Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WashingtonFirst Bankshares, Inc. | a8-kannualmeetingpresentat.htm |

NASDAQ: WFBI Annual Shareholder Meeting April 29, 2015 11:00 a.m. The Tower Club Tysons Corner, Virginia

NASDAQ: WFBI Disclaimer WashingtonFirst Bankshares, Inc. and Subsidiary (the “Company”) make forward-looking statements in this presentation that are subject to risks and uncertainties. These forward-looking statements include: statements of goals, intentions, earnings expectations, and other expectations; estimates of risks and of future costs and benefits; assessments of probable loan losses; assessments of market risks; and statements of the ability to achieve financial and other goals. These forward-looking statements are subject to significant uncertainties because they are based upon or are affected by: management’s estimates and projections of future interest rates, market behavior, and other economic conditions; future laws and regulations; and a variety of other matters which, by their nature, are subject to significant uncertainties. Because of these uncertainties, the Company’s actual future results may differ materially from those indicated. In addition, the Company’s past results of operations do not necessarily indicate its future results. Please also see the discussion of “RISK FACTORS” in the Company’s 10-K dated March 19, 2014 which is available online at www.sec.gov. For further information on the company please contact: Matthew R. Johnson Executive Vice President / Chief Financial Offer (703) 840-2422 mjohnson@wfbi.com 1

NASDAQ: WFBI 2014 Year in Review 2 Millennium Acquisition (Herndon branch) Key hires of proven Lenders and senior leadership Rockville and McLean branches opened Reduced NPAs by approximately 57% Increased quarterly cash dividend to $0.05

NASDAQ: WFBI 2014 Year in Review (cont.) 3 Repaid initial 25% of the SBLF funding Declared 5% stock dividend Record annual earnings – 50% increase over 2013 Top 20 Fastest Growing Banks in USA #23 of 50 Fastest Growing Companies in DC Among “Most Admired CEOs”…Shaza Andersen (Washington Business Journal)

NASDAQ: WFBI 4 Growth Total Deposits (in millions) Total Loans* (in millions) $330 $420 $753 $838 $1,065 $0 $150 $300 $450 $600 $750 $900 $1,050 $1,200 2010 2011 2012 2013 2014 * Loans held for investment, at amortized cost. $354 $479 $973 $949 $1,086 $0 $150 $300 $450 $600 $750 $900 $1,050 $1,200 2010 2011 2012 2013 2014

NASDAQ: WFBI 5 Loans As of December 31, 2014 Diversified loan portfolio with a strong credit culture Construction and Development 15% Commercial Real Estate (Owner Occupied) 18% Commercial Real Estate (Investment Property) 43% Residential Real Estate 11% Commercial and Industrial 12% Consumer 1% Amount Number (in thousands) of Loans Yield Construction and Development 156,241$ 203 5.31% Commercial Real Estate (Owner Occupied) 196,878 220 4.77% Commercial Real Estate (Investment Property) 453,173 232 4.77% Residential Real Estate 122,306 1,275 4.87% Commercial and Industrial 127,084 586 5.34% Consumer 9,376 247 4.64% Total 1,065,058$ 2,763 4.93%

NASDAQ: WFBI 6 NPAs / Assets 1.23% 1.25% 1.92% 1.97% 0.84% 2.80% 2.98% 2.48% 2.33% 1.71% 0.25% 0.75% 1.25% 1.75% 2.25% 2.75% 3.25% 3.75% 2010 2011 2012 2013 2014 WFBI Peers* Source: SNL Financial * 2010-2012 peer group defined as banks between $300-$600M, 2013-2014 peer group defined as banks between $750M-$1.5B in VA, MD and DC, as of 3Q14.

NASDAQ: WFBI Non-Interest Bearing 26% NOW, MMA & Savings 40% Time Deposits (including brokered) 34% Amount Number of Cost of (in thosuands) Accounts Funds Non-Interest Bearing 278,051$ 5,474 0.00% NOW, MMA & Savings 437,108 4,273 0.40% Time Deposits 360,886 3,752 1.06% Brokered Deposits 10,018 1 1.28% Total Deposits 1,086,063$ 13,500 0.53% WFBI Peers* Non-Interest Bearing 26% 20% NOW, MMA & Savings 40% 41% Time Deposits 34% 39% Favorable deposit mix based on core relationships and diversification Deposits As of December 31, 2014 Source: SNL Financial * 2008-2012 peer group defined as banks between $300-$600M, 2013 peer group defined as banks between $750M-$1.5B in VA, MD and DC. 7

NASDAQ: WFBI All Banks Headquartered in Washington, DC, Metro Area Total Asset Size As of December 31, 2014 Source: SNL Financial 8 (Table here)

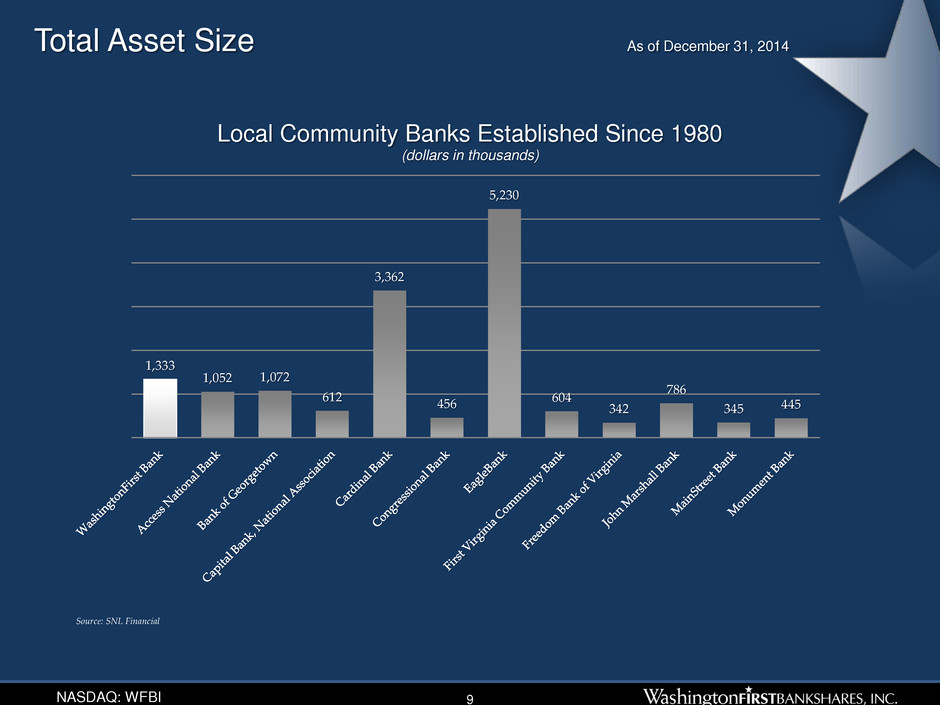

NASDAQ: WFBI Total Asset Size As of December 31, 2014 Source: SNL Financial 9 1,333 1,052 1,072 612 3,362 456 5,230 604 342 786 345 445 Local Community Banks Established Since 1980 (dollars in thousands)

NASDAQ: WFBI Leader Among Local Community Banks of Similar Age Total Asset Size As of December 31, 2014 Source: SNL Financial 10 1,333 1,072 456 604 342 786 345 445 Local Community Banks Established Since 2000 (dollars in thousands)

NASDAQ: WFBI Leader Among Local Community Banks of Similar Age Deposit Market Share As of June 30, 2014 Source: SNL Financial, most recent data available per FDIC 11 0.74 0.51 0.41 0.29 0.17 0.35 0.18 0.21 Local Community Banks Established Since 2000 (percent of market)

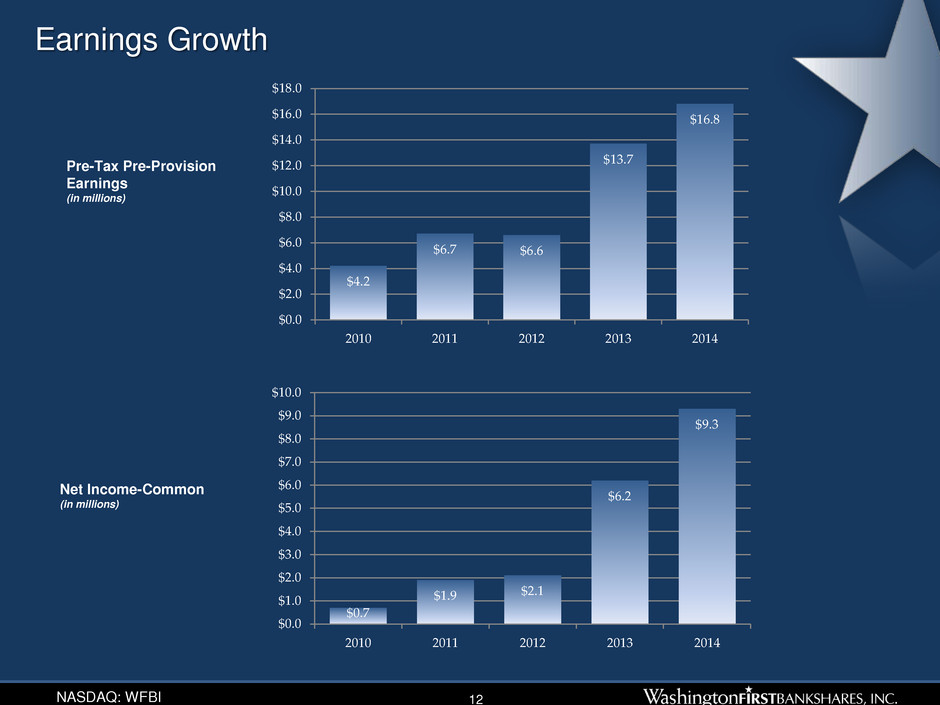

NASDAQ: WFBI 12 Earnings Growth Pre-Tax Pre-Provision Earnings (in millions) $4.2 $6.7 $6.6 $13.7 $16.8 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 $18.0 2010 2011 2012 2013 2014 Net Income-Common (in millions) $0.7 $1.9 $2.1 $6.2 $9.3 $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 $9.0 $10.0 2010 2011 2012 2013 2014

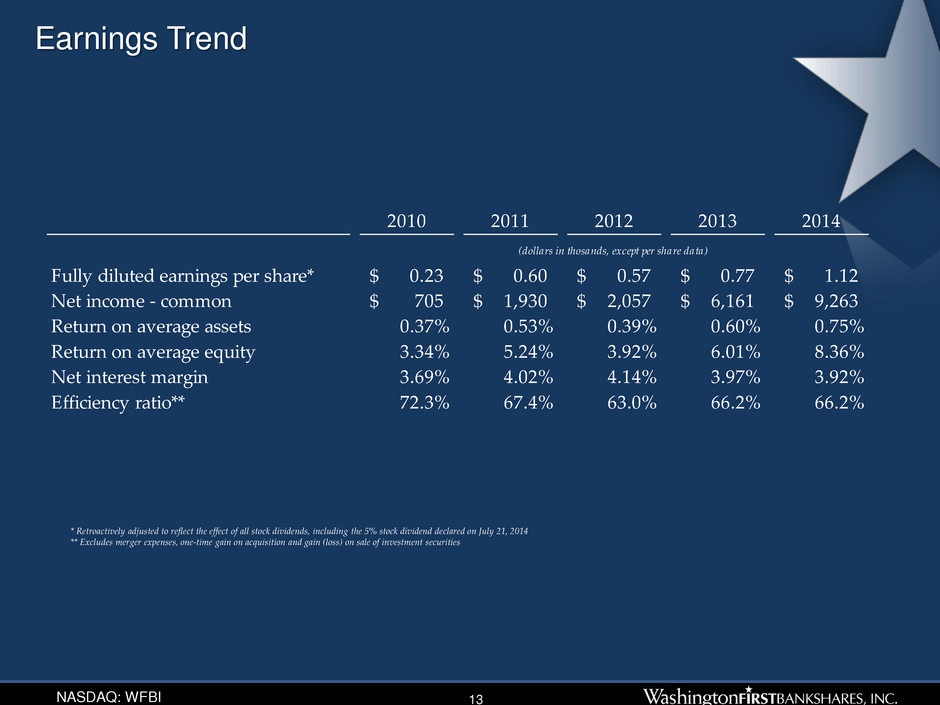

NASDAQ: WFBI 13 Earnings Trend 2010 2011 2012 2013 2014 Fully diluted earnings per share* 0.23$ 0.60$ 0.57$ 0.77$ 1.12$ Net income - common 705$ 1,930$ 2,057$ 6,161$ 9,263$ Return on average assets 0.37% 0.53% 0.39% 0.60% 0.75% Return on average equity 3.34% 5.24% 3.92% 6.01% 8.36% Net interest margin 3.69% 4.02% 4.14% 3.97% 3.92% Efficiency ratio** 72.3% 67.4% 63.0% 66.2% 66.2% (dollars in thosands, except per share data) * Retroactively adjusted to reflect the effect of all stock dividends, including the 5% stock dividend declared on July 21, 2014 ** Excludes merger expenses, one-time gain on acquisition and gain (loss) on sale of investment securities

NASDAQ: WFBI Net Interest Margin 3.69% 4.02% 4.14% 3.97% 3.92% 3.74% 4.08% 3.91% 3.56% 3.76% 3.50% 3.75% 4.00% 4.25% 2010 2011 2012 2013 2014 Source: SNL Financial * 2010-2012 peer group defined as banks between $300-$600M, 2013-2014 peer group defined as banks between $750M-$1.5B in VA, MD and DC as of 3Q14. WFBI Peers* 14

NASDAQ: WFBI Efficiency Ratio 72.3% 67.4% 63.0% 66.2% 66.2% 74.5% 70.6% 71.5% 70.2% 67.9% 60.00% 65.00% 70.00% 75.00% 80.00% 2010 2011 2012 2013 2014 WFBI** Source: SNL Financial * Peer data for 2010-2012 defined as banks between $300-$600M; 2013-2014 peer group defined as banks between $750M-$1.5B in VA, MD and DC as of 3Q14. ** Excludes merger expenses, one-time gain on acquisition, and gains/(losses) on sale of investment securities and loans. Peers* 15

NASDAQ: WFBI Capital Strength (dollars in thousands) 2010 2011 2012 2013 2014 Total Assets 434,526$ 559,462$ 1,147,818$ 1,127,559$ 1,333,390$ Total Shareholders' Equity 46,121 53,477 101,520 107,604 134,538 TCE / Tangible Assets 6.92% 5.78% 6.97% 7.64% 8.62% Total risk based capital ratio 12.46% 11.84% 13.77% 14.05% 13.20% Tier 1 risk based capital ratio 11.50% 10.73% 12.71% 12.80% 12.14% Tier 1 leverage ratio 9.62% 9.06% 9.97% 10.53% 10.23% 16

NASDAQ: WFBI WFBI Stock Performance (LTM) As of April 28, 2015 Source : SNL Financial 17 WashingtonFirst Bankshares, Inc. – Stock Price 18.70%

NASDAQ: WFBI Recent Developments – 2015 First Quarter Earnings increased 77% over 2014 Q1 • $2.8 million net income • Organic growth NPAs decreased to 0.64% Repaid additional 25% of SBLF funding Signed lease Old Town Alexandria, VA Signed lease Potomac, MD $0.05 cash dividend April 1, 2015 18

NASDAQ: WFBI 19 Branch Network WashingtonFirst Corporate Office District of Columbia Maryland Virginia Coming Soon Alexandria, VA Potomac, MD WashingtonFirst Branch Offices Coming Soon – Potomac, MD and Alexandria, VA

NASDAQ: WFBI 20 Our Strategy WashingtonFirst seeks to capitalize on market opportunities while maintaining disciplined and conservative credit underwriting that has been the cornerstone of our past profitability. Opportunity Organic Growth Focus on relationships Enhance existing footprint Hire seasoned lenders Blueprint for Success Profitability Continued emphasis on Net Interest Margin Enhance fee income Continued diligence to minimize overhead Opportunistic Growth Explore potential acquisitions Cultivate relationships with institutional investors Maintain Credit Quality Continued diligence on credit quality Conservative credit culture Disciplined underwriting

NASDAQ: WFBI WFYF Golf Invitational 21

NASDAQ: WFBI NASDAQ: WFBI www.wfbi.com Thank You