Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Gogo Inc. | d921743d8k.htm |

| EX-99.1 - EX-99.1 - Gogo Inc. | d921743dex991.htm |

1

st

Quarter

2015

Earnings Results

Michael Small –

Chief Executive Officer

Norman Smagley –

Chief Financial Officer

May 7, 2015

Exhibit 99.2 |

©2014 Gogo Inc. and Affiliates. Proprietary & Confidential.

2

SAFE HARBOR STATEMENT

2

Safe Harbor Statement

This presentation contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act

of 1934 that are based on management’s beliefs and assumptions and on information

currently available to management. Most forward-looking statements contain words

that identify them as forward-looking, such as “anticipates,”

“believes,” “continues,” “could,” “seeks,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,”

“projects,” “should,” “will,” “would” or

similar expressions and the negatives of those terms that relate to future events. Forward-looking statements involve known and

unknown risks, uncertainties and other factors that may cause Gogo’s actual

results, performance or achievements to be materially different from any projected results,

performance or achievements expressed or implied by the forward-looking statements.

Forward-looking statements represent the beliefs and assumptions of Gogo only

as of the date of this presentation and Gogo undertakes no obligation to update or

revise publicly any such forward-looking statements, whether as a result of new

information, future events or otherwise. As such, Gogo’s future results may vary

from any expectations or goals expressed in, or implied by, the forward-looking

statements included in this presentation, possibly to a material degree.

Gogo cannot assure you that the assumptions made in preparing any of the

forward-looking statements will prove accurate or that any long-term financial or operational

goals and targets will be realized. In particular, the availability and performance of

certain technology solutions yet to be implemented by the Company set forth in this

presentation represent aspirational long-term goals based on current expectations.

For a discussion of some of the important factors that could cause Gogo’s results to

differ materially from those expressed in, or implied by, the forward-looking

statements included in this presentation, investors should refer to the disclosure contained

under the headings “Risk Factors” and “Cautionary Note Regarding

Forward-Looking Statements” in the Company’s Annual Report on Form 10-K filed with the SEC on

February 27, 2015.

Note to Certain Operating and Financial Data

In addition to disclosing financial results that are determined in accordance with U.S.

generally accepted accounting principles (“GAAP”), Gogo also discloses in this

presentation certain non-GAAP financial information, including Adjusted EBITDA and

Cash CapEx. These financial measures are not recognized measures under GAAP, and

when analyzing our performance or liquidity, as applicable, investors should (i) use Adjusted EBITDA in addition to, and not as an alternative to, net loss attributable

to common stock as a measure of operating results, and (ii) use Cash CAPEX in addition

to, and not as an alternative to, consolidated capital expenditures when

evaluating our liquidity.

In addition, this presentation contains various customer metrics and operating data,

including numbers of aircraft or units online, that are based on internal company data,

as well as information relating to the commercial and business aviation market, and our

position within those markets. While management believes such information and

data are reliable, they have not been verified by an independent source and there are

inherent challenges and limitations involved in compiling data across various

geographies and from various sources.

|

©2014 Gogo Inc. and Affiliates. Proprietary & Confidential.

3

Q1 2015 EARNINGS CALL OBJECTIVES

3

Perspective on the in-flight connectivity industry

Why Gogo wins

Update on the quarter |

©2014 Gogo Inc. and Affiliates. Proprietary & Confidential.

4

GLOBAL AERO-COMMUNICATIONS SERVICE

PROVIDER REQUIREMENTS

4

Global scale is essential

Most bandwidth at the lowest cost

Invest in R&D and network engineering capabilities |

©2014 Gogo Inc. and Affiliates. Proprietary & Confidential.

5

GOGO CHECKS ALL THE BOXES

5

We have the largest scale

We are global

We have nearly 1,000 smart, specialized, and passionate

employees around the world

We have industry leading R&D and network capabilities

GOGO DELIVERS HIGHLY RELIABLE AND SOPHISTICATED

IN-FLIGHT CONNECTIVITY SOLUTIONS |

©2014 Gogo Inc. and Affiliates. Proprietary & Confidential.

6

GOGO LEADS TECHNOLOGY INNOVATION

6

1

st

generation

–

ATG

/

ATG4

2

nd

generation

–

2Ku

3

rd

generation

–

in

progress…

GOGO IS PLAYING TO WIN |

©2014 Gogo Inc. and Affiliates. Proprietary & Confidential.

7

DELIVERING ON 2015 PRIORITIES

7

Add new aircraft

Increase bandwidth to aircraft

Hit the numbers

(1) As of March 31, 2015.

-

Expanded partnership with NetJets

-

Expanded partnership with Delta

-

Installed 300+ broadband aircraft

-

Announced ATG8000 and ATG1000 for BA

-

730

ATG4

equipped

aircraft

(1)

-

Nearly 50% of data traffic goes through ATG4 equipped aircraft

-

2Ku will bring more capacity starting in 2016

-

Record revenue of $116M, up 21% Y/Y

-

Service revenue of $95M, up 32% Y/Y

-

Combined segment profit margin for CA-NA and BA of 23%

-

Issued $362M in convertible notes |

©2014 Gogo Inc. and Affiliates. Proprietary & Confidential.

8

8

Gogo has a scalable business model

Gogo has industry leading R&D capabilities

WE ARE PLAYING TO WIN

IFC industry is large and global

Gogo has scale and experience

EXECUTING ON THE WORLD’S FASTEST GLOBAL

COMMUNICATIONS INFRASTRUCTURE DEPLOYMENT YET |

©2014 Gogo Inc. and Affiliates. Proprietary & Confidential.

9

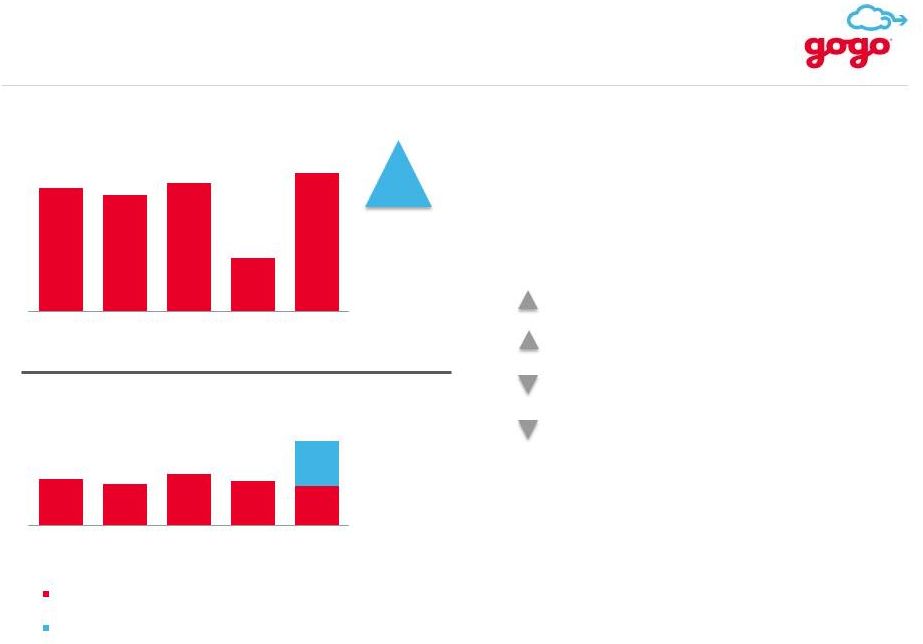

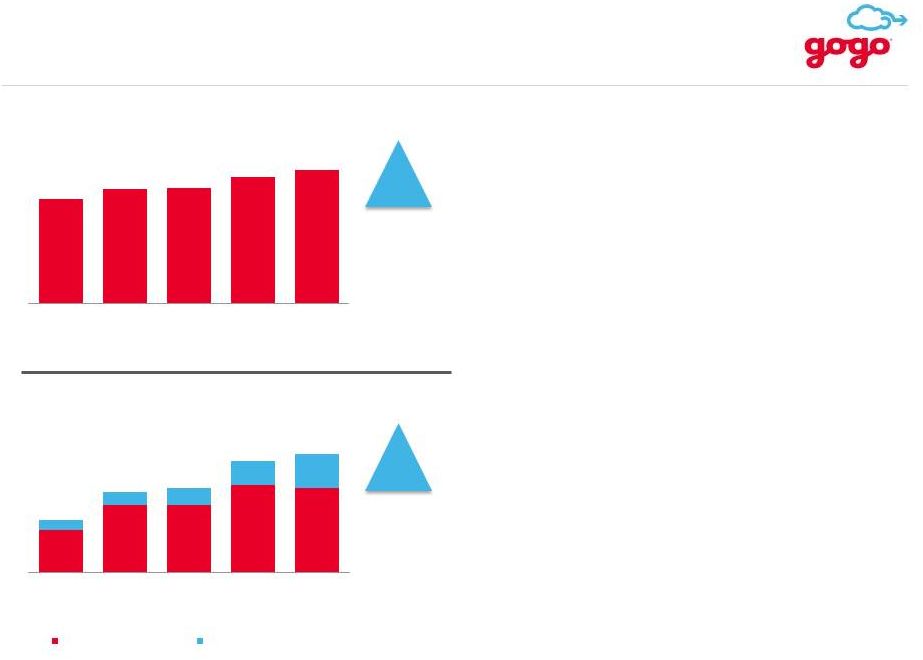

Q1 2015 RECORD REVENUE & ADJUSTED EBITDA

9

21%

Y/Y Growth

•

Q1 2015 record revenue quarter:

-

Service revenue up 32% y/y

-

CA-NA service revenue up 28% y/y

-

BA service revenue up 38% y/y

•

Q1 2015 Adjusted EBITDA

margin of 7%

54%

Y/Y Growth

$96

$116

$104

$100

$109

Note: Minor differences exist due to rounding

$72

$79

$82

$90

$95

$23

$20

$22

$20

$20

Q1 '14

Q2 '14

Q3 '14

Q4 '14

Q1 '15

Total Revenue ($MM)

Service Revenue

Equipment Revenue

$5

$3

$1

$1

$8

6%

3%

1%

1%

7%

Q1 '14

Q2 '14

Q3 '14

Q4 '14

Q1 '15

Adjusted EBITDA ($MM)

Adjusted EBITDA

Adjusted EBITDA Margin |

©2014 Gogo Inc. and Affiliates. Proprietary & Confidential.

10

CONSOLIDATED CASH CAPEX & CASH

10

CA facilities build out of $6M

Airborne equipment purchases

ATG network

Airborne equipment proceeds

$400

$3MM

Y/Y Increase

Note: Minor differences exist due to rounding. Cash balance is end of period.

All figures as of 3/31/2015

$29

$27

$30

$12

$32

Q1 '14

Q2 '14

Q3 '14

Q4 '14

Q1 2015

Cash CapEx ($MM)

$220

$196

$243

$211

$189

$212

Q1 '14

Q2 '14

Q3 '14

Q4 '14

Q1 '15

Cash Balance ($MM)

Cash

Convertible Debt Proceeds Net of Issuance Costs and

the Prepaid Forward Transactions

•

Q1 ’15 Y/Y changes in capital

expenditures:

•

Strong cash position following

$362M convertible notes offering |

©2014 Gogo Inc. and Affiliates. Proprietary & Confidential.

11

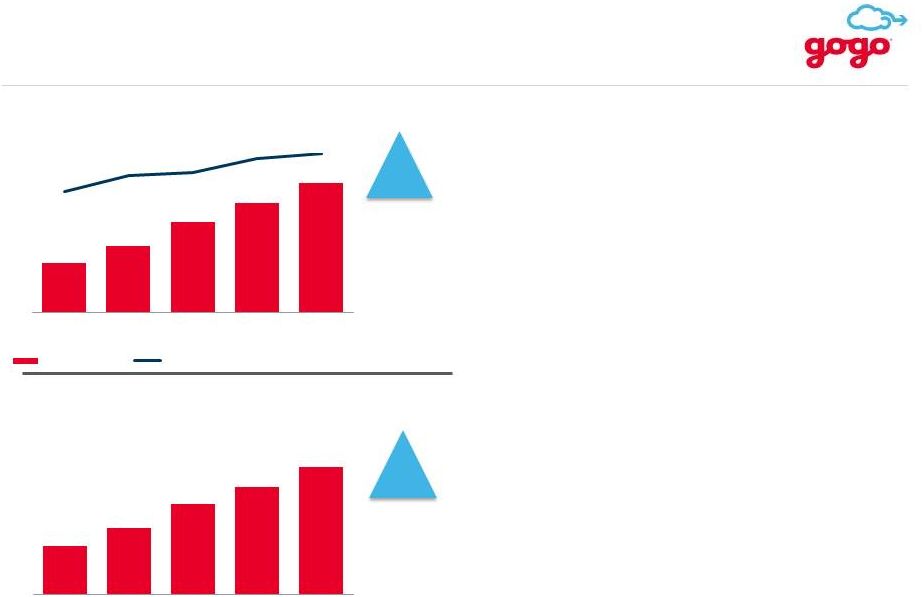

CA-NA STRONG REVENUE & ARPA GROWTH

11

28%

Y/Y Growth

•

Service revenue driven by:

-

22% y/y growth in ARPA

-

7% y/y growth in aircraft online

•

Strong ARPA growth continues:

-

Changes in pricing and product mix

drove ARPS increase

-

In-flight wireless entertainment revenue

continues to grow

-

Connectivity take rate increased

excluding impact of sponsorships

22%

Y/Y Growth

Note: Minor differences exist due to rounding

$110

$120

$122

$131

$134

$56

$62

$62

$68

$72

Q1 '14

Q2 '14

Q3 '14

Q4 '14

Q1 '15

Service Revenue ($MM)

$106

$115

$115

$122

$121

$4

$5

$6

$9

$14

Q1 '14

Q2 '14

Q3 '14

Q4 '14

Q1 '15

Annualized ARPA

Connectivity Revenue

Other Service Revenue

Note: Other service revenue includes content filtering, VoIP access for airlines’ flight crews,

portal development services, operations-oriented communications services, third-party

advertising, e-commerce revenue share arrangements and partner co-branding and reseller arrangements.

|

©2014 Gogo Inc. and Affiliates. Proprietary & Confidential.

12

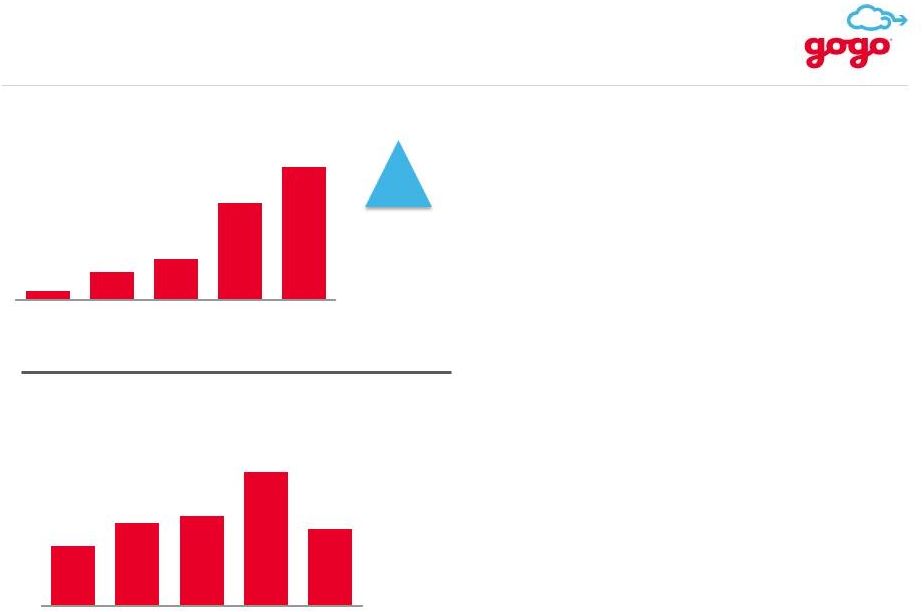

CA-NA AIRCRAFT ONLINE

& SEGMENT PROFIT GROWTH

12

7%

Y/Y Growth

Note: Minor differences exist due to rounding

•

102 aircraft online added in

Q1 2015

•

Segment profit margin

expands to 13%

•

Strong leverage of network

infrastructure

2,200

2,098

2,044

2,058

2,056

66%

Y/Y Growth

Q1 '14

Q2 '14

Q3 '14

Q4 '14

Q1 '15

Aircraft Online

(End of Period)

$6

$6

$6

$8

$10

10%

10%

9%

12%

13%

Q1 '14

Q2 '14

Q3 '14

Q4 '14

Q1 '15

Segment Profit ($MM)

Segment Profit

Segment Profit Margin |

©2014 Gogo Inc. and Affiliates. Proprietary & Confidential.

13

BA SERVICE REVENUE

& ATG AIRCRAFT ONLINE GROWTH

13

•

Strong growth in ATG aircraft

online and ATG ARPU

•

NetJets expands long-standing

partnership

•

Announced ATG 8000 &

ATG1000

38%

Y/Y Growth

41%

46%

47%

51%

52%

33%

Y/Y Growth

$16

$17

$19

$20

$22

Q1 '14

Q2 '14

Q3 '14

Q4 '14

Q1 '15

Service Revenue ($MM)

Service Revenue

Service Revenue as a % of Total BA Revenue

2,250

2,415

2,637

2,797

2,983

Q1 '14

Q2 '14

Q3 '14

Q4 '14

Q1 '15

ATG Aircraft Online

(End of Period) |

©2014 Gogo Inc. and Affiliates. Proprietary & Confidential.

14

BA REVENUE & SEGMENT PROFIT GROWTH

14

8%

Y/Y Growth

$39

$42

$37

$40

Note: Minor differences exist due to rounding

•

Q1 2015 record revenue quarter:

-

Service revenue up 38% y/y

-

ATG aircraft online up 33% y/y

•

Equipment revenue down Y/Y

-

Change in product mix

-

Normalized sales of Text & Talk

•

Q1 2015 segment profit margin of

40%

$40

$16

$17

$19

$20

$22

$23

$20

$21

$19

$20

Q1 '14

Q2 '14

Q3 '14

Q4 '14

Q1 '15

Total Revenue ($MM)

Service Revenue

Equipment Revenue

$16

$15

$15

$16

$17

43%

42%

37%

41%

40%

Q1 '14

Q2 '14

Q3 '14

Q4 '14

Q1 '15

Segment Profit ($MM)

Segment Profit

Segment Profit Margin |

©2014 Gogo Inc. and Affiliates. Proprietary & Confidential.

15

FOCUS ON INTERNATIONAL EXPANSION

15

36%

Q/Q Growth

•

31 Ku aircraft installed in Q1 2015

•

Revenue of $1.4M impacted by:

-

Classification of certain CA-ROW

transactions

-

Some aircraft flying CA-NA routes

-

Adjusting for the above activities

revenue would have been approx. $2.6M

•

Y/Y increase in segment loss

includes higher SG&A and satellite

costs

•

Decrease in segment loss from Q4

2014 impacted by timing of STC

milestones and related design work

5

19

35

85

116

Q1 '14

Q2 '14

Q3 '14

Q4 '14

Q1 '15

Satellite Aircraft Online

(End of Period)

Q1 '14

Q2 '14

Q3 '14

Q4 '14

Q1 '15

$17

$19

$19

$23

$18

CA-ROW Segment Loss ($MM) |

©2014 Gogo Inc. and Affiliates. Proprietary & Confidential.

16

2015 GUIDANCE

16

Revenue

$485 -

$505 million

CA-NA

$300 -

$320 million

BA

$170 -

$180 million

CA-ROW

$10 -

$15 million

Adjusted EBITDA

$15 -

$25 million

Cash CAPEX

$100 -

$120 million |

©2014 Gogo Inc. and Affiliates. Proprietary & Confidential.

17

STRONG Q1 FINANCIAL PERFORMANCE

17

Record revenue of $116M, up 21% y/y

Adjusted EBITDA of $8.2M, up 54% y/y

Strong cash position of $400M

WELL POSITIONED TO ACHIEVE OUR GOALS |

Q&A |

Appendix |

©2014 Gogo Inc. and Affiliates. Proprietary & Confidential.

20

CONVERTIBLE NOTES DETAILS

20

•

$362 million aggregate principal amount of 3.75% Convertible Senior Notes issued in

March 2015, due March 1, 2020; conversion price of $23.85 per share.

•

Conversion may occur prior to December 1, 2019 upon the occurrence of certain events or

any time after December 1, 2019.

•

In conjunction with the convertible notes offering, the company entered into forward

stock purchase transactions for approximately $140 million, representing 7.2

million shares to settle on or around March 1, 2020.

Transaction Summary

Accounting

EPS Impact

•

“If converted”

method is used to account for dilution caused by convertible notes.

•

Approximately 7.2 shares of common stock that will be effectively repurchased through

the forward stock purchase transactions are treated as retired shares for basic

and diluted EPS purposes although they remain legally outstanding.

•

Cash increased by $212 million, net of approximately $140 million in forward stock

purchase transactions and $10.4 million in issuance costs.

•

Convertible

allocation

to

long-term

debt

at the time of issuance is $262 million and additional paid in capital

is

$100

million.

•

Long-term debt portion of convertible is booked on the balance sheet at fair value

and is accreted to full principal amount of convertible notes outstanding over

life of notes. The accretion expense is recognized on the income statement as

non-cash interest. |

©2014 Gogo Inc. and Affiliates. Proprietary & Confidential.

21

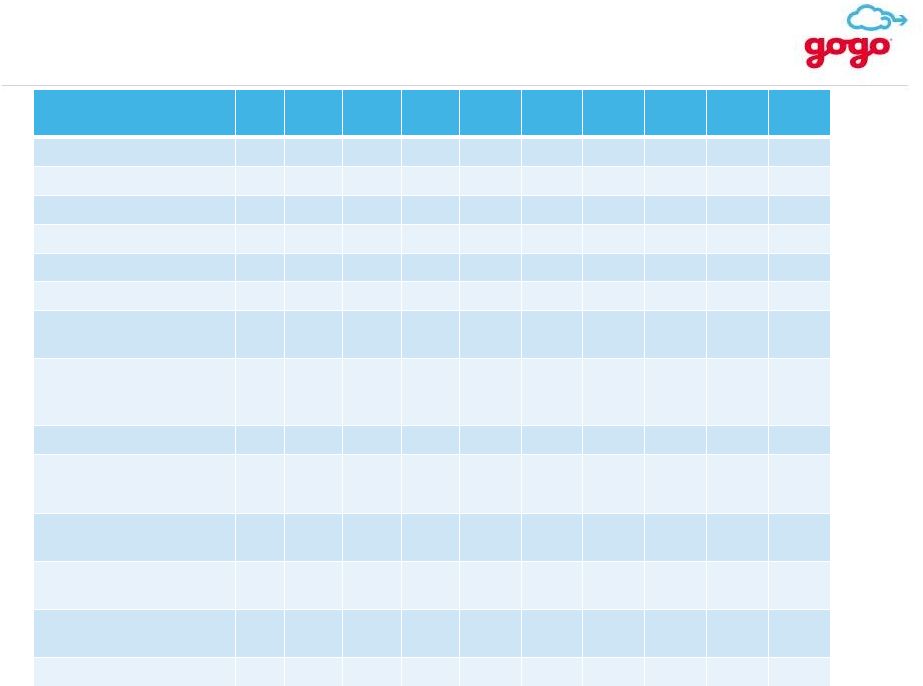

ADJUSTED EBITDA RECONCILIATION ($MM)

2009

2010

2011

2012

2013

2014

Q1

2014

Q2

2014

Q3

2014

Q4

2015

Q1

Net Income

(142)

(140)

(18)

(96)

(146)

(17)

(19)

(25)

(24)

(20)

Interest Income

(0)

(0)

(0)

(0)

(0)

(0)

(0)

(0)

(0)

(0)

Interest Expense

30

–

1

9

29

7

7

9

9

10

Income Tax Provision

–

3

1

1

1

–

–

–

–

–

Depreciation & Amortization

22

31

33

37

56

16

15

17

17

19

EBITDA

(91)

(106)

16

(49)

(60)

6

4

2

2

9

Fair Value Derivative

Adjustments

–

33

(59)

(10)

36

–

–

–

–

–

Class

A and Class B Senior

Convertible Preferred Stock

Return

–

18

31

52

29

–

–

–

–

–

Accretion of Preferred Stock

–

9

10

10

5

–

–

–

–

–

Stock-based Compensation

Expense

1

2

2

4

6

2

2

3

3

3

Loss on Extinguishment of

Debt

2

–

–

–

–

–

–

–

–

–

Write Off of Deferred Equity

Financing Costs

–

–

–

5

–

–

–

–

–

–

Amortization of Deferred

Airborne Lease Incentives

–

(1)

(1)

(4)

(8)

(3)

(3)

(4)

(4)

(4)

Adjusted EBITDA

(89)

(45)

(1)

9

8

5

3

1

1

8

Note: Minor differences exist due to rounding |

©2014 Gogo Inc. and Affiliates. Proprietary & Confidential.

22

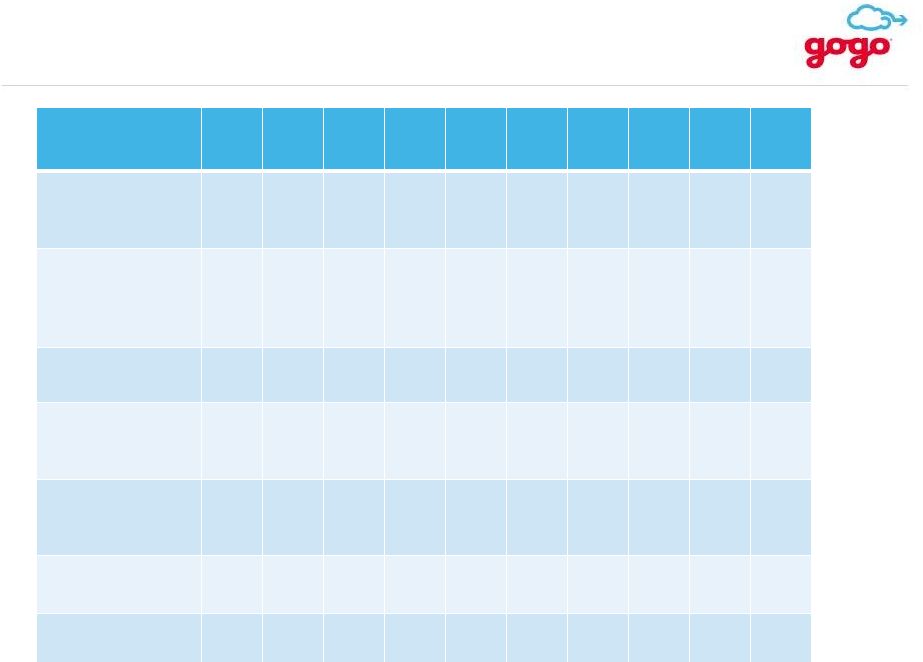

CASH CAPEX RECONCILIATION ($MM)

2009

2010

2011

2012

2013

2014

Q1

2014

Q2

2014

Q3

2014

Q4

2015

Q1

Purchases of

Property and

Equipment

(69)

(33)

(33)

(67)

(105)

(32)

(28)

(35)

(37)

(53)

Acquisition of

Intangible Assets

(Capitalized

Software)

(8)

(7)

(10)

(12)

(16)

(4)

(5)

(5)

(3)

(4)

Consolidated Capital

Expenditures

(77)

(40)

(43)

(79)

(121)

(36)

(33)

(41)

(40)

(57)

Change in Deferred

Airborne Lease

Incentives

–

9

11

18

9

5

3

5

17

9

Amortization of

Deferred Airborne

Lease Incentives

–

1

1

4

8

3

3

3

4

4

Landlord Incentives

–

–

–

–

–

–

–

2

7

12

Cash CapEx

(77)

(30)

(31)

(58)

(104)

(29)

(27)

(30)

(12)

(32)

Note: Minor differences exist due to rounding |