEN and Skilled were combined (the Combination). On February 2, 2015, the Combination was completed.

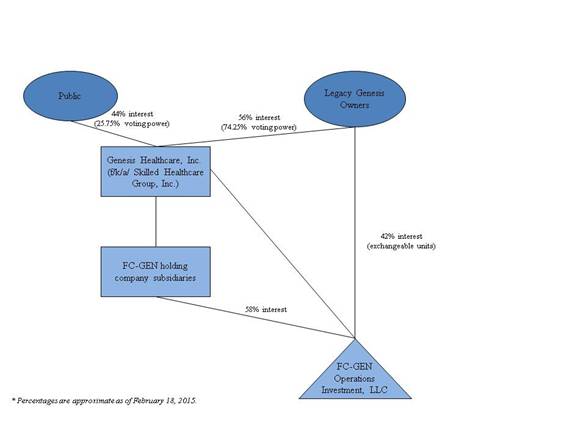

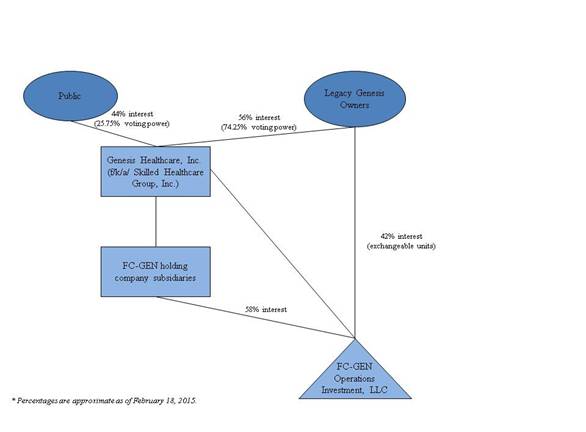

The following diagram depicts the organizational structure of the Company at the time of the Combination:

Upon completion of the Combination, the Company began operating under the name Genesis Healthcare, Inc. and the Class A common stock of the combined company continues to trade on the NYSE under the symbol “GEN”. Upon the closing of the Combination, the former owners of FC-GEN held 74.25% of the economic interests in the combined entity and the former shareholders of Skilled held the remaining 25.75% of the economic interests in the combined entity post-transaction, in each case on a fully-diluted, as-exchanged and as-converted basis. Under applicable accounting standards, FC-GEN was the accounting acquirer in the Combination, which was treated as a reverse acquisition. The acquisition method has been applied to the Combination based on Skilled’s stock price (level 1 valuation technique - quoted prices in active markets for identical assets or liabilities) as of the acquisition date. The consideration has been

GENESIS HEALTHCARE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

allocated to the legacy Skilled business that was acquired on the acquisition date with the excess consideration over the fair value of the net assets acquired recognized as goodwill. As of the effective date of the Combination, FC-GEN’s assets and liabilities remained at their historical costs.

Because FC-GEN’s pre-transaction owners held an approximately 58% direct controlling interest in Skilled and a 74.25% economic and voting interest in the combined company, FC-GEN is considered to be the acquirer of Skilled for accounting purposes. Following the closing of the Combination, the combined results of Skilled and FC-GEN are consolidated with approximately 42% direct noncontrolling economic interest shown as noncontrolling interest in the financial statements of the combined entity. The 42% direct noncontrolling economic interest is in the form of membership units that are exchangeable on a 1 to 1 basis to public shares of the Company. The 42% direct noncontrolling economic interest will continue to decrease as membership units are converted to public shares of the Company.

Consideration Price Allocation

The total Skilled consideration price of $348.1 million was allocated to Skilled’s net tangible and identifiable intangible assets based upon the estimated fair values at February 2, 2015. The excess of the consideration price over the estimated fair value of the net tangible and identifiable intangible assets was recorded as goodwill. The allocation of the consideration price to property, plant and equipment, identifiable intangible assets and deferred income taxes was based upon valuation data and estimates. The Company has not finalized the analysis of the consideration price allocation and will continue its review during the measurement period. The aggregate goodwill arising from the Combination is based upon the expected future cash flows of the Skilled operations. Goodwill recognized from the Combination is the result of (i) the expected savings to be realized from achieving certain economies of scale and (ii) anticipated long-term improvements in Skilled’s core businesses. The Company has estimated $79.8 million of pre-existing Skilled goodwill that is deductible for income tax purposes related to the Combination.

The consideration price and related allocation are summarized as follows (in thousands):

|

Accounts receivable |

|

$ |

128,782 |

|

|

Deferred income taxes and other current assets |

|

42,533 |

| |

|

Property, plant and equipment |

|

495,692 |

| |

|

|

|

|

|

Weighted |

| |

|

Identifiable intangible assets: |

|

|

|

|

| |

|

Management contracts |

|

30,900 |

|

3.5 |

| |

|

Customer relationships |

|

13,400 |

|

10.0 |

| |

|

Favorable lease contracts |

|

18,220 |

|

12.8 |

| |

|

Trade names |

|

3,400 |

|

Indefinite |

| |

|

Total identifiable intangible assets |

|

65,920 |

|

|

| |

|

Deferred income taxes and other assets |

|

59,196 |

|

|

| |

|

Accounts payable and other current liabilities |

|

(115,292 |

) |

|

| |

|

Long-term debt, including amounts due within one year |

|

(428,342 |

) |

|

| |

|

Unfavorable lease contracts |

|

(11,480 |

) |

|

| |

|

Deferred income taxes and other long-term liabilities |

|

(142,574 |

) |

|

| |

|

Total identifiable net assets |

|

94,435 |

|

|

| |

|

Goodwill |

|

253,705 |

|

|

| |

|

Net assets |

|

$ |

348,140 |

|

|

|

GENESIS HEALTHCARE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

Pro forma information

The acquired business contributed net revenues of $152.7 million and a net income of $5.3 million, to the Company for the period from February 1, 2015 to March 31, 2015. The unaudited pro forma net effect of the Combination assuming the acquisition occurred as of January 1, 2014 is as follows (in thousands, except per share amounts):

|

|

|

Pro Forma Three months ended March 31, |

| ||||

|

|

|

2015 |

|

2014 |

| ||

|

|

|

|

|

|

| ||

|

Revenues |

|

$ |

1,414,289 |

|

$ |

1,393,844 |

|

|

Loss attributable to Genesis Healthcare, Inc. |

|

(16,317 |

) |

(17,568 |

) | ||

|

|

|

|

|

|

| ||

|

Loss per share from continuing operations attributable to Genesis Healthcare, Inc. |

|

|

|

|

| ||

|

Basic |

|

(0.18 |

) |

(0.16 |

) | ||

|

Diluted |

|

(0.19 |

) |

(0.22 |

) | ||

The unaudited pro forma financial data have been derived by combining the historical financial results of the Company and the operations acquired in the Combination for the periods presented. The unaudited pro forma financial data includes transaction and financing costs totaling $84.7 million incurred by both the Company and Skilled in connection with the Combination. These costs have been eliminated from the results of operations for the three months ended March 31, 2015 for purposes of the pro forma financial presentation.

Related Party Transactions

On March 31, 2015, the Company sold its investment in FC PAC Holdings, LLC (FC PAC), an unconsolidated joint venture in which it held an approximate 5.4% interest, for $26.4 million. The Company recognized a gain on sale of $8.4 million recorded as other income on the statement of operations. FC PAC ownership includes affiliates of Formation Capital, a private equity sponsor of the Company prior to the Combination, and also represented by members of the Company’s board of directors.

GENESIS HEALTHCARE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(4) Earnings (Loss) Per Share

The Company has three classes of common stock. Classes A and B are identical in economic and voting interests. Class C has a 1:1 voting ratio with the other two classes, representing the voting interests of the approximate 42% noncontrolling interest of the legacy FC-GEN owners. See Note 3 — “Significant Transactions and Events — the Combination with Skilled”. Class C common stock is a participating security; however, it shares in a de minimis economic interest and is therefore excluded from the denominator of the basic earnings per share calculation.

Basic net loss per share was computed by dividing net loss by the weighted-average number of outstanding common shares for the period. Diluted earnings per share is computed by dividing loss plus the effect of assumed conversions (if applicable) by the weighted-average number of outstanding shares after giving effect to all potential dilutive common stock, including options, warrants, common stock subject to repurchase and convertible preferred stock, if any.

The computations of basic and diluted loss per share are consistent with any potentially dilutive adjustments to the numerator or denominator being anti-dilutive and therefore excluded from the dilutive calculation. A reconciliation of the numerator and denominator used in the calculation of basic and diluted net income per common share follows (in thousands, except per share data):

|

|

|

Three Months Ended March 31, |

| ||||

|

|

|

2015 |

|

2014 |

| ||

|

|

|

|

|

|

| ||

|

Numerator: |

|

|

|

|

| ||

|

Loss from continuing operations |

|

$ |

(118,362 |

) |

$ |

(40,788 |

) |

|

Less: Net (loss) income attributable to noncontrolling interests |

|

(5,684 |

) |

185 |

| ||

|

Loss from continuing operations attributable to Genesis Healthcare, Inc. |

|

(112,678 |

) |

(40,973 |

) | ||

|

Income (loss) from discontinued operations, net of income tax |

|

112 |

|

(3,194 |

) | ||

|

Net loss attributable to Genesis Healthcare, Inc. |

|

$ |

(112,566 |

) |

$ |

(44,167 |

) |

|

|

|

|

|

|

| ||

|

Denominator: |

|

|

|

|

| ||

|

Weighted average shares outstanding for basic and diluted net loss per share |

|

75,234 |

|

49,865 |

| ||

|

|

|

|

|

|

| ||

|

Basic and diluted net loss per common share: |

|

|

|

|

| ||

|

Loss from continuing operations attributable to Genesis Healthcare, Inc. |

|

$ |

(1.50 |

) |

$ |

(0.82 |

) |

|

Income (loss) from discontinued operations |

|

— |

|

(0.06 |

) | ||

|

Net loss attributable to Genesis Healthcare, Inc. |

|

$ |

(1.50 |

) |

$ |

(0.88 |

) |

The following were excluded from net income attributed to Genesis Healthcare, Inc. and the weighted-average diluted shares computation for the three months ended March 31, 2015 and 2014, as their inclusion would have been anti-dilutive (shares in thousands):

GENESIS HEALTHCARE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

|

|

|

Three Months Ended March 31, |

| ||||||||

|

|

|

2015 |

|

2014 |

| ||||||

|

|

|

Net loss |

|

|

|

Net loss |

|

|

| ||

|

|

|

attributed to |

|

|

|

attributed to |

|

|

| ||

|

|

|

Genesis Healthcare, |

|

Anti-dillutive |

|

Genesis Healthcare, |

|

Anti-dillutive |

| ||

|

|

|

Inc. |

|

shares |

|

Inc. |

|

shares |

| ||

|

|

|

|

|

|

|

|

|

|

| ||

|

Exchange of restricted stock units of noncontrolling interests |

|

$ |

(4,217 |

) |

41,534 |

|

$ |

— |

|

— |

|

Because the Company is in a net loss position for the three months ended March 31, 2015, the combined impact of the assumed conversion of the approximate 42% noncontrolling interest to common stock and the related tax implications, are anti-dilutive to EPS. As of March 31, 2015 there were 64,449,380 units attributed to the noncontrolling interests outstanding. See Note 3 — “Significant Transactions and Events — the Combination with Skilled.” There were no convertible instruments issued or outstanding as of March 31, 2014 that could be potentially dilutive to net loss for that period.

(5) Segment Information

The Company has three reportable operating segments: (i) inpatient services; (ii) rehabilitation therapy services; and (iii) other services. For additional information on these reportable segments see Note 1 — “General Information — Description of Business.”

GENESIS HEALTHCARE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

A summary of the Company’s unaudited condensed consolidated statement of operations follows:

|

|

|

Three months ended March 31, 2015 |

| ||||||||||||||||

|

|

|

Inpatient |

|

Rehabilitation |

|

Other Services |

|

Corporate |

|

Eliminations |

|

Consolidated |

| ||||||

|

|

|

(In thousands) |

| ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Net revenues |

|

$ |

1,145,009 |

|

$ |

263,051 |

|

$ |

52,336 |

|

$ |

210 |

|

$ |

(117,605 |

) |

$ |

1,343,001 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Salaries, wages and benefits |

|

542,692 |

|

214,797 |

|

33,244 |

|

29,205 |

|

— |

|

819,938 |

| ||||||

|

Other operating expenses |

|

419,306 |

|

19,226 |

|

15,074 |

|

12,283 |

|

(117,604 |

) |

348,285 |

| ||||||

|

Lease expense |

|

35,528 |

|

41 |

|

459 |

|

391 |

|

— |

|

36,419 |

| ||||||

|

Depreciation and amortization expense |

|

48,225 |

|

2,867 |

|

362 |

|

8,479 |

|

— |

|

59,933 |

| ||||||

|

Interest expense |

|

103,654 |

|

1 |

|

10 |

|

17,771 |

|

(123 |

) |

121,313 |

| ||||||

|

Loss on extinguishment of debt |

|

— |

|

— |

|

— |

|

3,234 |

|

— |

|

3,234 |

| ||||||

|

Investment income |

|

(358 |

) |

— |

|

— |

|

(181 |

) |

123 |

|

(416 |

) | ||||||

|

Other income |

|

|

|

— |

|

— |

|

(7,611 |

) |

— |

|

(7,611 |

) | ||||||

|

Transaction costs |

|

371 |

|

— |

|

— |

|

85,698 |

|

— |

|

86,069 |

| ||||||

|

Equity in net (income) loss of unconsolidated affiliates |

|

(309 |

) |

— |

|

— |

|

(220 |

) |

376 |

|

(153 |

) | ||||||

|

(Loss) income before income tax benefit |

|

(4,100 |

) |

26,119 |

|

3,187 |

|

(148,839 |

) |

(377 |

) |

(124,010 |

) | ||||||

|

Income tax benefit |

|

— |

|

— |

|

— |

|

(5,648 |

) |

— |

|

(5,648 |

) | ||||||

|

(Loss) income from continuing operations |

|

$ |

(4,100 |

) |

$ |

26,119 |

|

$ |

3,187 |

|

$ |

(143,191 |

) |

$ |

(377 |

) |

$ |

(118,362 |

) |

|

|

|

Three months ended March 31, 2014 |

| ||||||||||||||||

|

|

|

Inpatient |

|

Rehabilitation |

|

Other Services |

|

Corporate |

|

Eliminations |

|

Consolidated |

| ||||||

|

|

|

(In thousands) |

| ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Net revenues |

|

$ |

1,000,217 |

|

$ |

255,324 |

|

$ |

35,814 |

|

$ |

137 |

|

$ |

(104,948 |

) |

$ |

1,186,544 |

|

|

Salaries, wages and benefits |

|

491,072 |

|

206,149 |

|

24,039 |

|

25,230 |

|

— |

|

746,490 |

| ||||||

|

Other operating expenses |

|

357,623 |

|

18,930 |

|

10,460 |

|

10,633 |

|

(104,948 |

) |

292,698 |

| ||||||

|

Lease expense |

|

32,320 |

|

44 |

|

213 |

|

222 |

|

— |

|

32,799 |

| ||||||

|

Depreciation and amortization expense |

|

40,220 |

|

2,787 |

|

250 |

|

4,243 |

|

— |

|

47,500 |

| ||||||

|

Interest expense |

|

96,460 |

|

1 |

|

209 |

|

12,203 |

|

(123 |

) |

108,750 |

| ||||||

|

Loss on extinguishment of debt |

|

— |

|

— |

|

— |

|

499 |

|

— |

|

499 |

| ||||||

|

Investment income |

|

(424 |

) |

— |

|

— |

|

(642 |

) |

123 |

|

(943 |

) | ||||||

|

Transaction costs |

|

— |

|

— |

|

— |

|

2,249 |

|

— |

|

2,249 |

| ||||||

|

Equity in net (income) loss of unconsolidated affiliates |

|

(290 |

) |

— |

|

— |

|

— |

|

334 |

|

44 |

| ||||||

|

(Loss) income before income tax benefit |

|

(16,764 |

) |

27,413 |

|

643 |

|

(54,500 |

) |

(334 |

) |

(43,542 |

) | ||||||

|

Income tax benefit |

|

— |

|

— |

|

— |

|

(2,754 |

) |

— |

|

(2,754 |

) | ||||||

|

(Loss) income from continuing operations |

|

$ |

(16,764 |

) |

$ |

27,413 |

|

$ |

643 |

|

$ |

(51,746 |

) |

$ |

(334 |

) |

$ |

(40,788 |

) |

GENESIS HEALTHCARE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

The following table presents the segment assets as of March 31, 2015 compared to December 31, 2014 (in thousands):

|

|

|

March 31, 2015 |

|

December 31, 2014 |

| ||

|

|

|

|

|

|

| ||

|

Inpatient services |

|

$ |

5,239,633 |

|

$ |

4,381,044 |

|

|

Rehabilitation services |

|

416,652 |

|

322,268 |

| ||

|

Other services |

|

93,216 |

|

44,814 |

| ||

|

Corporate and eliminations |

|

281,855 |

|

393,282 |

| ||

|

Total assets |

|

$ |

6,031,356 |

|

$ |

5,141,408 |

|

(6) Property and Equipment

Property and equipment consisted of the following as of March 31, 2015 and December 31, 2014 (in thousands):

|

|

|

March 31, 2015 |

|

December 31, 2014 |

| ||

|

|

|

|

|

|

| ||

|

Land, buildings and improvements |

|

$ |

594,970 |

|

$ |

225,536 |

|

|

Capital lease land, buildings and improvements |

|

913,814 |

|

910,820 |

| ||

|

Financing obligation land, buildings and improvements |

|

2,549,389 |

|

2,526,792 |

| ||

|

Equipment, furniture and fixtures |

|

411,446 |

|

276,983 |

| ||

|

Construction in progress |

|

34,150 |

|

55,295 |

| ||

|

|

|

|

|

|

| ||

|

Gross property and equipment |

|

4,503,769 |

|

3,995,426 |

| ||

|

Less: accumulated depreciation |

|

(555,828 |

) |

(502,176 |

) | ||

|

|

|

|

|

|

| ||

|

Net property and equipment |

|

$ |

3,947,941 |

|

$ |

3,493,250 |

|

GENESIS HEALTHCARE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(7) Long-Term Debt

Long-term debt at March 31, 2015 and December 31, 2014 consisted of the following (in thousands):

|

|

|

March 31, 2015 |

|

December 31, 2014 |

| ||

|

|

|

|

|

|

| ||

|

Revolving credit facility |

|

$ |

250,000 |

|

$ |

254,500 |

|

|

Term loan facility, net of original issue discount of $10,400 at March 31, 2015 and $11,375 at December 31, 2014 |

|

219,964 |

|

219,297 |

| ||

|

Real estate bridge loan |

|

360,000 |

|

— |

| ||

|

HUD insured loans |

|

100,845 |

|

— |

| ||

|

Mortgages and other secured debt (recourse) |

|

13,370 |

|

14,488 |

| ||

|

Mortgages and other secured debt (non recourse) |

|

49,478 |

|

49,961 |

| ||

|

|

|

|

|

|

| ||

|

|

|

993,657 |

|

538,246 |

| ||

|

Less: |

|

|

|

|

| ||

|

Current installments of long-term debt |

|

(12,746 |

) |

(12,518 |

) | ||

|

|

|

|

|

|

| ||

|

Long-term debt |

|

$ |

980,911 |

|

$ |

525,728 |

|

Revolving Credit Facilities

In connection with the Combination, on February 2, 2015 the Company entered into new revolving credit facilities and terminated its former revolving credit facilities. The new revolving credit facilities (the Revolving Credit Facilities) consist of a senior secured, asset-based revolving credit facility of up to $550 million under three separate tranches: Tranche A-1, Tranche A-2 and FILO Tranche. Interest accrues at a per annum rate equal to either (x) a base rate (calculated as the highest of the (i) prime rate, (ii) the federal funds rate plus 3.00%, or (iii) LIBOR plus the excess of the applicable margin between LIBOR loans and base rate loans) plus an applicable margin or (y) LIBOR plus an applicable margin. The applicable margin is based on the level of commitments for all three tranches, and in regards to LIBOR loans (i) for Tranche A-1 ranges from 3.25% to 2.75%; (ii) for Tranche A-2 ranges from 3.00% to 2.50%; and (iii) for FILO Tranche is 5.00%. The Revolving Credit Facilities mature on February 2, 2020, provided that if the Term Loan Facility (defined below) or the Real Estate Bridge Loan (defined below) is not refinanced with longer term debt or their terms not extended prior to their current maturities of December 4, 2017 and August 27, 2017, respectively, the Revolving Credit Facilities will mature 90 days prior to such maturity date, as applicable. Borrowing levels under the Revolving Credit Facilities are limited to a borrowing base that is computed based upon the level of the Company’s eligible accounts receivable, as defined. In addition to paying interest on the outstanding principal borrowed under the Revolving Credit Facilities, the Company is required to pay a commitment fee to the lenders for any unutilized commitments. The commitment fee rate ranges from 0.375% per annum to 0.50% depending upon the level of unused commitment.

GENESIS HEALTHCARE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

Borrowings and interest rates under the three tranches were as follows at March 31, 2015:

|

|

|

|

|

Weighted |

| |

|

|

|

|

|

Average |

| |

|

Revolving credit facility |

|

Borrowings |

|

Interest |

| |

|

FILO tranche |

|

$ |

25,000 |

|

5.36 |

% |

|

Tranche A-1 |

|

150,000 |

|

3.28 |

% | |

|

Tranche A-2 |

|

75,000 |

|

2.76 |

% | |

|

|

|

$ |

250,000 |

|

3.33 |

% |

As of March 31, 2015, the Company had outstanding borrowings under the Revolving Credit Facilities of $250.0 million and had $109.2 million of drawn letters of credit securing insurance and lease obligations, leaving the Company with approximately $165.8 million of available borrowing capacity under the revolving credit facilities.

Term Loan Facility

Prior to the Combination, FC-GEN and certain of its subsidiaries became a party to a five-year term loan facility (the Term Loan Facility). The Term Loan Facility is secured by a first priority lien on the membership interests in the Company and on substantially all of the Company’s and its subsidiaries’ assets other than collateral held on a first priority basis by the Revolving Credit Facilities lender. Borrowings under the Term Loan Facility bear interest at a rate per annum equal to the applicable margin plus, at the Company’s option, either (x) LIBOR or (y) a base rate determined by reference to the highest of (i) the lender defined prime rate, (ii) the federal funds rate effective plus one half of one percent and (iii) LIBOR described in subclause (x) plus 1.0%. LIBOR based loans are subject to an interest rate floor of 1.5% and base rate loans are subject to a floor of 2.5%. The Term Loan Facility matures on December 4, 2017. On September 25, 2014, FC-GEN entered into an amendment to the Term Loan Facility providing for changes to the financial covenants and other provisions allowing for and accommodating the Combination. On February 2, 2015, the amendment to the Term Loan Facility became effective. The Term Loan Facility currently has an outstanding principal balance of $230.4 million. Base rate borrowings under the Term Loan Facility bore interest of approximately 10.75% at March 31, 2015. One-month LIBOR borrowings under the Term Loan Facility bore interest of approximately 10.0% at March 31, 2015.

Principal payments for the three months ended March 31, 2015 were $0.3 million. The Term Loan Facility amortizes at a rate of 5% per annum. The lenders have the right to elect ratable principal payments or defer principal recoupment until the end of the term.

Real Estate Bridge Loan

In connection with the Combination on February 2, 2015, the Company entered into a $360.0 million real estate bridge loan (the Real Estate Bridge Loan), which is secured by a mortgage lien on the real property of 67 facilities and a second lien on certain receivables of the operators of such facilities. The Real Estate Bridge Loan is subject to a 24-month term with two extension options of 90-days each and accrues interest at a rate equal to LIBOR, plus 6.75%, plus an additional margin that ranges up to 7.00% based on the aggregate number of days the Real Estate Bridge Loan is outstanding. The interest rate is also subject to a LIBOR interest rate floor of 0.5%. The Real Estate Bridge Loan bore interest of 7.25% at March 31, 2015. The Real Estate Bridge Loan is subject to payments of interest only during the term with a balloon payment due at maturity, provided, that to the extent the subsidiaries receive any net proceeds from the sale and / or refinance of the underlying facilities such net proceeds are required to be used to repay the outstanding

GENESIS HEALTHCARE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

principal balance of the Real Estate Bridge Loan. The proceeds of the Real Estate Bridge Loan were used to repay Skilled’s first lien senior secured term loan, repay Skilled’s mortgage loans and asset based revolving credit facility with MidCap Financial with excess proceeds used to fund direct costs of the Combination with the Company. The Real Estate Bridge Loan has an outstanding principal balance of $360.0 million at March 31, 2015.

The Revolving Credit Facilities, the Term Loan and Real Estate Bridge Loan (collectively, the Credit Facilities) each contain a number of restrictive covenants that, among other things, impose operating and financial restrictions on the Company and its subsidiaries. The Credit Facilities also require the Company to meet defined financial covenants, including interest coverage ratio, a maximum consolidated net leverage ratio and a minimum consolidated fixed charge coverage ratio, all as defined in the applicable agreements. The Credit Facilities also contain other customary covenants and events of default. At March 31, 2015, the Company was in compliance with its covenants.

HUD Insured Loans

In connection with the Combination on February 2, 2015, the Company assumed certain obligations under 10 loans insured by HUD. The loans are secured by 10 of the Company’s skilled nursing facilities that were acquired in the Combination. The HUD insured loans have an average all in interest rate of approximately 5.3% and an original amortization term of 30 to 35 years. As of March 31, 2015 the HUD insured loans have a combined aggregate principal balance of $100.8 million including a $14.9 million debt premium established in purchase accounting in connection with the Combination.

These mortgages have an average remaining term of 33 years with fixed interest rates ranging from 3.4% to 4.6% and a weighted average interest rate of 4.2%. Depending on the mortgage agreement, prepayments are generally allowed only after 12 months from the inception of the mortgage. Prepayments are subject to a penalty of 10% of the remaining principal balances in the first year and the prepayment penalty decreases each subsequent year by 1% until no penalty is required. Any further HUD insured mortgages will require additional HUD approval.

All HUD-insured mortgages are non-recourse loans to the Company. All mortgages are subject to HUD regulatory agreements that require escrow reserve funds to be deposited with the loan servicer for mortgage insurance premiums, property taxes, insurance and for capital replacement expenditures. As of March 31, 2015, the Company has total escrow reserve funds of $4.9 million with the loan servicer that are reported within prepaid expenses.

GENESIS HEALTHCARE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

Other Debt

Mortgages and other secured debt (recourse). The Company carries two mortgage loans on two of its corporate office buildings. The Company has an outstanding note payable for an acquired facility. The loans are secured by the underlying real property and have fixed or variable rates of interest ranging from 1.9% to 6.0% at March 31, 2015, with maturity dates ranging from 2018 to 2019.

Mortgages and other secured debt (non-recourse). Loans are carried by certain of the Company’s consolidated joint ventures. The loans consist principally of revenue bonds and secured bank loans. Loans are secured by the underlying real and personal property of individual facilities and have fixed or variable rates of interest ranging from 2.5% to 21.9% at March 31, 2015, with maturity dates ranging from 2018 to 2036. Loans are labeled “non-recourse” because neither the Company nor any of its wholly owned subsidiaries is obligated to perform under the respective loan agreements.

The maturity of total debt of $993.7 million at March 31, 2015 is as follows (in thousands):

|

Twelve months ending March 31, |

|

|

| |

|

2016 |

|

$ |

12,829 |

|

|

2017 |

|

372,972 |

| |

|

2018 |

|

218,687 |

| |

|

2019 |

|

13,842 |

| |

|

2020 |

|

254,380 |

| |

|

Thereafter |

|

120,947 |

| |

|

Total debt payments |

|

$ |

993,657 |

|

(8) Leases and Lease Commitments

The Company leases certain facilities under capital and operating leases. Future minimum payments for the next five years and thereafter under such leases at March 31, 2015 are as follows (in thousands):

|

Twelve months ending March 31, |

|

Capital Leases |

|

Operating Leases |

| ||

|

|

|

|

|

|

| ||

|

2016 |

|

$ |

91,697 |

|

$ |

143,415 |

|

|

2017 |

|

93,871 |

|

143,002 |

| ||

|

2018 |

|

96,088 |

|

136,130 |

| ||

|

2019 |

|

98,455 |

|

132,616 |

| ||

|

2020 |

|

100,924 |

|

131,259 |

| ||

|

Thereafter |

|

3,027,741 |

|

373,463 |

| ||

|

Total future minimum lease payments |

|

3,508,776 |

|

$ |

1,059,885 |

| |

|

Less amount representing interest |

|

(2,500,217 |

) |

|

| ||

|

Capital lease obligation |

|

1,008,559 |

|

|

| ||

|

Less current portion |

|

(3,004 |

) |

|

| ||

|

Long-term capital lease obligation |

|

$ |

1,005,555 |

|

|

| |

GENESIS HEALTHCARE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

Capital Lease Obligations

The capital lease obligations represent the present value of minimum lease payments under such capital lease and cease use arrangements and bear imputed interest at rates ranging from 3.5% to 12.8% at March 31, 2015, and mature at dates ranging from 2015 to 2045.

Deferred Lease Balances

At March 31, 2015 and December 31, 2014, the Company had $64.1 million and $47.8 million, respectively, of favorable leases net of accumulated amortization, included in other identifiable intangible assets, and $41.3 million and $31.4 million, respectively, of unfavorable leases net of accumulated amortization included in other long-term liabilities on the consolidated balance sheet. Favorable and unfavorable lease assets and liabilities, respectively, arise through the acquisition of leases in place which requires those contracts be recorded at their then fair value. The fair value of a lease is determined through a comparison of the actual rental rate with rental rates prevalent for similar assets in similar markets. A favorable lease asset to the Company represents a rental stream that is below market, and conversely an unfavorable lease is one with cost above market rates. These assets and liabilities amortize as lease expense over the remaining term of the respective leases on a straight-line basis. At March 31, 2015 and December 31, 2014, the Company had $21.8 million and $20.6 million, respectively, of deferred straight-line rent balances included in other long-term liabilities on the consolidated balance sheet.

Lease Covenants

Certain lease agreements contain a number of restrictive covenants that, among other things and subject to certain exceptions, impose operating and financial restrictions on the Company and its subsidiaries. These leases also require the Company to meet defined financial covenants, including a minimum level of consolidated liquidity, a maximum consolidated net leverage ratio, a minimum consolidated fixed charge coverage and a minimum level of tangible net worth. At March 31, 2015, the Company was in compliance with its covenants under its lease arrangements.

In connection with the Combination on February 2, 2015, the Company and certain of its lessors amended the existing lease agreements. These amendments modified certain financial covenants to reflect the combined company. There were no other significant changes to the lease agreements in the reporting period.

GENESIS HEALTHCARE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(9) Financing Obligation

Future minimum payments for the next five years and thereafter under leases classified as financing obligations at March 31, 2015 are as follows (in thousands):

|

Twelve months ending March 31, |

|

|

| |

|

|

|

|

| |

|

2016 |

|

$ |

262,053 |

|

|

2017 |

|

270,608 |

| |

|

2018 |

|

278,319 |

| |

|

2019 |

|

286,253 |

| |

|

2020 |

|

294,241 |

| |

|

Thereafter |

|

9,887,841 |

| |

|

Total future minimum lease payments |

|

11,279,315 |

| |

|

Less amount representing interest |

|

(8,349,219 |

) | |

|

Financing obligation |

|

$ |

2,930,096 |

|

|

Less current portion |

|

(1,098 |

) | |

|

Long-term financing obligation |

|

$ |

2,928,998 |

|

(10) Income Taxes

Upon completion of the Combination, the Company effectively owns 58% of FC-GEN, an entity taxed as a partnership for U.S. income tax purposes. This is the Company’s only source of taxable income. The transaction did not materially impact the percentage of pre-tax income taxed as corporate income.

For the three months ended March 31, 2015, the Company recorded an income tax benefit of $5.6 million from continuing operations representing an effective tax rate of 4.6% compared to an income tax benefit of $2.8 million from continuing operations, representing an effective tax rate of 6.3% for the same period in 2014. The 1.7% decrease in the effective tax rate is attributable to a higher amount of projected U.S. federal tax credits for the 2015 tax year and the write-off of a portion of deferred tax assets on U.S. federal and state net operating losses. The write-off is a result of a more restrictive change of ownership limitation under IRC Section 382 by which a taxpayer is limited to a certain amount of net operating losses it can utilize in a given tax year.

Exchange Rights and Tax Receivable Agreement

Following the Combination, the owners of FC-GEN will have the right to exchange their membership interests in FC-GEN for shares of Class A Common Stock of the Company or cash, at the Company’s option. As a result of such exchanges, the Company’s membership interest in FC-GEN will increase and its purchase price will be reflected in its share of the tax basis of FC-GEN’s tangible and intangible assets. Any resulting increases in tax basis are likely to increase tax depreciation and amortization deductions and, therefore, reduce the amount of income tax the Company would otherwise be required to pay in the future. Any such increase would also decrease gain (or increase loss) on future dispositions of the effected assets.

Concurrent with the Combination, the Company entered into a tax receivable agreement (TRA) with the owners of FC-GEN. The agreement provides for the payment by the Company to the owners of FC-GEN of 90% of the cash savings, if any, in U.S. federal, state and local income tax that the Company actually realizes as a result of (i) the increases in tax

GENESIS HEALTHCARE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

basis attributable to the owners of FC-GEN and (ii) tax benefits related to imputed interest deemed to be paid by the Company as a result of the TRA. Under the TRA, the benefits deemed realized by the Company as a result of the increase in tax basis attributable to the owners of FC-GEN generally will be computed by comparing the actual income tax liability of the Company to the amount of such taxes that the Company would have been required to pay had there been no such increase in tax basis.

Estimating the amount of payments that may be made under the TRA is by its nature imprecise, insofar as the calculation of amounts payable depends on a variety of factors. The actual increase in tax basis and deductions, as well as the amount and timing of any payments under the TRA, will vary depending upon a number of factors, including: