Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - VISTEON CORP | d918821dex322.htm |

| EX-31.1 - EX-31.1 - VISTEON CORP | d918821dex311.htm |

| EX-31.2 - EX-31.2 - VISTEON CORP | d918821dex312.htm |

| EX-32.1 - EX-32.1 - VISTEON CORP | d918821dex321.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-15827

VISTEON CORPORATION

(Exact name of registrant as specified in its charter)

| State of Delaware | 38-3519512 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| One Village Center Drive, Van Buren Township, Michigan | 48111 | |

| (Address of principal executive offices) | (Zip code) | |

Registrant’s telephone number, including area code: (800)-VISTEON

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on which Registered | |

| Common Stock, par value $0.01 per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

Warrants, each exercisable for one share of Common Stock at an exercise price of $58.80 (expiring October 15, 2015)

(Title of class)

Warrants, each exercisable for one share of Common Stock at an exercise price of $9.66 (expiring October 15, 2020)

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates of the registrant on June 30, 2014 (the last business day of the most recently completed second fiscal quarter) was approximately $4.3 billion.

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes x No ¨

As of February 17, 2015, the registrant had outstanding 44,438,803 shares of common stock.

Document Incorporated by Reference

| Document |

Where Incorporated | |

| None | None |

Explanatory Note

Visteon Corporation (“Visteon” or the “Company”) filed its Annual Report on Form 10-K for the year ended December 31, 2014 (the “Annual Report”) with the Securities and Exchange Commission (the “SEC”) on February 26, 2015. Pursuant to General Instruction G(3) to Form 10-K, we incorporated by reference the information required by Part III of Form 10-K from our definitive proxy statement for the 2015 Annual Meeting of Shareholders. Because of late developments relating to a shareholders proposal, the definitive proxy statement will not be filed with the Commission within 120 days after our fiscal year end, and we are filing this Amendment No. 1 to the Annual Report (the “Form 10-K/A”) to provide the additional information required by Part III of Form 10-K. In addition, pursuant to the rules of the SEC, Item 15 of Part IV of the Annual Report also has been amended to include the certifications from the Company’s Chief Executive Officer and Chief Financial Officer, as required by Sections 302 and 906 of the Sarbanes-Oxley Act of 2002. The certifications of the Company’s Chief Executive Officer and Chief Financial Officer are attached to this Form 10-K/A as Exhibits 31.1, 31.2, 32.1 and 32.2. This Form 10-K/A does not otherwise change or update the previously reported financial statements or any of the other disclosures contained in Part I, Part II or Part IV or any exhibits as originally filed and does not otherwise reflect events occurring after the original filing date of the Annual Report. Accordingly, this Form 10-K/A should be read in conjunction with our filings with the SEC subsequent to the filing of the Annual Report.

1

Part III

| Item 10. | Directors, Executive Officers and Corporate Governance |

Information Regarding Current Directors

Duncan H. Cocroft is 71 years old and he has been a director of Visteon since October 18, 2010. Mr. Cocroft is the former Executive Vice President, Finance and Treasurer of Cendant Corporation, a provider of consumer and business services primarily in the travel and real estate services industries, a position he held from June 1999 until March 2004. During that time, Mr. Cocroft also served as Executive Vice President and Chief Financial Officer of PHH Corporation, Cendant’s wholly-owned finance subsidiary. Prior to joining Cendant in June 1999, Mr. Cocroft served as Senior Vice President, Chief Administrative Officer and Principal Financial Officer of Kos Pharmaceuticals, Inc. and as Vice President and Chief Financial Officer of International Multifoods Corporation. Mr. Cocroft also serves as a director of SBA Communications Corporation.

Mr. Cocroft has experience as a chief financial officer and other financial oversight positions at large, global public companies, as well as other senior management experience including the oversight of information systems and human resources. He also has experience chairing the audit committee of a public company.

Jeffrey D. Jones is 62 years old and he has been a director of Visteon since October 1, 2010. Mr. Jones is an attorney with Kim & Chang, a South Korea-based law firm, a position he has held since 1980. Mr. Jones serves as Chairman of the Board of Partners for Future Foundation, a Korean non-profit foundation. Mr. Jones has also served as a director of POSCO and the Doosan Corporation during the past five years.

Mr. Jones has over thirty years of international legal experience, with particular focus on Asia. He has served on the board of multinational companies and has been active in civic and charitable activities. He has served as chairman of the American Chamber of Commerce in Korea, as an advisor to several organizations and government agencies in Korea, and as a recognized member of the Korean Regulatory Reform Commission.

Timothy D. Leuliette is 65 years old and he has been Visteon’s Chief Executive Officer and President since September 30, 2012, and a director of the Company since October 1, 2010. From August 10, 2012 to September, 30, 2012 Mr. Leuliette served as Visteon’s Interim Chairman of the Board, Interim Chief Executive Officer and Interim President, and prior to that Mr. Leuliette was the Senior Managing Director of FINNEA Group, LLC, an investment and financial services firm since October 14, 2010. Mr. Leuliette has also served as the President and Chief Executive Officer of Dura Automotive LLC, an automotive supplier, from July 2008, a director of Dura from June 2008, and the Chairman of the Board of Dura from December 2008. Mr. Leuliette also served as a Managing Director of Patriarch Partners LLC, the majority stockholder of Dura. Prior to that, he served as Co-Chairman and Co-Chief Executive Officer of Asahi Tec Corporation, a manufacturer of automotive parts and other products, and Chairman, Chief Executive Officer and President of Metaldyne Corporation, an automotive supplier, from January 2001 to January 2008. Over his career he has held executive and management positions at both vehicle manufacturers and suppliers and has served on both corporate and civic boards, including as Chairman of the Detroit Branch of the Federal Reserve Bank of Chicago.

Mr. Leuliette has extensive experience in the automotive industry, including leadership roles with diversified suppliers of automotive components, systems and modules. He has deep experience with integrating acquired business, overseeing sophisticated sale transactions and restructuring distressed companies.

Joanne M. Maguire is 61 years old and has been a Director of Visteon since January 6, 2015. Ms. Maguire served as Executive Vice President of Lockheed Martin Space Systems Company, a provider of advanced-technology systems for national security, civil and commercial customers, from July 2006 until she retired in May 2013. Ms. Maguire joined Lockheed Martin in 2003. Ms. Maguire also serves on the board of Freescale Semiconductor, Inc.

Ms. Maguire has extensive experience in the technology sector, including senior leadership positions with a publicly traded company, including responsibility for operations and profitability.

2

Robert Manzo is 57 years old and has been a director of Visteon since June 14, 2012. Mr. Manzo is the founder and managing member of RJM I, LLC, a provider of consulting services to troubled companies, a position he has held since 2005. From 2000 to 2005, Mr. Manzo was the senior managing director of FTI Consulting, Inc., a global business advisory firm. Mr. Manzo is a graduate of Rider University and is a certified public accountant.

Mr. Manzo has extensive experience advising distressed companies in the automotive and other industries, and possesses financial and accounting expertise.

Francis M. Scricco is 65 years old. He was appointed Visteon’s non-Executive Chairman of the Board on September 30, 2012, and has been a director of Visteon since August 10, 2012. Mr. Scricco is the former Senior Vice President, Manufacturing, Logistics and Procurement of Avaya, Inc., a global business communications provider, a position he held from February 2007 to October 2008. Prior to that he was Avaya’s Senior Vice President, Global Services since March 2004. Mr. Scricco also served as the interim Chief Operating Officer of Oasys, Inc. from August 2011 to December 2011 and again from May 2012 to September 2012. Mr. Scricco currently serves on the boards of Masonite, Inc. and Tembec, Inc., both public companies as well as Wastequip, LLC, a privately held company.

Mr. Scricco has extensive global business leadership experience, including public company board service. Mr. Scricco has spent more than twenty-five years are a senior P&L manager in six different industries. His P&L experience ranges from CEO of a venture capital technology start-up to CEO of a $13 billion publicly traded Fortune 200 company.

David L. Treadwell is 60 years old and he has been a director of Visteon since August 10, 2012. Mr. Treadwell currently serves on the boards of Flagstar Bank and FairPoint Communications, both which are publicly traded on U.S. stock exchanges. Mr. Treadwell also serves, since January 2011, as Chairman of C & D Technologies, a producer and marketer of electrical power storage and conversion products; since March 2012, as Chairman of Revere Industries, a manufacturer of various plastic and metal components for industrial use; since January 2013, as Chairman of Grow Michigan, LLC, a $30 million mezzanine debt fund targeted to promoting economic growth in Michigan’s small business community; and since July 2013, as Chairman of AGY, LLC, a leading producer of high tech glass fiber for a variety of global applications. Mr. Treadwell served as President and CEO of EP Management Corporation, formerly known as EaglePicher Corporation, from August 2006 to September 2011. Mr. Treadwell was EaglePicher’s chief operating officer from June 2005 to July 2006. Prior to that, he served as Oxford Automotive’s CEO from 2004 to 2005.

Mr. Treadwell has extensive experience advising and leading distressed companies in the automotive and other industries.

Harry J. Wilson is 43 years old and he has been a Director of Visteon since July 28, 2011. He has been the Chairman and Chief Executive Officer of MAEVA Group, LLC, a turnaround and restructuring boutique, since January 2011. Prior to that, he served as a Senior Advisor on the President’s Automotive Task Force from March 2009 to August 2009, and he was a Partner at Silver Point Capital, a credit oriented investment fund, where he joined as a Senior Analyst in May 2003 and served until August 2008. Mr. Wilson was the Republican nominee for the office of New York State Comptroller in 2010. During the past five years he has served on the boards of Yahoo! Inc. and YRC Worldwide, Inc., and currently also serves on the board of Sotheby’s.

Mr. Wilson has extensive financial and transactional expertise including advising distressed companies in the automotive and other industries.

Rouzbeh Yassini-Fard is 56 years old and he has been a Director of Visteon since January 5, 2015. He is founder and CEO of YAS Capital Partners, a boutique firm specializing in advancement of broadband Internet technology and services founded in 1997, and an Executive Director of the University of New Hampshire Broadband Center of Excellence. Dr. Yassini-Fard is known as the “father of the cable modem” for his pioneering work in broadband technology and creation of global standards for broadband. He has previously served on the boards of LANcity, Broadband Access Systems, TrueChat and Entropic Communications.

Dr. Yassini-Fard has extensive executive business experience with specific focus in the technology sector furthering the advancement of broadband Internet technology and services for ubiquitous connectivity worldwide.

Kam Ho George Yuen is 70 years old and he has been a director Visteon since June 13, 2013. Mr. Yuen is the former Chief Executive of The Better Hong Kong Foundation, a non-profit organization founded to enhance public confidence in Hong Kong

3

with overseas business and political leaders, a position he held from September 1997 until August 2006. Prior to that, he was the Assistant Director/Acting Deputy Director of the Information Services Department of the Hong Kong Government. Mr. Yuen is also a non-executive director of PNG Resources Holdings Limited, a Hong Kong listed company, and Industrial and Commercial Bank of China (Asia) Limited. He also served as a non-executive director of Tradelink Electronic Commerce Limited, a Hong Kong listed company, from November 2006 and May 2011. Mr. Yuen is a Standing Committee Member of Convocation and Member of the Court of the University of Hong Kong, and a board director/Vice-Chairman of the Hong Kong Society for the Aged since 1979.

Mr. Yuen is active in many international business conferences and government and community activities, including being a Chairman of the Banking and Finance Task Force of the Business Advisory Council of the United Nations Economic and Social Commission for Asia and Pacific (UNESCAP), Special Adviser of the China National Committee for Pacific Economic Cooperation (PECC China), a member of The Chinese People’s Political Consultative Conference, Guangxi Autonomous Region, China, an adviser of the Institute of Finance and Trade Economics, a Fellow of the Hong Kong Institute of Directors, a member of the British Institute of Management and the Institute of Marketing, United Kingdom. He graduated from The University of Hong Kong with a Bachelor’s Degree (Honors) and attended post-graduate studies at the International Marketing Institute, Oxford University, and INSEAD.

Committees of the Board of Directors

The Board has established four standing committees. The principal functions of each committee are briefly described on the following pages.

Audit Committee

The Board has a standing Audit Committee, currently consisting of Duncan H. Cocroft (Chair), Robert J. Manzo and David L. Treadwell, all of whom are considered independent under the rules and regulations of the Securities and Exchange Commission, the New York Stock Exchange listing standards and the Visteon Director Independence Guidelines. The Board has determined that each of the current members of the Audit Committee has “accounting and related financial management expertise” within the meaning of the listing standards of the New York Stock Exchange, and Messrs. Cocroft and Manzo are qualified as an “audit committee financial expert” within the meaning of the rules and regulations of the Securities and Exchange Commission. During 2014, the Audit Committee held eight regularly scheduled and special meetings. The duties of the Audit Committee are generally:

| • | to select and evaluate the independent registered public accounting firm; |

| • | to approve all audit and non-audit engagement fees and terms; |

| • | to review the activities and the reports of the Company’s independent registered public accounting firm; |

| • | to review internal controls, accounting practices, financial structure and financial reporting, including the results of the annual audit and review of interim financial statements; |

| • | to review and monitor compliance procedures; and |

| • | to report the results of its review to the Board. |

The charter of the Audit Committee, as well as any future revisions to such charter, is available on the Company’s website at www.visteon.com/investors.

Organization and Compensation Committee

The Board also has a standing Organization and Compensation Committee, consisting of David L. Treadwell (Chair), Duncan H. Cocroft, Jeffrey D. Jones and Harry J. Wilson, all of whom are considered independent under the New York Stock Exchange listing standards and the Visteon Director Independence Guidelines. During 2014, the Organization and Compensation Committee held ten regularly scheduled and special meetings, and took action by written consent once. The Organization and Compensation Committee oversees the Company’s programs for compensating executive officers and other key management employees, including the administration of the Company’s stock-based compensation plans, and approves the salaries, bonuses and other awards to executive officers. Other duties of the Organization and Compensation Committee are generally:

| • | to review and approve corporate goals and objectives relative to the compensation of the Chief Executive Officer, evaluate the Chief Executive Officer’s performance and set the Chief Executive Officer’s compensation level based on this evaluation; |

4

| • | to review and approve executive compensation and incentive plans; |

| • | to approve the payment of cash performance bonuses and the granting of stock-based awards to the Company’s employees, including officers; and |

| • | to review and recommend management development and succession planning. |

The charter of the Organization and Compensation Committee, as well as any future revisions to such charter, is available on the Company’s website at www.visteon.com/investors.

The Chief Executive Officer of the Company, with the consultation of the Vice President, Human Resources, provides recommendations to the committee on the amount and forms of executive compensation, and assists in the preparation of Committee meeting agendas. Pursuant to the Company’s 2010 Incentive Plan, the Committee may delegate its power and duties under such plan to a committee consisting of two or more officers of the Company except in respect of individuals subject to the reporting or liability provisions of Section 16 of the Securities Exchange Act of 1934, as amended. The Committee has authorized the Vice President, Human Resources, together with the concurrence of either of the Chief Financial Officer or the General Counsel, to approve awards of up to 30,000 stock options and/or stock appreciation rights (subject to an annual limit of 300,000 stock options and/or stock appreciation rights) and up to 15,000 shares of restricted stock and/or restricted stock units (subject to an annual limit of 150,000 shares of restricted stock and/or restricted stock units) to individuals the Company desires to hire or retain, except any individual who is or upon commencing employment will be subject to the liability provisions of Section 16 of the Securities Exchange Act of 1934, as amended.

The Committee has the authority to retain, approve the fees and other terms of, and terminate any compensation consultant, outside counsel or other advisors to assist the committee in fulfilling its duties. During 2014, the Committee retained the firm of Frederic W. Cook & Co., Inc., an executive compensation consulting firm, to advise the Committee on competitive market practices and trends as well as on specific executive and director compensation matters as requested by the Committee or the Board. The Company maintains no other significant direct or indirect business relationships with this firm, and no conflict of interest with respect to such firm was identified. In addition, the Company utilizes Towers Watson and Pay Governance to provide broad-based benchmarking data for executive pay.

Corporate Governance and Nominating Committee

The Board also has a standing Corporate Governance and Nominating Committee, consisting of Robert J. Manzo (Chair), Joanne M. Maguire, Rouzbeh Yassini-Fard and Kam Ho George Yuen, all of whom are considered independent under the New York Stock Exchange listing standards and the Visteon Director Independence Guidelines. During 2014, the Corporate Governance and Nominating Committee held five regularly scheduled and special meetings. The duties of the Corporate Governance and Nominating Committee are generally:

| • | to develop corporate governance principles and monitor compliance therewith; |

| • | to review the performance of the Board as a whole; |

| • | to review and recommend to the Board compensation for outside directors; |

| • | to develop criteria for Board membership; |

| • | to identify, review and recommend director candidates; and |

| • | to review and monitor certain environmental, safety and health matters. |

The charter of the Corporate Governance and Nominating Committee, as well as any future revisions to such charter, is available on the Company’s website at www.visteon.com/investors.

The Corporate Governance and Nominating Committee has the authority to retain consultants to assist the Committee in fulfilling its duties with director recruitment and compensation matters. During 2014, the Corporate Governance and Nominating Committee retained the firm of Frederic W. Cook & Co., Inc., to advise the Committee on competitive market practices and trends for outside director compensation.

Finance and Corporate Strategy Committee

The Board has a standing Finance and Corporate Strategy Committee, consisting of Harry J. Wilson (Chair), Jeffrey D. Jones, Robert J. Manzo, David L. Treadwell and Kam Ho George Yuen, all of whom are considered independent under the Visteon

5

Director Independence Guidelines. During 2014, the Finance and Corporate Strategy Committee held eleven regularly scheduled and special meetings. The duties of the Finance and Corporate Strategy Committee generally are:

| • | to review and make recommendations to the Board regarding the Company’s cash flow, capital expenditures and financing requirements; |

| • | to review the Company’s policies with respect to financial risk assessment and management including investment strategies and guidelines; |

| • | to review and make recommendations on mergers, acquisitions and other major financial transactions requiring Board approval; |

| • | to consider and recommend to the Board stock sales, repurchases or splits, as appropriate, and any changes in dividend policy; and |

| • | to evaluate bona fide proposals in respect of major acquisitions, dispositions, mergers and other transactions for recommendation to the Board. |

The charter of the Finance and Corporate Strategy Committee, as well as any future revisions to such charter, is available on the Company’s website at www.visteon.com/investors.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’s executive officers, directors and greater than 10% stockholders to file certain reports (“Section 16 Reports”) with respect to their beneficial ownership of the Company’s equity securities. Based solely on a review of copies of reports furnished to the Company, or written representations that no reports were required, the Company believes that all Section 16 Reports that were required to be filed were filed on a timely basis except for one Form 4 report for Martin Thall related to the vesting of a restricted stock unit award that was filed one day late due to an administrative error.

Code of Ethics

The Company has adopted a code of ethics, as such phrase is defined in Item 406 of Regulation S-K that applies to all directors, officers and employees of the Company and its subsidiaries, including the Chief Executive Officer, the Executive Vice President and Chief Financial Officer and the Senior Vice President and Chief Accounting Officer. The code, entitled “Ethics and Integrity Policy,” is available on the Company’s website at www.visteon.com.

Communications with the Board of Directors

Stockholders and other persons interested in communicating directly with the Chairman of the Board, a committee chairperson or with the non-management directors as a group may do so as described on the Company’s website (www.visteon.com/investors), or by writing to the chairperson or non-management directors of Visteon Corporation c/o of the Corporate Secretary, One Village Center Drive, Van Buren Township, Michigan 48111.

The Corporate Governance and Nominating Committee also welcomes stockholder recommendations of director candidates. Stockholders may suggest candidates for the consideration of the committee by submitting their suggestions in writing to the Company’s Secretary, including the agreement of the nominee to serve as a director. In addition, the Company’s Bylaws contain a procedure for the direct nomination of director candidates by stockholders, and any such nomination will also be automatically submitted to the Corporate Governance and Nominating Committee for consideration.

Executive Officers of the Registrant

The following table shows information about the executive officers of the Company and other key employees. Ages are as of February 1, 2015:

| Name |

Age |

Position | ||

| Timothy D. Leuliette | 65 | President and Chief Executive Officer | ||

| Jeffrey M. Stafeil | 45 | Executive Vice President and Chief Financial Officer | ||

| Martin T. Thall | 53 | Executive Vice President and President, Electronics Product Group | ||

| Michael J. Widgren | 46 | Senior Vice President, Corporate Controller and Chief Accounting Officer | ||

| Peter M. Ziparo | 45 | Vice President and General Counsel | ||

| Yong Hwan Park | 58 | President and Chief Executive Officer, Halla Visteon Climate Control Corporation |

6

Timothy D. Leuliette has been Visteon’s Chief Executive Officer and President since September 30, 2012, and a director of the Company since October 1, 2010. From August 10, 2012 to September, 30, 2012 Mr. Leuliette served as Visteon’s Interim Chairman of the Board, Interim Chief Executive Officer and Interim President, and prior to that Mr. Leuliette was the Senior Managing Director of FINNEA Group, LLC, an investment and financial services firm since October 14, 2010. Mr. Leuliette has also served as the President and Chief Executive Officer of Dura Automotive LLC, an automotive supplier, from July 2008, a director of Dura from June 2008, and the Chairman of the Board of Dura from December 2008. Mr. Leuliette also served as a Managing Director of Patriarch Partners LLC, the majority stockholder of Dura. Prior to that, he served as Co-Chairman and Co-Chief Executive Officer of Asahi Tec Corporation, a manufacturer of automotive parts and other products, and Chairman, Chief Executive Officer and President of Metaldyne Corporation, an automotive supplier, from January 2001 to January 2008. Over his career he has held executive and management positions at both vehicle manufacturers and suppliers and has served on both corporate and civic boards, including as Chairman of the Detroit Branch of the Federal Reserve Bank of Chicago.

Jeffrey M. Stafeil has been Visteon’s Executive Vice President since joining the Company on October 31, 2012 and Chief Financial Officer since November 2, 2012. Prior to joining the Company, Mr. Stafeil was the chief executive officer of DURA Automotive Systems LLC, an automotive supplier, since October 2010, and DURA’s executive vice president and chief financial officer between December 2008 and October 2012. Prior to that, Mr. Stafeil was the chief financial officer and a board member at the Klöckner Pentaplast Group, a producer of films for packaging, printing and specialty applications, from July 2007 to December 2008. From July 2003 to July 2007, he was the executive vice president and chief financial officer of Metaldyne Corporation, an automotive supplier. Prior to joining Metaldyne in 2001, Mr. Stafeil served in a variety of management positions at Booz Allen and Hamilton, Peterson Consulting and Ernst and Young. In addition, from January 2007 to July 2009, he served on the board of directors and was co-chairman of the audit committee for Meridian Automotive Systems, and served on the board of directors and was audit committee chairman of J.L. French Automotive Castings, Inc. from September 2009 to June 2012.

Martin T. Thall has been Visteon’s Executive Vice President and President, Electronics Product Group since November 19, 2013. Before joining Visteon, Mr. Thall was a vice president at Verizon Communications, a mobile phone service provider, from January 2012 to April 2013, and Chief Executive Officer of Vehicle ICT Corporation, a provider of management consulting services to automotive and information technology firms, from January 2010 to December 2011. Prior to that, he served in various management roles at Microsoft Corporation from 1996 to 2008, including Vice President and General Manager of the Automotive Business Unit. Mr. Thall also served as director of Blackline GPS, Inc. from July 2009 to December 2011.

Michael J. Widgren has been Visteon’s Senior Vice President, Corporate Controller and Chief Accounting Officer since November 1, 2013. Prior to that he was Vice President, Corporate Controller and Chief Accounting Officer since May 2007, served as Visteon’s interim Chief Financial Officer from October 3, 2012 to November 2, 2012, and was Assistant Corporate Controller since joining the Company in October 2005. Before joining Visteon, Mr. Widgren served as Chief Accounting Officer for Federal-Mogul Corporation.

Peter M. Ziparo has been Visteon’s Vice President and General Counsel since April 2014. Prior to that, he was Assistant General Counsel since 2005 and Associate General Counsel since joining the Company in October 2002. Before joining Visteon, Mr. Ziparo was a corporate associate with Morrison & Foerster LLP and Chadbourne & Parke LLP.

Yong Hwan Park has been Halla Visteon Climate Control Corporation’s President and Chief Executive Officer since March 2012. From June 2011 until March 2012, Mr. Park served as President and Chief Operating Officer of Halla Visteon Climate Control Corporation. Prior to that, he was Vice President, Corporate Planning from January 2011 until May 2011, and Senior Director, Corporate Planning prior thereto. Mr. Park joined Halla Visteon Climate Control Corporation in 1986 when the company was formed and has held various roles of increasing responsibility.

7

| Item 11. | Executive Compensation |

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This Compensation Discussion and Analysis presents information about the compensation of the following executive officers named in the Summary Compensation Table below (the “Named Executive Officers” or “NEOs”), including:

| • | Timothy D. Leuliette, President and Chief Executive Officer (CEO); |

| • | Jeffrey M. Stafeil, Executive Vice President and Chief Financial Officer (CFO); |

| • | Martin T. Thall, Executive Vice President and President, Electronics Product Group; |

| • | Peter M. Ziparo, Vice President and General Counsel, effective April 2014; and |

| • | Michael J. Widgren, Senior Vice President, Corporate Controller and Chief Accounting Officer. |

Executive Summary

The executive team’s primary focus remains on optimizing the business portfolio in order to deliver profits and generate cash, maximizing shareholder value. During 2014, we implemented changes and entered into significant agreements to unlock shareholder value and strongly position the new Visteon for future growth. Specifically, as we enter 2015, we are positioning the Company to become a pure-play, world-class Cockpit Electronics Ecosystems Enterprise (“Electronics business”) that is a leader in innovation.

Highlights of these key actions and other 2014 financial and strategic achievements are summarized below.

| • | 2014 Adjusted EBITDA of $702 million, up 17% from 2013; |

| • | 2014 Adjusted Free Cash Flow of $111 million; |

| • | Completing the acquisition of the JCI Electronics business, which, when combined with our existing capabilities, is expected to enhance Visteon’s competitive position in the fast-growing vehicle cockpit electronics segment by strengthening its global scale, manufacturing and engineering footprint, product portfolio and customer penetration. On a combined basis, the Company’s Electronics business is expected to have approximately $3 billion in annual revenue with a No. 2 global position in driver information and above-average growth rates for the cockpit electronics segment, supplying nine of the world’s ten largest vehicle manufacturers; |

| • | Winning a record $1.3 billion of new and re-win Electronics business during 2014; |

| • | Strengthening our balance sheet by transferring approximately $350 million of U.S. pension assets to Prudential Insurance Company of America in settlement of approximately $350 million of U.S. pension obligation, which substantially reduces the related risk of economic volatility associated with the pension assets and obligation; |

| • | Acquiring the thermal and emissions product line of Cooper Standard, which was added to our Halla Visteon Climate Control Corporation (“HVCC”) business; |

| • | Completing the divestiture of the majority of the Interiors business, which allows the Company to focus on its market-leading position in the Electronics business; |

| • | Entering into a Share Purchase Agreement in December 2014 with Hahn & Co. Auto Holdings Co., Ltd. and Hankook Tire Co., Ltd. to sell all of our outstanding shares in HVCC for approximately $3.6 billion or KRW 52,000 per share. The agreement, subject to regulatory reviews, shareholder approval and other conditions, is expected to be completed in the first half of 2015; and |

| • | Returning approximately $500 million in cash to shareholders through share repurchases in 2014. |

8

Our recent total shareholder returns (TSR) have been strong, as shown below, with 2014 at +30% and the three-year TSR (2012 to 2014) at +114%.

| 2014 Named Executive Officer Annualized Target Compensation Opportunity Is Primarily Performance-based

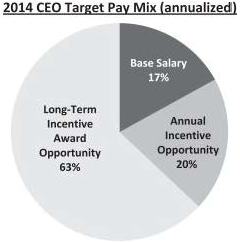

The vast majority of the annualized target compensation opportunity (including long-term incentives awarded in 2012) is performance-based with the amounts realized, if any, based on our financial results or stock price performance. In 2014, 83% of the CEO’s annualized target compensation was provided through annual and long-term incentive award opportunities.

• Base Salary 17% of the target compensation mix

• Annual Incentive award opportunity 20%

• Long-Term Incentive award opportunity 63% |

|

Our Strong 2014 Performance Results Are Reflected in 2014 Compensation

The 2014 compensation for our Named Executive Officers is commensurate with the Company’s 2014 performance and the goals of our executive compensation program. The mix of award types and incentive plan performance measures was selected to align with our business strategy, talent needs, and market practices. Actual pay realized by the executive officers was based primarily on the Company’s financial and stock price performance results. A minority of pay was based on fixed elements (base salaries, perquisites, and retirement benefit contributions on base salaries), given our focus on performance-based pay elements (annual and long-term incentives).

The Company‘s Adjusted EBITDA performance for 2014 far exceed our targeted Adjusted EBITDA metric for our Annual Incentive award opportunity. The Company also generated total shareholder return of +30% for 2014.

No New Long-Term Incentive Compensation Awards for Longer Serving NEOs

In 2012, the Organization and Compensation Committee (the “Committee”) granted long-term incentive awards to certain Named Executive Officers that were designed to cover awards that would have been made in each of 2013, 2014 and 2015. As a result, the CEO and other Named Executive Officers hired/in the role before 2014 did not receive an annual grant of long-term incentive awards in 2014. The 2012 awards are tied to long-term value creation, as measured by total shareholder return and sustained stock price appreciation. The Organization and Compensation Committee designed the executive officer long-term incentive structure to align management with the ultimate measure of the Company’s success by our shareholders — long-term stock price performance. Mr. Thall, who joined the Company in November 2013, was awarded a long-term incentive opportunity that is based on increasing the value of the Company’s Electronics business. Executives who participated in the Late 2012 Three-Year award (covering 2013 to 2015) did not participate in the 2014 Long-Term Incentive (LTI) award. Mr. Ziparo’s late 2012 award was a one year award covering 2013, as such he was the only NEO to receive an LTI award in 2014.

2014 Say-on-Pay Advisory Vote Outcome

In 2014, our executive compensation program received 88.8% approval from our shareholders. This strong level of shareholder support was an improvement on the 72.4% approval received in 2013. Our goal is to continue to meet the approval of our shareholders and remain responsive to their concerns. As such, we regularly have discussions with shareholders to ensure they

9

understand our officer pay program and to address any questions. During 2014 these discussions did not identify any issues, which further confirmed that, overall, our officer pay program is well aligned to shareholder value creation. As detailed throughout this Compensation Discussion & Analysis, we believe the officer compensation program is strongly aligned with shareholder value creation, and reflects strong corporate governance practices.

Executive Compensation Program Design and Governance Practices

Our executive compensation program is designed to provide strong alignment between executive pay and Company performance, and incorporates best practices. Here are some of the compensation practices we follow and those that we avoid.

| What We Do |

ü | The Committee approves all aspects of officer pay | ||

| ü | Target pay levels, on average, to be within a competitive range of the median of comparable companies, considering an individual’s responsibilities, business impact, performance and other factors | |||

| ü | Provide the majority of pay through performance-based annual and long-term programs | |||

| ü | Balance short- and long-term incentives using multiple performance metrics, covering individual, financial and total shareholder return performance | |||

| ü | Have “double trigger” (qualified termination of employment following a change in control) equity acceleration for all of the CEO’s awards and most equity awards granted since mid-2012. Beginning in 2015, all equity awards have a “double trigger”, as specified in the amended 2010 Incentive Plan (shareholder proposal herein) | |||

| ü | Cap incentive awards that are based on performance goals | |||

| ü | Have change in control agreements with a “double trigger” for cash severance payments to be made | |||

| ü | Apply robust stock ownership guidelines to ensure ongoing and meaningful alignment with stockholders | |||

| ü | Have a compensation recovery (“clawback”) policy for executive officers in the event of a financial restatement | |||

| ü | Prohibit hedging transactions, purchasing the Company’s common stock on margin or pledging such shares | |||

| ü | Provide limited perquisites | |||

| ü | Review key elements of the officer pay program annually, as conducted by the Committee, which also considers our business and talent needs, and market trends | |||

| ü | Use an independent compensation consultant | |||

| What We Don’t Do |

× | Do not provide excise tax gross-ups | ||

| × | Do not have excessive compensation practices that encourage excessively risky business decisions | |||

| × | Do not grant stock options or stock appreciation rights with an exercise price less than the fair market value on the grant date | |||

| × | Do not provide dividends or dividend equivalents on unearned PSUs | |||

10

Executive Compensation Program Administration

The Committee is primarily responsible for administering the Company’s executive compensation program. The Committee reviews and approves all elements of the executive compensation program that cover the Named Executive Officers. In fulfilling its responsibilities, the Committee is assisted by its independent compensation consultant and takes into account recommendations from the CEO. The primary roles of each party are summarized below.

| Party: |

Primary Roles: | |||

| Organization and Compensation | • | Oversee all aspects of the executive compensation program | ||

| Committee (comprised solely of independent directors) | • | Approve officer compensation levels, incentive plan goals, and award payouts | ||

| • | Approve specific goals and objectives, as well as corresponding compensation, for the CEO | |||

| • | Ensure the executive compensation program best achieves the Company’s objectives, considering the business strategy, talent needs, and market trends | |||

| Senior Management (CEO, CFO, VP HR, and General Counsel) |

• | Make recommendations regarding the potential structure of the executive compensation program, including input on key business strategies and objectives | ||

| • | Make recommendations regarding the pay levels of the officer team (excluding the CEO) | |||

| • | Provide any other information requested by the Committee | |||

| Compensation Consultant (Frederic W. Cook & Co., Inc.) |

• | Advise the Committee on competitive market practices and trends | ||

| • | Provide proxy pay data for our compensation peer group | |||

| • | Present information and benchmarking regarding specific executive compensation matters, as requested by the Committee | |||

| • | Review management proposals and provide recommendations regarding CEO pay | |||

Additional information about the role and processes of the Committee is presented above under “Committees of the Board of Directors — Organization & Compensation Committee.”

Executive Compensation Program Philosophy

The primary objectives of the Company’s executive compensation program are to recruit, motivate, and retain highly-qualified executives who are key to our long-term success and will focus on maximizing shareholder value. As such, the Company’s executive compensation program is structured to accomplish the following:

| • | Drive achievement of the Company’s strategic plans and objectives; |

| • | Create strong alignment of the interests of executives with the creation of shareholder value, particularly as measured by total shareholder return/stock price appreciation; |

| • | Provide a market competitive total compensation package customized to fit our business and talent needs; and |

| • | Be cost-effective and straightforward to understand and communicate. |

For each element of compensation and in total, the Company generally targets annualized compensation to be within a competitive range of market median, considering an individual’s experience, performance, and business impact, as well as our organizational structure and cost implications. The target compensation mix is set based on position responsibilities, individual considerations, and market competitive practices. The proportion of variable, or “at risk”, compensation, provided through incentive programs, increases as an employee’s level of responsibility increases commensurate with the position’s impact on the business. The actual pay earned, if any, for annual and long-term incentives reflects Company and individual performance.

11

Market Compensation Practices

As one of the inputs in determining executive compensation each year, the Company reviews survey and proxy compensation data regarding market practices. In 2014, the Company reviewed NEO base salaries, target annual and long-term incentive award opportunities, as well as selected pay program design practices. In conducting this review, the Committee selected 16 companies in similar industries (the “Compensation Peer Group”) with median annual revenues of approximately $7 billion (range of $2 to $16 billion), and general industry as comparators. We believe the Compensation Peer Group represents a reasonable comparator group of direct automotive supplier peers and other related companies with which we currently compete for executive talent. When general industry compensation data are used, the Company is not aware of the specific participant companies in the analysis. The Compensation Peer Group, which is unchanged from 2013, is listed below.

| American Axle & Manufacturing | Flowserve Corp. | Oshkosh Corporation | ||

| Autoliv, Inc. | ITT | Rockwell Automation Inc. | ||

| BorgWarner Inc. | Lear Corporation | SPX Corporation | ||

| Dana Holding Corporation | Meritor, Inc. | Tenneco Inc. | ||

| Federal-Mogul Corp. | Navistar International Corporation | Timken Co. | ||

| TRW Automotive Holdings Corp. |

Executive Compensation Program — Description of Primary Elements

An overview of the primary elements of the executive compensation program is presented below. Consistent with our emphasis on aligning pay and performance, the largest portion of the target compensation opportunity is provided through annual and long-term incentive programs.

Each primary element of the executive compensation program is described below.

Base Salary

Base salaries, combined with medical, life and disability benefits, provide basic security for our employees at levels necessary to attract and retain a highly qualified and effective salaried workforce. Base salaries are determined taking into account market data as well as an individual’s position, responsibilities, experience, and value to the Company. During 2014 three of the Named Executive Officers received base salary increases. Effective April 1, 2014, Messrs. Stafeil and Widgren received merit-based salary increases of 3% to $689,585 and $422,300, respectively and, coinciding with his promotion, Mr. Ziparo received a market- and merit-based increase resulting in an annualized salary of $350,000. The actual salaries paid to each Named Executive Officer for 2014 are presented in the “Summary Compensation Table.”

Annual Incentive Awards

The Company’s Annual Incentive (“AI”) program provides key salaried employees the opportunity to earn an annual cash bonus based on specified individual, financial, operational and/or strategic goals. This program is designed to motivate executives to achieve key short-term financial and operational goals of the Company. The target incentive opportunities are expressed as a percentage of base salary, which are set by the Committee considering the potential impact on the business of each role, the relationships among the roles and market competitive levels for the positions. The target annual incentive opportunities, as a percentage of base salary as of December 31, 2014, are: Mr. Leuliette 125%, Messrs. Stafeil and Thall 80%, Mr. Ziparo 50% and Mr. Widgren 60%. Actual awards earned can range from 0% to 200% of target based on Company, business unit and individual performance.

On February 26, 2014, the Committee approved 2014 AI award opportunities for approximately 1,500 global salaried employees, including the Named Executive Officers. The Committee determined that the maximum amount an executive officer would be eligible for under the 2014 AI would be based upon the Company’s achievement of Adjusted EBITDA in 2014, which serves as a single umbrella performance measure. The Committee would then exercise its negative discretion from these maximum amounts based on assessment of individual, product group and Company performance with respect to relevant financial and operational goals.

Specific threshold, target, and maximum goals for the 2014 AI are set forth below, as well as the percentage of the target award earned and 2014 actual results.

| Measure ($ in millions) |

2014 Threshold (0%) |

2014 Target (100%) |

2014 Maximum (200%) |

2014 Actual | Resulting Award as % of Target |

|||||||||||||||

| Adjusted EBITDA |

<$ | 340 | $ | 340 | $ | 580 | $ | 702 | 200 | % | ||||||||||

12

Adjusted EBITDA was defined as net income (loss) attributable to the Company, plus net interest expense, provision for income taxes, depreciation and amortization and net income attributable to non-controlling interests, as further adjusted to eliminate the impact of asset impairments, gains or losses on divestitures, discontinued operations, net restructuring expenses and other reimbursable costs, non-cash stock-based compensation expense, certain non-recurring employee charges and benefits, reorganization items, other non-operating gains and losses, and equity in net income of non-consolidated affiliates.

In its exercise of negative discretion from these maximum amounts, the Committee reduced the awards payable to all NEOs under the umbrella arrangement and determined their actual AI awards based on their individual performance and the degree of achievement of the general financial performance, new business wins and quality goals used in determining the funding of AI awards for employees other than executive officers. The total funding available for Corporate and Electronics participants was based on achieved Adjusted EBITDA results of $702 million and $208 million, respectively, for 2014.

The Committee considered the following factors in determining the amount of the final awards:

| • | Individual performance factors, including strategic transactions, leadership and balance sheet improvement; |

| • | Adjusted Free Cash Flow performance; |

| • | New Business Wins; and |

| • | Quality. |

As a result of the foregoing, the executives’ 2014 incentive awards were paid at approximately the following rates: 145% of target for Mr. Thall reflecting the Electronics group performance, 113% of target for Mr. Leuliette, 125% of target for Mr. Stafeil, 136% of target for Mr. Ziparo and 103% of target for Mr. Widgren. The payouts for the executives reflect their leadership and significant contributions to our strong 2014 performance, including the electronics acquisition, interiors divestiture, overall financial results and TSR of +30% as detailed in the “Executive Summary”. The amounts paid to the Named Executive Officers are set forth in the “Summary Compensation Table” under the column “Non-Equity Incentive Plan Compensation.”

Long-Term Incentive Awards

The Company’s Long-Term Incentive program is designed to reward executives for the achievement of specified multi-year goals that are linked to the Company’s long-term financial performance, to align the delivery of incentive value with increases in the Company’s stock price and to retain key employees. Typically awards are granted each year with a vesting or performance period of three years; however, in some situations, such as the recruitment of new executives or to focus on objectives with a different duration, the Company may use a shorter or longer period. The annualized total targeted long-term incentive award opportunity, expressed as a percentage of base salary, is typically determined by organization level.

2014 Long-Term Incentive Grants to Mr. Ziparo

On March 27, 2014, Mr. Ziparo, who did not participate in the Late 2012 Three-Year Awards (discussed below), received regular long-term incentive grants with a grant date value, in total, equal to 105% of base salary. The grant mix was performance stock units, stock options and restricted stock units, as described below.

13

| Award Type and Weighting |

Primary Role |

Design Features | ||||

| Performance Stock Units (50% of the total LTI award) | Reward the achievement of total shareholder return (TSR) results over 2014 to 2016 relative to returns of 17 similar companies | • | Performance stock units (PSU) provide executives the opportunity to earn shares based on the Company’s three-year total shareholder return (TSR) relative to 17 automotive sector peer companies (listed below) | |||

| • | The awards are divided among three periods with all earned awards paid at the end of the three-year cycle (paid in early 2017) | |||||

| • | 2014 TSR performance (25% of award opportunity) | |||||

| • | 2014 to 2015 TSR performance (25% of award opportunity) | |||||

| • | 2014 to 2016 TSR performance (50% of award opportunity) | |||||

| • | The awards for the first and second performance periods will be increased to reflect the performance over the entire three-year cycle, if greater. If the Company’s actual TSR is negative during a performance period, the award earned for that period cannot exceed 100% of target (regardless of ranking within the peer group). | |||||

| • | Awards can be earned up to 150% of the target award opportunity based on the Company’s TSR performance ranking within the comparator group (Visteon plus the 17 TSR peer companies) | |||||

| • | No award earned if Visteon is in the bottom 4 companies | |||||

| • | #5 rank, 35% of the target award is earned | |||||

| • | #10 rank, 100% of the target award is earned | |||||

| • | #15 or higher rank, 150% of the target award is earned | |||||

| • | Award payouts for performance between the rankings specified above is determined based on interpolation | |||||

| • | TSR is calculated using the 20-trading day average closing price at the start and end of the performance period, adjusted for dividends | |||||

| Stock Options (25% of the total LTI award) | Reward for appreciation in the Company’ stock price | • | Exercise price equal to the average of the high and low trading prices on the date of grant ($84.67) | |||

| • | Vest one-third per year beginning one year after the date of grant | |||||

| • | Seven-year term, upon which any unexercised options would expire | |||||

| Restricted Stock Units (25% of the total LTI award) | Facilitate retention and provide an ownership-like stake | • | Vest one-third per year beginning one year after the date of grant | |||

14

Relative TSR Peer Group (17 companies)

| Autoliv, Inc. | Delphi Automotive | Magna International, Inc. | ||

| BorgWarner Inc. | Denso | Meritor Inc. | ||

| Calsonic Kansai | Faurecia | Tenneco Inc. | ||

| Continental | Federal-Mogul Corp. | TRW Automotive Holdings Corp. | ||

| Cooper Standard | Johnson Controls Inc. | Valeo | ||

| Dana Holding Corporation | Lear Corporation |

Long-Term Incentive Grants Awarded in Late 2012 (Three-Year Award) to Cover 2013-2015

In support of the Company’s business strategy and to ensure the executive officer team’s potential awards are aligned to the achievement of specific levels of shareholder value creation, equity grants were made in the fourth quarter of 2012 in lieu of additional regular annual grants through 2015. Consistent with our focus on shareholder value creation, a majority of the award opportunity (75% of the grant date value) was provided through performance-based stock units and the remainder in time-based restricted stock units. The terms of the performance-based stock units and restricted stock units, which were made under the Visteon Corporation 2010 Incentive Plan, are substantially the same for all participating Named Executive Officers (excluding Mr. Thall, who was hired during 2013), and are intended to be in lieu of future potential awards under the Company’s long-term incentive program for 2013, 2014, and 2015. The number of stock units awarded to the three participating NEOs in late 2012 is as follows: Mr. Leuliette — 431,170, Mr. Stafeil — 149,176 and Mr. Widgren — 37,293. Mr. Ziparo received an equity grant of 7,260 stock units in the fourth quarter of 2012 in lieu of a grant in 2013.

The performance-based stock units will be earned, subject to continued employment, based on TSR for the period between the grant date and December 31, 2015. Vesting requires both stock price achievement and continued employment. TSR, which is stock price plus cash dividend payments, of at least $70.00 must be achieved to vest in all of the shares, which represents appreciation of approximately 60% from the date of grant. Upon achievement of the TSR goal, which was achieved during 2013, all of the performance-based stock units were earned, but do not vest (are not paid) until the end of the performance period on December 31, 2015 assuming continued employment (or earlier for certain types of termination of employment).

The time-based restricted stock units will vest in three equal annual installments beginning one year after the date of grant based on continued employment.

Mr. Thall’s Long-Term Incentive Compensation

Mr. Thall was hired on November 19, 2013, to lead and grow the value of our Electronics business. In order to induce Mr. Thall to join the Company, he received a cash bonus of $300,000 (paid in January 2014) and a restricted stock unit award of 16,000 units, which vest annually, in one third increments, on the anniversary of the grant date.

In order to best align the long-term award opportunity with his role, Mr. Thall’s long-term incentive award opportunity is based on the growth in the valuation of the Electronics business unit over three to five years. Specifically, he is eligible to receive 2.2% of the incremental value created relative to the base valuation as of December 31, 2013, subject to a minimum compound annual growth rate of 5.0%. An annual valuation of the business unit will be conducted, as of year-end, by an independent appraisal firm selected by the Committee. Subject to continued employment and achieving the minimum annual growth goal, the award will become vested in three equal annual installments on each of December 31st 2016, 2017, and 2018.

Other Compensation Elements

Stock Ownership Guidelines

The Company has adopted stock ownership goals for all elected officers of the Company. The goal for these officers is to own common stock worth a multiple of salary, ranging from one times salary up to six times salary for the CEO, within five years from their date of hire or election, if later. All of the Named Executive Officers employed by the Company as an officer for five years or more are in compliance with the stock ownership guidelines. For the purpose of determining compliance with the stock ownership guidelines, the calculation includes stock owned directly, restricted stock, and restricted stock units (but excludes unexercised stock options and stock appreciation rights, and unearned performance stock units). The stock ownership guidelines are as follows:

| • | Chief Executive Officer — six times base salary; |

| • | Executive and Senior Vice Presidents and Product Group Presidents — three times base salary; and |

| • | All other officers — one times base salary. |

Executive Perquisites and International Service Employee Program

The Company provides the Named Executive Officers with a flexible perquisite allowance program to provide basic competitive benefits. The flexible perquisite allowance is a fixed amount that is paid to each eligible executive and is designed to cover his or her expenses related to legal and financial counseling, excess liability insurance premiums, tax preparation, and airfare for spouse or partner accompanying employee on business travel, among other items. For Named Executive Officers, the amount of the

15

allowance varies by management level, with a current range of $15,000 to $60,000 per year and is not grossed up. The amount paid to the Named Executive Officers in 2014 pursuant to the flexible perquisite allowance program is set forth in the “All Other Compensation” column of the “Summary Compensation Table.” The Company also maintains an Executive Security Program that permits the CEO to use corporate provided aircraft for personal and business travel, and provides the benefit of various personal health and safety protections. The CEO does not receive a tax “gross-up” for personal use of corporate provided aircraft. There was no personal use of corporate provided aircraft during 2014.

As a global organization, senior executives of the Company are located in key business centers around the world. To facilitate the assignment of experienced employees to support the business, the Company has an International Long Term Assignment Policy to address incremental costs incurred by assignees as a result of their international assignments. The policy provides for the reimbursement of incremental housing, cost of living, education and other costs incurred in conjunction with international assignments as well as the tax costs associated with these payments. The Company provides tax equalization to employees on international assignment. The tax equalization policy is intended to ensure that the employee bears a tax burden that would be comparable to the home country tax burden on income that is not related to the international assignment. It is the objective of the Company’s International Long Term Assignment Policy that the employee not be financially disadvantaged as a result of the international assignment nor that the employee experience windfall gains. Mr. Thall began an international assignment in January 2015 and is now based in Kerpen, Germany.

Retirement Benefits Overview

The Named Executive Officers participate in the Company’s qualified retirement and savings plans in their respective home countries on the same basis as other similarly situated employees. Over the last several years, the Company has made changes to the type of retirement plans and the level of benefits provided under such plans, based on an assessment of the Company’s business and talent needs, costs, market practices, and other factors. Effective December 31, 2011, the U.S. defined benefit pension plan was frozen for all participants. All of the NEOs participate in U.S.-based plans.

The Named Executive Officers, as well as most U.S. salaried employees, are entitled to participate in the Visteon Investment Plan, Visteon’s 401(k) investment and savings plan. The Company’s match is 100% of the employee’s eligible contributions up to 6% of eligible pay (subject to IRS limits), which was designed to attract and retain employees in light of the Company’s freezing of other retirement benefit plans. Amounts deferred for each Named Executive Officer are reflected in the “Salary” column of the “Summary Compensation Table.” The Company also maintains a Savings Parity Plan, which provides eligible participants with Company contributions of 6% of eligible pay that are restricted due to IRS limits under the broad-based, qualified 401(k) plan. The Company’s Supplemental Executive Retirement Plan (SERP) provides eligible participants annual Company contributions of 6%, 9% (Executive and Senior Vice Presidents), or 14.5% (CEO) of pay in place of the prior defined benefit formulas in the plan for service after January 1, 2012. The SERP is closed to new entrants other than elected Company officers. Company contributions to these plans on behalf of the NEOs are included in the “All Other Compensation” column of the “Summary Compensation Table.”

Additional details about the Company’s prior and current retirement plans are presented in a later section, under “Retirement Benefits.”

Severance and Change in Control Benefits

The Company has entered into change in control agreements with all of its executive officers, including the Named Executive Officers. These agreements, which were last revised in October 2012, provide for certain benefits if a qualifying termination occurs following a change in control of the Company. For the Named Executive Officers, change in control cash severance benefits are provided as a multiple of 1.5, 2.0 (EVPs), or 2.5 (CEO) times the officer’s sum of annual base salary and target annual incentive. In addition, the agreements provide for other severance benefits, such as the continuation of medical benefits and outplacement assistance. The agreements have a “double trigger” provision, which would require that the executive’s employment terminate following a change in control in order to receive benefits under the agreement. No excise tax gross-up provisions are contained in the change in control severance arrangements.

Upon the involuntary termination of employment by the Company (other than for specified reasons, including disability, availability of other severance benefits, and inappropriate conduct), executive officers are entitled to severance benefits under the 2010 Visteon Executive Severance Plan, which was revised effective October 2012. Under this Plan, a specific and consistent level of severance benefits are provided with a cash severance payment of 1.0 (VPs) or 1.5 (SVPs, EVPs and CEO) times the sum of an executive’s annual base salary and target annual incentive. Executives would also be entitled to the reimbursement of medical coverage premiums under COBRA for up to eighteen months following termination, the provision of outplacement services for up to twelve months, and the payment of a pro-rated portion of any outstanding annual incentive bonus based on actual Company performance during the performance period.

The severance plan and change in control agreements provide that outstanding stock-based awards vest only in accordance with the applicable terms and conditions of such awards. For additional details about the change in control agreements, the severance plan, the terms and conditions of awards, and the estimated value of these potential payouts, see the section “Potential Payments Upon Termination.” The terms of Mr. Leuliette’s compensation package, including potential severance and change in control benefits, are detailed in his employment agreement, see the section “Employment Agreement with Mr. Leuliette.”

16

Other Executive Compensation Policies

Stock Awards Granting Policy. In 2014 the Company granted regular stock awards to one of its Named Executive Officers (Mr. Ziparo). Stock awards made to executives and key employees at the time they become employees or officers of the Company (such as for Mr. Thall, who joined the Company in 2013) have a grant date on the later of the date employment commences or the date the Committee approves the awards. In all cases, the exercise price of stock options and stock appreciation rights is the average of the high and low trading price on the grant date. Stock price is not a factor in selecting the timing of equity-based awards.

Securities Trading and Anti-Hedging/Anti-Pledging Policy. The Company maintains a Policy Regarding Purchases and Sales of Company Stock that imposes specific standards on directors and officers of the Company. The policy is intended not only to forbid such persons from trading in Company stock on the basis of inside information, but to avoid even the appearance of improper conduct on the part of such persons. In addition to the specific restrictions set forth in the policy, the policy requires that all transactions in Company stock by such persons and by others in their households be pre-cleared by the General Counsel. The only exception to the pre-clearance requirement is regular, ongoing acquisition of Company stock resulting from continued participation in employee benefit plans that the Company or its agents may administer. The policy also expressly prohibits directors and officers from engaging in hedging transactions involving the Company’s stock or pledging the Company’s stock.

Pay Clawbacks. In April 2013, the Company adopted a compensation recovery policy, which requires each executive officer of the Company to repay or forfeit a portion or all of any annual incentive, performance stock units or other performance-based compensation granted to him or her on or after September 29, 2012 if:

| • | the payment, grant, or vesting of such compensation was based on the achievement of financial results that were subsequently the subject of a restatement of the Company’s financial statements filed with the Securities and Exchange Commission; |

| • | the amount of the compensation that would have been received by the executive officer had the financial results been properly reported would have been lower than the amount actually received; and |

| • | the Board determines in its sole discretion that it is in the best interests of the Company and its stockholders for the executive officer to repay or forfeit all or any portion of the compensation. |

Tax Deductibility of Executive Compensation. Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), limits the Company’s federal income tax deduction to $1 million per year for compensation to its CEO and certain other highly compensated executive officers. Qualified performance-based compensation for the CEO and certain “covered officers” is not, however, subject to the deduction limit, provided certain requirements of Section 162(m) are satisfied. We consider the impact of this rule when developing and implementing our executive compensation program. Annual Incentive awards, performance-based stock units, and stock options (and stock appreciation rights) generally are designed to meet the deductibility requirements. We also believe that it is important to preserve flexibility in administering compensation programs in a manner designed to promote varying business and talent goals. Accordingly, we have not adopted a policy that all compensation must qualify as deductible under Section 162(m).

Statement Regarding Compensation Risk Assessment

The Company believes that its compensation programs, policies and practices do not create risks that are reasonably likely to have a material adverse effect on the Company. Specifically, as detailed previously, the Company maintains a market competitive, balanced executive compensation program with varying incentive award types, performance metrics, performance/vesting periods and includes governance features that mitigate potential risk (including Committee oversight, maximum potential payouts are set under incentive plans, stock ownership guidelines, and a pay clawback policy).

17

Summary Compensation Table

The following table summarizes the compensation that was earned by, or paid or awarded to, the Named Executive Officers. The “Named Executive Officers” are the Company’s Chief Executive Officer, the Company’s Chief Financial Officer and the three other most highly compensated executive officers serving as such as of December 31, 2014, determined based on the individual’s total compensation for the year ended December 31, 2014 as reported in the table below, other than amounts reported as above-market earnings on deferred compensation and the actuarial increase in pension benefit accruals.

| Name and Principal Position |

Year | Salary ($) | Bonus ($)(1) |

Stock Awards ($)(2) |

Options Awards ($)(3) |

Non-Equity Incentive Plan Compensation ($)(4) |

Change in Pension Value & Nonqualified Deferred Compensation Earnings ($)(5) |

All Other Compensation ($)(6) |

Total ($) |

|||||||||||||||||||||||||

| Timothy D. Leuliette |

2014 | $ | 1,184,500 | $ | — | $ | — | $ | — | $ | 1,673,106 | $ | — | $ | 1,010,256 | $ | 3,867,862 | |||||||||||||||||

| Chief Executive Officer |

2013 | $ | 1,167,250 | $ | — | $ | — | $ | — | $ | 2,842,800 | $ | — | $ | 438,199 | $ | 4,448,249 | |||||||||||||||||

| and President |

2012 | $ | 450,000 | $ | 1,000,000 | $ | 14,989,157 | $ | — | $ | 495,413 | $ | — | $ | 111,505 | $ | 17,046,075 | |||||||||||||||||

| Jeffrey M. Stafeil |

2014 | $ | 684,564 | $ | — | $ | — | $ | — | $ | 691,571 | $ | — | $ | 306,476 | $ | 1,682,611 | |||||||||||||||||

| Executive Vice President |

2013 | $ | 659,750 | $ | — | $ | — | $ | — | $ | 1,071,200 | $ | — | $ | 140,468 | $ | 1,871,418 | |||||||||||||||||

| and Chief Financial |

2012 | $ | 110,688 | $ | 475,000 | $ | 5,198,368 | $ | — | $ | — | $ | — | $ | 16,749 | $ | 5,800,805 | |||||||||||||||||

| Officer |

||||||||||||||||||||||||||||||||||

| Martin T. Thall |

2014 | $ | 595,000 | $ | — | $ | — | $ | — | $ | 690,200 | $ | — | $ | 800,906 | $ | 2,086,106 | |||||||||||||||||

| Executive Vice President |

2013 | $ | 70,833 | $ | 300,000 | $ | 1,225,120 | $ | — | $ | 89,278 | $ | — | $ | 9,959 | $ | 1,695,190 | |||||||||||||||||

| And President, Electronics |

||||||||||||||||||||||||||||||||||

| Product Group |

||||||||||||||||||||||||||||||||||

| Peter M. Ziparo |

2014 | $ | 333,480 | $ | — | $ | 280,884 | $ | 102,416 | $ | 237,405 | $ | 34,378 | $ | 81,717 | $ | 1,070,280 | |||||||||||||||||

| Vice President and General Counsel (7) |

||||||||||||||||||||||||||||||||||

| Michael J. Widgren |

2014 | $ | 419,225 | $ | — | $ | — | $ | — | $ | 260,981 | $ | 33,115 | $ | 155,375 | $ | 868,696 | |||||||||||||||||

| Senior Vice President, |

2013 | $ | 406,667 | $ | — | $ | — | $ | — | $ | 444,276 | $ | — | $ | 99,892 | $ | 950,835 | |||||||||||||||||

| Corporate Controller and |

2012 | $ | 354,950 | $ | — | $ | 1,523,202 | $ | 87,305 | $ | 195,000 | $ | 29,753 | $ | 86,215 | $ | 2,276,425 | |||||||||||||||||

| Chief Accounting Officer |

||||||||||||||||||||||||||||||||||

| (1) | This column is comprised of sign-on bonus payments to Messrs. Leuliette and Stafeil in 2012 and Mr. Thall in 2013. |

| (2) | The amounts shown in this column represent the grant date fair values for performance stock units, restricted common stock and restricted stock unit awards in 2014, 2013 and 2012. The grant date fair values have been determined based on the assumptions and methodologies set forth in Note 16 “Stock-Based Compensation” to the consolidated financial statements included in Item 8 “Financial Statements and Supplementary Data” of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 (the “2014 10-K”). |

| (3) | The amounts shown in this column represent the grant date fair values for stock options and stock appreciation rights granted in 2014 and 2012. The grant date fair values have been determined based on the assumptions and methodologies set forth in Note 16 “Stock-Based Compensation” to the consolidated financial statements included in Item 8 “Financial Statements and Supplementary Data” of the Company’s 2014 10-K. No stock options or stock appreciation rights were granted to the Named Executive Officers during 2013. |

| (4) | For 2014, this column is comprised of the amounts payable to each of the Named Executive Officers under the 2014 annual incentive performance bonus program, as further described in the “Compensation Discussion and Analysis,” above. There were no earnings on non-equity incentive plan compensation earned or paid to the Named Executive Officers in or for 2014. |

| (5) | This column reflects an estimate of the aggregate change in actuarial present value of each Named Executive Officers’ accumulated benefit under all defined benefit and actuarial pension plans from the measurement dates for such plans used for financial statement purposes. See “Retirement Benefits — Defined Benefit Plans,” below. None of the Named Executive Officers received or earned any above-market or preferential earnings on deferred compensation. |