Attached files

| file | filename |

|---|---|

| 8-K - 8-K - 1Q15 EARNINGS RELEASE - PREFERRED APARTMENT COMMUNITIES INC | a8-k_xx1q15xearningsxrelea.htm |

| EX-99 - 1Q15 EARNINGS RELEASE - PREFERRED APARTMENT COMMUNITIES INC | a1q15_earningsxpressxrelea.htm |

GA

First Quarter 2015 Preferred Apartment Communities, Inc. Page 2 Supplemental Financial Data Table of Contents Company Profile 3 Financial Summary of the First Quarter 2015 4 2015 Guidance 4 Highlights of the First Quarter 2015 and Subsequent Events 4 Consolidated Statements of Operations 6 Reconciliation of Funds From Operations Attributable to Common Stockholders and Unitholders, Normalized Funds From Operations Attributable to Common Stockholders and Unitholders, and Adjusted Funds From Operations Attributable to Common Stockholders and Unitholders to Net (Loss) Income Attributable to Common Stockholders 7 Notes to Reconciliation of Funds From Operations Attributable to Common Stockholders and Unitholders, Normalized Funds From Operations Attributable to Common Stockholders and Unitholders, and Adjusted Funds From Operations Attributable to Common Stockholders and Unitholders to Net (Loss) Income Attributable to Common Stockholders 8 Consolidated Balance Sheets 9 Consolidated Statements of Cash Flows 10 Real Estate Loan Portfolio, Capital Expenditures 11 Multifamily Occupancy 12 Retail Portfolio 12 Multifamily Same Store Financial Data 13 Definitions of Non-GAAP Measures 14

Preferred Apartment Communities, Inc. Page 3 Supplemental Financial Data Preferred Apartment Communities, Inc. Preferred Apartment Communities, Inc. (NYSE MKT: APTS), or the Company, is a Maryland corporation formed primarily to acquire and operate multifamily properties in select targeted markets throughout the United States. As part of our business strategy, we may enter into forward purchase contracts or purchase options for to-be-built multifamily communities and we may make mezzanine loans, provide deposit arrangements, or provide performance assurances, as may be necessary or appropriate, in connection with the construction of multifamily communities and other properties. As a secondary strategy, we also may acquire or originate senior mortgage loans, subordinate loans or mezzanine debt secured by interests in multifamily properties, membership or partnership interests in multifamily properties and other multifamily related assets and invest not more than 20% of our assets in other real estate related investments, such as grocery-anchored necessity retail shopping centers, as determined by Preferred Apartment Advisors, LLC, or our Manager, as appropriate for us. At March 31, 2015, the Company was the approximate 98.7% owner of Preferred Apartment Communities Operating Partnership, L.P., or the Operating Partnership. We elected to be taxed as a real estate investment trust under the Internal Revenue Code of 1986, as amended, commencing with our tax year ended December 31, 2011. Forward-Looking Statements “Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995: Estimates of future earnings, guidance, goals and performance are, by definition, and certain other statements in this Supplemental Financial Data Report may constitute, “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance, achievements or transactions to be materially different from the results, guidance, goals, performance, achievements or transactions expressed or implied by the forward-looking statements. Factors that impact such forward-looking statements include, among others, our business and investment strategy; legislative or regulatory actions; the state of the U.S. economy generally or in specific geographic areas; economic trends and economic recoveries; our ability to obtain and maintain debt or equity financing; financing and advance rates for our target assets; our leverage level; changes in the values of our assets; availability of attractive investment opportunities in our target markets; our ability to maintain our qualification as a real estate investment trust, or REIT, for U.S. federal income tax purposes; our ability to maintain our exemption from registration under the Investment Company Act of 1940, as amended; availability of quality personnel; our understanding of our competition and market trends in our industry; and interest rates, real estate values, the debt securities markets and the general economy. Except as otherwise required by the federal securities laws, we assume no liability to update the information in this Supplemental Financial Data Report. We refer you to the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the twelve months ended December 31, 2014 that was filed with the Securities and Exchange Commission, or SEC, on March 16, 2015, which discusses various factors that could adversely affect our financial results. Such risk factors and information may have been updated or supplemented by our Form 10-Q and Form 8-K filings and other documents filed after March 16, 2015 and from time to time with the SEC. Cover Photo Crosstown Walk is a 342-unit multifamily community located in Tampa, Florida, the development of which is partially financed by a mezzanine loan originated and held by Preferred Apartment Communities, Inc.

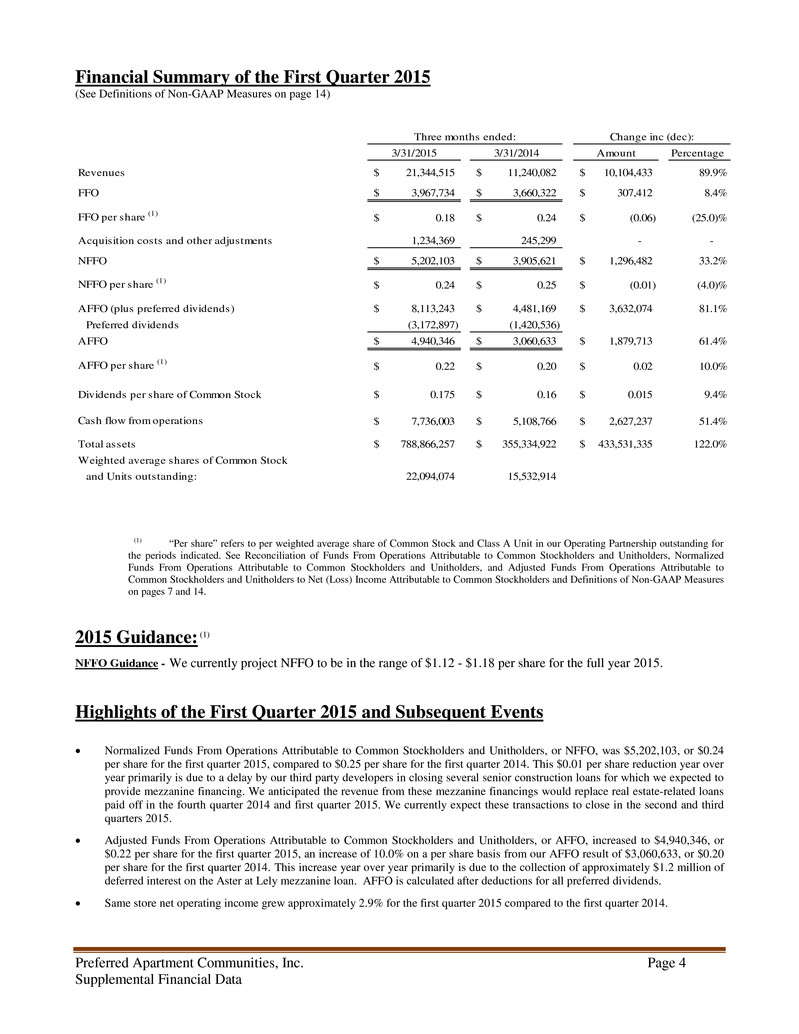

Preferred Apartment Communities, Inc. Page 4 Supplemental Financial Data Financial Summary of the First Quarter 2015 (See Definitions of Non-GAAP Measures on page 14) 3/31/2015 3/31/2014 Amount Percentage Revenues 21,344,515$ 11,240,082$ 10,104,433$ 89.9% FFO 3,967,734$ 3,660,322$ 307,412$ 8.4% FFO per share (1) 0.18$ 0.24$ (0.06)$ (25.0)% Acquisition costs and other adjustments 1,234,369 245,299 - - NFFO 5,202,103$ 3,905,621$ 1,296,482$ 33.2% NFFO per share (1) 0.24$ 0.25$ (0.01)$ (4.0)% AFFO (plus preferred dividends) 8,113,243$ 4,481,169$ 3,632,074$ 81.1% Preferred dividends (3,172,897) (1,420,536) AFFO 4,940,346$ 3,060,633$ 1,879,713$ 61.4% AFFO per share (1) 0.22$ 0.20$ 0.02$ 10.0% Dividends per share of Common Stock 0.175$ 0.16$ 0.015$ 9.4% Cash flow from operations 7,736,003$ 5,108,766$ 2,627,237$ 51.4% Total assets 788,866,257$ 355,334,922$ 433,531,335$ 122.0% Weighted average shares of Common Stock and Units outstanding: 22,094,074 15,532,914 Three months ended: Change inc (dec): (1) “Per share” refers to per weighted average share of Common Stock and Class A Unit in our Operating Partnership outstanding for the periods indicated. See Reconciliation of Funds From Operations Attributable to Common Stockholders and Unitholders, Normalized Funds From Operations Attributable to Common Stockholders and Unitholders, and Adjusted Funds From Operations Attributable to Common Stockholders and Unitholders to Net (Loss) Income Attributable to Common Stockholders and Definitions of Non-GAAP Measures on pages 7 and 14. 2015 Guidance: (1) NFFO Guidance - We currently project NFFO to be in the range of $1.12 - $1.18 per share for the full year 2015. Highlights of the First Quarter 2015 and Subsequent Events • Normalized Funds From Operations Attributable to Common Stockholders and Unitholders, or NFFO, was $5,202,103, or $0.24 per share for the first quarter 2015, compared to $0.25 per share for the first quarter 2014. This $0.01 per share reduction year over year primarily is due to a delay by our third party developers in closing several senior construction loans for which we expected to provide mezzanine financing. We anticipated the revenue from these mezzanine financings would replace real estate-related loans paid off in the fourth quarter 2014 and first quarter 2015. We currently expect these transactions to close in the second and third quarters 2015. • Adjusted Funds From Operations Attributable to Common Stockholders and Unitholders, or AFFO, increased to $4,940,346, or $0.22 per share for the first quarter 2015, an increase of 10.0% on a per share basis from our AFFO result of $3,060,633, or $0.20 per share for the first quarter 2014. This increase year over year primarily is due to the collection of approximately $1.2 million of deferred interest on the Aster at Lely mezzanine loan. AFFO is calculated after deductions for all preferred dividends. • Same store net operating income grew approximately 2.9% for the first quarter 2015 compared to the first quarter 2014.

Preferred Apartment Communities, Inc. Page 5 Supplemental Financial Data • As of March 31, 2015, our total assets were approximately $788.9 million, an increase of approximately $433.5 million, or 122% compared to our total assets of approximately $355.3 million at March 31, 2014. • Total revenues for the first quarter 2015 were approximately $21.3 million, an increase of approximately $10.1 million, or 90%, compared to approximately $11.2 million for the first quarter 2014. • Our Common Stock dividend of $0.175 per share for the first quarter 2015 represents a 40% overall growth rate from our initial Common Stock dividend of $0.125 per share, or approximately 10.8% on an annualized basis since June 30, 2011. • At March 31, 2015, our leverage, as measured by the ratio of our debt to the undepreciated book value of our total assets, was 53.0%. • For the first quarter 2015, our average multifamily physical occupancy was 94.2% and our retail portfolio was 95.1% leased as of March 31, 2015. • For the first quarter 2015, our NFFO payout ratio to our Common Stockholders and Unitholders was approximately 75.0% and our AFFO payout ratio to Common Stockholders and Unitholders was approximately 78.9%. (2) • For the first quarter 2015, our NFFO payout ratio (before the deduction of preferred dividends) to our Series A Preferred Stockholders was approximately 37.9% and our AFFO payout ratio (before the deduction of preferred dividends) to our Series A Preferred Stockholders was approximately 39.1%. (2) • On January 27, 2015, we originated a mezzanine loan of up to $10,975,000 to partially finance a planned 300-unit multifamily community located in Atlanta, Georgia. The loan pays current monthly interest of 8.5% per annum and accrues deferred interest of 5% per annum. • Also on January 27, 2015, we entered into a purchase agreement to acquire a multifamily community located in Sarasota, Florida representing 237 units, for a purchase price of approximately $47.4 million. • On February 13, 2015, we acquired two multifamily communities located in Houston, Texas representing 520 units, for an aggregate purchase price of approximately $76.0 million. With the closing of the Sarasota acquisition referenced above and upon completion of all the projects and assuming the exercise of all potential purchase options within our real estate loan portfolio, we would own 17 additional multifamily properties, including four student housing communities, comprising an additional 4,360 units. • On February 27, 2015, we converted our Summit Crossing III bridge loan to a mezzanine loan of up to approximately $7.2 million to partially finance a 172-unit planned third phase of our Summit Crossing multifamily community located in Atlanta, Georgia. The loan pays current monthly interest of 8.5% per annum and accrues deferred interest of 5% per annum. • On April 9, 2015, we converted our bridge loan to a mezzanine loan of up to approximately $15.6 million to partially finance a planned student housing project located in Lubbock, Texas. The loan pays current monthly interest of 8.5% per annum and accrues deferred interest of 5% per annum. • On April 17, 2015, we originated a bridge loan of up to $2.9 million to fund predevelopment costs for a proposed 158-unit student housing project adjacent to the University of South Florida in Tampa, Florida. The loan pays current monthly interest of 10.0% per annum. • On April 29, 2015, we declared a Common Stock dividend of $0.18 per share for the second quarter 2015, which represents a 44% overall growth rate from our initial Common Stock dividend of $0.125 per share, or approximately 11.1% on an annualized basis since June 30, 2011. • On May 1, 2015, we originated a mezzanine loan of up to approximately $15.5 million to partially finance a planned 250-unit student housing project located adjacent to Baylor University in Waco, Texas. The loan pays current monthly interest of 8.5% per annum and accrues deferred interest of 5.0% per annum. (1) “Per share” refers to per weighted average share of Common Stock and Class A Unit in our Operating Partnership outstanding for the periods indicated. See Reconciliation of Funds From Operations Attributable to Common Stockholders and Unitholders, Normalized Funds From Operations Attributable to Common Stockholders and Unitholders, and Adjusted Funds From Operations Attributable to Common Stockholders and Unitholders to Net (Loss) Income Attributable to Common Stockholders and Definitions of Non-GAAP Measures on pages 7 and 14. (2) We calculate the NFFO and AFFO payout ratios to Common Stockholders and Unitholders as the ratio of Common Stock dividends and distributions to Unitholders to NFFO or AFFO, respectively. We calculate the NFFO and AFFO payout ratios to Series A Preferred Stockholders as the ratio of Preferred Stock dividends to the sum of Preferred Stock dividends and NFFO or AFFO, respectively. See Definitions of Non-GAAP Measures on page 14.

Preferred Apartment Communities, Inc. Page 6 Supplemental Financial Data 2015 2014 Revenues: Rental revenues (See note 1) 13,141,120$ 5,869,291$ Other property revenues 1,969,767 645,042 Interest income on loans and notes receivable 4,875,086 4,293,442 Interest income from related party 1,358,542 432,307 Total revenues 21,344,515 11,240,082 Operating expenses: Property operating and maintenance 2,079,359 912,549 Property salary and benefits reimbursement to related party 1,117,573 625,261 Property management fees 570,406 262,121 Real estate taxes 2,076,677 659,049 General and administrative 458,204 188,839 590,308 444,222 Depreciation and amortization 7,945,428 2,308,526 Acquisition and pursuit costs 423,592 188,031 Acquisition fees to related parties 760,300 57,268 Asset management fees to related party 1,350,890 688,749 Insurance, professional fees, and other expenses 705,552 393,971 Total operating expenses 18,078,289 6,728,586 Management fees deferred (345,960) - Net operating expenses 17,732,329 6,728,586 Operating income 3,612,186 4,511,496 Interest expense 4,377,115 1,715,651 Net (loss) income (764,929) 2,795,845 Consolidated net loss (income) attributable to non-controlling interests (See note 2) 9,699 (38,862) Net (loss) income attributable to the Company (755,230) 2,756,983 Dividends declared to Series A preferred stockholders (3,172,897) (1,420,536) Earnings attributable to unvested restricted stock (6,863) (4,678) Net (loss) income attributable to common stockholders (3,934,990)$ 1,331,769$ Net (loss) income per share of Common Stock available to Common Stockholders: Basic (0.18)$ 0.09$ Diluted (0.18)$ 0.09$ Dividends per share declared on Common Stock 0.175$ 0.16$ Weighted average number of shares of Common Stock outstanding: Basic 21,813,974 15,316,816 Diluted 21,813,974 15,562,608 Equity compensation to directors and executives Preferred Apartment Communities, Inc. Consolidated Statements of Operations (Unaudited) Three months ended March 31,

Preferred Apartment Communities, Inc. Page 7 Supplemental Financial Data 3/31/2015 3/31/2014 Net (loss) income attributable to common stockholders (3,934,990)$ 1,331,769$ Add: Income attributable to non-controlling interests (See note 2) (9,699) 38,862 Depreciation of real estate assets 5,308,610 1,879,670 Amortization of acquired real estate intangible assets 2,603,813 410,021 Funds from operations attributable to common stockholders and Unitholders 3,967,734 3,660,322 Add: Acquisition and pursuit costs 1,183,892 245,299 Loan cost amortization on acquisition Term Note (See note 3) 50,477 - Normalized funds from operations attributable to common stockholders and Unitholders 5,202,103 3,905,621 Non-cash equity compensation to directors and executives 590,308 444,222 Amortization of loan closing costs (See note 4) 297,061 140,659 Depreciation/amortization of non-real estate assets 33,005 18,835 Net loan fees received (See note 5) 195,049 10,788 Deferred interest income received (See note 6) 1,040,879 554,689 Less: Non-cash loan interest income (See note 5) (1,909,220) (1,838,812) Abandoned pursuit costs - (66,570) Cash paid for loan closing costs (96,658) - Amortization of acquired real estate intangible liabilities (See note 7) (206,028) (5,827) Normally recurring capital expenditures (See note 8) (206,153) (102,972) Adjusted funds from operations attributable to common stockholders and Unitholders 4,940,346$ 3,060,633$ Common Stock dividends and distributions to Unitholders declared: Common Stock dividends 3,850,754$ 2,453,769$ Distributions to Unitholders (See note 2) 49,063 36,552 Total 3,899,817$ 2,490,321$ Common Stock dividends and Unitholder distributions per share 0.175$ 0.16$ FFO per weighted average basic share of Common Stock and Unit 0.18$ 0.24$ NFFO per weighted average basic share of Common Stock and Unit 0.24$ 0.25$ AFFO per weighted average basic share of Common Stock and Unit 0.22$ 0.20$ Weighted average shares of Common Stock and Units outstanding: (A) Basic: Common Stock 21,813,974 15,316,816 Class A Units 280,100 216,098 Common Stock and Class A Units 22,094,074 15,532,914 Diluted: (B) Common Stock and Class A Units 22,314,081 15,562,151 Actual shares of Common Stock outstanding, including 39,216 and 29,016 unvested shares of restricted Common Stock at March 31, 2015 and 2014, respectively 22,170,406 15,420,076 Actual Class A Units outstanding 280,360 144,432 Total 22,450,766 15,564,508 (A) Units and Unitholders refer to Class A Units in our Operating Partnership, or Class A Units, and holders of Class A Units, respectively. The Unitholders were granted awards of Class B Units in our Operating Partnership, or Class B Units, for annual service which became vested and earned and automatically converted to Class A Units. The Class A Units collectively represent an approximate 1.27% weighted average non-controlling interest in the Operating Partnership for the three-month period ended March 31, 2015. (B) Since our NFFO and AFFO results are positive for the periods reflected above, we are presenting recalculated diluted weighted average shares of Common Stock and Class A Units for these periods for purposes of this table, which includes the dilutive effect of common stock equivalents from grants of the Class B Units, as well as annual grants of restricted Common Stock. The weighted average shares of Common Stock outstanding presented on the Consolidated Statements of Operations are the same for basic and diluted for any period for which we recorded a net loss available to common stockholders. Reconciliation of Funds From Operations Attributable to Common Stockholders and Unitholders, Adjusted Funds From Operations Attributable to Common Stockholders and Unitholders to Net (Loss) Income Attributable to Common Stockholders (A) Three months ended: Normalized Funds From Operations Attributable to Common Stockholders and Unitholders, and See Notes to Reconciliation of Funds From Operations Attributable to Common Stockholders and Unitholders, Normalized Funds From Operations Attributable to Common Stockholders and Unitholders, and Adjusted Funds From Operations Attributable to Common Stockholders and Unitholders to Net (Loss) Income Attributable to Common Stockholders on page 8.

Preferred Apartment Communities, Inc. Page 8 Supplemental Financial Data Notes to Reconciliation of Funds From Operations Attributable to Common Stockholders and Unitholders, Normalized Funds From Operations Attributable to Common Stockholders and Unitholders, and Adjusted Funds From Operations Attributable to Common Stockholders and Unitholders to Net (Loss) Income Attributable to Common Stockholders 1) Rental and other property revenues and expenses for the three-month period ended March 31, 2015 include activity for the Spring Hill Plaza, Parkway Town Centre, Deltona Landings, Powder Springs, Kingwood Glen, Parkway Centre, Barclay Crossing, Sweetgrass Corner and Salem Cove grocery-anchored necessity retail shopping centers, and the Estancia, Sandstone Creek, Stoneridge Farms and Vineyards multifamily communities, as well as partial periods of results for the Avenues at Cypress and Avenues at Northpointe multifamily communities from the date of acquisition of February 13, 2015. Rental and other property revenues and expenses for the three-month period ended March 31, 2014 do not include results for these properties as they were acquired subsequent to March 31, 2014. 2) Non-controlling interests in our Operating Partnership consisted of a total of 280,360 Class A Units as of March 31, 2015, which were awarded primarily to our key executive officers. The Class A Units are apportioned a percentage of our financial results as non- controlling interests. The weighted average ownership percentage of these holders of Class A Units was calculated to be 1.27% and 1.39% for the three-month periods ended March 31, 2015 and 2014, respectively. 3) We incurred loan closing costs of approximately $97,000 on our $32 million acquisition term loan facility with Key Bank National Association, or Term Loan, which were deferred and are being amortized over the life of the loan. Since the Term Loan was entered into for the express purpose of partially financing the acquisitions of the Avenues at Cypress and Avenues at Northpointe multifamily communities on February 13, 2015, this amortization expense is similar in character to an acquisition cost and is therefore an additive adjustment in the calculation of NFFO. 4) We incurred loan closing costs on our existing mortgage loans, which are secured on a property-by-property basis by each of our acquired multifamily communities and retail assets, and also to secure and subsequently amend our $50 million revolving line of credit with Key Bank National Association, or our Revolving Line of Credit. These loan closing costs are being amortized over the lives of the respective mortgage loans and the Revolving Line of Credit, and the non-cash amortization expense is an addition to NFFO in the calculation of AFFO. Neither we nor the Operating Partnership have any recourse liability in connection with any of the mortgage loans, nor do we have any cross-collateralization arrangements with respect to the assets securing the mortgage loans, other than security interests in 49% of the equity interests of the subsidiaries owning such assets, granted in connection with our Revolving Line of Credit, which provides for full recourse liability. At March 31, 2015, aggregate unamortized loan costs were approximately $5.5 million, which will be amortized over a weighted average remaining loan life of approximately 5.2 years as of that date. 5) We receive loan fees in conjunction with the origination of certain real estate loans. These fees are then recognized as revenue over the lives of the applicable loans as adjustments of yield using the effective interest method. The total fees received in excess of amortization income, after the payment of acquisition fees to Preferred Apartment Advisors, LLC, our Manager, are additive adjustments in the calculation of AFFO. Correspondingly, the non-cash income recognized under the effective interest method is a deduction in the calculation of AFFO. We also accrue over the lives of certain loans additional interest amounts that become due to us at the time of repayment of the loan or refinancing of the property, or when the property is sold to a third party. This non-cash income is deducted from NFFO in the calculation of AFFO. 6) The Company records deferred interest revenue on certain of its real estate loans. These adjustments reflect the receipt in the three month periods ended March 31, 2015 and 2014 of accrued interest income earned prior to the periods presented on various real estate loans. 7) This adjustment reflects the reversal of the non-cash amortization of below-market and above-market lease intangibles, which were recognized in conjunction with the Company’s acquisitions and which are amortized over the estimated average remaining lease terms from the acquisition date for multifamily communities and over the remaining lease terms for retail assets. The adjustments for the three-month period ended March 31, 2015 pertain to the acquisition of the grocery-anchored necessity shopping centers. The adjustments for the three-month period ended March 31, 2014 pertain to the acquisition of the Woodstock Crossing retail asset and the Trail II multifamily community which was acquired in 2013. At March 31, 2015, the balance of unamortized below-market lease intangibles was approximately $5.7 million, which will be recognized over a weighted average remaining lease period of approximately 9.1 years. 8) We deduct from NFFO normally recurring capital expenditures that are necessary to maintain our assets’ revenue streams in the calculation of AFFO. No adjustment is made in the calculation of AFFO for nonrecurring capital expenditures, which totaled $109,925 and $161,398 for the three-month periods ended March 31, 2015 and 2014, respectively. See Definitions of Non-GAAP Measures beginning on page 14.

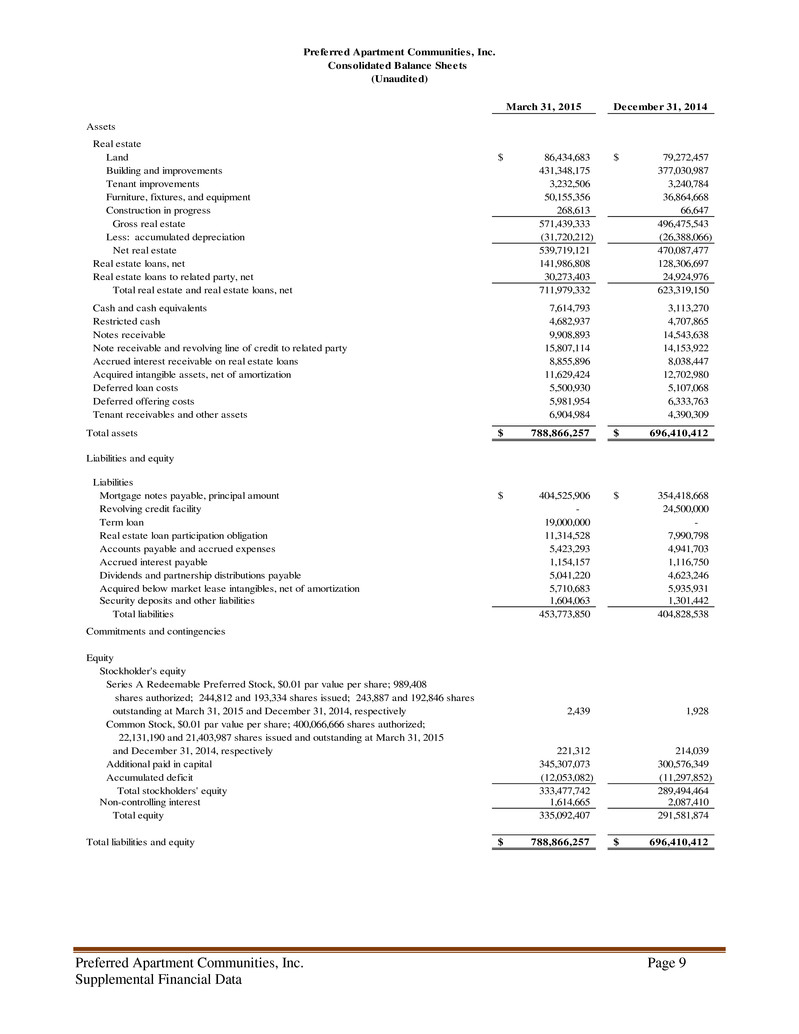

Preferred Apartment Communities, Inc. Page 9 Supplemental Financial Data March 31, 2015 December 31, 2014 Assets Real estate Land 86,434,683$ 79,272,457$ Building and improvements 431,348,175 377,030,987 Tenant improvements 3,232,506 3,240,784 Furniture, fixtures, and equipment 50,155,356 36,864,668 Construction in progress 268,613 66,647 Gross real estate 571,439,333 496,475,543 Less: accumulated depreciation (31,720,212) (26,388,066) Net real estate 539,719,121 470,087,477 Real estate loans, net 141,986,808 128,306,697 Real estate loans to related party, net 30,273,403 24,924,976 Total real estate and real estate loans, net 711,979,332 623,319,150 Cash and cash equivalents 7,614,793 3,113,270 Restricted cash 4,682,937 4,707,865 Notes receivable 9,908,893 14,543,638 Note receivable and revolving line of credit to related party 15,807,114 14,153,922 Accrued interest receivable on real estate loans 8,855,896 8,038,447 Acquired intangible assets, net of amortization 11,629,424 12,702,980 Deferred loan costs 5,500,930 5,107,068 Deferred offering costs 5,981,954 6,333,763 Tenant receivables and other assets 6,904,984 4,390,309 Total assets 788,866,257$ 696,410,412$ Liabilities and equity Liabilities Mortgage notes payable, principal amount 404,525,906$ 354,418,668$ Revolving credit facility - 24,500,000 Term loan 19,000,000 - Real estate loan participation obligation 11,314,528 7,990,798 Accounts payable and accrued expenses 5,423,293 4,941,703 Accrued interest payable 1,154,157 1,116,750 Dividends and partnership distributions payable 5,041,220 4,623,246 Acquired below market lease intangibles, net of amortization 5,710,683 5,935,931 Security deposits and other liabilities 1,604,063 1,301,442 Total liabilities 453,773,850 404,828,538 Commitments and contingencies Equity Stockholder's equity Series A Redeemable Preferred Stock, $0.01 par value per share; 989,408 shares authorized; 244,812 and 193,334 shares issued; 243,887 and 192,846 shares outstanding at March 31, 2015 and December 31, 2014, respectively 2,439 1,928 Common Stock, $0.01 par value per share; 400,066,666 shares authorized; 22,131,190 and 21,403,987 shares issued and outstanding at March 31, 2015 and December 31, 2014, respectively 221,312 214,039 Additional paid in capital 345,307,073 300,576,349 Accumulated deficit (12,053,082) (11,297,852) Total stockholders' equity 333,477,742 289,494,464 Non-controlling interest 1,614,665 2,087,410 Total equity 335,092,407 291,581,874 Total liabilities and equity 788,866,257$ 696,410,412$ Preferred Apartment Communities, Inc. Consolidated Balance Sheets (Unaudited)

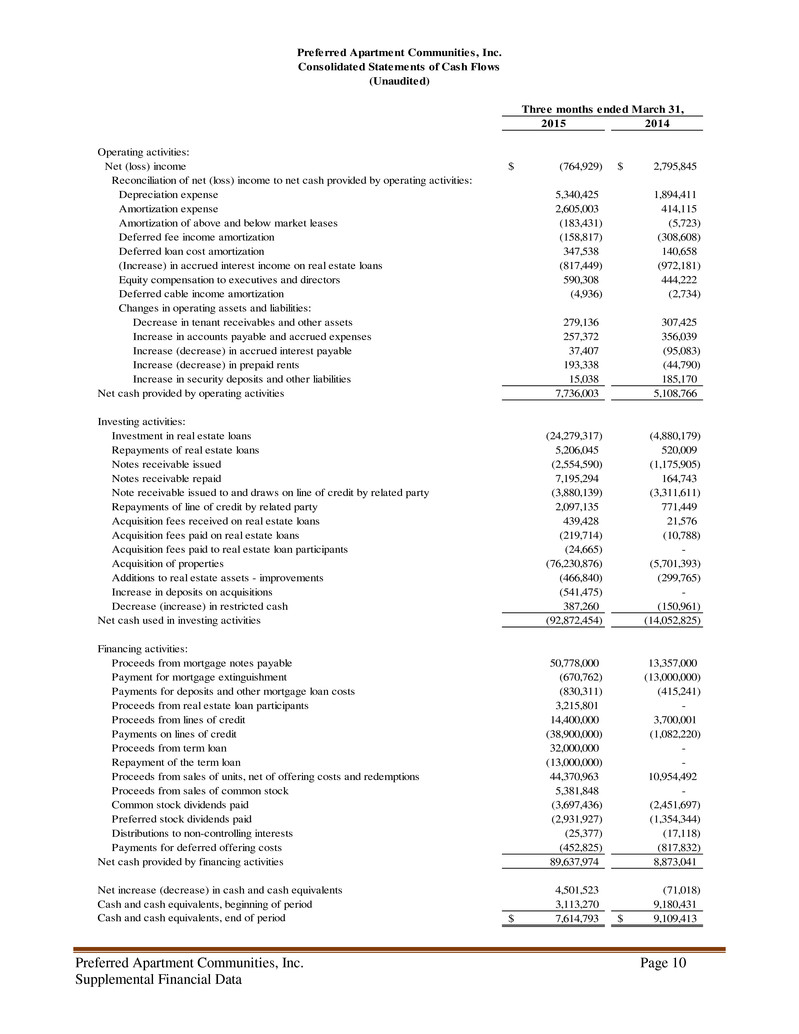

Preferred Apartment Communities, Inc. Page 10 Supplemental Financial Data 2015 2014 Operating activities: Net (loss) income (764,929)$ 2,795,845$ Reconciliation of net (loss) income to net cash provided by operating activities: Depreciation expense 5,340,425 1,894,411 Amortization expense 2,605,003 414,115 Amortization of above and below market leases (183,431) (5,723) Deferred fee income amortization (158,817) (308,608) Deferred loan cost amortization 347,538 140,658 (Increase) in accrued interest income on real estate loans (817,449) (972,181) Equity compensation to executives and directors 590,308 444,222 Deferred cable income amortization (4,936) (2,734) Changes in operating assets and liabilities: Decrease in tenant receivables and other assets 279,136 307,425 Increase in accounts payable and accrued expenses 257,372 356,039 Increase (decrease) in accrued interest payable 37,407 (95,083) Increase (decrease) in prepaid rents 193,338 (44,790) Increase in security deposits and other liabilities 15,038 185,170 Net cash provided by operating activities 7,736,003 5,108,766 Investing activities: Investment in real estate loans (24,279,317) (4,880,179) Repayments of real estate loans 5,206,045 520,009 Notes receivable issued (2,554,590) (1,175,905) Notes receivable repaid 7,195,294 164,743 Note receivable issued to and draws on line of credit by related party (3,880,139) (3,311,611) Repayments of line of credit by related party 2,097,135 771,449 Acquisition fees received on real estate loans 439,428 21,576 Acquisition fees paid on real estate loans (219,714) (10,788) Acquisition fees paid to real estate loan participants (24,665) - Acquisition of properties (76,230,876) (5,701,393) Additions to real estate assets - improvements (466,840) (299,765) Increase in deposits on acquisitions (541,475) - Decrease (increase) in restricted cash 387,260 (150,961) Net cash used in investing activities (92,872,454) (14,052,825) Financing activities: Proceeds from mortgage notes payable 50,778,000 13,357,000 Payment for mortgage extinguishment (670,762) (13,000,000) Payments for deposits and other mortgage loan costs (830,311) (415,241) Proceeds from real estate loan participants 3,215,801 - Proceeds from lines of credit 14,400,000 3,700,001 Payments on lines of credit (38,900,000) (1,082,220) Proceeds from term loan 32,000,000 - Repayment of the term loan (13,000,000) - Proceeds from sales of units, net of offering costs and redemptions 44,370,963 10,954,492 Proceeds from sales of common stock 5,381,848 - Common stock dividends paid (3,697,436) (2,451,697) Preferred stock dividends paid (2,931,927) (1,354,344) Distributions to non-controlling interests (25,377) (17,118) Payments for deferred offering costs (452,825) (817,832) Net cash provided by financing activities 89,637,974 8,873,041 Net increase (decrease) in cash and cash equivalents 4,501,523 (71,018) Cash and cash equivalents, beginning of period 3,113,270 9,180,431 Cash and cash equivalents, end of period 7,614,793$ 9,109,413$ Preferred Apartment Communities, Inc. Consolidated Statements of Cash Flows (Unaudited) Three months ended March 31,

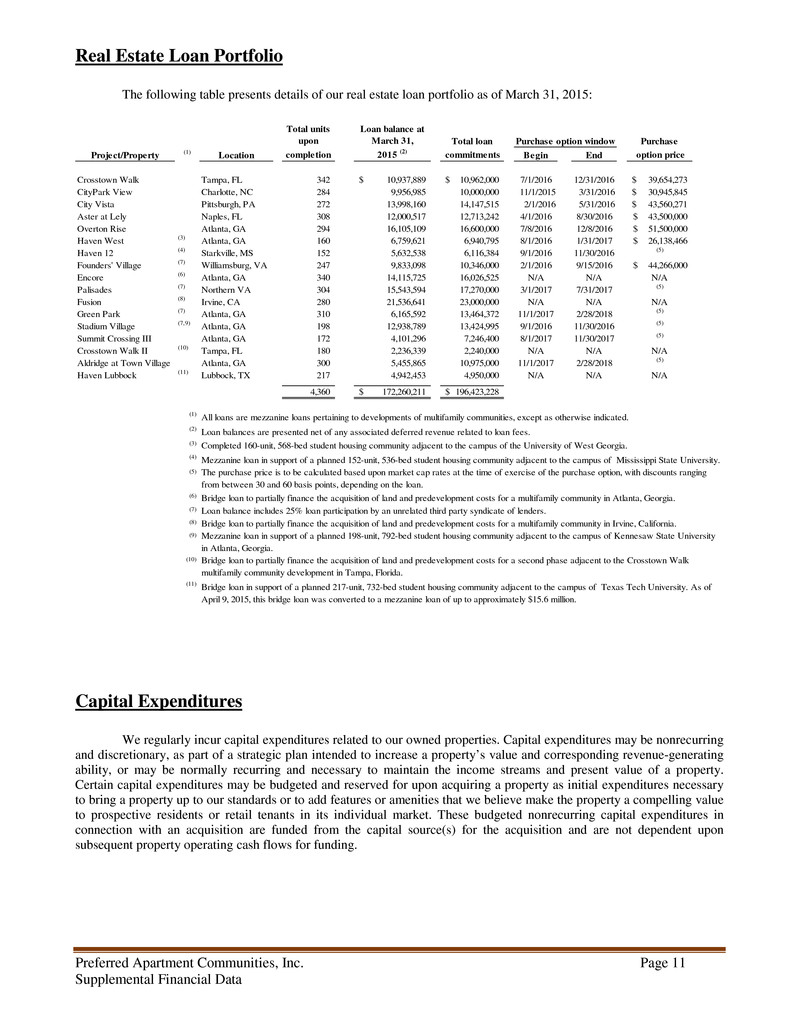

Preferred Apartment Communities, Inc. Page 11 Supplemental Financial Data Real Estate Loan Portfolio The following table presents details of our real estate loan portfolio as of March 31, 2015: Total units upon Loan balance at March 31, Total loan Purchase Project/Property (1) Location completion 2015 (2) commitments Begin End option price Crosstown Walk Tampa, FL 342 10,937,889$ 10,962,000$ 7/1/2016 12/31/2016 39,654,273$ CityPark View Charlotte, NC 284 9,956,985 10,000,000 11/1/2015 3/31/2016 30,945,845$ City Vista Pittsburgh, PA 272 13,998,160 14,147,515 2/1/2016 5/31/2016 43,560,271$ Aster at Lely Naples, FL 308 12,000,517 12,713,242 4/1/2016 8/30/2016 43,500,000$ Overton Rise Atlanta, GA 294 16,105,109 16,600,000 7/8/2016 12/8/2016 51,500,000$ Haven West (3) Atlanta, GA 160 6,759,621 6,940,795 8/1/2016 1/31/2017 26,138,466$ Haven 12 (4) Starkville, MS 152 5,632,538 6,116,384 9/1/2016 11/30/2016 (5) Founders' Village (7) Williamsburg, VA 247 9,833,098 10,346,000 2/1/2016 9/15/2016 44,266,000$ Encore (6) Atlanta, GA 340 14,115,725 16,026,525 N/A N/A N/A Palisades (7) Northern VA 304 15,543,594 17,270,000 3/1/2017 7/31/2017 (5) Fusion (8) Irvine, CA 280 21,536,641 23,000,000 N/A N/A N/A Green Park (7) Atlanta, GA 310 6,165,592 13,464,372 11/1/2017 2/28/2018 (5) Stadium Village (7,9) Atlanta, GA 198 12,938,789 13,424,995 9/1/2016 11/30/2016 (5) Summit Crossing III Atlanta, GA 172 4,101,296 7,246,400 8/1/2017 11/30/2017 (5) Crosstown Walk II (10) Tampa, FL 180 2,236,339 2,240,000 N/A N/A N/A Aldridge at Town Village Atlanta, GA 300 5,455,865 10,975,000 11/1/2017 2/28/2018 (5) Haven Lubbock (11) Lubbock, TX 217 4,942,453 4,950,000 N/A N/A N/A 4,360 172,260,211$ 196,423,228$ (1) All loans are mezzanine loans pertaining to developments of multifamily communities, except as otherwise indicated. (2) Loan balances are presented net of any associated deferred revenue related to loan fees. (3) Completed 160-unit, 568-bed student housing community adjacent to the campus of the University of West Georgia. (4) Mezzanine loan in support of a planned 152-unit, 536-bed student housing community adjacent to the campus of Mississippi State University. (5) (6) (7) (8) (9) (10) (11) Bridge loan in support of a planned 217-unit, 732-bed student housing community adjacent to the campus of Texas Tech University. As of April 9, 2015, this bridge loan was converted to a mezzanine loan of up to approximately $15.6 million. Bridge loan to partially finance the acquisition of land and predevelopment costs for a second phase adjacent to the Crosstown Walk multifamily community development in Tampa, Florida. Purchase option window Mezzanine loan in support of a planned 198-unit, 792-bed student housing community adjacent to the campus of Kennesaw State University in Atlanta, Georgia. The purchase price is to be calculated based upon market cap rates at the time of exercise of the purchase option, with discounts ranging from between 30 and 60 basis points, depending on the loan. Bridge loan to partially finance the acquisition of land and predevelopment costs for a multifamily community in Atlanta, Georgia. Loan balance includes 25% loan participation by an unrelated third party syndicate of lenders. Bridge loan to partially finance the acquisition of land and predevelopment costs for a multifamily community in Irvine, California. Capital Expenditures We regularly incur capital expenditures related to our owned properties. Capital expenditures may be nonrecurring and discretionary, as part of a strategic plan intended to increase a property’s value and corresponding revenue-generating ability, or may be normally recurring and necessary to maintain the income streams and present value of a property. Certain capital expenditures may be budgeted and reserved for upon acquiring a property as initial expenditures necessary to bring a property up to our standards or to add features or amenities that we believe make the property a compelling value to prospective residents or retail tenants in its individual market. These budgeted nonrecurring capital expenditures in connection with an acquisition are funded from the capital source(s) for the acquisition and are not dependent upon subsequent property operating cash flows for funding.

Preferred Apartment Communities, Inc. Page 12 Supplemental Financial Data For the three-month period ended March 31, 2015, our capital expenditures were as follows: Budgeted at acquisition Other Total Total Summit Crossing $ - 12,896$ 12,896$ $ 22,062 34,958$ Trail Creek - 68,802 68,802 17,919 86,721 Stone Rise - 949 949 13,835 14,784 Ashford Park - 14,864 14,864 34,355 49,219 McNeil Ranch - - - 14,240 14,240 Lake Cameron - 4,900 4,900 23,934 28,834 Stoneridge - 1,323 1,323 24,070 25,393 Vineyards - - - 14,609 14,609 Enclave - 6,191 6,191 15,790 21,981 Sandstone - - - 24,279 24,279 Cypress - - - 1,060 1,060 Northpointe - - - - - Retail - - - - - Total $ - 109,925$ 109,925$ 206,153$ $ 316,078 Nonrecurring capital expenditures Recurring capital expenditures Multifamily Occupancy For the three-month period ended March 31, 2015, our average multifamily physical occupancy was 94.2% and our average multifamily economic occupancy was 91.9%. We define “multifamily physical occupancy” as the number of units occupied divided by total apartment units. We calculate “average multifamily economic occupancy” by dividing gross potential rent less vacancy losses, model expenses, bad debt expenses and concessions by gross potential rent. All our multifamily properties are included in this calculation except for properties which are not yet stabilized (Cypress and Northpointe) and properties which are undergoing significant capital projects (Sandstone). Retail Portfolio Our retail portfolio consists of the following properties: Property name Location Year built GLA (1) Percent leased Anchor tenant Woodstock Crossing Atlanta, GA 1994 66,122 90.8% Kroger Parkway Town Centre Nashville, TN 2005 65,587 89.7% Publix Spring Hill Plaza Nashville, TN 2005 61,570 100.0% Publix Barclay Crossing Tampa, FL 1998 54,958 100.0% Publix Deltona Landings Orlando, FL 1999 59,966 95.5% Publix Kingwood Glen Houston, TX 1998 103,397 98.0% Kroger Parkway Centre Columbus, GA 1999 53,088 89.5% Publix Powder Springs Atlanta, GA 1999 77,853 87.7% Publix Sweetgrass Corner Charleston, SC 1999 89,124 100.0% Bi-Lo Salem Cove Nashville, TN 2010 62,356 97.8% Publix 694,021 (1) Gross leasable area, or GLA, represents the total amount of property square footage that can be leased to tenants.

Preferred Apartment Communities, Inc. Page 13 Supplemental Financial Data As of March 31, 2015, our retail portfolio was 95.1% leased. We define “percent leased” as the percentage of gross leasable area that is leased, including lease agreements that have been signed which have not yet commenced. Details regarding lease expirations (assuming no exercise of renewal options) within our retail assets as of March 31, 2015 were: Number of leases Leased GLA (1) Percent of leased GLA Month to month 3 6,420 1.0% 2015 13 23,110 3.5% 2016 19 28,671 4.3% 2017 21 39,602 6.0% 2018 15 30,963 4.7% 2019 10 125,036 19.0% 2020 8 78,349 11.9% 2021 6 14,080 2.1% 2022 1 1,082 0.2% 2023 - - - 2024+ 10 312,493 47.3% 106 659,806 Total retail portfolio Multifamily Same Store Financial Data The following chart presents same store operating results for the Company’s multifamily communities that have been owned for at least 15 full months, enabling comparisons of the current reporting period to the prior year comparative period. For the periods presented, same store operating results consist of the operating results of our Trail Creek, Stone Rise, Summit Crossing, Lake Cameron, Ashford Park, and McNeil Ranch communities. Same store net operating income is a non-GAAP measure that is most directly comparable to net income, with a reconciliation following below. $ inc % inc 3/31/2015 3/31/2014 (dec) (dec) Revenues: Rental revenues 5,968,646$ 5,781,976$ 186,670$ 3.2% Other property revenues 701,495 628,312 73,183 11.6% Total revenues 6,670,141 6,410,288 259,853 4.1% Operating expenses: Property operating and maintenance 935,066 905,523 29,543 3.3% Payroll 603,750 625,261 (21,511) (3.4)% Property management fees 266,395 258,121 8,274 3.2% Real estate taxes 762,147 649,576 112,571 17.3% Other 242,893 221,110 21,783 9.9% Total operating expenses 2,810,251 2,659,591 150,660 5.7% Same store net operating income 3,859,890$ 3,750,697$ 109,193$ 2.9% Three months ended: Same Store Net Operating Income Trail Creek, Stone Rise, Summit Crossing, Ashford Park, McNeil Ranch, Lake Cameron Multifamily Communities

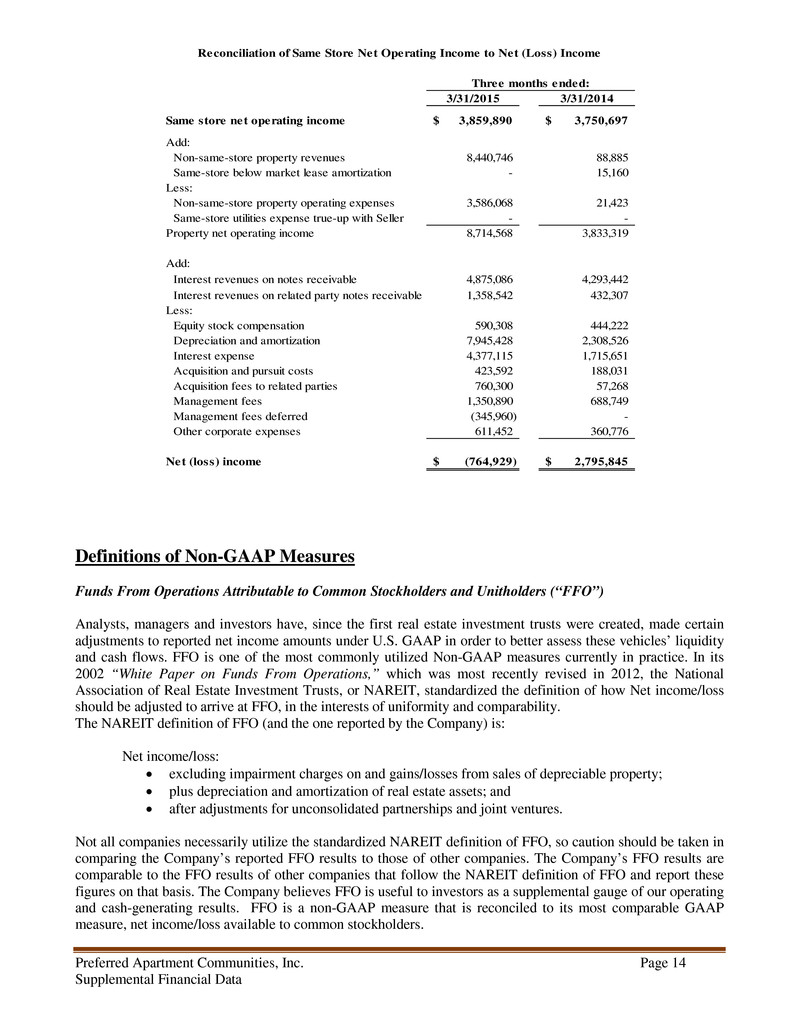

Preferred Apartment Communities, Inc. Page 14 Supplemental Financial Data 3/31/2015 3/31/2014 Same store net operating income 3,859,890$ 3,750,697$ Add: Non-same-store property revenues 8,440,746 88,885 Same-store below market lease amortization - 15,160 Less: Non-same-store property operating expenses 3,586,068 21,423 Same-store utilities expense true-up with Seller - - Property net operating income 8,714,568 3,833,319 Add: Interest revenues on notes receivable 4,875,086 4,293,442 Interest revenues on related party notes receivable 1,358,542 432,307 Less: Equity stock compensation 590,308 444,222 Depreciation and amortization 7,945,428 2,308,526 Interest expense 4,377,115 1,715,651 Acquisition and pursuit costs 423,592 188,031 Acquisition fees to related parties 760,300 57,268 Management fees 1,350,890 688,749 Management fees deferred (345,960) - Other corporate expenses 611,452 360,776 Net (loss) income (764,929)$ 2,795,845$ Three months ended: Reconciliation of Same Store Net Operating Income to Net (Loss) Income Definitions of Non-GAAP Measures Funds From Operations Attributable to Common Stockholders and Unitholders (“FFO”) Analysts, managers and investors have, since the first real estate investment trusts were created, made certain adjustments to reported net income amounts under U.S. GAAP in order to better assess these vehicles’ liquidity and cash flows. FFO is one of the most commonly utilized Non-GAAP measures currently in practice. In its 2002 “White Paper on Funds From Operations,” which was most recently revised in 2012, the National Association of Real Estate Investment Trusts, or NAREIT, standardized the definition of how Net income/loss should be adjusted to arrive at FFO, in the interests of uniformity and comparability. The NAREIT definition of FFO (and the one reported by the Company) is: Net income/loss: • excluding impairment charges on and gains/losses from sales of depreciable property; • plus depreciation and amortization of real estate assets; and • after adjustments for unconsolidated partnerships and joint ventures. Not all companies necessarily utilize the standardized NAREIT definition of FFO, so caution should be taken in comparing the Company’s reported FFO results to those of other companies. The Company’s FFO results are comparable to the FFO results of other companies that follow the NAREIT definition of FFO and report these figures on that basis. The Company believes FFO is useful to investors as a supplemental gauge of our operating and cash-generating results. FFO is a non-GAAP measure that is reconciled to its most comparable GAAP measure, net income/loss available to common stockholders.

Preferred Apartment Communities, Inc. Page 15 Supplemental Financial Data Normalized Funds From Operations Attributable to Common Stockholders and Unitholders (“NFFO”) Normalized FFO makes certain adjustments to FFO, which are either not likely to occur on a regular basis or are otherwise not representative of the Company’s ongoing operating performance. For example, since the Company is acquiring properties on a regular basis, it incurs substantial costs related to such acquisitions, which are required under GAAP to be recognized as expenses when they are incurred. The Company adds back any such acquisition and pursuit costs, including costs incurred in connection with obtaining short term debt financing for acquisitions, to FFO in its calculation of NFFO since such costs are not representative of our fund generating results on an ongoing basis. The Company also adds back any realized losses on debt extinguishment and any non-cash dividends in this calculation. NFFO figures reported by us may not be comparable to those NFFO figures reported by other companies. We utilize NFFO as a measure of the operating performance of our portfolio of real estate assets. We believe NFFO is useful to investors as a supplemental gauge of our operating performance and is useful in comparing our operating performance with other real estate companies that are not as involved in ongoing acquisition activities. NFFO is a non-GAAP measure that is reconciled to its most comparable GAAP measure, net income/loss available to common stockholders. Adjusted Funds From Operations Attributable to Common Stockholders and Unitholders (“AFFO”) AFFO makes further adjustments to NFFO results in order to arrive at a more refined measure of operating and financial performance. There is no industry standard definition of AFFO and practice is divergent across the industry. The Company calculates AFFO as: NFFO, plus: • non-cash equity compensation to directors and executives; • amortization of loan closing costs, excluding costs incurred in connection with obtaining short term financing related to acquisitions; • depreciation and amortization of non-real estate assets; • net loan fees received; and • deferred interest income received; Less: • non-cash loan interest income; • cash paid for pursuit costs on abandoned acquisitions; • cash paid for loan closing costs; • amortization of acquired real estate intangible liabilities; and • normally-recurring capital expenditures. AFFO figures reported by us may not be comparable to those AFFO figures reported by other companies. We utilize AFFO as another measure of the operating performance of our portfolio of real estate assets. We believe AFFO is useful to investors as a supplemental gauge of our operating performance and is useful in comparing our operating performance with other real estate companies. AFFO is a non-GAAP measure that is reconciled to its most comparable GAAP measure, net income/loss available to common stockholders. Same Store Net Operating Income (“NOI”) The Company uses same store net operating income as an operational metric for properties the Company has owned for at least 15 full months, enabling comparisons of those properties’ operating results between the current reporting period and the prior year comparative period. The Company defines net operating income as rental and other property revenues, less total property and maintenance expenses, property management fees, real estate taxes, general and administrative expenses, and property insurance. The Company believes that net operating income is an important supplemental measure of operating performance for a REIT’s operating real estate because it provides a measure of the core operations, rather than factoring in depreciation and

Preferred Apartment Communities, Inc. Page 16 Supplemental Financial Data amortization, financing costs, acquisition costs, and other corporate expenses. Net operating income is a widely utilized measure of comparative operating performance in the REIT industry, but is not a substitute for its closest GAAP-compliant measure, net income/loss. Additional Information The SEC has declared effective the registration statement (including prospectus) filed by the Company for each of the offerings to which this communication may relate. Before you invest, you should read the final prospectus, and any prospectus supplements, forming a part of the registration statement and other documents the Company has filed with the SEC for more complete information about the Company and the offering to which this communication may relate. In particular, you should carefully read the risk factors described in the final prospectus and in any related prospectus supplement and in the documents incorporated by reference in the final prospectus and any related prospectus supplement to which this communication may relate. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively the Company or its dealer manager, International Assets Advisory, LLC (with respect to the offering of up to a maximum of 900,000 Units, with each Unit consisting of one share of Series A Redeemable Preferred Stock and one Warrant to purchase up to 20 shares of our Common Stock, or the Follow-On Offering), or its sales agent, MLV & Co. LLC (with respect to the issuance and offering of up to $100 million of its Common Stock from time to time in an "at the market" offering, or the ATM Offering), will arrange to send you the prospectus if you request it by calling Leonard A. Silverstein at (770) 818-4100, or writing to 3284 Northside Parkway NW, Suite 150, Atlanta, Georgia 30327. The final prospectus for the Follow-On Offering, dated October 11, 2013, can be accessed through the following link: http://www.sec.gov/Archives/edgar/data/1481832/000148183213000128/a424b3prospectus900m.htm The final prospectus and prospectus supplement for the ATM Offering, dated July 19, 2013 and February 28, 2014, respectively, can be accessed through the following link: http://www.sec.gov/Archives/edgar/data/1481832/000148183214000015/prospectussupplementatm-20.htm For further information: Leonard A. Silverstein President and Chief Operating Officer Preferred Apartment Communities, Inc. lsilverstein@pacapts.com +1-770-818-4147