Attached files

| file | filename |

|---|---|

| EX-99.1 - 1Q15 EARNINGS CALL TRANSCRIPT - MOSAIC CO | finalmos1q15transcript.htm |

| 8-K - 8-K - Q1 2015 EARNINGS CALL TRANSCRIPT AND SLIDES - MOSAIC CO | a8-kcy15xq1earningscalltra.htm |

The Mosaic Company Earnings Conference Call – First Quarter 2015 April 30, 2015 Jim Prokopanko, President and Chief Executive Officer Rich Mack, Executive Vice President and Chief Financial Officer Laura Gagnon, Vice President Investor Relations

Click to edit Master title style 2 Safe Harbor Statement This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about the Wa’ad Al Shamal Phosphate Company (also known as the Ma’aden joint venture), the acquisition and assumption of certain related liabilities of the Florida phosphate assets of CF Industries, Inc. (“CF”) and Mosaic’s ammonia supply agreements with CF; repurchases of stock; other proposed or pending future transactions or strategic plans and other statements about future financial and operating results. Such statements are based upon the current beliefs and expectations of The Mosaic Company’s management and are subject to significant risks and uncertainties. These risks and uncertainties include but are not limited to risks and uncertainties arising from the ability of the Ma’aden joint venture to obtain additional planned funding in acceptable amounts and upon acceptable terms, the timely development and commencement of operations of production facilities in the Kingdom of Saudi Arabia, the future success of current plans for the Ma’aden joint venture and any future changes in those plans; difficulties with realization of the benefits of the transactions with CF, including the risk that the cost or capital savings from the transactions may not be fully realized or may take longer to realize than expected, or the price of natural gas or ammonia changes to a level at which the natural gas based pricing under one of the long term ammonia supply agreements with CF becomes disadvantageous to Mosaic; customer defaults; the effects of Mosaic’s decisions to exit business operations or locations; the predictability and volatility of, and customer expectations about, agriculture, fertilizer, raw material, energy and transportation markets that are subject to competitive and other pressures and economic and credit market conditions; the level of inventories in the distribution channels for crop nutrients; changes in foreign currency and exchange rates; international trade risks and other risks associated with Mosaic’s international operations and those of joint ventures in which Mosaic participates, including the risk that protests against natural resource companies in Peru extend to or impact the Miski Mayo mine; changes in government policy; changes in environmental and other governmental regulation, including greenhouse gas regulation, implementation of numeric water quality standards for the discharge of nutrients into Florida waterways or efforts to reduce the flow of excess nutrients into the Mississippi River basin, the Gulf of Mexico or elsewhere; further developments in judicial or administrative proceedings, or complaints that Mosaic’s operations are adversely impacting nearby farms, business operations or properties; difficulties or delays in receiving, increased costs of or challenges to necessary governmental permits or approvals or increased financial assurance requirements; resolution of global tax audit activity; the effectiveness of Mosaic’s processes for managing its strategic priorities; adverse weather conditions affecting operations in Central Florida, the Mississippi River basin, the Gulf Coast of the United States or Canada, and including potential hurricanes, excess heat, cold, snow, rainfall or drought; actual costs of various items differing from management’s current estimates, including, among others, asset retirement, environmental remediation, reclamation or other environmental regulation, Canadian resources taxes and royalties, the liabilities Mosaic assumed in the Florida phosphate assets acquisition, or the costs of the Ma’aden joint venture, its existing or future funding and Mosaic’s commitments in support of such funding; reduction of Mosaic’s available cash and liquidity, and increased leverage, due to its use of cash and/or available debt capacity to fund share repurchases, financial assurance requirements and strategic investments; brine inflows at Mosaic’s Esterhazy, Saskatchewan, potash mine or other potash shaft mines; other accidents and disruptions involving Mosaic’s operations, including potential mine fires, floods, explosions, seismic events or releases of hazardous or volatile chemicals; and risks associated with cyber security, including reputational loss, as well as other risks and uncertainties reported from time to time in The Mosaic Company’s reports filed with the Securities and Exchange Commission. Actual results may differ from those set forth in the forward-looking statements.

Visible Strategic Progress 2 $0.52 $0.70 $0.06 $0.07 $0.07 $0.02 $0.00 $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 $0.70 $0.80 Q1 14 Adjusted EPS CF Volume Lower Potash Costs/Tonne Lower Share Count Other Q1 15 Adjusted EPS E P S 3

Click to edit Master title style 4 First Quarter Financial Highlights $1,172 $439 $653 Net Sales Phosphates International Distribution Potash $190 $3 $204 Operating Earnings $0.80 diluted earnings per share • Includes $0.10 positive impact of notable items $656 million in cash from operations $2.1 billion $319 million

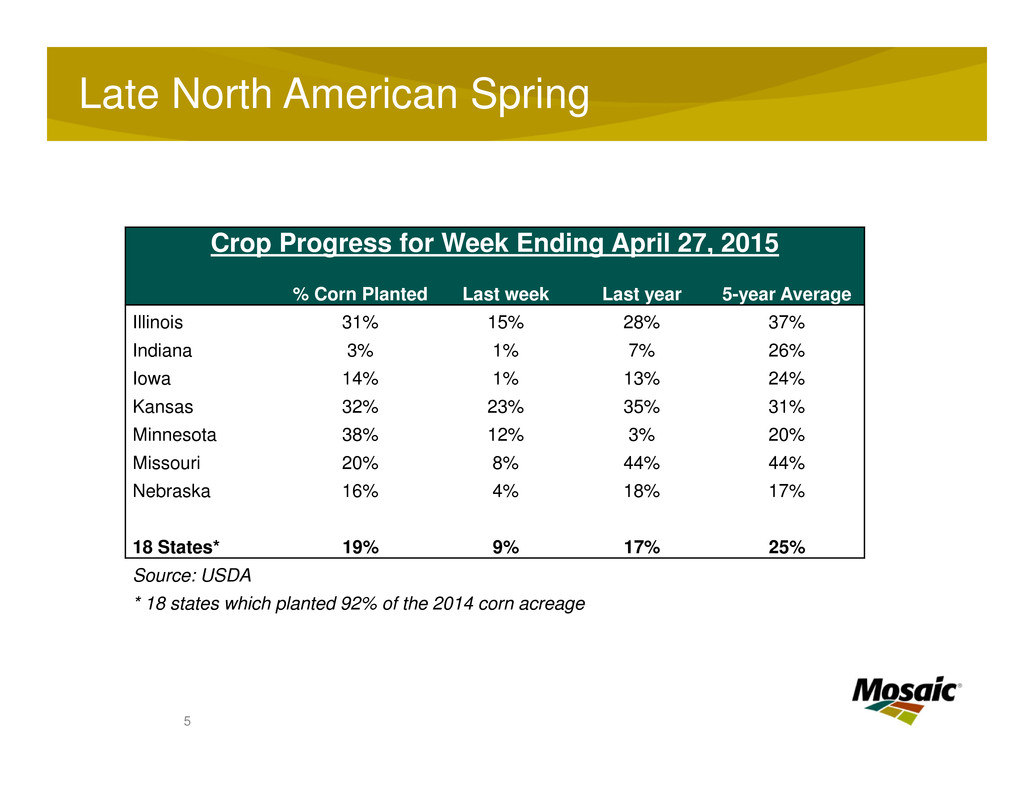

Late North American Spring 2 5 Crop Progress for Week Ending April 27, 2015 % Corn Planted Last week Last year 5-year Average Illinois 31% 15% 28% 37% Indiana 3% 1% 7% 26% Iowa 14% 1% 13% 24% Kansas 32% 23% 35% 31% Minnesota 38% 12% 3% 20% Missouri 20% 8% 44% 44% Nebraska 16% 4% 18% 17% 18 States* 19% 9% 17% 25% Source: USDA * 18 states which planted 92% of the 2014 corn acreage

Financial Results Review

First Quarter Highlights: • The year-over-year increase in net sales is driven by higher realized finished product prices and higher sales volumes. • The year-over-year increase in operating earnings reflects higher finished product selling prices and higher sales volumes, partially offset by higher ammonia and sulfur costs. Phosphates Segment Highlights $ In millions, except DAP price Q1 2015 Q4 2014 Q1 2014 Net sales $1,172 $1,212 $959 Gross margin $222 $231 $200 Percent of net sales 19% 19% 21% Operating earnings $190 $135 $146 Sales volumes 2.3 2.4 2.1 NA production volume(a) 2.3 2.4 2.0 Finished product operating rate 79% 81% 79% Avg DAP selling price $458 $447 $413 (a) Includes crop nutrient dry concentrates and animal feed ingredients 0 50 100 150 200 250 300 Q1 2014 OE Sales price Sales volumes Raw materials Other Q1 2015 OE OPERATING EARNINGS BRIDGE $ IN MILLIONS 7

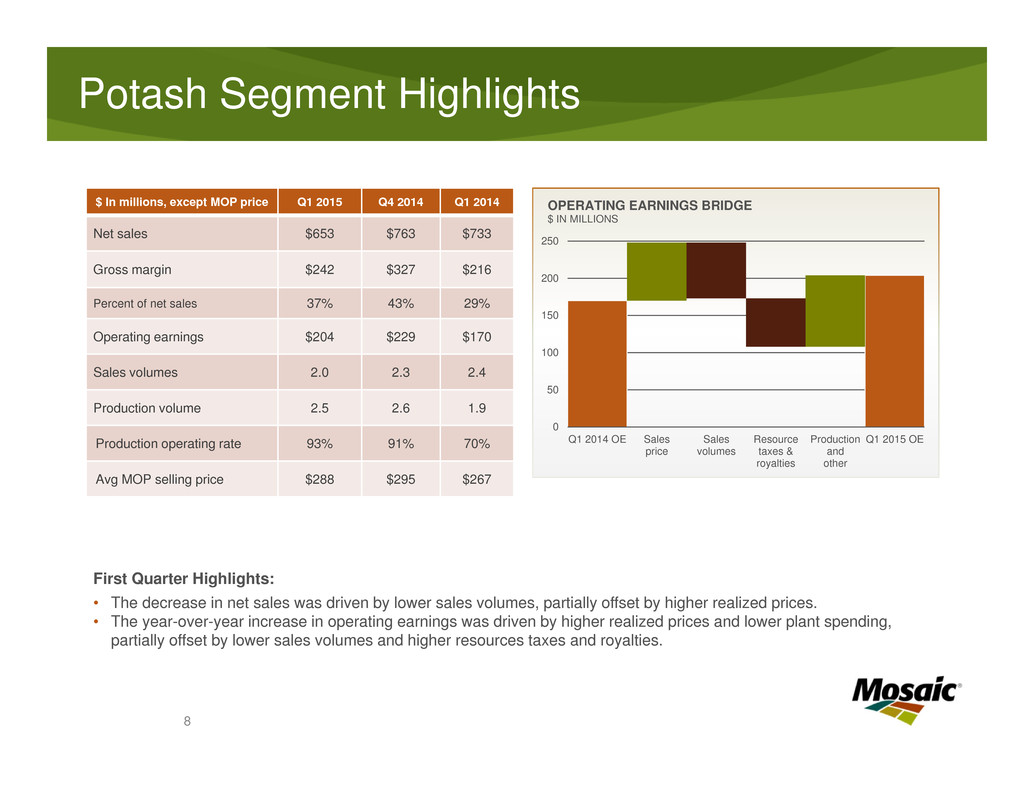

First Quarter Highlights: • The decrease in net sales was driven by lower sales volumes, partially offset by higher realized prices. • The year-over-year increase in operating earnings was driven by higher realized prices and lower plant spending, partially offset by lower sales volumes and higher resources taxes and royalties. Potash Segment Highlights $ In millions, except MOP price Q1 2015 Q4 2014 Q1 2014 Net sales $653 $763 $733 Gross margin $242 $327 $216 Percent of net sales 37% 43% 29% Operating earnings $204 $229 $170 Sales volumes 2.0 2.3 2.4 Production volume 2.5 2.6 1.9 Production operating rate 93% 91% 70% Avg MOP selling price $288 $295 $267 0 50 100 150 200 250 Q1 2014 OE Sales price Sales volumes Resource taxes & royalties Production and other Q1 2015 OE OPERATING EARNINGS BRIDGE $ IN MILLIONS 8

First Quarter Highlights: • The increase in net sales was driven by higher sales volumes and higher average realized prices. • The year-over-year decrease in operating earnings was driven by lower per tonne profitability as a result of a higher mix of nitrogen sales in Brazil. International Distribution Segment Highlights $ In millions, except Blends price Q1 2015 Q4 2014 Q1 2014 Net sales $439 $516 $393 Gross margin $21 $41 $22 Percent of net sales 5% 8% 6% Operating earnings $3 $22 $8 Sales volumes 976 1,113 870 Margin per tonne $21 $37 $25 Average realized price (FOB destination) $444 $456 $438 0 10 20 30 Q1 2014 OE Sales price Sales volumes & mix Product cost Other Q1 2015 OE OPERATING EARNINGS BRIDGE $ IN MILLIONS 9

Balance Sheet and Capital Update Maintain Strong Financial Foundation Sustain Assets & Dividend Grow Business Return 10

Click to edit Master title style 11 Financial Guidance Summary Phosphates 2015 Q2 Sales volumes 2.3 to 2.7 million tonnes Q2 DAP selling price $425 to $450 per tonne Q2 Gross margin rate Around 20 percent Q2 Operating rate 80 to 85 percent Full year sales volumes 9 to 10 million tonnes International Distribution 2015 Q2 Sales volumes 1.4 to 1.7 million tonnes Q2 Gross margin per tonne $18 to $25 per tonne Full year sales volumes 6 to 7 million tonnes

Click to edit Master title style 12 Financial Guidance Summary Potash 2015 Q2 Sales volumes 2.0 to 2.4 million tonnes Q2 MOP selling price $265 to $290 per tonne Q2 Gross margin rate Upper 30 percent range Q2 Operating rate 85 to 90 percent Full year sales volumes 8.5 to 9 million tonnes Full Year Canadian Resources Taxes and Royalties $325 to $375 million Full year brine management costs $180 to $200 million Consolidated Full Year 2015 Total SG&A $360 to $380 million Capital Expenditures and Equity Investments $1.1 to $1.4 billion Effective Tax Rate High teens

Helping the World Grow the Food it Needs

Market Update: North America 14 1.0 2.0 3.0 4.0 5.0 6.0 Jul‐Dec 2014 (A) Jan‐Jun 2015 (F) Jul‐Dec 2015 (F) Jan‐Jun 2016 (F) North American Potash Shipments Spring 15 Range Fall 15 Range Spring 16 Range Fall 14 Actual 7‐Yr Olympic Average 7‐Yr Min‐Max Range 2.0 2.5 3.0 3.5 4.0 4.5 5.0 Jul‐Dec 2014 (A) Jan‐Jun 2015 (F) Jul‐Dec 2015 (F) Jan‐Jun 2016 (F) North American Phosphate Shipments M i l l i o n T o n n e s M i l l i o n T o n n e s Source: Mosaic Estimates

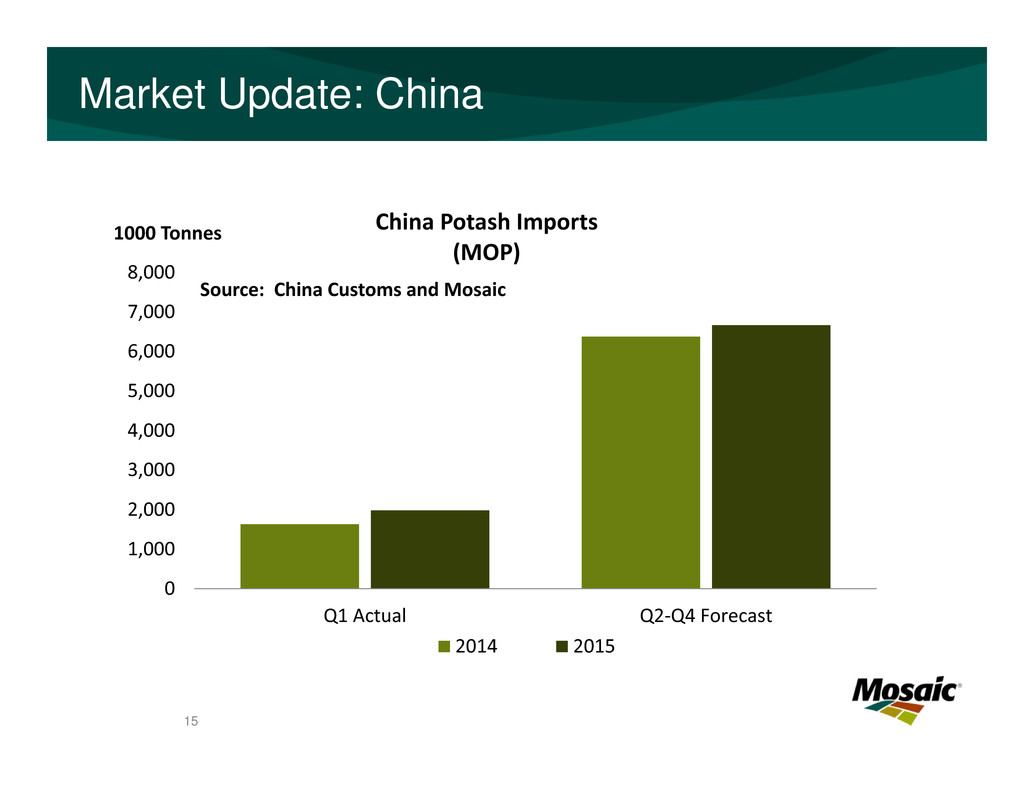

Market Update: China 2 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 Q1 Actual Q2‐Q4 Forecast 1000 Tonnes Source: China Customs and Mosaic China Potash Imports (MOP) 2014 2015 15

Market Update: India 2 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 Q1 Actual Q2‐Q4 Forecast 1000 Tonnes Source: FAI and Mosaic India Phosphate & Potash Imports (DAP/MOP) 2014 2015 16

Market Update: Brazil 2 0 2,000 4,000 6,000 8,000 10,000 12,000 Q1 Actual Q2‐Q4 Forecast 1000 Tonnes Source: ANDA and Mosaic Brazil Phosphate & Potash Imports (DAP/MAP/MES/TSP/MOP) 2014 2015 17

Thank You The Mosaic Company Earnings Conference Call – First Quarter 2015 April 30, 2015 Market Update

Thank You The Mosaic Company Earnings Conference Call – First Quarter 2015 April 30, 2015

Appendix

Q1 2015 Percent Ammonia ($/tonnes) Realized in COGS $519 Average Purchase Price $499 Sulfur ($/ton) Realized in COGS $145 Average Purchase Price $161 Phosphate rock (realized in COGS) ('000 tonnes) U.S. mined rock 3,755 91% Purchased Miski Mayo Rock 334 8% Other Purchased Rock 18 1% Total 4,107 100% Average cost / tonne consumed rock $61 Raw Material Cost Detail 21

$- $25 $50 $75 $100 $125 $150 $175 $200 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015F Realized Costs Market Prices $- $100 $200 $300 $400 $500 $600 $700 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015F Realized Costs Market Prices 22 Phosphate Raw Material Trends Ammonia Sulfur ($/tonne) ($/tonne) 1. Market ammonia prices are average prices based upon Tampa C&F as reported by Fertecon 2. Market sulfur prices are average prices based upon Tampa C&F as reported by Green Markets 3. Realized raw material costs include: ~$20/tonne of transportation, transformation and storage costs for sulfur ~$30/tonne of transportation and storage costs for ammonia 2 21

(a) These factors do not change in isolation; actual results could vary from the above estimates (b) Assumes no change to KMAG pricing 2015 Q1 Actual Change 2015 Q1 Margin % Actual % Impact on Segment Margin Pre-Tax Impact EPS Impact Marketing MOP Price ($/tonne)(b) $288 $50 37% 15% $95 $0.21 Potash Volume (million tonnes) 2.0 0.5 37% 15% $97 $0.22 DAP Price ($/tonne) $458 $50 19% 10% $115 $0.26 Phosphate Volume (million tonnes) 2.3 0.5 19% 6% $69 $0.15 Raw Materials Sulfur ($/lt) $145 $50 19% 4% $51 $0.11 Ammonia ($/tonne) $519 $50 19% 2% $26 $0.06 Earnings Sensitivity to Key Drivers(a) 23

24 Reconciliation: Adjusted EPS Three months ended March 31, 2015 2014 Diluted earnings per share, as reported $ 0.80 $ 0.54 Items included in EPS: Foreign currency transaction gain 0.09 0.08 Unrealized gain (loss) on derivatives (0.08) (0.01) Discrete tax items 0.08 0.16 Remediation of a pre‐combination environmental matter (0.01) (0.01) Sales tax refund 0.02 ‐ Share repurchase ‐ (0.15) Special equity incentive ‐ (0.03) Severance ‐ (0.01) Closing and integrations costs for CF acquistion ‐ (0.01) Diluted earnings per share, as adjusted $ 0.70 $ 0.52

25 Reconciliation: Excess Cash Cash and cash equivalents at March 31, 2015 $ 2,517 Adjustments: Asset retirement obligations (650) Share Repurchase authorization (149) Liquidity buffer (1,000) Excess Cash at March 31, 2015 $ 718