Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ENTERPRISE FINANCIAL SERVICES CORP | a2015-048kannualshareholde.htm |

Enterprise Financial Services Corp ANNUAL SHAREHOLDER MEETING – APRIL 30, 2015

1 JAMES J. MURPHY, JR. CHAIRMAN, EFSC 2015 ANNUAL SHAREHOLDER MEETING

2 BRENDA D. NEWBERRY THANK YOU FOR YOUR SERVICE AND MANY CONTRIBUTIONS 2007-2015

3 JOHN Q. ARNOLD WELCOME TO THE EFSC BOARD OF DIRECTORS 2015 ANNUAL SHAREHOLDER MEETING

4 KEENE S. TURNER CHIEF FINANCIAL OFFICER, EFSC 2015 ANNUAL SHAREHOLDER MEETING

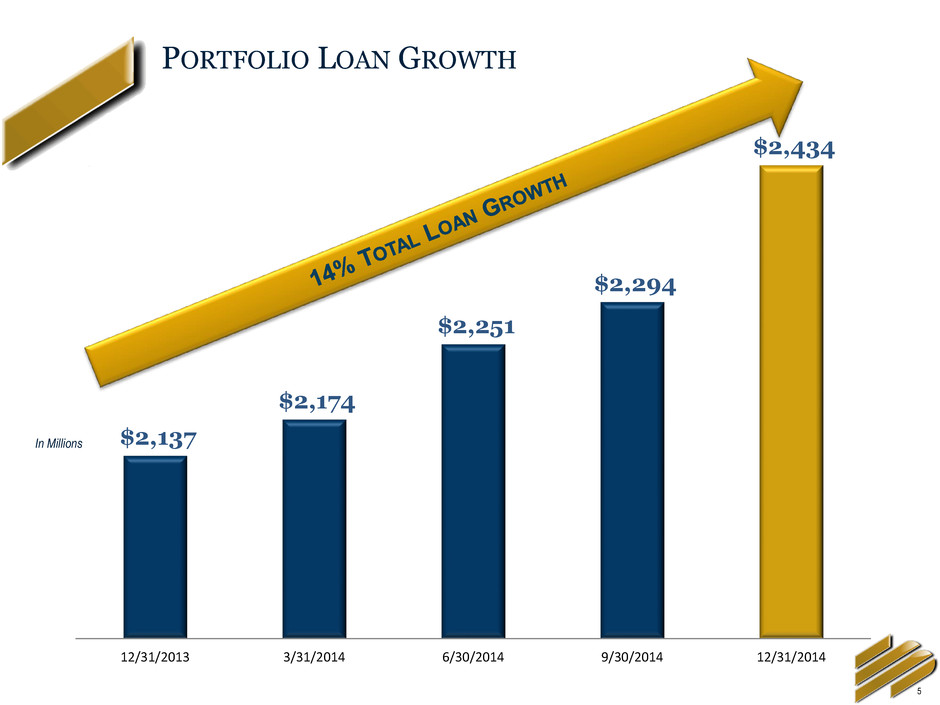

5 PORTFOLIO LOAN GROWTH $2,137 $2,174 $2,251 $2,294 $2,434 12/31/2013 3/31/2014 6/30/2014 9/30/2014 12/31/2014 In Millions

6 HISTORY OF STRONG C&I GROWTH $- $200 $400 $600 $800 $1,000 $1,200 $1,400 2009 2010 2011 2012 2013 2014 $594 In millions $554 $763 $963 $1,042 $1,270

7 $1,041 $1,060 $1,135 $1,172 $1,270 12/31/2013 3/31/2014 6/30/2014 9/30/2014 12/31/2014 COMMERCIAL & INDUSTRIAL LOAN GROWTH In Millions

8 FULL YEAR EARNINGS PER SHARE TRENDS $22,387 $1.38 $1.32 $1.20 $1.35 $0.09 $0.03 < $0.03> < $0.15> $1.29 EPS Debt Extinguishment Facilities Disposal Transaction Fee Income Non-Core Covered Assets Core EPS In Millions * A Non GAAP Measure Refer to Appendix for Reconciliation (1) FDIC Loss Sharing Agreements (2) Refer to 9/30/2014 Form 10-Q for Additional Details REPORTED VS. CORE EPS* 2014 (2) (1)

9 FULL YEAR EARNINGS PER SHARE TRENDS $1.47 < $0.13> $0.06 < $0.17 > < $0.02 > $0.08 $1.29 2013 PCI Loan NII Core Asset NII Portfolio Loan Loss Provision Non-Interest Income Operating Expenses 2014 In Millions CHANGES IN CORE EPS* * A Non GAAP Measure Refer to Appendix for Reconciliation

10 POSITIVE MOMENTUM IN CORE* EARNINGS PER SHARE $0.28 $0.31 $0.37 $0.33 $0.35 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Note: * A Non-GAAP Measure, Refer to Appendix for Reconciliation 25% CORE EPS GROWTH FROM Q1 2014 TO Q1 2015

11 NET INTEREST INCOME DRIVING CORE REVENUE GROWTH* In Millions Note: * A Non-GAAP Measure, Refer to Appendix for Reconciliation $23.7 $24.2 $24.9 $25.7 $25.6 3.44% 3.41% 3.41% 3.45% 3.46% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% $- $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 $9.0 $10.0 $11.0 $12.0 $13.0 $14.0 $15.0 $16.0 $17.0 $18.0 $19.0 $20.0 $21.0 $22.0 $23.0 $24.0 $25.0 $26.0 $27.0 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Core Net Interest Income* FTE Net Interest Margin*

12 CREDIT TRENDS FOR PORTFOLIO LOANS 8 bps 15 bps -5 bps 10 bps 25 bps Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 0 NET CHARGE-OFFS (1) 2014 NCO = 7 BPS (1) Portfolio loans only, excludes PCI loans $36.7 $77.1 $43.8 $139.1 $1.6 0 50 100 150 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 PORTFOLIO LOAN GROWTH $1.0 $1.3 $0.1 $2.0 $1.6 $- $0.6 $1.2 $1.8 $2.4 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 PROVISION FOR PORTFOLIO LOANS Q1 2015 EFSC Peer(2) NPA’S/ASSETS = 0.52% 0.91% NPL’S/LOANS = 0.62% 1.03% ALLL/NPL’S = 200% 122% ALLL/LOANS = 1.24% 1.28% (2) Peer data as of 12/31/2014 (source: SNL Financial) In Millions In Millions

13 MANAGED OPERATING EXPENSES* IMPROVING EFFICIENCY In Millions Note: * A Non-GAAP Measure, Refer to Appendix for Reconciliation $20.4 $19.5 $19.3 $20.2 $19.1 68.2% 64.5% 62.8% 62.8% 60.7% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 0 6 12 18 24 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Operating Expenses* Core Efficiency Ratio*

14 CONTINUED GROWTH IN CORE EPS DRIVE NET INTEREST INCOME GROWTH IN DOLLARS WITH FAVORABLE LOAN GROWTH TRENDS DEFEND NET INTEREST MARGIN MAINTAIN HIGH QUALITY CREDIT PROFILE ACHIEVE FURTHER IMPROVEMENT IN OPERATING LEVERAGE ENHANCE DEPOSIT LEVELS TO SUPPORT GROWTH FINANCIAL PRIORITIES TREND FROM PRIOR YEAR 25% 8% 2 BPS 0.09% NPLS/LOANS 7% 9%

15 PETER F. BENOIST CHIEF EXECUTIVE OFFICER, EFSC 2015 ANNUAL SHAREHOLDER MEETING

16 IMPROVING BUT CONTINUED SLOW ECONOMIC GROWTH INTENSE COMPETITION AND CONTINUED PRESSURE ON LOAN YIELDS INTEREST RATES WILL REMAIN HISTORICALLY LOW THE OPERATING ENVIRONMENT FOR BANKS

17 KANSAS CITY MSA ST. LOUIS MSA JOHNSON COUNTY PHOENIX MSA 3.3% 0.6% 5.0% 7.4% 5-YEAR PROJECTED POPULATION GROWTH Source: Neilson Data

18 INTENSE COMPETITION AND CONTINUED PRESSURE ON LOAN YIELDS THE OPERATING ENVIRONMENT FOR BANKS

19 INTEREST RATES WILL REMAIN HISTORICALLY LOW THE OPERATING ENVIRONMENT FOR BANKS

20 3-YEAR STOCK PRICE Source: SNL Financial

21 YEAR-TO-DATE STOCK PRICE Source: SNL Financial

22 SMALL & MID-SIZED BANKS ARE MORE HIGHLY VALUED Source: SNL Financial and FactSet Research Systems; Market data as of 12/31/2014 Note: Banks with assets under $500 million have limited research coverage and are thus excluded from the Price/Forward Earnings chart 1.55x 1.80x 2.32x 2.53x 2.91x 2.73x 3.38x 0.92x 1.04x 1.33x 1.58x 1.81x 1.70x 1.54x 0.00x 1.00x 2.00x 3.00x 4.00x <$500mm $500mm - $1bn $1.0bn - $2.5bn $2.5bn - $5.0bn $5.0bn - $10.0bn $10.0bn - $50.0bn >$50.0bn 13.6x 14.0x 14.8x 15.5x 13.8x 12.6x 14.3x 14.7x 14.3x 15.3x 15.2x 13.1x 9.0x 11.0x 13.0x 15.0x 17.0x $500mm - $1bn $1.0bn - $2.5bn $2.5bn - $5.0bn $5.0bn - $10.0bn $10.0bn - $50.0bn >$50.0bn Price / Tangible Book Value (x) Price / Forward Earnings (x) 2005Q4 2014Q4

23 NATIONWIDE BANK M&A DEAL VALUES Aggregate Value of Transactions ($bn) $29bn $108bn $69bn $34bn $1bn $10bn $17bn $12bn $14bn $18bn $0 $20 $40 $60 $80 $100 $120 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 BANK M&A ACTIVITY IN TERMS OF DEAL VALUE INCREASED FROM $14BN IN 2013 TO $18BN IN 2014. 254 278 270 122 78 121 122 197 214 281 # OF TRANSACTIONS Source: SNL Financial and FactSet Research Systems. Data as of 12/31/2014. Note: Includes whole depository transactions, excluding recapitalizations and terminated deals

24 CONSOLIDATION TRENDS – U.S. BANKS & THRIFTS M edian P /E ( x) & C o re D e p o sit P remi u m (% ) M edian P ric e t o B o o k ( % ) an d M edian P ric e t o T an g ible B o o k ( % ) Note: Includes pending and completed transactions. Data as of 12/31/2014. Source: SNL Financial

25 Enterprise Financial Services Corp ANNUAL SHAREHOLDER MEETING – APRIL 30, 2015