Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - Resolute Energy Corp | ren-ex312_201412317.htm |

| EX-31.1 - EX-31.1 - Resolute Energy Corp | ren-ex311_201412316.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

|

¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 001-34464

RESOLUTE ENERGY CORPORATION

(Exact Name of Registrant as Specified in its Charter)

|

Delaware |

|

27-0659371 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification Number) |

|

1700 Lincoln, Suite 2800 Denver, CO |

|

80203 |

|

(Address of principal executive offices) |

|

(Zip Code) |

(303) 534-4600

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

|

Name of Exchange on Which Registered |

|

Common Stock, par value $0.0001 per share |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15 of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, indefinite proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

x |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

¨ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of registrant’s common stock held by non-affiliates on June 30, 2014, computed by reference to the price at which the common stock was last sold as posted on the New York Stock Exchange, was $463.6 million.

As of February 27, 2015, 77,612,287 shares of the Registrant’s $0.0001 par value Common Stock were outstanding.

The following documents are incorporated by reference herein: None.

TABLE OF CONTENTS

|

PART III -- |

|

|

|

|

|

Item 10. |

|

|

3 |

|

|

Item 11. |

|

|

10 |

|

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

37 |

|

Item 13. |

|

Certain Relationships and Related Transactions and Director Independence |

|

40 |

|

Item 14. |

|

|

41 |

|

|

PART IV -- |

|

|

|

|

|

Item 15. |

|

|

42 |

|

|

|

|

|

||

RESOLUTE ENERGY CORPORATION

Amendment No. 1 to Annual Report on Form 10-K

For the year ended December 31, 2014

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (the “Amendment”) amends the Annual Report on Form 10-K for the year ended December 31, 2014 (the “Original Form 10-K”), filed by Resolute Energy Corporation (the “Company,” “we” or “us”) on March 5, 2015. We are filing this Amendment to furnish the information required by Items 10, 11, 12, 13 and 14 of Part III of Form 10-K previously omitted from the Original Form 10-K in reliance on General Instruction G(3) to Form 10-K. We are filing this Amendment because we will not file our definitive proxy statement within 120 days after the end of our fiscal year ended December 31, 2014.

In addition, in connection with the filing of this Amendment and pursuant to Rules 12b-15 and 13a-14(a) under the Securities Exchange Act of 1934 (the “Exchange Act”), we are including with this Amendment certain currently dated certifications and, therefore, we are amending Part IV solely for that purpose. Except as described above, no other amendments are being made to the Original Form 10-K.

Board of Directors

The following table sets forth certain information as of April 30, 2015, regarding the composition of the Board, including the term of each director.

|

Name |

Age |

Position |

Director |

Current |

|

Nominees |

|

|

|

|

|

Class III |

|

|

|

|

|

Nicholas J. Sutton |

70 |

Chairman and Chief Executive Officer |

2009 |

2015 |

|

Thomas O. Hicks, Jr. |

37 |

Director |

2009 |

2015 |

|

Gary L. Hultquist |

71 |

Director |

2014 |

2015 |

|

|

|

|

|

|

|

Other Directors |

|

|

|

|

|

Class I |

|

|

|

|

|

James E. Duffy |

64 |

Director |

2009 |

2016 |

|

William K. White |

73 |

Director |

2014 |

2016 |

|

|

|

|

|

|

|

Class II |

|

|

|

|

|

James M. Piccone |

64 |

President and Director |

2009 |

2017 |

Nicholas J. Sutton has been Chairman of the Board and Chief Executive Officer of the Company since the Company’s formation in July 2009. Mr. Sutton has been the Chief Executive Officer of, and previously served on the board of managers of, Resolute Natural Resources Company, LLC and related companies and of Resolute Holdings since their founding in 2004. Mr. Sutton was a co-founder, Chairman and Chief Executive Officer of HS Resources, an NYSE-listed company, from 1987 until the company’s acquisition by Kerr-McGee Corporation in late 2001. From 2002 until the formation of Resolute Holdings in 2004, Mr. Sutton was a director of Kerr-McGee Corporation. From 2006 until 2014, Mr. Sutton served as a director of Tidewater, Inc. He also is a member of the Society of Petroleum Engineers and of the American Association of Petroleum Geologists and of the California Bar Association (inactive status). In determining Mr. Sutton’s qualifications to serve on the Board, the Board has considered, among other things, his experience and expertise in the oil and gas industry, his track record in growing public oil and gas companies, including managing acquisition programs, as well as his role in the founding of Resolute Holdings, as well as his experience in serving on the boards of directors of other public companies in the oil and gas industry. In addition, Mr. Sutton has degrees in engineering and law, and has

3

attended the Harvard Owner/President Management program, giving him expertise in many of the areas of importance to the Company.

Thomas O. Hicks, Jr. was elected to the Board in September 2009. Mr. Hicks has been a member of the Corporate Governance/Nominating Committee since September 25, 2009. Between September 25, 2009 and December 15, 2009, he was also a member of the Compensation Committee. Mr. Hicks has served as a vice president of Hicks Holdings LLC since its inception in 2005. He was a vice president of Hicks Acquisition Company I, Inc. from February 2007 through September 2009 and was its secretary from August 2007 to September 2009. He also served as Secretary and Vice President of Hicks Acquisition Company II, Inc. from October 2010 to July 2011. Hicks Holdings LLC is a Dallas-based family holding company for the Hicks family and a private investment firm which owns and manages real estate assets and makes corporate acquisitions. Mr. Hicks has been a director of Drilling Tools International Holdings, Inc. since January 2012 and served as a director of Carol’s Daughter Holding, LLC from April 2014 to November 2014. In 2004 and 2005, Mr. Hicks served as Director, Corporate and Suite Sales, for the Texas Rangers Baseball Club. From 2001 to 2003, Mr. Hicks was an analyst at Greenhill & Co. LLC, a New York-based merchant banking firm. From May 2010 to August 2010, Mr. Hicks served as Executive Vice President of Texas Rangers Baseball Partners, Rangers Equity Holdings, L.P. and Rangers Equity Holdings GP, LLC. On May 24, 2010, Texas Rangers Baseball Partners filed a voluntary petition for bankruptcy and on May 28, 2010, a group of creditors filed an involuntary bankruptcy petition against Rangers Equity Holdings, L.P. and Rangers Equity Holdings GP, LLC. In determining Mr. Hicks’s qualifications to serve on the Board, the Board has considered, among other things, his experience and expertise in sales, banking and management.

Gary L. Hultquist was appointed to the Board in February 2014. Mr. Hultquist has been a member of the Compensation Committee and the Corporate Governance/Nominating Committee since February 2014, and a member of the Audit Committee since March 2015. Mr. Hultquist has been a Director of NYSE-listed Kinder Morgan, Inc. (KMI) since December 2014. Prior to the merger of KMI and Kinder Morgan Energy Partners, L.P. (KMP) in November 2014 (the “Merger”), Mr. Hultquist had been a Director of Kinder Morgan G.P., Inc., the General Partner of KMP, since 1999, where he served as Lead Independent Director, Chair of the Compensation Committee and Member of the Audit Committee and Nominating and Governance Committee. He also served as Chair of the Special Committee of Independent Directors of KMP for the $77 billion Merger. Since 1986, he has been an international investment banker and strategic advisor, to public and private company clients in the U.S., Europe and Asia, handling corporate financings, mergers and acquisitions. He is currently a Managing Director of Viant Capital, LLC, an investment banking firm in San Francisco, specializing in energy and technology. From 1995 to 1997, Mr. Hultquist also served on the board of directors and as chair of the audit committee of OnTrak Systems, Inc. during its IPO and subsequent merger with NASDAQ-listed Lam Research for over $400 million. He also served as board member and advisor to Rodel, Inc. during its acquisition by Rohm and Haas. Mr. Hultquist holds securities licenses 7, 63 and 24 (General Securities Principal) from FINRA and is a member of the California Bar Association. Mr. Hultquist practiced law in California for over 13 years. Mr. Hultquist has also served on the boards of directors of several private companies. He received his B.S. Degree in Accounting-Finance from Northwest Missouri State University, a J.D. degree from the University of Missouri Law School and attended the George Washington University Law School’s LLM in Taxation program. In determining Mr. Hultquist’s qualifications to serve on the Board, the Board has considered, among other things, his experience and expertise in the legal and finance aspects of the oil and gas industry.

James E. Duffy was elected to the Board in September 2009. Mr. Duffy has been a member of the Compensation and Audit Committees since September 25, 2009, and between September 25, 2009 and December 15, 2009, was also a member of the Corporate Governance/Nominating Committee. He is a co-founder and, since 2003, Chairman of ReadyMax, Inc. (f/k/a StreamWorks Products Group, Inc.), a private consumer products development company that manufactures products for the industrial safety, specialty tool and outdoor recreation industries. From 1990 to 2001, he served as Chief Financial Officer and director of HS Resources until its sale to Kerr-McGee Corporation. Prior to that time, he served as Chief Financial Officer and Director of a division of Tidewater, Inc. He was also a general partner in a boutique investment banking business specializing in the oil and gas business, and began his career with Arthur Young & Co. in San Francisco. He is a certified public accountant. In determining Mr. Duffy’s qualifications to serve on the Board, the Board has considered, among other things, his experience and expertise in oil and gas finance, accounting and banking, as well as his position as chief financial officer of two public oil and gas companies and his service as an audit manager for a major accounting firm with engagement responsibility for public and private entities.

William K. White was elected to the Board in April 2014. Mr. White has been a member of the Compensation Committee and the Corporate Governance/Nominating Committee since April 28, 2014, and a member of the Audit Committee since March 2015. He has been a Director of the General Partner of Eagle Rock Partners, L.P. since October 2006, serves as Chairman of the Audit Committee and was appointed to the Compensation Committee effective February 7, 2012. Mr. White also serves as the Audit Committee financial expert. Mr. White is a retired oil and gas executive. From May 2005 to September 2007, he served as an independent Director and member of the Audit and Compensation Committees of the Board of Directors of Teton Energy Corporation, a public company. From July 2008 through December 2008, Mr. White served as independent Director, Audit Committee Chairman and member of the Compensation Committee of CRC-Evans International, Inc., an affiliate of a portfolio company of Natural Gas Partners (“NGP”). In December 2012, Mr. White joined the Board of Directors of NGP Capital Resource Company as an Independent Director where he also served on the Compensation, Audit, Conflicts and Nominating and Governance

4

Committees. In the fourth quarter of 2014, NGP Capital Resource Company changed investment managers and Mr. White, along with the existing directors, resigned from the Board of Directors as part of the transaction. From September 1996 to November 2002, Mr. White was Vice President, Finance and Administration and Chief Financial Officer for Pure Resources, Inc., an NYSE-listed independent oil and gas producer.

James M. Piccone has been the President and a member of the Board since the Company’s formation in July 2009. He was also General Counsel and Secretary of the Company from its formation in July 2009 until July 2010. Mr. Piccone has served as president of various Company subsidiaries and affiliates collectively referred to as “Predecessor Resolute”), and of Resolute Holdings, LLC (“Resolute Holdings”), since the formation of these entities beginning in 2004. He also served as general counsel and secretary of each of these entities until July 2010 and as a member of the board of managers of certain of these entities. From January 2002 until January 2004, Mr. Piccone was executive vice president and general counsel for Aspect Energy, LLC, a private oil and gas company. He also served as a contract attorney for Aspect Energy from October 2001 until January 2002. Mr. Piccone served as vice president — general counsel and Secretary of HS Resources, Inc. from May 1995 until the acquisition of HS Resources by Kerr-McGee Corporation in August 2001. Currently, Mr. Piccone is a director of Western Energy Alliance. He is admitted to the practice of law in Colorado and is a member of local and national bar associations. In determining Mr. Piccone’s qualifications to serve on our Board of, the Board has considered, among other things, his management and legal expertise, his knowledge of the oil and gas industry and the role he played in the success of HS Resources and Resolute Holdings, including his role in the September 25, 2009 business combination with Hicks Acquisition Company I, Inc. (the “Resolute Transaction”).

Executive Officers

The following table sets forth certain information as of April 30, 2015, regarding the current executive officers of the Company.

|

Name |

|

Age |

|

Position |

||

|

Nicholas J. Sutton |

|

|

70 |

|

|

Chairman and Chief Executive Officer |

|

James M. Piccone |

|

|

64 |

|

|

President and Director |

|

Richard F. Betz |

|

|

53 |

|

|

Executive Vice President and Chief Operating Officer |

|

Theodore Gazulis |

|

|

60 |

|

|

Executive Vice President and Chief Financial Officer |

|

Michael N. Stefanoudakis |

|

|

44 |

|

|

Senior Vice President, General Counsel and Secretary |

|

Bob D. Brady, Jr. |

|

|

57 |

|

|

Vice President, Operations |

|

James A. Tuell |

|

|

55 |

|

|

Vice President and Chief Accounting Officer |

Nicholas J. Sutton — See “— Board of Directors” above for Mr. Sutton’s biography.

James M. Piccone — See “— Board of Directors” above for Mr. Piccone’s biography.

Richard F. Betz has been Executive Vice President and Chief Operating Officer since March 2012, was Senior Vice President, Strategy and Planning of the Company from September 2009 to March 2012, and was Vice President — Business Development of the Company from July 2009 to September 2009. He has been Vice President, Business Development of Predecessor Resolute and Resolute Holdings since their founding in 2004. From September 2001 to January 2004, Mr. Betz was involved in various financial consulting activities related to the energy industry. Prior to that, Mr. Betz spent 17 years with Chase Securities and successor companies, where he was involved primarily in oil and gas corporate finance. Mr. Betz was a Managing Director in the oil and gas investment banking coverage group with primary responsibility for mid-cap exploration and production companies as well as leveraged finance and private equity. In that capacity, Mr. Betz worked with the HS Resources management team for approximately twelve years. Mr. Betz received a B.S. in Finance from Villanova University and an MBA from the Wharton School at the University of Pennsylvania.

Theodore Gazulis has been Executive Vice President and Chief Financial Officer (“CFO”) since March 2012, was Senior Vice President and Chief Financial Officer of the Company from September 2009 to March 2012, and was Vice President of Finance,

5

Chief Financial Officer and Treasurer of the Company from July 2009 to September 2009. He had been Vice President — Finance, Chief Financial Officer, Treasurer and Assistant Secretary of Predecessor Resolute and Resolute Holdings since their founding in 2004. Mr. Gazulis served as a Vice President of HS Resources from 1984 until its merger with Kerr-McGee Corporation in 2001. Mr. Gazulis had primary responsibility for HS Resources’ capital markets activity and for investor relations and information technology. Subsequent to HS Resources’ acquisition by Kerr-McGee Corporation and prior to the formation of Predecessor Resolute, Mr. Gazulis was a private investor and also undertook assignments with two privately-held oil and gas companies. Prior to joining HS Resources, he worked for Amoco Production Company and Sohio Petroleum Company. Mr. Gazulis received an AB with Distinction from Stanford University and an MBA from the UCLA Anderson Graduate School of Management. Mr. Gazulis is a member of the American Association of Petroleum Geologists.

Michael N. Stefanoudakis has been Senior Vice President, Secretary and General Counsel of the Company since July 1, 2010. From April 2009 until June 2010, Mr. Stefanoudakis served as Senior Vice President, Secretary and General Counsel of StarTek, Inc., an NYSE listed company in the business processing outsourcing industry. From 2006 to 2008, Mr. Stefanoudakis was Vice President and General Counsel at BioFuel Energy Company, a NASDAQ-listed company in the ethanol production industry. From 2004 to 2006, Mr. Stefanoudakis served as Vice President and General Counsel of Patina Oil & Gas Corporation, an NYSE listed oil and gas exploration company, until its merger with Noble Energy, Inc. Prior to his public company experience, Mr. Stefanoudakis spent eight years as a practicing attorney, most recently at the legal firm Hogan & Hartson LLP (now Hogan Lovells). Mr. Stefanoudakis graduated from the University of San Diego with a B.A. in Economics in 1993 and from Harvard Law School with a J.D. in 1996. He is admitted to the practice of law in Colorado and is a member of local, state and national bar associations.

Bob D. Brady, Jr. has been Vice President, Operations of the Company since June 1, 2010. From March 1, 2006 until May 31, 2010, Mr. Brady served as the Company’s Operations Manager. Mr. Brady previously served as Drilling Manager and Engineer for El Paso Production Company and Medicine Bow Energy Corporation (acquired by El Paso) from February 2004 until March 2006. Mr. Brady was Vice President of Engineering and Operations for Double Eagle Petroleum Company from April 2002 until February 2004. Prior to working for Double Eagle, Mr. Brady was Operations Manager for Prima Oil & Gas Company from November 2000 until April 2002. Prior to working for Prima, Mr. Brady was Vice President of Engineering and Operations for Evergreen Operating Company. He has over 30 years’ experience in natural gas and oil industry operations. He graduated from the Colorado School of Mines in 1984 with a Bachelor of Science degree in Petroleum Engineering. He has been a member of the Society of Petroleum Engineers since 1982.

James A. Tuell has been Vice President and Chief Accounting Officer of the Company since June 1, 2010. From December 2009 until May 31, 2010, Mr. Tuell served as the Company’s Interim Chief Accounting Officer. Prior to joining Resolute, Mr. Tuell owned and operated an accounting and finance consultancy which served Resolute and numerous other independent energy companies from January 2009 through December 2009 and from July 2001 to February 2004. Mr. Tuell served as a director of Infinity Energy Resources, Inc. from April 2005 until June 2008. He also served in various officer capacities with Infinity Energy Resources, Inc. from March 2005 through August 2007, including as President, Chief Operating Officer, Chief Executive Officer, principal financial and accounting officer and Executive Vice President. Mr. Tuell also served as President of Infinity Oil & Gas of Wyoming, Inc. and Infinity Oil and Gas of Texas, Inc., wholly-owned subsidiaries of Infinity Energy Resources, Inc., from February 2004 and June 2004, respectively, until May 2007. From 1996 through July 2001, Mr. Tuell served as Controller and Chief Accounting Officer of Basin Exploration, Inc. From 1994 through 1996, he served as Vice President and Controller of Gerrity Oil & Gas Corporation. Mr. Tuell was employed by the independent accounting firm of Price Waterhouse from 1981 through 1994, most recently as a Senior Audit Manager. He earned a B.S. in accounting from the University of Denver and is a certified public accountant.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our directors and executive officers, and persons who own more than ten percent of our Common Stock, to file with the SEC initial reports of ownership and reports of changes in ownership of our Common Stock. To our knowledge, based solely on a review of the copies of such reports available to us and written representations from our executive officers and directors that no other reports were required, we believe that all reporting obligations of our officers, directors and greater than ten percent stockholders under Section 16(a) were satisfied during the year ended December 31, 2014.

CORPORATE GOVERNANCE

General

The Company’s business is managed under the direction the Board. In connection with its oversight of the Company’s operations and governance, the Board has adopted, among other things, the following:

|

• |

Corporate Governance Guidelines to implement certain policies regarding the governance of the Company; |

|

• |

a Code of Business Conduct and Ethics to provide guidance to directors, officers and employees with regard to certain |

6

|

ethical and compliance issues; |

|

• |

Charters of the Audit Committee, the Compensation Committee, and the Corporate Governance/Nominating Committee of the Board; |

|

• |

an Insider Trading Policy to facilitate compliance with insider trading regulations; |

|

• |

an Audit Committee Whistleblower Policy (i) to allow directors, officers and employees to make confidential anonymous submissions regarding concerns with respect to accounting or auditing matters and (ii) which provides for the receipt of complaints regarding accounting, internal controls or auditing; and |

|

• |

a Stockholder and Interested Parties Communications Policy pursuant to which holders of our securities and other interested parties can communicate with the Board, Board Committees and/or individual directors. |

Other than the Insider Trading Policy, each of these documents can be viewed on the Company’s website, at www.resoluteenergy.com, under the “Investor Relations” tab, subheading “Corporate Governance.” The Company’s website and the information contained on or connected to its website are not incorporated by reference herein and its web address is included as an inactive textual reference only. Copies of the foregoing documents and disclosures are available without charge to any person who requests them. Requests should be directed to Resolute Energy Corporation, Attn: Secretary, 1700 Lincoln Street, Suite 2800, Denver, Colorado 80203.

The Board meets regularly to review significant developments affecting the Company and to act on matters requiring its approval. The Board held nine meetings in 2014 and acted twice by written consent. No director attended fewer than 75% of the total number of meetings of the Board and committees on which he served during his period of service in 2014.

Directors are encouraged, but not required, to attend the Company’s annual stockholders’ meetings. Messrs. Sutton and Piccone attended the 2014 annual stockholders’ meeting, and Mr. White participated telephonically.

Director Independence

Under the rules of the NYSE, a majority of the members of the Board and all of the members of certain committees must be composed of “independent directors,” as defined in the rules of the NYSE. In general, an “independent director” is a person other than an officer or employee of the Company or any other individual who has a relationship, which, in the opinion of the Board, would interfere with the director’s exercise of independent judgment in carrying out the responsibilities of a director. Additional independence and qualification requirements apply to our directors serving on certain committees. As discussed under “—Board Committees,” the Company has standing Audit, Compensation and Corporate Governance/Nominating Committees, each of which is composed entirely of independent directors, under each of the applicable standards. The Board has determined that, other than Messrs. Sutton and Piccone, each member of the Board is independent under the NYSE rules. In making that determination, the Board considered (i) the relationship of Mr. Hicks with Hicks Holdings LLC, a stockholder of the Company and affiliate of the sponsor of our 2009 public merger transaction and (ii) the investment by several of the Company’s executive officers in ReadyMax, Inc., a company of which Mr. Duffy is the Chairman, a co-founder and a stockholder, in an aggregate interest of less than 10% of the outstanding shares of such company.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee has been an officer or employee of the Company. None of the Company’s executive officers serves as a member of the Board or the compensation committee of any entity that has one or more executive officers serving on the Board, or on the Compensation Committee of the Board.

Board Committees

The composition and primary responsibilities of the Audit Committee, the Compensation Committee and the Corporate Governance/Nominating Committee are described below.

Audit Committee

The Company has a separately designated Audit Committee, the members of which are Messrs. Hultquist, Duffy and White, with Mr. White serving as Chairman. The primary function of the Audit Committee is to assist the Board in its oversight of the Company’s financial reporting process. Among other things, the committee is responsible for reviewing and selecting our independent registered public accounting firm and reviewing our accounting practices and policies, and to serve as an independent and objective party to monitor the financial reporting process. The Board has determined that each of Messrs. Hultquist, Duffy and White qualifies as an “audit committee financial expert” as defined in Item 407(d)(5) of SEC Regulation S-K and that each member of the committee is independent under applicable NYSE rules and for purposes of SEC Rule 10A-3, and “financially literate” for purposes of

7

applicable NYSE rules. See “— Board of Directors” for a summary of the business experience of each member of the committee. During 2014, the Audit Committee held six meetings.

Compensation Committee

The Company has a separately designated Compensation Committee, which currently consists of Messrs. Duffy, Hultquist and White, with Mr. Duffy serving as Chairman. Mr. Hultquist has been appointed by the Board to succeed Mr. Duffy as the Chairman of the Compensation Committee effective upon the date of the Annual Meeting (assuming Mr. Hultquist is re-elected at the Annual Meeting). The Compensation Committee’s primary function is to discharge the Board’s responsibilities relating to the compensation of our Chief Executive Officer and to make recommendations to the Board regarding the compensation of our other executive officers. Among other things, the committee reviews and approves corporate goals and objectives for setting Chief Executive Officer compensation, evaluates the performance of the Chief Executive Officer in light of those goals and objectives and sets the compensation of the Chief Executive Officer. In February 2012, the Compensation Committee engaged Longnecker and Associates (“L&A”) as its independent compensation consultant and L&A remains in that capacity currently. The Board has determined that each member of the committee is (i) independent under applicable NYSE rules, (ii) a “non-employee director” as defined in Rule 16b-3 under the Exchange Act and (iii) an “outside director” as defined in Section 162(m) of the Internal Revenue Code (the “Code”). During 2014, the Compensation Committee held five meetings.

Corporate Governance/Nominating Committee

The Company has a separately designated Corporate Governance/Nominating Committee, the current members of which are Messrs. Hicks, Hultquist and White, with Mr. Hicks serving as Chairman. The primary function of the Corporate Governance/Nominating Committee is (i) to assist the Board with identifying, evaluating and recommending to the Board qualified candidates for election or appointment to the Board, (ii) reviewing, evaluating and recommending changes to the Company’s corporate governance guidelines and (iii) monitoring and overseeing matters of corporate governance, including the evaluation of Board and management performance and the “independence” of directors. The Board has determined that each member of the committee is independent under applicable NYSE rules. During 2014, the Corporate Governance/Nominating Committee held five meetings and acted twice by written consent.

Director Nominations

The charter of the Corporate Governance/Nominating Committee provides that director candidates recommended by security holders will be considered on the same basis as candidates recommended by other persons. A security holder who wishes to recommend a candidate should send complete information regarding the candidate to Resolute Energy Corporation, Attn: Secretary, 1700 Lincoln Street, Suite 2800, Denver, Colorado 80203. The information provided with respect to the nominee should include five years of professional background, academic qualifications, whether the nominee has been subject to any legal proceedings in the past ten years, the relationship between the security holder and the nominee, and any other specific experience, qualifications, attributes or skills that qualify the nominee for the Board. The committee will assess each candidate, including candidates recommended by security holders, by evaluating all factors it considers appropriate, which may include career specialization, relevant technical skills or financial acumen, diversity of viewpoint and industry knowledge. The charter provides that nominees must meet certain minimum qualifications. In particular, a nominee must:

|

• |

have displayed the highest personal and professional ethics, integrity and values and sound business judgment; |

|

• |

be highly accomplished in his or her field, with superior credentials and recognition and broad experience at the administrative or policy-making level in business, government, education, technology or public interest; |

|

• |

have relevant expertise and experience and be able to offer guidance and advice to the chief executive officer based on that expertise and experience; |

|

• |

with respect to a majority of directors, be independent and able to represent all stockholders and be committed to enhancing long term stockholder value; and |

|

• |

have sufficient time available to devote to the activities of the Board and to enhance his or her knowledge of the Company’s business. |

The committee does not have a formal policy with respect to the consideration of diversity when assessing director nominees, but considers diversity as part of its overall assessment of the Board’s functioning and needs. The committee has retained Preng & Associates, a search firm, to assist it in identifying potential Board candidates although there is no active search for additional directors proceeding currently.

8

Non-Management Sessions

The Board generally schedules regular executive sessions involving exclusively non-management directors, as required by NYSE rules, at the time of each in-person board meeting. Our Lead Independent Director presides at all such executive sessions. Mr. Duffy is our current Lead Independent Director.

Stockholder and Interested Parties Communications Policy

In recognition of the importance of providing all interested parties, including but not limited to, the holders of Resolute securities, with the ability to communicate with members of the Board, including non-management directors, the Board has adopted a Stockholder and Interested Parties Communications Policy, a copy of which is available on our website at www.resoluteenergy.com. Pursuant to the policy, interested parties may direct correspondence to the Board, or to any individual director and the Lead Independent Director by mail to the following address: Resolute Energy Corporation, Attn: Lead Independent Director, 1700 Lincoln Street, Suite 2800, Denver, CO 80203.

Communications should not exceed 1,000 words in length and should indicate (i) the type and amount of Resolute securities held by the person submitting the communication, if any, and/or the nature of the person’s interest in Resolute, (ii) any personal interest the person has in the subject matter of the communication and (iii) the person’s mailing address, e-mail address and telephone number. Unless the communication relates to an improper topic (e.g., it contains offensive content or advocates that we engage in illegal activities) or it fails to satisfy the procedural requirements of the policy, we will deliver it to the person(s) to whom it is addressed.

Board Leadership Structure and Risk Management

The Board currently consists of six directors, all of whom, other than Messrs. Sutton and Piccone, have been determined to be “independent directors” under the rules of the NYSE. Mr. Sutton has served as Chairman and Chief Executive Officer since the Company became a public company in September 2009, was Chairman and Chief Executive Officer of Resolute Holdings from its inception in 2004, and was instrumental in the completion of the Resolute Transaction. He is most familiar with the Company’s properties and, based on his years as chairman and chief executive officer of HS Resources from 1987 to 2001, has demonstrated skills in building and leading a public oil and gas company. Accordingly, the Board believes that he is uniquely qualified to be the person who sets the agenda for, and leads discussion of, strategic issues for the Company. Our Lead Independent Director presides over executive sessions of the independent directors, which generally occur at the time of each in-person board meeting, and also presides over any Board meetings at which Mr. Sutton is not present. The Lead Independent Director reviews agendas for Board meetings, reviews with Mr. Sutton annual goals and objectives for the Company and consults with the Board regarding its evaluation of the performance of the Chief Executive Officer. The Board believes that its supermajority of independent directors and other aspects of its governance provide appropriate independent oversight to Board decisions.

The Board oversees the risks involved in the Company’s operations as part of its general oversight function, integrating risk management into the Company’s compliance policies and procedures. While the Board has the ultimate oversight responsibility for the risk management process, the Audit Committee has certain specific responsibilities relating to risk management. Among other things, the Audit Committee, pursuant to its charter, addresses Company policies with respect to risk assessment and risk management, and reviews major risk exposures (whether financial, operating or otherwise) and the guidelines and policies that management has put in place to govern the process of assessing, controlling, managing and reporting such exposures. While the charters of the Compensation and Corporate Governance/Nominating Committees do not assign specific risk-related responsibilities to those committees, the committees nevertheless consider risk and risk management issues in the course of performing their duties with respect to compensation and governance issues, respectively.

Family Relationships

There are no family relationships among any of the Company’s directors and executive officers.

Code of Ethics

The Company has adopted a code of ethics that applies to its directors, officers and employees that complies with the rules and regulations of the NYSE and SEC. The Company’s Code of Business Conduct and Ethics is posted on the Company’s website, at www.resoluteenergy.com, under the “Investor Relations” tab, subheading “Corporate Governance.” All amendments to, and waivers granted under, the Company’s code of ethics will be disseminated on the Company’s website in the manner required by SEC and NYSE rules.

9

Compensation Discussion and Analysis

The following discussion and analysis is designed to provide insight into our compensation philosophy, practices, plans and decisions. This CD&A is intended to be read in conjunction with the tables beginning on page 28 below, which provide detailed historical compensation information for our principal executive officer, our principal financial officer and three other most highly compensated executive officers (the NEOs). For 2014, our NEOs are:

|

|

|

|

|

Name |

|

Title |

|

Nicholas J. Sutton |

|

Chairman and Chief Executive Officer |

|

James M. Piccone |

|

President and Director |

|

Richard F. Betz |

|

Executive VP – Chief Operating Officer |

|

Theodore Gazulis |

|

Executive VP – Chief Financial Officer |

|

Michael N. Stefanoudakis |

|

Senior VP – General Counsel and Secretary |

Recent Changes to Our Compensation Programs

Beginning in March 2013, the Compensation Committee and the Board implemented substantial changes to the Company’s executive compensation programs, including the implementation of annual and long-term incentive programs that are based on objective performance criteria and which are designed to better tie pay to performance, including the following:

|

• |

Re-assessed the compensation and performance peer group to ensure proper relative size alignment. The result was a peer group that matches up more closely from a revenue perspective. |

|

• |

Adopted a formal compensation philosophy which targets base salaries of the NEOs at the median of the market. |

|

• |

Instituted a relative total shareholder return (“TSR”) based long-term incentive program to create better alignment of executives and stockholders through long-term incentives. |

In March 2014, the Compensation Committee and the Board implemented additional changes to the Company’s executive compensation programs, including the following:

|

• |

Amended our long-term incentive program for our NEOs such that the vesting schedule for equity grants will be one-half performance based and one-half time based (rather than one-third performance based and two-thirds time based, as was the previous practice). |

|

• |

Adopted formal share ownership guidelines applicable to our officers and directors. |

|

• |

Amended our Insider Trading Policy to prohibit hedging of shares and to restrict pledging of shares by officers and directors. |

|

• |

Formalized its intent to adopt a clawback policy consistent with Dodd-Frank required rules once such rules are promulgated by the SEC. |

In January 2015 - April 2015, the Compensation Committee and the Board implemented additional changes to the Company’s executive compensation programs primarily designed to recognize the depressed commodity price environment in which the Company currently operates, including the following:

|

• |

Approved significant voluntary salary reductions by the Company’s executive officers, including a reduction of our CEO’s annual salary from $590,000 to $24,000, effective February 1, 2015. |

|

• |

Reduced executive officer annual short-term incentive targets by 30% for 2015. |

|

• |

Reduced executive officer long-term incentive targets by 35% for 2015. |

|

• |

Suspended the automatic period by period 401(k) matching contribution by the Company. |

10

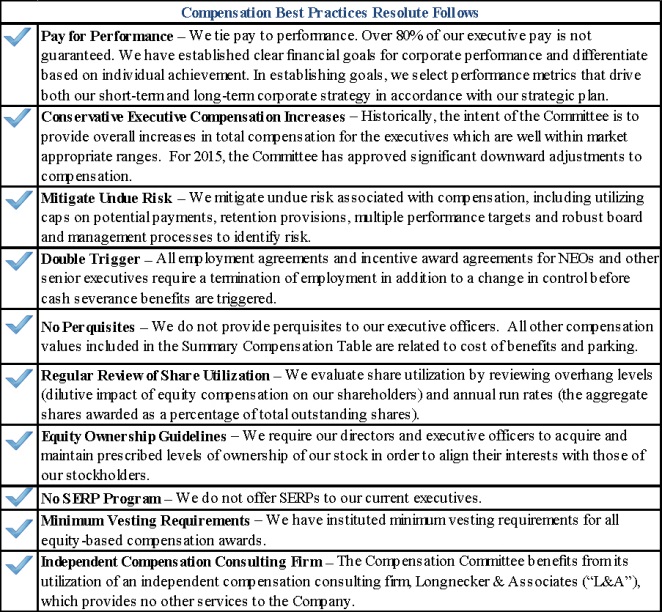

Our Executive Compensation Practices

Below we highlight certain executive compensation practices, both the practices we have implemented to drive performance, and the practices we have not implemented because we do not believe they would serve our stockholders’ interests.

11

Resolute Pays for Performance

We understand our responsibility to maintain an executive compensation program that fairly and appropriately compensates and retains our executive officers and we are also committed to providing value to our stockholders. At our 2014 Annual Meeting, the compensation of our named executive officers was approved by approximately 96% of the votes cast on that proposal (excluding broker non-votes). Although those results reflect strong support of our executive compensation programs by our stockholders, we have continued to dedicate significant efforts to ensure our executive compensation programs remain appropriate and for performance, particularly in a changing commodity price environment, and in a manner consistent with feedback received from stockholders, compensation programs of industry peers and advice from compensation experts.

2014 Resolute Performance and Related Compensation Outcomes

In 2014, Resolute achieved the following operational and financial results that were all considered by the Compensation Committee and the Board in determining 2014 STI performance and the 2015 adjustments to our compensation programs:

|

· |

The Company was within or better than 2014 guidance in all categories, including production, lease operating expense and general and administrative expense. |

|

· |

The Company’s application of capital, control of costs and operating performance was excellent in the Aneth Field located in the Paradox Basin (the “Aneth Field”), beating budget on both capital spend and lease operating expense (“LOE”), while exceeding budget on production. |

|

· |

In the Permian Basin, the Company demonstrated drilling success and improved cost control through the year. |

|

· |

Even with the commodity price collapse, which started in June 2014 and accelerated in the fourth quarter of 2014, the Company came within 10% of planned Adjusted EBITDA. |

|

· |

The Company secured the maximum permitted level of hedges for both 2015 and 2016 at very attractive prices, which will assist us significantly in withstanding the current low commodity price environment. |

|

· |

The Company booked an increase of 15 million barrels of proved reserves from year end 2013 to year end 2014, an increase of 25%, while producing 4.6 million barrels. |

|

· |

In the midst of an ever-weakening market, the Company secured a $150 million second lien tranche of debt that will provide it with liquidity and stability to endure the down cycle on commodity prices. |

Despite the above successes during the year, which position us well for future growth and stockholder value creation, the precipitous decline in commodity prices in the second half of 2014 had an extremely negative effect on our stock price along with the stock prices of many oil and gas producing companies. This macro market development prevented the Company’s operational and strategic successes from being reflected in our stock price and interrupted certain important initiatives. Because of the oil price slide, the Company was unable to close a transaction for the partial monetization of our Aneth asset, a strategic objective for 2014. This transaction was a high priority of management and substantial progress had been made toward this goal during the year including detailed negotiations with a prominent global asset manager; however, the product price environment was moving exponentially lower and successfully completing the transaction became impossible. In its place, the Company moved quickly to secure additional debt financing needed to preserve stockholder value but remained relatively over-levered. As the commodity price declined, Resolute’s stock price was also negatively impacted, particularly from early September 2014 to the end of 2014, during which period the stock price steadily declined from the $8.00 range to $1.32 on December 31, 2014. This stock price decline was greater than the average small cap E&P company stock price decline, but was about the same as small cap E&P companies with similar levels of debt.

In light of all the above, the Compensation Committee and the Board made 2014 compensation awards, and adjustments to the various elements of our compensation programs for 2015, to recognize the performance of the management team vis-à-vis the objective performance criteria of the Company’s short term incentive compensation plan, but also to recognize the commodity price environment and stock price decline, as well as the loss of over $29 million in the aggregate value of both the owned and unvested shares held by our NEOs (including a drop in value of shares held by our CEO of over $11.8 million) over the second half of 2014, a period during which none of our executive officers sold any shares.

As stated above, the management team was able to deliver good operational and financial results which will position the Company well in the coming years despite the challenging commodity price environment in the latter half of 2014 which had significantly negative effects on our stock price. When measuring the actual results of metrics specifically assigned to our annual incentive program, overall performance was well above target on G&A Expenses, where performance exceeded stretch levels, and

12

somewhat below target with respect to Aggregate Production, Lease Operating Expense, and Capital Projects (see tables on pages 22 and 24 below). This resulted in an average metric performance of 85.72%. The Compensation Committee and Board took this into account when assessing individual performance under our short term incentive compensation plan and determined that reductions to targeted levels were appropriate. As a result, the CEO and NEO’s were awarded 75% and 85% of the targeted individual performance level, respectively.

Realized Pay: CEO’s Actual Compensation

The following is a chart of Resolute’s CEO reportable and realized compensation in relation to our three-year stock price performance over the past three years. Our stock performance over 2012, 2013 and the first half of 2014 remained relatively flat, and realized CEO compensation as shown in the following section likewise remained relatively flat, displaying good alignment between pay and performance. The rapid and extreme decline in our stock price caused by the deteriorating commodity price environment over the second half of 2014 skews the results somewhat, but we believe that over time there has been good alignment between pay and performance. Furthermore, because of the significant reduction in base salary, STI target and LTI target for our CEO and our NEOs, the realized compensation of our CEO and NEOs will decline again significantly in 2015, which will ensure continued good alignment between pay and performance.

Note: The realized long-term incentive values which were determined within the Realized total direct compensation for the chart above include the restricted stock shares and the performance shares vested in each of the years at the year-end stock price. Stock prices are as of December 31 of each year.

Realized Compensation Reflects Alignment with Stockholders

At Resolute, a substantial portion of the compensation granted by the Compensation Committee to the CEO and reported in the Summary Compensation Table represents an incentive for future performance, not current cash compensation. This analysis demonstrates the link with performance and actual realized compensation. The table below sets forth the difference between pay shown in the Summary Compensation Table (“Reported Compensation”) and the actual pay realized by the CEO for fiscal years 2014, 2013, 2012 and 2011:

|

Year of Compensation |

|

Reported Total Direct Compensation |

|

% Difference In Realized Pay vs. Reported Pay |

|

2014 |

$5,050,061 |

$1,392,206 |

-72% |

|

|

2013 |

$5,241,979 |

$2,287,504 |

-56% |

|

|

2012 |

$2,705,088 |

$2,183,598 |

-19% |

|

|

2011 |

$2,919,064 |

2,042,753 |

-30% |

|

Realized compensation is different than Reported Compensation as disclosed in the Summary Compensation Table below.

13

Reported Total Direct Compensation is the total compensation based on the current SEC reporting rules applicable to the Summary Compensation Table disclosed by a Company. Reported pay includes the “grant date fair value” of equity awards (i.e. restricted stock and performance shares), rather than the annual expense value or the actual value ultimately received by the executive.

Realized Total Direct Compensation is the total compensation actually received by the executive during the fiscal year, including base salary, the current bonus cash payout, market value as of December 31 of the applicable year of previously granted time-based restricted stock that vested in the current year, market value as of December 31 of the applicable year of previously awarded performance-based restricted stock that vested in the current year (if performance was actually achieved), and all other compensation amounts realized in the current year. This excludes the value of newly awarded/unvested restricted stock and performance share grants, and other amounts that will not actually be received until a future date.

A realized compensation analysis measures cash compensation received, as well as the value of long-term compensation as it is earned rather than the value at the time of the grant. The tables above illustrate the actual difference in reported pay versus realized pay for the CEO for calendar years 2011-2014. As the tables display, the actual compensation realized by Mr. Sutton is significantly less than the value reported in the Summary Compensation Table for each of the last three years.

As Resolute is ultimately focused on the interests of the stockholder, the realized compensation of the executive team, and in particular the CEO, is linked to the performance of the Company’s TSR and other performance metrics as described in the summary of compensation components below. As such, we have provided the chart below which details the performance of TSR over the past three years in comparison to reported compensation and the compensation that was actually realized by the CEO in order to show that based on our compensation philosophy, the compensation plans are in alignment with stockholder return.

Note: The TSR for each year is the value of the stock performance between January 1 and December 31 of that year. The Realized total direct compensation for the chart above includes realized long-term incentive values based upon the number of time-vested and performance-vested shares that actually vested in each of the years at the year-end stock price for such year.

As the analyses above display, the executive compensation programs we have implemented appropriately align the compensation received by our CEO with the returns realized by our stockholders. During the period where stockholder returns rose, both reported total direct compensation and realized total direct compensation rose. During the period where stockholder returns declined, reported total direct compensation and realized total direct compensation also declined. The unusual stock price decline in the second half of 2014 resulted in a significant decrease in the realized total direct compensation of the CEO, which we believe indicates good pay for performance alignment. The reason for the variance between reported total direct compensation and realized total direct compensation is primarily related to the accounting fair value of restricted stock awards at the time of grant compared to the actual value received by the executive. The realized compensation of the CEO is very relevant for 2014 in particular because it recognizes the impact of the significant stock price decline in the second half of 2014 on the value of the compensation received by the CEO. Although the CEO’s shares that vested in March 2014 had a market value of $9.16 as of the vesting date (excluding taxes

14

due upon vesting), the value of those same shares had decreased to $1.32 per share by December 31, 2014, representing an 86% decrease in value.

Furthermore, our performance-based equity awards are structured such that if performance goals are not met, the performance shares are forfeited. In 2014, performance-based equity awards that were granted in 2011 expired as a result of the performance goals set forth in those grants not being achieved. The following table displays the number of shares expired in 2014 by each NEO.

|

Executive |

2011 Performance Shares Expired on 12/31/14 |

|

Chief Executive Officer |

38,713 |

|

President |

20,212 |

|

Executive VP – Chief Operating Officer |

11,539 |

|

Executive VP – Chief Financial Officer |

11,539 |

|

Senior VP – General Counsel and Secretary |

6,351 |

Performance-based equity awards were also awarded in 2012 and are scheduled for vesting in 2015. While these awards still have the potential to vest, we believe that such vesting is improbable as the Company’s 30-day average trading price as of December 31, 2015 must be $17.04 in order for such vesting to occur. Based on these facts, it is our opinion that the compensation programs are aligned with stockholders and motivate executives to focus on building long-term value for stockholders.

We note that over 55% of our equity awards over each of 2012, 2013 and 2014 were granted to employees other than our continuing named executive officers, and grants to our CEO in each of those years comprised less than 20% of the overall awards.

Process for Establishing Executive Compensation

Role of the Board and the Compensation Committee

The Board has responsibility for establishing, implementing and continually monitoring adherence with the Company’s compensation philosophy, as described below under “Compensation Philosophy.” The Board has delegated to the Compensation Committee its responsibilities with respect to development of a compensation program and primary implementation of that program. The Compensation Committee is solely responsible for determining the compensation of the Chief Executive Officer and makes recommendations to the Board regarding the compensation of the other executive officers. It also makes recommendations to the Board regarding awards under the 2009 Performance Incentive Plan. Generally, the types of compensation and benefits provided to the Company’s executive officers are similar to those provided to the Company’s other officers and employees, although the LTI awards to officers are subject to performance requirements not applicable to other employees. The Company does not have compensation plans that are solely for executive officers.

Role of Management

The Chief Executive Officer plays a key role in determining executive compensation for the other NEOs and other officers. The Chief Executive Officer generally attends the meetings of the Compensation Committee at which executive compensation other than his own is being discussed and makes recommendations to the Compensation Committee. In arriving at his recommendations, the Chief Executive Officer evaluates the performance of each executive and solicits input from the peers of such executives and others, if necessary. This evaluation is shared with the Compensation Committee and forms the basis for the recommendation. These recommendations are considered by the Compensation Committee and the Board, along with other relevant data, in determining the base salary, annual cash incentives, long-term equity incentives, and benefits and perquisites for such executives.

Role of Compensation Consultant

The Compensation Committee, which has sole authority to retain and terminate any compensation consulting firm, may independently retain compensation consultants to assist in deliberations regarding executive compensation. The Compensation Committee retained the sole authority to select, retain, terminate, and approve fees and other retention terms of the relationship with L&A.

15

The Compensation Consultant provides various executive compensation services to the Compensation Committee. Generally, these services include advising the Compensation Committee on the principles of our executive compensation program and providing market information and analysis regarding the competitiveness of our program design and award values in relationship to performance.

During 2014, the Compensation Committee engaged L&A to assist in providing a comprehensive assessment of our executive compensation programs. The Compensation Committee sought advice from L&A regarding base salary, annual bonus, the nature and amount of long-term incentives, performance measures for short-term and long-term incentives, identification of representative peer groups and general market data. L&A evaluated our executive compensation and recommended continued focus on total direct compensation as a means to achieve the compensation objectives outlined above while remaining competitive with the external market. Following the review of the L&A analysis, the Compensation Committee determined that the general structure of the Company’s compensation programs were generally competitive and did not require any immediate action by the committee.

Specifically, during 2014 and early 2015, the Compensation Consultant performed the following services for the Committee:

|

• |

Conducted an evaluation of the total compensation for each of the NEOs; |

|

• |

Advised the Compensation Committee on current trends in executive compensation programs among energy companies in the current depressed commodity price environment, particularly with respect to the discretionary components of STI awards for 2014, and adjustments to structure and pool amounts for the 2015 STI and LTI programs; |

|

• |

Presented information regarding regulatory developments affecting executive compensation programs in our market; |

|

• |

Assisted with the analysis and selection of peer group companies for compensation purposes and for comparative TSR purposes under our 2014 long-term incentive grants; |

|

• |

Assisted in the development of the performance-based long-term incentive plan; |

|

• |

Reviewed the annual short-term incentive plan; and |

|

• |

Assisted in the drafting and review of the 2014 Compensation Discussion and Analysis and compensation tables for the annual proxy statement. |

The NYSE has adopted guidelines for compensation committees to consider when identifying Compensation Committee advisor independence. The Compensation Committee reviewed these guidelines and determined that L&A is an independent consultant under these guidelines. This independence was confirmed in writing by L&A. L&A performs no services for the Company other than those specific to assignments requested by the Board and Compensation Committee regarding executive and non-employee director compensation. Our management communicates with L&A and provides data to L&A regarding our executive officers, but does not direct L&A’s activities.

16

Benchmarking and Peer Group Comparison

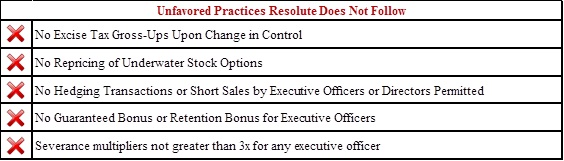

The Compensation Committee, along with L&A and management, established the following peer group for compensation purposes for 2014:

L&A compiled compensation data for the peer group from the summary compensation tables within proxy statements, as well as narrative disclosures in the CD&A sections. The consultant also provided published survey compensation data from multiple sources, including the following surveys: Economic Research Institute, Mercer, Inc. Energy Survey, Kenexa and Towers Watson. For each survey, L&A adjusted the data to appropriately reflect companies of a similar size to the Company.

For each element of compensation for which data was available, L&A averaged the 25th percentile from the peer group and the published survey data to approximate the 25th percentile for the “market.” A similar process was used to establish the 50th and 75th percentiles. The combination of published survey data and peer compensation data was then used to compare the compensation of our NEOs to comparably titled persons at companies within our peer group and in the survey data.

The Compensation Committee makes modifications to the peer group from time to time due to consolidations within the market, and to accommodate new companies entering the oil and gas exploration and production industry, or for other reasons. The Compensation Committee, in connection with L&A and management, determined that the 2014 peer group would remain appropriate for 2015.

Compensation Philosophy and Components

Compensation Philosophy

The Company believes that the most effective compensation program is one that is designed to reward all employees, not just executives, for the achievement of the Company’s short-term and long-term strategic goals which are aligned with the stockholders’ interests. As a result, the Company’s compensation philosophy is to provide all employees (except a relatively small group of employees covered by a union contract that sets out specific compensation arrangements) with cash incentives or a combination of cash and equity-based incentives that foster the continued growth and overall success of the Company and encourage employees to maximize stockholder value.

17

Under this philosophy, all Company employees (with the exception noted above) have aligned interests. When establishing total compensation, the Company has the following objectives:

|

• |

To attract, retain and motivate highly qualified and experienced individuals; |

|

• |

To provide financial incentives through an appropriate mix of fixed and variable pay components to achieve the organization’s key financial and operational objectives; |

|

• |

To ensure that a portion of total compensation is “at risk” in the form of performance-based and equity compensation; and |

|

• |

To offer competitive compensation packages that are consistent with the Company’s core values, including the balance of fairness to the individual and the organization, and the demand for commitment and dedication in the performance of the job. |

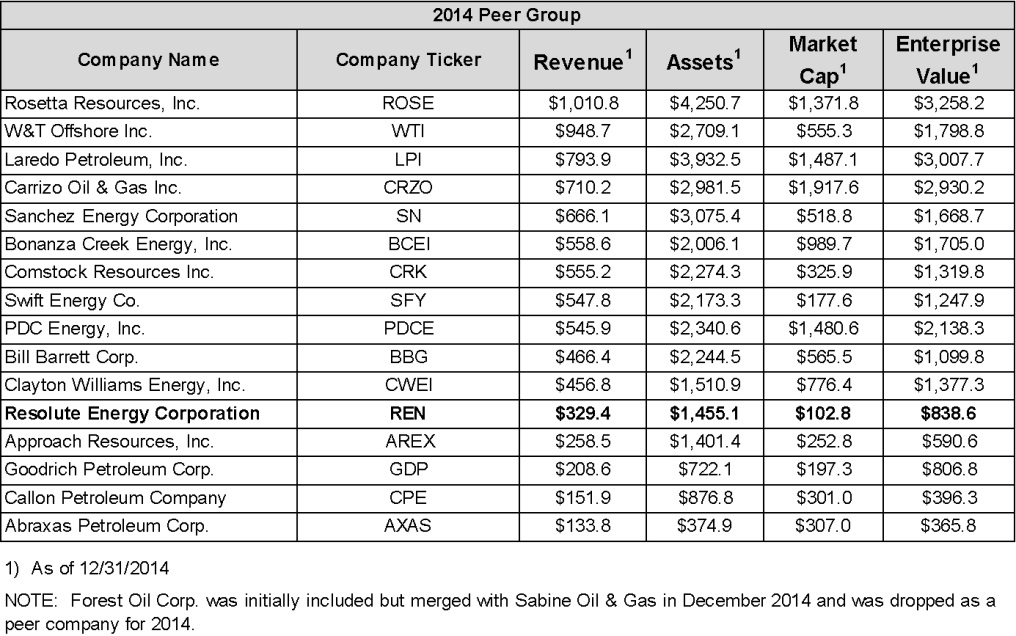

The core principle of our executive compensation philosophy is to pay for performance. Accordingly, our executive compensation program is heavily weighted toward “at-risk” performance-based compensation. We have three elements of total direct compensation: base salary, annual short-term incentive and long-term equity compensation. These elements provide our Compensation Committee with a platform to reinforce our pay-for-performance philosophy to address our business needs and goals with appropriate flexibility.

In 2014, 88% of total direct compensation to our CEO was provided through incentive-based compensation, while 82% of NEO compensation was incentive-based, based on compensation information contained in the Summary Compensation Table.

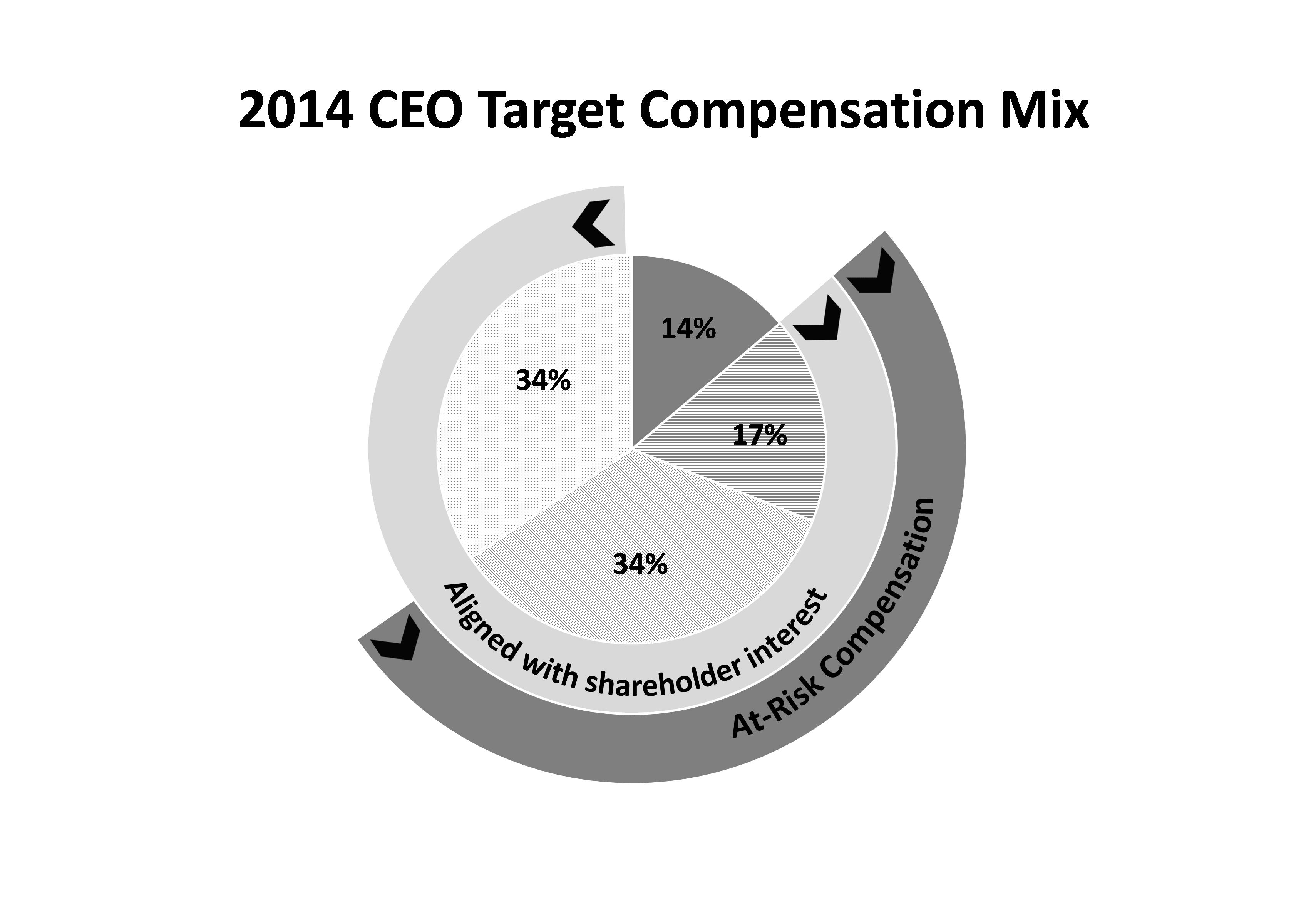

The following charts display the mix of total compensation components of Resolute for the CEO and the other NEOs in 2014. This includes 2014 base salaries, annual incentive cash bonuses, time and performance-based long-term incentives, and all other compensation. As Resolute is focused on the alignment of the interests of its executives with the interests of stockholders, a majority of compensation is provided through incentive-based compensation with metrics intended to drive long-term company growth. In 2014 the Compensation Committee and the Board further adjusted the composition of the restricted stock awards granted to the CEO and other NEOs such that one-half of the shares of restricted stock were granted as time-vested shares and one-half of the shares were granted performance-vested shares, thus increasing the “at risk” portion of CEO and NEO compensation and further aligning total compensation to stockholder returns. The chart also displays the “at risk compensation,” or the performance based components:

Note: All other income is less than 1%

In addition, in 2015, as a result of the significant reductions of annual salaries by the CEO and the NEOs, in addition to the reduction of STI and LTI targets by 30% and 35%, respectively, the “at risk” portion of CEO and NEO compensation was increased, further aligning total compensation to stockholder returns.

It is the Compensation Committee’s policy to provide incentives that promote both our short-term and long-term financial objectives that are appropriate to the nature of our assets. Short-term incentive compensation is designed to reward achievement of short-term objectives, while the long-term incentive compensation is intended to encourage employees, particularly executives, to focus on our long-term goals. Base salary, annual cash bonuses and equity or equity-based awards have traditionally been the primary components of our compensation program and we believe that attention to all three elements is important to retain our existing personnel and to attract and hire new employees. As to any given individual, the factors considered in any compensation decision

18

include, but are not limited to, the complexity of that individual’s job, the person’s dedication and demonstrated contribution of value to the Company, competitive pressures in the marketplace and his or her relative performance compared to peers within the Company.

We consider an inability to attract or retain qualified motivated employees as a significant risk for the Company as we operate in a highly competitive industry for talent. In approving elements of the compensation program, the Compensation Committee and the Board prefer a balancing of factors, so that no single performance metric becomes an overriding influence. For that reason, the incentive compensation program described below balances a number of metrics. Our Long-Term Incentive Program, also described below, generally provides for vesting over a multi-year period and , with respect to performance–vested shares, based on achievement of total shareholder return goals, in order to mitigate against a short-term focus at the expense of long-term results by our senior executives, including the NEOs.

Setting the Company’s Executive Compensation Levels and Pay Mix

Executive compensation is reviewed by the Compensation Committee no less frequently than annually. Compensation is expected to be based on the foregoing objectives and to include as integral components: base salary, and annual and long-term incentive-based cash and non-cash compensation. In performing its compensation reviews and making its compensation decisions regarding the compensation of the Company’s Chief Executive Officer and recommendation to the full Board regarding the compensation of the other executive officers, the Compensation Committee will conduct an ongoing review of compensation data from the peer group and the industry in general.

In establishing executive compensation, base salaries are expected to be targeted near the midpoint of a range established by peer and industry review, although adjustments are made for such things as experience, market factors or exceptional performance, among other factors. Potential total compensation, including annual incentive compensation, is expected to be at the upper range of total compensation at comparable companies if performance targets are met.

The combination of base salary, annual cash incentives and equity or equity-based awards comprises total direct compensation. In setting executive compensation, the Compensation Committee considers the aggregate compensation payable to an executive officer and the form of that compensation. The Compensation Committee seeks to achieve the appropriate balance between immediate cash rewards and long-term financial incentives for the achievement of both annual and long-term financial and non-financial objectives. The Compensation Committee may decide, as appropriate, to modify the mix of base salary, annual cash incentives and long-term equity incentives to best fit an executive officer’s specific circumstances. For example, the Compensation Committee may make the decision to award more cash and not award an equity grant. The Compensation Committee may also increase the size of equity grants to an executive officer if the total number of career equity grants does not adequately reflect the executive’s current position with the Company.

Annual cash incentive and equity incentive awards are designed to reflect progress toward company-wide financial goals and personal objectives, as well as salary grade level, and to balance rewards for short-term and long-term performance. Long-term incentive compensation will be used to reward and to encourage long-term performance and an alignment of interests between the individual, the organization and the stockholders. Long-term incentive grants will be used not only to reward prior performance, but also to retain executive officers and other employees and provide incentives for future exceptional performance. Annual cash incentives and equity incentive awards are expected to be targeted at the upper end of the range established by peer and industry review such that an individual’s total compensation may move from the median to the high end of ranges established with reference to peer data to the extent that business success makes long-term incentive awards more valuable.

In determining the allocation between cash short-term and non-cash long-term incentive compensation for executive officers, the Compensation Committee engages in an individual analysis for each executive. Factors affecting compensation decisions include:

|

(i) |

The Company’s annual performance; |

|

(ii) |

Impact of the employee’s performance on the Company’s results; |

|

(iii) |

The Company’s objective to provide total compensation that is higher than competitive levels when aggressive goals of the Company are exceeded; and |

|

(iv) |

Internal equity. |

The Compensation Committee also takes into consideration the fact that, although our officers are responsible for specific business functions, together they share responsibility for the performance of the Company. As we seek to attract and retain the best talent available, we also wish to have employees view employment at the Company as a career decision. It takes a long period of time and a significant investment to develop the experienced executive talent necessary to succeed in the oil and gas business; senior executives must have experience with all phases of the business cycle to be effective leaders. We have a very experienced executive

19

team, many members of which have been in the oil and gas industry for thirty years or more, and we believe that our future success will be enhanced by retaining these experienced employees through our compensation philosophy and practices.

We believe that the proportion of total compensation that is performance-based, and therefore “at risk,” should increase with an individual’s level of responsibility. Therefore, long-term incentive compensation grants will typically represent a larger proportion of the total compensation package as the level of responsibility of the executive increases. For the Chief Executive Officer, long-term incentive grants are typically the largest element of the total compensation package. Executive officers generally receive the same benefits as other employees, although not necessarily in the same mix or amounts.

Compensation Components

The following table summarizes the Company’s various compensation components for 2014 and the purposes and peer group benchmark level associated with each component:

|

Component |

Purpose of Component |

Key Characteristics |

Benchmark |

|

Base Salary |

Base level of compensation which is determined based on an executive’s performance, experience and tenure, as well as the competitive market for talent. |

Fixed compensation which is reviewed by the Compensation Committee annually. |

50th Percentile |

|

STI Annual Incentive Award |

Motivates executives to achieve short-term business goals and objectives which ultimately drive long-term company performance. |

At-risk compensation which is based on the achievement of annual corporate and individual goals and objectives. |

Up to 75th Percentile |

|

Time-Vested Restricted Stock |

Reinforces a strong link between executives and stockholders through stock ownership. It also functions as a highly effective retention tool by reducing the volatility of incentive awards in an unpredictable market. |

Long-term incentive award which time vests ratably over a three year period. |

Up to 75th Percentile |

|

Performance-Vested Restricted Stock |

Motivates executives to increase stockholder value creation and develop the Company for continued long-term success. Promotes a strong link between the interests of our executives and stockholders. |

At-risk compensation which is tied to the relative stock performance as compared to similar companies over a three year period. |

Up to 75th Percentile |

|

All Other Compensation |

Provides benefits intended to enhance employee health which further assists in our efforts to attract and retain qualified executives. |

Includes health and welfare plans and minimal perquisites. |

Minimal |