Attached files

| file | filename |

|---|---|

| 8-K - UIL HOLDINGS CORPORATION 8-K 4-30-2015 - UIL HOLDINGS CORP | form8k.htm |

| EX-99.1 - EXHIBIT 99.1 - UIL HOLDINGS CORP | ex99_1.htm |

Exhibit 99.2

1Q ‘15 Earnings PresentationMay 1, 2015 Exhibit 99.2

Forward Looking Statements Certain statements contained in this communication regarding matters that are not historical facts, are forward-looking statements (as defined in the Private Securities Litigation Reform Act of 1995). These include statements regarding management’s intentions, plans, beliefs, expectations or forecasts for the future. Such forward-looking statements are based on our expectations and involve risks and uncertainties; consequently, actual results may differ materially from those expressed or implied in the statements. In addition, risks and uncertainties related to the proposed merger with Iberdrola USA include, but are not limited to, the expected timing and likelihood of completion of the pending merger, including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the pending merger that could reduce anticipated benefits or cause the parties to abandon the transaction, the ability to successfully integrate the businesses, the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement, the possibility that UIL’s shareowners may not approve the merger agreement, the risk that the parties may not be able to satisfy the conditions to the proposed merger in a timely manner or at all, risks related to disruption of management time from ongoing business operations due to the proposed merger, the risk that any announcements relating to the proposed merger could have adverse effects on the market price of UIL’s common stock, and the risk that the proposed transaction and its announcement could have an adverse effect on the ability of UIL to retain and hire key personnel and maintain relationships with its suppliers, and on its operating results and businesses generally. New factors emerge from time to time and it is not possible for us to predict all such factors, nor can we assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. These risks, as well as other risks associated with the merger, will be more fully discussed in the joint proxy statement/prospectus that will be included in the Registration Statement on Form S-4 that will be filed with the Securities and Exchange Commission (“SEC”) in connection with the merger. Additional risks and uncertainties are identified and discussed in UIL’s reports filed with the SEC and available at the SEC’s website at www.sec.gov. Forward-looking statements included in this release speak only as of the date of this release. Neither UIL nor Iberdrola USA undertakes any obligation to update its forward-looking statements to reflect events or circumstances after the date of this release. UIL Holdings believes that a breakdown presented on a net income and per share basis is useful in understanding the change in the consolidated results of operations for UIL Holdings from one reporting period to another. UIL Holdings presents such per share amounts by taking the net income determined in accordance with generally accepted accounting principles (GAAP), and then dividing the results by the average number of diluted shares of UIL Holdings common stock outstanding for the periods presented. Any such amounts provided are provided for informational purposes only and are not intended to be used to calculate "Pro-forma" amounts.UIL Holdings also believes presenting earnings excluding certain non-recurring items, as well as earnings per share (EPS) information by line of business, including as presented above in the net income discussion and in the earnings guidance section, are useful in understanding and evaluating actual and projected financial performance and contribution of UIL’s businesses. EPS by business is calculated by taking the pre-tax amounts determined in accordance with GAAP of each line of business, and applying the effective statutory federal and state tax rate and then dividing the results by the average number of diluted shares of UIL common stock outstanding for the periods presented. Total consolidated EPS is a GAAP-basis presentation. James TorgersonPresident and Chief Executive OfficerRichard NicholasExecutive Vice President and Chief Financial Officer Visit our website at www.UIL.com

Important Information For Investors &Shareholders Important Information For Investors And ShareholdersThis communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. This communication may be deemed to be solicitation material in respect of the proposed transaction between UIL Holdings Corporation (“UIL”) and Iberdrola USA, Inc. (“Iberdrola USA”). In connection with the proposed transaction between UIL and Iberdrola USA, Iberdrola USA intends to file with the SEC a registration statement on Form S-4, containing a proxy statement of UIL, that will also constitute a prospectus of Iberdrola USA. UIL will mail the proxy statement/prospectus to UIL’s shareholders. UIL AND IBERDROLA USA URGE INVESTORS AND SHAREHOLDERS TO READ THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED MERGER WHEN IT BECOMES AVAILABLE, AS WELL AS OTHER DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC, BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. This communication is not a substitute for the registration statement, definitive proxy statement/prospectus or any other documents that Iberdrola USA or UIL may file with the SEC or send to shareholders in connection with the proposed transaction. You may obtain copies of all documents filed with the SEC regarding this proposed transaction (when available), free of charge, at the SEC’s website (www.sec.gov). Copies of the documents filed with the SEC by UIL are available free of charge on UIL’s website at www.uil.com or by contacting UIL’s Investor Relations Department at 203-499-2409. Copies of the documents filed with the SEC by Iberdrola USA are available free of charge on Iberdrola USA’s website at www.iberdrolausa.com or by contacting Iberdrola’s Investor Relations department at +34-91-784-2743. Participants in Solicitation UIL and its directors and executive officers, and Iberdrola USA and its directors and executive officers, may be deemed to be participants in the solicitation of proxies from the holders of UIL common stock in respect of the proposed transaction. Information about UIL’s executive officers and directors is set forth in UIL’s definitive proxy statement for its 2014 Annual Meeting of Shareholders, which was filed with the SEC on April 3, 2014. Other information regarding the interests of such individuals, as well as information regarding Iberdrola USA’s directors and executive officers, will be set forth in the joint proxy statement/prospectus, which will be included in Iberdrola USA’s registration on Form S-4 when it is filed with the SEC. You may obtain free copies of these documents as described in the preceding paragraph. 3 1Q ’15 Earnings

1Q ’15 consolidated net income was $57.6M, or $1.01 per diluted share, compared to $55.5M, or $0.97 per diluted share, in the 1Q ’14Consolidated earnings for 1Q ’15 and 1Q ‘14 reflect non-recurring after-tax items, as follows:Merger-related expenses associated with the pending merger of UIL and a subsidiary of Iberdrola USA recorded in the 1Q ‘15Acquisition-related expenses recorded in the 1Q ’14 associated with the now-terminated proposed acquisition of Philadelphia Gas WorksReserves recorded in the 1Q ’15 related to the transmission ROE proceedings pending at the FERCExcluding non-recurring items, consolidated earnings were: 1Q ‘15 Earnings Summary

Iberdrola USA/UIL Merger

Summary Transaction OverviewTotal Value to UIL Shareholdersq Transaction represents total value of $50.97 – $54.53 per share, a 20.4% – 28.8% premium to the closing price on February 25, 2015 and 15.3% – 23.3% premium to the average closing price over the 30 calendar days preceding 2/25 (1)§$40.47 – $44.03 per share in common stock of combined company§$10.50 per share in one-time cash paymentqName / ListingqIberdrola USA to be renamed and shares to be listed on the NYSE at closingqOwnershipqCombined company to be owned 81.5% by Iberdrola, S.A. / 18.5% by former UIL shareholdersqGovernanceqJames Torgerson to be CEO of the combined companyqCombined company to retain corporate offices in Connecticut and Massachusetts, as well as current Iberdrola USA offices in Maine and New YorkqBoard to consist of 3 current UIL Directors (including CEO) and up to 9 additional DirectorsqApprovalsqTransaction requires, among others, UIL shareholder vote, approval of state regulators in Connecticut and Massachusetts, and customary federal approvals qExpect to close by year-endNotes1.Assuming FY2 and FY3 P/E multiples of 17.5x and 16.5x applied to midpoint of combined company 2016E and 2017E EPS guidance of $2.31 and $2.67 per share

State of Connecticut application – filed 3/25/15120 day statutory deadline with option to extend an additional 30 daysRegulatory time schedule establishedProposed final decision expected end of JuneFinal decision expected mid-JulyState of Massachusetts application – filed 3/25/15No statutory deadlinePublic comment hearing scheduled for 5/6/15Hart-Scott Rodino – filed 3/25/15Early termination granted on 4/7/15FERC filing – filed on 3/25/15 SEC S-4/Proxy – expected to be filed in 2Q ‘15UIL shareholder vote – date TBD Regulatory Timeline - expect to close by y

Regulatory Timeline - expect to close by year-end ‘15 State of Connecticut PURA application – filed 3/25/15120 day statutory deadline with option to extend an additional 30 daysRegulatory time schedule establishedProposed final decision expected end of JuneFinal decision expected mid-JulyState of Massachusetts DPU application – filed 3/25/15No statutory deadlinePublic comment hearing scheduled for 5/6/15Hart-Scott Rodino – filed 3/25/15Early termination granted on 4/7/15FERC filing – filed on 3/25/15SEC S-4/Proxy – expected to be filed in 2Q ‘15UIL shareholder vote – date TBD

UIL Holdings Stand-alone

$4.2B 10-yr Capital Expenditure Plan Amounts may not add due to rounding 2015P-2024P

Rate Base Growth * Includes Distributed Energy Resources** Includes 338(h)(10) electionAmounts may not add due to rounding ‘15-’19 Rate Base CAGR 7.7% Gas Distribution:8.0%Electric Transmission:7.1%Electric Distribution*:7.7% $M

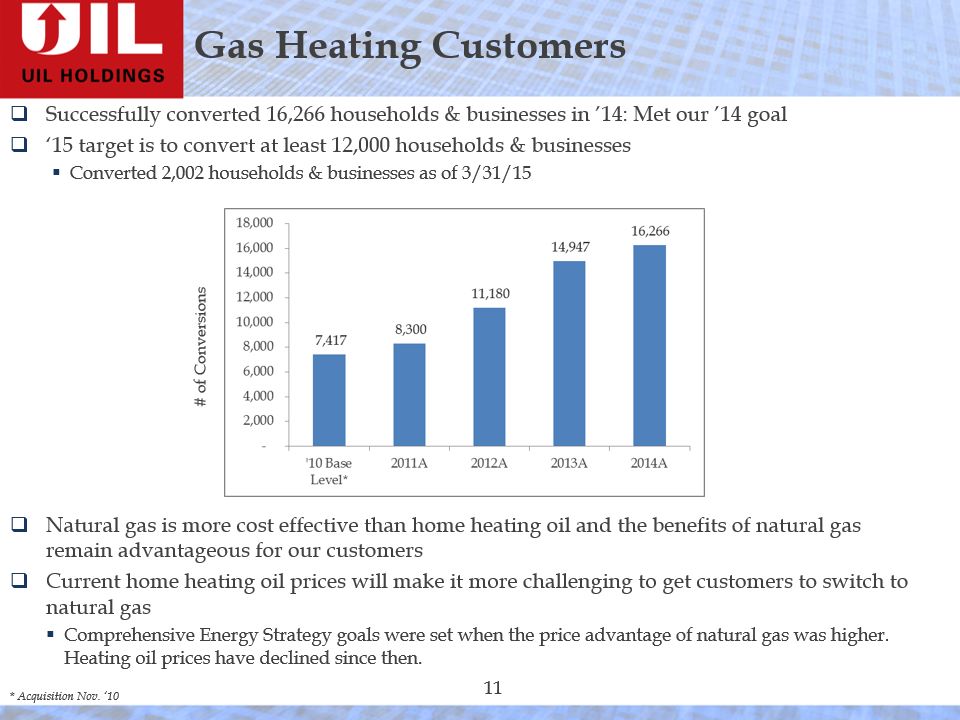

Successfully converted 16,266 households & businesses in ’14: Met our ’14 goal‘15 target is to convert at least 12,000 households & businessesConverted 2,002 households & businesses as of 3/31/15Natural gas is more cost effective than home heating oil and the benefits of natural gas remain advantageous for our customersCurrent home heating oil prices will make it more challenging to get customers to switch to natural gasComprehensive Energy Strategy goals were set when the price advantage of natural gas was higher. Heating oil prices have declined since then. * Acquisition Nov. ‘10 Gas Heating Customers # of Conversions

Transmission ROE Proceeding Challenge to Transmission Base ROE: “206” complaints filed at the FERC claiming that the then current approved base ROE of 11.14% on Transmission investments is not just and reasonable 10.57% base ROE10.57% base ROE 10/16/14 and forward (subject to 2nd & 3rd Complaints)11.74% cap on total company Transmission ROEOn 3/3/15 the FERC issued an Order on Rehearing in the 1st Complaint denying all rehearing requests from the Complainants and the New England Transmission Owners 2nd & 3rd Complaints consolidated for hearing purposes; different time frames for ROE analysis remainTestimony filedHearings to begin in 2Q ‘15ALJ decision should be rendered within 12 months of the commencement of hearing procedures - by 4Q ‘15Decision by FERC expected by 4Q ‘16 After-tax reserves of $2.2M recorded in the 1Q ‘15

1Q ‘15 Financial Results by Segment ~6% increase in Gas Distribution net income mainly from weather and customer growthOverall ~2% increase in net income, excluding non-recurring items

1Q ‘15 Financial Results - Details Electric Distribution1Q ’15 earnings of $11.3M, or $0.20 per diluted share, compared to earnings of $14.0M, or $0.25 per diluted share, in the 1Q ’14Decrease in earnings primarily due to –- Increased employee expenses, outside services and depreciation and amortization expensesGenConn contributed pre-tax earnings of $2.9M in 1Q ’15, compared to $3.4M in the 1Q ’1412-month average D ROE as of 3/31/15: 8.75%Electric TransmissionExcluding non-recurring FERC ROE reserves, 1Q ’15 earnings were flat compared to the 1Q ’14Overall weighted-average T ROE* as of 3/31/15: 11.36% (excl. reserve recorded in 1Q ‘15); 10.92% (incl. reserve recorded in 1Q ’15)* Weighted-average ROEs as of 3/31/15 based on projected year-end rate base and allowed ROEs

Gas Distribution1Q ’15 earnings of $41.2M, or $0.72 per diluted share, compared to earnings of $39.0M, or $0.68 per diluted share, in the 1Q ’14Increase in earnings primarily due to –-Colder weather and customer growthWeighted average heating degree days compared to normal & same period in ’14Impact of weather, NUPC and customer growth: 1Q ‘15 compared to the same period in ’14 1Q ‘15 Financial Results - Details

1Q ‘15 Financial Results - Details Gas Distribution – cont.Preliminary 12-month avg. ROEs* as of 3/31/15: SCG 9.50-9.70%, CNG 8.67-8.87%Preliminary 12-month avg. weather normalized ROEs* as of 3/31/15: SCG 8.53-8.73%, CNG 8.67-8.87%Corporate1Q ‘15 & 1Q ‘14 include interim tax benefits recognized at the UIL corporate level, which will reverse over the year as each segment reflects its seasonal activity1Q ’15 increase in earnings, excluding non-recurring merger/acquisition-related expenses, was primarily due to these interim tax benefits and increased returns on shared capital assets * Including impact of 338(h)(10)

Updating 2015 Earnings Guidance

Guidance Assumptions – Business Segments Electric Distribution - revised to $0.80-$0.95 per diluted share, compared to the previously reported estimate of $0.85-$1.00 per diluted share The revision is primarily due to increased depreciation expense resulting from when the timing of UI distribution capital projects were closed to plant in service in 2014Total Electric - revised to $1.40-$1.60 per diluted share, compared to the previously reported estimate of $1.45-$1.65 per diluted share Gas Distribution - revised to $0.95-$1.05 per diluted share, compared to the previously reported estimate of $0.90-$1.00 per diluted share The revision is primarily due to the earnings impact related to the increased margin from customer growth and from the colder weather

Questions