Attached files

| file | filename |

|---|---|

| 8-K - 2015 ANNUAL MEETING OF SHAREHOLDERS' PRESENTATION - Pathfinder Bancorp, Inc. | form8-k.htm |

Exhibit 99.1

Diversified Growth through Community Leadership 2015 Annual Meeting of Shareholders 10 a.m., May 6, 2015 Alexandria’s at the Lake Ontario Conference and Events Center Oswego, New York

Diversified Growth through Community Leadership * Welcoming Remarks Chris R. BurrittChairman of the Board

* Diversified Growth through Community Leadership Agenda Call to Order–Chris Burritt, Chairman of the Meeting Introduction of President and Corporate Secretary Introduction of Officers, Directors and Director Nominees Introduction of Inspector of Election Presentation of Proposals Report to Shareholders Adjournment

* Diversified Growth through Community Leadership Board of Directors Director Since David A. Ayoub 2012 William A. Barclay 2011 John P. Funiciello 2011 Adam C. Gagas 2015 George P. Joyce 2000 Thomas W. Schneider, President & CEO 2001 John F. Sharkey, III 2015 Lloyd “Buddy” Stemple 2005 Chris R. Burritt, Chairman 1986

* Diversified Growth through Community Leadership Executive Officers Current Position Since Thomas W. Schneider President & CEO 2000 James A. Dowd, CPA Senior Vice President & Chief Financial Officer 2000 Melissa A. Miller Senior Vice President & Chief Operating Officer 2005 Edward A. Mervine, ESQ Senior Vice President, General Counsel & Corporate Secretary 2002 Ronald Tascarella Senior Vice President & Chief Credit Officer 2006 Daniel R. Phillips Senior Vice President & Chief Information Officer 2014

Diversified Growth through Community Leadership * Independent Registered Public Accounting Firm Jamie L. KeiserBonadio & Company

* Diversified Growth through Community Leadership Business of 2015 Annual Meeting of Shareholders The Election of Three Directors John P. FunicielloThomas W. SchneiderLloyd “Buddy” Stemple An advisory vote on executive compensation (“Say-on-Pay”)An advisory vote on the frequency of future “Say-on-Pay” votesRatification of the appointment of Bonadio & Co., LLP as independent registered public accounting firm

Diversified Growth through Community Leadership * Executive Management Presentation Thomas W. SchneiderPresident & Chief Executive Officer

* Diversified Growth through Community Leadership Executive Management Presentation This discussion may contain the words or phrases “will likely result”, “are expected to”, “will continue”, “is anticipated”, “estimate”, ”project” or similar expression are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are subject to certain risks and uncertainties. By identifying these forward-looking statements for you in this manner, the Company is alerting you to the possibility that its actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward-looking statements. Important factors that could cause the Company’s actual results and financial condition to differ from those indicated in the forward-looking statements include, among others: Credit quality and the effect of credit quality on the adequacy of our allowance for loan losses;Deterioration in financial markets that may result in impairment charges relating to our securities portfolio; Competition in our primary market areas; significant government regulations, legislation and potential changes thereto;A reduction in our ability to generate or originate revenue-producing assets as a result of compliance with heightened capital standards; Increased cost of operations due to greater regulatory oversight, supervision and examination of banks and bank holding companies, and higher deposit insurance premiums; The limitation on our ability to expand consumer product and service offerings due to anticipated stricter consumer protection laws and regulations: and other risks described herein and in the other reports and statements we file with the SEC.These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. The Company wishes to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. The Company wishes to advise readers that the factors listed above could affect the Company’s financial performance and could cause the Company’s actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements. Additionally, all statements in this document, including forward-looking statements, speak only as of the date they are made, and the Company undertakes no obligation to update any statement in light of new information or future events.

* Diversified Growth through Community Leadership Historic Performance in 2014 Record Net Income of $2.7 million Raised $24.9 Million in New Capital – Second Step Stock Offering Opened New Business Banking Office in Downtown Syracuse FitzGibbons Agency Revenue Increased 19.2% Total Loans at 12/31/14 of $387.5 Million, 13.4% Growth

* Diversified Growth through Community Leadership Top line revenue growth through loan growthSmall business lendingCommercial real estateMaintained Net Interest Margin against compression headwinds Historic Performance in 2014 Record Net Income of $2.7 Million Net Interest Income Growth of $1.5 Million 9.4% Noninterest income Growth of $834,000 32.3%

* Diversified Growth through Community Leadership Enhanced liquidity for common stockImmediately accretive to book value per shareProvides capital for continued growthEliminated a limited structure (MHC)Increased flexibility for mergers and acquisitions Historic Performance in 2014 Raised $24.9 Million in New Capital – Second Step Stock Offering Current Ownership

* Diversified Growth through Community Leadership Concerted efforts since 2006Lead with lending activitiesAnticipate increased business deposit gathering capabilityKey personnel and Board Members with extensive Syracuse market experienceAlignment with centers of influenceCommunity interaction driving toward leadershipBrand awareness Historic Performance in 2014 Opened New Business Banking Office in Downtown Syracuse

* Diversified Growth through Community Leadership Historic Performance in 2014 Opened New Business Banking Office in Downtown Syracuse

* Diversified Growth through Community Leadership Partnered with the FitzGibbons Agency, LLC in 2013Goal of increasing non-interest income and providing deeper services to our customersCommercial Line expertiseOperating in an expanded footprint2015 Huntington Agency acquisition Historic Performance in 2014 FitzGibbons Agency Revenue Increased 19.2%

* Diversified Growth through Community Leadership Historic Performance in 2014 FitzGibbons Agency Revenue Increased 19.2%

* Diversified Growth through Community Leadership Enhanced geographic footprintRe-urbanization trends in the city of SyracuseFavorable commercial real estate and development trendsCenters of influence and referrals Historic Performance in 2014 Total Loans at 12/31/14 of $387.5 Million, 13.4% Growth

* Diversified Growth through Community Leadership Abundant CapitalLoan Portfolio DiversificationRevenue DiversificationStrong Competitive Market Position Positioned for Growth

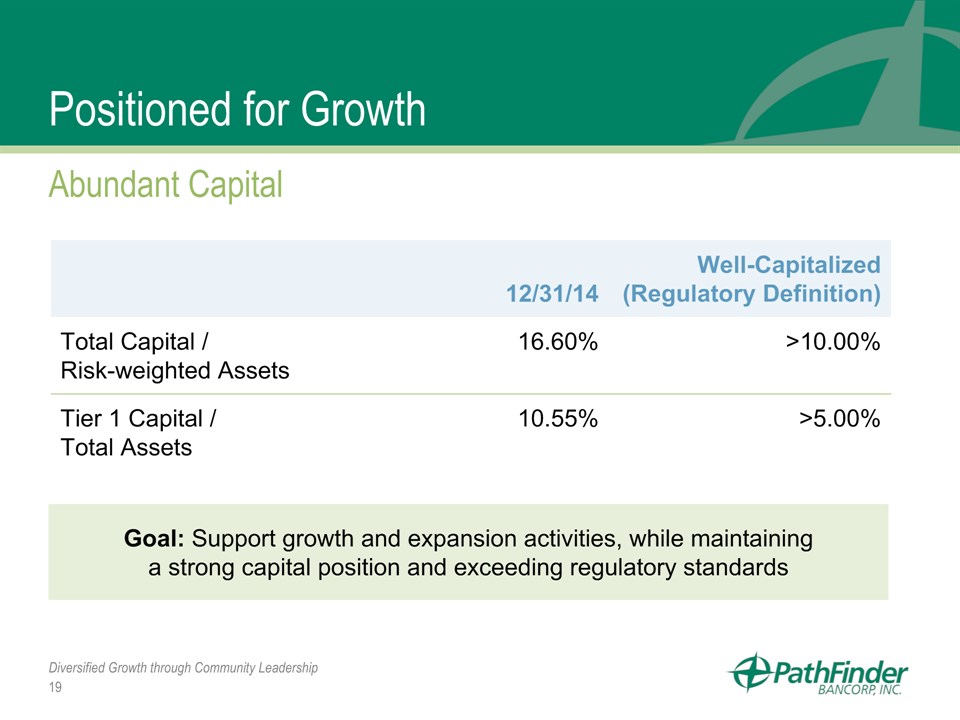

* Diversified Growth through Community Leadership Positioned for Growth Abundant Capital 12/31/14 Well-Capitalized (Regulatory Definition) Total Capital /Risk-weighted Assets 16.60% >10.00% Tier 1 Capital /Total Assets 10.55% >5.00% Goal: Support growth and expansion activities, while maintaining a strong capital position and exceeding regulatory standards

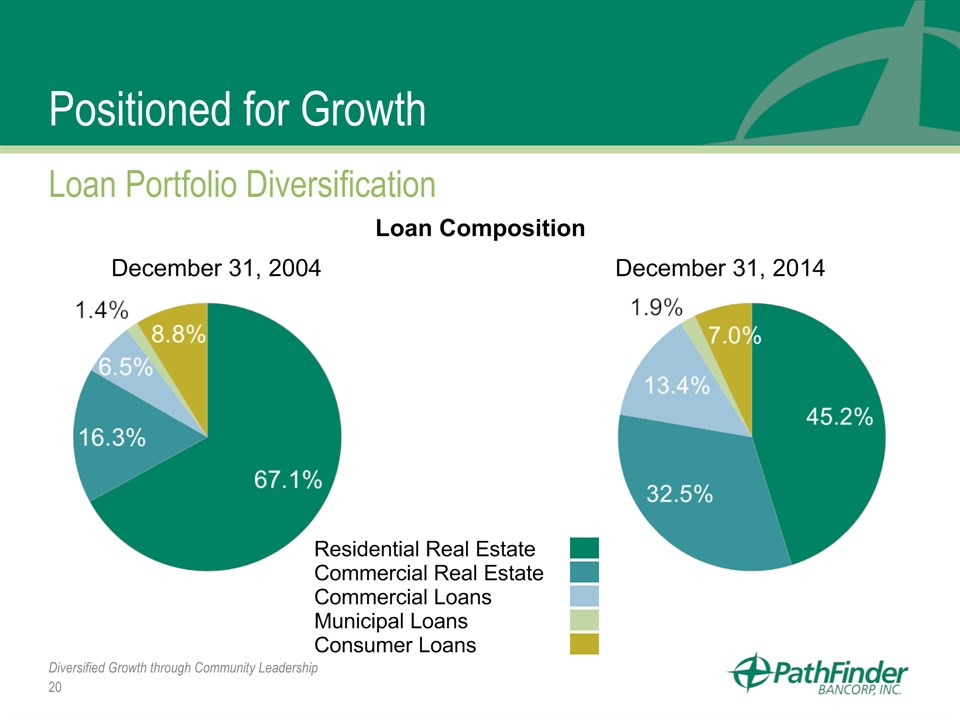

* Diversified Growth through Community Leadership Positioned for Growth Loan Portfolio Diversification Loan Composition December 31, 2004 December 31, 2014 Residential Real Estate Commercial Real Estate Commercial Loans Municipal Loans Consumer Loans

* Diversified Growth through Community Leadership Positioned for Growth Core Revenue Growth

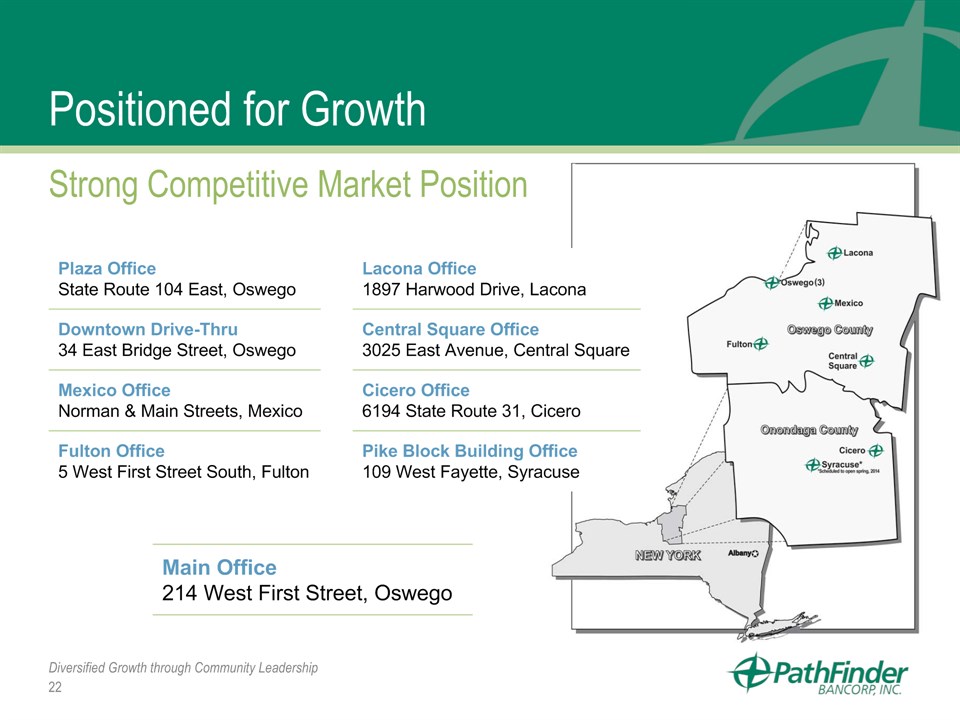

* Diversified Growth through Community Leadership Positioned for Growth Strong Competitive Market Position Plaza OfficeState Route 104 East, Oswego Downtown Drive-Thru34 East Bridge Street, Oswego Mexico OfficeNorman & Main Streets, Mexico Fulton Office5 West First Street South, Fulton Lacona Office1897 Harwood Drive, Lacona Central Square Office3025 East Avenue, Central Square Cicero Office6194 State Route 31, Cicero Pike Block Building Office109 West Fayette, Syracuse Main Office214 West First Street, Oswego

* Diversified Growth through Community Leadership Positioned for Growth Strong Competitive Market Position – #1 Market Share Holder in Oswego County Source: FDIC Deposit Market Share Report at 6-30-14 2014 Rank Institution (ST) Total Deposits ($000) Market Share (%) 1 Pathfinder Bancorp Inc. (NY) 398,685 33.55% 2 Fulton Savings Bank (NY) 196,681 16.55% 3 Community Bank System Inc. (NY) 162,122 13.64% 4 Bank of America Corp. (NC) 147,490 12.41% 5 NBT Bancorp Inc.(NY) 126,531 10.65% 6 KeyCorp (OH) 109,037 9.18% 7 JP Morgan Chase & Co. (NY) 47,254 3.98% 8 Woodforest Financial Group (TX) 444 0.04% Total for Institutions in Market $ 1,188,244

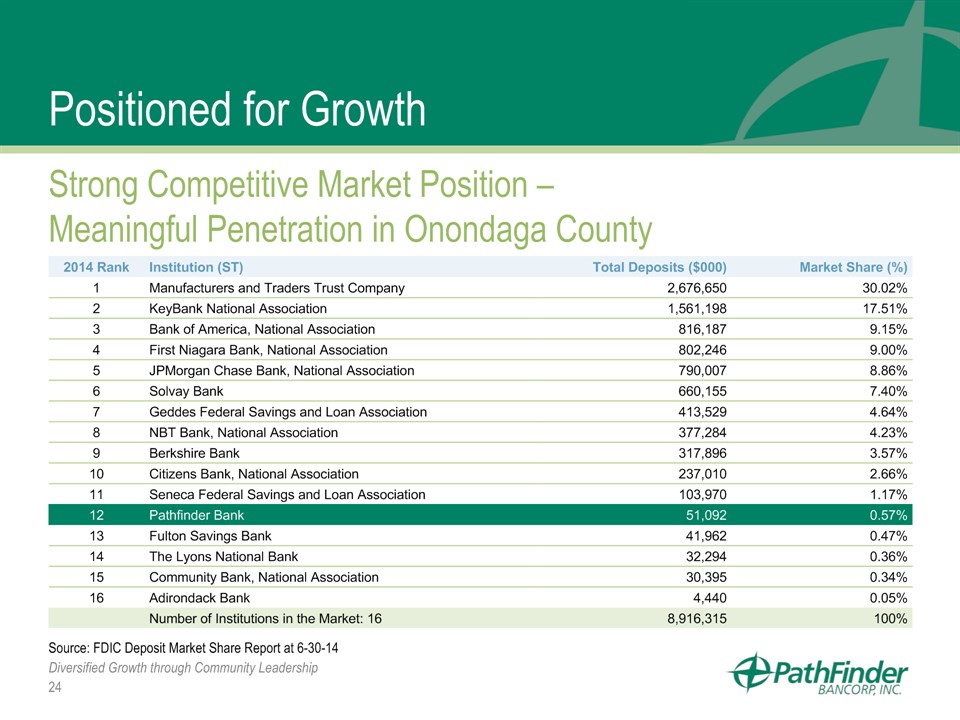

* Diversified Growth through Community Leadership Positioned for Growth Strong Competitive Market Position – Meaningful Penetration in Onondaga County Source: FDIC Deposit Market Share Report at 6-30-14 2014 Rank Institution (ST) Total Deposits ($000) Market Share (%) 1 Manufacturers and Traders Trust Company 2,676,650 30.02% 2 KeyBank National Association 1,561,198 17.51% 3 Bank of America, National Association 816,187 9.15% 4 First Niagara Bank, National Association 802,246 9.00% 5 JPMorgan Chase Bank, National Association 790,007 8.86% 6 Solvay Bank 660,155 7.40% 7 Geddes Federal Savings and Loan Association 413,529 4.64% 8 NBT Bank, National Association 377,284 4.23% 9 Berkshire Bank 317,896 3.57% 10 Citizens Bank, National Association 237,010 2.66% 11 Seneca Federal Savings and Loan Association 103,970 1.17% 12 Pathfinder Bank 51,092 0.57% 13 Fulton Savings Bank 41,962 0.47% 14 The Lyons National Bank 32,294 0.36% 15 Community Bank, National Association 30,395 0.34% 16 Adirondack Bank 4,440 0.05% Number of Institutions in the Market: 16 8,916,315 100%

Diversified Growth through Community Leadership * Executive Management Presentation James A. Dowd, CPASenior Vice President & Chief Financial Officer

* Diversified Growth through Community Leadership Loan Growth CAGR 7.96%

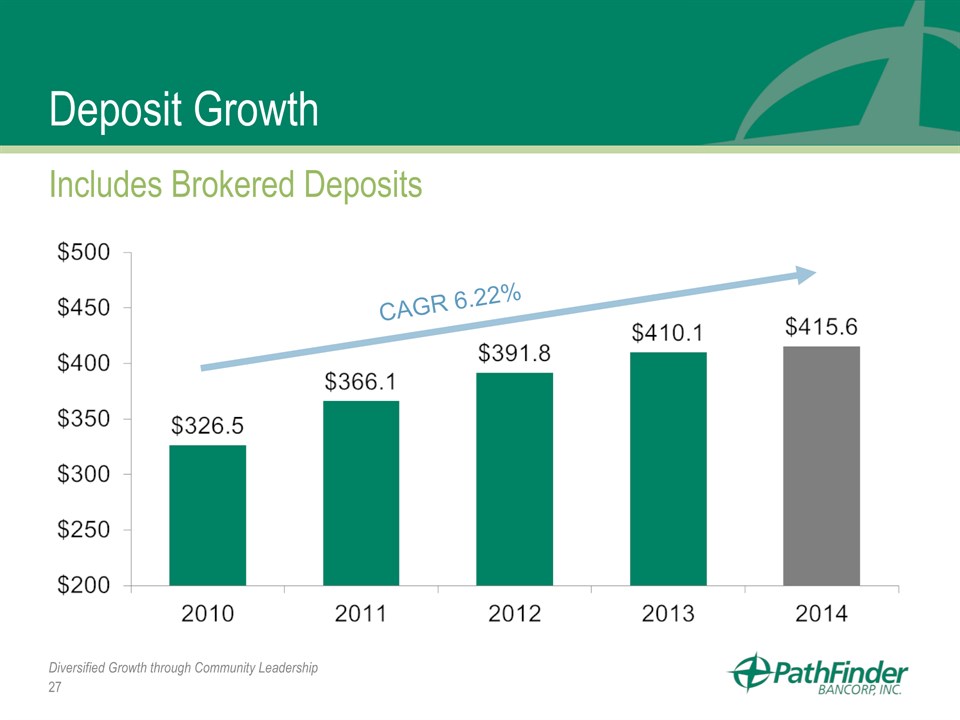

* Diversified Growth through Community Leadership Deposit Growth Includes Brokered Deposits CAGR 6.22%

* Diversified Growth through Community Leadership Deposit Composition Includes Brokered Deposits December 31, 2004 December 31, 2014 Retail Commercial Municipal

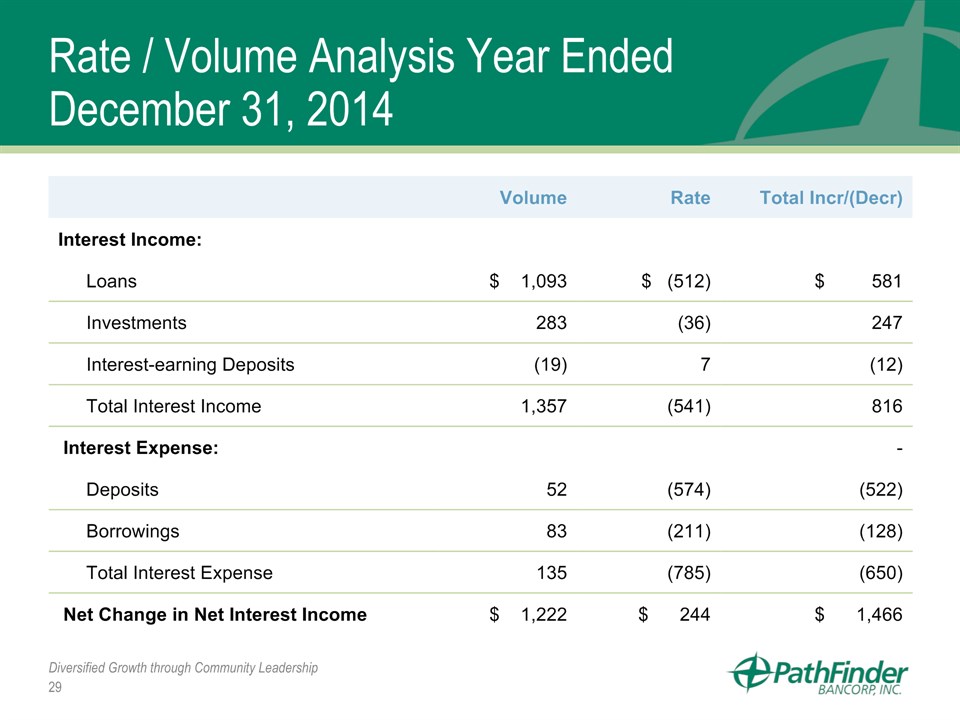

* Diversified Growth through Community Leadership Rate / Volume Analysis Year Ended December 31, 2014 Volume Rate Total Incr/(Decr) Interest Income: Loans $ 1,093 $ (512) $ 581 Investments 283 (36) 247 Interest-earning Deposits (19) 7 (12) Total Interest Income 1,357 (541) 816 Interest Expense: - Deposits 52 (574) (522) Borrowings 83 (211) (128) Total Interest Expense 135 (785) (650) Net Change in Net Interest Income $ 1,222 $ 244 $ 1,466

* Diversified Growth through Community Leadership Net Interest Margin

* Diversified Growth through Community Leadership Revenue and Operating Expense Trends

* Diversified Growth through Community Leadership Stable Asset Quality Metrics Dec 2010 Dec 2011 Dec2012 Dec 2013 Dec 2014 Non-performing Loans to Total Loans 2.08% 1.55% 1.66% 1.57% 1.61% Non-performing Assets to Total Assets 1.54% 1.19% 1.25% 1.18% 1.16% Allowance for Loan Losses to Total Loans 1.28% 1.31% 1.35% 1.48% 1.38% Allowance for Loan Losses to Non-performing Loans 61.58% 84.18% 81.13% 94.22% 85.50%

* Diversified Growth through Community Leadership Net Income and EPS (Diluted) Growth Net Income CAGR 11.2%

* Diversified Growth through Community Leadership Return on Average Assets

* Diversified Growth through Community Leadership Return on Average Common Equity

* Diversified Growth through Community Leadership Total Return Performance

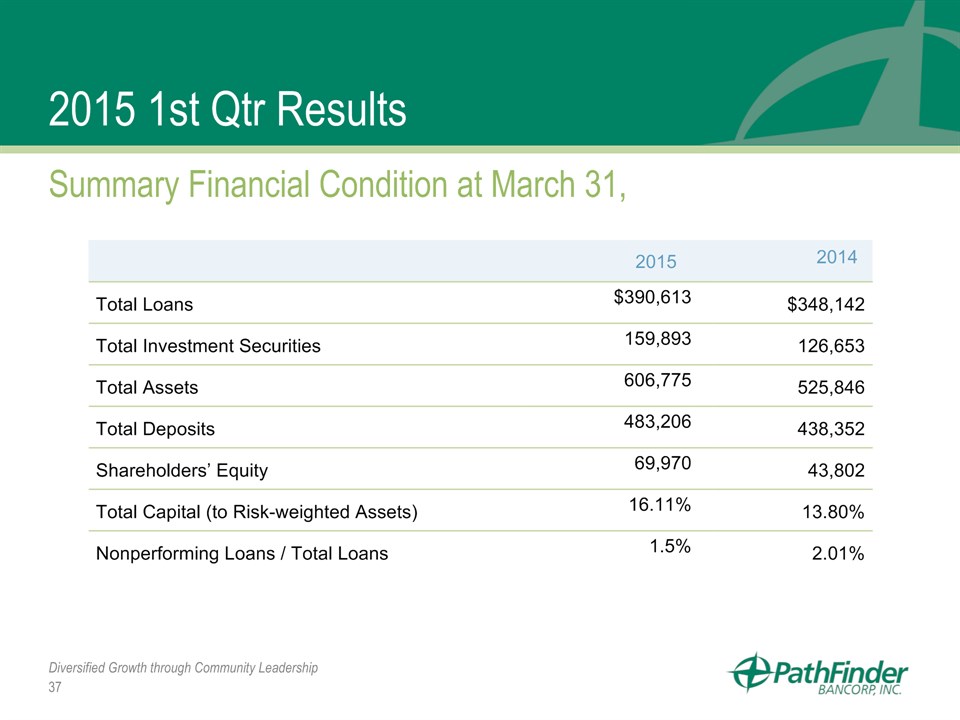

* Diversified Growth through Community Leadership 2015 1st Qtr Results Summary Financial Condition at March 31, 2015 2014 Total Loans $390,613 $348,142 Total Investment Securities 159,893 126,653 Total Assets 606,775 525,846 Total Deposits 483,206 438,352 Shareholders’ Equity 69,970 43,802 Total Capital (to Risk-weighted Assets) 16.11% 13.80% Nonperforming Loans / Total Loans 1.5% 2.01%

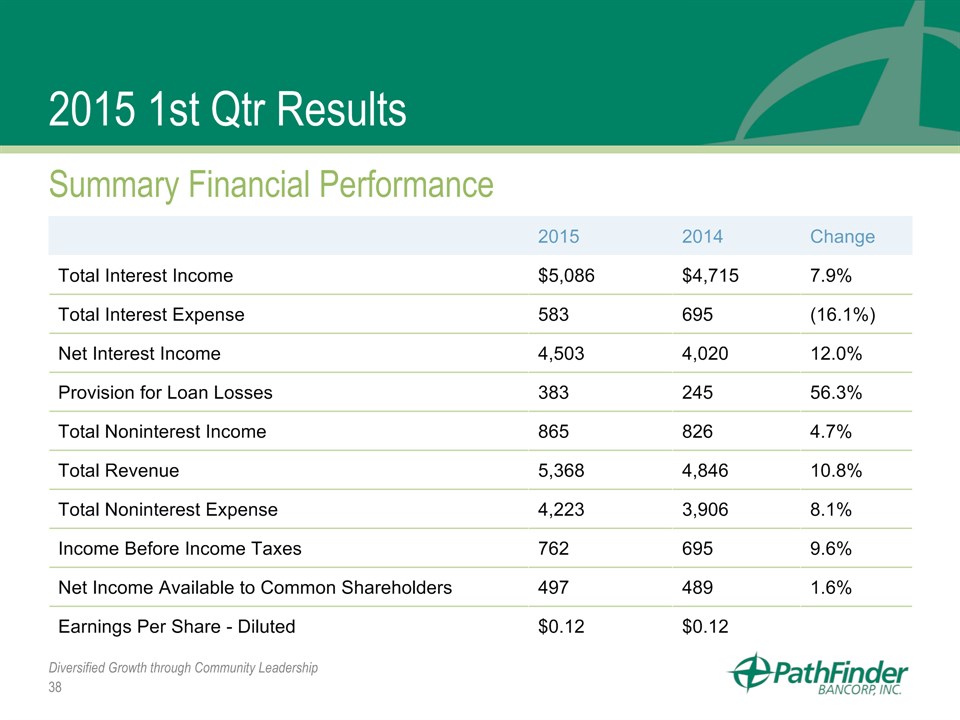

* Diversified Growth through Community Leadership 2015 1st Qtr Results Summary Financial Performance 2015 2014 Change Total Interest Income $5,086 $4,715 7.9% Total Interest Expense 583 695 (16.1%) Net Interest Income 4,503 4,020 12.0% Provision for Loan Losses 383 245 56.3% Total Noninterest Income 865 826 4.7% Total Revenue 5,368 4,846 10.8% Total Noninterest Expense 4,223 3,906 8.1% Income Before Income Taxes 762 695 9.6% Net Income Available to Common Shareholders 497 489 1.6% Earnings Per Share - Diluted $0.12 $0.12

Diversified Growth through Community Leadership * Executive Management Presentation Thomas W. SchneiderPresident & Chief Executive Officer

* Diversified Growth through Community Leadership Strategic capital managementMarket expansionOrganic and balanced growth in loans and depositsImproving efficienciesDiversifying revenue sourcesEnhancing the customer experience to gain greater depth and breadth within our market Strategic Growth & Profitability Initiatives

* Diversified Growth through Community Leadership Abundant capital provides flexibility to pursue growth opportunitiesDominant deposit share in primary market – Oswego CountySignificant opportunity for growth in greater Syracuse Second step offering created additional liquidity for stockStable asset quality metrics reflective of approach to underwriting Investment Rationale

Diversified Growth through Community Leadership * Questions and Discussion

Diversified Growth through Community Leadership * Voting ResultsChris R. Burritt – ChairmanInspector of Elections Report – Edward Mervine

Diversified Growth through Community Leadership 2015 Annual Meeting of Shareholders 10 a.m., May 6, 2015 Meeting AdjournedThank You for Attending