Attached files

| file | filename |

|---|---|

| 8-K - 8-K - A10 Networks, Inc. | atenq12015pressrelease8kdoc.htm |

| EX-99.1 - EXHIBIT 99.1 - A10 Networks, Inc. | may42015pressreleasebya10n.htm |

A10 Networks – Q1 2015 Earnings 5/4/2015 1 | P a g e

A10 Networks – Q1 2015 Earnings 5/4/2015 2 | P a g e Thank you all for joining us today. I am pleased to welcome you to A10 Networks first quarter 2015 financial results conference call. This call is being recorded and webcast live and may be accessed for 90 days via the A10 Networks website, www.a10networks.com. Joining me today are A10’s Founder & CEO, Lee Chen; A10’s CFO, Greg Straughn; and our VP of Global Sales, Ray Smets. Before we begin, I would like to remind you that shortly after the market closed today, A10 Networks issued a press release announcing its first quarter 2015 financial results. Additionally, A10 published a presentation along with its prepared comments for this call and supplemental trended financial statements. You may access the press release, presentation with prepared comments, and trended financial statements on the investor relations section of the company’s website www.a10networks.com.

A10 Networks – Q1 2015 Earnings 5/4/2015 3 | P a g e During the course of today’s call, management will make forward-looking statements, including statements regarding our projections for our second quarter operating results, our expectations for future revenue growth, profitability and operating margin, expectations of customer buying patterns and the growth of our business generally. These statements are based on current expectations and beliefs as of today, May 4, 2015. A10 disclaims any obligation to update information contained in these forward-looking statements whether as a result of new information, future events, or otherwise. These forward-looking statements involve a number of risks and uncertainties, some of which are beyond our control that could cause actual results to differ materially. We disclaim any obligation to update these forward-looking statements as a result of future events or otherwise. For a more detailed description of these risks and uncertainties, please refer to our 10-K filed on March 11th.

A10 Networks – Q1 2015 Earnings 5/4/2015 4 | P a g e Please note that with the exception of revenue, financial measures discussed today are on a non-GAAP basis and have been adjusted to exclude certain charges. A reconciliation between GAAP and non-GAAP measures can be found in the press release issued today and on the trended quarterly financial statements posted on the company’s website. We will provide our current expectations for the second quarter of 2015 on a non-GAAP basis. However, we will not make available a reconciliation of non-GAAP guidance measures to corresponding GAAP measures on a forward-looking basis due to high variability and low visibility with respect to the charges, which are excluded from these non-GAAP measures. Before I turn the call over to Lee, I’d like to announce that management will attend the RBC Mobile and Cloud Networking Investor day in Boston on this Thursday, May 7th and present at the JP Morgan Global Technology, Media, and Telecom Conference on May 19th in Boston and at the Bank of America Merrill Lynch Global Technology conference on June 3rd in San Francisco. We hope to see many of you there. Now I would like to turn the call over to Lee for opening remarks.

A10 Networks – Q1 2015 Earnings 5/4/2015 5 | P a g e

A10 Networks – Q1 2015 Earnings 5/4/2015 6 | P a g e Overall, the team executed well during the quarter. We delivered revenue within our guidance and drove leverage through our operating structure, resulting in a 24% sequential improvement in our bottom line. Looking at our results in more detail. Our first quarter 2015 revenue came in at 44.0 million dollars, reflecting stronger than expected demand in North America, offset by Q1 seasonality and continued weakness in the service provider segment. While we continue to see a cautious service provider spending environment, we gained traction with our security products, and we made good progress toward growing our presence in the enterprise and diversifying our revenue base. Our pipeline remains very strong, our win rate remains consistently high and we are pleased to report that in Q1, we returned to year over year product bookings growth.

A10 Networks – Q1 2015 Earnings 5/4/2015 7 | P a g e Revenue from the enterprise grew 26% from the prior year and 6% sequentially and accounted for 57% of our total first quarter revenue. In total, we added close to 200 new customers in the quarter and we now serve over 4,000 customers.

A10 Networks – Q1 2015 Earnings 5/4/2015 8 | P a g e We saw good demand for our ADC solutions driven by our rich security features including SSL insight and web application firewall. Industry analysts currently estimate that 20% to 35% of enterprise traffic is encrypted, and they expect this to grow rapidly throughout 2015 and beyond. With the growth in encrypted traffic, we believe we are very well positioned to gain market momentum. Our Thunder ADC solution is the first ADC to offer SSL Insight features and we provide a comprehensive and high performance SSL insight solution. In the first quarter, we landed a new Fortune 50 customer with our Thunder ADC SSL insight solution. This customer chose A10 to help protect their network from incoming threats because of our ability to seamlessly scale and inspect SSL traffic as well as load balance between their firewalls. We are very proud of this new win as it was our first sale into this very large enterprise where our largest competitor had a strong hold.

A10 Networks – Q1 2015 Earnings 5/4/2015 9 | P a g e We also continue to gain momentum for our Thunder TPS DDoS mitigation security solution and we are receiving positive customer feedback from the recently released fully programmable policy engine. Although TPS revenue remains a small percentage of our total revenue, we are very excited by our momentum among both enterprise and service provider customers. Based on conversations with our customers, we estimate that our TPS opportunity within certain customers could grow to be between three to eight times the initial buy within a two-year period. In Q1, we added a record number of new TPS DDoS mitigation customers, many of which were international. It is important to note that 50% of our TPS customers in Q1 are new to A10, providing us with an opportunity to expand into new areas of their network. Let me share with you a few of our new TPS customer engagements: A North America based broadband provider chose our Thunder TPS solution after repeated outages due to DDoS attacks. In this competitive win, we believe we won because our high- capacity, small form factor product, helping provide both CapEx and OpEx savings to the customer while at the same time increasing the protection of their network. C4L, a data center colocation provider, chose our Thunder TPS solution because we demonstrated a four-fold increase in the available DDoS mitigation performance on their network versus the competition. And in Japan, both an industry leading enterprise and a marquee service provider customer chose our Thunder TPS solution for an initial deployment. It has been close to one year since we launched our Affinity channel program and we have seen a nice uptick in channel led, closed and initiated deals compared with this time last year. Additionally our channel pipeline has grown over 75%.

A10 Networks – Q1 2015 Earnings 5/4/2015 10 | P a g e In summary, our high performance Thunder product suite continues to gain momentum in the market driven by our high performance, flexibility and advanced security features as well as our ability to integrate with other leading networking, security and cloud providers. A10 addresses some of today’s most critical application and security challenges. As cyber attacks grow in size and sophistication -- the manageability, scalability and flexibility of the network becomes even more important in order to conserve and protect network resources. Our ACOS based Thunder platform enables an open, programmable interface that can easily scale from megabit to terabit of throughput and delivers 2-5 times the performance of our competitors. Our recently introduced proprietary ACOS 4.0, automatically generates Application Programming Interface (API), and provides A10 the agility to deliver new modules, new functions and new features, as well as, rapidly integrate with other solutions. We believe we are well positioned competitively, and are encouraged by the opportunities we see ahead. Furthermore, we strengthened our executive team with the recent appointment of Sanjay Kapoor as VP of Marketing. Sanjay is well recognized for developing global marketing programs that helped accelerate growth and increase brand awareness at some of the most well known technology companies. With that, I’d like to turn the call over to Greg to review the details of our first quarter financial performance and second quarter guidance.

A10 Networks – Q1 2015 Earnings 5/4/2015 11 | P a g e

A10 Networks – Q1 2015 Earnings 5/4/2015 12 | P a g e We delivered first quarter revenue of 44.0 million dollars, compared with 45.7 million dollars in the prior year first quarter. Deferred revenue, consisting almost entirely of customer maintenance and support contracts, was up 36% year-over-year, totaling 59.7 million dollars.

A10 Networks – Q1 2015 Earnings 5/4/2015 13 | P a g e First quarter product revenue totaled 30.5 million dollars, representing 69% of total revenue. This compares with 36.4 million dollars or 80% of total revenue in the prior year first quarter. As Lee mentioned, first quarter product bookings grew on a year-over-year basis. Service revenue was 13.5 million dollars, accounting for 31% of total revenue, compared with 9.3 million dollars or 20% in the first quarter of 2014. First quarter revenue from the United States grew 26% year-over-year and 12% sequentially to reach 22.9 million dollars, representing approximately 52% of total revenue. First quarter revenue from Japan was 8.8 million dollars, representing 20% of total revenue, compared with 17.3 million dollars or 38% of total revenue in the same quarter of the prior year, which was unusually high given the backlog from Japan we carried into the quarter. Revenue generated from EMEA was 6.2 million dollars, an increase of 50% over Q1 of the prior year and represented 14% of total revenue. Revenue from APAC (excluding Japan) was 4.6 million dollars, representing 10% of revenue, compared with 4.3 million or 9% in the prior year first quarter. Our enterprise and service provider revenue split this quarter was 57% and 43% of total revenue, respectively. Revenue from enterprise customers totaled 25.0 million dollars, up 26% from Q1 in the prior year and up 6% sequentially. Service provider revenue was 19.0 million dollars, compared with 21.7 million dollars in the prior quarter and 25.8 million dollars in the first quarter of 2014. Consistent with the revenue diversification we have seen over recent quarters we did not have any 10% or greater customers in Q1.

A10 Networks – Q1 2015 Earnings 5/4/2015 14 | P a g e Moving beyond revenue, all further metrics discussed on this call are on a non-GAAP basis, unless expressly stated otherwise. We delivered a first quarter total gross margin of 76.6%, down 60 basis points when compared with Q4 of 2014. On a constant currency basis versus Q1 of 2014 gross margin was reduced by 50 basis points on a year-over-year basis due to changes in the Yen-to-Dollar conversion rate. While product gross margin remained relatively inline with the prior quarter and came in at 77.1%, our services gross margin came in at 75.5%, a decline of 167 basis points compared with Q4’14, and an increase of 280 basis points over Q1 of 2014. Services gross margin was impacted by our investment in building out our professional services organization.

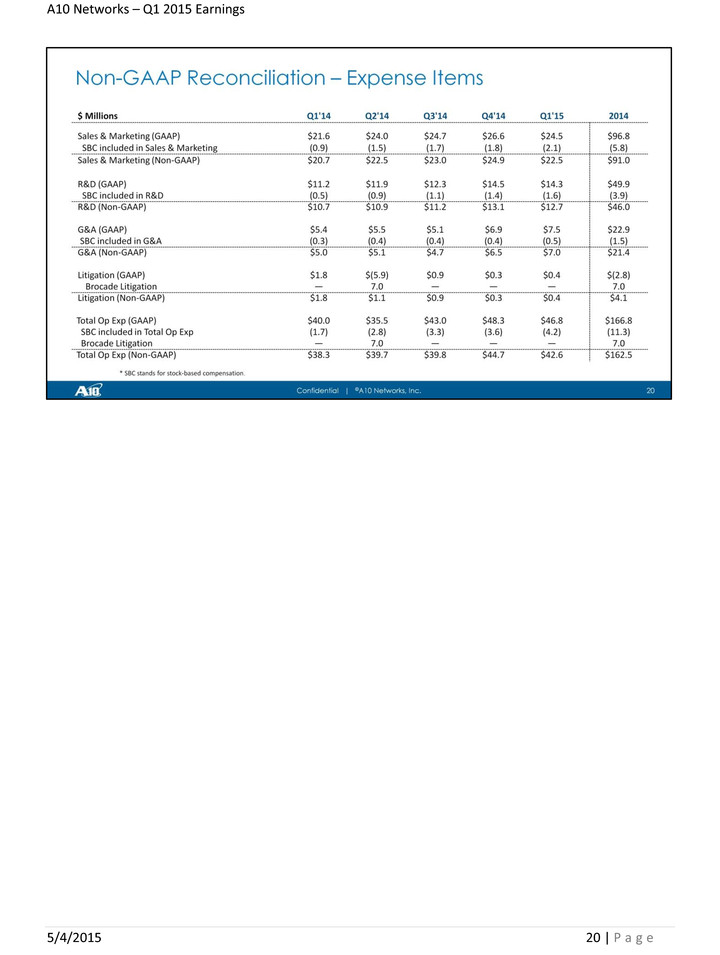

A10 Networks – Q1 2015 Earnings 5/4/2015 15 | P a g e We ended the quarter with staff of 761, up from 759 at the end of 2014. In Q1 Sales and marketing expense was 22.5 million dollars, compared with 24.9 million dollars in Q4 of 2014. On a percentage basis, sales and marketing expense was 51.0% of revenue, compared with 55.0% in the prior quarter. In Q1 R&D expense totaled 12.7 million dollars or 28.9% of revenue, compared with 13.1 million dollars and 29.0% in the preceding quarter. First quarter combined G&A and litigation expense was approximately 7.5 million dollars or 17.0% of total revenue, compared with 6.8 million dollars or 15.0% of revenue in Q4. This increase was primarily related to indirect taxes due in Q1 and litigation expenses. In total, first quarter non-GAAP operating expenses were 42.6 million dollars. First quarter non-GAAP operating loss was 8.9 million dollars, compared with 9.8 million dollars in the fourth quarter. Our non-GAAP net loss in the first quarter was 9.1 million dollars or 15 cents per share, a 24% improvement when compared with a net loss of 12.0 million dollars or 20 cents per share in Q4. Basic and diluted weighted outstanding shares for the quarter were approximately 61.5 million shares.

A10 Networks – Q1 2015 Earnings 5/4/2015 16 | P a g e Moving to the balance sheet, at March 31, 2015 we had 85.6 million dollars in total cash and equivalents. During the quarter cash used for operations was 5.5 million dollars. We ended Q1 with 52.8 million dollars of net accounts receivable, compared with the Q4’14 balance of 54.0 million dollars. Average days sales outstanding were 110 days, up from 97 days in the prior quarter. The increase in the Q1 value is primarily related to the above average opening balance at the beginning of Q1 and its impact on calculating the average accounts receivable balance.

A10 Networks – Q1 2015 Earnings 5/4/2015 17 | P a g e

A10 Networks – Q1 2015 Earnings 5/4/2015 18 | P a g e

A10 Networks – Q1 2015 Earnings 5/4/2015 19 | P a g e

A10 Networks – Q1 2015 Earnings 5/4/2015 20 | P a g e

A10 Networks – Q1 2015 Earnings 5/4/2015 21 | P a g e

A10 Networks – Q1 2015 Earnings 5/4/2015 22 | P a g e