Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

April 30, 2015

Date of Report (date of earliest event reported)

MyDx, Inc.

(Exact name of Registrant as specified in its charter)

| Nevada | 333-191721 | 99-0384160 | ||

| (State or other

jurisdiction of incorporation or organization) |

(Commission File Number) | (I.R.S. Employer Identification Number) |

4225

Executive Square, Suite 600

La Jolla, California 92037

(Address of principal executive offices)

(800) 814-4550

(Registrant’s telephone number, including area code)

Brista Corp.

302 San Anselmo Avenue, Suite 220

San Anselmo, California 94960

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which statements involve substantial risks and uncertainties. In some cases, it is possible to identify forward-looking statements because they contain words such as “anticipates,” believes,” “contemplates,” “continue,” “could,” “estimates,” “expects,” “future,” “intends,” “likely,” “may,” “plans,” “potential,” “predicts,” “projects,” “seek,” “should,” “target” or “will,” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions. Many factors could cause our actual operations or results to differ materially from the operations and results anticipated in forward-looking statements. These factors include, but are not limited to:

| ● | our financial performance, including our history of operating losses; |

| ● | our ability to obtain additional funding to continue our operations; |

| ● | our ability to successfully develop and commercialize our products; |

| ● | changes in the regulatory environments of the United States and other countries in which we intend to operate; |

| ● | our ability to attract and retain key management and marketing personnel; |

| ● | competition from new market entrants; |

| ● | our ability to successfully transition from a research and development company to a marketing, sales and distribution concern; |

| ● | our ability to identify and pursue development of additional products; and |

| ● | the other factors contained in the section entitled “Risk Factors” contained in this Current Report on Form 8-K. |

We have based the forward-looking statements contained in this Current Report on Form 8-K primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, results of operations and prospects. The outcome of the events described in these forward-looking statements are subject to risks, uncertainties, assumptions, and other factors including those described in the section of this Current Report on Form 8-K entitled “Risk Factors.” Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements used herein.

You should not rely on forward-looking statements as predictions of future events. Except as required by law, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements, and we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements.

EXPLANATORY NOTE

As used in this Current Report on Form 8-K, (1) the terms the “Company,” “we,” “us,” and “our” refer to the combined enterprises of MyDx., Inc., a Nevada corporation, formerly named Brista Corp. (“Brista”), and CDx, Inc., a Delaware corporation (“CDx”), after giving effect to the Merger (defined below) and the related transactions described herein, (2) the term Brista refers to the business of Brista Corp., prior to the Merger, and (3) the term “CDx” refers to the business of CDx, Inc., prior to the Merger, in each case unless otherwise specifically indicated or as is otherwise contextually required. Although Brista Corp. changed its name to MyDx, Inc. on April 24, 2015, to avoid confusion and for purposes of clarity, the historical pre-merger operations of the Company are referred to in this Current Report as “Brista”.

| -1- |

This Current Report on Form 8-K is being filed in connection with a series of transactions consummated by us that relate to the Merger (as defined below) between us and CDx, Inc., which transactions are described herein, together with certain related actions taken by us.

The information contained in this Current Report on Form 8-K responds to the following items of Form 8-K:

| Item 1.01 | Entry into a Material Definitive Agreement. | |

| Item 2.01 | Completion of Acquisition or Disposition of Assets. | |

| Form 10 Information | ||

| Description of Business | ||

| Risk Factors | ||

| Management’s Discussion and Analysis | ||

| Description of Properties | ||

| Security Ownership of Certain Beneficial Owners and Management | ||

| Directors, Executive Officers and Corporate Governance | ||

| Executive Compensation | ||

| Certain Relationships and Related Transactions, and Director Independence | ||

| Legal Proceedings | ||

| Recent Sales of Unregistered Securities | ||

| Controls and Procedures | ||

| Market for Registrants Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | ||

| Description of Capital Stock | ||

| Indemnification of Officers and Directors | ||

| Financial Statements and Supplementary Data | ||

| Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | ||

| Exhibits, Financial Statement Schedules | ||

| Item 3.02 | Unregistered Sales of Equity Securities. | |

| Item 4.01 | Changes in Registrant’s Certifying Accountant. | |

| Item 5.01 | Changes in Control of Registrant. | |

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. | |

| Item 5.03 | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. | |

| Item 5.06 | Change in Shell Company Status. | |

| Item 7.01 | Regulation FD Disclosure. | |

| Item 9.01 | Financial Statements and Exhibits. |

| Item 1.01. | Entry into a Material Definitive Agreement. |

On April 9, 2015, Brista entered into an Agreement and Plan of Merger (the “Merger Agreement”) with CDx Merger Inc., a Nevada corporation and wholly owned subsidiary of Brista (“Merger Sub”), and CDx. Pursuant to the Merger Agreement, Merger Sub merged with and into CDx with CDx surviving the merger as Brista’s wholly owned subsidiary (the “Merger”). On April 24, 2015, in anticipation of closing the Merger, Brista changed its name to MyDx, Inc.

For a description of the Merger and the material agreements entered into in connection with the Merger, please see the disclosures set forth in Item 2.01 of this Current Report on Form 8-K, which disclosures are incorporated into this Item 1.01 by reference. Item 2.01 of this Current Report on Form 8-K contain only a brief description of the material terms of the Merger Agreement, and does not purport to be a complete description of the rights and obligations of the parties thereunder, and such description is qualified in their entirety by reference to the Merger Agreement which is filed as an exhibit to this Current Report on Form 8-K.

| -2- |

| Item 2.01. | Completion of Acquisition or Disposition of Assets. |

The Merger and Related Transactions

On April 30, 2015, pursuant to the Merger Agreement, Merger Sub and CDx consummated the Merger, and CDx became a wholly owned subsidiary of Brista.

Pursuant to the Merger Agreement, upon consummation of the Merger, each share of CDx’s capital stock issued and outstanding immediately prior to the Merger was converted into the right to receive one (1) share of Brista’s common stock, par value $0.001 per share (the “Common Stock”). Additionally, pursuant to the Merger Agreement, upon consummation of the Merger, Brista assumed all of CDx’s options and warrants issued and outstanding immediately prior to the Merger, which are now exercisable for approximately 1,902,173 and 7,571,000 shares of Common Stock, respectively, as of the date of the Merger. Prior to and as a condition to the closing of the Merger, each then-current Brista stockholder agreed to sell certain shares of common stock held by such holder to Brista and the then-current Brista stockholders retained an aggregate of 1,990,637 shares of common stock. Therefore, following the Merger, CDx’s former stockholders now hold 19,484,615 shares of Brista common stock which is approximately 92% of the Company Common Stock outstanding.

Upon consummation of the Merger, Brista expanded its board of directors (the “Board”) from one to seven directors, each of whom will be directors designated by CDx.

Pursuant to the Merger Agreement, each party has made certain customary representations and warranties to the other parties thereto. The Merger was conditioned upon approval by CDx’s stockholders and certain other customary closing conditions.

The foregoing description of the Merger Agreement is only a summary and is qualified in its entirety by reference to the complete text of the Original Merger Agreement and the Amendment, which are filed as Exhibit 2.1 and Exhibit 2.2, respectively, to this Current Report on Form 8-K, and each of which is incorporated by reference herein.

Accounting Treatment

The Merger is being treated as a reverse acquisition of Brista, a public shell company, for financial accounting and reporting purposes. As such, CDx is treated as the acquirer for accounting and financial reporting purposes while Brista is treated as the acquired entity for accounting and financial reporting purposes. Further, as a result, the historical financial statements that will be reflected in the Company’s future financial statements filed with the United States Securities and Exchange Commission (“SEC”) will be those of CDx, and the Company’s assets, liabilities and results of operations will be consolidated with the assets, liabilities and results of operations of CDx.

Smaller Reporting Company

Following the consummation of the Merger, the Company will continue to be a “smaller reporting company,” as defined in Regulation S-K promulgated under the Exchange Act.

Stock Repurchase Agreement

In connection with the Merger, Brista entered into a Stock Repurchase Agreement (the "Repurchase Agreement") with each of its stockholders pursuant to which Brista repurchased 17,533,363 shares of its common stock (the "Repurchased Shares") from such shareholders. Upon the repurchase, Brista cancelled all of the Repurchased Shares.

| -3- |

FORM 10 INFORMATION

For purposes of this Current Report on Form 8-K, the Company is providing certain information that it would be required to disclose if it were a registrant filing a general form for registration of securities on Form 10 under the Exchange Act. As such, the terms the “Company,” “we,” “us,” and “our” refer to the combined enterprises of Brista and CDx, after giving effect to the Merger and the related transactions described below, except with respect to information for periods before the consummation of the Merger which refer expressly to CDx or Brista, as specifically indicated.

BUSINESS

Company Overview

Immediately following the Merger, the business of CDx became our business.

CDx, Inc. was incorporated under the laws of the State of Delaware on September 16, 2013. We are an early-stage science and technology company. We have developed and are commercializing technology and devices to accurately measure chemicals of interest in solid, liquid, or gas samples. Our mission is to enable people to live a healthier life by revealing the purity of certain compounds they eat, drink and inhale in real time through a device they can hold in the palm of their hand. We provide a quick, easy and affordable way for consumers to test the safety and composition of what they consume. We believe that the broad application and ease of use of our technology puts us in an ideal position to provide consumers with a practical and affordable way to trust and verify what they are putting into their bodies without leaving the comfort of their homes.

Our foundational proprietary technology derives from research developed at the California Institute of Technology, Pasadena, California, for the Jet Propulsion Laboratory, used by NASA as well as an additional project funded by the Bill & Melinda Gates Foundation for other exploratory research and medical applications. We have a portfolio of intellectual property rights covering principles and enabling instrumentation of chemical sensing technology across solid, liquid, and gas samples, including certain patented and patent pending technologies from a third party pursuant to a joint development agreement (the rights in this paragraph are sometimes referred to herein as the “Intellectual Property Rights”). See “Intellectual Property.”

We believe that our portfolio of Intellectual Property Rights provides us with a strong and defensible market position from which to commercialize our portable electronic nose and analyzing technology and to build our business by expanding our core technology across a variety of applications. Our current business strategy includes collaborations with a variety of industry partners for the development of products to support our portable sensing and analyzing technology.

Product Overview: MyDx

How MyDx Works

Our core technology is centered on a portable chemical sensing and analyzing method, represented by our first product, MyDx. MyDx is a portable chemical sensor, combined with a hand-held analyzer and associated mobile app, which together, acts as an electronic nose by detecting and analyzing molecules present in a given sample. MyDx aims to take chemical analysis out of the lab and to put it into the palm of the user’s hand. MyDx permits analysis of a wide array of substances using one device with interchangeable sensors which will be rolled out over coming years.

Each MyDx sensor has sensitivity in parts per billion, which the Company believes is unique for a handheld chemical analyzer at our anticipated consumer price-point for MyDx. The MyDx device has a user-friendly interface and is designed to easily communicate via Bluetooth with our mobile app, which can be downloaded on any iOS, Android, or Windows smartphone. Given the sensitivity of the MyDx device, once the app is downloaded and the device is synced, a small sample can be placed in the sample chamber, which is then stimulated, releasing the chemicals of interest into a vapor for identification by the MyDx Analyzer. The process of analysis takes about three minutes, after which the user will be able to view the parts per billion chemical composition of the sample on his or her mobile smart phone via our mobile app. In addition, the app will track and save the results of each analysis for future reference and comparison, and will aggregate reports on and analyses of various chemical compounds to help educate the consumer about the results. MyDx sensors can be switched by the user based on the type of the sample being tested, and the user will simply launch the associated app from their smartphone. The Company believes that, based on its portability, MyDx is the first portable chemical sensing and analyzing technology available for use by a broad range of consumers. This technology could help consumers to test for, among other things, pesticides in food, chemicals in water, toxins in the air in their own homes, and cannabis for its chemical content. Over the course of the next two years, the MyDx team plans to roll out four different sensors including Organa, Canna, Aero, and Aqua. These four sensor types are described in more detail below.

| -4- |

The Company currently has working prototypes of the Canna Sensor combined with the MyDx Analyzer.

About the MyDx Solution

The Company believes that MyDx is the first portable chemical analyzer available for use by consumers. Designed to work in combination with the Company’s mobile app, the MyDx solution provides seamless integration with iOS, Android, and Windows mobile smart phones and will make the analysis of chemical data meaningful to users. The Company’s first four planned interchangeable sensors include:

| ● | Organa – The Organa Sensor will be used to identify pesticides present in fruits and vegetables. MyDx will be able to analyze samples of food and detect levels of certain chemicals that might be harmful, such as Bisphenol-A, Phthalates, pesticides, herbicides, and countless others that could lead to hormone imbalances, sickness, cancer, and various other diseases. This product would allow parents to be more informed about the food they are feeding to their children, a population segment vulnerable to these chemicals. Many of the harmful chemicals detected by MyDx are legal in the United States. The MyDx device, once available, will be one of the first options consumers will have to educate themselves, in real-time about whether their foods contain such chemicals by actually testing the food themselves. In addition, because the mobile app paired with the MyDx Analyzer quickly and easily indicates the presence of various chemicals, consumers do not need to be fully educated about the various chemicals in order to use the device effectively. |

| ● | Aero – The Aero Sensor will be used for testing air quality. Air quality can vary greatly depending on the time of day and location. The Aero Sensor will allow the user to measure the local air quality in any location, and the information included in the mobile app will aid in their understanding of the air quality measurement. The Company expects, although it cannot assure, that there will be global interest in its air quality sensor, especially in urban and industrial areas where air quality is often poor. |

| ● | Aqua – The Aqua Sensor will be used for testing water quality. Water often contains harmful chemicals and minerals such as hexavalent chromium, fluoride, mercury, chlorine, lead, and many others. The use of the Aqua Sensor with the MyDx Analyzer will enable people to test water for these harmful chemicals. Because the MyDx device is easily transported, consumers will be able to test the local tap water while traveling, which the Company believes will be a popular use for the device. |

| ● | Canna – The Canna Sensor is used to identify the chemical composition of cannabis, the use of which is increasingly being permitted for medicinal and other purposes across North America. The cannabis plant is versatile, and certain strains could aid with the treatment of different ailments and symptoms. When presented with a sample of cannabis, the MyDx test and mobile app will identify the chemical compounds of the unique strain being tested, inform the user about its potency,and enable the consumer to associate feelings and ailments with the test results. With the introduction of our Canna Sensor, the Company’s goal is to promote patient and consumer safety by giving them the ability to correlate the chemical composition of their cannabis with feelings and ailments. This will allow consumers to use MyDx to educate themselves on responsible use and dosage by giving them an understanding of their body’s reaction to the sample being tested. Note that consumers cannot inhale or use cannabis with the MyDx device. It is simply an analyzer. We believe the legalization of cannabis both for medical and other uses will continue, and that the success of our Canna Sensor will benefit from this trend. |

The Company currently has working prototypes of the Canna Sensor combined with the MyDx Analyzer. We shipped the first 231 beta devices of our Canna Sensor in February 2015, and plan to ship commercial units with Canna Sensors over the remainder of 2015. However, unexpected circumstances could delay or completely alter our anticipated product rollout.

| -5- |

Product Features

MyDx Service

The MyDx Analyzer comes with a variety of product features that provide consumers with a user-friendly experience. The Company has developed a sleek and durable unit that, paired with our four sensors, has capabilities to analyze a variety of chemical compounds in the palm of the user’s hand.

The MyDx Service connects the MyDx Analyzer to the MyDx App using BLE (Bluetooth Low Energy) connection. The MyDx App communicates with the secure MyDx Cloud via the Internet.

MyDx Analyzer

The MyDx Analyzer comes with Bluetooth connectivity in order to engage the MyDx App, which provides the user with additional information to help them understand the chemicals found by the MyDx Analyzer. The MyDx Cloud compares what was sensed by the MyDx Analyzer with scientific data about that sample on the back-end, revealing Tetrahydrocannabinol (“THC”) and Cannabidiol (“CBD”) levels found in the sample.

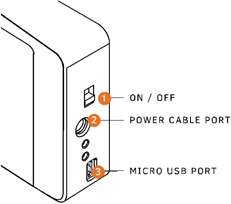

Using the MyDx Analyzer is simple and easy. Below are the steps to power on/charge the MyDx Analyzer, open/close the Sample Chamber, and insert/remove the Sample Insert.

|

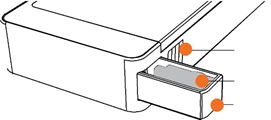

1) Power: Turn on and off MyDx 2) Power Cable Port: Charge MyDx Analyzer and power the device 3) Micro USB Port: Connect to computer to charge and power MyDx Analyzer 4) Press on the Chamber Release Button to open the Sliding Sample Chamber 5) Open the Sliding Sample Chamber to insert Disposable Sample Insert 6) After testing, remove the Disposable Sample Insert |

| -6- |

|

CHAMBER RELEASE BUTTON

DISPOSABLE SAMPLE INSERT

SLIDING SAMPLE CHAMBER |

|

The MyDx App

All of the software necessary to run the MyDx Analyzer is built-in so the consumer will have no need to manage any software other than the MyDx App. The MyDx App is available for the iPhone, iPad, and IOS, Android and Windows platforms.

Once the MyDx App is installed on the consumer’s mobile device, the consumer merely turns on the MyDx Analyzer using the small button on the side next to the power cable slot. The green power light will illuminate. MyDx Analyzer and the mobile device must be within 5 feet of each other when testing, or they must be connected with the USB cable provided.

From the MyDx App home screen, the consumer can either click the center OrganaDx logo and click “Test with MyDx” or click the orange “Add Profile +” button at the bottom of the page and “Use MyDx”.

|

| -7- |

|

Connect:

Next, the MyDx App will attempt to find and sync with the MyDx Analyzer via a wireless Bluetooth connection.

|

|

Sample:

The consumer will then load their sample into the Sample Chamber. They will take an empty disposable Sample Insert and place their sample into the Sample Insert. This is done by gently grinding the sample between their fingers and letting the contents fall into the chamber. They fill the sample up to just below the rim of the insert. Once the sample is loaded and the chamber is closed, they follow the onscreen instructions and click “Next”.

|

|

Analyze:

The MyDx Analyzer is placed on a flat surface, and the consumer presses the “Start” button. Three minutes later, they have their results. |

| -8- |

Target Audiences

The initial target audience for MyDx is consumers who are concerned with health and are interested in understanding what they are putting into their bodies. As described above, the MyDx Analyzer is intended to have a variety of sensors, and consumers will be able to insert the appropriate sensor to match the type of material to be analyzed. We believe that, as consumers become more educated about the risks of pesticides and other harmful chemicals that can be present in their food, water and in the air they breathe, the demand for a product like MyDx will increase.

Globally, the Company expects, but cannot guarantee, far-reaching adoption inasmuch as our MyDx product has the potential to address some of the world’s most important human health problems. Air quality and water quality, internationally, are of concern to many, and regulations attempting to limit air and water pollution exist in countries across the globe. The Aero and Aqua Sensors could be used to alert consumers that certain activities are emitting too many pollutants in to the air or water. MyDx’s capability of analyzing local air and water quality could be useful in other ways to locals and travelers alike, from parents measuring particulate matter levels in the air in their homes, to a traveler or foreign aid worker testing tap water in a foreign country before taking or offering a drink. Along similar lines, the Organa Sensor can be used to detect pesticides and other harmful chemicals in food. As the organic food movement grows and consumers become increasingly interested in identifying pesticide content in the fruits and vegetables they are eating, MyDx’s target audience will expand. We believe that MyDx’s interchangeable sensor design allows it to address a broad array of problems faced in the modern world.

The Canna Sensor may have broad appeal to individuals who use medicinal cannabis for their health. In many cases, the chemical compounds consumers need to know about are not correctly identified at the point-of-sale, and the consumers may not be aware of whether a particular strain will treat the symptoms they are experiencing. Using the Canna Sensor, consumers will be able to identify certain chemical compounds in different strains of cannabis that are associated with the desired response to its use. This makes MyDx an important tool for both cannabis patients and recreational users who want to understand the product they are consuming, how it affects their body and treats any symptoms they may have.

In addition to the consumer audience for our MyDx Canna Sensor, we expect businesses in the cannabis industry, including cultivators, processors, dispensaries, and retail distributors to use MyDx as an additional test for their own products or the products that they are buying for resale to consumers. However MyDx is not a replacement for commercial lab testing using standard gas chromatography and other lab equipment.

We believe the target audience for sales of our Organa, Aqua and Aero Sensors will be the individual consumer. We plan to offer those sensors for sale to consumers through our website shopping cart and at traditional brick and mortar retail stores.

Distribution and Marketing Strategy

The Company expects to distribute its products through various channels, including distributors, e-commerce via the Company’s website, direct to retail, and sales through affiliate partners. As part of our marketing strategy, the Company intends to partner with certain bloggers, websites and social media channels with large audiences, to ensure that the potential market knows and understands the promise of the MyDx Analyzer. The Company plans to use industry conferences, media outreach, and social media channels such as Facebook, LinkedIn, Twitter, Instagram, Google+ and more to push its message to the right audiences.

Despite having no marketing budget since its inception, to date, the Company has received hundreds of requests to purchase the device and has presold nearly 300 devices. Some of the Company’s channel partners have expressed interest in purchasing large unit quantities. The Company expects that when the first product is launched and the Company has the financial resources to implement its marketing strategy, the Company will be able to stimulate further interest and quickly generate product sales.

| -9- |

Market Overview

Organic Food Demand

The global organic food and beverage market is expected to grow from $80 billion in 2013 to $162 billion by 2018, which is a 15% compounded annual growth rate. Sales of organic products in the United States grew 12% in 2013 to $35 Billion. Over 10% of fruits and vegetables sold in the United States are organic (See Reportlinker.com; June 2014; Organic Trade Association - OTA’s 2014 Organic Industry Survey). The Company believes that the consumption of organic foods will continue to become more mainstream. The popularity of farmers’ markets in the United States has grown in conjunction with the rise in organic production and consumer interest in locally and organically produced foods See: http://www.ers.usda.gov/publications/vgs-vegetables-and-pulses-outlook; and http://www.ers.usda.gov; and http://www.organicconsumers.org/Organic/marketincrease73001.cfm). Recent surveys of parents across the country indicate that 81% of parents reported purchasing organic foods at least sometimes. (See http://www.prnewswire.com/news-releases/eight-in-ten-us-parents-report-they-purchase-organic-products-201477661.html) This trend toward “organics” is in part a function of consumers attempting to avoid harmful pesticides and foods created with genetically modified organisms (“GMOs”), as well as concerns regarding animal welfare and the environment.

We believe that this trend toward organic foods puts MyDx in a unique position to meet demand. The market for the Organa Sensor could grow alongside consumers becoming more concerned with the source and quality of their foods, and as farmer’s markets and organics become increasingly popular, MyDx could be used to test foods before they are purchased or sold. MyDx could, in this way, be a useful tool for consumers at farmer’s markets, and even at non-organic food stores, because MyDx can be used to test both organic and non-organic foods to ensure that consumers are given real-time and potentially comparative information about the foods they are buying.

Air Quality

As air pollution levels increase, air quality is rapidly deteriorating in countries across the globe. Air pollution consists of both gaseous and fine particulate contaminants present in the atmosphere. Pollutants can be released directly into the air, or can be formed when pollutants in the air react with one another. Based on a recent article by the World Health Organization (“WHO”), half of the urban populations of over 1,600 cities worldwide are exposed to air pollution every day. The WHO warns that air pollution for an average urban citizen is 2.5 times higher than what is considered a healthy environment. (See: http://www.who.int/phe/health_topics/outdoorair/databases/cities/en.) Air pollution has been linked to numerous health problems, including aggravation of respiratory and cardiovascular disease, decreased lung function, increased susceptibility to respiratory infection, and cancer (See http://www.epa.gov/airtrends/2011/report/airpollution.pdf; and http://www.epa.gov/airtrends/2011/). Certain “sensitive” populations, such as asthmatics, diabetics, children, and the elderly, experience greater impact from pollutants in the air.

In order to stem the tide of increasing air pollution, the United States Environmental Protection Agency has set National Ambient Air Quality Standards (“NAAQS”) for pollutants considered harmful to the environment and to the public health. Based on the NAAQS, all states in the United States are required to develop emission reduction strategies in order to lower levels of these harmful pollutants. Along the same lines, local governments are undertaking air quality studies to assess potential public health impacts pollutants in the air, and are promulgating rules to govern pollution-causing activities on the local level. State, federal, and local laws also exist to govern things like demolition and remodeling activities, emissions of asbestos fibers in the air, and the maintenance and removal of lead paint. In addition to regulations on air pollution, there are a variety of voluntary measures, including pollution prevention and control methods that can be implemented by willing individuals and businesses.

MyDx, paired with our Aero Sensor, is intended to present a solution for air quality monitoring for individuals within populations that are sensitive to air pollution, such as parents of asthmatic children who want to monitor the quality of the air in their homes. As both air pollution and public awareness of contaminants in the air increase, so will the market for a relatively low-cost air quality monitor. Furthermore, we believe that MyDx could be used both to help ensure compliance with air quality regulations and to help achieve voluntary control measures for pollution prevention. Individuals and small businesses conducting activities such as demolition or remodeling could use MyDx to ensure that their chosen means of conducting the activity is in compliance with the law. One step further, MyDx could be used to voluntarily ensure that, for instance, one’s car or lawn mower is not emitting harmful chemicals into the air. In any case, we believe that MyDx’s portability and low cost make it an ideal candidate to allow for convenient and accurate air quality monitoring from small sample, without the need for any governmental overhead or a trip to a laboratory. The Company does not intend to commercialize and offer for the sale the Aero Sensor during 2015.

| -10- |

Water Quality

Global water quality is also rapidly declining. Every day two million tons of sewage is discharged into our water. Recent United Nation estimates indicate that about 1,500 km3 of wastewater is produced annually, which is six times more water than is present in all the rivers of the world (See http://www.pacinst.org/wp-content/uploads/sites/21/2013/02/water_quality_facts_and_stats3.pdf). To put this issue in perspective, here are some facts about how water pollution can and is affecting everyone on a global scale:

| ● | Lack of adequate sanitation contaminates water courses worldwide and is one of the most significant forms of water pollution. Worldwide, 2.5 billion people live without improved sanitation. |

| ● | 18% of the world’s population, or 1.2 billion people (1 out of 3 in rural areas), defecate in the open. Open defecation significantly compromises quality in nearby water bodies and poses an extreme human health risk. |

| ● | Worldwide, infectious diseases such as waterborne diseases are the number one killer of children under five years old and more people die from unsafe water annually than from all forms of violence, including war. |

| ● | Unsafe or inadequate water, sanitation, and hygiene cause approximately 3.1% of all deaths worldwide, and 3.7 percent of disability adjusted life years worldwide. |

| ● | Unsafe water causes four billion cases of diarrhea each year, and results in 2.2 million deaths, mostly of children under five. This means that 15% of child deaths each year are attributable to diarrhea – a child dying every 15 seconds. In India alone, the single largest cause of ill health and death among children is diarrhea, which kills nearly half a million children each year. (See: http://www.pacinst.org/wpcontent/uploads/sites/21/2013/02/water_quality_facts_and_stats3.pdf; and http://www.un.org/waterforlifedecade/quality.shtml http://www.gemstat.org/ |

We believe that MyDx and our Aqua Sensor could be an indispensable tool for individuals and businesses trying to solve water contamination problems. Similar to air quality, water contamination has both local and far-reaching impacts. We believe that MyDx could be used by anyone from a parent testing the water in their own home, to a traveler testing the tap water in a foreign country, to a foreign aid worker trying to ensure that individuals in countries without adequate sanitation are not exposed to drinking contaminated water. As part of our long-term business plan, we believe that the Aqua Sensor could be used on the ground in water filtration and treatment facilities in developing countries that may not have access to a local testing laboratory. As a relatively low-cost and portable water testing device, MyDx paired with our Aqua Sensor, could therefore have a market that stretches around the globe. The Company does not intend to commercialize and offer for the sale the Aqua Sensor during 2015.

Cannabis

In 1996, Oregon and California passed legislation legalizing the possession and use of cannabis for medical purposes. As of 2014, both Colorado and Washington have passed laws allowing for recreational cultivation and use of cannabis among adults aged 21 and over, and over 20 states and the District of Columbia have passed regulations permitting cannabis use in one form or another. There are currently approximately 2.4 million medicinal cannabis users in the United States (See: www.ProCon.org). According to a recent study by Archview Market Research, the United States national legal cannabis market was valued at $1.53 billion in 2013, including all states that had active sale of cannabis to consumers legally allowed to possess cannabis. According to this report, this market is expected to grow to $10.2 billion in five years.

Given the relative youth of the industry, and the lack of federal legalization of either medical or recreational cannabis use, few practical cannabis quality control solutions exist today. Medicinal cannabis patients therefore often have a very difficult time understanding what psychotropic effects they should expect before consuming a particular strain of cannabis, even when the strain is labelled with the percentage concentration of THC or CBD, two common cannabinoids present in the cannabis plant that impact its potency and impact on the user. Both medical cannabis patients and recreational consumers deserve a practical and affordable solution to gain control over what to expect from a given strain before choosing to put it into their body. MyDx, used in conjunction with the app, is designed to enable those individuals to gain control over what they are consuming and to achieve some consistency in how they are feeling or how effectively certain symptoms are being treated. This is accomplished by having the user enter “feeling data” (e.g. anxious, tired, pain relief) into the app and comparing that feeling data to the specific chemical composition of the cannabis ingested. In such manner, a database can be developed enabling MyDx users to be more deliberate as to the strain and chemical features THC, TCB-2, etc.) of the cannabis they choose to procure in the future. MyDx users may also elect to develop and maintain their own personal database within the app.

| -11- |

Competition

Currently, the Company believes there are no portable, consumer-focused, reasonably-priced sensors on the market that can measure chemicals at parts per billion levels, as MyDx’s interchangeable sensors can. The Company is aware that there are companies developing devices that can measure at the parts per hundred or parts per thousand level although, to the Company’s knowledge, none of these products have yet been delivered. The Company is also aware of two hand-held analyzer devices in development which are being marketed to consumers. One is Scio, which plans to use spectrometer technology to externally scan food, medicine and plants. The other one is FOOD sniffer, which is being marketed as the world’s first electronic nose that helps consumers determine the quality of meat, poultry and fish before they eat it, thereby reducing the risk of food poisoning by testing food to confirm that it is safe to consume. In addition, larger gas chromatography units that range from $25,000 to well over $100,000, are available, but we believe these larger units ultimately will not compete for the consumer base to which that the Company plans to market MyDx.

In contrast, the Company intends to bring to market a consumer-focused, parts per billion device for under $700. The Company believes that the combination of a relatively low price point, parts per billion sensitivity, and patentable intellectual property provide barriers to competition. However, companies with far greater resources than the Company could develop competing technologies and products that could impact the market for the Company’s products.

The Company does not plan to commercialize its Aqua and Aero Sensors in 2015 and has not performed a competitive analysis with respect to those planned uses of MyDx.

Research and Development

MyDx is built on technology that has been available for at least a decade, but appears to never have been used at the consumer level. We have filed four United States provisional patent applications and an international patent application citing priority to those United States provisional patent applications is pending. We are developing our intellectual property rights in order to create and protect the MyDx Analyzer with respect to competitors. Our intellectual property is intended to aid us in bringing this technology to consumers in a portable, handheld unit. Moving forward, we expect many other applications of the technology may arise for both consumers and small businesses. For instance, we have had inquiries from the wine industry about analyzing chemicals in wine. We have also had inquiries from various consumer appliance manufacturers for detecting both spoiling foods and when food preparation is complete.

The Company incurred research and development expenses of approximately $1,500,000 in 2014 related to the development of the MyDx Analyzer and the sensors.

Current Sensor Commercialization R&D Status

Currently the Company has operational sensors in two different laboratories, and at its corporate headquarters in San Diego. The other units are newer but are testing with similarly favorable results. The Company is continuing to test its various sensors to ensure that the sensors and overall units are working appropriately.

Analyzing the results from these combined testing and development efforts, the Company is convinced that the MyDx technology is working and will soon be ready for commercial launch. However, until the Company begins to manufacture the products in commercial volumes, there can be no assurance that the development efforts will result in a marketable product that will achieve acceptance and profitable results of operations.

| -12- |

Manufacturing

CDx is using a contract manufacturing model. It is currently evaluating a variety of contract manufacturers who are capable of delivering over 20,000 units per month. The Company intends to sign an agreement with at least one contract manufacturer, and possibly more, if there is sufficient demand for the MyDx product. The Company’s contract manufacturer will not only deliver units, but will also help with design, manufacturing, and testing and review of the MyDx unit and sensor. In addition, the contract manufacturer will be responsible for customer logistics management, packaging, fulfillment and more. Our aim is to initially use contract manufacturers based in California, so that we can have hands-on control of product manufacturing to ensure the MyDx units produced are ready for sale.

Intellectual Property

We strive to protect the proprietary technologies that we believe are important to our business, including seeking and maintaining patent protection intended to cover the device products, their methods of use, related technology and other inventions that are important to our business. We also rely on trade secrets and careful monitoring of our proprietary information to protect aspects of our business that are not amenable to, or that we do not consider appropriate for, patent protection.

We believe our success will depend significantly on our ability to (i) obtain and maintain patent and other proprietary protection for commercially important technology, inventions and know-how related to our business; (ii) defend and enforce our patents;(iii) maintain our licenses to use intellectual property owned by third parties; (iv) preserve the confidentiality of our trade secrets; and (v) operate without infringing valid and enforceable patents and other proprietary rights of third parties. We also rely on know-how, and continuing technological innovation to develop, strengthen and maintain our proprietary position in the field of handheld sensor technology.

We plan to continue to expand our intellectual property portfolio by filing patent applications directed to handheld sensor technology. We anticipate seeking patent protection in the United States and internationally for compositions of matter, apparatuses, and methods related to handheld sensor technology.

On July 2, 2014, the Company filed assignments of all right, title and interest for four United States provisional patent applications that were recorded with the United States Patent and Trademark Office on July 3, 2014. The United States provisional patent applications assigned to the Company were acquired for consideration that included cash and stock. The Company filed an international patent application with an international filing date of July 14, 2014 that cites priority to the four United States provisional patent applications. The international patent application is currently pending. The Company also has an exclusive option to acquire specific patents with a third party development partner.

The term of individual patents depends upon the legal term of the patents in the countries in which they are obtained. In most countries in which we file, the patent term is 20 years from the earliest date of filing a Patent Cooperation Treaty (PCT) application or a non-provisional patent application, subject to any disclaimers or extensions. The term of a patent in the United States can be adjusted and extended due to the failure of the United States Patent and Trademark Office following certain statutory and regulation deadlines for issuing a patent.

The following is a list of the Company’s Trademarks.

AeroDx™

AquaDx™

CannaDx™

MyDx™

Trust & Verify™

| -13- |

Below is a current list of patent applications owned by the Company:

| ● | A PORTABLE CHEMICAL ANALYSIS METHOD BY VOLATILIZATION AND SUBLIMATION. US Patent Application Number 61/846,996; |

| ● | A PORTABLE GAS CHROMATOGRAPHIC ANALYSIS AND DISTRIBUTION SYSTEM. US Patent Application Number 61/864,515; |

| ● | A PORTABLE GAS CHROMATOGRAPHIC ANALYSIS AND DISTRIBUTION SYSTEM FOR THE EXTRACTION AND DELIVERY OF COMPOUNDS IN CANNABIS. US Patent Application Number 61/864,517; |

| ● | Method for Therapeutic Development, Preparation and Administration US Patent application Number 61/927,992; and |

| ● | Apparatus for Detection and Delivery of Volatilized Compounds and Related Methods International Patent application Number PCT/US 14/46500. |

In addition to the applications for patent owned by the Company, the Company has a joint development agreement with Next Dimension Technologies, Inc. (“NDT”) to develop and provide the sensor used in our MyDx devices. NDT was founded in May 2004 and is based in Pasadena, California. The company develops detection solutions for chemical sensing applications using novel sensor and sensor array technologies. NDT’s sensor-array technology allows a single, leveraged platform to address a wide variety of vapor detection markers and applications. NDT holds rights to a broad portfolio of patents covering many aspects of its unique sensor array technology. NDT’s intellectual property gives it significant advantages over traditional sensor technologies and provides significant competitive advantages.

Government Regulation

As of the date of this Current Report, our products require CE Marking (European Conformity), Federal Communications Commission and other government safety approvals. We are working with various partners to secure all approvals. Inasmuch as we are a sensor technology company, except with respect to government regulations related to the cannabis industry described in more detail below, we do not foresee any other probable government regulations on our business outside of normal business practices.

With respect to our Canna Sensor, there is a substantial amount of change occurring in the United States regarding both the medical and recreational use of cannabis, and a number of individual states have enacted state laws to enable distribution, possession, and use of cannabis for medical, and in some cases, recreational purposes. Despite the development of a legal medical or recreational cannabis industry under certain state laws, cannabis use and possession remains illegal under federal law, and such state laws are in conflict with the Federal Controlled Substances Act. The Obama Administration has effectively stated that it is not an efficient use of resources to direct federal law enforcement agencies to prosecute individuals lawfully abiding by state-designated laws allowing for use and distribution of medical and recreational cannabis. However, there is no guarantee that the Obama Administration will not change its stated policy regarding enforcement of federal laws in states where cannabis has been legalized. Further, the change in administration after the 2016 presidential election cycle could introduce a less favorable policy with respect to enforcement of federal laws concerning cannabis.

Also, the possession, use, cultivation, or transfer of cannabis remains illegal under the Federal Controlled Substances Act. Our Canna Sensor may be sold to customers that are engaged in the business of possession, use, cultivation, or transfer of cannabis. As a result, law enforcement authorities regulating the illegal use of cannabis may seek to bring an action or actions against us, including, but not limited, to a claim of aiding and abetting another’s criminal activities. The federal aiding and abetting statute provides that anyone who “commits an offense against the United States or aids, abets, counsels, commands, induces or procures its commission, is punishable as a principal.” 18 U.S.C. §2(a).

| -14- |

Employees

We presently have 15 full and part-time employees, and make extensive use of third-party contractors, consultants, and advisors to perform many of our present activities. We have not entered into any collective bargaining agreements with any of our employees, and we believe our relationships with our employees and any third-party contractors, consultants, and advisors are strong.

Legal Proceedings

We are not aware of any legal proceedings contemplated by any governmental authority or any other party involving us or our properties. As of the date of this Current Report, no director, officer or affiliate is (i) a party adverse to us in any legal proceeding, or (ii) has an adverse interest to us in any legal proceedings. Management is not aware of any other legal proceedings pending or that have been threatened against us or our properties.

Litigation

We are not presently a party to any litigation nor to the knowledge of management is any litigation threatened against us which may materially affect our business or its assets. However, we may become involved with various legal matters arising in the ordinary course of our business that are complex in nature and have outcomes that are difficult to predict.

Reports to Security Holders

Our Internet address is http://www.cdxlife.com. The content on our website is available for information purposes only. It should not be relied upon for investment purposes, nor is it incorporated by reference into this Current Report. The public may read and copy any materials we file with the SEC, including our annual reports, quarterly reports, current reports, proxy statements, information statements and other information, at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549, on official business days during the hours of 10 a.m. to 3 p.m. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov.

| -15- |

RISK FACTORS

An investment in our Company involves a significant level of risk. Investors should carefully consider the risk factors described below together with the other information included in this Current Report on Form 8-K. If any of the risks described below occurs, or if other risks not identified below occur, our business, financial condition, and results of operations could be materially and adversely affected.

Risks Related to our Business

We have a limited operating history and a history of operating losses, and we may not be able to achieve or sustain profitability. In addition, we may be unable to continue as a going concern.

We were incorporated in September 2013 and have only a limited operating history. We are not profitable and have incurred losses since our inception. We continue to incur research and development and general and administrative expenses related to our operations.

We incurred a net loss of approximately $3,528,000 for the year ended December 31, 2014 and a cumulative net loss of approximately $3,530,000 from September 16, 2013 (date of inception) to December 31, 2014.

We expect to continue to incur losses for the foreseeable future, and these losses will likely increase as we continue to commercialize our products. The amount of future losses and when, if ever, we will achieve profitability are uncertain. If our products do not achieve market acceptance, we may never become profitable. The initial cost of completing development of our products and penetrating our anticipated markets will be substantial, and there is no assurance that we will be successful in doing so. We have no revenues to date and have not proven that we have been able to commercialize the product. Additionally, if we are not successful in growing revenues and controlling costs, we will not achieve profitable operations or positive cash flow, and even if we achieve profitability in the future, we may not be able to sustain profitability in subsequent periods. Absent a significant increase in revenue or additional equity or debt financing, we may not be able to sustain our ability to continue as a going concern.

We are an early-stage company, and as such, we have no meaningful operating or financial history, we have no products in the marketplace, and we are pre-revenue at this time.

We commenced operations in January 2014. Therefore, there is limited historical financial information upon which to base an evaluation of our performance and future prospects. Due to our lack of operating history, our prospects must be considered in light of the uncertainties, risks, expenses, and difficulties frequently encountered by companies in the early-stage of operations, including, without limitation, the following:

| ● | absence of an operating history; |

| ● | absence of any revenues; |

| ● | absence of any products in the marketplace; |

| ● | insufficient capital; |

| ● | expected continual losses for the foreseeable future; |

| ● | no history on which to evaluate our ability to anticipate and adapt to a developing market; |

| ● | uncertainty as to market acceptance of our initial and future products; |

| ● | limited marketing experience and lack of sales organization; and |

| ● | competitive and highly regulated environment. |

| -16- |

Because we are subject to these risks, potential investors may have a difficult time evaluating our business and their investment in our Company. We may be unable to successfully overcome these risks, any of which could irreparably harm our business.

The likelihood of our success must be considered in light of the problems, expenses, difficulties, complications, and delays frequently encountered in connection with a new enterprise, the commercial launch of a new product which still requires testing, and the operation in a competitive industry. We expect to sustain losses in the future as we implement our business plan. There can be no assurance that we will ever generate revenues or operate profitably.

We will require substantial additional funding, which may not be available to us on acceptable terms, or at all.

Our cash balance at December 31, 2014 was approximately $745,000. We may not have adequate funds to fully develop our business, and we may need other capital investment to fully implement our business plans. We also expect that we will need substantial additional capital following this Merger. We do not have any contracts or commitments for additional funding, and there can be no assurance that financing will be available in amounts or on terms acceptable to us, if at all. The inability to obtain additional capital will restrict our ability to grow and may reduce our ability to continue to conduct business operations. If we are unable to obtain additional financing, we will likely be required to curtail our development plans. In that event, current stockholders would likely experience a loss of most or all of their investment. Additional funding that we do obtain may be dilutive to the interests of existing stockholders.

We are dependent on our current management team. If we fail to attract and retain key management personnel, we may be unable to successfully develop or commercialize our products.

In the early stages of development, our business will be significantly dependent on our management team. Our success will be particularly dependent upon Daniel Yazbeck, Thomas Gruber, and Skip Sanzeri. The loss of any of their services could have a material adverse effect on us. We have not obtained key-man insurance on the lives of any members of our management team. Moreover, in order to successfully implement and manage our business plan, we will be dependent upon, among other things, successfully recruiting qualified sales and marketing personnel. Competition for qualified individuals is intense. There can be no assurance that we will be able to find, attract and retain existing employees or that we will be able to find, attract and retain qualified personnel to join the Company on acceptable terms.

We may not be able to attract or retain qualified management and research personnel in the future due to the intense competition for qualified personnel in our industry. If we are not able to attract and retain the necessary personnel to accomplish our business objectives, we may experience constraints that will impede significantly the achievement of our research and development objectives, our ability to raise additional capital and our ability to implement our business strategy. In particular, if we lose any members of our senior management team, we may not be able to find suitable replacements in a timely fashion or at all, and our business may be harmed as a result.

Initially we will be dependent on two products.

Our Aero and Aqua Sensors will not be commercialized in the near future. Therefore, when commercialized, the Canna and Organa Sensors will account for a substantial portion of our revenues for the foreseeable future. As a result, our future operating results are dependent upon market acceptance of those products, neither of which has been commercially launched as of the date hereof. Factors adversely affecting the pricing of, demand for, or market acceptance of the sensors, such as regulatory complications, competition, or technological change, could have a material adverse effect on our business, operating results, and financial condition.

| -17- |

One of our initial product candidates, the Canna Sensor, relates to cannabis, which is a controlled substance under Federal law.

Despite the development of a legal medical or recreational cannabis industry under certain state laws, cannabis use and possession remains illegal under Federal law, and such state laws are in conflict with the Federal Controlled Substances Act. Since one of our initial product candidates, the Canna Sensor, relates to the use of cannabis, it may generate public controversy and be the subject of federal regulation or other action. Political and social pressures and negative publicity could limit or restrict the introduction and marketing of our initial or future product candidates. Adverse publicity from cannabis misuse, adverse side effects from cannabis or other cannabinoid products may harm the commercial success or market penetration achievable by our Canna Sensor. The nature of our Canna Sensor product attracts a high level of public and media interest, and in the event of any resultant negative publicity, our reputation may be harmed.

Laws and regulations affecting the cannabis industry are constantly changing, which could detrimentally affect our business, and we cannot predict the impact that future legislation or changes in enforcement practices may have on our company.

There is a substantial amount of change occurring in the United States regarding both the medical and recreational use of cannabis, and a number of individual states have enacted state laws to enable distribution, possession, and use of cannabis for medical, and in some cases, recreational purposes. The Obama Administration has effectively stated that it is not an efficient use of resources to direct federal law enforcement agencies to prosecute individuals lawfully abiding by state-designated laws allowing for use and distribution of medical and recreational cannabis. However, there is no guarantee that the Obama Administration will not change its stated policy regarding enforcement of federal laws in states where cannabis has been legalized. Further, the change in administration after the 2016 presidential election cycle could introduce a less favorable policy with respect to enforcement of federal laws concerning cannabis.

Future active enforcement of the current federal regulatory position on cannabis on a regional or national basis may directly and adversely affect the willingness of customers to invest in or buy our Canna Sensor, which is used in connection with cannabis. In addition, federal or state legislation could be enacted in the future that could prohibit customers of our Canna Sensor from distributing, possessing, or using cannabis. If such legislation were enacted, customers may discontinue use of our Canna Sensor, our potential source of customers would be reduced, and our revenues may decline. Violation of any federal or state law, or allegations of such violations, could disrupt our business and result in a material adverse effect on our revenues, profitability, and financial condition.

As the possession and use of cannabis is illegal under the Federal Controlled Substances Act, we may be deemed to be aiding and abetting illegal activities through the services that we provide to users, and as such may be subject to enforcement actions which could materially and adversely affect our business

The possession, use, cultivation, or transfer of cannabis remains illegal under the Federal Controlled Substances Act. Our Canna Sensor may be sold to customers that are engaged in the business of possession, use, cultivation, or transfer of cannabis. As a result, law enforcement authorities regulating the illegal use of cannabis may seek to bring an action or actions against us, including, but not limited, to a claim of aiding and abetting another’s criminal activities. The Federal aiding and abetting statute provides that anyone who “commits an offense against the United States or aids, abets, counsels, commands, induces or procures its commission, is punishable as a principal.” 18 U.S.C. §2(a). As a result of such an action, we may be forced to cease operations and our investors could lose their entire investment. Such an action would have a material negative effect on our business and operations.

Due to the use of one of our products, the Canna Sensor, in the cannabis industry, we may have a difficult time obtaining the various insurances that are desired to operate our business, which may expose us to additional risk and financial liabilities.

Insurance that is generally readily available, such as workers compensation, general liability, and directors and officers insurance, may be more difficult for us to find, and more expensive, because our Canna Sensor provides a service to companies and customers in the cannabis industry. There are no guarantees that we will be able to secure such insurances in the future, or that the cost will be affordable to us. If we are forced to go without such insurances, we may be prevented from entering into certain business sectors, our growth may be inhibited, and we may be exposed to additional risks and financial liabilities.

| -18- |

We may not be able to compete effectively against products introduced into our market space.

The industry surrounding handheld consumer analyzers is rapidly evolving, and the market landscape is currently uncertain. However, we expect that as consumers begin to learn and adapt to having handheld analyzer capability, products that will compete with our offerings will rapidly proliferate. These competitive products could have similar applications, perhaps using superior technology, and may provide additional benefits that our sensors do not. We expect that the market could be occupied by larger competitors with greater financial and other resources, which could hinder our market share. We may be forced to modify or alter our business and regulatory strategy, as well as our sales and marketing plans, in response to, among other things, changes in the market, competition, and technological limitations. Such modifications may pose additional delays in achieving our goals.

Because our manufacturing capabilities are limited, we will rely on third parties to manufacture and supply all of our initial products.

Our initial products will manufactured by third parties. If these manufacturing partners are unable to produce our products or component parts in the amounts or on the timeline that we require, the development and initial commercialization of our products may be delayed, depriving us of potential product revenue and resulting in other losses. Our ability to replace any then-existing manufacturer may be difficult because the number of potential manufacturers is limited. It may be difficult or impossible for us to identify and engage a replacement manufacturer on acceptable terms in a timely manner, or at all. If we need to engage a replacement manufacturer but are unable to do so, our business and results of operations could be severely impacted.

Even after our initial product launch, we will depend on third-party suppliers for materials and components for our products.

We will depend on a limited number of third-party suppliers for the materials and components required to manufacture our products. A delay or interruption by our suppliers may harm our business, results of operations, and financial condition, and could also adversely affect our future profit margins. In addition, the lead time needed to establish a relationship with a new supplier can be lengthy, and we may experience delays in meeting demand in the event we must change or add new suppliers. Our dependence on our suppliers exposes us to numerous risks, including but not limited to the following: our suppliers may cease or reduce production or deliveries, raise prices, or renegotiate terms; we may be unable to locate a suitable replacement supplier on acceptable terms or on a timely basis, or at all; and delays caused by supply issues may harm our reputation, frustrate our customers, and cause them to turn to our competitors for future needs.

Our failure to effectively manage growth could impair our business.

Our business strategy envisions a period of rapid growth after our initial product launches, which may put a strain on our administrative and operational resources, and our funding requirements. Our ability to effectively manage growth will require us to successfully expand the capabilities of our operational and management systems, and to attract, train, manage, and retain qualified personnel during our initial product launch and future launches of our other products. There can be no assurance that we will be able to do so, particularly if losses continue and we are unable to obtain sufficient financing. If we are unable to appropriately manage growth, our business, prospects, financial condition, and results of operations could be adversely affected.

We may be subject to product liability claims, and may not have sufficient product liability insurance to cover any such claims, which may expose us to substantial liabilities.

We may be exposed to product liability claims from consumers of our products. It is possible that any product liability insurance coverage we obtain will be insufficient to protect us from future claims. Further, we may not be able to obtain or maintain insurance on acceptable terms or such insurance may be insufficient to cover any potential product liability claim or recall. Failure to obtain or maintain sufficient insurance coverage could have a material adverse effect on our business, prospects, and results of operations if claims are made that exceed our coverage.

| -19- |

We have incurred costs and expect to incur additional costs related to the Merger.

We have incurred, and expect to continue to incur, various non-recurring costs associated with the Merger, including, but not limited to, legal, accounting, and financial advisory fees. The substantial majority of our non-recurring expenses have been composed of these costs and expenses related to the execution of the acquisition

From time to time we may need to license patents, intellectual property, and proprietary technologies from third parties, which may be difficult or expensive to obtain.

We may need to obtain licenses to patents and other proprietary rights held by third parties to successfully develop, manufacture and market our products. As an example, it may be necessary to use a third party’s proprietary technology to reformulate a product in order to create a new type of sensor in response to market demand, or to improve the abilities of our current sensors. If we are unable to timely obtain these licenses on reasonable terms, our ability to commercially exploit our products may be inhibited or prevented.

If we are unable to adequately protect our technology or enforce our intellectual property rights, our business could suffer.

Our success with the products we will develop will depend, in part, on our ability to obtain and maintain patent protection for these products. The coverage claimed in a patent application can be significantly reduced before the patent is issued, and the patent’s scope can be modified after issuance. Furthermore, if patent applications that we file or license are not approved or, if approved, are not upheld in a court of law, our ability to competitively exploit our products would be substantially harmed. Additionally, such patents may or may not provide competitive advantages for their respective products or they may be challenged or circumvented by our competitors, in which case our ability to commercially exploit any related products may be diminished.

We also will rely on trade secret and contractual protections for our unpatented, confidential, and proprietary technology. Trade secrets are difficult to protect. While we will enter into proprietary information agreements with certain of our employees, consultants, and others, these agreements may not successfully protect our trade secrets or other confidential and proprietary information. It is possible that these agreements will be breached, or that they will not be enforceable in every instance, and that we will not have adequate remedies in the case of any such breach. It is also possible that our trade secrets will become known or independently developed by our competitors. If we are unable to adequately protect our technology, trade secrets, or proprietary know-how, or enforce our patents, our business, financial condition, and prospects could suffer.

Intellectual property litigation is increasingly common and increasingly expensive, and may result in restrictions on our business and substantial costs, even if we prevail.

Patent and other intellectual property litigation is becoming more common, and such litigation may be necessary to defend against or assert claims of infringement, to protect trade secrets, to determine the scope and validity of proprietary rights of third parties, or to enforce our patent rights, including those we may license from others. Currently, no third party is asserting that we are infringing upon their patent or other intellectual property rights, nor are we aware or believe that we are infringing or will infringe upon any third party’s patent or other intellectual property rights. We may, however, currently be infringing or infringe in the future upon a third party’s patent or other intellectual property rights. In that event, litigation asserting such claims might be initiated in which we may not prevail, or may not be able to obtain the necessary licenses on reasonable terms, if at all. All such litigation, whether meritorious or not, as well as litigation initiated by us against third parties, is time-consuming and very expensive to defend or prosecute and to resolve. In addition, if we infringe the intellectual property rights of others, we could lose our right to develop, manufacture, or sell our products or could be required to pay monetary damages or royalties to license proprietary rights from third parties. An adverse determination in a judicial or administrative proceeding or a failure to obtain necessary licenses could prevent us from manufacturing or selling our products, which could harm our business, financial condition, and prospects.

| -20- |

If our competitors prepare and file patent applications in the United States that claim technology we also claim, we may have to participate in interference or derivation proceedings required by the United States Patent and Trademark Office to determine priority of invention, which could result in substantial costs, even if we ultimately prevail. Results of these proceedings are highly unpredictable and may result in us having to try to obtain licenses in order to continue to develop or market our product candidate.

If our competitors file administrative challenges of our patent applications after grant, we may have to participate in post-grant challenge proceedings, such as oppositions, inter-partes review, post grant review or a derivation proceeding, that challenge our entitlement to an invention or the patentability of one or more claims in our patent applications or issued patents. Such proceedings could result in substantial costs, even if we ultimately prevail. Results of these proceedings are highly unpredictable and may result in us losing proprietary intellectual property rights as claimed in the challenged patents.

We may encounter unanticipated obstacles to execution of our business plan which may cause us to change or abandon our current business plan.

Our business plan may change significantly based on our encountering unanticipated obstacles. Many of our potential business endeavors are capital intensive, and may be subject to statutory or regulatory requirements and other factors that we cannot control, and which could be detrimental to our business plan. We believe that our chosen undertakings and strategies make our plans achievable in light of current economic and legal conditions and with the skills, background, and knowledge of our management team and advisors. We reserve the right to make significant modifications to our stated strategies depending on future events.

Risks Related to Our Common Stock

There is currently a limited public trading market for our common stock and one may never develop.

There currently is a limited public trading market for our securities, and it is not assured that any such public market will develop in the foreseeable future. While this is true of any small cap company, the fact that one of our initial products is a device that will be associated with the use of cannabis, the legal status of which has not been completely resolved at the state level in many states or on the federal level, may make the path to a listing on an exchange or actively traded in the over-the-counter market more problematic. Moreover, there can be no assurance that even if our common stock is approved for listing on an exchange or is quoted in the over-the-counter market in the future, that an active trading market will develop or be sustained. Therefore, we cannot predict the prices at which our common stock will trade in the future, if at all. As a result, our investors may have limited or no ability to liquidate their investments.