Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CONSUMER PORTFOLIO SERVICES, INC. | cps_8k.htm |

Exhibit 99.1

Investor Presentation As of March 31, 2015

2 » Consumer finance company focused on sub - prime auto market » Established in 1991. IPO in 1992 » Through March 31,2015, over $11.6 billion in contracts purchased from automobile dealers » From 2002 – 2011, four mergers and acquisitions aggregating $822.3 million » Irvine, California operating headquarters; Branches in Nevada, Illinois, Virginia and Florida » Approximately 880 employees » $944.9 million contract purchases in 2014; $233.9 million in Q1 2015 » $1.7 billion outstanding managed portfolio at March 31, 2015

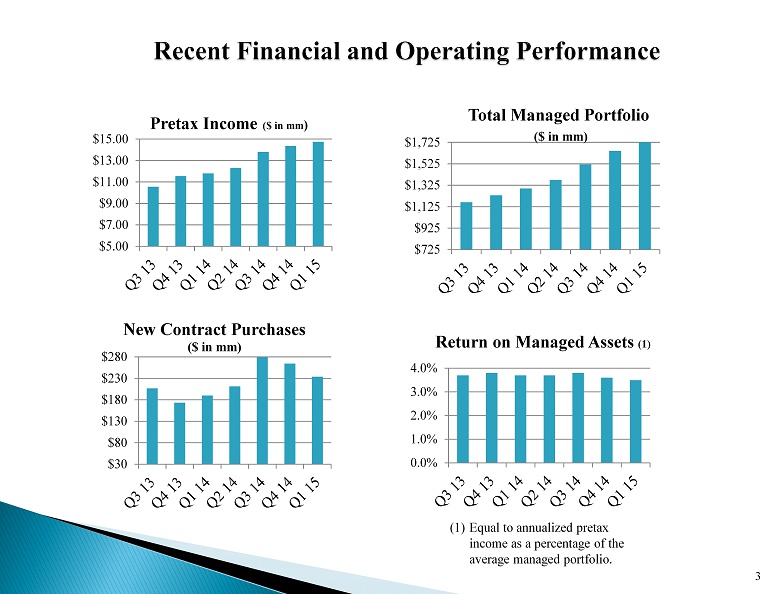

3 $725 $925 $1,125 $1,325 $1,525 $1,725 Total Managed Portfolio ($ in mm) $5.00 $7.00 $9.00 $11.00 $13.00 $15.00 Pretax Income ($ in mm ) $30 $80 $130 $180 $230 $280 New Contract Purchases ($ in mm) (1) Equal to annualized pretax income as a percentage of the average managed portfolio. 0.0% 1.0% 2.0% 3.0% 4.0% Return on Managed Assets (1)

4 » Lower funding costs and improvements in operating leverage offsetting lower contract APRs resulting in steady returns on managed portfolio. (1) As a percentage of the average managed portfolio. Percentages may not add due to rounding. Quarter Ended March 31, 2015 March 31, 2014 December 31, 2014 Interest Income 19.3% 20.4% 19.9% Servicing and Other Income 0.9% 1.0% 1.0% Interest Expense (3.1%) (4.2%) (3.2%) Net Interest Margin 17.1% 17.2% 17.6% Provision for Credit Losses (7.8%) (7.5%) (7.8%) Core Operating Expenses (5.8%) (6.0%) (6.2%) Pretax Return on Assets 3.5% 3.7% 3.6%

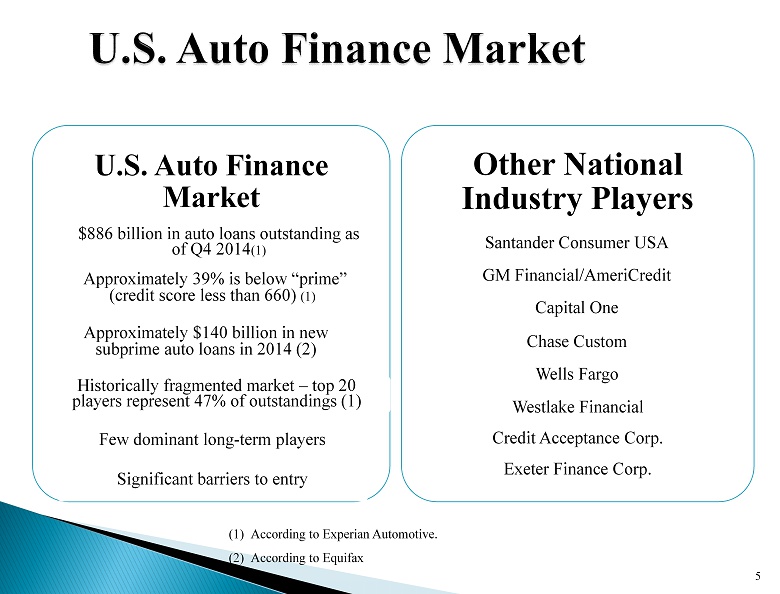

U.S. Auto Finance Market $886 billion in auto loans outstanding as of Q4 2014 (1) Approximately 39% is below “prime” (credit score less than 660) (1) Approximately $140 billion in new subprime auto loans in 2014 (2) Historically fragmented market – top 20 players represent 47% of outstandings (1) Few dominant long - term players Significant barriers to entry Other National Industry Players Santander Consumer USA GM Financial/AmeriCredit Capital One Chase Custom Wells Fargo Westlake Financial Credit Acceptance Corp. Exeter Finance Corp. 5 (1) According to Experian Automotive. (2) According to Equifax

» Purchasing contracts from dealers in 48 states across the U.S. » As of March 31, 2015 had 123 employee marketing representatives, 53 in the field and 70 in - house » Primarily factory franchised dealers 6 (1) Under the CPS programs for contracts purchased during Q1 2015. 68% 32% Contract Purchases (1) Factory Franchised Independents

$284 $691 $1,019 $1,283 $297 $9 $113 $552 $764 $945 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 ($ in millions) $234 7 » Since inception through March 31, 2015 the Company has purchased over $11.6 billion in contracts » New contract purchases have ramped up significantly since financial crisis

$1,231 $1,122 $1,644 $1,566 $2,126 $1,664 $1,195 $756 $795 $898 $1,726 $0 $500 $1,000 $1,500 $2,000 $2,500 ($ in millions) 8 » Decline through 2010 was the result of the financial crisis

0% 2% 4% 6% 8% 10% 12% 14% 16% 18% Model Year 9 • 18% New • 82% Pre - owned • 43% Domestic • 57% Imports Primarily late model, pre - owned vehicles (1) Under the CPS programs for contracts purchased during Q1 2015.

10 » CPS’s proprietary scoring models and risk - adjusted pricing result in program offerings covering a wide band of the credit spectrum (1) Under the CPS programs for contracts purchased during Q1 2015. (2) Contract APR as adjusted for fees charged (or paid) to dealer. Program (1) Avg. Yield (2) Avg. Amount Financed Avg. Annual Household Income Avg. Time on Job (years) Avg. FICO % of Purchases Preferred 13.6% $18,974 $88,467 9.6 592 4% Super Alpha 15.5% $19,130 $73,001 8.3 576 12% Alpha Plus 17.8% $17,585 $60,225 7.2 573 16% Alpha 20.1% $16,514 $50,454 6.0 567 41% Standard 23.7% $13,724 $49,706 4.8 561 11% Mercury / Delta 24.2% $13,041 $43,939 4.5 559 9% First Time Buyer 23.6% $12,417 $37,639 2.9 576 7% Total 19.7% $15,924 $53,499 6.0 569 100%

11 » Yields and credit metrics are significantly stronger today than at the end of the last cycle (1) (1) For new contracts purchased during the calendar quarter under the CPS programs. Averages are weighted by principal balance. (2) Contract APR as adjusted for fees charged (or paid) to dealer . (3) Wholesale loan - to - value ratio. Q1 2007 Q1 2008 Q1 2010 Q1 2011 Q1 2012 Q1 2013 Q1 2014 Q1 2015 New Contract Purchases ($ in mm) $319.8 $166.7 $17.4 $50.0 $119.9 $180.0 $189.9 $233.9 Avg. Yield (2) 18.9% 19.7% 25.2% 24.6% 23.8% 22.2% 21.0% 19.7% Avg. FICO 522 526 568 568 559 562 567 569 Avg. Original Term (months) 65 65 61 63 62 62 63 63 Avg. LTV (3) 115.5% 114.7% 112.3% 114.0% 113.4% 114.2% 113.0% 113.9%

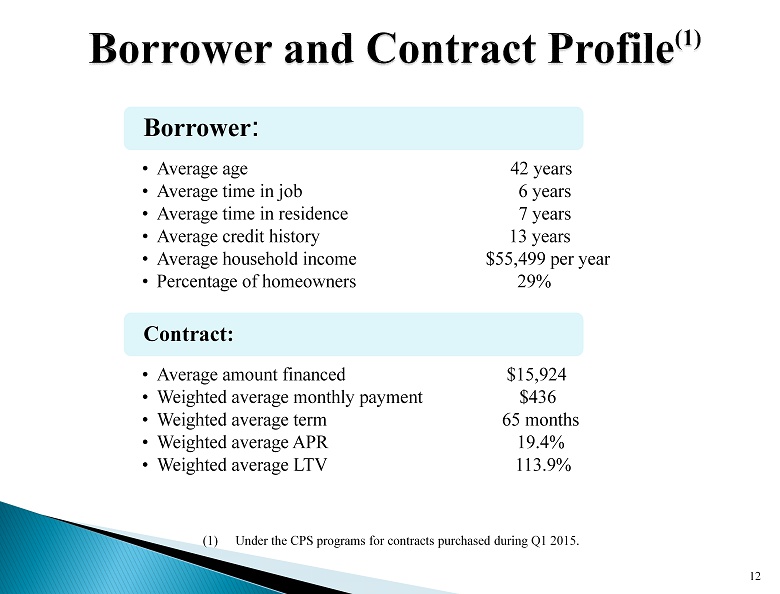

• Average age 42 years • Average time in job 6 years • Average time in residence 7 years • Average credit history 13 years • Average household income $55,499 per year • Percentage of homeowners 29% Borrower : • Average amount financed $15,924 • Weighted average monthly payment $436 • Weighted average term 65 months • Weighted average APR 19.4% • Weighted average LTV 113.9% Contract: 12 (1) Under the CPS programs for contracts purchased during Q1 2015.

Contract Originations » Centralized contract originations at Irvine HQ » Maximizes control and efficiencies » Certain functions performed at Florida and Nevada offices » Proprietary auto - decisioning system » Makes initial credit decision on over 99% of incoming applications » Uses both criteria and proprietary scorecards in credit and pricing decisions » Pre - funding verification of employment, income and residency » Protects against potential fraud 13 Servicing » Geographically dispersed servicing centers enhance coverage and staffing flexibility and drive portfolio performance » Early contact on past due accounts; commencing as early as first day after due date » Early stage workload supplemented by automated intelligent predictive dialer » Workloads allocated based on specialization and behavioral scorecards, which enhances efficiencies

» $200 million in interim funding capacity through two credit facilities » $100 million with Fortress; revolves to April 2017, due in April 2019 » $100 million with Citibank; revolves to August 2016, due in August 2017 » Regular issuer of asset - backed securities, providing long - term matched funding » $9.6 billion in over 66 deals from 1994 through March 2015. » Have completed 16 senior subordinated securitizations since the beginning of 2011 » In March 2015 transaction, sold five tranches of rated bonds from triple “A” down to single “B” with a blended coupon of 3.01% » $12.1 million in residual interest financing, maturing in April 2018 » Total corporate debt of $15.1 million » $15.1 million of subordinated unsecured retail notes » $38.6 million senior secured debt prepaid without penalty in Q1 2014 14

0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% 20.00% 22.00% Months Seasoned 2002 2003 2004 2005 2006 2007 2008 2010 2011 2012 2013 2014 15 » Average of quarterly vintage cumulative net losses as of March 31, 2015 » 2010 and later vintages in line or better than 2003 - 2005 vintages

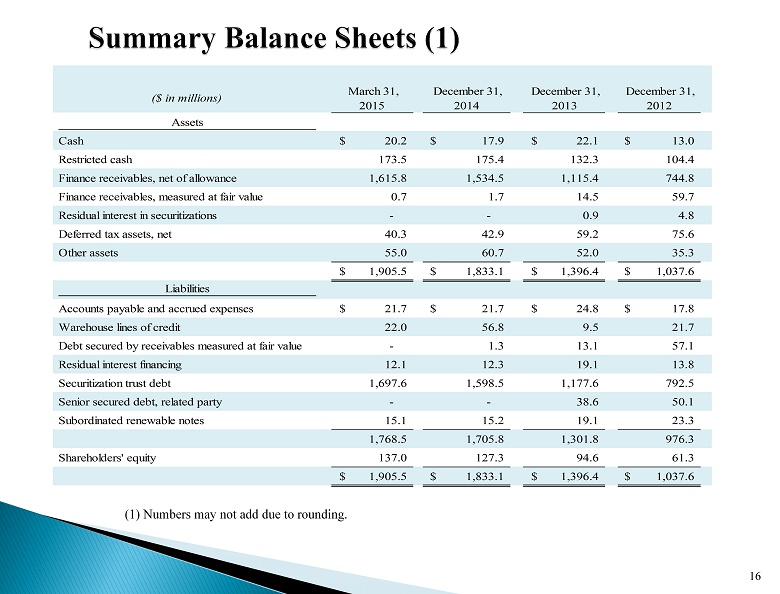

($ in millions) March 31, 2015 December 31, 2014 December 31, 2013 December 31, 2012 Assets Cash 20.2$ 17.9$ 22.1$ 13.0$ Restricted cash 173.5 175.4 132.3 104.4 Finance receivables, net of allowance 1,615.8 1,534.5 1,115.4 744.8 Finance receivables, measured at fair value 0.7 1.7 14.5 59.7 Residual interest in securitizations - - 0.9 4.8 Deferred tax assets, net 40.3 42.9 59.2 75.6 Other assets 55.0 60.7 52.0 35.3 1,905.5$ 1,833.1$ 1,396.4$ 1,037.6$ Liabilities Accounts payable and accrued expenses 21.7$ 21.7$ 24.8$ 17.8$ Warehouse lines of credit 22.0 56.8 9.5 21.7 Debt secured by receivables measured at fair value - 1.3 13.1 57.1 Residual interest financing 12.1 12.3 19.1 13.8 Securitization trust debt 1,697.6 1,598.5 1,177.6 792.5 Senior secured debt, related party - - 38.6 50.1 Subordinated renewable notes 15.1 15.2 19.1 23.3 1,768.5 1,705.8 1,301.8 976.3 Shareholders' equity 137.0 127.3 94.6 61.3 1,905.5$ 1,833.1$ 1,396.4$ 1,037.6$ 16 (1) Numbers may not add due to rounding.

17 ($ in millions) March 31, 2015 March 31, 2014 December 31, 2014 December 31, 2013 December 31, 2012 Revenues . . . Interest income 82.4$ 65.0$ 286.7$ 231.3$ 175.3$ Servicing fees 0.1 0.5 1.4 3.1 2.3 Other income 3.5 2.6 12.1 10.4 9.6 Gain on cancellation of debt - - - 11.0 - 86.0 68.1 300.2 255.8 187.2 Expenses Employee costs 14.5 10.9 50.1 43.0 35.6 General and administrative 10.2 8.2 39.3 32.7 29.5 Interest 13.2 13.4 50.4 58.2 79.4 Provision for credit losses 33.4 23.9 108.2 76.9 33.5 Provision for contingent liabilities - - - 7.8 - 71.3 56.4 248.0 218.6 178.0 Pretax income 14.7 11.7 52.2 37.2 9.2 Income tax expense (gain) 6.4 5.0 22.7 16.2 (60.2) Net income 8.3$ 6.7$ 29.5$ 21.0$ 69.4$ EPS (fully diluted) 0.26$ 0.21$ 0.92$ 0.67$ 2.72$ Years EndedThree Months Ended (1) Numbers may not add due to rounding.

18 (1) Revenues less interest expense and provision for credit losses. (2) Total expenses less provision for credit losses and interest expense. (3) Equal to annualized pretax income as a percentage of the average managed portfolio. ($ in millions) March 31, 2015 March 31, 2014 December 31, 2014 December 31, 2013 December 31, 2012 Auto contract purchases 233.9$ 189.9$ 944.9$ 764.1$ 551.7$ Total managed portfolio 1,725.5$ 1,295.2$ 1,643.9$ 1,231.4$ 897.6$ Risk-adjusted margin (1) 39.4$ 30.9$ 141.6$ 109.8$ 74.3$ Core operating expenses (2) $ amount 24.6$ 19.1$ 89.4$ 75.7$ 65.1$ % of avg. managed portfolio 5.8% 6.0% 6.3% 7.0% 7.9% Pretax return on managed assets (3) 3.5% 3.7% 3.7% 3.4% 1.1% Total delinquencies and repo inventory (30+ days past due) As a % of total owned portfolio 6.9% 6.3% 7.2% 6.9% 5.6% Annualized net charge-offs As a % of total owned portfolio 6.6% 5.5% 5.8% 4.7% 3.6% Three Months Ended Years Ended

» CPS has weathered two industry cycles to remain one of the few independent public auto finance companies » Fourteen consecutive quarters of improving profitability » Attractive industry fundamentals with fewer large competitors than last cycle » Credit performance of 2010 and later vintages in line or better than 2003 - 2005 vintages 19 » Growing portfolio enhances operating leverage through economies of scale » Opportunistic, successful acquisitions » Stable senior management team with significant equity ownership » Senior management, including vice presidents, average 18 years of service with CPS

Any person considering an investment in securities issued by CPS is urged to review the materials filed by CPS with the U . S . Securities and Exchange Commission ("Commission") . Such materials may be found by inquiring of the Commission‘s EDGAR search page (http : //www . sec . gov/edgar/searchedgar/companysearch . html) using CPS's ticker symbol, which is "CPSS . " Risk factors that should be considered are described in Item 1 A, “Risk Factors," of CPS's annual report on Form 10 - K, which report is on file with the Commission and available for review at the Commission's website . Such description of risk factors is incorporated herein by reference . 20

Information included in the preceding slides is believed to be accurate, but is not necessarily complete . Such information should be reviewed in its appropriate context . The implication that historical trends will continue in the future, or that past performance is indicative of future results, is disclaimed . To the extent that one reading the preceding material nevertheless makes such an inference, such inference would be a forward - looking statement, and would be subject to risks and uncertainties that could cause actual results to vary . Such risks include variable economic conditions, adverse portfolio performance (resulting, for example, from increased defaults by the underlying obligors), volatile wholesale values of collateral underlying CPS assets, reliance on warehouse financing and on the capital markets, fluctuating interest rates, increased competition, regulatory changes, the risk of obligor default inherent in sub - prime financing, and exposure to litigation . 21