Attached files

| file | filename |

|---|---|

| 8-K - ARROW ELECTRONICS, INC. 8-K - ARROW ELECTRONICS INC | a51092072.htm |

| EX-99.1 - EXHIBIT 99.1 - ARROW ELECTRONICS INC | a51092072ex99_1.htm |

Exhibit 99.2

In the first quarter we

executed well on our strategic initiatives and continued to deliver

best-in-class financial performance. As reflected in our earnings

release, there are a number of items that impact the comparability of

our results with those in the trailing quarter and the first quarter of

last year. Any discussion of our results will exclude these items to

give you a better sense of our operating results. As always, the

operating information we provide to you should be used as a complement

to GAAP numbers. For a complete reconciliation between our GAAP and

non-GAAP results, please refer to our earnings release and the earnings

reconciliation found at the end of this document. The following first

quarter as reported and adjusted information included in this CFO

commentary is unaudited and should be read in conjunction with the Form

10-Q for the quarterly period ended March 28, 2015 and the company’s

2014 Annual Report on Form 10-K as filed with the Securities and

Exchange Commission. CFO Commentary

First-Quarter 2015

investor.arrow.com Frter 2015 CFO Commentary First-Quarter Summary In

the first quarter we executed well on our strategic initiatives,

continued to deliver best-in-class financial performance, and returned

substantial capital to our shareholders through our buyback program.

First-quarter sales were $5 billion advancing 3% year over year adjusted

for the impact of acquisitions and changes in foreign currencies. Sales,

as reported, declined 2% year over year. Operating income was $205

million, a 9% increase year over year adjusted for currency. Operating

margins advanced year over year as well, increasing by 10 basis points

to 4.1%, the highest first-quarter level since 2012. Trailing

twelve-month cash generated from operating activities was $308 million.

Global components sales were $3.35 billion. Sales increased 2% year over

year adjusted for the impact of acquisitions and changes in foreign

currencies. Global components had one fewer shipping day in the first

quarter of 2015 compared to the first quarter of 2014 and this

negatively impacted the rate of sales growth by approximately 1.5

percentage points. The overall market for our global components business

remains stable, with lead times and customer order patterns operating in

normal ranges. First-quarter book-to-bill was 1.02. In the Americas, our

sales were flat year over year. In Europe, sales increased 10% year over

year adjusted for the impact of acquisitions and changes in foreign

currencies. Sales in Asia were flat year over year. Sales in our core

Asia components business grew 6% year over year. Global components

operating margin of 5.1% increased 20 basis points year over year. In

enterprise computing solutions, sales of $1.66 billion increased 7% year

over year adjusted for the impact of acquisitions and changes in foreign

currencies. In the Americas, sales grew 6% year over year adjusted for

the impact of acquisitions and changes in foreign currencies. In Europe,

sales increased 8% year over year adjusted for the impact of

acquisitions and changes in foreign currencies. Global enterprise

computing solutions achieved record first-quarter operating income of

$73 million and operating margin of 4.4%. In the first quarter, both

global components and enterprise computing solutions operating margins

advanced 20 basis points year over year. investor.arrow.com

First-Quarter 2015 CFO

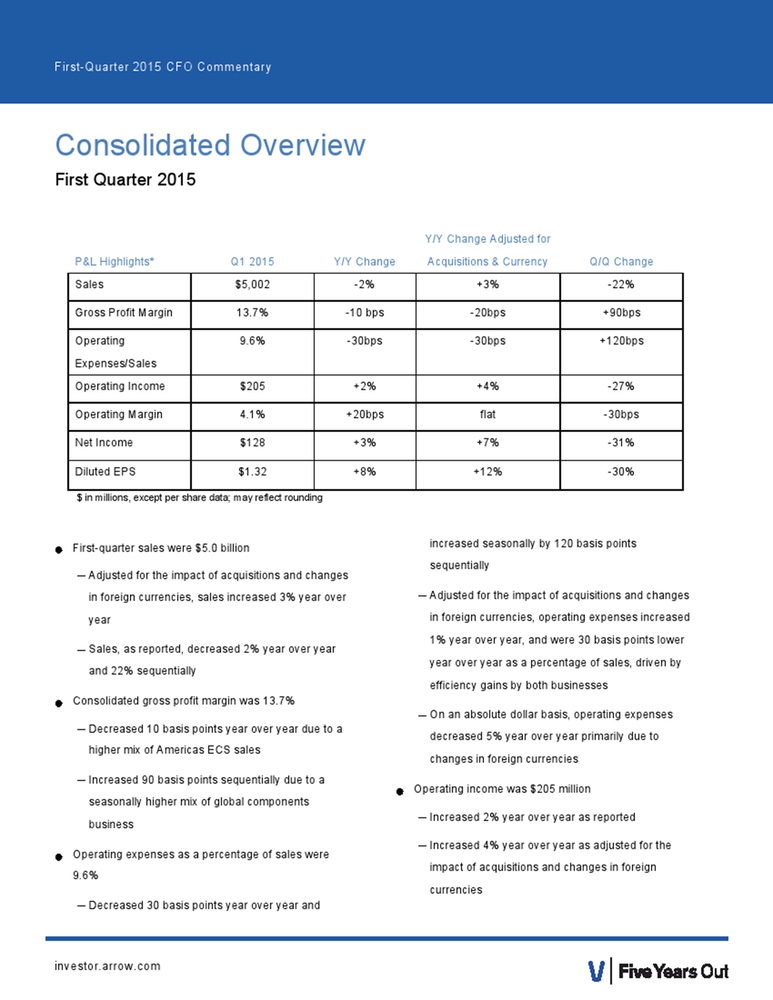

Commentary P&L Highlights* Q1 2015 Y/Y Change Y/Y Change Adjusted for

Acquisitions & Currency Q/Q Change Sales $5,002 -2% +3% -22% Gross

Profit Margin 13.7% -10 bps -20bps +90bps Operating Expenses/Sales 9.6%

-30bps -30bps +120bps Operating Income $205 +2% +4% -27% Operating

Margin 4.1% +20bps flat -30bps Net Income $128 +3% +7% -31% Diluted EPS

$1.32 +8% +12% -30% Consolidated Overview First Quarter 2015

First-quarter sales were $5.0 billion – Adjusted for the impact of

acquisitions and changes in foreign currencies, sales increased 3% year

over year– Sales, as reported, decreased 2% year over year and 22%

sequentially Consolidated gross profit margin was 13.7%– Decreased 10

basis points year over year due to a higher mix of Americas ECS sales –

Increased 90 basis points sequentially due to a seasonally higher mix of

global components business Operating expenses as a percentage of sales

were 9.6% – Decreased 30 basis points year over year and increased

seasonally by 120 basis points sequentially – Adjusted for the impact of

acquisitions and changes in foreign currencies, operating expenses

increased 1% year over year, and were 30 basis points lower year over

year as a percentage of sales, driven by efficiency gains by both

businesses – On an absolute dollar basis, operating expenses decreased

5% year over year primarily due to changes in foreign currencies

Operating income was $205 million – Increased 2% year over year as

reported – Increased 4% year over year as adjusted for the impact of

acquisitions and changes in foreign currencies

Operating income as a

percentage of sales was 4.1% $ in millions, except per share data; may

reflect rounding investor.arrow.com First-Quarter 2015 CFO Commentary –

Operating income as a percentage of sales increased 20 basis points year

over year Effective tax rate for the quarter was 27.0% Net income was

$128 million – Increased 3% year over year – Adjusted for the impact of

acquisitions and changes in foreign currencies, net income increased by

7% year over year Earnings per share were $1.33 and $1.32 on a basic and

diluted basis, respectively – Diluted EPS increased 8% year over year –

Adjusted for the impact of acquisitions and changes in foreign

currencies, diluted EPS increased by 12% year over year

investor.arrow.com

First-Quarter 2015 CFO

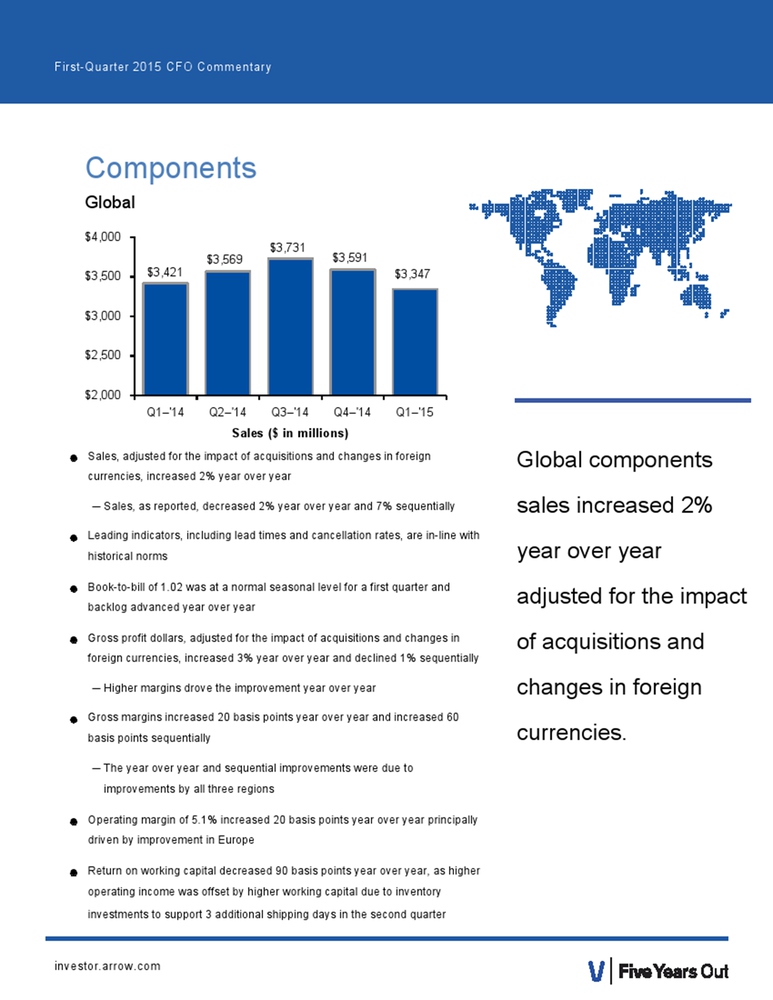

Commentary Components Global Global components sales increased 2% year

over year adjusted for the impact of acquisitions and changes in foreign

currencies. Sales, adjusted for the impact of acquisitions and changes

in foreigncurrencies, increased 2% year over year– Sales, as reported,

decreased 2% year over year and 7% sequentially Leading indicators,

including lead times and cancellation rates, are in-line withhistorical

norms Book-to-bill of 1.02 was at a normal seasonal level for a first

quarter and backlog advanced year over year Gross profit dollars,

adjusted for the impact of acquisitions and changes in foreign

currencies, increased 3% year over year and declined 1% sequentially –

Higher margins drove the improvement year over year Gross margins

increased 20 basis points year over year and increased 60 basis points

sequentially – The year over year and sequential improvements were due

to improvements by all three regions Operating margin of 5.1% increased

20 basis points year over year principally driven by improvement in

Europe Return on working capital decreased 90 basis points year over

year, as higher operating income was offset by higher working capital

due to inventory investments to support 3 additional shipping days in

the second quarter$3,347 $3,591 $3,731 $3,569 $3,421 $2,000 $2,500$3,000

$3,500 $4,000 Q1–'14 Q2–'14 Q3–'14 Q4–'14 Q1–'15 Sales ($ in millions)

investor.arrow.com

First-Quarter 2015 CFO

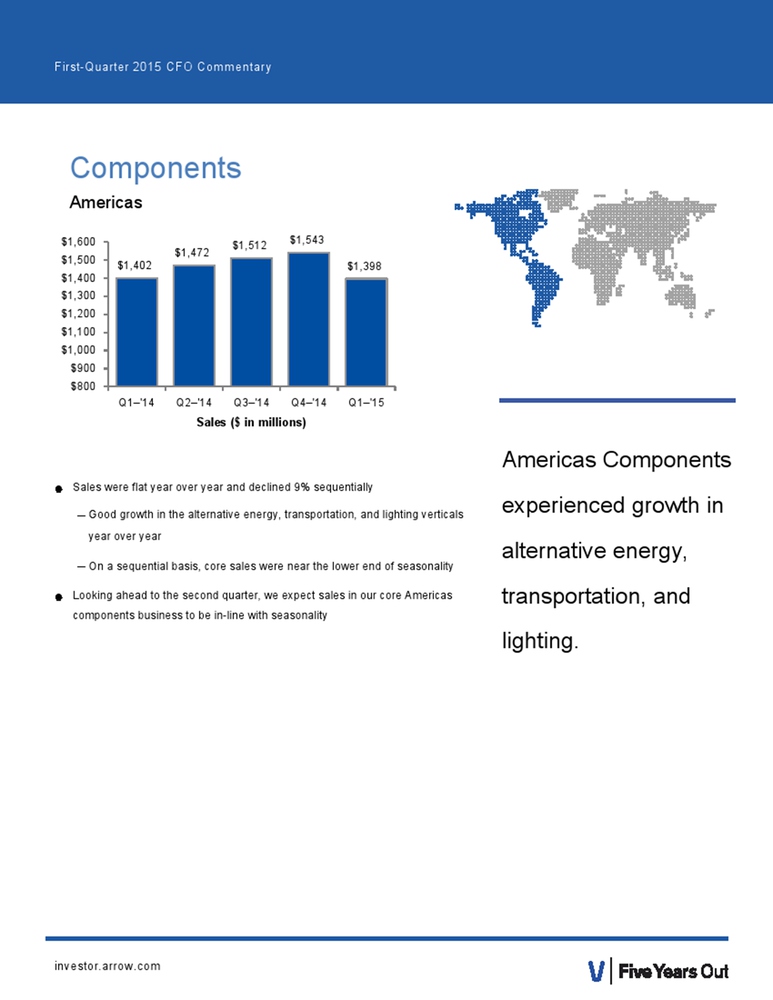

Commentary Components Americas Americas Components experienced growth in

alternative energy, transportation, and lighting. Sales were flat year

over year and declined 9% sequentially – Good growth in the alternative

energy, transportation, and lighting verticals year over year – On a

sequential basis, core sales were near the lower end of seasonality

Looking ahead to the second quarter, we expect sales in our core

Americas components business to be in-line with seasonality $1,402

$1,472 $1,512 $1,543 $1,398 $800 $900 $1,000 $1,100 $1,200 $1,300 $1,40

$1,500 $1,600 Q1–'14 Q2–'14 Q3–'14 Q4–'14 Q1–'15 Sales ($ in

millions)investor.arrow.com

First-Quarter 2015 CFO

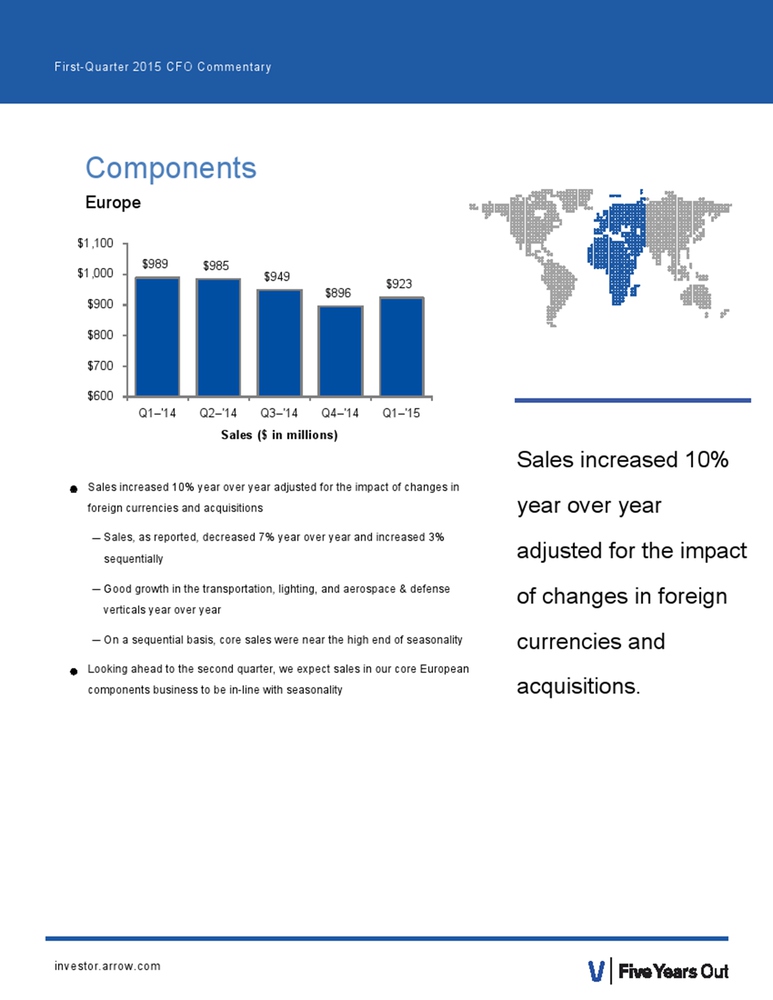

Commentary Components Europe Sales increased 10% year over year adjusted

for the impact of changes in foreign currencies and acquisitions. Sales

increased 10% year over year adjusted for the impact of changes in

foreign currencies and acquisitions – Sales, as reported, decreased 7%

year over year and increased 3% sequentially – Good growth in the

transportation, lighting, and aerospace & defense verticals year over

year – On a sequential basis, core sales were near the high end of

seasonality Looking ahead to the second quarter, we expect sales in our

core European components business to be in-line with seasonality $989

$985 $949 $896 $923 $600$700 $800 $900 $1,000 $1,100 Q1–'14 Q2–'14

Q3–'14 Q4–'14 Q1–'15 Sales ($ in millions)investor.arrow.com

First-Quarter 2015 CFO

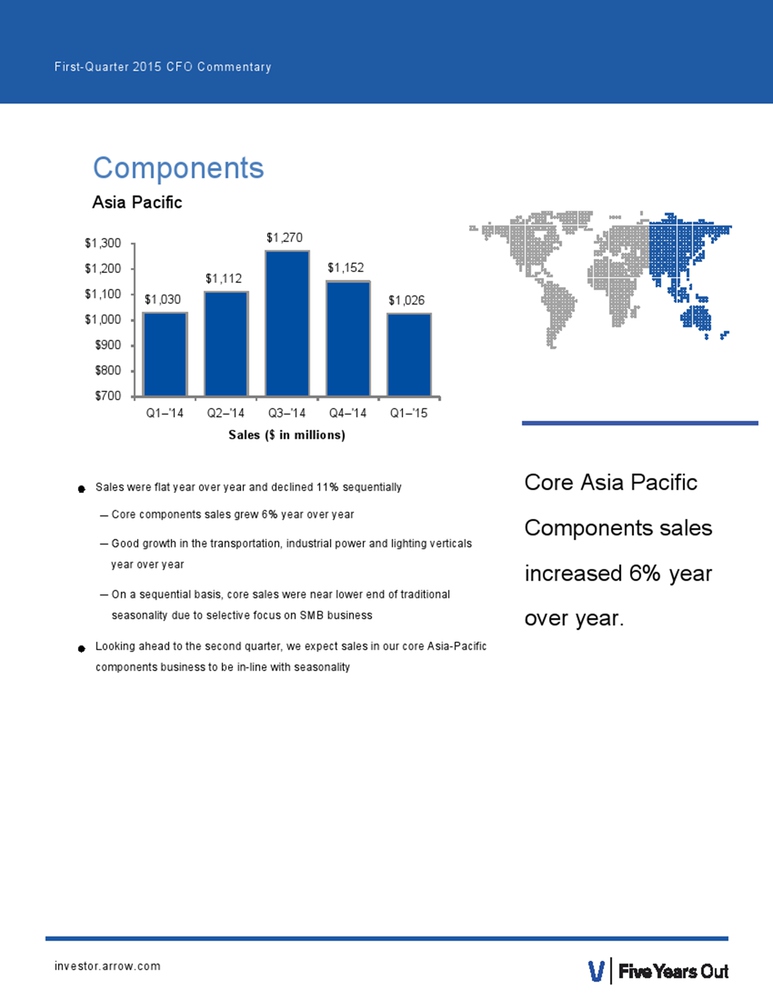

Commentary Components Asia Pacific Core Asia Pacific Components sales

increased 6% year over year. Sales were flat year over year and declined

11% sequentially – Core components sales grew 6% year over year – Good

growth in the transportation, industrial power and lighting verticals

year over year – On a sequential basis, core sales were near lower end

of traditional seasonality due to selective focus on SMB business

Looking ahead to the second quarter, we expect sales in our core

Asia-Pacific components business to be in-line with seasonality $1,030

$1,112 $1,270 $1,152 $1,026 $700 $800 $900 $1,000 $1,100 $1,200 $1,300

Q1–'14 Q2–'14 Q3–'14 Q4–'14 Q1–'15 Sales ($ in millions)

investor.arrow.com

First-Quarter 2015 CFO

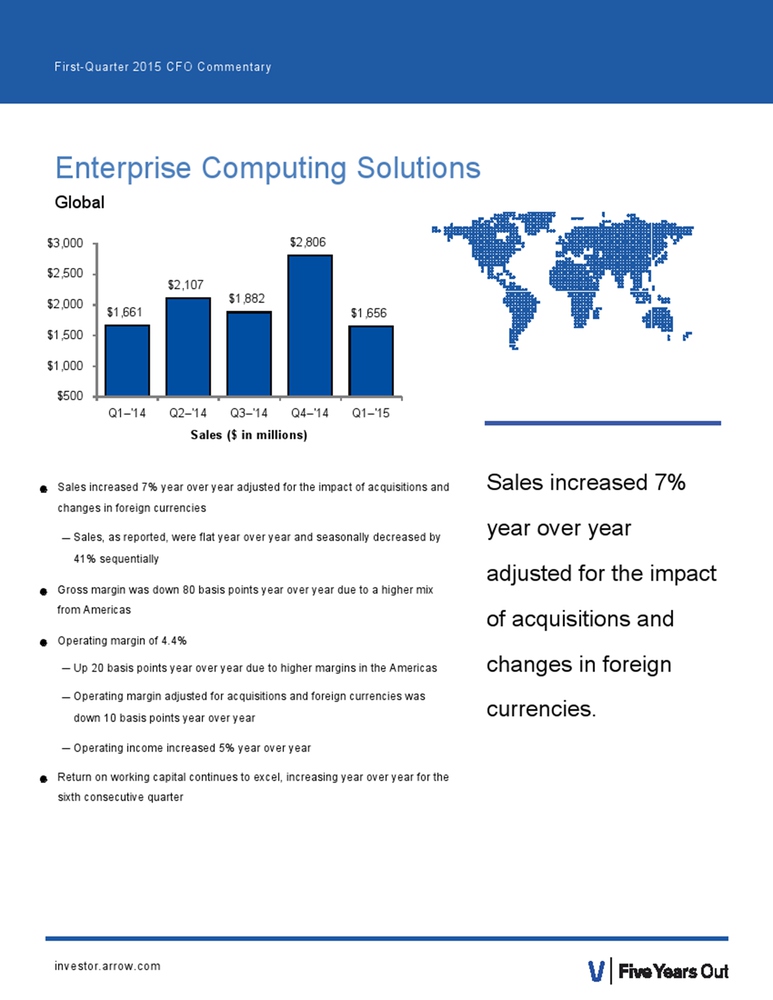

Commentary Enterprise Computing Solutions Global Sales increased 7% year

over year adjusted for the impact of acquisitions and changes in foreign

currencies. Sales increased 7% year over year adjusted for the impact of

acquisitions and changes in foreign currencies – Sales, as reported,

were flat year over year and seasonally decreased by 41% sequentially

Gross margin was down 80 basis points year over year due to a higher mix

from Americas Operating margin of 4.4%– Up 20 basis points year over

year due to higher margins in the Americas – Operating margin adjusted

for acquisitions and foreign currencies was down 10 basis points year

over year – Operating income increased 5% year over year Return on

working capital continues to excel, increasing year over year for the

sixth consecutive quarter $1,661 $2,107 $1,882 $2,806 $1,656 $500 $1,000

$1,500 $2,000 $2,500 $3,000 Q1–'14 Q2–'14 Q3–'14 Q4–'14 Q1–'15 Sales ($

in millions)investor.arrow.com

First-Quarter 2015 CFO

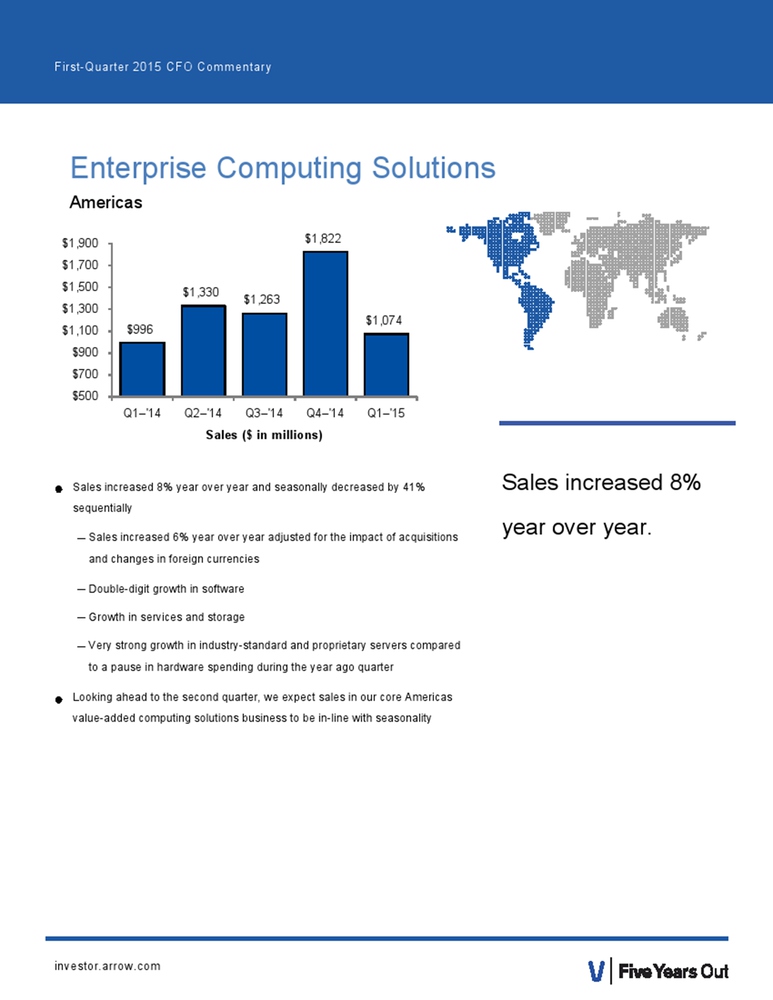

Commentary Enterprise Computing Solutions Americas Sales increased 8%

year over year. Sales increased 8% year over year and seasonally

decreased by 41% sequentially – Sales increased 6% year over year

adjusted for the impact of acquisitions and changes in foreign

currencies – Double-digit growth in software – Growth in services and

storage – Very strong growth in industry-standard and proprietary

servers compared to a pause in hardware spending during the year ago

quarter Looking ahead to the second quarter, we expect sales in our core

Americas value-added computing solutions business to be in-line with

seasonality $996 $1,330 $1,263 $1,822 $1,074 $500 $700 $900 $1,100

$1,300 $1,500 $1,700 $1,900 Q1–'14 Q2–'14 Q3–'14 Q4–'14 Q1–'15 Sales ($

in millions) investor.arrow.com

First-Quarter 2015 CFO

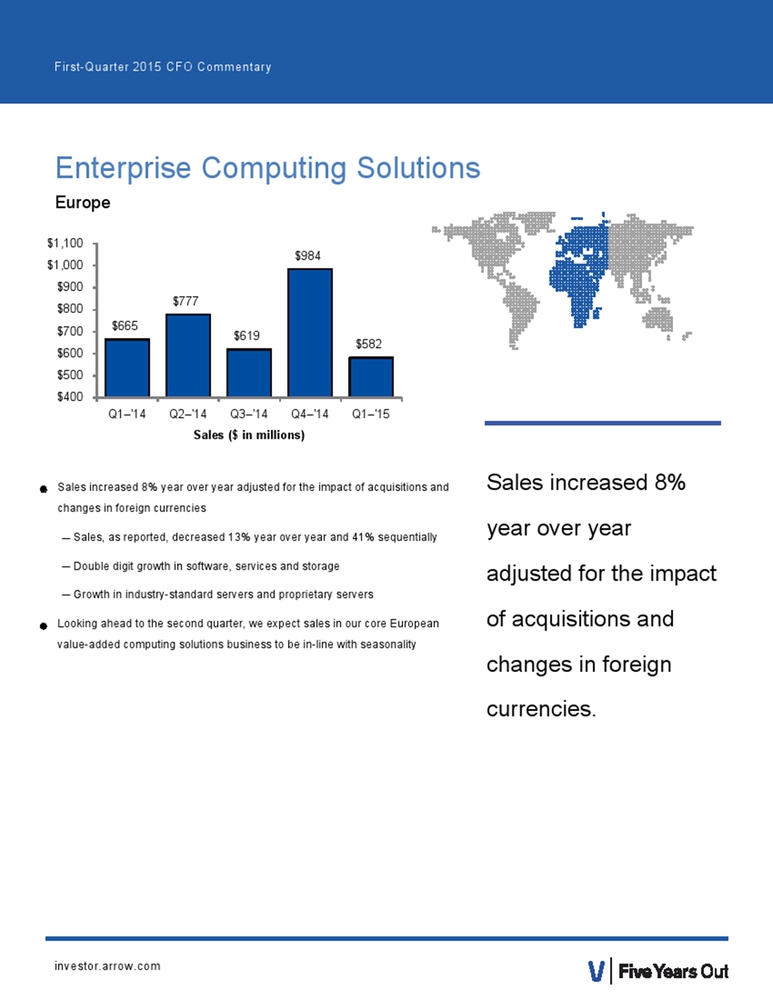

Commentary Enterprise Computing Solutions Europe Sales increased 8% year

over year adjusted for the impact of acquisitions and changes in foreign

currencies. Sales increased 8% year over year adjusted for the impact of

acquisitions and changes in foreign currencies – Sales, as reported,

decreased 13% year over year and 41% sequentially – Double digit growth

in software, services and storage – Growth in industry-standard servers

and proprietary servers Looking ahead to the second quarter, we expect

sales in our core European value-added computing solutions business to

be in-line with seasonality $665 $777 $619 $984 $582 $400 $500 $600 $700

$800$900 $1,000 $1,100 Q1–'14 Q2–'14 Q3–'14 Q4–'14 Q1–'15 Sales ($ in

millions) investor.arrow.com

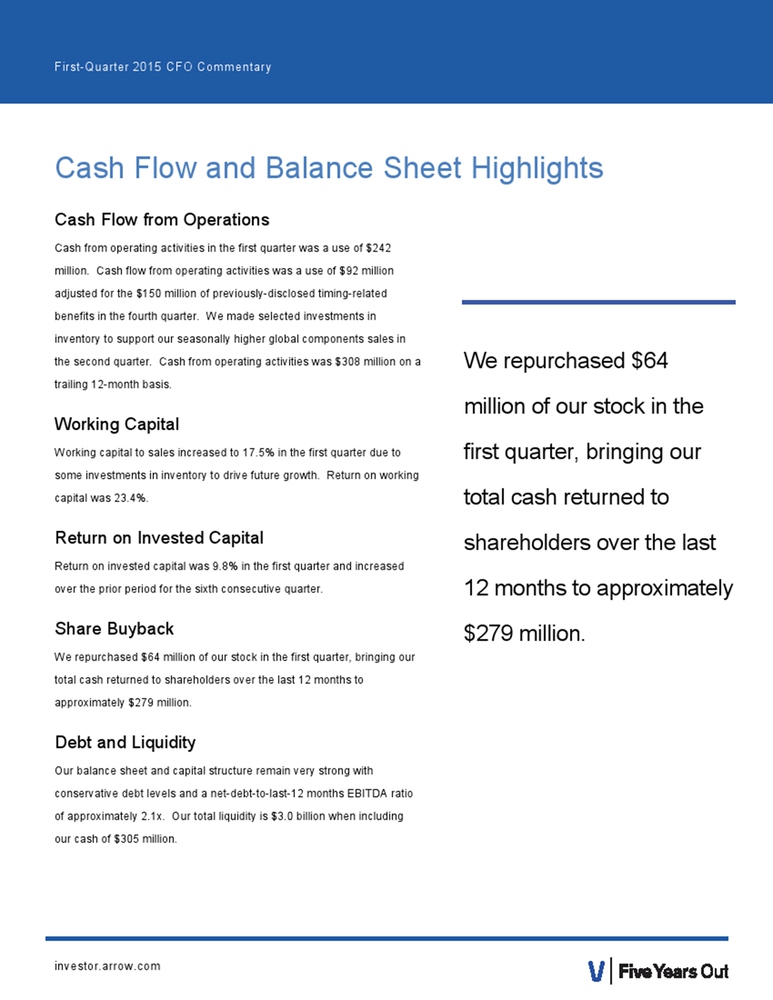

First-Quarter 2015 CFO Commentary Cash Flow and Balance Sheet Highlights Cash Flow from Operations Cash from operating activities in the first quarter was a use of $242 million. Cash flow from operating activities was a use of $92 million adjusted for the $150 million of previously-disclosed timing-related benefits in the fourth quarter. We made selected investments in inventory to support our seasonally higher global components sales in the second quarter. Cash from operating activities was $308 million on a trailing 12-month basis. Working Capital Working capital to sales increased to 17.5% in the first quarter due to some investments in inventory to drive future growth. Return on working capital was 23.4%. Return on Invested Capital Return on invested capital was 9.8% in the first quarter and increased over the prior period for the sixth consecutive quarter. Share Buyback We repurchased $64 million of our stock in the first quarter, bringing our total cash returned to shareholders over the last 12 months to approximately $279 million. Debt and Liquidity Our balance sheet and capital structure remain very strong with conservative debt levels and a net-debt-to-last-12 months EBITDA ratio of approximately 2.1x. Our total liquidity is $3.0 billion when including our cash of $305 million. We repurchased $64 million of our stock in the first quarter, bringing our total cash returned to shareholders over the last 12 months to approximately $279 million. investor.arrow.com

First-Quarter 2015 CFO

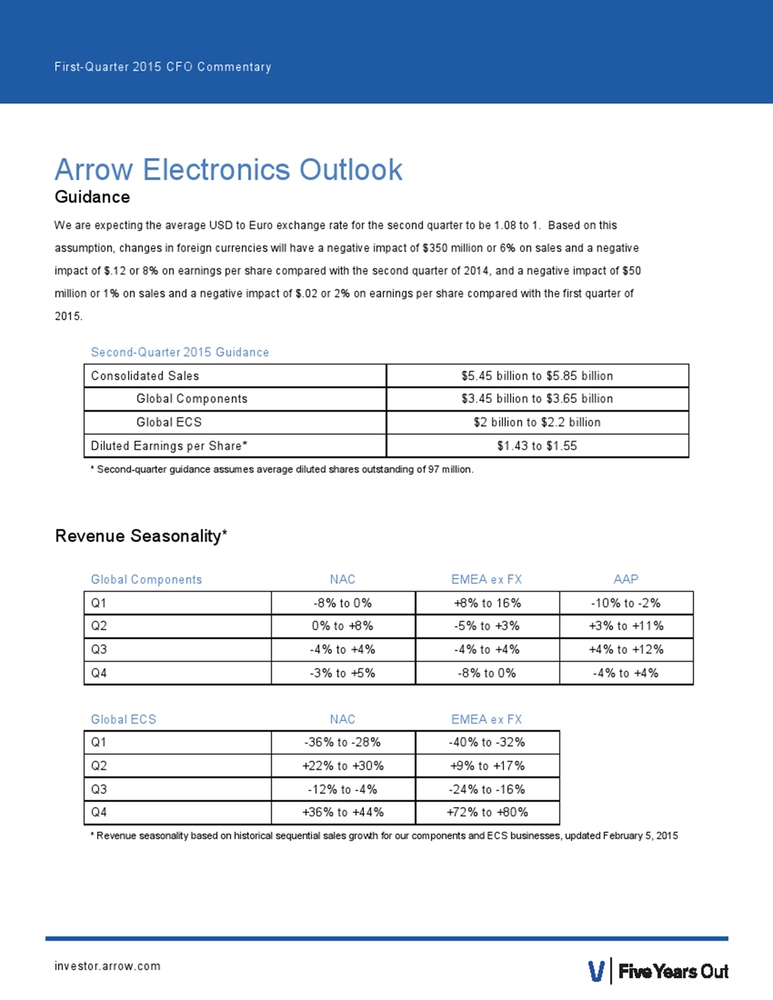

Commentary Second-Quarter 2015 Guidance Consolidated Sales $5.45 billion

to $5.85 billion Global Components $3.45 billion to $3.65 billion Global

ECS $2 billion to $2.2 billion Diluted Earnings per Share* $1.43 to

$1.55 * Second-quarter guidance assumes average diluted shares

outstanding of 97 million. Global Components NAC EMEA ex FX AAP Q1 -8%

to 0% +8% to 16% -10% to -2% Q2 0% to +8% -5% to +3% +3% to +11% Q3 -4%

to +4% -4% to +4% +4% to +12% Q4 -3% to +5% -8% to 0% -4% to +4% Global

ECS NAC EMEA ex FX Q1 -36% to -28% -40% to -32% Q2 +22% to +30% +9% to

+17% Q3 -12% to -4% -24% to -16% Q4 +36% to +44% +72% to +80% * Revenue

seasonality based on historical sequential sales growth for our

components and ECS businesses, updated February 5, 2015 Arrow

Electronics Outlook Guidance We are expecting the average USD to Euro

exchange rate for the second quarter to be 1.08 to 1. Based on this

assumption, changes in foreign currencies will have a negative impact of

$350 million or 6% on sales and a negative impact of $.12 or 8% on

earnings per share compared with the second quarter of 2014, and a

negative impact of $50 million or 1% on sales and a negative impact of

$.02 or 2% on earnings per share compared with the first quarter of

2015. Revenue Seasonality*investor.arrow.com

First-Quarter 2015 CFO

Commentary Risk Factors The discussion of the company’s business and

operations should be read together with the risk factors contained in

Item 1A of its 2014 Annual Report on Form 10-K, filed with the

Securities and Exchange Commission, which describe various risks and

uncertainties to which the company is or may become subject. If any of

the described events occur, the company’s business, results of

operations, financial condition, liquidity, or access to the capital

markets could be materially adversely affected. Information Relating to

Forward- Looking Statements This press release includes forward-looking

statements that are subject to numerous assumptions, risks, and

uncertainties, which could cause actual results or facts to differ

materially from such statements for a variety of reasons, including, but

not limited to: industry conditions, company’s implementation of its new

enterprise resource planning system, changes in product supply, pricing

and customer demand, competition, other vagaries in the global

components and global enterprise computing solutions markets, changes in

relationships with key suppliers, increased profit margin pressure,

effects of additional actions taken to become more efficient or lower

costs, risks related to the integration of acquired businesses, changes

in legal and regulatory matters, and the company’s ability to generate

additional cash flow. Forward-looking statements are those statements

which are not statements of historical fact. These forward-looking

statements can be identified by forward-looking words such as “expects,”

“anticipates,” “intends,” “plans,” “may,” “will,” “believes,” “seeks,”

“estimates,” and similarexpressions. Shareholders and other readers are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date on which they are made. The

company undertakes no obligation to update publicly or revise any of the

forward-looking statements. For a further discussion of factors to

consider in connection with these forward-looking statements, investors

should refer to Item 1A Risk Factors of the company’s Annual Report on

Form 10-K for the year ended December 31, 2014.investor.arrow.com

First-Quarter 2015 CFO

Commentary Certain Non-GAAP Financial Information In addition to

disclosing financial results that are determined in accordance with

accounting principles generally accepted in the United States (“GAAP”),

the company also provides certain non-GAAP financial information

relating to sales, operating income, net income attributable to

shareholders, and net income per basic and diluted share. The company

provides sales on a non-GAAP basis adjusted for the impact of changes in

foreign currencies and the impact of acquisitions by adjusting the

company’s prior periods to include the sales of businesses acquired as

if the acquisitions had occurred at the beginning of the earliest period

presented (referred to as “impact of acquisitions”). Operating income,

net income attributable to shareholders, and net income per basic and

diluted share are adjusted for certain charges, credits, gains, and

losses that the company believes impact the comparability of its results

of operations. These charges, credits, gains, and losses arise out of

the company’s efficiency enhancement initiatives, acquisitions

(including intangible assets amortization expense), trade name

impairment charge, gain on sale of investment, and prepayment of debt. A

reconciliation of the company’s non- GAAP financial information to GAAP

is set forth in the tables below. The company believes that such

non-GAAP financial information is useful to investors to assist in

assessing and understanding the company’s operating performance and

underlying trends in the company’s business because management considers

these items referred to above to be outside the company’s core operating

results. This non- GAAP financial information is among the primary

indicators management uses as a basis for evaluating the company’s

financial and operating performance. In addition, the company’s Board of

Directors may use this non-GAAP financial information in evaluating

management performance and setting management compensation. The

presentation of this additional non-GAAP financial information is not

meant to be considered in isolation or as a substitute for, or

alternative to, operating income, net income attributable to

shareholders and net income per basic and diluted share determined in

accordance with GAAP. Analysis of results and outlook on a non-GAAP

basis should be used as a complement to, and in conjunction with, data

presented in accordance with GAAP. The company believes that such

non-GAAP financial information is useful to investors to assist in

assessing and understanding the company’s operating performance.

investor.arrow.com

First-Quarter 2015 CFO

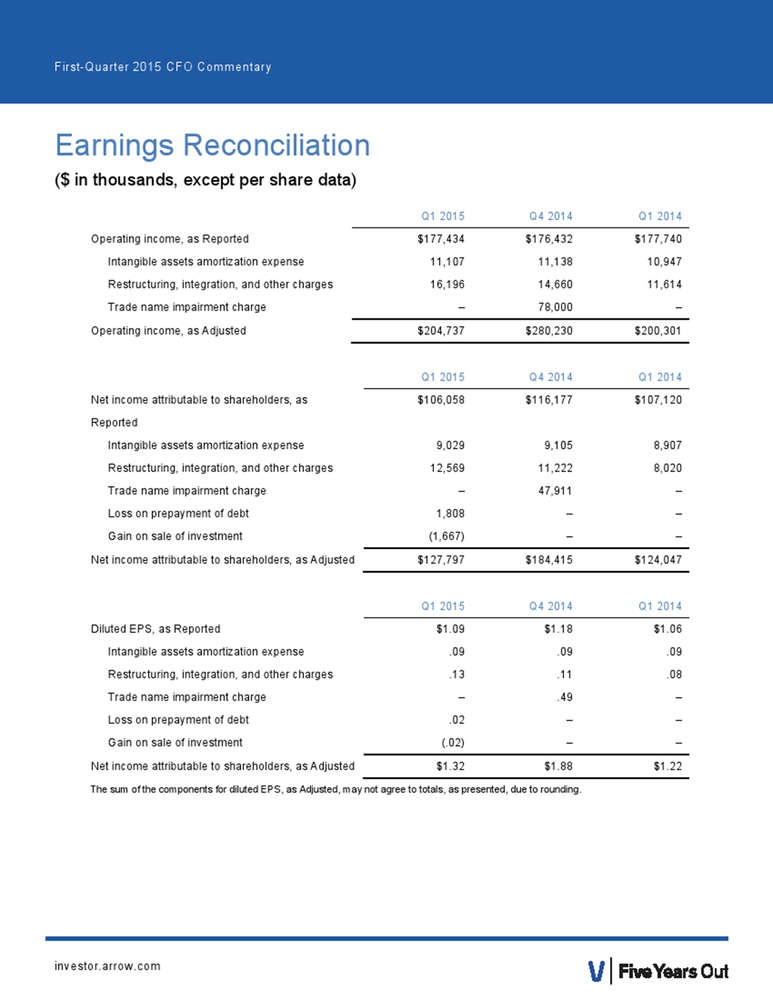

Commentary Q1 2015 Q4 2014 Q1 2014 Operating income, as Reported

$177,434 $176,432 $177,740 Intangible assets amortization expense 11,107

11,138 10,947 Restructuring, integration, and other charges 16,196

14,660 11,614 Trade name impairment charge – 78,000 – Operating income,

as Adjusted $204,737 $280,230 $200,301 Q1 2015 Q4 2014 Q1 2014 Net

income attributable to shareholders, as Reported $106,058 $116,177

$107,120 Intangible assets amortization expense 9,029 9,105 8,907

Restructuring, integration, and other charges 12,569 11,222 8,020 Trade

name impairment charge – 47,911 – Loss on prepayment of debt 1,808 – –

Gain on sale of investment (1,667) – – Net income attributable to

shareholders, as Adjusted $127,797 $184,415 $124,047 Q1 2015 Q4 2014 Q1

2014 Diluted EPS, as Reported $1.09 $1.18 $1.06 Intangible assets

amortization expense .09 .09 .09 Restructuring, integration, and other

charges .13 .11 .08 Trade name impairment charge – .49 – Loss on

prepayment of debt .02 – – Gain on sale of investment (.02) – – Net

income attributable to shareholders, as Adjusted $1.32 $1.88 $1.22 The

sum of the components for diluted EPS, as Adjusted, may not agree to

totals, as presented, due to rounding. Earnings Reconciliation ($ in

thousands, except per share data) investor.arrow.com

First-Quarter 2015 CFO Commentary Earnings Reconciliation References to restructuring and other charges refer to the following incremental charges taken in the periods indicated: Q1-15 Intangible Assets Amortization Expense During the first quarter of 2015, the company recorded intangible assets amortization expense of 11.1 million ($9.0 million net of related taxes or $.09 per share on both a basic and diluted basis). Q1-15 Restructuring, Integration, and Other Charges During the first quarter of 2015, the company recorded restructuring, integration, and other charges of $16.2 million ($12.6 million net of related taxes or $.13 per share on both a basic and diluted basis). Q1-15 Loss on prepayment of debt During the first quarter of 2015, the company recorded a loss on prepayment of debt of $2.9 million ($1.8 million net of related taxes or $.02 per share on both a basic and diluted basis), related to the redemption of $250.0 million principal amount of its 3.375% notes due November 2015. Q1-15 Gain on sale of investment During the first quarter of 2015, the company recorded a gain on sale of investment of $2.0 million ($1.7 million net of related taxes or $.02 per share on both a basic and diluted basis). Q4-14 Intangible Assets Amortization Expense During the fourth quarter of 2014, the company recorded intangible assets amortization expense of $11.1 million ($9.1 million net of related taxes or $.09 per share on both a basic and diluted basis). Q4-14 Restructuring, Integration, and Other Charges During the fourth quarter of 2014, the company recorded restructuring, integration, and other charges of $14.7 million ($11.2 million net of related taxes or $.12 and $.11 per share on a basic and diluted basis, respectively). Q4-14 Trade name impairment Charge During the fourth quarter of 2014, the company recorded a noncash impairment charge associated with discontinuing the use of a trade name of $78.0 million ($47.9 million net of related taxes or $.49 per share on both a basic and diluted basis). Q1-14 Intangible Assets Amortization Expense During the first quarter of 2014, the company recorded intangible assets amortization expense of $10.9 million ($8.9 million net of related taxes or $.09 per share on both a basic and diluted basis). Q1-14 Restructuring, Integration, and Other Charges During the first quarter of 2014, the company recorded restructuring, integration, and other charges of $11.6 million ($8.0 million net of related taxes or $.08 per share on both a basic and diluted basis).