Attached files

| file | filename |

|---|---|

| EX-2.1 - SHARE EXCHANGE AGREEMENT - Technovative Group, Inc. | f8k042015ex2i_technovative.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 24, 2015

Technovative Group, Inc.

(Exact name of registrant as specified in its charter)

| Wyoming | 333-175148 | 38-3825959 | ||

(State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

Room 1512, Silvercord Building, Tower 2

30 Nathan Road, TsimTsaTsui, Hong Kong.

(Address of Principal Executive Offices)

Tel. +852 35472191

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

TABLE OF CONTENTS

| Item No. | Description of Item | Page No. | ||

| Item 1.01 | Entry Into a Material Definitive Agreement | 3 | ||

| Item 2.01 | Completion of Acquisition or Disposition of Assets | 4 | ||

| Item 3.02 | Unregistered Sales of Equity Securities | 29 | ||

| Item 5.01 | Change in Control of the Registrant | 29 | ||

| Item 5.06 | Change in Shell Company Status | 29 | ||

| Item 9.01 | Financial Statements and Exhibits | 30 |

| 2 |

EXPLANATORY NOTE

This Current Report on Form 8-K is being filed for Technovative Group, Inc. We are reporting the acquisition of a new business and providing a description of this business and its audited financials below.

USE OF DEFINED TERMS

Except as otherwise indicated by the context, references in this Report to:

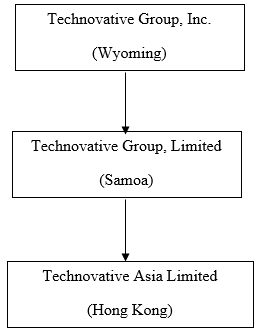

| ● | The “Company,” “we,” “us,” or “our,” are references to the combined business of (i) Technovative Group, Inc., a Wyoming corporation (“TEHG”), (ii) Technovative Group Limited, a company incorporated under the laws of Samoa and a wholly-owned subsidiary of TEHG (“TGL”), and (iii) Technovative Asia Limited, a company incorporated under the laws of Hong Kong and a wholly-owned subsidiary of TGL (“TAL”). |

| ● | “U.S. dollar,” “$” and “US$” refer to the legal currency of the United States. |

| ● | “Hong Kong dollar” and “HKD” refer to the legal currency of Hong Kong. |

| ● | “Securities Act” refers to the Securities Act of 1933, as amended. |

| ● | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended. |

Item 1.01 Entry Into A Material Definitive Agreement

Share Exchange Transaction

On April 24, 2015, TEHG, TGL and the sole stockholder of TGL who owns 100% of the equity interests of TGL (the “TGL Stockholder”) entered into and consummated transactions pursuant to a Share Exchange Agreement (the “Share Exchange Agreement,” such transaction referred to as the “Share Exchange Transaction”), whereby the Company issued to the TGL Stockholder an aggregate of 100,000 shares of its Series A Preferred Stock, par value $.001 per share (“Series A Preferred Stock”), in exchange for 100% of the TGL equity interest held by the TGL Stockholder. The 100,000 shares of Series A Preferred Stock will automatically convert into 51,500,000 shares of common stock, par value $.001 per share (“Common Stock”) upon the effectiveness of a 1-for-10 reverse stock split (“Reverse Split”) to be conducted by TEHG after the Share Exchange Transaction. As a result of the Share Exchange Transaction, TGL became our direct wholly-owned subsidiary and TAL became our indirect subsidiary. The shares of our Common Stock received by the TGL Stockholder, upon the completion of the Reverse Split and conversion of the Series A Preferred Stock, will constitute approximately 99.5% of our then issued and outstanding Common Stock.

AS A RESULT OF THE FOREGOING TRANSACTION, THE OWNERSHIP INTEREST OF ALL OF OUR COMMON SHAREHOLDERS IN THE COMPANY WILL BE 0.5% OF OUR TOTAL OUTSTANDING SHARES.

The Share Exchange Agreement contains representations and warranties by us, TGL and the TGL Stockholder which are customary for transactions of this type such as, warranties with respect to the Company which include the following: organization, good standing and qualification to do business; capitalization; subsidiaries; authorization and validity of the transaction and transaction documents; valid consents being obtained or not being required to consummate the transaction; no conflict or violation of Articles of Incorporation, warranties and representations with respect to TGL include the following: authorization; capitalization; and title to TGL’s ordinary shares being exchanged, and warranties and representations with respect to TGL Stockholder include the following: authorization; no conflict or violation of law; investment purpose; non-U.S. person status; reliance on exemption on the Company’s Series A Preferred Stock to be exchanged.

The Share Exchange Agreement has been reviewed by a Samoan law firm which opined that the execution and delivery of the Share Exchange Agreement, the performance by TGL of its obligations thereunder and the transfer of the shares of TGL to TEHG pursuant to the Share Exchange Agreement do not conflict with or result in a breach of any of the terms or provisions of the Memorandum and Articles of Association of TGL or any law, public rule or regulation applicable to TGL in Samoa currently in force and that the Share Exchange Agreement vested in the Company ownership of 100% of the equity interests of TGL.

| 3 |

Our acquisition of TGL and its subsidiary pursuant to the Share Exchange Agreement was accounted for as a reverse acquisition and recapitalization effected by a share exchange. TGL is considered the acquirer for accounting and financial reporting purposes. The assets and liabilities of the acquired entity have been brought forward at their book value and no goodwill has been recognized.

The foregoing description of the terms of the Share Exchange Agreement is qualified in its entirety by reference to the provisions of the Share Exchange Agreement, dated April 24, 2015 and attached as Exhibit 2.1 to this Current Report and is incorporated by reference herein.

Item 2.01 Completion of Acquisition or Disposition of Assets

As set forth above, on April 24, 2015, we completed the acquisition of TGL pursuant to the Share Exchange Agreement. The acquisition was accounted for as a reverse acquisition and recapitalization effected by a Share Exchange Transaction. TGL is considered the acquirer for accounting and financial reporting purposes. The assets and liabilities of the acquired entity have been brought forward at their book value and no goodwill has been recognized.

OUR CORPORATE STRUCTURE

Organizational History of Technovative Group, Inc.

The Company was incorporated in the state of Wyoming on August 12, 2010 under the name “Glacier Point Corp.” On December 6, 2010, the Company filed an amendment with the State of Wyoming to change the name from “Glacier Point Corp.” to “Solar America Corp.” On June 4, 2013, the Company filed an amendment with the State of Wyoming to change the name from “Solar America Corp.” to “Horizon Energy Corp.” On February 26, 2015, the Company changed its name from “Horizon Energy Corp.” to “Technovative Group, Inc.”

On December 16, 2010, the Company entered into an Agreement for Sale and Purchase of Business (the “Acquisition”) with the shareholder of Solar N’ Stuff, Inc. (“SNS”), a corporation organized under the laws of the State of Louisiana, whereby the Company acquired 100% of the issued and outstanding shares of SNS in exchange for consideration in the aggregate amount of $100,000. As a result of the Acquisition, the business of SNS became our principal business. On July 1, 2013, the Company decided to terminate the operations of SNS, effective immediately. On November 14, 2014, the Company and Cannon Investments, Inc. (“Cannon”) entered into an equity sale and settlement agreement (“Equity Sale and Settlement Agreement”), whereby the Company transferred 100% of the equity interests of SNS to Cannon in exchange for the settlement of the unpaid amount of the promissory notes owed to Cannon in the aggregate amount of $150,250.

On April 25, 2014, the Company and Ponta E&P, LLP, a Texas Limited Liability Partnership (“Ponta”) entered into a Letter Agreement (the “Ponta Agreement”), whereby the Company acquired a 25% working interest in Ponta’s Holmes Oil Unit #1 in return for a capital infusion of $115,000 (the “Holmes Investment”). Additionally, pursuant to the terms of the Ponta Agreement, the Company received an additional 25% working interest until such time as the Holmes Investment has been fully repaid. On November 14, 2014, the Company entered into a Debt Settlement Agreement and Mutual Release (“Debt Settlement Agreement”) with Tenton Global LLC (“Tenton”), pursuant to which Tenton agreed to settle and cancel the unpaid amount of the promissory note owed to Tenton by the Company in the aggregate amount of $906,772, in consideration of assignment by the Company of its rights and interests in a the Ponta Agreement. As a result of the Debt Settlement Agreement, the Company has no interests and rights in Holmes Investments.

| 4 |

Until November 14, 2014, the Company has issued an aggregate of 3,745,911 shares of common stock to Tuverga Finance Ltd., a corporation formed pursuant to the statutes of Republic of Cyprus (“Tuverga”) pursuant to an Equity Investment Agreement (“Equity Investment Agreement”) entered on April 15, 2014. Under the Equity Investment Agreement, the Company agreed to issue to Tuverga a number of shares of Common Stock of the Company for up to $2,500,000 (the “Commitment Amount”) upon providing advance notice to the Company. On November 14, 2014, the Company and Tuverga entered into a termination agreement (“Termination Agreement”) whereby the Company and Tuverga terminated the Equity Investment Agreement and thus Tuverga has no right to purchase and the Company has no obligation to sell shares of Common Stock to Tuverga under the Equity Investment Agreement thereafter.

On November 14, 2014, Salty Pepper Corp. (“SPC”) and Celestial Melody Limited (“CML”), a corporation formed under the laws of Samoa, entered into a Common Stock Purchase Agreement (the “Common Stock Purchase Agreement”), pursuant to which SPC sold to CML 30,000,000 shares of Common Stock of the Company for an aggregate of $200,000. On the same day, Tuverga and Jing Zhang, a citizen of the People’s Republic of China, entered into a Stock Purchase Agreement (the “Stock Purchase Agreement”), pursuant to which Tuverga sold to Ms. Zhang 3,745,911 shares of Common Stock in consideration of $75,000. As a result of the closing of the two aforementioned transactions, CML and Ms. Jing Zhang own approximately 65.2% of the total outstanding shares of the Company’s Common Stock as of the date of this Current Report. After the Reverse Split takes effect, CML and Ms. Jing Zhang will own approximately 0.33% of the total outstanding shares of the Company’s Common stock and the rest of our holders of Common Stock will own approximately 0.17%.

On February 26, 2015, the Company amended its Articles of Incorporation to: (i) change the Company’s name from “Horizon Energy, Corp.” to “Technovative Group, Inc.”, and (ii) implement a 1-for-20 reverse stock split of its issued and outstanding Common Stock.

As a result of the Share Exchange Transaction, the Company ceased to be a shell and started engaging in its business of assisting small businesses with website creation and providing management solutions and e-commerce stores in Hong Kong to interested retailers.

History of TGL

On October 14, 2014, TGL was incorporated in Samoa, a jurisdiction which permits the filing of documents and maintenance of accounts by electronic means. TGL is a holding company. TGL’s wholly-owned and operating subsidiary is TAL, a company incorporated in Hong Kong on November 21, 2014. TAL is dedicated to producing and marketing the platform called “SpeedG Platform.”

| 5 |

The following diagram sets forth the structure of the Company as of the date of this Current Report:

OUR BUSINESS

Overview

We are a website creation and e-commerce enablement provider for the online presence needs of small to mid-size business retailers. Our Company is currently in the development stage. Our mission is to assist small to mid-size businesses to easily launch fully operational websites with e-commerce features without employing a team of Information Technology (“IT”) staffs or website designers. We strive to provide both the technology and support that our clients need.

We have developed a platform branded as “SpeedG,” which was launched in January of 2015. Our website can be viewed at http://www.speedg.com. We believe that the SpeedG Platform is a combination of easy to use products that provide solutions for our clients to establish and maintain their online presence as well as allows our clients to promote and market their businesses effectively. In addition to creating and publishing a website utilizing the SpeedG Platform, the SpeedG Platform also includes a dashboard feature (the “SpeedG Dashboard”) which our clients can utilize to manage their websites and e-commerce stores, as well as keep track of user data, such as daily views and recurring views. We have also designed a mobile application (“app”) builder for our clients to create their own mobile apps. We plan to launch a mobile app store where our clients will be able to place their apps for their customers to download. We believe we can assist our clients to establish their digital identities which enable their businesses to survive and thrive. In addition to website creation services, we also plan to provide marketing and promotional services to help the businesses of less tech-savvy retailers grow and enhance the visibility of their products.

The Company principally operates in Hong Kong. We plan to expand our business to Mainland China by the end of 2016 if sufficient capital is available to us from operations or through raising capital.

Our Products

We believe we have designed and developed a set of easy to use products

in the SpeedG Platform that can enable our clients to launch an operational website, conduct online commerce activities, connect

with their customers and manage their business operations. Currently, the SpeedG Platform is comprised of four utilities: (a)

Website hosting; (b) SpeedG Creator; (c) SpeedG Timeline; and (d) SpeedChat.

| 6 |

Website Hosting

Our website hosting service provides our clients with access to rent or buy space on our server, which can house multiple websites. Our clients can choose to lease or buy the space from the server depending on their needs and available resources. We operate the website hosting feature in our data center in Hong Kong and we monitor, maintain, and secure the server for our clients so that they get the benefit of not actually running the server themselves.

In addition, we can also assist our clients to register their domain name through a third-party provider and offer Internet connectivity to the domain name they apply for.

SpeedG Creator

The SpeedG Creator allows our clients to build their own website and create their own mobile app regardless of their technical skill level or knowledge. The SpeedG Creator provides website templates for our clients to choose from to allow them to build their websites on a do it yourself basis. A client can choose from the templates and customize their websites by adding photos, text, and charts. In the SpeedG Creator, clients can also decide the specific features to be included by simply dragging and dropping the pre-designed modules to their website templates. The webpages created through the SpeedG Creator can be viewed on any screen size and on any device in standard screen resolution.

Through the mobile app builder feature on the SpeedG Creator, clients can also easily set up their own mobile apps. Similar to designing a website, the SpeedG Creator allows clients to upload images and edit text on their mobile apps and manage and operate their apps from both their mobile and desktop devices. The mobile apps created through the SpeedG Creator will be compatible with most Android and iOS operating systems.

We currently provide two templates for clients to choose from depending on their desired specifications. Clients can select either the personal or business template for their website and mobile app designs. We also provide e-commerce features for clients who wish to build an e-commerce store online. Our clients can upload their product information to their e-commerce store, and their customers will be able to purchase the products by simply clicking the “Buy” button. Selected products will be saved into their virtual shopping cart where customers will be able to complete their purchase by using a secured payment method. We are currently partnered with PayPal which allows our clients’ customers to complete their transactions through PayPal’s secured payment gateway. By adding the e-commerce features, we believe the SpeedG Creator will enable our clients to set up a fully operational e-commerce store.

We are also planning to develop more templates to cater to various needs of clients from different industry sectors.

SpeedG Dashbaord

The SpeedG Dashboard is a place where our clients can manage and operate their websites as well as keep track of important customer data. Clients can use the SpeedG Dashboard to edit their website content, as well as access customer statistics like the number of views their website gets, the location of website visitors, and the length of time a visitor spends viewing a particular product offered on the clients’ website. Clients can also use the SpeedG Dashboard to track their sales figures for all products they sell. With the assistance of the SpeedG Dashboard, our clients can tailor their marketing and business development strategies based on the customer data they can obtain.

| 7 |

SpeedG Timeline

The SpeedG Timeline is a communication tool that our clients and their customers can use to post messages and share information. Our retailer clients can use their SpeedG account to access the SpeedG Timeline, which is an official timeline with no restrictions on who can view and comment on it. In addition, individual users can also establish their own SpeedG Timeline by creating their SpeedG accounts. Individual users can send requests to add their contacts as “Friends.” Once the contacts become “Friends,” they are able to view their contacts’ timeline and comment on their friends’ posts. Both the retailer and individual users of the SpeedG Timeline can display events and activities they choose to share on the SpeedG Timeline in an organized chronological order. Users choose the information to share on their SpeedG Timeline, such as their photos, activities, interests, and contact information. In addition, there is a “Like” function on the SpeedG Timeline where individual users can “Like” the official account of the retailers, which can enhance product visibility for our clients.

SpeedChat

The SpeedChat is an instant messenger tool that supports both text and voice messaging. The SpeedChat has a group chat feature which allows group communication and sharing. Our clients can send messages to their customers who “Like” their SpeedG Timelines. With the assistance of the SpeedChat, our clients can interact with their customers in order to provide better customer service, answer customer inquiries, obtain feedback and provide trouble shooting services. The SpeedChat also allows our clients to send their customers the latest product information as well as upcoming discount offers.

The SpeedChat is available on our webpage and can also be used through the SpeedG App which can be downloaded on both iOS and Android smartphone devices.

SpeedG Packages

We offer a Basic Package and an E-commerce Package. The monthly subscription fees for the different packages can range from $12 to $60 depending on the different features to which our clients elect to subscribe.

The Basic Package includes the website hosting service, use of the SpeedG Creator for both personal or business templates, as well as access to the SpeedG Dashboard and the SpeedG Timeline. Under the Basic Package, retailers are able to build elegant websites irrespective of their technical skills.

For retailers who desire to have an e-commerce store, we offer the E-commerce Package, which includes not only all the utilities offered in Basic Package, but also the e-commerce features, including the purchase function, the virtual shopping cart, and the secured payment gateway.

Retailers currently enjoy a 30-day free trial of the Basic Package and the E-Commerce Package.

Plan of Operations

As a development-stage company, we continue to work to perfect the SpeedG Platform and are planning to develop a variety of products and services. In the upcoming six months, we plan to develop and launch the followings:

E-mail Accounts

We plan to offer email accounts for our clients. We plan to design our e-mail accounts to be advertising-free and include security functionality designed to protect our clients from cyber-attacks and exposure to potential computer viruses.

Inventory tracking

We are developing our system to add a feature into the SpeedG Dashboard to keep track of inventory information for our e-commerce clients. This function will allow our clients to link their warehouse system to the SpeedG Platform in order to be able to track the flow of their products.

Mobile App Store

We plan to launch a Mobile App Store which will gather and display our clients’ mobile apps. Our client’s customers will be able to access to Mobile App Store to discover and download different types of apps from our clients.

| 8 |

Customer Service

We also plan to provide customer service to help our clients with product suggestions and technical questions. Our plan is to engage customer specialists to provide both online and phone customer support. Our customer service specialists will act as consultants to advise our clients of products that can best suit their needs and assist clients with any problems they encounter in using our products.

Consulting Services

In order to better serve our clients, we also plan to provide consulting and management services to clients who desire additional assistance, including consulting services to help our clients integrate third party platforms, for example, social media platforms. We expect to provide add-on services to integrate additional functions, such as accounting and billing functions, into our clients’ websites through the application programming interface (“API”) technology.

Our Value Proposition

Online commerce continues to grow and retailers are either seeking to, or are compelled by the market to move at least part of their businesses online. We believe our platform provides the tools for many types of retailers to build an online presence through e-commerce capable websites and allow them to better compete in the market. We believe our products will bring significant value to retailers in the following ways:

One Stop Solution

The SpeedG Platform is a one stop solution created to assist our clients with operating their business online. Through our platform, our clients are able to construct their own websites using the SpeedG Creator, market and promote their businesses through the SpeedG Timeline, and interact with their customers through the SpeedChat. With all of these features, we believe that the SpeedG Platform is an integrated product that provides intelligent, secure, and easy to use solutions to our clients.

Keeping Track of Business Data

We not only provide a platform to create a client’s online store, but also assist clients in managing their sales through the SpeedG Dashboard. Every client will have their own dashboard that displays their sales and transaction figures in both a daily and yearly basis. The statistics can also be converted into a PDF file in order to keep the records for analysis purposes.

Accessible in All Platforms

The SpeedG Platform allows users to create an online store that can be accessed from desktop, mobile devices, and tablets. Moreover, SpeedG is compatible with HTML 5, Android, iOS, and Windows operating systems that are commonly used by retailers.

Our Growth Strategy

In order for us to compete in the market, we have tailored our strategies for our Company’s growth, including:

Expanding our sales team and forming strategic partnerships: To compete against our competitors in Hong Kong, we will seek to expand our sales team and initiate more marketing campaigns. We also plan to focus on developing partnerships that are able to extend our client base and enable us to enter into new markets. We are working on a partner network to allow channel partners to resell our packages. These potential partners would be business associations or any association that has access to retailers and could resell our packages. We plan to partner with software providers and local communities to promote our platform as well.

| 9 |

Developing more templates and modules for the platform: In order to be more competitive in this market, we plan to conduct research and develop more modules to enhance our platform. Additionally, we plan to engage independent developers to develop customized features using our API.

Our existing templates are only designed to accommodate a limited amount of industries, such as food and beverage industry and other traditional retail shops. We expect to expand out platform to be able to serve a variety of industries; therefore, we plan to design more templates within the coming six months, which we believe will enable us to provide more choices for our clients and stay ahead of our competitors.

Marketing Strategy

We currently offer a 30-day free trial period for anyone who registers on our website. We believe this will attract potential clients and increase our website’s traffic. We also plan to utilize various online and offline channels to build our brand awareness. The channels we will use include traditional media advertising, online campaigns, and social media campaigns. We also plan to participate in conferences, trade shows and industry events to establish our brand.

Another strategy we plan to use is to host training seminars and online webinars for retailers to discuss emerging e-commerce industry developments and the online business environment. We plan to host these events based on information we gather and our clients’ needs.

Customers

Our targeted clients are those who want to create a digital identity so their customers can find, engage and transact with them online. Our targeted clients will be comprised of all kinds of small to mid-sized retail merchants in different industries. We also plan to target shopping and outlet mall retailers. Although the needs of our clients vary depending on their industries, we expect to provide all of our clients with a reliable and affordable product to fit their varied needs.

Market Opportunities

A 2014 report conducted by the Hong Kong Trade Development Council showed that in 2012, e-commerce sales accounted for 3.7% of total business receipts of those companies who offered e-commerce based sales. In 2013, 26.4% of Hong Kong companies had their own websites, increasing 7.1% from 2008. According to Boston Consulting Group, the Internet is expected to contribute about HK$146 billion (approximately $18.8 billion) to Hong Kong’s economy and about 7% of GDP by 2015. Therefore, the e-commerce market has a lot of room for growth as more and more people realize the importance of doing business online. However, many retailers are not expanding in this direction due to their lack of IT knowledge and lack of a sufficient budget to finance the development of their own website. We aim to target these retailers by offering them an affordable and easy way to build their website, and thus provide them with access to the online world.

Competition

The market for companies that provide website creation is highly competitive. Our competitors include i) Shopify; ii) Bigcommerce and iii) Bigcartel among others. However, we believe that our strengths could put us in an advantageous position against our competitors. Unlike our competitors, we do not simply provide retailers with an opportunity to create an online shop; instead we also offer our clients a combination of products which provide the clients with promotional tools through the SpeedG Timeline and an interactive communication method with their customers through the SpeedChat. Our SpeedChat stands out from other instant messenger services because it provides retailers with the ability to form a VIP group of their designated customers to send out discount information or pre-selected product offerings. In addition, within the VIP group, retailers can also establish another smaller group to allow certain customers to share relatively confidential information with each other.

| 10 |

Additionally, we believe we have an advantage in terms of our location and the market we are targeting. The Hong Kong e-commerce market is still developing and our competitors such as Shopify, Bigcartel or Bigcommerce have a relatively small market share in Hong Kong. Therefore, we believe there is an opportunity for us to expand and penetrate into the Hong Kong market. More importantly, our system supports Chinese, which makes it easier for merchants in Hong Kong to start their online business with us.

We are also well acquainted with the Hong Kong culture and are familiar with doing business in Hong Kong; therefore, we can better tailor solutions for our clients in the Hong Kong market than our competitors who don’t have the same experience. We integrate localized features and design templates customized to fit the Hong Kong market. We believe that assisting retailers based in Hong Kong to easily launch and set up their on-line stores gives us an edge over our competitors.

Security

Our business faces potential security risks from hackers who wish to infiltrate the system. To mitigate these risks, we have employed various security strategies on the network topology, hardware and application system.

For network security, we have relied on Datacenter’s in-house security expert to assess our servers. Comprehensive firewall architecture and policies have been implemented to prevent unauthorized access to our servers.

In terms of application and system security, we implemented a network detection and prevention system to block malicious inbound traffic packages such as cross-site scripting exploits and phishing. Our system has been designed to apply proper authentication and authorization modules which will ensure that only authorized users will be able to perform their activities securely across multiple platforms.

For payment transactions, we are collaborating with Paypal in order to take advantage of its expertise in payment services. By partnering with Paypal, we are mitigating the risks involved in storing consumer payment details and the history of our e-commerce users.

For web security, we are using Secure Sockets Layer certificates from a well-known certificate authority. It offers high encryption strength of 2048-bit, SHA-2 Hashing Algorithm, 99.9% browser support and 24/7 customer support. Our users will be able to identify our certified website through the secure site seal and perform online transaction at our website safely.

Regulation

Hong Kong

The websites created through our platform are maintained through a server in Hong Kong. Therefore, our data usage policy and regular terms of service for retailers must comply with the applicable rules and regulations in Hong Kong. We will need to comply with the Hong Kong Personal Data (Privacy) Ordinance (Cap 486). Non-compliance with such rules in Hong Kong may result in fines of up to HKD500,000 (approximately $64,511). Officers and directors of our Company may also be personally liable for the Company’s violation of Hong Kong Personal Data (Privacy) Ordinance.

In the upcoming six months, we intend to engage a third party company which specializes in compliance with the Hong Kong Personal Data (Privacy) Ordinance to review our privacy policy and data protection system to ensure that the Company complies with applicable Hong Kong laws.

| 11 |

Mainland China

In Mainland China, the regulations that we need to comply with are the Computer Information System Safety Protection Regulation, Computer Information Global Internet Confidentiality Regulation and the Global Internet Information Protection Regulation. Prior to entering into the Mainland China market, we plan to engage local counsel and a third party management consulting firm to advise the Company regarding compliance with applicable regulations in Mainland China.

Intellectual Property

| Mark | Country of Registration | Application Number | Class | Description | Current Owner | Application Status | ||||||||||

| Hong Kong | 303338172 | 35, 42 | Class 35 Advertising; business management; business administration; office functions. Class 42 Scientific and technological services and research and design relating thereto; industrial analysis and research services; design and development of computer hardware and software. | TAL | Pending | ||||||||||

| 12 |

| Mark | Country of Registration | Application Number | Class | Description | Current Owner | Application Status | ||||||||||

| SpeedG | Hong Kong | 303338163 | 35, 42 | Class 35 Advertising; business management; business administration; office functions. Class 42 Scientific and technological services and research and design relating thereto; industrial analysis and research services; design and development of computer hardware and software. | TAL | Pending | ||||||||||

| 快速聚 | Hong Kong | 303338154 | 35, 42 | Class 35 Advertising; business management; business administration; office functions. Class 42 Scientific and technological services and research and design relating thereto; industrial analysis and research services; design and development of computer hardware and software. | TAL | Pending | ||||||||||

Property

Our headquarters is located in Hong Kong. The office is rented at a monthly rate of HKD80,769 (approximately $10,422). Our office is located at Room 1512, Silvercord Building, Tower 2, 30 Nathan Road, Tsim Tsa Tsui, Hong Kong.

Employees

We currently have seven employees. We have three employees on the research and development team, two people on the marketing and sales team and two people in the administrative department.

| 13 |

Risk Factors

Risk Factors related to the Business

If we are not able to develop enhancements to our platform that achieve market acceptance and that keep pace with technological developments, our business will be harmed.

Our ability to attract new clients depends in large part on our ability to enhance and improve our platform and to introduce new products and services. In order to grow our business, we must develop products and services that reflect the changing nature of e-commerce. The success of any enhancement to our platform depends on several factors, including timely completion, adequate quality testing, and market acceptance. Any new product or service that we develop may not be introduced in a timely or cost-effective manner, may contain defects, or may not achieve the market acceptance necessary to generate sufficient revenue. If we are unable to successfully develop new products or services, enhance our existing platform to meet customer requirements or otherwise gain market acceptance, our business and operating results will be harmed.

We need to continuously modify and enhance our platform to keep pace with changes in Internet-related hardware, software, communications, and database technologies and standards. If we are unable to respond in a timely and cost-effective manner to these rapid technological developments and changes in standards, our platform may become less marketable, less competitive, or obsolete, and our operating results will be harmed.

We have a limited operating history, which makes it difficult to evaluate our prospects and future operating results.

We incorporated and first launched our platform in 2014. As a result of our limited operating history, our ability to forecast our future operating results is limited and subject to a number of uncertainties, including our ability to plan for and model future growth. Further, in future periods, our revenue could decline for a number of reasons, including any reduction in demand for our platform, increased competition, contraction of our overall market, or our failure, for any reason, to capitalize on growth opportunities. We have encountered and will encounter risks and uncertainties frequently experienced by growing companies in rapidly changing industries, such as the risks and uncertainties described herein. If our assumptions regarding these risks and uncertainties, which we use to plan our business, are incorrect or change, or if we do not address these risks successfully, our operating and financial results could differ materially from our expectations, and our business could suffer.

If we do not develop and market products that respond to needs of our clients, our business and operating results will be affected.

Online business is a highly competitive industry with low barriers of entry. If we do not develop our products in a direction that will attract customers in accordance to the needs of our clients, we will lose our customer base. This will also affect our ability to attract new clients. In addition, our new products could also fail to attract meaningful market acceptance for many reasons.

We are exposed to risk of system failures.

Our business largely depends on the stability of our server. We may face system failures and outages that will disrupt the operation of our website and the platform. System failure could result in several scenarios: damage from fire, power loss, telecommunication failures, computer viruses, physical and electronic break-ins and similar events. If such events occur, it will affect our reputation and the ability to attract and retain clients, which will adversely affect our operating results.

| 14 |

We rely on our marketing efforts and channels to promote our brand and acquire new clients. These efforts may require significant expense and may not be successful.

We will employ various marketing tactics and use a variety of marketing channels to promote our brand, including sponsorships, advertisement, email and social media marketing. If we lose access to one or more of these channels for any reason, we will not be able to promote our brand effectively which could limit our ability to grow. Further, if the marketing activities fail to generate traffic to our website, attract new clients or lead new and renewal sales of our products, our business and operating results could be affected. There is no assurance the result of the marketing efforts. If customer acquisition cost increases, the operating results could also be affected.

If the rate of growth for small and medium businesses and ventures declines it will affect our results adversely.

Our expectations for future revenue growth are based on targeting small and medium businesses or ventures. If there is a decline in the establishment of small and medium businesses and ventures due to market conditions or other factors, this could affect our performance and target market size which could affect our operating results.

Our ability to enhance our products may be harmed if we are unable to attract and retain sufficient research and development staff.

In order to be competitive, we must continue to develop new solutions and modules to add on our existing platform. As we are still growing, there are larger companies hiring similar research and development staffs to our company, who offer more favorable compensation and incentive packages than us. If we cannot attract or retain sufficiently skilled employees, our business and results of operations could be affected.

The success of our products depends heavily on the importance for retailers of having an online presence.

The success of our products is predicated on the assumption that an online presence is, and will continue to be, an important factor in our clients’ abilities to establish, expand and manage their businesses quickly, easily and affordably online. If we are incorrect in this assumption or if the importance of an online presences becomes irrelevant, for example due to the introduction of a new technology or industry standard that supersedes the importance of an online presence or renders our existing or future products obsolete, then our ability to retain existing clients and attract new clients could be adversely affected, which could harm our ability to generate revenue and meet our targets.

If our network or computer systems are breached or unauthorized access to customer data is otherwise obtained, our platform may be perceived as insecure, we may fail to attract new customers, and we may incur significant liabilities.

Use of our platform involves the storage, transmission, and processing of our clients’ proprietary data, including personal or identifying information regarding their customers or employees. Unauthorized access to or security breaches of our platform could result in the loss of data, loss of intellectual property or trade secrets, loss of business, severe reputational damage, which will adversely affect client confidence. It will also cause regulatory investigations and orders, litigation, indemnity obligations, damages for contract breach, penalties for violation of applicable laws, regulations, or contractual obligations, and significant costs for remediation that may include liability for stolen assets or information and repair of system damage that may have been caused, incentives offered to clients or other business partners in an effort to maintain business relationships after a breach, and other liabilities. Notifications related to a security breach regarding or pertaining to any of such service providers could impact our reputation, harm customer confidence, or hurt our sales and expansion into new markets.

Because the techniques used and vulnerabilities exploited to obtain unauthorized access or to sabotage systems change frequently and generally are not identified until they are launched against a target, we may be unable to anticipate these techniques or vulnerabilities or implement adequate preventative measures. We may also experience security breaches that may remain undetected for an extended period.

| 15 |

Real or perceived errors, failures, or bugs in our platform could adversely affect our operating results and growth prospects.

Because our platform is complex, undetected errors, failures, vulnerabilities, or bugs may occur, especially when updates are deployed. Our platform are often used in connection with large-scale computing environments with different operating systems, system management software, equipment, and networking configurations, which may cause errors or failures of our platform, or other aspects of the computing environment into which they are deployed. In addition, deployment of our platform into complicated, large-scale computing environments may expose undetected errors, failures, vulnerabilities, or bugs in our platform. Real or perceived errors, failures, vulnerabilities, or bugs in our platform could result in negative publicity, loss of or delay in market acceptance of our platform, loss of competitive position, or claims by clients for losses sustained by them. The loss due to our errors and omissions may not be covered by any insurance and we may not be able to afford to bear the cost of liabilities arising in connection with security and privacy damages.

We depend on our executive officers and the loss of one or more of these executives or an inability to attract and retain highly skilled employees could adversely affect our business.

Our success depends largely upon the continued services of our executive officers and other key employees. We rely on our leadership team in the areas of research and development, operations, security, marketing, sales, support, general and administrative functions, and on individual contributors in our research and development and operations. From time to time, there may be changes in our executive management team resulting from the hiring or departure of executives, which could disrupt our business. We do not have employment agreements with our executive officers or other key personnel that require them to continue to work for us for any specified period and, therefore, they could terminate their employment with us at any time. The loss of one or more of our executive officers, especially our Chief Executive Officer, or key employees could have an adverse effect on our business.

We are highly dependent upon free trials of our platform and other strategies to drive our sales and revenue. If these strategies fail to continue to generate sales opportunities or do not convert into paying customers, our business and results of operations will be harmed.

We are highly dependent upon our marketing strategy of offering free trials of our platform to generate sales opportunities. This strategy may not be successful in continuing to generate sufficient sales opportunities necessary to increase our revenue. Many early users never convert from the trial version to a paid version of our platform. Further, we often depend on individuals within an organization who initiate the trial versions of our customer service platform and live chat software being able to convince decision makers within their organization to convert to a paid version. Many of these organizations have complex and multi-layered purchasing requirements. To the extent that these users do not become, or are unable to convince others to become, paying customers, we will not realize the intended benefits of this marketing strategy and our ability to grow our revenue will be adversely affected.

Our business is exposed to risks associated with credit card and other online payments, which risks if realized could adversely affect our business.

A majority of our client fees are processed through credit cards and other online payments which are all currently processed through PayPal, a third party payment gateway. Payments made online are subject to inherent risks related to credit card fraud and we cannot guarantee that credit card and other payments processed through our secured payment gateway partners now and in the future will be free of such fraud. Our failure to limit fraudulent transactions conducted through our websites use of a third party payment gateway could hurt our business and harm our reputation.

Risk Factors Related to Our Common Stock

The Common Stock is subject to risks arising from restrictions on reliance on Rule 144 by shell companies or former shell companies.

Under a regulation of the SEC known as “Rule 144,” a person who beneficially owns restricted securities of an issuer and who is not an affiliate of that issuer may sell them without registration under the Securities Act provided that certain conditions have been met. One of these conditions is that such person has held the restricted securities for a prescribed period, which will be 6 months for the Common Stock. However, Rule 144 is unavailable for the resale of securities issued by an issuer that is a shell company (other than a business combination related shell company) or, unless certain conditions are met, that has been at any time previously a shell company. The SEC defines a shell company as a company that has (a) no or nominal operations and (b) either (i) no or nominal assets, (ii) assets consisting solely of cash and cash equivalents; or (iii) assets consisting of any amount of cash and cash equivalents and nominal other assets. Until the Share Exchange Transaction, the Company was a shell company and, while we believe that a result of the reverse acquisition, the Company ceased to be a shell company, the SEC and others whose approval is required in order for shares to be sold under Rule 144 might take a different view.

| 16 |

Rule 144 is available for the resale of securities of former shell companies if and for as long as the following conditions are met:

(i) the issuer of the securities that was formerly a shell company has ceased to be a shell company,

(ii) the issuer of the securities is subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act,

(iii) the issuer of the securities has filed all Exchange Act reports and material required to be filed, as applicable, during the preceding 12 months (or such shorter period that the issuer was required to file such reports and materials), other than Current Reports on Form 8-K; and

(iv) at least one year has elapsed from the time that the issuer filed current comprehensive disclosure with the SEC reflecting its status as an entity that is not a shell company known as “Form 10 Information.”

Although the Company files Form 10 Information with the SEC on this Form 8-K, shareholders who receive the Company’s restricted securities will not be able to sell them pursuant to Rule 144 without registration until the Company has met the other conditions to this exception and then for only as long as the Company continues to meet the condition described in subparagraph (iii) above, and is not a shell company. No assurance can be given that the Company will meet these conditions or that, if it has met them, it will continue to do so, or that it will not again be a shell company.

Our shares of common stock are subject to penny stock regulations. Because our common stock is a penny stock, holders of our common stock may find it difficult or may be unable to sell their shares.

The SEC has adopted rules that regulate broker/dealer practices in connection with transactions in penny stocks. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange system). The penny stock rules require a broker/dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document prepared by the SEC that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker/dealer also must provide the customer with bid and offer quotations for the penny stock, the compensation of the broker/dealer, and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from such rules, the broker/dealer must make a special written determination that a penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in any secondary market for a stock that becomes subject to the penny stock rules, and accordingly, holders of our common stock may find it difficult or may be unable to sell their shares.

Our stock price may be volatile and you may not be able to resell your shares at or above the price you paid. In addition, volatility in the price of our common stock may subject us to securities litigation resulting in substantial costs and liabilities and diverting management’s attention and resources.

The market price of our common stock is likely to be highly volatile and could fluctuate widely in price in response to various factors, many of which are beyond our control, including the following:

| ● | our ability to execute our business plan; |

| ● | changes in our industry; |

| ● | competitive pricing pressures; |

| ● | our ability to obtain working capital financing; |

| ● | additions or departures of key personnel; |

| ● | limited “public float” in the hands of a small number of persons whose sales or lack of sales could result in positive or negative pricing pressure on the market price for our common stock; |

| 17 |

| ● | sales of our common stock (particularly following effectiveness of the registration statement of which this prospectus is a part); |

| ● | operating results that fall below expectations; |

| ● | regulatory developments; |

| ● | economic and other external factors; |

| ● | period-to-period fluctuations in our financial results; |

| ● | our inability to develop or acquire new or needed technologies; |

| ● | the public’s response to press releases or other public announcements by us or third parties, including filings with the SEC; |

| ● | changes in financial estimates or ratings by any securities analysts who follow our common stock, our failure to meet these estimates or failure of those analysts to initiate or maintain coverage of our common stock; |

| ● | the development and sustainability of an active trading market for our common stock; and |

| ● | any future sales of our common stock by our officers, directors and significant stockholders. |

FINRA sales practice requirements may also limit a stockholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, FINRA has adopted Rule 2111 that requires a broker-dealer to have reasonable grounds for believing that an investment is suitable for a customer before recommending the investment. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

Because we are a small company with limited operating history, stockholders may find it difficult to sell our common stock in the public markets.

Our common stock is currently traded on Over-the-Counter (“OTC”) Market under the symbol “TEHG.” The number of persons interested in purchasing our common stock at or near bid prices at any given time may be relatively small. This situation is attributable to a number of factors, including the fact that we are a small company which is still relatively unknown to stock analysts, stock brokers, institutional investors, and others in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons, they tend to be risk-averse and would be reluctant to follow an unproven company such as ours or purchase or recommend the purchase of our common stock until such time as we became more viable. Additionally, many brokerage firms may not be willing to effect transactions in our securities. As a consequence, there may be periods of several days or more when trading activity in our common stock is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on the stock price. We cannot give you any assurance that an active public trading market for our common stock will ever develop or be sustained, or that trading levels will be sustained.

Future issuances of our preferred stock could dilute the voting and other rights of holders of our common stock.

Our board of directors has the authority to issue shares of preferred stock in any series and may establish, from time to time, various designations, powers, preferences and rights of the shares of each such series of preferred stock. Any issuances of preferred stock may have priority over the common stock with respect to dividend or liquidation rights. Any future issuance of preferred stock may have the effect of delaying, deferring or preventing a change in control of our company and may adversely affect the voting and other rights of the holders of our Common Stock.

| 18 |

If we are unable to comply with the financial reporting requirements mandated by the SEC’s regulations, investors may lose confidence in our financial reporting and the price of our common stock could decline.

If we fail to maintain effective internal controls over financial reporting, our ability to produce timely, accurate and reliable periodic financial statements could be impaired. If we do not maintain adequate internal control over financial reporting, investors could lose confidence in the accuracy of our periodic reports filed under the Exchange Act. Additionally, our ability to obtain additional financing could be impaired or a lack of investor confidence in the reliability and accuracy of our public reporting could cause our stock price to decline.

If securities or industry analysts do not publish research or reports about our business, if they adversely change their recommendations regarding our common stock, or if our operating results do not meet their expectations, our stock price and trading volume could decline.

The trading market for our common stock will be influenced by the research and reports that securities or industry analysts publish about us or our business. We do not currently have, and may never obtain, research coverage by securities analysts. We do not have any control over these reports or analysts. If any of the analysts who cover our company downgrades our stock, or if our operating results do not meet the analysts’ expectations, our stock price could decline. Moreover, if any of these analysts ceases coverage of our company or fails to publish regular reports on our business, we could lose visibility in the financial markets, which in turn could cause our stock price and trading volume to decline.

DESCRIPTION OF PROPERTY

Our headquarters is located in Hong Kong. The office is rented at a monthly rate of HKD80,769 (approximately $10,422). Our office is located at the following address: Room 1512, Silvercord Building, Tower 2, 30 Nathan Road, Tsim Tsa Tsui, Hong Kong.

LEGAL PROCEEDINGS

None.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

Previous Independent Accountants

On March 11, 2015, the Company dismissed McConnell & Jones LLP (“McConnell”) as the Company’s independent registered public accounting firm. The reports of McConnell, on our financial statements for the fiscal years ended December 31, 2013 and 2012 did not contain any adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles, except that such reports contained explanatory paragraphs in respect to uncertainty as to our ability to continue as a going concern due to our dependence on a successful execution of our plan of operations and ability to raise additional financing, our lack of generating revenues, and our stockholders’ deficit and negative working capital. The decision to change independent accountants was approved by our Board of Directors on March 11, 2015.

During the fiscal years ended December 31, 2013 and 2012 and the subsequent interim periods in 2014 and through the date of this report, we have had no disagreements with McConnell, on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of McConnell, would have caused it to make reference to the subject matter of such disagreements in its report on our financial statements for such periods.

During the fiscal years ended December 31, 2013 and 2012 and the subsequent interim periods in 2014 and through the date of this report on Form 8-K, there have been no reportable events as defined under Item 304(a)(1)(v) of Regulation S-K adopted by the Securities and Exchange Commission (the “SEC”).

New Independent Accountants

Our Board of Directors appointed AWC (CPA) Limited (“AWC”) as our new independent registered public accounting firm effective as of March 11, 2015. During the fiscal years ended December 31, 2013 and 2012 and the subsequent interim periods in 2014 and through the date of our engagement, we did not consult with AWC regarding either (1) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on our financial statements, or (2) any matter that was either the subject of a disagreement or a reportable event (as defined in Item 304(a)(1)(v) of Regulation S-K).

| 19 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND PLAN OF

OPERATIONS

This Current Report on Form 8-K contains forward-looking statements within the meaning of the federal securities laws. These include statements about our expectations, beliefs, intentions or strategies for the future, which we indicate by words or phrases such as “anticipate,” “expect,” “intend,” “plan,” “will,” “we believe,” “management believes” and similar language. Except for the historical information contained herein, the matters discussed in this “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and elsewhere in this Current Report are forward-looking statements that involve risks and uncertainties. The cautionary language in this Current Report, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from those projected. Except as may be required by law, we undertake no obligation to update any forward-looking statement to reflect events after the date of this Current Report on Form 8-K.

The "Company", "we," "us," and "our," in this Management’s Discussion and Analysis of Financial Condition and Plan of Operation refer to the combined business of TGL and TAL.

Overview

On October 14, 2014, TGL was incorporated in Samoa, a jurisdiction which permits the filing of documents and maintenance of accounts by electronic means. TGL is a holding company. TGL’s wholly-owned and operating subsidiary is TAL, a company incorporated in Hong Kong on November 21, 2014. TAL is dedicated to producing and marketing the platform called SpeedG Platform.

Results of Operations

For the year ended December 31, 2014

Revenues

The Company receive sales revenues of nil for the year ended December 31, 2014.

Operating Expenses

Operating expenses for the year ended December 31, 2014 was $2,799. The expenses consisted of professional fees, incorporation fees, and other general expenses.

We expect that our general and administrative expenses will continue to increase as we incur additional costs to sup-port the growth of our business.

Net Loss

Net Loss for the year ended December 31, 2014 was ($2,799). Basic and diluted net income (loss) per share amounted to 1 for the year ended December 31, 2014.

| 20 |

Liquidity and Capital Resources

As of December 31, 2014, we had working capital deficit of ($2,799) consisting of cash on hand of $1,070.

Net cash used in operating activities for the year ended December 31, 2014 was $2,799. The cash used in operating activities are mainly for professional fees and general expenses.

Net cash provided for the year ended December 31, 2014 was $3,869. The cash was provided by our former director, Lee Chan Yue, who is also the CEO and president of TEHG as a loan (“Loan”) for incorporation expense. The Loan is non-interest bearing and payable upon demand.

We will likely require additional capital to continue to operate our business, and to further expand our business. Sources of additional capital through various financing transactions or arrangements with third parties may include equity or debt financing, bank loans or revolving credit facilities. We may not be successful in locating suitable financing trans-actions in the time period required or at all, and we may not obtain the capital we require by other means. Our inability to raise additional funds when required may have a negative impact on our operations, business development and financial results.

Critical Accounting Policies and Estimates

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent liabilities at dates of the financial statements and the reported amounts of revenue and expenses during the periods. Actual results could differ from these estimates. Our significant estimates and assumptions include depreciation and the fair value of our stock, stock-based compensation, debt discount and the valuation allowance relating to the Company’s deferred tax assets.

Recently Issued Accounting Pronouncements

Reference is made to the “Recent Accounting Pronouncements” in Note 1 to the Financial Statements included in this Current Report for information related to new accounting pronouncement, none of which had a material impact on our consolidated financial statements, and the future adoption of recently issued accounting pronouncements, which we do not expect will have a material impact on our consolidated financial statements.

Off-Balance Sheet Arrangements

As of December 31, 2014, we did not have any off-balance sheet arrangements.

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

Set forth below is the biographical information about our executive officer and director:

| Name | Age | Position | ||

| Lee Chan Yue | 61 |

Chief Executive Officer, President, Treasurer, Secretary, and Director |

Mr. Lee Chan Yue, age 61, has extensive experience in the areas of private equity and loan financing. He has been serving as director of D.S. International Holding, Ltd. since 2006, where he is in charge of daily operations and loan financing of investment projects. From 2004 to 2006, Mr. Lee was the director at Capital Bridge (Universal) Limited, where he developed a marketing plan and strategy for the company. From 2002 to 2004, Mr. Lee served as head of Private Banking and Treasury Marketing in Nedbank Limited, Hong Kong branch. He worked at Delta Asia Financial Group from 1998 to 2002 as group treasurer. From 1996 to 1998, Mr. Lee was a senior manager in Standard London Limited. From 1994 to 1996, he worked as senior Treasury Manager at Dao Heng Bank Ltd. Hong Kong. Mr. Lee graduated from Hong Kong Polytechnic University in 1974.

| 21 |

Mr. Lee, as the sole member of the Board of Directors, reached a conclusion that he should serve as a Director of the Company based on his experience in management.

Promoters

The following persons and entities are promoters with respect to the Company as that term is defined in Rule 405 of Regulation C promulgated under the Securities Act.

Celestial Melody Limited

Celestial Melody Limited (“CML”), a corporation formed under the laws of Samoa, purchased 30,000,000 shares of Common Stock (“CML Shares”) of the Company from SPC pursuant to the Common Stock Purchase Agreement in November 2014. As a result, it owns 57.9% of the total issued and outstanding shares of the Company and is the majority holder of the Company’s Common Stock. After the Reverse Split, CML will own approximately 0.29% of the Company’s Common Stock.

Mr. Leung Kam Tim is the sole director and registered member of CML and has done prior business with James Tan, who is also a promoter and is listed below.

Other than the CML Shares, CML is not receiving any other shares or other form of consideration.

Jing Zhang

Ms. Jing Zhang, a citizen of People’s Republic of China, purchased 3,745,911 shares of Common Stock (“Zhang Shares”) of the Company from Turvaga pursuant to the Stock Purchase Agreement in November 2014. As a result, she owns 7.2% of the total issued and outstanding shares of the Company currently. After the Reverse Split, Ms. Zhang will own approximately 0.04% of the Company’s Common Stock.

Ms. Zhang has done prior business with James Tan, another promoter listed below.

Other than the Zhang Shares, Ms. Zhang is not receiving any other shares or other form of consideration.

James Tan

Mr. James Mengdong Tan is currently an interim Chief Executive Officer, President, Secretary and Treasurer, and director of Moxian China, Inc., a public company in the U.S., and a promoter with respect to Rebel Group, Inc., a public company in the U.S. Mr. Tan is also the director and CEO of 8i Capital Limited. From 2005 to 2009, he was the Chairman and CEO of Vashion Group, a company listed on the Singapore Stock Exchange. From 2005 to 2007, he was the Executive Director and CEO of Vantage Corporation Limited, a company listed on the Singapore Stock Exchange. At the same time, he served as a director on the Board of Pacific Internet Ltd, a company listed on Nasdaq until its sale to Connect Holdings, a group comprising of Ashmore Investment Management Limited, Spinnaker Capital Limited and Clearwater Capital Partners. From 2012 to 2014, he acted as an independent director of New Trend Lifestyle Group PLC, a London AIM listed company.

In November 2014, Mr. Tan assisted in the negotiation of the acquisition of approximately 65.2% of the then outstanding shares of the Company by CML and Jing Zhang from SPC and Tuverga. CML and Ms. Zhang agreed to purchase the majority of the Company’s Common Stock as an investment, with the understanding that the promoters would seek to cause TGL to combine with the Company. Mr. Tan assisted CML and Ms. Zhang to source this Company for the purpose of effecting a going public transaction for TGL and assisted TGL to complete the Share Exchange Transaction with the Company. There is no written or oral agreement in place between Mr. Tan and the Company or CML or Ms. Zhang for Mr. Tan to receive any compensation with respect to his assistance of the Company or CML or Ms. Zhang; however, Mr. Tan may receive compensation for his assistance in the future.

There is currently no written or oral agreement between the Company or TGL and CML or Ms. Zhang with respect to their roles in assisting TGL to go public in the United States. CML and Ms. Zhang entered into the transactions described herein solely for investment purposes and did not receive any other consideration or compensation.

| 22 |

Committees

We do not have a standing nominating, compensation or audit committee. Rather, our full board of directors performs the functions of these committees. We do not believe it is necessary for our board of directors to appoint such committees because the volume of matters that come before our board of directors for consideration permits the directors to give sufficient time and attention to such matters to be involved in all decision making. Additionally, because our Common Stock is not listed for trading or quotation on a national securities exchange, we are not required to have such committees.

Director Independence

Our securities are not listed on a national securities exchange or in an inter-dealer quotation system which has requirements that directors be independent. No member of the Company’s board of directors qualifies as an independent director pursuant to the definition of “independent director” under the Rules of NASDAQ, Marketplace Rule 5605(a)(2). We do not have majority of independent directors.

Code of Ethics

We have adopted a code of ethics that applies to all of our directors, officers and employees, including our principal executive officer, principal financial officer and principal accounting officer. The code addresses, among other things, honesty and ethical conduct, conflicts of interest, compliance with laws, regulations and policies, including disclosure requirements under the federal securities laws, confidentiality, trading on inside information, and reporting of violations of the code.

Meetings of the Board of Directors

During its fiscal year ended December 31, 2014, the Board of Directors did not meet on any occasion, but rather transacted business by unanimous written consent.

EXECUTIVE COMPENSATION

Summary Compensation

The following is a summary of the compensation we paid to our executive officers, for the fiscal years ended December 31, 2014 and 2013 for TEHG.

| Name and Principal Position | Year | Salary

($) | Bonus

($) | Stock

Awards ($) | Option

Awards ($) | Non-Equity

Incentive Plan Compensation ($) | Change

in Pensions Value and Non-Qualified Compensation Earnings | All

Other Compensation ($) | Total ($) | |||||||||

Lee Chan Yue (1) President and CEO | 2014 | – | – | – | – | – | – | – | – | |||||||||

Robert Bludorn(2) President | 2014 | – | – | – | – | – | – | – | – | |||||||||

| and CEO | 2013 | – | – | – | – | – | – | – | – |

| (1) Mr. Lee is serving as the President and CEO of the Company since November 14, 2014. |

| (2) Mr. Bludorn was the Company’s President, CEO and Director from February 15, 2013 through November 14, 2014. |

The following is a summary of the compensation TGL paid to our executive officers for the fiscal year ended December 31, 2014.

| Name and Principal Position | Year | Salary ($) |

Bonus ($) |

Stock Awards ($) |

Option Awards ($) |

Non-Equity Incentive Plan Compensation ($) |

Change in Pensions Value and Non-Qualified Compensation Earnings |

All Other Compensation ($) |

Total ($) | |||||||||

Lee Chan Yue(1) President and CEO | 2014 | – | – | – | – | – | – | – | – | |||||||||

(1) Lee Chan Yue served as director of TGL from October 14, 2014 to January 5, 2015.

| 23 |

Aggregated Option Exercises and Fiscal Year-End Option Value Table

There were no stock options exercised since the date of inception of the Company through the date of this Current Report on Form 8-K by the executive officers named in the Summary Compensation of TEHG and TGL.

Long-Term Incentive Plan (“LTIP”) Awards Table

There were no awards made to any named executive officers in the last completed fiscal year under any LTIP.

Employment Agreements

None.

Compensation of Directors

For the fiscal year ended December 31, 2014, none of the members of our Board of Directors received compensation for their services as directors. We do not currently have an established policy to provide compensation to members of our Board of Directors for their services in that capacity.

Option Plan

We currently do not have a Stock Option Plan. However, we may to issue stock options pursuant to a Stock Option Plan in the future. Such stock options may be awarded to management, employees, members of the Company’s Board of Directors and consultants of the Company.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

Our policy is that a contract or transaction either between the Company and a director, or between a director and another company in which he is financially interested is not necessarily void or void-able if the relationship or interest is disclosed or known to the board of directors and the stockholders are entitled to vote on the issue, or if it is fair and reasonable to our company.

As of December 31, 2014, TEHG’s CEO and president, Lee Chan Yue, who is also a former director of TGL, provided a loan to the Company at $3,869 (the “Loan”). The cash was provided for incorporation expense. The Loan is non-interest bearing and payable upon demand.

Except the above transactions or as otherwise set forth in this report or in any reports filed by the Company with the SEC, the Company was not a party to any transaction (where the amount involved exceeded the lesser of $120,000 or 1% of the average of our assets for the last two fiscal years) in which a director, executive officer, holder of more than five percent of our common stock, or any member of the immediate family of any such person have or will have a direct or indirect material interest and no such transactions are currently proposed. The Company is currently not a subsidiary of any company.

The Company’s Board conducts an appropriate review of and oversees all related party transactions on a continuing basis and reviews potential conflict of interest situations where appropriate. The Board has not adopted formal standards to apply when it reviews, approves or ratifies any related party transaction. However, the Board believes that the related party transactions are fair and reasonable to the Company and on terms comparable to those reasonably expected to be agreed to with independent third parties for the same goods and/or services at the time they are authorized by the Board.

| 24 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT