Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - Cleco Corporate Holdings LLC | cnl-12312014xex31210ka.htm |

| EX-31.4 - EXHIBIT 31.4 - Cleco Corporate Holdings LLC | cnl-12312014xex31410ka.htm |

| EX-31.3 - EXHIBIT 31.3 - Cleco Corporate Holdings LLC | cnl-12312014xex31310ka.htm |

| EX-31.1 - EXHIBIT 31.1 - Cleco Corporate Holdings LLC | cnl-12312014xex31110ka.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________

FORM 10-K/A

Amendment No. 1

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

Or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

__________________

Commission file number 1-15759

CLECO CORPORATION

(Exact name of registrant as specified in its charter)

__________________

Louisiana (State or other jurisdiction of incorporation or organization) | 72-1445282 (I.R.S. Employer Identification No.) | |

2030 Donahue Ferry Road, Pineville, Louisiana (Address of principal executive offices) | 71360-5226 (Zip Code) | |

Registrant’s telephone number, including area code: (318) 484-7400 | ||

Securities registered pursuant to Section 12(b) of the Act: | ||

Title of each class | Name of each exchange on which registered | |

Common Stock, $1.00 par value, and associated rights to purchase Preferred Stock | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: | ||

Title of each class | ||

4.50% Cumulative Preferred Stock, $100 Par Value | ||

Commission file number 1-05663

CLECO POWER LLC

(Exact name of registrant as specified in its charter)

Louisiana (State or other jurisdiction of incorporation or organization) | 72-0244480 (I.R.S. Employer Identification No.) | |

2030 Donahue Ferry Road, Pineville, Louisiana (Address of principal executive offices) | 71360-5226 (Zip Code) | |

Registrant’s telephone number, including area code: (318) 484-7400 | ||

Securities registered pursuant to Section 12(b) of the Act: | ||

Title of each class | Name of each exchange on which registered | |

6.50% Senior Notes due 2035 | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: | ||

Title of each class | ||

Membership Interests | ||

Cleco Power LLC, a wholly owned subsidiary of Cleco Corporation, meets the conditions set forth in General Instruction (I)(1)(a) and (b) of Form 10-K and is therefore filing this Form 10-K with the reduced disclosure format. | ||

Indicate by check mark if Cleco Corporation is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o | ||

Indicate by check mark if Cleco Power LLC is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x | ||

Indicate by check mark if the Registrants are not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x | ||

Indicate by check mark whether the Registrants: (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrants were required to file such reports) and (2) have been subject to such filing requirements for the past 90 days. Yes x No o | ||

Indicate by check mark whether the Registrants have submitted electronically and posted on their corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the Registrants were required to submit and post such files). Yes x No o | ||

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of each of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x | ||

Indicate by check mark whether Cleco Corporation is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one): Large accelerated filer x Accelerated filer o Non-accelerated filer o (Do not check if a smaller reporting company) Smaller reporting company o | ||

Indicate by check mark whether Cleco Power LLC is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one): Large accelerated filer o Accelerated filer o Non-accelerated filer x (Do not check if a smaller reporting company) Smaller reporting company o | ||

Indicate by check mark whether the Registrants are shell companies (as defined in Rule 12b-2 of the Exchange Act) Yes o No x | ||

CLECO CORPORATION | ||

CLECO POWER | 2014 FORM 10-K/A | |

(Continuation of cover page)

The aggregate market value of the Cleco Corporation voting stock held by non-affiliates was $3,509,403,678 as of the last business day of Cleco Corporation’s most recently completed second fiscal quarter, based on a price of $58.95 per common share, the closing price of Cleco Corporation’s common stock as reported on the NYSE on such date. Cleco Corporation’s Cumulative Preferred Stock is not listed on any national securities exchange, nor are prices for the Cumulative Preferred Stock quoted on any national automated quotation system; therefore, its market value is not readily determinable and is not included in the foregoing amount. As of April 20, 2015, there were no outstanding shares of Cleco Corporation’s preferred stock.

As of April 20, 2015, there were 60,480,586 outstanding shares of Cleco Corporation’s Common Stock, par value $1.00 per share. As of April 20, 2015, all of Cleco Power’s membership interest was owned by Cleco Corporation.

2

CLECO CORPORATION | ||

CLECO POWER | 2014 FORM 10-K/A | |

EXPLANATORY NOTE

This Amendment No. 1 (this “Amendment”) to the 2014 Annual Report on Form 10-K for each of Cleco Corporation (the “Company,” “Cleco,” “we,” “us,” or “our”) and Cleco Power LLC (“Cleco Power”) filed with the Securities and Exchange Commission (the “SEC”) on February 27, 2015 (the “Original Form 10-K”), is being filed solely to include Part III information that had been omitted from the Original Form 10-K in reliance on General Instruction G(3) thereto. All references to Cleco Corporation’s definitive proxy statement in the Original Form 10-K as a document incorporated by reference are hereby deleted.

This Amendment consists solely of the preceding cover page, this explanatory note, the information required by Part III, Items 10, 11, 12, 13, and 14 of Form 10-K, a signature page, and certifications required to be filed as exhibits hereto. In accordance with Rule 12b-15 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), Items 10, 11, 12, 13, and 14 of the Original Form 10-K have been amended and restated in their entirety, and Item 15 of Part IV of the Original Form 10-K has also been amended and restated in its entirety to include new certifications by our and Cleco Power’s principal executive officer and principal financial officer. No other items or sub-items of the Original Form 10-K for each of Cleco and Cleco Power are being revised by this Amendment.

This Amendment does not reflect events occurring after the filing of the Original Form 10-K, and does not modify or update the disclosures in any way other than as required to reflect the amendments as described above and set forth herein.

The section of this Amendment entitled “Report of the Compensation Committee” is not deemed to be “soliciting material” or to be “filed” with the SEC under or pursuant to Section 18 of the Exchange Act or subject to Regulation 14A thereunder, and shall not be incorporated by reference or deemed to be incorporated by reference into any filing by Cleco or Cleco Power under either the Securities Act of 1933, as amended, or the Exchange Act, unless otherwise specifically provided for in such filing.

3

CLECO CORPORATION | ||

CLECO POWER | 2014 FORM 10-K/A | |

TABLE OF CONTENTS | ||

PAGE | ||

4

CLECO CORPORATION | ||

CLECO POWER | 2014 FORM 10-K/A | |

PART III | ||||

Cleco Power

The information called for by Items 10, 11, 12 and 13 with respect to Cleco Power is omitted pursuant to General Instruction I(2)(c) to Form 10-K (Omission of Information by Certain Wholly Owned Subsidiaries).

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE OF THE REGISTRANTS | ||||

Board of Directors of Cleco

As of April 28, 2015, Cleco Corporation’s Board is comprised of 8 directors, as set forth below. The directors’ ages, dates of election, employment history, and committee assignments as of April 20, 2015, are set forth below. An amendment to declassify Cleco’s Board became effective October 25, 2014. Unless and until the closing of the Merger, as discussed below, Messrs. King and Stewart, who were elected for a three-year term at the 2012 annual meeting, will serve until the 2015 annual meeting; Messrs. Marks, Scott and Walker, who were elected for a three-year term at the 2014 annual meeting, will serve until the 2017 annual meeting; Ms. Bailey and Messrs. Kruger and Williamson, who were elected for a three-year term at the 2013 annual meeting, will serve until the 2016 annual meeting. Unless and until the closing of the Merger, as discussed below, all directors will be elected annually beginning with the 2017 annual meeting.

As previously announced, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”), dated October 17, 2014, with Cleco Partners L.P., and its subsidiary pursuant to which Cleco Partners’ subsidiary will be merged with and into the Company and the Company will cease to be a publicly traded company and will be a wholly owned subsidiary of Cleco Partners (the “Merger”). The Merger Agreement was approved by the Company’s shareholders at a special shareholders’ meeting held on February 26, 2015. The Merger Agreement is subject to other conditions to closing, including various regulatory approvals. Upon the closing of the Merger, the Company’s directors will cease to serve as such and the directors of Cleco Partners’ subsidiary will become the directors of the Company.

Vicky A. Bailey has served as the president of Anderson Stratton International, LLC, a strategic consulting and government relations company, since 2005. She also is a partner in BHMM Energy Services, LLC, a certified minority-owned energy facilities management group. Ms. Bailey has served on the Blue Ribbon Commission on America’s Nuclear Future since 2010. From 2004 to 2005, she was a partner in Johnston & Associates, LLC, a firm representing clients before the federal government in the fields of energy, education, environment, defense and other issue areas. Ms. Bailey is 62 years old and became a director of Cleco in 2013. She is a member of the Audit and Nominating/Governance Committees.

Ms. Bailey has an extensive understanding of the energy sector. In addition to her experience described above, she served as a commissioner with the Federal Energy Regulatory Commission from 1993 through 2000 and was the Assistant Secretary for Policy and International Affairs from 2001 through 2004. Ms. Bailey was a member of the Board of Trustees of the North American Electric Reliability Corporation from 2010 until 2013. She was the president and a member of the board of directors of PSI Energy Inc., the Indiana electric utility

subsidiary of Cinergy Corporation, which is now part of Duke Energy, from 2000 until 2001. Ms. Bailey currently serves as a director of EQT Corporation, an integrated energy company, and Cheniere Energy, Inc., a company primarily engaged in the liquefied natural gas-related business. She also serves as a director of Battelle Memorial Institute, a nonprofit research and development organization that serves the national security, health and life sciences, and energy and environmental industries. Ms. Bailey’s valuable utility leadership background, knowledge of the utility sector, broad understanding of public policy and corporate governance, and longstanding energy and corporate board experience make her an asset to Cleco’s board of directors.

Elton R. King, who is retired, was employed as president and chief executive officer (“CEO”) of Visual Networks, Inc., a company engaged in providing application performance and network management solutions, from June 2001 until August 2002 and also served as a member of its board of directors during that time. Mr. King retired from BellSouth Telecommunications, Inc. (“BellSouth”) in 1999, serving most recently as the president of its network and carrier services group. He also served as a director of Hibernia Corporation and Hibernia National Bank until November 2005. Mr. King is 68 years old and became a director of Cleco in 1999. He is chairman of the Finance Committee and a member of the Nominating/Governance Committee.

Mr. King joined BellSouth in 1968 after graduating from Mississippi State University with a degree in electrical engineering. He worked his way up through the organization to the leadership of the 35,000-employee network and carrier services group. During his 31-year career with BellSouth, Mr. King served in various leadership positions in company operations in Alabama, Louisiana and Mississippi. While serving as BellSouth’s Louisiana state president, Mr. King played a major role in the economic development of the New Orleans area. He led the effort to create the MetroVision Economic Development Partnership, which promotes economic growth in nine southeastern Louisiana parishes. Mr. King’s business acumen and drive for innovation and growth make him a valuable member of Cleco’s board of directors.

Logan W. Kruger, who is retired, served as the president and CEO of SUN Gold Limited, a privately-held company based in the Channel Islands, between March 2012 and December 31, 2014. SUN Gold Limited is engaged as an entity for discovery, development and conversion of natural resources outside the United States. Mr. Kruger served as the president, CEO and a director of Century Aluminum Company (“Century”), a publicly held company owning primary aluminum capacity in the United States and Iceland, from December 2005 until November 2011. Prior to that time, Mr. Kruger was employed by Inco Limited, a publicly held company engaged in the

5

CLECO CORPORATION | ||

CLECO POWER | 2014 FORM 10-K/A | |

mining, processing and marketing of nickel and nickel-related products, where he served as executive vice president of technical services from September 2003 until September 2005 and as president, Inco Asia Pacific, from September 2005 until November 2005. Mr. Kruger is 64 years old and became a director of Cleco in 2008. He is chairman of the Compensation Committee and a member of the Audit Committee.

Mr. Kruger has spent over 30 years in the commodities business, including his early career with Anglo American’s gold, uranium and coal companies. He served in various positions of increasing responsibility over mining operations and technical services, which contributed to his deep understanding of the energy business. With his years of managerial experience, Mr. Kruger brings to the board of directors demonstrated management ability at senior levels and a strong operations-oriented perspective. In his role as CEO at Century, he gained valuable experience evaluating the results of a public corporation, which contributes to his service as a member of Cleco’s board of directors.

William L. Marks, who is retired, was CEO and chairman of the board of directors of Whitney Holding Corporation (“Whitney”), a bank holding company engaged in commercial, retail and international banking services, as well as brokerage, investment, trust and mortgage services, and Whitney National Bank for more than five years before retiring in March 2008. He also has served as a director of Adtran, Inc. (“Adtran”), a global provider of networking and communications equipment, since 1993. Mr. Marks is a member of Adtran’s audit committee. He also serves as a Life Trustee of Wake Forest University in North Carolina. Mr. Marks is 72 years old and became a director of Cleco in 2001. He serves as the Board’s lead director and also is a member of the Finance Committee and the Compensation Committee.

Mr. Marks spent over 40 years in the banking business where he held various positions of increasing responsibility, including his position as CEO and chairman of the board of directors of Whitney. Mr. Marks oversaw the implementation of Whitney’s compliance with the Sarbanes-Oxley Act of 2002. The depth and breadth of his exposure to complex financial issues during his career make him a skilled advisor as the board’s lead director.

Peter M. Scott III, who is retired, was employed by Progress Energy, Inc., a publicly held utility company headquartered in Raleigh, North Carolina, where he served as executive vice president and chief financial officer (“CFO”) from 2000 to 2003 and 2005 to 2008. He also served as president and CEO of Progress Energy Service Company, LLC from 2004 until September 2008. Mr. Scott is 65 years old and became a director of Cleco in 2009. He is chairman of the Audit Committee and a member of the Compensation Committee.

Mr. Scott received his master’s degree in business administration from the University of North Carolina at Chapel Hill in 1977. During his career with Progress Energy, Mr. Scott’s focus was on finance, accounting, risk management, human resources and corporate governance. He also has served on the audit and finance committees of Nuclear Electric Insurance Limited, and he currently serves as vice chairman of the Board of Governors of Research Triangle Institute International and also serves as chairman of the audit committee. Mr. Scott is a member of the board of directors of Duke Realty Corporation, where he serves on the audit and finance committees. He serves on the Board of Visitors of the Kenan-Flagler School of

Business at the University of North Carolina at Chapel Hill. Mr. Scott’s financial, audit and corporate governance experience enables him to provide critical insight as the chairman of Cleco’s Audit Committee.

Shelley Stewart, Jr. has served as vice president - sourcing & logistics and chief procurement officer for E.I. du Pont de Nemours & Company since June 2012. From 2003 to 2012, he was senior vice president, operational excellence & chief procurement officer of Tyco International Limited (“Tyco”), a publicly held company headquartered in Princeton, New Jersey. Mr. Stewart also served as vice president of Tyco’s supply chain management from 2003 until 2006. Prior to joining Tyco, he was senior vice president of supply chain for Invensys PLC, a global technology group, from 2001 until 2003. Mr. Stewart is 62 years old and became a director of Cleco in April 2010. He is chairman of the Nominating/Governance Committee and a member of the Audit Committee.

Mr. Stewart received his master’s degree in business administration from the University of New Haven in 1990. Throughout his career, Mr. Stewart has held numerous positions of increasing responsibility, including senior-level supply chain and operational duties with leading industrial companies. He formerly served as the chairman of the board of directors of the Institute for Supply Management, the world’s largest supply management association. Mr. Stewart’s global experience in developing and managing highly effective, cross-functional teams, as well as his extensive supply chain and operational experience, position him well to serve on the board of directors and as chairman of the Nominating/Governance Committee and a member of the Audit Committee.

William H. Walker, Jr., who is retired, was the president and a director of Howard Weil, Inc. (“Howard Weil”), an investment banking firm, for more than five years before retiring in 2005. Mr. Walker is 69 years old and became a director of Cleco in 1996. He is a member of the Compensation Committee and the Finance Committee.

Mr. Walker is a 1967 graduate of Mississippi State University. He has a variety of experience, including a background in sales and systems engineering with International Business Machines Corporation, as well as service in the United States Army, where he was an officer in the Adjutant General’s Corps and a teacher at the Army War College. Mr. Walker began his career in the securities business in New York in 1972. He has since been involved in many aspects of the securities business, including sales, trading, research and investment banking with respect to both debt- and equity-related instruments. Mr. Walker joined Howard Weil in 1976 and was named president in 1990. This experience enables him to be a valuable contributor to the board of directors, especially in his role as a member of the Compensation Committee and the Finance Committee.

Bruce A. Williamson has served as chairman, president and CEO of Cleco Corporation since April 2014. He joined Cleco in July 2011 as its president and CEO. Prior to joining Cleco, Mr. Williamson was chairman, president and CEO of Dynegy, Inc. (“Dynegy”) from 2004 until 2011, and was president and CEO of Dynegy from 2002 to 2004. Mr. Williamson is 55 years old and became a director of Cleco in July 2011.

6

CLECO CORPORATION | ||

CLECO POWER | 2014 FORM 10-K/A | |

Mr. Williamson serves as a member of the board of directors for Questar Corporation, where he serves as chairman of the finance and audit committee and is a member of the management performance committee. He also serves on the board of Southcross Energy Partners, L.P., where he serves on the audit, compensation and conflicts committees. Mr. Williamson is a member of the University of Houston Dean’s Advisory Board. He earned his master’s degree in business administration from the University of Houston in 1995. Mr. Williamson has held numerous positions of increasing responsibility in finance and corporate development. His 30+ years of broad energy industry and financial experience position him well to serve as the chairman of the board of directors and as the Company’s chairman, president and CEO.

Audit Committee

Cleco has a separately-designated standing audit committee established in accordance with section 3(a)(58)(A) of the Exchange Act. The members of Cleco’s Audit Committee are Peter M. Scott III, Vicky A. Bailey, Logan W. Kruger and Shelley Stewart, Jr. Cleco’s board of directors has determined that Mr. Peter M. Scott III, who serves as the chairman of the Audit Committee, fulfills the requirements for an independent audit committee financial expert for Cleco Corporation as required by the NYSE Listing Standards.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires Cleco’s executive officers and directors, and persons who beneficially own more than 10% of a registered class of Cleco’s equity securities, to file with the SEC and the NYSE initial reports of ownership and reports of changes in ownership of Cleco’s equity securities. To Cleco’s knowledge, based solely on review of the copies of such reports furnished to Cleco, for the fiscal year ended December 31, 2014, all Section 16(a) filing requirements applicable to its executive officers, directors and greater-than-10% shareholders were satisfied.

Code of Business Conduct & Ethics and Related Party Transactions

Cleco has adopted a Code of Conduct that applies to its principal executive officer, principal financial officer, principal accounting officer and treasurer. Cleco also has adopted Ethics & Business Standards applicable to all employees and the board of directors. In addition, the board of directors has adopted Conflicts of Interest and Related Policies to prohibit certain conduct and to reflect the expectation of the board of directors that its members engage in and promote honest and

ethical conduct in carrying out their duties and responsibilities,

including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships and corporate opportunities. Under the Conflicts of Interest and Related Policies, Cleco considers transactions that are reportable under the SEC’s rules for transactions with related parties to be conflicts of interest and prohibits them. Any request, waiver, interpretation or other administration of the policy shall be referred to the Nominating/Governance Committee. Any recommendations by the Nominating/Governance Committee to implement a waiver shall be referred to the full board of directors for a final determination. The Code of Conduct, Ethics & Business Standards, and Conflicts of Interest and Related Policies are posted on Cleco’s web site at www.cleco.com; Investors-Codes of Conduct. Each of these documents is also available free of charge by request sent to: Shareholder Services, Cleco, P.O. Box 5000, Pineville, LA 71361-5000.

Communications with the Board

The Corporate Governance Guidelines provide for communications with the board of directors by shareholders and other interested persons. In order for shareholders, employees and other interested persons to make their concerns known to the board, Cleco has established a procedure for communications with the board through the board’s independent lead director. The procedure is intended to provide a method for confidential communication, while at the same time protecting the privacy of the members of the board. Any shareholder or other interested person wishing to communicate with the board of directors, or the non-management members of the board, may do so by addressing such communication as follows:

Lead Director of the Board of Directors

c/o Corporate Secretary

Cleco Corporation

P. O. Box 5000

Pineville, LA 71361-5000

Upon receipt, Cleco’s corporate secretary will forward the communication, unopened, directly to the lead director. The lead director will, upon review of the communication, make a determination as to whether it should be brought to the attention of the other non-management members and/or the management member of the board of directors and whether any response should be made to the person sending the communication, unless the communication was made anonymously.

7

CLECO CORPORATION | ||

CLECO POWER | 2014 FORM 10-K/A | |

ITEM 11. EXECUTIVE COMPENSATION | ||||

Compensation Discussion and Analysis (“CD&A”)

Executive Summary

Cleco’s executive compensation and benefits philosophy is to provide market-based programs that pay or award our executive officers at levels approximating the competitive market. We believe in paying above the market for superior performance and below the market for underperformance unless extraordinary circumstances compel us otherwise. Our overall executive compensation design philosophy reflects our Compensation Committee’s desire to align management’s actions with the interests of our shareholders. Our executive benefits philosophy is to offer plans and programs that allow us to consistently attract and retain executive talent.

2014 Results and Our Compensation Philosophy

Cleco had a successful 2014. We met or exceeded all of our financial goals and completed or made significant progress

toward completion of several strategic initiatives.

Highlights for 2014 include:

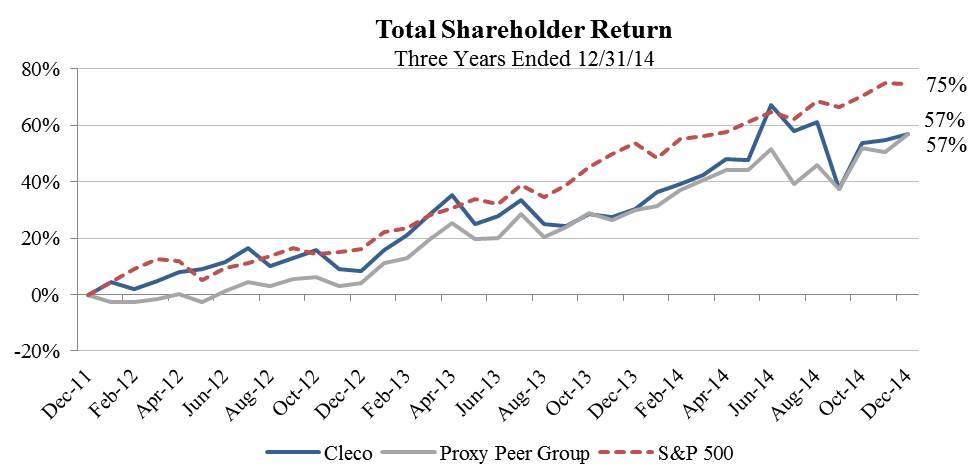

• | A total shareholder return (“TSR”) of 21% for the year ended December 31, 2014, and 57% for the three-year period ended December 31, 2014. |

• | An effective cost-reduction program that significantly contributed to the achievement of operational earnings per share (“EPS”) of $2.74. |

• | A 10% increase in the quarterly dividend to shareholders from $0.3625 to $0.40. |

• | Successful transfer of Cleco Midstream’s Coughlin Power Station to Cleco Power under its proposals/integrated resource planning process. |

• | An investment of $47 million to improve the environmental performance of Cleco Power’s generating fleet and to meet stricter environmental regulations. |

• | Successful integration of Cleco Power into the Midcontinent Independent System Operator, Inc. (“MISO”) market. |

• | Four-year extension of Cleco Power’s Formula Rate Plan with a targeted return on equity of 10.0%. |

As a direct result of our success in 2014, performance on many of our incentive measures met or exceeded our targets. Performance related to each of these measures is explained further in “Details Related to Corporate Performance Metrics Established to Determine 2014 PFP Plan Award Levels.” Due to strong annual EPS and three-year TSR performance (the primary performance metrics in our annual and long-term incentive plans), actual incentive compensation for our named executive officers — 2014 cash incentive and long-term incentive award for the 2012 to 2014 performance cycle — exceeded each plan’s target by 10.0% and 20.0%, respectively. Our Compensation Committee, in reviewing and approving the 2014 award levels, concluded that this attained compensation level was consistent with our performance results described above, as well as with progress made on our major strategic initiatives. Overall, we believe the Company’s executive compensation program is working as intended, remains consistent with practices within our Comparator Group, as defined under “Market Data and Comparator Group,” and is aligned with shareholder outcomes.

As previously disclosed, at a special meeting of shareholders held on February 26, 2015, our shareholders approved the Merger Agreement. Completion of the Merger is subject to several other closing conditions, including various

regulatory approvals. Cleco expects the transaction to close in the second half of 2015. As a result of the pending transaction, this CD&A addresses historical executive compensation decisions and references the definitive proxy statement filed in connection with the Merger and dated January 13, 2015 for details regarding the effect of the Merger on our executive compensation philosophy.

Our 2014 Compensation Objectives

To align our compensation practices with our philosophy of providing competitive market-based programs that allow for pay opportunities above the market for superior performance and below the market for underperformance, we seek to provide our executive officers with total compensation opportunities that:

1. are competitive with those of comparable electric utilities and energy service companies where we compete for talent;

2. deliver a majority of compensation that is contingent on performance;

3. ensure there is a direct link between compensation and our financial and operational performance; and

8

CLECO CORPORATION | ||

CLECO POWER | 2014 FORM 10-K/A | |

4. align our officers’ long-term compensation opportunities with shareholder outcomes.

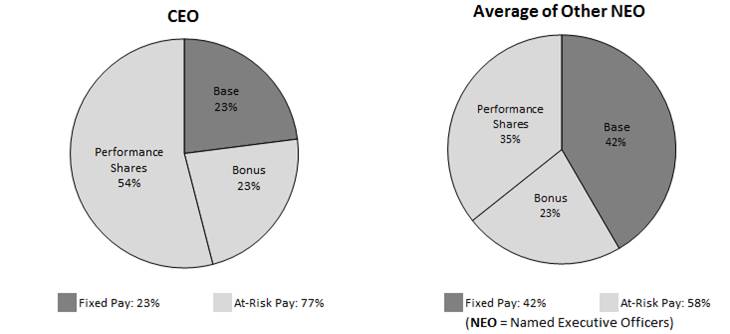

Pay for Performance

We define performance-based pay as pay that is dependent upon our performance against pre-established measures and/or our performance compared to the performance of companies in our Proxy Peer Group, as defined under “Market Data and Comparator Group.” The pie charts below

demonstrate our commitment to the delivery of a pay for performance compensation program, as the only fixed element of our ongoing compensation program is base salary. Our annual and long-term incentive plans are fully performance-based. Time-based restricted stock is occasionally awarded in special circumstances to address retention concerns, attract external new hires or reward outstanding individual performance.

Compensation Governance

• | Clawback Policy: The formal recoupment policy, applicable to officer incentive compensation awards, authorizes our Compensation Committee to recover officer incentive payouts if those payouts are based on financial performance results that are subsequently revised or restated to levels that would have produced lower incentive plan payouts. The recoupment policy is intended to reduce potential risks associated with our incentive plans, and thus more closely align the long-term interests of our named executive officers and our shareholders. |

• | Stock Ownership Guidelines: Our officer stock ownership requirements strengthen the alignment of the financial interests of our executive officers with those of shareholders and provide an additional basis for sharing in the Company’s success or failure as measured by overall shareholder returns. For 2014, 10 out of 11 of our officers had achieved their established ownership levels based on the requirements, and the other officer is on track to meet the required ownership level. |

• | Performance-based Incentive Programs: The Company’s total compensation program does not provide for guaranteed bonuses and has multiple performance measures. Annual cash incentive components focus on both the actual results and the quality of those results. The annual cash incentive plan for employees and executives contains both economic and qualitative components. The plan also focuses on system reliability, generation fleet availability, safety results and individual performance through Cleco Corporation’s Pay for Performance Plan (the “PFP Plan”). |

• | Anti-hedging Policy: The “anti-hedging” policy in the Company’s insider trading policy states that all directors, officers and employees are prohibited from hedging the economic interest in the Company shares they hold. |

• | No Excise Tax Gross-ups: No change in control arrangement includes an Internal Revenue Code (“IRC”) Section 280G excise tax gross-up provision. |

• | Use of Independent Consultants: The Compensation Committee has a formalized process to ensure the independence of the executive compensation consultant plus other advisors and reviews and affirms the independence of advisors annually. |

• | Double-trigger Equity Vesting: Beginning with awards made in 2013, the Compensation Committee revised equity awards to require a termination event and change in control to accelerate equity vesting following a change in control. |

Pay Elements

Our Compensation Committee targets total compensation (made up of the elements described below) to be competitive with the median of our Comparator Group, but individual positioning may vary above or below the median depending on each executive’s experience, performance and contribution to the Company. For 2014, we believe that we accomplished our philosophy through the following compensation and benefit components:

9

CLECO CORPORATION | ||

CLECO POWER | 2014 FORM 10-K/A | |

2014 Pay Element | Description |

Base Salary | • Fixed pay element • Delivered in cash |

Annual Cash Incentive (PFP Plan) | • Performance-based annual incentive plan that pays out in cash • EPS is primary measure for our named executive officers • Additional metrics include safety, system reliability and generation fleet availability • Quality Performance Factor allows for payout to be adjusted up or down by 10% of the target award based on quality of earnings or other performance |

Long-Term Incentives | • Annual equity grant is delivered in the form of performance shares • Payout of performance shares is contingent on TSR relative to a group of peers, measured during a three-year performance cycle • Time-based restricted stock is occasionally awarded in special circumstances to address retention concerns, attract external new hires or reward outstanding individual performance |

Benefits | • Broad-based benefits such as group medical, dental, vision and prescription drug coverage; basic life insurance; supplemental life insurance; dependent life insurance; accidental death and dismemberment insurance; a defined benefit pension plan (for those employees hired prior to August 1, 2007); and a 401(k) Savings Plan with a Company match for those employees hired before August 1, 2007, as well as a 401(k) Savings Plan with an enhanced benefit for those employees hired after August 1, 2007; same as those provided to all employees |

Executive Benefits | • Supplemental Executive Retirement Plan (closed to new participants in 2014) • Nonqualified Deferred Compensation Plan |

Perquisites | • Limited to executive physicals, spousal/companion travel and relocation assistance |

The Executive Compensation Process

Our Compensation Committee

Our Compensation Committee met six times during 2014, including three telephone meetings. Our Compensation Committee’s meetings in January, July, October and December are devoted to issues analysis, market analysis and performance tracking of our compensation and benefit programs. Our CEO and senior vice president, corporate services & information technology attend our Compensation Committee’s meetings on behalf of management, but do not participate in the Compensation Committee’s executive sessions.

Our Compensation Committee’s responsibilities, which are more fully described in our Compensation Committee’s charter, include:

• | establishing and overseeing the Company’s executive compensation and benefit programs; |

• | determining if the Company’s executive compensation and benefit programs are achieving their intended purpose, being properly administered and creating proper incentives in light of the Company’s risk factors; |

• | analyzing the executive compensation and benefits practices of peer companies and annually reporting to the board of directors or recommending for approval by the board of directors the overall design of the Company’s executive compensation and benefit programs; |

• | annually evaluating the performance of the CEO and recommending to the board of directors adjustments in the CEO’s compensation and benefits; |

• | annually reporting and recommending to the board of directors pay adjustments for the non-CEO executive officers (including new hires), which includes base salary and incentive plan targets; and |

• | annually reviewing the Compensation Committee’s charter and revising as necessary. |

The Compensation Consultant

In 2010, our Compensation Committee engaged Frederic W. Cook & Co., Inc. (“Cook & Co.”) to consult on matters concerning executive officers’ compensation and benefits. All executive compensation adjustments and award calculations for 2014 were reviewed by Cook & Co. on behalf of our

Compensation Committee. Cook & Co. acted at the direction of our Compensation Committee and was independent of management. Our Compensation Committee determined Cook & Co.’s ongoing engagement activities, and Cook & Co. endeavored to keep our Compensation Committee informed of executive officers’ compensation trends and regulatory compliance developments throughout 2014. Cook & Co. was responsible for providing market data and analysis of 2014 compensation and benefits for our executive officers.

Our Compensation Committee has assessed the independence of Cook & Co. pursuant to SEC rules and concluded that its work did not raise any conflict of interest that would prevent Cook & Co. from independently representing our Compensation Committee.

The Role of the Chief Executive Officer

Our CEO annually reviews the performance of our named executives (other than himself) and makes recommendations to our Compensation Committee regarding base salary adjustments, cash incentives and long-term incentive awards. Our CEO participates in meetings of our Compensation Committee to discuss executive compensation, including measures and performance targets, but is subsequently excused to allow the independent members of our Compensation Committee to meet in executive session. For 2014, the measures and performance targets also were reviewed by Cook & Co. prior to adoption by our Compensation Committee.

Our Compensation Committee also has delegated limited authority to our CEO to extend employment offers to officers at the level of vice president or lower. The CEO may make such offers without prior approval of the board of directors provided no compensation component falls outside our Compensation Committee’s approved policy limits as described in “Decisions Made in 2014 with Regard to Each Compensation and Benefit Component.” Our Compensation Committee still approves any grant of Cleco common stock or other equity award made pursuant to this delegation of authority prior to issuance of the grant. No such employment offers were made under this delegation of authority during 2014.

Shareholder Advisory Vote

We provide an annual shareholder advisory vote on the compensation of Cleco’s named executive officers. In 2014,

10

CLECO CORPORATION | ||

CLECO POWER | 2014 FORM 10-K/A | |

shareholders strongly supported (approximately 97% of votes cast at the annual meeting voted for) our “say-on-pay” proposal. This “say-on-pay” vote is not binding on Cleco, our Compensation Committee or our board of directors; however, our board of directors and our Compensation Committee review the voting results and consider them, along with any specific insight gained from Cleco’s shareholders, when making decisions regarding executive compensation.

Evaluation and Design of Our Compensation and Benefit Programs

Market Data and Comparator Group

Our Compensation Committee believes that compensation and benefits for our executive officers who successfully enhance shareholder value should be competitive with the compensation and benefits offered by similar publicly held companies in our industry to attract and retain the high quality executive talent required by the Company. Our Compensation Committee examines our executive officers’ compensation against comparable positions using publicly available proxy data for a group of 18 industry peers (the “Proxy Peer Group”) and utility industry survey data to help design and benchmark our executive officer compensation. This evaluation includes base salary, annual and long-term incentive plan targets, other potential equity awards and target total compensation. The Proxy Peer Group, approved by the Compensation Committee in July 2013 and 2014, is also used to track comparable performance of our long-term incentive plan. The combination of the Proxy Peer Group and the utility industry survey data is referred to as “our Comparator Group.”

The Compensation Committee periodically examines the Proxy Peer Group to ensure that peer companies continue to meet the criteria of our model portfolio. The general criteria examined in developing our Proxy Peer Group include:

• | Operational fit: companies in the same industry with similar business operations and energy portfolio (e.g., companies that derive a majority of their revenues from a state regulated utility and have no large scale nuclear operations); |

• | Financial scope: companies of similar size and scale. Size is measured on a number of criteria relevant to this industry (e.g., market capitalization, enterprise value, assets and revenues). Most of the peer companies are within one to three times the size of Cleco’s market capitalization, which is the principle measure of scale in this industry. Revenues, used most frequently in general industry, may not lend itself as the most appropriate measure of scale in the utilities industry due to significant volatility in annual revenues. In limited circumstances, the small number of direct competitors in our industry may require the inclusion of one or more companies that are outside of this range if they are a direct competitor for business or talent. Cleco’s market capitalization is positioned at or near the median against the Proxy Peer Group; |

• | Competitors for talent: companies with whom Cleco competes for executive talent or those that employ similar labor or talent pools; and |

• | Competitors for investor capital. |

The Proxy Peer Group Companies | ||

AGL Resources Inc. | El Paso Electric Company | Pinnacle West Capital Corporation |

ALLETE, Inc. | Energen Corporation (1) | PNM Resources, Inc. |

Alliant Energy Corporation | Great Plains Energy Incorporated | Portland General Electric Company |

Avista Corporation | IDACORP, Inc. | TECO Energy, Inc. |

Black Hills Corporation | NorthWestern Corporation | UNS Energy Corporation (2) |

Calpine Corporation | OGE Energy Corp. | Vectren Corporation |

(1) | Energen Corporation divested 100% of its natural gas utility Alabama Gas Corporation to the Laclede Group, Inc. effective August 31, 2014 and was removed from the Proxy Peer Group effective January 1, 2015. |

(2) | UNS Energy Corporation was acquired by Fortis Inc. effective August 15, 2014 and was removed from the Proxy Peer Group effective January 1, 2015. |

In setting executive compensation levels in 2014, our Compensation Committee also used utility industry survey data from the 2013 Towers Watson Energy Services Executive Compensation Database. Survey data provides a broader energy industry perspective. This survey data is used in conjunction with the Proxy Peer Group data as a competitive market reference point for the Compensation Committee to consider in determining pay levels.

Decisions Made in 2014 with Regard to Each Compensation and Benefit Component

Base Salary

We strive to set base salary levels for our executive officers as a group, including the named executive officers, at a level approximating +/-15% of our Comparator Group market median for base pay. For 2014, actual base salaries for our executive officers as a group were 97% of the Comparator Group median.

In 2014, base salary increases for our named executive officers averaged 4.3%. Typically, the amount of a base salary increase is based on an appraisal of individual performance by the named executive officer’s supervisor and, in the case of our CEO, by our board of directors and the terms of his

employment agreement, as well as position-specific market data provided by Cook & Co. to our Compensation Committee.

Base salaries for our named executive officers in 2014 are shown in the table below:

Name | 2014 Base Salary | 2014 % Change | ||

Mr. Williamson | $ | 745,000 | 1.4 % | |

Mr. Miller | $ | 300,000 | 7.1 % | |

Mr. Olagues | $ | 390,000 | 4.0 % | |

Mr. Hoefling | $ | 290,000 | 3.6 % | |

Ms. Miller | $ | 290,000 | 5.5 % | |

Average % Change | 4.3 % | |||

Our Compensation Committee approved these adjustments based on the following:

• | Mr. Williamson — favorable overall performance in 2013, continued cost cutting initiatives, and execution of several major initiatives including a 10-year contract with the Mississippi Delta Energy Agency (70 megawatts) and a 20-year contract with the City of Alexandria (30 to 60 megawatts). |

• | Mr. Miller — favorable overall performance in his role as senior vice president & CFO, including oversight of the |

11

CLECO CORPORATION | ||

CLECO POWER | 2014 FORM 10-K/A | |

Company’s cost-reduction program and investor relations initiatives, and positioning to market.

• | Mr. Olagues — favorable overall performance in his role as president - Cleco Power, including oversight of the successful migration of Cleco Power into the MISO market, environmental capital expenditures and the Coughlin Power Station transfer into Cleco Power. |

• | Mr. Hoefling — favorable overall performance in 2013, especially related to cost cutting efforts in connection with external legal services, as well as supply chain and vehicle fleet functions. |

• | Ms. Miller — favorable overall performance in 2013 in her position as senior vice president over the following functions: human resources; health, safety & environmental services; and telecommunications/facilities/information technology support where improvement was needed to continue to drive cultural change to grow the Company. |

Annual Cash Incentive

We maintain an annual, performance-based cash incentive plan called the Cleco Corporation Pay for Performance Plan or PFP Plan. The PFP Plan became effective January 1, 2012, and it superseded the Company’s Annual Incentive Plan (“AIP”) and Employee Incentive Plan. The PFP Plan applies to all regular, full-time employees, and it includes weighting for corporate and individual performance goals. Our executive officers have 100% of their PFP Plan targets weighted on corporate goals, since they have more influence over corporate-level results. As mentioned, the Compensation Committee targets PFP Plan award opportunities for executive officers to approximate the median of the annual cash incentive target award of our Comparator Group. Payouts are capped at 200% of target.

The table below presents the target PFP Plan opportunities for the named executive officers in 2014:

Name | Target as % of Base Salary |

Mr. Williamson | 100% |

Mr. Miller | 50% |

Mr. Olagues | 65% |

Mr. Hoefling | 50% |

Ms. Miller | 50% |

The 2014 PFP Plan award for our named executive officers was based entirely on the corporate performance measures described below. The 2014 PFP Plan corporate performance measures consisted of the six metrics listed below (weighting):

• | EPS (70%) |

• | System Average Interruption Duration Index or SAIDI (5%) |

• | Equivalent Availability Factor or EAF (5%) |

• | Safety (10%) |

- Personal Injuries (5%)

- Vehicle Accidents (5%)

• | Quality Performance Factor (10%) |

In establishing the 2014 PFP Plan corporate metrics, the Compensation Committee believed it was most important to reward senior executives for the overall financial performance of the Company, and therefore weighted EPS most heavily at 70%. In addition, to continually focus the executives and the entire organization on the importance of safety, system reliability and generation fleet availability, 20% of the bonus opportunity attributable to the corporate measures was

contingent on safety and operational performance. Finally, in 2011, the Compensation Committee established the “Quality Performance Factor” with a 10% weighting. This factor permits the Compensation Committee to assess how performance was achieved during the year and to adjust the payout using a number of subjective factors based on its discretion and management input.

In December of each fiscal year, our CEO recommends the PFP Plan financial performance and other measures to our Compensation Committee for the upcoming year. Based on our historical performance relative to target and our relative historical performance versus our Comparator Group, our Compensation Committee reviews, revises as appropriate and approves the PFP Plan measures for the upcoming year.

Details Related to Corporate Performance Metrics Established to Determine 2014 PFP Plan Award Levels

Metric # 1: EPS — For 2014, the following EPS matrix was developed to determine performance and payout ranges related to EPS performance. This measure represents 70% of the overall PFP Plan award for the corporate measures.

EPS MATRIX (70%)

Performance Level | Fully DilutedEarnings Per Share * | % of Financial Target Award Paid | |||

<$ | 2.4975 | 0% | |||

Threshold | $ | 2.4975 | 50% | ||

Target | $ | 2.7000 | 100% | ||

Maximum | $ | 2.9700 | 200% | ||

2014 Result | $ | 2.7400 | 114.8% | ||

* Consolidated EPS (operational earnings)

Metric # 2: SAIDI — The average amount of time a customer’s service is interrupted during the year. Measured in hours per customer per year and based on a ten-year rolling average of Cleco Power’s performance. This metric represents 5% of the overall PFP Plan award for the corporate measures.

SAIDI MATRIX (5%)

Performance Level | Hours Per Customer Per Year | % of SAIDI Target Award Paid |

>2.50 | 0% | |

Threshold | 2.45 to 2.50 | 50% |

Target | 2.39 to 2.44 | 100% |

2.33 to 2.38 | 150% | |

Maximum | <2.33 | 200% |

2014 Result | 2.36 Hours | 150% |

Metric # 3: EAF — Measures the percentage of time that a generation unit is available to generate electricity after all types of outages are taken into account. Measured as a percentage based on a three-year MISO equivalent forced outage rate, demand and Cleco Power’s planned maintenance for the year. This metric represents 5% of the overall PFP Plan award for the corporate measures.

12

CLECO CORPORATION | ||

CLECO POWER | 2014 FORM 10-K/A | |

EAF MATRIX (5%)

Performance Level | % Generation Fleet Availability | % of EAF Target Award Paid |

<82.62% | 0% | |

Threshold | 82.62% to 84.73% | 50% |

Target | 84.74% to 86.85% | 100% |

86.86% to 89.02% | 150% | |

Maximum | >89.02% | 200% |

2014 Result | 83.16% | 50% |

Metric # 4: Personal Injury Safety — Compares Cleco’s personal injuries in the current year against the Company’s performance the prior year. For 2014, the Company’s target goal with respect to personal injuries was a 20% reduction over the number of injuries sustained in 2013. This metric represents 5% of the overall PFP Plan award for the corporate measures.

SAFETY - PERSONAL INJURIES MATRIX (5%)

Performance Level | Performance Relative to 2013 | % of Safety - Injuries Target Award Paid |

Worse than or a fatality | 0% | |

Threshold | No change | 50% |

Target | 20% reduction (6 to 7 injuries) | 100% |

1 to 5 injuries | 150% | |

Maximum | 0 injuries | 200% |

2014 Result | 7 injuries | 100% |

Metric # 5: Vehicle Accident Safety — Compares Cleco’s avoidable vehicle accidents in the current year against the Company’s performance the prior year. For 2014, the Company’s target goal with respect to avoidable vehicle accidents was a 20% reduction over the number of avoidable accidents in 2013. This metric represents 5% of the overall PFP Plan award for the corporate measures.

SAFETY - VEHICLE ACCIDENTS MATRIX (5%)

Performance Level | Performance Relative to 2013 | % of Safety - Accidents Target Award Paid |

Worse than or a fatality | 0% | |

Threshold | No change | 50% |

Target | 20% reduction (7 to 8 accidents) | 100% |

1 to 6 accidents | 150% | |

Maximum | 0 accidents | 200% |

2014 Result | 17 accidents | 0% |

Metric # 6: Quality Performance Factor — Our Compensation Committee reviewed and considered 2014 results and determined that continued cost-reduction measures implemented by management and the completion of several other major initiatives contributed to the achievement of 2014 EPS. Our Compensation Committee further considered the Company’s successful integration of Cleco Power into the MISO market, the transfer of Cleco Midstream’s Coughlin Power Station to Cleco Power and the four-year extension of Cleco Power’s Formula Rate Plan approved in 2014. Based on these considerations, input from the CEO and through its use of discretion, our Compensation Committee decided that a payout of 146.3% related to the Quality Performance Factor

was appropriate. This metric represents 10% of the overall PFP Plan award for the corporate measures.

Total Payout: Our Compensation Committee determined that a total PFP Plan payout at 110% of target for the corporate measures was reasonable based on the Company’s performance in 2014. The resulting total PFP Plan corporate payout for 2014 was calculated as follows:

% of Target | x | Award Level | = | % of Payout | ||

EPS | 70% | 114.8% | 80.4% | |||

SAIDI | 5% | 150% | 7.5% | |||

EAF | 5% | 50% | 2.5% | |||

Safety-Personal Injuries | 5% | 100% | 5.0% | |||

Safety-Vehicle Accidents | 5% | 0% | 0% | |||

Quality Performance Factor | 10% | 146.3% | 14.6% | |||

Total | 100% | 110% | ||||

Our Compensation Committee may adjust the PFP Plan targets to more closely align incentive targets and awards with investor concerns.

Our Compensation Committee also has the authority to adjust the amount of any individual PFP Plan award with respect to the total award or the corporate or individual component of the award upon recommendation by our CEO. Adjustments for PFP Plan participants, except for our executives, may be made by the CEO in his discretion. Adjustments are based on our annual performance review process. No adjustments were made to the 2014 PFP Plan awards for our named executive officers.

Additional details on the 2014 PFP Plan measures and target levels regarding our named executives may be found in “Non-Equity Incentive Plan Compensation” and “Estimated Future Payments under Non-Equity Incentive Plan Awards (PFP Plan).”

Equity Incentives

Our executive officers and other key employees are eligible to receive performance-based and other grants of restricted stock, common stock equivalent units (“CEUs”), stock options and stock appreciation rights. These grants are made pursuant to the Cleco Corporation 2010 Long-Term Incentive Compensation Plan (the “LTIP”). A grant gives the recipient the right to receive or purchase shares of our common stock under specified circumstances or to receive cash awards based on the appreciation of our common stock price or the achievement of pre-established long-term performance goals. Taxes on equity incentives awarded pursuant to our LTIP are borne by the executive officer.

Upon closing of the Merger, unvested performance-based equity grants for the three-year performance cycles beginning January 1, 2013 and January 1, 2014 will vest at target based on a price per share equal to $55.37. For the three-year performance period beginning January 1, 2015, unvested performance-based equity grants will vest at target based on a price per share equal to $55.37, and the equity grant target shares will be prorated based upon the number of days lapsed in the 2015 cycle. Outstanding time-based equity awards also will vest based on a price per share equal to $55.37 upon closing of the Merger. For additional details regarding the effect of the Merger on equity incentives, see “Interests of Our Directors and Executive Officers in the Merger” beginning on page 52 of the definitive proxy statement dated January 13, 2015.

13

CLECO CORPORATION | ||

CLECO POWER | 2014 FORM 10-K/A | |

Performance-Based Restricted Stock

Historically, our primary equity incentive tool has been an annual award of performance-based restricted stock under the LTIP. We commonly refer to these awards as the “LTIP award.”

2014 LTIP Award

Each LTIP award performance cycle is three years. For 2014, the performance cycle covered January 1, 2014 to December 31, 2016. The LTIP award performance measure is TSR. The LTIP has a minimum award of 0% of target and a maximum possible award of 200%. The performance measure used for the three-year LTIP performance cycle is Cleco’s TSR relative to the Proxy Peer Group.

The table below presents the TSR performance and payout range established to determine payouts for the 2014 LTIP award:

Performance Level | TSR Percent Rank | Payout | |

<30th %ile | 0 | % | |

Threshold | 30th %ile | 30 | % |

Target | 50th %ile | 100 | % |

Maximum | 100th %ile | 200 | % |

Each year the Compensation Committee approves an LTIP award to eligible executives. The target number of LTIP shares is a function of the grant date value, set as a percentage of base salary, divided by the price of our stock on the date of grant calculated as the average of the high and low price of our stock on the date of grant rounded to the nearest eighth.

Example: Base Salary = $100,000; LTIP Value = $50,000 (50% of base salary); Stock Price = $50/share; Target LTIP Shares = 1,000 shares

Each executive officer’s target LTIP award level is set, so in combination with other pay elements, it will deliver a total compensation opportunity that approximates the median of our Comparator Group. The chart below details the targeted opportunity for each of the named executives expressed as a percentage of base salary:

Name | 2014 LTIP Target as % of Base Salary |

Mr. Williamson | 235% |

Mr. Miller | 75% |

Mr. Olagues | 110% |

Mr. Hoefling | 75% |

Ms. Miller | 75% |

2012 - 2014 LTIP Award

Our Compensation Committee approved an overall award level of 120% of target for the LTIP performance cycle that ended on December 31, 2014. This award level reflects our TSR performance in the 60th percentile of the Proxy Peer Group as defined above under “Market Data and Comparator Group — The Proxy Peer Group Companies” for the three-year period ended December 31, 2014. Dividends accrued during the three-year period ended December 31, 2014 were paid to the extent the award was earned up to an award level of 100%. Dividends were not paid on the opportunity shares awarded for performance above 100%.

The table below summarizes our recent LTIP award history:

LTIP Historical Performance | 2012 | 2013 | 2014 |

TSR for the Three-Year Performance Period ended December 31 | 66% | 65% | 62% |

Percentile Rank in the Proxy Peer Group (100% is highest; 0% is lowest) | 73% | 81% | 60% |

LTIP Award Percentage | 146% | 163% | 120% |

TSR for purposes of the 2012 - 2014 LTIP performance cycle was calculated using the quarterly return method.

Our Compensation Committee may adjust our LTIP award if it determines that circumstances warrant. Any adjustment applies to all participants equally. No such adjustment was made for the LTIP award approved for the cycle ended December 31, 2014. There are no provisions in the LTIP for individual award adjustment. Details on how our LTIP grants and awards are calculated are included in “Stock Awards.”

Time-Based Restricted Stock

Time-based restricted stock typically is not an element of our annual long-term incentive award opportunity. The Compensation Committee will and has awarded grants of time-based restricted stock that are typically associated with mid-year promotions, at the time of an external executive hiring or to reward our named executive officers for extraordinary performance above that which can be rewarded through the PFP Plan. Our Compensation Committee uses such awards to increase ownership and encourage retention. For an external executive hiring, an award may be made to offset comparable awards or other value forfeited as a result of the executive’s leaving the former employer. The award of time-based restricted shares or unrestricted shares of our common stock is recommended by the CEO and approved by our Compensation Committee and our board of directors, or in the case of a grant to the CEO, is recommended jointly by our Compensation Committee and Nominating/Governance Committee to our board of directors. The award is conditioned upon continued employment at the time of vesting, which is typically three years after the award date. Taxes on time-based restricted stock are borne by the executive officer.

No time-based restricted stock awards were made to our named executive officers in 2014.

Stock Options

Our Compensation Committee did not approve the grant of any stock options during 2014. Our Compensation Committee last approved a stock option grant in July 2007.

Stock Appreciation Rights

We have not granted any stock appreciation rights under the terms of the LTIP since its adoption.

Nonqualified Deferred Compensation Plan

We maintain a Deferred Compensation Plan so that directors, executive officers and certain key employees may defer receipt and taxation of certain forms of compensation. Directors may defer up to 100% of their compensation; executive officers and other key employees may defer up to 50% of their base salary and up to 100% of their annual cash incentive. We find the use of deferred compensation plans prevalent within our industry and within the companies in our Proxy Peer Group. Cleco does not match deferrals or contribute to the plan. Actual participation in the plan is

14

CLECO CORPORATION | ||

CLECO POWER | 2014 FORM 10-K/A | |

voluntary. The notional investment options made available to participants are selected by our CFO. The allocation of deferrals among investment options is made by individual participants. The notional investment options include money market, fixed income and equity funds. Cleco common stock is not currently an investment option under the plan, except for directors. No changes were made to the plan during 2014.

In connection with the Merger, payment of deferred compensation plan balances that accrued before 2005 may be accelerated by means of an election made pursuant to the terms of our compensation plans triggered by a change in control involving the Company. One director, Mr. Walker, has made such an election. Accelerated payment of any deferred compensation plan balance accrued prior to 2005 will be made in the form of a single lump sum payment as soon as practicable following the effective date of the Merger. For additional details regarding the effect of the Merger on our deferred compensation plan, see “Interests of Our Directors and Executive Officers in the Merger” beginning on page 52 of the definitive proxy statement dated January 13, 2015.

Supplemental Executive Retirement Plan (“SERP”)

We maintain a SERP for the benefit of our executive officers who are designated as participants by our Compensation Committee. The SERP is designed to attract and retain executive officers who have contributed and will continue to contribute to our overall success by ensuring that adequate compensation will be provided or “replaced” during retirement.

Benefits under our SERP vest after ten years of service or upon death or disability while a participant is employed by Cleco. Our Compensation Committee may reduce the vesting period to less than ten years, which typically would occur in association with recruiting efforts. Benefits, whether or not vested, are forfeited in the event a participant is terminated for cause.

Benefits are based upon a participant’s attained age at the time of separation from service. The maximum benefit is payable at age 65 and is 65% of final compensation. Payments from the Company’s defined benefit pension plan (“Pension Plan”), certain employer contributions to our 401(k) Savings Plan and payments paid or payable from prior and subsequent employers’ defined benefit retirement or similar supplemental plans reduce or offset our SERP benefits. If a participant has not attained age 55 at the time of separation and receives SERP benefits before attaining age 65, SERP benefits are actuarially reduced to reflect early payment. The “Pension Benefits” table lists the present value of accumulated SERP benefits for our named executives as of December 31, 2014.

In 2011, our Compensation Committee amended the SERP to eliminate the business transaction benefit previously included in the SERP, as well as the requirement that a SERP participant be a party to an employment agreement to receive change in control benefits.

In July 2014, our board of directors voted to close the SERP to new participants. With regard to current SERP participants, including former employees or their beneficiaries, all terms of the SERP will continue.

In connection with the Merger, if a SERP participant’s employment is involuntarily terminated without cause, or the participant terminates his or her employment on account of good reason, either occurring within the 60-day period preceding, or the 36-month period following the Merger for all participants who commenced participation in the SERP prior to October 28, 2011 or within the 60-day period preceding, or the

24-month period following the Merger for all participants who commenced participation in the SERP on or after October 28, 2011, such participant’s SERP benefits shall: (i) become fully vested; (ii) be increased by adding three years to an affected participant’s age, subject to a minimum benefit of 50% of final compensation; and (iii) be subject to a modified reduction determined by increasing the executive’s age by three years. For additional details regarding the effect of the pending Merger on our SERP, see “Interests of Our Directors and Executive Officers in the Merger” beginning on page 52 of the definitive proxy statement dated January 13, 2015.

Change in Employment Status and Change in Control Events

During 2011, in conjunction with his being hired as CEO, we entered into an employment agreement with Mr. Williamson (the “Williamson Agreement”). This agreement is further discussed in “Mr. Williamson’s Employment Agreement.”

Generally in connection with recruiting efforts, the Company may enter into employment agreements with its executives. Our standard agreement provides for a non-renewing term, generally two years, and does not contain a change in control tax gross-up provision. Our Compensation Committee approved other revisions to our standard executive employment agreement based on input from Cook & Co., which we believe are consistent with current market trends while allowing us to maintain a competitive executive officer recruiting process. The Company has no executive employment agreements other than the Williamson Agreement.

See the section titled “Potential Payments at Termination or Change in Control” for a quantification and discussion of the material terms, potential payments and benefits associated with the Williamson Agreement, as well as the value of accelerated compensation and benefits under various separation scenarios for our named executives who do not have executive employment agreements.

The Cleco Corporation Executive Severance Plan

In recognition of the non-renewal of executive employment contracts, the board of directors adopted the Cleco Corporation Executive Severance Plan (the “Executive Severance Plan”) on October 28, 2011. The Executive Severance Plan provides our executive officers and other key employees with cash severance benefits in the event of a termination of employment, including involuntary termination in connection with a change in control.

In October 2014, our Compensation Committee, with the approval of the full board of directors, approved an amendment to the Executive Severance Plan to provide that an officer cannot trigger “Good Reason” under the Executive Severance Plan based on the fact the Company is no longer publicly traded. In December 2014, our Compensation Committee, with the approval of the full board of directors, approved additional amendments to the Executive Severance Plan expanding the definition of “Committee,” removing the authority of the Compensation Committee to continue making determinations of “Good Reason,” and clarifying that a potential acquirer of the Company cannot terminate the Executive Severance Plan during a change in control period without the consent of the “Covered Executive.”

15

CLECO CORPORATION | ||

CLECO POWER | 2014 FORM 10-K/A | |

Perquisites and Other Benefits

We may make available the following perquisites to our executive officers:

• | Executive officer physicals — as a condition of receiving their PFP Plan award, we require and pay for an annual physical for our executive officers and their spouses; |

• | Spousal/companion travel — in connection with the various industry, governmental, civic and entertainment activities of our executive officers, we pay for spousal/companion travel associated with such events; |

• | Relocation program — in addition to our standard relocation policy available to all employees, we maintain a policy whereby our executive officers and other key employees may request that we pay real estate agent and certain other closing fees should the officer or key employee sell his/her primary residence or that we purchase the executive officer’s or key employee’s primary residence at the greater of its documented cost (not to exceed 120% of the original purchase price) or average appraised value. Typically, this occurs when an executive officer or key employee relocates at the Company’s request; and |

• | Purchase program — under our Executive Severance Plan, a covered executive officer may request the Company to purchase his/her primary residence in the event he or she is involuntarily terminated without cause or separates for good reason, either in connection with a change in control and further provided the executive officer relocates more than 100 miles from the residence to be purchased. Limits on the purchase amount are the same as our relocation program described above. |

Our Compensation Committee approves the perquisites based on what it believes is prevailing market practice, as well as specific Company needs. Cook & Co. assists our Compensation Committee in this regard. We believe the relocation program is an important element in attracting executive talent to the central Louisiana area. Perquisite expenses related to business and spousal/companion travel for our executive officers are reviewed by internal audit and any exceptions are reported to our Audit Committee.

See the section titled “All Other Compensation” for details of these perquisites and their value for our named executives.

Our executive officers, including the named executives, also participate in our other benefit plans on the same terms as other employees. These plans include paid time off for vacation, sick leave and bereavement; group medical, dental, vision and prescription drug coverage (including our annual wellness program); basic life insurance; supplemental life insurance; dependent life insurance; accidental death and dismemberment insurance; defined benefit pension plan (for those hired prior to August 1, 2007); and the 401(k) Savings Plan with a Company match for those employees hired before August 1, 2007, as well as a 401(k) Savings Plan with an enhanced benefit for those employees hired after August 1, 2007, including Messrs. Williamson and Miller.

Other Tools and Analyses to Support Compensation Decisions

Tally Sheets

At least annually, our Compensation Committee reviews tally sheets that set forth the items listed below. This review is conducted as part of the comparison of the compensation and benefit components that are prevalent within our Comparator

Group. The comparison facilitates discussion with our Compensation Committee’s outside independent consultant as to the use and amount of each compensation and benefit component versus the applicable peer group.

• | Annual compensation expense for each named executive — this includes the rate of change in total cash compensation from year-to-year; the value of equity awards; the annual periodic cost of providing retirement benefits; and the annual cost of providing other benefits such as health insurance, as well as the status of any deferred compensation. |

• | Reportable compensation — to further evaluate total compensation; to evaluate total compensation of our CEO compared to the other executive officers; and to otherwise evaluate internal equity among our named executives. |

• | Company stock ownership — for each executive officer expressed as a multiple of base salary compared to industry standards provided by Cook & Co. Outstanding stock options and the in-the-money value of those options, if any, also are reviewed, as are each executive’s Cleco common stock purchases and sales history. |

• | Post-employment payments — reviewed pursuant to the potential separation events discussed in “Potential Payments at Termination or Change in Control.” |

Trends and Regulatory Updates

As needed, and at least annually, our Compensation Committee reviews reports related to industry trends, legislative and regulatory developments and compliance requirements based on management’s analysis and guidance provided by Cook & Co., as applicable. Plan revisions and compensation program design changes are implemented as needed.

Risk Assessment

Our Compensation Committee also seeks to structure compensation that will provide sufficient incentives for our executive officers to drive results while avoiding unnecessary or excessive risk taking that could harm the long-term value of the Company. Our Compensation Committee believes that the following actions and/or measures help achieve this goal:

• | at least annually, our Compensation Committee reviews the design of our executive compensation program to ensure an appropriate balance between business risk and resulting compensation; |

• | our Compensation Committee allocates pay mix between base salary and performance-based pay to provide a balance of incentives; |

• | the design of our incentive measures, including the interrelation between our PFP Plan and LTIP, is structured to align management’s actions with the interests of our shareholders; |

• | incentive payments are dependent on our performance measured against pre-established targets and goals and/or compared to the performance of companies in our Proxy Peer Group; |

• | the range and sensitivity of potential payouts relative to target performance are reasonable; |

• | our Compensation Committee imposes checks and balances on the payment of compensation discussed herein; |

16

CLECO CORPORATION | ||

CLECO POWER | 2014 FORM 10-K/A | |

• | our Recovery Policy discussed in the section entitled “Recoupment of Prior Awards Paid” below; |

• | detailed processes establish Cleco’s financial performance measures under our incentive plans; and |

• | incentive targets are designed to be challenging, yet achievable, to mitigate the potential for excessive risk-taking behaviors. |

During 2014, our Compensation Committee, with the assistance of Cook & Co., reviewed the Company’s assessment of compensation risk of the Company’s incentive plans. Our Compensation Committee concluded that our compensation policies do not create risks that are reasonably likely to have a material adverse effect on the Company.

Stock Ownership Requirements for Executive Officers