UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1 to Form 10-K

(Mark One)

| x | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended: December 31, 2014

| ¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission File Number: 0-26001

Hudson City Bancorp, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 22-3640393 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| West 80 Century Road Paramus, New Jersey | 07652 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

(201) 967-1900

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.01 par value

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of April 23, 2015, the registrant had 741,466,555 shares of common stock, $0.01 par value, issued and 529,530,968 shares outstanding. The aggregate market value of voting stock held by non-affiliates of the registrant as of June 30, 2014 was $4,635,705,602. This figure was based on the closing price by the NASDAQ Global Market for a share of the registrant’s common stock, which was $9.83 as reported by the NASDAQ Global Market on June 30, 2014.

FORM 10-K/A

EXPLANATORY NOTE

This Amendment No. 1 to the annual report of Hudson City Bancorp, Inc. on Form 10-K/A (“Form 10-K/A”) amends the Company’s annual report on Form 10-K for the year ended December 31, 2014, which was originally filed with the Securities and Exchange Commission on March 2, 2015 (“Original Form 10-K”). This Form 10-K/A is being filed for the sole purpose of providing information required by Part III of Form 10-K that was not included in the Original Form 10-K. The Part III information may be incorporated by reference from the Company’s definitive proxy statement, or if such proxy statement is not filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year, such information may be included in an amendment to the Form 10-K.

Except as expressly noted herein, this Form 10-K/A does not modify or update in any way the disclosures made in the Original Form 10-K and does not reflect events occurring after the filing of the Original Form 10-K.

As used in this Form 10-K/A, unless we specify otherwise, “Hudson City Bancorp,” and “Company,” refer to Hudson City Bancorp, Inc., a Delaware corporation. “Hudson City Savings” and “Bank” refer to Hudson City Savings Bank, a federal stock savings bank and the wholly-owned subsidiary of Hudson City Bancorp and “we,” “us,” “our” and “Hudson City” refer collectively to the Company and the Bank.

1

PART III

Item 10. Directors, Executive Officers and Corporate Governance

Who Our Directors Are

The table below states certain information with respect to each director of the Hudson City Bancorp Board of Directors (“Board” or “Board of Directors”) (including time spent on the Board of Directors or Board of Managers of the Bank prior to the incorporation of Hudson City Bancorp on March 4, 1999). There are no arrangements or understandings between Hudson City Bancorp and any director or nominee pursuant to which such person was elected or nominated to be a director of Hudson City Bancorp. For information with respect to security ownership of directors, see “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters – Directors and Executive Officers.”

| Name (1) |

Age (2) | Director Since | Term Expires | Positions Held at Hudson City Bancorp | ||||||||||

| Denis J. Salamone |

62 | 2001 | 2015 | Director, Chairman and Chief Executive Officer | ||||||||||

| Anthony J. Fabiano |

54 | 2014 | 2015 | Director, President and Chief Operating Officer | ||||||||||

| Michael W. Azzara |

68 | 2002 | 2015 | Director | ||||||||||

| Victoria H. Bruni |

73 | 1996 | 2015 | Director | ||||||||||

| Donald O. Quest, M.D. |

75 | 1983 | 2015 | Director | ||||||||||

| Joseph G. Sponholz |

71 | 2002 | 2015 | Director | ||||||||||

| Cornelius E. Golding |

67 | 2010 | 2015 | Director | ||||||||||

| William G. Bardel |

75 | 2003 | 2015 | Director | ||||||||||

| Scott A. Belair |

67 | 2004 | 2015 | Director | ||||||||||

| (1) | Mr. Ronald E. Hermance, Jr., Hudson City Bancorp’s Chairman and Chief Executive Officer, passed away on September 11, 2014. On September 16, 2014, the Board of Directors filled the vacancy caused by Mr. Hermance’s passing by appointing Mr. Anthony J. Fabiano to serve as a director. |

| (2) | As of May 1, 2015. |

Directors

Denis J. Salamone has served as Chairman of the Board and Chief Executive Officer of Hudson City Bancorp and Hudson City Savings since September 2014. Mr. Salamone previously served as President and Chief Operating Officer of Hudson City Bancorp and Hudson City Savings from December 2010 to September 2014. Prior to assuming these positions, Mr. Salamone served as Senior Executive Vice President and Chief Operating Officer of Hudson City Bancorp and Hudson City Savings from January 1, 2002 and prior to that time served as Senior Executive Vice President since October 2001. He was elected to the Board in October 2001. Prior to joining the Company, Mr. Salamone had a 26 year career with the independent accounting firm of PricewaterhouseCoopers LLP, where he had been a partner for 16 years. Immediately prior to joining Hudson City Bancorp, Mr. Salamone was the Global Financial Services leader for Audit and Business Advisory Services, and a member of the PricewaterhouseCoopers eighteen member board of partners. Mr. Salamone is a member of the American Institute of CPAs and a member of the New York State Society of CPAs. He graduated in 1975 with a B.S. in Accounting from St. Francis College where he is currently a member of its Board of Trustees. Mr. Salamone served as Acting Chairman and Chief Executive Officer of Hudson City Bancorp and Hudson City Savings during Mr. Hermance’s medical leave in 2012.

Mr. Salamone has 39 years of experience in the financial services industry. Prior to joining the Company, for 26 years Mr. Salamone served a clientele consisting of many banks and investment banks as a professional advisor. As a partner at a major accounting firm working with financial institutions, Mr. Salamone developed a depth of knowledge in areas of accounting, risk management, internal control, regulatory compliance and operational efficiency and effectiveness which are a valuable asset to the Board. Mr. Salamone’s skills, experience and knowledge strengthen the Board’s collective knowledge, capabilities and experience.

Anthony J. Fabiano has served as President and Chief Operating Officer of Hudson City Bancorp and Hudson City Savings since September 2014. Mr. Fabiano has served as the principal accounting officer of Hudson City Bancorp and Hudson City Savings since April 2011. Mr. Fabiano previously served as Executive Vice President, Finance and Administration from July 2012 until September 2014. He previously served as Senior Vice President/Finance of Hudson City Savings and Hudson City Bancorp from January 2010 to June 2012. He previously served as First Vice President/Finance of Hudson City Savings and Hudson City Bancorp from January 2007 to December 2009. Mr. Fabiano also served as the Vice President and Treasurer of each of Hudson City Preferred Funding and Sound REIT, Inc. from January 2008 to December 2011 and served as the Secretary and Director of HudCiti Service Corp. from January 2008 to September 2014 and currently serves as the Vice President and Director. Immediately prior to joining the Company, Mr. Fabiano was the Senior Vice President, Chief Financial Officer and Corporate Secretary of Sound Federal Bancorp

2

from January 2001 to July 2006, and the Vice President and Chief Financial Officer of Sound Federal Bancorp from July 1998 to December 2000. Mr. Fabiano was the Senior Vice President and Chief Financial Officer of MSB Bancorp, Inc. from July 1992 to June 1998 and was employed by KPMG from August 1982 until June 1992 in the audit practice. Mr. Fabiano is a CPA and is a member of the American Institute of CPAs and the New York State Society of CPAs. Mr. Fabiano is a graduate of Manhattan College and the National School of Banking at Fairfield University.

Mr. Fabiano has 33 years of experience in the financial services industry. Mr. Fabiano brings to his position a long history of senior management and leadership experience both at Hudson City Savings and other thrift institutions. Mr. Fabiano has developed a depth of knowledge in the areas of accounting and finance, as well as regulatory compliance and bank administration. Mr. Fabiano’s skills, experience and knowledge strengthen the Board’s collective knowledge, capabilities and experience.

Michael W. Azzara has been a part-time Senior Consultant with the executive search and consulting firm of Foley Proctor Yoskowitz since October 2003. He is the retired President and Chief Executive Officer of Valley Health System, a regional health care provider comprised of The Valley Hospital in Ridgewood, New Jersey, Valley Home Care and the Valley Health Medical Group, a position he held from 1997 to his retirement in 2003. Prior to assuming such position, Mr. Azzara served as President and Chief Executive Officer of The Valley Hospital. Mr. Azzara serves on the Board of Trustees of Rutgers University and as Chair of the Advisory Board to the Dean of the School of Arts and Sciences at Rutgers University. He also serves on the Board of Trustees of the non-profit Bergen Volunteer Medical Initiative. Mr. Azzara had served on the Board of Directors of Ridgewood Savings Bank for 13 years until its purchase by another community bank. A graduate of Rutgers University, he has a Masters degree from Cornell Graduate School of Business and Public Administration. Mr. Azzara is also a Life Fellow of the American College of Health Care Executives.

As a former health care executive with 22 years of experience serving as a Chief Executive Officer, Mr. Azzara has developed and demonstrated valuable leadership skills and extensive experience with the myriad of issues facing corporate entities, including government regulations, risk management, governance, leadership development and human resources. A resident of northern New Jersey for his entire life, and a former board member of a northern New Jersey savings bank, Mr. Azzara possesses insightful knowledge of the market area currently served by Hudson City Savings, including regional economic conditions and the competitive landscapes. All of these qualities, as well as the unique contributions Mr. Azzara makes as the only outside director with experience as a Chief Executive Officer, strengthen the Board’s collective knowledge, capabilities and experience.

William G. Bardel was the Associate Headmaster and Chief Financial Officer of the Lawrenceville School, a preparatory high school in Lawrenceville, New Jersey, from 1994 until 2006. The Lawrenceville School had an annual budget of $40 million and an endowment of $200 million. Previously, from 1988 to 1994, he served as head of the Government Advisory Group of Lehman Brothers in London, England, which provided financial market guidance to developing nations in Africa, Asia, Eastern Europe, South America and the Middle East, having been named a Managing Director of Lehman Brothers in 1984. Since 2006, Mr. Bardel has acted as a financial consultant to a number of educational institutions. Mr. Bardel currently serves as the Audit Committee’s financial expert. A graduate of Yale University, he has a Masters degree from Oxford University where he was a Rhodes Scholar. Mr. Bardel received his J.D. from Harvard Law School and was a member of the bar in the state of New York until he ceased the active practice of law. Mr. Bardel currently serves as the Board’s lead independent director.

Having worked for many years in the financial services industry and as the Chief Financial Officer of a prestigious educational institution, Mr. Bardel possesses a strong overall knowledge of both business and finance. In addition, as an attorney Mr. Bardel also possesses a valuable understanding of the legal system and an ability to assess and evaluate risk from a legal as well as a business standpoint. These skills, combined with Mr. Bardel’s leadership experience in several capacities, strengthen the Board’s collective knowledge, capabilities and experience.

Scott A. Belair is a co-founder of Urban Outfitters, Inc., a NASDAQ-listed retailer and wholesaler operating under the brand names Urban Outfitters, Anthropologie and Free People, and has served on its Board of Directors since 1970. Previously, Mr. Belair, a CPA, was a Principal at Morgan Stanley and Vice President and Chief Financial Officer of the international offices and subsidiaries at Goldman Sachs, having worked at these investment banks for more than 15 years. In addition, Mr. Belair has been Principal at The ZAC Group, performing financial advisory services, since 1989. Mr. Belair also serves as a member on the Board of Directors of the Ridgewood YMCA in Ridgewood, New Jersey. A graduate of Lehigh University, Mr. Belair has an MBA from the University of Pennsylvania.

As a CPA, and having previously served in various senior managerial roles for financial services companies, Mr. Belair has gained extensive knowledge of the financial services industry and the many accounting, regulatory and risk management issues faced by financial institutions. The unique perspective Mr. Belair brings from his background as an entrepreneur and his extensive experience in the areas of business growth and the development of business strategy as a co-founder of Urban Outfitters, Inc., strengthen the Board’s collective knowledge, capabilities and experience.

3

Victoria H. Bruni served as Vice President for Administration and Finance at Ramapo College of New Jersey, a public four year liberal arts college with an annual budget of over $100 million, from June 1993 until July 2006. She was responsible for financial planning and reporting, budgets, public financings, accounting operations, and purchasing, as well as administrative functions such as human resources and capital facilities planning, construction and maintenance. From 1964 to 1993 she served in various management and executive positions at New Jersey Bell Telephone Co./Bell Atlantic, including Assistant Comptroller, Treasurer, Assistant Secretary and Attorney. A graduate of Smith College, she received her J.D. with honors from Seton Hall University School of Law. Ms. Bruni was a member of the bar in the state of New Jersey until she ceased the active practice of law. Ms. Bruni is a former member of the NYC Downtown Economists Club.

Prior to Ms. Bruni’s retirement in 2006, her professional career spanned 42 years, all of which were spent in managerial and executive positions where she gained valuable leadership and governance experience and a strong understanding of corporate financial matters and human resources related issues. In addition, as an attorney admitted to the bar since 1978, Ms. Bruni possesses a valuable understanding of the legal system and the ability to assess and evaluate risk from a legal as well as a business standpoint. Ms. Bruni’s skills, experience and knowledge, as well as the unique perspective she brings as the only outside director with line officer experience in human resources management, strengthen the Board’s collective knowledge, capabilities and experience.

Cornelius E. Golding was the Senior Vice President and Chief Financial Officer of Atlantic Mutual Insurance Company, where, among other responsibilities, he oversaw the corporate investment portfolio, a position he held from August 1994 to his retirement in September 2003. Previously, from 1981 to 1994, Mr. Golding served in various management and executive positions at Atlantic Mutual Insurance Company, including Senior Vice President and Comptroller, Vice President and Comptroller and Vice President-Internal Audit. Prior to joining Atlantic Mutual Insurance Company, Mr. Golding served as the Vice President of Ideal Mutual Insurance Company in 1979 and as the Assistant Controller of AIG, a position he held from December 1979 to March 1980. From 1974 to 1979 Mr. Golding served in various positions at Crum & Forster, including Assistant Controller and from 1972 to 1974 Mr. Golding was employed by the Robert Stigwood Organization. Prior to 1972, Mr. Golding worked for the independent accounting firm of Price Waterhouse (now PricewaterhouseCoopers) as an auditor. Mr. Golding serves on the Board of Directors of United Automobile Insurance Group where he is a member of the Corporate Governance Committee, Audit Committee and Investment Committee. Mr. Golding also serves on the Board of Directors of Retrophin Inc. (a public company listed on the NASDAQ Global Market) where he is chairman of the Audit Committee, and as Trustee of the John A. Forster Trust. Mr. Golding previously served on the Board of Directors of Neurologix, Inc. where he was Chairman of the Audit Committee and a member of the Compensation Committee. Mr. Golding previously served on the Board of Directors of Somerset Hills Bancorp and National Atlantic Holdings Corporation. Mr. Golding is a retired CPA and a member of the American Institute of CPAs and a member of the New York State Society of CPAs. A graduate of St. John Fisher College, Mr. Golding holds an MBA from Fairleigh Dickenson University. Mr. Golding is also a graduate of the Advanced Education Program at the Wharton School of the University of Pennsylvania.

As a former executive in the financial services industry, serving as a Chief Financial Officer for over 10 years, and serving on several boards of directors, including a publicly held bank holding company, Mr. Golding has developed extensive financial and accounting expertise. As a retired CPA, Mr. Golding has gained a valuable understanding of financial institutions and the financial, accounting, operational, regulatory and risk management issues faced by such institutions. Such skills strengthen the Board’s collective knowledge, capabilities and experience.

Donald O. Quest, M.D. has been a neurological surgeon since 1976, a professor at Columbia University since 1989, Assistant Dean for Student Affairs at Columbia University since 2002, and an attending physician at The Valley Hospital and Columbia-Presbyterian Medical Center since 1978. He is a member of the Neurosurgical Associates of New York and New Jersey and a member of the Board of Trustees of Mary Imogene Bassett Hospital in New York. Dr. Quest has been President of the American Association of Neurological Surgeons, the American Academy of Neurological Surgeons, the Congress of Neurological Surgeons, the Chairman of the American Board of Neurological Surgery and the Chairman of the Residency Review Committee for Neurological Surgery. A graduate of the University of Illinois, he received his M.D. from Columbia University.

As a result of the senior positions Dr. Quest has held in professional organizations during his career, Dr. Quest has developed valuable leadership skills and experience related to governance and ethical issues. In addition, Dr. Quest has developed a broad understanding of the banking industry based on his service on the Company’s Board since 1983. As the Company’s longest serving continuing director, Dr. Quest makes a unique contribution through his institutional knowledge of the evolution of the Company’s business and the policies and practices of the Board as its governing body. Dr. Quest’s leadership skills, governance experience and knowledge of the Company strengthen the Board’s collective knowledge, capabilities and experience.

Joseph G. Sponholz is a retired Vice Chairman of Chase Manhattan Bank, a position he held from 1997 to his retirement in 2000. Prior to assuming the position of Vice Chairman, Mr. Sponholz had served as Chief Administrative Officer of Chase Manhattan Bank. Serving as a member of Chase’s Executive Committee, Mr. Sponholz spearheaded Chase’s Internet efforts as leader of Chase.com. Prior to its merger with Chase, he served as Chief Financial Officer and Chief Technology Officer at Chemical Bank as part of a 20 year career at that institution and its successor. Prior to joining Chemical Bank, Mr. Sponholz spent 7 years, including two

4

years as a Partner, at the financial advisory firm of Booz Allen Hamilton. Mr. Sponholz currently serves as a member on the Board of Directors of the Bedford Stuyvesant Restoration Corp, in Brooklyn, New York. A graduate of Fordham University, Mr. Sponholz holds an MBA in Finance from New York University. Mr. Sponholz served as the Board’s lead independent director from 2008 until March 31, 2012, and currently serves as the Chairman of the Company’s Audit Committee.

As the former Chief Financial Officer of one of the largest banks in the country, Mr. Sponholz is recognized as an industry leader in the areas of business strategy, technology and financial management. During his 30 year career working in the banking industry, Mr. Sponholz held many significant leadership roles and developed a detailed understanding of financial institutions and the financial, operational and regulatory issues they confront on a daily basis. Mr. Sponholz’s financial and leadership skills and his experience and knowledge of the financial services industry, and the unique contribution he makes as the only continuing outside director with experience as a senior retail and commercial banking executive, strengthen the Board’s collective knowledge, capabilities and experience.

Executive Officers

In addition to Messrs. Salamone and Fabiano, Hudson City Bancorp and Hudson City Savings have the following executive officers:

Louis J. Beierle, age 63, has been a Senior Vice President of Hudson City Savings and Hudson City Bancorp since January 2011. He is currently responsible for the internal audit function of both Hudson City Savings and Hudson City Bancorp, having been appointed Director of Internal Audit in January 2007. Mr. Beierle previously served as First Vice President from 2004 through 2010, and as a Vice President from 1993 to 2004, during which time he served in various roles, including assisting in the preparation for Hudson City Bancorp’s initial public offering and the development of the Investor Relations department, as well as serving as the Compliance Officer. Mr. Beierle joined Hudson City Savings in 1993 as Vice President/Special Projects. Prior to joining Hudson City Savings, Mr. Beierle was Chief Financial Officer of Montclair Savings Bank, a position he held from 1989 to 1993, and a Senior Manager in the financial institutions practice of KPMG Peat Marwick from 1980 to 1989. Mr. Beierle is a member of the American Institute of CPAs and the New Jersey Society of CPAs. A graduate of Montclair State College, Mr. Beierle holds an MBA from Rutgers University.

Ronald J. Butkovich, age 65, has been Senior Vice President of Hudson City Savings and Hudson City Bancorp since April 2004. He is responsible for the development of the Long Island Region. Mr. Butkovich joined Hudson City Savings in 2004. He formerly served as Operations/Retail Banking officer of Southold Savings Bank on Long Island, New York for 16 years and the Director of Real Estate, Branch Development, and Construction for North Fork Bank for 16 years. Mr. Butkovich has served on various industry, community, and civic associations including treasurer of the Southold Fire Department since 1978. Mr. Butkovich earned his undergraduate degree at the State University of New York at Albany and is a graduate of the National School of Savings Banks and a graduate of the Executive Development Program at Fairfield University.

V. Barry Corridon, age 66, joined Hudson City Savings in 1970. He has been Senior Vice President of Mortgage Servicing of Hudson City Savings since January 2000 and Senior Vice President of Hudson City Bancorp since January 2004. He previously served as First Vice President of Mortgage Servicing of Hudson City Savings from 1995 to 2000 and as a Vice President from 1982 to 1995. He is responsible for the administration of our mortgage portfolio, supervision of new loan set-up, post-closing, payoffs, mortgage accounting, collections and foreclosures. Mr. Corridon was President of the Mortgage Bankers Association of New Jersey in 1995. He is a former President of the Mortgage Bankers Association’s Educational Foundation. Mr. Corridon is an emeritus member of WOODLEA/PATH Advisory Council of Children’s Aid and Family Services. He earned his undergraduate degree at Fairleigh Dickinson University and is also a graduate of the Graduate School of Savings Banking at Brown University and the Executive Development Program at Fairfield University.

Michael Daly, age 62, joined Hudson City Savings on December 5, 2011 as a First Vice President and Director of Interest Rate Risk Management. Mr. Daly was promoted to Senior Vice President, effective July 1, 2012. Prior to joining Hudson City Savings, Mr. Daly worked at State Street Corporation in its Global Treasury function as Vice President and Head of Quantitative Research. He was also previously employed at JPMorgan Chase in its mortgage banking division as Vice President, Risk Management and Valuation Control. Mr. Daly was awarded a Ph.D. in Economics from Temple University (Philadelphia, PA). He also holds an M.A. degree in Economics from Georgetown University (Washington, D.C.).

Tracey A. Dedrick, age 58, joined Hudson City Savings and Hudson City Bancorp in July of 2011 as Executive Vice President and Chief Risk Officer. From January 2010 to February 2011, Ms. Dedrick served as the Treasurer of PineBridge Investments, an asset management company with $83 billion in assets under management where her responsibilities included managing Treasury, Investor Relations and Risk Management. Ms. Dedrick was employed by MetLife, the largest insurance company in the United States, from June 2001 until September 2009, where she served as Assistant Treasurer from June 2001 until July 2004, charged with the responsibility for building a treasury function for the recently demutualized company as well as managing the capital, liquidity and

5

interest rate risk in the $500 billion balance sheet. At MetLife, Ms. Dedrick served as the Senior Vice President and Head of Market Risk from July 2007 until September 2009 where she was charged with the task of implementing a new economic capital and market risk model used to successfully measure the market risk of the entire balance sheet for the first time. Ms. Dedrick earned her undergraduate degree at the University of Minnesota. .

James A. Klarer, age 62, joined Hudson City Savings in 1976. He has served as Senior Vice President of Hudson City Savings and Hudson City Bancorp since January 2005. He previously served as First Vice President of Hudson City Savings from 2002 to 2004, and as a Vice President from 1992 to 2002. Mr. Klarer also served as Secretary of HudCiti Service Corp., a subsidiary of Hudson City Savings, from January 1993 to January 2008. He is responsible for real estate development, branch expansion, insurance, purchasing and general services. Mr. Klarer also manages the disposition of ORE properties. Mr. Klarer is a former member of the Institute of Real Estate Management (IREM) and is a current member of the Building Owners and Managers Association (BOMA). He is a graduate of William Paterson College.

James C. Kranz, age 66, has been Executive Vice President and Chief Financial Officer of Hudson City Savings and Hudson City Bancorp since October 2007. He previously served as Senior Vice President and Chief Financial Officer of Hudson City Savings and Hudson City Bancorp from January 2007 to October 2007, and as Senior Vice President and Investment Officer of Hudson City Savings from January 2000 to January 2007, and as Senior Vice President of Hudson City Bancorp from January 2004 to 2006. He maintains oversight of the entire accounting and finance functions as well as primary execution responsibility for investments and borrowings. Mr. Kranz joined Hudson City Savings in 1983. Mr. Kranz serves on the Asset and Liability Management Committee of the New Jersey Bankers Association. Mr. Kranz has an undergraduate degree and an MBA from Lehigh University. He is a graduate of the Graduate School of Savings Banking at Brown University.

William J. LaCalamito, age 55, has served as Senior Vice President of Hudson City Savings and Hudson City Bancorp since January 2012. He previously served as First Vice President – Retail Banking of Hudson City Savings and Hudson City Bancorp from July 2006 to December 2011. Immediately prior to joining the Company, Mr. LaCalamito was Vice President and Regional Manager of Sound Federal Bancorp, Inc., a position he held from July 2000 to July 2006. Mr. LaCalamito was the Chief Operating Officer, President, Corporate Secretary and Director of Peekskill Financial Corporation from December 1995 to July 2000. From October 1988 to December 1995, Mr. LaCalamito served in various officer capacities at First Federal Savings and Loan Association of Peekskill. Mr. LaCalamito was employed by KPMG from July 1981 until October 1988 in the audit practice. Mr. LaCalamito is a CPA and earned his undergraduate degree and an MBA from Pace University.

Thomas E. Laird, age 62, joined Hudson City Savings in 1974. He has served as Executive Vice President and Chief Lending Officer of Hudson City Savings and Hudson City Bancorp since October 2007. He previously served as Senior Vice President and Chief Lending Officer of Hudson City Savings and Hudson City Bancorp from January 2002 to September 2007, Senior Vice President of Hudson City Bancorp since January 2004 and Senior Vice President and Mortgage Officer from January 2000 to 2002. Prior to that, he served as First Vice President and Mortgage Officer from 1991 to 2000. His primary job responsibilities encompass oversight of the full range of managerial duties for loan review, compliance and credit analysis functions, including adherence to policies and procedures of the institution and applicable regulatory and governmental agencies. Mr. Laird holds an undergraduate degree from St. Peter’s University and is a graduate of the National School of Banking at Fairfield University. Mr. Laird was actively involved from 1989 to 1999 on the Wanaque Board of Education, having served for two terms as Board President. He has also been active in the New Jersey Bankers Association. He is a former member of the Board of Governors of the Mortgage Bankers Association of New Jersey and a former board member of the Dover Housing Development Corporation.

Christopher L. Mahler, age 54, has worked for Hudson City Savings since 1982 in various capacities related to retail banking, mortgage servicing and mortgage originations. Since January 2010, Mr. Mahler has served as Senior Vice President – Mortgage Lending of Hudson City Savings and Hudson City Bancorp. His primary job responsibilities encompass the full range of managerial duties for loan review, compliance and credit analysis functions, including adherence to policies and procedures of the institution and applicable regulatory and governmental agencies. He previously served as First Vice President and Mortgage Officer of Hudson City Savings and Hudson City Bancorp from December 2003 to December 2009 and Vice President from January 1992 to December 2002. Additionally, Mr. Mahler has served as President and Director of Hudson City Preferred Funding since its incorporation in May 2000 and President and Director of Sound REIT, Inc. since 2006. Hudson City Preferred Funding and Sound REIT, Inc. are both subsidiaries of Hudson City Savings. Mr. Mahler graduated from Providence College in Rhode Island with a B.S. degree. He received his MBA from Saint Peter’s University in New Jersey. He also graduated from the Graduate School of Banking at Fairfield University. Mr. Mahler has been a member of the Mortgage Bankers Association of New Jersey, serving on both the Affordable Housing Committee as well as the Conventional Loan Committee. He is also active with the Community Bankers Association of New Jersey. Mr. Mahler also had been active with Bergen County Habitat for Humanity having served three years on its board of directors as well as Vice President and Chairman of the Construction Committee.

6

Michael McCambridge, age 52, joined Hudson City Savings in 1986 and has served as Senior Vice President of Hudson City Savings and Hudson City Bancorp since January 2010. He previously served as First Vice President of Hudson City Savings and Hudson City Bancorp from 2003 to 2009, and as Vice President from 1998 to 2002. Mr. McCambridge is responsible for asset/liability management reports including income and growth forecasting. He also manages the borrowing portfolio and is responsible for daily cash management. Prior to this, Mr. McCambridge was responsible for the financial and regulatory reporting of Hudson City Bancorp and Hudson City Savings. Mr. McCambridge received a B.A. from the University of Delaware and a B.S. in accounting from Ramapo College of New Jersey. Mr. McCambridge is a member of the American Institute of CPAs and a member of the New Jersey Society of CPAs.

Ken McIntyre, age 54, has served as Senior Vice President — Commercial Real Estate of Hudson City Savings and Hudson City Bancorp since April 2014. Prior to joining the Company, Mr. McIntyre served as the Managing Principal of Passport Real Estate LLC, a company founded in 2012 that provided commercial real estate consulting services to Hudson City Savings Bank from September of 2013 until April of 2014. Previously, he served as a Managing Director at MetLife Real Estate Investments from October of 2002 until September of 2012. While at MetLife, Mr. McIntyre served as a member of the Investment Committee for Commercial Mortgages and was the Senior Real Estate Officer for MetLife Bank. Mr. McIntyre has over 30 years of experience in credit and commercial real estate originations and has held positions at multiple financial institutions, including Chase, UBS and GE Capital. Mr. McIntyre holds a Certified Retail Property Executive Certification (CRX) from the International Council of Shopping Centers (ICSC). He graduated from Florida A&M University with a BS degree in Economics.

Joseph Michalik, age 53, has been a Senior Vice President of Hudson City Savings and Hudson City Bancorp since January 2015. He is currently responsible for the development and implementation of Hudson City Savings’ credit risk management program. Mr. Michalik previously served as First Vice President from 2012 to December 2014. Prior to joining Hudson City Savings, Mr. Michalik served as a founding member of the management team of MetLife Bank, NA from 2001 through 2012. During his tenure, he served as the MetLife Bank’s Senior Credit Officer, head of Commercial Credit Risk Management and as Chief Credit Officer responsible for all credit and lending functions of MetLife Bank. Prior to joining MetLife Bank, Mr. Michalik served as a Senior Vice President and Deputy General Manager of the credit department of an international bank for five years and was employed for four years in the Corporate Finance Group of Viacom, four years as Director of Information Systems/chief information & technology officer of the New York State Department of Banking (now part of the New York State Department of Financial Services) and four years as a Bank Examiner and Financial Analyst at the Federal Reserve Bank of New York. Mr. Michalik holds a B.A. in Economics from St. Peter’s University and an M.B.A. in Finance from New York University Graduate School of Business (Stern).

J. Christopher Nettleton, age 59, has served as Senior Vice President of Hudson City Savings and Hudson City Bancorp since January 2012. He previously served as First Vice President from 2005 to 2011 and as Vice President from 2004 to 2005. Mr. Nettleton is responsible for the management of the Human Resources function. Prior to joining the Company, he worked in the Human Resources department of Ingersoll Rand, Promus Hotels and other major companies for 20 years. Mr. Nettleton has served on various community and civic associations. He holds an undergraduate degree from Arizona State University. Mr. Nettleton is a member of the American Institute of CPAs.

Veronica A. Olszewski, age 55, has served as Senior Vice President, Treasurer and Corporate Secretary of Hudson City Bancorp and Hudson City Savings since June 2007. She previously served as Senior Vice President and Corporate Secretary of Hudson City Bancorp and Hudson City Savings from January 2004 to June 2007, Senior Vice President from January 2002 to December 2003, First Vice President from January 2000 to December 2001 and Vice President and Assistant Auditor from March 1997 to December 1999. Ms. Olszewski joined Hudson City Savings in 1980. She is responsible for the functions of Corporate Secretary, special projects and strategic planning. Ms. Olszewski is a member of the American Institute of CPAs and a member of the New Jersey Society of CPAs. Ms. Olszewski is also a member of the American Society of Corporate Governance Professionals. She is a graduate of Jersey City State College.

Donna Orlich, age 51, has been a Senior Vice President of Hudson City Bancorp and Hudson City Savings since January 2015. She is currently the Chief Information Officer of Hudson City Savings and Hudson City Bancorp. Ms. Orlich previously served as First Vice President from 2013 to December 2014. Prior to joining Hudson City Savings, Ms. Orlich was employed by Société Générale from 1992 to 2013, during which time she served in various roles, including Head of Operations Transformation/Change Management, Head of Data Management and Technology Chief of Staff and Head of Strategy & Architecture. Ms. Orlich holds a bachelors degree from the Wharton School of Business of the University of Pennsylvania.

Steven M. Schlesinger, age 59, joined Hudson City Savings in 1978. He has served as Senior Vice President of Information Services of Hudson City Bancorp and Hudson City Savings since January 2009. He previously served as First Vice President of Information Services of Hudson City Savings and Hudson City Bancorp from 2003 to 2008 and Vice President from 1989 to 2003. He is responsible for the Information Services department and has over 39 years of progressive experience in information technology including operations, programming, systems and data communication. He holds an AAS degree in Computer Sciences and graduated from the National School of Banking at Fairfield University.

7

Dennis J. Valentovic, age 63, joined Hudson City Savings in 1976. He has served as Senior Vice President, Retail Banking of Hudson City Savings and Hudson City Bancorp since February 2012. He previously served as First Vice President from 2005 to January 2012. Prior to that, Mr. Valentovic served as a Regional Vice President based in Jersey City for 15 years after having been the manager of a succession of retail branch offices. Mr. Valentovic is responsible for branch administration and oversees the activities of the retail support departments. He is a former member of the Board of Trustees of the Bloomfield Public Library, having served several terms as both Treasurer and President. Mr. Valentovic holds an undergraduate degree from Colgate University and is a graduate of the National School of Banking at Fairfield University.

8

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) requires Hudson City Bancorp’s executive officers and directors, and persons who own more than 10% of Hudson City Bancorp common stock to file with the Securities and Exchange Commission reports of ownership and changes of ownership. Officers, directors and greater than 10% shareholders are required by Securities and Exchange Commission regulation to furnish Hudson City Bancorp with copies of all Section 16(a) forms they file. Based solely on its review of the copies of such forms received by it, or written representations from certain reporting persons, Hudson City Bancorp believes that all filing requirements applicable to its executive officers, directors and greater than 10% beneficial owners were complied with for 2014, except for one Form 4 that was filed on behalf of J. Christopher Nettleton and one Form 4 that was filed on behalf of Christopher Mahler. Although they were filed timely, these forms contained inadvertent clerical errors relating to one transaction each. Amended Form 4s have been filed for Mr. Nettleton and Mr. Mahler to correct these clerical errors.

Audit Committee

Hudson City Bancorp’s Board has a separately-designated standing Audit Committee. This committee consists of Mr. Bardel, Ms. Bruni, Mr. Golding and Mr. Sponholz, each of whom has been determined by the Board to be independent of Hudson City Bancorp and meets the definition of independence set forth in Rule 5605(a)(2) of the NASDAQ listing rules. Mr. Sponholz serves as Chairman of the Audit Committee, and Hudson City Bancorp’s Board has determined that Mr. Bardel is an “audit committee financial expert,” as defined by the rules and regulations of the Securities and Exchange Commission.

Item 11. Executive Compensation

Compensation Committee Interlocks and Insider Participation

During 2014, the following directors served as members of the Compensation Committee: Mr. Azzara, Mr. Belair and Dr. Quest, with Mr. Belair serving as Chairman. None of the members was, during 2014, an officer or employee of Hudson City Bancorp or Hudson City Savings; and none of them has formerly been an officer or employee of Hudson City Bancorp or Hudson City Savings. In addition, none of them has any relationship requiring disclosure by us in this Form 10-K/A under the caption “Certain Transactions with Members of Our Board of Directors and Executive Officers.”

None of our executive officers served as a director or member of the compensation committee (or equivalent body) of another entity where any of our directors or any member of our Compensation Committee served as an executive officer or director.

Compensation Committee Report

The Compensation Committee has reviewed the Compensation Discussion and Analysis included in this Form 10-K/A and has discussed it with management. Based on such review and discussion, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this Form 10-K/A.

| Compensation Committee of Hudson City Bancorp, Inc. |

| Scott A. Belair, Chair |

| Michael W. Azzara, Member |

| Donald O. Quest, Member |

9

COMPENSATION DISCUSSION AND ANALYSIS

Private Securities Litigation Reform Act Safe Harbor Statement

This Compensation Discussion and Analysis contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 which may be identified by the use of such words as “may,” “believe,” “expect,” “anticipate,” “consider” “should,” “plan,” “estimate,” “predict,” “continue,” “probable” and “potential” or the negative of these terms or other comparable terminology. Examples of forward-looking statements include, but are not limited to estimates with respect to the financial condition, results of operations and business of Hudson City Bancorp, Inc. and Hudson City Bancorp, Inc.’s strategies, plans, objectives, expectations and intentions, and other statements contained herein that are not historical facts. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors (many of which are beyond our control) that could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. These factors include, but are not limited to:

| • | the timing and occurrence or non-occurrence of events may be subject to circumstances beyond our control; |

| • | there may be increases in competitive pressure among financial institutions or from non-financial institutions; |

| • | changes in the interest rate environment may reduce interest margins or affect the value of our investments; |

| • | changes in deposit flows, loan demand or real estate values may adversely affect our business; |

| • | changes in accounting principles, policies or guidelines may cause our financial condition to be perceived differently; |

| • | general economic conditions, including unemployment rates, either nationally or locally in some or all of the areas in which we do business, or conditions in the securities markets or the banking industry may be less favorable than we currently anticipate; |

| • | legislative or regulatory changes including, without limitation, the provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act, may adversely affect our business; |

| • | enhanced regulatory scrutiny may adversely affect our business and increase our cost of operation; |

| • | applicable technological changes may be more difficult or expensive than we anticipate; |

| • | success or consummation of new business initiatives may be more difficult or expensive than we anticipate; |

| • | litigation or matters before regulatory agencies, whether currently existing or commencing in the future, may delay the occurrence or non-occurrence of events longer than we anticipate, resulting in operational changes or increase our cost of operations; |

| • | the risks associated with adverse changes to credit quality, including changes in the level of loan delinquencies and non-performing assets and charge-offs, the length of time our non-performing assets remain in our portfolio and changes in estimates of the adequacy of the allowance for loan losses; |

| • | difficulties associated with achieving expected future financial results; |

| • | our ability to restructure our balance sheet, diversify our funding sources and access the capital markets; |

| • | our ability to comply with the terms of the Memorandum of Understanding with the Board of Governors of the Federal Reserve System (the “Federal Reserve”); |

| • | our ability to pay dividends, repurchase our outstanding common stock or execute capital management strategies each of which requires the approval of the Office of the Comptroller of the Currency (the “OCC”) and the Federal Reserve; |

| • | the effects of changes in existing U.S. government or U.S. government sponsored mortgage programs; |

| • | the risk of an economic slowdown that would adversely affect credit quality and loan originations; |

| • | the potential impact on our operations and customers resulting from natural or man-made disasters, acts of terrorism and cyberattacks; |

10

| • | the actual results of the pending merger (the “Merger”) with Wilmington Trust Corporation (“WTC”), a wholly owned subsidiary of M&T Bank Corporation (“M&T”) could vary materially as a result of a number of factors, including the possibility that various closing conditions for the Merger may not be satisfied or waived, and the Merger Agreement (defined below) with M&T and WTC could be terminated under certain circumstances; |

| • | outcome of any judicial decision related to the settlement of existing class action lawsuits related to the Merger; |

| • | further delays in closing the Merger, including the possibility that the Merger may not be completed prior to the end of the extension period previously agreed to with M&T; and |

| • | difficulties and delays in the implementation of our written strategic plan (the “Strategic Plan”) in the event the Merger is further delayed or is not completed. |

Our ability to predict results or the actual effects of our plans or strategies is inherently uncertain. As such, forward-looking statements can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties. Consequently, no forward-looking statement can be guaranteed. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this filing. We do not intend to update any of the forward-looking statements after the date of this Form 10-K/A or to conform these statements to actual events.

Introduction and Explanatory Notes

This section of this Form 10-K/A (i) describes our decision- and policy-making process for executive compensation, (ii) discusses the background and objectives of our compensation programs for executive officers, and (iii) sets forth the material elements of the compensation of the individuals listed below (the “named executive officers”) for 2014.

We note that Mr. Ronald E. Hermance, Jr., the Company’s Chairman of the Board and Chief Executive Officer, passed away on September 11, 2014. Following Mr. Hermance’s passing, Mr. Denis J. Salamone was appointed to succeed Mr. Hermance and serve as Chairman of the Board and Chief Executive Officer. Prior to that time, Mr. Salamone served as the President and Chief Operating Officer. On September 16, 2014, Mr. Anthony J. Fabiano was appointed to succeed Mr. Salamone and serve as President and Chief Operating Officer. Prior to that time, Mr. Fabiano served as Executive Vice President, Finance and Administration.

NAMED EXECUTIVE OFFICERS — 2014

| Name |

Title | |

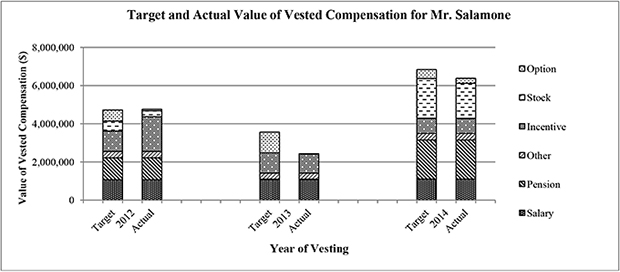

| Denis J. Salamone | Chairman of the Board and Chief Executive Officer (Principal Executive Officer) | |

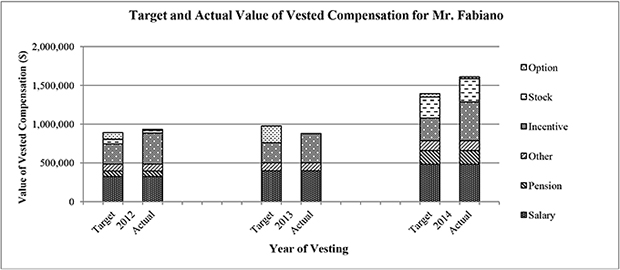

| Anthony J. Fabiano | President and Chief Operating Officer | |

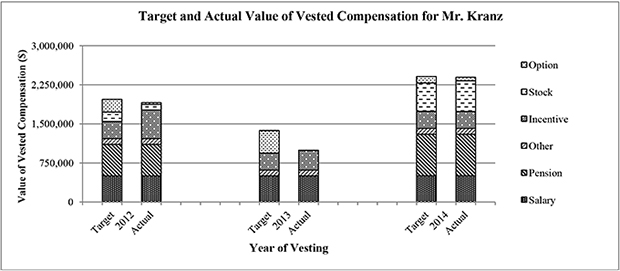

| James C. Kranz | Executive Vice President and Chief Financial Officer (Principal Financial Officer) | |

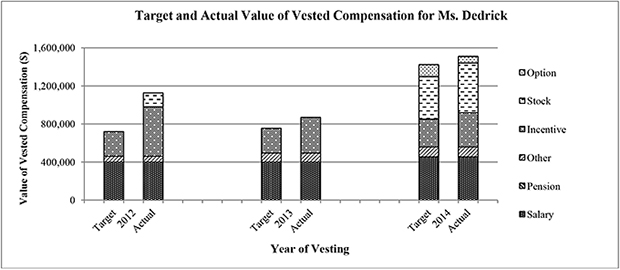

| Tracey A. Dedrick | Executive Vice President and Chief Risk Officer | |

| Thomas E. Laird | Executive Vice President and Chief Lending Officer | |

| Ronald E. Hermance, Jr. (deceased) | Former Chairman of the Board and Chief Executive Officer |

Descriptions of compensation plans, programs and individual arrangements referred to in this Compensation Discussion and Analysis (other than broad-based plans that are open to substantially all salaried employees) that are governed by written documents are qualified in their entirety by reference to the full text of their governing documents. We have filed these documents as exhibits to the Original Form 10-K and incorporate them here by this reference.

Executive Summary

Our Strategic Goals, Challenges and Accomplishments. Throughout 2014, Hudson City conducted its operations with two primary objectives: continue to pursue the agreed-upon combination with M&T and pursue the prioritized initiatives under its Strategic Plan in accordance with the Bank’s commitments to the OCC. While pursuing these objectives, we continued to focus on our consumer-oriented business model through the origination of one- to four-family mortgage loans. We have traditionally funded this loan production with customer deposits and borrowings. Market interest rates remained at historically low levels during 2014, which provided limited opportunities for the reinvestment of repayments received on our mortgage related assets. As a result, we continued to reduce the size of our balance sheet and we continue to carry an elevated level of short-term liquid assets. We believe that while carrying this level of short-term liquid assets adversely impacts our earnings, it better positions our balance sheet for a potential balance sheet restructuring. The delay in the execution of the balance sheet restructuring and our continuing to carry an excess liquidity position is primarily due to the delay in completing the Merger, though a variety of factors are involved in the decision regarding any such restructuring.

11

On August 27, 2012, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”) with M&T and WTC. The Merger Agreement provides that, upon the terms and subject to the conditions set forth therein, the Company will merge with and into WTC, with WTC continuing as the surviving entity. On four occasions, Hudson City Bancorp and M&T have agreed to extend the date after which either party may elect to terminate the Merger Agreement, with the latest extension being to October 31, 2015. Each extension has been documented by an amendment to the Merger Agreement, and the most recent amendment, Amendment No. 4, provides that the Company may terminate the Merger Agreement at any time if it reasonably determines that M&T is unlikely to be able to obtain the requisite regulatory approvals in time to permit the closing to occur on or prior to October 31, 2015. Amendment No. 4 and applicable provisions from the prior amendments, permit the Company to take certain interim actions without the prior approval of M&T, including with respect to the Bank’s conduct of business, implementation of its Strategic Plan, retention incentives and certain other matters with respect to Bank personnel, prior to the completion of the Merger. There can be no assurances that the Merger will be completed by October 31, 2015 or that the Company will not exercise its right to terminate the Merger Agreement in accordance with its terms.

Prior to the announcement of the Merger, the Company retained an outside consultant to assist management in developing the Strategic Plan. The operational core of the Strategic Plan is the expansion of our loan and deposit product offerings over time to create more balanced sources of revenue and funding. We believe that the markets in which we operate provide significant opportunities for the Hudson City brand to capture market share in products and services that we have not actively pursued previously. The Strategic Plan includes initiatives such as:

| • | origination of residential mortgages for sale to the secondary mortgage market, |

| • | establishment of a commercial real estate (“CRE”) lending unit, |

| • | the analysis of a balance sheet restructuring transaction, |

| • | establishment of a small business banking unit, |

| • | tactical deposit pricing, and |

| • | developing a more robust suite of consumer banking products. |

Prior to the execution of Amendment No. 1, implementation of the Strategic Plan was suspended pending completion of the Merger. When we announced in April 2013 that additional time would be required to obtain regulatory approval for the Merger, we charted a dual path for Hudson City. We continued to plan for the completion of the Merger, but we also refreshed the Strategic Plan, prioritizing the initiatives that we could achieve during the pendency of the Merger, such as establishing a secondary mortgage market operation and CRE lending business, and proceeded with planning for the implementation of those prioritized initiatives. Given the continued delay in completing the Merger, the Company and M&T have agreed that Hudson City may proceed with the implementation of the Strategic Plan. Many of the initiatives require significant lead time for full implementation and roll-out to our customers. Roll-out of the prioritized initiatives commenced during the second half of 2014 with the initial implementation of the CRE lending initiative. During 2014, the Bank purchased CRE and multi-family loans and interests in such loans.

On March 30, 2012, Hudson City Savings entered into a Memorandum of Understanding with the OCC (the “OCC MOU”), which was substantially similar to and replaced the memorandum of understanding Hudson City Savings entered into with our former regulator, the Office of Thrift Supervision (the “OTS”), on June 24, 2011. In accordance with the OCC MOU, Hudson City Savings adopted and implemented enhanced operating policies and procedures that are intended to enable us to continue to: (a) reduce our level of interest rate risk, (b) reduce our funding concentration, (c) diversify our funding sources, (d) enhance our liquidity position, (e) monitor and manage loan modifications and (f) maintain our capital position in accordance with our existing capital plan. In addition, we developed the Strategic Plan, which establishes objectives for Hudson City Savings’ overall risk profile, earnings performance, growth and balance sheet mix and to enhance our enterprise risk management program. Based on the work completed by the Bank through year-end 2014, on February 26, 2015, the OCC terminated the OCC MOU.

The Company entered into a separate Memorandum of Understanding with the Federal Reserve (the “Federal Reserve MOU”) on April 24, 2012, which is substantially similar to and replaced the memorandum of understanding the Company entered into with our former regulator, the OTS, on June 24, 2011. The Federal Reserve MOU requires the Company to: (a) obtain approval from the Federal Reserve prior to receiving a capital distribution from Hudson City Savings or declaring a dividend to shareholders and (b) obtain approval from the Federal Reserve prior to repurchasing or redeeming any Company stock or incurring any debt with a maturity of greater than one year. In accordance with the Federal Reserve MOU, the Company submitted a comprehensive capital plan and a comprehensive earnings plan to the Federal Reserve. The Federal Reserve MOU will remain in effect until modified or terminated by the Federal Reserve.

The delay in completing the Merger has posed unique challenges for Hudson City. The December 2013 amendment of the Merger Agreement to extend the time to complete the Merger caused Hudson City to refocus on the Strategic Plan initiatives while managing the uncertainty associated with the delay of the completion of the Merger, particularly among the employee base. However,

12

preparation for a potential closing in the second half of 2014 resulted in a delay in the pursuit of the Strategic Plan objectives. During 2014, Hudson City continued to experience a challenging operating environment with elevated mortgage prepayments and reduced origination volumes as the result of continued competition from government-sponsored entities. We also faced continuing high regulatory burdens resulting from regulatory reform in the financial services industry and significant additional regulatory scrutiny as a result of the continued delay in the Merger. Management’s response to this operating environment included the following:

| • | We continued to be profitable in 2014 on both a core earnings and GAAP basis. However, we experienced further compression in our net interest margin as implementation of the initiatives under our Strategic Plan was delayed in connection with our focus on managing our business in anticipation of the closing of the Merger, and significant funds from mortgage prepayments that could not be deployed in new mortgage originations were placed in cash or cash equivalents, resulting in a significant drag on our earnings. |

| • | Credit quality improved primarily due to improving economic conditions, increasing home prices, lowered unemployment rates, a decrease in the size of the loan portfolio, a decrease in net charge-offs and a decrease in the amount of total delinquent loans. The decrease in the amount of delinquent loans was largely the result of the sale of a pool of non-performing FHA loans along with the improving market conditions. |

| • | We continued to substantially advance implementation of enhanced enterprise-wide risk management and compliance functions through systems and policy enhancements, as well as the ongoing use of outside consultants to assist with these enhancements. These actions were significant factors in the OCC terminating the OCC MOU in February 2015 and helped us anticipate and manage a broader range of business-related risks, but have added to our overhead costs and impacted our operating efficiency. |

| • | We implemented an employee retention program in response to the second extension of the Merger in December 2013 in order to avoid a material drain in talent and resources, and implemented a similar program after the third extension in December 2014. Although we have experienced some employee headcount reductions, all key areas are staffed with new hires or through outsourcing arrangements with consulting firms, assuring continued smooth operation of our business. |

| • | Despite the fact that the Merger was not completed in 2014, pursuant to Amendment No. 4 and the prior amendments, we continue to have the ability to pursue our prioritized initiatives under our Strategic Plan and to terminate the Merger Agreement in the event M&T is unable to obtain the requisite regulatory approvals. |

Shareholder Outreach and Responses to 2013 Advisory Vote on Named Executive Officer Compensation. Due to the extension of the time to complete the Merger, Hudson City Bancorp postponed its 2013 Annual Meeting of Shareholders until December. Following the 2013 Annual Meeting of Shareholders, management successfully conducted a shareholder outreach program regarding Hudson City Bancorp’s executive compensation programs. The investor outreach team consisted of Mr. Fabiano, Ms. Dedrick and our Investor Relations Manager, our Senior Vice President, Human Resources and our Corporate Secretary. The investor outreach team began by identifying the 25 largest shareholders of Hudson City Bancorp, accounting for 62% of the unaffiliated shares outstanding (“USO”), which excludes shares held in the Company’s employee benefit plans and shares held by directors and executive officers. The investor outreach team contacted each of the 25 largest shareholders and was able to arrange calls with 11 shareholders representing 32% of the USO. These discussions focused on governance issues, compensation best practices, aligning executive compensation with performance and peers, and the significant financial, operational and regulatory challenges faced by the Company during the extended pendency of the Merger. Results of the shareholder outreach program were shared with and reviewed by the Compensation Committee and the Board.

13

The following summarizes the shareholder feedback received and the actions taken in response by the Company for 2014:

| Shareholder Feedback |

Company Response | |

| Annual executive compensation as disclosed does not appear linked to the Company’s performance. | Annual executive compensation for 2014 was linked to a variety of financial and non-financial performance factors, both formulaically and qualitatively applied. See “Key Elements of the Compensation Package – Cash Incentives.” | |

| Annual executive compensation as disclosed does not appear linked to the Company’s performance in relation to its peers. | The annual cash incentive and equity compensation programs were recalibrated to reduce award opportunities for Messrs. Salamone and Hermance for 2014 to reflect the Company’s smaller size and resulting reduced earnings potential. See “Key Elements of the Compensation Package – Cash Incentives.” | |

| Shareholders would prefer a more explicit explanation of the process and factors used in deciding annual cash incentive payments and in exercising discretion over such payments. | A more detailed discussion of this process and the factors considered by the Compensation Committee is included in “Key Elements of the Compensation Package – Cash Incentives.” | |

| Shareholders would prefer an annual cash incentive program that is more formula-based and less discretionary | The annual cash incentive program for 2014 was designed to include more explicit performance factors and weightings. See “Key Elements of the Compensation Package – Cash Incentives.” | |

| Shareholders would prefer regular rotation of independent directors as Compensation Committee members and as Committee Chair. | Our Board of Directors appreciates the value of rotation but believes that rotation is not in the best interest of the Company or its shareholders at this time as the Board addresses issues related to the pending Merger. | |

| Shareholders would prefer severance under employment and change in control agreements to be subject to a “double trigger” (triggered only on involuntary termination of employment in connection with a change in control), rather than “single trigger” (triggered on a change in control regardless of whether employment terminates), and not include a tax gross up. | It is the policy of the Company and the Bank not to enter into employment or change in control agreements with single-trigger severance benefits or tax gross ups. Of our current officers, only Mr. Salamone has agreements that provide single-trigger severance benefits and tax gross ups. These agreements were entered into in 2001, and have been amended since only for tax compliance. Further, M&T has notified Mr. Salamone of its intention to terminate his employment upon or shortly after completion of the Merger. As a result, the Compensation Committee believes that the absence of a “double trigger” for Mr. Salamone would have no practical impact in the context of the Merger. | |

Shareholder feedback on matters not related to executive compensation were referred to the Nominating & Governance Committee and are not addressed in this Compensation Discussion and Analysis.

Key Compensation Policies. The following summarizes certain executive compensation practices the Company has implemented in order to promote the generation of long-term value for shareholders without exposure to excessive risk:

| • | Pay for performance: Significant portions of the compensation provided to named executive officers are delivered through variable compensation plans where payouts are contingent on Company and individual performance. In evaluating Company performance, the Compensation Committee takes into account, where it determines applicable, the practical difficulties of operating the Company during the pendency of the Merger, including the limitations placed on the Company pursuant to the terms of the Merger Agreement. |

| • | Balance of short-term and sustained results: The Company uses a mix of annual and long-term incentives that reinforce attention to established business plans and strategies while balancing long-term risk outcomes. |

| • | Use of multiple performance measures: The Company’s annual cash incentive plan and equity incentive plan use different threshold performance measures and a designated portion of each named executive officer’s annual cash incentive is determined based on satisfaction of multiple performance measures, to reflect a holistic assessment of performance. |

| • | Minimum stock ownership and retention guidelines: The Company has adopted stock ownership and retention guidelines to further align the interests of the named executive officers with those of shareholders and to assure that named executive officers retain exposure to the risk outcomes of their actions. |

| • | Anti-hedging policy: The Company has adopted an anti-hedging policy to reinforce the impact of stock ownership guidelines and equity awards. |

| • | Clawback policy: The Company has adopted a policy to recoup payments to named executive officers in the event of financial restatements. |

| • | Pay caps on cash-based awards: The Company uses pay caps on individual cash-based awards to mitigate risk. |

14

| • | Use of discretion to reduce payments or awards: The Compensation Committee has the ability to exercise discretion to reduce formula-based pay-for-performance compensation. |

| • | No special pension credits. The Company has a policy against extra service credits toward pensions. The last time the Company granted such service credits was in 2004. |

| • | Limited tax gross-ups. The Company does not include tax gross-up provisions in new employment agreements or change in control agreements. Of our current officers, only Mr. Salamone has an agreement that provides a tax gross up. This agreement was entered into in 2001, and has been amended since only for tax compliance. |

| • | Limited use of single-trigger employment and change in control agreements. The Company does not include single trigger provisions in new employment or change in control agreements. Of our current officers, only Mr. Salamone has agreements that provide single-trigger severance benefits. These agreements were entered into in 2001, and have been amended since only for tax compliance. Further, M&T had notified Mr. Salamone of its intention to terminate his employment upon or shortly after completion of the Merger. As a result, the Compensation Committee believes that the absence of a “double trigger” would have no practical impact in the context of the Merger. |

| • | Use of independent compensation consultant. The Compensation Committee directly engages an independent, nationally recognized compensation consultant who performs no other services for the Company. |

Objectives

The creation of long-term value for our shareholders is highly dependent on the development and execution of our business strategy by our executive officers. Our executive officer compensation program seeks to:

| • | attract and retain executive officers with the skills, experience and vision to create and execute a strategy for the prudent and efficient deployment of invested capital and retained earnings in a manner that will create superior long-term, cumulative returns to our shareholders through dividends and stock price appreciation, |

| • | motivate behavior in furtherance of these goals through an incentive program that appropriately balances short- and long-term performance objectives without encouraging unnecessary or excessive risks, and |

| • | reward favorable results. |

Our executive officer compensation program for 2014 sought to balance incentives created by the often competing objectives of (i) working toward an efficient completion of the Merger and transition to M&T, (ii) managing the disruption created by the extension of time to complete the Merger and (iii) pursuing the prioritized initiatives of the Strategic Plan. With the multiple extensions of the time to complete the Merger during 2013 and 2014, a strictly formula-based link of incentive compensation to performance would have been difficult to accomplish as corporate goals for 2014 were not easily encapsulated in simple financial measures. The extensions of time to complete the Merger created significant stress among all personnel and executive management was required to spend considerable time and effort on both tactical and broad-based retention efforts and employee replacement. In addition, the Compensation Committee was restricted in its ability to significantly alter compensation policies for senior executives as the Compensation Committee believed the executives needed to be focused on the significant challenges created by the Merger and the delay in its completion without the inherent distraction that could arise from a redesign of the compensation programs. Accordingly, the unique merger-related events of 2012, 2013 and 2014 have had a significant influence on the design of our executive compensation program.

We expect that the components of our executive compensation program and their relative significance could change in the future from year to year as circumstances change.

Key Elements of the Compensation Package

In General. Our executive compensation program consists of three key elements: (i) base salary to provide a reasonable level of predictable income; (ii) annual cash incentives to motivate our executives to meet or exceed annual performance objectives derived from our business plan; (iii) long-term incentives to retain talented executives and provide an incentive to maximize shareholder return in the long term. We provide retirement and other termination benefits to address concerns about post-employment income and focus our executives on our current operations and long-term success. We also provide fringe benefits and perquisites that support outside activities that benefit Hudson City. Performance-based compensation opportunities make up a significant portion of each named executive officer’s total annual compensation opportunities. Long-term incentives, with values derived from stock price, make up a majority of the performance-based compensation opportunities.

15

Compensation Determinations. The Compensation Committee sets pay levels and determines the elements of compensation, and their relative weight in the compensation packages of our named executive officers. The following table summarizes the most significant elements of our named executive officers’ compensation packages and the basis, in addition to cost considerations, on which each has been determined:

| Element |

Basis of Determination |

Selected Contributing Factors | ||

| Base Salary | Compensation Committee discretion subject to the terms of the employment agreements with Messrs. Salamone and Fabiano | Informed but not dictated by peer group practices

Tenure in office

Individual long-term performance

Local cost-of-living factors | ||

| Annual Cash Incentive | Participation and incentive opportunities are at Compensation Committee discretion | Informed but not dictated by peer group practices | ||

| Actual awards are largely derived by achievement of pre-established performance goals | Strategic and operating objectives derived from business plan, risk management considerations and personal influence over same | |||

| Additional cash awards may be provided to recognize substantial individual contributions and promotions. | Individual performance | |||

| Stock Incentives | Participation and award opportunities are at Compensation Committee discretion | Informed but not dictated by peer group practices | ||

| Actual awards are derived by achievement of pre-established performance goals, and subject to reduction based on the Compensation Committee’s discretion | Strategic and operating objectives that support earnings growth, dividend policy and share price appreciation consistent with long-term strategic plan | |||

| Retirement Benefits | Qualified plans – formula applicable to all participating employees | N/A | ||

| Non-qualified plans – participation at Compensation Committee’s discretion; benefits are formula-based for all participants | Informed but not dictated by peer group practices | |||

| Fringe Benefits | Group insurance and other broad-based benefits – formula applicable to all participating employees | N/A | ||

| Other – Compensation Committee discretion | Informed but not dictated by peer group practices

Internal custom and practice | |||

| Termination Benefits | Compensation Committee discretion subject to the terms of the Employment Agreements with Messrs. Salamone and Fabiano and the Change of Control Agreements with Mr. Kranz, Ms. Dedrick and Mr. Laird | Informed but not dictated by peer group practices

Benefit demands of external management recruits | ||

In 2014, we reevaluated the Compensation Committee’s use of discretion in determining the level of payouts to executives under our annual incentive plan and determined that a percentage of each executive’s award should be determined solely based on attainment of quantitative financial goals (in addition to the threshold goal that determines whether any part of the award may be paid). For our named executive officers, this percentage ranged from 60% for Messrs. Salamone and Hermance, to 45% for Mr. Kranz, 35% for Messrs. Laird and Fabiano and 30% for Ms. Dedrick.

16

Base Salary. Base salaries are reviewed annually. They do not vary substantially and directly with annual performance. Instead, they reflect market factors, experience and tenure in office, job content and sustained job performance over an extended period, and general cost of living. In 2014, base salaries for Messrs. Salamone and Hermance were above the median of an indicated range of salaries for their respective positions, and the base salaries of our other named executive officers approximated the medians for their respective positions.

| Name |

% Increase | $ Increase | Resulting Annual Base Salary Rate |

|||||||||

| Denis J. Salamone |

12.1% | $ | 130,000 | $ | 1,200,000 | |||||||

| Anthony J. Fabiano |