Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K 4-29-15 - Piedmont Office Realty Trust, Inc. | pdm331158kq12015erandsupps.htm |

| EX-99.1 - Q1 2015 EARNINGS RELEASE - Piedmont Office Realty Trust, Inc. | pdm33115ex991q12015earning.htm |

EXHIBIT 99.2

Quarterly Supplemental Information

March 31, 2015

Corporate Headquarters | Institutional Analyst Contact | Investor Relations |

11695 Johns Creek Parkway, Suite 350 | Telephone: 770.418.8592 | Telephone: 866.354.3485 |

Johns Creek, GA 30097 | research.analysts@piedmontreit.com | investor.services@piedmontreit.com |

Telephone: 770.418.8800 | www.piedmontreit.com | |

Piedmont Office Realty Trust, Inc.

Quarterly Supplemental Information

Index

Page | Page | |||

Introduction | Other Investments | |||

Corporate Data | Other Investments Detail | |||

Investor Information | Supporting Information | |||

Financial Highlights | Definitions | |||

Key Performance Indicators | Research Coverage | |||

Financials | Non-GAAP Reconciliations & Other Detail | |||

Balance Sheets | Property Detail | |||

Income Statements | Risks, Uncertainties and Limitations | |||

Funds From Operations / Adjusted Funds From Operations | ||||

Same Store Analysis | ||||

Capitalization Analysis | ||||

Debt Summary | ||||

Debt Detail | ||||

Debt Analysis | ||||

Operational & Portfolio Information - Office Investments | ||||

Tenant Diversification | ||||

Tenant Credit Rating & Lease Distribution Information | ||||

Leased Percentage Information | ||||

Rental Rate Roll Up / Roll Down Analysis | ||||

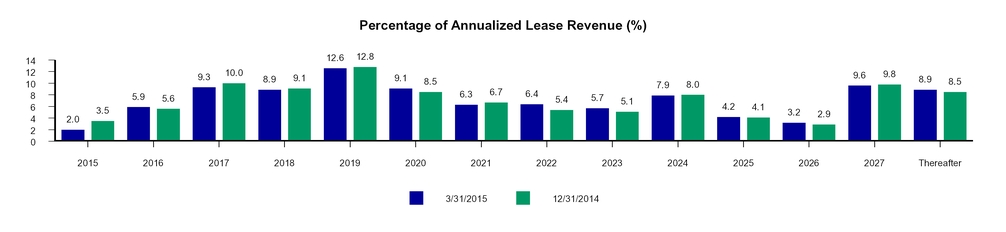

Lease Expiration Schedule | ||||

Quarterly Lease Expirations | ||||

Annual Lease Expirations | ||||

Capital Expenditures & Commitments | ||||

Contractual Tenant Improvements & Leasing Commissions | ||||

Geographic Diversification | ||||

Geographic Diversification by Location Type | ||||

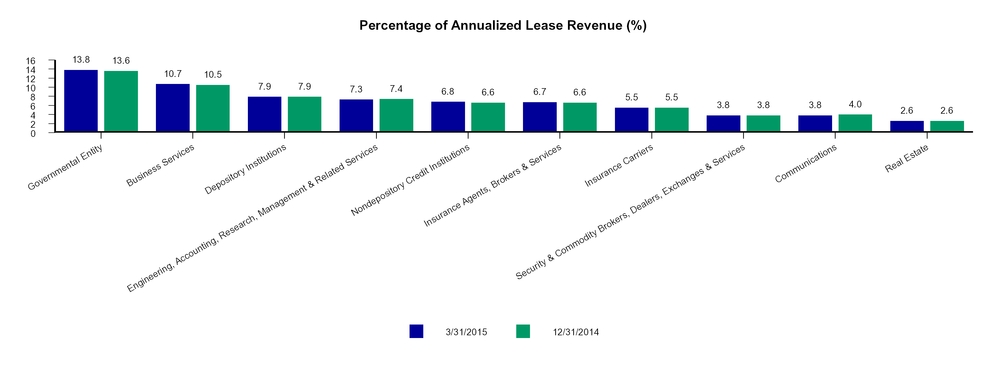

Industry Diversification | ||||

Property Investment Activity | ||||

Notice to Readers: |

Please refer to page 48 for a discussion of important risks related to the business of Piedmont Office Realty Trust, Inc., as well as an investment in its securities, including risks that could cause actual results and events to differ materially from results and events referred to in the forward-looking information. Considering these risks, uncertainties, assumptions, and limitations, the forward-looking statements about leasing, financial operations, leasing prospects, etc. contained in this quarterly supplemental information report might not occur. |

Certain prior period amounts have been reclassified to conform to the current period financial statement presentation. In addition, many of the schedules herein contain rounding to the nearest thousands or millions and, therefore, the schedules may not total due to this rounding convention. Prior to the second quarter of 2014, when the Company sold properties or was under a binding contract to sell properties, it restated historical income statements with the financial results of the sold or under contract assets presented in discontinued operations. |

Piedmont Office Realty Trust, Inc.

Corporate Data

Piedmont Office Realty Trust, Inc. (also referred to herein as "Piedmont" or the "Company") (NYSE: PDM) is an owner, manager, developer and operator of high-quality, Class A office properties located in select sub-markets of major U.S. cities. Its geographically-diversified, over $5 billion portfolio is comprised of more than 21 million square feet. The Company is a fully-integrated, self-managed real estate investment trust ("REIT") with local management offices in each of its major markets and is investment-grade rated by Standard & Poor’s and Moody’s. Piedmont is headquartered in Atlanta, GA.

This data supplements the information provided in our reports filed with the Securities and Exchange Commission and should be reviewed in conjunction with such filings.

As of | As of | ||||

March 31, 2015 | December 31, 2014 | ||||

Number of consolidated office properties (1) | 74 | 74 | |||

Rentable square footage (in thousands) (1) | 21,531 | 21,471 | |||

Percent leased (2) | 88.8 | % | 87.7 | % | |

Capitalization (in thousands): | |||||

Total debt - principal amount outstanding | $2,328,654 | $2,279,787 | |||

Equity market capitalization (3) | $2,872,258 | $2,907,466 | |||

Total market capitalization (3) | $5,200,912 | $5,187,253 | |||

Total debt / Total market capitalization (3) | 44.8 | % | 43.9 | % | |

Total debt / Total gross assets | 38.7 | % | 38.2 | % | |

Common stock data | |||||

High closing price during quarter | $20.01 | $20.00 | |||

Low closing price during quarter | $17.65 | $17.61 | |||

Closing price of common stock at period end | $18.61 | $18.84 | |||

Weighted average fully diluted shares outstanding during quarter (in thousands) | 154,580 | 154,420 | |||

Shares of common stock issued and outstanding (in thousands) | 154,340 | 154,324 | |||

Annual dividend per share (4) | $0.82 | $0.81 | |||

Rating / outlook | |||||

Standard & Poor's | BBB / Stable | BBB / Stable | |||

Moody's | Baa2 / Stable | Baa2 / Stable | |||

Employees | 130 | 130 | |||

(1) | As of March 31, 2015, our consolidated office portfolio consisted of 74 properties (exclusive of our equity interest in one property owned through an unconsolidated joint venture and one property that was taken out of service for redevelopment on January 1, 2014, 3100 Clarendon Boulevard in Arlington, VA). During the first quarter of 2015, we sold 3900 Dallas Parkway, a 120,000 square foot office building located in Plano, TX, and acquired Park Place on Turtle Creek, a 178,000 square foot office building located in Dallas, TX. For additional detail on asset transactions, please refer to page 37. |

(2) | Calculated as leased square footage plus square footage associated with executed new leases for currently vacant spaces divided by total rentable square footage, all as of the relevant date, expressed as a percentage. This measure is presented for our consolidated office properties and excludes unconsolidated joint venture properties and one out of service property. Please refer to page 27 for additional analyses regarding Piedmont's leased percentage. |

(3) | Reflects common stock closing price as of the end of the reporting period. |

(4) | Total of the per share dividends paid over the prior four quarters. |

3

Piedmont Office Realty Trust, Inc.

Investor Information

Corporate |

11695 Johns Creek Parkway, Suite 350 |

Johns Creek, Georgia 30097 |

770.418.8800 |

www.piedmontreit.com |

Executive Management | |||

Donald A. Miller, CFA | Robert E. Bowers | Laura P. Moon | Raymond L. Owens |

Chief Executive Officer, President | Chief Financial Officer and Executive | Chief Accounting Officer and | Executive Vice President, |

and Director | Vice President | Senior Vice President | Capital Markets |

Joseph H. Pangburn | Thomas R. Prescott | Carroll A. Reddic, IV | Robert K. Wiberg |

Executive Vice President, | Executive Vice President, | Executive Vice President, | Executive Vice President, |

Southwest Region | Midwest Region | Real Estate Operations and Assistant | Mid-Atlantic Region and |

Secretary | Head of Development | ||

Board of Directors | |||

Michael R. Buchanan | Wesley E. Cantrell | William H. Keogler, Jr. | Barbara B. Lang |

Director and Chairman of the | Director and Chairman of | Director | Director |

Board of Directors | Governance Committee | ||

Frank C. McDowell | Donald A. Miller, CFA | Raymond G. Milnes, Jr. | Donald S. Moss |

Director, Vice Chairman of the | Chief Executive Officer, President | Director and Chairman of | Director |

Board of Directors and Chairman | and Director | Audit Committee | |

of Compensation Committee | |||

Jeffery L. Swope | |||

Director and Chairman of | |||

Capital Committee | |||

Transfer Agent | Corporate Counsel |

Computershare | King & Spalding |

P.O. Box 30170 | 1180 Peachtree Street, NE |

College Station, TX 77842-3170 | Atlanta, GA 30309 |

Phone: 866.354.3485 | Phone: 404.572.4600 |

4

Piedmont Office Realty Trust, Inc.

Financial Highlights

As of March 31, 2015

Financial Results (1)

Funds from operations (FFO) for the quarter ended March 31, 2015 was $60.0 million, or $0.39 per share (diluted), compared to $58.0 million, or $0.37 per share (diluted), for the same quarter in 2014. The increase in FFO for the three months ended March 31, 2015 as compared to the same period in 2014 was primarily attributable to increased operating income contributions from 1) the commencement of several new leases, most notably the 222,000 square foot lease with Epsilon Data Management at 6021 Connection Drive in Irving, TX and the 174,000 square foot lease with Integrys at Aon Center in Chicago, IL, 2) leases under which operating expense recovery abatements have expired, and 3) newly acquired properties, all of which were partially offset by 4) lower non-recurring casualty and litigation insurance recoveries in 2015 over that received in 2014, 5) increased general and administrative expense in 2015 primarily related to higher incentive compensation expense associated with overall operating results for 2014 and stronger stock performance relative to peers, as well as 6) the loss of operating income contributions from properties sold since the beginning of 2014, including 3900 Dallas Parkway in Plano, TX.

Core funds from operations (Core FFO) for the quarter ended March 31, 2015 was $60.1 million, or $0.39 per share (diluted), compared to $55.1 million, or $0.36 per share (diluted), for the same quarter in 2014. Core FFO is defined as FFO with incremental adjustments for certain non-recurring items such as net insurance recoveries or losses from casualty events and litigation settlements, acquisition-related costs and other significant non-recurring items. The change in Core FFO for the three months ended March 31, 2015 as compared to the same period in 2014 was primarily attributable to the items described above for changes in FFO, with the exception of non-recurring insurance recoveries, which are not included in Core FFO.

Adjusted funds from operations (AFFO) for the quarter ended March 31, 2015 was $45.6 million, or $0.30 per share (diluted), compared to $32.0 million, or $0.21 per share (diluted), for the same quarter in 2014. The increase in AFFO for the three months ended March 31, 2015 as compared to the same period in 2014 was primarily related to the items described above for changes in FFO and Core FFO, as well as lesser amounts of straight line rent adjustments and non-incremental capital expenditures in 2015 when compared to 2014. Piedmont experienced a period of high lease expirations from 2011 to 2013. Given the competitive leasing environment over the last several years, many of the recent leases that the Company entered into included rental abatements, which typically occur at the beginning of a new lease's term. Many of the replacement or renewal leases with rental abatements are in the early stages of the new leases' terms, resulting in temporarily higher straight line rent adjustments for Piedmont. As the rental abatement periods continue to expire, the straight line rent adjustments will continue to decrease. The higher non-incremental capital expenditures in 2014 when compared to 2015 was also related to the high volume of lease transactions completed during the period from 2011 to 2013; the decrease in non-incremental capital expenditures in 2015 is reflective of the end of this high lease expiration and re-leasing period.

Operations & Leasing

On a square footage leased basis, our total office portfolio was 88.8% leased as of March 31, 2015, as compared to 87.7% in the prior quarter and 86.7% a year earlier. Please refer to page 27 for additional leased percentage information.

The weighted average remaining lease term of our portfolio was 7.0 years(2) as of March 31, 2015 as compared to 7.1 years at December 31, 2014.

As previously disclosed, Piedmont commenced the redevelopment of its 3100 Clarendon Boulevard property, a 262,000 square foot office and retail property located in Arlington, VA, during the first quarter of 2014. The building's existing retail tenants have remained in occupancy during the redevelopment. Therefore, from an accounting standpoint, the office component of the building has been out of service and the retail portion of the building, comprised of approximately 28,000 square feet, has remained in service during the redevelopment. However, for the purposes of statistical reporting throughout this supplemental report, the entire building has been removed from Piedmont's operating portfolio. For additional information regarding the redevelopment of 3100 Clarendon Boulevard, please refer to the Financing and Capital Activity section within the Financial Highlights of this report.

(1) | |

(2) | Remaining lease term (after taking into account leases for vacant spaces which had been executed but not commenced as of March 31, 2015) is weighted based on Annualized Lease Revenue, as defined on page 39. |

5

During the three months ended March 31, 2015, the Company completed 817,000 square feet of total leasing. Of the total leasing activity during the quarter, we signed renewal leases for 442,000 square feet and new tenant leases for 375,000 square feet. The average committed tenant improvement cost per square foot per year of lease term for renewal leases signed at our consolidated office properties during the three months ended March 31, 2015 was $1.75 and the same measure for new leases was $5.26 (see page 33).

During the three months ended March 31, 2015, we executed nine leases greater than 20,000 square feet with lengths of term of more than one year at our consolidated office properties. Information on those leases is set forth below.

Tenant | Property | Property Location | Square Feet Leased | Expiration Year | Lease Type |

Americredit (1) | Chandler Forum | Chandler, AZ | 149,863 | 2022 | Renewal / Expansion |

United States of America (Corporation for National and Community Service) | One Independence Square | Washington, DC | 84,606 | 2030 | New |

Comcast | Windy Point I | Schaumburg, IL | 72,513 | 2023 | Renewal / Contraction |

Microsoft | Aon Center | Chicago, IL | 63,888 | 2022 | Renewal / Contraction |

Liberty Mutual Insurance Company | Suwanee Gateway One | Suwanee, GA | 59,579 | 2020 | New |

Accertify | Two Pierce Place | Itasca, IL | 40,451 | 2026 | New |

Access Intelligence | 9211 Corporate Boulevard | Rockville, MD | 32,402 | 2026 | New |

W. W. Grainger | 3750 Brookside Parkway | Alpharetta, GA | 29,246 | 2016 | Renewal |

Robert Half International | US Bancorp Center | Minneapolis, MN | 22,580 | 2023 | Renewal |

As of March 31, 2015, there were two tenants whose leases were scheduled to expire during the eighteen month period following the end of the first quarter of 2015 which individually contributed greater than 1% in net Annualized Lease Revenue ("ALR"). Information regarding the leasing status of the spaces associated with these tenants' leases is presented below.

Tenant | Property | Property Location | Net Square Footage Expiring | Net Percentage of Current Quarter Annualized Lease Revenue Expiring (%) | Expiration | Current Leasing Status |

KeyBank | 2 Gatehall Drive | Parsippany, NJ | 200,000 | 1.0% | Q1 2016 | The tenant is not expected to renew its lease. The space is currently being marketed for lease. |

Harcourt | Braker Pointe III | Austin, TX | 195,230 | 1.1% | Q2 2016 | The primary tenant is not expected to renew its lease. Discussions with current subtenants for direct leases have commenced. The Company is actively marketing the remainder of the space for lease. |

(1) | In addition to expanding its lease by 36,692 square feet, absorbing all remaining available space in the building, the tenant extended its lease for its existing space by several months. |

6

Future Lease Commencements and Abatements

As of March 31, 2015, our overall leased percentage was 88.8% and our economic leased percentage was 80.6%. The difference between overall leased percentage and economic leased percentage is attributable to two factors:

1. | leases which have been contractually entered into for currently vacant spaces but have not yet commenced (amounting to approximately 477,000 square feet of leases as of March 31, 2015, or 2.2% of the office portfolio); and |

2. | leases which have commenced but the tenants have not commenced paying full rent due to rental abatements (amounting to 1.7 million square feet of leases as of March 31, 2015, or a 6.0% impact to leased percentage on an economic basis). |

Piedmont focuses its marketing efforts on large corporate office space users. The average size of lease in the Company's portfolio is approximately 28,000 square feet. Due to the large size and length of term of new leases, Piedmont typically signs leases several months in advance of their anticipated lease commencement dates. Presented below is a schedule of uncommenced leases greater than 50,000 square feet and their anticipated commencement dates. Lease renewals are excluded from this schedule.

Tenant | Property | Property Location | Square Feet Leased | Space Status | Estimated Commencement Date | New / Expansion |

Schlumberger Technology Corporation | 1430 Enclave Parkway | Houston, TX | 53,258 | Vacant | Q2 2015 | New |

Liberty Mutual Insurance Company | Suwanee Gateway One | Suwanee, GA | 59,579 | Vacant | Q3 2015 | New |

Lockton Companies | 500 West Monroe Street | Chicago, IL | 52,201 | Vacant | Q3 2015 | New |

United States of America (Corporation for National and Community Service) | One Independence Square | Washington, DC | 84,606 | Vacant | Q4 2015 | New |

Due to the current economic environment, many recently negotiated leases provide for rental abatement concessions to tenants. Rental abatements typically occur at the beginning of a new lease's term. Since 2010, Piedmont has signed approximately 15.3 million square feet of leases within its consolidated office portfolio. Due to the large number of new leases in the Company's portfolio, abatements provided under those new leases have impacted the Company's current cash net operating income and AFFO. Presented below is a schedule of leases with abatements of greater than 50,000 square feet that are either currently under abatement or will be so within the next twelve months.

Tenant | Property | Property Location | Square Feet | Remaining Abatement Schedule | Lease Expiration |

Piper Jaffray | US Bancorp Center | Minneapolis, MN | 123,882 | June 2014 through May 2015 | Q4 2025 |

GE Capital | 500 West Monroe Street | Chicago, IL | 53,283 | December 2014 through June 2015 (26,317 square feet); March 2015 through March 2016 (26,966 square feet) | Q4 2027 |

Aon | Aon Center | Chicago, IL | 413,778 | January through May 2015 and 2016 (382,076 square feet); January 2014 through March 2015 (31,702 square feet) | Q4 2028 |

Miller Canfield | 150 West Jefferson | Detroit, MI | 109,261 | January through March 2015 (entire space); January 2016 (69,974 square feet) | Q2 2026 |

Thoughtworks | Aon Center | Chicago, IL | 52,529 | January through March 2015, 2016 and 2017 | Q4 2023 |

Mitsubishi Hitachi Power Systems | 400 TownPark | Lake Mary, FL | 75,321 | February and March 2015, 2016, 2017 and 2018 | Q1 2026 |

Advanced Micro Devices | 90 Central Street | Boxborough, MA | 107,244 | March through November 2015 | Q4 2020 |

Catamaran | Windy Point II | Schaumburg, IL | 50,686 | March 2015 through April 2016 | Q1 2025 |

Integrys | Aon Center | Chicago, IL | 160,423 | May through September 2015 and 2016 | Q2 2029 |

Liberty Mutual Insurance Company | Suwanee Gateway One | Suwanee, GA | 59,579 | July through October 2015 | Q4 2020 |

Lockton Companies | 500 West Monroe Street | Chicago, IL | 52,201 | August 2015 through July 2016 | Q3 2026 |

Americredit | Chandler Forum | Chandler, AZ | 149,863 | September 2015 (78,182 square feet); January 2016 (149,863 square feet); September 2016 and 2017 (99,213 square feet) | Q1 2022 |

Comcast | Windy Point I | Schaumburg, IL | 72,513 | October 2015 through February 2016 | Q1 2023 |

Nestle | 800 North Brand Boulevard | Glendale, CA | 400,892 | December 2015 through March 2016 | Q1 2021 |

DDB Needham | Aon Center | Chicago, IL | 187,000 | January 2016 through June 2018 | Q2 2018 |

United States of America (Corporation for National and Community Service) | One Independence Square | Washington, DC | 84,606 | January 2016 through June 2017 | Q4 2030 |

7

Financing and Capital Activity

As of March 31, 2015, our ratio of debt to total gross assets was 38.7%. This debt ratio is based on total principal amount outstanding for our various loans at March 31, 2015.

On February 5, 2015, the Board of Directors of Piedmont declared a dividend for the first quarter of 2015 in the amount of $0.21 per common share outstanding to stockholders of record as of the close of business on February 27, 2015. The dividend was paid on March 20, 2015. The Company's dividend payout percentage for the three months ended March 31, 2015 was 54% of Core FFO and 71% of AFFO.

Dispositions (1)

On January 30, 2015, Piedmont sold 3900 Dallas Parkway, a 120,000 square foot, 100% leased office building located in Plano, TX. The property was sold for $26.2 million, or $218 per square foot. The sale allowed Piedmont to exit a non-strategic suburban asset and redeploy the sale proceeds into an urban infill asset in a target submarket, Park Place on Turtle Creek in the Uptown/Turtle Creek submarket of Dallas. Piedmont recorded a $10.1 million gain on the sale of the asset. For additional information on the disposition, please refer to page 37.

Acquisitions

On January 16, 2015, Piedmont completed the purchase of Park Place on Turtle Creek, a fourteen-story, 178,000 square foot office building located in the Uptown/Turtle Creek submarket of Dallas, TX for $46.6 million, or $263 per square foot. Built in 1986 and 88% leased, the asset offers immediate earnings growth and value accretion potential through leasing up existing vacancies and resetting below-market leases to market rental rates. The building is located along Dallas's prestigious Turtle Creek Boulevard and affords tenants an excellent amenity base, including numerous proximate restaurants and hotels, and immediate access to Highland Park, a housing location of choice for Dallas area executives. The property is located adjacent to The Mansion on Turtle Creek, one of Dallas's top-rated hotels, and is only steps away from the Katy Trail, a popular walking and biking trail. The acquisition was completed utilizing proceeds from the sale of 3900 Dallas Parkway mentioned above, and was consistent with two of the Company’s strategic objectives: 1) recycle out of non-strategic properties and 2) increase ownership in high-quality assets within its core operating markets which are considered to have above-average rent and value appreciation potential. For additional information on the acquisition, please refer to page 37.

Finance

At December 31, 2014, the Company had mortgage debt of $105 million and $168 million maturing in 2015 and 2016, respectively, in addition to a $50 million term loan maturing in 2015. As the year began, little to no debt was set to mature on the Company's debt maturity schedule in 2018, 2021, or 2022. In an effort to continue to ladder out its debt maturity schedule, on March 27, 2015, Piedmont closed on a $170 million, three-year unsecured term loan maturing on May 15, 2018. The proceeds were used to repay the Company's $50 million unsecured term loan and to reduce the balance outstanding under the revolving line of credit. The loan has a variable interest rate; Piedmont may select from multiple interest rate options under this facility, including the prime rate and various length LIBOR locks. The selected rate is subject to an additional spread based on Piedmont’s then current credit rating. As of March 31, 2015, the interest rate for LIBOR based loans was LIBOR + 112.5 basis points.

In anticipation of paying off a maturing mortgage and considering the current, historically-low interest rate environment, Piedmont entered into a forward-starting swap hedging program for planned 2016 financing activity. During the first quarter of 2015, the Company entered into four, ten-year forward-starting swaps with a notional amount of $250 million for a potential debt issuance in 2016. Under this hedging program, the Company has effectively locked the treasury interest rate component of the targeted future financing. At current swap spread levels, the treasury component for a possible 2016 debt issuance maturing in 2026 was effectively locked at approximately 2.21%. Piedmont also has $250 million in notional amount of forward-starting swaps outstanding for an anticipated 2015 fixed-rate financing. At current swap spread levels, the Company effectively locked the treasury component for a possible 2015 fixed-rate debt issuance maturing in 2022 at approximately 2.04%.

(1) | On April 1, 2014, Piedmont early-adopted the provisions of Financial Accounting Standards Board ASU 2014-08. As such, Piedmont will no longer reclassify to discontinued operations the operating income associated with newly-sold single assets or small portfolios which do not represent a strategic shift or significant impact on Piedmont's future operations. There will be no restatement for prior periods and all operating income associated with assets either sold or under binding contract to sell as of the end of the first quarter of 2014 will continue to be reflected in discontinued operations. Assuming future sales do not meet the new criteria for reclassification as discontinued operations, such future sales will not be presented in discontinued operations. |

8

Development

During the first quarter of 2014, Piedmont commenced the redevelopment of its 3100 Clarendon Boulevard property, a 262,000 square foot office and retail property located adjacent to the Clarendon Metrorail Station in Arlington, VA. Until the end of 2013, the property had been predominantly leased to the United States of America (Defense Intelligence Agency) for the previous 15+ years. The expiration of the U.S. Government's lease afforded Piedmont the opportunity to upgrade and reposition the property in order to attract private sector tenants and to capture the incremental value potential for the location (attributable primarily to nearby amenities desirable to tenants, including housing, retail, and Metrorail transportation). The project remains on schedule; the office tower redevelopment is substantially complete and the retail portion of the redevelopment is underway and should be completed during the third quarter of 2015. During the redevelopment, the office component of the building has been out of service and the retail portion of the building, comprised of approximately 28,000 square feet, has remained in service. However, for the purposes of statistical reporting on the Company's assets in this supplemental report, the entire building has been removed from Piedmont's operating portfolio. It is anticipated that the costs to redevelop the building (exclusive of capitalized implied financing costs) will be approximately $33 million, approximately $21.8 million of which had been recorded in work in progress as of March 31, 2015. Following the completion of the redevelopment, the Company anticipates incurring additional re-leasing costs.

During the fourth quarter of 2013, Piedmont announced the development of Enclave Place, a 301,000 square foot office building located in Houston, TX. The eleven-story building is being constructed on Piedmont's 4.7 acre development site adjacent to its 1430 Enclave Parkway property and located within a deed-restricted and architecturally-controlled office park in Houston's Energy Corridor. Ground was broken in April 2014, and physical construction is targeted to be completed during the third quarter of 2015. The development costs are anticipated to be approximately $85 million to $90 million, inclusive of leasing costs. Approximately $44.0 million had been recorded in work in progress as of March 31, 2015.

Stock Programs

During the first quarter of 2015, the Company did not repurchase any shares of common stock under its share repurchase program. Since the stock repurchase program began in December 2011, the Company has repurchased a total of 18.9 million shares at an average price of $16.92 per share, or approximately $319.6 million in aggregate (before the consideration of transaction costs). As of quarter end, Board-approved capacity remaining for additional repurchases through November 2015 totaled $37.0 million under the stock repurchase plan.

On February 19, 2015, Piedmont entered into an equity offering sales agreement whereby it may sell up to a total of $250.0 million in shares of its common stock through an "at-the-market" equity offering program. The Company has no obligation to sell any of the shares in the offering and has no immediate plans to be active under the program. The implementation of this program adds to Piedmont's various capital-raising options. The Company intends to use any proceeds raised from the offering for working capital, capital expenditures and other general corporate purposes, which may include the acquisition, development and redevelopment of office properties or the repayment of debt.

Subsequent Events

On April 1, 2015, Piedmont entered into a binding contract to sell River Corporate Center, a 133,000 square foot, single-tenant, 100% leased office building located in Tempe, AZ for $24.6 million, or $185 per square foot. The disposition of this two-story, ground-leased, secondary market asset will allow the Company to reduce its ownership exposure to non-strategic markets and non-core assets. Proceeds from the sale will be used to pay down the Company's revolving line of credit balance. The sale of the asset was completed on April 29, 2015.

On April 7, 2015, Piedmont entered into a binding contract to sell 5601 Headquarters Drive, a 166,000 square foot, single-tenant, 100% leased office building located in Plano, TX for $33.7 million, or $203 per square foot. The sale will allow the Company to divest a non-core, suburban asset and to exit a non-strategic sub-market. The sale of the asset was completed on April 28, 2015.

On April 10, 2015, Piedmont repaid a maturing mortgage totaling $105 million secured by US Bancorp Center in Minneapolis, MN. The loan was open to prepayment without any yield maintenance requirements.

On April 15, 2015, Piedmont entered into a binding contract to sell Copper Ridge Center, a 268,000 square foot office building located in Lyndhurst, NJ. The sale will allow Piedmont to divest an asset located in a non-strategic sub-market. The transaction is anticipated to close during the second quarter of 2015.

On April 28, 2015, the Board of Directors of Piedmont declared a dividend for the second quarter of 2015 in the amount of $0.21 per common share outstanding to stockholders of record as of the close of business on May 29, 2015. The dividend is to be paid on June 19, 2015.

9

Guidance for 2015

The following financial guidance for calendar year 2015 remains unchanged and is based upon management's expectations at this time.

Low | High | ||

Core Funds from Operations | $238 million | $254 million | |

Core Funds from Operations per diluted share | $1.54 | $1.64 | |

These estimates reflect management’s view of current market conditions and incorporate certain economic and operational assumptions and projections. Actual results could differ from these estimates. Note that individual quarters may fluctuate on both a cash basis and an accrual basis due to the timing of lease commencements and expirations, repairs and maintenance, capital expenditures, capital markets activities, seasonal general and administrative expenses, and one-time revenue or expense events. In addition, the Company’s guidance is based on information available to management as of the date of this supplemental report.

10

Piedmont Office Realty Trust, Inc.

Key Performance Indicators

Unaudited (in thousands except for per share data)

This section of our supplemental report includes non-GAAP financial measures, including, but not limited to, Core Earnings Before Interest, Taxes, Depreciation, and Amortization (Core EBITDA), Funds from Operations (FFO), Core Funds from Operations (Core FFO), and Adjusted Funds from Operations (AFFO). Definitions of these non-GAAP measures are provided on page 39 and reconciliations are provided beginning on page 41. |

Three Months Ended | ||||||||||||||

3/31/2015 | 12/31/2014 | 9/30/2014 | 6/30/2014 | 3/31/2014 | ||||||||||

Selected Operating Data | ||||||||||||||

Percent leased (1) | 88.8 | % | 87.7 | % | 87.5 | % | 87.0 | % | 86.7 | % | ||||

Percent leased - economic (1) (2) | 80.6 | % | 81.3 | % | 78.7 | % | 78.8 | % | 74.0 | % | ||||

Rental income | $117,807 | $115,915 | $114,529 | $113,287 | $110,904 | |||||||||

Total revenues | $149,759 | $146,711 | $144,641 | $138,580 | $136,320 | |||||||||

Total operating expenses | $121,545 | $117,922 | $117,442 | $112,024 | $111,043 | |||||||||

Real estate operating income | $28,214 | $28,789 | $27,199 | $26,556 | $25,277 | |||||||||

Core EBITDA | $79,314 | $78,613 | $77,613 | $74,745 | $74,098 | |||||||||

Core FFO | $60,099 | $59,618 | $58,814 | $56,614 | $55,054 | |||||||||

Core FFO per share - diluted | $0.39 | $0.39 | $0.38 | $0.37 | $0.36 | |||||||||

AFFO | $45,608 | $41,205 | $21,829 | $23,105 | $32,038 | |||||||||

AFFO per share - diluted | $0.30 | $0.27 | $0.14 | $0.15 | $0.21 | |||||||||

Gross dividends | $32,411 | $32,408 | $30,865 | $30,865 | $30,858 | |||||||||

Dividends per share | $0.210 | $0.210 | $0.200 | $0.200 | $0.200 | |||||||||

Selected Balance Sheet Data | ||||||||||||||

Total real estate assets | $4,094,942 | $4,075,092 | $4,058,414 | $3,968,329 | $3,924,352 | |||||||||

Total gross real estate assets | $5,297,481 | $5,253,356 | $5,197,338 | $5,072,559 | $4,998,289 | |||||||||

Total assets | $4,819,862 | $4,795,501 | $4,778,302 | $4,661,826 | $4,611,945 | |||||||||

Net debt (3) | $2,320,504 | $2,261,802 | $2,226,326 | $2,098,704 | $2,024,503 | |||||||||

Total liabilities | $2,533,939 | $2,483,486 | $2,439,456 | $2,304,641 | $2,232,987 | |||||||||

Ratios | ||||||||||||||

Core EBITDA margin (4) | 53.0 | % | 53.6 | % | 53.7 | % | 53.9 | % | 53.8 | % | ||||

Fixed charge coverage ratio (5) | 4.0 x | 4.0 x | 4.0 x | 4.0 x | 3.8 x | |||||||||

Average net debt to Core EBITDA (6) | 7.2 x | 7.1 x | 6.9 x | 6.8 x | 6.9 x | |||||||||

(1) | Please refer to page 27 for additional leased percentage information. |

(2) | Economic leased percentage excludes the square footage associated with executed but not commenced leases for currently vacant spaces and the square footage associated with tenants receiving rental abatements (after proportional adjustments for tenants receiving only partial rental abatements). Due to variations in rental abatement structures whereby some abatements are provided for the first few months of each lease year as opposed to being provided entirely at the beginning of the lease, there will be variability to the economic leased percentage over time as abatements commence and expire. Please see the Financial Highlights section for details on near-term abatements for large leases. |

(3) | Net debt is calculated as the total principal amount of debt outstanding minus cash and cash equivalents and escrow deposits and restricted cash. The increase in net debt over the last year is primarily attributable to net property acquisitions completed during calendar year 2014 and capital expenditures, both of which were largely funded with debt. |

(4) | Core EBITDA margin is calculated as Core EBITDA divided by total revenues (including revenues associated with discontinued operations). |

(5) | The fixed charge coverage ratio is calculated as Core EBITDA divided by the sum of interest expense, principal amortization, capitalized interest and preferred dividends. The Company had no preferred dividends during any of the periods presented; the Company had capitalized interest of $823,770 for the quarter ended March 31, 2015, $688,177 for the quarter ended December 31, 2014, $541,349 for the quarter ended September 30, 2014, $460,251 for the quarter ended June 30, 2014, and $384,843 for the quarter ended March 31, 2014; the Company had principal amortization of $132,969 for the quarter ended March 31, 2015, $262,284 for the quarter ended December 31, 2014, $193,560 for the quarter ended September 30, 2014, and $64,223 for the quarter ended June 30, 2014. |

(6) | Core EBITDA is annualized for the purposes of this calculation. The average net debt to Core EBITDA ratios for the first, second, third and fourth quarters of 2014 and the first quarter of 2015 are higher than our historical performance on this measure primarily as a result of increased net debt attributable to property acquisitions completed since the beginning of 2014, as well as capital expenditures and stock repurchases, all of which were largely funded with debt. This measure has also been impacted by downtime associated with recent re-tenanting efforts, as well as rent roll downs. For the purposes of this calculation, we use the average daily balance of debt outstanding during the period, less cash and cash equivalents and escrow deposits and restricted cash as of the end of the period. |

11

Piedmont Office Realty Trust, Inc.

Consolidated Balance Sheets

Unaudited (in thousands)

March 31, 2015 | December 31, 2014 | September 30, 2014 | June 30, 2014 | March 31, 2014 | |||||||||||||||

Assets: | |||||||||||||||||||

Real estate, at cost: | |||||||||||||||||||

Land assets | $ | 707,340 | $ | 702,800 | $ | 694,912 | $ | 689,042 | $ | 683,314 | |||||||||

Buildings and improvements | 4,352,822 | 4,312,240 | 4,284,098 | 4,178,684 | 4,120,851 | ||||||||||||||

Buildings and improvements, accumulated depreciation | (1,118,327 | ) | (1,088,062 | ) | (1,053,290 | ) | (1,020,115 | ) | (993,836 | ) | |||||||||

Intangible lease asset | 153,466 | 150,037 | 150,336 | 145,179 | 140,391 | ||||||||||||||

Intangible lease asset, accumulated amortization | (84,212 | ) | (79,860 | ) | (75,409 | ) | (74,132 | ) | (70,360 | ) | |||||||||

Construction in progress | 83,853 | 63,393 | 43,106 | 34,768 | 28,847 | ||||||||||||||

Real estate assets held for sale, gross | — | 24,886 | 24,886 | 24,886 | 24,886 | ||||||||||||||

Real estate assets held for sale, accumulated depreciation & amortization | — | (10,342 | ) | (10,225 | ) | (9,983 | ) | (9,741 | ) | ||||||||||

Total real estate assets | 4,094,942 | 4,075,092 | 4,058,414 | 3,968,329 | 3,924,352 | ||||||||||||||

Investments in and amounts due from unconsolidated joint ventures | 7,820 | 7,798 | 7,638 | 7,549 | 13,855 | ||||||||||||||

Cash and cash equivalents | 7,479 | 12,306 | 8,815 | 8,563 | 9,271 | ||||||||||||||

Tenant receivables, net of allowance for doubtful accounts | 30,132 | 27,711 | 28,403 | 25,024 | 22,196 | ||||||||||||||

Straight line rent receivable | 175,340 | 169,532 | 163,011 | 154,969 | 147,321 | ||||||||||||||

Escrow deposits and restricted cash | 671 | 5,679 | 908 | 911 | 751 | ||||||||||||||

Prepaid expenses and other assets | 26,879 | 27,820 | 36,733 | 32,132 | 28,154 | ||||||||||||||

Goodwill | 180,097 | 180,097 | 180,097 | 180,097 | 180,097 | ||||||||||||||

Interest rate swap | 520 | 430 | 434 | — | 464 | ||||||||||||||

Deferred financing costs, less accumulated amortization | 7,391 | 7,667 | 7,969 | 8,386 | 8,545 | ||||||||||||||

Deferred lease costs, less accumulated amortization | 288,591 | 280,105 | 284,423 | 274,194 | 275,058 | ||||||||||||||

Other assets held for sale | — | 1,264 | 1,457 | 1,672 | 1,881 | ||||||||||||||

Total assets | $ | 4,819,862 | $ | 4,795,501 | $ | 4,778,302 | $ | 4,661,826 | $ | 4,611,945 | |||||||||

Liabilities: | |||||||||||||||||||

Unsecured debt, net of discount | $ | 1,877,318 | $ | 1,828,544 | $ | 1,784,412 | $ | 1,657,408 | $ | 1,617,297 | |||||||||

Secured debt | 448,791 | 449,045 | 449,427 | 449,677 | 412,525 | ||||||||||||||

Accounts payable, accrued expenses, and accrued capital expenditures | 119,466 | 133,988 | 135,320 | 126,273 | 130,530 | ||||||||||||||

Deferred income | 25,970 | 22,215 | 21,958 | 21,923 | 23,042 | ||||||||||||||

Intangible lease liabilities, less accumulated amortization | 42,978 | 43,277 | 44,981 | 43,389 | 45,227 | ||||||||||||||

Interest rate swaps | 19,416 | 6,417 | 3,358 | 5,971 | 4,366 | ||||||||||||||

Total liabilities | 2,533,939 | 2,483,486 | 2,439,456 | 2,304,641 | 2,232,987 | ||||||||||||||

Stockholders' equity: | |||||||||||||||||||

Common stock | 1,543 | 1,543 | 1,543 | 1,543 | 1,543 | ||||||||||||||

Additional paid in capital | 3,667,574 | 3,666,182 | 3,669,541 | 3,668,836 | 3,669,561 | ||||||||||||||

Cumulative distributions in excess of earnings | (1,378,786 | ) | (1,365,620 | ) | (1,345,609 | ) | (1,323,907 | ) | (1,305,321 | ) | |||||||||

Other comprehensive loss | (5,437 | ) | 8,301 | 11,758 | 9,104 | 11,562 | |||||||||||||

Piedmont stockholders' equity | 2,284,894 | 2,310,406 | 2,337,233 | 2,355,576 | 2,377,345 | ||||||||||||||

Non-controlling interest | 1,029 | 1,609 | 1,613 | 1,609 | 1,613 | ||||||||||||||

Total stockholders' equity | 2,285,923 | 2,312,015 | 2,338,846 | 2,357,185 | 2,378,958 | ||||||||||||||

Total liabilities, redeemable common stock and stockholders' equity | $ | 4,819,862 | $ | 4,795,501 | $ | 4,778,302 | $ | 4,661,826 | $ | 4,611,945 | |||||||||

Common stock outstanding at end of period | 154,340 | 154,324 | 154,325 | 154,324 | 154,278 | ||||||||||||||

12

Piedmont Office Realty Trust, Inc.

Consolidated Statements of Income

Unaudited (in thousands except for per share data)

Three Months Ended | ||||||||||||||||||||

3/31/2015 | 12/31/2014 | 9/30/2014 | 6/30/2014 | 3/31/2014 | ||||||||||||||||

Revenues: | ||||||||||||||||||||

Rental income | $ | 117,807 | $ | 115,915 | $ | 114,529 | $ | 113,287 | $ | 110,904 | ||||||||||

Tenant reimbursements | 31,390 | 30,295 | 29,579 | 24,745 | 24,929 | |||||||||||||||

Property management fee revenue | 562 | 501 | 533 | 548 | 487 | |||||||||||||||

149,759 | 146,711 | 144,641 | 138,580 | 136,320 | ||||||||||||||||

Expenses: | ||||||||||||||||||||

Property operating costs | 64,236 | 62,002 | 62,027 | 57,136 | 58,271 | |||||||||||||||

Depreciation | 36,232 | 35,442 | 35,366 | 34,144 | 33,644 | |||||||||||||||

Amortization | 14,670 | 14,172 | 14,235 | 13,599 | 14,573 | |||||||||||||||

General and administrative | 6,407 | 6,306 | 5,814 | 7,145 | 4,555 | |||||||||||||||

121,545 | 117,922 | 117,442 | 112,024 | 111,043 | ||||||||||||||||

Real estate operating income | 28,214 | 28,789 | 27,199 | 26,556 | 25,277 | |||||||||||||||

Other income / (expense): | ||||||||||||||||||||

Interest expense | (19,016 | ) | (18,854 | ) | (18,654 | ) | (18,012 | ) | (18,926 | ) | ||||||||||

Other income / (expense) | (181 | ) | (6 | ) | 524 | (366 | ) | (90 | ) | |||||||||||

Net recoveries / (loss) from casualty events and litigation settlements (1) | — | 2,478 | (8 | ) | 1,480 | 3,042 | ||||||||||||||

Equity in income / (loss) of unconsolidated joint ventures | 159 | 160 | 89 | (333 | ) | (266 | ) | |||||||||||||

(19,038 | ) | (16,222 | ) | (18,049 | ) | (17,231 | ) | (16,240 | ) | |||||||||||

Income from continuing operations | 9,176 | 12,567 | 9,150 | 9,325 | 9,037 | |||||||||||||||

Discontinued operations: | ||||||||||||||||||||

Operating income, excluding impairment loss | — | (42 | ) | 16 | 514 | 466 | ||||||||||||||

Gain / (loss) on sale of properties | — | — | — | 1,304 | (106 | ) | ||||||||||||||

Income / (loss) from discontinued operations (2) | — | (42 | ) | 16 | 1,818 | 360 | ||||||||||||||

Gain on sale of real estate | 10,073 | (8 | ) | — | 1,140 | — | ||||||||||||||

Net income | 19,249 | 12,517 | 9,166 | 12,283 | 9,397 | |||||||||||||||

Less: Net income attributable to noncontrolling interest | (4 | ) | (3 | ) | (4 | ) | (4 | ) | (4 | ) | ||||||||||

Net income attributable to Piedmont | $ | 19,245 | $ | 12,514 | $ | 9,162 | $ | 12,279 | $ | 9,393 | ||||||||||

Weighted average common shares outstanding - diluted | 154,580 | 154,520 | 154,561 | 154,445 | 155,025 | |||||||||||||||

Net income per share available to common stockholders - diluted | $ | 0.12 | $ | 0.08 | $ | 0.06 | $ | 0.08 | $ | 0.06 | ||||||||||

(1) | Presented on this line are net expenses and insurance reimbursements related to 1) two class action lawsuits settled in 2013 and 2) damage caused by Hurricane Sandy in October 2012. |

(2) | Reflects operating results for 11107 and 11109 Sunset Hills Road in Reston, VA, which were sold on March 19, 2014; and 1441 West Long Lake Road and 4685 Investment Drive in Troy, MI, which were sold on April 30, 2014. In the future, it is less likely that any additional single-asset or small portfolio dispositions will be reclassed to discontinued operations; please find additional information on this change in the Financing and Capital Activity section of Financial Highlights. |

13

Piedmont Office Realty Trust, Inc.

Consolidated Statements of Income

Unaudited (in thousands except for per share data)

Three Months Ended | ||||||||||||

3/31/2015 | 3/31/2014 | Change ($) | Change (%) | |||||||||

Revenues: | ||||||||||||

Rental income | $ | 117,807 | $ | 110,904 | $ | 6,903 | 6.2 | % | ||||

Tenant reimbursements | 31,390 | 24,929 | 6,461 | 25.9 | % | |||||||

Property management fee revenue | 562 | 487 | 75 | 15.4 | % | |||||||

149,759 | 136,320 | 13,439 | 9.9 | % | ||||||||

Expenses: | ||||||||||||

Property operating costs | 64,236 | 58,271 | (5,965 | ) | (10.2 | )% | ||||||

Depreciation | 36,232 | 33,644 | (2,588 | ) | (7.7 | )% | ||||||

Amortization | 14,670 | 14,573 | (97 | ) | (0.7 | )% | ||||||

General and administrative | 6,407 | 4,555 | (1,852 | ) | (40.7 | )% | ||||||

121,545 | 111,043 | (10,502 | ) | (9.5 | )% | |||||||

Real estate operating income | 28,214 | 25,277 | 2,937 | 11.6 | % | |||||||

Other income / (expense): | ||||||||||||

Interest expense | (19,016 | ) | (18,926 | ) | (90 | ) | (0.5 | )% | ||||

Other income / (expense) | (181 | ) | (90 | ) | (91 | ) | (101.1 | )% | ||||

Net recoveries / (loss) from casualty events and litigation settlements (1) | — | 3,042 | (3,042 | ) | (100.0 | )% | ||||||

Equity in income / (loss) of unconsolidated joint ventures | 159 | (266 | ) | 425 | 159.8 | % | ||||||

(19,038 | ) | (16,240 | ) | (2,798 | ) | (17.2 | )% | |||||

Income from continuing operations | 9,176 | 9,037 | 139 | 1.5 | % | |||||||

Discontinued operations: | ||||||||||||

Operating income, excluding impairment loss | — | 466 | (466 | ) | (100.0 | )% | ||||||

Gain / (loss) on sale of properties | — | (106 | ) | 106 | 100.0 | % | ||||||

Income / (loss) from discontinued operations (2) | — | 360 | (360 | ) | (100.0 | )% | ||||||

Gain on sale of real estate | 10,073 | — | 10,073 | — | % | |||||||

Net income | 19,249 | 9,397 | 9,852 | 104.8 | % | |||||||

Less: Net income attributable to noncontrolling interest | (4 | ) | (4 | ) | — | — | % | |||||

Net income attributable to Piedmont | $ | 19,245 | $ | 9,393 | $ | 9,852 | 104.9 | % | ||||

Weighted average common shares outstanding - diluted | 154,580 | 155,025 | ||||||||||

Net income per share available to common stockholders - diluted | $ | 0.12 | $ | 0.06 | ||||||||

(1) | Presented on this line are net expenses and insurance reimbursements related to 1) two class action lawsuits settled in 2013 and 2) damage caused by Hurricane Sandy in October 2012. |

(2) | Reflects operating results for 11107 and 11109 Sunset Hills Road in Reston, VA, which were sold on March 19, 2014; and 1441 West Long Lake Road and 4685 Investment Drive in Troy, MI, which were sold on April 30, 2014. In the future, it is less likely that any additional single-asset or small portfolio dispositions will be reclassed to discontinued operations; please find additional information on this change in the Financing and Capital Activity section of Financial Highlights. |

14

Piedmont Office Realty Trust, Inc.

Funds From Operations, Core Funds From Operations and Adjusted Funds From Operations

Unaudited (in thousands except for per share data)

Three Months Ended | ||||||||

3/31/2015 | 3/31/2014 | |||||||

Net income attributable to Piedmont | $ | 19,245 | $ | 9,393 | ||||

Depreciation (1) (2) | 36,097 | 33,727 | ||||||

Amortization (1) | 14,686 | 14,804 | ||||||

Loss / (gain) on sale of properties (1) | (10,073 | ) | 106 | |||||

Funds from operations | 59,955 | 58,030 | ||||||

Adjustments: | ||||||||

Acquisition costs | 144 | 66 | ||||||

Net (recoveries) / loss from casualty events and litigation settlements (1) | — | (3,042 | ) | |||||

Core funds from operations | 60,099 | 55,054 | ||||||

Adjustments: | ||||||||

Deferred financing cost amortization | 724 | 863 | ||||||

Amortization of note payable step-up | (121 | ) | — | |||||

Amortization of discount on senior notes | 48 | 34 | ||||||

Depreciation of non real estate assets | 196 | 114 | ||||||

Straight-line effects of lease revenue (1) | (4,510 | ) | (9,412 | ) | ||||

Stock-based and other non-cash compensation expense | 725 | 636 | ||||||

Amortization of lease-related intangibles (1) | (1,122 | ) | (1,364 | ) | ||||

Acquisition costs | (144 | ) | (66 | ) | ||||

Non-incremental capital expenditures (3) | (10,287 | ) | (13,821 | ) | ||||

Adjusted funds from operations | $ | 45,608 | $ | 32,038 | ||||

Weighted average common shares outstanding - diluted | 154,580 | 155,025 | ||||||

Funds from operations per share (diluted) | $ | 0.39 | $ | 0.37 | ||||

Core funds from operations per share (diluted) | $ | 0.39 | $ | 0.36 | ||||

Adjusted funds from operations per share (diluted) | $ | 0.30 | $ | 0.21 | ||||

(1) | Includes adjustments for consolidated properties, including discontinued operations, and for our proportionate share of amounts attributable to unconsolidated joint ventures. |

(2) | Excludes depreciation of non real estate assets. |

(3) | Non-incremental capital expenditures are defined on page 39. |

15

Piedmont Office Realty Trust, Inc.

Same Store Net Operating Income (Cash Basis)

Unaudited (in thousands)

Three Months Ended | |||||||

3/31/2015 | 3/31/2014 | ||||||

Net income attributable to Piedmont | $ | 19,245 | $ | 9,393 | |||

Net income attributable to noncontrolling interest | 4 | 4 | |||||

Interest expense (1) | 19,016 | 18,926 | |||||

Depreciation (1) | 36,292 | 33,841 | |||||

Amortization (1) | 14,686 | 14,804 | |||||

Acquisition costs | 144 | 66 | |||||

Net (recoveries) / loss from casualty events and litigation settlements (1) | — | (3,042 | ) | ||||

Loss / (gain) on sale of properties (1) | (10,073 | ) | 106 | ||||

Core EBITDA | 79,314 | 74,098 | |||||

General & administrative expenses (1) | 6,416 | 4,582 | |||||

Management fee revenue (2) | (330 | ) | (259 | ) | |||

Other (income) / expense (1) (3) | 38 | 30 | |||||

Straight-line effects of lease revenue (1) | (4,510 | ) | (9,412 | ) | |||

Amortization of lease-related intangibles (1) | (1,122 | ) | (1,364 | ) | |||

Property net operating income (cash basis) | 79,806 | 67,675 | |||||

Change period over period | 17.9 | % | N/A | ||||

Deduct net operating (income) / loss from: | |||||||

Acquisitions (4) | (2,665 | ) | — | ||||

Dispositions (5) | (230 | ) | (1,560 | ) | |||

Other investments (6) | (296 | ) | 383 | ||||

Same store net operating income (cash basis) | $ | 76,615 | $ | 66,498 | |||

Change period over period | 15.2 | % | N/A | ||||

(1) | Includes amounts attributable to consolidated properties, including discontinued operations, and our proportionate share of amounts attributable to unconsolidated joint ventures. |

(2) | Presented net of related operating expenses incurred to earn the revenue; therefore, the information presented on this line will not tie to the data presented on the income statements. |

(3) | Figures presented on this line may not tie back to the relevant sources as some activity is attributable to property operations and is, therefore, presented in property net operating income. |

(4) | Acquisitions consist of 5 Wall Street in Burlington, MA, purchased on June 27, 2014; 1155 Perimeter Center West in Atlanta, GA, purchased on August 28, 2014; TownPark Land in Lake Mary, FL, purchased on November 21, 2014; and Park Place on Turtle Creek in Dallas, TX, purchased on January 16, 2015. |

(5) | Dispositions consist of 11107 and 11109 Sunset Hills Road in Reston, VA, sold on March 19, 2014; 1441 West Long Lake Road and 4685 Investment Drive in Troy, MI, sold on April 30, 2014; 2020 West 89th Street in Leawood, KS, sold on May 19, 2014; and 3900 Dallas Parkway in Plano, TX, sold on January 30, 2015. |

(6) | Other investments consist of operating results from our investments in unconsolidated joint ventures and our redevelopment projects. Additional information on our unconsolidated joint ventures and redevelopment projects can be found on page 38. The operating results from both the office and retail portions of 3100 Clarendon Boulevard in Arlington, VA, are included in this line item. |

16

Piedmont Office Realty Trust, Inc.

Same Store Net Operating Income (Cash Basis)

Unaudited (in thousands)

Same Store Net Operating Income (Cash Basis) | |||||||||||

Contributions from Seven of the Largest Markets | Three Months Ended | ||||||||||

3/31/2015 | 3/31/2014 | ||||||||||

$ | % | $ | % | ||||||||

Washington, D.C. (1) | $ | 12,467 | 16.3 | $ | 13,392 | 20.1 | |||||

New York | 11,792 | 15.4 | 12,028 | 18.1 | |||||||

Chicago (2) (3) | 10,763 | 14.0 | 3,634 | 5.5 | |||||||

Dallas (4) | 6,100 | 8.0 | 4,308 | 6.5 | |||||||

Boston | 5,924 | 7.7 | 5,786 | 8.7 | |||||||

Minneapolis (5) | 4,635 | 6.1 | 5,508 | 8.3 | |||||||

Los Angeles | 4,149 | 5.4 | 3,583 | 5.4 | |||||||

Other (6) | 20,785 | 27.1 | 18,259 | 27.4 | |||||||

Total | $ | 76,615 | 100.0 | $ | 66,498 | 100.0 | |||||

(1) | The decrease in Washington, D.C. Same Store Net Operating Income for the three months ended March 31, 2015 as compared to the same period in 2014 was primarily attributable to lease expirations at 9200 Corporate Boulevard and 9211 Corporate Boulevard in Rockville, MD, as well as a lease contraction at 4250 North Fairfax Drive in Arlington, VA. |

(2) | The increase in Chicago Same Store Net Operating Income for the three months ended March 31, 2015 as compared to the same period in 2014 was primarily related to the expiration of rental abatement and operating expense recovery abatement periods associated with several leases at 500 West Monroe Street in Chicago, IL, Aon Center in Chicago, IL, and Windy Point II in Schaumburg, IL. |

(3) | The percentage contribution from Chicago to our total Same Store Net Operating Income is smaller than our geographic concentration percentage in Chicago, which is presented on an ALR basis (see page 34), primarily because of the large number of leases with gross rent abatements and a number of leases yet to commence for currently vacant spaces (the projected gross rent for which is included in our ALR calculation). As the gross rent abatements burn off and as the executed but not commenced leases begin, the Same Store Net Operating Income percentage contribution from Chicago should increase and should be more closely aligned with our Chicago concentration percentage as presented on page 34. |

(4) | The increase in Dallas Same Store Net Operating Income for the three months ended March 31, 2015 as compared to the same period in 2014 was primarily related to the commencement of a new lease with Epsilon Data Management at 6021 Connection Drive in Irving, TX, in addition to increased economic occupancy associated with recent leasing activity at One Lincoln Park in Dallas, TX. |

(5) | The decrease in Minneapolis Same Store Net Operating Income for the three months ended March 31, 2015 as compared to the same period in 2014 was primarily due to a renewal-related contraction by US Bancorp and downtime and/or rental abatements associated with several replacement leases for spaces formerly occupied by US Bancorp at US Bancorp Center in Minneapolis, MN. |

(6) | The increase in Other Same Store Net Operating Income for the three months ended March 31, 2015 as compared to the same period in 2014 was primarily attributable to increased rental income as a result of: 1) increased economic occupancy associated with recent leasing activity at The Medici in Atlanta, GA, 2) the restructured lease with Independence Blue Cross at 1901 Market Street in Philadelphia, PA, and 3) a tenant expansion at Chandler Forum in Chandler, AZ. |

17

Piedmont Office Realty Trust, Inc.

Same Store Net Operating Income (Accrual Basis)

Unaudited (in thousands)

Three Months Ended | |||||||

3/31/2015 | 3/31/2014 | ||||||

Net income attributable to Piedmont | $ | 19,245 | $ | 9,393 | |||

Net income attributable to noncontrolling interest | 4 | 4 | |||||

Interest expense (1) | 19,016 | 18,926 | |||||

Depreciation (1) | 36,292 | 33,841 | |||||

Amortization (1) | 14,686 | 14,804 | |||||

Acquisition costs | 144 | 66 | |||||

Net (recoveries) / loss from casualty events and litigation settlements (1) | — | (3,042 | ) | ||||

Loss / (gain) on sale of properties (1) | (10,073 | ) | 106 | ||||

Core EBITDA | 79,314 | 74,098 | |||||

General & administrative expenses (1) | 6,416 | 4,582 | |||||

Management fee revenue (2) | (330 | ) | (259 | ) | |||

Other (income) / expense (1) (3) | 38 | 30 | |||||

Property net operating income (accrual basis) | 85,438 | 78,451 | |||||

Change period over period | 8.9 | % | N/A | ||||

Deduct net operating (income) / loss from: | |||||||

Acquisitions (4) | (2,909 | ) | — | ||||

Dispositions (5) | (178 | ) | (1,422 | ) | |||

Other investments (6) | (299 | ) | 373 | ||||

Same store net operating income (accrual basis) | $ | 82,052 | $ | 77,402 | |||

Change period over period | 6.0 | % | N/A | ||||

(1) | Includes amounts attributable to consolidated properties, including discontinued operations, and our proportionate share of amounts attributable to unconsolidated joint ventures. |

(2) | Presented net of related operating expenses incurred to earn the revenue; therefore, the information presented on this line will not tie to the data presented on the income statements. |

(3) | Figures presented on this line may not tie back to the relevant sources as some activity is attributable to property operations and is, therefore, presented in property net operating income. |

(4) | Acquisitions consist of 5 Wall Street in Burlington, MA, purchased on June 27, 2014; 1155 Perimeter Center West in Atlanta, GA, purchased on August 28, 2014; TownPark Land in Lake Mary, FL, purchased on November 21, 2014; and Park Place on Turtle Creek in Dallas, TX, purchased on January 16, 2015. |

(5) | Dispositions consist of 11107 and 11109 Sunset Hills Road in Reston, VA, sold on March 19, 2014; 1441 West Long Lake Road and 4685 Investment Drive in Troy, MI, sold on April 30, 2014; 2020 West 89th Street in Leawood, KS, sold on May 19, 2014; and 3900 Dallas Parkway in Plano, TX, sold on January 30, 2015. |

(6) | Other investments consist of operating results from our investments in unconsolidated joint ventures and our redevelopment projects. Additional information on our unconsolidated joint ventures and redevelopment projects can be found on page 38. The operating results from both the office and retail portions of 3100 Clarendon Boulevard in Arlington, VA, are included in this line item. |

18

Piedmont Office Realty Trust, Inc.

Same Store Net Operating Income (Accrual Basis)

Unaudited (in thousands)

Same Store Net Operating Income (Accrual Basis) | |||||||||||

Contributions from Seven of the Largest Markets | Three Months Ended | ||||||||||

3/31/2015 | 3/31/2014 | ||||||||||

$ | % | $ | % | ||||||||

Washington, D.C. (1) | $ | 13,151 | 16.0 | $ | 13,594 | 17.6 | |||||

Chicago (2) (3) | 13,117 | 16.0 | 8,758 | 11.3 | |||||||

New York (4) | 11,126 | 13.5 | 13,351 | 17.2 | |||||||

Dallas (5) | 6,414 | 7.8 | 4,912 | 6.3 | |||||||

Boston | 6,122 | 7.5 | 6,121 | 7.9 | |||||||

Minneapolis (6) | 5,088 | 6.2 | 5,955 | 7.7 | |||||||

Los Angeles | 4,247 | 5.2 | 4,142 | 5.4 | |||||||

Other (7) | 22,787 | 27.8 | 20,569 | 26.6 | |||||||

Total | $ | 82,052 | 100.0 | $ | 77,402 | 100.0 | |||||

(1) | The decrease in Washington, D.C. Same Store Net Operating Income for the three months ended March 31, 2015 as compared to the same period in 2014 was primarily attributable to lease expirations at 9200 Corporate Boulevard and 9211 Corporate Boulevard in Rockville, MD, and a lease contraction at 4250 North Fairfax Drive in Arlington, VA, partially offset by increased rental income at Two Independence Square in Washington, D.C., attributable to the phased commencement of the NASA lease renewal at a higher rental rate. |

(2) | The increase in Chicago Same Store Net Operating Income for the three months ended March 31, 2015 as compared to the same period in 2014 was primarily related to increased rental income due to the commencement of several leases and/or the expiration of operating expense recovery abatement periods associated with several leases at 500 West Monroe Street in Chicago, IL, Aon Center in Chicago, IL, and Windy Point II in Schaumburg, IL. |

(3) | The percentage contribution from Chicago to our total Same Store Net Operating Income is smaller than our geographic concentration percentage in Chicago, which is presented on an ALR basis (see page 34), primarily because of the large number of leases with operating expense recovery abatements (which abatements are not included in straight line rent adjustments) and a number of leases yet to commence for currently vacant spaces (the projected gross rents for which are included in our ALR calculation). As the operating expense recovery abatements burn off and as the executed but not commenced leases begin, the Same Store Net Operating Income percentage contribution from Chicago should increase and should be more closely aligned with our Chicago concentration percentage as presented on page 34. |

(4) | The decrease in New York Same Store Net Operating Income for the three months ended March 31, 2015 as compared to the same period in 2014 was primarily attributable to the downtime between the expiration of several leases and the commencement of replacement leases at 60 Broad Street in New York, NY. |

(5) | The increase in Dallas Same Store Net Operating Income for the three months ended March 31, 2015 as compared to the same period in 2014 was primarily related to the commencement of a new lease with Epsilon Data Management at 6021 Connection Drive in Irving, TX, in addition to increased rental income associated with new leasing activity at One Lincoln Park in Dallas, TX. |

(6) | The decrease in Minneapolis Same Store Net Operating Income for the three months ended March 31, 2015 as compared to the same period in 2014 was primarily due to a renewal-related contraction by US Bancorp and downtime associated with several replacement leases for spaces formerly occupied by US Bancorp at US Bancorp Center in Minneapolis, MN. |

(7) | The increase in Other Same Store Net Operating Income for the three months ended March 31, 2015 as compared to the same period in 2014 was primarily attributable to greater rental income as a result of: 1) recent new-tenant leasing activity at The Medici in Atlanta, GA, 400 TownPark in Lake Mary, FL, and 150 West Jefferson in Detroit, MI, 2) the restructured lease with Independence Blue Cross at 1901 Market Street in Philadelphia, PA, and 3) a tenant expansion at Chandler Forum in Chandler, AZ. |

19

Piedmont Office Realty Trust, Inc.

Capitalization Analysis

Unaudited (in thousands except for per share data)

As of | As of | |||||||

March 31, 2015 | December 31, 2014 | |||||||

Common stock price (1) | $ | 18.61 | $ | 18.84 | ||||

Total shares outstanding | 154,340 | 154,324 | ||||||

Equity market capitalization (1) | $ | 2,872,258 | $ | 2,907,466 | ||||

Total debt - principal amount outstanding | $ | 2,328,654 | $ | 2,279,787 | ||||

Total market capitalization (1) | $ | 5,200,912 | $ | 5,187,253 | ||||

Total debt / Total market capitalization (1) | 44.8 | % | 43.9 | % | ||||

Total gross real estate assets | $ | 5,297,481 | $ | 5,253,356 | ||||

Total debt / Total gross real estate assets (2) | 44.0 | % | 43.4 | % | ||||

Total debt / Total gross assets (3) | 38.7 | % | 38.2 | % | ||||

(1) | Reflects common stock closing price as of the end of the reporting period. |

(2) | Gross real estate assets is defined as total real estate assets with the add back of accumulated depreciation and accumulated amortization related to real estate assets. |

(3) | Gross assets is defined as total assets with the add back of accumulated depreciation and accumulated amortization related to real estate assets. |

20

Piedmont Office Realty Trust, Inc.

Debt Summary

As of March 31, 2015

Unaudited ($ in thousands)

Floating Rate & Fixed Rate Debt

Debt (1) | Principal Amount Outstanding | Weighted Average Stated Interest Rate | Weighted Average Maturity | ||

Floating Rate | $533,000 | (2) | 1.34% | 31.5 months | |

Fixed Rate | 1,795,654 | 3.90% | 65.6 months | ||

Total | $2,328,654 | 3.31% | 57.8 months | ||

Unsecured & Secured Debt

Debt (1) | Principal Amount Outstanding | Weighted Average Stated Interest Rate | Weighted Average Maturity | |||

Unsecured | $1,883,000 | 2.78% | (3) | 66.5 months | ||

Secured | 445,654 | 5.56% | 21.0 months | |||

Total | $2,328,654 | 3.31% | 57.8 months | |||

Debt Maturities

Maturity Year | Secured Debt - Principal Amount Outstanding (1) | Unsecured Debt - Principal Amount Outstanding (1) | Weighted Average Stated Interest Rate | Percentage of Total | |

2015 | $105,000 | $— | 5.29% | 4.5% | |

2016 | 167,525 | — | 5.55% | 7.2% | |

2017 | 140,000 | 363,000 | (4) | 2.58% | 21.6% |

2018 | — | 170,000 | 1.31% | 7.3% | |

2019 | — | 300,000 | 2.78% | 12.9% | |

2020 + | 33,129 | 1,050,000 | 3.57% | 46.5% | |

Total | $445,654 | $1,883,000 | 3.31% | 100.0% | |

(1) | All of Piedmont's outstanding debt as of March 31, 2015 was interest-only debt with the exception of the $33.1 million mortgage associated with 5 Wall Street located in Burlington, MA. |

(2) | Amount represents the outstanding balance as of March 31, 2015, on the $500 million unsecured revolving credit facility and the $170 million unsecured term loan. Two other loans, the $300 million unsecured term loan that closed in 2011 and the $300 million unsecured term loan that closed in 2013, have stated variable rates. However, Piedmont entered into $300 million in notional amount of interest rate swap agreements which effectively fix the interest rate on the 2011 unsecured term loan at 2.39% through November 22, 2016 (please see page 22 for information on additional swap agreements for this loan that will become effective after November 22, 2016), assuming no credit rating change for the Company, and $300 million in notional amount of interest rate swap agreements which effectively fix the interest rate on the 2013 unsecured term loan at 2.78% through its maturity date of January 31, 2019, assuming no credit rating change for the Company. The 2011 unsecured term loan and the 2013 unsecured term loan, therefore, are reflected as fixed rate debt. Please note that Piedmont currently has $250 million of forward-starting swaps for a 2015 fixed-rate financing and $250 million of forward-starting swaps for a 2016 fixed-rate financing. After taking into account these forward-starting swaps and the use of the proceeds from the related planned financings, the Company's effective exposure to floating interest rates is much less than the current amount of floating-rate debt. |

(3) | The weighted average interest rate is a weighted average rate for amounts outstanding under our $500 million unsecured revolving credit facility, our unsecured senior notes and our unsecured term loans. As presented herein, the weighted average stated interest rate is calculated based upon the principal amounts outstanding. |

(4) | The initial maturity date of the $500 million unsecured revolving credit facility is August 19, 2016; however, there are two, six-month extension options available under the facility providing for a final extended maturity date of August 21, 2017. For the purposes of this schedule, we reflect the maturity date of the facility as the final extended maturity date of August 2017. |

21

Piedmont Office Realty Trust, Inc.

Debt Detail

Unaudited ($ in thousands)

Facility | Property | Stated Rate (1) | Maturity | Principal Amount Outstanding as of March 31, 2015 | ||||

Secured | ||||||||

$105.0 Million Fixed-Rate Loan | US Bancorp Center | 5.29 | % | 5/11/2015 | $ | 105,000 | ||

$125.0 Million Fixed-Rate Loan | Four Property Collateralized Pool (2) | 5.50 | % | 4/1/2016 | 125,000 | |||

$42.5 Million Fixed-Rate Loan | Las Colinas Corporate Center I & II | 5.70 | % | 10/11/2016 | 42,525 | |||

$140.0 Million WDC Fixed-Rate Loans | 1201 & 1225 Eye Street | 5.76 | % | 11/1/2017 | 140,000 | |||

$35.0 Million Fixed-Rate Loan (3) | 5 Wall Street | 5.55 | % | 9/1/2021 | 33,129 | |||

Subtotal / Weighted Average (4) | 5.56 | % | $ | 445,654 | ||||

Unsecured | ||||||||

$500.0 Million Unsecured Line of Credit (5) | N/A | 1.36 | % | (6) | 8/21/2017 | $ | 363,000 | |

$170.0 Million Unsecured 2015 Term Loan | N/A | 1.31 | % | (7) | 5/15/2018 | 170,000 | ||

$300.0 Million Unsecured 2013 Term Loan | N/A | 2.78 | % | (8) | 1/31/2019 | 300,000 | ||

$300.0 Million Unsecured 2011 Term Loan | N/A | 2.39 | % | (9) | 1/15/2020 | 300,000 | ||

$350.0 Million Unsecured Senior Notes | N/A | 3.40 | % | (10) | 6/1/2023 | 350,000 | ||

$400.0 Million Unsecured Senior Notes | N/A | 4.45 | % | (11) | 3/15/2024 | 400,000 | ||

Subtotal / Weighted Average (4) | 2.78 | % | $ | 1,883,000 | ||||

Total Debt - Principal Amount Outstanding / Weighted Average Stated Rate (4) | 3.31 | % | $ | 2,328,654 | ||||

GAAP Accounting Adjustments (12) | (2,545 | ) | ||||||

Total Debt - GAAP Amount Outstanding | $ | 2,326,109 | ||||||

(1) | All of Piedmont’s outstanding debt as of March 31, 2015, was interest-only debt with the exception of the $33.1 million of debt associated with 5 Wall Street located in Burlington, MA. |

(2) | The four property collateralized pool includes 1430 Enclave Parkway, Windy Point I and II, and 1055 East Colorado Boulevard. |

(3) | The loan is amortizing based on a 25-year amortization schedule. |

(4) | Weighted average is based on the principal amount outstanding and interest rate at March 31, 2015. |

(5) | All of Piedmont’s outstanding debt as of March 31, 2015, was term debt with the exception of $363 million outstanding on our unsecured revolving credit facility. The $500 million unsecured revolving credit facility has an initial maturity date of August 19, 2016; however, there are two, six-month extension options available under the facility providing for a total extension of up to one year to August 21, 2017. The final extended maturity date is presented on this schedule. |

(6) | The interest rate presented for the $500 million unsecured revolving credit facility is the weighted average interest rate for all outstanding draws as of March 31, 2015. Piedmont may select from multiple interest rate options with each draw under the facility, including the prime rate and various length LIBOR locks. All LIBOR selections are subject to an additional spread (1.175% as of March 31, 2015) over the selected rate based on Piedmont’s current credit rating. |

(7) | The $170 million unsecured term loan has a variable interest rate. Piedmont may select from multiple interest rate options under the facility, including the prime rate and various length LIBOR locks. All LIBOR selections are subject to an additional spread (1.125% as of March 31, 2015) over the selected rate based on Piedmont’s current credit rating. |

(8) | The $300 million unsecured term loan that closed in 2013 has a stated variable rate; however, Piedmont entered into interest rate swap agreements which effectively fix the interest rate on this loan at 2.78% through its maturity date of January 31, 2019, assuming no credit rating change for the Company. |

(9) | The $300 million unsecured term loan that closed in 2011 has a stated variable rate; however, Piedmont entered into interest rate swap agreements which effectively fix the interest rate on this loan at 2.39% until November 22, 2016, assuming no credit rating change for the Company. Additionally, for the period from November 22, 2016 to January 15, 2020, Piedmont has entered into interest rate swap agreements which effectively fix the interest rate on this loan at 3.35%, assuming no credit rating change for the Company. |

(10) | The $350 million unsecured senior notes were offered for sale at 99.601% of the principal amount. The resulting effective cost of the financing is approximately 3.45% before the consideration of transaction costs and proceeds from interest rate hedges. After the application of proceeds from interest rate hedges, the effective cost of the financing is approximately 3.43%. |

(11) | The $400 million unsecured senior notes were offered for sale at 99.791% of the principal amount. The resulting effective cost of the financing is approximately 4.48% before the consideration of transaction costs and proceeds from interest rate hedges. After the application of proceeds from interest rate hedges, the effective cost of the financing is approximately 4.10%. |

(12) | The GAAP accounting adjustments relate to the original issue discounts and fees associated with the $350 million unsecured senior notes, the $400 million unsecured senior notes, the $300 million unsecured 2011 term loan and the $170 million unsecured term loan, along with debt fair value adjustments associated with the assumed 5 Wall Street debt. The original issue discounts and fees, along with the debt fair value adjustments, will be amortized to interest expense over the contractual term of the related debt. |

22

Piedmont Office Realty Trust, Inc.

Debt Analysis

As of March 31, 2015

Unaudited

Bank Debt Covenant Compliance (1) | Required | Actual |

Maximum Leverage Ratio | 0.60 | 0.43 |

Minimum Fixed Charge Coverage Ratio (2) | 1.50 | 3.65 |

Maximum Secured Indebtedness Ratio | 0.40 | 0.08 |

Minimum Unencumbered Leverage Ratio | 1.60 | 2.35 |

Minimum Unencumbered Interest Coverage Ratio (3) | 1.75 | 4.62 |

Bond Covenant Compliance (4) | Required | Actual |

Total Debt to Total Assets | 60% or less | 43.7% |

Secured Debt to Total Assets | 40% or less | 8.5% |

Ratio of Consolidated EBITDA to Interest Expense | 1.50 or greater | 4.29 |

Unencumbered Assets to Unsecured Debt | 150% or greater | 248% |

Three Months Ended | Year Ended | |

Other Debt Coverage Ratios | March 31, 2015 | December 31, 2014 |

Average net debt to core EBITDA (5) | 7.2 x | 6.9 x |

Fixed charge coverage ratio (6) | 4.0 x | 4.0 x |

Interest coverage ratio (7) | 4.0 x | 4.0 x |

(1) | Debt covenant compliance calculations relate to specific calculations detailed in the relevant credit agreements. |

(2) | Defined as EBITDA for the trailing four quarters (including the Company's share of EBITDA from unconsolidated interests), less one-time or non-recurring gains or losses, less a $0.15 per square foot capital reserve, and excluding the impact of straight line rent leveling adjustments and amortization of intangibles divided by the Company's share of fixed charges, as more particularly described in the credit agreements. This definition of fixed charge coverage ratio as prescribed by our credit agreements is different from the fixed charge coverage ratio definition employed elsewhere within this report. |

(3) | Defined as net operating income for the trailing four quarters for unencumbered assets (including the Company's share of net operating income from partially-owned entities and subsidiaries that are deemed to be unencumbered) less a $0.15 per square foot capital reserve divided by the Company's share of interest expense associated with unsecured financings only, as more particularly described in the credit agreements. |

(4) | Please refer to the Indenture dated May 9, 2013, and the Indenture and the Supplemental Indenture dated March 6, 2014, for additional information on the relevant calculations. |