Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FIRST PRIORITY FINANCIAL CORP. | d918304d8k.htm |

Exhibit 99.1

First Priority Financial Corp.

Annual Shareholders’ Meeting

May 5th, 2015

Safe Harbor Regarding Forward Looking Statements

This presentation contains certain forward-looking information about First Priority Financial Corp. that is intended to be covered by the safe harbor for forward-looking statements provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that are not historical facts and can be identified by the use of forward-looking terminology such as the words “believes,” “expects,” “anticipates,” “estimates,” “plans,” “projects,” “predicts,” “intends,” “seeks,” “will,” “may,” “should,”

“would,” “continues,” “hope” and similar expressions, or the negative of these terms. Such statements are based on current expectations and are subject to risks, uncertainties and changes in condition, significance, value, and effect. Such risks, uncertainties and changes in condition, significance, value and effect could cause First Priority Financial Corp.’s actual results to differ materially from those anticipated events.

Factors, risks, uncertainties, and contingencies that may cause actual results to differ from those anticipated include, but are not limited to, the following: the strength of the United States economy in general and the strength of the regional and local economies in which First Priority conducts operations; the effects of changing economic conditions in First Priority’s market areas and nationally; the effects of, and changes in, trade, monetary, and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System; changes in federal and state banking, insurance, and investment laws and regulations which could impact First Priority’s operations; inflation, interest rate, market, and monetary fluctuations; First Priority’s timely development of competitive new products and services in a changing environment and the acceptance of such products and services by customers; the impact of changes in financial services policies, laws, and regulations, and the impact of changes in and interpretations of generally accepted accounting principles; the occurrence of adverse changes in the securities markets; the effects of changes in technology or in consumer spending and savings habits; armed conflicts involving the United States; regulatory or judicial proceedings; changes in asset quality; and First Priority’s success in managing the risks involved in the foregoing.

You are cautioned not to place undue reliance on any such forward-looking statements, which speak only as of the date of this presentation.

| 2 |

|

Overview First Priority Financial Corp.

| • |

|

Headquarters: 2 W. Liberty Blvd. Malvern, PA |

| • |

|

Website: www.fpbk.com |

| • |

|

Total Assets: $471 million(3/31/15) |

| • |

|

Total Shareholders’ Equity: $51 million(3/31/15) |

| • |

|

Trading Symbol: FPBK |

| • |

|

Total Shares Outstanding: 6,446,819(3/31/15) |

Three Original Shareholder Groups: FPFC 290 Prestige 162 Affinity 307

Total 759

| • |

|

Full Time Equivalent Employees: 70.5 |

| • |

|

Book Value per Share: $6.42 (3/31/15) |

| • |

|

Tangible Book Value per Share: $5.94 (3/31/15) |

| • |

|

Market Reach: |

o Number of Relationships: 6,598 touching about 15,000 customers o Total Revenues (2014): $16.78 million o Number of Offices: 9

| 3 |

|

First Priority Timeline

| • |

|

January, 2006: First Priority Bank opened to public |

| • |

|

February, 2007: First Priority Financial Corp. formed |

| • |

|

May, 2007: Bank became subsidiary of FPFC |

| • |

|

February, 2008: Acquired Prestige Community Bank |

| • |

|

February, 2013: Acquired Affinity Bank |

| • |

|

March 13, 2015: Began trading stock on OTCQX |

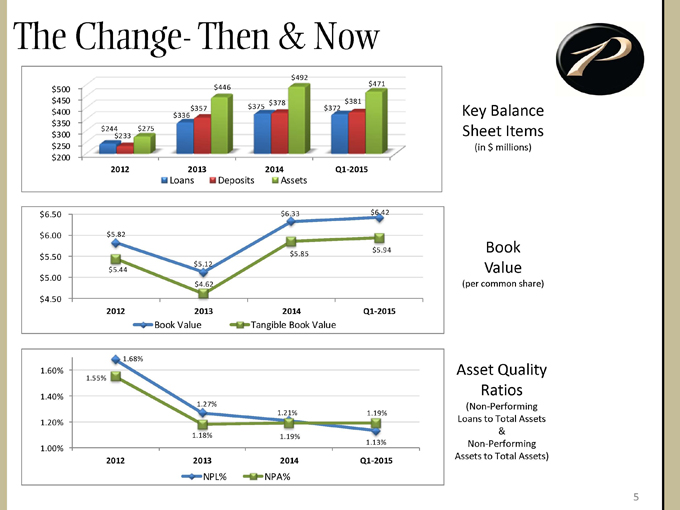

The Change- Then & Now

$492 $471 $500 $446 $450 $375 $378 $381 $357 $372

$400 Key Balance

$336 $350

$300 $244 $275 Sheet Items

$233

$250 (in $ millions) $200

2012 2013 2014 Q1-2015

Loans Deposits Assets

$6.50 $6.33 $6.42

$6.00 $5.82

$5.94 Book

$5.50 $5.85

$5.44 $5.12 Value

$5.00 $4.62

(per common share)

$4.50

2012 2013 2014 Q1-2015

Book Value Tangible Book Value

1.68%

1.60% Asset Quality

1.55%

Ratios

1.40%

1.27% (Non-Performing

1.21% 1.19%

1.20% Loans to Total Assets &

1.18% 1.19%

1.13% Non-Performing

1.00% Assets to Total Assets)

2012 2013 2014 Q1-2015

NPL% NPA%

| 5 |

|

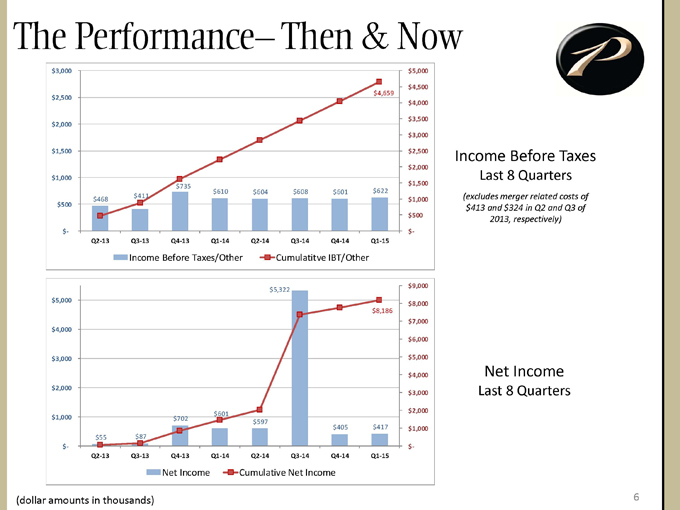

The Performance– Then & Now

$3,000 $5,000

$4,500 $4,659 $2,500 $4,000 $2,000 $3,500 $3,000

$1,500 $2,500 Income Before Taxes

$2,000

$1,000 $1,500 Last 8 Quarters

$735 $411 $610 $604 $608 $601 $622

$468 $1,000 (excludes merger related costs of $500 $413 and $324 in Q2 and Q3 of

$500

2013, respectively)

$- $-Q2-13 Q3-13 Q4-13 Q1-14 Q2-14 Q3-14 Q4-14 Q1-15

Income Before Taxes/Other Cumulatitve IBT/Other

$9,000 $5,322 $5,000 $8,000 $8,186 $7,000 $4,000 $6,000

$3,000 $5,000

$4,000 Net Income

$2,000 $3,000 Last 8 Quarters

$2,000 $601 $1,000 $702 $597 $405 $417 $1,000

$55 $87

$- $-Q2-13 Q3-13 Q4-13 Q1-14 Q2-14 Q3-14 Q4-14 Q1-15

Net Income Cumulative Net Income

(dollar amounts in thousands) 6

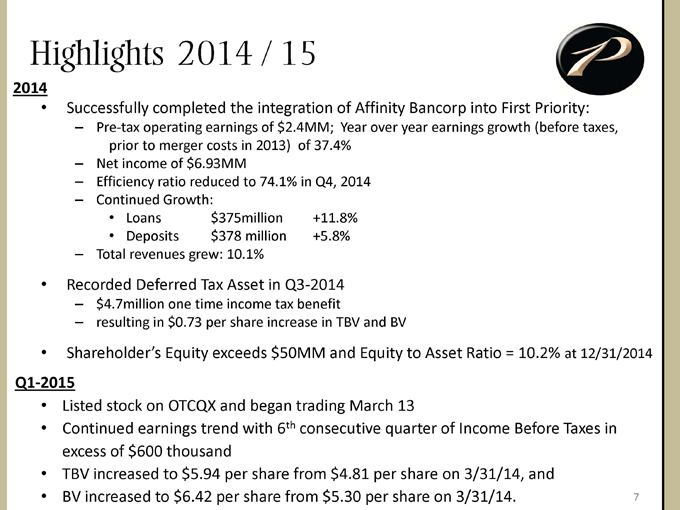

Highlights 2014 / 15

2014

Successfully completed the integration of Affinity Bancorp into First Priority:

– Pre-tax operating earnings of $2.4MM; Year over year earnings growth (before taxes, prior to merger costs in 2013) of 37.4%

– Net income of $6.93MM

– Efficiency ratio reduced to 74.1% in Q4, 2014

– Continued Growth:

Loans $375million +11.8%

Deposits $378 million +5.8%

– Total revenues grew: 10.1%

Recorded Deferred Tax Asset in Q3-2014

– $4.7million one time income tax benefit

– resulting in $0.73 per share increase in TBV and BV

Shareholder’s Equity exceeds $50MM and Equity to Asset Ratio = 10.2% at 12/31/2014

Q1-2015

Listed stock on OTCQX and began trading March 13

Continued earnings trend with 6th consecutive quarter of Income Before Taxes in excess of $600 thousand

TBV increased to $5.94 per share from $4.81 per share on 3/31/14, and

BV increased to $6.42 per share from $5.30 per share on 3/31/14. 7

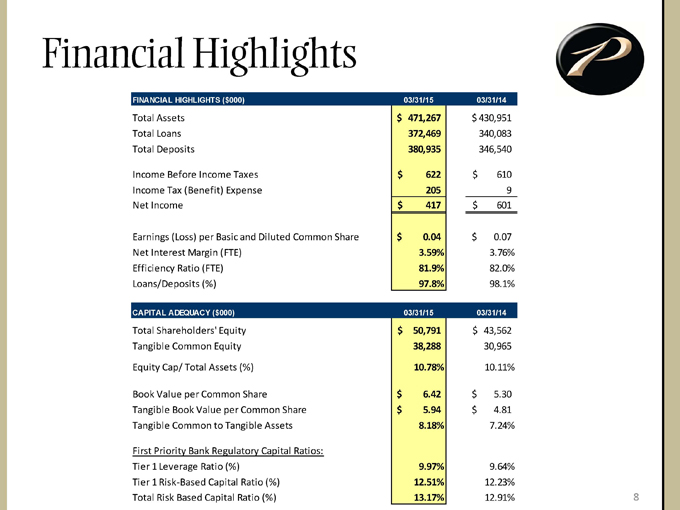

Financial Highlights

FINANCIAL HIGHLIGHTS ($000)

03/31/15

03/31/14

Total Assets $471,267 $430,951

Total Loans 372,469 340,083

Total Deposits 380,935 346,540

Income Before Income Taxes $622 $610

Income Tax (Benefit) Expense 205 9

Net Income $417 $601

Earnings (Loss) per Basic and Diluted Common Share $0.04 $0.07

Net Interest Margin (FTE) 3.59% 3.76%

Efficiency Ratio (FTE) 81.9% 82.0%

Loans/Deposits (%) 97.8% 98.1%

CAPITAL ADEQUACY ($000) 03/31/15 03/31/14

Total Shareholders’ Equity $50,791 $43,562

Tangible Common Equity 38,288 30,965

Equity Cap/ Total Assets (%) 10.78% 10.11%

Book Value per Common Share $6.42 $5.30

Tangible Book Value per Common Share $5.94 $4.81

Tangible Common to Tangible Assets 8.18% 7.24%

First Priority Bank Regulatory Capital Ratios:

Tier 1 Leverage Ratio (%) 9.97% 9.64%

Tier 1 Risk-Based Capital Ratio (%) 12.51% 12.23%

Total Risk Based Capital Ratio (%) 13.17% 12.91% 8

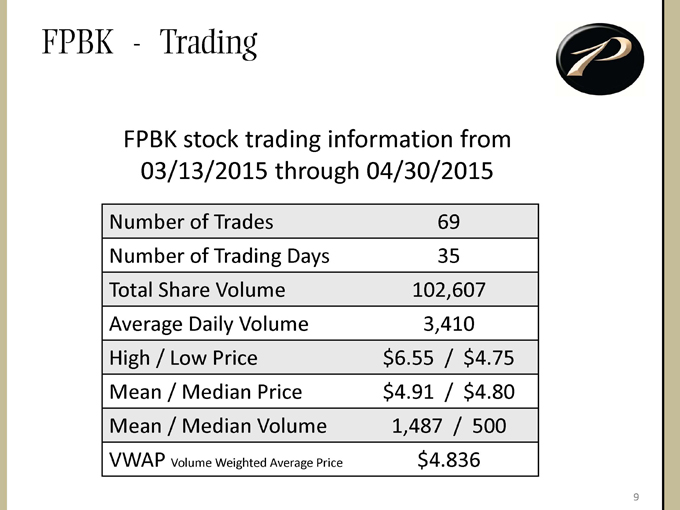

FPBK

Trading FPBK stock trading information from 03/13/2015 through 04/30/2015

Number of Trades 69

Number of Trading Days 35

Total Share Volume 102,607

Average Daily Volume 3,410

High / Low Price $6.55 / $4.75

Mean / Median Price $4.91 / $4.80

Mean / Median Volume 1,487 / 500

VWAP Volume Weighted Average Price $4.836 9

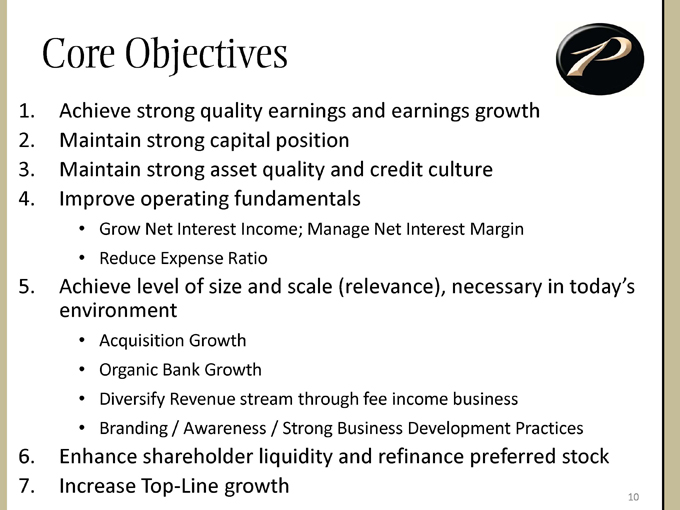

Core Objectives

1. Achieve strong quality earnings and earnings growth

2. Maintain strong capital position

3. Maintain strong asset quality and credit culture 4. Improve operating fundamentals

Grow Net Interest Income; Manage Net Interest Margin

Reduce Expense Ratio

5. Achieve level of size and scale (relevance), necessary in today’s environment

Acquisition Growth

Organic Bank Growth

Diversify Revenue stream through fee income business

Branding / Awareness / Strong Business Development Practices

6. Enhance shareholder liquidity and refinance preferred stock 7. Increase Top-Line growth

10

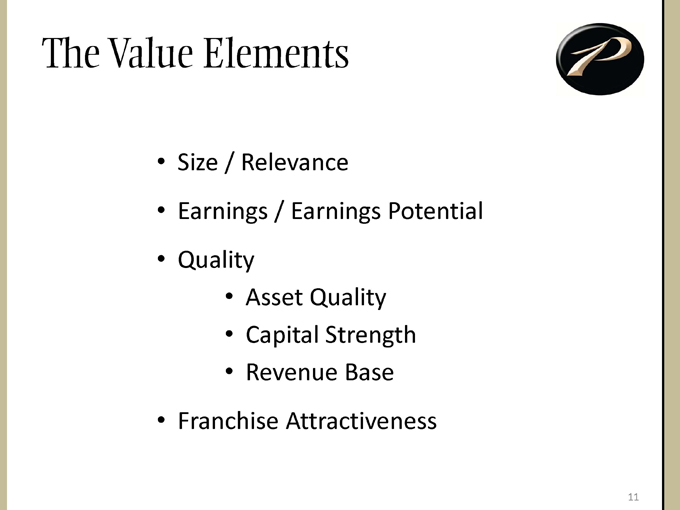

The Value Elements

Size / Relevance

Earnings / Earnings Potential

Quality

Asset Quality

Capital Strength

Revenue Base

Franchise Attractiveness

The Environment and Our Vision …

Mission

First Priority Bank is a full service commercial banking company that provides a complete range of banking and personal financial services and solutions for individuals and businesses. The Bank is a relationship driven organization that provides a highly attentive and focused concierge level of service delivered with the highest level of integrity.

First Priority Financial Corp. seeks to provide superior value for investors by achieving strong and increasing returns in operating performance while maintaining a safe, strong and sound financial position.