Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 17, 2015

CONTENT CHECKED HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 333-190656 | 99-0371233 | ||

| (State

or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S.

Employer Identification Number) |

8730 Sunset Blvd., Suite 240

West Hollywood, California 90069

(Address of principal executive offices) (zip code)

(424) 205-1777

(Registrant’s telephone number, including area code)

Copies to:

Jonathan Shechter, Esq.

Sasha Ablovatskiy, Esq.

Foley Shechter LLP

65 Route 4 East, 2nd Fl.

River Edge, New Jersey 07661

Phone: (917) 688-4099

Fax: (917) 688-4092

56-26 Chongshan Middle Rd, 1-5-1, Huanggu

Shenyang, Liaoning, China, 110031

(Former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

EXPLANATORY NOTE NO. 1

On April 17, 2015, Content Checked Holdings, Inc.’s (“we,” “us,” “our” and the “Company”) wholly owned subsidiary, Content Checked Acquisition Corp., a corporation formed in the State of Wyoming (“Acquisition Sub”), merged (the “Merger”) with and into Content Checked, Inc., a corporation incorporated in the State of Wyoming (“Content Checked”). Content Checked was the surviving corporation in the Merger and became our wholly owned subsidiary. As a result of the Merger, we discontinued our pre-Merger business and acquired the business of Content Checked and will continue the existing business operations of Content Checked as a publicly traded company under the name Content Checked Holdings, Inc. Please see “Explanation Note No. 2” and the rest of this Current Report on Form 8-K (this “Current Report”) for detailed information about the Merger and the related transactions.

Prior to the Merger, we were a “shell company” (as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)). As a result of the Merger, we have ceased to be a shell company. However, due to an unanticipated and unintended delay we need additional time to obtain the audited financial statements of Content Checked as of, and for the period from July 19, 2013 (Inception) to March 31, 2014, and the accompanying notes, the unaudited financial statements of Content Checked as of, and for the interim period through December 31, 2014, and the accompanying notes, and the unaudited pro forma financial information with respect to the Merger (collectively, the “Financial Statements”). Accordingly, the Financial Statements and related “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section are not included in this Current Report, and shall be filed by amendment as soon as possible.

Therefore, the information contained in this Current Report does not constitute the “Form 10 information” necessary to satisfy the requirements contained in Items 2.01(f), 5.01(a)(8) and 9.01(c) of the Form 8-K. Upon discovery of the delay in obtaining the required Financial Statements, we have taken affirmative steps to ensure that this does not occur again. Such steps include (i) filing this Current Report in order to comply with as much of the requirements of the Form 8-K and Federal securities laws as possible and to give our shareholders current information with respect to the Merger and the relate transactions and our Company, and (ii) instituting and adopting controls and procedures to prevent the occurrence of a similar event in the future. We intend to amend this Current Report as soon as possible to comply with such requirements.

| 2 |

TABLE OF CONTENTS

Content Checked, Contentcheckedsm are among the trademarks of Content Checked, Inc. or its subsidiaries.

| 3 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K (this “Current Report”) contains forward-looking statements, including, without limitation, in the sections captioned “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Plan of Operations,” and elsewhere. Any and all statements contained in this Current Report that are not statements of historical fact may be deemed forward-looking statements. Terms such as “may,” “might,” “would,” “should,” “could,” “project,” “estimate,” “pro-forma,” “predict,” “potential,” “strategy,” “anticipate,” “attempt,” “develop,” “plan,” “help,” “believe,” “continue,” “intend,” “expect,” “future,” and terms of similar import (including the negative of any of the foregoing) may be intended to identify forward-looking statements. However, not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements in this Current Report may include, without limitation, statements regarding (i) the plans and objectives of management for future operations, including plans or objectives relating to the design, development and commercialization of a smartphone application designed for use by people with food allergies/intolerances, and those who care for them, (ii) a projection of income (including income/loss), earnings (including earnings/loss) per share, capital expenditures, dividends, capital structure or other financial items, (iii) our future financial performance, including any such statement contained in a discussion and analysis of financial condition by management or in the results of operations included pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”), (iv) our beliefs regarding potential health benefits of our smartphone application, and (v) the assumptions underlying or relating to any statement described in points (i), (ii), (iii) or (iv) above.

The forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which we have no control over. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence or contribute to the inaccuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation, our inability to obtain adequate financing, the significant length of time and resources associated with the development and commercialization of our smartphone applications and related insufficient cash flows and resulting illiquidity, our inability to expand our business, significant government regulation of smartphone applications and the healthcare industry, the results of clinical studies or trials, lack of product diversification, existing or increased competition, results of arbitration and litigation, stock volatility and illiquidity, and our failure to implement our business plans or strategies. A description of some of the risks and uncertainties that could cause our actual results to differ materially from those described by the forward-looking statements in this Current Report appears in the section captioned “Risk Factors” and elsewhere in this Current Report.

Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them and to the risk factors. We disclaim any obligation to update the forward-looking statements contained in this Current Report to reflect any new information or future events or circumstances or otherwise.

Readers should read this Current Report in conjunction with the discussion under the caption “Risk Factors,” our financial statements and the related notes thereto in this Current Report, and other documents which we may file from time to time with the SEC.

We were incorporated as Vesta International, Corp. in Nevada on May 11, 2011. Prior to the Merger (as defined below), we intended to commence operations in the distribution of ceramic sanitary ware. Since May 11, 2011 (“Inception”) through December 31, 2014, we have not generated any revenue and have accumulated losses of $40,315.

As previously reported, on January 26, 2015, we completed a 2.44-for-1 forward split of our Common Stock, with the result that the 12,530,000 shares of our Common Stock outstanding immediately prior to the stock split became 30,573,202 shares of our Common Stock outstanding immediately thereafter. All share and per share numbers in this Current Report relating to our Common Stock have been adjusted to give effect to this stock split, unless otherwise stated.

Also as previously reported, on December 18, 2014, (i) we changed our name to Content Checked Holdings, Inc., and (ii) we increased our authorized capital stock from 75,000,000 shares of common stock, par value $0.001, to 250,000,000 shares of common stock, par value $0.001 (the “common stock”), and 10,000,000 shares of “blank check” preferred stock, par value $0.001.

| 4 |

On April 17, 2015, our wholly owned subsidiary, Content Checked Acquisition Corp., a corporation formed in the State of Wyoming (“Acquisition Sub”), merged (the “Merger”) with and into Content Checked, Inc., a corporation incorporated in the State of Wyoming on July 19, 2013 (“Content Checked”). Content Checked was the surviving corporation in the Merger and became our wholly owned subsidiary. All of the outstanding Content Checked stock was converted into shares of our Common Stock, as described in more detail below.

As a result of the Merger, we discontinued our pre-Merger business and acquired the business of Content Checked and will continue the existing business operations of Content Checked as a publicly traded company under the name Content Checked Holdings, Inc.

In connection with the Merger and pursuant to the Split-Off Agreement (defined below), we transferred our pre-Merger assets and liabilities to our pre-Merger majority stockholders, in exchange for the surrender by them and cancellation of 24,400,000 shares of our Common Stock. See Item 2.01, “Split-Off” below.

As a result of the Merger and Split-Off, we discontinued our pre-Merger business and acquired the business of Content Checked, and will continue the existing business operations of Content Checked as a publicly-traded company under the name Content Checked Holdings, Inc.

Also on April 17, 2015, we closed a private placement offering (the “PPO”) of 4,299,400 shares of our restricted common stock. Additional information concerning the PPO is presented below under Item 2.01, “Merger and Related Transactions—the PPO” and “Description of Securities,” and Item 3.02, “Unregistered Sales of Equity Securities.”

On April 15, 2015 the Company received a loan from Buyside Equity Partners, LLC in the amount of $45,000. The unsecured loan is due six months from the date made and accrues interest at the rate of 5% per annum until paid in full.

In accordance with “reverse merger” accounting treatment, our historical financial statements as of period ends, and for periods ended, prior to the Merger will be replaced with the historical financial statements of Content Checked prior to the Merger in all future filings with the SEC.

As used in this Current Report henceforward, unless otherwise stated or the context clearly indicates otherwise, the terms the “Company,” the “Registrant,” “we,” “us,” and “our” refer to Content Checked Holdings, Inc., incorporated in Nevada, after giving effect to the Merger and the Split-Off.

This Current Report contains summaries of the material terms of various agreements executed in connection with the transactions described herein. The summaries of these agreements are subject to, and are qualified in their entirety by, reference to these agreements, which are filed as exhibits hereto and incorporated herein by reference.

This Current Report is being filed in connection with a series of transactions consummated by the Company and certain related events and actions taken by the Company.

This Current Report responds to the following Items in Form 8-K:

| Item 1.01. | Entry into a Material Definitive Agreement | |

| Item 2.01. | Completion of Acquisition or Disposition of Assets | |

| Item 3.02. | Unregistered Sales of Equity Securities | |

| Item 4.01. | Changes in Registrant’s Certifying Accountant | |

| Item 5.01. | Changes in Control of Registrant | |

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers | |

| Item 5.03 | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year | |

| Item 5.06. | Change in Shell Company Status | |

| Item 9.01. | Financial Statements and Exhibits |

| 5 |

Item 1.01 Entry into a Material Definitive Agreement

The information contained in Item 2.01 below relating to the various agreements described therein is incorporated herein by reference.

Item 2.01 Completion of Acquisition or Disposition of Assets

THE MERGER AND RELATED TRANSACTIONS

On April 17, 2015 (the “Closing Date”), the Company, Acquisition Sub and Content Checked entered into an Agreement and Plan of Merger and Reorganization (the “Merger Agreement”), which closed on the same date. Pursuant to the terms of the Merger Agreement, Acquisition Sub merged with and into Content Checked, which was the surviving corporation and thus became our wholly-owned subsidiary.

Pursuant to the Merger, we acquired the business of Content Checked to develop, market and sell a smartphone application designed for use by those who suffer from food allergies and intolerances.

At the closing of the Merger, each of the 1,000,000 shares of Content Checked’s common stock issued and outstanding immediately prior to the closing of the Merger was converted into 24 shares of our common stock. As a result, an aggregate of 24,000,000 shares of our common stock were issued to the holders of Content Checked’s stock.

The Merger Agreement contained customary representations and warranties and pre- and post-closing covenants of each party and customary closing conditions. Breaches of the representations and warranties will be subject to certain indemnification provisions. Kris Finstad, our CEO and Chairman of the Board, will initially receive in the Merger all of the shares to which he is entitled, except for 500,000 shares of our Common Stock which will be held in escrow for one year to satisfy post-closing claims for indemnification by the Company (“Indemnity Shares”). Any of the Indemnity Shares remaining in escrow at the end of such one-year period shall be distributed to Mr. Finstad. The Merger Agreement also contains a provision providing that a certain pre-Merger stockholder of the Company will deposit 500,000 shares of our Common Stock in escrow for one year to satisfy post-closing claims for indemnification Content Checked and its pre-Merger shareholders (“Company Indemnity Shares”). Any of the Company Indemnity Shares remaining in escrow at the end of such one-year period shall be distributed to such stockholder. The value of the Indemnity Shares and the Company Indemnity Shares issued pursuant to the foregoing adjustment mechanisms is fixed at $0.50 per share. The foregoing mechanisms are the exclusive remedies of the Company on one hand and the pre-Merger stockholders of Content Checked and Content Checked for satisfying indemnification claims under the Merger Agreement.

The Merger will be treated as a recapitalization of the Company for financial accounting purposes. Content Checked will be considered the acquirer for accounting purposes, and our historical financial statements before the Merger will be replaced with the historical financial statements of Content Checked before the Merger in all future filings with the SEC.

The Merger is intended to be treated as a tax-free reorganization under Section 368(a) of the Internal Revenue Code of 1986, as amended.

The issuance of shares of our common stock to holders of Content Checked’s capital stock in connection with the Merger was not registered under the Securities Act, in reliance upon the exemption from registration provided by Section 4(2) of the Securities Act, which exempts transactions by an issuer not involving any public offering, and/or Regulation D and Regulation S promulgated by the SEC under that section. These securities may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirement, and some of these securities are subject to further contractual restrictions on transfer as described below.

We also agreed not to register under the Securities Act the resale of the shares of our Common Stock received in the Merger by Mr. Finstad and Mr. David R. Wells, our Interim Chief Financial Officer, for a period of six months following the closing of the Merger, provided that the foregoing will not prohibit us from registering for resale shares of common stock held by such persons with the written approval of the lead underwriter of any underwritten public offering of our securities for gross proceeds of at least $25 million.

The form of the Merger Agreement is filed as an exhibit to this Report. All descriptions of the Merger Agreement herein are qualified in their entirety by reference to the text thereof filed as an exhibit hereto, which is incorporated herein by reference.

| 6 |

Split-Off

Upon the closing of the Merger, under the terms of a split-off agreement and a general release agreement, the Company transferred all of its pre-Merger operating assets and liabilities to its wholly-owned special-purpose subsidiary, Vesta International Split Off Corp., a Nevada corporation (“Split-Off Subsidiary”). Thereafter, pursuant to the Split-Off Agreement, the Company transferred all of the outstanding shares of capital stock of Split-Off Subsidiary to Mr. Yan Wang, the pre-Merger majority stockholder of the Company, and the former sole officer and sole director of the Company (the “Split-Off”), in consideration of and in exchange for (i) the surrender and cancellation of an aggregate of 24,400,000 shares of our common stock held by Yan Wang (which were cancelled and will resume the status of authorized but unissued shares of our Common Stock) and (ii) certain representations, covenants and indemnities. All descriptions of the Split-Off Agreement and the General Release Agreement herein are qualified in their entirety by reference to the text thereof filed as exhibits hereto, which are incorporated herein by reference.

The Bridge Financings

Between August 2014 and April 2015, Content Checked offered and sold in a series of private placement to accredited investors an aggregate of $1,503,450 principal amount of its unsecured convertible promissory notes (the “Unsecured Bridge Notes”). The Unsecured Bridge Notes bore interest at 5% per annum and were payable between March 31, 2015 and April 30, 2015 (as applicable), subject to conversion as described below. Interest on the Unsecured Bridge Notes would have been payable at maturity; however, upon conversion of the Unsecured Bridge Notes as described below, accrued interest was forgiven.

Additionally, on May 5, 2014, Content Checked offered and sold in a private placement to an accredited investor $250,000 principal amount of its secured convertible promissory note (the “Secured Bridge Note”). The Secured Bridge Note bore interest at 5% per annum and was payable on March 31, 2015, subject to conversion as described below. Interest on the Secured Bridge Notes would have been payable at maturity; however, upon conversion of the Secured Bridge Notes as described below, accrued interest was forgiven. The Secured Bridge Note was secured by a priority security interest on all of the assets of Content Checked. This security interest terminated upon conversion of the Secured Bridge Note.

Upon the closing of the Merger and the PPO, the outstanding principal amount of the Unsecured Bridge Notes and Secured Bridge Note was automatically converted into shares of our common stock (as described below under “The Private Placement Offering”) at a conversion price of $0.45 and $0.40 per share, respectively.

The Private Placement Offering

Concurrently with the closing of the Merger the Company held a closing of its PPO in which it sold $166,700 of shares of common stock at a purchase price of $0.50 per share, which resulted in the issuance of 333,400 shares of our restricted common stock.

Purchasers of the restricted shares of our common stock have weighted average anti-dilution protection with respect to the shares of our common stock purchased by them in the PPO if within 24 months after the final closing of the PPO the Company shall issue additional shares of Common Stock or Common Stock equivalents (subject to customary exceptions) for consideration per share less than $0.50. The aggregate gross proceeds of the PPO were $1,920,150 (including the aggregate principal amount of Unsecured Bridge Notes and Secured Bridge Notes converted and before deducting expenses of the offering, estimated at approximately $125,000).

The PPO was exempt from registration under Section 4(2) of the Securities Act of 1933, as amended (the “Securities Act”), in reliance upon the exemption provided by Regulation D and/or Regulation S promulgated by the SEC thereunder. The PPO was sold to “accredited investors,” as defined in Regulation D, and/or foreign investors in compliance with Regulation S.

The closing of the PPO and the closing of the Merger were conditioned upon each other.

In connection with the PPO we did not pay any finders fees or Placement Agent commissions.

| 7 |

Registration Rights

In connection with the PPO, we entered into a Registration Rights Agreement, pursuant to which we have agreed that promptly, but no later than 90 calendar days from the final closing of the PPO, the Company will file a registration statement with the SEC (the “Registration Statement”) covering (a) the shares of Common Stock issued in the PPO (including those issued upon conversion of the Unsecured Bridge Notes and Secured Bridge Notes, and (b) other than any shares of our Common Stock issued to Mr. Finstad in the Merger, shares of our Common Stock issued to the shareholders of Content Checked, pursuant to the Merger Agreement (collectively, the “Registrable Shares”). We agreed to use our commercially reasonable efforts to ensure that such Registration Statement is declared effective within 180 calendar days of filing with the SEC. If we are late in filing the Registration Statement or if the Registration Statement is not declared effective within 180 days of filing with the SEC, liquidated damages payable by us to the holders of Registrable Shares that have not been so registered will commence to accrue and cumulate at a rate equal to 1.00% of the Offering Price per share for each full month that (i) the Company is late in filing the Registration Statement or (ii) the Registration Statement is late in being declared effective by the SEC; provided, however, that in no event shall the aggregate of any such liquidated damages exceed 5% of the PPO offering price per share. No liquidated damages will accrue with respect to any Registrable Shares removed from the Registration Statement in response to a comment from the staff of the SEC limiting the number of shares of Common Stock which may be included in the Registration Statement (a “Cutback Comment”) or after the shares may be resold under Rule 144 under the Securities Act or another exemption from registration under the Securities Act.

The holders of Registrable Shares (including any shares of Common Stock removed from the Registration Statement as a result of a Cutback Comment) shall have “piggyback” registration rights for such Registrable Shares with respect to any registration statement filed by the Company following the effectiveness of the Registration Statement that would permit the inclusion of such shares.

We will pay all expenses in connection with any registration obligation provided in the Registration Rights Agreement, including, without limitation, all registration, filing, stock exchange fees, printing expenses, all fees and expenses of complying with applicable securities laws, and the fees and disbursements of our counsel and of our independent accountants. Each investor will be responsible for its own sales commissions, if any, transfer taxes and the expenses of any attorney or other advisor such investor decides to employ.

All descriptions of the Registration Rights Agreement herein are qualified in their entirety by reference to the text thereof filed as an exhibit hereto, which is incorporated herein by reference.

2015 Equity Incentive Plan

Before the Merger, our Board of Directors adopted, and our stockholders approved, our 2015 Equity Incentive Plan (the “2015 Plan”), which provides for the issuance of incentive awards of up to 5,000,000 shares of our Common Stock to officers, key employees, consultants and directors. See “Market Price of and Dividends on Common Equity and Related Stockholder Matters - Securities Authorized for Issuance under Equity Compensation Plans” below for more information about the 2015 Plan.

On the closing of the Merger, our Board granted to our officers and directors options to purchase an aggregate of 2,300,000 shares of our Common Stock under the 2015 Plan. See “Description of Securities—Options” below for additional information about these awards.

Departure and Appointment of Directors and Officers

Our Board of Directors currently consists of 1 member. On the Closing Date, Yan Wang, our sole director before the Merger, resigned his position as a director, and Mr. Kris Finstad was appointed to the Board of Directors.

Also on the Closing Date, Mr. Finstad was appointed as our Chief Executive Officer and President, David R. Wells was appointed as our Interim Chief Financial Officer, Secretary and Treasurer, by the Board.

See “Management – Directors and Executive Officers” below for information about our new directors and executive officers.

Lock-up Agreements and Other Restrictions

In connection with the Merger, each of Messrs. Finstad and Wells (the “Restricted Holders”), holding at that date in the aggregate of approximately 20 million shares of our Common Stock, entered into agreements (the “Lock-Up and No Shorting Agreements”), whereby they are restricted for a period of 6 months after the Merger from certain sales or dispositions of shares of our Common Stock held by them immediately after the Merger, except in certain limited circumstances.

Further, for a period of 12 months after the Merger, each Restricted Holder has agreed in the Lock-Up and No Shorting Agreements to be subject to restrictions on engaging in certain transactions, including effecting or agreeing to effect short sales, whether or not against the box, establishing any “put equivalent position” with respect to our Common Stock, borrowing or pre-borrowing any shares of our Common Stock, or granting other rights (including put or call options) with respect to our Common Stock or with respect to any security that includes, relates to or derives any significant part of its value from our Common Stock, or otherwise seeks to hedge his position in our Common Stock.

| 8 |

Pro Forma Ownership

Immediately after giving effect to (i) the Merger and (ii) the cancellation of 24,400,000 shares in the Split-Off, and (iii) the closing of the PPO, there were 34,622,602 issued and outstanding shares of our Common Stock, as follows:

| ● | the stockholders of Content Checked prior to the Merger hold 24,000,000 shares of our Common Stock; | |

| ● | the stockholders of the Company prior to the Merger hold 6,173,202 shares of our Common Stock; | |

| ● | the investors in the Secured Bridge Notes, Unsecured Bridge Notes and the PPO hold 4,299,400 shares of our Common Stock; and | |

| ● | Mr. Wells will be issued 150,000 shares of our Common Stock. |

In addition, the 2015 Plan authorizes issuance of up to 5,000,000 shares of our Common Stock as incentive awards to executive officers, key employees, consultants and directors.

No other securities convertible into or exercisable or exchangeable for our Common Stock are outstanding.

Our Common Stock is quoted on the OTC Pink markets under the symbol “CNCK.” Promptly after the merger, we expect that our Common Stock shall commence being quoted on the OTCQB over the counter market, as prior to the Merger, we submitted an application to be quoted on the OTCQB.

Accounting Treatment; Change of Control

The Merger is being accounted for as a “reverse merger,” and Content Checked is deemed to be the acquirer in the reverse merger. Consequently, the assets and liabilities and the historical operations that will be reflected in the financial statements prior to the Merger will be those of Content Checked and will be recorded at the historical cost basis of Content Checked, and the consolidated financial statements after completion of the Merger will include the assets and liabilities of Content Checked, historical operations of Content Checked and operations of the Company and its subsidiaries from the closing date of the Merger. As a result of the issuance of the shares of our Common Stock pursuant to the Merger, a change in control of the Company occurred as of the date of consummation of the Merger. Except as described in this Current Report, no arrangements or understandings exist among present or former controlling stockholders with respect to the election of members of our Board of Directors and, to our knowledge, no other arrangements exist that might result in a change of control of the Company.

As discussed in the Explanatory Note No. 1, due to an unanticipated and unintended delay, Content Checked’s audited financial statements as of, and for the period from July 19, 2013 (Inception) to March 31, 2014, and the accompanying notes, its unaudited financial statements as of, and for the interim period through December 31, 2014, and the accompanying notes, and the unaudited pro forma financial information with respect to the Merger are not included in this Current Report, and shall be filed by amendment to this Current Report as soon as possible.

We continue to be a “smaller reporting company,” as defined under the Exchange Act, following the Merger. We believe that as a result of the Merger we have ceased to be a “shell company” (as such term is defined in Rule 12b-2 under the Exchange Act).

| 9 |

As a result of the Merger, Content Checked became a wholly owned subsidiary of the Company. The acquisition of Content Checked is treated as a reverse acquisition (the “Reverse Acquisition”), and the business of Content Checked became the business of the Company. At the time of the Reverse Acquisition, Content Checked Holdings, Inc. (formerly Vesta International, Corp.) was not engaged in any significant active business.

References to “we”, “us”, “our” and similar words refer to the Company and its wholly-owned subsidiary, Content Checked, Inc., unless the context otherwise requires, and prior to the effectiveness of the Reverse Acquisition, these terms refer to Content Checked. References to Content checked Holdings, Inc. or CCH refer to the Company and its business prior to the Reverse Acquisition.

Summary

Content Checked is a Wyoming corporation formed July 19, 2013 (“Content Checked” or the “Company”). Content Checked is a family of smartphone applications designed for people with dietary restriction, those who care for them, and organizations that cater for them. Content Checked is building a revolutionary digital marketplace these people and organizations.

Content Checked was organized under the laws of the State of Wyoming on July 19, 2013 (Inception) and its fiscal year end is March 31. The Company has no subsidiaries. The principal executive offices are located at 8730 Sunset Blvd., Suite 240, West Hollywood, California 90069. Our website address is www.Content Checked.com.

Content Checked has created and introduced to the market smartphone applications designed for use by those who suffer from; food allergies & intolerances, and migraine & chronic headaches. The applications allow its user to have the ability to scan product’s bar code and determine if it is safe for consumption. Their friends and family can also use it to assist in their food selections. The Company’s management believes it has created the first applications with genuine comprehensive content information and in-depth allergen and migraine definitions for most U.S. food products and is designed to meet the needs for millions of people in the United States. The Company has unique database of allergens, migraine triggers, and food ingredients that directly correlate with food allergies & intolerances and/or migraine & chronic headaches. Currently there are several hundreds of thousand products in the database and it is constantly growing. The applications are highly scalable and can expand into new geographic areas and product categories with limited modifications and investment.

The Content Checkedsm smartphone application helps users to personalize their shopping lists and makes sure they purchase products that are compatible with their specific allergies and intolerances. The Content Checkedsm application and supporting database allows its user to save time and make better decisions while grocery shopping since the application will guide and direct shopping based upon the user’s dietary needs.

MigraineChecked, which is created under Content Checked, is based on research from the University of Berkley California. The application helps migraine sufferers, and those who care for them, to save time and make better decisions while grocery shopping since the application will guide and direct shopping based upon the user’s dietary needs.

Upon closing of the Merger and Minimum Offering, (i) $250,000 outstanding principal amount of Content Checked’s senior secured convertible note (the “Secured Bridge Note”) issued in the second quarter of 2014 will convert into the shares, at a conversion price of $0.40 per share, and (ii) $1,503,450 of outstanding principal amount of convertible unsecured promissory notes will convert into the shares at a price of $0.45 per share.

The Registrant has not generated any revenue from its business operations or explorations to date, and to date, the Registrant has been able to raise additional funds $1,920,150 to implement its operations. As a result, the Registrant consummated the Merger with Content Checked Holdings, Inc. On March 3, 2015, the Company changed its stock symbol to CNCK”.

Business Summary

Content Checked has created and introduced to the market a Content Checkedsm smartphone application designed for use by those who suffer from food allergies and intolerances. The application allows its users the ability to scan product’s bar code and determine if it is safe for consumption. Their friends and family can also use it to assist in their food selections. The Company believes it has created the first application with genuine comprehensive content information and in-depth allergen definitions for most U.S. food products and is designed to meet the need for millions of people in the United States. The Company has unique database of allergens and food ingredients that directly correlate with allergies and intolerances. Currently there are several hundreds of thousand products database and it is constantly growing. The application is highly scalable and can expand into new geographic areas and product categories with limited modifications and investment.

| 10 |

The Content Checkedsm smartphone application helps users to personalize their shopping lists and makes sure they purchase products that compatible with their specific allergies and intolerances. The Content Checkedsm application and supporting database allows its user to save time and make better decisions while grocery shopping since the application will guide and direct shopping.

Our Industry and Market

To management’s knowledge, 28% of the U.S. population has an allergy or intolerance to various ingredients and products. Among the most common products are eggs, milk and nuts. The Content Checkedsm application also has a comprehensive recipe database which provides details instructions on food preparation for people with allergies. The application allows setting up profiles and favorites for the user and others for whom the user is shopping.

The Content Checkedsm application allows food manufacturers to showcase the products in a simple, effective and relevant way. The application serves as a platform to communicate to the user on a variety of alternatives that are better suited to them. Both manufacturers and consumers benefit from targeted communication. If those whom the manufacturer prepares food for are allergic to specific food substances, the user would look to make sure that the food does not contain ingredients that may be harmful or cause discomfort or, potentially, serious illness.

Our market has seen a greater use of the Internet by consumers and physicians. As a major communications medium the Internet has changed the healthcare industry and is transforming how consumers and physicians find and utilize healthcare information. Healthcare consumers increasingly seek to educate themselves online about their allergy-related disorders, motivated by the desire to become better-informed patients and to become more engaged healthcare consumers, due in part to increased healthcare costs.

Today, consumers can and do obtain health and wellness information online, enabling them to have immediate access to searchable information and dynamic interactive content to check allergens, nutritional benefits, products designed for certain intolerances and allergies, recipe data base for consumers with particular dietary preferences, and find food producers to meet their criteria.

Product Description

Grocery shopping can be time-consuming and difficult if you or someone for whom you shop has specific dietary restrictions. Ingredient list can be hard to understand and time consuming to monitor. Content Checked’s market research has shown that consumers tend to stay in their comfort zone and not try new products once they have identified one that fits the dietary profile they are looking for, people usually end up going for the safe bet and don’t invest any time to find new alternatives. The Content Checkedsm, applications and supporting database allows its users to save time and make better decisions while grocery shopping since the applications will guide and direct shopping based on known relationships between allergies, migraine triggers, sugar profile, and other specific dietary preferences, and certain foods. Suffering from or obtaining a certain dietary profile no longer means that you have to bring your own food to functions or inconvenience others. By using the Content Checkedsm applications, friends and family can identify what foods can be safely consumed.

The Content Checkedsm applications are designed in a way that lets the user adjust food preferences on a personal profile. As an initial step, a user must download the application onto a smart phone or tablet (iOS and Android operating systems), register and then enter specific dietary details. The user can then simply scan a product’s bar code to immediately identify if the associated product is safe for consumption. By scanning the barcode, the application will quickly identify the product specifications and the consumer will have a full overview over his or her pre-defined allergy or intolerance as the Content Checkedsm application references the products contents against its database; based on the user’s profile, the application provides a warning of any of the allergens or intolerance ingredients present in the product. If a particular food is identified as being unsafe for the user based on the profile, sensitivities and intolerances they indicate, Content Checkedsm application technology further aids the user by suggesting alternatives the user can consume with specified allergies or intolerances. The users can also program the application to search for specific substances, which could represent a health threat for them. Additionally, the user can benefit from a comprehensive selection of recipes available on the application. All this works the same way for each application area that Content Checked has and will develop.

In addition to consumer use, the application is also a potential marketing tool for food producers since they are able to target their marketing efforts to specific groups with specific needs. This ability is very unique as it offers food manufacturers to reach and promote their products to a consumer that is actively asking for this specific message during their point of purchase.

Finally, the usage of the applications offer a vast majority of data behavior that imply what consumers are searching for and where opportunity might be at hand. This data is highly attractive for food manufacturers R&D departments.

| 11 |

Product Development

The Content Checked application was initially conceptualized by its founder, Kris Finstad. Realizing the opportunity to apply technology to a significant world health issue, Mr. Finstad researched available data sources and determined that due to a variety of factors (country to country differences for the same product, multiple names for the same ingredients, lack of national standards for ingredient disclosure), a new approach was required to improve reliability and safety for those suffering from food allergies & intolerances. Operating in certain Scandinavian countries known for their consistency with the U.S. market, he purchased and licensed available data on food products in that region. He then developed a data scheme that allowed for mapping of the ingredients in a related and comprehensive way, ensuring that the users were provided a near certain reference to their profiled allergies and intolerances. Simultaneously he developed a user application that was platform-agnostic allowing utility on all currently available smart phone platforms.

Following market testing, significant value was identified in the database itself, and its designed inter-relationships. Accordingly, additional research was undertaken for its application into additional markets where food ingredients were a basis for food selection. These markets are further discussed below in “New Products and Development Opportunities”.

Revenue Model

Content Checked seeks to maximize shareholder value through a set of revenue drivers, which are scalable accordingly with operational leverage.

| ● | Advertising and Product Placement. The anticipated primary source of revenue is sales of product placement and advertising on the Content Checkedsm application platform. The Content Checkedsm application allows food manufacturers to showcase and target their products to the application user for a fixed fee and a performance based variable cost. Food producers utilize the platform to exhibit the products as an alternative that is safe or safer for consumption. The user benefits from browsing recommended products when searching for a particular item that is allergies free and health safe. | |

| Revenue from product placement depends upon the number of instances where our application is downloaded by the consumer. The Company has identified approximately 700 different food categories each of which represent an opportunity to sell at least three ads. As of the date of this report, pricing for advertising is expected to range from $500 to $3,000 per month depending on the product category, such as milk, wheat, etc. Compared to existing marketing channels this represents a highly targeted alternative, and the Content Checkedsm application is unique in terms of the opportunity to both select target groups and to address the opportunity at the point-of-purchasing-decision. The application showcases manufacturers products to a user that is actively asking to have a similar product showcased, making their attention and engagement level very high. | ||

| ● | Product Sales. The application will prompt users to buy products that they have just been show cased to. The application will offer users to accept a coupon that they can redeem at the point of sale or the user can buy the product online and have it send to their home. In either instance Content Checked has generated a track able sale / new customer for the manufacturer. | |

| ● | Download Fees. While not anticipated to be the primary source of revenue, the Company has determined that charging a fee for the application’s “premier” version is preferred due to value this provides to the consumer. Considering the health and related benefits, and the risks to certain users of ingesting ingredients to which they are allergic, by imposing a charge for the application increases the value and utility. Accordingly the Company is currently charging a per user download fee of $2.99 through iTunes and Google Play (for which the Company pays to Apple a fee of 30%, for a net of $2.69). The Company does provide a trial period which allows the prospective user to setup their profile and use the application for 50 scans, at which point it becomes disabled and requires payment of the noted fee. | |

| Content Checked has also determined that providing an incentive to non-profit organizations who have formed to support the different affected groups provides the best access to their constituents and events (see below, “Marketing Strategy”). Accordingly, Content Checked intends to offer a donation of up to $1.00 per user who downloads the application and pays the Full User fee. For those users Content Checked will receive approximately $1.69 per download. | ||

| The Content Checkedsm application is available at no charge with limited functionalities and paid version with extensive range of available tools. The goal is to convert as many free users as possible over to the paid version, but at this stage of development it is early to estimate the conversion rate. Although we offer a no-charge application, the advertising revenue associated with the projected usage of the free application supports the strategy of offering this limited functioned app for free to the consumer. | ||

| ● | Other Products and Services. The application also creates a way of communicating with the consumer that will support a robust business model: distribution of recipes, newsletters and direct marketing of new products. Content Checked is utilizing a platform to communicate allergies and intolerances on a variety of alternatives that are better suited to the customer. The application is scalable and can expand into new geographic areas and product categories with limited modifications and investment. |

| 12 |

Marketing Strategy

The Company expects to promote its products through supporting each applications community. Building community is key in their marketing. They aim to support these communities; food allergy, migraine, health and diabetics, vegan, kosher. These groups all face different challenges and in their marketing we will facilitate solutions and inspiration on how to live a safer, healthier, and easier life, suffering from dietary restrictions. A selection of the companies marketing efforts are listed below:

1. Own their own media. The Company is building a strong social media presence. Whereas their community is coming to them for inspiration. The Company converts these people to their influencers and ambassadors. They have established their own blog with expert guest bloggers for each application and results have been increased community engagement, application downloads and attained email subscribers.

2. Support organizations that support the communities. The company identifies non-profits that support the community.

| ● | The Company supports Food Allergy Research & Education (‘FARE’), who works on behalf of Americans with food allergies. The Company recently co-sponsored an event. Content Checked expects to sponsor additional events with FARE in the future, and will get a direct exposure to allergy intolerant audience via newsletters, flyers, email and online representation. The Content Checked logo is engraved on all FARE marketing materials for the sponsored events and conferences. They donate $1 from every application purchase of their paid version. | |

| ● | Scheduled 7 appearances on Lifetime television surrounding topics of holiday food consumption, migraine-related foods, and food allergy awareness week. | |

| ● | Attending and participating in national conventions. The first of these was the Food Allergy Bloggers Conference (www.fablogcon.com) held in Las Vegas in late September 2014. Events like these create awareness in the active circles surrounding those with food allergies and intolerances, and those groups that provide support and information to them. |

3. Bought media. The Company buys ads on specifically targeted medias such as; specific groups of people on Facebook and Google, dietary blogs, dietary magazines.

4. Be present at Expos. The Company has gone into a partnership with a company that represents them on 5 different expos in 2015 through out America. The partnering company informs people of the benefits of the Content Checked Inc., applications and gets them to download their applications.

5. Public relations. With a team of full-time nutritionist on our board, Content Checked, are experts in their domain. The Company creates state of the art informational content that will be distributed by their PR agency as part of a strategy to establish them as a featured expert voice on various editorial sites and magazines.

As discussed above, the donation mechanism will operate on a case-by-case basis to determine the per download donated to relevant organizations that are registered as Non-Profit 501(c)(3). Content Checked has been developing these relationships and continues to undertake such efforts. In order to efficiently market the application to various food producers, Content Checked has established a sales force team and operational office in West Hollywood, California of 5 individuals, and intends to expand its team to 10 individuals within a year. Infomercials and commercials to describe the application and market the product is currently being distributed, and new infomercials are being created with some celebrity endorsements.

In addition, the Company will use existing contacts with international food producers in Europe and follow them to the U.S. Content Checked has also established different market channels such as website and newsletter.

| 13 |

New Products and Development Opportunities

On September 1, 2014 the Company released MigraineChecked. Statistics indicate that over 36 million Americans have the disease. Similar in function to Content Checked, MigraineChecked allows the user to scan and avoid known triggers in food and drinks. The Company is able to utilize its existing comprehensive menu and recipe database to provide recommendations how to prepare food for individuals with Migraine headaches. MigraineChecked allows you to set up profiles and favorites for not just yourself but also your friends and family making sharing of favorites and ideas fun and simple. MigraineChecked allows food manufacturers to showcase their products in an effective and relevant way. They now have a platform to communicate to those having special food preferences, a variety of alternatives that are better suited to them. Both manufacturers and consumers benefit from targeted communication.

Additionally, Content Checked has already established plans for Kosher Checked (‘Koshercheckedsm), Vegan Checked (Vegancheckedsm), and Sugar Checked (‘Sugarcheckedsm), each of which will become additional proprietary databases. The addressable U.S. market size for food intolerances is approximately 52 million people where Kosher market size is approximately 11 million people, Vegetarian preferred diet accounts for 15 million, and the by far biggest is the No Sugar market where people in the danger zone on type 2 diabetes account to 98 million. (* Sources include Lubicon, Bloomberg Business, OU, FARE, American Coeliac association, Diabetes.org, CDC).

Preliminary market information is provided as follows:

| ● | Kosherchecked |

| ● | According to KosherFest, the annual dollar value of kosher market is estimated to be $12.5 million, and the dollar value of kosher goods produced for the U.S. market is $305 million. | |

| ● | The Jewish population in the U.S. is estimated to 5.2 million people, and the number of kosher consumers in the U.S. is estimated to be approximately 12 million. | |

| ● | Total Number of Jewish and other religions eating kosher products: 3.5 million. |

| ● | Veganchecked |

| ● | Increasing number of U.S. consumers are trying to limit their animal consumption. | |

| ● | 15 million Americans try to follow a Vegetarian diet |

| ● | Sugarchecked |

| ● | According to FoodInsight, when making decisions about buying packaged food or beverages, at least six in ten Americans report considering sugars in general (60%). | |

| ● | 98 Million Americans are in the danger zone of developing Type 2 diabetes |

.

| ● | Increasingly high numbers of Americans’ are looking for healthier food alternatives that don’t contain sugar, artificial sweeteners or sugar alcohols. |

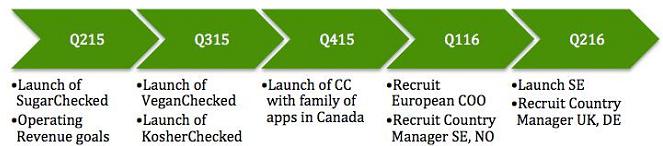

Content Checked has established a comprehensive timetable for 2015-2016:

Intellectual Property

| · | ● | Content Checked holds the Trademark and Service Mark for “CONTENT CHECKED” |

| · | ● | USPTO Reg. No. 4,622,497 INt. Cls 9 and 44 |

| 14 |

Proprietary Database

We have the most extensive database of its kind.

Ingredients with Values

We are assigning ingredients specific dietary values that create a universe of scalable applications. In other words, we are creating a web of links between a certain ingredient and know/scientific effects it has. Currently we have assigned 200,000 ingredients with specific values to the following applications areas you can see below.

Three areas of applications have been executed to date:

| 1) | People suffering from food allergies and intolerances now have access to the most advanced database ever built in favor for their dietary restrictions. These top 16 allergens listed below have all been cover in all our 200,000 ingredients. |

| a. | Celery | |

| b. | Eggs | |

| c. | Fish | |

| d. | Gluten | |

| e. | Lactose | |

| f. | Lupine | |

| g. | Milk | |

| h. | Mollusks | |

| i. | Mustard | |

| j. | Nuts | |

| k. | Peanuts | |

| l. | Sesame | |

| m. | Shellfish | |

| n. | Soy | |

| o. | Sulphites | |

| p. | Wheat |

| 2) | Migraine triggers; we have followed two extensive studies conducted by Berkley University in California and The Mayo Clinic to identify what are common migraine triggers in foods and assigned our 200,000 ingredients these values. | |

| 3) | Sugar is the cause to the single biggest health problem of American and the biggest health cost for the government. The general public wants to avoid sugars but feel that they don’t know how. Sugar is hidden in food products. We know where sugars hide and have assigned our ingredients values so that each product now has a sugar value for consumers. We have grouped sugars into four groups where consumers can chose to be warned and guided if a product contains this. Group a-c are usually very bad for a person’s health: |

a. Added Sugars (High fructose corn syrup, Malt syrup, Cane sugar, Dextrose, Syrups, etc.)

b. Artificial sweaters (Aspartame, Sucralose, Sweet n low, etc.)

c. Sugar Alcohols (Erythritol, Maltitol, Xylitol, etc.)

d. Natural Low-Cal Sweaters (Stevia, Munkfruit, etc.)

Possible application areas include:

| ● | Pregnancy diet | |

| ● | Vegetarian diet | |

| ● | Kosher diet | |

| ● | Halal diet | |

| ● | Paleo diet | |

| ● | Dogs diet |

Manufacturers with values

To ensure manufacturing practices and first information we are assigning manufacturers certain values in order to ensure consumer safety. We are building our own certification system. If a manufacturer is verified by Content Checked it means that they have passed our quality control and their information if first hand and accurate, information that is crucial for certain consumer and hard to attain without getting the manufacturer on the line to answer them. Our database is updated in real time if a manufacturer reports any changes to their practices. Something printed food packages, labels and/or guides cannot do.

| 15 |

Governmental Regulation and Product Approval

The FDA is focusing its oversight on mobile medical apps that:

| ● | are intended to be used as an accessory to a regulated medical device – for example, an application that allows a health care professional to make a specific diagnosis by viewing a medical image from a picture archiving and communication system (PACS) on a smartphone or a mobile tablet; or | |

| ● | transform a mobile platform into a regulated medical device – for example, an application that turns a smartphone into an electrocardiography (ECG) machine to detect abnormal heart rhythms or determine if a patient is experiencing a heart attack. Content Checked is not a substitute for advice and service provided by medical professionals. | |

| ● | The agency intends to exercise enforcement discretion (meaning it will not enforce requirements under the Federal Drug & Cosmetic Act) for the majority of mobile apps as they pose minimal risk to consumers. The FDA intends to focus its regulatory oversight on a subset of mobile medical apps that present a greater risk to patients if they do not work as intended. | |

| ● | Content Checked (CC) is not a substitute for advice and service provided by qualified and licensed medical professionals. Any health related information found herein is available as part of a general educational and commercial service. | |

| ● | CONTENT CHECKED does not assume any liability for inaccuracies or misstatements about products, whether based on manufacturer information or 3rd party. |

Competition

Content Checked is a family of mobile applications for those with dietary restrictions and preferences. Our company owns the largest and most comprehensive proprietary food product database in the United States. A team of dedicated nutritionists work with thousands of products every day reviewing and verifying every detail, ensuring that the database is the most extensive and detailed in the nation. There are several applications on the market that are similar in nature, but none have the qualitative and quantitative standard of ContentChecked. In the next section we will take a look at the numerous advantages ContentChecked has over its competitors.

Competitor Comparison

Allergy Free Entertaining. The app offers 130 recipes, shopping lists and is featured within the AppStore. Our app has more than double the amount of recipes, countless options to save products and we are in both the AppStore as well as GooglePlay.

Allergy Guard. This app features 2,000 ingredients, a food search option and the ability to save products for specific users. The ContentChecked database is the largest in the nation and has ten times more ingredients than Allergy Guard.

ScanAvert. An app with a subscription fee of $1.99 per month, offers 280,000 products, but does not allow saving of information. Our app is offered in both a LITE version as well as a $2.99 one-time fee where $1 is donated to food allergy research. Our product database is the most extensive in the United States with each product able to be saved to a personal favorite list.

Food Allergy Detective. Offered in the AppStore only, offers a journal entry system with manual entry options. ContentChecked offers a scanning app that helps users stay safe and time efficient while grocery shopping. Same audience, different product offerings.

iAvoid Food Allergy. Features eight allergens and the app sources information from online resources. Our app allows the option to select from 16 allergens and is built upon a proprietary database created from data collection directly from manufacturers, grocery stores and online sources. At ContentChecked all data goes through a detailed data cleaning process with our nutritional experts.

GF Overflow. The app provides a manual search option for gluten-free products within their database of 10,000 products. They are only offered in the AppStore. The ContentChecked app gives options for 16 different allergens in a database that is unparalleled in the United States which is accessible in both the AppStore and on GooglePlay.

Allergy Journal. Their app provides a food allergy journal to manually submit what affects the individual. Our system strives to prevent the effect by warning prior to using/consuming a product and giving the consumer an alternative product. Same audience, different product offerings.

| 16 |

With each app, ContentChecked exhibits a user interface that is more visually acclimated to the user as well as one of the most readily navigable. Taking into consideration these factors, ContentChecked has a market superiority that will remain substantial as long as these strengths continue to grow.

Employees

As of the date of the filing of this Current Report, we have one employee who is full time, and nine contractors who provide full time services to us. We currently plan to hire an additional 3 to 6 full time employees within the next 3-6 months, whose principal responsibilities will be the support of our sales, marketing, and tech development of our mobile applications.

We are headquartered in West Hollywood, CA, where we maintain a 1,900 sq. ft. office. We lease our facilities under a multi-year lease basis at a fixed rate of $9,000 per month. We believe this facility is adequate for our current needs. We do not own any real property.

| 17 |

AN INVESTMENT IN OUR SECURITIES IS HIGHLY SPECULATIVE AND INVOLVES A HIGH DEGREE OF RISK. WE FACE A VARIETY OF RISKS THAT MAY AFFECT OUR OPERATIONS OR FINANCIAL RESULTS AND MANY OF THOSE RISKS ARE DRIVEN BY FACTORS THAT WE CANNOT CONTROL OR PREDICT. BEFORE INVESTING IN THE SECURITIES YOU SHOULD CAREFULLY CONSIDER THE FOLLOWING RISKS, TOGETHER WITH THE FINANCIAL AND OTHER INFORMATION CONTAINED IN THIS CURRENT REPORT. IF ANY OF THE FOLLOWING RISKS ACTUALLY OCCURS, OUR BUSINESS, PROSPECTS, FINANCIAL CONDITION AND RESULTS OF OPERATIONS COULD BE MATERIALLY ADVERSELY AFFECTED. IN THAT CASE, THE TRADING PRICE OF OUR COMMON STOCK WOULD LIKELY DECLINE AND YOU MAY LOSE ALL OR A PART OF YOUR INVESTMENT. ONLY THOSE INVESTORS WHO CAN BEAR THE RISK OF LOSS OF THEIR ENTIRE INVESTMENT SHOULD CONSIDER AN INVESTMENT IN OUR SECURITIES.

THIS REPORT CONTAINS CERTAIN STATEMENTS RELATING TO FUTURE EVENTS OR THE FUTURE FINANCIAL PERFORMANCE OF OUR COMPANY. PROSPECTIVE INVESTORS ARE CAUTIONED THAT SUCH STATEMENTS ARE ONLY PREDICTIONS AND INVOLVE RISKS AND UNCERTAINTIES, AND THAT ACTUAL EVENTS OR RESULTS MAY DIFFER MATERIALLY. IN EVALUATING SUCH STATEMENTS, PROSPECTIVE INVESTORS SHOULD SPECIFICALLY CONSIDER THE VARIOUS FACTORS IDENTIFIED IN THIS CURRENT REPORT, INCLUDING THE MATTERS SET FORTH BELOW, WHICH COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE INDICATED BY SUCH FORWARD-LOOKING STATEMENTS.

If any of the following or other risks materialize, the Company’s business, financial condition, and results of operations could be materially adversely affected which, in turn, could adversely impact the value of our Common Stock. In such a case, investors in our Common Stock could lose all or part of their investment.

Prospective investors should consider carefully whether an investment in the Company is suitable for them in light of the information contained herein and the financial resources available to them. The risks described below do not purport to be all the risks to which the Company or the Company could be exposed. This section is a summary of certain risks and is not set out in any particular order of priority. They are the risks that we presently believe are material to the operations of the Company. Additional risks of which we are not presently aware or which we presently deem immaterial may also impair the Company’s business, financial condition or results of operations.

Risks Related to Our Business and the Industry in Which We Operate

We have a limited operating history upon which investors can evaluate our future prospects.

Both the Company and Content Checked have limited operating histories upon which an evaluation of their business plan or performance and prospects can be made. Indeed, Content Checkedsm mobile application was launched in June of 2014. The business and prospects of the Company must be considered in the light of the potential problems, delays, uncertainties and complications encountered in connection with a newly established business. The risks include, but are not limited to, the possibility that, following the Merger, we will not be able to develop functional and scalable products and services, or that although functional and scalable, our products and services will not be economical to market; that our competitors hold proprietary rights that preclude us from marketing such products; that our competitors market a superior or equivalent product; that we are not able to upgrade and enhance our technologies and products to accommodate new features and expanded service offerings; or the failure to receive necessary regulatory clearances for our products. To successfully introduce and market our products at a profit, we must establish brand name recognition and competitive advantages for our products. There are no assurances that the Company can successfully address these challenges. If it is unsuccessful, the Company and its business, financial condition and operating results could be materially and adversely affected.

Given the limited operating history, management has little basis on which to forecast future demand for Content Checked’s products from its existing customer base, much less new customers. The current and future expense levels of the Company following the Merger are based largely on estimates of planned operations and future revenues rather than experience. It is difficult to accurately forecast future revenues because the business of the Company is new and its market has not been developed. If the forecasts for the Company prove incorrect, the business, operating results and financial condition of the Company will be materially and adversely affected. Moreover, the Company may be unable to adjust its spending in a timely manner to compensate for any unanticipated reduction in revenue. As a result, any significant reduction in revenues would immediately and adversely affect the business, financial condition and operating results of the Company.

| 18 |

The industries in which the Company operates are highly competitive and subject to technological change. If our competitors are better able to develop and market products that are safer, more effective, less costly, easier to use, or are otherwise more attractive, we may be unable to compete effectively with other companies.

The food allergy industry is characterized by intense competition and rapid technological change, and we will face competition across Content Checked’s product lines and in each market in which our products are sold on the basis of product features, functionality and accuracy, outcomes, price, services and other factors. Competitors may include Food Guard Inc., Food Angle Inc., and other companies, some of which have significantly greater financial and marketing resources than we do, and firms that are more specialized than we are with respect to particular markets. Our competition may respond more quickly to new or emerging technologies, undertake more extensive marketing campaigns, have greater financial, marketing and other resources than we do or may be more successful in attracting potential customers, employees and strategic partners.

Our competitive position following the Merger will depend on multiple, complex factors, including our ability to achieve market acceptance for our products, develop new products, implement production and marketing plans, secure regulatory approvals for products under development and protect our intellectual property. In some instances, competitors may also offer, or may attempt to develop, alternative food allergy results in a speedier or more effective fashion. The development of new or improved products, processes or technologies by other companies may render Content Checked’s products or proposed products obsolete or less competitive. Our future success depends, among other things, upon our ability to compete effectively against current technology, as well as to respond effectively to technological advances, and upon our ability to successfully implement our marketing strategies and execute our research and development plan.

Our mobile applications may not be accepted in the market.

We cannot be certain that our current mobile application or any other mobile applications we may develop or market will achieve or maintain market acceptance. Market acceptance of our mobile applications depends on many factors, including our ability to convince key opinion leaders to provide recommendations regarding our mobile applications, convince users that our technology is an attractive alternative to other technologies, supply and service mobile quality, user friendly and user widely adopted mobile applications directly or through marketing alliances, and price mobile applications competitively in light of the current tech, mobile applications and macroeconomic environment, which, particularly in the case of the healthy industry, are becoming increasingly price sensitive.

If we are unable to provide content and services that attract users to our Content Checkedsm application on a consistent basis, our advertising and sponsorship revenue could be reduced.

We believe that the users of Content Checkedsm application have numerous other online and offline sources of allergy information and related services. Our ability to compete for user traffic on our public portals depends upon our ability to make available a variety of health, wellness and medical content, decision-support applications and other services that meet the needs of a variety of types of users, including consumers, physicians and other healthcare professionals, with a variety of reasons for seeking information. Our ability to do so depends, in turn, on:

| ● | our ability to hire and retain and grow product database; | |

| ● | our ability to license quality content from third parties; and | |

| ● | our ability to monitor and respond to increases and decreases in user interest in specific topics. |

If consumers and healthcare professionals do not perceive our content, applications and tools to be useful, reliable and trustworthy, we may not be able to attract or retain users or otherwise maintain or increase the frequency and duration of their engagement with our allergy information services. We cannot assure you that we will be able to continue to develop or acquire needed content, applications and tools at a reasonable cost. In addition, since consumer users of our public portals may be attracted to Content Checked as a result of a specific condition or for a specific purpose, it is difficult for us to predict the rate at which they will return to our public portals. Because we generate revenue by, among other things, selling sponsorships of specific products on Content Checkedsm application, a decline in user traffic levels or a reduction in the number of pages viewed by users could cause our revenue to decrease and could have a material adverse effect on our results of operations.

Dependence on patent and other proprietary rights and failing to protect such rights or to be successful in litigation related to such rights may result in our payment of significant monetary damages or impact offerings in our product portfolios.

Our long-term success largely depends on our ability to market technologically competitive mobile applications. If we fail to obtain or maintain adequate intellectual property protection, we may not be able to prevent third parties from using our proprietary technologies or may lose access to technologies critical to our mobile applications. Also, our currently pending or future patent applications may not result in issued patents, and issued patents are subject to claims concerning priority, scope and other issues.

| 19 |

Intellectual property litigation and infringement claims could cause us to incur significant expenses or prevent us from selling certain of our products.

The industries in which Content Checkedsm operates including, in particular, the food allergy detection industry, are characterized by extensive intellectual property litigation and, from time to time, we might be the subject of claims by third parties of potential infringement or misappropriation. Regardless of outcome, such claims are expensive to defend and divert the time and effort of our management and operating personnel from other business issues. A successful claim or claims of patent or other intellectual property infringement against us could result in our payment of significant monetary damages and/or royalty payments or negatively impact our ability to sell current or future products in the affected category and could have a material adverse effect on our business, cash flows, financial condition or results of operations.

Following the Merger, we could be subject to extensive governmental regulations relating to the use, labeling and marketing of Content Checked’s products.

Based on current U.S. Food and Drug Administration (the “FDA”) guidelines, Content Checked believes that it is currently not subject to any regulation by the FDA. However, Content Checked’s technology products and operations could be subject to regulation by the FDA, the European Union and other governmental authorities in the future. These agencies enforce laws and regulations that govern the development, testing, manufacturing, labeling, advertising, marketing and distribution and market surveillance that could eventually apply to the use of our products.

We face significant competition for our allergy information products and services.

The markets for healthcare information products and services are intensely competitive, continually evolving and, in some cases, subject to rapid change.

| ● | Content Checked faces competition from numerous other companies, both in attracting users and in generating revenue from advertisers and sponsors. We compete for users with Websites and mobile applications that provide health-related information, including both commercial ones and not-for-profit ones. We compete for advertisers and sponsors with: allergy-related Websites and mobile applications; general interest consumer Websites that offer specialized health sub-channels or functions; other high-traffic Websites that include both healthcare-related and non-healthcare- related content and services, including social media Websites; search engines that provide specialized health search; and advertising networks that aggregate traffic from multiple sites. Content Checked also faces competition from traditional media and offline publications and information services. | |

| ● | Our Content Checked private portals compete with: providers of healthcare decision-support tools and online health management applications, including personal health records; wellness and allergy management vendors; and health information services and health management offerings of healthcare benefits companies and their affiliates. |

Many of our competitors have greater financial, technical, product development, marketing and other resources than we do. These organizations may be better known than we are and have more customers or users than we do. We cannot provide assurance that we will be able to compete successfully against these organizations. In addition, we expect that competitors will continue to enter these markets. The competition we face for our services may result in fewer or smaller customer commitments or pressure to reduce prices, which could reduce our profit margins.

There are low barriers to entry, and we expect that competition will possibly intensify in the future. We believe that numerous factors, including price, client base, brand name, and general economic trends (particularly unfavorable economic conditions adversely affecting consumer investment), will affect our ability to compete successfully. Our competitors include companies that could have substantially greater market presence and financial, technical, marketing and other resources than we do. There can be no assurance that we will be have the financial resources, technical expertise or marketing and support capabilities to compete successfully. Increased competition could result in significant price competition, which in turn could result in lower revenues, which could materially adversely affect our potential profitability.