Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - Gramercy Property Trust | a2014123110-ka2ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 2)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number: 001-35933

CHAMBERS STREET PROPERTIES

(Exact name of registrant as specified in its charter)

Maryland | 56-2466617 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

47 Hulfish Street, Suite 210, Princeton, New Jersey 08542

(Address of principal executive offices) (Zip Code)

(609) 683-4900

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: | |

Title of each class | Name of each exchange on which registered |

Common Stock, $.01 par value | New York Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES x NO ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (229.405) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer x | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

(do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ¨ NO x

The aggregate market value of the voting and non-voting common shares held by non-affiliates of Chambers Street Properties was approximately $1,893,409,009 based on the quoted closing price on the New York Stock Exchange for such shares on June 30, 2014.

The number of shares outstanding of the registrant’s common shares, $0.01 par value, was 236,860,895 as of April 17, 2015.

Documents Incorporated by Reference

None.

Explanatory Note

This Amendment No. 2 on Form 10-K/A (this “Form 10-K/A”) amends the Annual Report on Form 10-K for the year ended December 31, 2014 of Chambers Street Properties filed with the Securities and Exchange Commission (the “SEC”) on March 2, 2015 (as amended by Amendment No. 1 on Form 10-K/A filed with the SEC on March 30, 2015, the “Original Form 10-K”). This Form 10-K/A is being filed to include certain information that was to be incorporated by reference from our definitive proxy statement (pursuant to Regulation 14A under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”)) for our 2015 Annual Meeting of Shareholders. This Form 10-K/A hereby amends and restates in their entirety the cover page and Items 10 through 14 of Part III of the Original Form 10-K.

Except as otherwise expressly noted herein and the filing of related certifications, this Form 10-K/A does not amend any other information set forth in the Original Form 10-K, and we have not updated disclosures contained therein to reflect any events that occurred at a date subsequent to the date of the Original Form 10-K, except to reflect the disclosures discussed herein. Accordingly, this Form 10-K/A should be read in conjunction with the Original Form 10-K and our other filings with the SEC.

Unless the context requires otherwise, all references to “Chambers Street,” “our company,” “we,” “our” and “us” mean Chambers Street Properties.

i

CHAMBERS STREET PROPERTIES

INDEX

Page | ||||

PART III | ||||

Item 10. | Trustees, Executive Officers of the Registrant and Corporate Governance | |||

Item 11. | Executive Compensation | |||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Matters | |||

Item 13. | Certain Relationships and Related Transactions, and Trustee Independence | |||

Item 14. | Principal Accounting Fees and Services | |||

PART IV | ||||

Item 15. | Exhibits, Financial Statement and Schedules | |||

SIGNATURES | ||||

ii

PART III

ITEM 10. | TRUSTEES, EXECUTIVE OFFICERS OF THE REGISTRANT AND CORPORATE GOVERNANCE |

Trustees of Chambers Street Properties

On March 5, 2015, Jack A. Cuneo stepped down as our President and Chief Executive Officer and resigned from our Board of Trustees. Excluding the vacancy resulting from Mr. Cuneo's resignation, our Board of Trustees currently consists of six trustees each serving for a term of one year and until their successors are duly elected and qualify, which term expires at each annual meeting of shareholders. Our declaration of trust and bylaws provide that a majority of the entire Board of Trustees may at any time increase or decrease the number of trustees. However, unless our declaration of trust and bylaws are amended, the number of trustees may never be less than the minimum number required by the Maryland REIT law.

The following table and biographical descriptions set forth certain information with respect to each trustee of our Board of Trustees:

Name | Age | Position | ||

Charles E. Black | 66 | Chairman of the Board of Trustees(1) | ||

Mark W. Brugger | 45 | Trustee(1) | ||

James L. Francis | 53 | Trustee(1) | ||

James M. Orphanides | 64 | Trustee(1) | ||

Martin A. Reid | 59 | Interim President, Interim Chief Executive Officer, Chief Financial Officer, Treasurer, Trustee | ||

Louis P. Salvatore | 68 | Trustee(1) | ||

__________

(1) | Independent trustee. |

Charles E. Black. Mr. Black has been one of Chambers Street Properties' (NYSE: CSG) trustees since June 2004 and has been the Chambers Street's Chairman of the Board of Trustees since June 2012. Mr. Black is the Chief Executive Officer of CB Urban Development, a development company he founded in 2007 which specializes in mixed-use urban development projects. Mr. Black is also an attorney in private practice who represents developers, land owners and businesses in the development, entitlement, financing and implementation of politically sensitive, public and private real estate projects. In addition, Mr. Black is Managing Director-Public Private Partnership for Gafcon Inc., of San Diego, California. Mr. Black's area of special focus in the real estate industry relates to structuring the entitlement and financing of large public/private mixed-use developments anchored by sports venues, convention centers and other public facilities. Before founding CB Urban Development, Mr. Black was the Regional Senior Vice President (San Diego region) of The Irvine Company. Prior to joining The Irvine Company in March 2006, Mr. Black was the Executive Vice President of JMI Realty, where he had overall management responsibility for the development of Petco Park, the $450 million San Diego Padres baseball park that was completed in February 2004. Prior to joining JMI Realty in 2002, Mr. Black was the President and Chief Operating Officer of the San Diego Padres Baseball Club. From 1991 to 2002, Mr. Black was a partner in the law firm of Gray, Cary, Ware & Freidenrich LLP, where his areas of expertise included real estate acquisition and development, urban planning and development law and development financing. Mr. Black is a member of the Urban Land Institute (ULI) and the land economics society Lambda Alpha International. Mr. Black received a B.S. from the United States Air Force Academy and a J.D. from the University of California at Davis.

Mark W. Brugger. Mr. Brugger has been one of Chambers Street Properties' (NYSE: CSG) trustees since September 2013. Mr. Brugger is a founder of DiamondRock Hospitality Company ("DiamondRock") where he has served as Chief Executive Officer and a member of the Board of Directors since September 1, 2008. Until he was promoted to his current role, Mr. Brugger served as DiamondRock's Executive Vice President, Chief Financial Officer and Treasurer since its formation in 2004. Previously, Mr. Brugger served Marriott International in a number of roles, including as the Chief Executive Officer of Marriott International's synthetic fuels company from 2001 to 2004 and as Vice President of Project Finance from 2000 to 2004. From 1997 to 2000, Mr. Brugger served as Vice President of Investment Sales at Transwestern Commercial Services. From 1995 to 1997, Mr. Brugger was the Land Development Director for Brookfield Residential, formerly Coscan Washington, Inc. Mr. Brugger received a Juris Doctor cum laude from the American University Washington College of Law in 1995 and a B.A. from the University of Maryland at College Park in 1992.

1

James L. Francis. Mr. Francis has been one of Chambers Street Properties' (NYSE: CSG) trustees since September 2013. Mr. Francis is President and Chief Executive Officer and a Trustee of Chesapeake Lodging Trust, a lodging REIT ("Chesapeake"), positions he has held since Chesapeake's formation. Prior to co-founding Chesapeake, Mr. Francis served as the President and Chief Executive Officer and a director of Highland Hospitality Corporation ("Highland"), positions that he held from Highland's IPO in December 2003 to its sale in July 2007. Following the sale of Highland, Mr. Francis served as a consultant to the affiliate of JER Partners that acquired Highland until September 2008. Since September 2008, until Chesapeake's formation, Mr. Francis was a private investor. From June 2002 until joining Highland in December 2003, Mr. Francis served as the Chief Operating Officer, Chief Financial Officer and Treasurer of Barceló Crestline Corporation ("Barceló"), and served as Executive Vice President and Chief Financial Officer of Crestline Capital Corporation ("Crestline Capital"), prior to its acquisition by Barceló, from December 1998 to June 2002. Prior to the spin-off of Crestline Capital from Host Hotels & Resorts, Inc. (formerly Host Marriott Corporation, "Host Marriott"), Mr. Francis held various finance and strategic planning positions with Host Marriott and Marriott International, Inc. ("Marriott International"). From June 1997 to December 1998, Mr. Francis held the position of Assistant Treasurer and Vice President Corporate Finance for Host Marriott, where he was responsible for Host Marriott's corporate finance function, business strategy and investor relations. Over a period of ten years, Mr. Francis served in various capacities with Marriott International's lodging business, including Vice President of Finance for Marriott Lodging from 1995 to 1997; Brand Executive, Courtyard by Marriott from 1994 to 1995; Controller for Courtyard by Marriott and Fairfield Inn from 1993 to 1994; Director of Finance and Strategic Planning for Courtyard by Marriott and Fairfield Inn from 1991 to 1993; and Director of Hotel Development Finance from 1987 to 1991. Mr. Francis received his B.A. in Economics and Business from Western Maryland College and earned an M.B.A. in Finance and Accounting from Vanderbilt University.

James M. Orphanides. Mr. Orphanides has been one of Chambers Street Properties' (NYSE: CSG) trustees since October 2005. Since January 2010, Mr. Orphanides has been a Partner and the President of Centurion Holdings LLC. Mr. Orphanides has been retired from First Industrial American Title Insurance Company of New York since 2008 where he served as Chairman Emeritus and as a director until the company merged with its parent, First American Title Insurance Company in November 2010. Mr. Orphanides worked for First American from 1992 through 2008 in key executive positions including, from 1996 through 2007, as President, Chief Executive Officer and Chairman of the Board. Prior to joining First American, Mr. Orphanides was a Principal and President of Preferred Land Title Services, Inc. from 1982 to 1992. Mr. Orphanides was an executive at Commonwealth Land Title Insurance Company from 1979 to 1982 and an executive at Chicago Title Insurance Company from 1972 to 1979. Mr. Orphanides was a trustee of Wilshire Enterprises, Inc. from January 2009 through January 2010 where he was a member of the Audit committee and chaired strategic planning. Mr. Orphanides has been actively involved in many non-for profit organizations. Until January 2012, Mr. Orphanides sat on the Board of the American Ballet Theatre. Currently, Mr. Orphanides sits on the Boards of the Foundation for Medical Evaluation and Early Detection, Citizen Budget Commission and CUNY TV Foundation. Mr. Orphanides is also a member of the Hellenic American Bankers Association (HABA); the Economic Club of New York; TPC Golf Club at Jasna Polana in Princeton, New Jersey; the Nassau Club in Princeton, New Jersey, the Union League Club in New York City and the Metropolitan Club in New York City. Mr. Orphanides received a B.A. from Heidelberg College and an M.A. from Queens College of New York.

Martin A. Reid. Mr. Reid has been one of Chambers Street Properties' (NYSE: CSG) trustees since March 2005, its Interim President and Chief Executive Officer since March 2015, its Chief Financial Officer since June 2012, its Treasurer since September 2012, and its Secretary from September 2012 to April 2015. Prior to his appointment as Interim President and Chief Executive Officer, Mr. Reid served as Executive Vice President since September 2012. Mr. Reid has over 35 years of experience in the real estate industry and capital markets. His experience includes a wide range of real estate investment, financing and management activity in both public and private markets. From September 2010 to June 2012, Mr. Reid was the Executive Vice President, Development and Acquisitions at Interstate Hotels & Resorts where he was responsible for real estate holdings, sourcing and acquiring hotels, and identifying management contract opportunities. Prior to joining Interstate, Mr. Reid was a partner in Cheswold Real Estate Investment Management. Prior to joining Cheswold, Mr. Reid was a partner in Redstone Hotel Partners, advising on hotel transactions and fund raising activities. From 1998 until 2006, Mr. Reid was Managing Director-Capital Markets of Thayer Lodging Group where he was responsible for acquisitions, dispositions, capital raising and financial matters. Mr. Reid's broad background in real estate investment, capital markets and finance also includes experience in public accounting and financial reporting. Mr. Reid received a B.S. in Accounting from the State University of New York at Albany and an M.B.A. in Financial Management from Pace University. Mr. Reid is a Member of the American Institute of Certified Public Accountants and is a Full Member of the Urban Land Institute (ULI).

Louis P. Salvatore. Mr. Salvatore has been one of Chambers Street Properties' (NYSE: CSG) trustees since July 2012. Mr. Salvatore has been employed by Arthur Andersen LLP since 1967, where he currently works part-time focusing on the wind down of the public

2

accounting practice. Mr. Salvatore was a partner at Arthur Andersen LLP from 1977 until 2002 and held a number of management positions with Arthur Andersen LLP including Office Managing Partner for Metro New York, Northeast Region Managing Partner, Member of the Worldwide Board of Partners and Interim Managing Partner of Andersen Worldwide. He also currently serves as an independent director and Chairman of the Audit Committee for public traded closed end and open end funds managed by Brookfield Asset Management and serves as a Board Member and Chairman of the Audit Committee for Turner Corporation and for SP Fiber Technologies Inc. Mr. Salvatore previously served as a Board Member and Chairman of the Audit Committee for Jackson Hewitt Tax Service Inc. from 2004 through 2011 and for Crystal River Capital Inc., a mortgage REIT sponsored by Brookfield Asset Management, from 2005 through 2010. In addition, Mr. Salvatore has served on the board of many of New York area civic and community organizations, including New York Partnership, United Way of New York City and Catholic Charities Dioceses of Brooklyn. Mr. Salvatore also holds a Masters Professional Director Certification from the American College of Corporate Directors. Mr. Salvatore received a B.S. in Accounting from Fordham University.

Non-Trustee Executive Officers of Chambers Street Properties

Philip L. Kianka. Mr. Kianka has been Chambers Street Properties' (NYSE: CSG) Executive Vice President and Chief Operating Officer since October 2008. Mr. Kianka has also been the Director of Operations of our former Investment Advisor since January 2006. Mr. Kianka was a Managing Director of CBRE Global Investors from January 2009 to June 2012. Mr. Kianka has over 30 years of experience in the real estate industry and has been involved in a wide range of activities including acquisitions, asset and portfolio management, development, dispositions, finance and joint venture structuring. Prior to joining CBRE Global Investors in January 2006, Mr. Kianka served as Vice President and senior asset manager for Lexington Properties Trust from 1997 to December 2005. Mr. Kianka also spent 13 years as Vice President at Merrill Lynch Hubbard, a real estate subsidiary of Merrill Lynch which acquired, operated and sold more than 100 properties valued at over $1.8 billion on behalf of over 240,000 individual investors. Mr. Kianka is a sustaining member of the Samuel Zell and Robert Lurie Real Estate Center at The Wharton School of the University of Pennsylvania, a member of The Greater Philadelphia Chapter of the National Association of Industrial and Office Properties and a full member of the Urban Land Institute. Mr. Kianka received a B.A. and a Masters of Architecture from Clemson University in Clemson, South Carolina and is a licensed architect in the State of New Jersey. Mr. Kianka is 58 years old.

Hugh S. O’Beirne. In April 2015, Mr. O’Beirne was appointed as Chambers Street Properties' (NYSE: CSG) Executive Vice President, Chief Legal Officer, General Counsel, and Secretary. Mr. O'Beirne was also appointed Chief Compliance Officer and Chief Risk Officer. Prior to his appointments, he served as our General Counsel since July 2012 and as the Senior Counsel for our former investment advisor since December 2007, where he has overseen and directed all of the legal affairs and compliance activities of our company. Mr. O’Beirne has 15 years of corporate and securities experience and 10 years of REIT experience. Prior to joining Chambers Street in December 2007, Mr. O’Beirne was a senior associate and member of the REIT practice at Alston & Bird LLP. Mr. O’Beirne joined Alston & Bird LLP in 2005. From 2000 through 2004, Mr. O’Beirne was an associate in the Corporate & Securities practice at Sidley Austin LLP. Mr. O’Beirne received a J.D. from Vanderbilt University School of Law in 2000, an M.A. from Boston College in 1997, and a B.A. from Merrimack College in 1993. Mr. O’Beirne is 44 years old.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”) requires our executive officers and trustees, and persons who own more than 10% of a registered class of our equity securities, to file reports of ownership and changes in ownership on Forms 3, 4 and 5 with the SEC. To our knowledge, based solely on a review of the copies of the forms received and written representations, we believe that during fiscal year 2014, our executive officers, trustees and persons who own more than 10% of a registered class of our equity securities complied with the beneficial ownership reporting requirements of Section 16 (a) of the Exchange Act.

Amended and Restated Code of Business Conduct and Ethics

Our Board of Trustees has adopted an amended and restated code of business conduct and ethics that applies to our trustees, executive officers and employees. Among other matters, our amended and restated code of business conduct and ethics was designed to deter wrongdoing and to assist our trustees, executive officers and employees in promoting honest and ethical conduct, including the following: ethical handling of actual or apparent conflicts of interest between personal and professional relationships; full, fair, accurate, timely and understandable disclosure in our SEC reports and other public communications; compliance with applicable governmental laws, rules and regulations; prompt and anonymous internal reporting of violations of the code to appropriate persons identified in the code; and accountability for adherence to the code.

3

Any amendment to, or waiver of, this amended and restated code of business conduct and ethics may be made only by our Board of Trustees or one of our board committees specifically authorized for this purpose and we intend to disclose any changes in or waivers from our code of ethics by posting such information on our website or by filing a Current Report on Form 8-K. The amended and restated code of business conduct and ethics is available free of charge on our website at http:// www.chambersstreet.com under the Investor Relations—Corporate Overview "Governance Documents" section.

Consideration of Trustee Candidates

The Nominating and Corporate Governance Committee considers properly submitted shareholder recommendations for candidates for membership on our Board of Trustees as described below under "Identifying and Evaluating Trustee Candidates." In evaluating such recommendations, the Nominating and Corporate Governance Committee seeks to achieve a balance of knowledge, experience and capability on our Board of Trustees and to address the membership criteria set forth below under "Trustee Qualifications." Any shareholder recommendations for consideration by the Nominating and Corporate Governance Committee should include the nominee's name and qualifications for Board of Trustees membership. The recommending shareholder should also submit evidence of the shareholder's ownership of our shares, including the number of shares owned and the length of time of ownership. The recommendation should be addressed to Chambers Street Properties, 47 Hulfish Street, Suite 210, Princeton, New Jersey 08542, Attn: Secretary.

Trustee Qualifications. Our corporate governance guidelines contain the membership criteria for our Board of Trustees. Trustees should (i) possess the highest personal and professional ethics, integrity and values, exercise good business judgment and be committed to representing the long-term interests of our company and our shareholders, and (ii) have an inquisitive and objective perspective, practical wisdom and mature judgment. We endeavor to have a Board of Trustees representing a diverse education and experience that provides knowledge of business, financial, governmental or legal matters that are relevant to our business and to our status as a publicly owned company.

Trustees must be willing to devote sufficient time and effort to carrying out their duties and responsibilities effectively and should be committed to serve on our Board of Trustees for an extended period of time. Trustees who also serve as chief executive officers or hold equivalent positions at other companies should not serve on more than two other boards of public companies in addition to our Board of Trustees and other trustees should not serve on more than four other boards of public companies in addition to our Board of Trustees. Current positions in excess of these limits may be maintained, unless our Board of Trustees determines that doing so would impair the quality of the trustee's service to our Board of Trustees.

The Nominating and Corporate Governance Committee ensures that the potential nominee is not an employee or agent of and does not serve on the board of directors or similar managing body of any of our competitors and determines whether the potential nominee has an interest in any transactions to which we are a party.

Prior to a vote as to whether a potential nominee is recommended to the Board of Trustees, each member of the Nominating and Corporate Governance Committee is provided reasonable access to such potential nominee. Such access includes a reasonable opportunity to interview such potential nominee in person or by telephone and to submit questions to such potential nominee. In addition, each potential nominee provides the Nominating and Corporate Governance Committee with a written detailed biography and identify on which committees of the Board of Trustees, if any, the potential nominee would be willing to serve.

Identifying and Evaluating Trustee Candidates. The Nominating and Corporate Governance Committee may solicit recommendations for trustee nominees from any or all of the following sources: non-management trustees, the Chief Executive Officer and President, other executive officers, third-party search firms or any other source it deems appropriate. As described above, the Nominating and Corporate Governance Committee will also consider potential nominees recommended by shareholders.

The Nominating and Corporate Governance Committee will review and evaluate the qualifications of any proposed nominee that it is considering in compliance with the Nominating and Corporate Governance Committee's procedures for that purpose, and conduct inquiries it deems appropriate into the background of any proposed nominee. In identifying and evaluating a proposed nominee, the Nominating and Corporate Governance Committee may consider, in addition to the minimum qualifications for Nominating and Corporate Governance Committee-recommended nominees, all facts and circumstances that it deems appropriate or advisable, including, among other things, the skills of the proposed nominee, his or her depth and breadth of business experience, his or her independence and the needs of our Board. Neither the Nominating and Corporate Governance Committee nor our Board of Trustees has a specific policy with regard to the consideration of diversity in identifying trustee nominees, although both may consider diversity when identifying and evaluating proposed nominees. The Board of Trustees does not discriminate on the basis of race, color, national

4

origin, gender, religion, disability, or sexual preference in selecting trustee candidates. Each trustee must represent the interests of all of our shareholders. As noted above, the Nominating and Corporate Governance Committee, when recommending a candidate for nomination to the Board of Trustees, may consider whether the nominee, if elected, assists in achieving a mix of board members that represents a diversity of background and experience. The Nominating and Corporate Governance Committee will evaluate all proposed nominees that it considers or who have been properly recommended to it by a shareholder based on the same criteria and in substantially the same manner, with no regard to the source of the initial recommendation of the proposed candidate for nomination.

Audit Committee

We have a standing Audit Committee, consisting of Messrs. Salvatore (Chairman), Black, Brugger and Francis, each of whom is "independent" as such term is defined by the applicable rules of the SEC and the New York Stock Exchange (the "NYSE"). Our Audit Committee's primary functions are to select and appoint our independent registered public accounting firm (including overseeing the auditor's qualifications and independence) and to assist our Board of Trustees in fulfilling its oversight responsibilities by reviewing (i) the financial information to be provided to the shareholders and others, (ii) the system of internal controls that management has established, (iii) the performance of our internal audit function and independent auditor, and (iv) the audit and financial reporting process. Our Audit Committee also prepares the report that the rules of the SEC requires to be included in our annual proxy statement and provides an open avenue of communication among our independent registered public accounting firm, our internal auditors, our management and our Board of Trustees. Our Board of Trustees has approved a written charter for our Audit Committee, a copy of which is available on our website at http:// www.chambersstreet.com under the Investor Relations—Corporate Overview "Governance Documents" section.

Audit Committee Financial Expert

Our Board of Trustees has determined that our Audit Committee has at least one "audit committee financial expert," as defined in Item 407(d)(5) of SEC Regulation S-K, such expert being Mr. Louis P. Salvatore, and that he is "independent" as such term is defined by the applicable rules of the SEC and the NYSE. Mr. Salvatore has agreed to serve as our audit committee financial expert.

ITEM 11. | EXECUTIVE COMPENSATION |

Compensation Discussion and Analysis

Introduction

This section describes the material elements of our executive compensation program, the compensation decisions our Compensation Committee has made under the program and the factors considered in making those decisions for our "named executive officers" or "executives" for 2014, who were:

Name | Position | Age | ||

Jack A. Cuneo | Former President and Chief Executive Officer(1) | 67 | ||

Martin A. Reid | Interim President and Chief Executive Officer, and Chief Financial Officer, and Treasurer | 59 | ||

Philip L. Kianka | Executive Vice President and Chief Operating Officer | 58 | ||

__________

(1) | On March 5, 2015, Mr. Cuneo stepped down as President and Chief Executive Officer and resigned from our Board of Trustees and Mr. Reid was named as our company's Interim President and Chief Executive Officer. The discussion in this Form 10-K/A regarding the various elements of Mr. Cuneo's 2014 compensation does not reflect any severance compensation, except as set forth under "—Mr. Cuneo’s Memorandum of Retirement" on page 15 below, where the actual amounts that Mr. Cuneo receives in connection therewith are described. |

Executive Summary

2014 Business Highlights

5

In 2014, we focused our efforts on disposing non-core office assets in our existing portfolio and acquiring high quality industrial assets. Further, we continued to successfully execute on our strategic objectives, including an intense focus on asset management, capital investment and balance sheet management.

We realized several significant accomplishments in 2014, including:

• | We acquired seven wholly-owned industrial properties located in the United States for approximately $203.6 million, each of which is fully leased to a creditworthy tenant. |

• | Pursuant to our investment strategy, we disposed of non-core assets consisting of (i) three office properties for approximately $64.7 million located in the United States and the United Kingdom, (ii) our last retail property located in the United Kingdom for approximately $63.0 million, and (iii) four multi-tenant office properties held in the Duke JV for approximately $71.8 million (of which our pro rata share was approximately $57.4 million). |

• | We leased over 4.1 million net rentable square feet, and at December 31, 2014, our portfolio was 98.3% leased. |

• | Our 2014 operating activities helped grow our funds from operations, or FFO, from $0.59 per share in 2013 to $0.64 per share in 2014, and our core funds from operations, or Core FFO, from $0.65 per share in 2013 to $0.69 per share in 2014. |

• | We declared and paid monthly distributions on our common shares, returning approximately $119.4 million to shareholders. |

Objectives of Our Compensation Program

The objectives of our compensation program include the following:

• | to attract and retain leading talent in our areas of operation; |

• | to motivate our executives to work toward short-term financial efficiency and long-term value creation based on our overarching business strategy; |

• | to align the interests of our management with those of our shareholders; and |

• | to achieve the appropriate balance between risk and reward while avoiding the creation of incentives for unnecessary or excessive risk taking. |

2014 Compensation Overview

Highlighted below are the key components of our executive compensation program, the purpose of each component and the process for determining each component.

Compensation Component | Description and Purpose | Process/Highlights |

Annual Base Salary | ● Fixed compensation necessary to attract and retain an exceptional management team. ● Based on competitive market, individual role, experience and potential. | ● Salaries are fixed in the employment agreements of each of our executives. 2014 salaries for our named executive officers were the same as 2013 salaries. ● Refer to the subsection entitled "Annual Base Salary" under the discussion of "—How We Determine Executive Compensation—Our Executive Compensation Elements." |

6

Compensation Component | Description and Purpose | Process/Highlights |

Annual Cash Incentive Compensation | ● Performance-based cash incentives that reward achievement of quantitative performance goals. ● Tied to our company's business plan and individual goals. ● Based 75% on our company's performance against four financial metrics (Core FFO per share, ratio of net debt to earnings before interest, taxes, depreciation and amortization, or EBITDA, dispositions of non-core assets, and percentage of portfolio leased), which are weighted based on relative importance. Refer to the Original Form 10-K for a reconciliation of FFO and Core FFO and refer to page 29 of this Form 10-K/A for a reconciliation of EBITDA to net income attributable to our common shareholders for the year ended December 31, 2014 and information regarding our use of these financial measures. ● Based 25% on individual performance goals. | ● In 2014, Core FFO per share was $0.69 resulting in achievement of 100% of target for this component; ratio of net debt to EBITDA was 6.82x resulting in achievement of 72.1% of target for this component; disposition of non-core assets was $185.1 million resulting in achievement of 135.1% of target for this component; and percentage of portfolio leased was 98.3% resulting in achievement of 144.3% of target for this component. ● Despite our strong operational performance, the Committee was disappointed in our relative total shareholder return. As a result, the Committee reduced the bonuses funded for each of our named executive officers. Actual bonuses paid in 2015 (for 2014 performance) to our named executive officers ranged from 75% to 79.5% of executive’s target opportunity. Mr. Reid also received an additional cash bonus of $100,000 for assisting our company in the transition to a new Chief Executive Officer. ● Refer to the subsection entitled "Annual Cash Incentive Compensation and Long-Term Equity Incentive Grants" under the discussion of "—How We Determine Executive Compensation—Our Executive Compensation Elements." |

7

Compensation Component | Description and Purpose | Process/Highlights |

Annual Long-Term Equity Incentive Grants | ● Aligns executive compensation with total shareholder return over multi-year performance and vesting periods. ● The number of shares granted in 2015 (for 2014 performance) as a percentage of each executive’s target based 100% on our company's performance against the same four financial metrics described above under Annual Cash Incentive Compensation. ● Starting with the 2015 grants (the size of which was based on 2014 performance), 50% of long-term equity incentives will be earned based on our company's three-year total shareholder return performance relative to peers. | ● Grants are made in the first quarter each year with the number of shares based on the prior year’s performance. ● The number of shares granted to each executive in 2014 was based on 2013 performance. Based on the Committee’s assessment of our company’s and each executive’s 2013 performance, the Committee granted Messrs. Cuneo, Reid, and Kianka 93%, 97.2%, and 97.2% of their respective annual target equity opportunities. Mr. Cuneo also received in 2014 40,875 restricted shares based on achievement of performance objectives that were not previously achieved in 2012. The 2014 grants (for 2013 performance) consisted of restricted shares vesting in three equal annual installments from the grant date based on continued employment. ● The number of shares granted to each executive in 2015 was based on 2014 performance. Despite our strong operational performance, the Committee was disappointed in our relative total shareholder return. As a result, the Committee reduced the shares granted to each of our named executive officers. Based on the Committee’s assessment of our company’s and each executive’s 2014 performance, the Committee granted Messrs. Cuneo, Reid, and Kianka 75%, 100%, and 83.3% of their respective annual target equity opportunities. Half of the shares granted in 2015 (for 2014 performance) were performance share units, or PSUs, that will be earned from 0% to 150% of the target number of PSUs based on our total shareholder return relative to an index of peers over a three-year performance period conditioned on continued employment. The other half of the shares were restricted share units, or RSUs, that vest in three equal annual installments from the date of grant based on continued employment. These awards will be included as a part of 2015 compensation in the Summary Compensation Table in our 2016 proxy statement. ● Refer to the subsection entitled "Annual Cash Incentive Compensation and Long-Term Equity Incentive Grants" under the discussion of "—How we Determine Executive Compensation—Our Executive Compensation Elements." |

8

Compensation Component | Description and Purpose | Process/Highlights |

Benefits and Perquisites | ● Designed to attract and retain high performing employees. ● Named executive officers may participate in the same benefits plans as all other employees. There are no perquisites provided exclusively to our executives. | ● Includes health, dental and vision insurance, group term life insurance, disability coverage, a 401(k) plan with matching contributions, and parking. ● All employee plans are reviewed annually. |

Compensation Mix

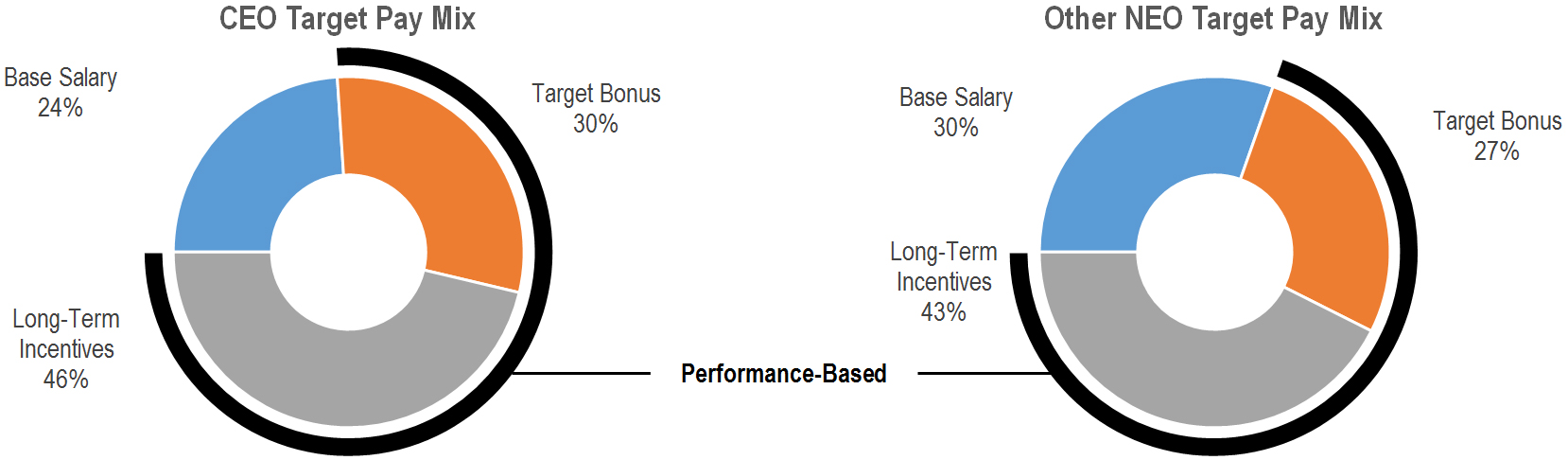

Our executive compensation program is designed to balance short-term and long-term objectives, support management's sustained ownership of company shares, and reinforce the importance of shareholder value creation by awarding variable compensation to our executives. The following charts illustrate the target mix between direct compensation elements (base salary, annual cash bonus and long-term equity incentives in the form of RSUs and PSUs) for our former Chief Executive Officer and the average of our other named executive officers for 2014:

Our Compensation Committee determined that this balance is appropriate to emphasize variable, performance-based compensation, including, equity-based compensation, to enhance our executives' focus on performance, and to align the interests of our executives and our shareholders.

9

Compensation Best Practices

Our executive compensation practices are intended to be consistent with recognized corporate governance best practices, as illustrated in the following list of what we do and do not do:

What We Do: | What We Do Not Do: |

ü Our executives' total compensation opportunity is primarily based on performance, awarded through our short (annual) and long-term incentive compensation programs. ü Starting with 2015 grants based on 2014 performance, fifty percent of our long-term incentive compensation is in PSUs, intended to reward future performance, which vest based on our relative total shareholder return performance versus the constituents of a peer index over a period of three years from the date of the grant. ü We have robust share ownership guidelines for our named executive officers and trustees. ü Our Compensation Committee retains and meets regularly with an independent compensation consultant to advise on executive and trustee compensation ü A “clawback” policy is in effect to recover cash and equity compensation amounts inappropriately paid to our named executive officers in the event of a restatement of our financial statements. ü Our Compensation Committee regularly reviews our company's incentive compensation programs to ensure they are designed to create and maintain shareholder value and do not encourage excessive risk taking. | û We do not provide golden parachute excise tax or other tax gross-ups. û We do not provide “single-trigger” cash severance upon a change in control. û We do not pay dividend equivalents on PSUs; we do not pay dividend equivalents on RSUs unless the underlying shares vest. û We do not provide executive perquisites. û Our equity plans expressly forbid option repricing, and exchange of underwater options for other awards or cash, without shareholder approval. û We prohibit executives and trustees from hedging and pledging company securities. |

Objectives of our Compensation Program

Our company recognizes that the knowledge, skills, abilities, and commitment of our named executive officers are critical factors that drive our long-term value. Therefore, the primary objective of our Compensation Committee is to ensure that our company has in place a competitive and comprehensive compensation program that allows us to attract and retain qualified and talented individuals who possess the skills and expertise necessary to lead, manage, and grow our company. The Compensation Committee strives to achieve the appropriate balance between risk and reward while avoiding the creation of incentives for unnecessary or excessive risk taking.

Our Compensation Committee designed our executive compensation program for the 2014 fiscal year to motivate our executives to work toward long-term value creation based on our overarching business strategy. In particular, annual cash incentive compensation and the award of annual long-term equity incentive grants serve directly to align value creation of our executives with our shareholders. Annual cash incentive compensation is intended to reward the executive team for short-term financial efficiency. Recurring annual equity incentive grants are intended to focus executives on long-term shareholder value creation. Both are also intended to provide a strong and immediate retention mechanism consistent with market practice.

Shareholder Advisory Vote

During our 2014 Annual Meeting, shareholders were provided the opportunity to cast votes to approve a non-binding advisory resolution on executive compensation (a "say-on-pay" proposal). Approximately 96.5% of shareholders voting on the proposal voted to approve the non-binding advisory resolution on executive compensation. No changes were made to our programs directly

10

because of the 2014 vote outcome. However, each year, our Compensation Committee reviews our executive compensation program and related practices to ensure they continue to support our business strategies and remain consistent with corporate governance “best practices.” For example, starting with 2015 long-term incentive grants for 2014 performance, half of the shares granted will vest based on our relative total shareholder return versus the constituents of a peer index. We have also broadened our clawback and anti-pledging policies for named executive officers. See "—Other Matters—Clawback Policy" and "—Other Matters—Anti-Hedging, Anti-Short Sale, and Anti-Pledging Policies." The Compensation Committee values feedback from shareholders and will continue to consider the results of our shareholders’ advisory vote on executive compensation in its evaluation of our programs.

How We Determine Executive Compensation

Our Compensation Committee determines incentive compensation for our named executive officers and is comprised of four of our independent trustees, Messrs. Brugger (Chairman), Black, Orphanides and Salvatore, each of whom is "independent" as such term is defined by the applicable rules of the SEC and the NYSE. Mr. Brugger took over for Mr. Black as Chairman of our Compensation Committee in October of 2014.

Our Compensation Committee meets during the year to evaluate executive performance, to monitor market conditions in light of our goals and objectives, to solicit input from our independent compensation consultant on market practices, including peer group pay practices and new developments, and to review our executive compensation practices. As part of these meetings, in evaluating its executive compensation policies and practices for 2014, our Compensation Committee considered industry best practices and the compensation programs of our peers.

Peer Group

Peer group data is used for market comparisons in setting target pay levels to determine whether our current incentive compensation design continues to be appropriate. Our peer group constitutes REITs that are comparable in size, scope and complexity, and that have a type and amount of assets under management similar to us. Through consultation with Towers Watson and our executives, our Compensation Committee identified 19 companies as members of our peer group for 2014. The constituency of the peer group will be revisited each year to ensure it remains appropriate.

The following companies comprise our current peer group of companies:

Peer Group Companies | |

Acadia Realty Trust | Highwoods Properties Inc. |

American Realty Capital Trust, Inc. | Hudson Pacific Properties, Inc. |

Biomed Realty Trust Inc. | Kilroy Realty Corp. |

Brandywine Realty Trust | Lexington Realty Trust |

Corporate Office Properties Trust | Liberty Property Trust |

DCT Industrial Trust Inc. | Mack-Cali Realty Corp. |

EastGroup Properties Inc. | Piedmont Office Realty Trust, Inc. |

First Industrial Realty Trust Inc. | Realty Income Corp. |

Franklin Street Properties Corp. | Spirit Realty Capital, Inc. |

Healthcare Trust of America, Inc. | Washington Real Estate Investment Trust |

Pay Philosophy

Our compensation program is focused on a pay for performance design. Our pay philosophy is to provide target total direct compensation opportunities through a competitive, comprehensive and integrated package, which is targeted at the median pay range of our peers and is aligned with the achievement of our corporate goals and objectives. Our Compensation Committee also

11

has the discretion to deviate from this philosophy when business conditions warrant. Actual compensation earned can be above or below target, based upon the achievement of quantitative factors that are objectively determined.

Use of Independent Compensation Consultants

In fiscal years 2012 and 2013, our Compensation Committee, in consultation with our former independent compensation consultant, Towers Watson & Co., or Towers Watson, established a discretionary executive compensation program as our company transitioned to an internalized management structure. With the transition complete, for fiscal year 2014, our Compensation Committee developed and implemented, in consultation with Towers Watson, a performance-oriented executive incentive compensation plan based on objectively determinable quantitative factors aligned with our company's performance. For further detail about our new executive incentive compensation plan, see "—How we Determine Executive Compensation-—Our Executive Compensation Elements."

In addition, in 2014 Towers Watson provided our Compensation Committee with relevant data concerning the marketplace, our peer group and its own independent analysis and recommendations concerning executive compensation. Towers Watson also regularly participated in Compensation Committee meetings in 2014. Towers Watson did not provide any additional services to our Compensation Committee and did not provide any services to our company other than to the Compensation Committee.

In January 2015, our company engaged a new independent compensation consultant, Frederick W. Cook & Co., Inc., or Cook & Co., to replace Towers Watson. Cook & Co. has assisted our Compensation Committee in analyzing 2014 executive performance under our new executive incentive compensation plan and in allocating cash bonuses and equity to our executives. Going forward, Cook & Co. will assume and perform the duties for which we previously retained Towers Watson. Our Compensation Committee has reviewed the independence of Cook & Co.'s advisory role relative to the six consultant independence factors adopted by the SEC to guide listed companies in determining the independence of their compensation consultants, legal counsel, and other advisors. Following our review, our Compensation Committee concluded that Cook & Co. has no conflicts of interest, and provides our Compensation Committee with objective and independent executive compensation advisory services. Cook & Co. does not provide any additional services to our Compensation Committee and does not provide any services to our company other than to the Compensation Committee.

Our Executive Compensation Elements

Annual Base Salary

The annual base salary for each of our named executive officers is as follows and fixed in their respective employment agreements:

• | Mr. Cuneo — $725,000 per year; |

• | Mr. Reid — $450,000 per year; and |

• | Mr. Kianka — $450,000 per year. |

Their employment agreements are further described herein under "—Employment Agreements with our Named Executive Officers—Base Salary.” Such base salary may be increased (but not decreased) at the discretion of our Compensation Committee. Base salaries are fixed at levels intended to reflect the scope of each executive's duties and responsibilities and further take into account the compensation paid by our peers for similar positions. In addition, we structure an executive's annual base salary to be a relatively low percentage (approximately 24%-30%) of total compensation as the Compensation Committee is focused on a pay-for-performance design.

Annual Cash Incentive Compensation and Long-Term Equity Incentive Grants

In fiscal year 2014, we introduced a new executive incentive compensation program for our named executive officers based on objective factors aligned with our company's performance. The two primary components of the incentive compensation program are:

• | annual cash incentive compensation; and |

• | annual long-term equity incentive grants. |

12

Our Compensation Committee determined that we should provide annual cash incentive compensation, sometimes referred to herein as a cash bonus, to motivate our named executive officers to achieve key short-term corporate strategic milestones and to reward achievement of certain individual goals. Annual long-term equity incentive awards for 2014 (granted in 2015) also motivate our named executive officers to achieve key annual objectives, and also reward our long-term absolute and relative total shareholder return performance, which further aligns the interests of executives with shareholder interests.

Establishing the Target Pools

For 2014, our Compensation Committee established a pool for each of the annual cash incentive compensation and annual long-term equity incentive grants. For the annual cash incentive compensation, the target amount of the pool equaled the sum of the annual cash incentive targets of each participant in the pool. For the annual long-term equity incentive grants, the target number of shares in the pool equaled the sum of each participant’s annual equity incentive share target.

Determining the Actual Pools

Our company's performance was measured based on the four financial metrics illustrated in the table below. These financial metrics were determined through discussions with our company’s management based upon on our company’s strategic objectives. Each metric was assigned a weight based on its relative importance in execution of our strategy. The actual size of each pool was determined based on our company's performance during 2014. Each metric has a performance goal established at threshold, target and maximum levels. Threshold performance would result in an actual pool equal to 50% of the target pool, target performance would result in an actual pool equal to 100% of the target pool, and maximum performance would result in an actual pool equal to 150% of the target pool. Linear interpolation was applied between the threshold and target goals and the target and maximum goals.

The following table sets forth the metrics, weightings, and performance goals used to determine the size of the incentive compensation pools:

Metric | Weight Relative to Target Pool Amount | Performance Levels | ||||

Threshold Goal | Target Goal | Maximum Goal | Actual | |||

50% of Target | 100% of Target | 150% of Target | 106%(1) | |||

(1) | Core FFO per Share | 50% | $0.655 | $0.69 | $0.725 | $0.69 |

(2) | Ratio of Net Debt to EBITDA | 20% | 7.0 | 6.6 | 6.2 | 6.82 |

(3) | Disposition of Non-Core Assets | 20% | $100 million | $150 million | $200 million | $185.1 million |

(4) | Percentage of Portfolio Leased | 10% | 94.5% | 96.5% | 98.5% | 98.3% |

__________

(1) | Total weighted target pool funding. |

Allocation of the Pools

With respect to allocation of the annual cash incentive pool, our Compensation Committee's intention was to base 75% of the payout to individuals on our company's performance against the quantitative metrics set forth above and 25% on each individual's performance against individual goals set during 2014 by our Compensation Committee. The entire allocation of RSUs and PSUs was intended to be based upon our company's performance against the quantitative metrics set forth above. However, despite our strong operational performance, the Committee chose to exercise its discretion to reduce allocations of cash, RSUs, and PSUs because it was disappointed in our relative total shareholder return.

The long-term equity grants are divided equally between RSUs and PSUs.

Restricted Share Units

13

RSUs are intended to reward the prior performance of our company. Shares subject to RSUs vest in three equal annual installments from the date of grant contingent on the grantee's continued employment with our company. Our company pays an amount into an escrow account for the benefit of the grantee, measured by the dividends and other distributions paid with respect to the number of shares underlying the RSU, or a Dividend Equivalent, between the grant date and the date such RSU vests. The Dividend Equivalent is paid to the grantee on the relevant vesting dates of the RSU.

Performance Share Units

PSUs are intended to reward the future performance of our company. Each PSU represents a target number of shares equal to the amount allocated to it from the long-term equity incentive pool. PSUs offer executives the opportunity to earn more or less than the target amount of shares based on our company's achievement of total shareholder return over the three-year period commencing on January 1, 2015 against the achievement of total shareholder return for the same period by the companies included in the FTSE NAREIT All Equity Total Return Index. Total shareholder return means the total percentage return per share of our company's and each index company's common shares over this three year period based on their beginning and ending share prices, assuming contemporaneous reinvestment in such shares of all dividends and distributions at the closing price of one share on the date such dividend or other distribution was paid.

The following table summarizes the thresholds for determining the number of PSUs earned:

Our Company's Relative TSR Percentage Rank(1) | Percent of Target PSUs Earned |

≥75th percentile | 150% of Target PSUs |

50th percentile | 100% of Target PSUs |

30th percentile | 50% of Target PSUs |

<30th percentile | 0% of Target PSUs |

__________

(1) | If the percentile rank falls between the 30th and 50th percentiles or between the 50th and 75th percentiles, the award earned will be calculated using linear interpolation. |

2013 Compensation Determinations

Our Compensation Committee granted restricted stock to our executives on March 15, 2014 (for 2013 performance) pursuant to our prior discretionary compensation program.

Our Compensation Committee analyzed the relative achievements and efforts of our executives and our 2013 performance with respect to our peers, based on targeting the median pay ranges of our peers but allowing for top quartile payout for top quartile performance. The Compensation Committee determined the actual amount of the annual incentive award granted to Mr. Cuneo based on targeted amounts stated in his employment agreement. Mr. Cuneo recommended to the Compensation Committee that awards to Messrs. Reid and Kianka would be based on their targeted levels as stated in their respective employment agreements.

The table below sets forth the actual incentive compensation awarded to each executive in March of 2014 (for 2013 performance):

2013 Annual Long-Term Equity Incentive Target | 2013 Annual Long-Term Equity Incentive Awards | |

Jack A. Cuneo | 200,000 shares | 226,875 shares(1) |

Martin A. Reid | 90,000 shares | 87,500 shares |

Philip L. Kianka | 90,000 shares | 87,500 shares |

__________

(1) | Our Compensation Committee determined on February 10, 2014, that each of the conditions established for the contingent payment of 40,875 restricted shares withheld from Mr. Cuneo's annual equity award for 2012 had been met. Accordingly, 40,875 restricted shares were awarded to Mr. Cuneo on March 15, 2014 in addition to the 186,000 shares for his 2013 performance. |

14

The annual long-term equity incentive awards granted in 2015 for the performance period ended December 31, 2014 (which will be reported in the various tables in our 2016 proxy statement) are also addressed below because they are relevant to understanding the Compensation Committee’s perspective on total compensation for fiscal year 2014.

2014 Compensation Determinations

Based on our company's 2014 performance, the size of each pool equaled approximately 106% of its target. However, based upon our 2014 total shareholder return, our Compensation Committee exercised its discretion to allocate to certain of our named executive officers certain amounts of cash, RSUs, and PSUs at less than their targets. The table below sets forth the actual incentive compensation awarded to each executive on March 13, 2015 from the pools of annual cash incentive compensation and annual equity grants of RSUs and PSUs and the target amounts. These incentive awards granted in 2015 (for 2014 performance) will be reported in the various tables in next year’s proxy statement.

2014 Annual Cash Incentive Target | 2014 Annual Cash Incentive Awards | 2014 Annual Long-Term Equity Incentive Target | 2014 Annual Long-Term Equity Incentive Awards(1) | |

Jack A. Cuneo | $900,000(2) | $675,000 | 200,000 units | 150,000 units |

Martin A. Reid | $400,000 | $318,000(3) | 90,000 units | 90,000 units |

Philip L. Kianka | $400,000 | $318,000 | 90,000 units | 75,000 units |

__________

(1) | 2014 annual long-term equity incentive awards divided equally between RSUs and PSUs. |

(2) | Mr. Cuneo's annual cash incentive target was increased in 2014 from $725,000 to $900,000. |

(3) | Does not include a cash award of $100,000 for Mr. Reid’s service during the Chief Executive Officer transition during 2014. |

Employee Benefits, Perquisites and Other Personal Benefits

For fiscal year 2014, our named executive officers participated in the same benefit plans as all other employees and we did not provide them any perquisites or personal benefits that are not otherwise offered on an employee-wide basis. We have a 401(k) Retirement Plan, or our 401(k) Plan, to cover eligible employees of ours and of any designated affiliate. Our 401(k) Plan permits eligible employees to defer a percentage of their annual compensation, subject to certain limitations imposed by the Internal Revenue Code as amended (the "Code"). The employees' elective deferrals are immediately vested and nonforfeitable upon contribution to the 401(k) Plan. We do not provide our named executive officers with a supplemental pension or any other retirement or nonqualified deferred compensation benefits that are in addition to the 401(k) benefits provided generally to our employees.

Mr. Cuneo’s Memorandum of Retirement

On November 10, 2014, we announced that Mr. Cuneo would step down as our President and Chief Executive Officer and resign from our Board of Trustees when a successor or interim Chief Executive Officer was named in accordance with the terms of a Memorandum of Retirement entered into on November 9, 2014 among Mr. Cuneo, our company and CSP Operating Partnership, LP. We also announced that the search for Mr. Cuneo's successor would be led by the Nominating and Corporate Governance Committee of our Board of Trustees, and that such search would commence immediately. The Memorandum of Retirement provides, among other things, that Mr. Cuneo will be treated as if he was terminated without cause under the terms of his existing employment agreement.

On March 5, 2015, Mr. Cuneo stepped down when we named Mr. Reid as our company's Interim President and Chief Executive Officer. The terms of Mr. Reid's employment with us are described under "—Employment Agreements with our Named Executive Officers" on page 22 of this Form 10-K/A. Upon stepping down, Mr. Cuneo was entitled to receive an aggregate amount of $3.25 million, which constituted severance equal to two times the sum of his most recent base salary and target annual cash incentive compensation, and Mr. Cuneo's restricted common shares of our company fully vested. Mr. Cuneo also received 200,000 common shares pursuant to the Memorandum of Retirement. Prior to Mr. Reid's appointment, Mr. Cuneo continued to perform his duties as President and Chief Executive Officer, aided in the search for a successor, and performed such other duties as were directed by the Board of Trustees. Mr. Cuneo may also be available for ongoing advice and consultation for 24 months following Mr. Reid's appointment.

15

Other Matters

Risk Mitigation

Our Compensation Committee, in consultation with of Cook & Co., concluded that our compensation policies and practices do not give rise to risk taking that is reasonably likely to have a material adverse effect on us. Our Compensation Committee regularly reviews our Company’s incentive compensation plans to ensure they are designed to create and maintain shareholder value and do not encourage excessive risk.

We do not believe that any of our compensation policies and practices encourage excessive risk-taking. Many elements of our executive compensation program serve to mitigate excessive risk-taking, including a mix of base salary, annual cash incentives and long-term equity incentives. Our base salary provides a guaranteed level of income that does not vary with performance. We balance incentives tied to short-term annual performance with equity incentives for which value is earned over a multiple-year period. In this way, our executives are motivated to consider the impact of decisions over the short, intermediate, and long terms.

Clawback Policy

We have adopted a formal clawback policy, which allows us to recoup incentive compensation paid to our current and former named executive officers based on financial results that are subsequently restated. Pursuant to this policy, if we are required to prepare an accounting restatement due to material noncompliance with any financial reporting requirement, then our Compensation Committee may require our current and former named executive officers to repay or forfeit to our company "excess compensation." Excess compensation includes annual cash incentive compensation and long term incentive compensation in any form received by that executive during the three-year period preceding the publication of the restated financial statements, that our Compensation Committee determines was in excess of the amount that such officer would have received had such compensation been determined based on the financial results reported in the restated financial statements.

Our Compensation Committee intends to periodically review this clawback policy and, as appropriate, conform it to any applicable final rules adopted pursuant to the Dodd Frank Wall Street Reform and Consumer Protection Act.

Anti-Hedging, Anti-Short Sale, and Anti-Pledging Policies

We have implemented policies pursuant to which members of our Board of Trustees, our executive officers and employees are strictly prohibited from (i) entering into certain forms of hedging and monetization transactions with securities of our company; (ii) selling any securities of our company that are not owned at the time of the sale ("short sale"); (iii) maintaining any standing orders to purchase or sell our common shares; (iv) entering into put, calls or other derivative securities transactions with securities of our company; (v) pledging our company's securities as collateral for obligations, including debt obligations, or (vi) holding our company's securities in a margin account.

Executive and Trustee Share Ownership Guidelines

We have adopted minimum share ownership guidelines to ensure alignment of the financial interests of our senior executives and members of our Board of Trustees with those of our shareholders. The share ownership guidelines apply to our Chief Executive Officer, his direct reports, and our Trustees. Unvested time-based equity awards, shares held for a participant in our 401(k) Plan, and shares held by a trust for estate planning purposes count toward satisfying the ownership requirements. Unvested PSUs do not count.

The share ownership guidelines require each of our Chief Executive Officer and his direct reports to maintain ownership of a minimum number of our common shares having a market value equal to or greater than a multiple (five times, in the case of our Chief Executive Officer, and three times, in the case of his direct reports) of such executive's base salary. Each executive must achieve the minimum ownership level within five years from the later of the date the guidelines were adopted on February 26, 2014 (for current executive officers) and the date of such executive's appointment (for new executive officers).

The share ownership guidelines require each of our Trustees to maintain ownership of a minimum number of our common shares having a market value equal to or greater than three times the Trustee's annual base retainer. Each Trustee must achieve the minimum ownership level within five years from the later of the date the guidelines were adopted on February 26, 2014 (for current Trustees) and the date of such Trustee's election to our Board or Trustees (for new Trustees).

16

Executives and Trustees who are not in compliance with the share ownership guidelines at the end of the five-year period are required to retain all of the net after-tax shares received upon vesting of their equity awards until they comply with these multiples.

Tax Treatment

We do not provide any gross‑up or similar payments to our named executive officers. According to their employment agreements, if any payments or benefits to be paid or provided to any of our named executive officers would be subject to "golden parachute" excise taxes under the Code, the executive's payments and benefits under his employment agreement will be reduced to the extent necessary to avoid such excise taxes, but only if such a reduction of pay or benefits would result in a greater net after-tax receipt for the executive.

The Compensation Committee takes into consideration the potential deductibility of our executives' compensation under Section 162(m) of the Code and aims to structure our executives' compensation in a manner that will maximize deductibility. However, as a REIT, Section 162(m) has limited applicability to our tax costs. Our Compensation Committee may choose to implement programs that are not fully or partially deductible under Section 162(m) if such programs are in our best interest.

17

Compensation Committee Report

Our Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management and, based on such review and discussions, our Compensation Committee recommended to our Board of Trustees that our Compensation Discussion and Analysis be included in this Form 10-K/A.

Submitted by our Compensation Committee

Mark W. Brugger (Chairman)

Charles E. Black

James M. Orphanides

Louis P. Salvatore

18

Summary Compensation Table

The following table sets forth certain information regarding the compensation paid to our "named executive officers" or the "executives." The table below reflects the total compensation earned by our named executive officers for the years ended December 31, 2012, December 31, 2013, and December 31, 2014. We did not have any employees prior to July 1, 2012, when the named executive officers and several other employees of an affiliate of our former investment advisor became employees of our company in connection with our transition to self‑management.

Name And Principal Position | Year(3) | Salary ($) | Bonus(5) ($) | Non-Equity Incentive Plan Compen- sation(7) ($) | Share Awards ($) | All Other Compen- sation ($) | Total ($) | ||||||||||||||

Jack A. Cuneo(1) | 2014 | 725,000 | — | 675,000 | 1,756,013 | (8)(9) | 10,400 | (12) | 3,166,413 | ||||||||||||

Former President and Chief Executive Officer | 2013 | 725,000 | 652,500 | — | 1,591,250 | — | 2,968,750 | ||||||||||||||

2012 | 346,533 | (4) | 1,725,000 | — | 1,500,000 | 17,500 | (13) | 3,589,033 | |||||||||||||

Martin A. Reid(2) | 2014 | 450,000 | 100,000 | (6) | 318,000 | 677,250 | (8)(10) | 4,846 | (12) | 1,550,096 | |||||||||||

Interim President and Chief Executive Officer, and Financial Officer, and Treasurer | 2013 | 450,000 | 400,000 | — | 325,000 | — | 1,175,000 | ||||||||||||||

2012 | 215,090 | (4) | 200,000 | — | — | 93,942 | (13) | 509,032 | |||||||||||||

Philip L. Kianka | 2014 | 450,000 | — | 318,000 | 677,250 | (8)(11) | 10,400 | (12) | 1,455,650 | ||||||||||||

Executive Vice President and Chief Operating Officer | 2013 | 450,000 | 400,000 | — | 900,000 | — | 1,750,000 | ||||||||||||||

2012 | 215,090 | (4) | 900,000 | — | 750,000 | 15,670 | (13) | 1,880,760 | |||||||||||||

__________

(1) | On March 5, 2015, Mr. Cuneo stepped down as President and Chief Executive Officer and resigned from our Board of Trustees and Mr. Reid was named as our company's Interim President and Chief Executive Officer. The discussion in this Form 10-K/A regarding the various elements of Mr. Cuneo's 2014 compensation does not reflect any severance compensation, except as set forth under "Compensation Discussion and Analysis-Mr. Cuneo's Memorandum of Retirement" on page 15 above, where the actual amounts that Mr. Cuneo receives in connection therewith are described. |

(2) | Mr. Reid was appointed Interim President and Chief Executive Officer on March 5, 2015. |

(3) | Bonus and Non-Equity Incentive Plan Compensation is reported for the fiscal year in which it was earned, including amounts paid or payable in a subsequent fiscal year. A share award is reported in the fiscal year in which it was granted, including awards earned in a prior fiscal year. |

(4) | Amounts shown reflect the base salary paid to each named executive officer for the period beginning on July 1, 2012, and ending on December 31, 2012. |

(5) | In 2014, our Compensation Committee developed and implemented an annual bonus plan based on objectively determinable quantitative performance factors. In prior years, although each executive had a target bonus, the plan was discretionary. Accordingly, our named executive officer's 2014 cash bonus is now reported under the column entitled "Non-Equity Incentive Plan Compensation." Amounts shown for fiscal years 2013 (paid in 2014) and 2012 (paid in 2013) reflect the cash bonus paid, respectively, based on the executive's achievement of performance objectives, as determined in the discretion of our Compensation Committee. |

(6) | Amount shown reflects compensation for Mr. Reid's service during 2014 in assisting our company during our Chief Executive Officer transition. |

(7) | In 2014, our Compensation Committee developed and implemented an annual bonus plan based on objectively determinable quantitative performance factors. In prior years, although each executive had a target bonus, the plan was discretionary. Accordingly, our named executive officer's 2014 cash bonus is now reported under the column entitled "Non-Equity Incentive Plan Compensation." |

(8) | Amounts shown are the grant date fair value of share awards determined in accordance with ASC 718 made to the executives in fiscal years 2014 (for 2013 performance) and 2013 (for 2012 performance), respectively, and in fiscal year 2012 in respect of sign-on awards. The assumptions used to calculate the grant date fair value of share awards granted are set forth under Note 2 of the Notes to the Consolidated Financial Statements included in our Annual Reports on Form 10-K. The per-share grant date fair value of the awards granted in 2014 was $7.74 per share, as determined in accordance with ASC 718. |

(9) | Pursuant to Mr. Cuneo's employment agreement, he (i) received an award of 186,000 restricted shares on March 15, 2014 (for 2013 performance) based on his achievement of performance objectives as determined in the discretion of our Compensation Committee, and (ii) received an award of 40,875 restricted shares on March 15, 2014 (for 2013 performance) based on his achievement of performance objectives as determined in the discretion of our Compensation Committee, with respect to 40,875 shares that were not earned for fiscal year 2012. |

(10) | Pursuant to Mr. Reid's employment agreement, as amended effective January 1, 2013, he received an award of 87,500 restricted shares on March 15, 2014 (for 2013 performance) based on his achievement of performance objectives as determined in the discretion of our Compensation Committee. |

(11) | Pursuant to Mr. Kianka's employment agreement he received an award of 87,500 restricted shares on March 15, 2014 (for 2013 performance) based on his achievement of performance objectives as determined in the discretion of our Compensation Committee. |

(12) | Amounts reflect matching contributions under our Section 401(k) plan. |

(13) | Amounts reflect reimbursement of legal fees incurred by each of our named executive officers in connection with the negotiation of the employment agreements in 2012, and fees paid to Mr. Reid in his capacity as an independent trustee of our company for the first six months of fiscal year 2012. |

19

Our Compensation Committee awarded RSUs and PSUs to our named executive officers in respect of achievement of performance goals during fiscal year 2014 (granted in 2015) in the following aggregate amounts: Mr. Cuneo — 150,000; Mr. Reid — 90,000; and Mr. Kianka — 75,000. The awards granted for the achievement of performance goals during fiscal year 2014 (granted in 2015) to our named executive officers was based on the business performance of our company and the executive's performance during the 2014 fiscal year, as described in "Compensation Discussion and Analysis—2014 Compensation Determinations." One-half of the total shares granted were in the form of RSUs, which vest one-third on each of the first three anniversaries of the date of grant if the executive remains employed by our company on such anniversary. The other half of the total shares granted were in the form of PSUs, which offer executives the opportunity to earn from 0% to 150% of the target number of shares based on our company's total shareholder return over the three-year period commencing on January 1, 2015 relative to the total shareholder return for the same period of the companies included in the FTSE NAREIT All Equity Total Return Index, as described in "Compensation Discussion and Analysis—How We Determine Executive Compensation—Our Executive Compensation Elements—Annual Cash Incentive Compensation and Long-Term Equity Incentive Grants—Performance Share Units." These grants are not included in the table above because they were awarded in the 2015 fiscal year, even though the number of share units granted was based on performance in 2014. Equity awards held by our executives are subject to accelerated vesting upon certain terminations of employment pursuant to their employment agreements. See "Potential Payments Upon Termination or Termination Following a Change in Control."

2014 Grants of Plan-Based Awards