Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - ICONIX BRAND GROUP, INC. | d899590dex312.htm |

| EX-31.1 - EX-31.1 - ICONIX BRAND GROUP, INC. | d899590dex311.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

(Commission File Number) 001-10593

ICONIX BRAND GROUP, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 11-2481903 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

1450 Broadway, New York, New York 10018

(Address of principal executive offices) ( zip code)

(212) 730-0030

Registrant’s telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $.001 Par Value | The NASDAQ Stock Market LLC (NASDAQ Global Market) |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the registrant’s Common Stock held by non-affiliates of the registrant as of the close of business on June 30, 2014 was approximately $2,062.5 million. As of April 21, 2015, 48,625,552 shares of the registrant’s Common Stock, par value $.001 per share, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

None

Table of Contents

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (the “Amendment”) amends the Annual Report on Form 10-K of Iconix Brand Group, Inc. for the fiscal year ended December 31, 2014, originally filed with the Securities and Exchange Commission (“SEC”) on March 2, 2015 (the “Original Filing”). We are filing this Amendment to amend Part III of the Original Filing to include the information required by and not included in Part III of the Original Filing because we no longer intend to file our definitive proxy statement within 120 days of the end of our fiscal year ended December 31, 2014 and the cover page of the Amendment reflects this fact. In connection with the filing of this Amendment and pursuant to the rules of the SEC, we are including with this Amendment certain new certifications by our principal executive officer and principal financial officer. Accordingly, Item 15 of Part IV has also been amended to reflect the filing of these new certifications.

Except as described above, no other changes have been made to the Original Filing. The Original Filing continues to speak as of the date of the Original Filing, and we have not updated the disclosures contained therein to reflect any events which occurred at a date subsequent to the filing of the Original Filing other than as expressly indicated in this Amendment. In this Amendment, unless the context indicates otherwise, the terms “Company”, “Iconix”, “we”, “us”, “our”, or similar pronouns refer to Iconix Brand Group, Inc. and its consolidated subsidiaries. Other defined terms used in this Amendment but not defined herein shall have the meaning specified for such terms in the Original Filing.

Table of Contents

| Page | ||||||

| Item 10. |

Directors, Executive Officers and Corporate Governance | 1 | ||||

| Item 11. |

Executive Compensation | 4 | ||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 36 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence | 38 | ||||

| Item 14. |

Principal Accounting Fees and Services | 38 | ||||

| Item 15. |

Exhibits, Financial Statement Schedules | 39 | ||||

| Signatures | 40 | |||||

| Index to Exhibits | 41 | |||||

Table of Contents

Item 10. Directors, Executive Officers and Corporate Governance

The following information includes information each director and executive officer has given us about his or her age, his or her principal occupation and business experience for at least the past five years, and the names of other publicly-held companies of which he or she currently serves as a director or has served as a director during the past five years. Certain individual qualifications and skills of our directors that contribute to our Board of Directors’ effectiveness as a whole and what makes the individuals suitable to serve on our Board of Directors are described in the following paragraphs.

Our executive officers and directors and their respective ages and positions are as follows:

| Name |

Age | Position(s) | ||||

| Neil Cole |

58 | Chairman of the Board, President and Chief Executive Officer | ||||

| David Blumberg |

56 | Executive Vice President—Head of Strategic Development and Interim Chief Financial Officer | ||||

| Jason Schaefer |

40 | Executive Vice President and General Counsel | ||||

| Barry Emanuel1,3 |

73 | Director | ||||

| Drew Cohen1,2 |

46 | Director | ||||

| F. Peter Cuneo2,3 |

71 | Director | ||||

| Mark Friedman1,3 |

51 | Director | ||||

| James A. Marcum1,2 |

55 | Director | ||||

| Sue Gove2 |

56 | Director | ||||

| (1) | Member of Governance/Nominating Committee. |

| (2) | Member of Audit Committee. |

| (3) | Member of Compensation Committee. |

Neil Cole has served as Chairman of our Board of Directors and as our Chief Executive Officer and President since February 1993. Prior to this, Mr. Cole served as Chairman of the Board, President and Treasurer of New Retail Concepts, Inc., a company he founded in 1986 and from which we acquired the Candies trademark in 1993. For over 30 years Mr. Cole has acquired, developed, promoted and managed a substantial portfolio of brands. As Chairman, Chief Executive Officer and President, Mr. Cole marshaled our transition from a traditional apparel and footwear operating entity to a brand management company. Since the completion of the transition in 2005 and as a result of Mr. Cole’s leadership, our portfolio of brands has grown from two brands to over 35 brands with tremendous diversification in apparel, footwear, sportswear, fashion accessories, beauty and fragrance, entertainment, home products and consumer electronics. In 2001, Mr. Cole founded The Candie’s Foundation, a non-profit organization that works to educate America’s youth about the devastating consequences of teenage pregnancy and creates a national dialogue on the issue. Mr. Cole was a member of Governor Cuomo’s SAGE Commission from April 2011 to February 2013, and currently serves as a director on the Board of Directors for The Candie’s Foundation, The Mount Sinai Children’s Center Foundation and Crutches 4 Kids. Mr. Cole received a Bachelor of Science degree in political science from the University of Florida in 1978 and his Juris Doctor from Hofstra law school in 1982. The Board of Directors believes that Mr. Cole’s global executive leadership skills, his significant experience as an executive in our industry, including as our Chief Executive Officer since inception, and his role in transforming our company from a manufacturing company to a leading brand management company make him uniquely qualified to sit on our Board of Directors and serve as its chairman.

David Blumberg has served as our Head of Strategic Development since February 2009 and has served as our Executive Vice President—Head of Strategic Development since August 2009. Since March 2015, Mr. Blumberg has served as our Interim Chief Financial Officer. From November 2006 through January 2009, Mr. Blumberg served our company as a full-time consultant, overseeing our merger and acquisition activities. Prior to joining our company as a consultant, from 2005 through October 2006, Mr. Blumberg worked as a consultant to LF Management Ltd., an affiliate of Li & Fung Limited/ LF USA. Prior to joining Li & Fung, from January 1997 to November 1999, Mr. Blumberg was president and managing director—investment banking of Wit Capital, Inc., an online investment bank. From 1981 to 1993, Mr. Blumberg was a managing director and senior vice president of Merrill Lynch Interfunding Inc. and Merrill Lynch Capital Markets—Investment Bank, respectively. Mr. Blumberg received a Bachelor of Science, cum laude in economics from Colgate University in 1981 and a Masters degree in business administration in corporate finance from New York University in 1987.

Jason Schaefer has served as our Executive Vice President and General Counsel since joining our company on September 9, 2013. From May 2008 until September 2013, Mr. Schaefer served as General Counsel of Pegasus Capital Advisors, L.P., a private equity fund. From March 2006 to May 2008, he advised on merger and acquisition transactions in both the private and public space at Akin

1

Table of Contents

Gump Strauss Hauer and Feld LLP. Prior to that time, Mr. Schaefer was an associate in the corporate group of Paul Weiss Rifkind Wharton and Garrison LLP, an international law firm. Mr. Schaefer received his Juris Doctor, cum laude, from Brooklyn Law School in 2001 and a Bachelor of Arts degree in political science from the University at Buffalo in 1996.

Barry Emanuel has served on our Board of Directors since May 1993. For more than the past five years, Mr. Emanuel has served as president of Copen United LLC, a textile manufacturer located in New York, New York. He received his Bachelor of Science degree from the University of Rhode Island in 1962. The Board of Directors believes that Mr. Emanuel’s more than 30 years of experience in the apparel industry, including his service as our director for over 20 years, contributes valuable insight to our Board of Directors.

Drew Cohen has served on our Board of Directors since April 2004. Since 2007 he has been the President of Music Theatre International, which represents the dramatic performing rights of classic properties, such as “West Side Story” and “Fiddler on the Roof,” and licenses over 50,000 performances a year around the world. Before joining Music Theatre International in September 2002, Mr. Cohen was, from July 2001, the Director of Investments for Big Wave NV, an investment management company, and, prior to that, General Manager for GlassNote Records, an independent record company. Mr. Cohen received a Bachelor of Science degree from Tufts University in 1990, his Juris Doctor degree from Fordham Law School in 1993, and a Masters degree in business administration from Harvard Business School in 2001. The Board of Directors believes that Mr. Cohen’s legal and business background, and experience as an executive in an industry heavily involved in the licensing business, make him well suited to serve on our Board of Directors.

F. Peter Cuneo has served on our Board of Directors since October 2006. From June 2004 through December 2009 Mr. Cuneo served as the Vice Chairman of the Board of Directors of Marvel Entertainment, Inc. (“Marvel Entertainment”), a publicly traded entertainment company active in motion pictures, television, publishing, licensing and toys, and prior thereto, he served as the President and Chief Executive Officer of Marvel Entertainment from July 1999 to December 2002. Mr. Cuneo has also served as the Chairman of Cuneo & Co., L.L.C., a private investment firm, since July 1997 and previously served on the Board of Directors of WaterPik Technologies, Inc., a New York Stock Exchange company engaged in designing, manufacturing and marketing health care products, swimming pool products and water-heating systems, prior to its sale in 2006. From October 2004 to December 2005, he served on the Board of Directors of Majesco Entertainment Company, a provider of video game products primarily for the family oriented, mass market consumer. Mr. Cuneo received a Bachelor of Science degree from Alfred University in 1967 and currently serves as the Chairman of the Alfred University Board of Trustees. Mr. Cuneo received a Masters degree in business administration from Harvard Business School in 1973. The Board of Directors believes that Mr. Cuneo’s extensive business and financial background and significant experience as an executive of Marvel Entertainment, an owner and licensor of iconic intellectual property, contributes important expertise to our Board of Directors.

Mark Friedman has served on our Board of Directors since October 2006. Mr. Friedman has been a Managing Director at The Retail Tracker, an investment advisory and consulting firm since May 2006. From 1996 to 2006 Mr. Friedman was with Merrill Lynch, serving in various capacities including group head of its U.S. equity research retail team where he specialized in analyzing and evaluating specialty retailers in the apparel, accessory and home goods segments. Prior to joining Merrill Lynch, he specialized in similar areas for Lehman Brothers Inc. and Goldman, Sachs & Co. Mr. Friedman has been ranked on the Institutional Investor All-American Research Team as one of the top-rated sector analysts. He received a Bachelor of Business Administration degree from the University of Michigan in 1986 and a Masters degree in business administration from The Wharton School, University of Pennsylvania in 1990. The Board of Directors believes that Mr. Friedman’s extensive business background and investment banking experience adds key experience and viewpoints to our Board of Directors.

James A. Marcum has served on our Board of Directors since October 2007. Since December 2014, Mr. Marcum has served as an Operating Partner and Operating Executive of Tri-Artisan Capital Partners, LLC, a merchant banking firm, a position he also held from 2004 until March 2008. From August 2013 to December 2014, Mr. Marcum served as Chief Executive Officer, President and a member of the Board of Directors of Heartland Automotive Services, Inc., the nation’s largest franchisee of Jiffy Lube’s. From February 2010 through December 31, 2012, Mr. Marcum served as the Chief Executive Officer, President and a member of the Board of Directors of Central Parking Corporation, a nationwide provider of professional parking management. From September 2008 to January 2010, Mr. Marcum served as Vice Chairman, Acting President and Chief Executive Officer of Circuit City Stores, Inc., a specialty retailer of consumer electronics, home office products and entertainment software. Mr. Marcum has served as a member of the Board of Directors of Circuit City Stores, Inc. since June 2008. Circuit City Stores, Inc. filed for bankruptcy in November 2008. From January 2005 to January 2006, he served in various capacities, including Chief Executive Officer and Director, of Ultimate Electronics, Inc., a consumer electronics retailer. Prior thereto, Mr. Marcum has served in various senior executive capacities for a variety of nationwide specialty retailers. He received a Bachelor of Science degree from Southern Connecticut State University in accounting and economics in 1980. The Board of Directors believes that Mr. Marcum’s contributions to the Board of Directors are well served by his extensive business background and his experience as a corporate executive of national retail establishments.

2

Table of Contents

Sue Gove has served on our Board of Directors since October 2014. Ms. Gove has been the President of Excelsior Advisors, LLC since May 2014. Ms. Gove had been the President of Golfsmith International Holdings, Inc. from February 2012 through April 2014 and Chief Executive Officer from October 2012 through April 2014. Previously, she was Chief Operating Officer of Golfsmith International Holdings, Inc. from September 2008 through October 2012, Executive Vice President from September 2008 through February 2012 and Chief Financial Officer from March 2009 through July 2012. Ms. Gove previously had been a self-employed consultant from April 2006 until September 2008, serving clients in specialty retail and private equity. Ms. Gove was a consultant for Prentice Capital Management, LP from April 2007 to March 2008. She was a consultant for Alvarez and Marsal Business Consulting, L.L.C. from April 2006 to March 2007. She was Executive Vice President and Chief Operating Officer of Zale Corporation from 2002 to March 2006 and a director of Zale Corporation from 2004 to 2006. She was Executive Vice President, Chief Financial Officer of Zale Corporation from 1998 to 2002 and remained in the position of Chief Financial Officer until 2003. Ms. Gove has been a director of AutoZone, Inc. since 2005. Ms. Gove received a Bachelor of Business Administration degree from the University of Texas at Austin. The Board of Directors believes that Ms. Gove’s financial background and extensive experience in executive management positions with leading retailers adds key insight and knowledge to our Board of Directors.

Appointment of officers

Our Board of Directors appoints the officers of the Company on an annual basis and its officers serve until their successors are duly elected and qualified, unless earlier removed by the Board of Directors. No family relationships exist among any of our officers or directors.

Election of directors

Our Board of Directors is currently comprised of seven directors. At each annual meeting of stockholders, the successors to the directors then serving are elected to serve from the time of their election and qualification until the next annual meeting following their election or until their successors have been duly elected and qualified, or until their earlier death, resignation or removal. Six of our current directors have been elected to serve until the annual meeting of stockholders to be held in 2015, and Ms. Gove, who joined our Board of Directors in October 2014, will stand for stockholder election for the first time at our annual meeting of stockholders to be held in 2015.

Audit Committee and Audit Committee Financial Expert

Our Board of Directors has appointed an Audit Committee each of whose members is, and is required to be, an “independent director” under the Listing Rules of NASDAQ. The members of our Audit Committee are Messrs. Cuneo, Cohen and Marcum and Ms. Gove, and Mr. Cuneo currently serves as its chairperson. In addition to being an “independent director” under the Listing Rules of NASDAQ, each member of the Audit Committee is an independent director under applicable SEC rules under the Securities Exchange Act of 1934. Our Board of Directors has also determined that Mr. Cuneo is our “audit committee financial expert,” as that term is defined under applicable SEC rules and NASDAQ Listing Rules, serving on the Audit Committee.

Our Audit Committee’s responsibilities include:

| • | appointing, replacing, overseeing and compensating the work of a firm to serve as the independent registered public accounting firm to audit our financial statements; |

| • | discussing the scope and results of the audit with the independent registered public accounting firm and reviewing with management and the independent registered public accounting firm our interim and year-end operating results, which includes matters required to be discussed under Rule 3200T of the Public Company Accounting Oversight Board (“PCAOB”); |

| • | considering the adequacy of our internal accounting controls and audit procedures; |

| • | approving (or, as permitted, pre-approving) all audit and non-audit services to be performed by the independent registered public accounting firm; and |

| • | receiving and reviewing written disclosures on independence required by PCAOB Rule 3526. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our officers and directors, and persons who beneficially own more than 10% of a registered class of our equity securities, to file reports of ownership and changes in ownership with the SEC. Officers, directors and greater than 10% owners are required by certain SEC regulations to furnish us with copies of all Section 16(a) forms filed by them. Based solely on our review of the copies of such forms received by us, we believe that during 2014, there was compliance with the filing requirements applicable to our officers, directors and greater than 10% common stockholders.

3

Table of Contents

Code of Business Conduct

We have adopted a written code of business conduct that applies to our officers, directors and employees. Copies of our code of business conduct are available, without charge, upon written request directed to our corporate secretary at Iconix Brand Group, Inc., 1450 Broadway, New York, NY 10018. Our code of business conduct is also available on our website, www.iconixbrand.com.

Item 11. Executive Compensation

Over the past several years, the Company continued its ongoing review of certain key governance, compensation and disclosure issues that were raised by the stockholder votes in previous years, and has continued to make certain changes to its compensations practices, policies and disclosures. At our 2014 annual meeting, our stockholders voted in favor of the Company’s executive compensation program. We seek to improve our overall vote results on our executive compensation program through various initiatives, including by providing below additional disclosure on performance-based compensation criteria, in order to assist in our stockholders’ review. The Company and the Compensation Committee continue to consider additional compensation changes to our programs and disclosure.

Compensation Discussion and Analysis

The purpose of this Compensation Discussion and Analysis is to provide the information necessary for understanding the compensation philosophy, policies and decisions which are material to the compensation of our principal executive officer, our principal financial officer and our three other most highly compensated executive officers during 2014 (we refer to these officers as our “named executive officers”). This Compensation Discussion and Analysis will place in context the information contained in the tables and accompanying narratives that follow this discussion.

Stockholder Vote & Outreach

At our 2014 Annual Meeting, stockholders voted in favor of our advisory vote on executive compensation (also commonly referred to as “Say on Pay”). We have maintained our stockholder outreach efforts that we began in 2012 in order to address issues that may be of continued concern to stockholders.

In the past two years, as a result of our stockholder outreach, we have specifically addressed the following:

| • | Disclosure of Peer Groups |

| • | Enhanced disclosure related to performance metrics |

| • | Discussion of difficulty of achievement of performance metrics |

| • | Clarified disclosure related to the time at which the long-term performance metrics are established |

Stockholder/Governance Friendly Aspects of the Current Program

| What we do |

What we don’t do | |

| Pay for Performance. Pursuant to Mr. Cole’s current employment agreement, for 2014, approximately 79% of his compensation was “at risk” (over the term) based on performance metrics. | No gross-ups. We do not have any provisions requiring the Company to gross-up compensation to cover taxes owed by our executives. | |

| Clawback Policy. We have adopted a clawback policy that applies if there is a restatement of our financial statements that is required, within the previous three years, to correct accounting errors due to material non-compliance with any financial reporting requirements under the federal securities laws. | No Excess Perquisites and Limited Retirement and Health Benefits. We have a 401k program and have never had a defined benefit plan. No supplemental executive retirement plans or other pension benefits. | |

4

Table of Contents

| What we do |

What we don’t do | |

| Election of Directors. We require directors to be elected annually by a majority of shares voting at the meeting. | No option repricing or exchanges. Historically, we have not

• Repriced options;

• Paid dividends on unvested shares of restricted stock; or

• Bought out underwater options for cash.

We have amended our Equity Incentive Plan to explicitly prohibit these practices, as well as recycling shares subject to stock options, stock grants or performance awards which, for any reason, after the date of the amendment, are cancelled. | |

| Anti-Hedging Policy. We have a policy prohibiting directors and officers from engaging in hedging transactions, which include puts, calls and other derivative securities, with respect to the Company’s equity securities. | Board Structure. We do not have a classified Board. | |

Our Performance

During 2014, we continued to execute on our key strategic initiatives. While compounded total shareholder return (“TSR”) measures at December 31, 2014 decreased when measured against the 2013 TSR, we believe we continue to deliver strong overall business performance, and our 3- and 5-year TSR demonstrates the creation of value for stockholders over time. The chart below illustrates the Company’s compounded TSR for the past one, three and five years at December 31, 2014:

| TOTAL SHAREHOLDER RETURNS | ||||||||||||

| 1 year | 3 year | 5 year | ||||||||||

| At December 31, 2014 |

(15 | %) | 27 | % | 22 | % | ||||||

5

Table of Contents

The chart below compares the Company’s TSR for the past one, three and five years also as of December 31, 2014 to the relative performance peer group used in determining the performance stock units, or PSUs, as described below. The Company’s TSR, when compared to the peer group below, puts the Company’s TSR in the 18th percentile, 61st percentile and 42nd percentile for the one-, three- and five-year TSRs of the peer group:

| TSR as of 12/31/2014 | ||||||||||||

| Company Name |

1-Year | 3-Year | 5-Year | |||||||||

| Carter’s, Inc. |

23 | % | 31 | % | 28 | % | ||||||

| Cherokee Inc. |

41 | % | 22 | % | 6 | % | ||||||

| Columbia Sportswear Company |

15 | % | 26 | % | 20 | % | ||||||

| Crocs, Inc. |

(21 | %) | (5 | %) | 17 | % | ||||||

| Deckers Outdoor Corporation |

8 | % | 6 | % | 22 | % | ||||||

| Delta Apparel, Inc. |

(40 | %) | (19 | %) | (1 | %) | ||||||

| Fossil, Inc. |

(8 | %) | 12 | % | 27 | % | ||||||

| G-III Apparel Group Ltd. |

37 | % | 59 | % | 36 | % | ||||||

| Gildan Activewear Inc. |

7 | % | 46 | % | 19 | % | ||||||

| Hanesbrands Inc. |

61 | % | 73 | % | 36 | % | ||||||

| Kate Spade & Co. |

0 | % | 55 | % | 42 | % | ||||||

| lululemon athletica inc. |

(5 | %) | 6 | % | 30 | % | ||||||

| Madden Steven Ltd. |

(13 | %) | 11 | % | 21 | % | ||||||

| Movado Group Inc. |

(35 | %) | 19 | % | 26 | % | ||||||

| Oxford Industries, Inc. |

(31 | %) | 8 | % | 23 | % | ||||||

| PVH Corp. |

(6 | %) | 22 | % | 26 | % | ||||||

| Rocky Brands, Inc. |

(5 | %) | 16 | % | 13 | % | ||||||

| Skechers U.S.A., Inc. |

67 | % | 66 | % | 13 | % | ||||||

| Superior Uniform Group Inc. |

95 | % | 40 | % | 31 | % | ||||||

| Tumi Holdings Inc. |

5 | % | N/A | N/A | ||||||||

| Under Armour, Inc. |

56 | % | 56 | % | 58 | % | ||||||

| Vera Bradley, Inc. |

(15 | %) | (14 | %) | N/A | |||||||

| VF Corp. |

22 | % | 36 | % | 35 | % | ||||||

| Wolverine World Wide, Inc. |

(12 | %) | 19 | % | 18 | % | ||||||

| 25th %ile |

(13 | %) | 10 | % | 18 | % | ||||||

| Median |

2 | % | 22 | % | 25 | % | ||||||

| 75th %ile |

26 | % | 43 | % | 30 | % | ||||||

| Iconix Brand Group, Inc. |

(15 | %) | 27 | % | 22 | % | ||||||

| Iconix’s Percentile Rank |

18 | % | 61 | % | 42 | % | ||||||

6

Table of Contents

How Pay Aligns with Performance

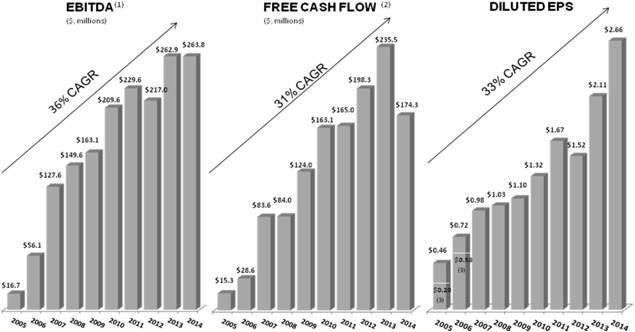

The following graphs display our performance from 2005 through 2014 for the performance metrics utilized by the Company in determining the vesting of our PSUs and one component of our Chief Executive Officer’s cash bonuses.

| (1) | EBITDA, a non-GAAP financial measure, represents net income before income taxes, interest, other non-operating gains and losses, depreciation and amortization expenses. We believe EBITDA provides additional information for determining our ability to meet future debt service requirements, investing and capital expenditures. See Exhibit 10.65 for a reconciliation of EBITDA to GAAP net income. |

| (2) | Free Cash Flow, a non-GAAP financial measure, represents net cash provided by operating activities, plus cash received from the sale of trademarks and formation of joint ventures, less distributions to non-controlling interests and capital expenditures. Free Cash Flow excludes notes receivable from sale of trademarks and the formation of joint ventures, cash used to acquire the membership interests of our joint venture partners, mandatory debt service requirements, and other non-discretionary expenditures. Free Cash Flow should not be considered in isolation, as a measure of residual cash flow available for discretionary purposes, or as an alternative to operating results presented in accordance with GAAP. The Company believes Free Cash Flow is useful because it provides information regarding actual cash received in a specific period from the Company’s comprehensive business strategy of maximizing the value of its brands through traditional licensing, international joint ventures and other arrangements. We have excluded the cash used to buy back our joint venture membership interests from the above definition because we believe that like other acquisitions, such actions are capital transactions. It also provides supplemental information to assist investors in evaluating the Company’s financial condition and ability to pursue opportunities that enhance shareholder value. See Exhibit 10.65 for a reconciliation of Free Cash Flow to GAAP net income. |

| (3) | In 2005 and 2006, respectively, the $0.20 and $0.58 represent YTD fully taxed diluted earnings per share assuming a tax rate of 34% and a CAGR or Compounded Annual Growth Rate based on the fully taxed number. |

Objectives of our Executive Compensation Program

The Company’s goals for its executive compensation program are to:

| • | Attract, motivate and retain a talented, entrepreneurial and creative team of executives who will provide leadership for the Company’s success in dynamic and competitive markets. |

7

Table of Contents

| • | Align pay with performance—as well as with the long-term interests of stockholders—by linking payouts to pre-determined performance measures that promote long-term stockholder value, including EBITDA, Free Cash Flow and Diluted Earnings Per Share, as well as acquisitions in the case of Mr. Blumberg. |

| • | Establish continuity of the services of named executive officers so that they will contribute to, and be a part of, the Company’s long-term success. |

Peer Group

We are a unique company with a unique business model. There are few, if any, companies that are our size and follow our business model. Very few stand-alone publicly-traded companies derive their revenues from monetizing a portfolio of brands. The Company does not derive revenues from the sale of manufactured products or services. Accordingly, the Company enjoys higher margins of gross profit, net income and EBITDA as a percentage of revenue than companies in the retail industry. Consequently, our Compensation Committee has determined that we do not target pay opportunities or actual pay to specific benchmarking against other companies. Instead, from time to time the Compensation Committee looks at various companies and their pay practices to determine market trends and market compensation levels.

We believe the relative proportion of performance equity grants to time-vested equity grants continues to align the interests of Mr. Cole and our other named executive officers with those of stockholders.

We do have a group of relative performance equity peers that we considered in connection with determinations as to vesting under our PSUs. This group of relative performance peers is reviewed for accuracy regularly by our Compensation Committee and updated when necessary, with recommendations from an independent compensation consultant, and is discussed in the section “2011 PSUs” below.

Neil Cole’s Vision and Its Importance to the Company’s Future Success

Neil Cole’s proven track record makes him a highly valued executive and leader of our Company. A significant reason for our Company’s success has been Mr. Cole’s vision and management. In 2014, Mr. Cole led the Company to achieve strong revenues and earnings per share, and delivered continued value to our stockholders. Given the nature of our business model, we operate with relatively fewer employees than other companies our size (we had only 150 full-time employees at December 31, 2014), which keeps our operating expenses lower than they otherwise would be.

Mr. Cole’s leadership position in the industry affords him numerous other employment opportunities. Without Mr. Cole’s leadership and vision, the Compensation Committee believed very strongly at the time of the June 2011 amendment to his employment agreement, referred to as the June 2011 amendment, that the Company would suffer if Mr. Cole left the Company, both in terms of growing the Company’s current brands, as well as acquiring new brands. In May 2010, when the Compensation Committee and Mr. Cole began negotiating the amendment to his employment agreement, the process was rigorous and long-lasting. The amendment was signed in June 2011 after more than a year of negotiations between the Compensation Committee and Mr. Cole. In addition, the Compensation Committee engaged James F. Reda & Associates LLC, referred to as JFR, to assist in evaluating the terms of the June 2011 amendment.

In approving the June 2011 amendment, the Compensation Committee and the Board of Directors recognized that the amendment was necessary to ensure Mr. Cole’s long-term future service, and that Mr. Cole’s retention would place the Company in the best possible position to continue to implement the Company’s strategic goals.

The Company’s performance during the tenure of Mr. Cole’s leadership has been exemplary. Mr. Cole is responsible for and oversaw the Company’s transition to its current model and is the key architect of the Company’s success. Since the completion of the Company’s transition to its current business model, the Company’s equity market capitalization increased from approximately $150 million at January 1, 2005, to approximately $1.7 billion as of December 31, 2014. Under Mr. Cole’s leadership and direction, from 2005 through 2014, the Company’s EBITDA grew from $16.7 million to $263.8 million and during the same period, the Company’s Free Cash Flow grew from $15.3 million to $174.3 million.

Due to Mr. Cole’s highly effective leadership, the Company has maintained strong profitability over the last nine years and also increased its global footprint and portfolio of iconic brands. Mr. Cole’s vision and leadership have poised the Company for continued growth, organically, internationally and through acquisition opportunities available to the Company. Such acquisition opportunities exist, in large part, because of prospective sellers’ confidence in Mr. Cole.

8

Table of Contents

Mr. Cole’s “At Risk” Compensation

We believe that the structure and size of Mr. Cole’s pay package appropriately pays for performance and, therefore, aligns Mr. Cole’s economic interests with those of our stockholders. Pursuant to the June 2011 amendment, for the year ended December 31, 2014, Mr. Cole’s percentage of performance-based compensation was 79% of his total contractual compensation package. Also see “Equity-based Compensation—PSUs”, which includes a discussion regarding 2011 PSUs that were unearned and the forfeiture of 2008 PSUs.

Other Named Executive Officers’ “At Risk” Compensation

For the year ended December 31, 2014, 28% of Mr. Lupinacci’s total potential compensation was performance-based, 26% of Mr. Horowitz’s total potential compensation was performance-based, 52% of Mr. Blumberg’s total potential compensation was performance-based and 33% of Mr. Schaefer’s total potential compensation was performance-based. Mr. Clamen, the former Chief Financial Officer, ceased to be an executive officer of the Company in March 2014. Mr. Lupinacci, the former Chief Financial Officer, ceased to be an executive officer of the Company in March 2015. Mr. Horowitz, the former Chief Operating Officer, ceased to be an executive of the Company in April 2015.

The Compensation Committee’s Rationale for Performance Metrics

Our executive compensation program considers each named executive officer’s function within the Company and sets performance goals that are relative to such function. The compensation packages and structure for our named executive officers are all similar, other than Mr. Blumberg. As Mr. Blumberg is responsible for finding and assisting the Company in closing acquisitions, one of his performance metrics relates to completed acquisitions. Each of these named executive officers plays a distinct role with related responsibilities within the Company, and each of their compensation packages are meant to acknowledge these differences and incentivize each named executive officer appropriately.

As Mr. Cole makes executive decisions that influence our direction and growth initiatives, his total compensation is intended to be strongly aligned with objective financial measures, including an annual cash bonus and his PSUs, which are determined by the specific performance criteria described below. During our 2014 stockholder outreach, we learned there was some confusion regarding when Mr. Cole’s financial measures for his performance-based compensation were established. There are two types of performance criteria for the PSUs. Generally, the first set of criteria is absolute EBITDA Growth, absolute EPS Growth and Free Cash Flow. The absolute performance criteria for Mr. Cole were pre-determined by our Compensation Committee at the time he entered into the June 2011 amendment, and are not subject to revision. If the absolute EBITDA Growth or absolute EPS Growth metrics are not met, then the relative EBITDA Growth and EPS Growth of the Company are considered. Relative performance measures were set in 2011 as well. As required in the PSU agreements, the Compensation Committee reviews and sets the peer group annually at the beginning of each year against which could affect whether the relative measures are met. The absolute and relative performance-criteria for the PSU awards for all of our other named executive officers are established in their respective employment agreements and are also not subject to revision.

As Mr. Blumberg is responsible for overseeing our merger and acquisition activities that influence our growth, a portion of his total compensation (in the form of PSUs) is performance-based and tied to our consummation of acquisitions that meet specified objective financial measures as set forth in his employment agreement. We believe that the stock awards create an incentive to identify acquisitions that are expected to add value to the Company in the long-term.

Mr. Schaefer is, and Messrs. Horowitz, Clamen and Lupinacci were, charged with implementing the goals for the Company set by the Board of Directors and Mr. Cole, and, therefore, an appropriate portion of their respective compensation was performance-based equity pursuant to their respective employment agreements.

Roles of Management and the Compensation Committee in Compensation Decisions

Compensation of our executive officers, including the named executive officers, has been determined by the Board of Directors pursuant to recommendations made by the Chief Executive Officer and the Compensation Committee. The Compensation Committee is responsible for, among other things, reviewing and making recommendations as to the compensation of our executive officers; administering our equity incentive and stock option plans; reviewing and making recommendations to the Board of Directors with respect to incentive compensation and equity incentive and stock option plans; evaluating our Chief Executive Officer’s performance in light of corporate objectives; and setting our Chief Executive Officer’s compensation based on the achievement of corporate objectives.

9

Table of Contents

The Compensation Committee has given great consideration to the relative merits of cash and equity as a device for retaining and motivating the named executive officers. The Compensation Committee considers an individual’s performance, an individual’s pay relative to others, contractual commitments pursuant to employment or other agreements, the value of already-outstanding grants of equity and aligning the executive’s interests with those of our stockholders in determining the size and type of equity-based awards to each named executive officer.

Upon recommendations from our Chief Executive Officer, the Compensation Committee approves equity-based awards to named executive officers other than our Chief Executive Officer. With respect to our Chief Executive Officer, the Compensation Committee discusses with the Chief Executive Officer, and utilizes a compensation consultant to assist in determining, the appropriate compensation package for the Chief Executive Officer. The final determination of the Chief Executive Officer’s compensation package is, however, approved by the Compensation Committee in the absence of the Chief Executive Officer and recommended to the full Board of Directors for approval.

The Compensation Committee also annually reviews and certifies whether performance targets are met pursuant to the Chief Executive Officer’s and other senior executives’ pay packages. In 2014, Mr. Cole did not receive any additional grants of RSUs or PSUs. The Compensation Committee determined the percentage of previously granted PSUs that were actually earned by the named executive officers in 2014, as well as the non-equity incentive bonus payable to eligible executives. See “Equity-based Compensation PSUs” for a discussion of the achievement of targets. Mr. Clamen has forfeited any rights to the vesting of PSUs and RSUs in respect of the 2014 fiscal year and thereafter. Messrs. Horowitz and Lupinacci have forfeited their rights to the vesting of PSUs and RSUs in respect of the 2015 fiscal year and thereafter.

Elements of Compensation

To accomplish our compensation objectives, our compensation program principally consists of performance-based equity awards in the form of PSU awards, long-term equity awards in the form of RSU awards, annual performance-based cash bonuses, base salaries and discretionary cash and stock awards. These elements are designed to reward performance in a simple and straightforward manner. The compensation program is heavily weighted towards performance-based equity awards rather than cash compensation and time-vested equity compensation in order to maximize pay-for-performance and ensure that the named executive officers’ compensation is tied to the Company’s long-term and short-term performance. The Company does provide certain limited perquisites to its named executive officers that are generally available to named executive officers. The Company has no long-term cash compensation program or supplemental retirement plan.

Base salary. Base salary represents amounts paid during the fiscal year to named executive officers as direct, guaranteed compensation under their employment agreements for their services to us. Base salaries are used to compensate each named executive officer for day-to-day operations during the year, and to encourage them to perform at their highest levels. We also use our base salary as an incentive to attract top quality executives and other management employees from other companies. Moreover, base salary and increases to base salary are intended to recognize the overall experience, position within our company and expected contributions of each named executive officer to us. Generally, the Company no longer provides automatic salary increases in employment agreements. Other than Mr. Horowitz, none of our named executive officers received an increase in base salary in 2014. Mr. Horowitz received an increase to his base salary related to his promotion to the new position of Chief Operating Officer in 2014. At the time of hire, our agreement with Mr. Lupinacci provided for a one-time $50,000 salary increase following his first eight months of employment with us.

Cash bonuses. Cash bonuses are made pursuant to our stockholder approved Executive Incentive Bonus Plan, referred to as our bonus plan, and pursuant to employment agreements. The bonus plan was approved by stockholders in May 2008 and meets the requirements of Section 162(m) of the Internal Revenue Code. The purpose of the bonus plan is to promote the achievement of our short-term, targeted business objectives by providing competitive incentive reward opportunities to our executive officers who can significantly impact our performance towards those objectives. Further, the bonus plan enhances our ability to attract, develop and motivate individuals as members of a talented management team. The bonus plan is administered, and can be amended, by the Compensation Committee. All awards are paid in cash. Awards made under the bonus plan are subject to a participant achieving one or more performance goals established by the Compensation Committee. The performance goals may be based on our overall performance, and also may recognize business unit, team and/or individual performance. In 2014, Mr. Cole received a cash bonus under the bonus plan based on the Company’s achievement of pre-determined target EBITDA of 270.2 million, 98% of which was achieved. The amount of Mr. Cole’s cash bonus for 2014 was $1.05 million less than his cash bonus for 2013, as our performance in 2014 was less than that of 2013. Mr. Cole was the only named executive officer who was eligible to receive a bonus under this plan.

Equity-based compensation. There are three types of equity based grants made to the named executive officers—initial grants when a named executive officer is hired, performance-based grants and retention grants, which are typically made in connection with new employment agreements or renewals of expiring agreements. An initial grant when an executive officer is hired or otherwise becomes

10

Table of Contents

a named executive officer serves to help us to recruit new executives and to reward existing officers upon promotion to higher levels of management. Because these initial grants are structured as an incentive for employment, the amounts of these grants may vary from executive to executive depending on the particular circumstances of the named executive officer and are usually recommended by the Chief Executive Officer and approved by the Compensation Committee. Time-vested grants of equity awards, as well as retention grants made in connection with renewals of employment agreements, are designed to compensate our named executive officers for their contributions to our long-term performance. Generally, restricted stock awards granted to named executive officers as either initial or annual performance grants vest in equal installments over the term of the agreement, or a period determined by the Compensation Committee, typically beginning on the first anniversary of the date of grant.

Awards of RSUs and PSUs are made under our Amended and Restated 2009 Equity Incentive Plan, referred to as the Plan. PSUs are granted on the basis of pre-determined long-term performance goals that are set to incentivize our executives to achieve the strategic goals of the Company. The Plan was approved by our stockholders in August 2009 and amended, restated and again approved by our stockholders in August 2012. In April 2013, we amended the Plan to specifically prohibit option repricing, payment of dividends on unvested shares of restricted stock, cash buyouts of underwater options and recycling shares subject to stock options, stock grants or performance awards which, for any reason are after the date of the amendment, are cancelled. Shares of restricted stock, including shares underlying RSUs and PSUs that were issued subject to a vesting schedule, cannot be sold until and to the extent the shares have vested. While we have not formally adopted any policies with respect to cash versus equity components in the mix of executive compensation, we feel that it is important to provide for a compensation mix that allows for acquisition of a meaningful level of equity ownership by our named executive officers in order to help align their interests with those of our stockholders. As of December 31, 2014, the number of shares remaining for issuance under the Plan,was 2,327,704. There are no shares remaining for issuance under any prior equity incentive plan.

In 2013, the Board of Directors approved a broad-based, executive PSU program, which provides for awards of PSUs to senior executives of the Company who are not named executive officers, based on the Company’s achievement of pre-determined goals over a four-year period. By providing a performance-based element of compensation to this group of executives, we continue to encourage additional focus on the long-term goals of the business. In 2014, an aggregate of 63,000 2013 PSUs were deemed vested and earned by 21 employees for achievement of the EBITDA Growth, EPS Growth and Free Cash Flow goals described below under the caption “-2013 PSUs.”

Perquisites and other personal benefits. During 2014, our named executive officers received a limited amount of perquisites and other personal benefits that we paid on their behalf. These consisted of payments of life insurance premiums and car allowances, totaling $127,128, in the aggregate.

Post-termination compensation. We have entered into employment agreements with each of our named executive officers. Each of these agreements provide for certain payments and other benefits if the executive’s employment terminated under certain circumstances, including, in the event of a “change in control”. See “Executive Compensation—Narrative to Summary Compensation Table and Plan-Based Awards Table—Employment Agreements” and “Executive Compensation—Potential Payments Upon Termination or Change in Control” for a description of the severance and change in control benefits.

Our Named Executive Officers’ Compensation for 2014

Base Salaries

Historically, the base salaries of our named executive officers were guaranteed in their respective employment agreements. Other than with respect to situations in which we have engaged a compensation consultant, the recommendations to the Board of Directors by the Compensation Committee with respect to base salaries are based primarily on informal judgments reasonably believed to be in our best interests. Base salary increases are not guaranteed for Messrs. Cole, Blumberg or Schaefer. In March 2014 Mr. Clamen ceased to be an executive officer of the Company. In March 2015, Mr. Lupinacci ceased to be an executive officer of the Company. In April 2015, Mr. Horowitz ceased to be an executive officer of the Company. No further payments in respect of base salary were payable to any of Messrs. Clamen, Lupinacci or Horowitz following the termination of their respective employment with the Company.

Cash Bonus Compensation

Cash bonuses are made pursuant to our stockholder approved bonus plan and pursuant to each of our named executive officers’ employment agreements. No payment will be made under the bonus plan unless the Compensation Committee certifies that at least the minimum objective performance measures have been met. Such performance measures may include specific or relative targeted amounts of, or changes in: EBITDA (as defined earlier); Free Cash Flow (as defined earlier); earnings per share; diluted earnings per share; revenues; expenses; net income; operating income; equity; return on equity, assets or capital employed; working capital; stockholder return; production or sales volumes; or certain other objective criteria.

11

Table of Contents

The amount of any award under the bonus plan may vary based on the level of actual performance. The amount of any award for a given year is determined for each participant by multiplying the individual participant’s actual base salary in effect at the end of that year by a target percentage (from 0% to 200%), related to the attainment of one or more performance goals, determined by the Compensation Committee. In the event that an award contains more than one performance goal, participants in the bonus plan will be entitled to receive the portion of the target percentage allocated to the performance goal achieved. In the event that we do not achieve at least the minimum performance goals established, no award payment will be made.

With respect to 2014, Mr. Cole was the only named executive officer who was eligible to receive a bonus under the bonus plan, and only he received a bonus under the bonus plan. Mr. Cole’s cash performance targets for 2014 were as follows: $1,125,000 (75% of base salary for achievement of 90% of the target level of EBITDA) was earned for our achievement of approximately $263.8 million of EBITDA. This EBITDA amount represents 98% of the targeted EBITDA, which was $270.0 million as established by the Board of Directors. Mr. Cole did not receive any discretionary cash bonuses in 2014.

In 2014, Messrs. Blumberg and Schaefer received discretionary cash bonuses of $350,000 and $200,000, respectively, in accordance with their employment agreements. These cash bonuses were recommended by our Chief Executive Officer to the Compensation Committee and were discretionary, up to 100% of their respective salaries, which limitation is superseded by the maximum amount available under the Company’s executive bonus program and any other bonus program generally applicable to senior executives of the Company. Messrs. Horowitz, Clamen and Lupinacci did not receive discretionary cash bonuses in 2014. However, Mr. Horowitz received a cash bonus paid in 2014 related to 2013 performance metrics under his employment agreement prior to the 2014 amendment thereof.

Equity-based Compensation

Equity-based compensation is typically awarded in the form of Performance Stock Units, referred to as PSUs, Restricted Stock Units, referred to as RSUs, and shares of restricted stock.

PSUs

Mr. Cole was the only executive with PSUs that were granted in 2008, referred to as the 2008 PSUs. The last performance year for the 2008 PSUs was December 31, 2012. Of the 2008 PSUs, 60% of them were forfeited by Mr. Cole for the Company’s failure to meet the performance criteria, illustrating the difficulty of achieving these metrics.

PSUs Outstanding as of December 31, 2014

Absolute Metrics – General

As of December 31, 2014, there were outstanding three tranches of PSUs: 2011 PSUs, 2013 PSUs and 2014 PSUs. Each has absolute performance metrics for EBITDA Growth, EPS Growth and Free Cash Flow, in differing percentages as described below. The metrics are set at the date of grant and each year a certain portion of PSUs are available to vest, based on the Company’s achievement of such metrics. The metrics compound EBITDA Growth and EPS Growth year over year, targeting a 10% growth rate, with a threshold set at a 5% growth rate. The Free Cash Flow metric is set at $125 million for each tranche of PSUs. Each tranche of PSUs has its own set of absolute metrics, as indicated below. Additionally, based on where the actual EBITDA Growth and actual EPS Growth fall, a portion of the PSUs may still vest based on the relative metrics analysis, which compares the Company’s actual results to those of a specific peer group as described below. During our stockholder outreach, we learned that some of our stockholders believed that the performance metrics of our PSUs were not difficult to achieve. We have noted below where certain performance metrics were not met and such corresponding PSUs did not vest.

Relative Metrics

If the Absolute EPS or Absolute EBITDA metrics are not fully met, the Compensation Committee must determine whether the relative metrics have been met. The Relative EBITDA Growth and Relative EPS Growth performance metrics are determined by reference to where the Actual EBITDA Growth and Actual EPS Growth achieved by the Company during the performance period places the Company in relation to the group of peer companies determined by the Compensation Committee prior to the beginning of the relevant performance period. This peer group must be based on companies in GICS codes 25203010 (Apparel, Accessories and Luxury Goods) and 25203020 (Footwear) with comparable revenue and earnings levels (comprised of annual revenue between $100 million and $5 billion and EBITDA and EPS greater than zero in the most recent fiscal year).

12

Table of Contents

The Compensation Committee engages an independent consultant to regularly review the peer group, and recommend changes as necessary, to ensure there is a consistent calculation of measures of performance. Below is the relative performance peer group that was used to determine Relative EBITDA Growth and Relative EPS Growth performance metrics under our each tranche of our PSUs for 2014:

| Carter’s Inc. | Gildan Activewear Inc. | Rocky Brands, Inc. | ||

| Cherokee Inc. | Hanesbrands Inc. | Skechers U.S.A., Inc. | ||

| Columbia Sportswear Company | Kate Spade & Co. | Superior Uniform Group Inc. | ||

| Crocs, Inc. | Lululemon athletic inc | Tumi Holdings Inc. | ||

| Deckers Outdoor Corporation | Madden Steven Ltd. | Under Armour Inc. | ||

| Delta Apparel, Inc. | Movado Group Inc. | Vera Bradley, Inc. | ||

| Fossil, Inc. | Oxford Industries, Inc. | VF Corp. | ||

| G-III Apparel Group Ltd. | PVH Corp. | Wolverine World Wide, Inc. |

Excluded from this group for the computation of the relative performance calculations were certain companies that did not meet the criteria for each of the specific performance metrics or that no longer filed public information. The Relative Metric analysis is applicable to all tranches of PSUs. There is a catch-up feature to the PSUs such that if, in subsequent years, the Company performs in a manner such that the executive would have been able to vest prior years’ PSUs, the metrics, the PSUs may vest at such later time.

2011 PSUs

Mr. Cole holds PSUs granted in 2011, as did Mr. Clamen, referred to as the 2011 PSUs. The pre-determined 2011 PSU performance goals are as follows: 33 1/3% of the 2011 PSUs vest on the achievement of a specified level of EBITDA Growth as set forth below; 33 1/3% of the 2011 PSUs vest on the achievement of a specified level of EPS Growth as set forth below; and 33 1/3% of the 2011 PSUs vest on the achievement of Free Cash Flow of $125 Million or more.

With respect to the 2011 PSUs, the EBITDA Growth and EPS Growth performance metrics are measured in two ways: Absolute Growth and Relative Growth. The annual performance goals required for the 2011 PSUs to vest for the year ended December 31, 2014 were as follows:

2011 PSU Absolute Metrics

| Performance Metric |

Requirement | |

| Target Absolute EBITDA Growth |

EBITDA of $305.5 million | |

| Threshold Absolute EBITDA Growth |

EBITDA of $265.7 million | |

| Target Absolute EPS Growth |

EPS of $1.98 | |

| Threshold Absolute EPS Growth |

EPS of $1.72 |

In 2014, the achievement of these 2011 PSU metrics resulted in vesting as to 227,687 of Mr. Cole’s 2011 PSUs. Of these 227,687 2011 PSUs, 113,843 vested based on the achievement of the Target Absolute EPS Growth and 113,844 vested based on the achievement of Free Cash Flow in excess of $125 million. We note that in 2014, none of the 2011 PSUs vested with respect to either the absolute or relative EBITDA metrics. Mr. Clamen ceased to be an executive officer of the Company in March 2014 and did not vest any additional shares, including 2011 PSUs, after such date, and has forfeited his rights with respect to them.

2013 PSU Absolute Metrics

We granted 2013 PSUs to Mr. Schaefer that vest as described in the section “Mr. Schaefer’s Performance Based Restricted Stock Award”. Mr. Blumberg received 2013 PSUs that vest as described in the section “Mr. Blumberg’s Performance Based Restricted Stock Awards”. Mr. Horowitz received 2013 PSUs that vest as described in the section “Mr. Horowitz’s Performance Based Restricted Stock Awards”. None of Messrs. Cole, Clamen or Lupinacci received any grants of 2013 PSUs. The Absolute Growth metrics for the 2013 PSUs are $125 million Free Cash Flow, and, with respect to EBITDA and EPS, the Absolute Growth metrics for the year ended December 31, 2014 were as follows:

13

Table of Contents

| Performance Metric |

Requirement | |

| Target Absolute EBITDA Growth |

EBITDA of $262.5 million | |

| Threshold Absolute EBITDA Growth |

EBITDA of $239.2 million | |

| Target Absolute EPS Growth |

EPS of $1.84 | |

| Threshold Absolute EPS Growth |

EPS of $1.68 |

The relative metrics applicable to the 2013 PSUs were calculated in the manner described above under “Relative Metrics”. As the performance metrics for Absolute EBITDA Growth and Absolute EPS Growth were fully achieved, there was no calculation based on the relative metrics for 2014 with respect to the 2013 PSUs.

2014 PSU Absolute Metrics

Mr. Horowitz received 2014 PSUs that were available to vest as described in the section “Mr. Horowitz’s Performance Based Restricted Stock Awards”. Mr. Lupinacci received 2014 PSUs that were available to vest as described in the section “Mr. Lupinacci’s Performance Based Restricted Stock Awards”. Neither of Messrs. Cole, Clamen, Blumberg or Schaefer received any grants of 2014 PSUs. The Absolute Growth metrics for the 2014 PSUs are $125 million Free Cash Flow, and, with respect to EBITDA and EPS, the Absolute Growth metrics for the year ended December 31, 2014 were as follows:

| Performance Metric |

Requirement | |

| Target Absolute EBITDA Growth |

EBITDA of $289.2 million | |

| Threshold Absolute EBITDA Growth |

EBITDA of $276.1 million | |

| Target Absolute EPS Growth |

EPS of $2.32 | |

| Threshold Absolute EPS Growth |

EPS of $2.21 |

The relative metrics applicable to the 2014 PSUs were calculated in the same manner described above under “Relative Metrics”. None of the 2014 PSUs vested with respect to either the Absolute or Relative EBITDA metrics.

Mr. Blumberg’s Performance Based Restricted Stock Awards

As Mr. Blumberg is our Executive Vice President, Head of Strategic Development, Mr. Blumberg’s PSUs have different performance metrics. Mr. Blumberg has received no additional compensation in exchange for serving as our Interim Chief Financial Officer. In 2012 and pursuant to Mr. Blumberg’s 2012 employment agreement, Mr. Blumberg was issued 37,800 shares of restricted stock subject to vesting based upon performance criteria related to “Acquisitions”. Through July 31, 2013, the Company completed four Acquisitions and therefore all of such shares vested. All Acquisitions are approved by our Board of Directors. We believe this mitigates any risk related to Mr. Blumberg’s compensation upon completion of Acquisitions.

An Acquisition under Mr. Blumberg’s 2012 employment agreement meant any direct or indirect investment or acquisition by the Company in or of any entity, business, brand, trademark, or other asset, that closes during the term of the agreement, or, if there is a letter of intent or similar agreement, that closes within 90 days from the end of the term.

In February 2013, Mr. Blumberg’s contract was amended, herein referred to as the 2013 amendment. Under the 2013 amendment, Mr. Blumberg was awarded 200,000 2013 PSUs that are subject to performance vesting described above under 2013 PSUs. Of the 2013 PSUs, two thirds of them vest in three equal installments beginning on December 31, 2013 subject to the following performance criteria: 22.22% of the 2013 PSUs vest based on the achievement of EBITDA Growth; 22.22% of the 2013 PSUs vest based on the achievement of EPS Growth; and 22.22% of the 2013 PSUs vest based on the achievement of Free Cash Flow. The goals for EBITDA Growth, EPS Growth and Free Cash Flow are set forth above under “-2013 PSUs”. The remaining one third of the 2013 PSUs vest upon the closing of Acquisitions (for this purpose, the acquisition must have a value (as defined in the 2013 amendment) of $5 million) during the extension term, which is the period from February 2, 2013 through January 31, 2016, unless earlier terminated. During the extension term, approximately 5.56% of the 2013 PSUs could vest upon the closing of an Acquisition, up to two Acquisitions per year (resulting in aggregate vesting of 11.11% of the 2013 PSUs in such year), subject to the ability for a future credit for Acquisitions in excess of two completed in any year in subsequent years and the ability to make up a deficit of less than two Acquisitions in prior years. If the Company closes Acquisitions with an aggregate value of $200 million or more between February 1, 2013 and January 31, 2016 (the term of the 2013 amendment), all of the Acquisition-based 2013 PSUs will be deemed to be vested on January 31, 2016, subject to Mr. Blumberg’s continued employment. In 2014, Mr. Blumberg was eligible to vest up to 66,666 2013 PSUs and 29,625 of the 2013 PSUs vested based on achievement of the performance metrics listed above, other than the portion related to Acquisitions. Of these 29,625 2013 PSUs, 9,875 of them vested on the achievement of each of the Target Absolute EPS Growth and the Target Absolute EBITDA Growth set forth in the chart above, and the Free Cash Flow performance metrics, related to the 2013 PSUs. In 2014, Mr. Blumberg did not receive any PSUs based on Acquisitions. In 2014, 37,041 2013 PSUs did not vest.

14

Table of Contents

Mr. Schaefer’s Performance Based Restricted Stock Award

Under the terms of his employment agreement, Mr. Schaefer was awarded 41,640 2013 PSUs that are subject to performance vesting as described above under 2013 PSUs. Mr. Schaefer’s 2013 PSUs vest as to 5,949 2013 PSUs on December 31, 2013 and as to 11,897 2013 PSUs on each of December 31, 2014, 2015 and 2016, subject to the following performance criteria: 33 1/3% of the 2013 PSUs vest based on the achievement of EBITDA Growth; 33 1/3% of the 2013 PSUs vest based on the achievement of EPS Growth; and 33 1/3% of the 2013 PSUs vest based on the achievement of Free Cash Flow. The goals for EBITDA Growth, EPS Growth and Free Cash Flow are set forth above under “-2013 PSUs”. In 2014, up to 11,896 2013 PSUs were available to vest and 11,896 of such 2013 PSUs vested based on the achievement of the performance metrics set forth above. Of these 11,896 2013 PSUs, 3,965 of them vested on the achievement of each of the Absolute Target EPS Growth and the Absolute Target EBITDA Growth set forth in the chart above, and the Free Cash Flow performance metrics, related to the 2013 PSUs.

Mr. Horowitz’s Performance Based Restricted Stock Award

Under the terms of the 2014 amendment to his employment agreement, Mr. Horowitz was awarded 69,279 2014 PSUs that were subject to performance vesting as described above under 2014 PSUs. Of the 2014 PSUs, they were available to vest in three annual installments of approximately 21%, 36% and 43% commencing December 31, 2014, subject to the following performance criteria: 33 1/3% of the 2014 PSUs based on the achievement of EBITDA Growth; 33 1/3% of the 2014 PSUs based on the achievement of EPS Growth; and 33 1/3% of the 2014 PSUs based on the achievement of Free Cash Flow. The goals for EBITDA Growth, EPS Growth and Free Cash Flow are described above under 2014 PSUs. In 2014, 14,549 2014 PSUs were available to vest and 8,097 of such 2014 PSUs vested based on achievement of the goals set forth above. Of the 8,097 2014 PSUs, 3,148 vested on achievement of EPS Growth and 4,949 vested on achievement of the Free Cash Flow performance metric. As no 2014 PSUs vested with respect to the absolute or relative EBITDA Growth performance metric, 6,452 of Mr. Horowitz’s 2014 PSUs did not vest and only 3,148 of Mr. Horowitz’s 2014 PSUs out of a possible 4,949 2014 PSUs vested based on EPS Growth. With respect to 2014, 8,400 of Mr. Horowitz’s 2013 PSUs vested pursuant to an award made under the terms of his employment agreement dated as of April 2, 2012 and his participation in our PSU program prior to his becoming an executive officer. Mr. Horowitz’s 2013 PSUs vested in four installments of 14%, 28%, 28% and 30% commencing December 31, 2013. Mr. Horowitz ceased to be an executive officer of the Company in April 2015.

Mr. Lupinacci’s Performance Based Restricted Stock Award

Under the terms of his employment agreement, Mr. Lupinacci was awarded 47,322 2014 PSUs that were subject to performance vesting as described above under 2014 PSUs. Of the 2014 PSUs, they were available to vest in three annual installments of 30%, 35% and 35%, commencing on December 31, 2014, subject to the following performance criteria: 33 1/3% of the 2014 PSUs based on the achievement of EBITDA Growth; 33 1/3% of the 2014 PSUs based on the achievement of EPS Growth; and 33 1/3% of the 2014 PSUs based on the achievement of Free Cash Flow. The goals for EBITDA Growth, EPS Growth and Free Cash Flow are set forth above. With respect to 2014, 7,915 of Mr. Lupinacci’s 2014 PSUs vested on achievement of the goals set forth above. Of the 7,915 2014 PSUs, 3,077 vested on achievement of EPS Growth and 4,837 vested on achievement of the Free Cash Flow performance metric. No 2014 PSUs vested with respect to the absolute or relative EBITDA Growth metric. Mr. Lupinacci ceased to be an executive officer of the Company in March 2015.

RSUs

Each of Messrs. Cole, Blumberg and Lupinacci received a portion of RSUs, a portion of which vested at December 31, 2014 as noted below. Mr. Horowitz was granted RSUs, which were scheduled to vest on December 31, 2015 and December 31, 2016, subject to Mr. Horowitz’s continued employment with the Company on the applicable vesting date. Mr. Horowitz ceased to be an executive officer in April 2015, and therefore forfeited his rights to the vesting of such RSUs. Messrs. Clamen and Lupinacci have ceased to be executive officers of the Company and no further vesting of their applicable RSUs will occur. Mr. Schaefer has not been granted RSUs.

| Total Number of RSUs Granted |

Number of Equal Installments |

First Installment Vesting Date |

||||||||||

| Neil Cole |

204,918 | Three | 12.31.2013 | |||||||||

| Jeff Lupinacci |

13,881 | Three | 12.31.2014 | |||||||||

| David Blumberg |

50,000 | Three | 12.31.2013 | |||||||||

15

Table of Contents

Stock Ownership

Ownership levels of common stock align stockholders’ and executives’ interests. Although the Company has not adopted stock ownership guidelines, as of December 31, 2014, the stock ownership of the named executive officers is considered exemplary as compared with best practices based on ISS’s Governance Risk Indicators—2014:

| Name |

2014 salary | ownership value as of 12/31/14 |

ownership compared to salary as of 12/31/14(1) |

best practices |

||||||||||||

| Neil Cole |

$ | 1,500,000 | $ | 68,548,658 | 63x | 5-8x | ||||||||||

| Jeff Lupinacci(2) |

$ | 550,000 | $ | 469,039 | 1x | 2-3x | ||||||||||

| David Blumberg |

$ | 550,000 | $ | 4,717,750 | 9x | 2-3x | ||||||||||

| Seth Horowitz(3) |

$ | 625,000 | $ | 3,059,685 | 5x | 2-3x | ||||||||||

| Jason Schaefer (4) |

$ | 400,000 | $ | 127,929 | 0.25x | 2-3x | ||||||||||

| (1) | Table does not include any unvested PSUs or unvested RSUs. As Mr. Clamen was not employed by the Company at December 31, 2014, he is not included in this chart. |

| (2) | Mr. Lupinacci joined the Company in 2014. Pursuant to most stock ownership policies, an executive is provided a period of time over which to build up his or her stock ownership to be in compliance with a company’s stock ownership guidelines. Mr. Lupinacci ceased to be an executive officer in March 2015. |

| (3) | Mr. Horowitz ceased to be an executive officer in April 2015. |

| (4) | Mr. Schaefer joined the Company in 2013. Pursuant to most stock ownership policies, an executive is provided a period of time over which to build up his or her stock ownership to be in compliance with a company’s stock ownership guidelines. |

Corporate Governance and Disclosure Changes

In 2014, as part of its ongoing effort to identify and recruit qualified candidates that provide diverse perspectives, strength of character, business expertise and relevant professional experience to our Board of Directors, our Nominating and Corporate Governance Committee identified and recruited Ms. Sue Gove as a director candidate and nominated her as a director candidate to our Board of Directors. The Board of Directors approved Ms. Gove’s nomination and she joined the Board of Directors on October 30, 2014, as previously announced in a Form 8-K filed with the SEC on November 4, 2014.

Tax Deductibility and Accounting Ramifications

The Compensation Committee generally takes into account the various tax and accounting ramifications of compensation paid to our executives. When determining amounts of equity-based grants to executives, the Compensation Committee also considers the accounting expense associated with the grants.

The Plan and our other plans, including the executive bonus plan, are intended to allow us to make awards to executive officers that are deductible under the Section 162(m) of the Code, which otherwise sets limits on the tax deductibility of compensation paid to a company’s most highly compensated executive officers. The Compensation Committee will continue to seek ways to limit the impact of Section 162(m). However, the Compensation Committee also believes that the tax deduction limitation should not compromise our ability to maintain incentive programs that support the compensation objectives discussed above or compromise our ability to attract and retain executive officers. Achieving these objectives and maintaining flexibility in this regard may therefore result in compensation that is not deductible by us for federal income tax purposes.

Assessment of Compensation-Related Risks

The Compensation Committee is responsible to assess the risks associated with the Company’s compensation practices, policies and programs. This assessment is performed to determine if such risks arising from such practices are appropriate or if they are reasonably likely to have a material adverse effect on the Company. The Compensation Committee performed this assessment and believes that, for 2014, the compensation policies did not incentivize our named executive officers to take unnecessary risks.

Summary

In summary, we believe that our mix of salary, cash incentives for short-term and long-term performance and the potential for additional equity ownership in our company motivates management to produce significant returns for our stockholders. Moreover, we believe that our compensation program strikes an appropriate balance between our interests and needs in operating and further developing our business and suitable compensation levels that can lead to the enhancement of stockholder value.

16

Table of Contents

Compensation Committee Interlocks and Insider Participation