Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PEAPACK GLADSTONE FINANCIAL CORP | form8k-13870_pgfc.htm |

Executing Our Strategy “Expanding Our Reach” Annual Meeting April 28, 2015 P EAPACK - G LADSTONE B ANK

A high - performing boutique bank, leaders in wealth, lending and deposit solutions, known nationally for our unparalleled client service, integrity and trust. Confidential 2 Vision Statement

• Wealth led relationship - based commercial bank headquartered in “wealth belt” of New Jersey delivering private bank level service • 94 years in business • Strong leadership team • Growth Strategy – “Expanding Our Reach” – launched in Q1 2013 • Four Private Banking locations: Bedminster, Morristown, Princeton, Teaneck • 23 Branches in five affluent New Jersey counties: Somerset, Morris, Hunterdon, Union, Middlesex • Douglas L. Kennedy, President & CEO, 36 years experience, previously with Capital One Bank/North Fork, Bank of America/Fleet, Summit Bank • John P. Babcock, President of Private Wealth Management, 35 years experience, previously with HSBC Private Bank, US Trust/Bank of America • Jeffrey J. Carfora, CPA, CFO, 35 years experience, previously with Penn Fed Financial Services, Carteret Bank, Marine Midland Bank, PricewaterhouseCoopers • Finn M. W. Caspersen, Jr., COO & General Counsel, 20 years experience, previously with Hale and Dorr, Merrill Lynch, Bencas Capital Company Profile Confidential 3

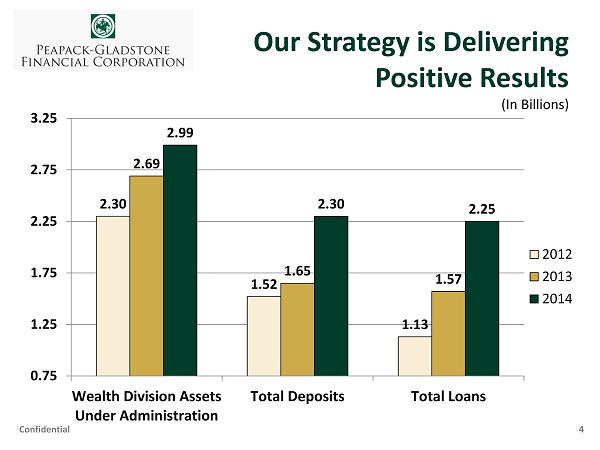

4 Confidential Our Strategy is Delivering Positive Results (In Billions) 2.30 1.52 1.13 2.69 1.65 1.57 2.99 2.30 2.25 0.75 1.25 1.75 2.25 2.75 3.25 Wealth Division Assets Under Administration Total Deposits Total Loans 2012 2013 2014

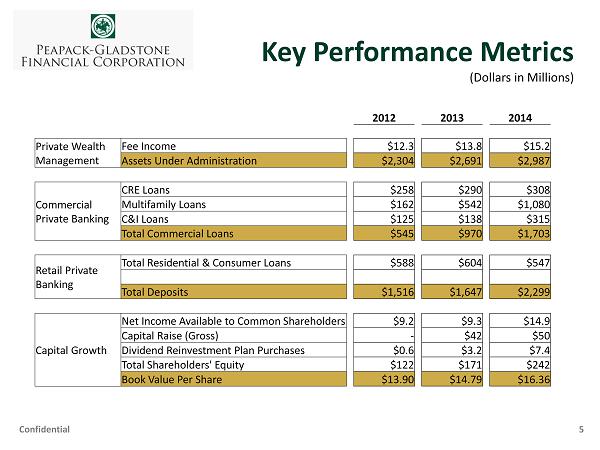

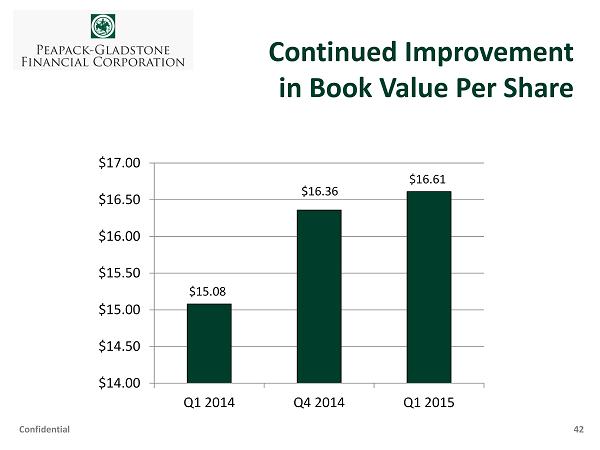

Key Performance Metrics (Dollars in Millions) Confidential 5 2012 2013 2014 Private Wealth Management Fee Income $12.3 $13.8 $15.2 Assets Under Administration $2,304 $2,691 $2,987 Commercial Private Banking CRE Loans $258 $290 $308 Multifamily Loans $162 $542 $1,080 C&I Loans $125 $138 $315 Total Commercial Loans $545 $970 $1,703 Retail Private Banking Total Residential & Consumer Loans $588 $604 $547 Total Deposits $1,516 $1,647 $2,299 Capital Growth Net Income Available to Common Shareholders $9.2 $9.3 $14.9 Capital Raise (Gross) - $42 $50 Dividend Reinvestment Plan Purchases $0.6 $3.2 $7.4 Total Shareholders' Equity $122 $171 $242 Book Value Per Share $13.90 $14.79 $16.36

Confidential 6 Balance Sheet / P&L Records YOY % Growth Total Assets $2.7 Billion + 37% Total Customer Deposits* $2.0 Billion + 21% Total Loans Closed $1.1 Billion + 38% Total Loans Outstanding $2.3 Billion + 43% Total Capital $242.3 Million + 42% Net Income $14.9 Million + 61% Wealth Management AUA $ 3.0 Billion + 11% 2014 A Year of Accomplishment *Excludes brokered CD's and brokered overnight Interest Bearing Checking Deposits

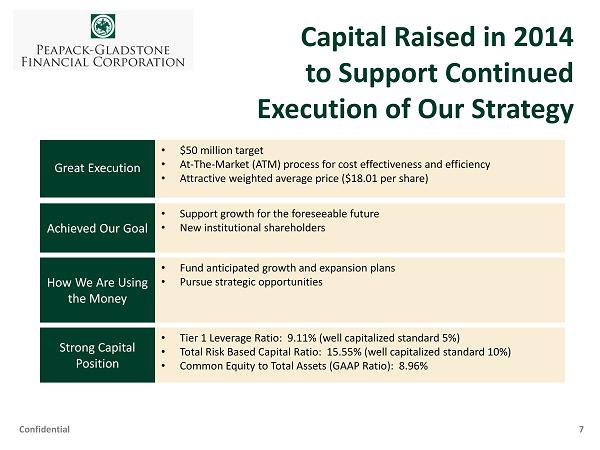

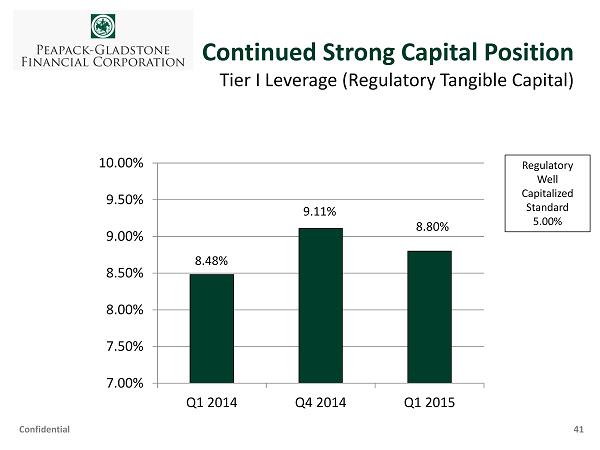

Confidential Great Execution Achieved Our Goal How We Are Using the Money • $50 million target • At - The - Market (ATM) process for cost effectiveness and efficiency • Attractive weighted average price ($18.01 per share) • Support growth for the foreseeable future • New institutional shareholders • Fund anticipated growth and expansion plans • P ursue strategic opportunities Capital Raised in 2014 to Support Continued Execution of Our Strategy 7 Strong Capital Position • Tier 1 Leverage Ratio: 9.11% (well capitalized standard 5%) • Total Risk Based Capital Ratio: 15.55% (well capitalized standard 10%) • Common Equity to Total Assets (GAAP Ratio): 8.96%

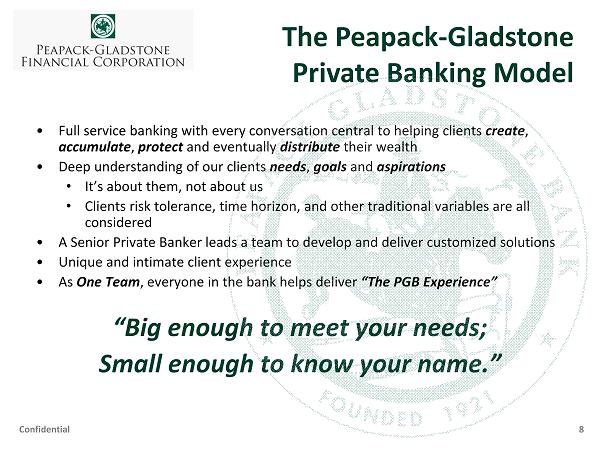

Confidential 8 The Peapack - Gladstone Private Banking Model • Full service banking with every conversation central to helping clients create , accumulate , protect and eventually distribute their wealth • Deep understanding of our clients needs , goals and aspirations • It’s about them, not about us • Clients risk tolerance, time horizon, and other traditional variables are all considered • A Senior Private Banker leads a team to develop and deliver customized solutions • Unique and intimate client experience • As One Team , everyone in the bank helps deliver “The PGB Experience” “Big enough to meet your needs; Small enough to know your name.”

Confidential Private Banking 9

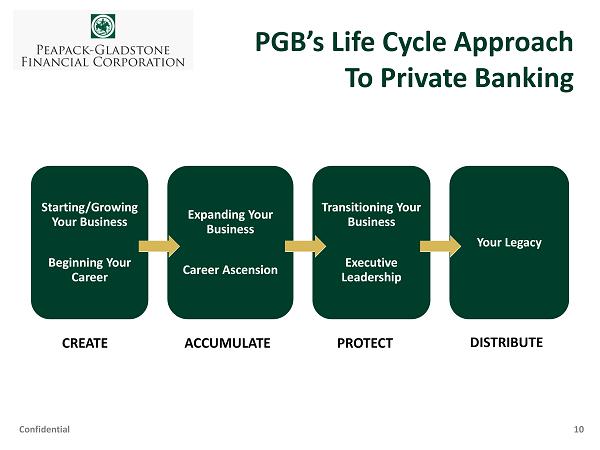

Starting/Growing Your Business Beginning Your Career Expanding Your Business Career Ascension Transitioning Your Business Executive Leadership Your Legacy PGB’s Life Cycle Approach To Private Banking CREATE ACCUMULATE PROTECT DISTRIBUTE Confidential 10

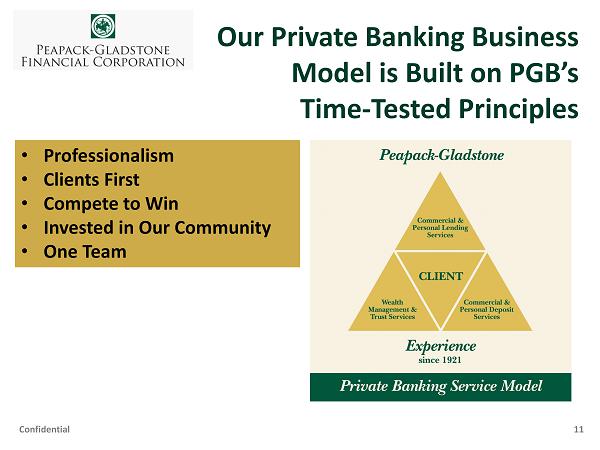

Our Private Banking Business Model is Built on PGB’s Time - Tested Principles Confidential 11 • Professionalism • Clients First • Compete to Win • Invested in Our Community • One Team

Confidential Our Private Banking Model Addresses a Number of Market Opportunities • We are known as the bank for the affluent and have an established core competency in wealth management • Favorable macro economic trends regarding wealth accumulation • The metro New York MSA has a plethora of these market opportunities • Our core competencies in wealth management, commercial banking, deposit solutions and providing exceptional client service position us well • A significant portion of the affluent and privately owned businesses are attracted to our business model - they are underserved by large bank competitors, and small banks lack the people and products to compete 12

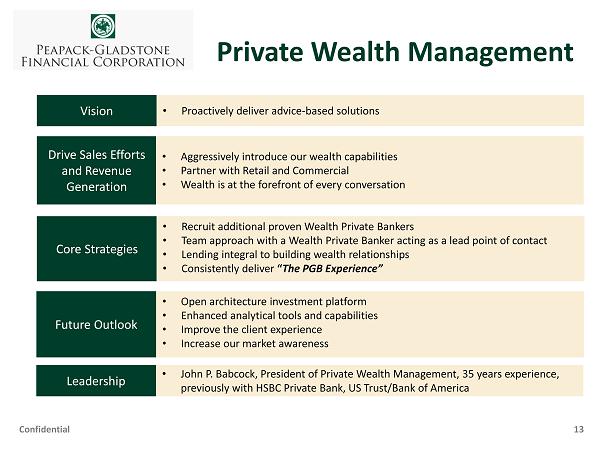

Confidential Drive Sales Efforts and Revenue Generation Future Outlook • Aggressively introduce our wealth capabilities • Partner with Retail and Commercial • Wealth is at the forefront of every conversation 13 Core Strategies • Recruit additional proven Wealth Private Bankers • Team approach with a Wealth Private Banker acting as a lead point of contact • Lending integral to building wealth relationships • Consistently deliver “ The PGB Experience” • Open architecture investment platform • Enhanced analytical tools and capabilities • Improve the client experience • Increase our market awareness Vision • Proactively deliver advice - based solutions Private Wealth Management Leadership • John P. Babcock, President of Private Wealth Management, 35 years experience, previously with HSBC Private Bank, US Trust/Bank of America

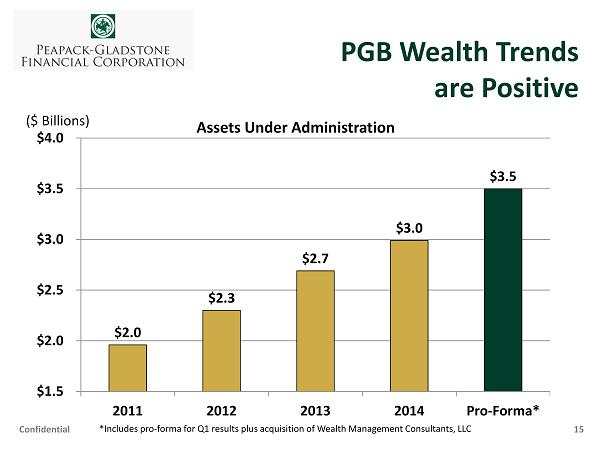

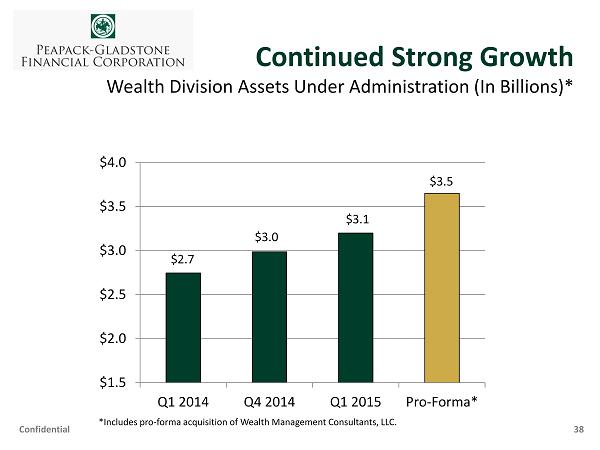

Confidential 14 Acquisition of Wealth Management Consultants LLC • Largely strategic driven: x Executive Leadership of Wealth Management Consultants (WMC) remains unchanged x Adds additional depth to our capability to provide expert advice x Augments our ability to deliver advice led wealth solutions x Provides an opportunity to offer a full bank relationship to the WMC client base • Financial implications: x Increases Assets Under Administration (AUA) by $450 million x Has minimal impact on tangible book value x E arnings neutral for year one and accretive to earnings thereafter

Confidential 15 $2.0 $ 2.3 $ 2.7 $3.0 $3.5 $1.5 $2.0 $2.5 $3.0 $3.5 $4.0 2011 2012 2013 2014 Pro-Forma* PGB Wealth Trends are Positive Assets Under Administration ($ Billions) *Includes pro - forma for Q1 results plus acquisition of Wealth Management Consultants, LLC

Confidential Continue CRE & Multifamily Focus Grow Commercial and Industrial Lending (C&I) Future Outlook • Lending efforts increasingly migrate to relationship - based • Multifamily concentration will be managed via participations sold • Typically floating rates of interest • Long - term relationships; clients tend to use multiple products; greater profitability • Seasoned professionals; all with proven track records from large bank competitors • Current pipeline is strong • ABL and SBA Lending capabilities • Goal of 30%+ of total loan portfolio by 2017 (14% currently) 16 Core Strategies • Proactively deliver advice - based solutions including Wealth Advisory • Generate revenue holistically through deposits, wealth and treasury management • Private Banker acts as lead point of contact • Consistently deliver “ The PGB Experience” Commercial Private Banking Leadership • Vincent A. Spero, Head of Commercial Real Estate, 27 years experience, previously with Lakeland Bank, Commerce Bank, Citizens First National Bank • Eric H. Waser, Head of Commercial Banking, 25 years experience, previously with Citibank, Sovereign Bank, Fleet Boston Financial/Nat West Bank

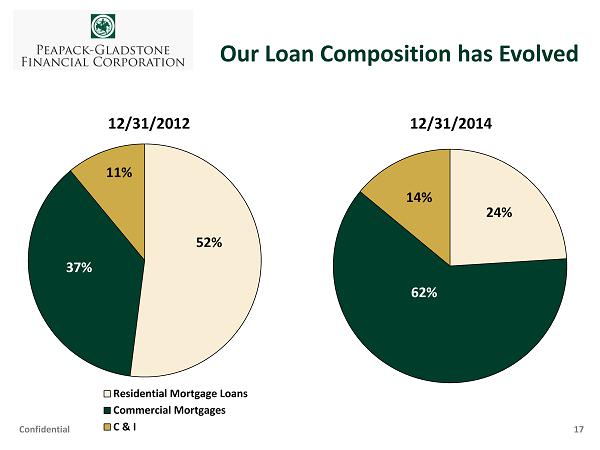

Confidential 17 Our Loan Composition has Evolved Residential Mortgage Loans Commercial Mortgages C & I 12/31/2012 12/31/2014 37% 52% 11% 62% 24% 14%

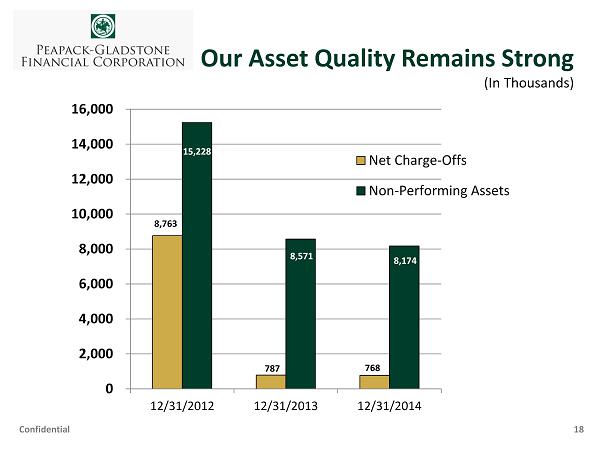

Our Asset Quality Remains Strong (In Thousands) Confidential 18 8,763 787 768 15,228 8,571 8,174 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 12/31/2012 12/31/2013 12/31/2014 Net Charge-Offs Non-Performing Assets

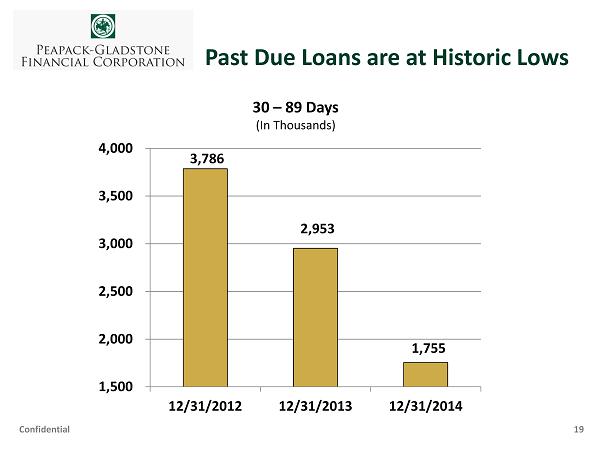

19 Past Due Loans are at Historic Lows Confidential 30 – 89 Days (In Thousands) 3,786 2,953 1,755 1,500 2,000 2,500 3,000 3,500 4,000 12/31/2012 12/31/2013 12/31/2014

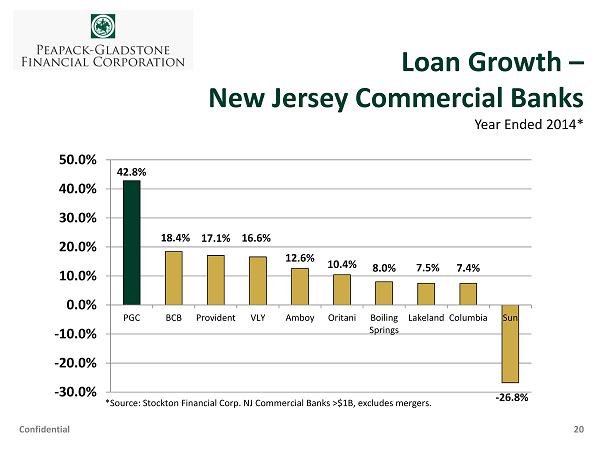

Confidential 42.8% 18.4% 17.1% 16.6% 12.6% 10.4% 8.0% 7.5% 7.4% - 26.8% -30.0% -20.0% -10.0% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% PGC BCB Provident VLY Amboy Oritani Boiling Springs Lakeland Columbia Sun *Source: Stockton Financial Corp. NJ Commercial Banks >$1B, excludes mergers. Loan Growth – New Jersey Commercial Banks Year Ended 2014* 20

Confidential Optimize Our Branch Network Enhance Our Sales/Service Culture Deepen Relationships • Culture of robust deposit generation • Qualified referrals • Leverage our Advisory Board and Community Ambassadors • Utilize Salesforce to manage sales efforts • Transition to an advice - based solutions • Intensified sales training • Employee empowerment • Consistently deliver “ The PGB Experience” • Wealth focused client conversations • A consultative approach • Enhanced product offerings • Private Banker acts as lead point of contact 21 • Cultivate utilization of alternative delivery channels • Adopt emerging technology Increased Efficiency Retail Private Banking • Anthony V. Bilotta, Jr, Head of Retail Banking & Marketing, 34 years experience, previously with Oritani Bank, New York Community Bank, Penn Federal Savings Bank, PNC, Hudson United Bank Leadership

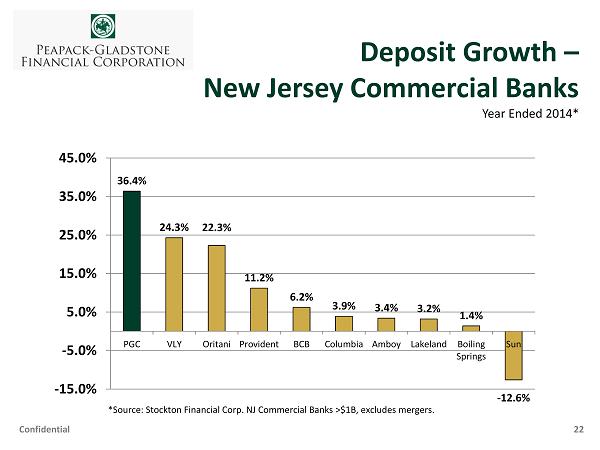

Confidential 36.4% 24.3% 22.3% 11.2% 6.2% 3.9% 3.4% 3.2% 1.4% - 12.6% -15.0% -5.0% 5.0% 15.0% 25.0% 35.0% 45.0% PGC VLY Oritani Provident BCB Columbia Amboy Lakeland Boiling Springs Sun *Source: Stockton Financial Corp. NJ Commercial Banks >$1B, excludes mergers . Deposit Growth – New Jersey Commercial Banks Year Ended 2014* 22

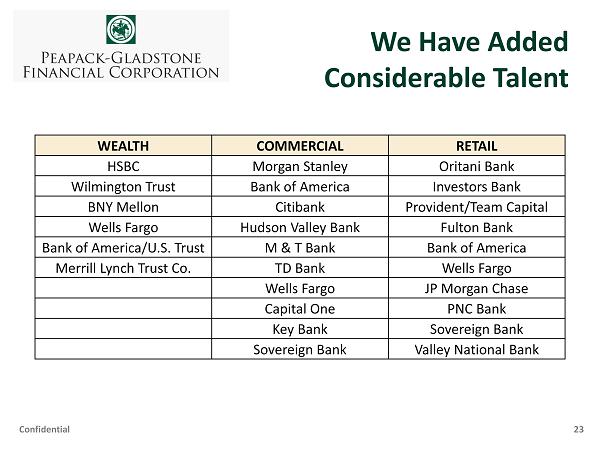

We Have Added Considerable Talent WEALTH COMMERCIAL RETAIL HSBC Morgan Sta nley Oritani Bank Wilmington Trust Bank of America Investors Bank BNY Mellon Citibank Provident/Team Capital Wells Fargo Hudson Valley Bank Fulton Bank Bank of America/U.S. Trust M & T Bank Bank of America Merrill Lynch Trust Co. TD Bank Wells Fargo Wells Fargo JP Morgan Chase Capital One PNC Bank Key Bank Sovereign Bank Sovereign Bank Valley National Bank Confidential 23

24 Confidential As We Invest to Grow Revenue, We Are Responsibly Managing Our Costs Efficiency Ratio Trend 71.4% 80.7% 78.8% 75.6% 70.1% 67.4% 66.6% 66.0% 50.0% 55.0% 60.0% 65.0% 70.0% 75.0% 80.0% 85.0%

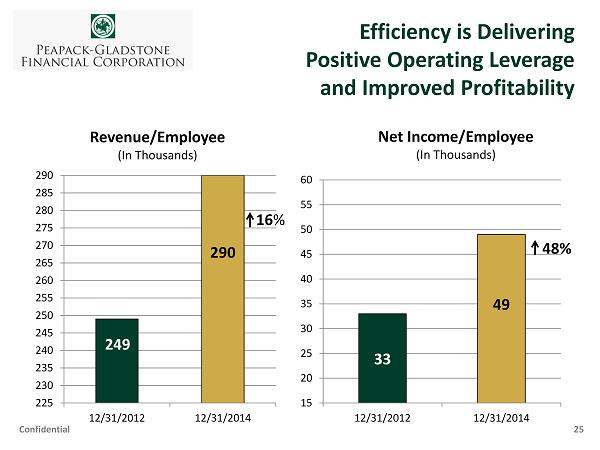

25 Confidential 33 49 15 20 25 30 35 40 45 50 55 60 12/31/2012 12/31/2014 Net Income/Employee (In Thousands) Efficiency is Delivering Positive Operating Leverage and Improved Profitability 48% 249 290 225 230 235 240 245 250 255 260 265 270 275 280 285 290 12/31/2012 12/31/2014 Revenue/Employee (In Thousands) 16 %

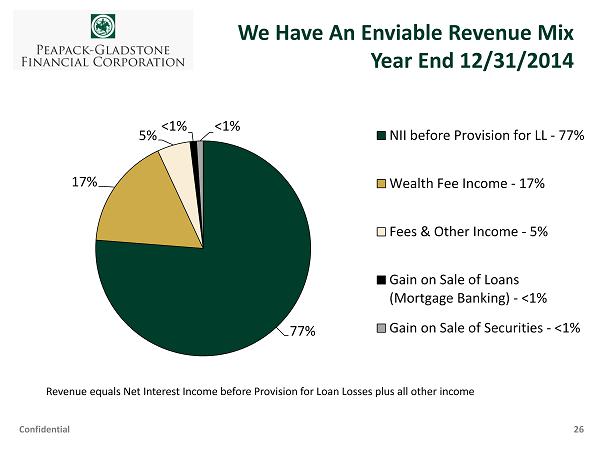

77% 17% 5% <1% <1% NII before Provision for LL - 77% Wealth Fee Income - 17% Fees & Other Income - 5% Gain on Sale of Loans (Mortgage Banking) - <1% Gain on Sale of Securities - <1% Revenue equals Net Interest Income before Provision for Loan Losses plus all other income We Have An Enviable Revenue Mix Year End 12/31/2014 26 Confidential

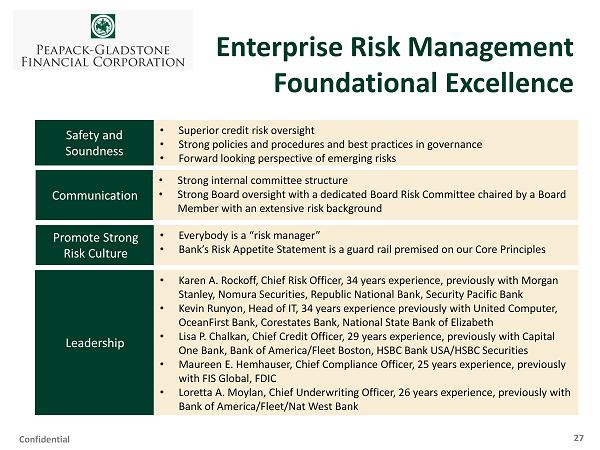

Confidential Safety and Soundness • Superior credit risk oversight • Strong policies and procedures and best practices in governance • Forward looking perspective of emerging risks Enterprise Risk Management Foundational Excellence Communication Promote Strong Risk Culture Leadership • Strong internal committee structure • Strong Board oversight with a dedicated Board Risk Committee chaired by a Board Member with an extensive risk background • Everybody is a “risk manager” • Bank’s Risk Appetite Statement is a guard rail premised on our Core Principles • Karen A. Rockoff, Chief Risk Officer, 34 years experience, previously with Morgan Stanley, Nomura Securities, Republic National Bank, Security Pacific Bank • Kevin Runyon, Head of IT, 34 years experience previously with United Computer, OceanFirst Bank, Corestates Bank, National State Bank of Elizabeth • Lisa P. Chalkan, Chief Credit Officer, 29 years experience, previously with Capital One Bank, Bank of America/Fleet Boston, HSBC Bank USA/HSBC Securities • Maureen E. Hemhauser, Chief Compliance Officer, 25 years experience, previously with FIS Global, FDIC • Loretta A. Moylan, Chief Underwriting Officer, 26 years experience, previously with Bank of America/Fleet/Nat West Bank 27

Confidential Liquidity Interest Rate Risk Capital • Standby liquidity with the Federal Home Loan Bank is managed to optimize capacity. At year - end, $670 million undrawn • In addition, an investment securities portfolio with $265 million is available • Interest rate shock simulation results for Net Interest Income and Economic Value of Equity monitored by ALCO and the Board of Directors • Performance standards for simulation results consistent with the recent OCC survey findings of 1,400 community banks • Comprehensive duration management encompasses the entire balance sheet • $ 92 million in additions realized in two successful capital raises in 13 - months • Continuous equity is provided by a popular Dividend Reinvestment Program • Capital ratios are managed to consistently exceed regulatory minimums for a well - capitalized bank (even before the equity raises ) • Regular capital stress testing We Are Actively Managing Our Balance Sheet 28 Leadership • Jeffrey J. Carfora, CPA, CFO, 35 years experience, previously with Penn Fed Financial Services, Carteret Bank, Marine Midland Bank, PricewaterhouseCoopers • Mary M. Russell, CPA, Comptroller, 29 years experience, previously with United Trust, Nisivoccia LLP, CPAs • Jan C. Barkley, Director of ALM, 30+ years experience , previously with MetLife Bank, Morgan Stanley, Nomura Securities

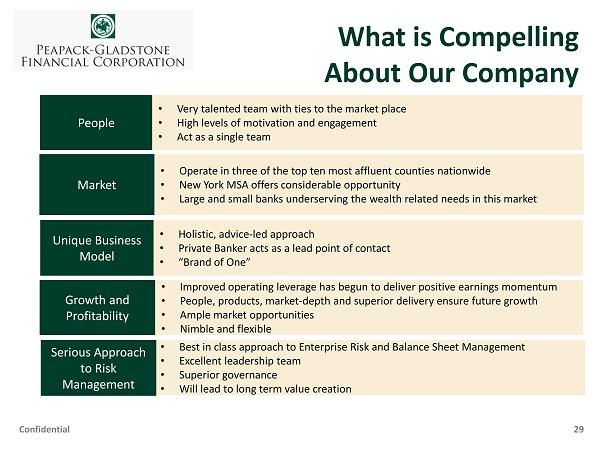

Confidential People Market Growth and Profitability • Very talented team with ties to the market place • High levels of motivation and engagement • Act as a single team • Operate in three of the top ten most affluent counties nationwide • New York MSA offers considerable opportunity • Large and small banks underserving the wealth related needs in this market • Improved operating leverage has begun to deliver positive earnings momentum • People , products, market - depth and superior delivery ensure future growth • Ample market opportunities • Nimble and flexible What is Compelling About Our Company 29 Unique Business Model • Holistic, advice - led approach • Private Banker acts as a lead point of contact • “Brand of One” • Best in class approach to Enterprise Risk and Balance Sheet Management • Excellent leadership team • Superior governance • Will lead to long term value creation Serious Approach to Risk Management

Select Financial Highlights Q1 2015 Annual Meeting April 28, 2015 P EAPACK - G LADSTONE B ANK

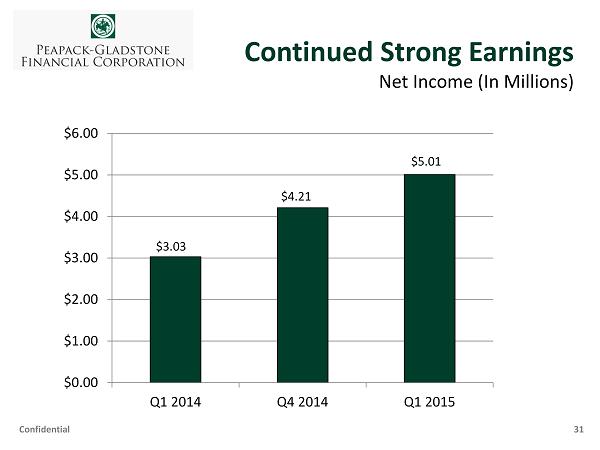

31 Confidential Continued Strong Earnings Net Income (In Millions) $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 Q1 2014 Q4 2014 Q1 2015 $5.01 $4.21 $3.03

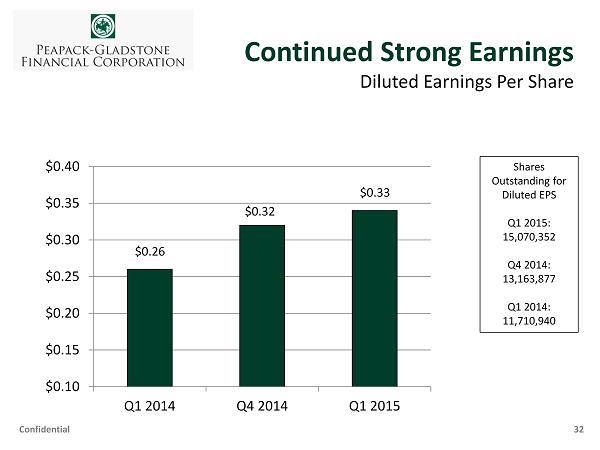

32 Confidential Continued Strong Earnings Diluted Earnings Per Share $0.10 $0.15 $0.20 $0.25 $0.30 $0.35 $0.40 Q1 2014 Q4 2014 Q1 2015 $0.33 $0.32 $0.26 Shares Outstanding for Diluted EPS Q1 2015: 15,070,352 Q4 2014: 13,163,877 Q1 2014: 11,710,940

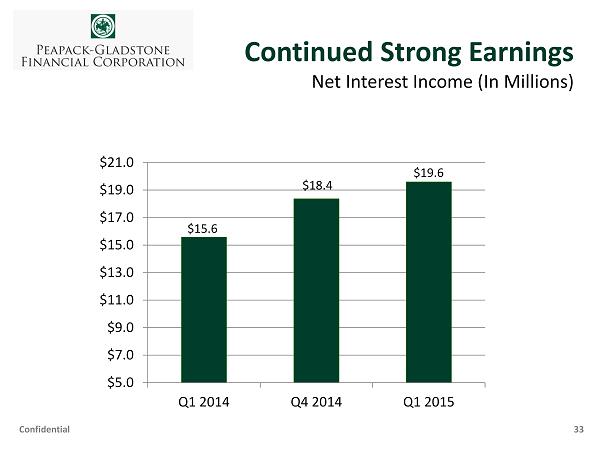

33 Confidential Continued Strong Earnings Net Interest Income (In Millions) $5.0 $7.0 $9.0 $11.0 $13.0 $15.0 $17.0 $19.0 $21.0 Q1 2014 Q4 2014 Q1 2015 $18.4 $19.6 $15.6

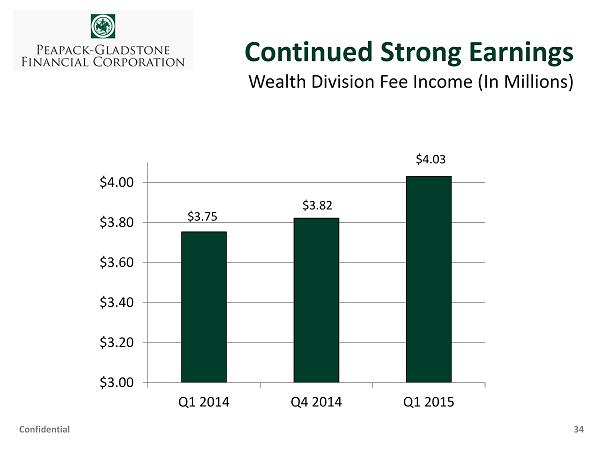

34 Confidential Continued Strong Earnings Wealth Division Fee Income (In Millions) $3.00 $3.20 $3.40 $3.60 $3.80 $4.00 Q1 2014 Q4 2014 Q1 2015 $3.82 $4.03 $3.75

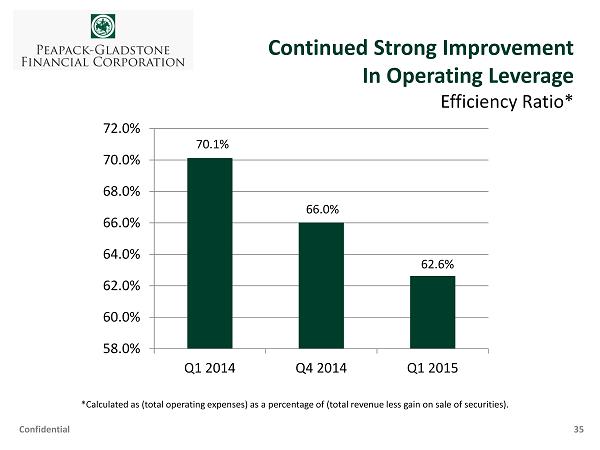

35 Confidential Continued Strong Improvement In Operating Leverage Efficiency Ratio* 58.0% 60.0% 62.0% 64.0% 66.0% 68.0% 70.0% 72.0% Q1 2014 Q4 2014 Q1 2015 *Calculated as (total operating expenses) as a percentage of (total revenue less gain on sale of securities). 70.1% 66.0% 62.6%

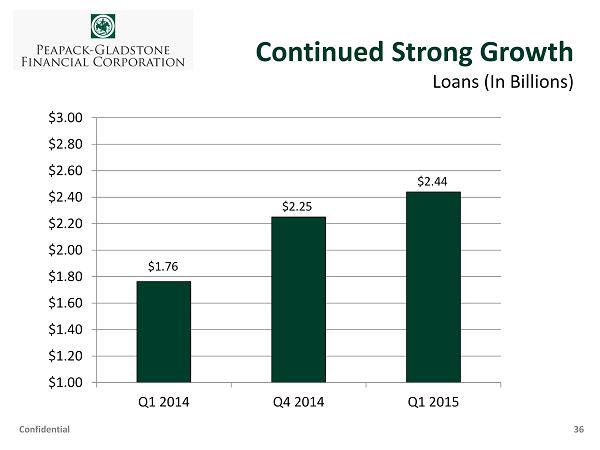

36 Confidential Continued Strong Growth Loans (In Billions) $1.00 $1.20 $1.40 $1.60 $1.80 $2.00 $2.20 $2.40 $2.60 $2.80 $3.00 Q1 2014 Q4 2014 Q1 2015 $2.25 $2.44 $1.76

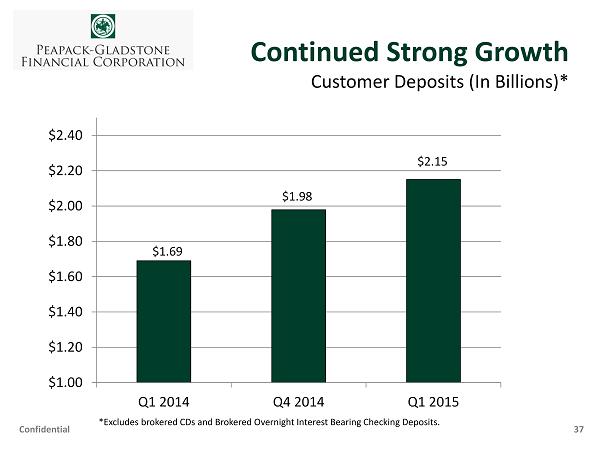

37 Confidential Continued Strong Growth Customer Deposits (In Billions)* $1.00 $1.20 $1.40 $1.60 $1.80 $2.00 $2.20 $2.40 Q1 2014 Q4 2014 Q1 2015 $1.98 $2.15 $1.69 *Excludes brokered CDs and Brokered Overnight Interest Bearing Checking Deposits.

38 Confidential Continued Strong Growth Wealth Division Assets Under Administration (In Billions)* $1.5 $2.0 $2.5 $3.0 $3.5 $4.0 Q1 2014 Q4 2014 Q1 2015 Pro-Forma* $3.0 $3.5 $2.7 $3.1 *Includes pro - forma acquisition of Wealth Management Consultants, LLC.

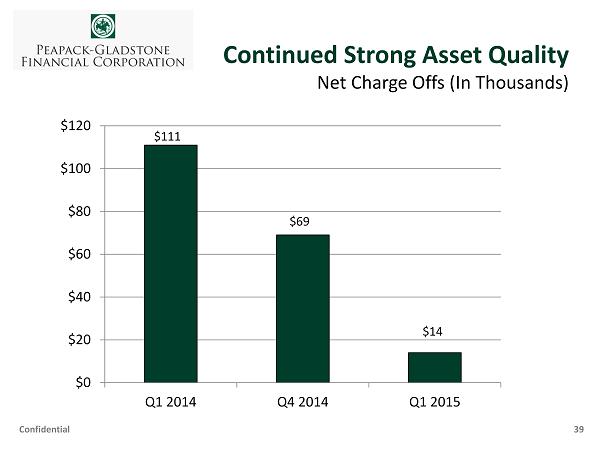

39 Confidential Continued Strong Asset Quality Net Charge Offs (In Thousands) $0 $20 $40 $60 $80 $100 $120 Q1 2014 Q4 2014 Q1 2015 $69 $111 $14

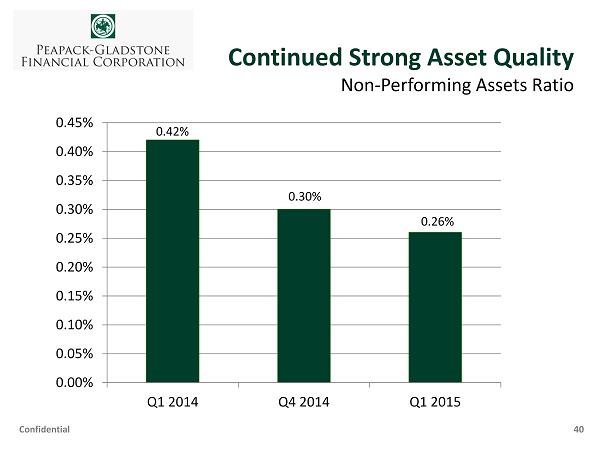

40 Confidential Continued Strong Asset Quality Non - Performing Assets Ratio 0.00% 0.05% 0.10% 0.15% 0.20% 0.25% 0.30% 0.35% 0.40% 0.45% Q1 2014 Q4 2014 Q1 2015 0.30% 0.42% 0.26%

41 Confidential Continued Strong Capital Position Tier I Leverage (Regulatory Tangible Capital) 7.00% 7.50% 8.00% 8.50% 9.00% 9.50% 10.00% Q1 2014 Q4 2014 Q1 2015 9.11% 8.48% 8.80% Regulatory Well Capitalized Standard 5.00%

42 Confidential Continued Improvement in Book Value Per Share $14.00 $14.50 $15.00 $15.50 $16.00 $16.50 $17.00 Q1 2014 Q4 2014 Q1 2015 $16.36 $15.08 $16.61

Q & A