Attached files

| file | filename |

|---|---|

| EX-10.50 - EX-10.50 - HMS HOLDINGS CORP | a2224512zex-10_50.htm |

| EX-31.4 - EX-31.4 - HMS HOLDINGS CORP | a2224512zex-31_4.htm |

| EX-31.5 - EX-31.5 - HMS HOLDINGS CORP | a2224512zex-31_5.htm |

| EX-10.48 - EX-10.48 - HMS HOLDINGS CORP | a2224512zex-10_48.htm |

| EX-10.47 - EX-10.47 - HMS HOLDINGS CORP | a2224512zex-10_47.htm |

| EX-10.49 - EX-10.49 - HMS HOLDINGS CORP | a2224512zex-10_49.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

Amendment No. 1

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2014 |

||

Or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission File Number 000-50194

HMS HOLDINGS CORP.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

11-3656261 (I.R.S. Employer Identification No.) |

|

5615 High Point Drive, Irving, TX (Address of principal executive offices) |

75038 (Zip Code) |

(Registrant's

telephone number, including area code)

(214) 453-3000

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

|---|---|---|

| Common Stock $0.01 par value | NASDAQ Global Select Market |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer ý | Accelerated Filer o | Non-Accelerated Filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes o No ý

The aggregate market value of the registrant's common stock held by non-affiliates as of June 30, 2014, the last business day of the registrant's most recently completed second quarter was $1.8 billion based on the last reported sale price of the registrant's Common Stock on the NASDAQ Global Select Market on that date.

There were 88,540,272 shares of common stock outstanding as of April 15, 2015.

Documents Incorporated by Reference

None.

HMS HOLDINGS CORP. AND SUBSIDIARIES

AMENDMENT NO. 1 TO THE ANNUAL REPORT ON FORM 10-K

2

This Amendment No. 1 to the Annual Report on Form 10-K/A (the "Amendment") amends the Registrant's Annual Report on Form 10-K for the year ended December 31, 2014 (the "Annual Report"), as filed by the Registrant with the Securities and Exchange Commission ("SEC") on March 2, 2015 (the "Original Filing"), and is being filed solely to replace Part III, Items 10 through Item 14 and to include additional exhibits to the Exhibit Index referenced in Item 15 of the Original Filing, which includes the Certifications to the Amendment. The reference in the Original Filing to the incorporation by reference of the Registrant's definitive proxy statement into Part III of the Annual Report on Form 10-K is hereby deleted.

For purposes of this Amendment, and in accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), (i) Items 10 through 14 in the Original Filing have been amended and restated in their entirety and (ii) the Exhibit Index in the Original Filing has been amended to include the new exhibits set forth herein. Except as specifically provided herein, this Amendment does not reflect events occurring after the filing of the Original Filing and no attempt has been made in this Amendment to modify or update other disclosures as presented in the Original Filing. Accordingly, this Amendment should be read in conjunction with the Original Filing and any filings with the SEC made thereafter.

3

Item 10. Directors, Executive Officers and Corporate Governance.

Board of Directors

The following table sets forth information with respect to our Board of Directors, including the composition of our four standing Committees: Audit, Compensation, Compliance and Nominating & Governance.

Name

|

Age | Position | Committee Memberships | ||||

|---|---|---|---|---|---|---|---|

Craig R. Callen |

59 | Class I Director | Compensation Nominating & Governance |

||||

Robert M. Holster(2) |

68 | Chairman and Class I Director | |||||

William C. Lucia(2) |

57 | President, Chief Executive Officer and Class I Director | |||||

Daniel N. Mendelson(3) |

50 | Class II Director | Compensation Compliance Nominating & Governance |

||||

William F. Miller III |

65 | Class II Director | |||||

Ellen A. Rudnick |

64 | Class II Director | Audit(1) Compliance Nominating & Governance |

||||

Bart M. Schwartz |

68 | Class I Director | Audit Compliance(1) Nominating & Governance |

||||

Richard H. Stowe(3) |

71 | Class II Director | Compensation(1) Nominating & Governance(1) |

||||

Cora M. Tellez(4) |

65 | Class II Director | Audit Nominating & Governance |

||||

- (1)

- Current

Committee Chair

- (2)

- In

April 2015, and effective as of the date of the 2015 Annual Meeting of Stockholders (the "2015 Annual Meeting"), Mr. Holster stepped down as

Chairman of the Board and the Board of Directors appointed Mr. Lucia as Chairman, President and Chief Executive Officer, also effective as of the date of the 2015 Annual Meeting.

- (3)

- In

April 2015, the Board of Directors appointed Mr. Mendelson as Chair of the Nominating & Governance Committee, with Mr. Stowe

continuing to serve as a member of the committee, effective as of the date of the 2015 Annual Meeting, subject to their re-election as a Class II director. In addition, in April 2015,

the Board of Directors appointed Mr. Stowe as Lead Independent Director, effective as of the date of the 2015 Annual Meeting, subject to his re-election as a Class II

director.

- (4)

- In April 2015, the Board of Directors appointed Ms. Tellez as an additional member of the Compliance Committee, effective as of the date of the 2015 Annual Meeting, subject to her re-election as a Class II director.

The Board of Directors believes that the combination of the business and professional experience of our directors and the diversity of their areas of expertise has been a contributing factor to its effectiveness and provides a valuable resource to management. The majority of our Board has over five years of service with us and four of our non-employee directors, Ms. Rudnick and Messrs. Holster, Miller and Stowe, have each served on our Board for more than ten years. During their tenure, our directors have gained considerable institutional knowledge about the Company and its operations. Given the growth of our

4

business and the rapidly changing healthcare environment, this continuity of service and development of institutional knowledge enables our Board to be more efficient and more effective in developing strategy and long-term plans for the Company.

A description of the specific experience, qualifications, attributes and skills that led our Board of Directors to conclude that each member of the Board of Directors should serve as a director follows the biographical information of each director below.

Class II: Directors Whose Terms Expire in 2015

William F. Miller III has served as one of our directors since October 2000. In 2013, Mr. Miller joined KKR Advisors, a global investment firm, as healthcare industry advisor. From 2006 to 2013, Mr. Miller was a partner at Highlander Partners, a private equity group in Dallas, Texas focused on investments in healthcare products, services and technology. From October 2000 to April 2005, Mr. Miller served as our Chief Executive Officer and from December 2000 to April 2006, Mr. Miller served as our Chairman. From 1983 to 1999, Mr. Miller served as President and Chief Operating Officer of EmCare Holdings, Inc., a national healthcare services firm focused on the provision of emergency physician medical services. From 1980 to 1983, Mr. Miller served as Administrator/Chief Operating Officer of Vail Mountain Medical. Mr. Miller also serves as a director of several private companies. From 1997 to 2012, Mr. Miller served as a director of Lincare Holdings, Inc.

Mr. Miller brings to the Board of Directors both a thorough understanding of our business and the healthcare industry and extensive experience in the financial markets. His significant operational experience, both at HMS and at EmCare Holdings, makes him well-positioned to provide the Company with insight on financial, operational and strategic issues.

Daniel N. Mendelson has served as one of our directors since February 2013. Mr. Mendelson is the Chief Executive Officer and Chairman of Avalere Health, a strategic advisory company which he founded in 2000. From 1998 to 2000, Mr. Mendelson served as Associate Director for Health at the White House Office of Management and Budget (OMB) in Washington, D.C. Prior to joining OMB, Mr. Mendelson served as Senior Vice President and Director of the Medical Technology practice at The Lewin Group. He is also on faculty at the Wharton School of Business at the University of Pennsylvania and serves as a director of Champions Oncology. From 2005 to 2013, Mr. Mendelson served as a director of Coventry Healthcare and from 2007 to 2011 he served as a director of PharMerica Corporation.

Mr. Mendelson brings over 20 years of experience with government healthcare programs, healthcare policy and business to the Board and is a recognized leader in healthcare policy. This expertise is complemented by his extensive operational and public company board experience, which make him well-positioned to serve as the Chair of the Nominating & Governance Committee and as a member of the Compensation and Compliance Committees. In addition, given that healthcare in the United States is continuously evolving, Mr. Mendelson's background and expertise is very valuable as we adapt our business to meet these changes.

Ellen A. Rudnick has served as one of our directors since 1997. Since 1999, Ms. Rudnick has served as Executive Director and Clinical Professor of the Polsky Center for Entrepreneurship, University of Chicago Booth School of Business. From 1993 to 1999, Ms. Rudnick served as Chairman of Pacific Biometrics, Inc., a publicly held healthcare biodiagnostics company and its predecessor, Bioquant, which she co-founded. From 1990 to 1992, she served as President and Chief Executive Officer of Healthcare Knowledge Resources (HKR), a privately held healthcare information technology corporation and subsequently served as President of HCIA, Inc. (HCIA) following the acquisition of HKR by HCIA. From 1975 to 1990, Ms. Rudnick served in various positions at Baxter Health Care Corporation, including Corporate Vice President and President of its Management Services Division. Ms. Rudnick also serves as a director of Patterson Companies, Inc. and First Midwest Bancorp, Inc.

5

Ms. Rudnick brings to the Board of Directors extensive business understanding and demonstrated management expertise, having served in key leadership positions at a number of healthcare companies. Ms. Rudnick has a comprehensive understanding of the operational, financial and strategic challenges facing companies and knows how to make businesses work effectively and efficiently. Her management experience and service on other public company boards has provided her with a thorough understanding of the financial and other issues facing large companies, making her particularly valuable as the Chair of our Audit Committee and as a member of our Compliance and Nominating & Governance Committees.

Richard H. Stowe has served as one of our directors since 1989. Mr. Stowe is a general partner of Health Enterprise Partners LP, a private equity firm. From 1999 to 2005, Mr. Stowe was a private investor, a senior advisor to the predecessor funds to Health Enterprise Partners, and a senior advisor to Capital Counsel LLC, an asset management firm. From 1979 until 1998, Mr. Stowe was a general partner of Welsh, Carson, Anderson & Stowe. Prior to 1979, he was a Vice President in the venture capital and corporate finance groups of New Court Securities Corporation (now Rothschild, Inc.). Mr. Stowe is also a director of several private and not-for-profit companies and educational institutions.

Mr. Stowe brings 40 years of financial, capital markets and investment experience to our Board of Directors. Mr. Stowe's background and extensive experience make him well-positioned to serve as the Chair of the Compensation Committee, a member of the Nominating & Governance Committee and as our Lead Independent Director. Mr. Stowe has effectively carried out his responsibilities as Chair for several of our Board committees and is well-respected by the independent directors. The Board believes that Mr. Stowe is highly qualified and will be successful as our Lead Independent Director.

Cora M. Tellez has served as one of our directors since October 2012. Ms. Tellez is the President and Chief Executive Officer of Sterling HSA, an independent health savings accounts administrator which she founded in 2004. Prior to starting Sterling HSA, Ms. Tellez served as President of the health plans division of Health Net, Inc., an insurance provider. She later served as President of Prudential's western health care operations, CEO of Blue Shield of California, Bay Region and Regional Manager for Kaiser Permanente of Hawaii. Ms. Tellez serves on the board of directors of several private and not-for-profit companies. From 2004 to 2007, Ms. Tellez served as a director of First Consulting Group.

Ms. Tellez brings over 25 years of healthcare policy and operations experience to the Board. Her public company operational, financial and corporate governance experience is a valuable resource for our Board and makes her well-positioned to serve as a member of the Audit, Compliance and Nominating & Governance Committees and as our Audit Committee Financial Expert.

Class I: Directors Whose Terms Expire in 2016

Craig R. Callen has served as one of our directors since October 2013. Mr. Callen is a Senior Advisor at Crestview Partners, a private equity firm with over $4.0 billion under management. From 2004 to 2007, Mr. Callen was Senior Vice President and Head of Strategic Planning and Business Development and a member of the Executive Committee for Aetna, Inc. In his role at Aetna, Mr. Callen reported directly to the Chairman and CEO and was responsible for oversight and development of Aetna's corporate strategy, including mergers and acquisitions. During his tenure, Mr. Callen and his team led the acquisitions of seven companies, investing over $2.0 billion, broadening Aetna's revenue, global presence, product line, targeted markets and participation in government programs. Prior to joining Aetna, Mr. Callen was a Managing Director and Head of U.S. Healthcare Investment Banking at Credit Suisse First Boston and Co-Head of Healthcare Investment Banking at Donaldson, Lufkin & Jenrette. Mr. Callen serves on the board of directors of Omega Healthcare Investors, Inc. and Symbion, Inc., a Crestview portfolio company. Previously he served on the boards of Sunrise Senior Living Inc. and Kinetic Concepts Inc. Mr. Callen holds a B.S./B.A. from Boston University and an MBA from Harvard Business School.

Mr. Callen brings 20 years of healthcare investment banking experience and corporate development expertise to our Board, which are invaluable to us as we evaluate, develop and implement new solutions for

6

clients. His extensive experience in a corporate setting and as an advisor to public/private healthcare companies positions him well to serve on the Compensation and Nominating & Governance Committees.

Robert M. Holster has served as one of our directors since May 2005, as Non-Executive Chairman from March 2009 to December 2010, and as Chairman of our Board from April 2006 to July 2015. Since 2001, Mr. Holster has held senior executive level positions with us, including serving as our Chief Executive Officer from May 2005 to February 2009 and as our President and Chief Operating Officer from April 2001 to May 2005. In March 2009, Mr. Holster stepped down as our Chief Executive Officer but remained an employee of the Company through December 2010. Previously, Mr. Holster served as our Executive Vice President from 1982 through 1993 and as one of our directors from 1989 through 1996. Mr. Holster previously served in a number of executive positions including Chief Executive Officer of HHL Financial Services, Inc., Chief Financial Officer of Macmillan, Inc. and Controller of Pfizer Laboratories, a division of Pfizer, Inc.

Mr. Holster served as a member of our management team and that of our predecessor, Health Management Systems, Inc., for an aggregate of over 20 years, including serving as our Chief Executive Officer for four years and as our President and Chief Operating Officer for four years. On April 24, 2015, Mr. Holster stepped down from his role as Chairman, effective as of the date of the 2015 Annual Meeting. Mr. Holster will remain on our Board and continue to work closely with Mr. Lucia to ensure a seamless transition of board leadership to Mr. Lucia. As a director who has served in the combined role as the Chairman and Chief Executive Officer of our Company, Mr. Holster will be able to provide guidance to Mr. Lucia on matters such as the Company's risk profile, long-term strategy and potential growth opportunities while offering the Board a unique insight into the Company's challenges, operations, and strategic opportunities. Given his extensive history with the Company and past experience as the Company's former Chairman and Chief Executive Officer, Mr. Holster brings an unmatched depth of industry and Company-specific experience to our Board.

William C. Lucia has served as our President and Chief Executive Officer since March 2009 and as one of our directors since May 2008. On April, 24, 2015, Mr. Lucia was appointed Chairman of the Board, to replace Mr. Holster effective as of the date of the 2015 Annual Meeting. From May 2005 to March 2009, Mr. Lucia served as our President and Chief Operating Officer, gaining critical insights into how to manage and grow our business in a complex and dynamic healthcare environment. Since joining us in 1996, Mr. Lucia has held several positions with us, including: President of our subsidiary, Health Management Systems, Inc., from 2002 to 2009; President of our Payor Services Division from 2001 to 2002; Vice President and General Manager of our Payor Services Division from 2000 to 2001; Vice President of our Business Office Services from 1999 to 2000; Chief Operating Officer of our former subsidiary Quality Medical Adjudication, Incorporated (QMA) and Vice President of West Coast Operations from 1998 to 1999; Vice President and General Manager of QMA from 1997 to 1998; and Director of Information Systems for QMA from 1996 to 1997. Prior to joining us, Mr. Lucia served in various executive positions including Senior Vice President, Operations and Chief Information Officer for Celtic Life Insurance Company and Senior Vice President, Insurance Operations for North American Company for Life and Health Insurance. Mr. Lucia is a Fellow of the Life Management Institute Program through LOMA, an international association through which insurance and financial services companies around the world engage in research and educational activities to improve company operations.

With over 19 years of experience with the Company working across multiple divisions and his prior experience in the insurance industry, Mr. Lucia brings to our Board in-depth knowledge of the Company and the healthcare and insurance industries, the evolving healthcare landscape and the array of challenges to be faced and demonstrates an ability to formulate and implement key strategic initiatives, making him well-positioned to lead our management team and provide essential insight and guidance to the Board as our Chairman.

7

Bart M. Schwartz has served as one of our directors since July 2010. Mr. Schwartz currently serves as the Chairman and Chief Executive Officer of SolutionPoint International, LLC, which provides an integrated array of business intelligence, security and compliance, identity assurance and situational awareness solutions. In 2003, Mr. Schwartz founded his own law firm, which specializes in, among other areas, conducting independent investigations, monitoring and Independent Private Sector Inspector General engagements and developing, auditing and implementing compliance programs. From 1991 to 2003, Mr. Schwartz served as the Chief Executive Officer of Decision Strategies, an internationally recognized investigative and security firm, which was sold to SPX Corporation in 2001. Mr. Schwartz has over 30 years' experience managing domestic and international investigations, prosecutions and assessments for clients in both the public and private sectors.

Mr. Schwartz brings extensive legal and compliance experience to our Board, which is particularly valuable as we continue to expand our business. Mr. Schwartz's background makes him well-positioned to serve as the Chair of the Compliance Committee and as a member of the Audit and Nominating & Governance Committees.

Audit Committee and Audit Committee Financial Expert

We have a separately-designated standing Audit Committee which consists of Ms. Rudnick (Chair), Mr. Schwartz and Ms. Tellez. The Board of Directors has determined that each member of the Audit Committee is an independent director, as defined in the NASDAQ Stock Market, Inc. Marketplace Rules (the "NASDAQ Marketplace Rules") and the independence requirements contemplated by Rule 10A-3 under the Exchange Act, and meets NASDAQ's financial knowledge and sophistication requirements. In addition, the Board has determined that Ms. Tellez qualifies as an "audit committee financial expert," as such term is defined in Item 407(d)(5)(ii) of Regulation S-K.

Material Changes to the Procedures for Recommending Nominees to the Board of Directors

There have been no material changes to the procedures described by which security holders may recommend nominees to our Board of Directors as described in our Proxy Statement for our 2014 Annual Meeting, filed with the SEC on April 30, 2014 (the "2014 Proxy Statement").

Executive Officers

The following table sets forth certain information with respect to each person who currently serves as one of our executive officers as of the date of this Amendment. Our executive officers are elected annually by our Board of Directors and generally serve at the discretion of our Board of Directors. There are no arrangements or understandings between any of our executive officers and any other person pursuant to which they were selected as an officer. None of our directors and/or executive officers is related to any other director and/or executive officer of HMS or any of its subsidiaries by blood, marriage or adoption.

Name

|

Age | Position | |||

|---|---|---|---|---|---|

William C. Lucia |

57 | President and Chief Executive Officer | |||

Eugene V. DeFelice |

56 | Executive Vice President, General Counsel and Corporate Secretary | |||

Cynthia Nustad |

44 | Executive Vice President and Chief Information Officer | |||

Jeffrey S. Sherman |

49 | Executive Vice President, Chief Financial Officer and Treasurer | |||

Tracy A. South |

56 | Chief Administrative Officer and Executive Vice President, Human Resources | |||

Semone Wagner |

51 | Executive Vice President, Operations | |||

Douglas M. Williams |

56 | Division President, Markets | |||

The principal occupations for the last five years, as well as certain other biographical information, for each of our current executive officers are set forth below.

8

William C. Lucia has served as our President and Chief Executive Officer since March 2009 and as one of our directors since May 2008. In addition, Mr. Lucia has been appointed by the Board of Directors to serve as Chairman of the Board, effective as of the date of the 2015 Annual Meeting. From May 2005 to March 2009, Mr. Lucia served as our President and Chief Operating Officer. Since joining us in 1996, Mr. Lucia has held several positions with us, including: President of our subsidiary, Health Management Systems, Inc. from 2002 to 2009; President of our Payor Services Division from 2001 to 2002; Vice President and General Manager of our Payor Services Division from 2000 to 2001; Vice President of our Business Office Services from 1999 to 2000; Chief Operating Officer of our former subsidiary Quality Medical Adjudication, Incorporated (QMA) and Vice President of West Coast Operations from 1998 to 1999; Vice President and General Manager of QMA from 1997 to 1998; and Director of Information Systems for QMA from 1996 to 1997. Prior to joining us, Mr. Lucia served in various executive positions including Senior Vice President, Operations and Chief Information Officer for Celtic Life Insurance Company, and Senior Vice President, Insurance Operations for North American Company for Life and Health Insurance. Mr. Lucia is a Fellow of the Life Management Institute Program through LOMA, an international association through which insurance and financial services companies around the world engage in research and educational activities to improve company operations.

Eugene V. DeFelice has served as our Executive Vice President, General Counsel and Corporate Secretary since March 2014. Mr. DeFelice has more than 30 years of legal experience, 20 years of which has been in corporate healthcare and technology. From September 2010 to March 2014, Mr. DeFelice served as Vice President, General Counsel and Corporate Secretary for Barnes & Noble, Inc. and was responsible for all legal matters. From November 2006 to August 2010, he served as Senior Vice President, General Counsel and Corporate Secretary of Savvis Inc., a global information technology service provider. Prior to Savvis, he held various general counsel and other legal positions, as well as operational roles, in several healthcare and technology companies, and also spent approximately nine years at Hoffmann-LaRoche in progressively senior positions.

Cynthia Nustad has served as our Executive Vice President and Chief Information Officer since February 2011. Ms. Nustad has over 17 years of management experience in the healthcare information technology industry. From January 2005 to January 2011, Ms. Nustad served as Vice President of Architecture and Technology for Regence (Blue Cross Blue Shield), where she was responsible for servicing a large corporation across multiple sites and states. From May 2002 to December 2004, Ms. Nustad served as the Vice President of Software Development and Product Management for OAO Healthcare Solutions, Inc. (OAO). During her tenure at OAO, Ms. Nustad managed, from inception to commercialization, the strategic development of a flagship platform and database-independent managed care benefits and claims processing system designed for healthcare plans, self-insured employer groups and government agencies—among others. Prior to OAO, Ms. Nustad held leadership roles at e-MedSoft.com and WellPoint Health Networks.

Jeffrey S. Sherman has served as our Executive Vice President, Chief Financial Officer and Treasurer since September 2014. Mr. Sherman has over 25 years of experience in healthcare operations, strategic planning and financial performance in senior financial executive positions. Prior to joining HMS, Mr. Sherman served as Executive Vice President and Chief Financial Officer of AccentCare, a healthcare delivery organization, from September 2013 to August 2014. From April 2009 to September 2013, he served as Executive Vice President and Chief Financial Officer of Lifepoint Hospitals, Inc. From September 2005 until April 2009, Mr. Sherman served as Vice President and Treasurer of Tenet Healthcare, where he managed all aspects of corporate finance, including cash flow management and capital structure, and was responsible for risk management. Mr. Sherman served in various capacities for Tenet and its predecessor company since 1990, including as a hospital chief financial officer and regional vice president.

Tracy A. South has served as our Chief Administrative Officer and Executive Vice President, Human Resources, since May 2014. She served as our Senior Vice President of Human Resources from December

9

2011 to May 2014. Ms. South has over 20 years of executive-level human resources experience, including at national healthcare organizations. From 2003 to 2011, Ms. South served as the Senior Vice President, Chief Human Resources Officer at Mosaic Sales Solutions, a privately-held full-service marketing agency in Irving, Texas. She built that company's North America Human Resources department, focusing on attracting and training a dispersed workforce of over 10,000 employees hired to represent world-class brands at retail, in the community and online. In her role, Ms. South oversaw Talent Acquisition, HR Services and Organizational Effectiveness. Ms. South also served as Vice President of Human Resources for Tenet Healthcare, initially for the Central Northeast Division, which included 38 hospitals and over 40,000 employees, and subsequently at the corporate level. Prior to Tenet, she led the Human Resources department for Aetna US Healthcare, where she oversaw a broad range of functions and designed human resources strategies to align with business practice areas.

Semone Wagner has served as our Executive Vice President of Operations since April 2013, responsible for our core operations, including the coordination of benefits service line. Ms. Wagner has extensive experience in healthcare claims processing, operations and reengineering. She has a track record for leading change, driving quality performance and reducing unit costs in complex operating environments. Prior to joining HMS, Ms. Wagner served as Senior Vice President of Claim Operations at United HealthCare (UHC), where she oversaw the operations for all business lines and major platforms processing over 500 million claims annually. Under her leadership, the company achieved industry-leading performance levels, earning the American Medical Association designation for the industry's best claim operation in 2011 and 2012.

Douglas M. Williams has served as our Division President of Markets since January 2015, responsible for leading the state and federal government and commercial markets, sales and marketing. From December 2013 to January 2015, he served as our Division President of Commercial Solutions, responsible for leading our commercial product and business development strategy. Mr. Williams has over 25 years of experience in healthcare information technology, sales, and operations. From 2010 to 2013, Mr. Williams served as Chief Information Officer of Aveta, which was acquired by Optum Inc. in 2012. From 2008 to 2010, he served as a Healthcare Partner with Protiviti, Inc., where he built a healthcare consulting practice. From 2006 to 2008, he served as Senior Vice President of the Payer Business Unit at MedeAnalytics, where he was responsible for building the sales team and significantly expanding the company's sales pipeline. Mr. Williams' healthcare consulting background also includes serving as a Global Healthcare Partner for IBM, where he was responsible for developing and managing IBM's global healthcare practice.

Section 16(A) Beneficial Ownership Reporting Compliance

Pursuant to Section 16(a) of the Exchange Act, as amended, our executive officers, directors and persons owning more than 10% of a registered class of our equity securities are required to file reports of ownership and changes in ownership of common stock with the SEC. Copies of such reports are required to be furnished to us.

Based solely on a review of the copies of such reports furnished to us, or written representations that no other reports were required, we believe that during fiscal year 2014, all of our executive officers and directors complied with the requirements of Section 16(a), except that (i) due to administrative error, 1 report covering 1 transaction was not timely reported by each of Mr. Donabauer and Ms. Wagner, and (ii) 5 late reports from 2009 through 2013, covering an aggregate of 14 transactions involving a change in beneficial ownership from direct holdings to indirect holdings through a series of gifts of shares to a revocable family trust for which Mr. Lucia serves as trustee were not timely reported by Mr. Lucia. All of such reports were promptly filed on behalf of the respective officers upon learning of the unreported transactions.

10

Code of Ethics

As previously disclosed, on July 31, 2014, our Board of Directors approved certain amendments to the Company's Code of Conduct, Code of Conduct for Designated Senior Financial Managers and Code of Ethics to harmonize the codes and integrate them into one document (the "Amended Code of Conduct") applicable to all of our directors, officers and employees, including all of the Company's subsidiaries' employees, officers, directors, contractors, contingent workers and business affiliates. No substantive amendment to any element of the "code of ethics" definition enumerated in Item 406(b) of Regulation S-K was effectuated as a result of these amendments. A copy of the Amended Code of Conduct is publicly available on our website under the "Investor Relations"/"Corporate Governance" section at: http://investor.hms.com/governance.cfm and can also be obtained free of charge by sending a request to our Corporate Secretary at 5615 High Point Drive, Irving, Texas 75038. We intend to disclose any future amendments or waivers to the provisions of the Amended Code of Conduct that relate to our principal executive officer, principal financial officer, principal accounting officer, controller or persons performing similar functions by filing such information on a Current Report on Form 8-K with the SEC within four business days, to the extent such filing is required by the NASDAQ Marketplace Rules; otherwise, we will disclose such amendments or waivers by posting such information on our website.

Item 11. Executive Compensation.

Compensation Discussion and Analysis

Introduction

This Compensation Discussion and Analysis ("CD&A"), describes our 2014 executive compensation program and should be read in conjunction with the compensation tables and related narrative descriptions that follow those tables. In particular, this CD&A explains how the Compensation Committee of the Board of Directors made its compensation decisions for our named executive officers for 2014.

For 2014, our named executive officers are:

- •

- William C. Lucia, President and Chief Executive Officer;

- •

- Jeffrey S. Sherman, Executive Vice President, Chief Financial Officer and Treasurer;

- •

- Eugene V. DeFelice, Executive Vice President, General Counsel and Corporate Secretary;

- •

- Cynthia Nustad, Executive Vice President and Chief Information Officer;

- •

- Semone Wagner, Executive Vice President, Operations;

- •

- Walter D. Hosp, former Executive Vice President, Chief Financial Officer and Chief Administrative Officer; and

- •

- Joseph M. Donabauer, Senior Vice President and Controller and former interim Principal Financial Officer and interim Treasurer.

On March 10, 2014, Mr. Hosp tendered his resignation as our Executive Vice President, Chief Financial and Administrative Officer, which was effective June 6, 2014. Mr. Donabauer served as interim Principal Financial Officer and interim Treasurer from June 6, 2014 through September 8, 2014, the date that Mr. Sherman joined the Company.

2014 Say-on-Pay Vote

At the Company's 2014 Annual Meeting of Stockholders, approximately 99% of the votes cast on the say-on-pay proposal were in favor of our executive compensation program described in our 2014 Proxy Statement. The Compensation Committee believes that this vote affirms stockholders' support of the Company's general approach to executive compensation, and therefore, did not change its compensation

11

philosophy as it made decisions for 2014. As market practices on executive compensation policies evolve, the Compensation Committee will continue to evaluate and, if needed, make changes to our executive compensation program to ensure that the program continues to reflect our pay-for-performance compensation philosophy and objectives. The Compensation Committee will also continue to consider the outcome of the Company's say-on-pay votes when making future compensation decisions for executive officers.

Executive Summary

2014 Financial Performance Overview

The following is an overview of our financial performance for the year ended December 31, 2014.

- •

- For the full year ended December 31, 2014, we reported revenue of $443.2 million, a 9.9% decrease compared to 2013

revenue of $491.8 million due primarily to an $86.0 million decline in our Medicare Recovery Audit Contractor (RAC) business. Excluding RAC revenue, revenue for the year increased by

$37.4 million, or 9.7%, to $421.2 million.

- •

- Our 2014 commercial revenue was $170.9 million, a 14.6% increase over 2013 commercial revenue of $149.1 million, and our

2014 state government revenue was $225.9 million, an 8.9% increase over 2013 state government revenue of $207.5 million.

- •

- We reported adjusted earnings before interest, taxes, depreciation, amortization and stock-based compensation expense (adjusted

EBITDA) of $101.2 million for the full year 2014, which represented a decrease of 30.2% compared to adjusted EBITDA of $145.0 million for the prior year.

- •

- Our stock price declined by 6.9% for the one-year period ending December 31, 2014 and declined 33.9% for the three-year period ended December 31, 2014.

A reconciliation of the non-GAAP measure adjusted EBITDA is set forth on Annex A of this Amendment.

Key Compensation Actions

The following highlights key decisions and actions during 2014 and early 2015 regarding our executive compensation practices and program. These decisions and actions were made with the advice of the Compensation Committee's independent consultant, Frederic W. Cook & Co., Inc. ("F.W. Cook") (see "Role of Compensation Consultant" below) and are discussed in greater detail elsewhere in this CD&A.

- •

- Changes to the Short-Term (Cash) Incentive

Program. In February 2014, we introduced certain corporate strategic objectives as a performance measure under the 2014 Short-Term

Incentive Program in addition to financial objectives, such as EBITDA and revenue. We believe that the addition of strategic objectives better balances the achievement of short-term financial goals

with other leading indicators of the Company's success.

- •

- New Executive

Talent. In order to attract and retain top executive talent in 2014, in connection with the commencement of employment of

Messrs. DeFelice and Sherman, we approved, among other things, a sign-on bonus, subject to certain conditions, and an initial equity grant, subject to certain conditions and restrictions, for

each of Messrs. DeFelice and Sherman, pursuant to their respective employment agreements with the Company. A discussion regarding these actions and decisions follows later in this CD&A.

- •

- Introduction of Stock Ownership Guidelines and Clawback Policy. In October 2014, to better align the interests of our directors and executives officers with the interests of our stockholders and further promote our commitment to sound corporate governance and executive compensation

12

- •

- Changes in Equity Mix of Long-Term Incentive

Awards. On October 20, 2014, with the advice of our independent consultant F.W. Cook., we approved changes in the equity mix of

the long-term incentive awards granted annually in the fourth quarter to our senior executives. Consistent with the market practice of our peers, we changed the mix of long-term incentive awards to

our senior executives, including the named executive officers, from 100% non-qualified stock options to 50% non-qualified stock options and 50% restricted stock units. Fifty percent of both the stock

option and restricted stock unit awards are subject to stock price performance conditions.

- •

- Updated Peer

Group. In November 2014, we modified our executive compensation peer group by adding one company and removing one company. These changes

were made to ensure that our peer group continues to provide an appropriate benchmark for competitive pay analyses.

- •

- Extension of President and Chief Executive Officer's Employment

Agreement. In January 2015, we amended our employment agreement with Mr. Lucia on substantially the same terms as his prior

agreement, in order to extend Mr. Lucia's employment with us for an additional three year term.

- •

- Combination of Two Annual Long-Term Incentive Awards into One Annual Award. We determined in October 2014 that, effective beginning in 2015, the two long-term incentive awards historically granted in the first and fourth quarters of each year will be combined instead into one annual grant in the first quarter of each year. This change better aligns us with peer group practice and simplifies our equity plan administration. We also believe that a single long-term incentive grant is more retentive and motivational than two smaller grants.

practices, the Board adopted stock ownership guidelines, as well as a "clawback" policy applicable to certain cash and equity compensation, to help protect against malfeasance risk.

Philosophy, Objectives and Principles of Our Executive Compensation Program

Our mission is to work passionately to increase the value of the healthcare system so healthcare dollars can benefit more people. To support this mission and other strategic objectives as approved by the Board and to provide adequate returns to stockholders, we must compete for, attract, develop, motivate and retain top quality executive talent at the corporate and operating business unit levels during periods of both favorable and unfavorable business conditions.

Our executive compensation program is a critical management tool in achieving this goal. "Pay for performance" is the underlying philosophy for our executive compensation program. The program is designed and administered to:

- •

- reward performance that drives the achievement of our short and long-term goals;

- •

- align the interests of our senior executives with the interests of our stockholders, thus rewarding individual and team achievements

that contribute to the attainment of our business goals;

- •

- foster teamwork and encourage our senior executives to work together with key personnel in the interest of company performance;

- •

- attract, develop, motivate and retain high-performing senior executives by providing a balance of total compensation opportunities,

including salary and short and long-term incentives that are competitive with similarly situated companies and reflective of our performance;

- •

- help ensure that costs are appropriately supported by performance in a manner consistent with our intention that, where practicable,

short and long-term incentive compensation payouts qualify as performance-based compensation that is tax deductible under Code Section 162(m); and

- •

- motivate our senior executives to pursue objectives that create long-term stockholder value and discourage behavior that could lead to excessive risk, by balancing our fixed and at-risk pay (both

13

short and long-term incentives) and choosing financial metrics that we believe drive long-term stockholder value.

Pay-For-Performance

We design our compensation programs to make a meaningful amount of target total direct compensation (salary, plus target annual incentive compensation, plus long-term incentives) dependent on the achievement of performance objectives. In the tables that follow, we compare the target total direct compensation for our Chief Executive Officer in each of the last three fiscal years (Table 1) to the corresponding amounts that were paid or that may be considered realizable (based on the methodology described below) as of December 31, 2014 (Table 2).

Table 1 below presents our President and Chief Executive Officer's salary, incentive bonus opportunity at the target level, stock awards and option awards for each of the last three fiscal years. In Table 1, the stock award and option award amounts reflect the grant date fair value of each such award (at the target level with respect to the stock awards for 2013 and 2014, which were subject to performance-vesting criteria), the same value at which such awards are required, under applicable SEC regulations, to be reflected in the Summary Compensation Table included in this Amendment.

Table 1—Target Total Direct Compensation—Chief Executive Officer

Fiscal Year

|

Salary ($) |

Short-Term (Cash) Incentive (STIP) Opportunity at Target ($) |

Stock Awards ($) |

Option Awards ($) |

Target Total Direct Compensation ($) |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

2014 |

650,000 | 650,000 | 1,412,490 | 737,497 | 3,449,987 | |||||||||||

2013 |

650,000 | 650,000 | 674,988 | 1,200,000 | 3,174,988 | |||||||||||

2012 |

650,000 | 650,000 | — | 1,200,000 | 2,500,000 | |||||||||||

| | | | | | | | | | | | | | | | | |

3-Year Totals |

1,950,000 | 1,950,000 | 2,087,478 | 3,137,497 | 9,124,975 | |||||||||||

Table 2 below illustrates how our performance affected payouts and realization of the target total direct compensation that was available to our President and Chief Executive Officer.

Table 2—Total Direct Compensation That May Be Considered Realizable at 12/31/2014 as a Percentage of Target Total Direct Compensation—Chief Executive Officer

Fiscal Year

|

Salary ($) | Short- Term (Cash) Incentive (STIP) Payout ($)(1) |

Value of Stock Awards at 12/31/2014 ($)(2) |

Intrinsic Value of Option Awards at 12/31/2014 ($)(3) |

Total Direct Compensation at 12/31/2014 ($) |

Total Direct Compensation at 12/31/2014 as a percentage of Target Total Direct Compensation (%) |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

2014 |

650,000 | 468,000 | 1,426,844 | — | 2,544,844 | 74 | |||||||||||||

2013 |

650,000 | — | 496,494 | — | 1,146,494 | 36 | |||||||||||||

2012 |

650,000 | — | — | — | 650,000 | 26 | |||||||||||||

| | | | | | | | | | | | | | | | | | | | |

3-Year Totals |

1,950,000 | 468,000 | 1,923,338 | — | 4,341,338 | ||||||||||||||

Percent of Corresponding Amount in Table 1 |

100 | % | 24 | % | 92 | % | 0% | 48 | % | 48 | % | ||||||||

- (1)

- This column shows the portion of the target-level STIP in Table 1 that was actually paid to our President and Chief Executive Officer in each of the last three fiscal years. Due to the level of

14

achievement in comparison to the performance objectives that were part of our annual incentive compensation program, payouts to our President and Chief Executive Officer over the past three fiscal years amounted to approximately 24% of the aggregate target short-term cash incentive compensation for such period.

- (2)

- Stock

awards for fiscal 2014 and 2013 are valued based on the closing market price per share of our common stock on December 31, 2014 of $21.14 per

share. There were no stock awards in 2012.

- (3)

- For purposes of this table, option awards are valued at zero because each such award has an exercise price that is greater than the closing market price for a share of our common stock on December 31, 2014. While our President and Chief Executive Officer may realize value on such option awards in the future, the value realized, if any, will depend on the extent to which there is appreciation in the market price of our common stock.

The foregoing tables illustrate that our annual and long-term incentive programs over the past three fiscal years have been designed to make a meaningful amount of our President and Chief Executive Officer's target total direct compensation dependent on the achievement of performance objectives and have resulted in actual compensation significantly less than the target amount.

Key Governance Features of Our Executive Compensation Program

Our executive compensation programs reflect a number of best practices implemented by the Compensation Committee and the Board of Directors in recent years, including:

- •

- No tax gross-ups on perquisites and no change-in-control-related excise tax gross-ups in employment agreements;

- •

- No history of option repricing or cash buyouts of underwater options;

- •

- Employees and directors are prohibited from pledging our securities as collateral for a loan and entering into hedging and derivative

transactions with respect to our securities;

- •

- Equity plans do not have evergreen share authorizations and do not allow for liberal share recycling;

- •

- Salary increases and short-term incentive compensation are not guaranteed;

- •

- Retention by our Compensation Committee of an independent compensation consultant;

- •

- No pensions or supplemental executive retirement plans;

- •

- Limited use of executive perquisites;

- •

- Significant stock ownership guidelines pursuant to which the Chief Executive Officer is required to hold five times his base salary in

our common stock and all other executive officers are required to hold two times their base salary in our common stock; and

- •

- Adoption of a clawback policy that permits the Company to recover from any current or former Company executive officer such executive officer's incentive bonus and equity compensation gains attributable to such executive officer's misconduct occurring after January 1, 2015, that causes a subsequent restatement of our financial statements.

Management and the Compensation Committee

Role of Management

Our President and Chief Executive Officer together with our Chief Financial Officer and Executive Vice President of Human Resources develop recommendations regarding the design of our executive compensation program. In addition, they are involved in setting the financial and strategic objectives that,

15

subject to the approval of the Board and the Compensation Committee, are used as the performance measures for the short and long-term incentive plans. Our Chief Financial Officer provides the Compensation Committee with financial information relevant to determining the achievement of performance objectives and related annual cash incentive compensation. As part of its review process, the Compensation Committee receives from our President and Chief Executive Officer a compensation recommendation and assessment of performance against individual objectives, for each other named executive officer and recommendations regarding base salary and short and long-term incentives.

Role of Compensation Committee

Our executive compensation program is administered by the Compensation Committee. The Compensation Committee determines and approves total executive remuneration based on its review and evaluation of recommendations presented by our President and Chief Executive Officer and the advice of F.W. Cook. Our President and Chief Executive Officer does not participate in the Compensation Committee's deliberations or decisions with regard to his own compensation.

Compensation Consultant and Peer Group Analysis

Role of Compensation Consultant

The Compensation Committee has retained F.W. Cook as its independent compensation consultant to provide advice and guidance with respect to executive compensation. F.W. Cook reports directly to the Compensation Committee and the Compensation Committee oversees the fees paid for F.W. Cook's services. The Compensation Committee uses F.W. Cook to review management's executive compensation recommendations with the instruction that F.W. Cook is to advise the Compensation Committee independent of management and to provide such advice for the benefit of the Company and its stockholders. F.W. Cook does not provide any consulting services to the Company beyond its role as a consultant to the Compensation Committee. The Compensation Committee has assessed the independence of F.W. Cook pursuant to SEC rules and concluded that no conflict of interest exists that would prevent F.W. Cook from serving as an independent consultant to the Compensation Committee.

F.W. Cook provided the following services to the Compensation Committee in 2014:

- •

- assisted in the design and development of all elements of the 2014 executive compensation program;

- •

- assisted with the review of the amendment to Mr. Lucia's employment agreement;

- •

- provided competitive benchmarking and market data analysis;

- •

- provided analyses and industry trends relating to the compensation of our President and Chief Executive Officer and our other named

executive officers;

- •

- aided the evaluation of modifications to long-term incentive grant practices, including changes to timing of equity grants, equity

mix, performance conditions, and allocation of equity amounts;

- •

- provided updates with regard to emerging trends and best practices in executive compensation; and

- •

- reviewed and provided advice on the Company's executive compensation-related disclosures in this Amendment.

Peer Group Compensation Analysis

When evaluating our executive compensation program, our Compensation Committee measures our program against that of a peer group of public companies that is developed with guidance from F.W. Cook. This peer group, which is reviewed annually by the Compensation Committee, consists of companies the Compensation Committee believes are generally comparable to us in size, financial profile and scope of operations and, in certain cases, against which the Compensation Committee believes we compete for executive talent.

16

Certain executive compensation decisions for 2014 were based in part on benchmarking data from the peer group established by the Compensation Committee in October 2013. Companies included in this peer group for purposes of establishing 2014 executive compensation levels through October 2014 were: Accretive Health, Inc., Acxiom Corp, Allscripts-Misys Healthcare Solutions Inc., AthenaHealth, Inc., Bottomline Technologies (de), Inc., DealerTrack Technologies,Inc., ExlService Holdings, Inc., Fair Isaac Corp, MAXIMUS, Inc., MedAssets, Inc., Medidata Solutions, Inc., NeuStar, Inc., Quality Systems, Inc., Tyler Technologies, Inc. and WEX, Inc. (collectively, the "2013 Peer Group"). This peer group reflects (relative to the Company's prior year peer group) the removal of Concur Technologies, Inc. and MICROS Systems, Inc. because of their difference in size relative to us.

The chart below compares HMS's revenue, net income, EBITDA and market capitalization to the median of our 2013 Peer Group at the time the 2013 Peer Group was established. Note that although our revenue and market capitalization are below the peer median, our net income and EBITDA are above the peer median.

(in millions)(1)

|

HMS | 2013 Peer Group Median |

|||||

|---|---|---|---|---|---|---|---|

Revenue |

$ | 489 | $ | 671 | |||

Net Income(2) |

$ | 48 | $ | 38 | |||

EBITDA |

$ | 151 | $ | 109 | |||

Market Capitalization(3) |

$ | 1,887 | $ | 2,103 | |||

- (1)

- Revenue,

Net Income and EBITDA based on most recently available four quarters as of October 21, 2013.

- (2)

- Before

extraordinary items and discontinued operations.

- (3)

- As of September 30, 2013.

In November 2014, the Committee, with guidance from F.W. Cook, reviewed the Company's peer group and determined that a majority of the peer group generally continues to be reasonable from both size and business model perspectives. Based on its annual review, the Committee updated the Company's peer group to include the following companies: Acxiom Corp, Allscripts-Misys Healthcare Solutions Inc., AthenaHealth, Inc., Bottomline Technologies (de), Inc., DealerTrack Technologies,Inc., ExlService Holdings, Inc., Fair Isaac Corp, MAXIMUS, Inc., MedAssets, Inc., Medidata Solutions, Inc., NeuStar, Inc., Omnicell, Inc., Quality Systems, Inc., Tyler Technologies, Inc. and WEX, Inc. (collectively, the "2014 Peer Group"). This peer group reflects (relative to the Company's prior peer group) the addition of Omnicell, Inc., a comparably-sized health care technology company, and the removal of Accretive Health because of its delisiting from the New York Stock Exchange in March 2014. We believe these changes maintain the Company's size positioning against the peer group within the median range, consistent with our overall total direct target compensation philosophy.

The chart below compares HMS's revenue, net income, EBITDA and market capitalization to the median revenue, net income, EBITDA and market capitalization for our 2014 Peer Group. Note that

17

although our revenue and market capitalization are below the median, our net income and EBITDA are above the peer median.

(in millions)(1)

|

HMS | 2014 Peer Group Median |

|||||

|---|---|---|---|---|---|---|---|

Revenue |

$ | 467 | $ | 672 | |||

Net Income(2) |

$ | 32 | $ | 29 | |||

EBITDA |

$ | 117 | $ | 107 | |||

Market Capitalization(3) |

$ | 1,654 | $ | 1,946 | |||

- (1)

- Revenue,

Net Income and EBITDA based on most recently available four quarters as of October 6, 2014.

- (2)

- Before

extraordinary items and discontinued operations.

- (3)

- As of September 30, 2014.

2014 Competitive Review

During the fourth quarter of 2014, the Compensation Committee retained F.W. Cook to conduct a competitive review of the overall compensation packages of our named executive officers (the "2014 Competitive Review"). The analysis was based on a review of the compensation of our named executive officers to similarly situated executives in the 2014 Peer Group. While we generally aim to set each named executive officer's target total direct compensation between the median and 75th percentile of the levels paid to similarly situated executives in our peer group, such data is intended to serve as one of several reference points to assist the Compensation Committee in its discussions and deliberation. The Compensation Committee reserves flexibility to vary from this positioning based on a variety of factors including prior year compensation targets, the named executive officer's overall performance, changes in roles or responsibilities, and prior year short- and long-term incentive payments.

As part of the 2014 Competitive Review, the Compensation Committee reviewed (i) a competitive analysis of the target total direct compensation of the named executive officers, including base salary and short and long-term incentives, (ii) an analysis of our 2013 actual compensation levels for the named executive officers and our performance relative to the peer group companies and (iii) a competitive assessment of our aggregate long-term incentive grant practices, including a review of share usage (shares granted in equity plans as a percentage of weighted average shares outstanding), potential dilution relative to peer group practice and fair value transfer that measures the aggregate value of long-term incentives in absolute dollars and as a percent of market capitalization.

18

2014 Executive Compensation Elements

The primary elements of our executive compensation program are as follows:

| | | | | |

Element

|

Type | Objective | ||

|---|---|---|---|---|

Annual Base Salary |

Fixed cash compensation for performing day-to-day responsibilities | Recognizes skills, experience and responsibilities | ||

Annual Short-Term Incentive Compensation |

Cash compensation awards based on the achievement of short-term financial goals and other strategic objectives measured over a specific year |

Promotes and rewards short-term corporate performance and achievement of our strategic objectives |

||

Annual Long-Term Incentive Compensation |

Restricted stock units |

Builds executive stock ownership, retains executives and aligns compensation with the achievement of our long-term financial goals of creating stockholder value and our strategic objectives as measured over multi-year periods |

In addition, we generally also provide salary and benefit continuation payments that are only payable if an executive officer's employment is terminated under specific circumstances. These benefits, which provide reasonable income protection in the event an executive officer's employment is terminated without cause or, following a change in control, an executive officer resigns for good reason, support our executive retention goal and encourages executive independence and objectivity in considering a potential change in control transaction.

The Compensation Committee does not have a formal or informal policy or target for allocating compensation between cash and non-cash compensation, or among the different forms of non-cash compensation. In allocating compensation between cash and non-cash forms, we, after reviewing information provided by F.W. Cook, determine what we believe in our business judgment is the appropriate level with respect to each of the various compensation components.

For 2014, the Compensation Committee re-evaluated the structure of our short-term (cash) incentive program and long-term incentive compensation and determined to implement a number of changes to establish increased linkage between metrics, goal-setting and incentive payouts and the Company's overall strategic goals, increase participant accountability, and balance annual and long-term results. These changes include modifying the Company's annual short-term (cash) incentive plan to include a portion based on the Company's achievement of non-financial strategic objectives and revising the equity mix of long-term incentive compensation.

Base Salary

Base salary is used to recognize the experience, skills, knowledge and responsibilities of our employees, including our named executive officers. The key factors in determining base salary are the competitive rate among our peers for positions of like responsibility and the level of the named executive officer's salary in relation to other employees within the Company with similar responsibilities and tenure.

19

The Compensation Committee reviews base salaries annually and, if appropriate, makes adjustments to reflect market levels generally every two years after taking into account individual responsibilities, performance and experience and the recommendations of the Chief Executive Officer. For 2014, the base salaries for Messrs. Lucia and Hosp and Ms. Nustad remained at $650,000, $450,000 and $425,000, respectively. With respect to Ms. Wagner, the Committee increased her base salary in March 2014, from $450,000 to $475,000 based on her significant contributions and increased scope of responsibilities as Executive Vice President of Operations, the recommendation of the Chief Executive Officer and the benchmarking data provided by F.W. Cook. In March 2014, Mr. Donabauer received a merit increase from $245,000 to $252,350 to recognize his performance, contributions and achievements in 2013. Both Mr. DeFelice and Mr. Sherman joined the Company during 2014, and their base salaries were established at $425,000 and $500,000, respectively.

Annual Short-Term (Cash) Incentive Compensation

The Compensation Committee awards annual short-term cash incentive compensation to our named executive officers in accordance with specific performance criteria established each year and based on the extent to which those criteria were achieved. The Compensation Committee believes that this element of our executive compensation program promotes the Company's performance-based compensation philosophy by providing named executive officers with direct financial incentives for achieving specific short-term performance goals. Performance criteria for the annual short-term cash incentive awards are established and awards are ultimately made in a manner intended to reward both overall corporate performance and an individual's participation in attaining such performance. Our annual short-term cash incentive awards are paid in cash, ordinarily in a single payment in the first quarter following the completion of the fiscal year.

Our Board of Directors has adopted, and our stockholders have approved, the HMS Holdings Corp. Annual Incentive Compensation Plan ("AIP") to provide key executives incentive awards that are intended to qualify as performance-based compensation and that are intended to be deductible for federal income tax purposes under the Internal Revenue Code of 1986 (the "Code"). The AIP is entirely objective. Participants in the AIP are eligible to receive a maximum bonus award of $2,000,000, subject to the Compensation Committee's authority to use negative discretion, if the predetermined objective goal for the fiscal year is met. EBITDA was selected as the performance metric under the AIP for fiscal year 2014 because it is a primary reporting metric for the Company. EBITDA is calculated based on generally accepted accounting principles (GAAP) income before income taxes to exclude the effects of interest, depreciation and amortization of intangible assets, as reported in our financial statements for the year ended December 31, 2014. All of the named executive officers other than Mr. Donabauer were participants under the AIP for fiscal 2014.

In February 2014, the Compensation Committee established the 2014 Short-Term (Cash) Incentive Plan ("2014 STIP"). The 2014 STIP operates as a sub plan under our stockholder approved AIP. This plan within a plan structure is designed to preserve deductibility under Section 162(m) of the Code, while giving the Compensation Committee the flexibility to grant awards that reflect financial and strategic achievements based on both objective and subjective criteria. The Compensation Committee established performance goals for each executive officer under the 2014 STIP that were used to determine actual bonus amounts that were paid in 2015, which are below the officers' maximum award under the AIP, if applicable.

Awards under the 2014 STIP were made from a bonus pool sized based on the aggregate target incentive opportunity for all eligible employees. Generally, an employee's target annual incentive opportunity is established based on the employees' management level within the Company and is

20

expressed as a percentage of annual base salary. The target annual incentive opportunities approved by the Compensation Committee for our named executive officers are as follows:

Named Executive Officer

|

Target Incentive Opportunity (as a % of base salary) |

|||

|---|---|---|---|---|

W. Lucia |

100 | % | ||

J. Sherman |

65 | % | ||

E. DeFelice |

65 | % | ||

K. Wagner |

65 | % | ||

C. Nustad |

65 | % | ||

W. Hosp(1) |

65 | % | ||

J. Donabauer |

50 | % | ||

- (1)

- Mr. Hosp resigned as our Executive Vice President, Chief Financial Officer and Treasurer, effective as of June 6, 2014.

2014 Performance Goals

For 2014, with input from F.W. Cook, the Compensation Committee determined to redesign the short-term (cash) incentive program, which was historically funded based solely on achievement of financial objectives, to include both financial and non-financial objectives. The Compensation Committee established revenue and adjusted EBITDA as the financial metrics under the 2014 STIP. We believe that revenue and adjusted EBITDA are strong indicators of our overall financial performance and are key indicators used by industry analysts to evaluate our operating performance. We define adjusted EBITDA, which is a non-GAAP measure, as earnings before interest, taxes, depreciation, amortization, and stock based compensation. In addition to the financial objectives, the Compensation Committee established certain strategic objectives under the 2014 STIP in order to motivate participants to achieve the overall short-term strategic goals of the Company. Weightings then were established for each of the three performance metrics for 2014—50% for adjusted EBITDA, 25% for revenue and 25% for strategic objectives, as well as specific performance targets for revenue and adjusted EBITDA. The adjusted EBITDA target for 2014 was $123.0 million. The revenue target for 2014 was $443.0 million.

The bonus pool under the 2014 STIP was funded based on the level of achievement of each of the performance objectives. As illustrated in the charts below, the applicable percentage of the bonus target to be paid varies with the Company's level of achievement of its adjusted EBITDA target and revenue target. Payout levels for the portions of the incentive award subject to achievement of these financial objectives were limited to 200% of target.

Percent of Target Achieved |

Bonus Multiple | |

|---|---|---|

<85% |

— | |

85% |

0.5 | |

86% - 99% |

Payout is a straight line from 0.5 to 1.0 | |

100% |

1.0 | |

101% - 130%(1) |

Payout is a straight line from 1.0 to 2.0 | |

| | | |

- (1)

- Payouts above 100% are subject to a limit of 20% of incremental adjusted EBITDA above budget.

21

Percent of Target Achieved |

Bonus Multiple | |

|---|---|---|

<90% |

— | |

90% |

0.5 | |

90% - 99% |

Payout is a straight line from 0.5 to 1.0 | |

100% |

1.0 | |

101% - 120%(1) |

Payout is a straight line from 1.0 to 2.0 | |

| | | |

- (1)

- Payouts above 100% are subject to a limit of 20% of incremental adjusted EBITDA above budget.

In addition to financial objectives, the following strategic objectives were established for 2014 to align our objectives with those of our customers, stockholders and employees:

- •

- Build increased sales competency: Establish a sales organization and formal sales process and develop a sales incentive plan focused

on accelerating profitable growth.

- •

- Drive operational effectiveness/margin improvement: Increase revenue per employee and product yield.

- •

- Rationalize product portfolio: Establish a Product Management function and exit or improve the profitability of underperforming

products.

- •

- Improve customer satisfaction: Improve Voice of the Customer participation and scores.

- •

- Enhance employee engagement: Improve engagement scores in 2014 survey.

The level of achievement of the strategic objectives is determined in the Compensation Committee's sole discretion.

When considering whether the Company has achieved its goals for payouts under the pre-existing terms of the short-term (cash) incentive program, the Compensation Committee may determine to exclude certain significant unplanned items that may distort the Company's performance and that were largely out of the control of management. This practice helps ensure that our senior executives will be fairly treated and remain engaged and motivated and will not be unduly influenced in their day-to-day decision-making because they would neither benefit nor be penalized as a result of certain unexpected and uncontrollable or strategic events that may positively or negatively affect the performance goals in the short-term.

2014 Short-Term (Cash) Incentive Compensation Calculation

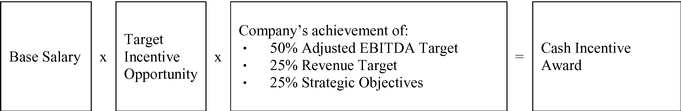

The named executive officers' 2014 incentive awards generally were determined by applying the predefined financial and strategic objectives weightings in the following formula:

For 2014, the Company had adjusted EBITDA of $101.2 million and revenue of $443.2 million. In determining the cash bonus amounts to be paid to the named executive officers for services performed in 2014, the Compensation Committee approved adjustments to the 2014 financial targets to exclude the Medicare RAC revenue due to the significant uncertainty with the related procurement and award process, which was substantially beyond the control of management, and an adjustment to the adjusted EBITDA

22

calculation to exclude the impact of 2014 legal fees incurred in connection with Public Consulting Group, Inc. ("PCG") litigation. The Compensation Committee determined that the facts giving rise to the PCG litigation were substantially outside of the control of current management and that the facts and circumstances underlying the litigation occurred in the past, prior to the employment of the management team (other than Mr. Lucia), and were related to the intervening wrongful acts of third parties. Additional considerations included fairness to the Company's management and employees and employee morale. These adjustments resulted in adjusted EBITDA of $107.4 million and adjusted revenue of $421.2 million, or 87.1% and 95.0% achievement of the respective financial objectives. In addition, the Compensation Committee determined that 100.0% of the strategic objectives for 2014 were met. Based on the Company's achievement level of each of the pre-determined performance objectives, the bonus pool under the 2014 STIP was funded at 72% of the target bonus pool.

Performance Objectives

|

Performance Objective Weighting |

Bonus Pool at Target |

Achievement of Performance Objective |

Computed Bonus Pool |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

(in thousands) |

|

(in thousands) |

|||||||||

Adjusted EBITDA |

50 | % | $ | 5,677 | 87.1 | % | $ | 3,234 | |||||

Revenue |

25 | % | $ | 2,838 | 95.0 | % | $ | 2,141 | |||||

Strategic Objectives |

25 | % | $ | 2,838 | 100.0 | % | $ | 2,838 | |||||

| | | | | | | | | | | | | | |

Totals |

100 | % | $ | 11,353 | $ | 8,213 | |||||||

| | | | | | | | | | | | | | |

% of Bonus Payout |

72% of target |

Below is a comparison of target bonus amounts to actual bonus amounts paid to the named executive officers under the 2014 STIP.

Named Executive Officer

|

Target Bonus | Actual Percentage of Target Bonus Paid |

Actual Bonus(1) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

W. Lucia |

$ | 650,000 | 72 | % | $ | 468,000 | ||||

J. Sherman |

$ | 325,000 | 48 | % | $ | 155,000 | ||||

E. DeFelice |

$ | 276,250 | 72 | % | $ | 198,000 | ||||

K. Wagner |

$ | 308,750 | 86 | % | $ | 265,000 | ||||

C. Nustad |

$ | 276,250 | 72 | % | $ | 200,000 | ||||

J. Donabauer |

$ | 126,175 | 75 | % | $ | 95,000 | ||||

W. Hosp(2) |

$ | 292,500 | — | — | ||||||

- (1)

- The

amounts in this column do not exceed the AIP maximum amounts of $2.0 million for any named executive officer.

- (2)

- Mr. Hosp resigned as our Executive Vice President, Chief Financial Officer and Treasurer, effective as of June 6, 2014.