Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - MACERICH CO | a2224484zex-99_2.htm |

| EX-31.4 - EX-31.4 - MACERICH CO | a2224484zex-31_4.htm |

| EX-31.3 - EX-31.3 - MACERICH CO | a2224484zex-31_3.htm |

| EX-99.1 - EX-99.1 - MACERICH CO | a2224484zex-99_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014

Commission File No. 1-12504

THE MACERICH COMPANY

(Exact name of registrant as specified in its charter)

| MARYLAND (State or other jurisdiction of incorporation or organization) |

95-4448705 (I.R.S. Employer Identification Number) |

401 Wilshire Boulevard, Suite 700, Santa Monica, California 90401

(Address of principal executive office, including zip code)

Registrant's telephone number, including area code (310) 394-6000

Securities registered pursuant to Section 12(b) of the Act

| Title of each class | Name of each exchange on which registered | |

|---|---|---|

| Common Stock, $0.01 Par Value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act YES ý NO o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act YES o NO ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. YES ý NO o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ý NO o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment on to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES o NO ý

The aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant was approximately $9.3 billion as of the last business day of the registrant's most recently completed second fiscal quarter based upon the price at which the common shares were last sold on that day.

Number of shares outstanding of the registrant's common stock, as of February 20, 2015: 158,160,241 shares

DOCUMENTS INCORPORATED BY REFERENCE

The following documents (or parts thereof) are incorporated by reference into the following parts of this Form 10-K/A: None

This Amendment No. 1 to Form 10-K (this "Amendment") amends the Annual Report on Form 10-K for the fiscal year ended December 31, 2014 originally filed on February 23, 2015 (the "Original Filing") by The Macerich Company, a Maryland corporation, ("Macerich", the "Company", "we" or "us"). We are filing this Amendment to present the information required by Part III of the Form 10-K as we will not file our definitive proxy statement within 120 days of the end of our fiscal year ended December 31, 2014.

Except as described above, no other changes have been made to the Original Filing. The Original Filing continues to speak as of the date of the Original Filing, and we have not updated the disclosures contained therein to reflect any events which occurred at a date subsequent to the filing of the Original Filing.

1

Item 10. Directors, Executive Officers and Corporate Governance

The following table sets forth, as of March 31, 2015, the names, ages and positions of our executive officers and the year each became an officer.

Name

|

Age | Position | Officer Since |

|||||

|---|---|---|---|---|---|---|---|---|

Arthur M. Coppola |

63 | Chairman of the Board of Directors and Chief Executive Officer | 1993 | |||||

Dana K. Anderson |

80 | Vice Chairman of the Board of Directors | 1993 | |||||

Edward C. Coppola |

60 | President | 1993 | |||||

Thomas E. O'Hern |

59 | Senior Executive Vice President, Chief Financial Officer and Treasurer | 1993 | |||||

Thomas J. Leanse |

61 | Senior Executive Vice President, Chief Legal Officer and Secretary | 2012 | |||||

Robert D. Perlmutter |

53 | Executive Vice President, Leasing | 2012 | |||||

Randy L. Brant |

62 | Executive Vice President, Real Estate | 2001 | |||||

Eric V. Salo |

49 | Executive Vice President | 2000 | |||||

Biographical information concerning Messrs. A. Coppola, Anderson and E. Coppola is set forth below under the "Director Biographical Information."

Thomas E. O'Hern became one of our Senior Executive Vice Presidents in September 2008 and has been our Chief Financial Officer and Treasurer since July 1994. Mr. O'Hern was an Executive Vice President from December 1998 through September 2008 and served as a Senior Vice President from March 1993 to December 1998. From our formation to July 1994, he served as Chief Accounting Officer, Treasurer and Secretary. From November 1984 to March 1993, Mr. O'Hern was a Chief Financial Officer at various real estate development companies. He was also a certified public accountant with Arthur Andersen & Co. from 1978 through 1984. Mr. O'Hern is a member of the board of directors, the audit committee chairman, a member of the nominating and corporate governance committee and was formerly a member of the compensation committee of Douglas Emmett, Inc., a publicly traded REIT, and is a board member of several other non-profit philanthropic and academic organizations.

Thomas J. Leanse joined our Company on September 1, 2012 as one of our Senior Executive Vice Presidents, and has been our Chief Legal Officer and Secretary since October 1, 2012. Prior to joining our Company, Mr. Leanse was a partner at Katten Muchin Rosenman LLP from 1992 through 2012, where he specialized in the shopping center industry, representing various developers, in addition to acting as amicus curiae for the International Council of Shopping Centers. Mr. Leanse received his JD from the University of San Diego School of Law in 1978, after graduating from UC San Diego in 1975 with a BA in Political Science and a minor in Economics. He was a partner in the Los Angeles office of Pepper Hamilton & Scheetz from 1987 to 1992, and an associate and then partner at the Long Beach office of Ball, Hunt, Hart, Brown and Baerwitz. Prior to that he was employed in Chicago, Illinois at the office of the Trust Counsel for Harris Bank and was also an Assistant State's Attorney in the Cook County State's Attorney's Office. Mr. Leanse has also acted as General Counsel to the US Ski Association and the US Ski Team. Mr. Leanse is on the Board of Directors of Cedars Sinai Medical Center and was an officer of the Pacific Southwest Region of the Anti-Defamation League.

Robert D. Perlmutter joined our Company as Executive Vice President of Leasing in April 2012, directing specialty store retail leasing. Mr. Perlmutter was the managing member of Davis Street Land Company, a privately-held real estate company focused on the management, development and ownership of upscale shopping centers from 1998 until March 2012. He was the Chief Executive Officer of Heitman Retail Properties, where he supervised overall operations and growth of its retail holdings from 1990 to 1998. Mr. Perlmutter is a member of the board of trustees of Chatham Lodging Trust, a publicly traded REIT which invests in upscale extended-stay hotels and premium-branded select-service hotels. In addition, he is a member of the International Council of Shopping Centers.

2

Randy L. Brant joined our Company in 2001 as our Senior Vice President of Development Leasing and was appointed our Executive Vice President of Real Estate in December 2007 and oversees our development operations. He has over 34 years of experience in the retail industry, specializing in upscale and entertainment-driven retail developments. Before joining our Company, he was President of Gordon/Brant, LLC, an international developer specializing in entertainment-oriented retail centers known for creating the first two phases of The Forum Shops at Caesar's Palace. Mr. Brant also previously served as Vice President of Real Estate for Simon Property Group and Vice President of Leasing for Forest City Enterprises. Mr. Brant began his career with the Ernest Hahn Company, where he was manager of shopping centers and went on to become Vice President of Leasing for the company.

Eric V. Salo was appointed Executive Vice President in February 2011 and directs the areas of asset management, property management, business development and marketing. Mr. Salo joined our Company in 1987 working in the acquisitions group, served as our Senior Vice President of Strategic Planning from August 2000 to November 2005, then as a Senior Vice President of Asset Management from November 2005 to February 2011, overseeing our Company's joint venture partner relationships, real estate portfolio performance and ancillary revenue programs. Mr. Salo served as board chairman of the Cancer Support Community—West Los Angeles, a non-profit organization providing cancer support and education from January 2009 to June 2012. In addition, Mr. Salo is a member of the International Council of Shopping Centers and directs a tuition assistance program through The Seattle Foundation.

The following provides certain biographical information with respect to our directors as well as the specific experience, qualifications, attributes and skills that led our Board to conclude that each director should serve as a member of our Board of Directors. Each director has served continuously since elected.

3

CLASS I DIRECTORS

(TERMS EXPIRING 2015)

Douglas D. Abbey

Independent Director

Term Expires 2015

Director Since: 2010

Age: 65

Board Committees: Audit; Nominating and Corporate Governance

Principal Occupation and Business Experience:

Mr. Abbey is a member of the board of IHP Capital Partners, an investment firm he co-founded in 1992, which provides capital to the home building and land development industry. He is also a Co-Founder of AMB Property Corporation where he worked in various capacities during a 22 year career from 1983 to 2005. Mr. Abbey has more than 38 years of experience in commercial and residential real estate investment and development. In addition, he is a member of the board of directors of Pacific Mutual Holding Company and Pacific LifeCorp, the parent companies of Pacific Life Insurance Company, serving on the compensation and investment committees. From September 23, 2009 to April 29, 2014, Mr. Abbey was a member of the board of directors of Apollo Commercial Real Estate Finance, Inc. On July 1, 2013, Mr. Abbey was appointed chairman of Swift Real Estate Partners.

Mr. Abbey is also a member of the board of Bridge Housing Corporation, a non-profit affordable housing developer based in California, serves on the real estate committee of the University of California San Francisco Foundation and is a lecturer in finance at the Stanford Graduate School of Business. Mr. Abbey formerly served as a trustee and was the past vice chairman of the Urban Land Institute.

Key Qualifications, Experience and Attributes:

Mr. Abbey brings to our Board not only the leadership expertise and unique perspective gained from co-founding IHP Capital Partners and AMB Property Corporation, but also substantial executive experience from his various positions at AMB Property Corporation. Mr. Abbey has extensive knowledge in the areas of commercial and residential real estate investment and development which allows him to bring a wealth of knowledge and experience to Board deliberations. His experience on the boards of other public and private companies further augments his range of knowledge.

Dana K. Anderson

Director

Term Expires 2015

Director Since: 1994

Age: 80

Principal Occupation and Business Experience:

Mr. Anderson has been Vice Chairman of our Board of Directors since our formation. In addition, Mr. Anderson served as our Chief Operating Officer from our formation until December 1997. Mr. Anderson is one of our Company's founders and has been with The Macerich Group or our Company since 1966. He has 50 years of shopping center experience with The Macerich Group and our Company and over 53 years of experience in the real estate industry.

Key Qualifications, Experience and Attributes:

Mr. Anderson's long standing history with our Company and his understanding of our operations and growth throughout the years provide an important perspective to our Board. This institutional knowledge is complemented by his substantial experience in the real estate industry, specifically with respect to leasing and operational matters.

4

Stanley A. Moore

Independent Director

Term Expires 2015

Director Since: 1994

Age: 76

Board Committees: Compensation; Nominating and Corporate

Governance

Other Public Company Boards: Industrial Income Trust, Inc.

Principal Occupation and Business Experience:

Mr. Moore is Chairman of the Board and co-founder of Overton Moore Properties and served as its chief executive officer from 1973 through March 2011. Mr. Moore has been a director of Overton Moore Properties (or its predecessor) since 1973. Overton Moore Properties, which develops, owns and manages office, industrial and mixed use space, is one of the top commercial real estate development firms in Los Angeles County. In addition, he is a member of the board of directors and chairman of the investment committee and nominating and corporate governance committee of Industrial Income Trust, Inc., a public, non-traded industrial REIT. Furthermore, Mr. Moore is a board member of the Economic Resources Corporation of South Central Los Angeles and is past president of the Southern California Chapter of the National Association of Industrial and Office Parks.

Key Qualifications, Experience and Attributes:

Mr. Moore's experience as a CEO of a leading commercial real estate developer gives him a broad understanding of the operational, financial and strategic issues facing our Company. By virtue of his extensive real estate experience, he brings to our Board valuable knowledge in the areas of acquisitions, development, property management and finance.

Dr. William P. Sexton

Independent Director

Term Expires 2015

Director Since: 1994

Age: 76

Board Committees: Audit; Compensation

Principal Occupation and Business Experience:

Dr. Sexton is Vice President, Emeritus, of the University of Notre Dame and assumed this position in 2003. From 1983 through 2003, Dr. Sexton was Vice President, University Relations of the University of Notre Dame and a member of the budget and finance committees of the University where he oversaw fiscal, internal control, personnel, budget and capital matters. After serving in this role for 20 years, he returned to teaching full time in the College of Business. He is a Full Professor in the Management Department and has taught in its Executive MBA Program for 16 years. Dr. Sexton has been employed as a professor in the Management Department of the Business School at Notre Dame since 1966. Dr. Sexton also served for 10 years as chairman of the audit committee of a large privately held company.

Key Qualifications, Experience and Attributes:

Our Board values Dr. Sexton's extensive business experience and knowledge gained from his positions as both a professor and officer of the University of Notre Dame. Our Board believes Dr. Sexton's background in management, finance and education not only supplements the experiences of our other directors but also provides a different and informative viewpoint on Board matters.

5

CLASS II DIRECTORS

(TERMS EXPIRING 2016)

Arthur M. Coppola

Director

Term Expires 2016

Director Since: 1994

Age: 63

Board Committees: Executive (Chair)

Principal Occupation and Business Experience:

Mr. A. Coppola has been our Chief Executive Officer since our formation and was elected Chairman of the Board in September 2008. As Chairman of the Board and Chief Executive Officer, Mr. A. Coppola is responsible for the strategic direction and overall management of our Company. He served as our President from our formation until his election as Chairman. Mr. A. Coppola is one of our Company's founders and has over 39 years of experience in the shopping center industry, all of which has been with The Macerich Group and our Company. From 2005 through 2010, Mr. A. Coppola was a member of the board of governors or the executive committee of the National Association of Real Estate Investment Trusts, Inc. ("NAREIT"), served as the 2007 chair of the board of governors and received the 2009 NAREIT Industry Leadership Award. Mr. A. Coppola is also an attorney and a certified public accountant.

Key Qualifications, Experience and Attributes:

As Chairman and CEO, our Board values Mr. A. Coppola's strategic direction and vision which has resulted in our Company growing from a privately held real estate company to a dominant national regional mall company that is part of the S&P 500, with 51 regional and eight community/power shopping centers consisting of approximately 54 million square feet of gross leasable area. He is not only the leader of our Company but also a recognized leader within the REIT industry. Mr. A. Coppola's knowledge of our Company and the REIT industry, as well as his extensive business relationships with investors, retailers, financial institutions and peer companies, provide our Board with critical information necessary to oversee and direct the management of our Company. His role and experiences at our Company and within our industry give him unique insights into our Company's opportunities, operations and challenges.

Fred S. Hubbell

Independent Director

Term Expires 2016

Director Since: 1994

Age: 63

Board Committees: Executive; Nominating and Corporate Governance

Other Public Company Boards: Voya Financial, Inc.

Principal Occupation and Business Experience:

Mr. Hubbell was a member of the executive board and Chairman of Insurance and Asset Management Americas for ING Group, a Netherlands-based company and one of the world's largest banking, insurance and asset management companies, and served as an executive board member from May 2000 through April 2006. The executive board was the first tier leadership board of ING Group and was responsible for the management of the company. Mr. Hubbell became Chairman of Insurance and Asset Management Americas in 2004 and was previously Chair of the Executive Committees of the Americas and Asia/Pacific beginning in January 2000. Mr. Hubbell was also responsible for Nationale Nederlanden, ING Group's largest Dutch insurance company, and ING Group's asset management operations throughout Europe from May 2004 to April 2006. Mr. Hubbell elected to retire from ING

6

Group's executive board effective April 25, 2006. From January 1, 2012 through October 31, 2012, Mr. Hubbell was a senior industry advisor to ING Group on a part time basis. Mr. Hubbell was formerly Chairman, President and Chief Executive Officer of Equitable of Iowa Companies, an insurance holding company, serving as Chairman from May 1993 to October 1997, and as President and Chief Executive Officer from May 1989 to October 1997. Mr. Hubbell served as interim director of the Iowa Department of Economic Development from October 5, 2009 through January 14, 2010. On December 31, 2012, Mr. Hubbell was elected as a member of the board of directors and audit committee of Voya Financial, which became a publicly traded company on May 2, 2013 following its divestiture from ING Group. On May 31, 2013, Mr. Hubbell was elected lead director, chairman of the nominating and governance committee and a member of the compensation and benefits committee of Voya Financial. Mr. Hubbell is also an attorney.

Key Qualifications, Experience and Attributes:

Mr. Hubbell's extensive executive experience and leadership roles at both ING Group and Equitable of Iowa Companies provide our Board with an important perspective in terms of the management and operation of our Company. His expertise in management, strategic planning and operations assists our Board in reviewing our financial and business strategies as well as addressing the challenges our Company faces. Mr. Hubbell's experience at ING Group also provides our Board with a global perspective. In addition, Mr. Hubbell was chosen by our independent directors to serve as our Lead Director and he collaborates with Mr. A. Coppola on Board matters.

Mason G. Ross

Independent Director

Term Expires 2016

Director Since: 2009

Age: 71

Board Committees: Nominating and Corporate Governance (Chair)

Principal Occupation and Business Experience:

Mr. Ross spent 35 years at Northwestern Mutual Life, an industry-leading life insurance company, the final nine years of which he served as Executive Vice President and Chief Investment Officer. As Chief Investment Officer, his responsibilities included the design and administration of investment compensation systems, oversight of investment risk management, and the formation of the asset allocation strategy of the investment portfolio. During his prior 27 years at Northwestern Mutual Life, he held a variety of positions, including leading the company's real estate investment and private securities operations. During that time, he also served as a director of Robert W. Baird, Inc., a regional brokerage and investment banking firm, and the Russell Investment Group, an international investment management firm. Since retiring from Northwestern Mutual Life in 2007, he has remained active in the investment business and currently serves as a director of Schroeder Manatee Ranch Inc., a privately held real estate company and as a trustee of several large private trusts. He is the past chairman of the National Association of Real Estate Investment Managers and a former trustee of the Urban Land Institute.

Key Qualifications, Experience and Attributes:

Our Board values the over 40 years of investment experience of Mr. Ross and his extensive involvement in commercial real estate. His real estate financing expertise acquired over a 25 year period of providing real estate financing for all types of properties provides our Board with important knowledge in considering our Company's capital and liquidity needs.

Andrea M. Stephen

Independent Director

Term Expires 2016

Director Since: 2013

Age: 50

Board Committees: Compensation (Chair); Executive

Other Public Company Boards: First Capital Realty, Inc.; Boardwalk Real Estate Investment Trust

7

Principal Occupation and Business Experience:

Ms. Stephen served as Executive Vice President, Investments for The Cadillac Fairview Corporation Limited ("Cadillac Fairview"), one of North America's largest real estate companies, from October 2002 to December 2011 and as Senior Vice President, Investments for Cadillac Fairview from May 2000 to October 2002, where she was responsible for developing and executing Cadillac Fairview's investment strategy. Prior to joining Cadillac Fairview, Ms. Stephen held the position of Director, Real Estate with the Ontario Teachers' Pension Plan Board, the largest single profession pension plan in Canada, from December 1999 to May 2000, as well as various portfolio manager positions from September 1995 to December 1999. Previously, Ms. Stephen served as Director, Financial Reporting for Bramalea Centres Inc. for approximately two years and as an Audit Manager for KPMG LLP at the end of her over six year tenure. Ms. Stephen is a member of the board of directors of First Capital Realty Inc., Canada's leading owner, developer and operator of supermarket and drugstore anchored neighborhood and community shopping centers, and a member of the board of trustees, serving on the audit and compensation committees, of Boardwalk Real Estate Investment Trust, Canada's leading owner and operator of multi-family communities. Ms. Stephen also previously served on the board of directors of Multiplan Empreendimentos Imobiliários, S.A., a Brazilian real estate operating company, from June 2006 to March 2012.

Key Qualifications, Experience and Attributes:

With over 25 years in the real estate industry and extensive transactional and management experience, Ms. Stephen has a broad understanding of the operational, financial and strategic issues facing real estate companies. She brings management expertise, leadership capabilities, financial knowledge and business acumen to our Board. Her significant international investment experience also provides a global perspective as well as international relationships. In addition, her service on various boards provides valuable insight and makes her an important contributor to our Board.

CLASS III DIRECTORS

(TERMS EXPIRING 2017)

Edward C. Coppola

Director

Term Expires 2017

Director Since: 1994

Age: 60

Principal Occupation and Business Experience:

Mr. E. Coppola was elected our President in September 2008. In partnership with our Chief Executive Officer, Mr. E. Coppola oversees the strategic direction of our Company. He has broad oversight over our Company's financial and investment strategies, including our Company's key lender and investor relationships. He also oversees our acquisitions and dispositions, department store relationships and development/redevelopment projects. Mr. E. Coppola was previously an Executive Vice President from our formation through September 2004 and was our Senior Executive Vice President and Chief Investment Officer from October 2004 until his election as President. He has 38 years of shopping center experience with The Macerich Group and our Company and is one of our founders. From March 16, 2006 to February 2, 2009, Mr. E. Coppola was a member of the board of directors of Strategic Hotels & Resorts, Inc., a publicly traded REIT which owns and manages high end hotels and resorts. Mr. E. Coppola is also an attorney.

Key Qualifications, Experience and Attributes:

As President, Mr. E. Coppola provides our Board with important information about the overall conduct of our Company's business. His day to day leadership of our Company provides our Board with valuable knowledge of our operations, plans and direction. Our Board appreciates his long history and experience

8

in the shopping center industry as well as his expertise with respect to strategic and investment planning, finance, capital markets, acquisition, disposition and development matters.

Diana M. Laing

Independent Director

Term Expires 2017

Director Since: 2003

Age: 60

Board Committees: Audit (Chair)

Principal Occupation and Business Experience:

Ms. Laing is the Chief Financial Officer of American Homes 4 Rent, a publicly traded REIT focused on the acquisition, renovation, leasing and operation of single-family homes as rental properties and has served in such capacity since May 2014. From May 2004 until its merger with Parkway Properties of Orlando, Florida in December 2013, Ms. Laing was the Chief Financial Officer and Secretary of Thomas Properties Group, Inc., a publicly traded real estate operating company and institutional investment manager focused on the development, acquisition, operation and ownership of commercial properties throughout the United States. She was responsible for financial reporting, capital markets transactions and investor relations. Ms. Laing served as Chief Financial Officer of each of Triple Net Properties, LLC from January through April 2004, New Pacific Realty Corporation from December 2001 to December 2003, and Firstsource Corp. from July 2000 to May 2001. From August 1996 to July 2000, Ms. Laing was Executive Vice President, Chief Financial Officer and Treasurer of Arden Realty, Inc., a publicly traded REIT which was the largest owner and operator of commercial office properties in Southern California. From 1982 to August 1996, she served in various capacities, including Executive Vice President, Chief Financial Officer and Treasurer of Southwest Property Trust, Inc., a publicly traded multi-family REIT which owned multi-family properties throughout the southwestern United States. Ms. Laing began her career as an auditor with Arthur Andersen & Co. She serves on the advisory boards to the Dean of the Spears School of Business and the Chairman of the School of Accounting at Oklahoma State University and is a member of the Board of Governors of the Oklahoma State University Foundation.

Key Qualifications, Experience and Attributes:

Our Board believes Ms. Laing's over 32 years of real estate industry experience, with her particular expertise in finance, capital markets, strategic planning, budgeting and financial reporting, make her a valuable member of our Board. This financial and real estate experience is supplemented by her substantive public company and REIT experience which enhances her understanding of the issues facing our Company and industry. Based on her financial expertise, Ms. Laing serves as the Chairperson of our Audit Committee and has been determined by our Board to be an audit committee financial expert.

Steven L. Soboroff

Independent Director

Term Expires 2017

Director Since: 2014

Age: 66

Board Committees: Compensation; Nominating and Corporate Governance

Principal Occupation and Business Experience:

Mr. Soboroff is the President of the Los Angeles Police Commission and has served in that position since his appointment to the Board of Police Commissioners by Los Angeles Mayor Eric Garcetti in August 2013. Since 1978, he has been the managing partner of Soboroff Partners, a shopping center development and leasing company. From January 1, 2009 to April 30, 2010, he served as Chairman and CEO of Playa Vista, one of the country's most significant multi use real estate projects, and was the President from October 15, 2001 to December 31, 2008. Mr. Soboroff also was President of the Los Angeles Recreation

9

and Parks Commission from 1995 to 2001 and a member of the Los Angeles Harbor Commission from 1994 to 1995. He previously served on the board of directors of FirstFed Financial Corp. beginning in 1991 through August 6, 2010. In addition, Mr. Soboroff is a board member of several non-profit philanthropic and academic organizations.

Key Qualifications, Experience and Attributes:

Mr. Soboroff is a well-recognized business and government leader with a distinguished record of public and private accomplishments. Mr. Soboroff contributes to the mix of experience and qualifications of our Board through both his real estate and government experience and leadership. During his career in both the public and private sectors, Mr. Soboroff acquired significant financial, real estate, managerial, and public policy knowledge as well as substantial business and government relationships. Our Board values his extensive real estate knowledge and insight into retail operations, developments and strategy, and his wealth of government relations experience. As a new board member, Mr. Soboroff further provides a fresh viewpoint to our Board's deliberations.

John M. Sullivan

Director

Term Expires 2017

Director Since: 2014

Age: 54

Other Public Company Boards: Multiplan Empreendimentos Imobiliários,

S.A.; Dream Global REIT

Principal Occupation and Business Experience:

Mr. Sullivan is the President and Chief Executive Officer of Cadillac Fairview and has served in such position since January 2011. Mr. Sullivan was previously the Executive Vice President of Development of Cadillac Fairview from November 2006 to January 2011. Prior to joining Cadillac Fairview, he held positions with Brookfield Properties Corporation and Marathon Realty Company Limited. Mr. Sullivan serves on the board of directors of Multiplan Empreendimentos Imobiliários, S.A., a Brazilian real estate operating company, and is a member of the board of directors and audit committee of Dream Global REIT, an open-ended Canadian REIT focusing on international commercial real estate.

Key Qualifications, Experience and Attributes:

Our Board values Mr. Sullivan's over 25 years of extensive real estate experience and relationships which will enrich our Company and Board. Mr. Sullivan brings to our Board strong executive management expertise, leadership and financial acumen, as well as significant transactional, leasing, finance, asset management and development experience in the commercial real estate industry. As a CEO, he has a unique knowledge of the issues companies address, ranging from strategic and operational to corporate governance and risk management. In addition, Mr. Sullivan has international expertise and public company board service that augment his understanding of the commercial real estate industry and our Company. As a recently-elected board member, Mr. Sullivan further provides a new perspective to our Board deliberations.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, or "Exchange Act" requires our executive officers and directors, and persons who own more than 10% of a registered class of our equity securities, to file reports of ownership and changes in ownership with the Securities and Exchange Commission or "SEC" and the New York Stock Exchange or "NYSE." Officers, directors and greater than 10% stockholders are required by the SEC's regulations to furnish our Company with copies of all Section 16(a) forms they file. To our knowledge, based solely on our review of the copies of such reports furnished to our Company during and with respect to the fiscal year ended December 31, 2014, all Section 16(a) filing requirements applicable to our executive officers, directors and greater than 10% beneficial owners were satisfied on a timely basis, with the exception of the Form 4 filed by Mr. Soboroff upon his appointment to our Board and Mr. Anderson did not timely report exempt gifts of an aggregate of 1,470 shares to three individuals.

10

The Board has a separately-designated Audit Committee established in accordance with Section 3(a)(58)(A) and Section 10A(m) of the Exchange Act. The following table identifies the current members of the Audit Committee, its principal functions and the number of meetings held in 2014.

| Name of Committee and Current Members |

Committee Functions |

Number of Meetings |

||

|---|---|---|---|---|

| Audit: Diana M. Laing, Chair* Douglas D. Abbey Dr. William P. Sexton * Audit Committee Financial Expert |

• appoints, evaluates, approves the compensation of, and, where appropriate, replaces our independent registered public accountants • reviews our financial statements with management and our independent registered public accountants • reviews and approves with our independent registered public accountants the scope and results of the audit engagement • pre-approves audit and permissible non-audit services provided by our independent registered public accountants • reviews the independence and qualifications of our independent registered public accountants • reviews the adequacy of our internal accounting controls and legal and regulatory compliance • reviews and approves related-party transactions in accordance with our Related Party Transaction Policies and Procedures as described below |

8 | ||

Code of Business Conduct and Ethics

The Company has adopted a Code of Business Conduct and Ethics that provides principles of conduct and ethics for its directors, officers and employees. This Code complies with the requirements of the Sarbanes-Oxley Act of 2002 and applicable rules of the SEC and the NYSE. In addition, the Company has adopted a Code of Ethics for CEO and Senior Financial Officers which supplements the Code of Business Conduct and Ethics applicable to all employees and complies with the additional requirements of the Sarbanes-Oxley Act of 2002 and applicable rules of the SEC for those officers. To the extent required by applicable rules of the SEC and the NYSE, the Company intends to promptly disclose future amendments to certain provisions of these Codes or waivers of such provisions granted to directors and executive officers, including the Company's principal executive officer, principal financial officer, principal accounting officer or persons performing similar functions, on the Company's website at www.macerich.com under "Investing—Corporate Governance-Code of Ethics." Each of these Codes of Conduct is available on the Company's website at www.macerich.com under "Investing—Corporate Governance."

Procedures for Recommending Director Nominees

During 2014, there were no material changes to the procedures described in the Company's proxy statement relating to the 2014 Annual Meeting of Stockholders by which stockholders may recommend director nominees to the Company.

11

Item 11. Executive Compensation

Compensation of Non-Employee Directors

Our non-employee directors are compensated for their services according to an arrangement authorized by our Board of Directors and recommended by the Compensation Committee. The Compensation Committee generally reviews director compensation annually. A Board member who is also an employee of our Company or a subsidiary does not receive compensation for service as a director. Messrs. A. Coppola, Anderson and E. Coppola are the only directors who are also employees of our Company or a subsidiary. Mr. Sullivan receives no compensation from our Company as a director because his employer's policies do not allow it, but he is reimbursed for his reasonable expenses.

In August 2013, Cook & Co. conducted a competitive review of our non-employee director compensation program and suggested changes for the Compensation Committee's consideration. Based on the recommendations by the Compensation Committee, our Board of Directors revised certain aspects of our non-employee director compensation, effective August 7, 2013. The following sets forth the compensation structure that became effective as of August 7, 2013 and was in place during 2014:

| Annual Retainer for Service on our Board | $60,000 | |

| Annual Equity Award for Service on our Board | $110,000 of restricted stock units based upon the closing price of our common stock, $0.01 par value per share, referred to as "Common Stock", on the grant date, which is in March of each year. The restricted stock units are granted under our 2003 Incentive Plan and have a one-year vesting period. | |

| Annual Retainer for Lead Director | $30,000 | |

| Annual Retainers for Chairs of Audit, Compensation, and Nominating & Corporate Governance Committees | Audit: $32,500 Compensation: $32,500 Nominating & Corp. Governance: $25,000 |

|

| Annual Retainer for Non-Chair Committee Membership | $12,500 | |

| Expenses | The reasonable expenses incurred by each director (including employee directors) in connection with the performance of their duties are reimbursed. | |

Non-Employee Director Equity Award Programs

In addition, our Director Phantom Stock Plan offers our non-employee directors the opportunity to defer cash compensation otherwise payable over a three-year period and to receive that compensation (to the extent that it is actually earned by service during that period) in cash or in shares of Common Stock as elected by the director, after termination of the director's service or on a specified payment date. Such compensation includes the annual cash retainers payable to our non-employee directors. Substantially all of our current non-employee directors during his or her term of service elected to receive all or a portion of such compensation in Common Stock. Deferred amounts are generally credited as stock units at the beginning of the applicable deferral period based on the present value of such deferred compensation divided by the average fair market value of our Common Stock for the preceding 10 trading days. Stock unit balances are credited with additional stock units as dividend equivalents and are ultimately paid out in shares of our Common Stock on a one-for-one basis. A maximum of 500,000 shares of our Common Stock may be issued in total under our Director Phantom Stock Plan, subject to certain customary adjustments for stock splits, stock dividends and similar events. The vesting of the stock units is accelerated in case of the death or disability of a director or, upon or after a change of control event, the termination of his or her services as a director.

12

Our Company has a deferral program for the equity compensation of our non-employee directors which allows them to defer the receipt of all or a portion of their restricted stock unit awards and receive the underlying Common Stock after termination of service or a specified payment date. Any dividends payable with respect to those deferred restricted stock units will also be deferred and will be paid in accordance with their payment election. The deferred dividend equivalents may be paid in cash or converted into additional restricted stock units and ultimately paid in shares of our Common Stock on a one-to-one basis. The vesting of the restricted stock units is accelerated in case of the death or disability of a director or upon a change of control event.

2014 Non-Employee Director Compensation

The following table summarizes the compensation paid, awarded or earned with respect to each of our non-employee directors during 2014. Mr. Soboroff joined our Board on January 29, 2014. Mr. Sullivan joined our Board on November 14, 2014, but receives no compensation from our Company as a director because his employer's policies do not allow it.

Name

|

Fees Earned or Paid in Cash ($)(1) |

Stock Awards ($)(2) |

Option Awards ($) |

Non-Equity Incentive Plan Compensation ($) |

Change in Pension Value and Nonqualified Deferred Compensation Earnings |

All Other Compensation ($) |

Total ($) |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Douglas D. Abbey |

85,000 | 110,000 | — | — | — | — | 195,000 | |||||||||||||||

Fred S. Hubbell |

134,178 | 110,000 | — | — | — | — | 244,178 | |||||||||||||||

Diana M. Laing |

99,178 | 110,000 | — | — | — | — | 209,178 | |||||||||||||||

Stanley A. Moore |

111,678 | 110,000 | — | — | — | — | 221,678 | |||||||||||||||

Mason G. Ross |

85,000 | 110,000 | — | — | — | — | 195,000 | |||||||||||||||

Dr. William P. Sexton |

85,000 | 110,000 | — | — | — | — | 195,000 | |||||||||||||||

Steven L. Soboroff |

66,926 | 137,790 | — | — | — | — | 204,716 | |||||||||||||||

Andrea M. Stephen |

85,000 | 110,000 | — | — | — | — | 195,000 | |||||||||||||||

John M. Sullivan |

— | — | — | — | — | — | — | |||||||||||||||

- (1)

- Pursuant

to our Director Phantom Stock Plan, each director receiving compensation, except Messrs. Ross and Soboroff, elected to defer fully his or

her annual cash retainers for 2014 and to receive such compensation in Common Stock at a future date. Mr. Ross elected to defer 50% of his annual retainer for 2014. Therefore, for 2014

compensation, Messrs. Abbey, Hubbell, Moore and Ross, Mses. Laing and Stephen and Dr. Sexton were credited with 3,176, 3,991, 3,510, 1,326, 1,950, 2,518 and 2,653 stock units,

respectively, which vested during 2014 as their service was provided. The amount shown for Mr. Soboroff represents the prorated share of his director fees beginning January 29, 2014, the

date he was elected as a director.

- (2)

- The

amounts shown represent the grant date fair value computed in accordance with Statement of Financial Accounting Standards Bulletin ASC Topic 718

referred to as "FASB ASC Topic 718," of restricted stock awards granted under our 2003 Incentive Plan. Any estimated forfeitures were excluded from the determination of these amounts and there were no

forfeitures of stock awards during 2014 by our directors. Assumptions used in the calculation of these amounts are set forth in footnote 18 to our audited financial statements for the fiscal year

ended December 31, 2014 included in the Original Filing.

Except for Mr. Sullivan, each of our non-employee directors received 1,825 restricted stock units on March 7, 2014 under our 2003 Incentive Plan. The closing price of our Common Stock on that date was $60.25. Mr. Soboroff also received 500 restricted stock units upon joining our Board on January 29, 2014. The closing price of our Common Stock on that date was $55.58.

13

As of December 31, 2014, our non-employee directors held the following number of unvested shares of restricted stock, unpaid phantom stock units and unvested restricted stock units:

Name

|

Unvested Shares of Restricted Stock (#) |

Phantom Stock Units (#) |

Unvested Restricted Stock Units (#) |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

Douglas D. Abbey |

1,265 | 9,165 | 1,825 | |||||||

Fred S. Hubbell |

1,265 | 58,042 | 1,825 | |||||||

Diana M. Laing |

1,265 | 25,030 | 1,825 | |||||||

Stanley A. Moore |

1,265 | 59,965 | 1,825 | |||||||

Mason G. Ross |

1,265 | 7,247 | 1,825 | |||||||

Dr. William P. Sexton |

1,265 | 57,227 | 1,825 | |||||||

Steven L. Soboroff |

— | — | 2,325 | |||||||

Andrea M. Stephen |

1,140 | 4,116 | 1,825 | |||||||

John M. Sullivan |

— | — | — | |||||||

The Compensation Committee of the Board of Directors of The Macerich Company, a Maryland corporation, has reviewed and discussed the Compensation Discussion and Analysis in this Amendment with management. Based on such review and discussion, the Compensation Committee recommended to our Board of Directors that the Compensation Discussion and Analysis be included in our Annual Report on Form 10-K for the year ended December 31, 2014.

| The Compensation Committee | ||

| Andrea M. Stephen, Chair Stanley A. Moore Dr. William P. Sexton Steven L. Soboroff |

14

COMPENSATION DISCUSSION AND ANALYSIS

Our objective is to closely align executive compensation with the creation of stockholder value, through a balanced focus on both short-term and long-term performance and a substantial emphasis on total stockholder return. We believe our executive compensation policies and practices appropriately align the interests of our executives with those of our stockholders through a combination of base salary, annual incentive compensation awards and long-term incentive equity awards with a heavy emphasis on performance-based equity awards. In this section, the "Committee" refers to the Compensation Committee of our Board, unless the context otherwise provides.

To better understand our compensation decisions, it is helpful to supplement the discussion of our executive compensation program with an overview of the strong performance of our Company over a sustained period of time. We design our program to reward consistent financial and operating performance, with a specific focus on creating stockholder value over the long-term.

2014 was a year of major progress and accomplishments for our Company on all fronts. As a result of our strong leadership, we continued to seize opportunities and further strengthen our Company and our growth prospects.

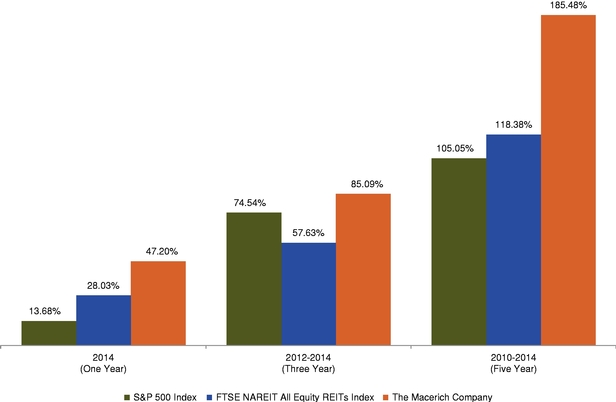

Our Company's one-year, three-year and five-year total stockholder return outperformed the FTSE NAREIT All Equity REITs Index and the S&P 500 Index over all three periods. Our Company's total stockholder return was 185% over the five years ended December 31, 2014, representing a compounded annual return of 23%.

Cumulative Total Stockholder Returns

15

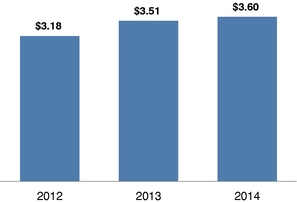

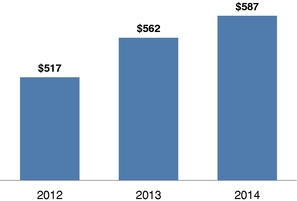

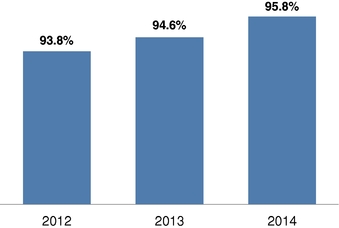

Over the past three years funds from operations ("FFO") per share-diluted,(1) sales per square foot and occupancy rates of our regional shopping center portfolio have grown steadily.(2)

| FFO Per Share-Diluted(1)(2) | Sales Per Square Foot(2) | |

|

|

|

Occupancy at Year-End(2) |

||

|

||

- (1)

- FFO

per share-diluted represents funds from operations per share on a diluted basis, excluding the gain or loss on early extinguishment of

debt and adjusting for certain items in 2012 related to Shoppingtown Mall, Valley View Center and Prescott Gateway. For the definition of FFO per share-diluted and a reconciliation of FFO per

share-diluted to net income per share attributable to common stockholders-diluted, see Exhibit 99.1 of this Amendment and "Management's Discussion and Analysis of Financial Condition and Results of

Operations—Funds from Operations and Adjusted Funds from Operations" in the Original Filing.

- (2)

- For additional information about these financial metrics, see the Original Filing.

16

Our 2014 Fiscal Year Highlights

The Committee believes that 2014 was a very productive year for our Company and that our executive officers were instrumental in achieving those results. The following are some of our Company's most notable accomplishments during 2014:

- •

- In November 2014, we acquired from our joint venture partner, Ontario Teachers' Pension Plan Board, its 49% interest in five top super

regional Centers in exchange for Common Stock. We now have 100% ownership of these highly productive, market-dominant Centers, two of which are among our Company's top five most productive assets on a

sales per square foot basis.

- •

- In October 2014, we acquired from our joint venture partner a 40% interest in Fashion Outlets of Chicago and now own 100% of this

recently-developed, and highly productive, 529,000 square foot center. As of December 31, 2014, this center was 94.4% occupied with annual tenant sales of $651 per square foot.

- •

- In July 2014, we formed a joint venture partnership with Pennsylvania Real Estate Investment Trust to redevelop The Gallery, which

consists of approximately 1,400,000 square feet of retail and office space in downtown Philadelphia. The Gallery is strategically positioned where mass transit, tourism, the residential population and

employment base converge. This joint venture redevelopment will focus on creating Philadelphia's only transit-oriented, retail-anchored, multi-use property offering accessible luxury retailing and

artisan food experiences.

- •

- In November 2014, we formed a 50/50 joint venture with Lennar Corporation, one of the nation's leading homebuilders, to develop a

500,000 square foot urban outlet project that will anchor a new community at Candlestick Point in San Francisco. This development will be one of the largest urban mixed-use projects in the United

States.

- •

- We continued to strengthen our balance sheet in 2014 and believe we have the strongest balance sheet in our Company's history. As of

December 31, 2014, our debt to EBITDA ratio was a healthy 7.2x, the weighted average term of our debt was 5.2 years, and our debt to total market capitalization was the lowest in our

history at 33.4%.

- •

- In December 2014 we increased our quarterly cash dividend by 4.8% from $0.62 to $0.65 per share.

- •

- Our Company was recognized for its Centers—a few of our acknowledgements were: Fashion Outlets of Chicago received the 2014 Best Factory Outlet Centre in the World MAPIC award and was honored as ICSC's 2014 U.S. Design and Development Gold recipient. Additionally, our Company received the 2014 Retail "Leader in the Light" Award from NAREIT, honoring superior and sustained energy practices, and was designated a Global Real Estate Sustainability Benchmark Green Star 2014, an important measure of sustainability performance for real estate portfolios around the world.

Our 2014 Fiscal Year in Review

Under Mr. A. Coppola's leadership, our executive team delivered the following achievements with respect to key quantitative and qualitative corporate goals set by the Committee for 2014 in consultation with Mr. A. Coppola and our other executives. Target and high performance levels were generally established for the quantitative goals and the Committee considered, among other factors, the actual achievements against each goal in its decision regarding the annual incentive bonuses for the named executive officers for 2014.

17

Operational Goals and Achievements

| Goal: | Achieve our FFO per share-diluted guidance of $3.50 to $3.60. | |

Achievement: |

FFO per share-diluted, excluding the loss on early extinguishment of debt, was $3.60 in 2014, at the high-end of our initial guidance and above the target performance level set by the Committee of $3.55. These positive results were fueled by strong fundamentals in our portfolio: solid tenant sales growth, good releasing spreads, continued same center net operating income growth and significant occupancy gains. |

|

Goal: |

Achieve same center net operating income growth of 2.75% to 4.25%. |

|

Achievement: |

Same center net operating income growth was 4.24% in 2014, above the target performance level set by the Committee of 3.50%. |

Leasing Goals and Achievements

| Goal: | Deliver double-digit releasing spreads from our high quality "A" Centers. | |

Achievement: |

The releasing spreads of our "A" Centers were 14.4% for 2014 and the releasing spreads for our entire portfolio were 22%. With respect to our "A" Centers, this well exceeded the target performance level set by the Committee and nearly met the high performance level of 15%. |

|

Goal: |

Obtain overall occupancy level at our Centers of at least 95%. |

|

Achievement: |

Our overall occupancy was 95.8% at December 31, 2014, a 120 basis point increase from 94.6% at December 31, 2013. This exceeded the target performance level set by the Committee and was our highest occupancy level in a decade. |

|

Goal: |

Convert temporary tenants to permanent tenants. |

|

Achievement: |

Temporary occupancy at December 31, 2014 decreased by 120 basis points from December 31, 2013. The Committee's high performance level for this goal was exceeded. |

|

Goal: |

Achieve pre-established leasing milestones at identified properties. |

|

Achievement: |

• Tysons Corner Center: signed leases for approximately 80% of the office tower. |

|

|

• Los Cerritos Center: executed leases to add a new state-of-the-art Harkins Theatres and Dick's Sporting Goods as junior anchors. |

|

|

• Santa Monica Place: received final city approval to add a 48,000 square foot state-of-the-art ArcLight Cinemas to the third-level entertainment and dining deck (construction underway, target completion Fall 2015). |

|

|

• Scottsdale Fashion Square: commenced expansion and executed leases with Dick's Sporting Goods and Harkins Theatres. |

|

These achievements, which met or exceeded the Committee's expectations for these goals, demonstrate our Company's longstanding ability to add significant value to our well-situated properties. |

18

Development Goals and Achievements

| Goal: | Acquire at least one new outlet center opportunity. | |

Achievement: |

We formed two joint ventures, which are prime examples of our successful outlet business strategy: |

|

|

• a redevelopment joint venture with Pennsylvania Real Estate Investment Trust for approximately 1,400,000 square feet of retail and office space at The Gallery in downtown Philadelphia. The Gallery is strategically positioned where mass transit, tourism, the residential population and employment base converge. |

|

|

• a development joint venture with Lennar Corporation, one of the nation's leading homebuilders, for a 500,000 square foot urban outlet project that will anchor a new community at Candlestick Point in San Francisco. |

|

These achievements exceeded the Committee's expectations for this goal. |

||

Goal: |

Achieve pre-established development milestones for identified projects. |

|

Achievement: |

• Tysons Corner Center: continued construction according to plan of a 430 unit luxury residential tower and 300 room Hyatt Regency hotel, which are part of the 1,400,000 square foot expansion of Tysons Corner Center. |

|

|

• Fashion Outlets of Niagara Falls USA: completed 175,000 square foot expansion, which opened in October 2014 on schedule and on budget. At December 31, 2014, we had signed leases for approximately 82% of the expansion, in excess of our 75% target. |

|

|

• Broadway Plaza: as part of a 235,000 square foot expansion, demolished two older inefficient parking structures and completed ahead of schedule a five-level parking deck. |

|

|

• Green Acres Mall: received city approval for a 335,000 square foot expansion, which exceeded our target. At December 31, 2014, we had executed letters of intent with respect to over 40% of the space. |

|

|

• Kings Plaza: developed a remerchandising plan for the Sears space and are discussing opportunities with prospective retail users. |

|

We achieved or exceeded the Committee's expectations for these goals. |

Strategic Goals and Achievements

| Goal: | Make significant progress regarding alternate plans for our JCPenney and Sears locations. | |

Achievement: |

We reduced the number, and related risk, of JCPenney and Sears stores, including working with Sears to lease a portion of their space at Danbury Fair Mall and Freehold Raceway Mall to Primark at no cost to us. We are working with Sears to further rationalize their footprints at several additional locations and expect announcements regarding this during 2015. These achievements met the Committee's expectations for this goal. |

|

Goal: |

Make progress on the repositioning of two of four identified "B" assets. |

|

Achievement: |

The progress made met the Committee's expectations for this goal. |

|

Goal: |

Complete dispositions of at least $250 million of non-core assets. |

|

Achievement: |

We continued execution of our proven strategic plan of transforming our portfolio through opportunistic dispositions of non-core assets and recycling the proceeds into our highly value-creative redevelopment pipeline. Dispositions during 2014 included interests in five Centers resulting in our pro rata share of the sales proceeds of approximately $360 million and net proceeds of approximately $326 million. These achievements exceeded the Committee's expectations for this goal. |

19

Principal Components of our Executive Compensation Program and Key Compensation Decisions for Fiscal Year 2014

Based on our 2014 fiscal year performance, highlights and achievements described above, the compensation decisions made by the Committee for our named executive officers for 2014 demonstrate a close link between pay and performance. The Committee believes strongly in linking compensation to performance: the annual incentive awards (which for 2014 were entirely in the form of equity awards) were approximately 33% of total compensation for our named executive officers, and the earned value of 75% of the long-term incentive equity awards depended on our 2014 total stockholder return relative to the total stockholder return of all publicly-traded equity REITs (the "Equity Peer REITs"). As used in this Compensation Discussion and Analysis section, "total compensation" refers to the named executive officer's base salary, the annual incentive award for 2014 performance and the grant date fair value (as determined for accounting purposes) of the long-term incentive equity awards granted during 2014.

20

The following chart summarizes, for each component of our executive compensation program, the objectives and key features and the compensation decisions made by the Committee for our named executive officers for 2014.

| Compensation Component |

Compensation Objectives and Key Features |

Key Compensation Decisions for Fiscal Year 2014 |

||

|---|---|---|---|---|

Base Salary |

• Relatively small, fixed cash pay based on the scope and complexity of each position, the officer's experience, competitive pay levels and general economic conditions. |

• There were no changes in salary in 2014 for the named executive officers. |

||

|

|

|

||

Annual Incentive Bonus |

• Variable cash and/or equity compensation that provides incentive and reward to our executive officers based on the Committee's assessment of performance, both corporate and individual. |

• Strong corporate and individual performance led the Committee to approve the following annual incentive awards, paid entirely in the form of fully-vested LTIP Units. The award amounts reflect the approximate midpoint between the target and high performance level for each named executive officer. |

||

|

• Measures of corporate performance principally focused on the achievement of operational, leasing, development and strategic goals, as described above. |

LTIP Unit |

||

Long-Term Incentive Equity Program |

• Variable equity compensation component that provides incentive for our executive officers to take actions that contribute to the creation of stockholder value by aligning the compensation earned with our relative total stockholder return performance. |

• For 2014, the Committee granted performance-based (75% of the total award) and service-based (25% of the total award) LTIP Units to our named executive officers. |

||

|

• Performance-based LTIP Units vested at 0% to 150% of target (linear function) based on our total stockholder return over the performance period compared to the Equity Peer REITs. For half of these performance-based LTIP Units, vesting was also subject to achievement of 3% absolute total stockholder return to further incentivize the creation of value for our stockholders. |

• The performance-based LTIP Units vested at 150% of the target number of units, based on the percentile ranking of our Company's total stockholder return for 2014 relative to the Equity Peer REITs, as well as our absolute total stockholder return level for the year. |

||

|

• Executive officers are not entitled to full distributions until performance-based LTIP Units vest. |

|||

|

• Vested performance-based LTIP Units must be retained for two years after vesting. |

• Even though these performance-based LTIP Units have vested, they must be retained by our executives until at least December 31, 2016. |

||

|

• Service-based LTIP Units promote retention and stability of our management team. |

• Service-based LTIP Units vest in annual installments over a three-year period. |

||

|

• LTIP Units are units in our "The Macerich Partnership, L.P., or our Operating Partnership" that are convertible into shares of our Common Stock under certain circumstances. |

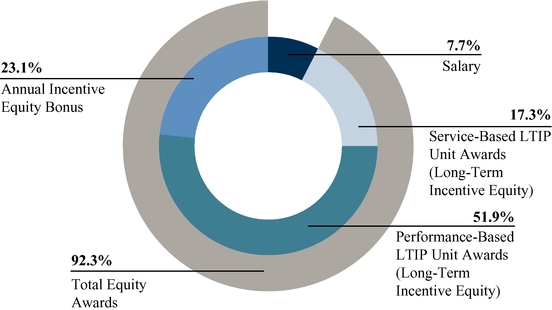

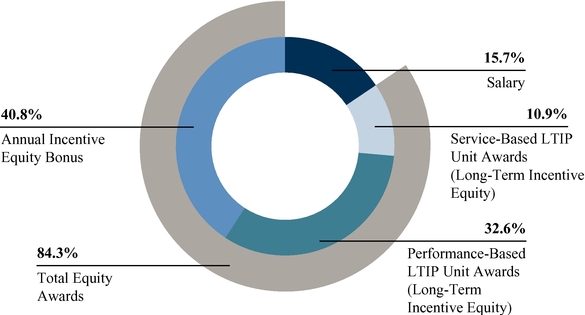

The following diagrams present our named executive officers' 2014 actual pay mix of total compensation as more fully described on pages 30-31 of this Amendment and highlight the substantial link between our named executive

21

officers' compensation and performance. The diagrams further illustrate the strong alignment of our named executive officers' interests with our stockholders' interests through our emphasis on equity award compensation for our named executive officers.

Chief Executive Officer

2014 Pay Mix

Other Named Executive Officers

2014 Pay Mix

22

Specific Compensation and Corporate Governance Features

Several elements of our program are designed to more strongly align our executive compensation with long-term stockholder interests, as described below. Our executive compensation program received overwhelming support at our annual meeting of stockholders in 2014 with approximately 98% of the votes cast in favor of our say-on-pay proposal.

Limited Employment Agreements. We have no employment agreements, except for our agreement with Mr. Leanse, our Senior Executive Vice President, Chief Legal Officer and Secretary, which terminates on December 31, 2015.

Elimination of Excise Tax Gross-Up Provisions. Significant progress has been made to eliminate all excise tax gross-up provisions from our management continuity agreements which provide change of control benefits. On March 15, 2013, in response to Mr. A. Coppola's offer, our Company and Mr. A. Coppola terminated his management continuity agreement. The management continuity agreements of Messrs. E. Coppola and O'Hern were not extended by our Company and, therefore, will terminate in December 2015. The termination of these agreements was primarily based on the desire of Mr. A. Coppola and the Committee to eliminate all change of control excise tax gross-ups consistent with good corporate governance practices. Upon termination of Messrs. E. Coppola and O'Hern's management continuity agreements, all excise tax gross-up provisions will have been eliminated.

Stock Ownership Guidelines. We have robust stock ownership policies for our named executive officers and directors and each of these individuals that are subject to them is in compliance with those policies. See "Stock Ownership Policies" on page 31 of this Amendment.

Clawback Policy. Our Board adopted a clawback policy that allows us to recover incentive compensation paid to our executive officers if the compensation was based on achieving financial results that were subsequently restated and the amount of the executive officer's incentive compensation would have been lower had the financial results been properly reported.

Anti-Hedging Policy. Our Board also adopted a policy prohibiting all of our directors, officers and employees from engaging in any hedging or monetization transactions that are designed to hedge or offset any decrease in the market value of our securities. This policy also prohibits short sales and the purchase and sale of publicly traded options of our Company.

Anti-Pledging Policy. In addition, our Board adopted a policy (a) prohibiting all our directors and executive officers from pledging our securities if they are unable to meet our stock ownership requirements without reference to such pledged shares and (b) recommending that our directors and executive officers not pledge our securities.

23

Our Executive Compensation Program

Inputs to Compensation Decisions

Role of the Compensation Committee. The Committee reviews and approves the compensation for our executive officers, reviews our overall compensation structure and philosophy and administers certain of our employee benefit and stock plans, with authority to authorize awards under our incentive plans. The Committee currently consists of four independent directors, Ms. Stephen, Messrs. Moore and Soboroff and Dr. Sexton.

Role of Compensation Consultant. The Committee may, in its sole discretion, retain or obtain the advice of any compensation consultant as it deems necessary to assist in the evaluation of director or executive officer compensation and is directly responsible for the appointment, compensation and oversight of the work of any such compensation consultant. As requested by the Committee, our compensation consultant periodically provides reviews of the various elements of our compensation programs, including evolving compensation trends and market survey data.

The Committee has retained Cook & Co. as its independent compensation consultant with respect to our compensation programs. Cook & Co.'s role is to evaluate the existing executive and non-employee director compensation programs, assess the design and competitive positioning of these programs, and make recommendations for change, as appropriate. The Committee has considered the independence of Cook & Co. and determined that its engagement of Cook & Co. does not raise any conflicts of interest with our Company or any of our directors or executive officers. Cook & Co. provides no other consulting services to our Company, our executive officers or directors.

Role of Data for Peer Companies. In 2013, Cook & Co. conducted a review of the design and structure of our executive compensation, including a competitive analysis of pay opportunities for our named executive officers. As part of Cook & Co.'s competitive review, the Committee selected the following U.S. publicly traded REITs to be included in a peer group to evaluate our executive compensation decisions for 2014. These REITs were selected because they are considered comparable to our Company primarily in terms of size, but also with consideration of property focus. We feel that size, as measured by total capitalization, and where applicable a focus on the retail sector, best depict a complexity and breadth of operations, as well as the amount of capital and assets managed, similar to our Company.

| Alexandria Real Estate Equities, Inc. | Kilroy Realty Corporation | |

| AvalonBay Communities, Inc. | Kimco Realty Corporation | |

| Boston Properties, Inc. | Prologis, Inc. | |

| Digital Realty Trust, Inc. | Regency Centers Corporation | |

| Douglas Emmett, Inc. | Simon Property Group, Inc. | |

| Equity Residential | SL Green Realty Corp. | |

| Federal Realty Investment Trust | Tanger Factory Outlets | |

| General Growth Properties, Inc. | Taubman Centers, Inc. | |

| HCP, Inc. | Ventas, Inc. | |

| Host Hotels & Resorts, Inc. | Vornado Realty Trust |

This is the same peer group used by the Committee for 2013. The Committee reviews compensation practices at peer companies to inform itself and aid it in its decision-making process so it can establish compensation programs that it believes are reasonably competitive. The Committee, however, does not set compensation components to meet specific benchmarks. Instead the Committee focuses on a balance of annual and long-term compensation, which is heavily weighted toward "at risk" performance-based compensation. While the Committee does review our executive compensation program relative to the peer group to help perform its subjective analysis, peer group data is not used as the determining factor in setting compensation because each officer's role and experience is unique and actual compensation for comparable officers at the peer companies may be the result of a year of over-performance or under-performance. The Committee believes that ultimately the decision as to appropriate

24

compensation for a particular officer should be made based on a full review of that officer's and our Company's performance.

Role of CEO. Mr. A. Coppola generally attends the Committee meetings (excluding any executive sessions) and provides his analysis and recommendations with respect to our Company's executive compensation program, including the compensation for our other named executive officers. Given his knowledge of our executive officers and our business, the Committee believes that Mr. A. Coppola's input is an integral and vital part of the compensation process and, therefore, values his recommendations. The Committee, however, is responsible for approving the compensation for all of our named executive officers.

Objectives of the Executive Compensation Program

Our executive compensation program is designed to attract, retain and reward experienced, highly motivated executives who are capable of leading our Company in executing our ambitious growth strategy. The Committee believes strongly in linking compensation to corporate performance: the annual incentive awards (which for 2014 were entirely in the form of equity awards) are primarily based on overall corporate performance and represented approximately 33% of total compensation for our named executive officers, and the earned value of 75% of the long-term incentive equity awards depends on our 2014 total stockholder return relative to the Equity Peer REITs. The Committee also recognizes individual performance in making its executive compensation decisions. The Committee believes this is the best program overall to attract, motivate and retain highly skilled executives whose performance and contributions benefit our Company and our stockholders. The Committee believes it utilizes the right blend of cash and equity awards to provide appropriate incentives for executives while aligning their interests with our stockholders and encouraging their long-term commitment to our Company. The Committee does not have a strict policy to allocate a specific portion of compensation to our named executive officers between either cash and non-cash or short-term and long-term compensation. Instead, the Committee considers how each component promotes retention and/or motivates performance by the executive.

Our executive compensation program includes the following three principal elements:

Base Salary. The executive's base salary is intended to create a minimum level of fixed compensation based on the experience, position and responsibilities of the executive. The base salary of each named executive officer is reviewed by the Committee on an annual basis and is subject to discretionary increases that generally are based on, in the subjective judgment of the Committee, competitive pay levels, general economic conditions and/or other factors deemed relevant by the Committee.

Annual Incentive Compensation Program. Our Company has an annual incentive compensation program for executive officers, other senior officers and key employees under which bonuses, which may be paid in the form of cash and/or equity awards, are awarded by the Committee to reflect corporate and individual performance during the prior calendar year. The Committee awards a level of annual incentive compensation that corresponds to the level of corporate and individual performance that the Committee determines was achieved for the year. The purpose of this annual incentive compensation program is to motivate and reward executives for performance that benefits our Company and our stockholders and to recognize the contributions of our key employees.

Corporate Performance. The annual incentive compensation award is primarily based on overall corporate performance, which for 2014 principally focused on the achievement of operational, leasing, development and strategic goals, as described above under "Executive Summary—Our 2014 Fiscal Year in Review." No particular weighting is assigned by the Committee to any performance measure for purposes of determining award amounts.

Individual Performance. The annual incentive compensation award is also based on the Committee's evaluation of the individual executive's performance and, therefore, provides executives with an incentive

25

- •

- 75% performance-based LTIP Units, which could be earned from 0% to 150% of the target number of units awarded based on

our total stockholder return performance for 2014 relative to the Equity Peer REITs. Half of the 2014 performance-based LTIP Units also required our absolute total stockholder return in 2014 to be at

least 3% for the LTIP Units to be earned. (See pages 37-39 of this Amendment for a more detailed description of the material terms of the performance-based LTIP Units as well as Exhibit 99.2

for the list of the Equity Peer REITs.)

- •

- 25% service-based LTIP Units, which vest in equal annual installments over a three-year period to promote retention and further alignment of our executives' interests with those of our stockholders.

for superior individual performance. The Committee evaluates the individual performance of our named executive officers and assesses the accomplishments and progress of each individual after generally reviewing their goals regarding their respective areas of responsibility.

Award Amounts. The actual annual incentive compensation awarded to each named executive officer is determined by the Committee in its discretion based on its assessment of corporate and individual performance as described above. For corporate and individual performance, the Committee determines the level of performance that has been achieved for the year, ranging from significantly below target up to and exceeding the high performance level.