Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - INTEGRATED FREIGHT Corp | ex31x2.htm |

| EX-32.2 - EXHIBIT 32.2 - INTEGRATED FREIGHT Corp | ex32x2.htm |

| EX-31.1 - EXHIBIT 31.1 - INTEGRATED FREIGHT Corp | ex31x1.htm |

| EX-32.1 - EXHIBIT 32.1 - INTEGRATED FREIGHT Corp | ex32x1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

☑

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934: For the fiscal year ended March 31, 2014

|

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934:

|

Commission file number: 000–14273

INTEGRATED FREIGHT CORPORATION

(Exact name of registrant as specified in its charter)

|

FLORIDA

|

|

84–0868815

|

|

State or other jurisdiction of

incorporation or organization

|

|

I.R.S. Employer

Identification No.

|

|

100 Main Street North 208

Southbury, Connecticut

|

|

06488

|

|

(Address of principal executive offices)

|

|

(Zip code)

|

Issuer’s telephone number: (203) 628-7142

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act:

|

Title of each class:

|

Name of Exchange on which registered:

|

||

|

Common Stock, $0.001 par value per share

|

(None)

|

||

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

Yes

☐

|

No

☑

|

|

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

|

Yes

☐

|

No

☑

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

Yes

☐

|

No

☑

|

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

Yes

☐

|

No

☑

|

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

|

☑

|

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

|

|

Non-accelerated filer

|

☐

|

Smaller reporting company

|

☑

|

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

|

Yes

☐

|

No

☑

|

|||

|

Aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter ended September 30, 2013 was approximately $55,780.

|

|

The number of shares of the registrant’s common stock outstanding at April 24, 2015 was: 434,580,251 shares

|

Table of Contents

|

PART I

|

5

|

|

ITEM 1. BUSINESS.

|

5

|

|

ITEM 1A. RISK FACTORS.

|

11

|

|

ITEM 1B. UNRESOLVED STAFF COMMENTS.

|

17

|

|

ITEM 2. PROPERTIES.

|

17

|

|

ITEM 3. LEGAL PROCEEDINGS.

|

18

|

|

ITEM 4. MINE SAFETY DISCLOSURES.

|

19

|

|

PART II

|

20

|

|

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

|

20

|

|

ITEM 6. SELECTED FINANCIAL DATA

|

21

|

|

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

|

22

|

|

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

|

30

|

|

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

|

30

|

|

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

30 |

|

ITEM 9A. CONTROLS AND PROCEDURES.

|

31 |

|

PART III

|

32

|

|

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE.

|

32

|

|

ITEM 11. EXECUTIVE COMPENSATION.

|

34

|

|

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS.

|

35

|

|

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE.

|

36

|

|

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES.

|

36

|

|

PART IV

|

37

|

|

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES.

|

37

|

|

SIGNATURES

|

38

|

3

USE OF PRONOUNS

“We”, “our” and “us", as used in this annual report, refer to Integrated Freight Corporation, and our wholly owned subsidiaries. The” Company”, as used in the notes to our financial statements, refers to Integrated Freight Corporation and subsidiaries on a consolidated basis. “You” as used in this annual report, refers to the reader.

DOCUMENTS INCORPORATED BY REFERENCE

We have not incorporated any documents by reference.

SUMMARIES OF REFERENCED DOCUMENTS

This annual report on Form 10-K contains references to, summaries of and selected information from agreements and other documents. These agreements and documents are not incorporated by reference; but, they are filed as exhibits to this annual report or to other reports we have filed with the U.S. Securities and Exchange Commission. Whenever we make reference in this annual report to any of our agreements and other documents, the references are not necessarily complete. The summaries of and selected information from those agreements and other documents are qualified in their entirety by reference to the full agreements and other documents. You may obtain the full text of the agreements and documents from the Public Reference Section of or online from the Commission. See “Where You Can Find Agreements And Other Documents Referred To In This Annual Report” for instructions as to how to access and obtain this information.

WHERE YOU CAN FIND AGREEMENTS AND OTHER DOCUMENTS REFERRED TO IN THIS ANNUAL REPORT

We file reports with the U.S. Securities and Exchange Commission pursuant to Section 15(d) of the Securities Exchange Act of 1934. You may read and copy any reports and other materials we have filed with the Commission at the Commission’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330. The Commission maintains an Internet site at which you may obtain all reports, proxy and information statements, and other information that we file with the Commission. The address of the Commission’s web site is http://www.sec.gov. Under “Forms and Filings”, select “Search for Company Filings”.

FORWARD-LOOKING STATEMENTS

This annual report on Form 10–K and the information incorporated by reference, if any, includes “forward–looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange Act of 1934, as amended. We intend the forward–looking statements to be covered by the safe harbor provisions for forward–looking statements in these sections.

This annual report on Form 10–K contains forward-looking statements that involve risks and uncertainties. We use words such as “project,” “believe,” “anticipate,” “plan,” “expect,” “estimate,” “intend,” “should,” “would,” “could,” “will,” or “may,” or other such words, verbs in the future tense and words and phrases that convey similar meaning and uncertainty of future events or outcomes to identify these forward-looking statements. There are a number of important factors beyond our control that could cause actual results to differ materially from the results anticipated by these forward-looking statements. While we make these forward–looking statements based on various factors and derived using numerous assumptions, you have no assurance the factors and assumptions will prove to be materially accurate when the events they anticipate actually occur in the future.

These important factors include those that we discuss in this annual report under the caption “Risk Factors”, as well as elsewhere in this annual report. You should read these factors and the other cautionary statements made in this annual report as being applicable to all related forward-looking statements wherever they appear in this annual report. If one or more of these factors materialize, or if any underlying assumptions prove incorrect, our actual results, performance or achievements may vary materially from any future results, performance or achievements expressed or implied by these forward-looking statements. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

4

PART I

ITEM 1. BUSINESS.

Our corporate and business history.

We have and have had the following wholly owned subsidiaries, during the periods indicated:

|

·

|

Integrated Freight Corporation, a Florida corporation, (“Original IFC”) between December 3, 2009, when we acquired a controlling interest in original IFC, and December 23, 2009, when we merged Original IFC into us.

|

|

·

|

Morris Transportation, Inc., an Arkansas corporation, beginning September 1, 2008, when we acquired a controlling interest in Original IFC. Original IFC purchased all of Morris Transportation’s common stock as of September 1, 2008.

|

|

·

|

Smith Systems Transportation, Inc., a Nebraska corporation, beginning September 1, 2008, when we acquired a controlling interest in Original IFC. Original IFC purchased all of Smith System’s common stock as of September 1, 2008.

|

|

·

|

Triple C Transport, Inc., a Nebraska corporation, beginning as of May 5, 2010, when we purchased all of its common stock, and June 30, 2012 when we sold Triple C Transport.

|

|

·

|

Cross Creek Trucking, Inc., an Oregon corporation, beginning April 1, 2011, when we purchased all of its common stock, and June 30, 2012 when we sold Cross Creek Trucking.

|

|

·

|

Integrated Freight Services, a Florida corporation, beginning April 1, 2011, when we formed the Company and began operations, and June 30, 2012 when we sold Integrated Freight Services.

|

The address of our principal executive office is 100 Main Street North, 208, Southbury, CT 06488 and our telephone number is (203) 628-7142.

We were incorporated as Douglas County Industries, Inc. in Colorado in 1981. We underwent several name changes prior to 1997, our name at that time being DCX, Inc. In 1997, we acquired all of the outstanding shares of what is now PlanGraphics, Inc. headquartered in Frankfort, Kentucky and in which we have no interest. In 1998, we changed our name to Integrated Spatial Information Solutions, Inc. from DCX, Inc. In 2002, we changed our name to PlanGraphics, Inc. from Integrated Spatial Information Solutions, Inc. On August 18, 2010, we changed our name to Integrated Freight Corporation when we changed our corporate domicile to Florida from Colorado. We have been continuously engaged in a business since inception in 1981 and have never been a shell company, as defined in the regulations under the federal securities laws.

Original IFC was incorporated as Integrated Freight Systems, Inc. in Florida on May 13, 2008 by Paul A. Henley, its founder. Original IFC changed its name to Integrated Freight Corporation on July 27, 2009. Original IFC was founded for the purpose of acquiring operating motor freight companies. We operate the following companies:

|

Company Name

|

Year Established

|

|

Acquisition Date

|

|

|

|

|

|

|

|

|

Morris Transportation, Inc.

|

1998

|

|

As of December 23, 2009

|

|

|

Smith Systems Transportation, Inc.

|

1992

|

|

As of December 23, 2009

|

|

In February 2011, we incorporated Integrated Freight Services, Inc. to operate as a freight brokerage company. We sold Cross Creek Trucking, Triple C Transport, and Integrated Freight Services to Deep South Capital effective June 30, 2012.

Although we may eventually consolidate some operational functions of these subsidiaries, such as insurance, fuel and tire purchasing, we are operating the two remaining subsidiaries as independent companies under the management of their founders and stockholders from whom we purchased them. Such operations are currently being conducted pursuant to the terms of Exhibit “B” to an Engagement Agreement for Consulting Services with Fuselier Consulting LLC.

5

Overview of Our Truck Transportation Business

We are a holding company with two operating motor freight carriers, providing truck load service throughout the forty-eight contiguous United States. We do not specialize in any specific types of freight or commodities. We carry dry freight and certain hazardous materials (“hazmat”) including hazardous waste. We provide long-haul, regional and local service to our customers. During parts of the fiscal year ended March 31, 2014, we also transported refrigerated freight. We have discontinued our refrigerated freight operations with the discontinuance of operations by Cross Creek Trucking and Triple C Transport.

Trucking Industry Background

Subsequent to the recession of 2008-2009, the trucking industry has staged a significant but difficult comeback. According to data from the American Trucking Associations Freight Tonnage Index and the Cass Information Systems Linehaul Rate Index (Supply Chain Digest, July 12, 2012), the decline in trucking volume and freight rates began with the recession in mid-2008. Total trucking shipment volume tracked with the recession by bottoming out in mid-2009 and recovering steadily through 2011 along with the economy. However, base freight rates, not including fuel surcharges or other adjustments, continued their downward slide until April 2010. Since that time, freight rates have recovered all of the ground lost during the recession and then some through the end of 2011--about 15%--from the bottom of the recession. It should be noted that the bulk of the freight demand and price rebound came in the last 2-3 months of 2011 which is believed to be attributable to end of year inventory and holiday shopping business.

In 2012 freight volumes were up approximately twenty percent through the end of May over the low point of the recession in mid-2009. However, according to the ATA Freight Index, both volume and rates were flat on a year-to- date basis. This reflects the generally consistent reports of another potential slowdown in the economy.

The effect and timing of the recession on the trucking industry was profound. In addition to the precipitous drop in freight volume, carriers had to contend with dramatically rising fuel prices which, unlike previous diesel price hikes, did not spike but remained at extraordinarily high levels. This was compounded further by new diesel engine emissions regulations promulgated by the U.S. Environmental Protection Agency that drove new truck prices to record high levels according to the ATA. Not surprisingly, thousands of motor carriers of all sizes, and in particular smaller carriers, ceased operations. Many carriers who did survive did so by laying off truck drivers, a practice that the chronically capacity-short industry had not seen in decades. Thousands of qualified truck drivers left the industry permanently.

We believe the aftermath of the recession and the subsequent, albeit slow, recovery has created a substantial opportunity. The capacity shortage has enabled carriers to increase market rates further while excess diesel costs are being offset by fuel surcharges. Access to debt and equity capital remains difficult; particularly for small to medium sized motor carriers. As a result, we believe that there are multiple small carriers serving defensible niche markets that would be a good strategic "fit" with our business model. In addition to healthy organic growth, we intend to acquire other motor carriers whose freight lanes and operational specialties, such as our present hazardous waste segment, are compatible and mutually supportable. We expect to be able to improve customer service and reduce operating costs by centralizing key administrative functions such as accounting, human resources, billing and collections. Additional savings will be realized through operating improvements as well as bulk purchasing practices related to fuel, tires, insurance, and maintenance. This strategy is highly dependent upon our ability to obtain suitable acquisition financing. We have experienced difficulty obtaining such financing and there is no assurance that we will be able to secure acquisition financing in the future.

6

Our Markets

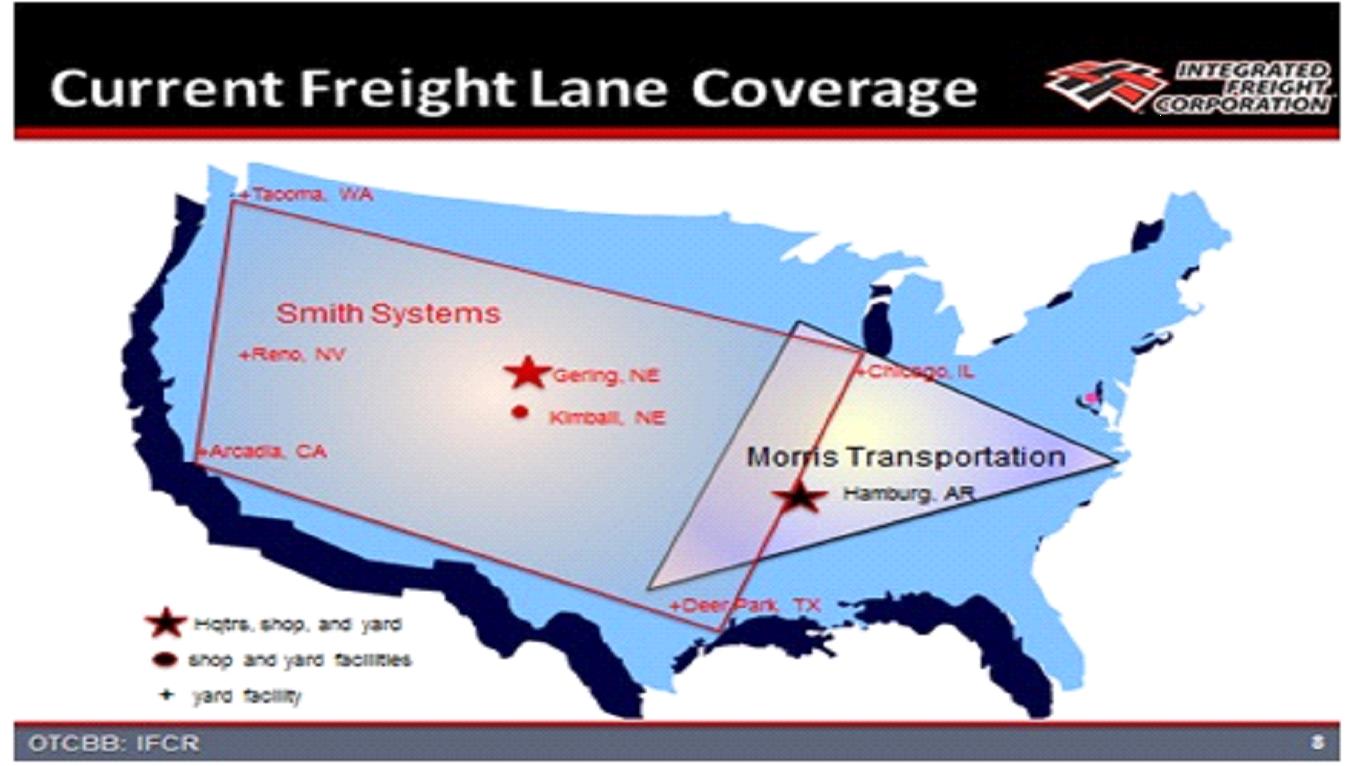

Historically, we have operated in well-established geographic traffic lanes or routes. These lanes are defined by our customers’ distribution patterns. Our dry van and hazardous materials subsidiaries operate in well-defined regional areas and, as a result, have approximate lengths of haul typical of one to two days of travel. Although the subsidiaries have operations ranging from coast to coast, they each serve relatively dense, frequently traveled lanes. Although the bulk of our capacity is composed of employee drivers, both subsidiaries are able to expand their customer service offerings with independent contractor “surge” capacity.

*A yard facility, or drop yard, is a temporary or semi-permanent location we rent to store trailers when not in use between pick-ups and deliveries. Typically, we rent yard facilities as needed in terminal facilities of other motor freight carriers, which provide security.

Our Customers and Marketing

We serve approximately 125 customers on a regular basis. Like most truckload carriers, we do not have contracts with any of these customers. Instead, we have long-standing relationships with most of them which include fixed pricing terms on a per mile or fixed point-to-point basis.

The following table presents information regarding the percentage-of-revenue concentration of the business with our customers.

|

Four customers

|

Up to 34%

|

|

All other customers

|

66% or more

|

The following table presents information regarding the average length of our trips.

|

Longest haul (overnight)

|

2,225 miles

|

|

Shortest haul

|

21 miles

|

|

Average haul

|

683 miles

|

7

All of the freight we hauled in fiscal year 2014 is dry van and hazmat freight. The following table presents information regarding the approximate percentage makeup of the freight we haul.

|

Forest and paper products

|

32%

|

|

Hazmat and hazwaste

|

45%

|

|

Non-Haz waste

|

3%

|

|

All other freight

|

20%

|

Marketing

Our sales and marketing force currently consists of two individuals. We have no formal marketing plan at the present time and, instead, have a direct sales process with selected shippers. We attend selected relevant trade shows and trade association meetings, and seek to maintain good relations with our existing customers.

Our People

We believe our employees are our most important asset. The table below presents information about our employees, other than drivers.

|

Fleet technicians

|

3

|

|

|

Dispatch

|

7

|

|

|

Sales

|

2

|

|

|

Office

|

6

|

|

|

Administrative and Executive

|

4

|

|

|

Total non-driver Employees

|

22

|

We also employ several persons in administrative and executive capacities on a part-time basis. None of our employees are represented by a collective bargaining unit. We consider relations with our employees to be good. We offer basic health insurance coverage to employees.

Our Drivers

The following table presents information about our drivers.

|

Drivers – company

|

81

|

|

Drivers – independent contractors

|

13

|

|

Total – all drivers

|

94

|

We believe that maintaining a safe and productive professional driver group is essential to providing excellent customer service and achieving profitability. All of our drivers must have three years of verifiable driving experience, a hazmat endorsement (if hauling hazmat), no major violations in the previous thirty-six months, and must comply with all requirements of employment by federal Department of Transportation and applicable state laws.

We select drivers, including independent contractors, using our specific guidelines for safety records, driving experience, and personal evaluations. We maintain stringent screening, training, and testing procedures for our drivers to reduce the potential for accidents and the corresponding costs of insurance and claims. We train new drivers in all phases of our policies and operations, as well as in safety techniques and fuel-efficient operation of the equipment. All new drivers also must pass DOT required tests prior to assignment to a vehicle.

We primarily pay company-employed drivers a fixed rate per mile. The rate increases based on length of service. Drivers also are eligible for bonuses based upon safe, efficient driving. We pay independent contractors on a fixed rate per mile. Independent contractors pay for their own fuel, insurance, maintenance, and repairs.

8

Competition in the trucking industry for qualified drivers is normally intense. Our operations have been impacted, and from time-to-time we have experienced under-utilization of equipment and increased expense, as a result of a shortage of qualified drivers. We place a high priority on the recruitment and retention of an adequate supply of qualified drivers. Our average annual turn-over rate is less than fifty percent compared to an industry average of over one ninety percent as published in The Journal of Commerce, April 1, 2015. Low driver turnover avoids costly repetitive recruiting and training efforts, promotes a culture of safety, and offers customers better overall service.

Our Operations

We currently conduct all of our freight transportation operations, including dispatch and accounting functions, from the facilities of our operating subsidiaries. During fiscal year 2014 we continued using the legacy information management systems and personnel that were employed when our operating subsidiaries were acquired. These arrangements produce overlaps and duplications in facilities, office systems and personnel. We believe that these operating arrangements provide less than optimal results and controls.

Our Revenue Equipment

The following table presents information regarding the mix of our revenue producing equipment.

|

Power units (tractors) – sleeper (83 company owned and 13 independent contractors)

|

96

|

|

|

|

|

|

|

Trailers

|

|

|

|

|

Flatbed

|

4

|

|

|

Dry van

|

230

|

|

|

Refrigerated

|

30

|

|

|

Other specialized

|

10

|

|

|

Tanker

|

4

|

|

Total – all types of trailers

|

278

|

|

The average age of our power units is approximately four years. Our power units include Mack, Freightliner and Volvo vehicles. Both subsidiaries also make use of full-service lease vehicles secured from a national vendor. This blend of equipment capacity offers the best overall equipment cost in terms of acquisition, operation, and maintenance costs. We plan to replace our power units at approximately four to five years of age. The average age of our trailers is approximately nine years. We maintain all of our revenue producing equipment in good order and repair. We believe we have an optimal tractor to trailer ratio based upon our current and anticipated customer activity.

Diesel Fuel Availability and Cost

Our operations are heavily dependent upon the use of diesel fuel. The price and availability of diesel fuel can vary and are subject to political, economic, and market factors that are beyond our control. Fuel prices have fluctuated dramatically and quickly at various times since early 2008. Prices remain high based on historical standards and can be expected to increase over the long term with increased demand for truck transportation in a recovering economy. We actively manage our fuel costs with volume purchasing arrangements with national fuel centers that allow our drivers to purchase fuel at a discount while in transit. Approximately eighty-five percent of our fuel purchases were made at contracted locations.

Among the greatest challenges presented by high and relatively unstable diesel fuel prices is monitoring and maintaining our fuel costs and insuring that the fuel surcharge levels are adequate to recapture incremental costs. We monitor the weekly U.S. Department of Energy regional and national diesel fuel pricing information and regulate our fuel surcharge levels accordingly. In addition, customer service representatives and operations personnel have been trained to take into account the cost of fuel (to include all empty miles) during the process of accepting and booking all shipments.

9

The federal fuel surcharge program cushions our exposure to increased fuel prices. This program has enabled us to pass through most long-term increases in fuel prices and related taxes to customers in the form of fuel surcharges. The fuel surcharge, which is adjusted weekly based upon US Energy Information Agency data, enables us to recover a substantial portion of fuel cost increases that occur from time to time above our base fuel cost. All fuel surcharges are based on US Department of Energy posted national averages. As of March 31, 2014 and, to date, we had no derivative financial instruments to reduce our exposure to fuel price fluctuations.

Our Competition and Industry

Trucks provide transportation services to virtually every industry operating in the United States and generally offer higher levels of reliability and faster transit times than other surface transportation options. Trucks hauled sixty-nine percent of all freight and took in eighty-one percent of all freight transportation revenue in 2013, according to American Trucking Association. The transportation industry is highly competitive on the basis of both price and service. The trucking industry is comprised principally of two types of motor carriers: truckload and less-than-truckload generally identified as LTL. Truckload carriers generally provide an entire trailer to one customer from origin to destination. LTL carriers pick up multiple shipments from multiple customers on a single truck and then route those shipments through service centers, where freight may be transferred to other trucks with similar delivery destinations. All of our business is truckload service.

The surface freight transportation market in which we operate is frequently referred to as highly fragmented and competitive. There are an estimated 172,000 transportation and warehousing companies in the US, according to the National Cooperative Freight Research Program’s 2011 report. Even the largest motor freight companies haul a small percentage of the total freight. The following table presents information regarding the estimated percentage of freight hauled by the largest trucking companies compared to all other trucking companies.

|

Ten largest trucking companies

|

10.7%

|

|

All other trucking companies

|

89.3%

|

|

*Transport Topics 2014 Top 100 Survey

|

According to the American Trucking Association’s June 2011 issue of Trucklines, “Trucking serves as a barometer of the U.S. economy, representing sixty-seven percent of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled nine billion tons of freight in 2010. Motor carriers collected $563.4 billion, or eighty-one percent of total revenue earned by all transport modes.”

Competition in the motor freight industry is based primarily on service (including on-time pickup and delivery), price, equipment availability and business relationships. We believe that we are able to compete effectively in our markets by providing high-quality and timely service at competitive prices. We believe our relationships with our customers are good. We compete with smaller and several larger transportation service providers. Some of the largest truckload carriers, including JB Hunt Transport Services, Inc., C.R. England, Inc. and Knight Transportation, Inc., may have more equipment, a broader coverage network and a wider range of services than we have. They also have greater financial resources and, in general, the ability to reduce prices to gain business, especially during times of reduced growth rates in the economy. This could potentially limit our ability to maintain or increase prices, and could also limit our growth in shipments and tonnage in the same markets. However, we will continue to execute our strategy of confining our primary sales and operations efforts to defensible, niche markets (hazardous waste, specialty papers, etc.) as opposed to generic, high volume freight segments.

We believe that we do not compete with transportation by air, train, barge or ship, which we believe are not options for our existing customers.

10

Regulation

Our operations as a for-hire motor freight carrier are subject to regulation by the U.S. Department of Transportation (USDOT) and its agency, the Federal Motor Carrier Safety Administration (FMCSA), and certain business is also subject to state rules and regulations. These agencies exercise broad powers over our business, generally governing such activities as authorization to engage in motor carrier operations, safety and insurance requirements. The FMCSA periodically conducts reviews and audits to ensure our compliance with all federal safety requirements, and we report certain accident and other information to the FMCSA.

Our company drivers and independent contractor drivers also must comply with the safety and fitness regulations promulgated by the FMCSA, including those relating to drug and alcohol testing and hours-of-service. Drivers may drive up to eleven hours within a fourteen-hour non-extendable window from the start of the workday, following at least ten consecutive hours off duty. Further, drivers may drive up to a total of seventy hours in any eight consecutive days. However, motor freight carriers and drivers may restart calculations of the seventy hour on-duty limit after the driver has at least thirty-four consecutive hours off duty.

We are also subject to various environmental laws and regulations dealing with the handling of hazardous materials, air emissions from our vehicles and facilities, engine idling, and discharge and retention of storm water. These regulations have not had a significant impact on our operations or financial results and we do not expect a negative impact in the future

ITEM 1A, RISK FACTORS.

We have recently experienced a change in our senior management, which limits your ability to judge our performance under new management.

On August 2, 2012, we entered into a consulting agreement with Fuselier Consulting LLC and employed David Fuselier, the principal of Fuselier Consulting, as our Chief Executive Officer. Mr. Fuselier also is one of our directors and serves as Chairman of the Board

Recent improvements in the motor freight industry may hinder or prevent our acquisition of additional trucking companies.

The motor freight industry, as a whole, has experienced an increased demand for trucks and an improvement in revenues, as our general economy appears to be recovering from the most recent recessionary period (American Trucking Associations and Cass Information, July 2014) While the growth in freight demand has been relatively flat from mid-2011 through 2013, freight tonnage was up over twenty percent relative to tonnages at the bottom of the recession in mid-2009. Although not as robust an economic recovery as many have hoped for, the economy seems to be slowly recovering. Through the first half of 2014 cargo volumes are trending upward. Moreover, because of the industry’s overall capacity constraint, prices have trended upward in early 2014, as well. If these trends continue, the financial viability of motor freight carriers who have survived the recession will likely improve and may decrease their interest in being acquired. Our acquisition and growth strategy has been based in part on depressed values for motor freight carriers and a desire to sell based on poorer than historical financial performance. Without these incentives, we may find it more difficult to locate trucking companies with an interest in being acquired, or if they have such an interest, being acquired for consideration that fits our financial model

Our recent experience with two acquisitions may hinder future acquisitions.

Subsequent to our acquisitions of Cross Creek Trucking and Triple C Transport, both ceased operations and have been sold. Our lack of success in maintaining and expanding the business of these two subsidiaries may discourage owners of desirable acquisition targets from considering a sale of their companies to us. Our growth will be hindered if we cannot make additional acquisitions.

11

We have experienced difficulty in combining and consolidating the management and operations of our acquired companies which has had a material adverse impact on our operations and financial performance, as well as on our future acquisitions, if any.

We have purchased our operating subsidiaries and expect any additional subsidiaries we purchase to be made from the founders and management of the acquired companies, all of whom have been responsible for their own businesses and methods of operations as independent business owners. While these individuals will continue to be responsible entirely or to a lesser degree for the continuing operations of our operating subsidiaries, we intend to centralize and standardize many areas of operations. We have had limited success in consolidating operating functions between our two subsidiaries. We may be able to develop a cohesive corporate culture in the future. Our inability to successfully combine and consolidate the policies, procedures and operations of our subsidiaries can be expected to have a material adverse effect on our business and prospects, financial and otherwise.

Our information management systems are diverse, may prove inadequate and may be difficult to integrate or replace.

We depend upon our information management systems for many aspects of our business. Each operating subsidiary and each company we acquire will have its own information management system with which its employees are acquainted. None of these systems are adequate to our consolidated operations and may not be compatible with a centralized information management system. We expect to require additional software to initially integrate existing systems or to ultimately replace these diverse systems. Switching to new information management systems is often difficult, resulting in disruption, delays and lost productivity, which could impact our dispatching, collections and other operations. Our business will be materially and adversely affected if our information management systems are disrupted or if we are unable to improve, upgrade, integrate, expand or replace our systems as we continue to execute our growth strategy. We anticipate a need to make substantial ongoing investments in our management information systems in order to properly and efficiently consolidate the operations of our acquired subsidiaries.

Our management information systems are subject to certain risks that we cannot control.

Our management information systems, including dispatching and accounting systems, are dependent upon third-party software, global communications providers, telephone systems and other aspects of technology and Internet infrastructure that are susceptible to failure. Our management information systems is susceptible to outages, computer viruses, break-ins and similar disruptions that may inhibit our ability to provide services to our customers and the ability of our customers to access our systems. This may result in the loss of customers or a reduction in demand for our services.

If we are unable to successfully execute our growth strategy, our business and future results of operations may suffer.

Our growth strategy includes the acquisition of additional motor freight companies to increase revenues, to selectively expand our geographic footprint and to broaden the scope of our service offerings. If we are unable to acquire additional motor freight companies at prices that meet our financial model, our growth will be limited to expanding sales and reducing expenses in our existing subsidiaries. In connection with our growth strategy, we may purchase additional equipment, expand and upgrade service centers, hire additional personnel and increase our sales and marketing efforts.

Our growth strategy exposes us to a number of risks, including the following:

|

·

|

Geographic expansion and acquisitions require start-up costs that could expose us to temporary losses;

|

|

·

|

Growth and geographic expansion is dependent on the availability of freight and customer needs. Shortages of suitable real estate that accommodates both customers’ and carriers’ needs may limit our geographic expansion and might cause congestion in our service center network, which could result in increased operating expenses;

|

|

·

|

Growth may strain our management, capital resources, information systems and customer service;

|

|

·

|

Hiring new employees may increase training costs and may result in temporary inefficiencies until those employees become proficient in their jobs;

|

12

|

·

|

Expanding our service offerings may require us to enter into new markets and encounter new competitive challenges;

|

|

·

|

Growth through acquisition could require us to temporarily match existing freight rates of the acquiree’s markets, which may be lower than the rates that we would typically charge for our services; and

|

|

·

|

We may be unable to obtain financing of the cash portion of an acquisition price or to provide a working capital infusion for an acquisition.

|

We have no assurance we will overcome the risks associated with our growth. If we fail to overcome these risks, we may not be able to make additional acquisitions, realize additional revenue or profits from our efforts, we may incur additional expenses and therefore our financial position and results of operations could be materially and adversely affected.

We operate in a highly competitive and fragmented industry, and our business will suffer if we are unable to adequately address potential downward pricing pressures and other factors that may adversely affect our operations and profitability.

We compete with many other truckload carriers of varying size that provide dry-van and temperature-sensitive service of varying sizes and, to a lesser extent, with less-than-truckload carriers, air freight, railroads and other transportation companies, many of which have more equipment, a wider range of services and greater capital resources than we do or have other competitive advantages. We expect to experience difficulty in competing with larger companies. Numerous other competitive factors could impair our ability to maintain our revenues and achieve profitability. These factors include, but are not limited to, the following:

|

·

|

We compete with many other transportation service providers of varying sizes, some of which may have more equipment, a broader coverage network, a wider range of services, greater capital resources or have other competitive advantages;

|

|

·

|

Some of our competitors periodically reduce their prices to gain business, especially during times of reduced growth rates in the economy, which may limit our ability to maintain or increase prices or maintain revenue growth;

|

|

·

|

Many customers reduce the number of carriers they use by selecting “core carriers,” as approved transportation service providers, and in some instances we may not be selected;

|

|

·

|

Many customers periodically accept bids from multiple carriers for their shipping needs, and this process may depress prices or result in the loss of some business to competitors;

|

|

·

|

The trend towards consolidation in the ground transportation industry may create other large carriers with greater financial resources and other competitive advantages relating to their size;

|

|

·

|

Advances in technology require increased investments to remain competitive, and our customers may not be willing to accept higher prices to cover the cost of these investments; and

|

|

·

|

Competition from non-asset-based logistics and freight brokerage companies may adversely affect our customer relationships and pricing policies.

|

If our employees were to unionize, our operating costs would increase and our ability to compete would be impaired.

None of our employees are currently represented under a collective bargaining agreement. From time to time there may be efforts to organize our employees. There is no assurance that our employees will not unionize in the future, particularly if legislation is passed that facilitates unionization, such as the Employee Free Choice Act. The unionization of our employees could have a material adverse effect on our business, financial condition and results of operations because:

|

· Some shippers have indicated that they intend to limit their use of unionized trucking companies because of the threat of strikes and other work stoppages;

|

|

· Restrictive work rules could hamper our efforts to improve and sustain operating efficiency;

|

|

· Restrictive work rules could impair our service reputation and limit our ability to provide next-day services;

|

|

· A strike or work stoppage would negatively impact our profitability and could damage customer and employee relationships; and

|

|

· An election and bargaining process could divert management’s time and attention from our overall objectives and impose significant expenses.

|

13

Insurance and claims expenses could significantly reduce our profitability.

We are exposed to claims related to cargo loss and damage, property, damage, personal injury, workers’ compensation, long-term disability and group health. We have insurance coverage with third-party insurance carriers, but retain or self-insure a portion of the risk associated with these claims. If the number or severity of claims increases, or we are required to accrue or pay additional amounts because the claims prove to be more severe than our original assessment, our operating results would be adversely affected. Insurance companies may require us to obtain letters of credit to collateralize our self-insured retention. If these requirements increase, our borrowing capacity could be adversely affected. Our future insurance and claims expense might exceed historical levels, which could reduce our earnings. We expect our growth strategy to require a periodic reassessment or our insurance strategy, including self-insurance of a greater portion of our claims exposure resulting from workers’ compensation, auto liability, general liability, cargo and property damage claims, as well as employees’ health insurance under pending federal legislation, which we are unable to predict. We may also become responsible for our legal expenses relating to such claims. With growth, we will be required to periodically evaluate and adjust our claims reserves to reflect our experience. However, ultimate results may differ from our estimates, which could result in losses over our reserved amounts. We maintain insurance above the amounts for which we self-insure with licensed insurance carriers. Although we believe the aggregate insurance limits should be sufficient to cover reasonably expected claims, it is possible that one or more claims could exceed our aggregate coverage limits. Insurance carriers have raised premiums for many businesses, including trucking companies. As a result, our insurance and claims expense could increase, or we could raise our self-insured retention when our policies are renewed. If these expenses increase, or if we experience a claim in excess of our coverage limits, or we experience a claim for which coverage is not provided, results of our operations and financial condition could be materially and adversely affected.

Our customers and suppliers’ business may be slow to recover from the most recent downturn in the world wide economy and disruption of financial markets. We cannot predict the impact on the national and worldwide economy of an economic downturn.

Our business is dependent on a number of general economic and business factors that may have a materially adverse effect on our results of operations, many of which are beyond our control, table terms, because of the disruptions to the capital and credit markets. These customers represent a greater potential for bad debt losses, which may require us to increase our reserve for bad debt. Economic conditions resulting in bankruptcies of one or more of our large customers could have a significant impact on our financial position, results of operations or liquidity in particular year or quarter. Our suppliers’ business levels have also been and may continue to be adversely affected by current economic conditions or financial constraints, which could lead to disruptions in the supply and availability of equipment, parts and services critical to our operations. A significant interruption in our normal supply chain could disrupt our operations, increase our costs and negatively impact our ability to serve our customers.

We may be adversely impacted by fluctuations in the price and availability of diesel fuel.

We require large amounts of diesel fuel to operate our tractors and to power the temperature-control units on our trailers. Fuel is one of our largest operating expenses. Fuel prices tend to fluctuate and prices and availability of all petroleum products are subject to political, economic and market factors that are beyond our control. We do not hedge against the risk of diesel fuel price increases. We depend primarily on fuel surcharges, auxiliary power units for our tractors, volume purchasing arrangements with truck stop chains and bulk purchases of fuel at our terminals to control and recover our fuel expenses. We have no assurance that we will be able to collect fuel surcharges or enter into volume purchase agreements in the future. An increase in diesel fuel prices or diesel fuel taxes, or any change in federal or state regulations that results in such an increase, could have a material adverse effect on our operating results, unless the increase is offset by increases in freight rates or fuel surcharges charged to our customers. Historically, we have been able to offset significant increases in diesel fuel prices through fuel surcharges to our customers, and we were able to minimize the negative impact on our profitability in fiscal 2011 through 2012 that resulted from the rapid and significant increase to the cost of diesel fuel. Depending on the base rate and fuel surcharge levels agreed upon by individual shippers, a rapid and significant decline in the cost of diesel fuel could also have a material adverse effect on our operating results. We continuously monitor the components of our pricing, including base freight rates and fuel surcharges, and address individual account profitability issues with our customers when necessary. While we have historically been able to adjust our pricing to offset changes to the cost of diesel fuel, through changes to base rates and/or fuel surcharges, we cannot be certain that we will be able to do so in the future. The absence of meaningful fuel price protection through these measures, fluctuations in fuel prices, or a shortage of diesel fuel, could materially and adversely affect our results of operations.

14

Our operations are subject to various environmental laws and regulations, the violation of which could result in substantial fines or penalties.

We are subject to various federal, state and local environmental laws and regulations dealing with the handling and transportation of hazardous materials (“hazmat”) and waste (“hazwaste”) (which accounts for approximately twenty percent of our current business). We operate in industrial areas, where truck terminals and other industrial activities are located, and where groundwater or other forms of environmental contamination have occurred. Our operations involve the risks of fuel spillage or seepage, environmental damage and hazardous waste disposal, among others. If a spill or other accident involving fuel, oil or hazardous substances occurs, or if we are found to be in violation of applicable laws or regulations, it could have a material adverse effect on our business and operating results. One of our subsidiaries specializes in transport of hazardous materials and waste. If we should fail to comply with applicable environmental laws and regulations, we could be subject to substantial fines or penalties, to civil and criminal liability and to loss of our licenses to transport the hazardous materials and waste. Under certain environmental laws, we could also be held responsible for any costs relating to contamination at our past facilities and at third-party waste disposal sites. Any of these consequences from violation of such laws and regulations could be expected to have a material adverse effect on our business and prospects, financial and otherwise.

Increased prices, reduced productivity, and restricted availability of new revenue equipment could cause our financial condition, results of operations and cash flows to suffer.

Prices for new tractors have increased over the past few years, primarily as a result of higher commodity prices, better pricing power among equipment manufacturers, and government regulations applicable to newly manufactured tractors and diesel engines. We expect to continue to pay increased prices for revenue equipment and incur additional expenses and related financing costs for the foreseeable future. Our business could be harmed if we are unable to continue to obtain an adequate supply of new tractors and trailers or if we have to pay increased prices for new revenue equipment. We face increasing prices for new power units.

Seasonality and the impact of weather can adversely affect our profitability.

Our tractor productivity generally decreases during the winter season because inclement weather impedes operations and some shippers reduce their shipments. At the same time, operating expenses generally increase with harsh weather creating higher accident frequency, increased claims and more equipment repairs. We can also suffer short-term impacts from weather-related events such as hurricanes, blizzards, ice-storms, and floods that could harm our results or make our results more volatile.

Increases in driver compensation, difficulty in attracting drivers and driver turn-over could affect our profitability and ability to grow.

We periodically experience difficulties in attracting and retaining qualified drivers, including independent contract drivers. With increased competition for drivers, we could experience greater difficulty in attracting sufficient numbers of qualified driers. Our competitors may offer better compensation plans, and thus increase the driver turnover we experience. Due to current economic conditions and regulatory changes which have recently increased the demand for drivers and the cost of fuel and insurance, the available pool of independent contractor drivers is smaller than it was during 2008 through 2010. Accordingly, we may and periodically do face difficulty in attracting and retaining drivers for all of our current tractors and for those we may add. We may face difficulty in increasing the number of our independent contractor drivers. In addition, our industry suffers from high turnover rates of drivers. Our turnover rate requires us to recruit a substantial number of drivers. Moreover, our turnover rate could increase. If we are unable to continue to attract drivers and contract with independent contractors, we could be required to continue adjusting our driver compensation package beyond the norm or let equipment sit idle. An increase in our expenses or in the number of power units without drivers could materially and adversely affect our growth and profitability. Our operations may be affected in other ways y a shortage of qualified drivers in the future, such as temporary under-utilization of our fleet, difficulty in meeting shipper demands and increases in compensation levels for our drivers. When we encounter difficulty in attracting or retaining qualified drivers, our ability to service our customers and increase our revenue could be adversely affected. A shortage of qualified drivers in the future could cause us to temporarily under-utilize our fleet, face difficulty in meeting shipper demands and increase our compensation levels for drivers.

15

Shrinkage in the pool of eligible drivers could affect our profitability and ability to grow.

The ongoing Comprehensive Safety Analysis, often referred to as CSA 2010, is projected to reduce the driver pool. Every driver receives a score based upon his or her individual performance in six categories, which are then combined into a single score, and this score is compared to the scores of all other drivers to determine how “safe” the driver is. Drivers with lower scores are less hirable or not hirable. (Fleet Owner, December 13, 2012) A shortage of qualified drivers from time to time could cause us to temporarily under-utilize our fleet, face difficulty in this seems aged a bit meeting shipper demands and increase our compensation levels for drivers.

We operate in a highly regulated industry and increased costs of compliance with, or liability for violation of, existing or future regulations could have a materially adverse effect on our business.

The USDOT and various state and local agencies exercise broad powers over our business, generally governing such activities as authorization to engage in motor carrier operations, safety and insurance requirements. Our company drivers and independent contractors also must comply with the safety and fitness regulations promulgated by the USDOT, including those relating to drug and alcohol testing and hours-of-service. We also may become subject to new or more restrictive regulations relating to fuel emissions, drivers’ hours-of-service, ergonomics, or other matters affecting safety or operating methods. Other agencies, such as the EPA and the Department of Homeland Security, or DHS, also regulate our equipment, operations, and drivers. Future laws and regulations may be more stringent and require changes in our operating practices, influence the demand for transportation services, or require us to incur significant additional costs. Higher costs incurred by us or by our suppliers who pass the costs onto us through higher prices could adversely affect our results of operations.

In the aftermath of the September 11, 2001 terrorist attacks, federal, state, and municipal authorities have implemented and continue to implement various security measures, including checkpoints and travel restrictions on large trucks. As a result, it is possible we may fail to meet the needs of our customers or may incur increased expenses to do so. These security measures could negatively impact our operating results.

Some states and municipalities have begun to restrict the locations and amount of time where diesel-powered tractors, such as ours, may idle, in order to reduce exhaust emissions. From time to time, various federal, state, or local taxes are increased, including taxes on fuels. We cannot predict whether, or in what form, any such increase applicable to us will be enacted, but such an increase could adversely affect our profitability.

Higher interest rates on borrowed funds would adversely impact our results of operations.

We rely on borrowings to finance our revenue equipment and receivables. We are subject to interest rate risk to the extent of our borrowings. Even though we attempt to manage our interest rate risk by managing the amount of debt we carry, our debt levels are not entirely within our control in the short term. An increase in the rates of interest we incur on borrowings and financing we cannot decrease in the short term without adversely impacting our level of service to our customers and expansion of our business will adversely affect our results of operations.

16

"Penny stock” rules may make buying and selling our common stock difficult.

Trading in our common stock is subject to the "penny stock" rules of the Securities and Exchange Commission. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock to deliver a standardized risk disclosure document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer must also provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, the penny stock rules generally require that prior to a transaction in a penny stock the broker-dealer make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for a stock that becomes subject to the penny stock rules. Our securities are subject to the penny stock rules, and investors may find it more difficult to sell their securities.

We do not have controls and procedures in place as required by Section 404 of the Sarbanes-Oxley Act of 2002.

As noted above, the operational and financial control of our subsidiaries has remained under the management of the founders of and stockholders from whom we acquired the respective companies. We do not have controls and procedures in place from a parent company level or the subsidiary level to satisfy Section 404 of the Sarbanes-Oxley Act of 2002. While we expect to put controls and procedures in place for these purpose in the process of consolidating and centralizing overlapping and duplicative elements of these companies, doing so will require debt or equity funding you have no assurance we will be able to obtain. Until we are able to put these controls and procedures in place, we expect to devote additional management time to confirming the accuracy and timeliness of our reports.

We will incur significant expense in complying with Section 404 of the Sarbanes-Oxley Act of 2002 on a timely basis.

The SEC, as directed by Section 404 of the Sarbanes-Oxley Act, adopted rules generally requiring each public company to include a report of management on the company's internal controls over financial reporting in its annual report on Form 10-K that contains an assessment by management of the effectiveness of the company's internal controls over financial reporting. We expect that we may need to hire and/or engage additional personnel and incur incremental costs in order to complete the work as required by Section 404. We have initially concluded that our internal controls are not effective; in the event that in the future we conclude that our internal controls are effective, our independent accountants may disagree with our assessment and may issue a report that is qualified. Any failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm our operating results or cause us to fail to meet our reporting obligations.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

We are not an accelerated filer or a large accelerated filer, as defined in Rule 12b-2 of the Exchange Act (§240.12b-2 of this chapter), or a well-known seasoned issuer as defined in Rule 405 of the Securities Act (§230.405 of this chapter); and, we are not subject to this item. Nevertheless, we do not have any unresolved comments from the SEC staff.

ITEM 2. PROPERTIES.

During this initial restructuring management elected to eliminate as much corporate overhead as possible to include its corporate headquarters office. Our senior management during this period provides services using a virtual office from their respective homes and home offices without charge to us. Our corporate office in Southbury, Connecticut refers to a virtual office of our Chief Executive Officer. Under new management, we anticipate that we will establish a corporate headquarters, but you have no assurance as to when or if we will do so.

17

The headquarters of our operating subsidiaries are located in Hamburg, Arkansas and Scotts Bluff, Nebraska. The following table presents information regarding these facilities.

|

Location

|

Acres

|

Under Roof*

|

Office*

|

Warehouse*

|

Service*

|

Trucks Accommodated

|

|||||||||||||||

|

|

|

||||||||||||||||||||

|

Hamburg facility (Morris)

|

10

|

15,000

|

3,000

|

none

|

12,000

|

170 trucks

|

|||||||||||||||

|

Scotts Bluff facility (Smith)

|

10

|

36,500

|

3,000

|

30,000

|

3,500

|

400 trucks

|

|||||||||||||||

_____________

*Number indicates square feet.

We lease both of these facilities. Terms of the leases are described in the following table:

|

Location

|

|

Lessor

|

|

|

Lease ends

|

|

|

Annual rental

|

|

|

Annual adjustment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hamburg facility (Morris)

|

|

T. Mark Morris

|

|

|

(1)

|

(1)

|

|

|

none

|

||

|

|

|

|

|

|

|

|

|

||||

|

Scotts Bluff facility (Smith)

|

|

Colorado Holdings

|

|

|

(2)

|

(2)

|

|

|

none

|

|

(1)

|

We have been paying the mortgage payments to an unrelated lender on behalf of an entity controlled by Mr. Morris as rent without a formal lease and intend to purchase the property at fair market value, as determined by appraisal, which may require us to refinance the mortgage.

|

|

(2)

|

The facility is owned by Colorado Holdings, a company controlled by Mr. Smith, Annual rental rate is $48,000, which we accrue but are not being required to pay until Smith Systems Transportation’s cash flow is adequate.

|

We also have a rented terminal operation in Arcadia, California principally to serve the Smith Systems Transportation eastbound shipments. We also rent yard facilities or drop yards on a short term basis as the seasonal and operational needs of our customers require. These yard facilities are routinely located in Kimball, Nebraska, Denver, Colorado, Las Vegas, Nevada, Tulsa, Oklahoma, Indianapolis, Indiana, and Houston, Texas. In most cases yard facilities are limited to leasing a specific number of secure (fenced) trailer parking places. Typically we rent on an as-needed basis in terminal facilities of other trucking companies.

We believe all of these facilities are adequate for our operations for the foreseeable future. We expect to acquire additional facilities for operations when we make future acquisitions, of which you have no assurance.

ITEM 3. LEGAL PROCEEDINGS

Our ability to aggressively defend and to prosecute the litigation described under this item depends significantly on our ability to fund legal fees and related costs of litigation.

Active litigation:

As a lender to the Company and its subsidiaries, Hillair Capital Investments, LP partially funded the Company’s acquisition of Cross Creek and a portion of the Company’s working capital requirements in 2011 via two notes totaling $339,660. Hillair initially sought $1,200,000 in unspecified damages in New York State. In 2014, the Company settled with Hillair for $400,000 payable $100,000 down and $300,000 paid pro rata over the following three year period. Under the court order the Company became in default of the agreement by its terms. In the event of a default, Hillair’s recovery is limited to $450,000. The Company continues to discuss with Hillair an economic resolution of the matter and has booked the full defaulted amount.

As a lender to the Company, Luberski, Inc. loaned the Company $400,000, via two Notes in 2011. The Company defaulted on both loans and Luberski ultimately received a judgment against one of Company’s two subsidiaries. In 2015, the Company and Luberski were actively negotiating the settlement of the outstanding balance. The Company has booked reserves equivalent to the debt outstanding plus interest and fees that may become due.

18

In 2012, Chapman and Associates sued the Company for fees related to their role as a broker of two acquired subsidiaries of the Company and received a judgment for the full amount of the suit. The Company had reserved approximately $900,000 relating to this debt and in March 2015 settled this judgment for $170,000 in cash and stock.

The Nutmeg/Fortuna Fund litigation relates to the collection on a 2008 promissory note wherein Nutmeg had received a judgment for $175,000 against the Company. In April 2015 the parties settled the judgment balance for $100,000 payable over six months.

Other litigation:

In April 2012, the Company entered into a forbearance agreement with Michael S. DeSimone, former owner of Cross Creek Trucking, Inc. As part of the agreement we issued a confession of judgment to Mr. DeSimone in the amount of $3,745,415 plus accrued interest. We agreed to pay $5,000 per month commencing September 1, 2012 but are not currently in compliance with the agreement and are in negotiations to restructure the terms of the original agreement.

In January 2013 Robins Consulting, Inc. filed suit against us and our former CEO Paul Henley for $572,000 in broker fees related to the acquisition of Cross Creek Trucking, and in December 2014, received a judgment in the amount of $991,000. The Company has filed counter claims, and a bill of review to overturn the judgment. In addition, the Company has filed suit against Robins for its role in the acquisition of Cross Creek Trucking. The amount of $572,500 is included in notes payable at March 31, 2014.

Litigation in the normal course of business

We expect to be engaged in litigation from time to time in the normal course of our business as a motor freight carrier. Claims for worker’s compensation, auto accident, general liability and cargo and property damage are routine occurrences in the motor transportation industry. We have programs and policies which are designed to minimize the events that result in such claims. We maintain insurance against workers’ compensation, auto liability, general liability, cargo and property damage claims. We are responsible for deductible amounts up to $3,000 per accident. We periodically evaluate and adjust our insurance and claims reserves to reflect our experience. Our workers’ compensation claims are entirely covered by our insurance. Insurance carriers have raised premiums for many businesses, including truck transportation companies. As a result, our insurance and claims expense could increase, or we could raise our deductible when our policies are renewed. We believe that our policy of self-insuring up to set limits, together with our safety and loss prevention programs, are effective means of managing insurable costs.

ITEM 4. MINE SAFETY DISCLOSURES.

Not applicable.

19

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Market information. Our common stock trades on OTC Bulletin Board under the symbol, IFCR. The following quotations reflect inter–dealer prices without retail markup, markdown, or commission, and may not necessarily represent actual transactions. The quarterly ranges of high and low sales prices per share for the past two fiscal years have been as follows:

|

|

Sales Price

|

|||||||

|

Quarters Ended

|

High

|

Low

|

||||||

|

|

||||||||

|

June 30, 2012

|

$

|

.05

|

$

|

.001

|

||||

|

September 30, 2012

|

.02

|

.001

|

||||||

|

December 31, 2012

|

.05

|

.002

|

||||||

|

March 31, 2013

|

.04

|

.01

|

||||||

|

June 30, 2013

|

$

|

.03

|

$

|

.003

|

||||

|

September 30, 2013

|

.035

|

.001

|

||||||

|

December 31, 2013

|

.02

|

.001

|

||||||

|

March 31, 2014

|

.02

|

.005

|

||||||

On April 24, 2015, the last reported sales price of our common stock was $.0023.

Dividends. We have never declared or paid any dividends on our common stock. Because we currently intend to retain any future earnings to finance operations and growth, we do not anticipate paying any cash dividends in the foreseeable.

Transfer Agent. We have engaged Direct Transfer LLC, 500 Perimeter Park Drive, Suite D, Morrisville, NC, 27560 as our transfer agent. The telephone number of our transfer agent is 919-481-4000.

Recent Sales of Unregistered Securities. All sales of equity securities during our fiscal year ended March 31, 2012 have been reported on Form 8-K and Form 10-Q. The following is a listing of all equity securities issued since that date through the date of this report;

In April, 2012, the Company issued 1,444,473 common shares in satisfaction of convertible debt

In April, 2012, the Company issued 649,996 common shares for services

In May, 2012, the Company issued 3,445,614 common shares in satisfaction of convertible debt

In June, 2012, the Company issued 1,857,143 common shares in satisfaction of convertible debt

On June 30, 2012, the Company issued 20,000,000 common shares in conjunction with the sale of all of its interest in the discontinued operations of Triple C Transport, Cross Creek Trucking and Integrated Freight Services

20

On August 3, 2012, the Company issued 10,000,000 common shares to Fuselier Consulting in accordance with the terms of a consulting contract. The stock was valued at $.002, its fair market value at the date of issuance

In August, 2012, the Company issued 5,000,000 common shares to Jackson Morris for services. The stock was valued at $.002 per share, its fair market value at the date of issuance

In October, 2012, the Company issued 30,247,500 common shares for services. The stock was valued at $.005 per share, its fair market value at the date of issuance

In August, 2013, the Company issued 5,000,000 common shares for services.

In October, 2013, the Company issued 5,606,061 common shares for services

In December, 2013, the Company issued 60,000,000 common shares for accrued compensation to Officers of the Company. The shares were valued using a volume weighted average price of $.004 per share

In February, 2014, the Company issued 73,407,828 common shares for accrued compensation to Officers of the Company. The shares were valued using a volume weighted average price of $.007 per share

In October, 2014, the Company issued 10,000,000 common shares for services.

In October, 2014, the Company issued 20,000,000 common shares to Fuselier Consulting in accordance with the terms of a consulting contract. The stock was valued at $.0071 per share, its fair market value at the date of issuance

In November, 2014, the Company issued 13,500,000 common shares for services. The stock was valued at $.0072 per share, its fair market value at the date of issuance

In November, 2014, the Company issued 8,278,265 common shares for accrued compensation to Officers of the Company. The shares were valued using a volume weighted average price of $.017 per share

In January, 2015, the Company issued 35,219,711 common shares in satisfaction of convertible debt

In February, 2015, the Company issued 875,000 common shares as part of a negotiated settlement on debt

In February, 2015, the Company issued 9,198,529 common shares for services.

In February, 2015, the Company issued 36,310,721 common shares in satisfaction of convertible debt

In March, 2015, the Company issued 40,223,804 common shares in satisfaction of convertible debt

These shares were issued in transactions deemed exempt from the registration requirements of the Securities Act, in reliance of either or both Regulation D or Section 4(2) of the Securities Act as a transaction by an issuer not involving a public offering.

ITEM 6. SELECTED FINANCIAL DATA

As a Smaller Reporting Company, we are not required to include the disclosure under this Item 6 Selected Financial Data.

21

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

You should read the following information in conjunction with our financial statements and related notes contained elsewhere in this report. You should consider the risks and difficulties frequently encountered by early-stage companies, particularly those engaged in new and rapidly evolving markets and technologies. Our limited operating history provides only a limited historical basis to assess the impact that critical accounting policies may have on our business and our financial performance.

Overview

The main factors that affect our results of operations are the number of tractors we operate, our revenue per tractor (which includes primarily our revenue per total mile and our number of miles per tractor), and our ability to control our costs.

Over the course of the last year, market prices for diesel fuel have been substantially more stable than 2011-2012. As a result, fuel surcharges have tended to more adequately reflect the recapture of continued high fuel costs. Management routinely compares market fuel price fluctuations relative to the Company base fuel price in an effort to insure that its fuel surcharge level is adequate and that it is properly applied to all freight invoices.

Operating Results

The following table presents and compares the results of our operations for the fiscal years ended March 31, 2014 and 2013.

|

2014

|

2013

|

$ change

|

% change

|

|||||||||||||

|

Revenue

|

20,166,312

|

20,102,263

|

64,049

|