Attached files

| file | filename |

|---|---|

| 8-K - 8-K 1Q 2015 EARNINGS RELEASE - CommunityOne Bancorp | a1q2015earningsrelease8-k.htm |

| EX-99.1 - EXHIBIT 99.1 PRESS RELEASE DATED APRIL 30, 2015 - CommunityOne Bancorp | a1q2015earningsrelease.htm |

CommunityOne Bancorp First Quarter 2015 Earnings Presentation April 30, 2015

Presenters Bob Reid President / Chief Executive Officer David Nielsen Chief Financial Officer Neil Machovec Chief Credit Officer 2

Forward Looking Statements & Other Information 3 Forward Looking Statements This presentation contains certain forward-looking statements within the safe harbor rules of the federal securities laws. These statements generally relate to COB’s financial condition, results of operations, plans, objectives, future performance or business. They usually can be identified by the use of forward-looking terminology, such as “believes,” “expects,” or “are expected to,” “plans,” “projects,” “goals,” “estimates,” “may,” “should,” “could,” “would,” “intends to,” “outlook” or “anticipates,” or variations of these and similar words, or by discussions of strategies that involve risks and uncertainties. Forward looking statements are subject to risks and uncertainties, including but not limited to, those risks described in COB’s Annual Report on Form 10-K for the year ended December 31, 2014 under the section entitled “Item 1A, Risk Factors,” and in the Quarterly Reports of Form 10-Q and other reports that are filed by COB with the Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which are subject to numerous assumptions, risks and uncertainties, and which change over time. These forward-looking statements speak only as of the date of this presentation. Actual results may differ materially from those expressed in or implied by any forward looking statements contained in this presentation. We assume no duty to revise or update any forward-looking statements, except as required by applicable law. Non-GAAP Financial Measures In addition to the results of operations presented in accordance with Generally Accepted Accounting Principles (GAAP), COB management uses and this presentation contains or references, certain non-GAAP financial measures, such as pre-credit and non-recurring (PCNR) earnings, PCNR noninterest income, PCNR noninterest expense, and tangible shareholders’ equity. COB believes these non-GAAP financial measures provide information useful to investors in understanding our underlying operational performance and our business and performance trends as they facilitate comparisons with the performance of others in the financial services industry; however, these non-GAAP financial measures should not be considered an alternative to GAAP. The non-GAAP financial measures contained within this presentation should be read in conjunction with the audited financial statements and analysis as presented in COB’s Annual Report on Form 10-K as well as the unaudited financial statements and analyses as presented in COB’s Quarterly Reports on Form 10-Q. A reconciliation of non-GAAP measures to the most directly comparable GAAP measure is included within tables in the presentation or with the appendix to this presentation.

Quarterly Operating Highlights Net income of $2.5 million, $0.10 per share – Net income up 97% over 1Q 2014 – $3.9 million pre tax net income, up 203% over 1Q 2014 and 84% over 4Q 2014 – PCNR earnings of $3.5 million, up 111% over 1Q 2014 and 19% over 4Q 2014 Strong diversified loan growth – Portfolio grew $38.1 million, an 11% annualized growth rate Annualized deposit growth of 3% – Noninterest-bearing deposits grew at 17% annualized rate Continued positive credit trends – NPA’s fell to 1.9% of assets – Provision recovery of $1.1 million Net interest income grew 8% over 1Q 2014; flat to 4Q on fewer days – 3.54% NIM, up 11 bps over 1Q 2014 and 5 bps over 4Q 2014 NIE fell 4% from 1Q 2014 and 12% from 4Q 2014 – PCNR NIE to average assets was 3.15% in 1Q Announced branch purchase from CertusBank Quarterly Results Results of Operations Dollars in thousands 1Q 2014 2Q 2014 3Q 2014 4Q 2014 1Q 2015 Net interest income 15,479$ 15,718$ 15,848$ 16,721$ 16,774$ Recovery of provision 684 1,685 1,679 1,323 1,137 Noninterest income 3,943 4,893 3,985 4,543 4,034 Noninterest expense 18,806 19,268 20,015 20,446 18,008 Net income before tax 1,300 3,028 1,497 2,141 3,937 Income tax benefit (expense) (23) (236) 276 142,475 (1,418) Net income 1,277 2,792 1,773 144,616 2,519 PCNR earnings 1 1,642$ 2,551$ 2,013$ 2,906$ 3,460$ 1 Non-GAAP measure. See appendix for reconciliation to GAAP presentation. 4 Quarterly Performance Metrics Dollars in thousands except per share data 1Q 2014 2Q 2014 3Q 2014 4Q 2014 1Q 2015 Net income per share - diluted 0.06$ 0.13$ 0.08$ 6.62$ 0.10$ Return on average assets 0.26% 0.56% 0.35% 28.10% 0.46% Pre-tax return on average assets 0.27% 0.61% 0.30% 0.42% 0.73% Return on average equity 6.2% 12.7% 7.6% 577.0% 3.8% et i margin 3.43% 3.40% 3.38% 3.49% 3.54% PCNR noninterest expense to average assets 1 3.59% 3.47% 3.55% 3.55% 3.15% Loans held for investment 1,219,785$ 1,269,865$ 1,318,117$ 1,357,788$ 1,395,911$ Deposits 1,767,930 1,763,765 1,758,930 1,794,420 1,807,472 NPA's to total assets 2.9% 2.7% 2.4% 2.1% 1.9% Loans to deposits 69% 72% 75% 76% 77% Tier 1 Leverage 6.2% 6.4% 6.5% 9.8% 8.5% Tier 1 Common Equity N/A N/A N/A N/A 11.86% Tangible book value to tangible assets 1 3.7% 4.1% 4.2% 11.7% 11.8% 1 Non-GAAP measure. See appendix for reconciliation to GAAP presentation.

4th consecutive quarter of double digit annualized loan growth – Average earning assets grew at a 5% annualized rate in 1Q – Annualized loan growth of 11% in 1Q, and 16% for organic loans vs 10- 12% goal – Loans to deposits ratio grew to 77% vs year end goal of 80-85% Asset growth Core deposit growth ahead of plan in 1Q – Deposits grew at 3% annualized rate, which included impact of branch closures – Low cost core deposits grew at 4% annual rate in 1Q – Noninterest-bearing deposits grew $13.6 million, an annualized growth rate of 17%, on commercial relationship acquisition and treasury management products Continued deposit growth Announced the purchase of certain assets and deposits of the Lenoir and Granite Falls branches of CertusBank, N.A. – Approximately $65 million in deposits and the addition of 1 branch will complement Hickory/Lenoir area branch network Explore M&A opportunities NIE reduced 4% from prior year and 12% from last quarter – NIE / average assets ratio was 3.15%, approaching our 2015 goal of 3.10% – Completed 6 branch closures in March, improving branch efficiency and moving average deposits per branch to $41 million, up 23% since 1Q 2014 Monetize expense efforts Progress on 2015 Goals Fee income grew 2% over last year driven by strong mortgage activity – Mortgage loan income up 167% from 1Q 2014 on 134% increase in origination volume from refinance activity and non-branch channel volume – SBA business expected to contribute in 2Q 2015 – Wealth and merchant services businesses were impacted in 1Q 2015 by platform/vendor conversions that will improve go forward revenues – Service charges weaker on lower NSF and overdraft activity levels Enhanced fee income 5

Net Interest Income Net interest income increased $1.3 million (8%) from 1Q 2014, and $0.1 million from 4Q 2014 Earning assets level and mix continued to improve from 4Q – Average earning assets grew $21.9 million – Average loans increased $38.0 million – Average cash balances declined $26.8 Net interest margin increased to 3.54%, 11 bps and 5 bps increase from 1Q 2014 and 4Q 2104, respectively – Driven by improved asset mix and interest recoveries – Securities yield flat at 2.58% – Non cash accretion on PI loans was $0.7 million in 1Q 2015 and 4Q 2014, and $0.9 million in 1Q 2014 1Q cost of interest bearing deposits of 48 bps and cost of all deposits unchanged at 39 bps 6 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 1Q 2014 2Q 2014 3Q 2014 4Q 2014 1Q 2015 Yield on Loans Yield on Investment Securities 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 1Q 2014 2Q 2014 3Q 2014 4Q 2014 1Q 2015 Cost of Interest Bearing Deposits N t Interest Margin Quarterly Results Average Balances, Yields and Net Interest Margin Dollars in thousands 1Q 2014 2Q 2014 3Q 2014 4Q 2014 1Q 2015 Average loans (includes loans held for sale) 1,209,714$ 1,238,847$ 1,289,718$ 1,340,874$ 1,378,834$ Average yield 4.73% 4.66% 4.58% 4.70% 4.67% Average loans and securities 1,770,270 1,788,879 1,814,160 1,839,709 1,886,599 Average earning assets 1,830,822 1,855,092 1,862,479 1,900,647 1,922,497 Average yield 3.98% 3.95% 3.92% 4.03% 4.07% Average interest bearing liabilities 1,585,272 1,581,777 1,577,399 1,600,583 1,597,737 Average rate 0.63% 0.65% 0.64% 0.63% 0.63% Average cost of interest bearing deposits 0.48% 0.48% 0.48% 0.47% 0.48% Net interest margin 3.43% 3.40% 3.38% 3.49% 3.54% Net interest rate spread 3.35% 3.31% 3.28% 3.39% 3.44% Net interest income 15,479$ 15,718$ 15,848$ 16,721$ 16,774$ Quarterly Loan and Securities YieldsQuarterly Margin and Cost of Deposits

Noninterest Income Noninterest income increased $0.1 million from 1Q 2014 driven by mortgage – $0.3 million decline from 4Q 2014 – No PCNR items in 1Q Mortgage income increased $291 thousand, or 167%, from 1Q 2014 on 72% increase in loans originated for sale to investors – Total origination volume of $58.4 million, up 134% from 1Q 2014 Service charge income $0.2 million lower vs 1Q 2014 and 4Q 2014 on reduced overdraft and NSF activity Cardholder and merchant services income was flat to 1Q 2014, but $0.2 million lower than 4Q 2014 due to vendor transition and reduced interchange Wealth business fee income fell $36 thousand from 1Q 2014, as a result of conversion to new platform – Improved go forward fee revenue on new platform 7 Quarterly Results Noninterest Income Dollars in thousands 1Q 2014 2Q 2014 3Q 2014 4Q 2014 1Q 2015 Total noninterest income 3,943$ 4,893$ 3,985$ 4,543$ 4,034$ Less: Securities gains, net - 720 34 220 - PCNR noninterest income 1 3,943$ 4,173$ 3,951$ 4,323$ 4,034$ 1 Non-GAAP measure. Reconciliation to GAAP presentation included in this table. 2,046 2,026 1,946 2,040 1,872 174 261 205 241 465 1,113 1,209 1,183 1,298 1,125 358 399 344 394 322 252 278 273 350 250 $3,943 $4,173 $3,951 $4,323 $4,034 $0 $1,000 $2,000 $3,000 $4,000 $5,000 1Q 2014 2Q 2014 3Q 2014 4Q 2014 1Q 2015 Service charges and other fee income Mortgage loan income Cardholder and merchant services income Trust and investment services Bank-owned life insurance Total PCNR 1 Noninterest Income Trend 1 Non-GAAP measure. See table below for reconciliation to GAAP presentation.

$10,000 $12,500 $15,000 $17,500 $20,000 1Q 2014 2Q 2014 3Q 2014 4Q 2014 1Q 2015 576 558 568 568 571 500 525 550 575 600 1 14 2Q 2014 3Q 2014 4Q 2014 1Q 2015 Noninterest Expense NIE fell by $0.8 million (4%) from 1Q 2014 and by $2.4 million (12%) from 4Q 2014 – 4Q noninterest expense (NIE) includes $1.6 million charge related to branches that were closed in 1Q 2015 PCNR NIE was reduced $0.4 million (2%) from 1Q 2014 and $0.8 million (4%) from 4Q 2014 – Reduced branch costs, offset somewhat by investments in origination personnel Average FTE was 571 in Q1 – 1Q 2015 ending FTE was 554, reflecting branch closures in late March. Cost savings will begin in 2Q 2015 – Includes impact of hires of 3 non-branch retail mortgage originators in Raleigh and Charlotte OREO and collection expenses fell 28% year over year 8 Quarterly Results Noninterest Expense Dollars in thousands 1Q 2014 2Q 2014 3Q 2014 4Q 2014 1Q 2015 Personnel expense 10,393$ 9,956$ 12,616$ 10,717$ 10,594$ Net occupancy expense 1,553 1,512 1,521 1,526 1,469 Furniture, equipment and data processing expense 2,003 2,047 2,208 2,078 1,989 Professional fees 633 467 699 671 539 Stationery, printing and supplies 162 173 149 162 176 Advertising and marketing 153 147 142 274 186 Other real estate owned expense (recovery) 261 954 (29) 572 360 Credit/debit card expense 595 604 520 568 543 FDIC insurance 639 595 412 422 453 Loan collection expense 657 551 198 170 300 Core deposit intangible amortization 352 352 352 351 352 Other expense 1,405 1,910 1,227 2,935 1,047 Total noninterest expense 18,806$ 19,268$ 20,015$ 20,446$ 18,008$ PCNR noninterest expense 1 17,780$ 17,340$ 17,786$ 18,138$ 17,348$ Average Quarterly FTE Employees 576 558 568 568 571 1 Non-GAAP measure. See appendix for reconciliation to GAAP presentation. 5 Quarter PCNR NIE Trend 1 5 Quarter FTE Trend

5% 4% 3% 4% 2% 27% 27% 25% 22% 23% 60% 62% 64% 60% 62% 7% 7% 7% 6% 7% 0% 0% 0% 7% 6% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 1Q 2014 2Q 2014 3Q 2014 4Q 2014 1Q 2015 Cash and bank balances Investment securities Loans Other assets Deferred tax asset, net Balance Sheet Total assets increased $16.4 million in Q1, a 3% annualized growth rate – Deployed cash from 4Q private placement into loans and securities – Gross loans held for investment increased $38.1 million Investment portfolio increased by $15.9 million – Portfolio positioned to assist in funding loan growth – Portfolio weighted toward liquid Agency MBS 9 Quarterly Balance Sheet Dollars in thousands 1Q 2014 2Q 2014 3Q 2014 4Q 2014 1Q 2015 Cash and interest bearing bank balances 104,951$ 70,477$ 60,080$ 95,882$ 47,933$ Investment securities 551,528 546,165 507,980 492,501 508,401 Loans and loans held for sale, net 1,195,707 1,247,655 1,298,860 1,340,239 1,384,474 Other real estate owned 24,624 21,871 20,289 20,411 21,040 Intangible assets 10,802 10,501 10,191 9,886 9,705 Deferred tax asset, net 8,153 5,188 5,564 146,432 144,223 Other assets 112,716 111,656 112,829 110,163 116,158 Total assets 2,008,481$ 2,013,513$ 2,015,793$ 2,215,514$ 2,231,934$ Deposits 1,767,930$ 1,763,765$ 1,758,930$ 1,794,420$ 1,807,472$ Borrowings 140,406 143,594 147,484 139,350 138,118 Other liabilities 14,814 13,457 14,889 14,828 15,392 Equity 85,331 92,697 94,490 266,916 270,952 Total liabilities and equity 2,008,481$ 2,013,513$ 2,01 ,793$ 2,215,514$ 2,231,934$ Quarterly Balance Sheet Composition

Executing Our Loan Growth Strategy 10 NC projected to be second fastest growing SE state over next 5 years Four metro markets represent 71% of our organic loan portfolio – 3 of 4 markets projected to grow faster than 5 year projected U.S. growth rates – All 4 are in top 7 in NC Experienced origination teams in key growth markets driving strong year over year growth loan portfolio growth rates – Charlotte – 51% growth – Raleigh – 14% growth – Hickory – 3% growth – Greensboro / WS – 7% growth Full range of lending products – Commercial, SBA, Treasury, Consumer, Auto, Mortgage, Wealth – Commercial Real Estate including Builder Finance 51% 14% 3% 7% 12% 0% 10% 20% 30% 40% 50% 60% $0 $50,000 $100,000 $150,000 $200,000 $250,000 $300,000 $350,000 $400,000 $450,000 Charlotte MSA Raleigh / Durham MSA Hickory MSA Greensboro / WS MSA Non Metro MSAs Loan Portfolio Metro 12 Month Growth Rate 5 year Projected Growth Total 2014 Population Population Rank in NC 1 Charlotte MSA 6.3% 2,337,694 1 Raleigh & Durham MSAs 7.5% 1,750,092 2 Greensboro and W-S MSAs 3.7% 1,397,316 3 Hickory MSA 1.2% 364,754 7 North Carolina 4.8% United States 3.5% Source: SNL Financial 1 Excludes Virginia Beach, VA MSA Organic Loan Portfolio and Growth Rates by MSA

Accelerated Loan Growth Total loans held for investment grew $38.1 million in 1Q 2015; annualized growth rate of 11% – 4th consecutive quarter of double digit annualized growth rate – All lines of business grew loans during the quarter Organic loans (excluding purchased residential loans) grew $45.9 million; 16% annualized growth rate Total pass rated loans grew by $51.0 million; annualized growth rate of 16% Non-pass rated loans fell by $12.8 million, or 12% Loan portfolio composition balanced between consumer and commercial exposure 11 Loan Portfolio Growth Rates By Category Dollars in thousands 1Q 2014 4Q 2014 1Q 2015 $ % Annualized Commercial and Commercial Real Estate 381,733$ 467,432$ 492,192$ 24,761$ 5% 21% RE Construction 54,331 68,995 75,226 6,231 9% 36% Consumer/HELOC 191,030 217,258 227,578 10,319 5% 19% 1-4 Family Residential 251,035 291,712 309,131 17,419 6% 24% Pass Rated Organic Loans 878,128 1,045,397 1,104,127 58,730 6% 22% Purchased Resi Mortgage Loans 207,590 209,277 201,500 (7,777) (4%) (15%) Non Pass Rated Organic Loans 134,067 103,113 90,283 (12,830) (12%) (50%) Total Loans 1,219,785$ 1,357,788$ 1,395,911$ 38,123$ 3% 11% Total Organic Loans 1,012,195$ 1,148,511$ 1,194,410$ 45,900$ 4% 16% Total Pass Rated Loans 1,085,718 1,254,675 1,305,628 50,953 4% 16% 1Q Growth 1,219,785 1,269,865 1,3 8,117 1, 57,788 1,395,911 0% 5% 10% 15% 20% 25% $ $300,000 $600,000 $900,000 $1,200,000 $1,500,000 1Q 2014 2Q 2014 3Q 2014 4Q 2014 1Q 2015 Commercial RE Construction Consumer/HELOC 1-4 Family Residential Purchased Residential Non pass loans Total Loans Organic Growth Rate Annualized Quarterly Loan Portfolio Mix

18% 18% 18% 18% 19% 20% 19% 20% 20% 20% 5% 5% 5% 5% 5% 25% 24% 24% 24% 24% 18% 17% 17% 16% 15% 13% 14% 14% 15% 15% 1% 3% 2% 2% 2% 1Q 2014 2Q 2014 3Q 2014 4Q 2014 1Q 2015 Noninterest-bearing demand Interest-bearing demand Savings Money market Time deposits < $100,000 Time deposits > $100,000 Brokered Attractive and Growing Core Deposit Franchise Deposits increased by $13.1 million, a 3% annualized growth rate, in 1Q – Includes impact of 6 branch consolidations in March Low cost core deposits grew at an annualized rate of 4% in 1Q Noninterest-bearing deposits increased $13.6 million, or 4%, in 1Q, a 17% annualized growth rate – Driven by commercial relationship acquisition and improved treasury management product set Average deposits per branch has grown 23% since 1Q 2014 to $41 million per branch Core deposits stable at 83% of deposits Cost of interest bearing deposits stable at 48 bps, and the cost of all deposits was unchanged at 39 bps 12 Co re N o n Co re Quarterly Deposits Dollars in thousands 1Q 2014 2Q 2014 3Q 2014 4Q 2014 1Q 2015 Noninterest-bearing demand 315,515$ 321,829$ 317,981$ 323,776$ 337,417$ Interest-bearing demand 346,344 333,260 349,517 358,162 364,196 Savings 85,038 85,451 85,519 86,686 89,919 Money market 448,037 431,803 423,967 437,484 426,606 Brokered 25,468 47,783 37,673 38,378 37,433 Time deposits < $100,000 310,786 301,795 294,774 285,989 277,928 Time deposits > $100,000 236,742 241,844 249,499 263,945 273,973 Total deposits 1,767,930$ 1,763,765$ 1,758,930$ 1,794,420$ 1,807,472$ Total Time Deposits 572,996$ 591,422$ 581,946$ 588,312$ 589,334$ Low Cost Core Deposits 1,194,934 1,172,343 1,176,984 1,206,108 1,218,138 Core Deposits 1,505,720 1,474,138 1,471,758 1,492,097 1,4 6,066 Quarterly Deposit Mix

$34 $32 $28 $25 $20 $25 $22 $20 $20 $21 $0 $10 $20 $30 $40 $50 $60 $70 1Q 2014 2Q 2014 3Q 2014 4Q 2014 1Q 2015 M ill io ns o f D ol la rs Nonperforming loans OREO and foreclosed assets $43 $41 $36 $40 $35 $91 $80 $73 $63 $55 $0 $25 $50 $75 $100 $125 $150 $175 $200 1Q 2014 2 2014 3 2 4 1 5 M ill io ns o f D ol la rs Special Menti Loans Classified Loa s Credit Risk Well Managed 13 33% decline 30% decline Quarterly Asset Quality Dollars in thousands 1Q 2014 2Q 2014 3Q 2014 4Q 2014 1Q 2015 Allowance for loan losses (ALL) 26,039$ 23,975$ 21,525$ 20,345$ 19,008$ Nonperforming loans to total loans 2.8% 2.5% 2.2% 1.9% 1.5% Nonperforming assets to total assets 2.9% 2.7% 2.4% 2.1% 1.9% Annualized net charge-offs (recoveries) to avg. loans 0.02% 0.12% 0.24% (0.04%) 0.06% Allowance for loan loss to total loans 2.13% 1.89% 1.63% 1.50% 1.36% Classified assets to Tier 1 + ALL 78% 68% 62% 41% 39% Continued asset quality improvement in 1Q – Classified loans decreased by $7.9 million (12%) in 1Q – Nonperforming loans reduced to 1.5% of total loans, from 2.8% a year ago – NPA’s reduced to 1.9% of assets The ALL has been reduced to $19.0 million from $20.3 million at end of 4Q, reflecting the improved asset quality and continued low annualized charge-off rates ALL is 1.36% of loans held for investment $0.2 million in net charge-offs in 1Q 2015 – C&I and construction- $0.3 million net recovery – Consumer & 1-4 residential mortgage - $0.5 million net charge-off – 2015 annualized net charge-off of 6 bps Classified Asset Ratio improved to 39% Quarterly Asset Quality Trends Criticized LoansNonperforming Assets

Nonperforming Assets and Allowance 14 Quarterly Loan Portfolio and ALL 1Q 2014 2Q 2014 3Q 2014 4Q 2014 1Q 2015 Originated loans 1,043,263$ 1,101,736$ 1,162,793$ 1,211,794$ 1,271,783$ Granite purchased impaired (PI) loans 149,033 141,924 130,665 122,842 109,262 Granite purchased contractual (PC) loans 29,450 27,970 26,927 25,948 22,437 Total loans 1,221,746$ 1,271,630$ 1,320,385$ 1,360,584$ 1,403,482$ Originated loan ALL (20,286)$ (19,417)$ (17,184)$ (16,729)$ (15,390)$ Granite PI loan ALL (5,237) (4,123) (3,923) (3,237) (3,194) Granite PC loan ALL (516) (435) (418) (379) (424) Total ALL (26,039)$ (23,975)$ (21,525)$ (20,345)$ (19,008)$ Originated loan ALL / Originated loans (1.94%) (1.76%) (1.48%) (1.38%) (1.21%) Granite PI ALL / Granite PI loans (3.51%) (2.91%) (3.00%) (2.64%) (2.92%) Granite PC ALL / Granite PC loans (1.75%) (1.56%) (1.55%) (1.46%) (1.89%) T ota l ALL 2.13% 1.89% 1.63% 1.50% 1.36% Originated loans of $1.27 billion with ALL of $15.4 million (1.21%) at 1Q Granite PC loans of $22.4 million with ALL of $0.4 million (1.89%) at 1Q Granite PI loans of $109.3 million with $3.2 million ALL (2.92%) at 1Q 2015 Non-performing assets fell by $4.5 million (10%) during the quarter, and $17.3 million (30%) since 1Q 2014 Nonperforming loans fell by $5.1 million (20%) in 1Q, and by $13.7 million (40%) since 1Q 2014 OREO increased slightly (3%) in 1Q and decreased by $3.6 million (15%) since 1Q 2014 At the end of 1Q, $3.1 million of OREO (16%) was under contract for sale Nonperforming Loans and OREO Dollars in thousands 1Q 2014 2Q 2014 3Q 2014 4Q 2014 1Q 2015 Commercial and agricultural 450$ 400$ 351$ 608$ 515$ Real estate - construction 3,437 2,773 2,878 2,307 1,022 Real estate - mortgage: 1-4 family residential 10,151 9,083 8,777 8,637 8,856 Commercial 19,888 19,398 16,383 13,457 9,410 C nsumer 2 31 94 356 452 Total nonperforming loans 33,958 31,685 28,483 25,365 20,255 OREO and other foreclosed assets 24,623 21,871 20,289 20,411 21,040 Total nonperforming assets 58,581$ 53,556$ 48,772$ 45,776$ 41,295$ NPL / Total Loans Held For Investment 2.8% 2.5% 2.2% 1.9% 1.5%

Appendix 15

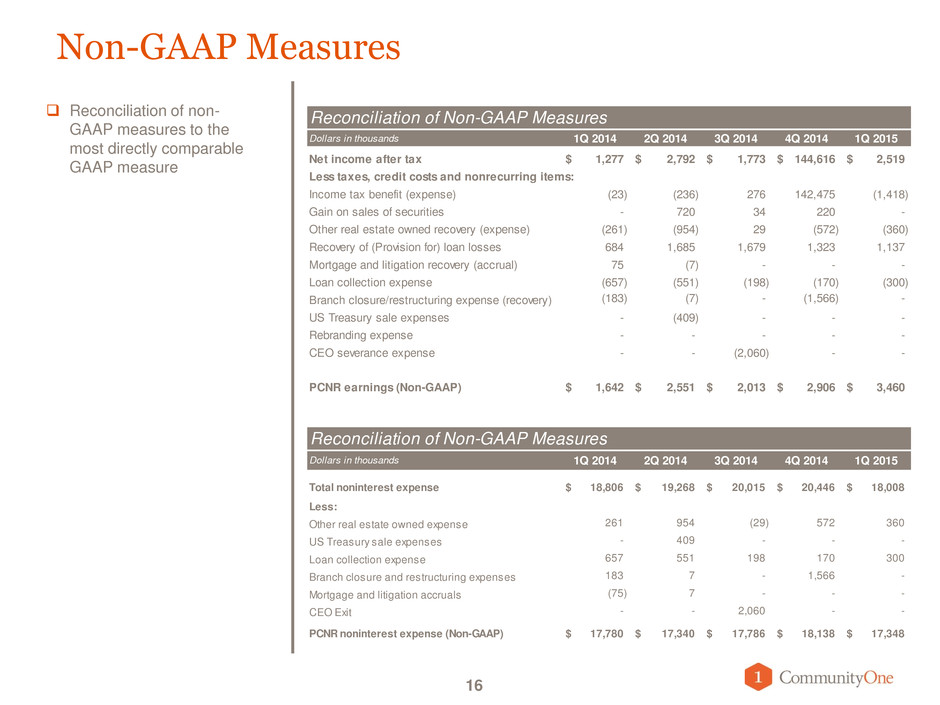

Non-GAAP Measures Reconciliation of non- GAAP measures to the most directly comparable GAAP measure 16 Reconciliation of Non-GAAP Measures Dollars in thousands 1Q 2014 2Q 2014 3Q 2014 4Q 2014 1Q 2015 Net income after tax 1,277$ 2,792$ 1,773$ 144,616$ 2,519$ Less taxes, credit costs and nonrecurring items: Income tax benefit (expense) (23) (236) 276 142,475 (1,418) Gain on sales of securities - 720 34 220 - Other real estate owned recovery (expense) (261) (954) 29 (572) (360) Recovery of (Provision for) loan losses 684 1,685 1,679 1,323 1,137 Mortgage and litigation recovery (accrual) 75 (7) - - - Loan collection expense (657) (551) (198) (170) (300) (183) (7) - (1,566) - US Treasury sale expenses - (409) - - - Rebranding expense - - - - - CEO severance expense - - (2,060) - - PCNR earnings (Non-GAAP) 1,642$ 2,551$ 2,013$ 2,906$ 3,460$ Branch closure/restructuring expense (recovery) Rec n iliation of Non-GAAP Measures Dollars in thousands 1Q 20 4 2Q 2014 3Q 2014 4Q 2014 1Q 2015 Total noninterest expense 18,806$ 19,268$ 20,015$ 20,446$ 18,008$ L ss: Other real estate owned expense 261 954 (29) 572 360 US Treasury sale expenses - 409 - - - Loan collection expense 657 551 198 170 300 Branch closure and restructuring expenses 183 7 - 1,566 - Mortgage and litigation accruals (75) 7 - - - CEO Exit - - 2,060 - - PCNR noninterest expense (Non-GAAP) 17,780$ 17,340$ 17,786$ 18,138$ 17,348$

Non-GAAP Measures 17 Reconciliation of non- GAAP measures to the most directly comparable GAAP measure Reconciliation of Non-GAAP Measures Dollars in thousands 1Q 2014 2Q 2014 3Q 2014 4Q 2014 1Q 2015 Book Value (Shareholders' equity) 85,331$ 92,697$ 94,490$ 266,916$ 270,952$ Less: Goodwill (4,205) (4,205) (4,205) (4,205) (4,205) Core deposit and other intangibles (6,597) (6,296) (5,986) (5,681) (5,500) 74,529$ 82,196$ 84,299$ 257,030$ 261,247$ Tangible book value (Tangible shareholders' equity) (Non-GAAP) Rec nciliation of Non-GAAP Measures Dollars in thousands 1Q 2014 2Q 2014 3Q 2014 4Q 2014 1Q 2015 2,008,481$ 2,013,513$ 2,015,793$ 2,215,514$ 2,231,934$ Le s: Goodwill (4,205) (4,205) (4,205) (4,205) (4,205) Core deposit and other intangibles (6,597) (6,296) (5,986) (5,681) (5,500) 1,997,679$ 2,003,012$ 2,005,602$ 2,205,628$ 2,222,229$ Total Assets Tangible Assets (Non-GAAP)